Market

A myriad of data points indicate buyer demand remains strong in luxury markets north of NYC, defying broader trends in luxury real estate.

Westchester ($2M and higher) and Putnam/Dutchess counties ($1M and higher) realized respectable gains in year-to-date closed sales. Luxury markets in CT (Greenwich, $3M and higher; Darien, Rowayton, and New Canaan, $2M and higher) posted a decline for the fourth consecutive quarter. Buyer demand is not waning, but the supply of homes for sale is, resulting in fewer closed sales.

Closed sales are a lagging indicator, and pended sales (expected to close within 2 to 3 months) provide a timelier look at the market. In Southern Westchester, pended sales are slightly higher than the same period last year; however, in Northern Westchester, pended sales declined by one-third, and supply inched lower. Dutchess and Putnam counties are level with last year, with supply declining.

In Greenwich, both inventory and pended sales are down. However, homes are selling faster and at the asking price, pointing to a healthy market that is suffering only from a lack of product. The $10M price range is the exception - supply has nearly doubled compared to last year with no pended sales. Fifteen homes closed at $10M+ in 2021 and in 2020, compared to 8 closed sales so far this year.

In Darien, Rowayton, and New Canaan, pended sales climbed by double-digits, and homes are selling more quickly than in the same period last year. There is an appetite for new inventory, underscoring the sustained buoyancy of the luxury market.

Despite the headlines of a housing downturn, we are fortunate to live in an area that is bucking the trends for now. If you currently have a home for sale that is not generating activity or offers, the price and presentation of your home could be standing in the way of a timely sale. Buyers are motivated, decisive, and knowledgeable. They are quick to say yes to a listing that meets their criteria and swift to discard it if they perceive a listing to be overpriced and visually underwhelming.

Luxury real estate relies on demand from high-net-worth individuals (HNWI). The rapid downturn in the stock market and the threat of wealth erosion is a tangible fear. Continued declines can negatively impact HNWI's desire for luxury real estate sales. Until then, it's an opportune time to be a seller north of NYC.

Sincerely,

Anthony P. Cutugno Sr. Vice President, Director of Private BrokerageQ3 2022 Q3 2021 % CHANGE

YTD 2022 YTD 2021 % CHANGE

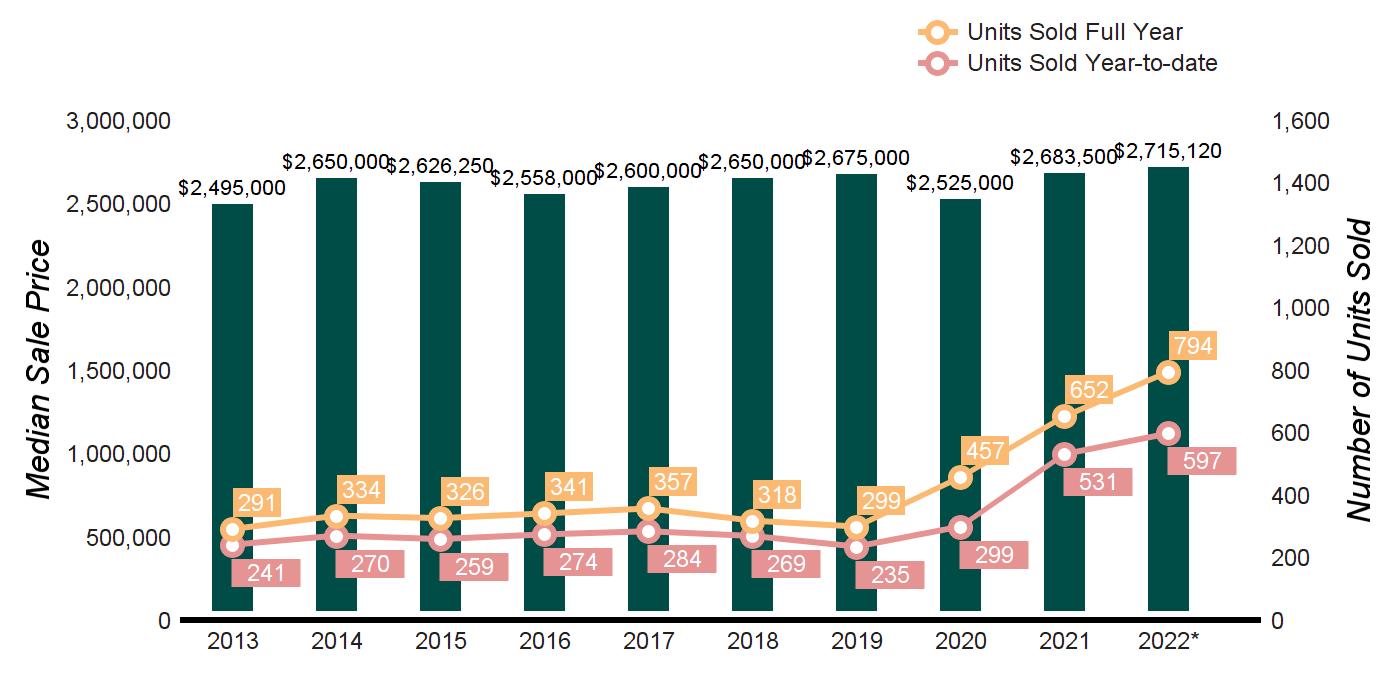

HOMES SOLD 267 242 10.3% 597 531 12.4%

TOTAL DOLLAR VOLUME $815,892,881 $708,597,314 15.1% $1,853,600,982 $1,598,037,626 16.0%

MEDIAN SALE PRICE $2,750,000 $2,622,500 4.9% $2,715,120 $2,650,000 2.5%

AVERAGE PRICE PER SQUARE FOOT $613 $545 12.5% $607 $546 11.2%

AVERAGE DAYS ON MARKET 36 54 -33.3% 45 75 -40.0%

% SALE PRICE TO LIST PRICE 103.7% 99.4% 4.3% 102.7% 98.2% 4.6%

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE

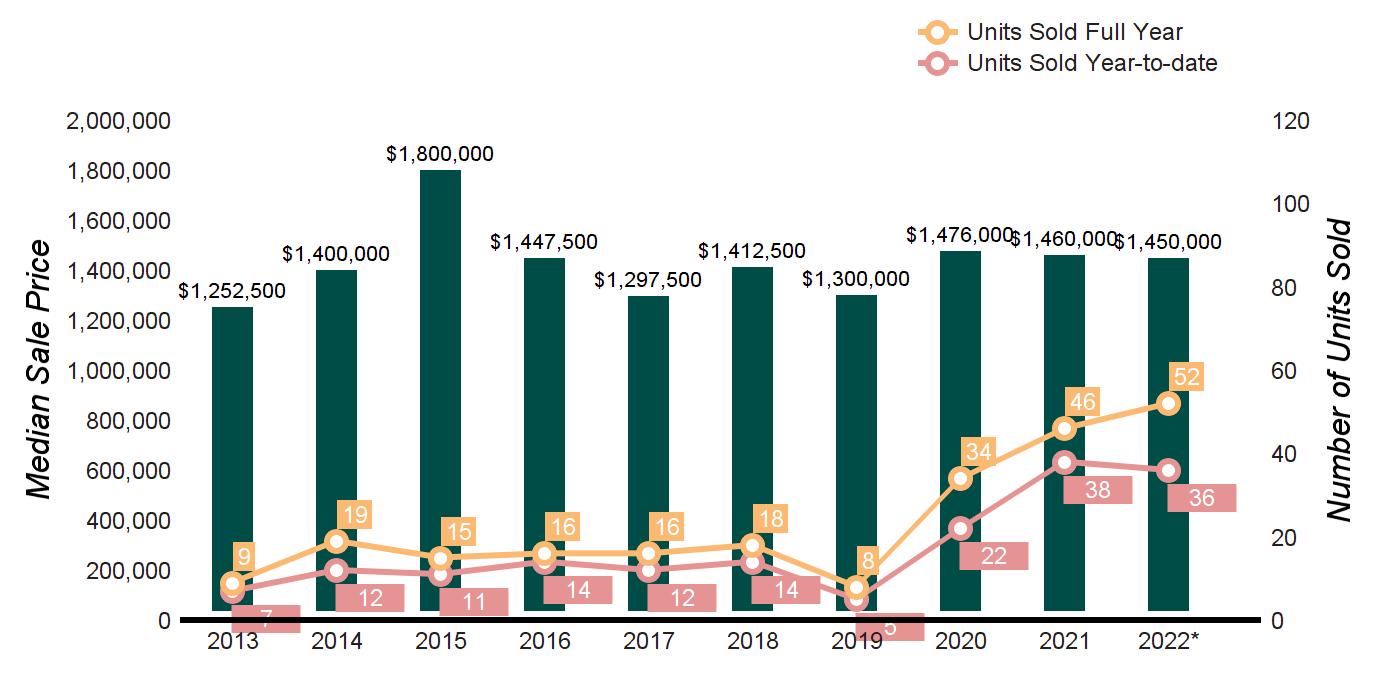

UNITS SOLD 32 46 -30.4% 121 118 2.5%

TOTAL DOLLAR VOLUME $77,390,997 $83,443,000 -7.3% $237,623,297 $239,733,306 -0.9%

MEDIAN SALE PRICE $1,450,000 $1,550,000 -6.5% $1,450,000 $1,590,115 -8.8%

AVERAGE PRICE PER SQUARE FOOT $456 $450 1.3% $441 $459 -3.9%

AVERAGE DAYS ON MARKET 116 179 -35.2% 158 182 -13.2%

% SALE PRICE TO LIST PRICE 89.4% 98.6% -9.3% 94.2% 95.8% -1.7%

Q3 2022 Q3 2021 % CHANGE

YTD 2022 YTD 2021 % CHANGE

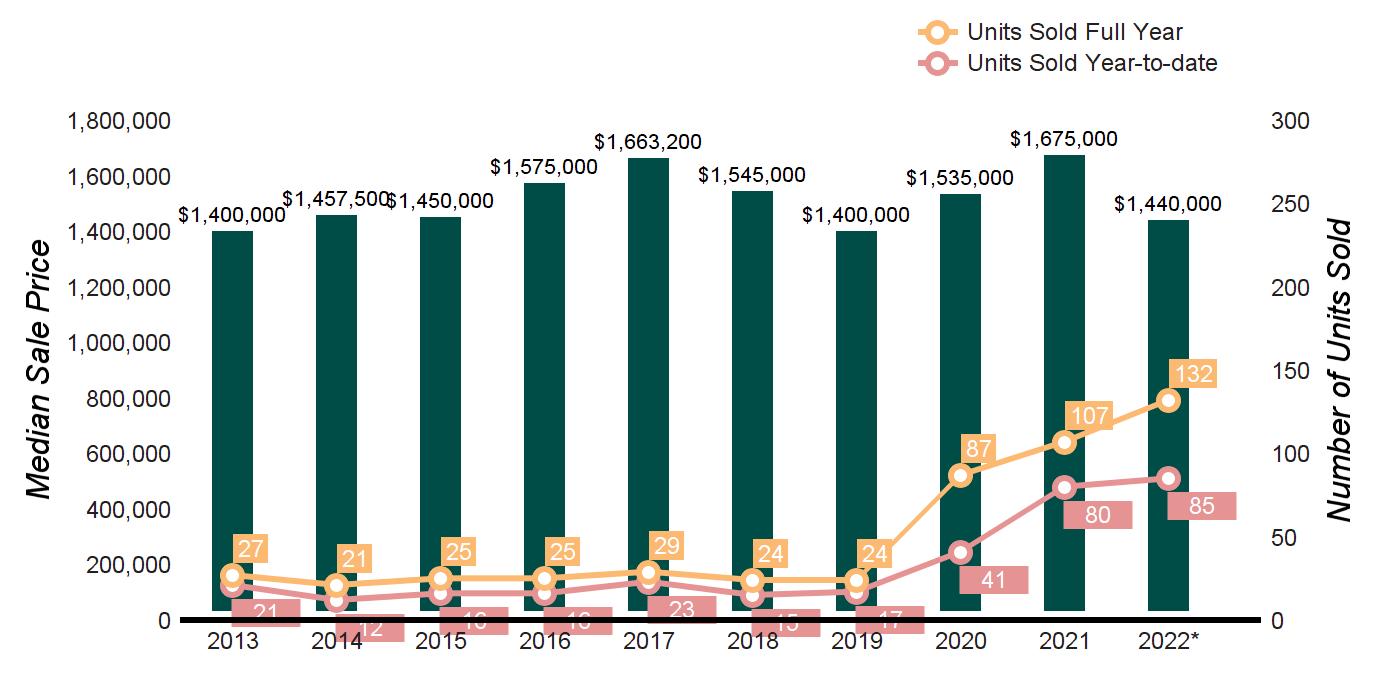

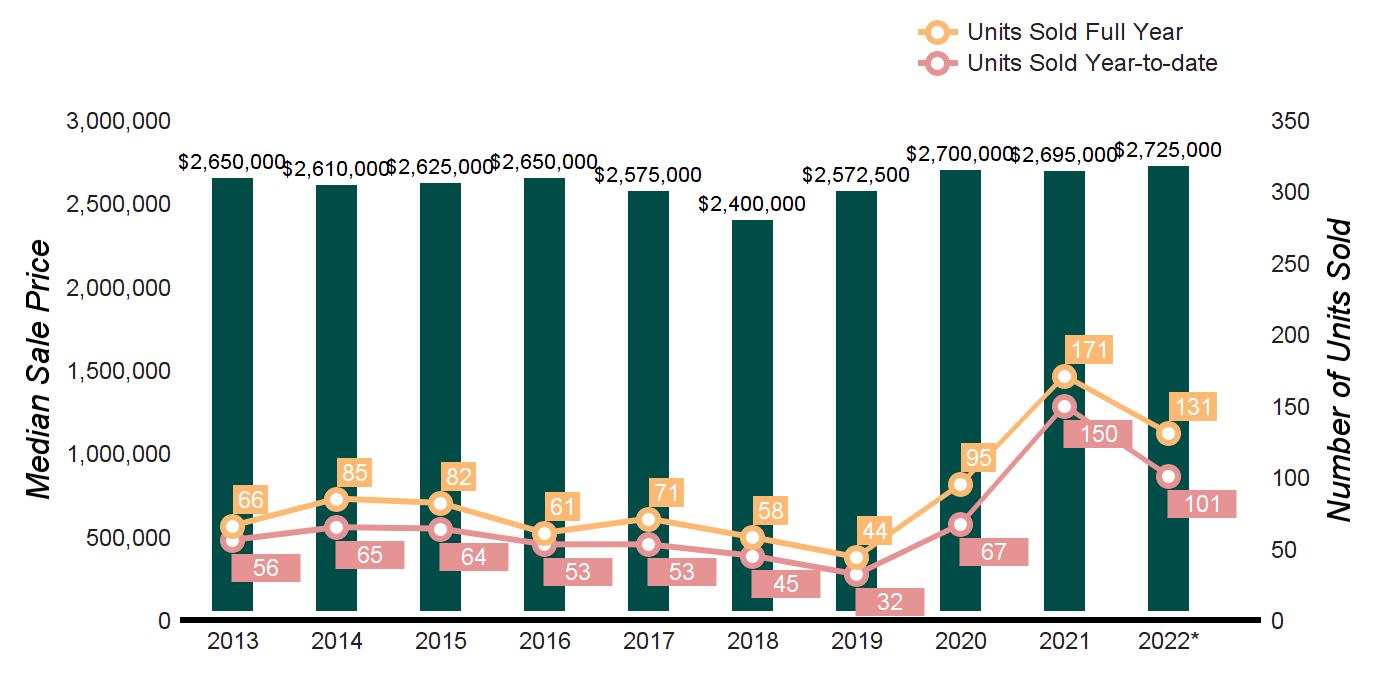

HOMES SOLD 85 120 -29.2% 223 309 -27.8%

TOTAL DOLLAR VOLUME $433,588,786 $597,638,896 -27.4% $1,136,746,613 $1,590,983,716 -28.6%

MEDIAN SALE PRICE $4,650,000 $4,237,500 9.7% $4,510,000 $4,275,000 5.5%

AVERAGE PRICE PER SQUARE FOOT $801 $793 1.0% $792 $761 4.1%

AVERAGE DAYS ON MARKET

SALE PRICE TO LIST PRICE

135 -49.6% 90 143 -37.1%

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE

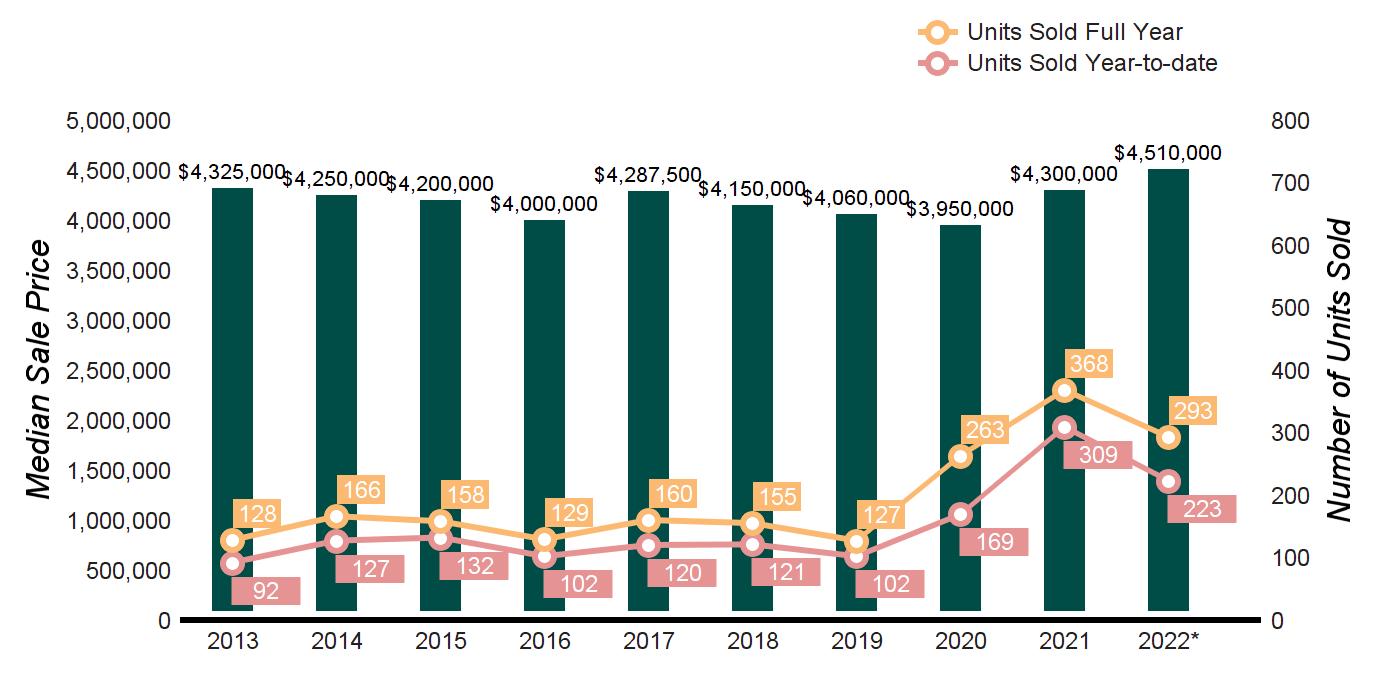

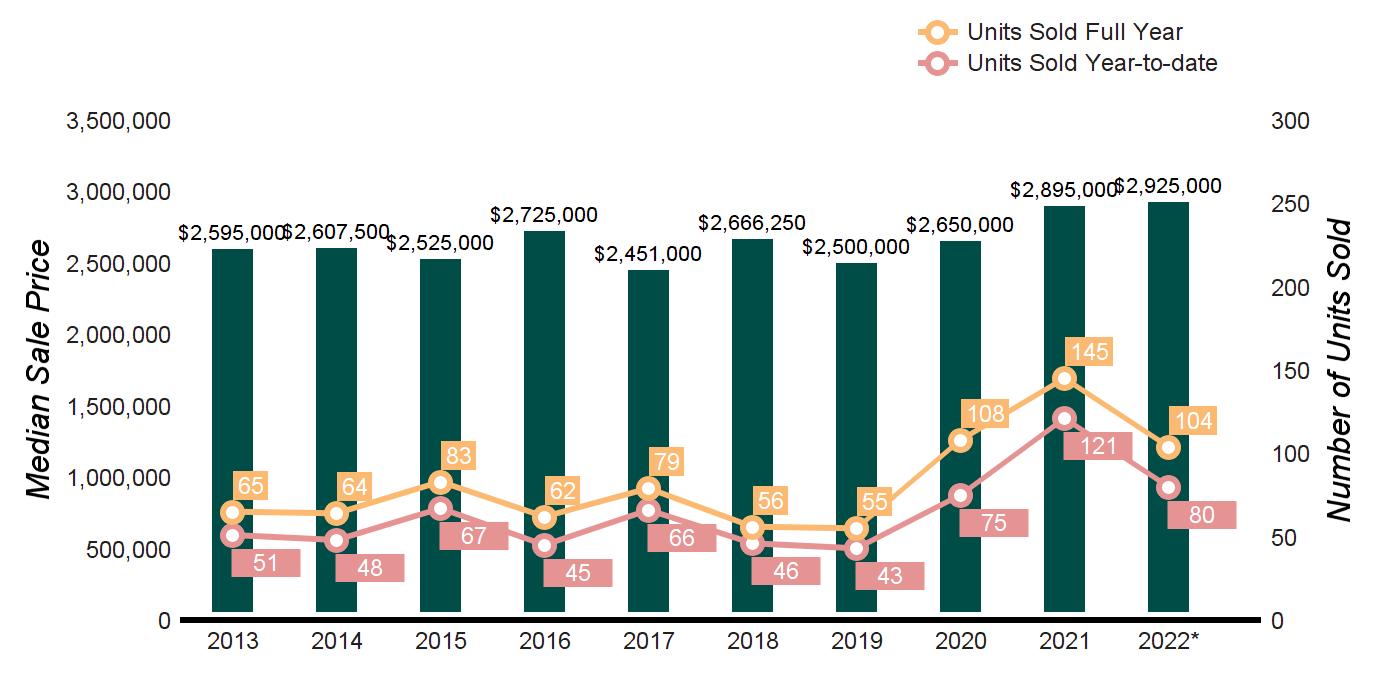

HOMES SOLD 30 48 -37.5% 80 121 -33.9%

TOTAL DOLLAR VOLUME $93,710,000 $154,880,781 -39.5% $257,358,997 $378,420,032 -32.0%

MEDIAN SALE PRICE $2,862,500 $2,775,000 3.2% $2,925,000 $2,800,000 4.5%

AVERAGE PRICE PER SQUARE FOOT $605 $564 7.3% $609 $561 8.6%

AVERAGE DAYS ON MARKET 25 50 -50.0% 41 91 -54.9%

% SALE PRICE TO LIST PRICE 103.4% 99.4% 4.0% 102.2% 98.5% 3.8%

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE

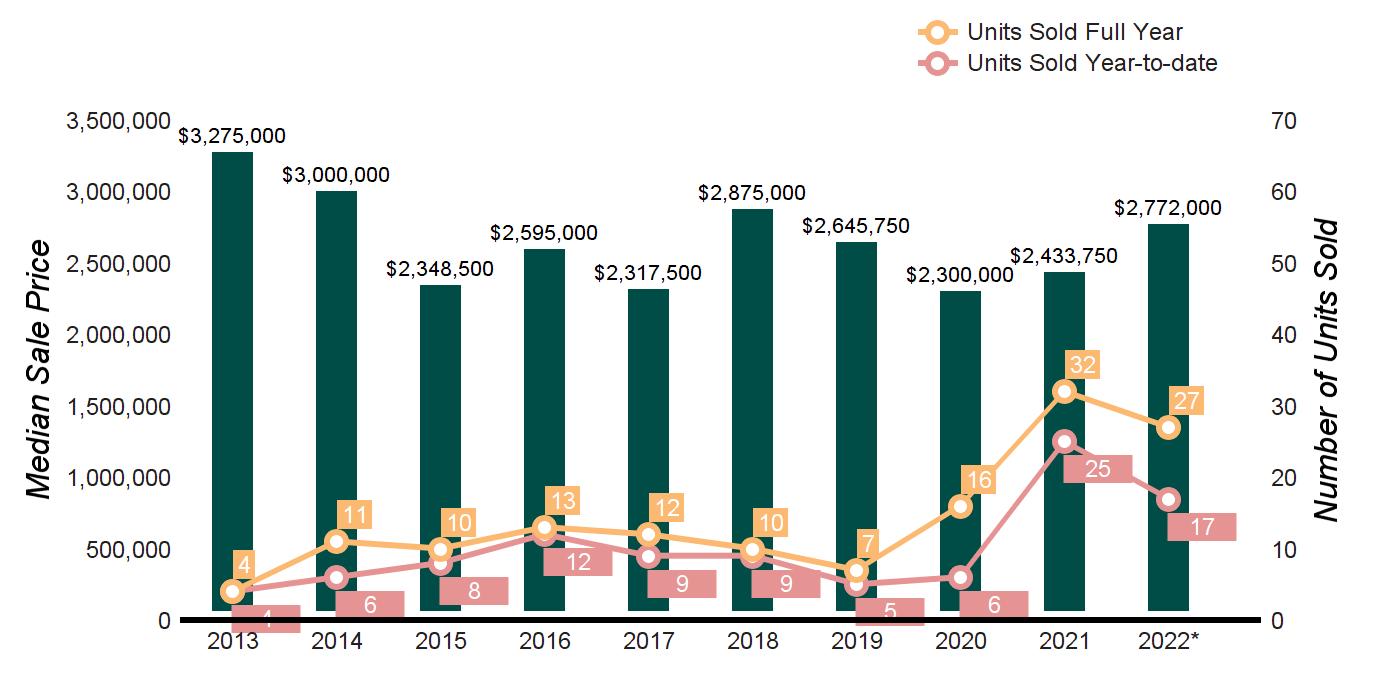

HOMES SOLD 9 10 -10.0% 17 25 -32.0%

TOTAL DOLLAR VOLUME $29,077,000 $26,667,500 9.0% $49,802,000 $66,865,360 -25.5%

MEDIAN SALE PRICE $2,830,000 $2,402,500 17.8% $2,772,000 $2,405,000 15.3%

AVERAGE PRICE PER SQUARE FOOT $787 $694 13.4% $761 $706 7.8% AVERAGE DAYS ON MARKET 53 55 -3.6% 34 59 -42.4%

% SALE PRICE TO LIST PRICE 103.1% 98.7% 4.5% 104.0% 98.9% 5.2%

2022

HOMES SOLD

TOTAL DOLLAR VOLUME

MEDIAN SALE PRICE

AVERAGE PRICE PER SQUARE FOOT

DAYS ON MARKET

SALE PRICE TO LIST PRICE

CHANGE

YTD 2022 YTD 2021 % CHANGE

-17.3% 101 150 -32.7%

$148,628,000 -3.6% $312,352,947 $437,820,597 -28.7%

$2,562,500

$2,725,000 $2,650,000 2.8%

25.7% $501 $415 20.7%

-21.3%

96 -38.5%

2.9%

2022

$2,000,000 - $2,999,999

$3,000,000 - $4,999,999

$5,000,000 - $9,999,999

Q3 2022 Q3 2021

CHANGE

YTD 2022 YTD 2021 % CHANGE

357 5%

139 33%

33 -6%

$1,000,000 - $1,999,999

$2,000,000 and up

33 -30%

13

$3,000,000 - $3,999,999

$4,000,000 - $4,999,999

$5,000,000 - $9,999,999

$10,000,000 and up

Q3 2022 Q3 2021

53

CHANGE

27 -48%

YTD 2022 YTD 2021 % CHANGE

79 16%

39 -25%

YTD 2022 YTD 2021 % CHANGE

138 -44%

60 -1%

100 -21%

11 -27%

YTD 2021

$2,000,000 - $2,999,999

$3,000,000 - $4,999,999

$5,000,000 - $9,999,999

$10,000,000 and up

CHANGE

-42%

-24%

YTD 2022 YTD 2021

$2,000,000 - $2,999,999

$3,000,000 - $4,999,999

$5,000,000 - $9,999,999

$10,000,000 and up

CHANGE

-22%

-71%

YTD 2022 YTD 2021

$2,000,000 - $2,999,999

$3,000,000 - $4,999,999

$5,000,000 - $9,999,999

$10,000,000 and up

CHANGE

-33%

-39%

SCHOOL DISTRICT # OF SALES

MEDIAN LUXURY SALE PRICE HIGHEST SALE PRICE

SCARSDALE 60 $2,820,000 $8,287,500

RYE CITY 34 $3,362,500 $8,500,000

MAMARONECK 31 $2,655,000 $5,200,000

HARRISON 27 $2,625,000 $3,855,000

CHAPPAQUA 20 $2,385,000 $3,800,000

BYRAM HILLS 18 $2,555,000 $4,000,000

BEDFORD 16 $3,650,000 $9,400,000

BRONXVILLE 12 $2,845,000 $3,675,000

KATONAH LEWISBORO 8 $2,697,500 $6,500,000

RYE NECK 8 $2,997,500 $4,125,000

IRVINGTON 6 $2,600,000 $5,000,000

PELHAM 4 $2,102,500 $3,000,000

NEW ROCHELLE 3 $2,400,000 $2,510,000

NORTH SALEM 1 $2,000,000 $2,000,000

TUCKAHOE 1 $2,200,000 $2,200,000

SCHOOL DISTRICT

# OF SALES

MEDIAN LUXURY SALE PRICE HIGHEST SALE PRICE

GARRISON 4 $1,312,500 $2,775,000

BREWSTER 2 $2,088,748 $2,178,497

TOWN/CITY

# OF SALES MEDIAN LUXURY SALE PRICE HIGHEST SALE PRICE

WASHINGTON 4

$1,315,000 $1,700,000

RHINEBECK 3 $1,450,000 $1,750,000

CLINTON 2 $2,825,000 $4,200,000

RED HOOK 1 $18,500,000 $18,500,000

PAWLING 1 $1,195,000 $1,195,000

TOWN/CITY

GREENWICH

RIVERSIDE

OLD GREENWICH

# OF SALES MEDIAN LUXURY SALE PRICE HIGHEST SALE PRICE

$5,075,000 $12,350,000

$4,200,000 $6,525,000

$3,805,000 $5,453,816

TOWN/CITY

WESTPORT

NEW CANAAN

DARIEN

# OF SALES MEDIAN LUXURY SALE PRICE HIGHEST SALE PRICE

$3,165,000 $11,400,000

$2,800,000 $10,800,000

$2,862,500 $4,600,000

FAIRFIELD 16 $2,261,250 $4,325,000

WESTON 12 $2,293,750 $6,500,000

WILTON 9 $2,275,000 $2,565,000

NORWALK

RIDGEFIELD

STAMFORD

REDDING

$2,830,000 $7,800,000

$2,700,000 $4,400,000

$2,075,000 $4,300,000

$2,025,000 $2,025,000

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$2,000,000 - $2,999,999

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

CHANGE IN LISTINGS

% CHANGE IN PENDINGS

-4.2% -2.8%

-17.5% 10.5% $5,000,000 - $9,999,999

$3,000,000 - $4,999,999

$10,000,000 and up

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$2,000,000 - $2,999,999

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

34.8%

200.0%

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

-10.3% -37.5%

-24.1% -75.0% $5,000,000 - $9,999,999

$3,000,000 - $4,999,999

29.4% 0.0% $10,000,000 and up

0.0% -100.0%

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

$1,000,000 - $1,999,999

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

-35.7% -50.0%

-26.1% 33.3% $2,000,000 and up

OF SEPTEMBER 30, 2021 2022 vs. 2021

ACTIVE LISTINGS

PENDING SALES

SUPPLY/ DEMAND RATIO*

CHANGE IN LISTINGS

% CHANGE IN PENDINGS

7.7% -29.4%

-20.7%

AS OF SEPTEMBER 30, 2022

PRICE RANGE

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

DEMAND RATIO*

ACTIVE LISTINGS

PENDING SALES

SUPPLY/ DEMAND RATIO*

CHANGE IN LISTINGS

% CHANGE IN PENDINGS

-25.6% -6.7% $4,000,000 - $4,999,999

$3,000,000 - $3,999,999

-9.7% -25.0% $5,000,000 - $9,999,999

AS OF SEPTEMBER 30, 2022

PRICE RANGE

$2,000,000 - $2,999,999

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

DEMAND RATIO*

-15.8% 6.3%

70.0% -100.0%

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

CHANGE IN LISTINGS

% CHANGE IN PENDINGS

30.0% 50.0%

-21.4% 100.0% $5,000,000 - $9,999,999

$3,000,000 - $4,999,999

-16.7% 0.0% $10,000,000 and up

AS OF SEPTEMBER 30, 2022

PRICE RANGE

$2,000,000 - $2,999,999

$3,000,000 - $4,999,999

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

Valid -100.0% 0.0%

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

Valid -75.0% 0.0%

-50.0% 200.0%

Valid -100.0% 0.0% $10,000,000 and up

$5,000,000 - $9,999,999

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$2,000,000 - $2,999,999

$3,000,000 - $4,999,999

$5,000,000 - $9,999,999

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

Valid 0.0%

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

CHANGE IN LISTINGS

-45.5%

-11.1%

-50.0%

% CHANGE IN PENDINGS

-100.0%

TROY,

Designed expressly for our region's most exceptional properties, Houlihan Lawrence Private Brokerage offers discreet advisory and brokerage services to our valued luxury clients. Since its inception in 1990, our exclusive luxury program directed by Senior Vice President, Anthony P. Cutugno has earned a reputation for personalized boutique-style service and nuanced marketing that best serves the interests of our clientele. Known for our prudence and reliability, Houlihan Lawrence has worked with many of the area's most prominent families, charitable trusts, banks and estate trustees in facilitating the sale of the region's most prestigious properties.

Based on the private banking model, Tony is personally involved in every transaction offering invaluable insight and advice honed by decades of experience in international trade and luxury real estate.

What sets Private Brokerage apart is our ability to leverage Houlihan Lawrence's vast resources and impressive global partners to successfully position a property within the international marketplace. With a reach that extends to 6 continents, Houlihan Lawrence Private Brokerage understands the world of luxury and has cultivated relationships with international partners and high net-worth clients across the globe. These world-class connections supported by the personal oversight of Tony and his Private Brokerage team create a powerful combination that drives results year-after-year.