Market Report

FULL YEAR 2022

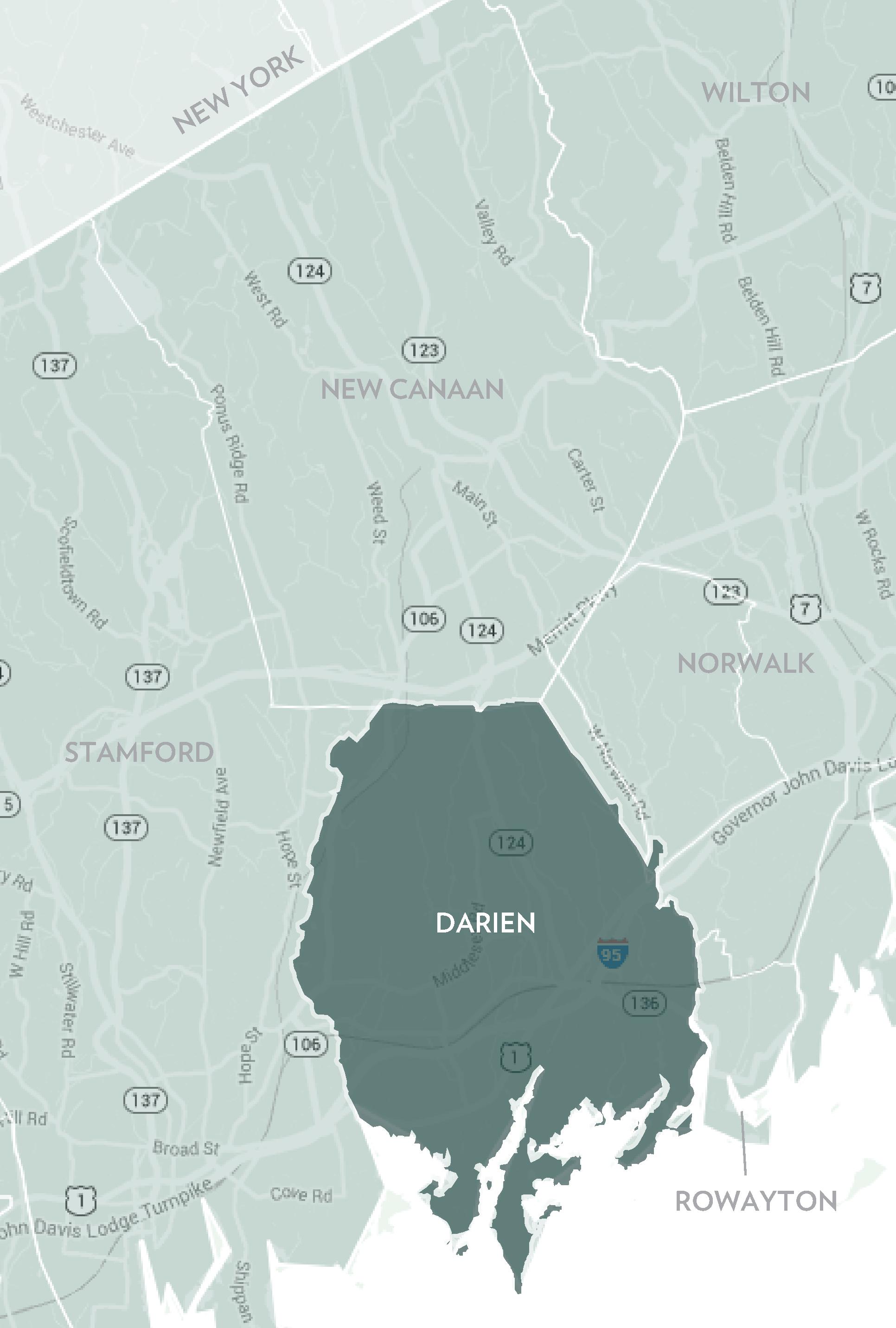

Throughout 2022, local real estate markets were marked by incredibly low inventory levels. The number of homes for sale at any given moment in Darien, New Canaan, and Rowayton was down compared to the same date last year. Given how constrained our markets are by low inventory levels, it is no surprise that sales trended downward during 2022.

Despite high inflation, stock market declines, and the Federal Reserve’s continued interest rate increases, the demand for homes in our markets continued to outpace supply during most of 2022. Appropriately priced homes across most price points continued to attract more than one bidder, with cash buyers active in the marketplace throughout the year. As mortgage interest rates continued to increase, we noticed a decline in the number of “trade-up” buyers within local markets. Seemingly, those who already own a home with a favorable mortgage rate are reluctant to trade their existing loan for a new one with a significantly higher rate.

Regardless, the continued low supply of homes for sale has been great news for sellers. The amount of time it takes to sell a home has plummeted more than 30% across our local markets, and the average price per square foot has increased more than 10% since last year.

As we look toward 2023, we believe that the art of pricing a home for sale will become more challenging as recent comparable transactions, which may have been driven by “pandemic urgency,” become less relevant. The successful seller may want to consider more historical sales data in developing a proper pricing strategy in the future.

As the #1 brokerage in Greenwich, Darien, New Canaan, and Rowayton, Houlihan Lawrence is uniquely positioned to assist local luxury home buyers and sellers. We look forward to an opportunity to serve you in 2023!

With Warm Regards,

Liz Nunan President and CEO

PRICE RANGE

AS OF DECEMBER 31, 2022

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

AS OF DECEMBER 31, 2021 2022 vs. 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

$0 - $499,999 0 1 0 0 1 0 0.0% 0.0% $500,000 - $699,999 1 1 1 0 2 0 0.0% -50.0% $700,000 - $999,999 4 2 2 4 4 1 0.0% -50.0%

$1,000,000 - $1,499,999 4 4 1 3 5 1 33.3% -20.0% $1,500,000 - $1,999,999 0 1 0 5 4 1 -100.0% -75.0%

$2,000,000 - $2,499,999 4 4 1 2 2 1 100.0% 100.0%

$2,500,000 - $2,999,999 0 3 0 0 3 0 0.0% 0.0% $3,000,000 - $3,999,999 5 2 3 0 6 0 0.0% -66.7% $4,000,000 and up 5 1 5 6 2 3 -16.7% -50.0%

YEAR-TO-DATE YEAR-OVER-YEAR

PRICE RANGE 01/01/202212/31/2022 01/01/202112/31/2021 % CHANGE 2022/2021 01/01/202212/31/2022 01/01/202112/31/2021 % CHANGE 2022/2021

$0 - $499,999 0 3 -100.0% 0 3 -100.0% $500,000 - $699,999 13 18 -27.8% 13 18 -27.8% $700,000 - $999,999 39 53 -26.4% 39 53 -26.4%

$1,000,000 - $1,499,999 68 113 -39.8% 68 113 -39.8% $1,500,000 - $1,999,999 55 90 -38.9% 55 90 -38.9% $2,000,000 - $2,499,999 31 35 -11.4% 31 35 -11.4% $2,500,000 - $2,999,999 26 45 -42.2% 26 45 -42.2% $3,000,000 - $4,999,999 44 58 -24.1% 44 58 -24.1% $5,000,000 and up 8 7 14.3% 8 7 14.3%

MarketTotals 284 422 -32.7% 284 422 -32.7% Source: Smart MLS, Darien, Single Family Homes, Sold

PRICE RANGE

AS OF DECEMBER 31, 2022

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

AS OF DECEMBER 31, 2021 2022 vs. 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

$0 - $499,999 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% $500,000 - $699,999 2 0 Not Valid 1 1 1 100.0% -100.0% $700,000 - $999,999 1 2 1 3 3 1 -66.7% -33.3% $1,000,000 - $1,499,999 0 0 Not Valid 1 0 Not Valid -100.0% 0.0% $1,500,000 - $1,999,999 2 0 Not Valid 0 0 Not Valid 0.0% 0.0%

$2,000,000 - $2,499,999 0 2 0 0 1 0 0.0% 100.0%

$2,500,000 - $2,999,999 0 0 Not Valid 1 0 Not Valid -100.0% 0.0% $3,000,000 - $3,999,999 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% $4,000,000 and up 2 1 2 1 0 Not Valid 100.0% 0.0%

YEAR-TO-DATE YEAR-OVER-YEAR

PRICE RANGE

01/01/202212/31/2022 01/01/202112/31/2021 % CHANGE 2022/2021 01/01/202212/31/2022 01/01/202112/31/2021 % CHANGE 2022/2021

$0 - $499,999 0 1 -100.0% 0 1 -100.0% $500,000 - $699,999 6 7 -14.3% 6 7 -14.3% $700,000 - $999,999 11 15 -26.7% 11 15 -26.7% $1,000,000 - $1,499,999 17 16 6.3% 17 16 6.3% $1,500,000 - $1,999,999 22 20 10.0% 22 20 10.0% $2,000,000 - $2,499,999 6 18 -66.7% 6 18 -66.7% $2,500,000 - $2,999,999 9 3 200.0% 9 3 200.0% $3,000,000 - $4,999,999 5 10 -50.0% 5 10 -50.0% $5,000,000 and up 1 1 0.0% 1 1 0.0%

-15.4%

-15.4%

PRICE RANGE

AS OF DECEMBER 31, 2022

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

AS OF DECEMBER 31, 2021 2022 vs. 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

% CHANGE IN LISTINGS

% CHANGE IN PENDINGS

$0 - $499,999 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% $500,000 - $699,999 0 0 Not Valid 2 0 Not Valid -100.0% 0.0% $700,000 - $999,999 8 1 8 4 1 4 100.0% 0.0% $1,000,000 - $1,499,999 3 3 1 10 7 1 -70.0% -57.1% $1,500,000 - $1,999,999 9 2 5 5 4 1 80.0% -50.0% $2,000,000 - $2,499,999 3 0 Not Valid 2 8 1 50.0% -100.0% $2,500,000 - $2,999,999 2 2 1 7 6 1 -71.4% -66.7% $3,000,000 - $3,999,999 9 2 5 10 5 2 -10.0% -60.0% $4,000,000 and up 19 1 19 17 3 6 11.8% -66.7%

YEAR-TO-DATE YEAR-OVER-YEAR

PRICE RANGE 01/01/202212/31/2022 01/01/202112/31/2021 % CHANGE 2022/2021 01/01/202212/31/2022 01/01/202112/31/2021 % CHANGE 2022/2021

$0 - $499,999 0 0 Not Valid 0 0 Not Valid

$500,000 - $699,999 4 9 -55.6% 4 9 -55.6% $700,000 - $999,999 19 33 -42.4% 19 33 -42.4% $1,000,000 - $1,499,999 65 116 -44.0% 65 116 -44.0% $1,500,000 - $1,999,999 50 111 -55.0% 50 111 -55.0% $2,000,000 - $2,499,999 39 66 -40.9% 39 66 -40.9% $2,500,000 - $2,999,999 41 43 -4.7% 41 43 -4.7% $3,000,000 - $4,999,999 36 58 -37.9% 36 58 -37.9% $5,000,000 and up 6 4 50.0% 6 4 50.0%

-40.9%

Leading Real Estate Companies of the World | Luxury Portfolio International Board of Regents Luxury Real Estate