Exploring the issues that shape today’s business world.

Exploring the issues that shape today’s business world.

Preparing for the Labor Cliff

Real Estate Considerations for Firms What You Need in a CAS Tech Stack Impact of Board Gender Diversity

Embracing Authenticity And More!

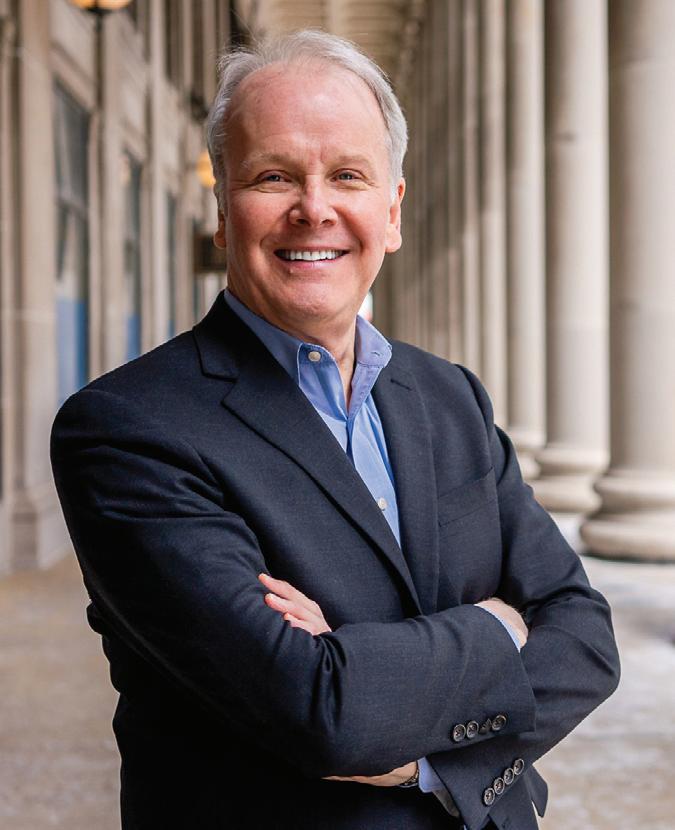

Geoffrey Brown, CAE President and CEO, Illinois CPA Society

As the college-age population shrinks, and baby boomers retire, the accounting profession has some major demographic cliffs to traverse as it seeks the talent it needs.

Within the last few months, the accounting profession has received the National Pipeline Advisory Group’s (NPAG’s) report, along with recommendations from other stakeholders, on how to address the profession’s workforce issues. Armed with all this new data and insight, the hope is that we can begin outlining a roadmap for the future and martial the necessary resources to bring about meaningful change, i.e., attracting more students and young professionals to the accounting profession (and hopefully shepherding them toward the CPA credential).

But before we can turn our attention toward execution, we need to understand what’s occurring outside the profession that’s impacting what’s happening inside it now and for the foreseeable future.

I’ll preface with this: The environmental factors affecting the workforce are challenging but not insurmountable. Here’s what we’re contending with.

A demographic cliff caused by approximately 17 years of declining birth rates in the United States is setting us up for a deficit of young people attending colleges and universities. The number of high school graduates is set to peak around 2025-2026, which will lead to a shrinking college-age population that’s projected to last deep into the next decade.

Now, also consider that around 11,000 baby boomers turn 65 each day, with some 4.1 million Americans reaching that age this year alone. Since many organizations in this profession have mandatory retirement ages of 65 or 66, we’re poised to lose valuable, experienced professionals in the coming years, which will put additional strain on the field. Given the profession’s aging workforce, it’s safe to say that we’re also facing a retirement cliff.

Further, even the traditional model of students attending four-year colleges or universities and entering the workforce is shifting

before our eyes. What this all means is that we can’t keep plugging away with dated approaches to raising awareness of the profession and acquiring talent. In my opinion, the profession needs to reconsider the value it provides if it wants to attract the next generation of talent—talent that has different attitudes, interests, and needs, along with other career opportunities to consider.

So, what do we do to capture the interest of the next generation of talent we desperately need? The NPAG’s recommendations are organized into six themes that offer a preliminary roadmap for navigating the workforce challenges and corresponding environmental factors above, among others. Two important themes are telling a more compelling story about accounting careers and enhancing the employee experience by evolving business models and cultures.

I think many stakeholders will naturally gravitate toward these areas as places where they can contribute their time and talents to make change. Modernizing business models, cultures, and the related employee experience are in the profession’s best interest. However, we must do more than just talk about telling a better story. We must also demonstrate that the story is better, which means changing the work experience for our professionals. And while nobody knows what’s going to happen in the future, we should still take the necessary steps to reimagine how we cultivate and steward the next generation of accounting and finance professionals. As a convener, I assure you the Illinois CPA Society is committed to supporting these efforts however we can.

The Illinois CPA Society is proud to recognize our 2024-2025

YP Ambassadors are elite volunteers who serve as a link between young professionals, their firms, and ICPAS. The program develops leadership skills for Ambassadors and cultivates a sense of community among young professionals at each firm.

Jonathan Acevedo, CPA Wipfli LLP

Sandra Arredondo Deloitte

Megan Chu, CPA Protiviti Inc.

Katie Coffey PwC

Paige Cohen, CPA Forvis Mazars LLP

Kiara Crick, CPA Deloitte

Dan DiMario Selden Fox Ltd.

Maria Garnica ORBA

Mirela Horozovic, CPA PwC

Yunhui Kim, CPA Tighe, Kress & Orr PC

John Lancaster, CPA Porte Brown LLC

Tim Long, CPA Miller Cooper & Company Ltd.

Nicole Maimon, CPA Deloitte

Courtney Mohr, CPA Lauterbach & Amen LLP

Chad O’Kane, CPA Sikich LLP

Rachel Ott, CPA StoneTurn Group

Ivy Pineda, CPA Baker Tilly US LLP

Marlena Rebidas RSM US LLP

Stacy Reynolds, CPA Plante Moran PLLC

Kevin Ryan, CPA BDO USA LLP

Ben Samson, CPA FGMK LLC

Amber Sarb, CPA RSM US LLP

Aroosa Shahab, CPA CLA (CliftonLarsonAllen LLP)

Daniel Shin, CPA FGMK LLC

Freddy Thomas, CPA Plante Moran PLLC

Danika Tillis, CPA RSM US LLP

Bo Wang, CPA Crowe LLP

Meghan Wilkosz, CPA BDO USA LLP

Are you interested in serving as a YP Ambassador?

Contact Malia Cook-Artis at Cook-ArtisM@icpas.org

ILLINOIS CPA SOCIETY

550 W. Jackson Boulevard, Suite 900, Chicago, IL 60661 www.icpas.org

Publisher | President and CEO

Geoffrey Brown, CAE

Editor

Derrick Lilly

Assistant Editor

Amy Sanchez

Senior Creative Director

Gene Levitan

Copy Editor

Mari Watts

Photography

Derrick Lilly | iStock

Circulation

John McQuillan

Chairperson

Deborah K. Rood, CPA, MST | CNA Insurance

Vice Chairperson

Brian J. Blaha, CPA

Secretary

Mark W. Wolfgram, CPA, MST | Bel Brands USA Inc.

Treasurer

Jennifer L. Cavanaugh, CPA | Grant Thornton US

Immediate Past Chairperson

Jonathan W. Hauser, CPA | KPMG LLP

Pedro A. Diaz de Leon, CPA, CFE, CIA | Sikich LLP

Kimi L. Ellen, CPA | Benford Brown & Associates LLC

Lindy R. Ellis, CPA | Ernst & Young LLP

Jennifer L. Goettler, CPA, CFE | Sikich LLP

Monica N. Harrison, CPA | Tinuiti

Joshua Herbold, Ph.D., CPA | University of Illinois

David W. Knutsen, Ph.D., CPA, CGMA, CFE | Outreach

Enrique Lopez, CPA | Lopez & Company CPAs Ltd.

Kimberly D. Meyer, CPA | Meyer & Associates CPA LLC

Matthew D. Panzica, CPA | BDO USA PC

Leilani N. Rodrigo, CPA, CGMA | Galleros Robinson CPAs LLP

Richard C. Tarapchak, CPA | Verano Holdings Corp.

Andrea Wright, CPA | Johnson Lambert LLP

Stephanie M. Zaleski-Braatz, CPA | ORBA

BACK ISSUES + REPRINTS

Back issues may be available. Articles may be reproduced with permission. Please send requests to lillyd@icpas.org.

Want to reach 20,700+ accounting and finance professionals? Advertising in Insight and with the Illinois CPA Society gives you access to Illinois’ largest financial community. Contact Mike Walker at mike@rwwcompany.com.

Insight is the magazine of the Illinois CPA Society. Statements or articles of opinion appearing in Insight are not necessarily the views of the Illinois CPA Society. The materials and information contained within Insight are offered as information only and not as practice, financial, accounting, legal or other professional advice. Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication. It is Insight’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin. The Illinois CPA Society reserves the right to reject paid advertising that does not meet Insight’s qualifications or that may detract from its professional and ethical standards. The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within Insight, and makes no representation or warranties about the products or services they may provide or their accuracy or claims. The Illinois CPA Society does not guarantee delivery dates for Insight. The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering Insight. Insight (ISSN1053-8542) is published four times a year, in spring, summer, fall, and winter, by the Illinois CPA Society, 550 W. Jackson, Suite 900, Chicago, IL 60661, USA, 312.993.0407. Copyright © 2024. No part of the contents may be reproduced by any means without the written consent of Insight. Send requests to the address above. Periodicals postage paid at Chicago, IL and at additional mailing offices.

Martin Green, ESQ

Senior Vice President and Legislative Counsel, Illinois CPA Society @GreenMarty

A series of budget pressures are creating the perfect storm for a professional services tax to surface in Chicago.

Enhanced budget pressures, including those from public schools and transit systems, are creating the perfect storm for a professional services tax proposal to surface and for the City of Chicago’s Mayor Brandon Johnson to introduce a legislative initiative in Springfield. Of course, if a mayoral legislative initiative of this nature surfaces, the danger becomes a broadening proposal for a statewide tax on professional services.

As it relates to Chicago’s acute budget situation, Johnson and the Chicago City Council will have to confront emerging expenditures as they begin crafting the city’s fiscal year (FY) 2025 operating budget. For example, significant annual costs, including increased pension obligations, have been added due to the adoption of a new contract with the Fraternal Order of Police. It’s also anticipated that the Chicago Firefighters Union will expect similar treatment with their contract, further adding to spiraling payroll and pension costs.

Additionally, the recently revamped Chicago Board of Education approved an operating budget for Chicago Public Schools (CPS) with a $505 million deficit. While I won’t dive into the details of CPS’ budget formulation, unfortunately, CPS leaders used one-time federal money (COVID funds) to cover long-term operating costs, and those funds have now expired. Similarly, the city used shortterm federal funds for community initiatives, and those funds are also running out.

Of course, the last leg of this fiscal reckoning is Chicagoland’s public transit systems (Chicago Transit Authority, Metra, Regional Transportation Authority, et al.). As I last reported in my Summer Insight column, legislation was introduced in both the House and Senate to reform the public transit systems and provide $1.5 billion in funding, absent a funding source. At this time, the trilogy of bills hasn’t been called for a vote and remain pending in the House and Senate. Illinois State Senator and Senate Transportation Committee Chair Ram Villivalam, who sponsored the legislation, has been holding hearings throughout the Chicagoland area on public transportation access and the impact on the region. To date, funding hasn’t been discussed but is on the docket for discussion at the committee’s Oct. 16 hearing.

Similarly, Johnson tapped freshman Alderman William Hall (Ward 6) to serve as the chair of a subcommittee that’s been tasked with

exploring new revenue sources for the city. At the first hearing held in June, the panel heard from city finance officials on city revenue streams and fixed expenditures. As the city begins preparation for the FY 2025 operating budget, City Budget Director Annette Guzman stated, “[W]e want the ability to go after the revenues that are needed to support the priorities of this administration.” It’ll remain to be seen whether the mayor and the city council approve a budget that’s a downpayment on the mayor’s priorities or if it includes expanded programs looking for a funding source.

The CPA Profession’s Next Steps

Suffice it to say, there are several reasons why I’m detailing this sequence of events. First, to illustrate that the threat is real. While the current state operating budget is balanced, long-term revenue projections are declining, and the crafting of the FY 2026 state operating budget will begin with a big hole based on decisions that were made for the FY 2025 state operating budget—a Chicago proposal could morph into a statewide tax on professional services. Second, to inform you that we’re taking this seriously and monitoring statements of officials and committee hearings. Please know that we’re prepared to respond to any legislative proposals that may surface. Lastly, and most importantly, we’ll need your help in leveraging your CPA credential through grassroots advocacy responses to legislators.

For the record, there’s no legislative proposal to tax services at this time. The timing of such a proposal may vary. For instance, the mayor releases his proposed city budget in September, and adoption by the city council is in December. The Illinois General Assembly has six days scheduled for veto session in November following the general election. There are also typically a few lameduck session days where the 103rd General Assembly will complete its work before members are sworn in for the new 104th General Assembly. Of course, the legislative schedule doesn’t align with Chicago’s budget timeline. Therefore, a tax on services might just be an issue for the new 104th General Assembly to work out.

Certainly, we’ll keep you informed on this important issue as things develop. In the meantime, keep the lines of communication open and feel free to reach out with any questions or concerns you may have along the way.

The rise of remote and hybrid work arrangements is pushing many accounting firms to rethink their physical real estate assets. Here’s what firms should consider to better manage their office spaces.

BY BRIDGET MCCREA

THE GLOBAL PANDEMIC fundamentally reshaped the workplace. During a period of uncertainty, remote work arrangements became the norm, with another wave of transformations following in the aftermath. And while return-to-office mandates have made headlines over the last couple of years, many organizations have decidedly embraced a hybrid schedule for the long term, driving them to rethink their physical real estate assets.

Accounting, tax, and consulting firm ORBA is one of those organizations. The firm had about four years remaining on its lease of prominent space in the NBC Tower in Chicago when COVID-19 emerged in March 2020. Like most other professional services firms at the time, ORBA sent its employees home with the expectation that they’d be back in the office within a few weeks.

“When two weeks became six-plus months, we started to survey our workforce to gauge a preference on how it wanted to work,” says Joseph A. Odzer, CPA, MST, managing director at ORBA. “Those surveys made it very clear that our accountants preferred the flexibility of working from home.”

Of course, once the pandemic eased, employees also wanted to be able to visit clients in person and then spend the balance of their days working from home, and some (about 33%) wanted to explore the idea of coming back into the office on a hybrid basis. This left ORBA with a problem: The company had multiple floors in the NBC Tower but no need for all the space.

About eight months ago, the company decided to eliminate one floor, effectively reducing its total leased space from 40,000 square feet to 17,000 square feet. Much of the new space was dedicated to hoteling, which would help accommodate its hybrid workforce via a program known as ORBA Flexibility and Choice. Through that

program, employees can work from home and/or the office, while also maintaining in-person meetings with clients.

As part of this workplace transition, ORBA also opened a 9,000 square foot office in a western suburb of Chicago—a move that was also based on employee feedback. Today, roughly 10 people go into its new suburban office on a daily basis, while 25-30 people go into its downtown location every day.

Odzer says the shifts have yielded largely positive results, and the firm uses weekly production reports and billable hours to keep tabs on productivity. “Employee turnover is lower, and people seem to be generally happier with the flexible arrangements,” he says. “They can work from home, take their children to school, walk their dogs, but also continue earning a living from home.”

From her vantage point, Edith Gonzalez, managing director of JLL Work Dynamics, a JLL division that optimizes workplaces and real estate portfolios with employee experience and business performance in mind, says she’s seeing a high percentage of firms adopt hybrid work programs. She notes that even before the pandemic you’d be hard-pressed to find accounting and consulting professionals going to an office five days a week.

Gonzalez stresses that flexible arrangements are important in the accounting profession, where “people are your capital.” These days, in order to grow and attract top talent, professional services firms have to meet their people where they’re at, and this means providing the accommodations and amenities they both want and need.

For example, Gonzalez says she’s seeing more companies taking ORBA’s approach of opening satellite offices that are located closer to the residential hubs of their employees and sticking to around three days of in-office work per week: “That’s across the board right now, and the number of in-office days is steadily increasing—from 3.1 a few months ago to a current 3.3 average in-office days per week.”

Additionally, Gonzalez is seeing more firms—and their landlords— incorporating more environmental, social, and governance initiatives into their real estate portfolios, such as alternative energy, lighting programs, and green roof space. Others are incorporating more amenities like gyms, pop-up lunch services, and elevated inhouse dining options.

For firms looking to reduce their physical footprints or renegotiate existing leases, Odzer advises getting a good, experienced real estate broker in your corner: “Find one that has deep experience working in the market and knows your building. If you’re looking for new space, research the financial strength of the company that owns the property—you don’t want a landlord that has a high mortgage payment and may foreclose on the property.”

Subletting is another option for firms that need to shed some space but can’t easily renegotiate their leases. In fact, Odzer suggests that firms look at their own client base for potential tenants: “Maybe you have a client that’s looking for space—we’ve used this strategy in the past and it worked out well.”

Gonzalez says property owners are also offering more flexible lease terms, knowing that the idea of signing a 20-year lease is a bit far-fetched for any accounting firm these days.

“We don’t know what the world is going to look like in six months, let alone 20 years,” Gonzalez points out. “Knowing this, landlords

have become much more willing to be flexible with terms and allow subletting, which can help a company generate some revenue by letting someone else make use of that unused space.”

Overall, cutting unnecessary real estate expenses has its benefits. For example, ORBA has been able to use its cost savings to invest in technology to effectively support their hybrid workforce and recruit more staff members from outside of its geographical region. In fact, the firm has grown its out-of-state employee base from 17 people to 41 people. “We took this as an opportunity to hire highend talent from out of state,” Odzer says.

Additionally, some of ORBA’s cost savings have been allocated to team-building activities. For example, Odzer says the firm hosts several events a year close to home in addition to an annual two-day trip for all employees to get together, team build, and have fun: “We fly everyone to the event, with ORBA paying for all the expenses.”

To other accounting firms that may be in a similar situation and needing to make the tough decision to relinquish or renegotiate real estate assets, Odzer says the best approach is to listen to your employees.

“Accounting is a people business—you can’t just ‘force’ your employees to come to an office,” he says. “If your employees like working from home, and if production isn’t suffering, then rewards like lower turnover and happier employees will be well worth the effort of accommodating them.”

Bridget McCrea is a Florida-based freelance writer specializing in business and technology.

Combining the right software and applications can help your CAS practice produce higher earnings and bring added value to your clients.

BY AYALA CLINKMAN, CPA, PMP

allow this—a CAS tech stack needs to be deliberately built based on the practice’s (and clients’) needs and environment.

OVER THE LAST COUPLE OF YEARS, it seems that every time I see the acronym CAS, which stands for client advisory services or client accounting services, I also see “tech” and “stack” mentioned nearby. But why is that?

CAS is the practice of providing services to take care of and address clients’ accounting and financial needs. These services can vary from basic bookkeeping all the way to serving as a client’s interim or outsourced chief financial officer or controller.

Tech (i.e., technology) refers to electronic tools used to accomplish tasks. Stack is a vertical pile of things. By combining tech and stack together, you’re referring to a firm’s set of applications, electronic tools, and software used on a regular basis to run the practice successfully. Ideally, all the technologies used are stacked together and integrated in some way to give staff everything they need to perform their jobs as efficiently and effectively as possible.

Therefore, the reason tech stack is talked about so frequently in the CAS space is because when combined (meaning, the right selection of software and applications), you can streamline tasks, produce higher earnings, and provide your clients a better experience—and therein lies a tech stack’s value. But it’s not just any software or application that’s randomly implemented that’ll

Whether you’re just starting a CAS practice, experiencing pains or bottlenecks due to manual processes or a small staff, trying to expand with efficiency, or specializing in a niche industry, it’s a good idea to evaluate if you’re using the best tech tools and software for the job and whether there are any areas where you could use technology more effectively.

Here, three leaders of CAS practices share what they consider to be important tech stack selection criteria and the available tools they recommend.

Irfan Dossani, CPA, partner in charge of client accounting and advisory services at Whitley Penn, recommends looking at your client base and analyzing what verticals you are (or could be) focusing on, as your tech stack will need to serve those verticals. He notes that some software is specifically designed to serve certain industries and their unique requirements. For example, the manufacturing industry has very different requirements than the nonprofit world. Stepping beyond your practice’s specialization, you must consider whether your software solutions meet the specialized situations of your clients—think location, number of employees, yearly revenue, multicurrency, etc.—since these too can impact which software tools are best for the job.

Dossani also recommends looking at your team. Are some of them really into a certain field or good at a certain area or task? Can you build around that? Can you capitalize on your team’s strengths and specialties to create a unique service offering or focus area? Of course, a third angle is listening to your clients. Are multiple clients asking for the same advice or service or struggling with similar tasks? Based on the answers to these questions, you can find ways to differentiate and create more opportunities for providing your clients with specialized services that’ll in turn need to be supported by specialized tech tools, which will help dictate what your tech stack should be comprised of.

Kane Polakoff, principal and CAS practice leader at CohnReznick LLP, says standardization across the firm is key. If there’s no standard solution to build from, it’s difficult to scale up. Polakoff says you want your people to become familiar with a tool and process. This essentially means selecting a standard tool per process or service and ensuring your team is well trained on both. Polakoff also suggests considering whether you’ll require your clients to adopt certain systems or processes as part of their acceptance criteria. This question should be answered as part of your practice’s revenue model and long-term strategy.

Laura Steuber, CPA, principal and director of CAS at Miller Cooper & Co. Ltd., emphasizes the importance of standardization and the efficiencies it brings. Additionally, she notes that it’s important to establish relationships with your go-to software providers, especially if you’re assigned to a dedicated representative who can assist with supporting and training your team. Once you purchase or license a software solution, you might be assigned a team or consultant that’ll help you implement it and be available for assistance if any issues arise. Which vendor(s) will provide additional services, like training and support, should be an evaluation point when you’re in the selection process.

So, what are some examples of software that can comprise a CAS practice’s tech stack?

First, Polakoff recommends choosing cloud-based software solutions, as this allows for greater flexibility and mobility (which could also help in attracting and retaining talent).

For small or new practices, Dossani recommends sticking to the basics and looking into one of Intuit’s simple platforms to start, like the ever-popular QuickBooks and TurboTax offerings. As your CAS practice grows, he recommends exploring the utilities of more robust solutions like Sage Intacct.

Generally speaking, Steuber says one of the most important tools for a CAS practice is a general ledger package. After that, she recommends implementing software that helps automate or upgrade processes for managing and monitoring bill payments, bank feeds, tax forms, expense reporting, payroll, and sales tax. Steuber likes Bill for a payments solution, Expensify for expense management, and Avalara for sales tax calculations and reporting. Once you establish your go-to tech for these processes, Steuber recommends considering a consolidations tool and a forecasting and budgeting system for greater business visibility.

Of course, there are countless more solutions out there. Overall, your CAS practice’s focus area(s) should drive what your tech stack is comprised of. Take some time to evaluate your options to determine which ones work well together and make the most sense for your practice, staff, and clients.

Ayala Clinkman, CPA, PMP, is a senior director of business solutions at Business Technology Partners LLP.

Join ICPAS President and CEO Geoffrey Brown, CAE, and Board of Directors Chair Deborah K. Rood, CPA, MST, as they dissect today’s toughest challenges and discuss big ideas to keep the profession moving forward.

Enjoy breakfast or lunch while you network with colleagues and earn 1.5 hours of CPE for FREE!

October 1, 2024 Rockford

November 5, 2024 Springfield

November 6, 2024 Champaign

November 19, 2024 Orland Park

November 21, 2024

Oakbrook Terrace

December 3, 2024 Glenview

December 4, 2024 Chicago

December 4, 2024 Virtual

To register or for more information visit: www.icpas.org/townhall

Help develop the future of our profession by inviting a young professional colleague to come with you.

Authenticity isn’t a destination—it’s a continuous exploration of the many selves we embody.

BY SERGIO RODRIGUEZ, CPA

“SERGIO, you have such good energy!” Hearing this often fills me with a mix of pride and puzzlement. Sure, I love a good laugh and dance, but that’s just the tip of the iceberg of what I’m about. These compliments, as well-meaning as they may be, sometimes echo hollow. It can feel as if they’re admiring a caricature—the life-of-theparty Latino or sassy gay friend. But hey, if I’ve only shown them my sparkle, can I blame them for not seeing my shadow?

A couple of years back, I laid out my thoughts on living loud and proud as a Latino and LGBTQIA+ certified public accountant (CPA) in the fall 2022 Insight article, “The Value of Unapologetic Authenticity.” Since then, I’ve dove deeper into what it means to be authentic to myself, and I’ve realized authenticity is about more than just wearing your identity like a badge—it’s about embracing the untold stories, unseen battles, and unshared dreams we all have.

Here, I want to share parts of my self-discovery story in hope it inspires others who may find themselves in similar situations or with similar feelings to set out on their own self-discovery journey (and know they aren’t alone).

One aspect of self-discovery and living authentically that can easily go overlooked is how we deal with stereotypes. Specifically, it’s so important to look at the parts of ourselves we feel compelled to either amplify to fit in or minimize to avoid conflict. It can be a delicate balancing act, choosing which parts of ourselves to highlight in order to connect and be accepted in places where people might not fully see or value all that we are.

For me, I’ve found that I sometimes cranked up the “spicy Latino” energy or leaned into the “witty gay friend” persona. The reality is, doing that is like putting on a brightly colored mask; sure, it’s protective, but it’s not authentic and it can be exhausting. However, it begs the question: Will people still appreciate me without these amplified personas?

The reality is that this act of amplification isn’t about denying my true self; rather, it’s about adapting parts of my identity to fit into a more widely accepted or recognizable framework. It serves as a survival tactic in environments where being noticed often depends on conforming to certain stereotypes. Essentially, it was my way of saying, “Hey, I’m here!” in spaces where I otherwise felt overlooked, even if it meant leaning on the oversimplified versions of myself.

Beneath the vibrant persona that my friends and colleagues were familiar with, there was a more nuanced reality. This contrasted sharply with the image of Sergio they’d known for years. In the fall of 2023, I began to navigate some significant personal challenges, including managing increased depression and anxiety, which made everyday tasks feel more daunting. There were mornings when the simple act of getting out of bed required extra effort and days when routine activities felt overwhelming.

The discrepancy between my internal experiences and the outward persona I’d carefully curated led to a cycle of stress. Maintaining this image became an exhausting endeavor, deepening feelings of isolation and disconnect from my true self. Opening up about these challenges was terrifying, but it ended up bringing me closer to the people I opened up to, showing me (and hopefully them) that it’s OK to be a work in progress no matter where you are in your life. My mental health is as much a part of my authentic self as my love for Spanish pop music and my knack for helping clients understand their tax returns.

Journeying back to my Latin roots has been nothing short of a revival. It started with a deep dive into Costa Rican literature, where I immersed myself in the words and worlds created by writers who share similar backgrounds as myself. I made a playful, yet profound decision to tell my friends, “I’m only listening to music in Spanish from now on.” This was a deliberate choice to surround myself with the rhythms and lyrics that echo my heritage, a way to keep my culture pulsing through my everyday life.

Amidst this journey of self-discovery, I made a significant change in how I introduce myself. I no longer say, “SER-gee-oh.” Instead, I honor its original pronunciation: “SER-hio” (with that soft “h” sound). I’ve also become more deliberate in my written expressions. A simple example of this is using “jaja” instead of “haha” in my laughs over texts. Though it may seem like a small detail, each “jaja” reconnects me to the lush valleys of Costa Rica where I was raised.

Saying my name the way it was meant to be said, diving into the traditions and tales of my ancestors, and bringing Latin music and expressions back into my life have been incredibly empowering. It’s not merely about reclaiming my narrative; it’s about confronting and challenging the narratives that attempt to diminish or oversimplify my rich history and culture.

Officially becoming a United States citizen this year was another watershed moment for me. It gave me a sense of belonging I hadn’t realized I was missing. Far from a simple legal formality, it became a profound revelation, as if I was granted “official” permission to embody my most authentic self, unchained and fearless. It was surprising how this legal affirmation unlocked parts of my identity I hadn’t fully realized were suppressed, as I imagine it may be for others pursuing citizenship. Aspects of my persona—nuances of speech, cultural expressions, and spontaneous bursts of dance— began to emerge more freely with my newfound freedom. That piece of paper affirmed that I officially belonged.

Of course, this stage of my journey has been a bit ironic, too. While gaining U.S. citizenship, I’ve also felt the most “Latino” I’ve been since leaving Costa Rica all those years ago. I’ve never been prouder of where I come from, and I’m all-in on sharing that joy and pride with the world.

Reflecting on the last few years, I’ve come to see that authenticity isn’t a destination—it’s a continuous exploration of the many selves we embody. Embracing authenticity is about more than just sharing our stories; it’s about forging connections that transcend our individual experiences, pushing us toward a world that values every facet of our identities. I’ve learned to not only embrace all parts of my story, including those I once concealed, but also to understand the profound impact of genuine recognition from others. These moments of acknowledgment (“we love your energy”) aren’t merely superficial; they’re affirmations of my true self. Every acknowledgment and every connection are steps toward fully realizing the authentic self that exists beyond the roles and masks we wear.

So, here I am, Sergio Rodriguez: CPA by day, and by all other times, just Sergio—complex, multifaceted, and still learning to navigate the depths of my identity. My journey is mine alone, but it’s one I share in the hope that it might inspire others to peel back their own layers.

Illinois CPA Society member Sergio Rodriguez, CPA, is a senior manager at Deloitte in Chicago, where he leads with a passion for diversity, equity, and inclusion, and continues to explore the depths of authenticity, driven by the transformative power of shared stories and experiences.

We’re planning for next year, and we want you to be a part of it.

Do you have a story to tell, or best practices and innovations you want to share?

Then share them at ICPAS SUMMIT25 and gain recognition from your peers as a presenter at the largest learning event for accounting and finance professionals in Illinois.

August 20-21, 2025

Donald E. Stephens Convention Center, Rosemont, IL

To learn more or submit a proposal, visit: www.icpas.org/summitspeakers

New research examines whether gender diversity on boards plays a role in corporate outcomes.

BY JOSHUA HERBOLD, PH.D., CPA

On the academic front, numerous studies have identified both arguments for and against diversity on boards. Regarding board gender diversity (BGD), some researchers have found:

IN 2019, Illinois passed House Bill (HB) 3394, requiring corporations in the state to disclose demographic characteristics of their boards of directors, with the goal of increasing director diversity. As HB 3394 states: “[W]omen and minorities are still largely underrepresented nationally in positions of corporate authority, such as serving as a director on a corporation’s board of directors. … Increased representation of these individuals as directors on boards of directors for corporations may boost the Illinois economy, improve opportunities for women and minorities in the workplace, and foster an environment in Illinois where the business community is representative of our residents.”

Beyond Illinois, currently at least 11 other states have enacted or considered similar laws promoting diversity on corporate boards. In contrast, a few large corporations have decreased or eliminated efforts to promote diversity, and three states (Tennessee, Texas, and Utah) have enacted anti-diversity, equity, and inclusion bills.

• Female directors have better attendance records than male directors and use more (and more detailed) information when making decisions than male directors, leading to improved monitoring by boards.

• Diverse boards bring a variety of perspectives to the decision-making process, which can help identify and evaluate opportunities and risks that could be overlooked by a less diverse board.

• Women tend to be more likely than men to rely on leadership styles based on trust and communication, which can reduce investment inefficiencies caused by incomplete information or miscommunication.

On the other hand, prior research has also shown that heterogeneity in board director characteristics (e.g., cognitive styles, values, personalities, and backgrounds) has its costs. For example, research has shown:

• Diverse groups may have less overall communication, less cooperation, and more conflict.

• Group members who are different from each other may be less likely to develop natural communication and interaction due to the lack of shared experiences or common backgrounds.

• Individuals who have majority status in a group may continue to dominate group discussions and decisions.

Despite these research findings, determining whether diversity on boards matters remains an open question left up for debate. Fortunately, researchers Dave (Young II) Baik at Nanyang Technological University, and Clara Xiaoling Chen and David Godsell at the University of Illinois Urbana-Champaign, provide new empirical evidence on the topic. In their research paper, “Board Gender Diversity and Investment Efficiency: Global Evidence From 83 Country-Level Interventions,” they explore the effects of laws that encourage gender diversity on corporate boards.

“By shedding light on one of the most important societal changes globally, which directly influences the structure at the highest echelons of organizations, our intent was to determine whether BGD and BGD interventions have real effects on corporate outcomes.”

According to the researchers, an “intervention” refers to a countrylevel policy designed to have an impact on the corporate-level board of directors. In the United States, BGD interventions are too new for reliable data, so the researchers turned their attention to similar laws outside the U.S.

“We were surprised to identify 83 interventions in 59 countries,” Godsell says. “While there are thousands of studies examining the association between BGD and corporate outcomes, nobody has yet considered cataloging all these interventions and using their differences across countries to explore their effects.”

Therefore, the researchers’ first step was identifying and summarizing all the different BGD interventions that countries have adopted. “By cataloging and characterizing these BGD interventions for the first time, our study facilitates future research that seeks to document the economic consequences of BGD and related policy interventions,” Godsell explains.

During this process, Baik notes how fascinating it was to discover how different countries had varied reasons for implementing BGD interventions: “Some countries aim to foster diversity at the upper levels of corporate structures, while others focus on improving corporate outcomes. These differing motivations suggest that the understanding and objectives of BGD interventions are still evolving and not fully standardized across the globe.”

After cataloging the BGD interventions, Baik, Chen, and Godsell gathered accounting and financial data for affected corporations. The team ended up with nearly 330,000 years’ worth of data (where each data point represents one firm in one year), making their research the largest BGD study to date. So, what did they discover?

Overall, the researchers found that BGD interventions do lead to increased female representation on corporate boards. In fact, according to their research paper, “The average post-intervention increase in BGD is 7.3 percentage points.”

By itself, this finding isn’t too surprising. The researchers note that if a country passes a law, most corporations in that country will adhere to the new law. However, they add that the more interesting part of their research is exploring whether increased BGD improves corporate outcomes.

To accomplish this, the team used a “difference-in-differences” research design to explore the effects of BGD interventions on investment efficiency by corporations. A difference-in-differences design uses a treatment group (in this case, companies affected by an intervention) and a control group (companies not concurrently affected by an intervention), along with different time periods (before and after the intervention). Researchers then compared outcomes within each group for the different time periods and across the groups over time to see how much more (or less) the treatment group changed compared to the control group.

“A major benefit of this design is that it goes a long way to ruling out alternative explanations for our results,” Godsell notes. “Because we have 83 interventions in 59 countries, it’s unlikely that an omitted variable could explain our results because it would have to vary with 83 interventions adopted in many different years and countries.”

To measure investment efficiency, the researchers examined how well firms invest in projects that have a positive net present value and avoid investments that have a negative net present value. Based on prior research, the researchers used a regression model to calculate an expected level of investment for each firm. This model includes data about capital expenditures; research and development expenditures; acquisitions/sales of property, plant, and equipment; and sales growth (which could be negative). Investment efficiency is measured by looking at the residuals from this regression model, which represent the difference between actual and expected investments for a given firm. Notably, smaller residuals mean that a firm’s actual investment is close to the expected optimal investment, which indicates higher investment efficiency.

“We found that investing too much in projects—from capital expenditures to research and development to acquisitions—can be inefficient. Investing too little can also be inefficient,” Chen says. “Overall, we found that increased BGD helps companies move toward the ‘Goldilocks’ level of investment—just right.”

Specifically, their research highlights that firms subject to BGD interventions “reduce inefficient investment by 0.6% of total assets, or 6.5% of total investment, and are 4 percentage points more likely to have above-median investment efficiency.”

Responding to the importance of this finding, Baik says, “This project was particularly meaningful as it demonstrates that accounting research can be connected to societal changes. Our study contributes to the understanding of these actions and underscores the potential of accounting research to provide valuable insights into significant societal shifts.”

In other words, this latest research shows that BGD and BGD interventions have real—and arguably positive—effects on corporate outcomes.

Joshua Herbold, Ph.D., CPA, is a teaching professor of accountancy and associate head in the Gies College of Business at the University of Illinois Urbana-Champaign and sits on the Illinois CPA Society Board of Directors.

For years, accounting leaders have been sounding the alarm on a major labor force shift expected to take a toll on the already weakened CPA pipeline. Here, experts share what firms can do now to prepare.

BY CLOEY CALLAHAN

the last half-decade, the accounting profession has become all too familiar with the many shifts to the labor force, ranging from widespread early retirements brought on by the pandemic, massive worker exits during the Great Resignation, and continued declines in the accounting major and CPA pipelines. But now, another major labor market shift is edging closer and is expected to compress the accounting talent pipeline even further—the “labor cliff.”

Comprised of three parts—demographics, retirement, and enrollment—the so-called labor cliff is projected to cause acute worker shortages across all industries. What, if anything, can firms and companies do now to prevent or lessen the impact?

Demographic Cliff

One of the main drivers of the labor cliff has arisen out of what’s happening with demographics in the United States. For about 17 years, the nation’s birth rate has been declining, and in 2023, it reached its lowest level in history, according to the Centers for Disease Control and Prevention. Overall, experts say this trend is a result of the 2008 recession.

“Individuals who were thinking about planning for children put that off because they just didn’t have enough money at that time,” stresses William “Bill” Bailey, CPA, JD, LL.M., associate professor of accounting at Bradley University. “Following most recessions, when the economy gets better, you see a bounce back in birth rates. But the U.S. didn’t see a bounce back after 2009.”

Additionally, observers have warned that low fertility, in combination with the aging population that it generates, implies fewer workers per capita and significant headwinds to economic growth, according to a May 23, 2024, White House brief.

Retirement Cliff

Another factor leading the U.S. toward a labor cliff is the significant and historic rise in the number of Americans at retirement age. Dubbed the “silver tsunami,” more than 11,000 baby boomers turn 65 each day, and this year, 4.1 million Americans will turn 65.

“It’s getting harder and harder to replace retiring talent because there just aren’t as many people coming into the profession,” says Laura Huggett, CPA, president and managing partner of Truity Partners. “There hasn’t been the ability to shift the work downward because employers can’t find enough people to do the work.”

With a growing number of people aging out of the workforce, more efforts are being made to convince people of retirement age to continue working longer, including solutions like offering “flextirement” or part-time working hours. However, these solutions may prove difficult, as Axios recently reported that the number of years Americans expect to continue working has decreased by

9.5% since March 2020, and only 46% of workers under 62 currently expect to continue working past that age.

Enrollment Cliff

Of course, rounding out the impending labor cliff crisis is the number of students enrolling in college. It’s predicted that the college-age population will shrink dramatically between 2025 and 2037. That, combined with fewer international students coming to the U.S., means the pipeline of new talent isn’t what it used to be.

At the university level, Bailey says they’ve been sounding the alarm, trying to help companies understand the later effects of this: “Remember, the kids that would’ve been born in 2008 or 2009 during the Great Recession, would’ve been enrolling in college around 2026.”

Now, some experts estimate that the number of 18- to 22-year-olds will be significantly lower over the next two decades, with a shortfall of 400,000 to 1 million students annually. This could lead to a 15% decrease in college-bound students over the next decade, starting with a loss of more than 400,000 students between 2025 and 2029.

In looking at the full picture of the labor cliff—demographics, retirement, and enrollment—Huggett says it’s not surprising that CPA firms are feeling the pressure, and they have good reason to worry about the profession’s future.

“It’s a cloud over the whole profession, specifically for public accounting firms,” Huggett says. “While there’s been a lot of initiatives, they haven’t been enough.”

Of course, among the initiatives are pay-based ones, which Huggett warns end up being costly and won’t work long term. Notably, Huggett says she’s seen firms—even those traditionally steadfast in their old ways—suddenly change course and find themselves in bidding wars to incentivize the few candidates that are available. In fact, she’s seen sign-on bonuses of up to $2,000 just for accounting interns.

On the flip side, when firms can’t expand their talent pools, other workers within the firms must take on the burden of increased workloads, which leads to burnout and, in the worst cases, turnover. Huggett sees this issue as a domino effect, citing a recent client situation she’s dealt with where three people gave notice because they were overwhelmed.

This negative impact is especially true at the leadership levels. According to the 2023 Insight Special Feature, “Righting Retention,” just over 67% of employers have seen workloads increase for staff at the leadership level when turnover happens, while 65% have seen workloads increase for remaining staff at similar levels. For public accounting firms, about 77% reported increasing workloads on firm leaders.

Katie Norman, recruiting manager of accounting and finance at LaSalle Network, says she’s seen significant issues with retention: “We’re seeing folks that went to school for accounting enter the profession and then look to get out of it pretty quickly. Part of this appears due to the historically long hours required of many accounting positions, but also the realization of the cyclical nature of what accountants do day in and day out isn’t the challenge they were looking for.”

Experts say firms can lessen the labor cliff’s impact, but it’ll take significant changes and work on every front, ranging from promoting the industry in new ways to allowing for more flexible options nearing retirement.

When it comes to enrollment, Huggett stresses that just educating students about accounting career opportunities won’t be enough. Instead, the profession might need to widen its candidate-type search, such as approaching business and finance students to get them interested in a switch to accounting.

Huggett also says that targeting even younger students might be the way: “While internships used to be an opportunity for just seniors, it’s beginning to shift to include juniors and, in some cases, even sophomores.”

Bailey says that universities are acknowledging the enrollment cliff by working on attracting three other cohorts: first-generation students, international students, and working adults.

Overall, Bailey says it’s about rebranding the accounting profession to be an attractive one that people are excited about: “I think we do a very poor job as an industry explaining what accounting actually is and the many opportunities careers in accounting offer. Until that gets fixed, we’re going to have these problems regardless of what’s happening with demographics.”

One way to help with this, Norman says, is leveraging “peer interviews” where someone who’s been in the profession for a few years can explain what it looks like on a day-to-day basis. This can be especially effective at campus recruiting events.

“I think there’s a lot of value in hearing from a peer,” Norman stresses. “Whether it’s a younger professional who’s been at the firm for a little while or a fresh grad that can more closely relate to the students, someone that can talk through the different projects they’ve taken on is going to be the best example to showcase the positives that can happen to someone when they join your firm.”

Norman says that firms also need to do a better job of offering unique career paths. For example, having a role that’s half accounting and half finance might be more attractive to new graduates. Additionally, firms might want to consider positioning and marketing accounting roles differently. For example, mindfully

changing a position’s title can call attention to specific aspects of the role, like “accounting analyst,” which emphasizes that the analytical skills will be a key aspect of the position and may help attract more candidates seeking careers in analytics.

Further, Norman suggests that firms open up their candidate pool by looking at people who are career changers or people that show promise but might need some additional training to make them a perfect fit for the firm.

“There may be candidates who have a degree in accounting but started in more of an entry-level, accounts payable or receivable role—consider training that person, Norman says. “It’s creative solutions like this—offering continuing education or financial support for additional classes or training—that can help firms secure the talent they need.”

To help with the retirement cliff, Huggett says flexibility will be the ticket: “Most people considering retirement don’t want to suddenly stop doing everything they used to do consistently. They might be open to working a few hours a week or even operating on a structured part-time basis.”

However, Huggett cautions that this solution is more complicated than it seems on the surface. It’ll require altering job descriptions, navigating what’s equitable, and looking at structural changes to phase them out gradually.

Bailey says firms are seeing more success in prolonging workers’ careers by offering greater work-life balance. However, he warns, “Just marketing work-life balance can create cynicism—the firm has to actually show work-life balance exists.”

Of course, financial incentives can also help attract (and retain) more accounting professionals. Bailey says that the profession has largely used an apprenticeship model where you learn a lot for little pay but then end up seeing a jump in salary over time. He argues that firms need to change that, paying their professionals for time and not just experience. But as Huggett mentioned, that also isn’t so easy to do without major structural changes to a firm—if you bring in new people and pay them more, you need to adjust the salaries of those who’ve been there for a lot longer.

Overall, Huggett reminds firm leaders that companies are resilient to crises, and the labor cliff will be no different: “Lots of things have happened over the years to create business challenges, and somehow, we’ve always seemed to figure them out. That said, navigating the labor cliff is going to take some thinking that challenges the accounting profession’s traditional mold.”

Cloey Callahan is a New York-based writer, who specializes in topics related to the future of work, spanning from workplace benefits and flexibility to technology and office design.

While an accounting career can lead to exciting, rewarding work, too often the profession’s negatives get highlighted. Here’s how CPAs change the narrative and tell a better story to support the talent pipeline.

BY NATALIE ROONEY

ast year, the Chicago White Sox wanted to hire an accounting manager. A first attempt netted 50 resumes but zero qualified applicants. The job was posted again, and the team finally landed a great candidate, but Mallory Penn, CPA, senior director of accounting for the White Sox, admits she was getting nervous. “I was a little surprised that we weren’t batting people away,” she says. “We’re a professional sports team—I thought we’d get hundreds of resumes!”

So, if a professional sports team is struggling to attract accounting talent, what does that mean for everyone else?

Neema Parikh, recruiting manager at Topel Forman, says the stakes are high as the pipeline for qualified candidates becomes more condensed: “The pipeline remains the profession’s biggest hurdle, and it trickles up—from entry-level recruits to experienced professionals. We need to help people understand that this is an amazing profession to come into and then stay in.”

Recognizing these concerns, the newly formed National Pipeline Advisory Group released its “Accounting Talent Strategy Report” in July 2024, detailing six strategies to help address the accounting talent shortage. Among the strategies—telling a more compelling story about accounting careers.

CPAs in particular can help lead the way in this charge to better attract and engage talent and support the pipeline.

Recently, Mark Wolfgram, CPA, MST, tax director at Bel Brands USA Inc., started to notice something: The first thing CPAs do when they get together is discuss how hard they’re working. “We always lead with that, and it’s not something that endears the profession to the young people we’re trying to keep,” he notes.

Jonathan Hauser, CPA, a partner in KPMG’s business tax services practice, noticed the same trend. “It’s our default as humans,” he says. “We focus on the hard things because it’s viewed as a badge of honor, but we don’t talk equally about the tremendous opportunities in this profession. Accounting professionals work hard, but the long hours are tempered with flexibility, interesting work, and many different career paths. So, rather than telling our war stories, we need to tell our glory stories.”

For Hauser, his glory story centers around the flexibility he’s incorporated into his own life over the course of his career. He emphasizes that flexibility isn’t only available to partners. “I was a senior-level staff member when my first son was born,” he says. “My hours were flexible and allowed me to do what I needed to do on a personal level and get my work finished to meet deadlines.”

Wolfgram says reframing the narrative in everyday conversations can go a long way. For example, when someone asks how he’s doing, instead of responding with how busy he is, he describes the good work he’s actually doing. His most recent response:

“I traveled to Paris, New York, and Washington, D.C. and worked with people in two different languages to file an application between the United States and French governments to determine how much profit each government gets to share. It was incredibly interesting, and I was able to enjoy spending time in each of those cities. This project has helped me grow as a professional, learn new things, and get better every day.”

Hauser says another part of the profession’s story must include how technology and artificial intelligence are being used to improve employees’ career trajectories: “These tools allow individuals to

feel like they didn’t spend four years in school just to calculate depreciation. Now, people can leverage their leadership training and technical skills to work with clients and build their toolboxes through experience. Technology is providing new opportunities— let’s tell people about that.”

Another important story to share is how CPAs’ unique skill sets allow them to give back to their communities in countless ways. Wolfgram says it’s a key issue for today’s young professionals, one that he often underestimates. “It can give a more meaningful experience to your life to know what you do makes a difference, and it’s probably the profession’s most underrated thing.”

Perhaps another underrated or underestimated highlight of the CPA profession is the ability to align your personal interests with your career.

While Penn admits she could be doing accounting and finance functions for any organization, working for one of the nation’s oldest professional baseball teams—the Chicago White Sox—is a childhood dream.

As a lifelong White Sox fan, Penn shares that working for the organization brings unique and fun everyday interactions and experiences, including walking through the tunnel leading to the players’ clubhouse and crossing paths with team members, working with members of the player development department who are often former professional baseball players themselves, conducting a financial analysis of a new sponsorship deal, training scouts to use a new expense reporting tool, or helping the groundskeeper with his budget.

“I love interacting with all of these people from different backgrounds,” Penn says. “Our accounting team does everything from budgeting to tax reporting to financial accounting to analysis, and I participate in things I wouldn’t get to do in a segmented corporate environment.”

What’s more, while the team’s baseball department handles the actual salary negotiations, Penn and her department are deeply involved from a budgeting and forecasting perspective. “We look at the organization’s bottom line to provide guidance to ownership and baseball leadership so they know what our financial position looks like,” she says.

Specifically, Penn recalls one notable off season where salary negotiations involved several big-name players (i.e., big salaries): “We had to forecast what it would look like to sign someone with a really big salary. We analyzed whether we could make that money back through better attendance or ticket sales. Everything we do is for the team on the field.”

But it’s on White Sox game days when the reality of working for a historic sports team really hits her: “There’s a Major League Baseball game going on just outside my office walls, and I can go watch a couple of innings at lunch!”

Martrice Caldwell, CPA, says earning her CPA credential opened many doors for her career: from the outset of her career in public accounting to spending more than 15 years in the nonprofit sector to now serving as controller for the Chicago Fire Football Club.

While Caldwell hadn’t necessarily pictured herself in the sports world at any point in her career, someone in her professional

network forwarded her the controller position description, and it turned out Caldwell knew the chief financial officer. “Yes, I was in the right place at the right time, but I also had the experience,” Caldwell says. “I had been growing my network, and I thought, ‘Why not me?’”

When Caldwell joined the Chicago Fire two years ago, she says there was definitely a learning curve. She knew how to write up the five-step process of revenue recognition, but now she needed to apply it to ticket sales, player transfer fees, sponsorships, and merchandise sales. She quickly learned how and why things are done the way they are for a professional sports team.

Like Penn, working for a professional sports team allows for interesting, unique work that most don’t get a chance to see up close. While Caldwell isn’t part of the salary negotiations themselves, her team helps those who are doing the negotiating understand the financial implications of roster decisions to ensure compliance with Major League Soccer (MLS) roster rules. MLS players are employed by the league rather than being paid by the team itself, creating complexities that must be carefully accounted for.

“We develop our rosters based on these rules, and it occasionally involves players who’ve been transferred from other leagues or clubs,” she says. “There can be transfer fees associated with player movement. The intricacies around those transactions and how they follow accounting principles are so interesting. We determine how to account for revenue and expenses in these different scenarios, and then we explain our processes to auditors.”

Although sharing the everyday good stories, like those of Penn and Caldwell, are a must for the profession, burying some of the profession’s problems isn’t going to help either. Experts warn that behind every good story there also needs to be the genuine truth.

“Young people are savvy,” Wolfgram cautions. “If we’re only producing social media posts and content that positively depict the profession, but then a student attends a Beta Alpha Psi meeting and hears from young professionals whose real-life stories don’t align, they’ll see right through it. There’s a difference between telling a good story and living it.”

Parikh says Topel Forman’s policy is to be very upfront with its staff about the hours and time commitments required of them, but they’ll work with their staff to balance their lives: “Our partners are dedicated to helping staff find their balance. Life happens. People get married. They get sick. The marketplace has shifted, and candidates are looking for that flexibility. I think public accounting firms have come a long way.”

For Wolfgram, he’s making sure to walk the talk with his own corporate finance team: “I’m trying to give them the opportunities to have the flexibility I enjoy—not just by saying I believe in it, but by letting them do it. That means if someone has a family event, I’m not going to call them about a tax return. These are the types of things that I can do personally without waiting for things to change on a bigger scale.”

Overall, Hauser calls potential solutions to the pipeline challenge a three-way street that involves: 1) employers doing a better job of helping employees avoid burnout, 2) employees owning their schedules and setting boundaries, and 3) managing client expectations—what needs to be completed today versus tomorrow.

“It’s tough to get the balance right, but we need to be focused on all three of these things,” he stresses. “Let’s take a step back, figure out how to help people live their lives, and share the good story.”

As he listens to conversations about the pipeline challenges, Wolfgram says his main takeaway is there’s no silver bullet that one person, firm, or organization can do to solve the problem: “But that doesn’t mean we give in. We’re problem solvers. We need to continue to do the best we can to solve this, and everyone can do it by tweaking their mindset.”

Caldwell adds: “Yes, accounting is demanding, and programs can be challenging, but you get to chart your own path. I don’t know anywhere else you can do that. Those are the kinds of messages we need to share.”

Natalie Rooney is a freelance writer based in Eagle, Colo. A former vice president of communications for the Ohio Society of CPAs, she has been writing for state CPA societies for more than 20 years.

As the National Pipeline Advisory Group says, “By working together, the profession can reshape perceptions, implement meaningful change, and inspire the next generation of accountants.” Here are three impactful ways you can support national and Illinois CPA Society (ICPAS) pipeline initiatives:

1. Commit to the Future: Take the Pipeline Pledge and be part of a national movement dedicated to nurturing and sustaining the accounting talent pipeline. Signing the pledge is an individual commitment to participate in at least two activities that will positively impact the next generation of accounting talent. Learn more at www.accountingpipeline.org/participate.

2. Inspire the Next Generation: Share your story directly with high school and college students. Your experiences and insights can guide students toward a rewarding career in accounting, helping to reshape perceptions and inspire future CPAs. ICPAS can help connect you with speaking opportunities. Visit www.icpas.org/speakoncampus.

3. Empower Change: Help pave the way for diverse and deserving aspiring CPAs by contributing to ICPAS’ charitable partner, the CPA Endowment Fund of Illinois. Your support will fund scholarships and outreach programs that open doors and create opportunities for those in need. Donate today at www.icpas.org/annualfund.

Claire Burke, CPA CFO and Treasurer, Dearborn Group claire_burke@mydearborngroup.com

To advance the overall organization, the finance function must serve as a valuable partner. Here are a couple ways to support this endeavor.

As I’m writing this, it’s late summer—one of my favorite times of the year. Not only is the weather delightful, but it’s when I begin planning for the upcoming year and start thinking about how to advance our finance function’s performance, as well as our overall organization.

During this planning phase, I think through the typical things: how to implement technology initiatives, improve processes, develop my team, and drive the company’s desired financial results. I also reflect on what we’ve accomplished over the past year, along with areas where we might’ve fallen short. But one overarching initiative that’s always at the top of my list is to find out how our team can better serve our organization.

As accounting and finance professionals, we tend to be laser focused on the numbers, ensuring what we’re reporting is accurate, complete, and timely. Overall, we focus on actual financial performance compared to projected. We also ensure that our financial controls are followed, employees and vendors are getting paid, customers are billed timely and accurately, cash flow is adequate, investments are achieving the best yields possible, and everything is “ticked and tied.” And while all of this benefits our organizations, it’s pretty much expected. Therefore, I believe in order for the finance function to truly help advance an organization, it needs to be a valuable financial partner to its key stakeholders.

One of the best ways for the finance function to bring value to an organization is through storytelling. The finance function must tell the story of what’s driving financial results and how these drivers could impact future financial performance. After all, understanding what’s causing the current situation, whether good or bad, goes a long way in understanding implications for future performance. Through storytelling, the finance function can serve as an invaluable asset in helping the organization’s key stakeholders (senior leaders, functional managers, shareholders, or clients, to name a few) connect the dots between strategic and business decision outcomes and financial outcomes. Of course, the finance function’s team can take advantage of numerous opportunities to share these stories, including at monthly financial results meetings, earnings calls, client meetings, or even setting up ad-hoc meetings to focus on particular performance metrics.

While this may sound easy, it’s important to know there’ll be challenges at first—it should be looked at as a continuously improving process. Telling the story behind the financials requires a combination of business and financial knowledge, as well as the art of storytelling. While not every person in the finance function can have a deep knowledge of the business, there

should be certain roles that are required to gain this knowledge. It should start at the top, with appropriate intel cascading down to other roles on a routine basis. In fact, anyone analyzing or reporting financials should have a general understanding of what’s going on across the organization. Questions like, “Did the company expand into a new market or implement a new pricing strategy? Is there a project going off the rails that’s driving up expenses?” should all be able to be answered by key players within the finance function. These folks should also be encouraged to meet with others across the organization to learn about the business and what’s happening outside of the finance department.

Overall, financial reporting and analysis shouldn’t be done in a vacuum. To develop the storytelling aspect, finance leaders can use dry runs for those presenting, with ongoing feedback to help the person develop a crisp delivery that effectively ties the financials to the business. Notably, this is a skill set that someone can—and should—continue honing over their entire career.

Of course, the other part of storytelling is time. People need time to learn about the business and dig into the financial results each month. This is the other part of the planning process that we do each year. My team looks for ways to improve our processes and drive efficiencies so we have time to develop our team and ensure they have the time to understand the business, digest the data, ask the right questions, and assess and formulate their stories.

Another avenue for the finance function to help advance the organization is by serving as a financial consultant to senior leaders and key decision-makers (this dovetails off the knowledge needed to tell the financial story). Consultation opportunities can arise

during strategic planning processes, including when evaluating financials to determine where to invest in corporate initiatives, launch new products, and enter new markets, to name a few.

Finance can also provide input for functions who want to add resources. They can help the business think through the financial return gained by investing in more resources, which also helps educate business decision-makers so they become more mindful of the organization’s return on investments.

Another consultation opportunity is during budget season. Using the budget process as a way to learn about what is and isn’t going well across the organization is vital information to help develop the appropriate budget for the following year. Instead of simply saying yes or no to additional funding requests, gaining business insight allows for a more informed answer.

As you can see, there are many opportunities for the finance function to be a valuable partner across the organization. By telling the story behind the financial results, the finance function equips key stakeholders with the knowledge needed to make sound business decisions. This also helps educate others outside of the finance function to be more fiscally responsible. By leaning into the consultant role, the finance function can help the organization be more strategic with where it invests and how it operates.

As you begin thinking about what you want to accomplish for the upcoming year, I encourage you to think about the ways in which you can both educate your team about the business and drive process improvements to free up time. After all, this will make the finance function a better financial partner to the business, which can only help position the company for future success and help bolster the bottom line.

The accounting profession has a branding problem—fixing it will require a collective voice to showcase all the good it has to offer future-driven professionals.

Through the ongoing efforts of stakeholder organizations like the Illinois CPA Society (ICPAS), AICPA, and the National Pipeline Advisory Group (NPAG), we know that the accounting profession has a branding problem—it has a bad rap. In the movies, accounting professionals are often depicted as boring or introverted math wizards, solely focused on tax preparation, always working with no family life, and the list goes on. So, with such strong stereotypes to break, how could we possibly attract the brightest students to our profession?

Those of us that have been in the profession for a long time got into accounting for various reasons, such as opportunity, career variety, lifestyle, flexibility, and long-term economic and financial stability. I recall learning about accounting disciplines from a general economic course in high school. Unfortunately, my small high school didn’t offer an accounting class, so I convinced my teacher to allow me to take an independent study class. Through that class, I chose accounting because I saw that it provided the most well-rounded business degree available. After all, accounting is the language of business—and if you understand the foundations of business, you can go anywhere.

All these reasons hold true today, but as a collective profession, we’ve done a horrible job of telling this story and all the other positive ones about choosing this career. We’ve let other professions, such as finance, engineering, computer science, and data analytics, become more attractive in the eyes of high school and college students. Having two college-aged children and one in high school, I often ask their friends, classmates, and parents what they’re majoring in—very few bring up accounting as an option. This is likely because the value propositions for a career in accounting are simply not known. Most of us in the profession know that a career in accounting offers:

• Better job prospects coming out of school.

• A decent starting salary.

• Economic stability (recession proof).

• Career advancement opportunities:

- Firms are dynamic organizations with career mobility opportunities.

- Entrepreneurship opportunities.

- Formal training and ongoing education (e.g., service skills, industry experience, and leadership and personal development).

• Professional support, mentorship, coaching, and networking.

• Purpose-oriented business resource groups (BRGs).

Unfortunately, branding of a profession, just like the branding of any company, can’t be fixed by one advertising campaign. It requires a strategic, consistent approach over time.

For most professionals, a career needs to provide a direct link to a sense of purpose. Therefore, that’s where our North Star must begin.

In our profession, our purpose has historically been built on the key elements of trust, integrity, care, and a helpful posture. Yet, our clients’ needs have changed, and what worked in the past isn’t the profession’s future. It’s time to address this problem with a sense of urgency before the profession that we know—and love— becomes a shadow of itself. The current generation of leadership must drive new service elements that position the next generation to realize the same successes we had—think driving value creation, advising clients on their goals, being future looking and skilled in technology, and serving as a resource through all aspects of a client’s business lifecycle.