From slips and falls to runny noses, eventually we all end up in the waiting room of a doctor’s office. While health care is a universal need, your clients’ health care related tax questions might be a little more unique. Health savings accounts? Health coverage tax credits? Employer paid or self-employed? No problem. We’ve heard it all before. That’s because if it’s out there, it’s in here.

“Good overview as well as detailed information on the health care reform law. Covers the important points in an organized manner better than some of the seminars I have attended.”

— Individual Tax Preparer, IL

In 1955, a young Lester McKeever is graduating from the highly rated University of Illinois with a degree in accounting. The University pushes Arthur Andersen to interview Lester While the firm is impressed with this potential recruit, they tell him he can’t be hired because he’s African American and therefore won’t be accepted by their clients Yes, you heard that correctly. Lester became very disheartened but, lucky for the profession, he eventually pursued his dream to be a CPA, and ultimately became the managing partner of Washington, Pittman and McKeever, LLC

I mention Lester ’s story because it came up in a recent visit with the partners of a mid-sized suburban firm But more on that later

It’s no secret that the accounting profession is minimally diverse, especially with regards to ethnicity and more specifically African Americans and Hispanics The numbers speak for themselves Seventeen percent and 13 percent of Americans are African American and Hispanic, respectively, yet only 1 percent of CPAs are African American and only 3 percent are Hispanic. The question is why? The reality is that there just aren’t enough diverse students pursuing careers in accounting.

We looked at 14 of the largest universities in Illinois and the graduating class of 2014 Among these schools there were just 108 graduates in accounting who were African American and 229 who were Hispanic Individuals of diverse backgrounds do go to college, with the top two areas of study being teaching and social services. The unfortunate reality is that many in diverse communities aren’t aware of the remarkable opportunities that the accounting profession offers

Your Illinois CPA Society, led by the Board of Directors, has elevated improving diversity in the profession to a key strategic initiative We have formed a Diversity Advisory Council, which includes leaders of all backgrounds charged with identifying those opportunities through which the Society can most efficiently impact the pipeline of diverse students entering the profession We will be identifying specific high schools to work with over the next few years to extoll the benefits of a career as a CPA The only way to impact the diversity of our profession is to change the pipeline

Now, back to my initial story and the mid-sized suburban firm I visited. In that meeting, a partner asked what many would say was a politically incorrect question: “Why should I care about diversity in the profession?” I was happy to answer

First, it’s the right thing to do Second, a more diverse workforce will bring in more diversity in thinking, which will only benefit the firm. Third, the primary driver of the growing economy is small-business startups and individuals of diverse backgrounds represent the largest segment creating those new businesses Finally, even if the firm’s clients are minimally, if at all, diverse, I believe that current and future generations of clients will have respect and admiration for a firm that promotes diversity in its team Clients expect, respect and, in many cases, reward diversity in the businesses they work with This isn’t 1955

Yes, the world has changed, but more change in our profession is needed. Your Society will continue to work with high schools, colleges, firms and companies in developing, identifying and implementing solutions so that, one day, our diverse profession reflects our diverse nation

{Follow Todd on Twitter @Todd ICPAS}

{Watch Todd’s CEO Video Series on YouTube}

This is Not 1955 making a case for diversity in the profession.

Publisher/President & CEO Todd Shapiro

Editor-in- Chief Judy Giannetto

Art Direction & Design Judy Giannetto

Production Design Rosa Garcia

Managing Editor Derrick Lilly

Photography Jay Rubinic, Derrick Lilly, Nancy Cammarata

Circulation Carl Siska

National Sales & Advertising

Michael W Walker

The RW Walker Company

P: 213 896 9210

E : mike@rwwcompany com

Editorial Offices

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

Chairperson, Scott D Stef fens, CPA Grant Thornton LLP

Vice Chairperson, Lisa A Har tkopf, CPA Ernst & Young LLP

Secretary, Rosaria Cammarata, CPA , CGMA Mattersight Corporation

Treasurer, Margaret M Hunn, CPA , CFE, CFF Rozovics Group LLP

Immediate Past Chairperson, Edward J. Hannon, CPA , JD, LLM Quarles & Brady LLP

Brent A Baccus, CPA Washington Pittman & McKeever LLC

Christopher F Beaulieu, CPA, MST CliftonLarsonAllen LLP

Terry A Bishop, CPA Sikich LLP

Jon S. Davis, CPA University of Illinois at Urbana

Eileen M Felson, CPA, CFF PricewaterhouseCoopers LLP

Stephen R Ferrara, CPA BDO USA LLP

Jonathan W Hauser, CPA KPMG LLP

Anne M Kohler, MBA, CPA, CGMA The Mpower Group

Thomas B Murtagh, CPA, JD BKD LLP

Elizabeth S Pittelkow, CPA, CITP, CGMA ArrowStream Inc

Maria de J Prado, CPA Prado & Renteria CPAs

Kelly Richmond Pope, Ph D , CPA DePaul University

Andrea K Urban, CPA ThoughtWorks Inc

Kevin V Wydra, CPA Crowe Horwath LLP

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 24,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Fall, Fall, Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA , 312 993 0407 or 800 993 0407, fax: 312 993 7713 Copyright © 2016 No part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may be sent to: Publications Specialist, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

twitter.com/IllinoisCPA

linkedin.com/company/Illinois-cpa-society

facebook.com/ICPAS

youtube.com/user/IllinoisCPASociety

$102.5B

wages earned from more than 1.7M jobs supported by illinois waterways.

[Illinois Chamber of Commerce Foundation]

Forbes offers job hunters these five tips before beginning their search for that much sought after dream job

1 Know where you are: List all the new titles, skills and goals reached over the last 12 months and add them to your social profiles and resume

2 Clear your resume cobwebs: At a certain point, that internship just doesn’t matter anymore and scrub out extraneous buzzwords while you ’ re at it

3. Use LinkedIn to the max: LinkedIn is great for networking, but offers a bunch of other tools like advanced searches to help you gain insight into how employers are looking for you

4 Polish your profiles: By simply updating your LinkedIn profile picture, for example, a notification is sent to everyone in your network That ’ s a lot of exposure!

5. Tap into your network: Send a status update or start a conversation on social media to get insights into who’s looking for candidates and what opportunities are out there

MarketWatch reports that the current federal tax rate on income earned by big, profitable domestic corporations is 35 percent Now compare that to Canada’s 15 percent, China’s 25 percent, Germany ’ s 15 percent, Ireland’s 12 5 percent, Japan’s 23 9 percent, Korea’s 22 percent, Switzerland’s 8 5 percent, Singapore’s 17 percent, Taiwan’s 17 percent, the UK’s 20 percent See the problem? Increasingly, U S companies are willing to move operations and jobs overseas to benefit from lower taxes And many are electing not to repatriate overseas earnings to avoid or defer U S taxes Alternatively, companies are taking advantage of various legal loopholes in the Internal Revenue Code to reduce their “effective tax rate ” What it all boils down to is this: The United States is missing out on a lot of revenue

“Eagles may soar, but weasels don't get sucked into jet engines.” Steven Wright

interviewees who lose interest if they don’t hear from you within two weeks. [accountemps]

According to a report by the Corporation for Enterprise Development (CFED), over the past 30 years the average wealth of white families grew 84 percent, or 1 2 times faster than for Latinos, and 3 times faster than for blacks This means that, by 2044, the wealth gap between white families and black families will double, and, according to the CFED, it will take black families around 228 years and Latino families 84 years to achieve the same average wealth that white families enjoy today With homeownership being the leading source of American wealth, the report found that only 41 percent of black households and 45 percent of Hispanic households own their homes, compared with 71 percent of white households On top of that, blacks and Latinos have built less wealth through homeownership than white homeowners Other factors exacerbating the wealth divide include greater rates of unemployment, lower returns on income earned, lower entrepreneurship rates and non- existent retirement savings

Robert Half reports that 72 percent of companies cover some or all of the costs for staff to obtain professional certifications, and 76 percent help in maintaining credentials once earned However, that still leaves almost 30 percent of organizations that don’t offer financial support Robert Half offers these tips for getting your employer on board:

1 Make a business case Describe how the certification will allow you to make greater contributions to the company

2. Cite immediate benefits. Show examples of how the certification will help to improve productivity, bring in additional revenue or allow you to take on additional responsibilities

3 Prepare for the future Explain how your training will better position you for a leadership position down the road

4. Share the wealth. Offer to share the information you learn by mentoring colleagues

5 Divide the cost If your manager denies your request, don't give up Offering to cover part of the fees might be enough to change their mind

ou

• o w y Allo

estyle? amily maintain their lif ur f ids’ college education? our k y ortably? our spouse to retire comf

ays a st s alw It’ struggles don’t

s why the That’

s emot amily’ our f e. But y v ou lo ruggle to lose someone y y financial problems. t need to be compounded b ance Plan is made e Insur erm Lif T vel ear Le Group 10 Y Year

Half

In today ’ s fast-changing cybersecurity world, it ’ s not out of the realm of possibility Virtually any object with access to the Internet is potentially vulnerable to increasingly sophisticated forms of IT attacks “Fitbits, Apple watches, insulin pumps, cars even your refrigerator can access the Internet, and so can your front door,” says Lillian Ablon of the RAND Corporation. Malware attacks on mobile devices, often through spoofed texts that look legitimate, are also expected to rise This all points to the need for education, vigilance and planning to keep IT systems safe, says John Pouey, a veteran of financial IT security “For the attackers, this is, essentially, a business,” he says Read more in Cyber Offensive, page 16

Q2 2016 marked the tenth consecutive quarter of more than $10B in VC investments The software industry was top of the list of targets, receiving $8 7B across 379 deals, including six megadeals in excess of $100M Software has held the top spot for dollars invested among all MoneyTree industries for 27 straight quarters Biotechnology came in second, receiving $1 7B into 100 deals, while IT service companies received the third largest amount of venture capital for the quarter $946M deployed across 80 deals Computer and Peripherals companies saw the largest increase in dollars versus the first quarter (172 percent), while 251 Internet-specific companies saw VCs invest $2 6B in the second quarter

Silicon Valley may still be the capitol of the tech universe, but it turns out that Chicago treats its techies pretty well

According to a recent report issued by Indeed, when costof-living differences are figured in, Chicago tech workers earn the fourth-highest average wages in the country, trailing only Austin, Seattle and San Francisco Mayor Rahm Emanuel and other officials have been upping their game when it comes to courting tech companies and startups as they look to bring new, high- earning jobs into the city

The IRS recently alerted tax pros to an emerging phishing scam emails claiming to be from tax software providers that contain requests to download and install an important software update However, the bogus link loads a program designed to track keystrokes a common tactic used to steal login information, passwords and other sensitive data The IRS has launched the “Protect Your Clients; Protect Yourself ” campaign to raise awareness of these and other security threats, and also suggests registering for e -News for Tax Professionals Additionally, tax pros can follow the IRS on Twitter and Facebook for updates Visit www irs gov for further information

Sarah Herrmann Hype It Editor ICPAS Member Outreach

Sarah Herrmann Hype It Editor ICPAS Member Outreach

What was square one for you in terms of launching your career? ”I have a recommendation that anyone can do right now to launch or relaunch their career It is to have grit There is an excellent TED Talk by Angela Lee Duckworth titled Grit: The power of passion and perseverance I recommend people watch it and incorporate it into their daily lives ”

What was your most exciting career moment? ”Passing the CPA exam! Studying for the exam taught me discipline and focus; passing the CPA exam gave me confidence and energy to pursue my career Another more recent exciting moment was lobbying in Washington, D.C. with Illinois CPA Society members of the AICPA Council. I feel strongly about advocating for the profession and making a difference for others ”

Who is your role model and why? ”My dad has always been and continues to be my role model. He has taught me the importance of working hard, being honest, mentoring others and caring about people He gave up his job and his daily activities to take care of my mom when she needed him most. Seeing my dad prioritize my mom above himself has taught me what love should look like.”

What energizes you most about the future? ”Being able to help shape it You can lead from wherever you are in life, and as Mahatma Gandhi said, you should “be the change that you wish to see in the world ” I want to contribute to the future of the profession in ways that inspire others to love the profession and want to contribute to it, too ”

If you could recommend just one book for an up-and-coming finance pro, what would it be? “The 7 Habits of Highly Effective People: Powerful Lessons in Personal Change by Stephen Covey. The habits are insightful and can be implemented by professionals at all levels of their careers I teach from this book and talk about it with others often ”

What’s the most rewarding aspect of being an involved member of the Illinois CPA Society? “The Society

me opportunities to serve where I feel the most purpose, which includes upholding our profession’s ethical standards, increasing diversity and promoting financial literacy The CPA Day of Service is one of my favorite days of the year because I am able to use my professional skills to improve the lives of others ”

To say the state’s medical marijuana industry has gotten off to a slow start would be putting it mildly.

By Derrick LillyIllinois’ four-year Compassionate Use of Medical Cannabis Pilot Program Act was signed into law by former Governor Pat Quinn back in 2013, but the state’s first medical marijuana (MMJ) sales didn’t sprout until November 2015

Further hampering Illinois’ new cannabusinesses is the patient population’s slow growth, no thanks to various levels of red tape and physician and community apprehension to support the use of MMJ. As recently as last December there were only 4,000 qualified patients and 23 fully licensed dispensaries across the state. While according to the Associated Press those numbers have climbed as of June of this year to 7,600 qualified MMJ patients and 39 registered dispensaries, the sustainability of the state’s newest industry remains questionable

As it stands, the current number of patients can’t possibly support the profitability of the full number of dispensaries (60) and cultivators (21) that eventually could be legally licensed to operate in Illinois (the state estimated having 75,000 to 100,000 qualified patients by the end of the program’s first year) In fact, some close to the industry speculate that some of those licenses may be surrendered or passed on if the original license winners can’t manage to get up and running

“It’s a huge, huge problem,” Michael Mayes, CEO of Chicago-based MMJ consultancy Quantum 9, told Marijuana Business Daily in a June interview “With the lack of patients into the registry, businesses will suffer greatly and may even go out of business due to the lack of a market ”

including the latest monthly sales record of $2 57M in June, up from May’s $2.3M, according to statistics issued by the Illinois Department of Agriculture. While the steady growth of retail sales bodes well for the budding industry, the real kicker is that the total number of patients able to access MMJ is currently a far cry from the numbers these businesses were expecting after clamoring to get licensed and open for business. Most MMJ business owners report needing a market of at least 20,000 to 30,000 patients to stabilize the industry as it tries to mature

So what’s going to save Illinois’ medical marijuana industry from going up in smoke?

For starters, our state legislators and Governor Rauner At the end of June, Rauner signed into law a previously vetoed extension of the state’s MMJ program While the program originally would have expired at the end of 2017, likely serving only a fraction of the patients originally intended, the pilot program will now run through 2020

But that’s not all The new law breathes new life into the program by adding two qualifying conditions for MMJ treatment: Post-Traumatic Stress Disorder (PTSD) and terminal illness

Combined with the tens of thousands of patients still making their way through the slow-going initial application process, those suffering from these added conditions could spur a surge in MMJ patients. PTSD alone could bring in thousands of new patients, considering that an estimated 8 percent of adults suffer from the psychiatric disorder, which stems from experiencing traumatic and life-threatening events such as military combat, violent crime and sexual assault. The Illinois Department of Public Health reportedly is already preparing new rules and application forms to reflect the inclusion of these conditions

The new law also clears away language that discouraged doctors from providing access to MMJ As it stands, doctors don’t actua

r o p i n i o n o n u s e ; rather, they certify that a patient suffers from one or more of the qualifying conditions Still, physicians may be one of the biggest barriers to MMJ access

As Molly Parker of The Southern Illinoisan reports, “While supporters of the state’s medical marijuana pilot program cheered the extension and changes signed into law on June 30, Southern Illinois patients still face more hurdles because the region’s major health systems Southern Illinois Healthcare, Heartland Regional Medical Center and the Southern Illinois University School of Medicine as well as some other smaller providers, have directed the physicians they employ not to participate.”

Literally thousands of potentially eligible MMJ patients are being denied access over healthcare provider and physician legal concerns that the latest law in fact aimed to alleviate. Many in the industry are banking on public outreach and educational campaigns for both patients and physicians that explain the medical benefits of cannabis in order to help bolster participation.

For now, Marijuana Business Daily estimates that Illinois is set to see $25M to $35M in MMJ sales this year, if the trend of roughly 20percent month-over-month sales increases continues, and the state keeps on expanding MMJ access to patients

While the numbers aren’t yet enough to ease the fears of MMJ business owners, it’s a move in the right direction and it goes to show that despite the naysayers, MMJ is becoming a viable cash business in Illinois

So you want a super secure IT system, one that provides around-the-clock protection from hacks, attacks and viral invasions? Good luck

“ T h e u n f o r t u n a t e t r u t h i s t h a t i t ’s j u s t n o t p o s s i b l e t o b e 1 0 0 - p e rc e n t s e c u r e , ” says Lillian Ablon, an information scientist at the RAND Corporation, and a prof e s s o r a t t h e P a r d e e R A N D G r a d u a t e School “The best we can do is to make it costly for the attackers in terms of time, money, resources, personnel and effort ”

While that may not be the comforting statement you were looking for, Ablon and other cybersecurity experts agree that foolproof security is a fallacy. That said, not spending the time and resources to make your computer systems as secure as possible is, well, foolish A well-developed plan that deters inside and outside IT threats as well as detailing what to do in an eventual breach is a must for even the smallest of CPA and financial services firms, they say

Although the task might seem insurmountable in this age of internationally leaked emails, threatening computer viruses and daring cyber heists, there are four key steps you can take to mitigate risks

First, get a good handle on just what you have and how safe it is “You have to understand what your most critical assets are. What are the things you have to do to stay in business?” says Summer Fowler, technical director for the Cybersecurity Risk and Resilience Directorate at the CERT Division of the Software Engineering

Institute, Carnegie Mellon University “It’s surprising how few organizations understand their most critical assets ”

Developing a data classification policy that clearly defines the data you have, its value and where it should be protected and then establishing a priority system for protection is essential to a solid IT protection system, explains Tim Erlin, senior director of IT Security and Risk Strategy for Tripwire, an IT software security firm.

“You need to do a risk assessment to see what matters the most,” Ablon adds “‘Who would pose the most threat? What do they want? What happens to my company if they get there?’”

For accounting and financial firms, it starts with developing a vulnerability policy that protects clients’ confidential financial information, says John Pouey, an IT specialist in the financial field with more than 15 years experience in IT audit, information security and risk management Pouey also serves as a volunteer with the Greater New Orleans Chapter of ISACA, the international association for IT security, assurance, risk management and governance professionals

“Everyone has something to protect work papers, customer lists, financial information,” he explains “You need to collect assets and rate their sensitivity ”

When it comes to protecting IT systems, a combination of simplicity and sophistication is often the recipe you are after, say the experts.

“You need to look at good, basic IT hygiene: Change passwords; protect mobile devices; keep separate accounts; when an employee leaves, deactivate accounts and create new passwords,” says Fowler Training employees on everything from password protection to turning off unattended computers, recognizing malware, spotting scams and avoiding suspicious attachments is a critical part of low-tech IT protection, Erlin adds “It has to be consistent,” he says of employee training. “These threats do change ”

One way Pouey likes to test employees is to use online programs that send suspicious emails, such as phishing scams, to help them recognize potentially dangerous outside system attacks Employees are encouraged to hover over a link before opening it and to look for common hacker signals, such as misspellings and a sense of urgency in the messages.

“We would rather they fail with us than get hit with some ransomware,”

he says “If it’s not expected and there’s an attachment, and it’s from the outside, be extra careful.”

Pouey cautions not to underestimate the role of employees, who are often the first line of defense in attempted system hacks “Train, train, train is probably the best device out there,” he says “Repeated awareness really drives the point home ”

There’s also a growing number of higher-tech tools to help companies fend off system attacks, Pouey adds, including automated malware protection software, data-loss prevention and detection tools, email monitoring tools, and automated scanning programs that spot viruses and vulnerabilities and offer fixes Penetration testing, which simulates cyberattacks, also helps companies spot weaknesses in their systems.

It’s not just external attacks that companies must fret over, however; ensuring that employees, ex-employees and other insiders can’t exploit IT security weaknesses is mission critical Policies should be in place to guarantee that employees can access only the systems they need, and that such access is closely monitored particularly at times when an employee’s job changes, or they are terminated.

“Access control needs to be dynamic,” says Ablon. “It’s probably not a good idea to have one username and one password to access all files, and to not change them ”

So, the inevitable happens and your company’s IT system is compromised: What’s your course of action? Surprisingly, many companies don’t have a plan in place to ensure damage is confined and, just as importantly, the company can continue to operate.

“There needs to be an incident response plan, and it needs to be corrective,” Pouey insists “It’s your safety net to limit the damage ”

One of the key words in a response plan is “resilience,” says Fowler Many companies tend to focus more on the threats rather than building up a resilient response to problems. Balancing those demands can be challenging particularly in the face of high-profile hacks and viruses but “the threat will change much more quickly than the impacts,” she says

For Erlin, an effective response plan includes a list of immediate technological steps to take to stem problems; a communication plan that lists personnel roles and responsibilities, as well as how employees and customers should be notified; a plan for contacting law enforcement and other authorities; and steps to ensure all backup programs are running and up-to-date

Erlin and other IT security professionals agree that when the time requirements and financial obligations are examined, many companies particularly solo and small-firm practitioners can find that the overall task of IT security, from planning to implementation, is daunting and a distraction from their bread-and-butter work Increasingly, they say, IT security firms can be called in to help

But selecting the right vendor one that’s willing to work with you and not just drop in low-cost tech tools is critical “The resources are out there, but no third party is going to understand what is most critical for your organization,” says Fowler. “You can’t blindly turn it over to someone else ”

Ultimately, today’s IT environment requires investment to protect yourself, your reputation and your business “Cybersecurity spending is a cost It’s not bringing in revenue,” says Ablon “But if you don’t spend it, you may have a different and more inconvenient cost to deal with.”

The hiring market is clamoring for more CPAs Are you ready to give it what it wants?

By Sheryl Nance-NashYou know the saying, “Get it while the getting’s good”? Well the getting is really good for CPAs anyway.

2016’s tight labor market has pushed unemployment rates for accounting and finance pros below the overall national rate of 5 percent, and the Bureau of Labor Statistics continues to project about 11-percent employment growth through 2020. Audit and tax pros are in high demand, as is expertise in risk, compliance, and mergers and acquisitions In other words, there’s never been a better time to be a CPA

During the recession employers became extremely specific about the qualifications they wanted to see in their potential new recruits Post-recession, they haven’t let up on those specifics “As a result, the demand for CPA candidates continues to increase, while the availability/supply does not,” says Ann Guerra, division director of Robert Half Finance & Accounting in Northbrook, Ill She points out that the additional credit hours now required to sit for the CPA exam is further pressuring candidate supply.

It’s no surprise, then, that finding and retaining talent ranks as a top concern for today’s CPA firms, and in many cases, private companies are fighting for that same talent.

Simply put, firms and companies need financial expertise to help guide smart business strategies

“There’s a growing visibility of the value a CPA can bring to this environment CPAs are becoming increasingly specialized, focusing on areas like big data analysis and technology and information

systems, personal financial planning, forensic accounting, management accounting or business valuation,” says Rebecca Blough, senior manager of college and university initiatives at the AICPA in North Carolina

“SEC reporting specialists, for example, are in high demand because there were more IPOs in 2014 than in any year since the dot-com boom in 2000 Although the IPO market has softened since, companies that went public in 2014 have seen greater needs for accounting and finance personnel to help with specialized tasks, including preparing SEC filings and SOX compliance,” says Christopher Kearney, managing partner, central region, for Tatum, a Randstad company.

The next wave of demand came by virtue of global M&A activity, which reached an all-time high last year. “Effectively integrating acquired companies is oftentimes consuming and intense Post-acquisition integration specialists, many of whom are CPAs, play a key role in generating the intended strategic, financial and operational benefits from acquisitions. Given the recent record-setting M&A volume, there has been rising demand for experts in accelerating the successful integration of acquired companies,” Kearney explains.

Without a doubt, CPAs are doing so much more these days From equity analysis to leading corporate finance departments, more companies are looking to the license for not only the work it represents, but also the meaning behind it.

“Having a CPA nowadays is no longer a career limited to auditing, financial reporting, or routine business functions,” says Roy Cohen, career coach and author of The Wall Street Professional’s Survival Guide “Increasingly, CPAs are being tapped for leadership roles ”

And while professional knowledge remains fundamental to the CPA’s function within the world of business and finance, those who hire CPAs are putting greater emphasis on essential critical thinking, professional skepticism, problem-solving and analytical skills “In fact, there will be changes to the CPA exam starting in 2017 that address the evolving skill sets required for newly minted CPAs,” Blough explains “Entry-level CPAs, too, are being asked to do more complicated tasks in the business world, and contribute to increasingly complex projects earlier in their accounting careers ”

“Business owners and management teams want accounting professionals to be more strategic than ever, and are seeking candidates that can help the business continuously improve,” says Jerry Murphy, CPA, CMA, CGMA, partner at Sikich, LLP

Simply, says Blough, “There is a certain level of confidence that having a CPA doing a job provides ”

When it comes to the question, should I get my CPA now or should I get it later, the answer is definitely NOW!

Why? Because, essentially, the CPA credential is your golden ticket It speaks volumes about your commitment and dedication, the skills you possess and the contribution you can make to an organization The earlier you have the CPA credential, the quicker you can differentiate yourself from all those candidates clamoring for the most select and lucrative positions.

“It immediately differentiates candidates from their peer group Employers will see you as someone who not only has the discipline and work ethic to study for and pass the exam, but who is serious about their accounting career and committed to investing time to develop themselves professionally,” says Guerra

Not only that, but CPAs are required to complete continuous professional education, which guarantees a high level of expertise and relevance within the profession As Christian Novissimo, managing partner, accounting and finance with New York recruiting firm the Lucas Group, puts it, “Companies feel they have an added layer of assurance that they’re hiring the best talent ”

In other words, having the CPA credential opens doors. “In both public accounting and industry, not earning a CPA can put a ceiling on professional growth It can be difficult to rise to the highest levels of an organization without it Many firms won’t even consider prospective employees for certain positions if they don’t have a CPA,” Murphy explains

What’s more, a CPA license can lead to a significant salary. “Becker CPA Review recently conducted a survey that stated, ‘over the course of a 40-year career, a CPA can earn as much as $1M more than a non-certified accountant’,” says Blough

How’s that for a golden ticket?

By Carolyn Kmet

By Carolyn Kmet

Stock indexes are near record highs, GDP is touching multi-year lows, and companies seeking big-time capital investments are feeling the pinch

But according to a report published by PricewaterhouseCoopers LLP and the National Venture Capital Association, $58.8B in venture capital was deployed across the United States in 2015, marking the second highest full year total in the last 20 years. So the challenge isn’t that there’s no money, it’s that there’s significantly more competition for those dollars

“Ten years ago, investors were putting money into initiatives that were just on paper, or t h a t w e r e v e r y r o u g h p r o t o t y p e s , ” e x p l a i n s Manish Shah, entrepreneur and founder of New York-based AcceleWeb, which creates digital products and marketplaces, and whom himself is creating a new platform to attract users and investors “Today, investors are being conservative and shying away from unproven models; investors want to see not only a functioning product, but also real users using the product. Developing working prototypes for digital products often takes at least three to six months, but it’s becoming a necessary hurdle ”

According to Zachary Weiner, owner of Emerging Insider Communications, a Chicago-based startup consultancy, investors are pulling away from dotcoms in favor of other industries promising high returns, including e-health, cyber security, alternative energy and green technologies

“We will see more and more of green tech, and we will also see anything that can innovate natural resources,” he predicts

Others familiar with the venture capital market say that today’s major investors are looking to invest only in business models that have proven 10-times or greater returns. “Number one is always SaaS, Software as a Service These are your Mailchimps, your Buffers, your Slacks, and so on,” says Khuram Malik, chief strategist and founder at Stratagem.io. And, in fact, according to the PricewaterhouseCoopers/National Venture Capital Association report, the software industry saw $4 5B flow into 369 deals in Q4 2015, the highest level of funding of all industries

It’s not only where capital is flowing that’s changing; it’s how it’s flowing as well. Traditionally, venture capital firms have been the largest investors as they seek to invest in, grow and then divest their interests in companies “However,” says entrepreneur and investor Lisa Song Sutton, “there is definitely a wave of smaller angel groups that invest in niche markets, whether geographical or industry based ” In fact, we’re seeing syndicate investing become more commonplace, where smaller investors pool their resources together to reduce risk exposure “And in the private sector, we’re seeing Russian oligarchs make very large tech and media investments,” Weiner adds.

t The level of involvement investors expect to have in the companies they invest in is also changing Today’s investors are savvier, and looking for ways to drive growth One example is Chicago-based VC firm Lightbank’s strategy of combining investment with guidance and direct involvement Per Lightbank’s website, “If you just want a check, you probably aren’t in the right place We look for opportunities to provide substantial value to the entrepreneurs that we partner with, and we’re big proponents of entrepreneurs getting to know their investors.”

On the flipside, many entrepreneurs say their biggest challenge today is getting in front of investors Shah suggests the best way to get their attention is to “know someone who knows someone ” For those not in the know, scouring LinkedIn and angel investor networks like Funded.com, and getting involved in incubator associations that try to connect entrepreneurs with potential investors, is all part of the hustle

Of course, a little positive press coverage never hurts either “If potential investors see press coverage, if they see that a company has successfully launched into the market and generated general intrigue, they’ll take that idea more seriously,” says Weiner.

But what happens once you land that critical meeting with a potential investor?

Jeff Ellman is a Chicago-based entrepreneur and co-founder of UrbanBound, a provider of relocation management software. Along with business partner Michael Krasman, Ellman has raised nearly $40M between the two companies they co-founded His advice for wooing investors: Solve an actual problem

“When selling the vision, don’t share ideas,” Ellman explains “Ideas are meaningless if they don’t address a core problem that someone is willing to pay you to solve. Share problems and your solutions ”

Having a commanding grasp of your business’ metrics helps as well “Investors are more cautious than they were a decade ago Investors are no longer just looking at financial performance, but also at customer conversion rates, user engagement rates, and much more,” Malik emphasizes “They’re assessing your business more holistically than before They’re also evaluating the potential of your business model against other similar success stories ”

Ultimately, however, it all comes down to ROI. Every investor wants to know, “If I invest one dollar in your business, how much will I get back?” To help answer this question, Malik advises preparing an accurate calculation of customer lifetime value (CLTV) and cost per acquisition (CPA) CLTV is the net present value of the revenue generated by a customer over the lifetime of their relationship with a business. CPA is how much it costs to acquire a customer “Both of these metrics will reveal how much it’s going to take to get your business to where you want it to be,” says Malik

Sutton adds that transparency is critical in attracting investors “If I sit down to hear a pitch, or open up a deck that doesn’t mention numbers, it makes me wary,” he explains. “Numbers are details If the founder isn’t interested in sharing the details of the company, why would I want to give them my money?”

Ellman also recommends knowing which three terms your investors want to negotiate before even meeting. For Ellman and his business partner, those terms were valuation, options pool and board control “Start off your negotiation by learning what terms are most important to them This guides conversations down the path of swallowing the largest frog first,” he advises. “If you can’t agree to your top three terms, you likely won’t have a deal.”

Entrepreneurs also need to be aware of how relevant their business is to the potential investors’ portfolio In a previous pitch, for example, Ellman referenced one of the investors’ former clients that generated a successful exit “This brought back positive emotions for the partners while we explained to them how our business would likely get similar results. This resulted in a term sheet immediately,” he explains

Ellman also suggests that bringing your team to the pitch yields better results “Going at it alone is a red flag,” he says “Investors want to invest in a team ” The rationale behind this approach is that no single individual can do it all; companies need sales, operations, finance and marketing people

One final tip for founders there is no line delineating personal and professional lives Sutton warns that risk-averse investors are very likely to dig deep into the backgrounds of the people and companies they’re considering investing in. This means that all information is fair game, including anything on social media

“Information is available right at our fingertips,” Sutton explains “We can easily Google a founder. If a founder ’s social media is filled with expletives and sloppy, drunk photos, most investors will definitely think twice before taking that pitch seriously, if at all ”

By Bridget McCrea

By Bridget McCrea

Millennials aren’t the most loyal bunch At least that’s what The Deloitte Millennial Survey 2016 tells us, where a whopping 44 percent of Millennials state they’re thinking about leaving you in the next two years Obviously, some CPA firms have a lot to learn in a very short time

As the nation’s largest living generation, the U S Census Bureau reports that Millennials (ages 19-35 presently) are on track to make up 75 percent of the working population by 2030. This presents both opportunities and challenges for CPA firms

First though, the hard truth: A half-baked approach to welcoming Millennial talent just won’t cut it, especially when competition for the best recruits is tougher than ever, and their expectations are higher than ever.

“This remarkable absence of allegiance represents a serious challenge to any business employing a large number of Millennials, especially those in markets like the U S where Millennials now represent the largest segment of the workforce,” the Deloitte survey points out But there’s a silver lining: Because most young professionals choose organizations that share their personal values, it’s not too late to overcome this “loyalty challenge,” Deloitte notes.

“We’re in an employees’ market right now, and top recruits have a lot of job options to choose from,” says Cara Silletto, a workforce expert with Louisville, Ken.-based Crescendo Strategies. “CPA firms are doing particularly well and are able to scoop up good talent from one another, pay those employees more, and treat them as they want to be treated.”

As for firms taking an antiquated approach to hiring, retention and work practices well, reconsider your strategy. You might be clinging to some of the Millennial generation’s biggest turn offs. Here are six of the top ones

W h e n S i l l e t t o w o r k s w i t h C PA f i r m s , o n e o f h e r f i r s t p i e c e s o f a d v i c e i s t o a b o l i s h s t r u c t u r e d o v e r t i m e , e s p e c i a l l y d u r i n g t a x season you know, when a 40-hour workweek just isn’t enough

Instead of implementing mandatory Saturday hours, for example, companies should consider allowing workers to extend their weekdays to accommodate the larger workload. “As long as the billable hours expectation is met, why does it matter when the work gets done?” Silletto challenges.

“This doesn’t mean you can’t expect overtime,” she adds, “but it does give your valued employees the flexibility to be able to meet their work goals and deadlines in their own way This can be a tremendous differentiator for gaining top talent over other firms ”

Taking the “my way or the highway” approach to employee development doesn’t go very far these days In fact, it only serves to drive most of your top talent away, says Howard Blumstein, CPA, BDO’s Chicago Assurance managing partner. Whether it means t a k i n g a n e w a p p r o a c h t o r e s u m e a n d s k i l l s r e v i e w s , o f f e r i n g opportunities that enhance work-life balance, or developing positive, nurturing leaders, the CPA firm that takes a flexible approach will come out the winner in today’s hiring market.

“It’s about openness and positivity versus just creating a structured, rigid management approach,” says Blumstein. For example, instead of turning away a potential recruit (or one who is ready for a promotion) because he or she is missing a critical skill, Blumstein’s team looks at the positive side of the equation and finds ways to help that person fill in those gaps

“We focus more on their strengths versus just their weaknesses,” h e s a y s , “ a n d s t r i v e t o p l a c e p e o p l e i n p o s i t i o n s w h e r e t h e i r strengths can be leveraged ”

“Twenty years ago CPAs had to be onsite to work, but today they can work from anywhere,” thanks to technology infrastructures that support employee flexibility, Silletto explains And contrary to traditional thinking, visibility in the office doesn’t always mean greater productivity.

e c t a t i o n s , ” s h e a d v i s e s , “and let your employees do their jobs wherever, whenever they a r e m o s t p r o d u c t i v e ” T h a t ’s w h e r e y o u i n s p i r e l o y a l t y i n y o u r most sought-after talent.

“Top professionals are self-directed and take pride in their capabilities,” says Mari Anne Snow, a learning and development execut i v e w i t h S o p h a y a i n B o s t o n “ O l d - s t y l e c o m m a n d - a n d - c o n t r o l m a n a g e m e n t i s s e e n a s d i s r e s p e c t f u l a n d c o n d e s c e n d i n g , ” s h e explains. “Over time, it kills morale.”

I n s t e a d o f m i c r o m a n a g i n g e m p l o y e e s , S n o w u rg e s C PA f i r m leaders to make those individuals part of the strategy discussion

“Don’t just relegate them strictly to transactional accounting,” she says. “Realize that smart people can see the meaning behind the numbers, and that they are interested in helping business leaders with their analysis ”

According to Deloitte’s survey, open communication, inclusiveness and attention to Millennials’ ambitions all help to foster loyalty. And having a strong sense of purpose beyond financial success is another key driver

D u r i n g a M i l l e n n i a l ’s i d e a l w o r k w e e k , f o r e x a m p l e , D e l o i t t e says there would be “significantly more time” devoted to the discussion of new ideas and ways of working, on coaching and mentoring, and the development of their leadership skills

“You learn a lot when you listen to your employees, and that’s one thing we are really focused on here at BDO,” says Blumstein. “We’re constantly talking to team members, getting a gauge on what motivates them, and figuring out what interests them the most ”

This, in turn, helps employees of all ages feel as though they have a real “voice” in important matters “No one wants to be told, ‘this is the way it is, and how we’ve done it for years,’” Blumstein points out “This is a completely different era, and one that requires CPA firms to talk to and listen to their new and prospective employees in a way that they may not have ever done in the past ”

Put simply, today’s top talent wants to know where its company stands, what it stands for, what types of operational strategies it’s using, and what policies they’ve instituted (and why)

“Expect to answer a lot of questions, and be ready for what they might throw at you,” Silletto advises. Consider, for example, how knowledgeable your younger recruits may be about recent financial scandals and the resulting transparency rules/laws

“It’s really no wonder that employees want more transparency in general, let alone within the financial sector,” says Silletto. “Answer with responses like, ‘That’s how it’s always been done around here’ and you’ll wind up losing a lot of good prospects ”

Use your expertise and leadership skills to help guide and govern the work of your Illinois CPA Society.

Volunteering is a great way to give back to and directly enhance the CPA profession. In return, you’ll have unique opportunities to interact with and learn from other professionals, all while enriching your own leadership skills.

Illinois CPA Society regular and affiliate members are encouraged to apply for a position for the term April 1, 2017 - March 31, 2018.

Application Deadline is December 9, 2016.

www.icpas.org/volunteer

Professional Practice Committees

Employee Benefits

Not-For-Profit Organizations

Taxation - Business

Taxation - Estate, Gift & Trusts

Taxation - Flow-Through Entities

Taxation - Individual

Taxation - International

Taxation - Practice & Procedures

Taxation - State & Local

Quality Assurance & Public Protection Committees

Accounting Principles *

Audit & Assurance Services *

Ethics*

Governmental Accounting Executive*

Governmental Report Review

Programs/Special Issues

Awards Committee

CPA Exam Award Task Force

Women’s Connections Committee

Women’s Executive Committee

Education

Conference Planning Task Forces

Chapters

Officers and Committee Chairs

Th i n k y o u ’ v e g o t w h a t i t t a k e s t o really make it in the awesome, attractive and all-out competitive corporate finance world? Your best strategy might be to play it cool becoming the standout recruit for that Fortune 500 finance position is going to take a lot of careful planning, patience and savvy

“Sometimes individuals have unrealistic expectations about the kinds of opportunities they can land on day one,” says Jeramy Kaiman, vice president with Accounting Principals, Parker + Lynch He notes that starting out at the ground level doesn’t mean you can’t do very well over time. “Being flexible about the types of opportunities they pursue to get into the market is important,” he explains

In reality, nearly half of young accounting professionals believe they’re illequipped for their first job, according to a recent Accountemps online survey that indicates the knowledge gained in the classroom doesn’t always translate to real-world work and the realm of office politics

“The accounting and finance profession has morphed, and accountants are no longer sitting in a corner, trying to understand the debits and credits of a business,” explains Peter Dousman, director of permanent placement services at Robert Half Finance and Accounting in Chicago. He notes that corporate finance departments increasingly are seeking candidates with enterprise resource planning experience and solid soft skills such as interpersonal communication and networking.

“It’s more of a business-partnering role Young accountants will need to be able to work with and share information with a variety of audiences, and also will need to be able to communicate to their bosses about where they want to be in the years to come ”

Peter Dousman, director of permanent placement services at Robert Half Finance and Accounting, shares four often overlooked best practices that may help you make it in the world of corporate finance:

1 Secure an internship while still in college This is key It shows a commitment to your career, and a greater ability to hit the ground running when you ’ re offered that full-time position

2. Hone your sof t skills. Technical skills are all-important, but they share the spotlight with the ability to communicate, network and work well within a team.

3. Know your personal brand. Use social media, but beware of what appears online; have a professional picture of yourself on LinkedIn and make sure your Facebook settings are private

4 Showcase your experience That means both on social media and in person Creating your own website or blog that illustrates your passion for and expertise in your profession can really help to get you noticed

So, how does a young pro hone his or her skill set for the corporate world? “For many, the best career path starts in public accounting,” says Kaiman. “The assumption is that if someone has gone into public accounting, they are very focused on their career willing to work extra hours, able to service their clients well. They get exposed to a lot of different industries and different sizes of companies, different ownership structures, different issues, so that breadth of experience allows them to be more technically well-rounded when they come into a corporate finance role,” he emphasizes

A tour through public accounting isn’t the only path to success, however Some companies are willing to hire college graduates straight out of school, but without question, they’re seeking applicants from the most reputable accounting programs Don’t be dissuaded; even starting out at the lowest levels has its rewards, like gaining experience in financial analysis, risk, compliance, business analysis and internal audit. “All of these areas provide professionals with the foundation and skills to move around within the organization as their careers progress,” says Dousman

For those looking for long-term growth, perhaps all the way to the C-suite, Kaiman suggests a balanced mix of experience in public accounting, financial analysis and corporate finance

Credentials are also a key differentiat o r i n t h e c o r p o r a t e f i n a n c e w o r l d I n fact, in-demand designations can boost one’s salary by up to 15 percent. Dousman and Kaiman point to the CPA credential as key to any accounting track, while also pairing it with an MBA from a reputable school.

“The CPA is really important for peop l e l o o k i n g t o a s c e n d t h r o u g h t h e organization Often, it’s a hard requirement for a controller or CFO role,” says K a i m a n “ A n d n o t j u s t a n y M B A p r og r a m i s s u f f i c i e n t W h e r e p e o p l e g e t their MBAs does matter It’s important that people understand that ”

If you’re striving to differentiate yours e l f f r o m t h e c o m p e t i t i o n , D o u s m a n r e c o m m e n d s t h a t y o u a l s o c o n s i d e r a t t a i n i n g t h e C M A ( C e r t i f i e d M a n a g ement Accountant), CIA (Certified Internal Auditor) and CFA (Chartered Financial Analyst). The CIA, in particular, is aimed at those interested in launching careers in internal audit, while the CFA c a n l e a d t o c a r e e r s a s p o r t f o l i o m a na g e r s , r e s e a rc h a n a l y s t s o r c o r p o r a t e risk managers

T h e C h a r t e r e d G l o b a l M a n a g e m e n t Accountant designation (or CGMA as it

is better known) is another worthwhile credential to pursue Created through a joint venture of the American Institute of Certified Public Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA), the CGMA is a global designation that recognizes the unique expertise and competencies of corporate accounting and finance professionals

If your goal is to make it in the world of corporate finance, get ready for a competitive climb. However, with the right stuff accounting experience, soft skills, credentials you’ll have every chance of reaching the top

Everybody loves a comeback story and the corporate world is no exception Whether driven by a bold, u n c o m p r o m i s i n g c h i e f e x e c u t i v e , a r e c o r d - b r e a k i n g government bailout, or the brilliant branding of a revol u t i o n a r y p r o d u c t , t h e b i g g e s t c o r p o r a t e t u r n a r o u n d s often become legendary.

Will we continue to see such remarkable mega-turnarounds in the years to come? That’s not so clear The turnaround industry has changed over the last decade, in part because of shifting laws governing turnaround deals and the economy, says Gregory Fine, CEO of the Chicago-based Turnaround Management Association

H i s t o r i c a l l y, b a n k s w e r e t h e p r i m a r y w a t c h d o g s i n tracking a company’s borrowing, strength and overall health. After all, they had a vested interest in making sure their loans were paid in full More often these days, accountants and other finance pros entrenched in corporate America are discovering the shortcomings and irregularities a company faces long before anyone else

“It can come down to whoever ’s doing the taxes A lot of times CPAs see red flags before anybody,” says Fine

A n d m o s t t u r n a r o u n d d e a l s o f t e n t a k e p l a c e i n t h e middle and lower-middle markets, “Because those are the companies that don’t have nearly the access to capital or the infrastructure and typical corporate discipline of a larger company,” Fine confides.

Five inspiring examples of companies that came back from corporate collapse.

By Timothy Inklebarger

By Timothy Inklebarger

Let’s be clear; corporate turnarounds are often a last-ditch effort to avoid bankruptcy, which is a far more complex undertaking since the financial crash of the late 2000s. Don Bibeault, a thought leader in the turnaround industry and author of the groundbreaking 1981 book, Corporate Turnaround: How Managers Turn Losers Into Winners, says tightened bankruptcy laws have expedited the schedule for forcing bad companies into insolvency a change that inadvertently helped to clear the field of potential clients for turnaround managers Laws passed around the time of the financial crisis give companies 120 days of exclusive rights to submit their bankruptcy plans Prior to those laws, bankruptcy cases could drag on for years Paired with regulations that allow banks to shed their worst loans in the wake of the crash, and the low interest rates now on the financial landscape, turnaround work has dried up and driven industry experts to refocus their business management expertise on keeping companies healthy.

“Initially, our membership was made up of people who were about saving the entity or maximizing the underlying value if it can’t be saved,” Fine explains “Ultimately, turnaround professionals work with companies on improving performance management, disruption restructuring, working through insolvency, preserving equity, enhancing enterprise value and driving improved results Most turnarounds are required because of a disruption as opposed to saving a company that’s headed for the cliff.”

Although a lot of the work in corporate turnarounds today hinges on smaller companies, the greatest comeback stories involve some of the nation’s most notable mega-corporations. Here are just a few.

Apple founder Steve Jobs is hailed by many as having pulled off the greatest corporate turnaround in history. Returning to the company in 1997 as its CEO, Jobs immediately began eliminating products, projects and employees in an attempt to soften the blow of the tech giant’s flagging sales Unnecessary projects, like the company’s line of printers and cameras, the Newton PDA and Cyberdog applications, among others, were the first to go

“Apple suffered from excessive product proliferation dilution and wasn’t focused on the right projects,” says Bibeault, adding that companies often find themselves in trouble when they direct too many resources towards losing products.

“You’re diluting your power on the winners and using your money on the losers; it’s robbing good Peter to pay bad Paul,” he says “It isn’t always straightforward because when you start out, how do you know iTunes is going to be a big winner?”

He says companies usually get a sense of winning products within the first two years “If there’s no traction within six to eight quarters and you have no real expertise with the product, I’d say you’re on dangerous ground then I’d call that ‘product proliferation ’”

Righting the ship, however, isn’t just about cutting jobs and unsuccessful products Bibeault explains that turnaround specialists can help corporations reform themselves into leaner, meaner versions of their bloated former selves, while keeping top talent on task “You’ve got to make sure your head of sales doesn’t go to your competitor,” he says

Apple weathered the storm and lived to fight another day and then some The success of the iPod, iPhone, iPad and more has made it one of the world’s most valuable companies

You don’t get the nickname “Government Motors” without good reason. The turnaround of General Motors (GM) will almost certainly remain one of the most storied corporate comebacks in modern history, thanks to its emergency government bailout and historic return to profitability

The auto manufacturer remains one of the nation’s oldest and most revered companies, but in the late 2000s, GM had grown bloated with products and a massive executive-level workforce. Bibeault wrote in a March 2009 Detroit Free Press op-ed that, “Management aligned with labor, not shareholders seeks to have taxpayers subsidize their profligate ways, or as promised, their less profligate ways.”

Despite the federal government pouring tens of billions of dollars into the company, GM eventually filed for bankruptcy protection as part of a massive reorganization plan that included cutting its less popular Saturn, Hummer and Pontiac product lines, and eliminating unnecessary middle-management and manufacturing positions The result was a rebound that hardly anyone expected.

Some have argued that GM was always too big to fail, and letting it go bankrupt might have been worse than a government-sponsored bailout We’ll never know But that’s where turnaround specialists prove their worth, says Fine.

“ Turnaro un d practitio ners are the trau ma surgeo ns of the financial world.”

“What turnaround people do is keep the market healthy by returning failing companies to profitability or preserving as much shareholder equity as possible by breaking businesses up and selling off their assets. Turnaround practitioners are the trauma surgeons of the financial world ”

Of course, Illinois came out ahead here as well. Fine says the GM bailout resulted in one of the biggest corporate turnarounds in history to affect the state because of the auto manufacturer ’s close ties to, and large manufacturing presence in, the Windy City

GM isn’t the only turnaround success story between Chicago and a Michigan-based manufacturer Sparton Corporation spent most of the 20th Century producing farming equipment, various parts for auto manufacturers and, ultimately, a dizzying array of electronic devices. But by 2008, the company was in turmoil, reporting millions in quarterly losses, and finding itself on the brink of being delisted from the New York Stock Exchange. Shareholder complaints led by the company’s biggest shareholder Lawndale Capital Management LLC followed, and eventually forced Sparton to right its course

The company first fired its long-time CEO David Hockenbrocht and brought in corporate turnaround expert Cary Wood Under Wood’s leadership, the company slashed its workforce by more than half, closed a number of unprofitable manufacturing plants and moved its Jackson, Mich -based headquarters to Schaumburg, Ill

Crain’s Detroit Business reported in 2014 that during the layoffs Wood received various anonymous threats, one stating that he would “pay the price” for his actions. Despite the controversy of the downsizing, Wood prevailed and returned the company to profitability.

Fine says the instinct to move forward against great adversity c o m e s n a t u r a l l y t o t h e c o r p o r a t e t u r n a r o u n d g r e a t s . A s Wo o d s illustrated, the sign of a great turnaround manager is “the ability to read a situation quickly and have the guts to make a decision.”

Turning to outside experts was an essential strategy for Howard Schultz, who brought Starbucks Corp. back from the edge of the abyss in the late 2000s The company had grown too far too fast, and its stock was plummeting. Schultz was able to reboot interest

in the brand by making tough belt-tightening decisions and getting down into the trenches with individual store managers to find out just what was broken and what problems they were facing daily on the frontlines

That hands-on approach is a vital part of any successful turnaround, says Bibeault, who contends that big decisions concerning how to save a company can’t all be made in the boardroom

“A lot of private equity executives went to Yale and then Wall Street and then an equity fund,” he says, asking the questions, “Hey, have you ever been to the factory and talked to the people on the floor? Have you ever gone into the warehouse?”

Within a couple of years, Schultz’s hands-on efforts paid off, and Starbucks was back on its way to profitability It was so successful, in fact, that he wrote a book about the turnaround in 2012 titled Onward: How Starbucks Fought for its Life Without Losing its Soul Like the turnaround itself, the book was a big success and became a New York Times bestseller

The Ontario-based tractor and farm equipment manufacturer had a major problem in 1981, when it touted $3B in sales and 65,000 employees worldwide Bibeault, who served as an advisor to the company, wrote in his 1981 book that the organization very nearly became another casualty of overexpansion

Specifically, in the late 1960s Massey-Ferguson chose to focus on international markets rather than compete in North America But “It shouldn’t have,” Bibeault wrote, noting that about 10 years after going international on “borrowed money,” the world farm equipment market “shriveled.” “Interest charges in 1977 were $198.5M compared to $48M in 1973,” Bibeault explained Massey-Ferguson’s losses grew to $225M in 1980.

In addition to the agricultural market’s sectorial downturn driven by changes in export laws, the company also was plagued with distribution inefficiencies Bibeault predicted a long-term secular downtrend. If you bet there’s a secular not cyclical downturn and you’re wrong, “you may deprive yourself of upside potential,” says Bibeault; but if that bet is right “you save the company.”

Massey-Ferguson followed his lead and bet on a long-term downturn. The company downsized its agriculture sector, going from about 80 percent of sales in 1981 to about 30 percent by 1986 and restructured itself to both survive and thrive.

There’s a war being waged in the accounting profession, and we’re the ones stoking its flames.

By Derrick LillyAn excerpt from the 2016 INSIGHT Special Feature, Pipeline Disruption: The search for solutions to the weakening supply of CPAs Find it at www icpas org/pipeline

The war for qualified and skilled talent is real, and we have the opportunity to be part of the problem or part of the solution.

Ask the top 25 public accounting firms in Chicago what they think of the CPA pipeline and 88 percent of them will tell you there aren’t enough CPAs to meet their wants and needs.

How do we know? We asked.

In May 2016 we wrapped up a survey of Chicago’s 25 largest public accounting firms that asked managing partners, HR leaders and other strategic decision-makers from each firm some tough questions about the state of the CPA pipeline and what they’re doing to support the CPA credential and their employees aspiring to earn it With pipeline supply and diversity being such hot-button issues in recent years, and 40 percent of firms reporting back that they’re flat out “struggling to find candidates to meet [their] CPA talent demands,” we expected some proactive and creative efforts on their behalf aimed at filling the CPA pipeline. We won’t name names or point fingers, but, frankly speaking, we found the results to be a bit lackluster

Every firm we spoke to 100 percent of them reported that the CPA credential is “very desirable” or “somewhat desirable” when hiring or recruiting professional staff No one even blinked at the question So it comes as a surprise that each and every one of these firms isn’t doing everything it can to ensure its people have the tools they need to earn the CPA.

Twelve percent of firms offer no financial assistance for CPA exam preparation courses or testing Another 12 percent only offer financial assistance for a prep course. Only two out of 25 firms offer financial assistance for taking the CPA exam more than once (even though the average candidate will need at least two, if not three attempts to pass some sections) one covers expenses for two attempts, while one firm will foot the bill for “as many as it takes ” Only 52 percent of firms provide both PTO and flexible work schedules for prep courses and testing And the most popular incentive for earning the CPA credential is drumroll please a one-time bonus (72 percent) Twelve percent of firms don’t even offer a reward or incentive

This all seems a bit counterintuitive when 92 percent of firms (23 of 25) “require professional staff to earn the CPA credential in order to be promoted to certain positions in the firm.”

Over and over we hear from firms that there’s a lack of CPAs and skilled candidates in the talent pool, that attracting new talent is a challenge, that there’s so much competition for top talent, and then retaining what talent they do have is a constant battle. These survey results should help to highlight, in part, why that may be

“One of the top reasons why working professionals say they took the CPA exam is because their employer encouraged them to We all know that it’s a really hard test that requires endurance and e n c o u r a g e m e n t t o g e t t h r o u g h . I f y o u ’ r e n o t s u p p o r t i n g y o u r e m p l o y e e s , t h e y ’ r e l i k e l y g o i n g t o g i v e u p b e c a u s e t h e y ’ r e n o t going to see the motivation as to why they’re doing it,” says Sarah Herrmann, Illinois CPA Society member outreach manager. “We also need to keep in mind that the average age of people sitting for the CPA exam in Illinois historically averages between 30 and 31 years old It’s pretty safe to say that a 30 or 31 year old likely has a lot of responsibilities at work, and they may be married or have children to take care of at home, so the ability to really dedicate a lot of time to studying is increasingly fleeting And if they’re not getting the time off or financial support to do what they need to succeed, they’re not going to do it, or they’re going to go somewhere where they’ll get it.”

“At the end of the day, public accounting firms, too, have to look at themselves Are we putting our money (literally not proverbially) where our mouth is? If we’re serious about getting more accounting majors and young professionals to become CPAs, we need to provide the financial and environmental support to complete the process,” says Todd M Shapiro, Illinois CPA Society president and CEO “This is where you can be part of the problem or the solution This is time and money we can’t afford not to invest ” Think about it. Are your resources and employee perks and benefits really in line with what your people or prospective recruits need? We hear about firms trying to woo the next generation of talent by moving towards casual work environments, jeans every day, remote work arrangements, unlimited time off, and more. But are

“The talent pipeline is one of the biggest risks to our fir m and our industry.”

John Bird, CPA, Partner, RSM US LLP

[ICPAS 2016 CPA Pipeline Survey]

those offerings going to help advance their careers? Are those offerings going to help advance your firm or help develop and retain the talent needed to sustain it?

“Make sure you’re talking about the importance of the CPA throughout your entire recruiting and retention process, and think about which resources your firm and people really need,” Herrmann suggests “Are the resources you’re offering matching those needs? Do your aspiring CPAs need more time off, financial assistance, or a buddy within the firm to keep them engaged and motivated to advance in the firm? At the very least, paying for the two or even three full attempts needed to pass the CPA exam is an easy thing to do That $1K, $2K or even $3K investment in an employee is minimal for a firm, but it could be life-changing for that employee, and it instills loyalty in them when they know that your support is there and that there’s a future for them with the firm.”

As the results show, nearly all firms require professional staff to have the CPA credential before they can advance to a manager role or higher in the audit and tax service lines Unfortunately, according to many survey responders, there’s a tightening bottleneck here because a growing number of staff either don’t have the CPA or aren’t pursuing it in lieu of advisory careers

“If accounting graduates and young professionals don’t make the jump to become CPAs, there’s a good chance that they’ll end up not working in the profession altogether,” Herrmann warns “What’s more is that there are so many other credentials to consider now that lead to other careers: CFA, CIA, MBA and more Public accounting firms need to be vocal about their desire and demand for CPAs even if advisory and consulting services are driving their growth ”

So we’d like to offer a friendly challenge to not just the largest firms and companies, but all firms and companies across our state to simply do all they can to truly support the future of the CPA credential and those aspiring to earn it Don’t worry; the Society will be here right alongside of you doing what it can to mend, expand and diversify the CPA pipeline. After all, as Herrmann kindly points out, “The onus is truly on all of us ”

“opens up doors and opportunities.”

Keith Schomig HR Coordinator, Legacy Professionals LLP

“is a pedestal of hard work, knowledge and effort.”

Robert J Hannigan, CPA Managing Partner, Bansley & Kiener LLP

“is absolutely necessary as a minimum to advance to the manager rank in the audit and tax service lines.”

Jackie Rosenfeldt, CPA Partner, Grant Thornton LLP

“is imperative for our firm.”

Janel O’Connor, SPHR, SHRM-SCP Director of Human Capital, Sikich LLP

[ICPAS 2016 CPA Pipeline Survey]

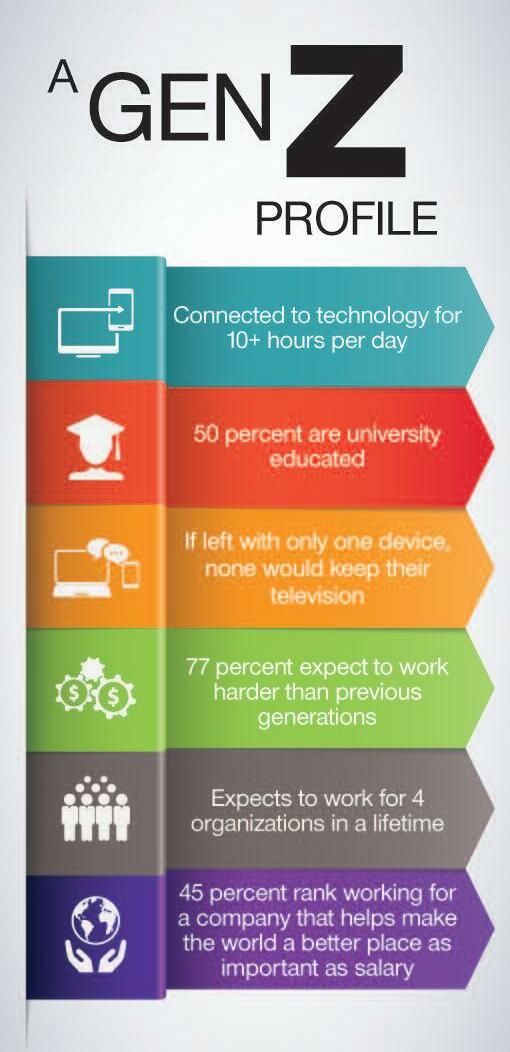

Every generation thinks it will be the one to set the world on fire But up-and-coming Gen Z made up of those born between 1995 and 2015 brings with it a humble pragmatism.

This new generation of workers has witnessed its parents and slightly older peers hop from job to job, with little security and no reward for loyalty. “This group has seen the hangover their slightly older counterparts, Millennials, suffer from,” says Jason Dorsey, co-founder of The Center for Generational Kinetics “College debt, failure to launch, delayed marriages and children. And they are swinging the pendulum in a decidedly new direction.”

What they’re hoping to distance themselves from is economic insecurity, a lack of work-life balance, and pingponging from company to company with no sense of purpose other than money-making What they hope to embrace is stability, hard work, opportunity, trustworthy leaders, clear purpose, and a desire to give back to

Though reminiscent of past generations, don’t think that these values bring us back to a slower, stodgier workplace. While Gen Z is clear on its values, it also favors speed, ubiquitous technology and immediate feedback.

Gen Z is set to change your work environment in myriad ways, but we’ll get you started with this cheat sheet of five of the most critical to prepare for.

“To a Gen Z member, technology is not something you go to It is something you carry with you, no matter where you are,” says Dorsey

Gen Z-ers multitask across at least five screens a day and spend 41 percent of their time outside of school/work with computers or mobile devices, reports Accounting Principals’ 2016 Generation Optimization white paper

“I walk by many of our new hires and see them answering email after email on their mobile phones, while their laptops sit untouched beside them,” says Jeramy Kaiman, vice president with Accounting Principals, Parker + Lynch. “They are just not interested in a device that’s not ultimately portable no matter what you are doing. That changes the way we work ”