From the

From the

Insurance agency perpetuation is something that will affect all agencies. But where do you start? The best way to handle it is to have a plan in place. Afterall, a plan is your road map: it shows the final destination and the best way to get there. In this issue of Kentucky IA Magazine, we provide information to help take those first steps in your perpetuation journey.

Have you heard of InsurBanc? It is an independent community bank founded by independent agents exclusively for independent agents. Organized in 2001 by the Big “I” specifically to serve independent insurance agents, InsurBanc specializes in agency financing including acquisition and perpetuation and custom cash management services. In this issue’s article “The Problem with Silence” by Carey Wallace, she talks about building a plan, communicating and providing the pathway to ownership for some of your key employees. Companies like Agency Focus are out there to assist you and your agency during this phase of your business life cycle.

Fortunately with my experience we have had several generations to perpetuate our agency. Our agency was started in 1929 by my grandfather. My dad joined in 1952 after leaving Great American Insurance Company and my brother Mike took over the agency in 1968 when my father passed away. Then when Mike retired, I took over. My niece and nephew are poised to take the reins next when I retire. We are very fortunate to have the willingness and talent within our family to continue our operation. But not every agency has these resources. That’s why it’s so important to start strategizing now. Our association is an excellent resource, both the staff and our membership. It’s always interesting to hear the thoughts of our fellow agents regarding their plan. And bring up perpetuation up at our various events. There are some really creative ideas out there.

Kevin T. Desmond Chair, Bellevue 859.491.5100

Whitney L. Floyd, CIC Chair-Elect, Henderson 270.827.3543

Laura Yount, CIC, CISR Vice-Chair, London 606.878.0100

Allen J. Crawford, CIC, CSRM Treasurer, Somerset 606.679.6311

George “Chip” Atkins III National Director, Louisville 502.585.3600

Ray A. Robertson

Immediate Past Chair, Mount Sterling 859.498.3410

Philip Anderton Lousiville, 502.585.3277

Mark Linkous, CIC Edmonton, 270.432.3491

John Purdom Murray, 270.753.4751

Carolyn Reynolds Richmond 859.623.8485

Nick Rolf Fort Thomas, 859.781.0434

Eric Schumacher Maysville, 606.759.5663

Chris J. Wiseman, CIC Bowling Green, 270.781.2020

Danny Yackey

Emerging Leader Chair, Louisville 502.380.6481

The Regular Session of the 2022 Legislature has ended and as always, there was enacted legislation that impacts insurance. The Department will post to its website by June 10, a summary of all applicable insurance legislation, but I want to make you aware of two bills that directly impact insurance producers/agents.

HB 91, an act related to military spouses and sponsored by Representative Danny Bentley, requires state government agencies to issue temporary licenses to the spouse of a current member of the Armed Forces, without requiring the payment of any dues or fees if the spouse meets the licensing requirements. Previously, the statute only required issuance of the temporary license to the spouse of an active-duty member of the Armed Forces.

Additionally, the legislation requires that no fees are charged to the spouse for either the initial issuance of the license or for ongoing renewals of the license.

HB 380 is an act relating to insurance trade practices sponsored by Representative Bart Rowland. This bill updates the Department of Insurance’s statutes allowing an insurer or an insurance producer to offer gifts of up to $250.00 in connection with the marketing, purchasing or renewal of insurance if the gift is not contingent upon the purchase or renewal of insurance. Prior to this legislation, the gift limit was $25.00 per KRS 304.12-110. An insurer or insurance producer may also conduct sweepstakes or drawings in connection with the marketing, purchasing, or renewal of insurance if all of the following conditions are met: there is no participation costs to entrants; either the prizes do not exceed $500.00 in value, or the combined value of all

prizes divided by the number of entrants is less than $10.00 each; and the sweepstakes or drawings do not obligate entrants to purchase or renew insurance.

Also, insurers or insurance producers may offer or provide products that relate to, or are in conjunction with, an insurance policy free of charge or that are offered at a discounted price if the products or services are primarily intended to educate about, access, monitor, control, mitigate, or prevent risk of loss to persons, their lives, health, property, or other insurable interest; or have a connection to, or enhance the value of the insurance benefits.

Charitable contributions by an insurer or insurance producer from the above limitations are exempted, unless contributions are made in connection with the purchase or renewal of insurance.

As always, if you have specific questions about this legislation or any other questions, please contact the Department. It is our strong preference to speak with you prior, rather than speak with you afterwards.

Fosson Sales & Marketing Director Amy Good Financial Services Director Katie Hines Membership Services Director Kristie Weyer, CISR Insurance Services Director Cassie Young Workforce Development Director

Death and taxes are as inevitable as life itself. Yet most fail to plan for the inevitable. An ounce of early preparation is worth a pound of last-minute maneuvering. Thinking through the eventual exit ahead of time allows you to build the systems and people equation that takes time. Investors look for businesses that run themselves and do not depend on an owner’s brilliance or consistency in order to profitably function. An Oak & Associates survey found that only 20% of agencies had a longterm plan, which was mainly a purchased life insurance policy.

There are two main ways owners perpetuate. The first is internally to members of the owner’s family or to loyal employees. The second is to an outside investor, such as another independent agency or a national broker with private equity monies.

The usual route for internal perpetuation is for the owner or owners to bonus or gift some stock to the key people. For the remaining

stock, there is usually a note promising to pay the owner their value over time, which is based on the firm’s fair market valuation and paid over seven to 10 years. This is compared to a third-party sale, which typically pays out over one to two years, or in some cases, today can be paid upfront. Remember the firm needs to be profitable into perpetuity if owners expect to receive their full value as it is paid from these earnings.

A popular option is a Grantor Retained Annuity Trust (GRAT), however, the owner cannot die within the first five years. If that is reasonably certain, this option allows the payments to be tax deductible to the agency. The candidates can be family members or key employees. If the former owner does not survive the payout period, the entire value reverts back to the owner’s estate.

There has been something of a gold rush in selling to private equity firms. Buoyed by low interest rates and salivating at the consistent earnings in insurance, private equity money managers have been rapidly consolidating the insurance agency industry over the last few years. This has made the decision for many clients to sell to a third party easier. Key employees and families benefit from large upfront direct bonuses and monetary gifts. This can reduce the payout period and uncertainty. Gold rushes do end, yet interest rates will continue to remain low for the next few years.

After exhausting internal perpetuation options, it is best to develop a great Agency Profile & Pro forma report to use in search of the right buyer.

The key is to find the best fit for the agency’s culture and book of business. It is also good for the owners to have representation, so word does not get out on the street and to ensure that confidentiality agreements are signed and the process is properly managed. In that way, the owners can still do what they do best, which is manage the firm and sell new business and handle existing key service aspects of their book of business.

Good consultants do add a lot to the process and are there to paint the picture of what the agency is. They also properly screen the buyers so that the number of buyers approached is reasonable and the private confidential information of the firm is not

placed in the hands of so many people. After the appropriate buyers are brought to the table and the offers are in, the consultant can manage the analysis of the letters of intent, negotiate price and terms and then can be there for the end of the due diligence process. When the final results come in, the consultant then helps manage why the data received may or may not match what was done in the Agency Profile and Pro forma report. These results then need to be negotiated.

The agency owner’s CPA and attorney are always involved. In addition, the consultant also helps with checking that the purchase agreement matches what was promised and some of the terms that are often typical from one deal to the next are checked. This includes the working capital requirement, agency errors and omissions liability tail coverage requirement, the settling of debts and also looking over the new employment agreements for the owners.

The perpetuation process of an agency is often not easy. It can be as simple as just doing a valuation and getting the price and terms in place if the right players are employed. It can also be a great education process for the perpetuation candidates and the owners. With the assistance of a third party, a perfect plan can be developed. If this does not work out, there then may need to be a sale to a third party with the help of a professional.

�ou’re caught up in the day�to�day shuf�le, working hard to get and keep business. But if you don’t step back and assess your agency procedures, you can walk right off a risk management cliff, landing your agency in court facing a professional liability lawsuit that may have been avoided.

Big “I” Professional Liability provides the E&O Happens Risk Management Website, featuring more than 700 pages of agency risk management information, available exclusively, and at no cost, to Big “I” members. Features include:

Claim examples - See benefits of when protocols are followed and what happens when they aren’t.

Risk management articles - Research case studies providing advice on mitigating or avoiding E&O claims.

E&O Claims Advisor newsletters - Read archived newsletters providing tips to all positions in the agency.

Sample disclaimers - Use these tools to help manage customer expectations and aid in defense of E&O claims.

Sample customer letters - Facilitate file documentation by confirming client discussions.

Webinars and podcast archive - Access discussions of hot topics influencing agents’ exposure to lawsuits.

www.iiaba.net/EOHappens.

I constantly hear from our member agencies, that other than employee compensation, equipping your agency's specific technology needs, rises to the top of your most costly overhead expense. You told us harnessing tech in your agency isn't easy.

You Big I Kentucky Board of Directors recently made a decision to help you with special tech guidance, tailored and assessed to meet your needs. Announcing Catalyt! All the agency tech guidance you need...in one place.

An exclusive benefit to members of Big I Kentucky. The number of ways independent insurance agencies can leverage tech to increase profit and serve customers is nearly unlimited. But time, know-how, and fear of rick are getting in the way.

Tara Purvis, President

Catalyt solves it for you and does it all in one place. Steve Anderson, THE insurance technology authority, has assembled a team of experts through Catalyt to deliver the best insights and information.

TOOLS: The Catalyt Success Journey, and their in-depth tech assessment, provide you with a custom roadmap for success.

GUIDE & REVIEWS: Their topic guides share insights, help you compare in minutes, and include reviews.

TRAINING: From live coaching and Q&A sessions to their on-demand video vault, you'll be able to get the most out of your tools.

COMMUNITY: Discuss trends, best practices, and challenges with peers, experts and providers.

CONSULTING: Need custom, one-on-one support? A team of experts can work directly with your agency.

Full access to Catalyt is open at any time. Starter Subscriptions will be offered FREE to Big I Kentucky member agencies beginning August 1, 2022.

THE FEATURES INCLUDE:

Access to a full Agency Technology Assessment-FREE Subscription to weekly newsletter TechTips-FREE Access to High-Level category overview-FREE Access to Agency user Reviews-FREE

-Ability to post a review

-Ability to see high-level ratings

SECURA’s team of insurance experts is making insurance genuine. They are here to support you and your clients. Our underwriting teams are quick to reply, open-minded, and know their stuff. Plus they are backed by our caring claims group who will get your clients back on their feet.

Interested in building a relationship? Contact us at secura.net/KY-agents.

Hear from our experts.

Want to learn more about what SECURA has to offer? Scan the QR code or visit secura.net/ky-agents for more information about the SECURA team.

insurance agents as a group are aging; the median age of a principal at an insurance agency, according to McKinsey & Co., is in the late 50s. What’s more, fewer than half of these agents have a perpetuation plan in place.

Just as you remind your clients, this should be a reminder to you that planning is the foundation of success. That includes creating and executing a strategy for the orderly transition of your business to a new owner, the capstone of an independent businessperson’s career.

At Live Oak Bank, we’ve seen our fair share of business transitions. Some go well …and others not so well. From surprise last-minute changes to bumps along the financing trail, there really are no guarantees. In watching these transactions, we’ve learned an important lesson: though it may feel overwhelming, perpetuation planning is not a mystery. Think of it as a sale to an internal rather than external, buyer. The key variables are the same: find a qualified and compatible purchaser such as a colleague or staff member, structure and price the deal appropriately, and manage the transition smoothly. It’s essential to effectively use the time prior to the transition to teach your successor(s) all aspects of the agency.

The following seven principles are the key to a successful perpetuation. None of them will surprise you, but it is surprising how often these key attributes are ignored.

Your successor should share your values and priorities for the firm but he or she doesn’t have to be a “mini-me.”

People and processes need to be in place for your perpetuation plan to be a complete success. Identify potential successors long before it is necessary so that you are able to train, encourage, and share responsibility. Your junior producer is likely more eager to take over than you realize, so communicate your plans clearly and stick to them.

If you are the founder of your agency, it’s likely that you’ve poured your soul into it. You see the business as your life’s achievement, and you want to be rewarded for your success. That’s understandable, but your asking price may be unrealistic.

by Kelly DrouillardMany agents complain that they can’t find a junior partner who will work as hard as they do, produce the way they do, and even cold call the way they do. But why should the new principal be just like you? The business has been established, and now it has to be sustained—two goals that require different skills. Having harmonious attitudes toward client service, the agency DNA, office management, and demeanor are necessary in order to retain current clients and staff. You’ll never find your exact match, though, and doing so might not even be the best idea for the business.

Did you grow as a business owner? So will your successor. Feel confident in your successor’s ability to run and build the agency. Ideally, this person will have taken on some responsibility for client acquisition, carrier relationships, and business retention long before you finalize the transition. A transition is a big change; your clients will be wary. They chose you for a reason, and they still need to feel well-served and secure. The more comfortable the fit with your successor, the more reassured they will be.

Your financials need to be strong. This is a perpetuation plan, not a rescue. You may feel fulfilled by looking back on your achievements, but your successor must look forward and find an opportunity to pursue. A well-managed, profitable, growing agency has good momentum to offer and will also qualify for better financing.

Strong financials also lead to a stronger valuation. Nothing is more important when valuing an agency than growth—both in total revenue and in profitability. Not only does growth counteract the natural attrition of clients but it also provides a future for the staff who can advance and take on additional responsibility. Growth motivates everyone, especially your successor.

Make sure the successor feels like he or she is in the game. In case things don’t work out, have at least one Plan B. To build a sustainable business, you always have to be thinking about the next generation. Process means making sure your financial strategy is in place. Consult your financial advisers before you finalize the plan. The transfer of a business has tax implications and legal considerations, and your choices, such as whether to choose an asset sale or a stock redemption, play a major role in how much money you keep. Engage your CPA, attorney, and financier early to develop a strategy that will make the details work for you.

Rather than looking at your past, anyone buying the agency will be thinking about its future. The valuation of your agency will be based on its revenues, profit, growth rate, retention, quality of carrier appointments, client list demographics, and other economic and intangible considerations. All those nights you spent working late don’t count—only their results do.

Develop a strategy for the actual transition and discuss it with your successor and staff. This ensures an orderly handoff of responsibilities. If one principal plans to leave the agency, it’s essential to create a written and executable transition plan with benchmarks for the transaction. A written plan focuses the attention, and the payout motivates the spirit—both buyer and seller need skin in the game.

Since you likely have an internal successor, the new principal probably knows the carriers and clients. Nevertheless, you may need to schedule some client meetings to explain the transition and share the strengths of the new owner. Include your successor in carrier communication and visits. Your carriers are as concerned with the future of the agency as your clients. Make sure they are comfortable with the future management.

If the average agent’s age is 59, one-fourth of the industry’s work force could retire by 2018 according to McKinsey & Co. MarshBerry research indicates that agencies should hire three young producers for every producer currently employed to cover this loss. This includes young hires as well as senior agents, with an ultimate goal of building an unbroken chain of talent to develop.

This wealth of talent will make your perpetuation plans robust, and provides young, tech-savvy agents an opportunity to work with new clients who are seeking insurance. Young agents can learn to produce by reaching out to prospects who belong to their generation, not yours. This future- and growth-oriented approach will make your agency more valuable and the transition to new ownership more stable. After all, your successor will need a successor too.

How long the seller is expected to stay involved is flexible. The buyer may be eager for the seller to leave in order to start implementing changes, but balky clients may need the seller to make a more gradual transition.

Bear in mind that, eventually, you need to let go. Complete the transition and take your hands off the wheel. It’s the new owner’s turn now.

7.

Clients deserve clear communication throughout the transition process. They should feel like the ownership change is transparent and easy. You may discover that many clients resent the fact that any change has to take place. Some may find a transition to be their opportunity to vent their frustrations. The simpler and more harmonious the change, the more likely that clients will settle quickly into the new office routine.

Hewing closely to these principles won’t necessarily make the perpetuation process easy, but it will make it more manageable.

Since 1983, ITC works exclusively with independent insurance agents to provide digital marketing solutions. ITC offers an in-depth understanding of the industry and serves approximately 6,000 agencies.

Typical set up fee $350 Monthly fee $5 - $300 (typical monthly fee is $69)

Titan web offers digital marketing products aimed at client growth and achieving goals. Their websites are full service and their service team is available to make all edits and updates within 1 business day.

Set up fee $600 - $800 Monthly fee $75 - $225

$95 discount on set up fee for Trusted Choice agents

Forge 3 creates dynamic and cutting edge websites. They offer many unique features and plug ins not available from other providers that keep visitors engaged while on your site. Websites are fully custom and updates can be done yourself or by the support team. Experienced insurance content writers are on staff.

Set up fee $0 Monthly fee $250

Since 1979, the Kentucky Associated General Contractors Self Insurers’ Fund has supported the local construction industry with unmatched expertise. Our members don’t just benefit from competitive rates, dividends and safety resources, they also have piece-of-mind that we will be there when they need us and will always act in their best interest. With over 40 years of experience as the only insurance provider dedicated to the Kentucky construction industry, why trust your workers’ compensation to anyone else?

Advisor Evolved exclusively services independent agents, and is very familiar with the challenges they face. Advisor offers a “white glove” service that includes unlimited support and assistance with content generation.

Set up fee $1800 | Monthly fee $150

25% off set up fee and 15% off monthly fee if adding optional “Powerpack”

Marketing 360 is a full service marketing company offering an array of not only digital marketing services, but print, production and mailing services as well. They serve over 20,000 clients and are a one stop shop for marketing needs.

$25/month basic | $395/month full service

10% discount on core packages for Trusted Choice agents Note:

The Big I Kentucky 2022 Leadership Conference was held on May 16-18, 2022 in Owensboro, KY. Our members kicked things off on Monday with the annual golf scramble at Owensboro Country Club. Tuesday was packed with renowned speakers Mike Hunt and David Carothers, who touched on the psychology of sales and new revenue generating ideas for your agency. Afterwards, we gathered for the first annual Big I Gives Back sponsored by KEMI service project, benefiting over 1,200 families in the Daviess County and Owensboro City schools. We ended the day with dinner overlooking the Ohio River and our Pitchin' For Pac corn hole tournament, which raised more than $11,000 for KAPAC and InsurPAC. Day three concluded the conference with a breakfast with Department of Insurance Commissioner Sharon Clark and a panel of four Kentucky independent agents who survived the December 2021 Western Kentucky tornadoes. They shared takeaways for how we can better prepare for natural disasters in the future.

Owensboro, KY

EMC provides tailored protection for the needs of countless types of manufacturers — plus robust loss control, claims and medical management services to help maximize their uptime. And as our agency partner, you can count on a high-performing program that helps your business thrive. Ask us how the EMC Manufacturing Program can feed your success today.

West Bend Mutual Insurance has a long history of writing workers’ compensation insurance. Our underwriters are knowledgeable and experienced. Our loss control reps have the expertise and tools to help keep employees safe. And our claims practices are the best in class.

From Main Street-type businesses to specialty businesses like childcare, West Bend has the experience and expertise to protect businesses of many kinds and many sizes. We want to write all of your workers’ compensation business, small to large!

When you select West Bend for your valued customers, you can rest assured you made the right choice. After all, we are the best remedy for workers’ compensation.

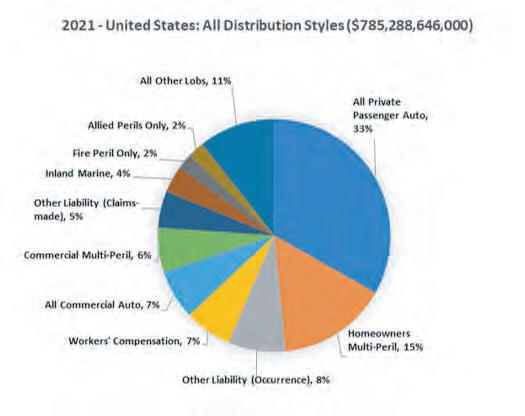

This report provides a summary of the 2021 property-casualty (p-c) insurance marketplace.

Unlike most industry watchers of insurer profitability and insolvency, we used direct written premiums-not net written premiums. This it to be consistent with our member agent's view of the insurance world.

A full report can be found on our website bigiky.org.

Virtual Lunch and Learn to review the full report conducted October 2022. Details to come.

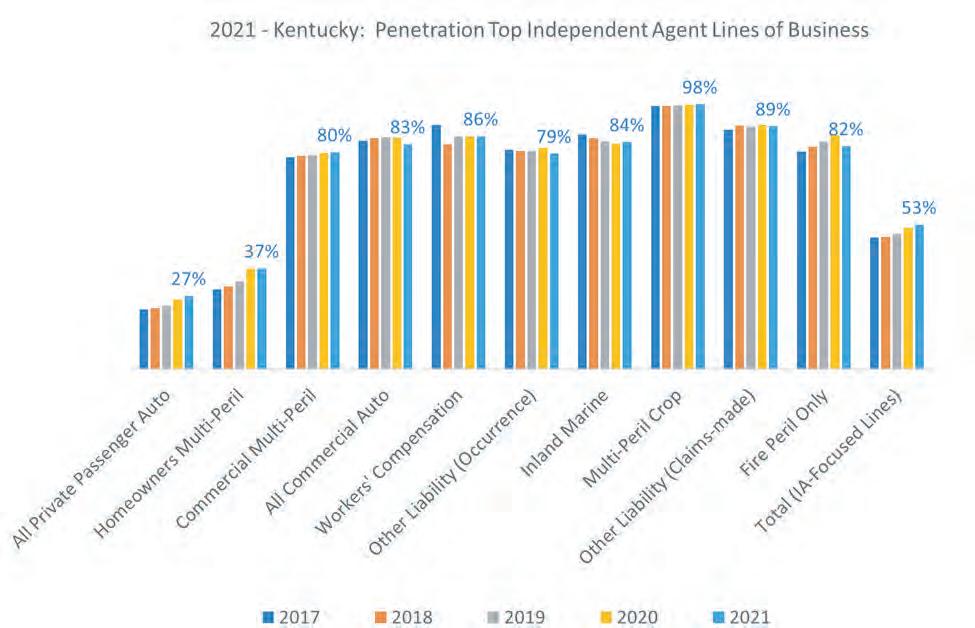

The clustered bar chart above shows independent agent penetration trends for the top lines of business. Shown are the top 10 lines of business in order of direct written premium written through independent agents. The percentages above are calculated based on premiums through independent agents, divided by all premiums for each line of business.

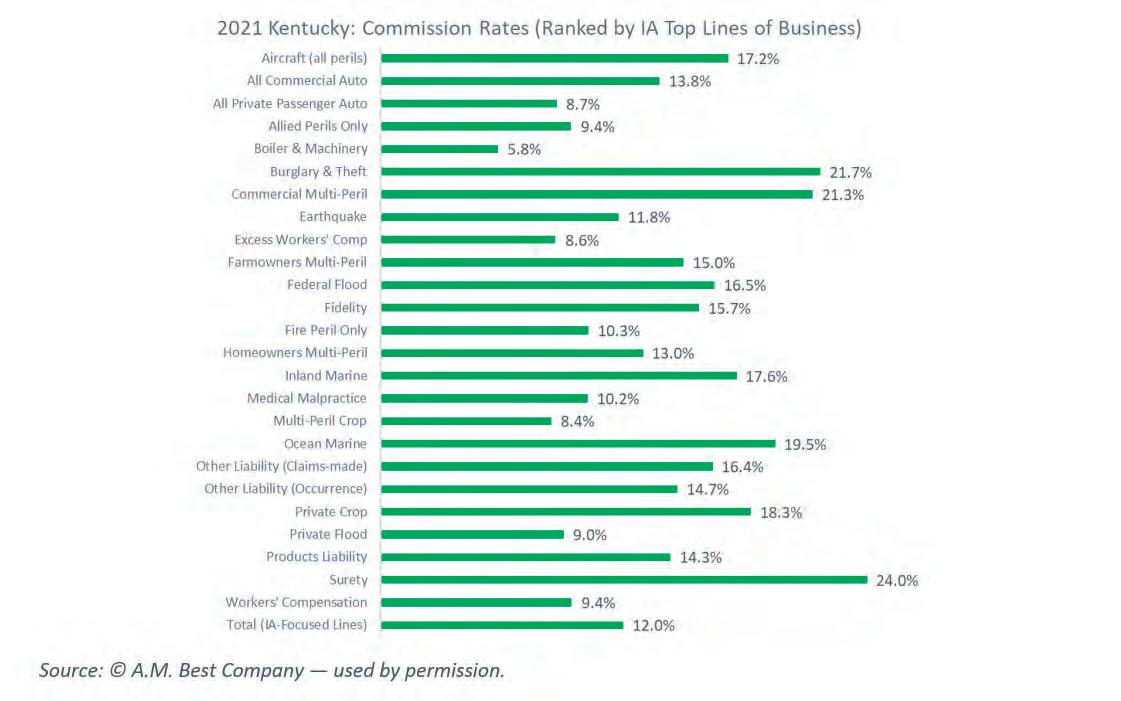

The above bar chart shows the commission rate paid by all insurers for 26 independent agent-focused lines of business in alphabetical order. Shown last, Total (All Lines) is the average commission paid on all lines of business.

HSAs are designed to offer the user triple tax benefits – you put money in tax-free, it accrues interest tax-free and you can withdraw it tax-free (for qualified medical expenses). You can budget how much to contribute, and unspent dollars are rolled over each year, making it a good retirement savings vehicle as well.

It is tough to accurately plan for medical expenses, as illness is unpredictable and hard to budget. You may have significant, unexpected outof-pocket costs, especially if you face a large medical expense. Also, because the HSA is such a valuable savings opportunity, some people forgo care they need to avoid spending money from the account.

The decision is different for each individual. If you are generally healthy and/or have an idea of your annual health care expenses, then you could save a lot of money from the lower premiums and valuable tax-advantaged account with the HSA plan. For example, even someone with a chronic condition could take advantage of an HSA if you have an idea of your annual expenses and budget enough money to cover your care. However, if you are older, more prone to illness or unexpected medical conditions, or prefer certainty in medical costs to the possible risk of unexpected out-of-pocket expenses, you may want to stick with a traditional plan. You’ll pay more in monthly premiums, but will have fixed copay and/or coinsurance amounts.

Contact Insurance Services Director Kristie Weyer for a Group Health Quote kweyer@bigiky.org 502-245-5432

The health savings account (HSA) is a growing trend in health care, but is it right for you? HSA is a costeffective option for many individuals and families. What are the benefits and drawbacks?

The Big “I” MEP 401(k) Plan was designed with our Big “I” members’ needs in mind. By capitalizing on our collective size, the Big “I” assembled a line up of best-of-breed retirement providers usually only available to Fortune 500 companies.

The Big “I” MEP 401(k) Plan was designed with our Big “I” members’ needs in mind. By capitalizing on our collective size, the Big “I” assembled a line up of best-of-breed retirement providers usually only available to Fortune 500 companies.

With the Big “I” MEP 401(k) Plan, members experience all the benefits of an unbundled plan without having the stress of managing the providers. Big “I” Retirement Services, in conjunction with our administrator, serves as a gatekeeper and provides members with one main point of contact for the operation of your plan.

With the Big “I” MEP 401(k) Plan, members experience all the benefits of an unbundled plan without having the stress of managing the providers. Big “I” Retirement Services, in conjunction with our administrator, serves as a gatekeeper and provides members with one main point of contact for the operation of your plan.

The MEP is a top-tier 401(k) plan with low cost mutual funds, competitive administrative costs, cutting edge educational tools and plan consulting. Learn how our plan compares; contact us for a complimentary consultation today. Participation in our plans is available exclusively to Big “I” members. www.iiaba.net/Retirement ©2021 Big “I” Retirement Services, LLC (“BIRS”), sponsor of the Big “I” MEP 401(k) Plan. Participating employers may retain limited fiduciary responsibility in connection with a decision to participate in the MEP and other matters. BIRS assumes fiduciary responsibility of sponsorship and administration unless otherwise delegated. The 3(38) to the plan assumes certain assumes certain fiduciary responsibilities as investment manager for investment selection and other similar functions.

The MEP is a top-tier 401(k) plan with low cost mutual funds, competitive administrative costs, cutting edge educational tools and plan consulting. Learn how our plan compares; contact us for a complimentary consultation today. Participation in our plans is available exclusively to Big “I” members.

When it comes to securing your future, there’s no room to miss the mark.

Choosing your 401(k) plan partner should feel like this.

When it comes to securing your future, there’s no room to miss the mark.

Choosing your 401(k) plan partner should feel like this.

Follow us on your favorite social media sites.

Facebook facebook.com/bigiky facebook.com/ELofIIAK

LinkedIn linkedin.com/in/bigiky Twitter twitter.com/bigikentucky Instagram instagram.com/bigiky

The Kentucky IA is the official magazine of Big I Kentucky, and is published quarterly.

All advertising and editorial submissions are welcome.

Office Address: 13265 O’Bannon Station Way, Louisville, Kentucky 40223. Telephone: (502) 245-5432 * Email: info@bigiky.org * Fax: (502) 245-5750

Established Louisville agency interested in acquiring insurance agencies in Jefferson and surrounding counties. If you are interested in selling, merging, or need assistance with perpetuation, we would like to talk with you in confidence.

Call Kevin Lavin, CIC or Philip Anderton, CIC, CRM at Sterling Thompson Company at 502-585-3277

CLAY SHOOT

August 11, 2022

Blue Grass Sportsman’s League Wilmore, KY

BIG I KY ROADSHOWS

August 18, 2022 - Hopkinsville

August 24, 2022 - Virtual

August 30, 2022 - Northern KY

August 31, 2022 - London

September 1, 2022 - Louisville

KEENELAND TAILGATE

October 14, 2022

Lexington, KY

CONVENTION & TRADE SHOW

November 16-18, 2022

Hyatt Regency Louisville, KY

Independent with top best markets looking to expand presence in Jefferson, Oldham or Shelby counties. Wanting Personal lines Producer or book of business to move or purchase. All arrangements possible, in strict confidence.

Please send inquiries to:

Turner Insurance Agency, 2460 Shelbyville Road, Shelbyville, KY 40065 or call Kurt Turner, CPCU at 502-633-6060.

If your clients are going on an extended vacation or have moved into a new house and still have the old one up for sale, vacant home insurance can be hard to get.

Vacant homes are an easy target for thieves, vandals or even homeless people.

Don’t put your clients at risk. Vacant homes are a specialty at Bolton & Company.

We have a program especially designed for this market.

Call us today and let your clients rest easy.

Great products, great rates, great service. That’s our policy. It’s why we’ve been in business over 50 years.

• Policy terms of 3, 6 or 12 months available

• Online rating at our website: www.boltonmga.com