MEET

EMERGING LEADER CHAIR

DATA PRIVACY

NEW ERA IN 2023

U.S. PG.

DANNY GREENE

PG. 19

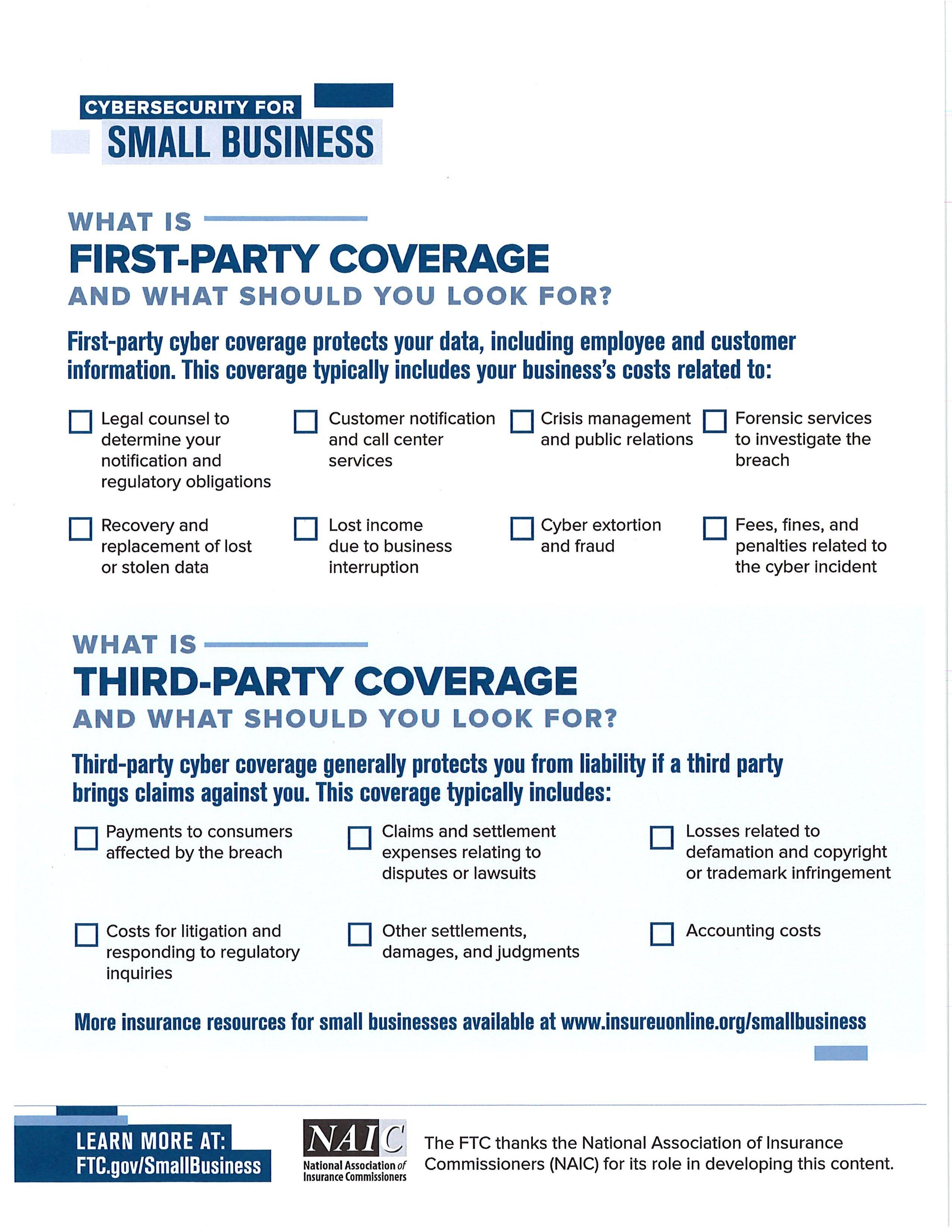

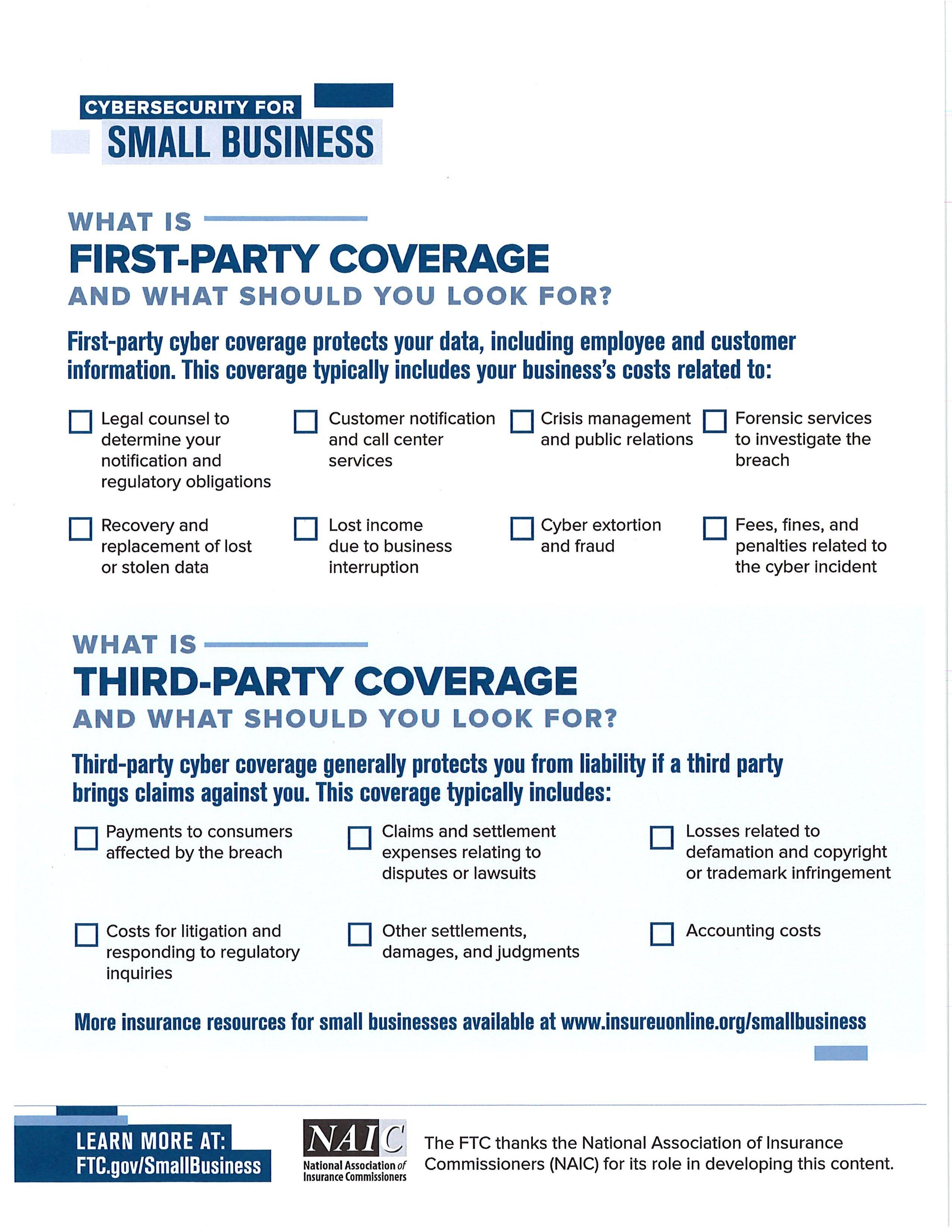

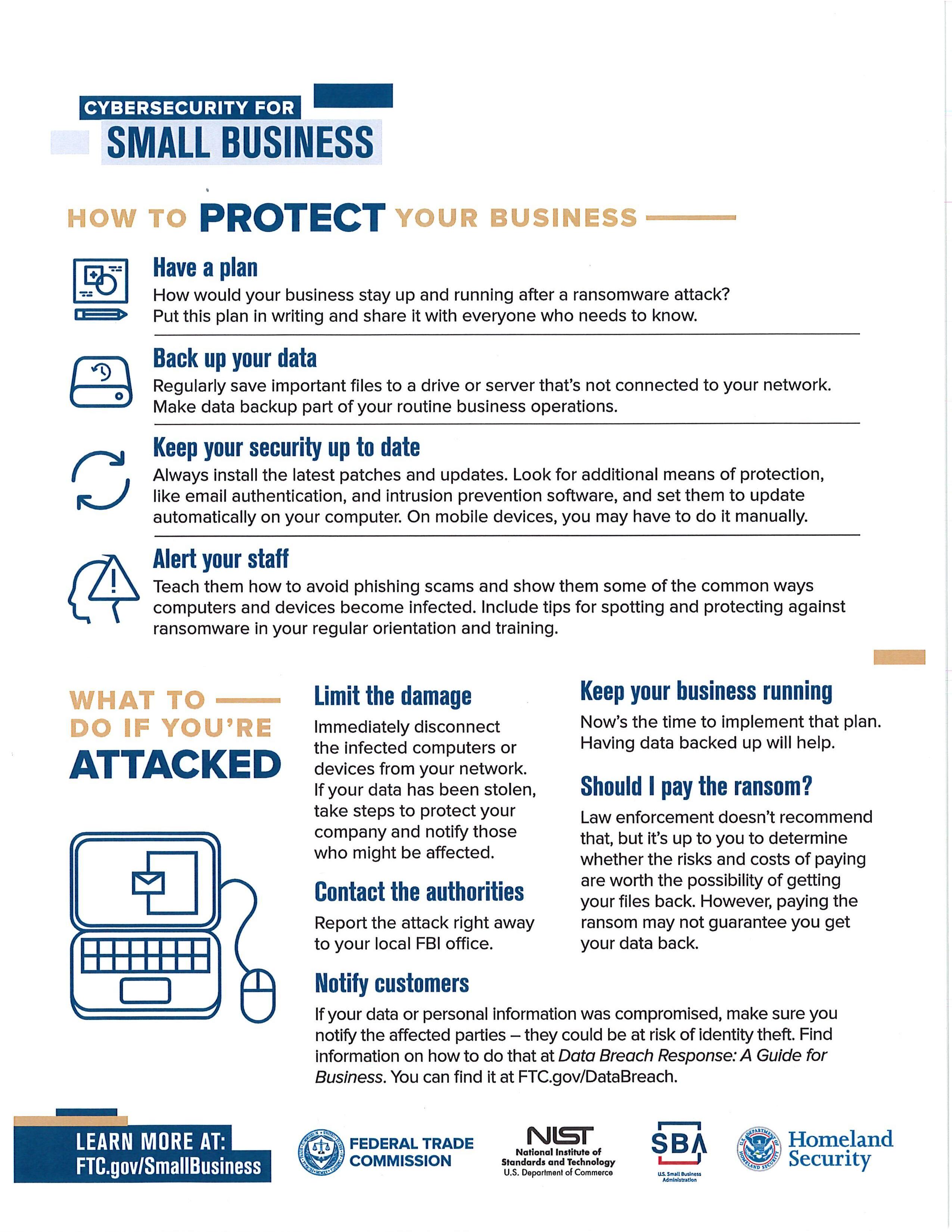

CYBERSECURITY FOR SMALL BUSINESS

PG.34

MEET

EMERGING LEADER CHAIR

DATA PRIVACY

NEW ERA IN 2023

U.S. PG.

DANNY GREENE

PG. 19

CYBERSECURITY FOR SMALL BUSINESS

PG.34

A MESSAGE FROM WHITNEY FLOYD

As we welcome the warmer temperatures of spring throughout the Commonwealth, I look forward to getting out of the office and seeing our Big I Kentucky members and partners. The Emerging Leader Chair, Danny Greene, and his committee members, planned a great lineup of events this season. From the May Leadership Conference in Bowling Green to the College Networking Nights at universities and colleges around the state, they’re excited to get our younger generation excited about insurance. And I’m excited to follow their efforts throughout the year. That’s a lot of excitement, wouldn’t you say?

In this issue, we want to bring light to the ever-changing landscape of technology. It’s altered how we engage not only with our clients and coworkers, but our family and friends. I previously mentioned the Big I Kentucky’s investment in Cataylit, the tech resource consulting platform, free to all members in 2023. But the services and products offered by our association don’t end there. And I’d love to share a few with you.

How many of you love having an auditor visit your office, take up 2-3 days of your work week and rummage through your files? If I could see the show of hands, I’d guess there wouldn’t be many. If you’re not familiar with the Virtual E&O Audit, take the time to learn more. You’ll reduce E&O exposures while improving customer service and increasing sales opportunities. The time commitment is 4 hours for the agency owner and 1 ½ for each employee. AND if you have your E&O insurance through Swiss RE at Big I Kentucky, you’ll receive a 10% credit for multiple years.

Copy and pasting your marketing emails can now be a thing of the past. Levitate is a mass email platform that has insurance industry email templates built into the system to save time and money. It’s simple, easy to use and looks like it’s coming directly from you. Big I Kentucky members received a waived onboarding fee of $450.

Need to increase your digital marketing efforts but don’t have a large budget? Trusted Choice has made some amazing changes to the Marketing Reimbursement program. Starting this year, each agency member will receive up to $1,000 in marketing reimbursement dollars. This can cover website design or Facebook ads, or even cover the costs of tech products from partner vendors like Levitate. Just co-brand with the Trusted Choice logo and save your receipt for reimbursement.

I’m honored to share my excitement with fellow members and partners. I encourage you to spread the word, reengage with Big I Kentucky products, services and in person opportunities to connect.

I’ll see you at the next event!

Whitney

Whitney L. Floyd , CIC Chair, Henderson 270.827.3543

Laura Yount, CIC, CISC Chair-Elect, London 606.878.0100

Chris Wiseman, CIC Vice-Chair, Bowling Green 270.781.2020

Allen J. Crawford, CIC, CSRM Treasurer, Somerset 606.679.6311

George “Chip” Atkins III National Director, Louisville 502.585.3600

Kevin Desmond

Immediate Past Chair, Bellevue 859-491-5100

Philip Anderton Louisville, 502.585.3277

Danny Greene Northern Kentucky, 513-534-0294

John Purdom Murray, 270.753.4751

Jared Pursley Glasgow, 270-646-8162

Carolyn Reynolds Richmond, 859-623-8485

Nick Rolf Fort Thomas, 859-781-0434

Eric Schumacher Maysville, 606-759-5663

Adam Sheridan Somerset, 606-679-6311

Tara T. Purvis President & CEO

Erin Fosson Sales & Marketing Director

Katie Hines Membership Services Director

Allie Kennada Office Manager

Kristie Weyer, CISR Insurance Services Director

Cassie Young Workforce Development Director

With more than half of insurance claims activities being replaced with automation in recent years, it is no surprise that technology has taken ahold of the insurance industry. We could all probably think of some negative impacts of the increase demand on technology in our lives but could also agree there are positive outcomes as well. For starters, more people are gaining access to information, and in this case insurance. Two, technology tends to create efficiency in our lives, especially in the workplace. With that, investments in technology could help modernize agencies and allow the producer and consumer relationship to grow.

Integrating new technologies inside the agency can redefine and streamline administrative tasks allowing the producer to focus on ways to effectively reduce risks of the consumer. It has been reported that producers and agencies have trouble managing behind-the-scenes workloads, which in turn has led to decreases in customers’ satisfaction, underinsurance, and profit maximizations. At times it can be difficult to know which customers may be underinsured and missing vital coverage, but there are technologies today that can help mitigate that issue. Automation software and AI can help producers catch these opportunities by detecting policies that are underinsured or policies that need updating to reflect big life events for the policyholder. If an agent can spend less time sifting through numerous amounts of data, he or she is better able to serve the consumer.

Software and applications can effectively allow producers and business entities to personalize marketing communications and branding. Automating communication through alert systems can help categorize customers and send outbound marketing materials, as well as follow up messages to help build better relationships with customers by focusing on their needs.

Social media applications can offer free and effective modes of marketing. By having a simple online presence through Facebook, Twitter, Instagram, or YouTube, a business entity or producer can provide quick information and updates to consumers and reach more prospective customers in the meantime.

Some of the higher-level technological advances such as block chain and predictive analytics are making their way to the day-to-day of underwriting with smart contracts and pricing packages. It is never too early to begin educating yourselves and your staff on these “new-wave” advances. As the adoption of these new technological advances, it is imperative, that a producer not only understands their uses in the marketplace but is able to explain the impacts to his or her customers. After all, customers depend on and trust their producers to educate and communicate these changes with them.

With that, research has shown that consumers still want touchpoints. Consumers are getting increasingly frustrated with virtual assistance and do not trust automated phone and web services. Consumers are showing more and more that they want human interaction, but they want the efficiencies of technology. There are ways to utilize technology to the advantages of all parties involved- and producers should strive to find that equilibrium.

by Chris Cicchetti, Financial Services Product Market Leader at Salesforce

by Chris Cicchetti, Financial Services Product Market Leader at Salesforce

What is insurtech? And why is it growing so fast, attracting a record $5.3 billion in investment in the last quarter of 2021?

The simple answer: Insurtech is any new insurance technology that helps to uplevel aging systems and propel digital innovation. With insurtech, everyone — from underwriters to brokers to policyholders — immediately benefits. When an insurance company says it is adapting insurtech or a startup enters the insurtech market, they aim to create customer experiences that rival the best of retail. This could mean focusing on value (like Warby Parker), personalization (like Netflix), or efficiency (like Amazon).

The result of building a modern tech stack can include things like:

• Artificial intelligence that makes quoting faster

• Smart chatbots to handle routine inquiries

• Mobile technology to support filing notices of loss in real-time

From traditional insurance companies to spry upstarts, insurtech is already spurring huge changes wherever you turn — surprising some who viewed the industry as slow to change and evolve. But carriers and brokers now realize that insurtech holds the power to help them build lasting, more satisfying relationships with clients and policyholders – especially as the economy enters uncertain times. And they know how to do it while navigating complex regulations and maintaining the highest levels of financial ethics.

What is insurtech? It’s the best way to prepare for turns in the cycle and be ready for whatever comes your way. Who is engaging and investing in insurtech? Anyone who understands that staying one step ahead is no longer optional for truly competitive companies. Insurtech is now a must-have.

Why is insurtech important? It frees carriers and brokers to be more human

Insurance technology is the driving force for innovation in an industry with a reputation for loving paperwork – a barrier to reaching customers who are digital natives and impatient with anything that isn’t instantaneous.

You might think insurance isn’t fun — and we don’t blame you — but tech innovations can actually make some

insurance interactions delightful. Verspieren, a major insurance broker, created a program allowing shoppers to instantly buy warranty insurance on their expensive purchases. That means near-instant quote-to-bind – just two minutes. And that’s digital innovation enabling simple, automated shopping experiences to give customers peace of mind, sans paperwork.

These moments are game-changing for the insurance industry. You can see why investors are so enthusiastic about insurtech. It can elevate service, streamline distribution, and collect data for sophisticated analysis. It’s the ultimate virtuous cycle – delight, collect data, and do even better the next time. And do it on any channel. Slack. Email. A phone call.

“We’ve built a holistic self-service experience, especially in our contact center where customers can do simple tasks,” said Stacey Goodman, chief information officer of Prudential Financial. “Additionally, we’ve built other capabilities around artificial intelligence, machine learning, natural language clouding, chatbots, and more to further our goal of being tech-forward.”

You don’t get to be as dominant after 150 years as Pacific Life has become without focusing on what’s coming next. Strictly speaking, Pacific Life isn’t an insurtech. But it is a company focused on digital-first strategies that foster innovation.

Like other long-lived competitors, insurtech is at the heart of Salesforce Trailblazer Pacific Life’s strategy. Indeed, 80% of insurance leaders say their business and technology strategies are inseparable. No surprise, then, that Pacific Life Chief Operating Officer Adrian Griggs focuses on upgrading the customer and broker experience through technology.

“We believe the next 10 years will see more change than the whole 150-year history of our company,” said Griggs. “The effective integration of channels across marketing, sales, and service activities is critical to delivering a positive, brand-reinforcing experience at every touchpoint in the customer relationship.”

Financial Services Cloud was Pacific Life’s tech of choice, with the goal of offering customers a retaillevel experience. This enabled the carrier to work more

effectively with independent agents and customers via a 360-degree view of their data. For example, using CRM Analytics, the carrier made data-driven decisions to determine the next-best actions with the support of AI and intelligent data visualization. Next up on its business plan: Connecting with customers and brokers on their preferred channels – email, chat, social, text, or phone.

Salesforce Trailblazer AAA Carolinas needed a strategy to add some spice to attract the attention of millennials and Gen Z. The nonprofit has an array of services to offer drivers as they explore the world, but realized it needed to reach the next generation.

AAA Carolinas had built its business around services and products. Its leaders realized they needed to put the customer at the center of their efforts. To do that, AAA Carolinas introduced technology innovation that would put all customer data into one place so everyone in the organization could have a 360-degree view of its users. The new technology enabled the nonprofit to introduce LiveAgent, an automated chat, for online support. This helped to increase member engagement by 330% and reduce service response time by 54%.

AAA Carolinas also automated ways to flag new sales opportunities when members transferred from one region to the next. This generated around 1,250 new opportunities per month and is estimated to drive $99,000 to $200,000 in additional gross revenue annually. With the help of Salesforce Program Architects, who provide strategic planning, deep industry and product knowledge, and

on-the-ground technical advice, AAA Carolinas electronically linked the organization to Edmunds, the car value database. Sales reps could spot potential safety issues for members and notify them of service needs.

Claims may be the most challenging area for carriers and brokers. If an individual or business is filing a claim, something has gone wrong for them. They don’t need cumbersome paperwork or clunky claims systems to make things feel worse.

Farmers Insurance used insurtech in its claims management system to create a platform reducing lossreporting time from 12 minutes to 3 minutes. Policyholders can now file a claim on their computers or phones; send in photos; find repair shops, and connect quickly with an adjuster more efficiently than buying groceries. Farmer’s also uses new technology to automate routine tasks so agents can spend more time with customers.

According to Forrester, 83% of insurance sales will involve a digital component. That’s impossible to ignore. And 87% of insurers say they will be investing in digital enhancements. The innovations your competitors are undertaking mean that insurtech is now an imperative. As markets change and the economic outlook gets murkier, you need the right technology to create the best experiences possible for your policyholders and clients.

West Bend Mutual Insurance has a long history of writing workers’ compensation insurance. Our underwriters are knowledgeable and experienced. Our loss control reps have the expertise and tools to help keep employees safe. And our claims practices are the best in class.

From Main Street-type businesses to specialty businesses like food trucks, West Bend has the experience and expertise to protect businesses of many kinds and many sizes. We want to write all of your workers’ compensation business, small to large!

When you select West Bend for your valued customers, you can rest assured you made the right choice. After all, we are the best remedy for workers’ compensation.

To find an agent near you, visit thesilverlining.com.

The year 2023 will go down in history as marking the beginning of a profound shift in the philosophy underlying data privacy laws in the United States.

Historically data privacy laws here have been rooted in a "harms-prevention-based" hodgepodge of privacy protections, seeking to prevent or mitigate harms in specific sectors. In contrast, under the broader "rightsbased" approach exemplified by the European Union's General Data Protection Regulation (GDPR), individuals effectively own their personal information and thus presumptively have the legal right to control it, and who can use it is a matter for them to decide.

Following California's lead, four other states — Colorado, Connecticut, Utah, and Virginia — will begin enforcing new GDPR-inspired statutes in 2023.

More states are sure to follow. The implications of this fundamental shift in the underlying philosophical framework regarding data privacy protection will be

profound in the years and decades to come. 2023 will mark the shift.

The United States has historically allowed businesses and institutions to collect personal information without express consent, while regulating those uses to prevent or mitigate harms in specific sectors.

Illustratively, these sectors have included laws and regulations applying to the financial (e.g., GrahamLeach-Bliley Act (GLBA)) and medical sectors (Health Insurance Portability and Accountability Act (HIPAA)), education (Family Educational Rights and Privacy Act (FERPA)), children (Children's Online Privacy Protection Act (COPPA)), and other sectors, at both the federal and state levels.

Statutes such as these create rules applicable to specific industries and types of institutions. These rules protect against and prevent misuse of certain categories of personal information.

Consistent with their underlying philosophy to allow collection and uses of personal information but prevent harms, these rules impose restrictions on industries and institutions regarding their handling of personal information.

In contrast to this harms-prevention-based philosophy, countries in the European Union (EU) have long pursued a rights-based regime for protecting personal information. Historically this philosophy holds that data privacy is a fundamental human right. Individuals effectively own their personal information, and who can use it is a matter for them to decide.

This differing worldview of the right to privacy has roots in Europeans' historical experience in suffering through the infamous data collection of the Nazis, who collected and catalogued information regarding individuals' ancestry and affiliations (among other facts) and used it in committing atrocities. The enormity of these crimes against humanity was followed by the similar collection of data by the formerly communist East Germany's secret police. This tragic history resulted in the understandable necessity of regulating the collection, storage, and usage of personal information.

In 1970, the German state of Hesse enacted the world's first data protection law decades before the Internet and the World Wide Web became ubiquitous. In 1978, Germany adopted its Federal Data Protection Act. And in 1983, the German Federal Constitutional Court held that each person has a constitutional right to "informational self-determination."

With this historical background in Europe, and Germany acting as a leader in developing data privacy laws, by 2016, the EU recognized the need for a modernized approach to data privacy. This recognition arose in light of advancements in information technology and accelerating use of personal data in a globally interconnected world. Accordingly, the EU adopted the General Data Protection Regulation (GDPR). The GDPR, which became enforceable in 2018, codified several key principles reflecting the Europeans' human-rights-based philosophical foundation for data privacy protection.

Understanding the underlying principles codified in the GDPR is useful in understanding what is going on with the new data privacy statutes slated to go into effect in the coming weeks and months of 2023.

The new laws coming online in 2023 in California, Colorado, Connecticut, Utah, and Virginia (and in the additional states likely to follow in their footsteps in the coming years) reflect the influence of GDPR's rightsbased philosophical framework. These new laws represent a comprehensive approach to privacy protection, applying to businesses across numerous sectors, in addition to the sector-specific laws that remain in place.

GDPR categorizes between "data controllers" and "data processors." Data controllers, as the name suggests, are the businesses and entities that control the collection and use of the data — the data controllers decide what to do with data. Data processors carry out the instructions provided by the data controllers. The obligations that apply to data controllers and their responsibilities differ from those that apply to the data processors. The new state data privacy laws contain this distinction and approach.

GDPR sets forth several rights of individuals with respect to their personal information. The specific rights that apply depend on the type of data, especially data deemed highly sensitive. Details among the U.S. laws differ, but basically the rights parallel those originally established in the GDPR.

These rights include the following:

• Access — individuals have the right to request access to inspect their personal information.

• Correction — individuals have the right to request that errors in their personal information be corrected.

• Portability — individuals have the right to request that their personal information be transferred to another entity.

• Erasure — individuals have the right to request that their personal information be deleted.

• Consent — individuals have the right to decide whether their personal information may be sold or whether it may be used for purposes of receiving targeted advertising.

• Appeal — individuals have the right to appeal a business's denial of their request.

In addition to providing for these rights for individuals (called "data subjects" in GDPR's parlance), GDPR lays out certain governing principles. These principles include the following:

• Privacy or data protection by design — the data management system should be designed with privacy protection in mind (including data mapping, so you know what data are stored where, and the protections are appropriate to the level of sensitivity of the data).

• Record-keeping — adequate records should be maintained regarding the collection, processing, and use of data.

• Data minimization — personal information, especially that which is sensitive, should be kept, if at all, only long enough to serve its purposes. If the data aren't stored, then they can't be stolen by hackers in a breach.

• Transparency, informed consent, and legitimate uses — personal information should be used with informed consent from the data subjects, in a way that is understandable to them, and only for legitimate uses allowed under law.

• Data protection officers and data impact protection assessments — trained personnel should be monitoring compliance with privacy protection requirements, and data protection should be assessed using appropriate risk-management principles.

• Best cybersecurity practices — data should be protected using best practices for cybersecurity to minimize the risks of data breaches, including appropriate physical as well as technological defenses.

• Data breach notifications — in the event of data breaches, a tested incident response plan should be in place to ensure that appropriate notifications can be delivered in a timely manner under the different deadlines applicable under law.

• Employee training — employees should be trained in privacy protection practices pursuant to well-designed policies, and employee access to sensitive personal information should be limited to mitigate risks.

• Requiring appropriate contractual language — contract provisions regarding data and privacy protection should be used to ensure that vendors and contractors are also guarding against misuses and breaches of personal information.

The foregoing lists of rights and legal principles are not exhaustive; GDPR's 99 articles contain much more. But becoming familiar with them helps in examining the rapidly evolving data privacy laws in the U.S. and in anticipating the new ones to come.

Here is a list of the new state data privacy statutes slated to come online in 2023:

1. Most of the provisions of the California Privacy Rights Act (CPRA) become effective on Jan. 1, 2023. CPRA amended the California Consumer Privacy Act (CCPA), which had already created a number of individual rights modeled after the GDPR. CPRA created a new state agency, similar to data protection agencies in the EU countries charged with enforcing the GDPR.

2. The Colorado Privacy Act (CPA) becomes effective on July 1, 2023. In addition to creating rights patterned after the individual rights under GDPR, CPA requires data security and contract provisions for vendors and assessments for "high-risk" processing.

3. The Connecticut Data Privacy Act (CDPA), like Colorado's new privacy law, goes into effect on July 1, 2023. CDPA likewise creates a suite of GDPR-like individual rights, and requires data minimization, security, and assessments for "high risk" processing.

4. The Utah Consumer Privacy Act (UCPA) becomes effective on Dec. 31, 2023. It provides for certain GDPR-like individual rights, and also requires data security and contract provisions. But UCPA does not include expressly required risk assessments.

The Virginia Consumer Data Privacy Act (VCDPA) becomes effective Jan. 1, 2023. It provides for certain GDPR-like individual rights. But in 2022, the "right-to-delete" was replaced with a right to opt out from certain processing.

While these new state statutes are intended to be comprehensive in scope, they contain certain carve-outs for data already protected under other laws, such as HIPAA. The statutes vary with respect to their reach, based on businesses that hit certain revenue thresholds or based on the number of residents, consumers, households, or devices with data in the applicable state. Each statute is different and should be carefully analyzed as to its scope, requirements, potential liabilities and penalties, and its means of enforcement.

However, an understanding of what these new laws are getting at, and where they are coming from, will create a foundation from which to analyze and understand their requirements, and those from new laws yet to come. Data privacy laws in this country (and around the world) are changing more in 2023, and there will be no looking back.

We’ve

Dedicated Risk Manager Big “I” policyholders have easy access to an E&O risk manager when those “tricky” situations arise. Even if it’s not so tricky, but you just want to run it by someone, your risk manager is available.

Your risk management department tracks the most common mistakes leading to E&O claims. With this knowledge, a series of short, informational webinars have been developed addressing these most problematic issues. They are available anytime you need them.

Regular Updates Every month policyholders are provided access to our newsletter dedicated to guiding agents around the E&O landmines. It’s a topical, timely, unique value for policyholders.

Hot Issues Webinars As you know, business moves quickly and the “status quo” doesn’t stay status quo long. Occasionally, a new challenge arises that requires quick attention. When policyholders are faced with a new challenge, we conduct a “hot issues” webinar to help you navigate the new situation.

Resources and Tools Procedures manuals, job descriptions, client letters are all available for 24/7 access on a dedicated website for policyholders.

Other Benets Access to cyber coverage and cyber risk management; exclusive access to agency technology resources through ACT; and the Virtual University – the association’s education provider.

Name: Danny Greene

Age: Too old to be an emerging leader; 38

Title: Vice President, Insurance Advisor

Agency: Foundation Risk Partners

Location: Northern Kentucky

Education: B.S. Business Administration from UNC Wilmington

What does your position entail?

Tailoring risk management programs for individual clients based off their exposures and individual needs

What are your goals for your year as Chair?

Sometimes I ask myself that same question; Honestly, sales has always been a part of my prior jobs. It provides flexibility and earning potential that is hard to beat, but also is rewarding when you are able to help a client

Professionally, I’d have to give credit to my boss and friend, Brian Talbot We established a strong relationship early in my career when he was a marketing rep for one of my carriers. The trust and partnership we’ve developed over the years is a major factor for my successes in this industry.

Kentucky's Emerging Leader Program has been flourishing for many years under the watchful eye of my predecessors and Katie Hines. I just want to make sure we continue that momentum moving forward and continue to be a collaborative group of professionals working together to better our industry, local communities and be an advocate for our clients. Receiving an ‘Eagle Award’ from the IIABA has been a goal of mine since my first visit to Washington D.C.- Stay tuned.

Tell me about your family : I am lucky enough to be married to my wife Molly, and blessed with two young daughters (Harper, 9 and Georgia, 5). Family core is rounded out with a rambunctious 10-year-old Silver Lab named Banks.

What has been the biggest challenge you have faced in your career?

Constant change. Covid years taking away the office dynamic of working with my peers, is particularly relevant. Recent hardening of markets during unsettled economic times have made for harder conversations with clients

Advice for fellow emerging leaders? Be deliberate with your time.

What accomplishment are you most proud of? My family.

Professionally, earning a client’s business from a referral always resonates as a proud moment.

Favorite Big I Kentucky memory?

I enjoy all the times we get together, but Washington D.C. trip is hard to top.

What’s playing in your earbuds right now? Stick Figure (Big Reggae Guy)

Favorite restaurant in your hometown?

Walt’s Hitching Post

First job?

First job out of college, Assistant Store Manager at Target in Myrtle Beach. Bike weeks were interesting.....

What do you enjoy most about your job/industry?

Working with talented clients. Many of these people are brilliant, dedicated entrepreneurs and have taken the chances to own/grow their own business. I respect that about my clients, and it brings me joy being a part of their trusted team.

Something others don’t know or would be surprised to know about you?

Avid scuba diver, spear fisherman… has become tough since moving back to KY from NC

What’s something that you’re really bad at that you would love to be great at?

Playing an instrument

Favorite music/band? Big Reggae guy

Favorite cereal?

Cookie Crunch, is that still a thing?

Starbucks order?

Coffee, black

Pet Peeve?

Lack of timeliness

Favorite movie/TV show?

Survivor

Favorite Golf course?

Kiawah

Unique Fact? I’ve been attacked by sharks and won the battle.

Point to www.iiaba.net/Flood.

“Our agency was approached by our Selective territory manager, Gregg Porter, to roll a portion of our ood business from another carrier to Selective. We were pleasantly surprised at how easy and seamless the whole process was. Gregg came into our office and basically did all the work for us. We had a high success rate and couldn’t be happier with Selective. Their customer service representatives and underwriters are very knowledgeable, friendly and always helpful. We are very satised with the whole experience and with Selective!” – IIABL Member

Selective makes the transfer process easy and profitable for IIABA members. Selective does not use any third party administrators for our processing, which allows us to tailor a transfer plan that works for both you and your customers. Our team will work directly with your agency to collect the required underwriting documents. Then our rollover underwriting team will handle the processing, including sending out a letter to your customers letting them know of the change. We also provide you with a real-time rollover tracking report to help monitor the status of the transfer.

Selective offers competitive commissions and transfer incentives for rollover business.

Selective began writing flood insurance in 1984 and has been the IIABA endorsed flood carrier since 2001. Point, click, roll and join us today!

To discuss transfer opportunities, or to place new �lood business with Selective, contact:

Don Burke National Flood Marketing ManagerSelective Insurance

don.burke@selective.com

(765) 577-0330

G a i n a c c e s s t o d a y , a n d l e t u s s h o w y o u w h y m o r e t h a n 3 5 , 0 0 0 a g e n t s t r u s t u s t o h a n d l e t h e i r s u r e t y n e e d s

The pace of change and technological development in the insurance and risk management industry is accelerating, thanks in large part to Insurtech firms driving innovation and partnering with legacy insurers to create new solutions to traditional challenges.

The next year will bring new ideas to the forefront of risk and insurance, introducing ways to protect people and property, lower expenses and reduce cycle time.

Below, leading Insurtech solution providers share their 2023 predictions.

The next evolution will include Insurtechs and incumbents working together as true

partners to find solutions to challenging problems.

Corvus CEO Madhu Tadikonda described this next iteration:

“Looking ahead to 2023, the ‘Insurtech 2.0’ landscape will continue to mature, with companies focusing more on profitability and honing in on areas with the biggest gap between customer needs and current capabilities. We see huge demand paired with limited supply, a result of relying on traditional questionnaire-based methods to gather data for underwriting.

“These methods have failed to appropriately quantify risk, leading to a chain reaction of underpricing, losses and market pullback. An Insurtech 2.0 approach will leverage the data and technology to properly assess and price risk, and even go beyond the insurance application to help proactively mitigate risk for policyholders.”

Guy Goldstein, CEO at Next Insurance, spoke more about how Insurtechs will prioritize profitability in 2023. Following the dismal earnings, disappointing stock prices and layoffs that plagued some Insurtechs in 2022, focusing on profits seems like a wise move.

“We’ve moved into a market that values sustainability, profitability and efficiency as high markers for companies that will endure the test of time. Insurtechs will prioritize profitability over growth, and their longterm investments in technology will put them in a prime position to continue to capture market share from legacy insurers,” Goldstein said.

“Those who don’t prioritize or achieve profitability in a timely fashion might not survive,” he warned. “2022 was a year for Insurtechs to reassess and reevaluate their operating costs, customer acquisition models and coverage offerings, laying a strong foundation for the path to profitability. In 2023, Insurtechs will continue to build on these changes, and will double down on digital solutions, AI and data analytics to improve underwriting, loss ratios and risk assessment to achieve sustainable profitability.

“Insurtechs will continue to stay competitive with traditional providers by capitalizing on the widening gap in digital experiences and tech-driven back-end efficiencies over the next 12 to 24 months, allowing them to create responsible, viable companies while delivering more choices and a better experience to customers.”

Andy Cohen, president at Snapsheet, discussed the impact on claims:

“From a claims perspective, 2023 will kick off an overdue wave of operating model transformation after the realization that loss cost and expense inflation are here to stay. This will consist of shifting away from legacy methods of inspection/ repair and aligning internal resources to customer-impacting activities and increased outsourcing in high-frequency, low-severity lines.”

“Insurers are now tasked with reconsidering where residual capital will be spent in 2023,” added Christian van Leeuwen, CSO and cofounder at FRISS. “New investments in digital transformation, AI and technology will also be looked at cautiously in the next few months.”

A common theme emerging from the Insurtech leaders was a focus on continued AI, machine learning and automation.

David Tobias, cofounder at BetterView, elaborated, saying, “2023 will see greater adoption of AI in all aspects of an insurance company’s daily operations, enabling greater automation and more actionable data-backed insights. We are seeing strong interest in how AI and computer vision is leveraged to reveal property-specific insights and optimize underwriting, inspections and claims.”

He described how advances in technology are driving more accurate rating and pricing.

“A property’s true and current condition is more powerful than simple historical models, particularly as insurers deal with a new economic climate, new regulations and increasing severe weather events like hurricanes, wildfires and windstorms,” said Tobias. “Insurers will need tools that enable them to consume massive amounts of data, reveal accurate risk, and price more accurately, yet still respond faster. AI and systems to consume that AI output can provide great benefit to carriers and insureds.”

Elad Tsur, cofounder and CEO at Planck, is focused on the impact of straight-through processing in commercial risks, streamlining the entire insurance ecosystem from application through to claims.

“I see straight-through processing (STP) as one of the top trends for 2023,” Tsur said. “STP has been a required operating practice in personal lines for at least a decade, but the greater level of complexity in even the smallest commercial risk has caused progress there to be much slower than many had hoped. True STP — a streamlining of the application, approval and claims process through automation — has been a goal of the insurance industry since the 1990s.”

“Carriers will address technology deficiencies in the claims space to drive differentiated outcomes around customer engagement, automation and efficiency, particularly in highfrequency lines,” Cohen predicted.

Tsur added, “Recent advances in workflow integration, data mining and AI allow carriers to reliably eliminate more decision noise and human error than ever before. A more informed and streamlined underwriting process greatly enhances risk selection, coverage construction and pricing. New technologies, such as Planck’s data- and AI-related capabilities, enable the kind of breakthrough functions the industry needs at numerous steps in the underwriting process.”

Embedded insurance is a trending area creating new opportunities for carriers and Insurtechs. Customers expect a seamless digital experience — and embedded insurance delivers.

“We live in a world where both consumers and business owners expect a convenient and seamless purchasing experience regardless of the product or service they are purchasing. A concoction of technology mixed with data has enabled the insurance industry to meet these

expectations in new and exciting ways,” said Coterie Insurance chief growth officer Bobbie Collies.

“InsTech London is forecasting the embedded insurance market to grow to $722 billion in gross written premiums (GWP) by 2030,” Collies continued. “A good portion of this GWP will be new revenue into the industry, capturing new premiums for risks that would have otherwise gone uninsured or perhaps underinsured.”

“One topic that has been on the rise in recent years is embedded insurance,” said van Leeuwen. “We are especially seeing new initiatives come to market not only with large auto manufacturers like Tesla and GM but also with other digital brands. These initiatives are leading many consumers to consider what the ‘new normal’ will look like.”

Embedded insurance is convenient, seamless and low-effort for consumers, which helps explain its popularity.

“Distribution is changing rapidly, particularly for risks that have a low complexity of underwriting. To stay relevant, 2023 will be a critical year for carriers, independent agents and Insurtechs to align strategies in an effort to meet customers where it’s most convenient for them to purchase insurance products,” Collies said.

One place where all the experts agree: 2023 will continue to be an exciting year for Insurtechs and the industry. As Cohen summed it up, “2023 sets up as a transition year for the industry, after a new normal was established in 2022.”

Abi Potter Clough, MBA, CPCU, is a keynote speaker, author and business consultant focused on Insurtech, leadership and strategy. She has over 15 years of experience at a Fortune 500 company with expertise in P&C claims operational leadership, lean management consulting, digital communications and Insurtech. As the past chair of the International Insurance Interest Group of the CPCU Society, Abi remains involved in many international initiatives and projects. She has published two books about change management and relocation. Abi can be reached at Abi1Leads@gmail.com.

YOU’RE INDEPENDENT, BUT YOU’RE NOT ALONE

Big “I” Hires℠ has curated resources to help you find, hire, assess and engage your team. When it’s time to assemble your dream team, the Big “I” has your back with cutting-edge tools that make hiring easy!

YOU’RE INDEPENDENT, BUT YOU’RE NOT ALONE

Big “I” Hires℠ has curated resources to help you find, hire, assess and engage your team. When it’s time to assemble your dream team, the Big “I” has your back with cutting-edge tools that make hiring easy!

All Big "I" members can access up to $1,000 in funds to offset the cost of marketing and customer experience improvement expenses.

logo

Add the Trusted Choice logo to any consumer facing ads or marketing to be eligible.

Members can choose from traditional options like billboards and print ads or from digital options like social media and streaming service ads.

Members can choose to use funds towards marketing or customer experience improvements with any of Trusted Choice's Preferred Vendors that are listed on the TechCompare site and labeled MRP eligible.

Services include SEO, Websites, Automation, Digital Advertising and more.

All members have access to up to $1,000. Reimbursements are made at 50% of final cost. Members can utilize funds in one or multiple transactions. Program is first come, first served until funds have been depleted

For full program details or to submit a reimbursement request visit trustedchoice.independentagent.com/MRP today!

All Big "I" members can access up to $1,000 in funds to offset the cost of marketing and customer experience improvement expenses.

logo

Add the Trusted Choice logo to any consumer facing ads or marketing to be eligible.

Members can choose from traditional options like billboards and print ads or from digital options like social media and streaming service ads.

Members can choose to use funds towards marketing or customer experience improvements with any of Trusted Choice's Preferred Vendors that are listed on the TechCompare site and labeled MRP eligible.

Services include SEO, Websites, Automation, Digital Advertising and more.

All members have access to up to $1,000. Reimbursements are made at 50% of final cost. Members can utilize funds in one or multiple transactions. Program is first come, first served until funds have been depleted

For full program details or to submit a reimbursement request visit trustedchoice.independentagent.com/MRP today!

Sometimes, insurance issues are, to use a cliché, old wine poured into new bottles. A recent case filing involving cyber issues illustrates this point.

The old or familiar part of the case is something that producers encounter unfortunately all too often: the insured misstating or overstating an important fact on application. Whether intentional or unintentional, a material misstatement on an application is grounds for rescinding the policy.

“Material” means that the true situation matters to the insurer – a missing middle initial in a name or an unimportant typo usually won’t do it. A material misrepresentation is one that affects whether the insurer would write the risk, or, at least, would price the risk differently.

A rescission of an insurance policy means that, in essence, the insurer returns the premium to the insured and figuratively “retrieves” the policy. It is much like unscrambling an egg. The important part of a rescission is that the insurance company takes the position that it never really issued the policy in the first place. Typically, the misstatement is covered after there is a loss which the insurer doesn’t want to cover. If the rescission is successful, the insurer does not have to cover the loss and the insured is left without any policy going forward for other losses which it might suffer.

The new part of these basic principles is that it can arise in the context of a cyber policy. Specifically, it can arise in the context of an insured’s representations about multifactor authentication (MFA)

The case is called Travelers Property Casualty Co of America v International Control Services Inc. It was filed in federal court in Illinois last July International Control Services applied for cyber from Travelers

ICS was asked to sign a form attesting to its level of compliance with multifactor authentication. MFA is simply a method by which a person seeking to gain access to a website, or an application, provides multiple pieces of evidence to verify who they are. The factors used for MFA can range from passwords to security questions to fingerprints or facial recognition.

According to reports, ICS did in fact have MFA. Unfortunately, that MFA was not being used for anything other than firewall protection. The Travelers application form that ICS had signed had ICS promising to require MFA or things such as email access, remote access, network backup, and network infrastructure.

After a cyberattack, the facts regarding MFA and what ICS was actually doing came to light. Travelers rescinded the policy and filed suit to validate its decision.

The war ended just after the first shot was fired.

Within two months of the suit being filed, the parties filed an agreed dismissal The Insurance Journal reports that, as a part of the dismissal, ICS agreed that “no insurance coverage shall be available to any person or entity under the policy for past, present and future claims, suits, loss, costs or expenses of any kind whatsoever.”

“No fibbin’, no fudgin’ and no wishful thinking” is a statement I’ve offered up in casual conversations (and sometimes even in a continuing education class!) about what to say to insureds as they fill out any application. The Travelers case does nothing to take away from that idea. In fact, it simply amplifies its importance in the new world of cyber. The status of an insured’s MFA is likely highly material to the risk and the application should reflect accurately what that status is.

M O D E R N M A R K E T I N G

4 A G E N T S

PRESENTED BY

Official Media Sponsor for Big I of Kentucky

Scan the QR Code below to register for any upcoming event.

Established Louisville agency interested in acquiring insurance agencies in Jefferson and surrounding counties. If you are interested in selling, merging, or need assistance with perpetuation, we would like to talk with you in confidence.

Call Kevin Lavin, CIC or Philip Anderton, CIC, CRM at Sterling Thompson Company at 502-585-3277

LEADERSHIP CONFERENCE

Bowling Green, KY

May 15-17, 2023

ROAD SHOWS (CE)

Virtual

August 1 and 3, 2023

EMERGING LEADER CLAY SHOOT

Wilmore, KY

August 17, 2023

LOUISVILLE CE DAY (CE) Louisville, KY

August 22, 2023

KEENELAND TAILGATE

Lexington, KY

October 20, 2023

ANNUAL CONVENTION & TRADE SHOW

Louisville, KY

November 15-17, 2023

Independent with top best markets looking to expand presence in Jefferson, Oldham or Shelby counties. Wanting Personal lines Producer or book of business to move or purchase. All arrangements possible, in strict confidence.

Please send inquiries to:

Turner Insurance Agency, 2460 Shelbyville Road, Shelbyville, KY 40065 or call Kurt Turner, CPCU at 502-633-6060.

We would like to thank our advertisers for their support. This publication would not be possible without you!

For classified ads or to advertise in the Kentucky IA, visit bigiky.org/magazine or call 502-245-5432.

SPONSOR MEDIA

Kentucky Growers Insurance Company Bolton & Company

Fund Insurance Company of America Amerisafe

AmWINS Brokerage Midwest LLC

Anthem Blue Cross and Blue Shield Auto-Owners Insurance Company

Berkshire Hathaway GUARD Insurance

Commercial Sector Insurance Brokers Countryway

EMC Insurance Companies

FCCI Insurance Group

FFVA Mutual

Midwestern Insurance Alliance

Big I Kentucky gratefully acknowledges these fine companies, our 2023 Industry Partners. Without their assistance, fees for the events and programs throughout the year would be significantly higher and/or the quality of the program would be restricted.

TO BECOME A SPONSOR OR FOR MORE INFORMATION ABOUT OUR INDUSTRY PARTNER PROGRAM, PLEASE CONTACT ERIN FOSSON, SALES & MARKETING DIRECTOR, AT 502-245-5432 OR EFOSSON@BIGIKY.ORG

In this era of high inflation, we have good news!

Our rates have gotten more competitive so you can now offer your customers even better quotes.

And, because we have been doing this since 1965, we know the ins and outs of the business so we can guide you through the process faster and easier.

Have you found some insurance companies difficult to deal with? You won’t have that problem with Bolton & Company.

Whether it’s a one-unit owner operator or a 250 unit fleet, we are able to provide the same consistent level of service.

Here’s what one of our long-time customers had to say: “When we think of truck insurance, we think of Bolton first.”

We offer:

• Auto Liability

• Physical Damage

• Cargo

• Excess Cargo • Contingent Cargo

• Truckers General Liability

• Excess Liability

• Logistics Companies (Brokers)

All we need is a DOT number to get started. Just send submissions to: trucks@boltonmga.com.

We are in business to make your life easier!