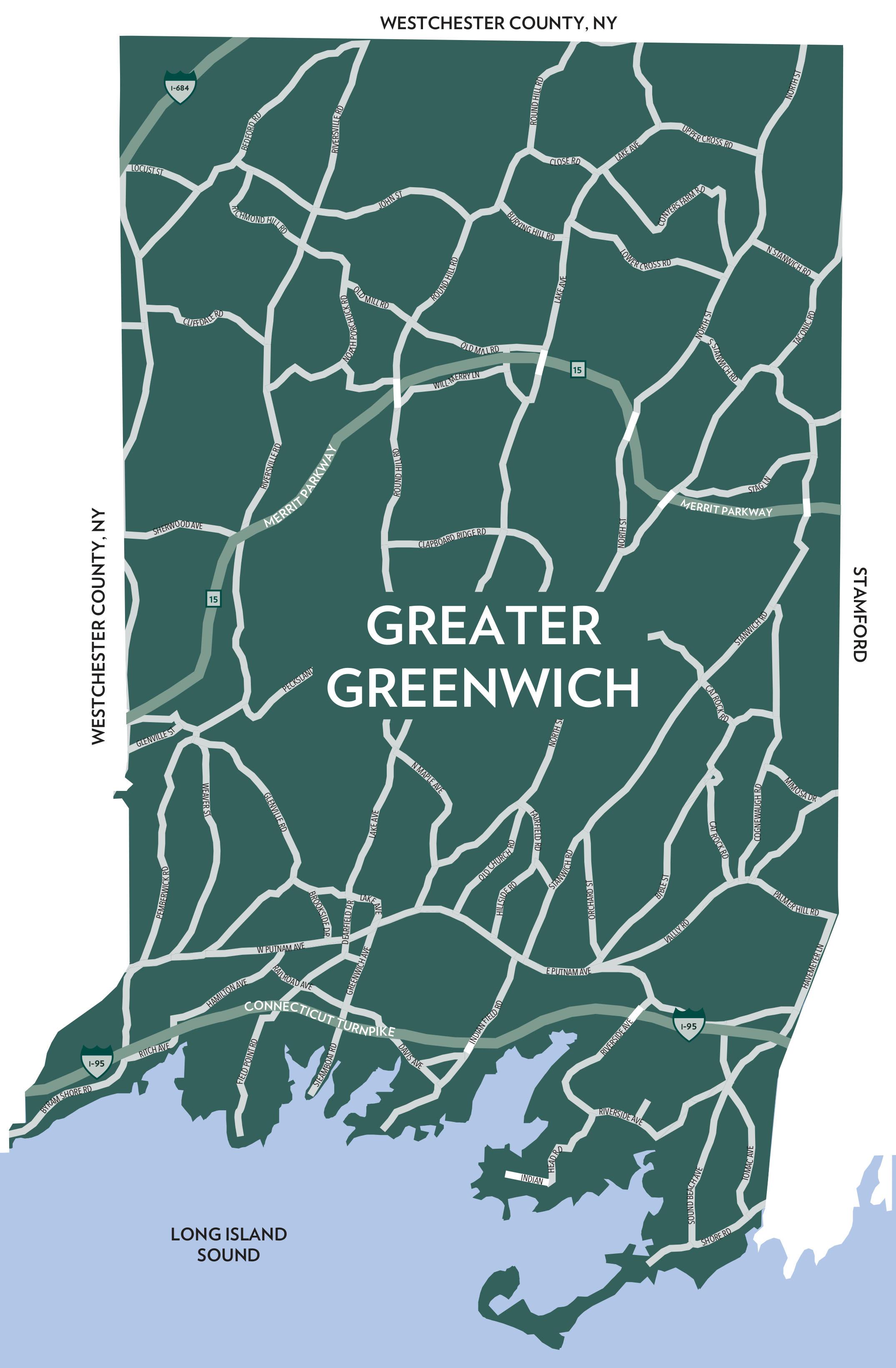

Market

Buyer demand for homes in Greenwich, Connecticut, remained strong in the third quarter. A limited inventory of homes for buyers to choose from continued to be the headwind that constrained market performance. Although home sales declined 36% in the third quarter versus Q3 2021, they improved compared to Q2 2022. Also, the time it took to sell a home tightened to just 58 days on the market while median prices rose to more than $2.4M. Simply put, it remains an opportune time to sell a home in Greenwich.

The $5M - $6M price range was a highlight at the end of the quarter, with the distinction of being the only price category showing an increase in sales contracts versus 2021. The $10M+ market was the only price range showing an uptick in inventory, with 34 homes for sale compared to 20 a year ago.

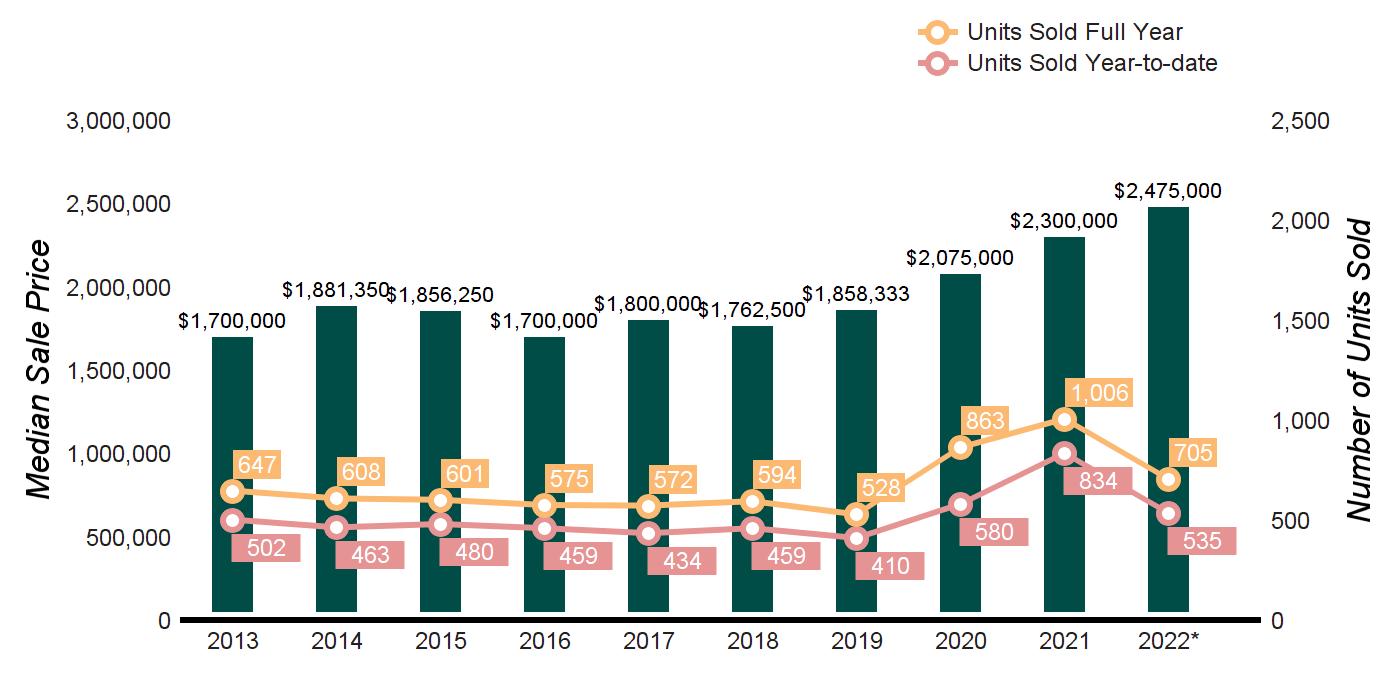

So far this year, 535 single family homes have sold in Greenwich, Connecticut. Although less than in 2020 and 2021, this is a marked improvement from the seven years leading up to the pandemic.

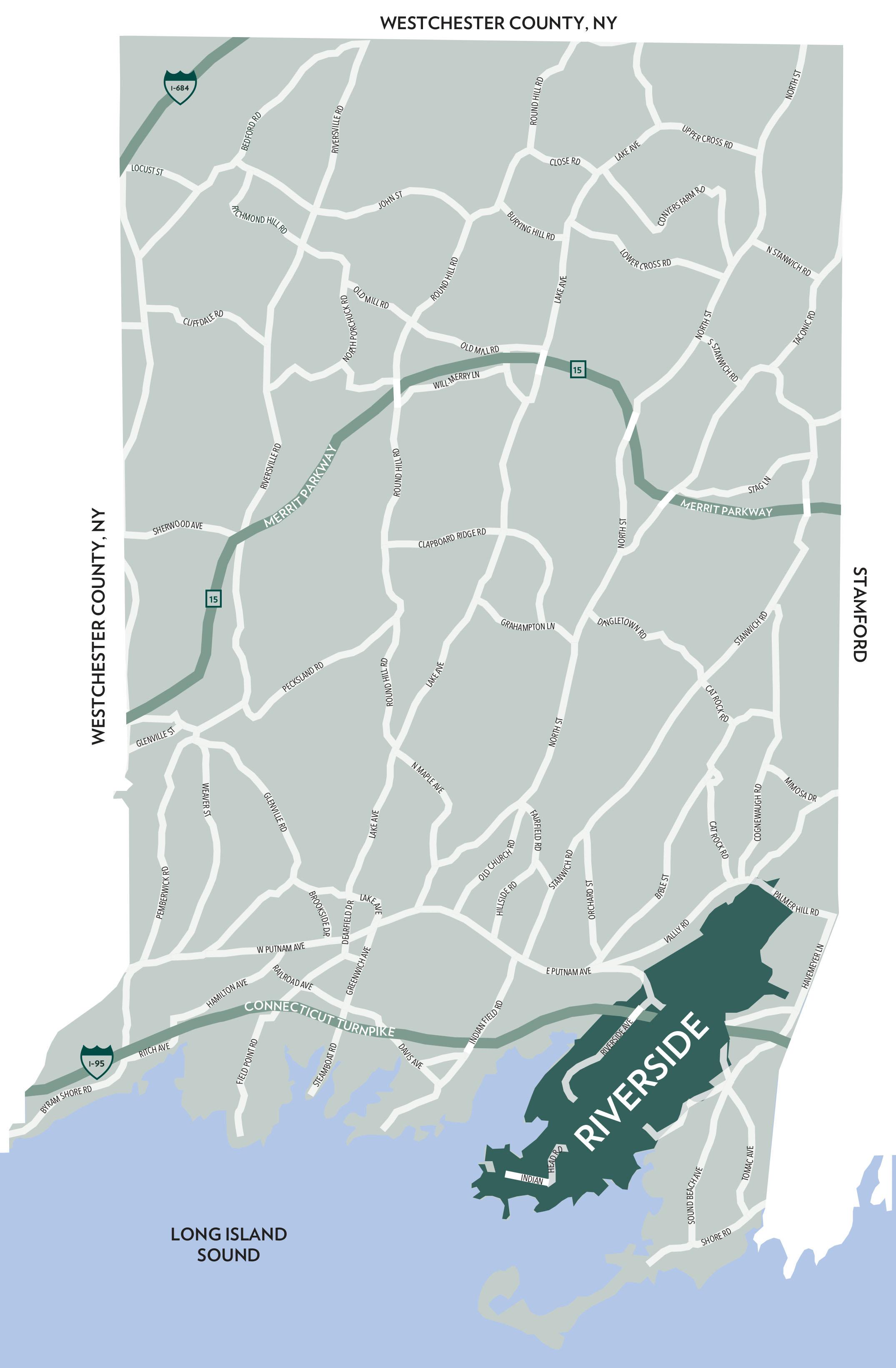

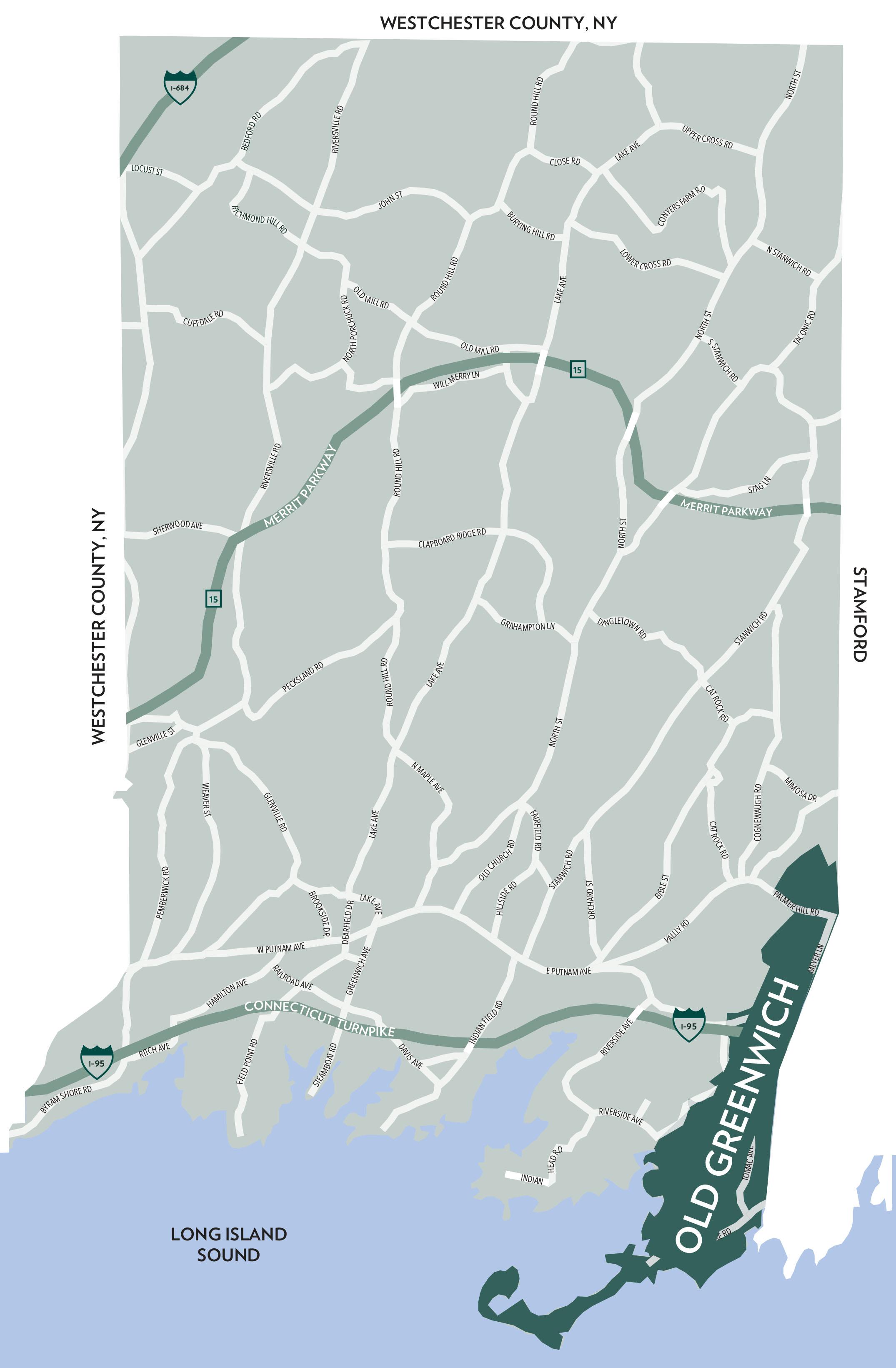

Four of our sub-market geographies in town averaged selling prices at or above the asking price in the third quar ter, including Mid-Country and South of the Post Road in Greenwich, Riverside, and Old Greenwich. Old Green wich was the standout, with homes selling at more than 4% over the asking price in the quarter. Strategic pricing can often result in interest from multiple buyers, which can help push prices higher.

Houlihan Lawrence remains the #1 real estate brokerage serving our destination hometown of Greenwich, Con necticut. We are grateful for our community, loyal clients, world-class agents, and support staff.

With Warm Regards, Liz Nunan President and CEO

HOMES SOLD

Q3

% CHANGE YTD

YTD

% CHANGE

320 -36.3% 535 834 -35.9%

AVERAGE SALE PRICE $3,130,587 $2,940,366 6.5% $3,104,528 $2,974,497 4.4%

MEDIAN SALE PRICE $2,411,250 $2,297,500 5.0% $2,475,000 $2,300,000 7.6%

AVERAGE PRICE PER SQUARE FOOT $717 $653 9.8% $694 $631 10.0%

AVERAGE DAYS ON MARKET

83 -30.1% 79 111 -28.8%

% SALE PRICE TO LIST PRICE 100.5% 98.5% 2.0% 99.8% 97.6% 2.3%

sold

year-to-date.

AS OF SEPTEMBER 30, 2022

PRICE RANGE

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

$0 - $999,999 11 4 3 20 13 2 -45.0% -69.2%

$1,000,000 - $1,999,999 43 11 4 57 32 2 -24.6% -65.6%

$2,000,000 - $2,999,999 36 18 2 47 19 2 -23.4% -5.3% $3,000,000 - $3,999,999 27 12 2 37 14 3 -27.0% -14.3% $4,000,000 - $4,999,999 28 5 6 29 8 4 -3.4% -37.5%

$5,000,000 - $5,999,999 18 7 3 18 3 6 0.0% 133.3%

$6,000,000 - $7,999,999 17 9 2 26 9 3 -34.6% 0.0%

$8,000,000 - $9,999,999 11

MarketTotals

01/01/202209/30/2022

$0 - $999,999

$1,000,000 - $1,999,999

70.0% -100.0%

3 -15.4% -75.0% $10,000,000 and up

-15.7% -35.0%

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/202109/30/2022 10/01/202009/30/2021 % CHANGE 2022/2021

-40.4%

124 -41.1%

335 -37.9% $2,000,000 - $2,999,999 116

-34.6%

-46.0% 157 274 -42.7% $3,000,000 - $3,999,999

127 -44.9% 90 166 -45.8% $4,000,000 - $4,999,999

-3.4%

$5,000,000 - $5,999,999

74 -8.1%

0.0% $6,000,000 - $7,999,999

$8,000,000 - $9,999,999

2.9%

-36.0%

61 -34.4%

21 -28.6% $10,000,000 and up

-26.7%

-33.3% MarketTotals

GREATER GREENWICH -36.7%

Source:

-27.3%

-35.9%

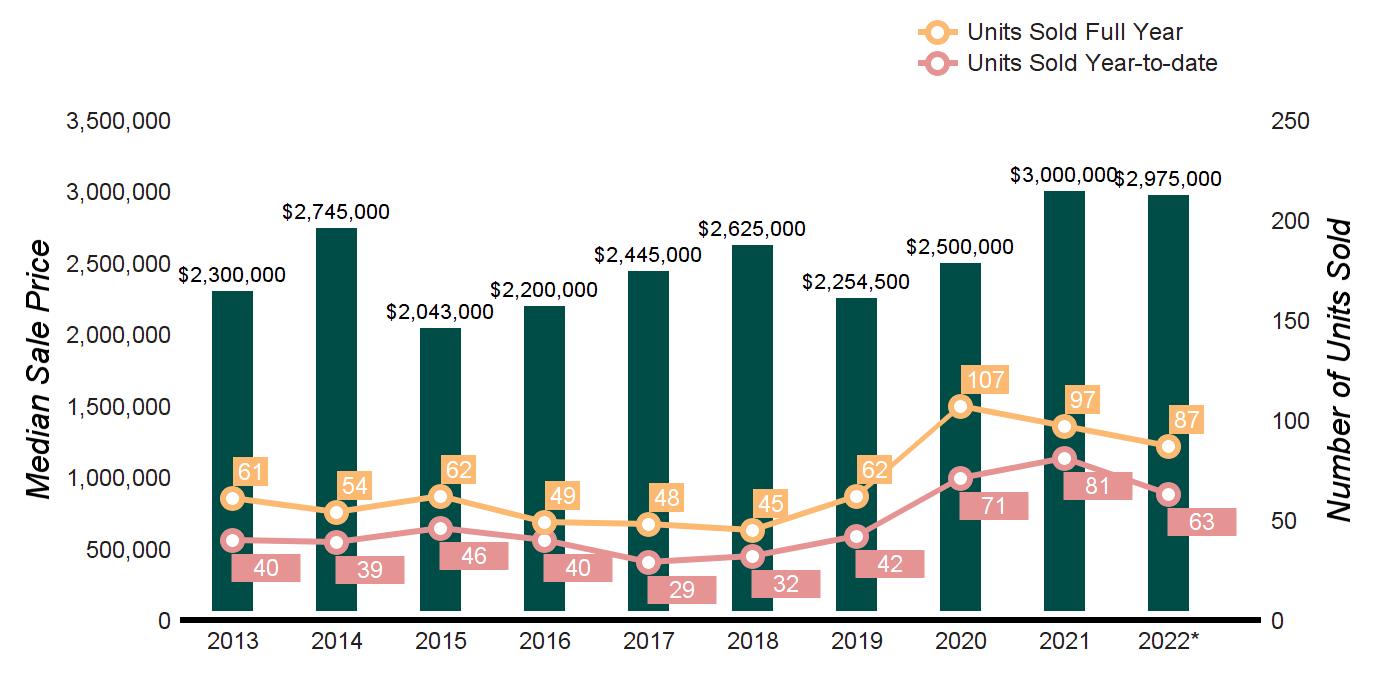

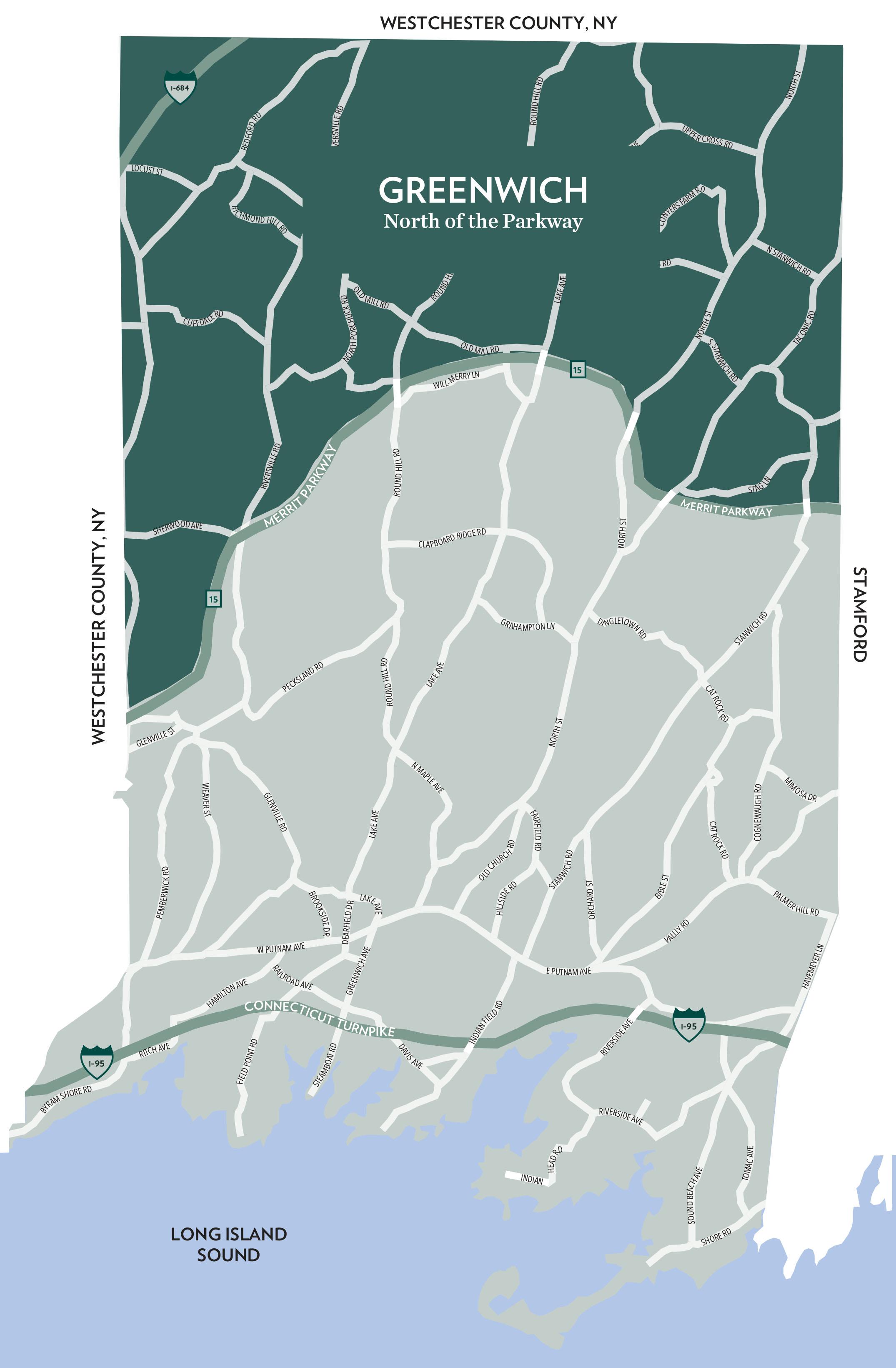

Q3

HOMES SOLD

Q3

% CHANGE YTD

YTD

% CHANGE

27 -7.4% 63 81 -22.2%

AVERAGE SALE PRICE $3,689,278 $4,135,212 -10.8% $3,605,774 $4,057,577 -11.1%

MEDIAN SALE PRICE $3,185,811 $3,100,000 2.8% $2,975,000 $3,000,000 -0.8%

AVERAGE PRICE PER SQUARE FOOT $631 $602 4.8% $606 $565 7.3%

AVERAGE DAYS ON MARKET

% SALE PRICE TO

212 -46.2% 111 168 -33.9%

PRICE 97.1% 97.1% 0.0% 96.6% 96.1% 0.5%

year-to-date.

AS OF SEPTEMBER 30, 2022

PRICE RANGE

$0 - $999,999

$1,000,000 - $1,999,999

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

$2,000,000 - $2,999,999

$4,000,000 - $4,999,999

$5,000,000 - $5,999,999

SUPPLY/ DEMAND RATIO*

AS OF SEPTEMBER 30, 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

2022 vs. 2021

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

0.0% 0.0%

Not Valid -44.4% 0.0%

-33.3% 0.0% $3,000,000 - $3,999,999

Not Valid

Not Valid

$6,000,000 - $7,999,999

$10,000,000 and up

$0 - $999,999

$1,000,000 - $1,999,999

YEAR-TO-DATE

01/01/202209/30/2022

-25.0% -33.3%

83.3% -100.0%

100.0% -100.0%

-28.6% 0.0% $8,000,000 - $9,999,999

Not Valid

Valid

Not Valid

20.0% -100.0%

01/01/202109/30/2021

CHANGE 2022/2021 10/01/202109/30/2022 10/01/202009/30/2021

-80.0%

87.5%

$2,000,000 - $2,999,999

CHANGE 2022/2021

-66.7%

19 -5.3%

-41.9% $3,000,000 - $3,999,999

$5,000,000 - $5,999,999

$6,000,000 - $7,999,999

-38.5%

-35.3%

-12.5%

-33.3%

100.0%

$8,000,000 - $9,999,999

-25.0%

-40.0% $4,000,000 - $4,999,999

-14.3%

100.0%

-100.0%

-50.0%

GREENWICH NORTH -22.2%

-66.7%

-85.7% $10,000,000 and

-32.5%

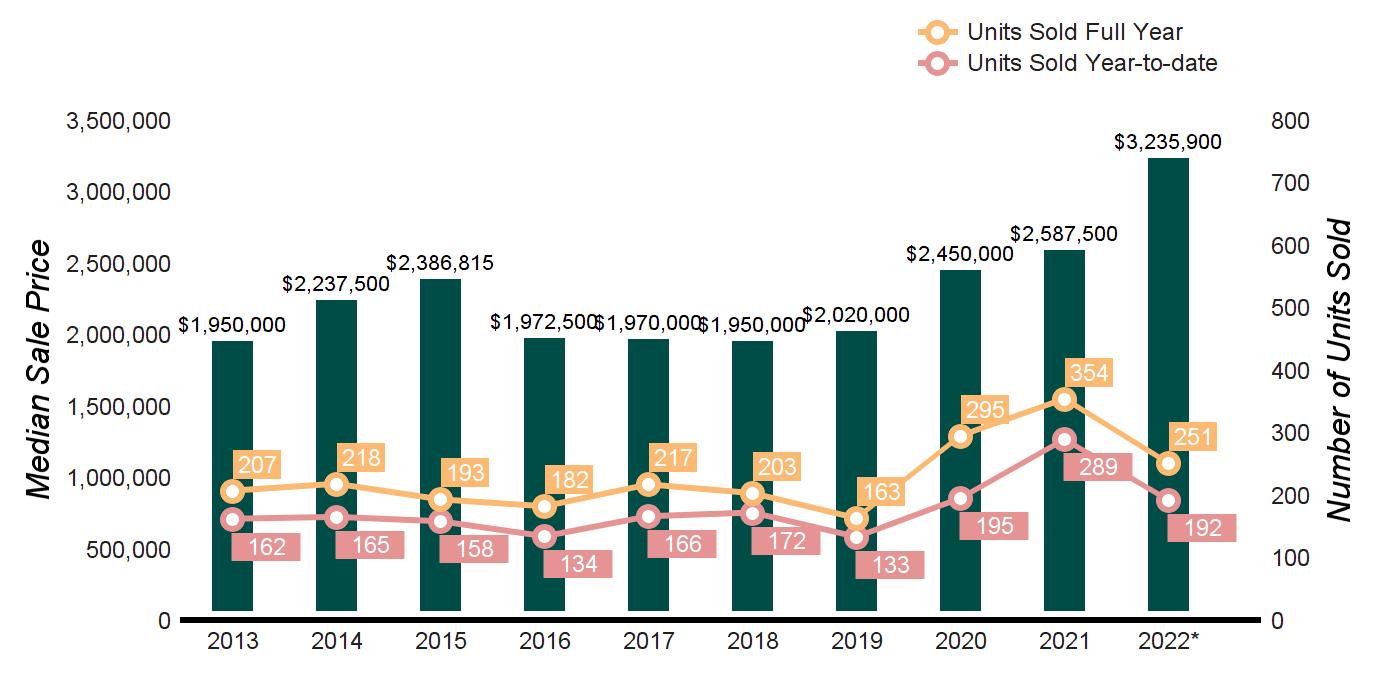

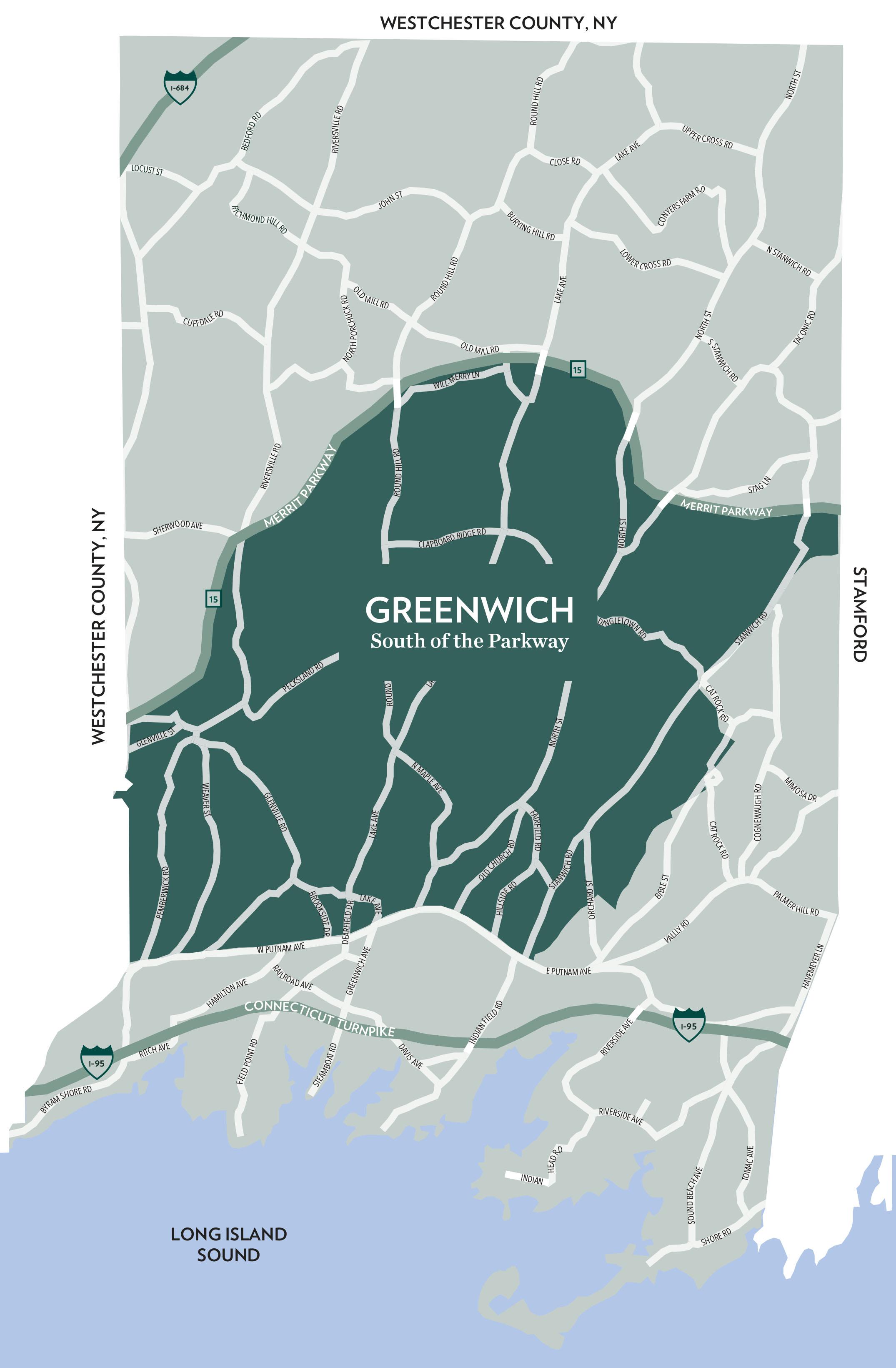

HOMES SOLD

Q3

Q3

% CHANGE YTD

YTD

% CHANGE

112 -37.5% 192 289 -33.6%

AVERAGE SALE PRICE $3,817,764 $3,201,436 19.3% $3,766,640 $3,292,439 14.4%

MEDIAN SALE PRICE $3,197,500 $2,500,000 27.9% $3,235,900 $2,750,000 17.7%

AVERAGE PRICE PER SQUARE FOOT $698 $609 14.6% $675 $591 14.2%

AVERAGE DAYS ON MARKET

95 -22.1% 99 130 -23.8%

% SALE PRICE TO LIST PRICE 100.1% 98.1% 2.0% 99.2% 97.1% 2.2%

year-to-date.

AS OF SEPTEMBER 30, 2022

PRICE RANGE

$0 - $999,999

$1,000,000 - $1,999,999

$2,000,000 - $2,999,999

$3,000,000 - $3,999,999

$4,000,000 - $4,999,999

$5,000,000 - $5,999,999

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

$6,000,000 - $7,999,999

$10,000,000 and up

YEAR-TO-DATE

01/01/202209/30/2022

SUPPLY/ DEMAND RATIO*

AS OF SEPTEMBER 30, 2021

SUPPLY: ACTIVE LISTINGS

$0 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

2022 vs. 2021

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

-42.9% -50.0%

-26.7% -50.0%

-23.1% -66.7%

-43.8% -37.5%

-7.7% -50.0%

-14.3% 200.0%

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/202109/30/2022

-45.9%

-43.6%

-50.0% -66.7%

-57.1% 0.0% $8,000,000 - $9,999,999

-100.0%

10/01/202009/30/2021

CHANGE 2022/2021

45 -40.0%

87 -42.5% $2,000,000 - $2,999,999

-45.6% 55 96 -42.7% $3,000,000 - $3,999,999

$5,000,000 - $5,999,999

$6,000,000 - $7,999,999

-34.0% 40 58 -31.0% $4,000,000 - $4,999,999

-11.5%

11.8%

-34.6%

32 -12.5%

24 -16.7%

31 -35.5% $8,000,000 - $9,999,999

-10.0%

GREENWICH SOUTH -33.6%

12 -8.3% $10,000,000 and up

66.7%

50.0%

PARKWAY -33.9%

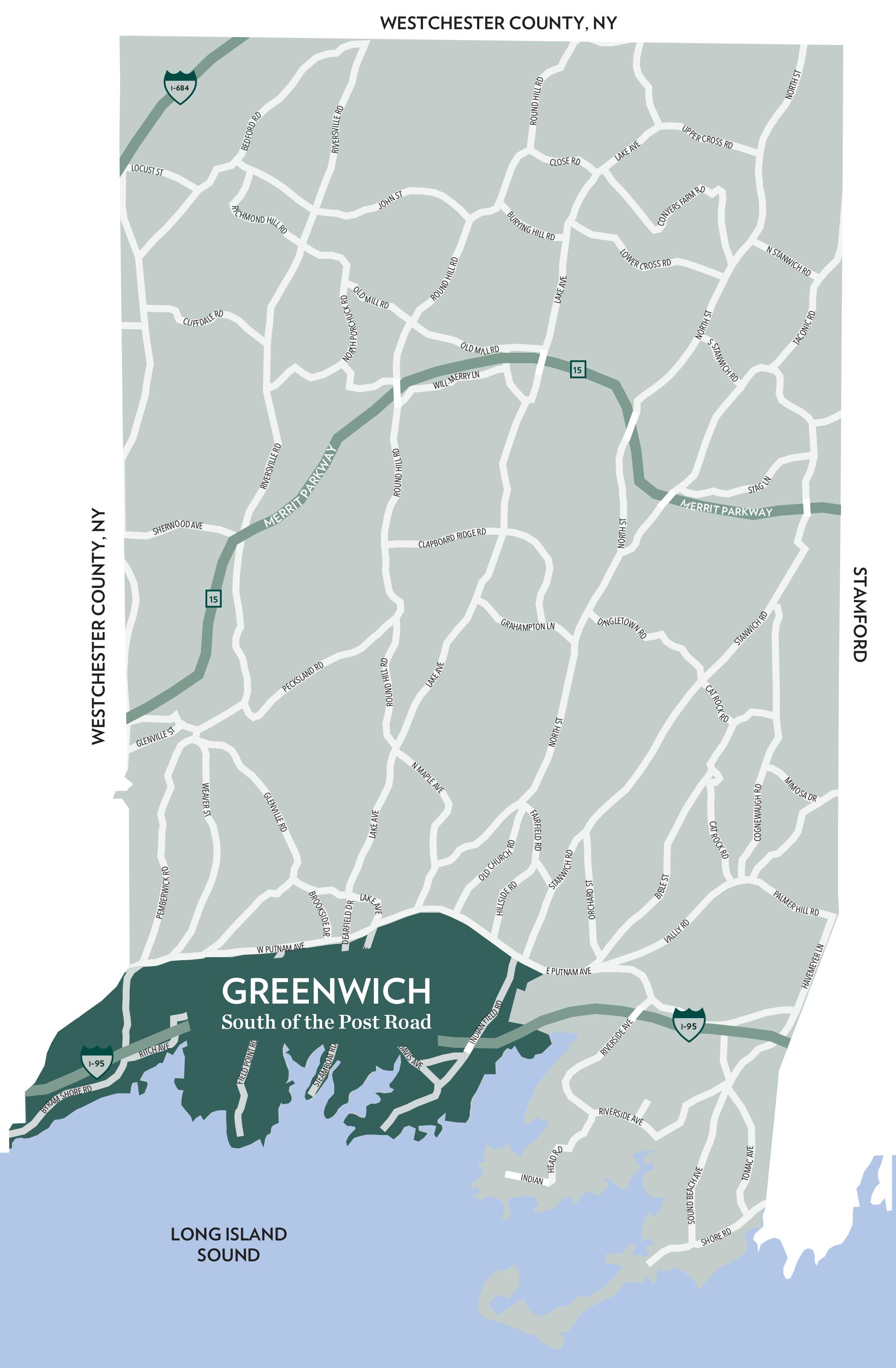

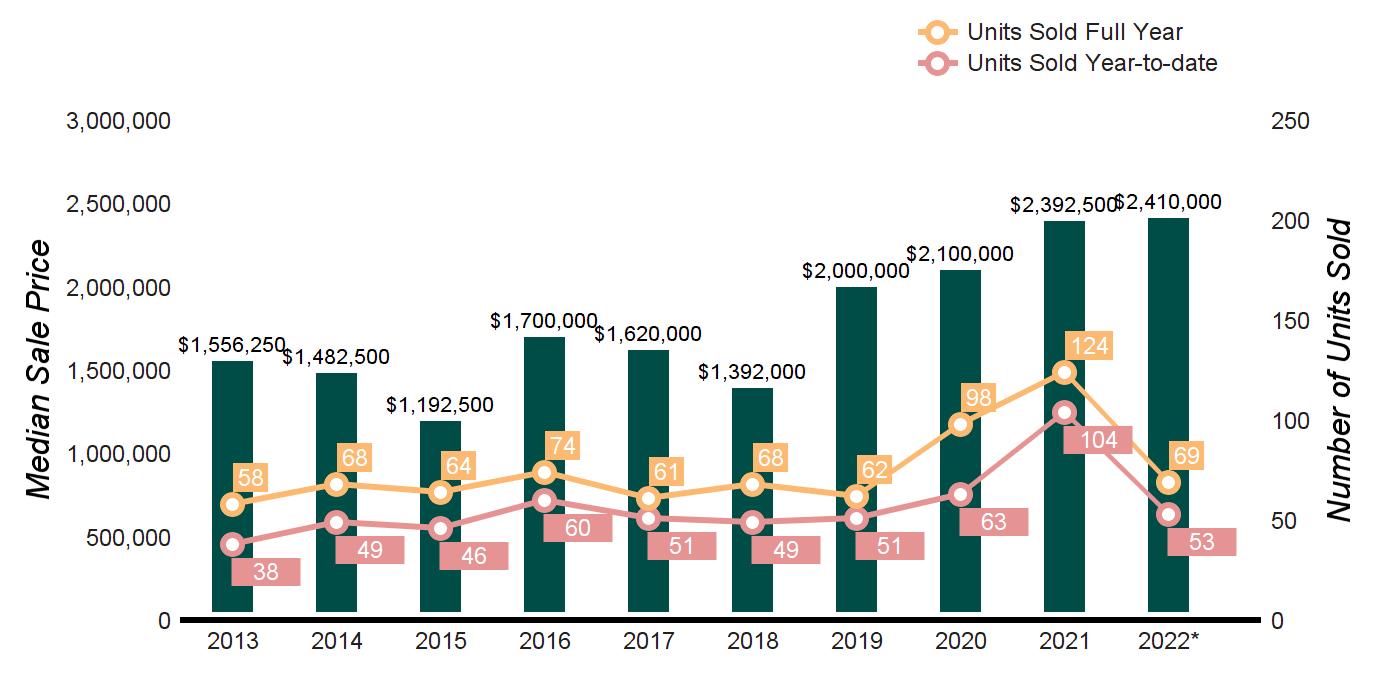

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE

HOMES SOLD 15 34 -55.9% 53 104 -49.0%

AVERAGE SALE PRICE $3,757,800 $3,289,024 14.3% $3,209,018 $3,428,421 -6.4%

MEDIAN SALE PRICE $4,400,000 $2,247,500 95.8% $2,410,000 $2,362,500 2.0%

AVERAGE PRICE PER SQUARE FOOT $768 $688 11.6% $712 $704 1.1%

AVERAGE DAYS ON MARKET 35 84 -58.3% 92 140 -34.3%

% SALE PRICE TO LIST PRICE 100.2% 97.1% 3.2% 100.2% 96.4% 3.9%

sold for 2022 are annualized based

sales year-to-date.

PRICE RANGE

AS OF SEPTEMBER 30, 2022

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

$0 - $999,999 2 1 2

$1,000,000 - $1,999,999 3

$2,000,000 - $2,999,999

$4,000,000 - $4,999,999 1

$5,000,000 - $5,999,999 1

SUPPLY/ DEMAND RATIO*

Not Valid

AS OF SEPTEMBER 30, 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

2022 vs. 2021

% CHANGE IN LISTINGS

2

% CHANGE IN PENDINGS

2 -66.7% -66.7%

1 -50.0% -100.0%

2 5 -11.1% 0.0% $3,000,000 - $3,999,999 3

$6,000,000 - $7,999,999

$10,000,000 and up

$0 - $999,999

$1,000,000 - $1,999,999

YEAR-TO-DATE

01/01/202209/30/2022

-40.0% -50.0%

-66.7% 0.0%

Not Valid 0.0% 0.0%

300.0% 200.0% $8,000,000 - $9,999,999

Not Valid

01/01/202109/30/2021

Not Valid 0.0% 0.0%

Not Valid

CHANGE 2022/2021 10/01/202109/30/2022

-35.3%

-64.3%

$2,000,000 - $2,999,999

10/01/202009/30/2021

CHANGE 2022/2021

-48.0%

-60.0%

25 -56.0% $3,000,000 - $3,999,999

$5,000,000 - $5,999,999

-63.2%

-62.5% $4,000,000 - $4,999,999

$6,000,000 - $7,999,999

-63.6%

-11.1%

80.0%

0.0%

100.0%

-76.9% $8,000,000 - $9,999,999

-77.8%

Not Valid

100.0% $10,000,000 and

GREENWICH -55.6%

-83.3%

-47.5%

Q3 2022 Q3

% CHANGE YTD 2022 YTD

% CHANGE

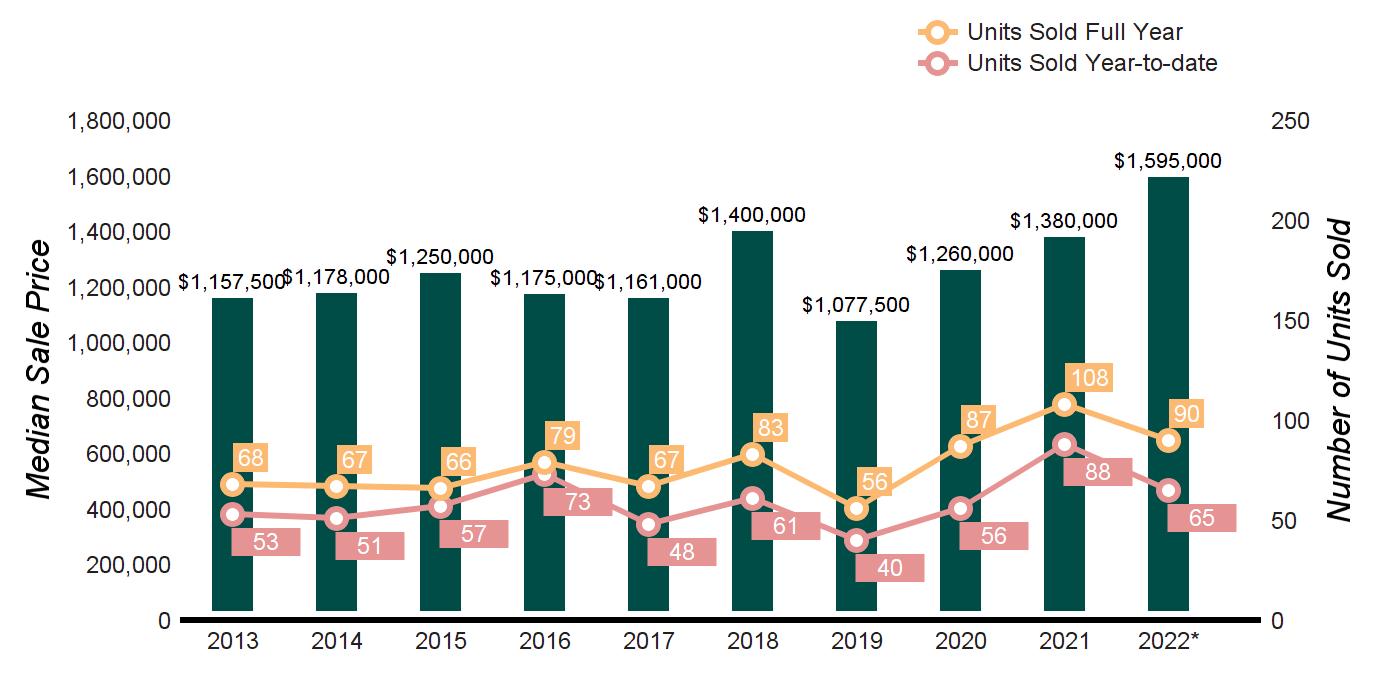

HOMES SOLD 19 39 -51.3% 65 88 -26.1%

AVERAGE SALE PRICE $1,647,296 $1,859,569 -11.4% $1,772,275 $1,678,275 5.6%

MEDIAN SALE PRICE $1,600,000 $1,895,000 -15.6% $1,595,000 $1,397,000 14.2%

AVERAGE PRICE PER SQUARE FOOT $580 $547 6.0% $581 $527 10.2%

AVERAGE DAYS ON MARKET 49 60 -18.3% 50 101 -50.5%

% SALE PRICE TO LIST PRICE 99.2% 98.4% 0.8% 101.4% 97.8% 3.7%

sold for 2022 are

based

sales year-to-date.

AS OF SEPTEMBER 30, 2022

PRICE RANGE

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

$0 - $999,999 2 0 Not Valid 2 4 1 0.0% -100.0%

$1,000,000 - $1,999,999 17 0 Not Valid 15 7 2 13.3% -100.0%

$2,000,000 - $2,999,999 1 2 1 3 1 3 -66.7% 100.0% $3,000,000 - $3,999,999 2 1 2 2 0 Not Valid 0.0% 0.0% $4,000,000 - $4,999,999 0 0 Not Valid 0

$5,000,000 - $5,999,999

0 0 Not Valid 0

$6,000,000 - $7,999,999 0 0 Not Valid 0

Not Valid 0.0% 0.0%

Not Valid 0.0% 0.0%

Not Valid 0.0% 0.0%

$8,000,000 - $9,999,999

Not Valid

Not Valid

Not Valid 0.0% 0.0%

Not Valid 0.0% 0.0% $10,000,000 and up

0.0% -75.0%

$0 - $999,999

$1,000,000 - $1,999,999

$2,000,000 - $2,999,999

$3,000,000 - $3,999,999

$4,000,000 - $4,999,999

$5,000,000 - $5,999,999

$6,000,000 - $7,999,999

$8,000,000 - $9,999,999

$10,000,000 and up

YEAR-TO-DATE

01/01/202209/30/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/202109/30/2022 10/01/202009/30/2021 % CHANGE 2022/2021

-28.6%

-29.2%

-15.8%

-33.3%

0.0%

Not Valid

Not Valid

Not Valid

Not Valid

COS COB MarketTotals

-26.1%

22 -31.8%

65 -29.2%

25 -28.0%

6 -16.7%

0.0%

Not Valid

Not Valid

Not Valid

Not Valid

-28.6%

Q3 2022 Q3

% CHANGE YTD

YTD

% CHANGE

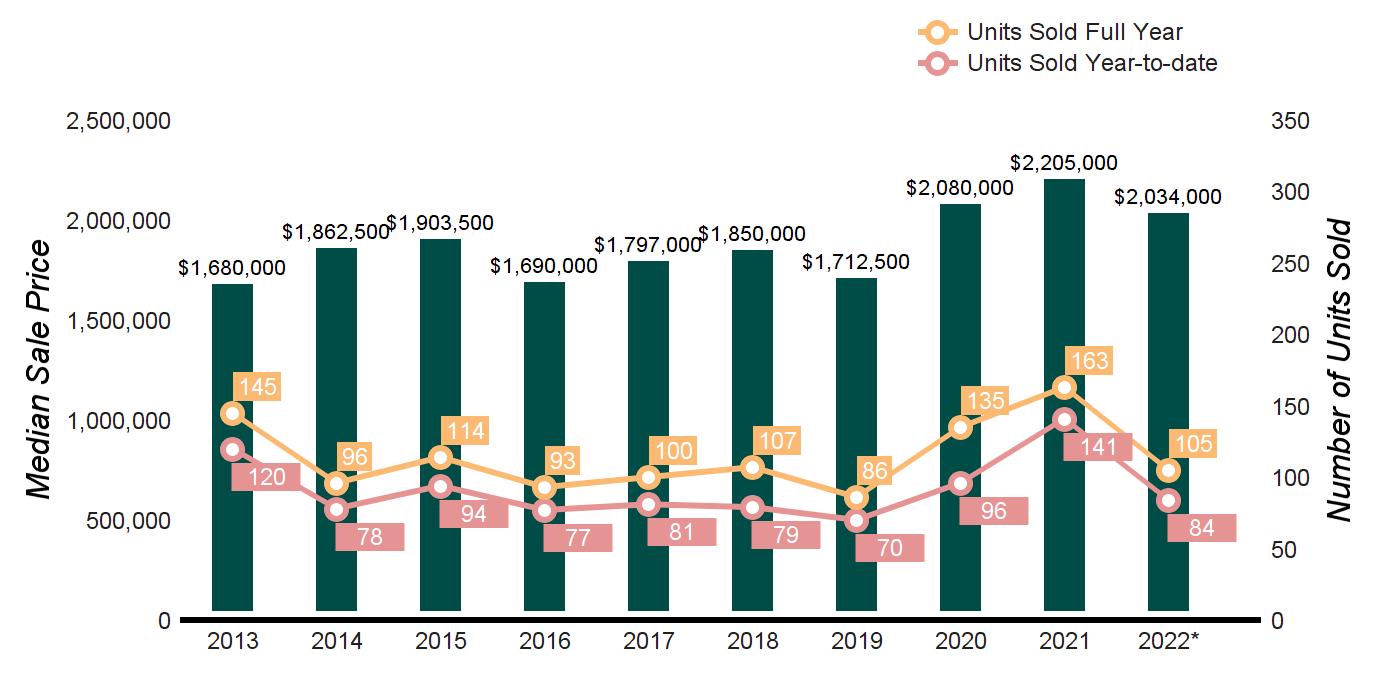

HOMES SOLD 36 51 -29.4% 84 141 -40.4%

AVERAGE SALE PRICE $2,570,152 $2,537,539 1.3% $2,521,627 $2,538,161 -0.7%

MEDIAN SALE PRICE $1,932,500 $2,195,000 -12.0% $2,034,000 $2,200,000 -7.5%

AVERAGE PRICE PER SQUARE FOOT $774 $691 12.0% $769 $663 16.0%

AVERAGE DAYS ON MARKET 38 56 -32.1% 53 76 -30.3%

% SALE PRICE TO LIST PRICE 102.0% 100.8% 1.2% 102.1% 99.8% 2.3%

sold

sales year-to-date.

AS OF SEPTEMBER 30, 2022

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

$0 - $999,999 2 1 2 3 2 2 -33.3% -50.0%

$1,000,000 - $1,999,999 2 2 1 9 2 5 -77.8% 0.0%

$2,000,000 - $2,999,999 6 6 1 7 1 7 -14.3% 500.0% $3,000,000 - $3,999,999 5 1 5 5 1 5 0.0% 0.0% $4,000,000 - $4,999,999 2 2 1 3 1 3 -33.3% 100.0%

$5,000,000 - $5,999,999 0 2 0 2 1 2 -100.0% 100.0%

$6,000,000 - $7,999,999 1 0 Not Valid 0 1 0 0.0% -100.0%

$8,000,000 - $9,999,999

$0 - $999,999

$1,000,000 - $1,999,999

0.0% 0.0% $10,000,000 and up

01/01/202209/30/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/202109/30/2022 10/01/202009/30/2021 % CHANGE 2022/2021

-41.7%

-29.2%

$2,000,000 - $2,999,999

$4,000,000 - $4,999,999

$5,000,000 - $5,999,999

$6,000,000 - $7,999,999

$8,000,000 - $9,999,999

$10,000,000 and

15 -33.3%

-37.5%

-55.0%

-50.0%

28.6%

-66.7%

-75.0%

Not Valid

RIVERSIDE Not Valid

-40.4%

32 -56.3%

47 -53.2% $3,000,000 - $3,999,999

22.2%

-14.3%

-50.0%

Not Valid

-100.0%

-41.1%

Q3

Q3

% CHANGE YTD

YTD

% CHANGE

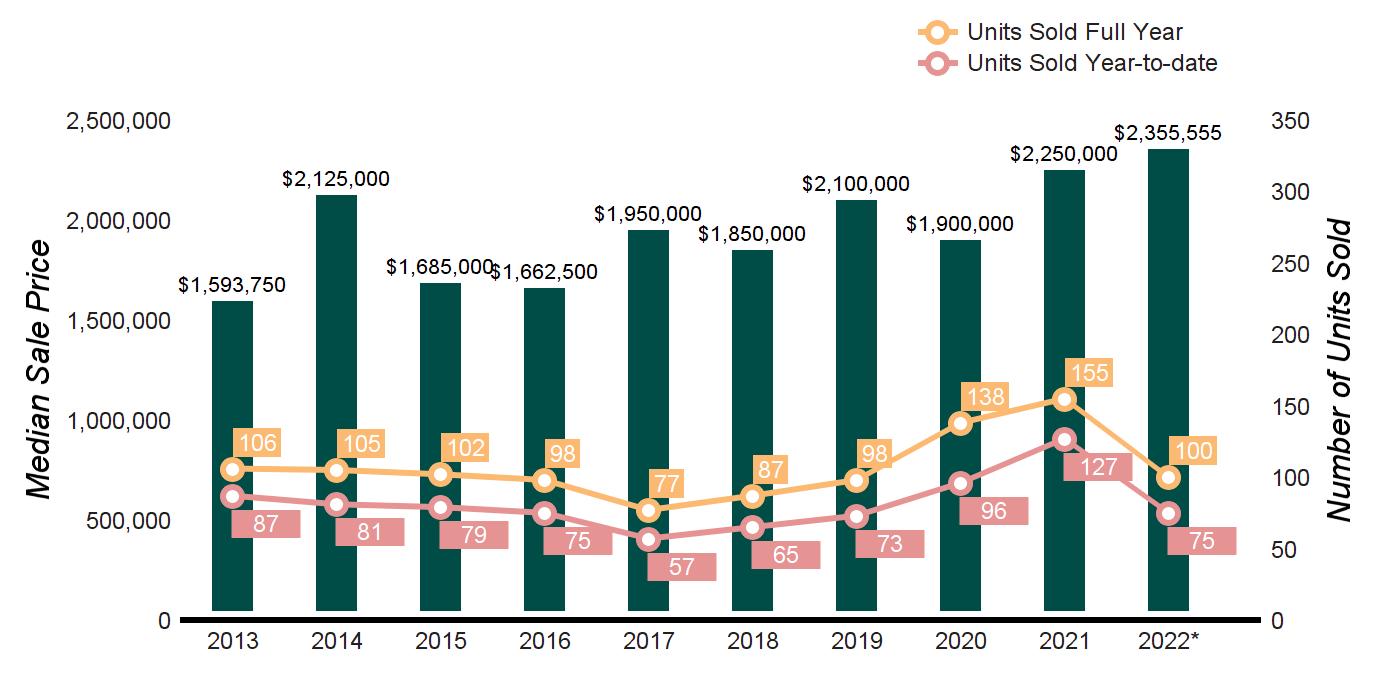

HOMES SOLD 37 57 -35.1% 75 127 -40.9%

AVERAGE SALE PRICE $2,597,357 $2,753,353 -5.7% $2,751,838 $2,609,975 5.4%

MEDIAN SALE PRICE $2,433,333 $2,250,000 8.1% $2,355,555 $2,250,000 4.7%

AVERAGE PRICE PER SQUARE FOOT $807 $789 2.3% $817 $747 9.4%

AVERAGE DAYS ON MARKET 23 38 -39.5% 45 58 -22.4%

% SALE PRICE TO LIST PRICE 104.1% 99.3% 4.8% 102.5% 99.1% 3.4%

sold

sales year-to-date.

AS OF SEPTEMBER 30, 2022

PRICE RANGE

$0 - $999,999

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

1 0 Not Valid 2 0 Not Valid -50.0% 0.0%

$1,000,000 - $1,999,999 5 3 2 2 8 1 150.0% -62.5%

$2,000,000 - $2,999,999 3 4 1 3 5 1 0.0% -20.0% $3,000,000 - $3,999,999 2 2 1 1 0 Not Valid 100.0% 0.0% $4,000,000 - $4,999,999 2 0 Not Valid 4 0 Not Valid -50.0% 0.0%

$5,000,000 - $5,999,999

1 1 1 0 0 Not Valid 0.0% 0.0%

$6,000,000 - $7,999,999 1 0 Not Valid 4 1 4 -75.0% -100.0%

$8,000,000 - $9,999,999 0

$0 - $999,999

$1,000,000 - $1,999,999

YEAR-TO-DATE

01/01/202209/30/2022

Not Valid

Not Valid

Not Valid 0.0% 0.0%

Not Valid 0.0% 0.0% $10,000,000 and up 1

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/202109/30/2022 10/01/202009/30/2021 % CHANGE 2022/2021

0.0%

-38.6%

8 -50.0%

62 -38.7%

$2,000,000 - $2,999,999

$4,000,000 - $4,999,999

-47.6%

-63.6%

0.0%

29 -65.5%

49 -32.7% $3,000,000 - $3,999,999

-20.0%

$5,000,000 - $5,999,999

$8,000,000 - $9,999,999

100.0%

-42.9%

Not Valid

OLD GREENWICH $10,000,000 and

Not

-22.2%

100.0% $6,000,000 - $7,999,999

-100.0%

Not Valid

HOMES

Q3

% CHANGE

YTD

% CHANGE

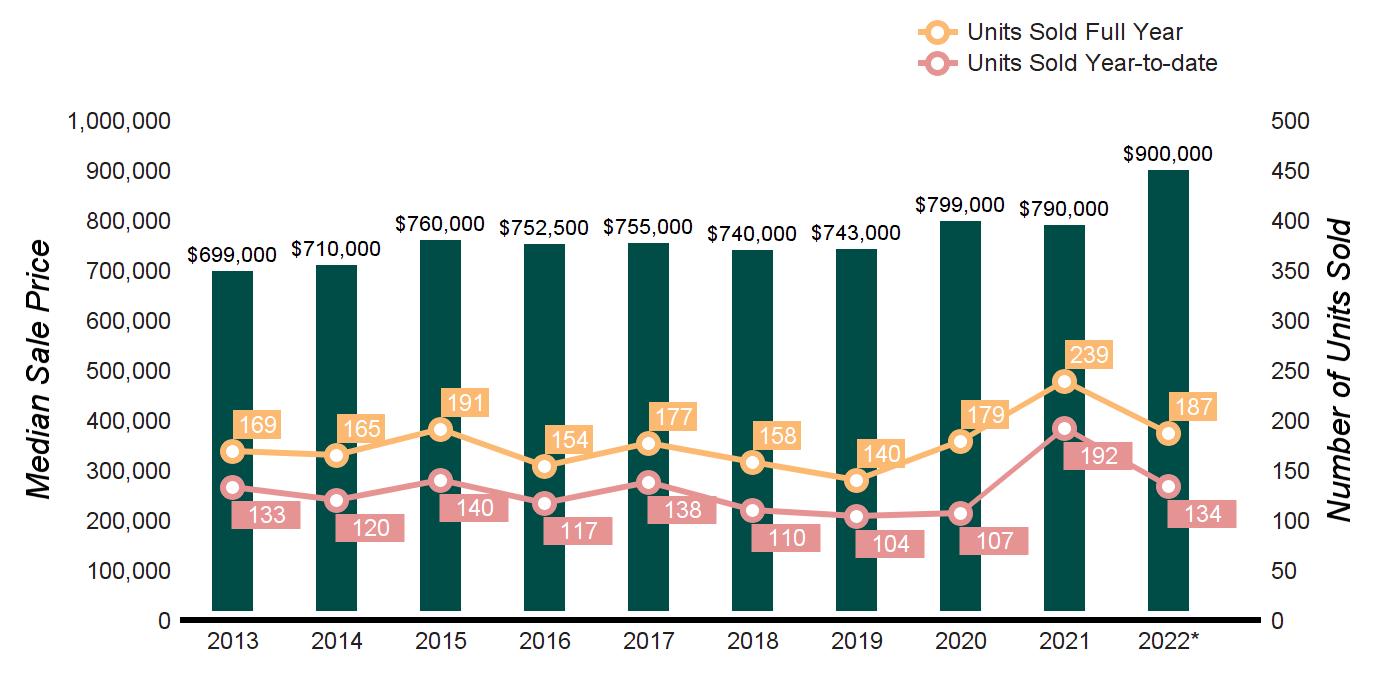

-42.9% 134 192 -30.2%

AVERAGE SALE PRICE $1,453,097 $1,138,967 27.6% $1,250,163 $1,062,445 17.7%

MEDIAN SALE PRICE $992,500 $780,000 27.2% $900,000 $771,625 16.6%

AVERAGE PRICE

AVERAGE DAYS

SQUARE FOOT $613 $583 5.1% $599 $541 10.7%

MARKET

112 -64.3% 61 117 -47.9%

98.3% 3.5% 101.8% 97.8% 4.1%

year-to-date.

AS OF SEPTEMBER 30, 2022

PRICE RANGE

$0 - $999,999

$1,000,000 - $1,999,999

$2,000,000 - $2,999,999

$3,000,000 - $3,999,999

$4,000,000 - $4,999,999

$5,000,000 - $5,999,999

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

2022 vs. 2021

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

70.6% 30.8%

-42.9% 200.0%

-30.8% -75.0%

-16.7% 100.0%

Not Valid -100.0% 0.0%

Not Valid

Not Valid 0.0% 0.0%

$6,000,000 - $7,999,999

$10,000,000 and up

$0 - $999,999

$1,000,000 - $1,999,999

01/01/2022 -

Not Valid

Not Valid 0.0% 0.0% $8,000,000 - $9,999,999

Not Valid

Not Valid

01/01/2021 -

CHANGE 2022/2021 10/01/202109/30/2022 10/01/202009/30/2021

-43.9%

-5.1%

CHANGE 2022/2021

-43.2%

-9.1%

$2,000,000 - $2,999,999

44.4%

26.7% $3,000,000 - $3,999,999

$5,000,000 - $5,999,999

$6,000,000 - $7,999,999

$8,000,000 - $9,999,999

-30.0%

50.0%

Not Valid

Not Valid

Not Valid

Not Valid

50.0%

-43.8% $4,000,000 - $4,999,999

Not Valid

Not

GREATER GREENWICH CONDOMINIUMS Not Valid $10,000,000 and

Not

Leading Real Estates Companies of the World | Luxury Portfolio International Mayfair International Realty | Board of Regents Luxury Real Estate