12 minute read

Members of IGU

by IGU

Albania Algeria Argentina Armenia Australia Austria Azerbaijan in IGU 86 Charter Members 14 Premium Associate Members Albania Albanian Energy Regulator (ERE) Algeria Association Algérienne de l’Industrie du Gaz – AIG Argentina Instituto Argentino del Petróleo y del Gas Armenia Union of Gas Companies of Armenia (UGCA) Australia Australian Gas Industry Trust Austria Österreichische Vereinigung für das Gasund Wasserfach (ÖVGW) Azerbaijan State Oil Company of the Azerbaijan Republic (SOCAR) Bahrain The National Oil and Gas Authority (NOGA) Belarus Gazprom Transgaz Belarus Belgium Association Royale des Gaziers Belges Bahrain Belarus Belgium Bolivia Bosnia and Herzegovina Brazil Brunei Bolivia Yacimientos Petrolíferos Fiscales Bolivianos (YPFB) Bosnia and Herzegovina Gas Association of Bosnia and Herzegovina Brazil Associação Brasileira das Empresas Distribuidoras de Gás Canalizado (ABEGÁS) Brunei Brunei Energy Association Bulgaria Overgas Inc. AD Cambodia Cambodian Natural Gas Corp. Ltd Cameroon Société Nationale des Hydrocarbures Canada Canadian Gas Association Chile Natural Gas Distributors Association (AGN) China, People’s Republic of China Gas Society Colombia Asociación Colombiana de Gas Natural – Naturgas Bulgaria Cambodia Cameroon Canada Chile China, People’s Republic of Côte d’Ivoire Société Nationale d’Opérations Pétrolières de la Côte d’Ivoire – PETROCI Holding Croatia Croatian Gas Association Cyprus Ministry of Energy, Commerce, Industry & Tourism Czech Republic Czech Gas Association Denmark Dansk Gas Forening – Danish Gas Association Egypt Egyptian Gas Association Equatorial Guinea Sociedad Nacional de Gas de Guinea Ecuatorial (SONAGAS G.E.) Finland Finnish Gas Association France Association Française du Gaz (AFG) Germany Deutscher Verein des Gasund Wasserfaches e.V. (DVGW Colombia Côte d’Ivoire Croatia Cyprus Czech Republic Denmark

Countries represented 61 Associate Members

Charter Members

Egypt Greece Public Gas Corporation of Greece S.A. (DEPA) Hong Kong, China The Hong Kong & China Gas Co. Ltd Hungary Hungarian Electricity Plc (MVM) – Hungarian Gas Trade India Gas Authority of India Ltd (GAIL) Indonesia Indonesian Gas Association (IGA) Iran National Iranian Gas Company (NIGC) Iraq State Oil Marketing Company/Ministry of Oil (SOMO) Ireland Gas Networks Ireland Israel The Israel Institute of Energy & Environment Italy Comitato Italiano Gas (CIG) Equatorial Guinea Finland France Germany Greece Hong Kong, China Hungary India Indonesia Iran Iraq Ireland Israel Italy Japan Korea, Republic of Kuwait Latvia Lebanon Libya Lithuania Macedonia Malaysia Mexico Monaco Mozambique Netherlands, The New Zealand Nigeria Norway Oman, Sultanate of Pakistan

Japan The Japan Gas Association Korea, Republic of The Korea Gas Union Kuwait Kuwait Petroleum Corporation (KPC) Latvia JSC Latvijas Gāze Lebanon Ministry of Energy and Water Libya National Oil Corporation Lithuania Nacionaline˙ Lietuvos Energetikos Asociacija (NLEA) Macedonia Macedonian Gas Association Malaysia Malaysian Gas Association Mexico Asociación Mexicana de Gas Natural, A.C. Monaco Société Monégasque de l’Électricité et du Gaz (SMEG) Peru Poland Portugal Qatar Romania Russian Federation Serbia Singapore Slovak Republic Slovenia South Africa Spain Sudan Sweden Switzerland Taiwan, China Thailand Timor-Leste Trinidad and Tobago Tunisia Turkey Ukraine United Arab Emirates United Kingdom United States of America Uzbekistan Venezuela Yemen

Mozambique Empresa Nacional de Hidrocarbonetos, E.P. (ENH) Netherlands, The Royal Dutch Gas Association – Koninklijke Vereniging van Gasfabrikanten in Nederland (KVGN) New Zealand The Petroleum Exploration & Production Association of New Zealand Inc. Nigeria Nigerian Gas Association c/o Nigeria Gas Co. Ltd Norway Petoro AS Oman, Sultanate of Oman LNG L.L.C. Pakistan Petroleum Institute of Pakistan Poland Polskie Zrzeszenie Inz˙ynierów i Techników Sanitarnych (PZITS) – Polish Gas Association Portugal Associação Portuguesa das Empresas de Gás Natural (AGN)

As in past years, the oil market continues to produce new challenges and 2018 has been no different. At BB Energy (BBE), the company goal is to overcome these events and ensure that business continues to grow by continuing to hire the best in the field and to increase its foothold in key areas.

BBE’s long term strategy has placed particular emphasis on the US market and Africa. The US has become a key export market for crudes and LNG and the complexity of the local logistics present further opportunities for new trades. With the new team in place in Houston, we have been able to execute our first pipeline trades, exported LNG from the US and have taken a few storage positions in the Americas. This has allowed BBE to expand our oil product business into Central and South America as well as allowing the global book to take advantage of arbitrage opportunities.

In addition to the above, BBE continues to make progress on Africa in both the downstream and cargo trading. We have acquired controlling interests in several downstream assets which we will use as a trading hub for Central Africa. These infrastructures are now being used to their full potential, for example we are now able to use both the Kenya and Tanzania routes to enhance our cargo trading as well as overland supply to DRC and the neighbouring countries. These assets have also allowed us to be competitive in winning part of the Zambian fuel supply tender – cementing our strategy and enhancing our inland profile.

In West Africa, BBE has been awarded its first NNPC crude export contract and established a strong local onshore presence for product sales from Lagos and Calabarto local distributors. The Company has made inroads in Ghana by processing crude at the refinery, product sales to local licensed players and pre-financing cargoes for export. All these activities reinforce our belief that the long-term future of our business is to focus on the last-mile delivery – a strategy that will be deployed in other parts of the world where we trade.

On the LPG front, the group continues to grow its fully-integrated business in Bangladesh and going forward BBE will look for opportunities to emulate the same models in the new markets where we operate.

The key to growth will remain BBE’s ability to finance business and to be able to offer financing structures that suit BBE’s customers’ needs while ensuring that the relevant risks are properly managed. We have done this by increasing our RCF to $245 million and our bilateral lines to more than $3.7 billion and by regularly accessing the banking and insurance markets to cover credit and performance risks.

Due to the above-mentioned strategy the group expects further growth in the 2019 sales volume, which is expected to grow at a rate of 10 to 15%

BBE continues to seek the best industry professionals to join the group. This can be challenging but as proven from the hirings made over the past few years, the company has strongly benefited from the skills and knowledge base they bring with them.

The middle-distillates sector is also likely to provide new trading opportunities, with the introduction of lower sulphur-content rules for shipping fuel in 2020. The International Maritime Organisation set 2020 as the implementation date for a reduction in the sulphur content of fuel oil used by ships to 0.5% from the current 3.5% limit. From BBE’s point of view this will create trading and blending opportunities.

www.bbenergy.com

Charter Members – continued

Qatar Qatar Liquefied Gas Company Ltd (Qatargas) Romania S.N.G.N. Romgaz S.A. Russian Federation OAO Gazprom Serbia Gas Association of Serbia Singapore SP PowerGrid Ltd Slovak Republic Slovak Gas and Oil Association Slovenia Geoplin South Africa South African Gas Development Company (Pty) Ltd Spain Spanish Gas Association – Asociación Española del Gas (Sedigas) Sudan Ministry of Petroleum and Gas Sweden Swedish Gas Association – Energigas Sverige Switzerland Swissgas Taiwan, China The Gas Association of Chinese Taipei Thailand PTT Public Company Ltd Timor-Leste TIMOR GAP, E.P. Trinidad and Tobago The National Gas Company of Trinidad and Tobago Ltd Tunisia Association Tunisienne du Petrole et du Gaz (ATPG) c/o STIR Turkey BOTAS¸ Ukraine Naftogaz of Ukraine United Arab Emirates Abu Dhabi Gas Liquefaction Company Ltd (ADGAS) United Kingdom

Anadarko Petroleum Corporation (USA) Beijing Gas Group (China) Cheniere Energy Inc. (USA) China National Petroleum Corporation – CNPC (China) Enagás (Spain) Abu Dhabi National Oil Company (ADNOC) Distribution (UAE) AGL Energy Ltd (Australia) Atlas Copco Gas & Process (USA) Australian Petroleum Production & Exploration Association – APPEA (Australia) Baker Hughes, a GE company (USA) BP Gas Marketing Ltd (United Kingdom) Bureau Veritas (France) Bursagaz (Turkey) Chevron Gas & Midstream Company (USA) China LNG Association (China) China Petrochemical Corporation – Sinopec (China) COM-therm (Slovakia) ConocoPhillips Company (USA) DNV GL (Norway) Edison S.p.A. (Italy) Enerdata s.a.s. (France) Energodiagnostika (Russia) Eni (Italy) Eurogas GasTerra B.V. (The Netherlands) ARPEL – Regional Association of Oil, Gas and Biofuels Sector Companies in Latin America and the Caribbean Energy Delta Institute (EDI) Gas Infrastructure Europe (GIE) Gas Technology Institute (GTI) GERG – Groupe Européen de Recherches Gazières/ European Gas Research Group ENGIE (France) Equinor ASA (Norway) ExxonMobil Gas & Power Marketing (USA) İGDAŞ – Istanbul Gas Distribution Co. (Turkey) Korea Gas Corporation – KOGAS (Korea) GAZBIR – Association of Natural Gas Distributors of Turkey Hermann Sewerin GmbH (Germany) HIMOINSA S.L. (Spain) Indian Oil Corporation Ltd (India) Indonesian Gas Society (Indonesia) INPEX Corporation (Japan) Instituto Brasileiro de Petróleo, Gás e Biocombustíveis – IBP (Brazil) Israel Natural Gas Lines Ltd (Israel) Liander N.V. (The Netherlands) Linde AG (Germany) Natural Gas Society (India) NextDecade Corporation (USA) N.V. Nederlandse Gasunie (The Netherlands) Oman Gas Company SAOC (Oman) OMV Gas & Power GmbH (Austria) ONC Energy (China) Origin Energy Limited (Australia) Petróleo Brasileiro S.A. – Petrobras (Brazil) Petronet LNG Limited (India) Posco Daewoo (Korea) PwC (The Netherlands) GIIGNL – Groupe International des Importateurs de Gaz Naturel Liquéfié/International Group of LNG Importers NGV Global NGVA Europe – European Association for Bio/Natural Gas Vehicles International Pipe Line & Offshore Contractors Association (IPLOCA) The Institution of Gas United States of America American Gas Association Uzbekistan Uzbekneftegaz (UNG) Venezuela Petróleos de Venezuela S.A. (PDVSA) Yemen Yemen LNG

Premium Associate Members

Engineers and Managers Naturgy (Spain) PT Pertamina – Persero (Indonesia) Royal Dutch Shell (The Netherlands/UK)

Associate Members

Organisations Affiliated to IGU

TOTAL S.A. (France) Regas (Italy) Repsol S.A. (Spain) Russian Gas Society (Russia) Samsung Engineering Co. Ltd (Korea) Santos Ltd (Australia) Schlumberger (USA) Sempra LNG & Midstream (USA) Simon Kucher & Partners (Germany) Société Suisse de l’Industrie du Gaz et des Eaux – SSIGE/SVGW (Switzerland) Sonorgás (Portugal) TAQA Arabia (Egypt) Tatweer Petroleum (Bahrain) TBG – Transportadora Brasileira Gasoduto Bolívia-Brasil S.A. (Brazil) TgP – Transportadora de Gas del Perú (Peru) The Association of Oil & Gas Exploration Industries in Israel Turboden (Italy) Uniper SE (Germany) Vitol S.A. (Switzerland) Westnetz GmbH (Germany)

Woodside (Australia) MARCOGAZ – Technical Association of the European Natural Gas Industry Pipeline Research Council International, Inc. (PRCI) Russian National Gas Engine Association (NGA) World LPG Association (WLPGA)

By T.K. Tamby

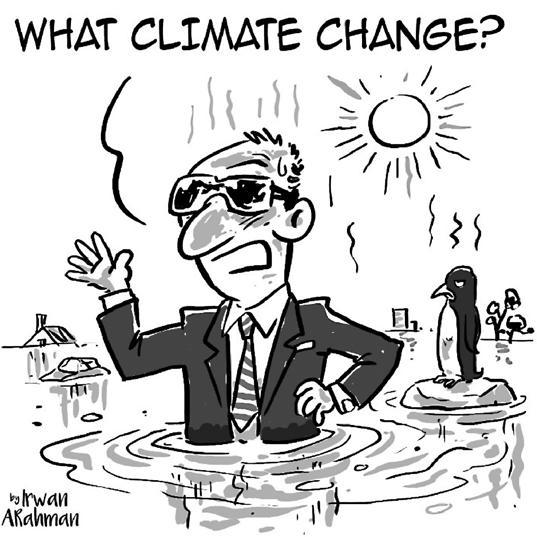

Climate change – no matter how you spin it, the stark image of melting ice sheets tells you that it’s real. And the oil and gas industry often finds itself stuck between the need to fulfill voracious energy demand and not destroying the environment in the process.

Despite its faults, can the oil and gas sector provide a remedy to reduce the amount of greenhouse gases (GHG) spewed into the atmosphere? Though renewables are hailed as the panacea for all that ails the environment, there is a ready solution with a largely untapped potential of reducing GHG emissions. This solution is natural gas.

Granted, it is still a fossil fuel – however, it is low carbon. When natural gas burns, it produces 50% less carbon dioxide (CO 2 ) than coal and 30% less than oil.

Though an obvious choice, there is considerable resistance especially from parties peddling other options for fuel. The number one argument against natural gas is that it consists purely of methane – a GHG 21 times more potent than CO 2 .

However, methane is a fuel that burns completely, emitting significantly less CO 2 – the primary GHG, as well as sulphur dioxide and nitrogen oxide – the precursor of acid rain. Additionally, natural gas produces no smog-creating ash and particulate matter, which affect health and visibility.

Global methane emissions are roughly split between anthropogenic and natural sources. Anthropogenic methane sources include agriculture, energy production, landfill and waste water. According to the US Environmental Protection Agency, agriculture accounts for more than 50% of total anthropogenic emissions followed by the oil and gas supply chain, which accounts for around 20% of emissions – mostly, fugitive emission from leaks along the value chain.

Natural emissions of methane are attributable to amongst others, wetland, natural seeps, animals and the decay of vegetation.

Over the years, there have been tremendous effort by oil majors to cut methane emissions. In the case of petronas, as part of its Carbon Commitment, the Group has imposed a mandatory requirement of no continuous venting and flaring of methane in the design of new facilities.

For inherited or legacy assets designed more than 20 years ago, methane is monetised in facilities with gas evacuation infrastructure. As for fugitive emissions, petronas has put in place a Leak Detection and Repair Programme.

There have been increased investments in research aimed at improving the industry’s ability to detect methane leaks, improve emissions reporting and enhance efforts to reduce emissions. Late last year, the

Canadian government announced an investment of C$5.3 million for seven projects aimed at tackling methane emissions in the oil and gas sector. petronas has pumped RM275 million into carbon reduction measures since 2013, which has contributed to an 8 million-tonne reduction of CO 2 equivalent emissions.

The push to reduce GHG emissions is not only motivated by the need to meet multiple environmental goals, but also to curb revenue loss. According to a 2015 article by Forbes, global oil and gas industries allow as much as 3.6 trillion cubic feet of natural gas to escape, representing at least $30 billion in lost revenue.

Resistance on the basis of methane leaks should not stop us from unlocking the immense potential of natural gas. Apart from electricity, it can be used as a fuel for any mode of transportation. Natural gas vehicles are not zero-emission but their environmental, economic and availability advantages make them a realistic alternative to vehicles running on other fossil fuels.

The reduction of pollution would be a much welcome change for cities shrouded in thick smog. The city of Lanzhou in China, once described as “a city you can’t see from satellite due to dense smog”, managed to improve its air quality after switching from coal to gas.