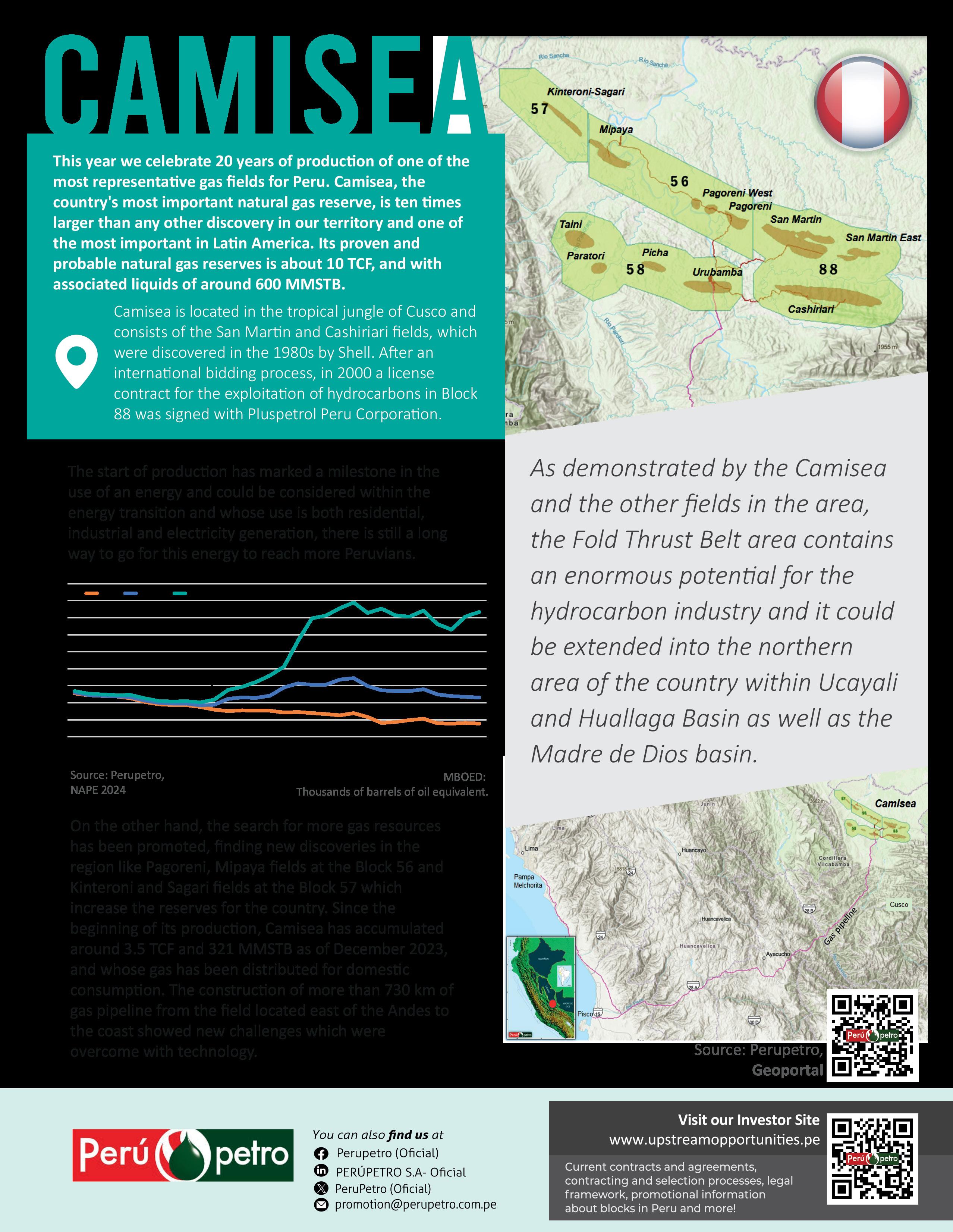

Dear Readers,

Welcome to the first issue of the IGU Global Voice of Gas magazine in 2024.

We are just two months away from the International Gas Research Conference (IGRC2024) in breathtaking Banff, Alberta, Canada. The theme for the event is Fuelling the Innovation Agenda

Innovation is critical to keep natural gas a reliable, affordable, and low-emission source of energy, and IGRC2024 will focus on technical research, gas clean-tech, technology start-ups, and social innovation to showcase global examples of innovation and its positive impact on both the gas sector and the societies it serves to energise. IGRC2024 is a very important technical conference of the IGU, and this year, it also features an outstanding strategic agenda.

I am very excited about taking part in this event, the heart of the engine, that will drive the future of gaseous energy through the ambitious transition we are in, and I encourage you all to join me in Canada on May 13th to 15th.

Turning to the global gas markets at large, 2024 set out to be a positive year. We had good fortune on our side, with the combination of unusually mild temperatures and high levels of storage in Europe, and steady global supply operations. This not only ensured that the European markets made it safely through the winter heating season, but also significantly lowered the global price of gas. As a result, consumers, including many Asian markets, which suffered shortages during the period of volatile and spiking prices over the previous two years, are sighing with relief.

However, as the level of geopolitical risk remains elevated, we should not rush to conclude that we are

out of crisis, as the additional volumes are still some years away, and the global market supply remains tight.

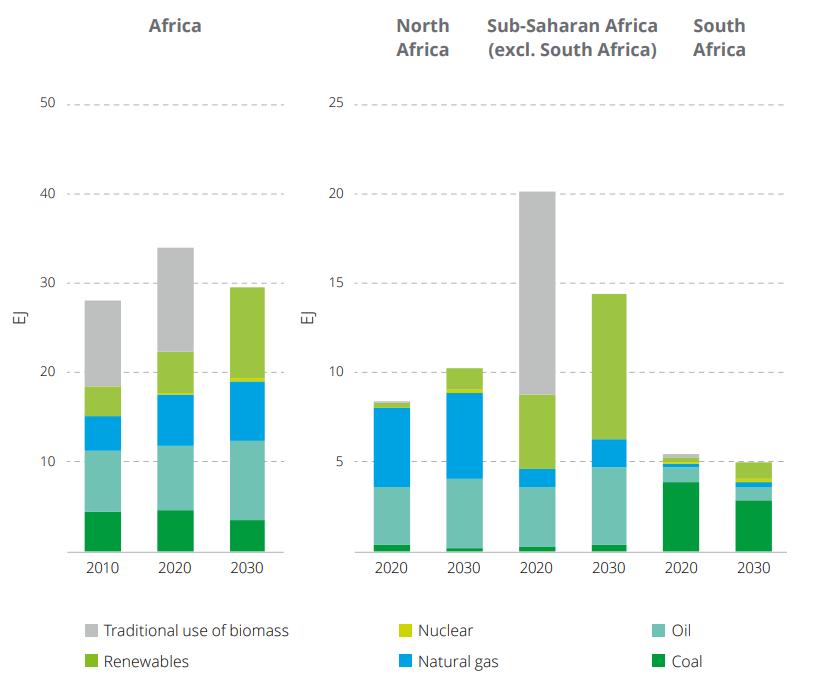

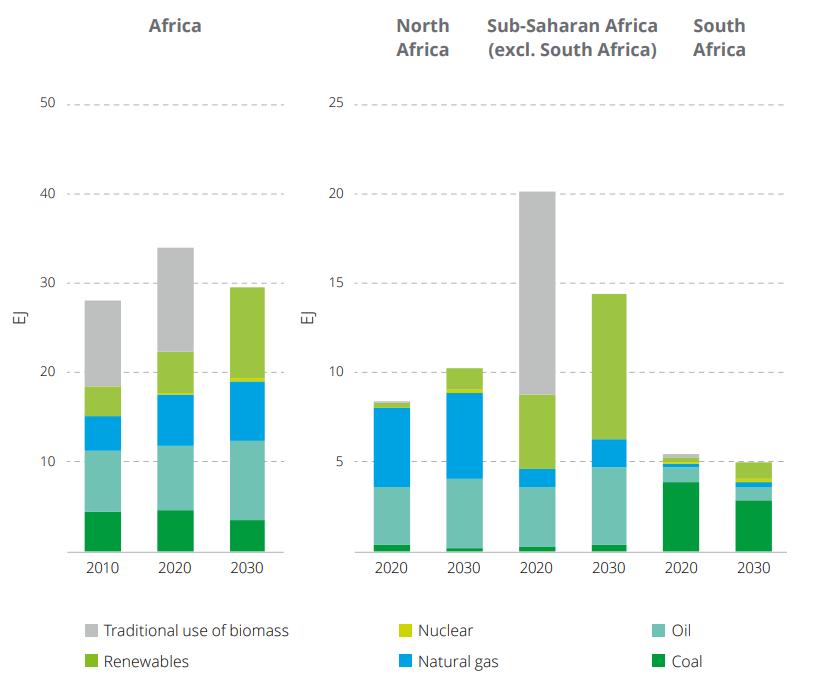

We should also not forget about growing energy needs of the world beyond OECD, and these needs will be met by different combinations of energy sources at their disposal. The countries and regions that are looking to provide energy to societies in environments facing energy and capital scarcity will look for the most affordable options first. That is simply the reality. When the affordability of gas has been challenged over those last few years, we saw a lot more coal entering the energy mixes of the world’s most energy-demanding and growing areas, and the global emissions level saw another rise.

Affordable natural gas is key to moving the needle on the energy transition. It is key to switching away from the most polluting and emitting sources, like coal; and policy, industry, technology and innovation are key to scaling and accelerating a deeper decarbonisation of the gaseous energy supply. These two pillars are necessary for a successful transition, while gas is essential for reliably providing the critical resiliency that the global energy system will need to maintain through the aggressive energy that is being undertaken in the world.

Our editors prepared an excellent issue on innovation and technology in the sector, and I hope you find it insightful and enjoyable.

Li Yalan, IGU President

Li Yalan, IGU President

Welcome to the 15th issue of the Global Voice of Gas magazine, an International Gas Union publication, produced in collaboration with Natural Gas World (NGW).

In the anticipation of the upcoming International Gas Research Conference 2024 happening in Banff, Canada, this May, the issue explores clean technology advances and innovations in gaseous energy, especially those supporting the decarbonisation of gas supply.

In an introductory article, Tim Egan, the President and CEO of the Canadian Gas Association hosting IGRC2024, shares that innovation is more than pure tech, pointing to its very important social dimensions, with examples from Canada.

We also interviewed Paula Gant, CEO of GTI Energy, a key US actor advancing energy technology innovation. Paula highlights that public-private partnerships and collaboration have been key in the net-zero innovation dynamic. We also spoke with Shamairi Ibrahim, Vice President of LNG Marketing & Trading at Petronas, about how Malaysia’s national LNG exporter is leveraging technology and innovation to provide lower-carbon energy, including through the pioneering use of floating LNGs, carbon capture and storage, zero flaring and upgraded LNG carriers.

Turning to Africa, the youngest continent, with an incredible 40% of the population aged 15 years or younger, its role in the future of energy and innovation is going to be pivotal. It is also a massive innovation playing field for energy. The challenge of its currently low energy could be turned into an opportunity to develop energy systems of the future, as the African communities industrialise and their economies grow.

We spoke to Osam Iyahen, Senior Director of the Africa Finance Corporation, established in 2007 to be the catalyst for private sector-led infrastructure investment across Africa. Now with almost two decades of experience and over $13bn in investment portfolio, AFC continues to deliver on its vision to be a leading energy infrastructure solutions provider – from renewables to gas projects.

Next, Rami Shabaneh, Research Fellow at King Abdullah Petroleum Studies and Research Center, stresses the strong value proposition of blue hydrogen as a tool for decarbonisation, and the need for developing an internationally-accepted standard for certifying low-carbon hydrogen. This will help unlock needed investment and facilitate trade, bringing about a much needed global market for the fuel.

Start-ups have played an instrumental role in providing new solutions to further decarbonise natural gas. One such company is Alberta-based Qube Technologies, which provides a continuous methane emissions monitoring solution that is low-cost and

scalable, helping oil and gas operators detect and eliminate methane leaks quickly and effectively, its COO Eric Wen explains in an interview. We look at other innovators in this field, including Californiabased Picarro, which mounts its cavity ring-down spectroscopy devices onto vehicles that survey distribution systems, and Quebec-based GHGSat, which now has 12 satellites in orbit detecting emissions with high-resolution equipment.

We also take stock of how the market for certified natural gas is developing, as a tool for producers to reduce their environmental footprint and prove that to their customers and their critics, and the growing production of bio-methane, or renewable natural gas, which not only has environmental benefits but in many countries can also more affordable than alternative fuels. Bio-methane can be used in all the same ways as natural gas, and when liquefied, has additional applications in both vehicle and maritime transport.

Innovation also means digitalisation and increased automation, which are helping the LNG industry reduce risk and boost efficiency, among other benefits, as we explore in this issue.

Carbon capture utilisation and storage technologies are the bedrock of any decarbonisation scenario, and just about every energy outlook scenario for the energy transition clearly demonstrates it. As experts tell GVG, the scale-up of CCUS is mission critical for meeting net zero. We explore this technology looking to understand where it stands today and what are the future prospects.

Given the decarbonisation imperative, our authors also consider key takeaways of the COP28 summit in Dubai: what were its key successes and which areas lacked progress?

GVG continues to follow critical developments impacting the natural gas market, and in this issue we share a review of risk exposure to potential critical maritime chokepoints, as shown all too clearly by events in the Red Sea region. We also take a look at the upcoming US presidential elections and what implications the result might have for policy affecting natural gas. In a year in which at least 64 countries, plus the EU, are holding votes on governments and legislatures, the US election is perhaps the most critical and divisive one for energy. Finally, our regular updates from the IGU Regional Coordinators will bring you up to speed with the latest developments in gas across Europe, North Asia and Austral-asia and Africa. We hope you enjoy this issue.

Tatiana Khanberg, Strategic Communications and Membership Director, IGUNatural gas indices across 130 locations in North America.

40+ daily power price indices in on-peak and off-peak markets. Outlooks and strategic analysis for power, gas, LNG and clean energy markets. News coverage on gas and power companies, infrastructure, policies, and regulations. 5-year short-term and 30-year long-term fundamentals and price forecasts.

Free content!

Check out our latest blog Top 10 questions facing North American gas and power markets in 2024

The Call for Abstracts for the 29th World Gas Conference (WGC2025) is currently underway, and we invite you to contribute, share your diverse perspectives and shape the event theme ‘Energising A Sustainable Future,’ scheduled for 19-23 May 2025 in Beijing, China.

This triennial event pledges a dynamic platform to delve into ground-breaking ideas, technological advancements, and sustainable solutions. Don’t miss your chance to contribute, define and transform the future of the energy sector in one of the curated topic themes:

1. Supply, demand, market and prices

2 Gas narratives under the new context

3. New momentum for LNG

4. Digital transformation

5. New gases in energy transition

6. Methane emission mitigation

7. Best practices through the whole value chain

RODNEY COX Director of Events, International Gas Union

RODNEY COX Director of Events, International Gas Union

Submit your abstract at www.wgc2025.com and take on a pivotal role at the forefront of discussions that are actively steering the future of energy.

Innovation is critical to keep natural gas a reliable, affordable, and low-emission source of energy.

Be part of the high quality program which includes:

• Global Spotlight Sessions on innovation & the energy trilemma (security, affordability, environment). Strategic panelists and moderators representing all regions of the world.

• Leadership Dialogues and keynotes by the likes of:

◦ Magatte Wade, Entrepreneur, speaker, and visionary leader on the role of African entrepreneurship and innovation

◦ Vaclav Smil, Distinguished Professor Emeritus, University of Manitoba, and Author

◦ Dr. Paula A. Gant, President and CEO, GTI Energy

◦ Dr. Bjorn Lomborg, President & Founder, Copenhagen Consensus Center

• Meet the finalists of the inaugural Global Cleantech Challenge

• Find out how the gas industry is addressing social innovation

• Learn about the latest global research and technical innovations from across the gas value chain

IGRC2024 is bringing global innovators, academics, researchers, and leaders from the gas industry to Banff, Canada. The conference will showcase the latest in technological innovations from across the gas value chain, host the first-ever Global Cleantech Challenge, and have strategic discussions and leadership dialogues to address a broader innovation agenda affecting all aspects of society, including economic development. Register now

Senior Adviser, Japan Gas Association, and IGU Regional Coordinator.

2023 has been another year of extreme volatility for energy.

» Natural gas prices in Asia are now lowered but not to levels seen before Russia’s war with Ukraine.

» While discussion of phasing out all fossil fuels including natural gas took placed in Dubai, COP28, December 2023, we have witnessed unprecedented numbers of final investment decisions taken on for new gas supplies, particularly in the US.

» But these FIDs are not enough to ease the current tight gas market in until at least in the mid of this decade.

» As the Russia- Ukraine war continues, the Asian gas market continues to be affected by disrupted natural gas supply chains.

» Further complicating matters, are the subsequent IsraelHamas conflict and mounting tension in South China Sea.

» In this new reality, the Asian LNG importing counties like, China, Japan, Korea, and Chinese Taipei are facing fundamental changes in the way they secure their energy.

» Australia remains one of the top four LNG suppliers in the world, with a yearly capacity of 89mn t/yr. and exports of 87 mil. tons, or 21% of world traded LNG. According to consultants EnergyQuest, this is contributing USD62.3B in export revenues in 2022, up 82% from previous year because of higher LNG global prices.

» However, tougher emission policies are putting pressure on LNG productions. The Labour government of Prime Minister Anthony Albanese, which came to power in May 2022, has made a legal commitment to achieve net zero by 2050 and pledged to cut GHG emissions by 43% from 2005 levels by 2030.

» Now, existing LNG projects that produce more than 100,000 tons of CO2 equivalent/yr must cut their emissions by 4.9%/yr between now and 2030. This is expected to affect about 215 oil, gas, and mining projects.

» In addition, the new legislation demands new gas fields to abate or offset all reservoir CO2 emissions within Australia. As a result, most new projects will have to combine carbon capture and storage (CCS), drastically increasing project costs. This will hit LNG producers soon as new fields need to be developed to substitute maturing fields that are becoming exhausted.

» The LNG industry could also be affected by gas supplies being diverted for domestic consumption. Under the Australian Domestic Gas Security Mechanism, introduced in 2017, Canberra is allowed to restrict LNG exports to ensure domestic gas supplies.

» The mechanism has never been used, but the new government has expressed a willingness to implement it.

» Given the complexity of evolving Canberra’s policy, foreign investors in Australian LNG projects and LNG importers are concerned about Australia’s long-term reliability as a source of supply.

» Japan was the largest buyer of Australian LNG last year, importing 31.2mn t/yr, equivalent to 43% of total Japanese LNG imports, with China send largest with 22.6mn tons.

» The Japanese government is particularly concerned about the impact on projects for which final investment decisions have already been taken and has requested Canberra to provide more detail information on whether CCS and ACCUs will enable project development.

» Japan may be especially perplexed by Canberra’s new stance because some Japanese customers chose not to renew long-term LNG contracts with Qatar that expired in 2021 and 2022.

» Japan has 24mn t/yr of long-term contracts with Australia, of which 8mn t/yr will expire by 2029. Some may switch to Middle Eastern suppliers that look less likely to try to cut LNG industry emissions in the same way as Canberra.

» Japan’s Minister of Economy, Trade and Industry Yasutoshi Nishimura said that bilateral talks were ongoing “regarding measures for protecting investors and ensuring a stable supply of LNG, to find a mutually acceptable solution”.

» Also, recent news that the White House is leading an interagency process to reconsider its approach to reviewing LNG export applications to non-FTA countries at DOE raised another concern for Japan. It is estimated that 110 mil. tons of LNG export may be affected of which 2 mil. tons are for Japan. This is also raising concern affecting long term energy security for countries relying on foreign energy imports.

» Japan chaired the G7 summit in 2023, and the G7 Climate, Energy and Environment Ministers’ Communiqué, in Sapporo for the first time stressed on the need of “Carbon Management” recognizing that Carbon Capture and Utilization (CCU)/carbon recycling and CCS can be an important part of a broad portfolio of decarbonization solutions to achieve net-zero emissions by 2050.

» CCU/carbon recycling technologies, including recycled carbon fuels and gas (RCFs) such as e-fuels and e-methane were focused on as important technologies to reduce emissions.

» Japan’s gas industry is aiming to replace natural gas with e-methane by 90% by the year of 2050. Existing and future natural gas infrastructure can be used to realise a smooth transition to low carbon gaseous energy.

» This will avoid natural gas infrastructure becoming stranded assets.

» In July 2023, the National Energy Administration’s (NEA) Natural Gas Development Report estimated gas demand would grow by between 5.5% to 7.0% in 2023. In September, a subsidiary of the state-run energy company CNOOC estimated it would be even higher, rising by 8%

» Noticeable gas demand increases came from higher utilisation of gas-fired generation in Southern China, influenced by lower spot LNG prices

» As a result, China’s LNG demand in 2023 seems to, once again, exceed that of Japan’s reaching a new record.

» In a longer-term perspective, China’s LNG demand is likely to continue to increase but not reaching the magnitude witnessed before. This is due to China’s emphasis on energy security prioritizing renewables and domestic coal.

» Chinese Taipei is investing USD 32 billion into renewables, hydrogen and CCS to realise a lower carbon society.

» While renewable energy sources are estimated to supply some 10% of the total electricity last year, it also continues to build new liquefied natural gas (LNG) importing terminals as part of its long-term energy mix strategy, balancing between securing energy supply and climate mitigation.

» Taoyuan LNG Terminal Development, third LNG terminal, located 1.2 km off the coast of Taoyuan City is expected to complete in 2025.

» Fourth phase of the Taichung LNG expansion project is scheduled to complete in 2029.

» Power generation accounted for 84% of total LNG demand in 2022, up 3.4% from 2021. LNG generates 35% of the country’s electricity with coal 45% and nuclear 12%.

Chinese Taipei is investing USD 32 billion for renewables, hydrogen and CCS to realize lower carbon society.

» By mid of this decade, approximately 50% of Taipei’s electricity is estimated to be generated from LNG, with the remaining 30% from coal and 20% from renewable sources.

» New Zealand is pursuing its Hydrogen roadmap to replace natural gas which outline the Government’s position on the future role of hydrogen supporting the transition to net zero 2050.

» As of June 2023, the government has invested $45.5 million in hydrogen-related research.

» New Zealand’s gas pipeline network is foreseeing transitioning to 100% hydrogen by 2050. Hydrogen blends of up to 20% can reduce carbon emissions by approx. 6% without changes to existing appliances. But once 20% of admixture is

reached, existing gas appliances need to be replaced.

» New Zealand’s transition to 100% hydrogen beyond 20% may serve as an example for others seeking replacing methane with hydrogen.

» With the change of government, energy policy may shift to more nuclear and LNG in coming years.

» South Korea relies on 100% of natural gas from overseas. It imported 45 mil tons in 2023 down from 2022 due to increase of nuclear power generation. KOGAS imports LNG based on 80% long term contract. It aims to diversify LNG sources reducing its share for Qatar from 40% down to 20% and reducing LNG from Russia but maintaining imports from Australia.

DIDIER HOLLEAUX

President Eurogas, Executive Vice President Engie and IGU Regional Coordinator.

DIDIER HOLLEAUX

President Eurogas, Executive Vice President Engie and IGU Regional Coordinator.

» After spending most of 2023 between 35 and 55 EUR/MWh (despite some weaknesses in late May and at the peak of summer) European prices of natural gas day ahead on the TTF market place (NL) started to decrease at the end of November.

» An unusually warm start of the winter (except in Scandinavia) combined with a very high level of gas in storage at the beginning of the winter (some significant quantities had even been stored in Ukraine for the western European countries) explained this decrease. By January 15, storage was still on average 80% full in the EU. This level didn’t allow Europe to import a lot of LNG and, as a consequence, some LNG was redirected to other destinations and the price of spot LNG weakened. By end of January the spot price is below €30 per MWh.

» The effect is even more impressive on the futures contracts. The prices of gas for delivery in 2024 remained between €45 and €60 per MWh during most of 2023. They started to decrease in November and are today around €30 per MWh, which translates into a very flat forward price curve.

» That means that the market thought that the risk of shortage of gas for winter 23/24 is very low. Nevertheless this isn’t the case for next winter, and even more for winter 25/26, when any combination of cold winter and production reduction may lead to a tense situation and high volatility.

» The consumption of gas in Europe in 2023 has remained at a low level, even lower than 2022 (around -8% or -31 bcm for EU+UK)

» On the industry side, this is a consequence of the

combination of efficiency efforts but also demand destruction (for instance in fertilisers), even if H2 2023 show some improvement compared to the first half of the year.

» Gas in power generation decreased by 15 bcm and accounted for almost half of the global reduction.

» On the heating side (roughly one third of the reduction) the reduction was due to warm weather, but also demand reduction under price pressure (the customers couldn’t afford to heat their homes or offices as much as usual).

» Russian pipe gas supplies remained more or less at the level where they had stabilized after summer 2022, i.e. 26 bcma (compared to 140 bcma in 2021, before the Russian war in Ukraine).

» Globally the LNG imports remained stable (142 bcm vs 144 bcm at EU+UK level), and the Russian LNG imports too (22.5 bcm vs 22 in 2022, and vs 18.5 in 2021).

» The share of US LNG in the imports increased (74 bcm vs 68 in 2021). Nevertheless, it has to be noted that, for EU only, the 61.6 bcm are less that 40 bcm higher than the pre-war level, and still far from the objective communicated by presidents Biden and Von der Leyen in March 22 (an additional US supply to the EU of 50 bcma ).

» Regarding LNG, we need to take into account that, following the agreement between Bulgaria and Turkiye, some quantities of LNG delivered in Turkish terminals may in fact supply the Southeastern European countries.

» Norwegian supplies to Europe decreased slightly (107 vs 115 bcm) due to maintenance. North African and Azeri supplies by pipe were stable (resp. 33 and 12 bcm).

» Globally (pipe + LNG) the supply of Russian gas to the EU is today less than one third of what it was before the war (48 bcm vs 153).

» The increase of the LNG import capacity is still very actively pursued in Europe with FSRUs being commissioned in 2023 (for instance Le Havre, France, or Piombino, Italy) or about to

be commissioned (Alexandroupolis, Greece), and LNG onshore terminal projects progressing (for instance in Germany).

» As far as pipe are concerned, following the completion of Interconnector Greece-Bulgaria in 2022, the countries of the region are working on developing their interconnections and specially the “vertical corridor” which will allow to ship gas from South to North along the Black Sea.

» In many parts of Europe, Gas TSOs have been actively improving their installations to adjust to the new gas flows resulting from the reduction of Russian gas imports.

» A lot of hydrogen projects are actively being developed in Europe, both for industry and mobility. Nevertheless, after a lot of enthusiasm in the past years, 2023 has seen some developers reassessing their projects, and putting some of them on the back burner, either because of inflation, because of supply chain issues (manufacturers of electrolysers are struggling to deliver quantities and quality), or lack of customer commitment.

» Biogas is still developing well. Europe produced 21 bcm of biogas through 1,300 plants in 24 countries in 2023, of which 4.2 bcm of biomethane. The industry is focusing on the target of more than 35 bcm of biomethane in 2030 in the EU.

» At the same time, other sources of biomethane are being developed, as the Salamnder Project in Le Havre, which was officially launched in June 2023 and aims at producing gas from plastic and timber waste.

» Therefore, we anticipate that the development of green and low-carbon gases could, within a few years, compensate the continued decrease of the domestic natural gas production in Europe, and stabilize the level of domestic gas resources.

» The European gas industry shall remain prudent for the two years to come because we know that the offer/demand balance is tight and that a cold winter or a combination of technical or political events could create a new crisis.

» In the long term, we see the world LNG offer/demand equilibrium improving after 2027, unless the Asian demand for gas increases dramatically.

» In this context the pause decided by the US administration in the permitting of new LNG project exporting to Europe is seen as a negative signal and a significant risk to increased prices and volatility in the medium term. The European industry has expressed its concerns to the US administration.

...any combination of cold winter and production reduction may lead to a tense situation and high volatility.

KHALED ABUBAKR

Chairman, Egyptian Gas Association. Executive Chairman, TAQA Arabia and IGU Regional Coordinator

The current dynamic developments in Africa’s gas industry demonstrate the continent’s growing importance as a key player in the global energy market. The agreements and projects outlined below highlight the efforts of African countries to increase domestic production, explore new reserves, and diversify their energy sources, while also looking to grow domestic economies and improve access to energy. These projects have high potential to drive economic growth, create employment opportunities, and improve energy security not only within Africa but also in neighbouring regions and even Europe.

» Eni and the National Oil Corporation of Libya (NOC) agreed on the development of “Structures A&E”, a strategic project aimed at increasing gas production to supply the Libyan domestic market as well as to ensure export to Europe. “Structures A&E” is the first major offshore project in the country since the early 2000s. The combined gas production from the two structures will start in 2026 and reach a plateau of 750 mmcf per day (million of standard gas cubic feet per day). The project also includes the construction of a Carbon Capture and Storage (CCS) facility at Mellitah, allowing a significant reduction of the overall carbon footprint, in line with Eni’s decarbonization strategy.

» Nigeria, Morocco intensified discussions to accelerate the Nigeria-Morocco Gas Pipeline Project in line with the series of Memoranda of Understanding (MoUs) signed between the two countries in Abuja in 2022. Both parties emphasized the strategic importance of the project to the two countries and the entire African continent and the need to drive it to

completion expeditiously in line with the objective of stemming energy poverty on the African continent. The 48” x 5,300Km pipeline, with capacity of 30 bcm per year, would traverse Republic of Benin, Togo, Ghana, Cote d’Ivoire, Liberia, Sierra Leone, Guinea, Guinea-Bissau, Gambia, Senegal, Mauritania, and terminate in Morocco with a spur to Spain.

» Algeria’s SONATRACH has signed a ten-year agreement that will extend the company’s long-term storage and redelivery capacity at the UK Grain LNG terminal starting from January 2029. This is the first agreement covering an import capacity of 125 GWh/d (equivalent to 3 MTPA of LNG), resulting from the competitive auction process initiated by Grain LNG, launched in September 2023. The Grain LNG terminal, located on the Isle of Grain in Kent, has been expanding to store and deliver the necessary quantities of gas to meet up to 33% of gas demand from the United Kingdom.

» Tanzania Petroleum Development Corp. has doubled its stake in the Mnazi Bay natural gas field operated by Etablissements Maurel & Prom SA as part of plans by the East African nation to increase government participation in strategic projects. TPDC signed an agreement with the French company on February 3 to boost its share in the gas-producing prospect south of the country to 40%, after purchasing a 20% stake from the Paris-based company for $23.6 million. Maurel & Prom – before the latest transaction – controlled 80% of the Mnazi Bay gas field. President Samia Suluhu Hassan is pushing for Tanzania to boost production of natural gas and build pipelines to export it to neighboring countries.

» Eni announced the introduction of gas into the Tango Floating Liquefied Natural Gas (FLNG) facility moored in Congolese waters, only twelve months after the final investment decision. Following completion of the commissioning phase, Tango FLNG will produce its first LNG cargo by the first quarter of 2024, placing the Republic of Congo on the list of LNG-producing countries. The Tango FLNG facility has a liquefaction capacity of about 1 bcm per year and is moored alongside the Excalibur Floating Storage Unit (FSU), using an innovative configuration called “split mooring,” implemented for the first time in a floating LNG terminal.

» Australia’s Invictus Energy Ltd. has discovered gas in northern Zimbabwe, nearly three decades after Exxon Mobil Corp. halted its efforts to locate oil in the area. Four samples from the Mukuyu-2 well at the CaboraBassa project have revealed the presence of gas. While this development is promising for the East Southern African nation, Invictus will need to conduct further drilling to determine the exact volume of the reserves. Exxon, then Mobil Oil Corp., abandoned exploration in Zimbabwe back in the 1990s after concluding that any discoveries were more likely to hold gas than oil. Its data was used by Invictus, which in March last year reached an agreement with Zimbabwe to increase its exploration license area sevenfold.

» Uganda and Tanzania have agreed to carry out a feasibility study for a pipeline linking Tanzania’s gas fields to Uganda. Tanzania has an estimated 57.5 trillion cubic feet of recoverable natural gas and uses some of it to produce 64% of the 1,872 MW electricity on the grid, according to the ministry of energy. Uganda has an installed generating capacity of about 1,500 MW reliant mainly on hydropower and is moving to diversify its sources of electricity and accelerate its energy transition. Tanzania is currently awaiting cabinet approval for a $42 billion liquefied natural gas (LNG) project after completing negotiations with Equinor, Shell and Exxon Mobil. The project would unlock a natural gas deposit of more than 36 trillion cubic feet.

» TotalEnergies and its partners CNOOC, Sapetro, Prime 130, Nigerian National Petroleum Company Ltd announced the start of production from the Akpo West field on the PML2 license in Nigeria. Located 135 kilometers off the coast, Akpo West is tied back to the existing Akpo Floating Production Storage and Offloading (FPSO) facility, which started-up in 2009 and produced 124,000 barrels of oil equivalent per day in 2023. By mid-2024, Akpo West will add 14,000 barrels of condensate production per day, to be followed by up to 4 mmcm of gas per day by 2028.

» Petrofac has secured a new contract from BP to provide operations services for the Greater TortueAhmeyim (GTA) liquefied natural gas project in Mauritania and Senegal. The multi-million-dollar deal is for three years and covers a wide scope of services, including onshore and offshore

management and supervision, provision of personnel, and equipment maintenance. The GTA project is about 90% complete, according to BP. The field, located offshore on the border between Mauritania and Senegal, will produce gas from an ultra-deepwater subsea system and mid-water floating production, storage and offloading (FPSO) vessel, which will process the gas and then transfer it to Golar LNG-owned Gimi FLNG unit.

» Angola’s Sonangol inaugurated December 14 the second phase of the Falcão project, an investment of $42.8 million dollars (€38.9 million) that will supply gas to the combined cycle thermoelectric plant and fertilizer factory in Soyo. The aim is to supply treated gas to the Soyo plant in Zaire province and to other industrial projects such as the ammonia and urea factory, which is considered strategic for the country, guaranteeing self-sufficiency in fertilizers.

The recent developments in the oil and gas industry in Africa demonstrate the continent’s growing importance as a key player in the global energy market.

Innovation is critical to maintaining the value proposition of energy to society. As will be seen at the upcoming IGRC2024 conference, there’s more to it than developing new technologies: it involves a host of other dimensions that have a positive impact on society.

Throughout history, innovation – in its broadest sense – has enabled society to prosper, and people to enjoy a better quality of life and greater freedom. This is especially true for energy, where the greater availability of affordable, reliable, acceptable energy has delivered profound benefits. But today when we think of innovation in the energy world, we tend to focus on specific technology developments, such as a gadget that delivers efficiency improvements or reduces environmental impacts. Such developments are indeed integral to innovation. However, a step back from the very particular technical sense to the broad sense opens the door to a much needed reflection on the deeper value of energy to society.

Gas Innovation Fund (NGIF) – a creation of the Canadian Gas Association to trigger entrepreneurial activity in the gas sector. That effort has evolved into a series of projects including a grants fund offering no-stringsattached awards to entrepreneurs with creative ideas, a venture fund making equity investments in start-ups that have proved themselves, and an emissions testing centre working to measure performance and de-risk various new ideas. Funded by the full gas value chain, the NGIF entities and their work with start-ups are driving innovation forward in Canada’s gas sector.

impacts, and better waste management practices are innovations in the sector driven by a commitment to continuously improve – which in itself is an innovative way for companies to operate. IGRC2024 will explore notable examples of gas sector innovation that have delivered significant environmental benefits.

And finally, on the broader topic of the value proposition of gas for society at large (and how that underscores innovation in all other things), IGRC2024 will see leaders from around the world share their perspectives on the status of the gas industry in their country, and how gas innovation is addressing and can further deliver on their country’s key priorities.

A special NGIF project for IGRC2024 – a Global Cleantech Challenge involving the award of up to $10 million in grant money – will see a selection of prize winners from across Canada and around the globe recognized at the Banff global conference. Award winners – after a rigorous review process – will be identified for their clean technology development ideas in natural gas production (upstream), transmission (mid-stream), and distribution and end-use applications (downstream). IGRC2024 will host the award ceremony for the finalists of this challenge.

TIMOTHY M. EGAN PRESIDENT & CEO, CANADIAN GAS ASSOCIATIONThe programme for the upcoming International Gas Research Conference (IGRC2024) reflects this broader scope of innovation. IGRC2024 is building on the tradition of past IGRC’s – a strong R&D focus – and adding other aspects of innovation including the merit of fuelling new ideas through start-ups, the long-term benefits of social innovation, deeper environmental benefits, and an appreciation of the value proposition of how gas energy and its infrastructure undergird a prosperous society. Exercising ‘home ice advantage’ (as we say in hockeyloving Canada) IGRC2024 will present an opportunity to showcase domestic examples of much of this broader reflection.

On start-ups, the event will give profile to the Natural

On the topic of social innovation, IGRC2024 will provide an overview of how Canadian energy companies and indigenous communities are working together to develop innovative new models for energy project development. One of the most remarkable aspects of the LNG industry in Canada today is that indigenous communities have become environmental regulators, partners, investors – and increasingly, champions – of projects. The message is that LNG development in Canada has presented a clear and key path to indigenous economic reconciliation – the extension of enormous opportunities for Indigenous Peoples in Canada to participate in and prosper from the natural gas value proposition.

Socially innovative models like these create value for communities, certainty for proponents and investors, and a foundation on which technical solutions can establish their value. They also show how gas energy development can address challenging global issues like poverty, which has been an all-too-common reality for many indigenous in Canada. Social innovation in the gas sector is helping indigenous people rise above that poverty.

On the broader environmental agenda, over the past several decades, increased gas use has delivered enormous environmental performance improvements. Lower air emissions, reduced water use, reduced land

One fundamental point likely to come out of these discussions is how maintaining energy diversity is a paramount concern. A recent weather episode serves as a vivid illustration. During the second week of January, a “polar vortex” locked in across North America, driving temperatures down well into the minus 40s (°C), with wind chills in the minus 50s (°C). It triggered alerts from various authorities to reduce electricity use. On January 12, around 4 pm in the western Canadian province of Alberta, wind and solar generation facilities were operating at only a few percentage points of their capacity. But power was desperately needed. Fortunately, a combination of in-province and neighbouring jurisdiction power sources – such as natural gas-powered plants – helped meet the power needs of the province.

The alerts were all about a single energy system: the Alberta electricity grid. While that grid was under strain, a parallel system – the natural gas delivery system –was supplying approximately nine times the energy and operating without any alerts required: while there was approximately 12,000 MW of electric power on hand, there was at the same time over 110,000 MW of gas energy equivalent keeping the province going.

The episode made clear how multiple options in an energy system are key – the innovative integration of those systems to ensure customers get the reliable, affordable, acceptable power they need is the priority.

When IGRC2024 comes around in Alberta at the beautiful mountain community of Banff this May, we should be past such extreme cold threats. The conversation will be thought provoking and rewarding. We hope you can join us to fuel the innovation agenda!

Innovations, supported by collaboration and public-private partnerships, will be essential to make a success out of the energy transition, GTI Energy CEO Paula Gant tells Global Voice of Gas.JOSEPH MURPHY

Collaboration and private-public partnerships can help drive the impactful innovation needed to fulfil the bold ambitions of the energy transition, which will involve not only decarbonising energy but all economic activity,

Paula Gant, CEO of US technology development group GTI Energy, tells Global Voice of Gas (GVG). Fuels – both liquid and gaseous – will continue to dominate global energy supply, GTI Energy believes, and the infrastructure used today for hydrocarbons will be of critical use for future drop-in fuels on the road to net zero.

In the years following the Paris Agreement in 2015, private investors and industry stepped up to channel capital into the energy transition, and turn aspirations into action, Gant says. By 2019, energy companies began announcing their own net-zero ambitions, mirroring those made earlier by governments.

“The money was starting to move, and it was no longer just about government intentions. It became about companies making commitments to their investors,” Gant says. “Then the industry started working back from those mid-century commitments to figure out how they will get to net zero. And that’s where innovation comes into play.”

So far, most focus has been on decarbonising electrical systems, and while that work must continue, reaching net zero is a monumental task that will require decarbonising not only entire energy systems but entire economies, Gant says.

“That’s going to take positive, disruptive innovation,” she says, citing the US shale revolution as an example, which in a relatively short amount of time has massively expanded global energy supply.

“There are lots of bold ambitions for the energy transition, but there is also a lot of uncertainty about pragmatically what to do about it,” Gant says. “At the same time there needs to be a sense of urgency – the future is now.”

“There are no solo acts in the energy transition,” she says. “We at GTI Energy are all about impact, and collaboration and partnerships allow us to create that impact.”

Following early research, government funding or other support often helps get technologies off the ground in terms of development. Then, in order to commercialise the technologies, large-scale operators and private equity bring to the table a business strategy and an understanding of how a solution is going to be received on the market, as well as operational and technological know-how and financing, Gant explains.

Despite the great uncertainty about how the energy transition will take shape, what is clear is that fuels, not just electrons, will be needed for the foreseeable future. GTI Energy last year published a meta analysis of five public studies on the pathways for decarbonising the US economy by 2050. The intent was to identify commonalities across the studies, to reduce the high level of uncertainty regarding the energy transition.

“A key thing that came out is that molecule fuels –gases and liquids – are ubiquitous in net-zero energy systems. They play a central role across the economy including in power generation. Even in the studies that assume the most aggressive electrification, we’re still seeing 60% of final energy demand underpinned by fuels.”

If fuels are to retain their dominant position, then efforts should be directed towards decarbonising those molecules, Gant says.

The analysis of the studies also concluded that pipeline gas infrastructure would be critical in every netzero scenario.

Energy systems need not only to be lower-carbon but also lower-cost. “We’re not just looking to decarbonise developed economies, we’re looking to have decarbonised, growing and robust economies in the developing world.”

This should be a central goal when mapping out the pathway towards net zero. The emphasis should also be on what can be achieved in the short term that can have multiplier benefits in the long term, whether in the developed or developing world, according to Gant.

“It may be that the molecules moving through those pipelines may change. We may have increasing renewable natural gas, or hydrogen-rich gas, or synthetic methane as drop-in fuels moving through those pipelines in the future, but we’re going to need that infrastructure,” she says. “It accelerates the pace and it reduces the cost of reaching net zero.”

In order to move new technologies and operational practices from the research phase to commercialisation, collaboration is key. GTI Energy seeks to create platforms where stakeholders can come together to de-risk the experimentation with these technologies and practices. Also critical to supporting new innovation is public-private partnerships.

Natural gas can support energy security, raise living standards and reduce emissions across the world, but addressing methane emissions is necessary to maximise its climate benefit, Gant says. Supporting this cause is the Veritas initiative.

For the last few years, GTI Energy has been working with operators across the natural gas supply chain along with other stakeholders – from academics and environmental NGOs to investors, policymakers and

“A key thing that came out is that molecule fuels – gases and liquids – are ubiquitous in net-zero energy systems. They play a central role across the economy including in power generation. Even in the studies that assume the most aggressive electrification, we’re still seeing 60% of final energy demand underpinned by fuels.”

PAULA GANT, CEO OF GTI ENERGY.

technology providers – to develop a consistent approach to measuring and verifying methane emissions. And Veritas, released in February 2023, was the product of that labour.

Veritas provides standardised, science-based and technology-neutral measurement protocols that are designed to assemble methane emissions inventories that are verified by direct field measurements, providing data that is credible that can in turn help the oil and gas industry report and ultimately address its emissions.

Heightened awareness of the climate impact of methane emissions has led to a flurry of technology and equipment solutions emerging to tackle the problem, as well as various emissions certification schemes.

“We were looking for a way of creating some simplicity out of that confusion with Veritas,” Gant says. “The elemental role is to create greater credibility assigned to the data that we’re getting off of all these new technologies that are coming into the space, and greater confidence in how companies are using that data to create their emissions inventories, whether for regulatory or investor reporting or natural gas certification.”

This helps operators and regulators determine which combinations of technologies provide the best information for specific types of operations. Not only does this lend credibility to reporting, but it also helps operators reduce the cost of quantifying and reducing their emissions.

GTI Energy and partners released an updated second version of the Veritas protocols in December.

The organisation is looking to introduce a similar standardised methodology for accounting for emissions from low-carbon hydrogen supply, through its Open Hydrogen Initiative.

“What success looks like for the Open Hydrogen Initiative is that we no longer talk about the colour of hydrogen, whether green or blue or otherwise, because we can be much more granular and accurate about what the carbon intensity of hydrogen is at the point of production,” Gant says. “Plan a funeral for the hydrogen colour wheel.”

Hydrogen is “having its moment,” she says. It is extremely versatile as a low-carbon fuel, with applications across heavy industry, transport and power generation, and serves as a valuable energy carrier. In the US, “catalytic” investments are being made to create the hydrogen economy. The role of the US Department of Energy has shifted, from being a subsidiser of early research and development to focusing on commercialising and scaling up hydrogen technologies, she says, from establishing public-private partnerships to providing low-cost capital through the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA).

Certified natural gas is increasingly being seen as a tool for producers to reduce their environmental footprint and, perhaps more importantly, prove that to their customers and their critics.DALE LUNAN

GEORGES TIBOSCH CEO, MIQ JON OLSON CEO, CG HUB

GEORGES TIBOSCH CEO, MIQ JON OLSON CEO, CG HUB

Natural gas is expected to fill an ongoing role in a secure global energy future, but producers are, at the same time, expected to strive for continuous improvement in their environmental performance and provide greater transparency surrounding the impact natural gas has on the environment.

In recent years, this has translated into a growing movement to certify natural gas as “responsibly produced” using a number of platforms. In some cases, producers are opting for more than one certification process, to capture the most benefit from the “responsibly produced” label.

MiQ, considered the global leader in methane emissions certification, has certified about 20% of US natural gas production. MiQ grades natural gas on its methane emissions and awards a letter grade – from ‘A’ to ‘F’ – to assist in the differentiation of natural gas production and incentivise continuous improvement along the natural gas supply chain.

Grade A certification is awarded for methane emission intensity at or below 0.05%; a B grade is awarded for methane intensity at or below 0.1%, while a C grade is

awarded for methane intensity at or below 0.2%. Only facilities with an A, B or C grade are certified.

In October 2023, Gulfport Energy was added to MiQ’s list of certified producers, earning an ‘A’ grade on its 1 bcfd of Appalachian gas production, while in November 2023, privately-owned PennEnergy Resources received an A grade from MiQ across its entire operating asset base of 400 Appalachian wells. That boosted the roster of MiQ-certified facilities to 19, operated by 13 of the largest US natural gas producers, including EQT, Chesapeake Energy, BP and Repsol.

MiQ says it has certified about 21 bcfd of US natural gas production, with 78% of the facilities it has assessed receiving an A grade, which is only available for facilities with methane intensity of 0.05% or less. All the others have methane intensities at or below 0.2%.

For comparison purposes, the MiQ-Highwood Index™, which measures methane intensities along the gas supply chain, applies a methane intensity of 1% to US natural gas production, and 2.2% for the entire gas supply chain.

“Across the total US supply chain the average methane leakage is about 1.0%. But 20%-plus of the US producers are less than 0.2%, which is very good, even on a global basis.”

GEORGES TIBOSCH, CEO, MIQ

“Across the total US supply chain the average methane leakage is about 1.0%,” MiQ CEO Georges Tibosch tells Global Voice of Gas (GVG). “But 20%-plus of the US producers are less than 0.2%, which is very good, even on a global basis.”

Most of MiQ’s certification work is focused on the upstream and midstream sectors of the industry, but it has also developed a greenhouse gas (GHG) emissions framework to assess all emissions of methane, CO2 and NOX from the LNG supply chain. By the end of the year, it hopes to begin certifying LNG production and to eventually provide certification that proves the methane intensity of a particular LNG cargo.

Such certification may become exponentially more valuable to gas producers and LNG developers in light of US President Joe Biden’s pause on new applications to export LNG to non-FTA countries. Biden ordered the review – apparently to improve his standing with his leftwing base ahead of the November presidential elections – and asked the Department of Energy to consider the methane intensity of LNG exports and how they impact the global climate crisis.

“This federal review is being used to hold the LNG industry accountable because operators have failed to be transparent on emissions,” Tibosch said when the review was announced.

If LNG is to be seen as an energy solution in the medium term – as many gas industry players insist – its emissions profile needs to be better than the coal it is intended to replace. And producers and LNG developers need to be able to prove that, Tibosch added.

“LNG exporters need to step up and have the emissions of their assets and gas purchased verified by third party auditors, so that they can prove their LNG is a net positive for the climate compared to coal.”

While all of MiQ’s certifications so far cover US natural gas production, it is looking abroad to expand its coverage, including in the North Sea, Tibosch tells GVG

“We are starting to engage with a lot of national oil companies as well, for example, because the national

oil companies, some of them might have high methane emissions, but the companies that have got high methane emissions, they are actually the easier ones to solve quite often because it’s much more difficult to go from 0.1% to 0.05% – by then you’re doing a lot of tweaking, but those first couple of percentage points, in particular, it is quite clear, generally, what needs to happen.”

Equitable Origin, another growing certification platform, measures the environmental impact of oil and gas production based on five principles – corporate governance, human rights, Indigenous Peoples’ rights, fair labour conditions, climate change, biodiversity and environment. Equitable Origin says it has certified about 15% of US and Canadian natural gas production, with some producers certified by both the MiQ and the EO100™ protocols. Apart from the joint certifications, Equitable Origin has certified about 3 billion cf of natural gas.

Equitable Origin’s EO100 Standard for Responsible Energy Development (EO100™) certification produces a letter grade for site performance in meeting each of the five principles, with a minimum ‘C’ grade for each of those principles required to achieve certification.

“The role of natural gas in the energy transition is highly contested and justly so,” Equitable Origin CEO Jason Switzer wrote in a year-end blog in January. “EO’s model of global standards and expert independent certification will be essential in helping to crediblydifferentiate better performance.”

Its partnership with MiQ, he added, allows producers to undertake both certifications at reduced cost and disruption, “combining our broad ESG coverage with their laser focus on methane abatement.”

Earlier this year, Seneca Resources became the first producer to receive an A grade under EO’s new system, demonstrating scores of 98% or higher across all five ESG principles in the EO100™ standard.

Alongside the original standard, Equitable Origin has developed technical supplements for onshore natural gas and light oil production, natural gas gathering and processing and natural gas transmission and storage, which is still in a draft stage.

“This is what the market needs –a centralised place for liquidity. The market needs a place where it can get that price discovery, count what, where and at what price. And they need market education.”JON OLSON, CEO, CG HUB

Some of the largest gas producers in the US and Canada have been certified under the EO100™ standard, including EQT, Chesapeake Energy, ARC Resources, Equinor, Seneca Resources, Northeast Natural Energy, Vermilion Energy and Pacific Canbriam Energy.

As the volume of certified gas continues to grow, the market is clamoring for a platform on which to trade both certified gas, which can fetch a premium, and the underlying environmental certificates generated by the production of certified gas.

Two platforms have emerged as leaders in this field, CG Hub, which was launched by TruMarx Data Partners in 2023, with the collaboration of from MiQ and other subject matter experts, and Xpansiv, which uses blockchain technology to facilitate the trade of certificates.

CG Hub trades in both physical gas and certificates, while Xpansiv trades only in certificates.

“The growth in the certified gas market has been rapid, and we expect to see the trading volumes rise as buyers are gaining a deeper understanding of how certified gas could contribute to their sustainability strategies,” Tijbosch says. “The ability to trade MiQ certificates on the CG Hub provides a huge opportunity for buyers to choose lower emissions natural gas and demonstrate Scope 3 emissions reductions, and we expect other platforms to join imminently too. Having certified 20% of US natural gas, we are moving closer

to achieving our goal of eliminating oil and gas methane emissions this decade.”

While Jon Olson, CEO of CG Hub, isn’t in a position to identify who is actively trading on the hub due to confidentiality provisions, he does tell GVG. “it’s a premier list with some great names, and it’s growing continually.”

Seneca Resources and Northeast Natural Energy were among the first to join the hub in the summer of 2023, and together provide customers access to more than a billion cfd of certified gas liquidity.

“This is what the market needs – a centralised place for liquidity,” Olson tells GVG. “The market needs a place where it can get that price discovery, and see who has what, where and at what price. And they need market education.”

Although the CG Hub is a marketing partner with MiQ, the platform is certifier agnostic, Olsen says. It manages information from Project Canary, another provider of certification services, from Equitable Origin, and from partners in the Oil & Gas Methane Partnership 2.0 (OGMP). It also will manage information provided by producers who choose to self-certify.

“We’re certifier agnostic, we’ll work with anybody. We’re registry agnostic, we’ll work with anybody. Our goal is to help our customers work with who they want to work with [and] to have a permanent record of what they did so they can report it. The whole name of this game is reporting. What’s the sense of measuring any of this stuff unless you report it.”

standard for certifying hydrogen as clean will unlock needed investment and facilitate trade, bringing about a global market for the fuel.JOSEPH MURPHY

Blue hydrogen has an important role to play in the energy transition, but a single internationally-accepted set of standards for certification of how cleanly it is produced is needed to unlock investment, facilitate trade and build a global market for the low-carbon fuel, the King Abdullah Petroleum Studies and Research Centre (KAPSARC) argues in a discussion paper published in December.

Hydrogen is classified as blue when it is produced from natural gas via steam methane reforming, with CO2 that results from the process being captured and safely stored. In the paper, Enabling Blue Hydrogen for a LowCarbon Future, KAPSARC notes that the technologies needed to produce blue hydrogen are both scalable and technologically mature, without needing significant innovation for deployment. In contrast, the development of large-scale electrolysers to produce green hydrogen from water “is still in its infancy,” Rami Shabaneh, a research fellow at KAPSARC that co-authored the report, tells Global Voice of Gas.

“Blue hydrogen can facilitate the rapid and substantial reductions in emissions that we need to meet those 2050 targets,” he says. “We cannot simply wait for green hydrogen to scale up. But blue hydrogen needs to be developed responsibly.”

Prior to the energy crisis, it cost $1.5-2.5/kg to produce blue hydrogen, versus a wide range of $3.1-9.0/kg for green hydrogen, according to the International Energy Agency (IEA) (see figure 1). When natural prices climbed to record heights in 2022, its cost rose to $5.3-8.6/kg, though gas prices have since subsided.

In any case, blue hydrogen can be developed more rapidly thanks to its technological maturity and scalability, supporting the development of hydrogen infrastructure and encouraging hydrogen utilisation, creating a market that is ready for when green hydrogen is available at scale, KAPSARC notes.

If you look at the emerging certification schemes, they are defining what is clean very differently.

RAMI SHABANEH, RESEARCH FELLOW AT KING ABDULLAH PETROLEUM STUDIES AND RESEARCH CENTER.

On how clean blue hydrogen can be, based on IEA data, that hydrogen produced using a SMR with a 60% carbon capture rate, which has been achieved at existing facilities, results in an emissions intensity of 5-8 kg of CO2 equivalent per kg of H2 (see figure 2). This drops to around 1-6 kg with capture rates above 90%, where upstream and midstream emissions comprise most of the overall emissions. KAPSARC notes that capture rates exceeding 90% are feasible when emissions are addressed from flue gases produced in the SMR furnace’s combustion process, and that advanced technologies such as partial oxidation reforming and autothermal reforming can achieve capture rates of more than 95%.

In contrast, green hydrogen has an intensity range of 1-2 kg.

However, though momentum behind clean hydrogen is

growing, it is critical that standards and certifications are implemented to build a sustainable economy for the fuel. The standards serve as predefined criteria or benchmarks for the value of the hydrogen in reducing emissions, while certification is needed to confirm whether those standards have been met, covering the whole supply chain from production to storage and transportation to end use.

Since the global clean hydrogen industry is very new, experience in certification is limited, and most existing and proposed schemes are focused on green rather than blue hydrogen.

“This situation is unsatisfactory given the significant role blue hydrogen could play in accelerating the commercialisation of clean hydrogen globally,” KAPSARC says.

As it currently stands, green hydrogen dominates

RAMI SHABANEH, RESEARCH FELLOW AT KING ABDULLAH PETROLEUM STUDIES AND RESEARCH CENTER.the pipeline for clean hydrogen projects. Of the clean hydrogen projects slated to come online by 2030, with a combined capacity of 38 MTPA, 25 are green hydrogen and only 13 are blue hydrogen.

Standards and certification are key to secure policy support for production projects, facilitate international trade and generate demand. But not only are most existing systems, including both voluntary and mandatory, designed for green hydrogen, as noted, those that do apply to blue hydrogen vary greatly in standards.

“You need certification because end users, who are paying a premium for it because it’s clean, need to know its environmental attributes, how it’s produced and its carbon intensity,” Shabaneh says. “But if you look at the emerging certification schemes, they are defining what is clean very differently.”

For instance, the EU classifies hydrogen as clean if its emissions intensity is no more than 3.4 kg of CO2 equivalent per kg of H2, whereas hydrogen must have an intensity of under 4 kg to secure subsidies in the US. In the UK it is only 2.4 kg.

Then there is the issue of how that intensity is calculated. While the EU RED II system covers well-towheel emissions, the UK and US schemes include only well-to-plant gate emissions. There is greater disparity in voluntary schemes, with China Hydrogen Alliance counting emissions only from the production plant and the Japa Aicihi Prefecture Low-Carbon Hydrogen Certification covering plant gate-to-wheel emissions, excluding the upstream.

This will cause problems given that there needs to be significant international trade of blue hydrogen for the fuel to make an impact on emissions, with countries like the US and in the Middle East positioning themselves as exporters to serve import markets such as Japan and the EU.

“If you’re an exporter like Saudi Arabia you are vulnerable because it’s very hard to design a plant right now when different regulations are in place in different countries, so hydrogen from your multibillion-dollar project could be accepted in one place and not another, because it doesn’t fit the criteria,” Shabaneh explains.

Governments need to work towards a mutuallyaccepted certification scheme based on the same

“We all need to be working on the same Excel sheet to calculate the carbon intensity of the hydrogen production, and this will facilitate trade and encourage investment,”

RAMI SHABANEH, RESEARCH FELLOW AT KING ABDULLAH PETROLEUM STUDIES AND RESEARCH CENTER.

standards, he says, with the same methodology used to calculate the carbon intensity of different production pathways.

“We all need to be working on the same Excel sheet to calculate the carbon intensity of the hydrogen production, and this will facilitate trade and encourage investment,” he says.

KAPSARC also argues in its paper that there should be separate certifications for surface and subsurface emissions. In the case of blue hydrogen, the former would primarily relate to those not captured from the SMR and upstream methane emissions associated with the natural gas supply. The latter would relate to any leakage from permanent storage sites. When it comes to storage, the good news is that there is already international guidance

by the IPCC and UNFCCC setting out definitive criteria for CO2 storage to be considered permanent, Shabaneh says.

Once there is an internationally-accepted standard for hydrogen, then an independent body would be used to audit emissions, with the process potentially supported by digitalisation, Shabaneh says.

A positive step was seen at COP28, when a declaration of intent was announced on global collaboration on certification schemes for hydrogen that has been signed by 40 countries. The intent also recognised the roles of both renewable and low-carbon hydrogen in addressing climate change. Shabaneh hopes that more countries will sign up to the initiative in the runup to COP29 in Baku later this year.

Coal Gasification (unabated)The world needs to embrace CCUS as an essential part of the energy transition, rapidly scaling up its development over the coming decades.JOSEPH MURPHY

Carbon capture utilisation and storage (CCUS) is a proven and practical solution for decarbonisation, and its rapid scale-up is mission critical for meeting net zero, experts tell Global Voice of Gas (GVG).

The case being made that CCUS should have a diminished or even negligible role in the energy transition often rests on unrealistic assumptions about how quickly the world can shift away from hydrocarbons. Time and time again, predictions of peaking demand for fossil fuels have not borne out.

Criticism of CCUS relies on “an uninformed view that the transition from fossil fuels can happen much faster and on a much larger scale than is physically possible, much less intellectually possible,” explains Charles McConnell, executive director for the Center for Carbon Management in Energy at the University of Houston.

“We’re going to add another 2-3bn people to this earth over the next 30 years and most of them will be located in cities.” This means the world will need more energy to move, power, heat, cool, and in many cases –build – these cities.

Adam Sieminski, senior advisor to the board of the Riyadh-based King Abdullah Petroleum Studies and

Research Center (KAPSARC), argues that

Rapidly replacing oil and gas also means rapidly replacing the extensive infrastructure that has been built to support the energy system. The more immediate focus should be on decarbonising hydrocarbon supply, through the elimination of methane emissions and routine flaring, and advancing CCUS, he says.

Often, according to Sieminski, scenarios where CCUS play a minor role in decarbonisation are based on two significant assumptions.

“Firstly, there is a very optimistic view on how much energy demand growth will slow down compared with its growth in the past,” he says. “The second problem is the fallacious idea has been embraced that renewables and increased energy efficiency are all you need to deliver rapid declines in emissions.”

In particular he stresses the lack of other feasible solutions for decarbonising hard-to-abate sectors such as aviation, cement production and metal smelting.

Too much discussion around the energy transition is guided by “philosophy”, McConnell believes. “We need practical solutions, and CCUS provides them.”

CCUS is not an inexpensive technology and the higher the capture rate the higher the cost. “But if you look back 20-25 years, there were people that were saying that solar and wind power were impractical because they were too costly,” Sieminski says. “What we managed to do with scientific and engineering innovations was to bring the costs down – we need to do the same thing with other technologies such as CCUS.”

Meanwhile, the idea that CCUS is an unproven technology is “demonstrably wrong,” he adds. “The oil and gas industry has been finding ways of capturing and storing carbon for half a century.”

Costs vary greatly from country to country and project to project, and are subject to factors such as the concentration of CO2 in the gas at the capture site, the means and distance of transport and whether the CO2 is stored onshore or offshore, according to Alex Zapantis, general manager for external affairs at Australia’s Global CCS Institute.

On one end of the spectrum he points to the Moomba CCS project in south Australia, which developer Santos estimates will have a full lifecycle cost of under $25 per T. The CO2 is separated from natural gas produced at Cooper Basin fields and then stored in depleted reservoirs. On the other end, he notes that costs can reach around $120 per T.

Even at this higher cost, though, the technology is still a very competitive abatement solution compared with the

available alternatives, Zapantis says. And like any other technology, such as renewables, costs will very likely fall as the industry expands, he says, through economies of scale, innovation, increased competition between vendors and greater specialisation, whereby different companies handle capture, transport and storage respectively.

“There is nothing special about CCS in this sense – just as with any other new industry, things get cheaper over time,” Zapantis says. “CCS is only just starting on that journey.”

James Fann, president and CEO of the Canada-based International CCS Knowledge Centre, notes that lessons are being learnt from projects already in operation. Some like the CCS facility at the Boundary Dam power plant in Saskatchewan have been capturing and safely storing CO2 for a decade. Those lessons are now being applied to new and larger developments, to improve capture efficiency and reduce operating and capital costs.

Just as policy support was critical when renewables were emerging, it is also essential for scaling up CCUS. Different countries have adopted different approaches to this support. While the US relies heavily on tax credits, the EU has focused more on grants and loans. Many governments have also restricted or priced emissions, while indirect support has also come from incentives provided for the production of blue hydrogen.

A global carbon tax is critical, McConnell stresses.

Getting one accepted around the world would be no small feat, but precedents have been set regarding other environmental issues, such as international limits on sulphur content in fuels.

“What a carbon tax does is raise the performance requirements for everyone across the board,” he explains. “But when you just have government grants and tax incentives in one place that aren’t there elsewhere, you end up with a global mismatch of countries enforcing requirements and others which are not.”

Policy should enable as many R&D and pilot CCUS projects to be developed globally as possible, Sieminski says, as well as prioritise the advancement of commercial ones that have the greatest impact on emissions. A global agreement on accepted, and robust measurement, reporting and verification (MRV) standards on emissions is also needed, to spur the development of a global market for CCUS.

Policymakers should keep an “open mind” about the options for establishing a circular carbon economy,

whether that is pursuing CCS, direct air capture (DAC) or carbon offset scheme such as forestation, according to Sieminski. An eventual goal should make capture costs so low that CO2 becomes a value-added product. He points to the example of locking away carbon within concrete, which not only abates emissions but also makes the concrete stronger and lighter.

McConnell says he is “encouraged that we’ve moved past the era of only institutional research and government grants, because if that’s all we’re ever going to do, it’s never going to be impactful.” Now the world is moving towards commercial models that can advance CCUS at scale, he says.

Predictable regulation and policy is also key.

“The biggest thing we hear from industry is the certainty they need from regulations and policies,” Fann says, with the lack of that certainty potentially holding back development.

“We can’t be hampering our ability to make investments by uncertainty in the regulatory regime here

“We can’t be hampering our ability to make investments by uncertainty in the regulatory regime here in the US or frankly anywhere in the world. Uncertainty directly impacts risk which directly impacts investment.”

CHARLES MCCONNELL, EXECUTIVE DIRECTOR FOR THE CENTER FOR CARBON MANAGEMENT IN ENERGY, UNIVERSITY OF HOUSTON

in the US or frankly anywhere in the world,” McConnell says. “Uncertainty directly impacts risk which directly impacts investment.”

Based on the average of 90 models reviewed by the UN International Panel on Climate Change (IPCC) in its Special Report on Global Warming of 1.5°C, approximately 10 GT of annual CO2 must be geologically stored by 2050 for the world to keep temperature rise under 1.5°C. According to the Global CCS Institute, there are currently 43 CCS projects operating with a combined capacity of 50 MTPA, another 28 under construction with 33 MTPA of capacity and more than 300 at the study phase with a capacity of around 300 MT.

To reach 10 GT of annual CO2 capacity by the middle of the century, capacity needs to reach the gigatonne level by 2030, but the current project pipeline means it is unlikely it will exceed 1 GT until the mid-2030s, Zapantis says.

“We are not on track, but CCS is not alone. Neither are renewables, bioenergy or many other technologies.”

To make a bigger impact faster, Sieminski stressed the importance of CCUS hubs, like those proposed in the US, Europe and the Middle East, where there is heavy industry to decarbonise, hydrocarbons to produce hydrogen and viable CO2 storage sites, as well as extensive infrastructure to support all this. “Essentially all the elements you need to make CCUS really work.”

But ultimately, progress on CCUS in only select locations in the world is not going to move the dial on climate change, according to McConnell. The technology needs to go global.

“If this doesn’t get all the way to China and India, sooner rather than later, it isn’t really going to make an impact,” he says. “The major emissions are there and we need to provide a technology solution that helps address them. And CCUS can be a big part of that solution.”

Source:

With more robust regulatory demands in Europe, the US and Canada, reliable leak detection technologies are emerging to support compliance.ELSIE ROSS

Amid global concerns about climate change, methane is increasingly important as the potent greenhouse gas driving global warming in the short term.

And as governments mandate Leak Detection and Repair (LDAR) programmes such as US EPA Method 21, Alberta Directive 060 and European Method EN 15446, reliable emissions monitoring has become an imperative for the oil and gas industry.

“What we see is absolutely, there is a lot of pressure at all levels on gas operators to clean up their operations, to convince and justify to their communities and their regulators that they are helping reduce emissions,” Julien Klein, senior director of product development in the gas group at Picarro, a California-based technology company focused on the distribution segment of the natural gas industry, tells Global Voice of Gas. “They have a challenge in convincing society that gas can be sustainable or a bridge energy for the next 50 years.”

In response to that demand, technology companies such as Picarro and Montreal satellite developer GHGSat are developing new technologies capable of more accurate and immediate measurement and leak detection.

Picarro employs vehicle-based surveys along distribution pipelines GHGSat now has a constellation of 12 satellites orbiting the earth to provide real-time leak detection, with

a focus on methane emissions.

Picarro’s AMLD (advanced minimum leak detection) technology is a vehicle-based solution to identify, measure and quantify low levels of methane fugitive leaks and emissions on the gas distribution grid from a distance of several hundred feet, from main or service pipelines.

“The productivity is much higher than the conventional methods of surveying scanning that are typically done on foot,” Klein says.

An analyser on board that is sensitive to parts per billion (essentially three orders of magnitude lower than previous technology) measures both methane and ethane, taking wind conditions into account.

“That allows us to sniff essentially leaks or plumes of gas, even if they’re highly diluted after propagating in the atmosphere,” he says.

As the vehicle goes through a plume, the analysis can determine the source and volume of gas being emitted and whether it’s coming from a natural gas facility with the right mix of methane and ethane or if it’s something that can be attributed to sewer gas or some other biogenic sources.

Data from multiple passes is combined to help narrow the geographical area of interest.

“So it’s not direct pinpointing of a leak, but it’s creating

basically an area of interest that can then be investigated on foot by an operator to find the actual leak,” Klein says.

“We make these very fine measurements and then we have protocols where our customers will join multiple times and will accumulate basically a statistical representation of whatever we are measuring,” he says.

“And we have [focused] in on some algorithms over the past decade, to turn that raw data into something that makes sense that can be consumed by an operator, and that can be acted on by an operator.”

Faster detection of leaks enables operators to repair them sooner, resulting in substantial emission reductions, which also is a driver for regulators, says Francois Rongere, Picarro’s senior director of solution architecture for climate and safety.