6 minute read

New developments in Energy & Utilities H2-Industries and Green Planet sign landmark Waste-to-Hydrogen feedstock deal during COP 27

GreenPlanet for Sustainable Environmental Solutions., an Egyptian company (S.A.E.) that specializes in the Environmental aspects, with a special emphasis on waste management systems, signed a memorandum of understand ing (MOU) with H2-Industries Inc. to provide the necessary feedstock comprising organic and non-recyclable plastic waste for the new Wasteto-Hydrogen plant at East Port Said/ Suez Canal Economic Zone, Egypt.

Signed by Mohamed Assad, Chairman of Green Plant for Sustainable Environmental Solutions, and Michael Stusch, Executive Chairman and CEO of H2-Industries Inc., the MOU is important as the new Waste-to-Hydrogen plant will need a constant supply of organic and non-recyclable plastic feedstock in order to produce the targeted 300,000 tons of clean hydrogen per year.

This MOU will enable the revolutionary new Waste-to-Hydrogen plant at East Port Said to operate producing clean hydrogen while significantly reduce plastic waste, a problem that is global in nature and a topic that is to be discussed at COP27.

Spanish

generation has more than tripled, reflecting a similar rise in plastic production. Today, we produce about 400 million tonnes of plastic waste every year, and this is forecasted to reach 1,100 million tonnes by 2050. Of the seven billion tonnes of plastic waste generated globally so far, less than 10 percent has been recycled.

In many countries, the infrastructure does not exist or is not sufficiently robust to guarantee waste collection, and therefore supplying a constant supply of feedstock is a challenge. Green Planet has undertaken to provide the necessary feedstock - up energy giant Iberdrola has sold off a 49% stake in its first operational offshore wind farm in Germany, the Wikinger offshore wind farm. to 4 million tons of waste annually and, as such, will be developing a full supply chain in addition to managing a pre-treatment facility. Establishing a robust supply chain will enable the new Waste-to-Hydrogen plant to operate at capacity and, in doing so, will solve two common problems. These are the environmentally friendly disposal of waste, especially plastic waste, and the creation of generation capacity for clean energy in the form of CO2-emission-free hydrogen challenges that many countries face today. needs of 1 million homes. In total, Iberdrola has approximately 5,000 MW of offshore wind projects under development in the United States, including Park City Wind with 804 MW and Commonwealth Wind with 1,232 MW.

Swiss-based energy investor Energy Infrastructure Partners (EIP) bought the stake for €700 million. Iberdrola will remain the majority 51% shareholder.

According to the agreement, Wikinger’s total valuation amounts to approximately €1.425 billion. Iberdrola will continue to control and manage the asset, leading the operations and maintenance services.

EIP is a major Swiss infrastructure investment company focused on the global energy transition, with a track record as a long-term shareholder in the industry and experience in infrastructure and renewable technology.

Iberdrola, chaired by Ignacio Galan, is a major global player in offshore wind power. Wikinger is one of the company’s flagship operational projects and was the first offshore wind farm developed by the group on its own. With an installed capacity of 350 megawatts (MW) it has been supplying clean energy to approximately 350,000 German households since it was commissioned in 2018.

The transaction further advances Iberdrola`s asset rotation plan to finance new renewable projects under development.

Iberdrola had almost 1,300 MW of offshore wind capacity in operation by the end of June 2022. In addition, it has 3,000 MW under construction, another 4,000 MW secured and an extensive project pipeline under development.

Elsewhere, the group has two offshore wind farms in operation: West of Duddon Sands and East Anglia One commissioned in 2017 and 2020 respectively and located in the UK.

Michael Stusch said, “This is just the first of several international projects where governments and responsible authorities around the globe realize that organic waste and especially plastic waste if treated correctly, can be a valuable asset and used to generate significant amounts of clean hydrogen”.

“The infrastructure that Green Planet will develop, and the feedstock it will provide as part of this landmark project, is truly a technology enabler accelerating energy transition in Egypt while providing an example to the rest of the world,” said Mohamed Assad.

In Germany, the group has started construction of the 476-MW Baltic Eagle project in the Baltic Sea. Next year, construction will begin on Windanker, which will have a capacity of 308 MW.

These new wind farms will be joined by Saint-Brieuc, in French waters, which is expected to come into operation in 2023. It will have a capacity of 496 MW and will be located off the coast of Brittany, 20 kilometres offshore.

Iberdrola’s global offshore wind pipeline includes a wide range of projects at different stages of development in countries such as the United Kingdom, the United States, Ireland and Sweden, along with an expanding portfolio in countries such as Japan, Taiwan, the Philippines and South Korea.

Oil & gas exploration shrinks, companies shift to lower-risk assets & regions

less eager to invest in fossil fuel production and instead look ahead to a net zero future.

“Global exploration activity has been on a downward trend in recent years, even before the Covid-19 pandemic and oil market crash, and that looks set to continue this year and beyond. It is clear that oil and gas companies are unwilling to take on the increased risk associated with new exploration or exploration in environmentally or politically sensitive areas,” says Aatisha Mahajan, Rystad Energy’s vice president of upstream analysis.

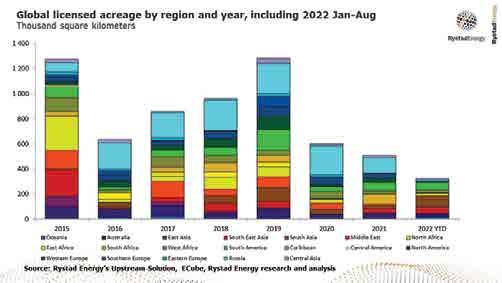

The decline in leasing activity has resulted in a considerable drop in Russian acreage awards, falling 90% from a year ago to 9,000 square kilometres, while licensed acreage in Africa shrank 70% to just 46,000 square kilometres spread across Angola, Egypt, Morocco and Zimbabwe, the only African countries to award new exploration acreage to date in 2022. On the other hand, new acreage awarded in Asia between January and August nearly quadrupled from the same period last year, while South American awarded acreage surged by 140%.

Gthisyear as the number of licensed blocks and total acreage fall to near all-time lows as the sector struggles to shake off the effects of the Covid-19 pandemic and the ensuing oil market crash, Rystad Energy research shows.

Only 21 lease rounds were completed globally through August this year, half of the 42 rounds held in the first eight months of 2021. The acreage awarded so far this year has shrunk to a 20-year low of 320,000 square kilometres. Global lease rounds are expected to total 44 this year, 14 less than in 2021 and the lowest level since 2000.

Global spending on exploration has been falling in recent years as oil and gas companies seek to limit risk by focusing on core producing assets and regions with guaranteed output, aiming to streamline their operations and build a more resilient business amid market uncertainty and the threat of a recession.

The political landscape is also contributing to the decrease in license awards, with many governments pausing or halting leases and encouraging companies to wrap up exploration activity within already awarded blocks. This trend is likely to continue as governments are

The onshore exploration sector is a significant contributor to the decline in awarded acreage. Total onshore acreage awarded in leasing activity has plummeted from more than 560,000 square kilometres in 2019 to a mere 115,000 square kilometres so far this year. Offshore leased acreage also hit a high point in 2019 before dropping off a cliff in 2020 and has remained relatively flat in the past two years.

Concluded lease rounds have dropped significantly in Russia, the US and Australia this year. These countries have held five lease rounds put together so far this year – three in Russia and one each in the US and Australia –down from 17 rounds in the first eight months of 2021 (eight in Russia, five in the US and four in Australia). The drop in the US is primarily driven by the cancellation of Lease Sales 259 and 261 in the Gulf of Mexico and Cook Inlet in Alaska.

Asian licensing has bucked the trend with increased activity and blocks awarded in Malaysia, Indonesia, India and Pakistan. The global decline in licensing rounds has directly affected the awarded acreage, which has hit an all-time low for the January to August period of about 320,000 square kilometres.

Brazil is the largest contributor in terms of blocks awarded so far this year, with 59 auctioned during its Third Permanent Offer Round. European majors Shell and TotalEnergies took all eight offshore blocks on offer – six and two, respectively. The remaining 51 onshore blocks in the Tucano, Espirito Santo, Potiguar, Reconcavo and Sergipe Alagoas basins went to regional players 3R Petroleum (six blocks), NTF (two), Petro Victory Energy (19), Origem Energia (18), Imetame Energia (three), Petroborn Oleo (two) and CE Engenharia (one).

Other sizeable block awards after Brazil were Norway with 54 new licenses in its APA 2021 round, India with 29 blocks in its OLAP Rounds 6 & 7, and Kazakhstan’s fourth oil and gas auction round, in which 11 blocks were awarded. There was also some sporadic activity in Africa between January and August, with Egypt providing rights to explore in nine blocks and Angola granting two blocks. South America also saw an offshore licensing round in Uruguay, where three exploration blocks were awarded – blocks OFF-2 and OFF-7 to Shell and Block OFF-6 to US independent APA. Challenger Energy signed a 30-year license for OFF-1 through direct negotiation with the government.