This month the magazine’s main topic is Big I of Ky’s products and services. YOUR Association has been hard at work planning for the future. During our strategic plan earlier this year our goal was to prioritize and be focused on our mission, to ‘create value for our members through innovative resources and legislative advocacy while fostering industry relationships’. One of our directives to the staff was to examine each of our more than 100 products and services and determine our top tier benefits to promote to our membership. We ranked each item by accessing the following characteristics: Type, Related to Mission, % of Members Using. Financial Revenue Potential, Effective Use Staff/Volunteer Time, Uniqueness, and Would we Start it today? Our goal is to give the members the most pertinent information possible to allow you to make informed decisions for your business. I’d like to this opportunity in my last message from the chair, to thank the many people who helped during my year as chair. The Executive Officers, Ray Robertson, Allen Crawford, Whitney Floyd, Chip Atkins and Laura Yount, were and continue to be a great asset to YOUR Association. The remaining Board Members have been a “huge” help making decisions and coming up with ideas to better the association. The staff of our Association is one of the best in the country. That’s not coming from me, but is what I hear time and time again at every National meeting from the employees of other states. Tara and all of our staff do an excellent job. The last person I would like to thank is my wife Karen. She is my rock and there is no way I could have pulled off my year as chair without her leadership.

In closing I like to say I’ve enjoyed being your chair, and look forward the leadership of your new Chair of the Board, Whitney Floyd.

Kevin T. Desmond Chair, Bellevue 859.491.5100

Whitney L. Floyd, CIC Chair-Elect, Henderson 270.827.3543

Laura Yount, CIC, CISR Vice-Chair, London 606.878.0100

Allen J. Crawford, CIC, CSRM Treasurer, Somerset 606.679.6311

George “Chip” Atkins III

National Director, Louisville 502.585.3600

Ray A. Robertson

Immediate Past Chair, Mount Sterling 859.498.3410

Philip Anderton Lousiville, 502.585.3277

Mark Linkous, CIC Edmonton, 270.432.3491

John Purdom Murray, 270.753.4751

Carolyn Reynolds Richmond, 859.623.8485

Nick Rolf Fort Thomas, 859.781.0434

Eric Schumacher Maysville, 606.759.5663

Chris J. Wiseman, CIC Bowling Green, 270.781.2020

Danny Yackey

Emerging Leader Chair, Louisville 502.380.6481

Amy Good Financial Services Director

Katie Hines

Membership Services Director

Kristie Weyer, CISR Insurance Services Director

Cassie Young Workforce Development Director

Insurtech, a subset of Fintech, or financial technology, can be described as the innovative use of technology in insurance. InsurTech is altering the business models and competitive landscape of the insurance industry and has increased significantly over the last few years continuing to attract significant attention. A large, national accounting firm estimates InsurTech startups have attracted $16.5 billion in investments in the past decade. While InsurTech remains is more prevalent in the European Union, we are seeing an increase in presence here in the United States and more specifically in our Kentucky marketplace

InsurTech innovation is occurring across the entire insurance value chain—from distribution and marketing to product design, underwriting, and claims and balance sheet This innovation leaves no line of insurance untouched. InsurTech startups are reaching customers through new distribution mediums, or more simply, how consumers purchase insurance—addressing shifts in the way people communicate, access information, and make decisions—striving to make insurance purchases full-service and fully online.

Examples of InsurTech products include customers purchasing on-demand hourly car insurance; insurance coverage bundled with other e-commerce purchases (i.e. Carvana or online mortgage lenders); websites or mobile application that provide end-to-end automated claims management pay-per-mile auto insurance to low mileage drivers; and creating ways for life and health insurers to use health data collected by wearable technology in underwriting, pricing, and claims handling.

Insurance regulators do not wish to stifle innovation. Instead, we want to work closely with innovators to ensure InsurTech product designs abide by the insurance laws and regulations to better protect consumers.

So, you may be asking yourself, what can you do as an agent to counteract the “convenience” of technology and online-direct product purchasing? Frequent personal consumer engagements and interactions tend to build trust and loyalty with clientele. This continues to be one of the most important aspects of the insurance purchasing transaction. Simply, show your face to stay involved and relevant with your customers as they make some of the most important decisions of their lives. These practices are critical to the survival of insurance producers as our world continues to navigate through the technology evolution.

Sharon P. Clark

has a 20year track record of beating the industry by more than double the growth and a full eight points on the combined

Technology is changing the insurance industry. In 2021 InsurTech firms raised over $15.4 Billion in funding, completed 566 deals, and 73% of those deals focused on P&C Insurance according to CB Insights. There are no signs of InsurTech slowing down any time soon. In fact, it is expected to continue to accelerate.

We have seen many companies enter the insurance marketplace, some focused on disrupting while others seek to build upon the infrastructure that exists and are focused on building integrations. We have watched and experienced the impact of those that have merged, evolved, and failed. There is no question that as an agency owner you are faced with an incredible number of technology options making it difficult, confusing, and sometimes even overwhelming. The agencies of today and tomorrow know that the adoption of technology is more than just a series of purchases – it is a necessary cultural change. This journey requires vision, patience, and buy-in to be successful.

The impact of technology on an agency can be exponential if it is executed well. It can also be a very expensive mistake. For many, jumping into that cultural change has been avoided because they have either been burned by past failed attempts or maybe because the current owner or staff isn’t motivated to adopt change because “business is good”. Change can be scary but staying stagnated in a world that is changing around us is far more terrifying. This gap in the

adoption of technology and the radical change that is needed in our industry has accelerated what I see as “The Great Divide” – those that are positioned to acquire and those that will BE ACQUIRED. Technology and data will shape the future of insurance without question.

The biggest factors in determining an agency’s value are growth, retention, profitability, overall volume, culture, and the risk inside that agency. The adoption of technology and data significantly impacts all of these areas. The biggest risk is that an agency’s book of business performance will be negatively impacted when a transition of ownership occurs. This could be caused by a strong dependence on a specific person, key relationships, specialized expertise, or access to an exclusive program or agreement. Knowing an agency’s areas of strengths and weaknesses can help define what technology and strategies an agency owner should focus on.

One of the biggest focuses for agencies is improving their growth and retention as this will have a direct impact on the agency’s value. Finding new business, retaining the business that they already have written, and rounding out those accounts are on the minds of agency owners. The current

book of business will represent 90% of the agency’s top-line income in the next year, so any way that agency can increase that percentage will make a huge impact on the organization.

Utilizing technology is critical for agencies in this process. There are tools such as Donna by Aureus Analytics that can efficiently find cross-sell opportunities, identify the accounts that may be in jeopardy by monitoring every interaction, and turn unstructured data such as phone calls and emails into insights that the employees can act upon. This technology is also able to combine external data with an agency’s internal data to identify high-quality leads and increase their likelihood of writing new business. The impact of implementing a tool like Donna can be profound on an agency and every member of the team, but it requires a commitment to data cleanup, the adoption of new processes and procedures, patience, constant evaluation, and most importantly a culture of openness to change.

Creating capacity on your team allows an agency to scale. The key here is an agency needs to change how they look at the roles within their agency and identify the areas that create friction or a delay in their process. What are the steps that take the most time and can be automated, do not require the expertise and focus of your highly skilled staff, and may even create frustration for your customers?

Both GloveBox and Tarmika are examples of technology that are designed to remove friction, save time and ultimately increase the efficiency and capacity of your team by either giving the customer access to self-serve when and how they want to and the other by streamlining the quoting process for your team. Both of these tools create efficiency inside the agency as it reduces the time spent on taking payments, making changes, and quoting which are all time-consuming processes as well as improve the customer experience. That can have an impact on retention, the agency’s ability to cross-sell, and the number of referrals. As more capacity is created on the team, production numbers will rise without increasing staffing costs leading to higher profitability and the exponential impact is realized.

The people in the agency will always be the most valuable part of your agency. They are the heart and soul of your business and the living example of your culture. Creating the right environment to attract and retain the talent you need has never been more important than it is today as we navigate The Great Resignation. Agencies that can provide their team with tools that will help them be successful are far more attractive to those that do not have any established onboarding, processes, or tools that set their team up for success. While compensation, benefits, and

flexible work environments are important, working for a forward-focused organization that is committed to adopting the tools and technology necessary to create efficiencies and the ability to compete and meet the needs of its customers is equally important. If you are making investments in technology it sets your agency apart and you should be highlighting it in your recruiting process. Having a strong team that is committed to the organization is a key factor in the agency’s value as they create the culture and provide continuity in your ongoing customer relationships.

The area that many agency owners overlook is the transferability of the business. This is difficult for many as they want to play a pivotal role inside the agency and find great pride in knowing that the agency needs them. The strongest agencies that command the highest multiples are those that are self-sustaining. They have processes, procedures, technology, and strong infrastructure that is not overly dependent on any one person, relationship, or partner. It is well diversified and runs like a well-oiled machine. Technology to automate marketing, reconcile accounts and commissions, documentation of client files, and predict possible coverage needs, or carrier options will help an agency maintain a high level of transferability.

Successful adoption and integration of technology can have an exponential impact on any organization. It will transform the processes and procedures that you use, change the nature of the roles inside the organization as well as the type of talent you will need, it will increase access to data, drive efficiencies, increase performance and position the organization for both growth and scale. Trying to quantify the impact on an organization is difficult as it is multifaceted and in some cases exponential. Successful adoption and integration are key, and that requires buy-in and enthusiastic support from all members of the team. This is where many organizations struggle as the desired impact of new technology is not well understood or communicated making the adoption and integration into the culture of the organization fail. Becoming a data-driven agency is a journey that requires strong leadership, open communication, and a team that trusts and believes in the process.

You can visit www.agency-focus.com or contact Carey Wallace at carey@agency-focus.com for more information on the impact technology will have on the value of your agency.

All the agency tech guidance you need... in one place.

The number of ways you can leverage tech to increase profits and serve customers is nearly unlimited. But time, know-how, and fear of risk are getting in the way.

Catalyit solves it for you. What will you gain by joining?

•Tools: The Catalyit Success Journey, and our in-depth tech assessment, provide you with a custom roadmap for success.

•Guides & Reviews: Our topic guides share insights, help you compare solutions in minutes, and include reviews.

•Training: From live coaching and Q&A sessions to our on-demand video vault, you’ll be able to get the most out of your tools.

•Community: Discuss trends, best practices, and challenges with peers, experts and providers.

•Consulting: Need custom, one-on-one support? Our team of experts can work directly with your agency.

See how Catalyit can help you thrive by visiting: Catalyit.com

Did you know that your Big “I” membership provides your agency access to powerful tools and discounts on our strategic non-insurance partners’ products and services?

Caliper’s hiring assessments help identify which person is best suited for a given job based on their intrinsic motivation relative to the role’s responsibilities.

IIABA members receive 10% off hiring profiles & staff development tools. calipercorp.com/iiaba

Start collecting esignatures and online payments all at once while streamlining signing processes and lowering costs. DocuSign’s

IIABA members receive 20% off Standard & Business annual plans. docusign.com/iiaba

Gain access to coverage checklists, commercial and personal lines risk at just $ 00/agency annually ($200 savings)! IIABA members pay deeply discounted rates compared to similar products. independentagent.com/roughnotes

solutions.

Do business with a bank founded by and for independent agents. insurbanc.com

Open or link your IIABA UPS Savings account to receive discounts and call 1-800-MEMBERS to take advantage of UPS Smart Pickup® service free for one year.

Big “I” members save up to 34% on shipping. savewithups.com/iiaba

Order your Big “I” and Trusted Choice logo calendars, business cards and promotional items from The Mines Press and you’ll know that your correspondence will deliver the message of quality as well as care. Doing business with Big “I” members for over 35 years. insurance.minespress.com

For more information on these member discounted programs, contact brett.sutch@iiaba.net or visit independentagent.com/businessresources

RLI’s motto is “Di erent Works.” Here are just a few of the ways that RLI’s umbrella is di erent from that of other stand-alone umbrella carriers:

No pre-approval needed for submissions

No need to send MVRs or underlying decs

No schedule of exposures to maintain mid-term

No need to update underlying policy details when required limits are still in place

Clients can keep their current home/auto carrier

Excess UM/UIM charged per driver, not per vehicle

Coverage can extend to trusts and LLCs without an endorsement

100/300 auto limits acceptable for some customers

Coverage can extend to personal use of company cars

Renters, full-timers, and even senior-living customers accepted

Self-quote in just 2 minutes, and issue quickly with esignature and online payment options FIND

The Big “I” works tirelessly to ensure that your interests as independent insurance agents are well represented on Capitol Hill. And your support of the Big “I” Flood program with Selective helps the Big “I” better serve you!

Most recently, the Big “I” and other stakeholders negotiated improvements to pending NFIP reauthorization legislation that could save agents millions of dollars in compensation if passed into law.

It is through production generated from Big “I” Flood appointed agents that Selective provides efforts on behalf of independent agents, by promoting NFIP reform and sustainability.

with Selective, you will enjoy competitive commissions while partnering with one of the most experienced and dedicated carriers in the marketplace.

Selective is also the only insurer that directly supports your national and state independent insurance of our Big “I” members in congress and with the National Flood Insurance Program. United, we can help all independent agents have a strong voice of

Flood program and you can help strengthen that voice!

Learn more about the Big “I” Flood program www.independentagent.com/Flood.

Trusted Choice® has ready to use agent materials. The Content-to-Share section on the Trusted Choice Agent Resource Website offers graphics, video and articles on a variety of insurance topics, specialty products and more. Search by topic or type of content.

Trusted Choice does the work so you can focus more on your clients.

Visit cobrand.iiaba.net/content-to-share to start using content today!

The workforce is shifting toward younger generations, with 50% of the current insurance workforce set to retire in the next 15 years, which will leave 400,000 open positions, according to the Bureau of Labor Statistics. Upcoming leaders, Millennials and Gen Z workers, are poised to take over for their older professional counterparts, but workplace changes over the last few years combined with shifting worker expectations means agencies may have to change their tactics in order to attract this new generation of talent.

Liberty Mutual and Safeco recently surveyed over 730 agents for their 2022 Agency Growth Survey, which delved into agencies’ strategies for growth, including their hiring and recruiting practices. Seventy-five percent of agencies are currently recruiting,

according to the survey, with the top recruiting methods including referrals and networking (80%), advertising online (42%), social media posting (39%) and hiring interns or college placements (20%). These recruiting numbers are up from their 2017 independent agent survey, when 65% of agencies said they were recruiting. While this bump in recruitment is good news for job-seekers, it creates a great deal more competition for the best insurance talent, and the survey found that agencies with the most focus on growth and willingness to try new approaches to hiring and recruiting are reaping the benefits. Agencies who stated they are aiming for aggressive growth see an average revenue growth of 22% year-over-year, as opposed to just 9% for agencies aiming for slow-and steady-growth.

“Attractive workplace cultures don’t just happen, they are created. As a new generation enters the workforce and employee expectations continue to rise, those agencies that actively prioritize people, create values-driven cultures and offer the flexibility employees want will outgrow and out-hire their competitors,”

Tyler Asher, president of independent agent distribution at Liberty Mutual and Safeco Insurance, is quoted in the survey report. “Now is the time for independent agents to get more intentional about their approach to finding and keeping talent.”

Of those surveyed, growth-focused agencies are more likely to focus on diversity in hiring (51%) than slow-and-steady agencies (33%), and are also almost twice as likely to hire remote employees.

Both of these elements – diversity in the workplace and flexibility – are among the top priorities for younger workers seeking employment. According to the survey, younger generations also value knowing their workplaces cares about their wellness, competitive pay and benefits and opportunities for career development. Ninety-five percent of Gen Z job seekers also said it is important they feel their work has meaning.

As such, when crafting job postings, it is important for agencies to emphasize initiatives and elements that make them an appealing choice for young insurance talent. Postings should mention any flexible work options (remote/hybrid), mentorship opportunities, unique benefits, information about the workplace culture and information about diversity and inclusion initiatives.

• Trusted Choice® is the na onal marke ng brand created exclusively for Big I members to help consumers understand the value an independent agent o ers. Use the Marke ng Reimbursement Program to co-brand your agency and o set costs. Plus, the pros at Trusted Choice can review your website, social media, and even give you ready to use digital content.

• TrustedChoice.com is the #1 online resource for connec ng insurance buyers with independent insurance agents and gets over 6 million shoppers each year.

• Emerging Leaders Commi ee serves as the uni ed voice for all young insurance professionals in Kentucky.

• Leadership Opportuni es - Join a commi ee and get involved.

• E&O Programs - our comprehensive program with competitive rates designed specifically for Big I Kentucky members.

• Big I Kentucky offers the Agency E&O Review Program both virtually and in-person for agencies participating in the Big I KY E&O insurance program

• Anthem Group Health Plan - provide a group plan for you and your employees that includes vision. Ancillary coverages include dental & life.

• Cyber Liability Programs discounted for you and your clients.

• Catalyit All the agency tech guidance you need in one place

•First Call Free Legal - receive 30 minutes of free legal advice per year from General Counsel, Rick Pi .

•ePayPolicy - accept credit card and ACH payments online while allowing transac fees to be covered by the payer.

•Big “I” Re rement will help you choose what retirement plan best meets your circumstances and achieve your goals.

•Big “I” Employment Bene ts: Group Life, Group Short & Long Term Disability, Group Dental and Group Vision

•Big “I” Flood coverages available through Selec ve.

•Big “I” Markets - no volume commitments, ini l access or termina n fees and you own your expira ns.

•Big “I” Personal Umbrella - you have access to two stand-alone personal umbrella markets which enables you to write most any risk you will run across.

•RLI At Home Business - provides a ordable coverage for those people who operate small home-based businesses.

•Independent Market S s- Kentucky exclusive market access, FREE for Big I KY members.

•It’s important that the voice of the independent agent doesn’t get lost. KAPAC and InsurPac, our state and na onal Poli cal Ac on Commi ees, respec vely, allow our industry to be present Kentucky and D.C. We also have lobbyists present every day looking out for your best interests.

•Legisla ve Bulle ns - receive an update each week of Kentucky Legisla ve session on the happenings in Frankfort.

• Big I KY has a range of CE courses:

• Designa on Classes: CRM

•Online Classes: ABEN (Agents & Brokers Educa on Network)

• KY Pre-Licensing: ExamFX

• myAgencyCampus is the perfect on-boarding solu on for new hires, producers and CSRs.

• We strive to think outside the box for fun and interes ng ways to facilitate networking opportuni es for our members.

•Big “I” Hires.com has cu -edge tools to help you hire top-performing sales and service sta .

•Work At Home Vintage Experts connect agencies & companies with experienced professionals to t your needs.

•Caliper - pre-employment assessments, sta development and corporate culture assessments available.

•Career Plug will allow you post jobs for FREE both on your own website and the state job board.

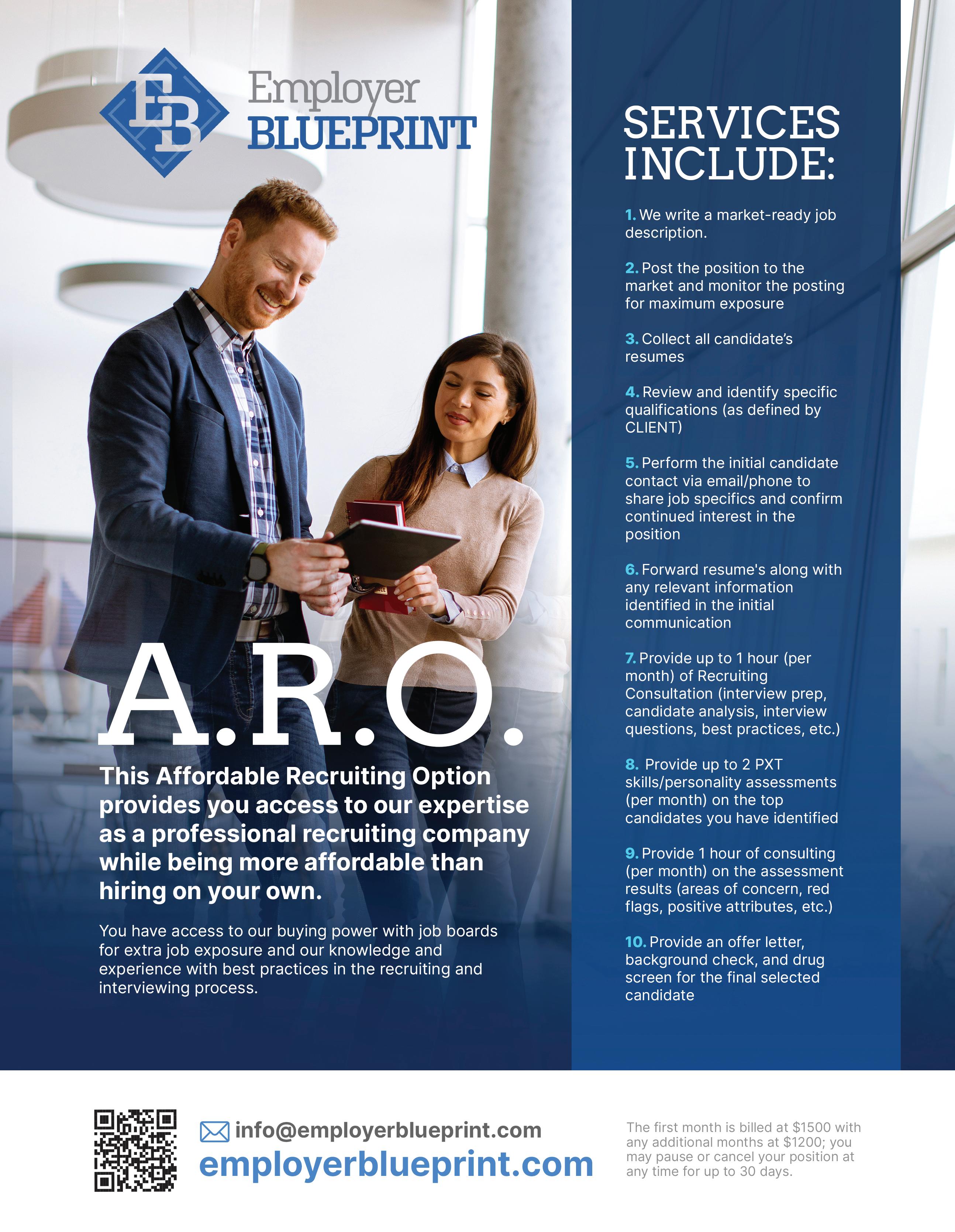

• rdable Recr n- We find and onboard talented employees while you con ue to run your agency

•Veteran Licensing Program - Free licensing available for vets and their spouses.

•Appren eship Program helps you grow your own talent with our na nally recognized program.

• Check out our Agent’s Guide for Internships.

•Edge Online - Hire a highly trained virutal assistant to assist with administra e du s.

• ACT - in leading technology experts provide blueprints on emerging trends to help your agency.

• stand ready to answer your complex insurance estions.

• P help take your agency from good to great.

• y can help you build your knowledge

• access

• TInvestment.

• Protect Your Clients. Protect Y se Every Proposal.

• E- & Kentucky IA M -gives a look at industry and association related news and events.

• perpetuation services and more

• Email on steroids touch while c remembering key facts and driving referrals.

SECURA’s team of insurance experts is making insurance genuine. They are here to support you and your clients. Our underwriting teams are quick to reply, open-minded, and know their stuff. Plus they are backed by our caring claims group who will get your clients back on their feet.

Interested in building a relationship? Contact us at secura.net/KY-agents.

Independent agency sale transactions are continuing at a strong pace in 2022. Organic growth rates and profitability are booming, according to Reagan Consulting. Those financial drivers continue to steer agency merger-and-acquisition prices upward.

In this environment, some agency principals are looking for a game plan to sell their firm, whether to an outside buyer (such as a strategic investor or a private-equity investor) or an inside buyer (through an agency perpetuation—continuing the independent agency as it exists but with new leadership).

Agency principals may perceive an outside sale as more lucrative than a perpetuation. But is an internal offer really worth less than an external? An internal offer to perpetuate an agency can be as appealing as an external sale or even more so. Here’s a look at why.

While the financial terms of the sale are always a top consideration, the price tag is only one of the key considerations for an agency owner. Some of the others typically are:

• The selling owner’s role in the agency after the sale.

• The timeline for the transaction (especially for the selling owner).

Agency owners looking to sell who look at the price tags of other merger-and-acquisition transactions in the marketplace are in essence starting at the finish line. Instead of doing that, it’s productive to start by looking at goals for 1) the owner and 2) the future of the agency.

Those aspirations provide a guiding light through the sometimes-complicated process of deciding upon an agency sale or perpetuation transaction. Questions to ask include: Do I want to continue working or retire outright? What responsibility if any do I want to take after I sell to a third party or perpetuate my agency to an internal buyer?

While any potential buyer covets the potential growth and profitability of a target agency, a handy way to categorize agency buyers is to divide them into inside buyers and outside buyers.

Internal buyers are those already working within an agency, and usually become owners through the principal’s decision to perpetuate. Commonly, inside buyers are family members and/ or producers or other key employees working at the agency.

External buyers come in a couple variations. First is the private equity (“PE”) buyer, who is not necessarily familiar to an agency owner but is attracted by the agency’s financial performance, growth prospects, and/or market share. Some PE buyers acquire an agency to merge its operations into another. In fact, some sellers perceive that PE buyers are making “book

of business purchases.” It’s often true, though, that PE buyers want the seller involved after the sale to run that book of business, continue to manage results, or take on a sales role.

A second type of outside buyer is the strategic buyer. Possibly already known to the owner, he or she might be a peer from a nearby geographic area or even the same city. Like a perpetuation buyer, a strategic buyer is likely to carry on an acquired agency’s operations as they are. However, it’s also possible the strategic buyer might want to change the name of the agency, consolidate operations, or make other changes. Strategic buyers might be less likely to want a selling owner to remain on, since these buyers are involved in the agency business already and might not need the support that a perpetuation buyer might want.

Perpetuation deals, as with any transaction, also involve a transition for the selling owner. Both the seller’s role and the transaction timeline are important here. The selling owner might take a role as a mentor, produce business, work as a consultant, and/or take other responsibilities while the new owners work into to their new roles. That transition role likely would be specified in the purchase agreement.

Staged perpetuations (those that take place over several years through two or more steps) can be appealing to owners who want to get out of the agency gradually. They can result in prices equivalent to or even more than an external sale by cashing in on a portion of ownership now and building shareholder value as the agency grows. Those shares could be worth more down the road and the principal continues to

A sale to a third-party buyer may seem to have the highest number at first look. But there could be non-financial factors at play. A private-equity buyer, for example, might fold the agency into another. This may mean the agency location may close, employee arrangements may change, agency branding may shift, and so on. An external buyer also might feel less obliged to continue the agency’s community involvement. A selling principal needs to consider those factors in light of the goals he or she has set.

An issue with outside buyers, often with PE deals, is the “earnout component” in the sale. These earnouts are payments triggered if the seller helps the agency hit financial targets after the sale.

Those targets can be ambitious to hit. So while PE deals might sound initially like big-dollar transactions, an outside observer might not really know how that earnout affects the price the seller gets. (Keep in mind that any agency merger-andacquisition information available through word of mouth is usually incomplete.)

For owners thinking about an agency perpetuation, it’s vital to discuss those ambitions with potential buyers as early as possible. This can help uncover how much interest they have in being future agency owners. Having those conversations can clarify what’s possible.

benefit from the agency’s cash flow while remaining a partial owner.

But owners who want to exit the business quickly might be more amenable to selling to a third party with no involvement after the sale. However, owners who make an outside sale without setting a plan for their career after selling their agency sometimes want to get back into the agency business after a couple of years—having experienced “seller’s remorse.”

For any agency sale, it can help to think of the owner’s role in terms of his or her “runway”: The principal may be taking off by selling the agency, but if they haven’t decided fully on a destination they might not be satisfied with where they land.

One other consideration for any agency owner is the tax treatment of the sale. For instance, a staged perpetuation can allow the owner to receive sale proceeds staggered over a period of years, which can be attractive not just for tax reasons but also financial reasons.

Whatever thoughts an agency owner has today about a future sale or perpetuation, the strongest advice I give to anyone is to take a broad view of the three factors: financial terms, the selling owner’s role after the sale, and the transaction timeline.

InsurBanc was founded by insurance industry leaders and the IIABA. We dedicate our entire bank to the financing needs of the independent insurance agency and understand the complex workings of your business from the inside out. We listen to the issues you face in the current banking arrangements and work diligently and with purpose to help your agency succeed.

As a result, we have developed the most relevant financial solutions to address the unique financial needs of independent insurance agencies like yours.

The InsurBanc team is led, supported and driven by experienced professionals who believe in the future of the insurance industry and in helping the independent insurance agent remain independent.

As a partner in your financial success, InsurBanc delivers products and services that give you the best combination of personal service and competitively priced financial tools.

You can rely on us for custom products designed to underwrite your success and making your agency more efficient and financially stable.

InsurBanc recognizes the value of your agency’s business and offers creative lending solutions to meet the needs of agency entrepreneurs. We provide loans for acquisitions, perpetuations, working capital, producer development and owner-occupied real estate investments.

InsurBanc is aware of the cash flow seasonality and fluctuations that are part of your business. We incorporate this knowledge in a wide range of deposit products and services including checking, savings and money market accounts, customterm CDs, online banking, remote deposit and merchant credit card services.

At InsurBanc, we know your life is busy, and we want to help by simplifying your banking. So, we also offer a complete line of personal banking products including checking, savings, and money market accounts, CDs, mortgages on homes and vacation properties, home equity loans and credit cards.

We’re confident that you’ll find InsurBanc’s combination of industry insight, customized products, and superior service unbeatable. Want proof?

Simply let us provide you with a free quote. InsurBanc’s quote will help your agency optimize the value of your banking relationship by comparing your current banking program with InsurBanc’s portfolio of agency-focused services. Through our review, we can recommend practical answers and actionable solutions to support your agency’s financial goals.

Simply speak to one of our banking professionals at 1-866-467-2262 or visit our website at www.InsurBanc.com.

Call 1.866.467.2262 for more information or visit www.InsurBanc.com

Aimee Stumler (Commercial)

P 317.581.3243 E astumler@crcgroup.com

Steve Shepard (Transportation) P 317.569.5447 E sshepard@crcgroup.com

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983. Browse all of our products at www.guard.com

Sallie Howerton (Team Stumler) P 317.581.3226 E showerton@crcgroup.com

Joni Baldwin (Garage) P 606.260.4018 E jodenny@crcgroup.com

Zach Wheeler (Personal Lines) P 317.581.3227 E zwheeler@crcgroup.com 350 Veterans Way • Suite 275 • Carmel, IN 46032 CRCGroup.com

Camille Knight (Aviation) P 312.442.4142 E cknight@crcgroup.com

We can make sure that’s a good thing. As one of Kentucky’s largest independent advertising firms, we know how to make a strong impression with potential clients. If you’re interested in growing your insurance business, let’s talk at hello@poweragency.com.

poweragency.com

Independent with top best markets looking to expand presence in Jefferson, Oldham or Shelby counties. Wanting Personal lines Producer or book of business to move or purchase. All arrangements possible, in strict confidence.

Accident

AmWINS

(as

EMC

Market

Peoples

In reality, while steps can be taken to mitigate duciary risk, no agency owner can eliminate that role entirely.

If your clients are going on an extended vacation or have moved into a new house and still have the old one up for sale, vacant home insurance can be hard to get.

Vacant homes are an easy target for thieves, vandals or even homeless people.

Don’t put your clients at risk. Vacant homes are a specialty at Bolton & Company.

We have a program especially designed for this market.

Call us today and let your clients rest easy.

Great products, great rates, great service. That’s our policy. It’s why we’ve been in business over 50 years. •

• Policy terms of 3, 6 or 12 months available

• Online rating at our website: www.boltonmga.com