(Chapter 1-17)(Custom Edition) 3/e

• 台灣客訂量身打造:依據台灣的教學生態、客製內容調整 書籍,版本更新除各章勘誤之外,特別針對Ch.15, Ch16 新增、更新圖表及照片,以更符合台灣現況。

• 內文編寫簡潔易懂:以簡潔的文字敘述、清晰的版面編排、 視覺化的圖表設計,讓學生更有效率的閱讀、更有效能的 吸收。

• 系統化會計計算步驟:循序漸進,精簡優化複雜的會計流 程,幫助學生融會貫通重要觀念和作業程序,引導學生靈 活思考、應用所學、強化教育訓練和職涯發展。

目錄

Ch 1 Accounting in Business

Ch 2 Analyzing and Recording

Transactions

Ch 3 Adjusting Accounts for Financial

Statements

Ch 4 Completing the Accounting Cycle

Ch 5 Accounting for Merchandising

Operations

Ch 6 Inventories and Cost of Sales

Ch 7 Accounting Information Systems

Ch 8 Cash, Fraud, and Internal Control

適用課程:初級會計學、會計學

ISBN-13:9786269646876

Ch 9 Accounting for Receivables

Ch10 Long-Term Assets

Ch11 Current Liabilities and Payroll Accounting

Ch12 Accounting for Partnerships

Ch13 Accounting for Corporations

Ch14 Long-Term Liabilities

Ch15 Investments

Ch16 Reporting the Statement of Cash Flows

Ch17 Analysis of Financial Statements

年份:2023 定價:1480

規格:641頁 / 彩色 / 平裝

教學配件:PowerPoint / 教師手冊 / 題庫 / 習題解答

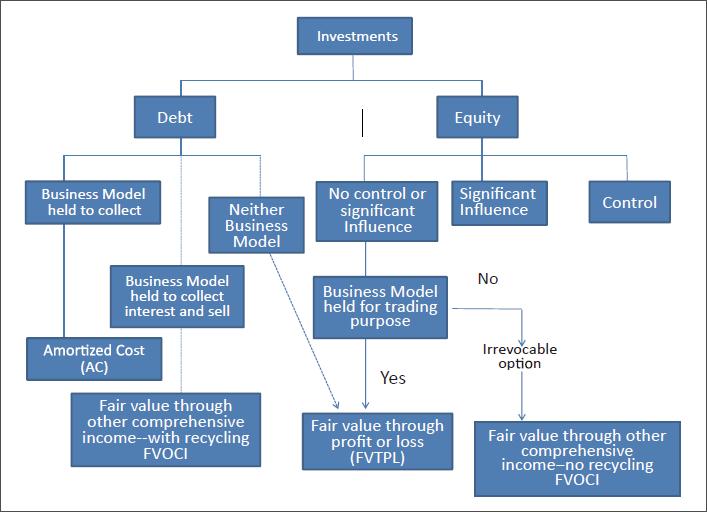

流程圖表闡述不同的 Business Model、 持有比例表決權之下 ,Debt Investments, Equity Investments 各自該如何判斷其認 列的原則,清晰加強 學生的對會計認列的 認知。

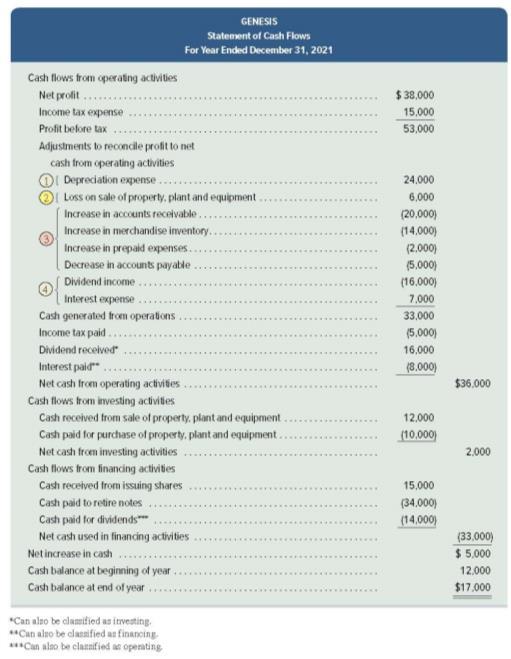

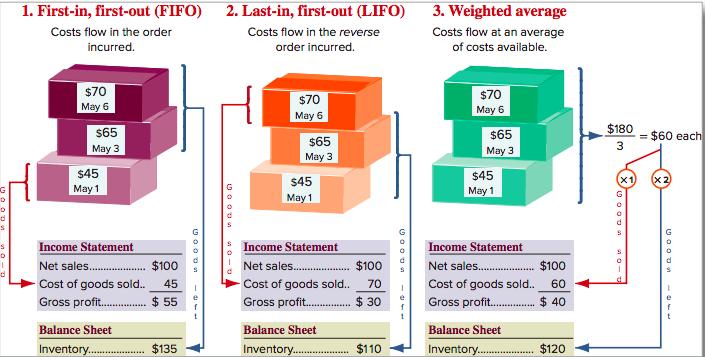

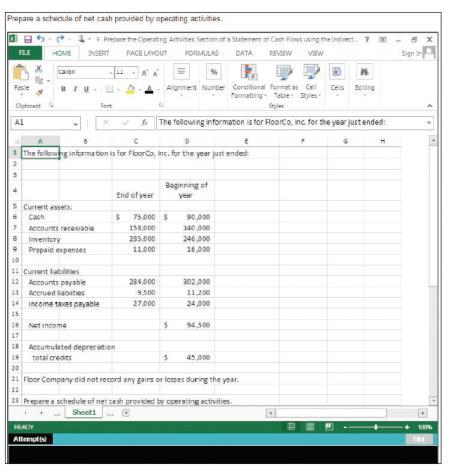

圖表化會計科目,引導學生快速理解現金的流入、流出使用不同的方法認 列時,在「現金流量表」上應如何呈現及差異。

研究分析顯示現代學生比較沒耐心長時間閱讀純文字,作者特別檢視 新版所有文字內容,用更簡明扼要的語句敘述,用更一目瞭然的視覺 圖像表達,減少文字贅述,去蕪存菁,精簡後更見精華。

新版各個章節的關鍵之處設計Need-to-Know Demos單元,以問題

的方式呈現,伴隨解答和步驟,幫助學生了解一定要懂的重要觀念。

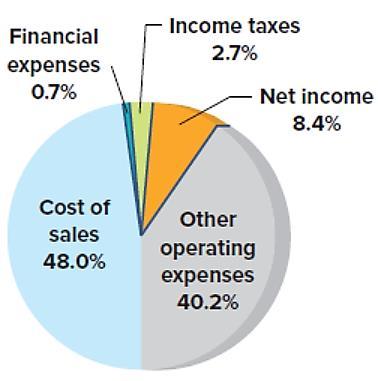

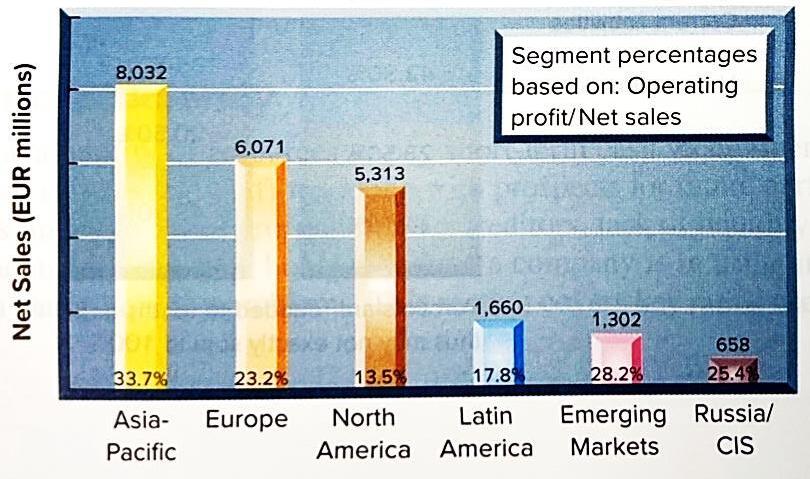

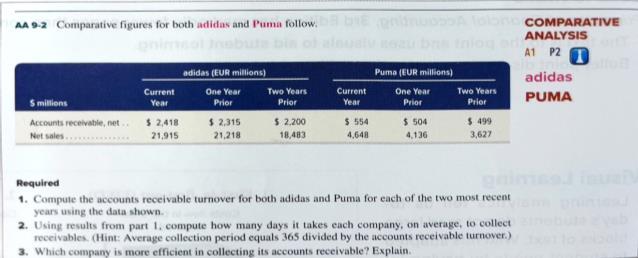

收錄知名企業的新年度數據資料,大量運用在作業習題和案例分析

ex:Apple、 PUMA、Adidas、Nestle,貼近市場的數據引發學生

學習興趣,提升學習效果,也讓學生有更深的領會。

作者在新版每個章節最後增加Summary:Cheat Sheet 摘要設計,

以一頁的長度,將每個章節的重要觀念、會計流程和公式,以視覺 化的圖像統整方式呈現給學生。

豐富多元結合實務的教學影片,

將重點文字轉化成視聽影音,

密切結合各個學習目標,有效

提升學生的學習興趣和效果。

多樣化的題型協助老師有效評

量學生學習成效,透過習題練 習幫助學生複習學習重點。

完整、豐富、多元的教學資源都可以在 Connect 教學學習平台上取

得,滿足老師/學生在課前/課中/課後多項的教學/學習需求。

C1 Short-term vs. longterm Debt vs. equity

C2 Classification and measurement

C3 Impairment

CONCEPTUAL

Recording debt investments

P1 Amortized cost (AC)

P2 Fair value through other comprehensive income (FVOCI)

P3 Fair value through profit or loss (FVTPL)

C1 Distinguish between short-term and long-term investments and between debt and equity investments.

C2 Describe different measurement classifications for investments in financial assets.

C3 Describe the general concept of impairment and expected credit loss model.

C4 Describe the concept of effective interest rate (EIR).

C5 Describe the accounting requirements for equity investments with control.

Recording equity investments

P4 No control or significant influence

P5 Significant influence

C5 Control NTK

Summary of debt and equity investments

Comprehensive income

A1 Yield to maturity (YTM)

A1 Use yield to maturity to evaluate the returns of debt investments

P1 Account for debt investments at AC.

P2

Account for debt investments at FVOCI.

P3 Account for debt securities at FVTPL.

P4 Account for equity investments with no control or significant influence.

P5 Account for equity securities with significant influence.

Chapter PreviewCompanies that are reporting their financials under the IFRS framework began to adopt IFRS 9 Financial Instruments globally, in place of IAS 39 Financial Instruments: Recognition and Measurement, on January 1, 2018. Under IFRS 9, all companies that hold debt and equity investments (as part of the wider scope of financial instruments) have to classify them into three broad measurement categories: amortized cost (AC), fair value through other comprehensive income (FVOCI), and fair value through profit or loss (FVTPL). IFRS 9 has a greater impact on the financial reporting of banks and investment funds, compared to non-financial institutions, as they have a higher proportion of financial instruments on their balance sheets.

Since January 1, 2018, OCBC Bank ( www.ocbc.com ), Southeast Asia’s second largest bank by total assets, has classified and measured its financial assets held according to IFRS 9.1

“In accordance with IFRS 9, we classify loans to our customers, the largest asset on our balance sheet, mainly under amortized cost. For debt and equity securities, we show the total holdings collectively as one item on the balance sheet and disclose the accounting classifications of AC, FVOCI and FVTPL in the accompanying notes to financial statements,” explains

Darren Tan, Chief Financial Officer of OCBC Group, “to provide information that is useful in making economic decisions”.

At the end of 2019, OCBC had loans to customer of S$265,000 million classified under AC. It had debt and equity securities of S$29,000 million, of which it classified S$65 million under AC, S$22,000 million under FVOCI and S$7,000 million under FVTPL. In comparison, non-financial institutions such as adidas and Nestlé had total financial assets of S$9,800 million (EUR6,500 million) and S$34,600 million (CHF25,000 million), respectively, at the end of 2019.

Source: OCBC. https://www.ocbc.com/assets/pdf/annual%20reports/2019/ocbc_ ar2019_english.pdf

In prior chapters, we covered the reporting of both equity (ordinary and preference shares) and debt (bonds and notes) from the standpoint of the issuer (also known as investee or seller). This chapter covers the reporting of investing in financial assets comprising equity and debt securities from the standpoint of the holder (also known as investor or buyer).

Distinguish between debt and equity securities and between short-term and long-term investments.

Investments exclude cash and cash equivalents held for meeting short-term needs, receivables from customers and loans provided to borrowers.2 Companies make investments for at least three reasons: (1) to invest the extra cash (or cash equivalents) to yield more income, (2) to invest for strategic reasons in companies such as suppliers, customers, business partners and even competitors, and (3) for some entities, such as investment funds (also known as mutual funds) and pension funds, to make collective investments on behalf of investors.

Investments can be in either financial assets such as debt and equity securities or non-financial assets such as land and buildings not used in the company’s own operations. On the balance sheets of most companies, investments in financial assets are shown as “financial assets” without the word “investments”.

This chapter covers investments in financial assets and excludes investments in land and buildings (known as investment property). Exhibit 15.1 shows short-term (ST) and long-term (LT) investments as a percentage of total assets for selected companies.

Short-term investments comprise securities that are (1) held primarily for the purpose of trading or (2) expected

1 To be precise, OCBC adopts Singapore Financial Reporting Standard (International) 9 (SFRS(I) 9), which is identical to IFRS 9.

2 Banks sometimes structure loans as bonds and they record these as loans to customers but not as investments, based on the economic substance rather than the legal form.

“Same debt or equity securities, different accounting treatments under different classifications”—

Darren Tan

to be realized within 12 months from the reporting date. They are presented as current assets. All other investments are regarded as long-term investments and are presented as non-current assets.

Investments in securities include both debt and equity securities. Debt securities, such as bonds and notes, reflect a lending arrangement. These are fixed-income securities issued by governments, government agencies and companies. Equity securities, such as investments in shares or units issued by companies, business trusts, real estate investment trusts or unit trusts (also known as mutual funds), reflect an ownership arrangement.

The objective of financial statements is to provide information that is relevant and useful in making economic decisions. To meet this objective, accounting for investments in financial assets considers four factors: (1) type of securities, either debt or equity; (2) for debt securities, the contractual cash flow characteristics of the securities and the investor’s “business model” (explained below) for managing them; (3) for equity securities, the percentage of voting power in the investee company held by the investor; and (4) for debt securities, the maturity date and for equity securities, the company’s expectation of holding over short term or long term.

Debt investments Regardless of whether they are quoted or unquoted, or whether they are held for short term or long term, debt investments are classified under one of the three measurement categories in IFRS 9.

The classification depends mainly on the contractual cash flow characteristics of the securities and the investor’s “business model” for managing them. Contractual cash flow characteristics refer to whether the cash flows of the securities reflect a basic lending arrangement or are modified by derivatives embedded in the debt securities (called the host). The term “business model” refers to how an investment is managed on its own or within a portfolio; it does not refer to the company’s overall business model. A company can have different “business models” for different investments or for different investment portfolios.

Under IFRS 9, all debt securities are recorded (measured) at the date of purchase at fair value (plus transaction costs where applicable) and subsequently classified under either amortized cost (AC), fair value through other comprehensive income3 (FVOCI) or fair value through profit or loss4 (FVTPL).

The AC classification is for debt securities (like bonds and notes) whose contractual cash flows are solely payments of principal and interest on the principal outstanding (SPPI) and which are managed within a “business model” to collect the contractual cash flows only. For these debt investments, amortized cost provides the most relevant and useful information for reporting the financial position and the performance.

The FVOCI classification is for debt securities whose contractual cash flows are SPPI and which are managed within a “business model” to collect the contractual cash flows and to sell before maturity from time to time. For these debt investments, a combination of fair value for reporting the financial position and amortized cost method for reporting the performance provides the most relevant and useful information.

The FVTPL classification is for debt securities that are managed within a “business model” to sell in the near term (that is, for the purpose of trading) and for any securities not eligible for AC or FVOCI classification – a residual classification. When one or more derivatives are embedded in the host debt securities such that the combined cash flows are not SPPI, the debt securities with the embedded derivative will not be eligible for AC and FVOCI classifications. For these debt investments, fair value is the most relevant and useful information for reporting the financial position and the performance.

Exhibit 15.2 shows the classifications of debt investments and equity investments. International Financial Reporting Standard 9 (IFRS 9) Financial Instruments require the classifications of debt investments and equity investments be based on company’s business model. When business model for holding debt investments is to collect interests and principle, the debt investments are classified as amortized cost (AC). IFRS 9 further requires the classification of debt investments into fair value through other comprehensive income (FVOCI) when business model is to hold to collect interest and to sell. When business model is neither, the debt investments are classified as fair value through profit or loss (FVTPL).

Companies may also designate any debt investment for measurement at FVTPL, if this helps to reduce a significant “accounting mismatch” that may arise from different bases of reporting gains and losses from financial assets and financial liabilities. This designation can only be done at the date of purchase and once done is not revocable.

The classifications of equity investments are based on the investor’s extent of voting power in the investee. In addition, the substance of the arrangements in each case must be considered as well. When the investor holding less than 20% of the voting power, it is presumed that there is no control or significant influence over the investee and the equity investments are classified

3 In IFRS 9, fair value through other comprehensive income means adjusting a financial asset’s carrying amount to fair value and recording the corresponding fair value gain or loss in other comprehensive income. This balance in the state ment of comprehensive income forms part of equity on the balance sheet as a separate line item called fair value reserve.

4 In IFRS 9, fair value through profit or loss means adjusting a financial asset’s carrying amount to fair value and recording the corresponding fair value gain or loss in profit or loss.

loss not over time required earned companies preadditional sale in for short (other than elect to FVOCI from or loss.

EXHIBIT 15.3

Classifications of Investments in Securities influenceControl accountingConsolidation securities than power investee

payments of Investing in deterioration investdecline

at the effective interest rate (EIR). For FVTPL debt investments, companies are not required to record interest income and may instead record fair value gain/loss inclusive of interest earned over time. However, there is no prohibition from doing so and in practice many companies prefer to record interest income separately before making the fair value adjustment as the additional interest income information is useful.

The value may also fall due to changes in macro-economic or market factors such as interest rates or market liquidity. These may cause declines in fair value which may not be impairment.

For all three classifications, companies must report subsequent realized gain/loss on sale in profit or loss.

For AC and FVOCI debt investments, a company reports interest income in profit or loss not based on the amount of interest received, but the amount of interest earned (accrued) over time at the effective interest rate (EIR). For FVTPL debt investments, companies are not required to record interest income and may instead record fair value gain/loss inclusive of interest earned over time. However, there is no prohibition from doing so and in practice many companies prefer to record interest income separately before making the fair value adjustment as the additional interest income information is useful.

For AC and FVOCI debt investments, a company reports interest income in profit or loss not based on the amount of interest received, but the amount of interest earned (accrued) over time at the effective interest rate (EIR). For FVTPL debt investments, companies are not required to record interest income and may instead record fair value gain/loss inclusive of interest earned over time. However, there is no prohibition from doing so and in practice many companies prefer to record interest income separately before making the fair value adjustment as the additional interest income information is useful.

For all three classifications, companies must report subsequent realized gain/loss on sale in profit or loss.

Equity investments Regardless of whether they are quoted or unquoted, or held for short term or long term, under IFRS 9 the default classification for all equity investments (other than in subsidiaries, joint ventures and associates) is FVTPL. Additionally, companies may elect to classify particular equity investments, only if they are not held for trading, under FVOCI from the date of purchase and report subsequent fair value gain or loss in OCI, instead of profit or loss. Under this option, companies must also report subsequent realized gain/loss on sale in OCI.

For AC and FVOCI debt securities, IFRS 9 requires an investor to recognize the impairment in profit or loss during the investment holding period when it expects the loss to arise in future, not when the issuer fails to pay any interest or principal when due or when the investor sells the investment at a loss. This requirement does not apply to FVTPL debt and equity securities as recording a decline in fair value would automatically include the impairment in profit or loss. It also does not apply to FVOCI equity investments as all related gains (other than dividend income) or losses are recorded in other comprehensive income as a special treatment of IFRS 9.

For all three classifications, companies must report subsequent realized gain/loss on sale in profit or loss.

For all three classifications, companies must report subsequent realized gain/loss on sale in profit or loss.

Equity investments Regardless of whether they are quoted or unquoted, or held for short term or long term, under IFRS 9 the default classification for all equity investments (other than in subsidiaries, joint ventures and associates) is FVTPL. Additionally, companies may elect to classify particular equity investments, only if they are not held for trading, under FVOCI from the date of purchase and report subsequent fair value gain or loss in OCI, instead of profit or loss. Under this option, companies must also report subsequent realized gain/loss on sale in OCI.

Equity investments Regardless of whether they are quoted or unquoted, or held for short term or long term, under IFRS 9 the default classification for all equity investments (other than in subsidiaries, joint ventures and associates) is FVTPL. Additionally, companies may elect to classify particular equity investments, only if they are not held for trading, under FVOCI from the date of purchase and report subsequent fair value gain or loss in OCI, instead of profit or loss. Under this option, companies must also report subsequent realized gain/loss on sale in OCI.

In either FVTPL or FVOCI classification, companies report dividends receivable as income in profit or loss unless such dividends are effectively partial recovery of the purchase cost.

Equity investments Regardless of whether they are quoted or unquoted, or held for short term or long term, under IFRS 9 the default classification for all equity investments (other than in subsidiaries, joint ventures and associates) is FVTPL. Additionally, companies may elect to classify particular equity investments, only if they are not held for trading, under FVOCI from the date of purchase and report subsequent fair value gain or loss in OCI, instead of profit or loss. Under this option, companies must also report subsequent realized gain/loss on sale in OCI.

In either FVTPL or FVOCI classification, companies report dividends receivable as income in profit or loss unless such dividends are effectively partial recovery of the purchase cost.

Impairment can arise due to many reasons and for debt investments, it is due mainly to a deterioration in credit quality. For estimation of a credit loss, IFRS 9 prescribes an expected credit loss model effective from January 1, 2018 to replace the incurred credit loss model under IAS 39. Expected credit loss model uses the probability of default, estimated loss given default and estimated exposure at default to estimate the credit loss before the actual loss occurs. Impairment in general and expected credit loss model in particular are advanced topics beyond the scope of this book.

Investments in Subsidiaries A company has control over an investee company if it holds a majority (more than 50%) of the voting power in the investee. In some cases, the single largest investor holding a substantial percentage, but not more than 50%, of the voting rights can have over the investee when all the remaining shares are held by many minority investors. Also, an investor holding not more than 50% of equity shares can have control by way of special arrangements for super-voting power or a special right to appoint directors to the board. Some digital economy giants, such as Alibaba, Alphabet, Facebook etc. have allowed the founders to retain control this way when they no longer hold more than 50% of the equity shares after the company’s initial public offering.

In either FVTPL or FVOCI classification, companies report dividends receivable as income in profit or loss unless such dividends are effectively partial recovery of the purchase cost.

In either FVTPL or FVOCI classification, companies report dividends receivable as income in profit or loss unless such dividends are effectively partial recovery of the purchase cost.

Investments in Subsidiaries A company has control over an investee company if it holds a majority (more than 50%) of the voting power in the investee. In some cases, the single largest investor holding a substantial percentage, but not more than 50%, of the voting rights can have control over the investee when all the remaining shares are held by many minority investors. Also, an investor holding not more than 50% of equity shares can have control by way of special arrangements for super-voting power or a special right to appoint directors to the board. Some digital economy giants, such as Alibaba, Alphabet, Facebook etc. have allowed the founders to retain control this way when they no longer hold more than 50% of the equity shares after the company’s initial public offering.

Investments in Subsidiaries A company has control over an investee company if it holds a majority (more than 50%) of the voting power in the investee. In some cases, the single largest investor holding a substantial percentage, but not more than 50%, the voting rights can have control over the investee when all the remaining shares are held by many minority investors. Also, an investor holding not more than 50% of equity shares can have control by way of special arrangements for super-voting power or a special right to appoint directors to the board. Some digital economy giants, such as Alibaba, Alphabet, Facebook etc. have allowed the founders to retain control this way when they no longer hold more than 50% of the equity shares after the company’s initial public offering.

Investments in Associates5 A company is presumed to have significant influence over the investee if it holds 20% to 50% of the voting power in the investee. It is presumed to have no control or significant influence if it holds less than 20% of the voting power.

Investments in Subsidiaries A company has control over an investee company if it holds a majority (more than 50%) of the voting power in the investee. In some cases, the single largest investor holding a substantial percentage, but not more than 50%, of the voting rights can have control over the investee when all the remaining shares are held by many minority investors. Also, an investor holding not more than 50% of equity shares can have control by way of special arrangements for super-voting power or a special right to appoint directors to the board. Some digital economy giants, such as Alibaba, Alphabet, Facebook etc. have allowed the founders to retain control this way when they no longer hold more than 50% of the equity shares after the company’s initial public offering.

Investments in Associates5 A company is presumed to have significant influence over the investee if it holds 20% to 50% of the voting power in the investee. It is presumed to have no control or significant influence if it holds less than 20% of the voting power.

Exhibit 15.3 identifies six classes of securities using the first three factors mentioned above. After the classification, the investment is presented as a current or a non-current asset based on the fourth factor.

Investments in Associates5 A company is presumed to have significant influence over the investee if it holds 20% to 50% of the voting power in the investee. It is presumed to have no control or significant influence if it holds less than 20% of the voting power.

Exhibit 15.3 identifies six classes of securities using the first three factors mentioned above. After the classification, the investment is presented as a current or a non-current asset based on the fourth factor.

Investments in Associates5 A company is presumed to have significant influence over the investee if it holds 20% to 50% of the voting power in the investee. It is presumed to have no control or significant influence if it holds less than 20% of the voting power.

Exhibit 15.3 identifies six classes of securities using the first three factors mentioned above. After the classification, the investment is presented as a current or a non-current asset based on the fourth factor.

Exhibit 15.3 identifies six classes of securities using the first three factors mentioned above. After the classification, the investment is presented as a current or a non-current asset based on the fourth factor.

著作權所有 侵害必究

be classified

Impairment

Impairment

Impairment

Investing in debt securities comes with a risk that the issuer may be unable to make payments of interest or principal when due. This is known as the default risk or credit risk. Investing in equity securities comes with the downside risk that the issuer may experience a deterioration in its financial or economic condition. In both cases, the value of the debt or the equity investments may decline and the investor may realize a loss from selling the investments. This decline in value is called impairment.

5 IAS 28 Investments in Associates and Joint Ventures defines an associate by reference to the concept of significant influence and a joint venture by reference to the concept of sharing of control. Accounting for investments in joint ventures is an advanced topic beyond the scope of this book.

5 IAS 28 Investments in Associates and Joint Ventures defines an associate by reference to the concept of significant influence and a joint venture by reference to the concept of sharing of control. Accounting for investments in joint ventures is an advanced topic beyond the scope of this book.

5 IAS 28 Investments in Associates and Joint Ventures defines an associate by reference to the concept of significant influence and a joint venture by reference to the concept of sharing of control. Accounting for investments in joint ventures is an advanced topic beyond the scope of this book.

5 IAS 28 Investments in Associates and Joint Ventures defines an associate by reference to the concept of significant influence and a joint venture by reference to the concept of sharing of control. Accounting for investments in joint ventures is an advanced topic beyond the scope of this book.

Describe the general concept of impairment expected credit

Chapter 15 Investments wiL23262_ch15_516-555.indd 519 05/17/21 EXHIBIT 15.3 Classifications of Investments in Securities Debt Investments Equity Investments AC FVOCI FVTPL No control or significant influence Significant influenceControl FVTPL or by election, FVOCI Equity accountingConsolidation Debt securities that are SPPI and held for collecting contractual cash flows only Debt securities that are SPPI and held for collecting contractual cash flows and for sale from time to time Debt securities held for trading or not eligible to be classified under AC or FVOCI (residual classification) Equity securities with less than 20% voting power in the investee Equity securities with 20% to 50% voting power in the investee Equity securities with more than 50% voting power in the investee

Chapter 15 Investments wiL23262_ch15_516-555.indd 519 05/17/21 EXHIBIT 15.3 Classifications of Investments in Securities Debt Investments Equity Investments AC FVOCI FVTPL No control or significant influence Significant influenceControl FVTPL or by election, FVOCI Equity accountingConsolidation Debt securities that are SPPI and held for collecting contractual cash flows only Debt securities that are SPPI and held for collecting contractual cash flows and for sale from time to time Debt securities held for trading or not eligible to be classified under AC or FVOCI (residual classification) Equity securities with less than 20% voting power in the investee Equity securities with 20% to 50% voting power in the investee Equity securities with more than 50% voting power in the investee

wiL23262_ch15_516-555.indd 519 05/17/21 EXHIBIT 15.3 Classifications of Investments in Securities Debt Investments Equity Investments AC FVOCI FVTPL No control or significant influence Significant influenceControl FVTPL or by election, FVOCI Equity accountingConsolidation Debt securities that are SPPI and held for collecting contractual cash flows only Debt securities that are SPPI and held for collecting contractual cash flows and for sale from time to time Debt securities held for trading or not eligible to

Describe the general concept of impairment expected credit

The value may also fall due to changes in macro-economic or market factors such as interest rates or market liquidity. These may cause declines in fair value which may not be impairment.

For AC and FVOCI debt securities, IFRS 9 requires an investor to recognize the impairment in profit or loss during the investment holding period when it expects the loss to arise in future, not when the issuer fails to pay any interest or principal when due or when the investor sells the investment at a loss. This requirement does not apply to FVTPL debt and equity securities as recording a decline in fair value would automatically include the impairment in profit or loss. It also does not apply to FVOCI equity investments as all related gains (other than dividend income) or losses are recorded in other comprehensive income as a special treatment of IFRS 9.

Impairment can arise due to many reasons and for debt investments, it is due mainly to a deterioration in credit quality. For estimation of a credit loss, IFRS 9 prescribes an expected credit loss model effective from January 1, 2018 to replace the incurred credit loss model under IAS 39. Expected credit loss model uses the probability of default, estimated loss given default and estimated exposure at default to estimate the credit loss before the actual loss occurs. Impairment in general and expected credit loss model in particular are advanced topics beyond the scope of this book.

annum. We can use the discounted cash flow (DCF) model to manually calculate the EIR. In practice, we usually use a financial calculator with the DCF function to calculate the EIR. Either way, the EIR for this bond works out to be 4.13% per annum.

Debt investments at amortized cost (AC) are presented as current assets if their maturity dates are within one year from the reporting date.7 Otherwise, they are presented as non-current assets.

The purchase cost (inclusive of commission) for debt investments can be either lower (at a discount) or higher (at a premium) than the amount repayable at maturity. The difference between the cost and the maturity value is amortized over the remaining life of the investment through the effective interest method.

Account for debt investments at AC.

As shown in Exhibit 15.5, the purchase cost is $9,500 and the maturity value is $10,000. The amortized cost at the end of each of the years increases over time from the difference between accruing interest at 4.13% of amortized cost and receiving the coupon at 3% of $10,000. If the company had purchased the bond at a premium, the amortized cost would have decreased over time from amortization of the premium instead.

7 Strictly speaking, for any coupon-paying debt investment, the present value of those coupons due within one year should be presented as current assets even if the principal is due for repayment after one year. For simplicity, companies tend to disregard coupons due within one year and present the entire debt investment under non-current assets when the principal is due after one year.

Recording Purchase Companies record all AC debt investments at cost (inclusive of commission) at the date of purchase.

Assume that DEF Ltd (the company) has paid-up capital of $9,500 and cash of $9,500. On January 1, 2021, the company purchases ABC Ltd’s bond with 5 years to maturity for cash of $9,500 and records the purchase as follows.

Record purchase of ABC Ltd bond at cost.

Recording Interest Income Companies accrue interest income on a time-proportion basis when earned (not when received). Companies that are not banks usually record the accrual of interest on a monthly basis while banks usually do so on a daily basis. For simplicity, in this example, the company accrues interest income on an annual basis.

Debt investments at amortized cost (AC) are presented as current assets if their maturity dates are within one year from the reporting date.7 Otherwise, they are presented as non-current assets.

Debt investments at amortized cost (AC) are presented as current assets if their maturity dates are within one year from the reporting date.7 Otherwise, they are presented as non-current assets.

P1

Account for debt investments at AC.

Under the effective interest method, interest income is the amount accrued at the EIR on the opening amortized cost and not the coupon of $300 received each year.

The purchase cost (inclusive of commission) for debt investments can be either lower (at a discount) or higher (at a premium) than the amount repayable at maturity. The difference between the cost and the maturity value is amortized over the remaining life of the investment through the effective interest method.

The purchase cost (inclusive of commission) for debt investments can be either lower (at a discount) or higher (at a premium) than the amount repayable at maturity. The difference between the cost and the maturity value is amortized over the remaining life of the investment through the effective interest method.

7 Strictly speaking, for any coupon-paying debt investment, the present value of those coupons due within one year should be presented as current assets even if the principal is due for repayment after one year. For simplicity, companies tend to disregard coupons due within one year and present the entire debt investment under non-current assets when the principal is due after one year.

7 Strictly speaking, for any coupon-paying debt investment, the present value of those coupons due within one year should be presented as current assets even if the principal is due for repayment after one year. For simplicity, companies tend to disregard coupons due within one year and present the entire debt investment under non-current assets when the principal is due after one year.

Accrue interest at EIR of 4.13% of the original cost.

For 2021, the company earns interest at the EIR of 4.13% on the original cost of $9,500. At December 31, 2021, the company accrues interest income of $392 as earned. Recording Coupon Received When the company receives the coupon, it records cash received of $300 as partial recovery of the amortized cost instead of interest income.