7 minute read

NARAYANAN SURESH

COO, ABLE (SRINIVAS RAO CHANDAN, CONSULTING EDITOR, ABLE)

START-UPS CONTINUE TO MUSHROOM

Advertisement

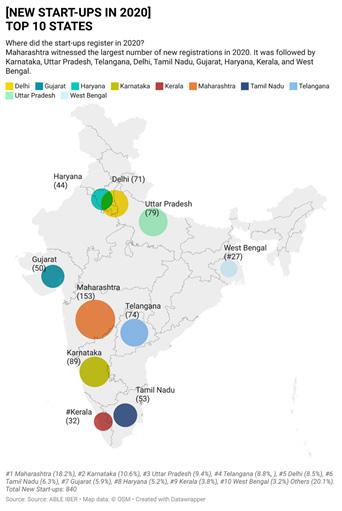

Number of Biotech establishments being formed in India continues to grow every year. Nearly 840 new biotech companies were established in 2020

Biotech Startup Trends

The entrepreneurship trends in the biotech industry can be classified into three major time frames. One is an era before 2000, the second period is between 2000-2012, and the third phase from 2013 onwards. The period before the year 2000 had a handful of biotech companies in the country. Some of the key enterprises of that era were Biocon, Biological E, Bharat Biotech, Shantha Biotechniques, Concord Biotech, Panacea Biotec, and Serum Institute of India. The period between 2000-2010 saw the emergence of new start-ups like Advanced Enzymes, MetaHelix Life Sciences, Strand Life Sciences, Shantha Biotech, xCyton Diagnostics, Sea6Energy and so on ... These were companies started by people who had been in the industry and founded companies to address a different set of market needs and regulatory conditions. The period since 2013 has been witnessing a new trend. We see a remarkable number of companies starting from the classrooms or premium schools and labs as well. The anchors in the era before the year 2000 were passionate people who defied the gravity of the situation then. These were entrepreneurs like Dr. Kiran

The Indian biotech ecosystem crossed an important Mazumdar-Shaw, Dr. Cyrus Poonawalla, milestone at the end of 2016 when the total bio- and Dr. Hamied Yusuf. They wanted to tech start-up base reached 1,022 by Decem- create a niche, they wanted to solve ber end. In the year 2012-13, the biotech the concerns of affordability, industry, policymakers, and the oth- sustainability, and qualer stakeholders in the country, had identified that “start-ups” will be one of the key drivers for the growth of the biotech sector in future. 5.8lk ity. The focus for them was “Made-in-India”, much before the emphasis of Made-inAt one of the deliberations between industry and the Department of Biotechnology (DBT), the participants did a quick calculation and suggested a target of creating 2,000 biotech start-ups by 2020. This was to “4,000+ startups; 150 marketed products; in 5.8 lakh square feet of incubation space” India gained attention in the last few years. The DBT was the anchor in creating skills promote innovation and R&D. This was accept- in the pre-2000 era. DBT ed as a guidance number. ABLE has been tracking was still the anchor during the status of start-ups for the last few years. 2000-2010. This was the period

According to the latest findings in the IBER 2020 Report of when the entrepreneurs like Dr. K. K. the Association of Biotechnology Led Enterprises (ABLE) and Narayanan, Dr. Krishna Ella, Dr. RaviBiotechnology Industry Research Assistance Council (BIRAC), kumar, Dr. Varaprasad Reddy, Dr. Vijay as of December 31, 2020, India has a cumulative biotech start- Chandru, and Dr. Rashmi Barbhaiya, up base of 4,237. This is nearly double the initial target of hav- waded through the barrage of hurdles on ing 2020 start-ups by the year 2020. the regulatory front. This was the time

when DBT leadership decided to remove the funding and regulatory hurdles engulfing the entrepreneurs and build an ecosystem that would foster more entrepreneurs, who could work and create IP and venture into newer areas.

DBT’s BIRAC was established to empower the emerging biotech enterprise to undertake strategic research and innovation, addressing nationally relevant product development needs. BIRAC become the anchor for the generation of companies after 2013. The environment outside the sector too helped the entrepreneurs like the emergence of new governments, newer industries, newer focus areas, and changing economic situations. Under these conditions, the biotech industry has many positives. Companies like Anthem Biosciences, Bugworks Research, String Bio, all emerged during this period.

Growth and health of biotech startups

The ABLE study, based on the data filed by enterprises with the Registrars of Companies (ROC) appointed under Section 609 of the Companies Act covering the various states and union territories, shows that the biotechnology sector had witnessed 4,237 companies registering with RoC during the last 10 years. Following were some of the key trends in company formation as of 2020. • 840 companies are less than a year in age (20 per cent of the total base) • 1,665 companies are between 1-2 years of age (39 per cent) • 1,000 companies are between 3-5 years of age (24 per cent) • 732 companies are over 5 years of age (17per cent)

Only a sixth (17per cent) of the total start-ups base today were set up between 2010-2015. The rest were formed in the last 5 years. Nearly 20 per cent of the companies were formed in the last 12 months. Almost 39 per cent of the companies are less than three-year-old.

A look at the start-ups’ set-up during the last three years

One interesting model that most of the companies registered in India adopt is a combination of services and products offering. The start-ups have been focusing on a wide spectrum of areas. These companies are there in medical devices, appliances, and diagnostic services; They have expertise in genomics, proteomics, and other IT healthcare areas. Some of them are into agronomics, CRAMS, energy, and devices sector too. Some of the products and services that start-ups are offering include anti-fungal products, antidiabetics, antidiarrheals, antipsoriatic, antivirals, anti-cancer drugs and detection kits, biosimilars, genome data analysis, personal genomics, IOT products among several other areas.

Based on the data of the companies provided to ROC, the activity of the companies can be considered under the following categories. • Research and experimental development (R&D)

• Medical health devices, diagnostics, and appliances (Medical devices &

Diagnostics) • Manufacture of basic chemicals for medical purposes (Basic biochemical manufacturers) • Manufacture of other biologic based products (Other green chemicals) • Clinical Research/Data analytics (Human Health) • Other companies that are registered as fibre manufacturers, IT services companies, etc (Others).

While bulk of the start-ups have been working with basic biochemical processes, nearly (60 per cent), the R&D kind of start-ups are on the rise too. Nearly 16 per cent of the start-ups have shown their activity as research and experimental development. This a good sign that innovation culture is now getting set into the DNA of start-ups. It also testifies the fact that BIRAC and industry are now working closely and there is some support to start-ups for research.

The status of capital and grants

The biotechnology sector hasn’t been a favourite of investors. Capital availability has been slightly better than in previous decades. Further, the current

set of start-ups have a strong and well- structured ecosystem. The start-ups today have access to a network of mentors, accelerators, and incubators. The story of Biotechnology Ignition Grant (BIG) projects reflects the trend.

BIG promoted start-ups have been the catalyst in triggering entrepreneurial energies. BIRAC has provided funding support of nearly Rs. 2,063 crore, supported 1,500 plus start-ups and nourished over 50 Bioincubators.

This sector has employed nearly a lakh people and nearly two out of every board of five members are women. The overall industry today is backed by a good ecosystem and the industry is on its path to reaching the 10,000 biotech start-ups target by 2025.

Biotech Start-ups & COVID-19 Fight

Biotech start-ups have played a signifi-

cant role in the COVID-19 pandemic fight. The solutions have been across the various segments of the industry. Over 100 types of products were introduced towards the fight.

Some of the examples include Catheter Reprocessing System, Point of Care Hand Held Multi-Analyte Diagnostic Device, Step-down ICU like continuous health monitor in less than 2 minutes of set-up, Hand Cranked Defibrillator for Sudden Cardiac Arrest, Applied AI on Radiology Imaging for Monitoring Severity of COVID-19 Patients, Mobile Labs, Automated screening of population to look for likely COVID19 infection by checking for fever plus associated respiratory diseases, Real-time Qualitative PCR kit, Suraksha Full Body Coverage Kits, Oxygen generators, CRISPR based diagnosis of COVID-19 using paper microfluidics, Development of necessary reagents and test-devices, etc. The list of interventions is exhaustive.

The critical part is about scale. Take for example Huwel Lifesciences. It was incorporated in 2015 and based in Hyderabad. It is involved in the manufacture of medical appliances and instruments. HuWel developed the Quantiplus COVID-19 detection kit with RT-PCR capabilities and has CDSCO and ICMR clearance for manufacturing and commercialization. It scaled up to provide Rs. 1 crore tests during COVID-19. The biggest challenge India faced was problems of shortage of plastics, columns, etc. or Mylab Discovery Solutions in Pune that produced the first home-made RT-PCR test kits for COVID-19.

The Indian biotech ecosystem played a significant role in testing, sanitisation, and healthcare management.