Forms adopted on 11/4/24 For mandatory use 1/3/25

Changes apply to all contract forms unless specified otherwise.

Paragraph numbers referenced are from the One to Four Family Residential Contract.

Forms are on the TREC website and in zipForms

The mandatory use date for the new forms is January 3rd, 2025.

= Removed BLUE = New

v One to Four Family Residential Contract 01/03/2025

v Residential Condominium Contract 01/03/2025

v Farm & Ranch Contract 01/03/2025

v Unimproved Property Contract 01/03/2025

v New Home Contract (Complete & Incomplete) 01/03/2025

v Third-Party Financing Addendum 01/03/2025

v Amendment 01/03/2025

v Addendum for ”Back-Up” Contract 01/03/2025

v Condominium Resale Certificate 01/03/2025

v NEW- Addendum for Section 1031 Exchange 01/03/2025

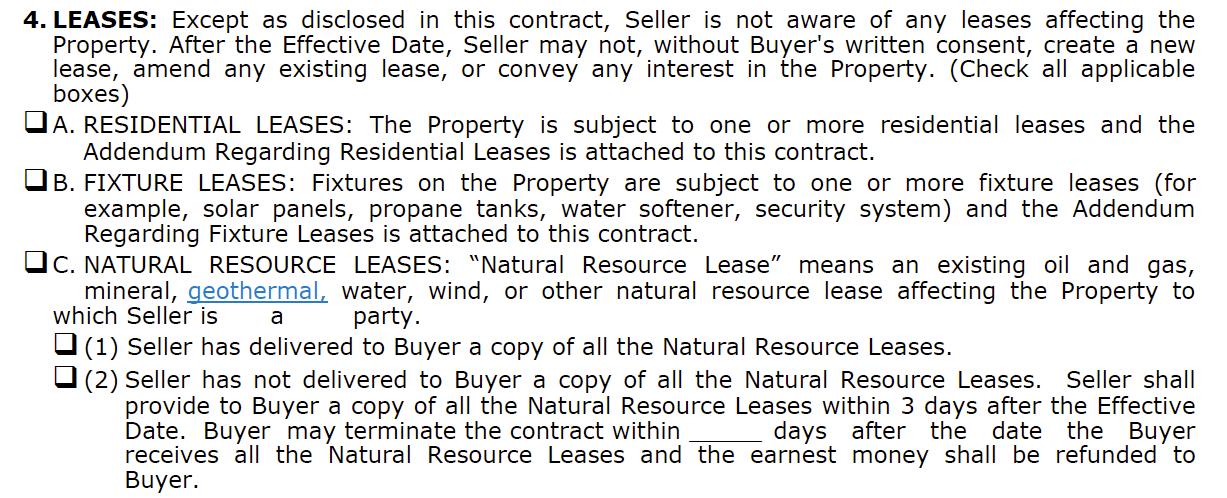

Paragraph 4 is amended to add the term “geothermal”.

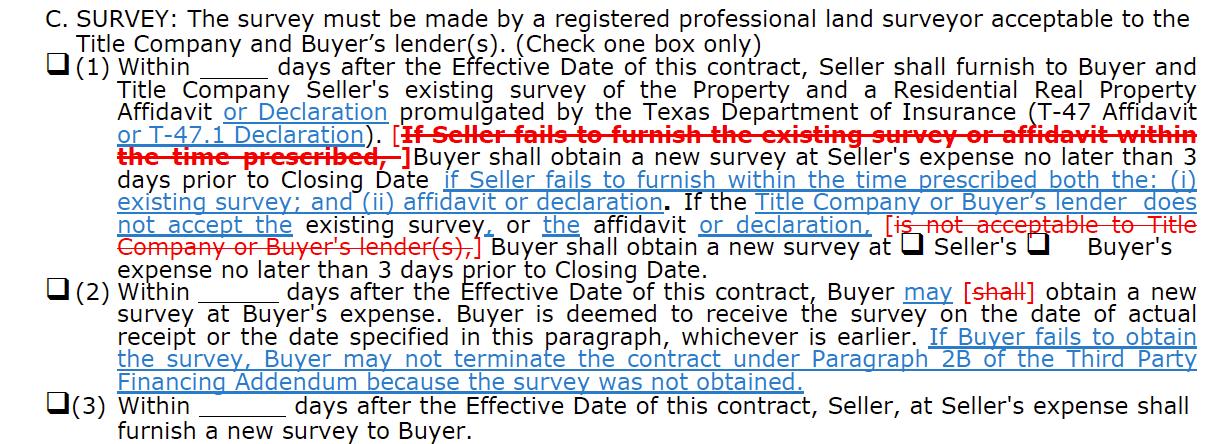

Paragraph 6C(1) is amended to include the option of providing the T-47.1.

To protect your seller’s privacy, hide their DOB and address when uploading the survey and T-47.1 to the MLS.

The new Paragraph 6E(11) is added to provide information regarding the mold remediation certificate.

This change does not apply to the Unimproved Property Contract.

Paragraph 6E(12) is modified to add specific examples of the types of notices.

Talk to your broker!

A. The following expenses must be paid at or prior to closing:

1. Seller shall pay the following expenses (Seller's Expenses):

Transaction items and “brokerage fees” the seller agreed to pay in the listing agreement.

a) releases of existing liens, including prepayment penalties and recording fees; release of Seller’s loan liability; tax statements or certificates; preparation of deed; one- half of escrow fee; brokerage fees that Seller has agreed to pay; and other expenses payable by Seller under this contract;

Use if the buyer wants the seller to pay brokerage fees agreed to in their buyer rep agreement.

b) the following amount to be applied to brokerage fees that Buyer has agreed to pay q $ or q % of the Sales Price (check one box only); and

Use if the buyer is asking the seller to pay other expenses such as closing costs etc.

c) an amount not to exceed $ to be applied to other Buyer’s Expenses.

Source Method Forms

Listing Agent Cooperative Compensation

Seller Seller Concessions

• Listing Agreement AND

• Comp Agreement Between Brokers ü (TXR 2402)

• Paragraph 12A. (1) (b) AND/OR

• Comp Agreement between Broker and Owner ü (TXR 2401)

Buyer Direct from buyer Buyer Rep Agreement

Compensation is negotiable and will be negotiated per transaction. What

Paragraph 12. A

Conforming changes were also made in the Amendment to the Contract.

The title of Paragraph 20 is changed to “Federal Requirements” from “Federal Tax Requirements.

Paragraph 20B of the Farm and Ranch contract has added information regarding the obligations related to the federal Agriculture Foreign Investment Disclosure Act.

Addendum for Section 1031 Exchange is added to Paragraph 22.

NEWAddendum for Section 1031 Exchange allows the seller or buyer to disclose an intent to use a 1031 Exchange.

The compensation disclosure in the Broker Information section on pg. 10 has been revised.

No changes to this page in the Farm & Ranch Contract.

Paragraph 3D is amended to include the same sales price adjustment language as in the Farm and Ranch contract.

Paragraph 2A, Buyer Approval, has been changed.

The language in Paragraph 2B is modified.

“Requirements” in Paragraph 4 is made singular.

Modified to clarify the timing and payment of the earnest money and option fee.

The Condominium Resale Certificate is amended to conform the language in Paragraphs K and L with section 82.157, Texas Property Code.