Founder & Mentor

Sanjay Chawla

Director, Publisher & CEO

Salil Chawla

Mangaging Editor

Sujata Dutta Sachdeva

Editorial Team

Ajanta Ganguly, Ranjit Kaur, Narayan Subramaniam

08-21

India : The Great Fabric Story

22-23 Lead Story : Absoluto

24-31 Trends Forecast

Marketing & Sales

Bipasha Bhattacharya

Webmaster

Abdul Hussain

Manager Coordination

Dinesh Poojari

Graphic Designer

Anil S. Kadale

MUMBAI OFFICE

38/314, Unnat Nagar 4, Off M. G. Road, MHADA Colony, Goregaon (W), Mumbai - 400 062.

Ph: 022 2875 5181, 2877 2282, 3001 4700

E-mail: dfuif@yahoo.co.in / dfu@rediffmail.com

DEHLI OFFICE

Salil Chawla, Business & Mktg: New Delhi - 11001.

Mobile: +9193503 18639

E-mail: salildfu@gmail.com, salil@dfupublications.com

The global textile fabric market is expected to witness significant growth in major regions, from USD 498 billion in 2021 to USD 842.9 billion by 2029, according to a recent market study by GreyViews.

The market has been segmented into various regions including North America, Europe, Asia, South America, and the Middle East and Africa. The key manufacturers and suppliers of textile fabrics are operating across various countries in these regions.

The study highlights that fibres are used in the textile industry to weave broad and narrow fabrics, as well as to finish and create goods. The market participants are expected to discover attractive opportunities by developing low-cost, lightweight, and multifunctional materials for use in athletics

over the next few years. Additionally, research and development efforts aimed at improving the quality of the product will contribute to the growth of the market.

The demand for clothing is expected to rise in the next few years, driven by factors such as social media, e-commerce, influencer marketing, urbanisation, and increased disposable income. The aesthetic qualities of comfort, softness, colour, and texture are crucial for sportswear and apparel wear, which further drives the growth of the textile fibre market.

The study further provides segmentation analysis based on type and application. The cotton segment is expected to witness the highest growth rate during the forecast period due to its excellent qualities like strength, absorbency, and colour retention. The fashion and clothing segment is

expected to be the fastest-growing segment in 2021 as all age groups around the world are becoming more and more interested in fashionable clothing.

The regional analysis reveals that the Asia Pacific region witnessed a major share in the market due to expanding economies, quick technological advancements in sericulture, and the growing usage of silk in textiles. China has the largest textile sector in the world in terms of production and exports, while Germany produces high-quality clothing thanks to significant technological innovation in the industry.

Lastly, the study highlights the impact of Covid-19 on the market, with the growth of the market mainly driven by the increasing demand for comfortable and stylish clothing among consumers.

The demand for clothing is expected to rise in the next few years, driven by factors such as social media, e-commerce, influencer marketing, urbanisation, and increased disposable income. The aesthetic qualities of comfort, softness, colour, and texture are crucial for sportswear

wear, which further drives the growth of the textile fibre market.

The readymade garment industry is a significant consumer of Indian fabrics, and the industry’s contribution innovation, India’s fabric producers are well positioned to meet the growing demand for high-quality

India, a land of diverse culture and tradition, is known for its rich history of textiles and fabrics. India’s textile industry is one of the oldest industries in the world, the country is blessed with a diverse range of natural resources, such as cotton, silk, wool, jute, and many others. The availability of such resources has made India a hub for textile production.

Today, India is a major player in the global textile industry, and its contribution to the readymade garment industry is immense. The readymade garment industry is a significant consumer of Indian fabrics. India is a leading producer of cotton fabrics, which is the most widely used fabric in the readymade garment industry. The country’s cotton production accounts for around 25% of the world’s cotton

production. Indian cotton is known for its high quality and strength, making it ideal for the production of garments.

Apart from cotton, India is also known for its production of silk fabrics. India is the world’s second-largest producer of silk, after China. Indian silk is known for its high quality and is used in the production of high-end garments. The country also produces a variety of other fabrics, such as wool, jute, and synthetic fabrics.

According to the Ministry of Textiles, the production of cotton fabrics in India stood at 6,040 million square meters in 2019-20. The production of man-made fabrics (including rayon and polyester) stood at 4,996 million square meters during the same period. Additionally, India produced 1,200 million square meters of denim fabric in 2019-20.

The Indian textile industry has been modernizing rapidly in recent years, with a focus on technology and innovation. The government has also been supportive of the industry, providing various incentives and subsidies to promote growth. As a result, the industry has seen a significant increase in investment and has become more competitive globally.

India’s fabric producers have also been focusing on sustainable and eco-friendly production practices. The industry has been adopting new technologies and processes to reduce its environmental impact. Many Indian textile companies have also received certifications such as GOTS (Global Organic Textile Standard) and OEKO-TEX, which ensure that their products are produced sustainably and without harmful chemicals.

The production of cotton fabrics in India stood at 6,040 million square meters in 2019-20. The production of man-made fabrics (including rayon and polyester) stood at 4,996 million square meters during the same period. Additionally, India produced 1,200 million square meters of denim fabric in 2019-20, according to the Ministry of Textiles.

contribution to the country’s economy is immense. With a focus on technology, sustainability, and textiles in the global market, analyses Sanjay Chawla, Founder, DFU Publications & FashionatingWorld.

India’s textile industry has several strengths, including a skilled workforce, diverse range of fabrics, and supportive government policies. However, it faces challenges such as competition from other countries, poor infrastructure, and environmental concerns. To capitalize on opportunities and overcome challenges, the industry needs to embrace modernization, innovation, and sustainable practices.

• India has a rich tradition in textile production and has a skilled workforce, which provides a competitive edge in the market.

• The country has a diverse range of fabrics, from traditional textiles like silk and cotton to modern, high-tech fabrics like polyester and nylon.

• India has a vast supply of raw materials, including cotton, jute, wool, and silk, which makes it an attractive destination for textile manufacturers.

• The government has been supportive of the industry, providing various incentives and schemes to boost production and exports.

• India has a large domestic market for textile and apparel products, which provides a stable demand base for the industry.

• The rising demand for sustainable and ecofriendly fabrics presents an opportunity for Indian manufacturers to develop and market these products.

• The growing middle-class population and increasing disposable income in India and other emerging markets provide a large consumer base for the textile and apparel industry.

• The Indian government’s “Make in India” campaign is aimed at boosting manufacturing in the country, providing a favorable environment for the textile industry.

• The government has also announced various incentives and schemes to promote exports, which can help the industry expand its global reach.

• The textile industry in India faces challenges such as poor infrastructure, inadequate power supply, and outdated machinery.

• The industry is also facing stiff competition from countries like China and Bangladesh, which offer cheaper labor and production costs.

• There is a lack of modernization and innovation in the industry, leading to a lack of competitiveness in the global market.

• Environmental regulations are not strictly enforced, leading to pollution and ecological damage from textile manufacturing.

• The COVID-19 pandemic has disrupted supply chains and led to a decline in demand for textile and apparel products, affecting the industry’s growth.

• The industry is heavily dependent on exports, and any changes in trade policies or regulations can impact its profitability.

• The industry needs to adopt modern technologies and processes to improve efficiency and competitiveness in the global market.

• The industry needs to address environmental concerns and adopt sustainable practices to ensure long-term growth and viability.

India’s millmade fabric industry plays a crucial role in the country’s textile sector, providing highquality fabrics for the production of readymade garments and other textiles.

Millmade fabrics are those that are produced in textile mills using automated machines. These fabrics are widely used in the production of readymade garments due to their consistent quality and high production volumes. India is a significant producer and exporter of millmade fabrics, with a diverse range of fabrics produced in the country. Some of the most commonly produced millmade fabrics in India include cotton, polyester, viscose, silk, and wool. These fabrics come in various textures, designs, and finishes and are suitable for a wide range of applications, including apparel, home textiles, and industrial textiles.

According to data from the Ministry of Commerce and Industry, India’s exports of

India’s exports of cotton fabrics were valued at US$ 2.24 billion, exports of synthetic filament yarn-woven fabrics were valued at US$ 840 million and exports of silk fabrics which were valued at US$ 426 million in the financial year 2020-21. Exports of millmade fabrics to the US were valued at US$ 789, to Bangladesh were valued at US$ 702 million, and UAE imported millmade fabrics worth US$ 531 million from India in the same period, according to data from the Ministry of Commerce and Industry.

cotton fabrics (HS code 5208) were valued at US$ 2.24 billion in the financial year 202021. The country’s exports of synthetic filament yarn-woven fabrics (HS code 5407) were valued at US$ 840 million in the same period. India also exports significant quantities of silk fabrics (HS code 5007), which were valued at US$ 426 million in the financial year 2020-21.

In terms of destinations, the United States,

Bangladesh, and the United Arab Emirates are the largest importers of Indian millmade fabrics. India’s exports of millmade fabrics to the United States were valued at US$ 789 million in the financial year 2020-21, while exports to Bangladesh were valued at US$ 702 million. The United Arab Emirates imported millmade fabrics worth US$ 531 million from India in the same period.

The powerloom sector in India faces several challenges, including competition from cheaper imports, outdated technology, low productivity, and lack of access to finance and technology. However, the government has initiated several measures to support the sector.

Powerloom fabrics are an important component of India’s textile industry, accounting for a significant portion of the country’s fabric production and export.

India produces a wide range of powerloom fabrics for the readymade garment industry. Some of the popular powerloom fabrics produced in India include cotton, polyester, viscose, silk, and blends of these fibers.

According to the Ministry of Textiles, India produced 64,320 million square meters of powerloom fabrics in 2019-2020. The production of powerloom fabrics has been steadily increasing over the years, with a CAGR of 5.6% from 2014-15 to 2019-20.

India is a major exporter of powerloom fabrics for readymade garments. According to the Export Promotion Council for Handicrafts, the export of powerloom fabrics (including grey, processed, and made-ups) was worth USD 2.55 billion in 2020-21, accounting for

India produced 64,320 million square meters of powerloom fabrics in 20192020, growing with a CAGR of 5.6% from 2014-15 to 2019-20, according to the Ministry of Textiles. According to the Export Promotion Council for Handicrafts, the export of powerloom fabrics (including grey, processed, and made-ups) was worth USD 2.55 billion in 2020-21, accounting for 17.29% of India’s total textile and apparel exports. USA was the largest export market for India’s powerloom fabrics, accounting for 15.41% of the total exports.

17.29% of India’s total textile and apparel exports.

The top export destinations for India’s powerloom fabrics include the USA, the UK, Germany, Italy, and France. In 2020-21, the USA was the largest export market for India’s powerloom fabrics, accounting for 15.41% of the total exports.

The powerloom sector in India faces several challenges, including competition from cheaper imports, outdated technology, low productivity,

and lack of access to finance and technology. However, the government has initiated several measures to support the sector, including the Technology Upgradation Fund Scheme, the Amended Technology Upgradation Fund Scheme, and the PowerTex India Scheme, among others. These initiatives aim to provide financial and technological support to the powerloom sector and help it become more competitive in the global market.

India’s fabric industry is a key strength of the country’s domestic readymade garment industry. The industry produces a diverse range of fabrics, which are highly prized in the domestic market for their quality and versatility. The government’s initiatives to support the textile and apparel industry are expected to further strengthen the fabric industry’s role in supporting the domestic RMG industry.

India’s fabric industry is a crucial component of the country’s textile and apparel sector, and it plays a vital role in supporting the domestic readymade garment (RMG) industry. The RMG industry is one of the largest contributors to India’s textile and apparel sector, and it is expected to continue to grow in the coming years.

India’s fabric industry has several strengths that make it well-suited to support the domestic RMG industry. The country produces a diverse range of fabrics, including cotton, silk, wool, jute, and synthetic fabrics, which are used to manufacture a wide variety of garments. Indian fabrics are known for their quality, durability, and versatility, and they are highly prized in the domestic market.

According to the data from the Ministry of

The domestic market for textiles and apparel in India was valued at INR 7.86 trillion in 2020-21. The readymade garment segment accounted for a significant portion of this market, with a value of INR 3.14 trillion, according to the data from the Ministry of Textiles.

Textiles, the domestic market for textiles and apparel in India was valued at INR 7.86 trillion in 2020-21. The readymade garment segment accounted for a significant portion of this market, with a value of INR 3.14 trillion. The demand for RMG in India is driven by several factors, including rising disposable incomes, changing fashion trends, and the growing influence of social media.

India’s fabric industry supports the domestic RMG industry by providing high-quality fabrics at competitive prices. The industry is highly fragmented, with numerous small and

medium-sized enterprises (SMEs) spread across the country. These SMEs cater to the diverse needs of the domestic market, and they are well-suited to producing small batches of fabrics and customized designs.

The government has also implemented several initiatives to support the domestic textile and apparel industry, such as the National Textile Policy and the Make in India initiative. These initiatives aim to promote domestic manufacturing, boost exports, and create employment opportunities in the industry.

India’s textile industry is a significant exporter of fabrics for the readymade garment industry. With a focus on technology, sustainability, and innovation, India’s textile exporters are well positioned to meet the growing demand for high-quality textiles in the global market, driven by the government’s supportive policies and the industry’s entrepreneurial spirit.

India’s textile industry is a significant exporter of fabrics for the readymade garment industry. With a focus on technology, sustainability, and innovation, India’s textile exporters are well positioned to meet the growing demand for high-quality textiles in the global market, driven by the government’s supportive policies and the industry’s entrepreneurial spirit.

India is one of the world’s largest producers and exporters of textiles and fabrics, making it a significant player in the global readymade garment industry. The country’s textile industry has a long history dating back to ancient times, and it has evolved into a modern, technologydriven sector that generates significant revenue through exports.

The readymade garment industry is a significant consumer of Indian fabrics, and India is one of the largest exporters of cotton fabrics in the world. In 2020, India exported cotton fabrics worth $2.84 billion, accounting for 14.4% of the country’s total textile exports. Apart from cotton, India is also known for its production of silk fabrics. The country is the world’s second-largest producer of silk, after

In 2020, India exported cotton fabrics worth $2.84 billion, accounting for 14.4% of the country’s total textile export and exported silk fabrics worth $0.36 billion, accounting for 1.8% of the country’s total textile exports. India exported woolen fabrics worth $0.22 billion, jute fabrics worth $0.13 billion, and synthetic fabrics worth $0.22 billion.

China, and is a major exporter of silk fabrics to the global market. In 2020, India exported silk fabrics worth $0.36 billion, accounting for 1.8% of the country’s total textile exports.

The Indian textile industry also produces a variety of other fabrics, such as wool, jute, and synthetic fabrics, and is a significant exporter of these fabrics to the global market. In 2020, India exported woolen fabrics worth $0.22 billion, jute fabrics worth $0.13 billion, and synthetic fabrics worth $0.22 billion.

The United States is the largest market for Indian textile exports, accounting for around 15% of the country’s total textile exports. Other major markets include the European Union, the United Arab Emirates, and Bangladesh. In 2020, India’s textile exports to the United States were valued at $3.83 billion, while exports to the European Union were valued at $3.34 billion.

The Indian government has been supportive of the textile industry, providing various incentives and schemes to promote exports. The Merchandise Exports from India Scheme (MEIS) provides financial assistance to exporters of textile products, while the Market Access Initiative (MAI) scheme provides funding for market development activities in foreign countries. The government has also set up textile parks and clusters to encourage the development of textile manufacturing and export hubs.

The COVID-19 pandemic had a significant impact on India’s textile exports, with exports declining by 17.5% in 2020-21 due to disruptions in supply chains and reduced demand from major markets. However, the industry has been bouncing back, with exports showing signs of recovery in the latter half of 2021.

Indian garment industry heavily relies on imports of fabrics to meet the demands of its growing market. The industry imports a significant amount of synthetic, man-made, and cotton fabrics from countries such as China, South Korea, and Bangladesh. With the Indian garment industry projected to grow in the coming years, the demand for imported fabrics is expected to increase, presenting opportunities for foreign fabric exporters.

Despite the India’s strength in textiles and fabrics, the country also imports fabrics to meet the demand of its thriving readymade garment industry. China is the largest source of fabric imports for India, accounting for 43% of the total imports in 2019-20. Other major sources of fabric imports for India include Korea, Taiwan, Indonesia, and Thailand.

India is a large importer of synthetic and man-made fabrics, as the country’s domestic production is not enough to meet the demands of its growing garment industry. In 2020, India imported around 423 million square meters of man-made fabrics, with polyester being the most imported fabric. India imported around 295 million square meters of polyester fabrics in 2020, followed by nylon and viscose.

According to the data from the Directorate General of Commercial Intelligence and Statistics (DGCI&S), India’s fabric imports were valued at USD 2.66 billion in 2019-20, up from USD 2.49 billion in the previous year. Polyester fabrics were the most imported, accounting for 32% of the total fabric imports, followed by cotton fabrics (21%), viscose fabrics (16%), and nylon fabrics (9%).

In 2020, India imported around 423 million square meters of man-made fabrics, with polyester fabric imports around 295 million square meters, followed by nylon and viscose. Indian garment manufacturers import fabrics from countries such as China, South Korea, Japan, Taiwan, and Indonesia.

The country also imported around 200 million square meters of cotton fabrics in 2020, with the majority of imports coming from countries such as Bangladesh, China, and Vietnam.

The Indian garment industry heavily relies on imports of fabrics to produce high-quality garments. Indian garment manufacturers import fabrics from countries such as China, South Korea, Japan, Taiwan, and Indonesia.

Apart from synthetic and man-made fabrics, India also imports a significant amount of cotton fabrics to meet the demand of its readymade garment industry. The country imported around 200 million square meters of cotton fabrics in 2020, with the majority of imports coming from countries such as Bangladesh, China, and Vietnam.

India imports a variety of fabrics from China, including both natural and synthetic fibers. According to the data from the Ministry of

Commerce and Industry, India’s imports of textile and apparel products from China stood at $2.8 billion in 2020-21, down from $3.3 billion in the previous year.

The Indian government has been supportive of the country’s garment industry and has implemented various policies and incentives to promote growth. However, the industry still relies heavily on imports of fabrics, as the domestic production is not enough to meet the demand of the growing industry.

The Indian garment industry is projected to grow at a compound annual growth rate (CAGR) of 9.4% from 2021 to 2026. This growth is expected to drive the demand for imported fabrics in the coming years.

India’s imports of fabrics from Europe play a crucial role in meeting the demands of the domestic textile and apparel industry. While the government has implemented measures to regulate imports and protect domestic interests, the import of fabrics from Europe is expected to continue to play an important role in the Indian textile and apparel industry.

India is one of the largest importers of fabrics from Europe. European countries are known for producing high-quality fabrics, and Indian textile and apparel manufacturers import a significant amount of fabrics from Europe to cater to the demands of the domestic market.

According to the data from the Ministry of Commerce and Industry, the total value of fabric imports from Europe to India in 202021 was USD 1.06 billion. This represents a decline of 30.54% compared to the previous year, which can be attributed to the disruptions caused by the COVID-19 pandemic.

The total value of fabric imports from Europe to India in 2020-21 was USD 1.06 billion. Italy is the largest exporter of fabrics to India. In 2020-21, the total value of fabric imports from Italy to India was USD 238.06 million. Other major European exporters of fabrics to India include Germany, Spain, France, and the United Kingdom, according to the data from the Ministry of Commerce and Industry.

Among European countries, Italy is the largest exporter of fabrics to India. In 2020-21, the total value of fabric imports from Italy to India was USD 238.06 million. Other major European exporters of fabrics to India include Germany, Spain, France, and the United Kingdom.

The types of fabrics that are imported from Europe to India vary widely, depending on the needs of the domestic market. Indian textile and apparel manufacturers import a range of fabrics such as wool, silk, cotton, linen, and synthetic fabrics from Europe. These fabrics are used to manufacture a variety of garments such as shirts, dresses, trousers, and suits.

The Indian government has implemented several measures to regulate the import of fabrics from Europe and other countries. These measures include import tariffs, anti-dumping duties, and quality control regulations. The government’s aim is to protect the interests of the domestic textile and apparel industry, while also ensuring that consumers have access to high-quality and affordable fabrics.

Import duty rates on fabrics can vary depending on the trade agreements and treaties signed between India and other countries. For instance, under the Asia-Pacific Trade Agreement (APTA), India provides preferential duty rates to member countries on a range of products, including textiles and clothing.

In India, the import duty on fabrics is structured based on the type of fabric and the country of origin. The applicable duty rates vary from 0% to 20% depending on the fabric type and origin.

For instance, the import duty on cotton fabrics from countries such as Bangladesh, Pakistan, and Sri Lanka is zero, while the duty on cotton fabrics from other countries is 5%. Similarly, the import duty on silk fabrics from all countries is 10%, while the duty on wool fabrics from all countries is 5%.The Indian government periodically revises the import duty rates on fabrics as part of its trade policy

The applicable duty rates vary from 0% to 20% depending on the fabric type and origin. For instance, the import duty on cotton fabrics from countries such as Bangladesh, Pakistan, and Sri Lanka is zero, while the duty on cotton fabrics from other countries is 5%.

measures. The aim of the duty structure is to protect the domestic textile industry while promoting the country’s trade interests.

It is worth noting that the import duty rates on fabrics can vary depending on the trade agreements and treaties signed between India and other countries. For instance, under the Asia-Pacific Trade Agreement (APTA), India

provides preferential duty rates to member countries on a range of products, including textiles and clothing.

The import duty structure on fabrics in India is designed to balance the interests of domestic producers and consumers with the country’s trade goals.

The Indian shirting fabric industry is a vital component of the country’s textile and apparel sector. The industry’s growth is supported by the government’s initiatives, and its exports are expected to continue to increase in the coming years.

Shirting fabrics are an essential component of the Indian textile and apparel industry, and India is one of the largest producers of shirting fabrics in the world. Shirting fabrics are primarily used for manufacturing shirts, which are popular among Indian consumers as well as in the international market.

Indian shirting fabrics are known for their quality, durability, and affordability. Indian manufacturers produce a wide range of shirting fabrics using different types of materials such as cotton, linen, silk, and synthetic fibers. The shirting fabrics are available in different weaves such as plain, twill, and satin weaves, and different finishes such as mercerized, nonmercerized, and easy care finishes.

According to the data from the Ministry of Commerce and Industry, the total value of shirting fabric exports from India in 2020-21 was USD 506.82 million. The major export destinations for Indian shirting fabrics are the United States, the United Arab Emirates, the United Kingdom, Sri Lanka, and Bangladesh.

The Indian shirting fabric industry is highly

The total value of shirting fabric exports from India in 2020-21 was USD 506.82 million. The major export destinations for Indian shirting fabrics are the United States, the United Arab Emirates, the United Kingdom, Sri Lanka, and Bangladesh, according to the data from the Ministry of Commerce and Industry.

fragmented, with numerous small and mediumsized enterprises (SMEs) spread across the country. These SMEs produce a range of shirting fabrics, from basic and affordable fabrics to high-end and premium fabrics. The industry is also known for its innovation and creativity, with manufacturers constantly developing new designs, weaves, and finishes to meet the changing demands of the market.

The Indian government has implemented several measures to support the shirting fabric industry, such as providing subsidies for technology upgradation, skill development initiatives, and export promotion schemes. These measures have helped the industry to enhance its competitiveness in the international market and increase its exports.

India’s shirting fabric imports are an important component of the country’s textile and apparel sector and the country relies heavily on imports to meet the domestic demand for shirts. The government’s initiatives to support the domestic shirting fabric industry may help reduce India’s dependence on imports in the long term

India imports a significant amount of shirting fabrics for shirts from other countries to meet the domestic demand. India’s shirting fabric imports include both basic and premium fabrics, as well as different weaves and finishes.

According to the data from the Ministry of Commerce and Industry, the total value of shirting fabric imports to India in 2020-21 was USD 1,233.26 million. The major shirting fabric import sources for India are China, South Korea, Indonesia, Thailand, and Italy.

China is the largest shirting fabric supplier to India, accounting for around 35% of India’s total shirting fabric imports in 2020-21. South

The total value of shirting fabric imports to India in 2020-21 was USD 1,233.26 million. China is the largest shirting fabric supplier to India, accounting for around 35% of India’s total shirting fabric imports in 202021. South Korea and Indonesia are the second and third-largest shirting fabric suppliers to India, with a share of around 13% and 12%, respectively, according to the data from the Ministry of Commerce and Industry.

Korea and Indonesia are the second and thirdlargest shirting fabric suppliers to India, with a share of around 13% and 12%, respectively.

India’s shirting fabric imports are expected to continue to grow in the coming years due to the rising demand for shirts in the domestic market. The Indian government has

implemented several measures to promote the domestic shirting fabric industry, such as providing subsidies for technology upgradation and skill development initiatives, which may help reduce the country’s dependence on imports.

India is a significant producer of suiting fabrics made from wool, polyester, and blends.

These fabrics are commonly used for making suits and trousers and are preferred for their durability, comfort, and aesthetic appeal.

As for statistics, the suiting fabric industry in India is a significant contributor to the country’s economy. According to the Ministry of Textiles, India’s suiting fabric production was around 20 million meters in 2019-20, with woolen fabrics accounting for 20% of the

India’s suiting fabric production was around 20 million meters in 2019-20, with woolen fabrics accounting for 20% of the production, polyester fabrics accounting for 50%, and blended fabrics accounting for the remaining 30%, according to the Ministry of Textiles.

production, polyester fabrics accounting for 50%, and blended fabrics accounting for the remaining 30%. The suiting fabric industry in India also provides employment to around 1.5

million people, making it a significant source of livelihood for many.

India also imports a significant amount of suiting fabrics made from wool, polyester, and blends to cater to the demand for high-quality fabrics.

India imports high-quality wool suiting fabrics from countries such as Italy, the UK, and Australia. These fabrics are known for their superior quality, luxurious feel, and natural drape.

India’s import of suiting fabrics has been on the rise in recent years. According to the Ministry of Commerce, India imported suiting fabrics worth $1.7 billion in 2020-21, a significant increase from $1.4 billion in 201920. The majority of the suiting fabrics imported were made from polyester, followed by wool and blended fabrics. China was the largest exporter of suiting fabrics to India, accounting

India imported suiting fabrics worth $1.7 billion in 2020-21, a significant increase from $1.4 billion in 2019-20. China was the largest exporter of suiting fabrics to India, accounting for over 50% of the total imports, followed by countries such as Italy, Korea, and Taiwan, according to the Ministry of Commerce.

for over 50% of the total imports, followed by countries such as Italy, Korea, and Taiwan. Polyester suiting fabrics are imported from countries such as China, Taiwan, and Korea. These fabrics are known for their affordability, durability, and wrinkle-resistant properties.

India imports blended suiting fabrics made from wool and polyester, wool and viscose, and wool and silk from various countries. These fabrics are popular for their durability, affordability, and natural drape.

India’s imports of fabrics from Europe play a crucial role in meeting the demands of the domestic textile and apparel industry. While the government has implemented measures to regulate imports and protect domestic interests, the import of fabrics from Europe is expected to continue to play an important role in the Indian textile and apparel industry.

Denim is a popular fabric for jeanswear, and India has emerged as a major producer of denim fabrics in recent years. The country produces a wide range of denim fabrics in different weights, shades, and finishes.

Indian denim manufacturers use various types of yarns, including cotton, polyester, and stretch yarns, to produce denim fabrics with different characteristics. The denim fabrics produced in India are known for their durability, comfort, and style.

The Indian denim industry has been growing rapidly in recent years, and the country is now one of the leading producers of denim fabrics in the world. According to a report by Statista, the production of denim fabric in India amounted to approximately 1.35 billion meters in 2020, up from 1.28 billion meters in 2019. The same report predicts that the production

The production of denim fabric in India amounted to approximately 1.35 billion meters in 2020, up from 1.28 billion meters in 2019, projected to reach 1.55 billion meters by 2025, according to a report by Statista.

of denim fabric in India will reach 1.55 billion meters by 2025.

India’s denim industry is concentrated in a few key states, including Gujarat, Maharashtra, and Tamil Nadu. The industry comprises a mix of large, medium, and small-scale units, and it is known for its innovative and sustainable practices.

Indian denim manufacturers are known for their ability to produce high-quality denim fabrics at competitive prices. The industry is expected to continue growing in the coming years, driven by increasing demand for denim apparel in both domestic and international markets.

To remain competitive in the global market, India’s denim fabric industry needs to focus on innovation, sustainability, and product diversification. With the right policy interventions and industry initiatives, India’s denim fabric industry can continue to grow and expand its global footprint.

India’s denim fabric exports have been growing steadily in recent years, driven by the increasing demand for denim apparel in the global market. According to data from the Ministry of Commerce and Industry, India exported denim fabric worth USD 548.46 million in 2020-21, up from USD 527.08 million in the previous year.

The top export destinations for Indian denim fabric include Bangladesh, Egypt, Turkey, Morocco, and Mexico. These countries are major producers of denim apparel and rely on Indian denim fabric for their manufacturing needs. In terms of volume, India exported around 192.56 million square meters of denim fabric in 2020-21, up from 181.04 million square meters in the previous year. The average export price of Indian denim fabric was USD 2.84 per square meter in 2020-21.

India exported denim fabric worth USD 548.46 million in 2020-21, up from USD 527.08 million in the previous year. In terms of volume, India exported around 192.56 million square meters of denim fabric in 2020-21, up from 181.04 million square meters in the previous year. The average export price of Indian denim fabric was USD 2.84 per square meter in 2020-21, according to data from the Ministry of Commerce and Industry.

India’s denim fabric industry is highly fragmented, with numerous small and mediumsized enterprises (SMEs) spread across the country. The country has a long history of denim fabric production, and its denim fabrics are known for their quality, durability, and affordability.

To remain competitive in the global market, India’s denim fabric industry needs to focus on innovation, sustainability, and product diversification. The industry needs to adopt

new technologies, reduce its environmental footprint, and develop new fabrics and finishes to cater to the changing demands of the global market.

With the right policy interventions and industry initiatives, India’s denim fabric industry can continue to grow and expand its global footprint.

India produces a wide range of fabrics for women’s western wear, including natural and synthetic fibers. The industry is expected to grow in the coming years, and the government’s initiatives to support the industry may help to boost production and meet the growing demand for women’s western wear.

India produces a wide range of fabrics for women’s western wear, including both natural and synthetic fibers. These fabrics are used to make a variety of garments such as dresses, skirts, tops, and trousers.

Cotton is one of the most commonly used fabrics for women’s western wear in India due to its comfort, durability, and affordability. India is one of the world’s largest producers of cotton, with a production of around 36 million bales in 2020-21.

Apart from cotton, India also produces other natural fabrics such as silk, wool, and linen. The country’s silk production was around 30,000 tonnes in 2019-20, making it the second-largest producer of silk in the world

The production of fabrics for women’s western wear in India was around 5,885 million square meters in 2019-20. Of this, cotton fabrics accounted for the majority of the production at around 54%, followed by polyester fabrics at around 20%, according to the data from the Ministry of Textiles.

after China.

In addition to natural fibers, India also produces a wide range of synthetic fabrics such as polyester, nylon, and rayon. Polyester is the most commonly used synthetic fabric in India’s women’s western wear industry due to its affordability and versatility.

According to the data from the Ministry of Textiles, the production of fabrics for women’s western wear in India was around 5,885 million square meters in 2019-20. Of

this, cotton fabrics accounted for the majority of the production at around 54%, followed by polyester fabrics at around 20%.

India’s women’s western wear fabric industry is expected to grow in the coming years due to the rising demand for western-style clothing among women in the country. The government has implemented several initiatives to support the growth of the industry, such as providing subsidies for technology upgradation and skill development initiatives.

India is a major importer of fabrics for women’s western wear. The country’s fashion industry is heavily influenced by western styles, and as a result, there is a significant demand for imported fabrics that are not produced locally.

Some of the commonly imported fabrics for women’s western wear in India include denims, the country mainly imports denim from China, Bangladesh, and Pakistan. Polyester fabrics are also being imported, India imports polyester fabrics from countries such as China, South Korea, and Taiwan.

Some of the other fabrics being imported for women’s western wear garments are Rayon, Lace fabrics and Silk fabrics. These fabrics are mainly imported from China, Indonesia, Hong Kong, South Korea whereas Silk fabrics are mainly imported from China, Japan, and Italy.

According to the Ministry of Commerce and Industry, the value of India’s fabric imports for the April-December 2021 period was $3.3 billion. Of this, the majority of imports were for cotton fabrics, followed by polyester fabrics. The largest exporters of fabrics to India during this period were China, Bangladesh, and Vietnam.

The value of India’s fabric imports for the April-December 2021 period was $3.3 billion. Of this, the majority of imports were for cotton fabrics, followed by polyester fabrics. The largest exporters of fabrics to India during this period were China, Bangladesh, and Vietnam, according to the Ministry of Commerce and Industry.

India is one of the largest producers and exporters of textiles in the world, including fabrics for kid’s wear. The country’s textile industry is diverse, ranging from traditional handloom textiles to modern textile manufacturing. Fabrics for kid’s wear produced in India include cotton, silk, polyester, and blends of various materials.

Cotton is the most commonly used fabric for kid’s wear in India due to its comfort, breathability, and affordability. Cotton is also easy to maintain and durable, making it a popular choice for everyday wear. India is the world’s largest producer of cotton, accounting for approximately 25% of the world’s cotton production.

Silk is another popular fabric for kid’s wear, particularly for special occasions such as weddings and festivals. India is known for its traditional silk fabrics such as Banarasi silk, Kanjeevaram silk, and Muga silk, which are popular choices for kid’s ethnic wear.

The Indian textile industry is expected to reach $223 billion by 2021, with the domestic market for kid’s wear growing at a CAGR of 8.5%, according to a report by the Textile Ministry of India.

Polyester and polyester blends are also commonly used for kid’s wear in India, particularly for sportswear and casual wear. Polyester is lightweight, durable, and easy to maintain, making it ideal for active children. According to a report by the Textile Ministry of India, the Indian textile industry is expected to reach $223 billion by 2021, with the domestic market for kid’s wear growing at a CAGR of 8.5%. The report also states that cotton accounts for approximately 67% of India’s total textile exports, with the United States, the European Union, and the United Arab Emirates being the largest importers of Indian textiles.

India imports a wide range of fabrics for kid’s wear, including cotton, polyester, nylon, and spandex. International brands produced in India source their materials from other countries, particularly for premium products and specialized clothing like sportswear and swimwear.

India is a major importer of fabrics for kid’s wear, with many international brands and retailers sourcing their materials from other countries. The most commonly imported fabrics for kid’s wear in India include cotton, polyester, nylon, and spandex.

Cotton is the most imported fabric for kid’s wear in India, with many brands sourcing high-quality cotton from countries like Egypt, the United States, and Australia. These cotton fabrics are often used for premium kid’s wear products, such as high-end baby clothes and designer kid’s wear.

Polyester is another commonly imported fabric for kid’s wear in India, particularly for sportswear and outdoor clothing. Many international brands source high-quality polyester fabrics from countries like China,

Cotton is the most imported fabric for kid’s wear in India, from countries like Egypt, the United States, and Australia. Polyester particularly for sportswear and outdoor clothingis imported from countries like China, Taiwan, and South Korea and Nylon and spandex fabrics are also imported for kid’s wear in India, particularly for activewear and swimwear from countries like Italy, Spain, and the United States.

Taiwan, and South Korea, which offer a wide range of options in terms of colors, textures, and finishes.

Nylon and spandex are also imported for kid’s wear in India, particularly for activewear and swimwear. Many international brands source high-quality nylon and spandex fabrics from countries like Italy, Spain, and the United States, which offer a range of options in terms

of stretch, durability, and UV protection. According to a report by the Ministry of Commerce and Industry, the value of textile imports in India stood at USD 6.28 billion in 2020, with cotton accounting for approximately 27% of the total value of textile imports. Polyester, nylon, and spandex together accounted for approximately 15% of the total value of textile imports.

for kid’s wear produced in India are diverse, with cotton being the most commonly used fabric due to its comfort, breathability, and affordability. The Indian textile industry is expected to continue growing, with the domestic market for kid’s wear showing strong growth potential.

Handloom fabrics have a rich tradition in India and are popular for their unique designs and craftsmanship. These fabrics are made by skilled artisans using traditional techniques and are often used to create high-end, luxury garments.

According to the Ministry of Textiles, the production of handloom fabrics in India stood at 720 million square meters in 2019-20, with a value of around Rs. 2,300 crore. The handloom sector provides employment to around 43 lakh weavers and allied workers in the country.

Here are some of the most popular handloom fabrics used in the readymade garment industry in India:

Khadi: Khadi is a handspun and handwoven fabric that is made using natural fibers like cotton, silk, or wool. It is known for its rough texture and is often used to make shirts, kurtas, and other traditional garments.

Chanderi: Chanderi is a lightweight fabric

The production of handloom fabrics in India stood at 720 million square meters in 2019-20, with a value of around Rs. 2,300 crore, according to the Ministry of Textiles.

that is made using a blend of silk and cotton. It is known for its sheer texture and delicate motifs and is often used to make sarees, suits, and dupattas.

Maheshwari: Maheshwari is a handloom fabric that is made using a combination of cotton and silk. It is known for its distinctive designs and is often used to make sarees, salwar suits, and dupattas.

Tussar Silk: Tussar silk is a type of silk that is produced by wild silkworms. It has a textured

surface and is known for its rich, earthy tones. It is often used to make sarees, suits, and other traditional garments.

Banarasi Silk: Banarasi silk is a luxurious fabric that is made using a combination of silk and zari (metallic thread). It is known for its intricate designs and is often used to make bridal wear and other high-end garments.

India is a major exporter of handloom fabrics and it exports a wide range of handloom fabrics for the production of ready-made garments. With the right policy support and industry initiatives, India’s handloom fabric industry can continue to thrive and grow, and maintain its status as a leading supplier of handloom fabrics to te world for the production of ready-made garments.

Handloom fabrics are an integral part of India’s rich cultural heritage, and they continue to be in demand both domestically and globally. Handloom fabrics are traditionally made using manual techniques on a loom, and they are known for their unique texture, weave, and design. They are popularly used in the production of ready-made garments, particularly in the high-end fashion industry.

India is a major exporter of handloom fabrics, and it exports a wide range of handloom fabrics for the production of readymade garments. The following are the details of the types of handloom fabrics that India exports for the production of ready-made garments, along with statistics: Khadi: Khadi is a hand-spun, hand-woven fabric made from cotton, silk, or wool. It is known for its unique texture, durability, and comfort. Khadi fabrics are widely used in the production of readymade garments, particularly in the high-end fashion industry. In 2020-21, India exported Khadi fabrics worth USD 4.9 million.

Ikat: Ikat is a hand-woven fabric that is characterized by its unique design, which is

In 2020-21, India exported Khadi fabrics worth USD 4.9 million, Ikat fabrics worth USD 4.2 million, Chanderi fabrics worth USD 3.9 million, Banarasi fabrics worth USD 3.4 million and Maheshwari fabrics worth USD 2.2 million.

created by tie-dyeing the yarn before weaving it on a loom. Ikat fabrics are known for their intricate patterns, bold colors, and durability.

In 2020-21, India exported Ikat fabrics worth USD 4.2 million.

Chanderi: Chanderi is a hand-woven fabric that is traditionally made using silk and cotton. It is known for its fine texture, lightweight, and sheer quality. Chanderi fabrics are widely used in the production of sarees, suits, and other traditional garments. In 2020-21, India exported Chanderi fabrics worth USD 3.9 million. Banarasi: Banarasi is a hand-woven fabric that is traditionally made in the city of Varanasi. It is known for its intricate designs, luxurious texture, and durability. Banarasi fabrics are widely used in the production of sarees, suits, and other traditional garments.

In 2020-21, India exported Banarasi fabrics worth USD 3.4 million.

Maheshwari: Maheshwari is a hand-woven fabric that is traditionally made in the town of Maheshwar. It is known for its unique designs, lightweight, and durability. Maheshwari fabrics are widely used in the production of sarees, suits, and other traditional garments. In 202021, India exported Maheshwari fabrics worth USD 2.2 million.

India’s handloom fabric industry is a vital part of the country’s cultural and economic landscape. The industry provides employment to millions of weavers, artisans, and workers across the country, and it contributes significantly to the country’s exports. With the right policy support and industry initiatives, India’s handloom fabric industry can continue to thrive and grow, and maintain its status as a leading supplier of handloom fabrics for the production of ready-made garments.

Launched way back in 2012, Absoluto offers high quality fashion fabric for Suitings, Ethnic wear and Jacketing, sourced from across the world. With its excellent quality of imported fabric and strong customer base, the fabric brand has already created a niche of its own. Kamal Seksaria, CEO, KBS International, the parent company of Absoluto, speaks to Team DFU about latest market trends, consumer behavior and his brand’s future plans.

The brand was launched in 2012. I have been into textiles for 41 years and the family is into exports since the last 45 years. And now our next generation, Harsh Seksaria is taking the command gradually. We are both into export and import. In Absoluto, we primarily deal in Semi Luxury and Luxury products with affordable high fashion fabrics for men’s wear. Our USP is offering best designs presented in the best manner. Our target consumer group is Youth ( 20 Years and above), an HNI and also celebrities/

We are fortunately from the first few entrants who understood the importance of changing market requirements two decades ago and wholeheartedly ventured in to TR suitings. Since then, we have been quite experimental towards quality enhancement, design and new texture developments, playing with colours going beyond even the range of Holi.

• Absoluto was launched in 2012, launched a new brand ‘Alacarte’ only for European fabrics

• Deals in high fashion Semi Luxury, Luxury affordable fabrics for men’s wear

• Deal in men’s western wear, designer wear and ethnic wear only

• Woven, knitted suiting, jacquards, embroidered fabrics in T/R, P/W, Pure Wool, Wool Silk and other Luxury blends

• Sourcing from the top notch factories of the world, best in the class!

• Target consumer group is Youth ( 20 Years and above),HNIs and celebrities

• Sells through wholesalers and 3000 retailers, 2 LFR stores and own boutiques in Delhi

• Wants to spread out more in international market

This business depends on the long standing relationships. If we do not think of the well being of customers then how can the product sell? Earlier, people were not aware of fashion but because of media, television and internet they have become aware of fashion, feel of fabric, style, look and fall of fabric and have become concerned about it. That is the trend now.

Today people are ready to spend. At times cost does not matter if the quality is good and

at times it does matter. If manufacturers take the initiative to increase quality by a small margin it will be beneficial for consumer as they get better quality and eventually sale goes up.

If you take any of our collection each product goes through six to seven odd manufacturing processes while others have to sell good quantity. They have market pressures, shareholder’s pressure and have to show turnover. We don’t have all these issues. We don’t have issue of production and shareholders and we don’t have targets,

“Recently we have launched a new brand Alacarte in which we are marketing only European fabrics. This is to cater sheer Luxury to the crème de la crème of the country. We are working on few still more luxury fabrics for India clients. Which is rarely been offered in true sense by Indian vendors.”

so we don’t have to hire anyone. Our business is small and we can take care of ourselves. Big players have a different way of handling their business and small players have their own way. We don’t want to reach high volume but want to concentrate on our product not our figures. The figures will follow the product.

We have an option of nearly thousands of fabric designs readily available. The range constitutes of woven and knitted suiting, jacquards, embroidered fabrics etc. from T/R to P/W, Pure Wool, Wool Silk, Wool Cashmere and other Luxury blends, as we basically deal in men’s western wear, designer wear and ethnic wear only.

The market is not changing, trends is changing. Previously the common man wore tailored clothes and rich wore readymade but today there is a 360 degree change. This is the reason for rise in readymade market. We are focusing on men’s section from the age group of 20 to 40 years for their requirement of readymade garment, such as office and casual wear. We want to give our customers complete comfortable fabric so they get complete comfort in their clothes.

We have been doing quite well in our own respect, in last 8 years our sales turnover has grown from ₹140 Million to ₹ 856 Million, which we think is satisfactory for a small company like us.

There is a huge awareness about quality products. People prefer to pay a little more if they get better quality. This prevails in between brand preferences also. I don’t see any challenge. If one can maintain product quality one need not worry about challenges.

We do all kinds of innovations with the fabric colour, texture, the feel of the fabric. We design the product and manufacture it with the best in class producers. Regarding distributors we have wholesalers and direct retailers and our own marketing network, own boutiques in Delhi and present in over 3000 MBO fabric retailers across the country. Retail is the best mode of business as it is over the counter sale. The best business comes from designer wear as it is customer oriented. We supply to major quality conscious garment manufacturers.

We would like to spread all over the world with our product so we are making our strategy plan.

What is your strategy to stay ahead?

Recently we have launched a new brand Alacarte in which we are marketing only European fabrics. This is to cater sheer Luxury to the crème de la crème of the country. We are working on few still more luxury fabrics for India clients. Which is rarely been offered in true sense by Indian vendors.

What has changed in fabric business and fabric buyers in India over the years? How has consumer changed?

There are few customers who still have an old approach of being brand conscious instead of quality conscious, but more of them are in rural area. Today, an urban client is very fashion and quality conscious. They are well accepting the new brands who understand the international quality and fashion trends.

In the top reality show KBC season 13 &14 and also in many more shows, Absoluto fabrics had been selected effortlessly on their merits. First time some fabric collection had passed all parameters in one go. That is the truthfulness of the product and sincere efforts that takes us to success.

Please share details about the impact of Covid on fabric business? Has it changed the business forever? What is the new normal?

IN 2020-21 business was to the tune of about 60% from previous year but in 202122 it picked up and we have comfortably crossed the pre-Covid sale . The last year was much better.

How have consumer trends changed?

In recent years consumers are more inclined towards Indian ethnic wear, mainly inspired by TV shows . It’s a good sign.

“Why should menswear always have just conventional colours?” is the question this young generation is replying by breaking conventional norms. Now menswear is becoming very vibrant, and that is good sign for lifestyle.

Tell us about the difference between Indian fabric manufacturers and international manufacturers?

In my eyes, with due respect, Indian manufacturers are not very disciplined or quality conscious. We source our goods from the top notch factories of the world, best in the class, so we always get good services and best quality.

What is bringing in change in retailing of fabrics over the counter, what seems to be the future?

Let me explain, earlier there was 1 host and 1 guest, whereas now in last 20-25 years the times have changed, there are 3 hosts for each guest .So each buyer there are many number of suppliers keen to supply, there is always excess supply in the market . This is good situation for people who have an eye for perfection and quest to deliver nothing but ONLY THE BEST. And we claim that ABSOLUTO THE BEST! Fortunately we sense the opportunity faster and earlier than average supplier, that gives us a big advantage.

What is your vision about the readymade garment business in India?

We trust readymade garment business will have more share in future and everyone have to be in that value chain to grow. There is going to be great market for high quality products at affordable prices.

“This is good situation for people who have an eye for perfection and quest to deliver nothing but ONLY THE BEST. And we claim that ABSOLUTO THE BEST! Fortunately we sense the opportunity faster and earlier than average supplier, that gives us a big advantage.”Harsh Saksaria, KBS International

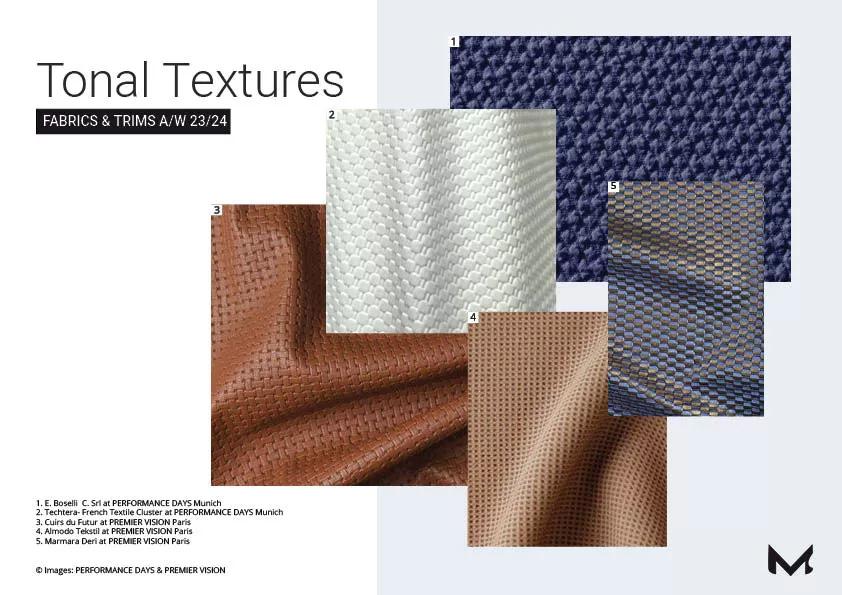

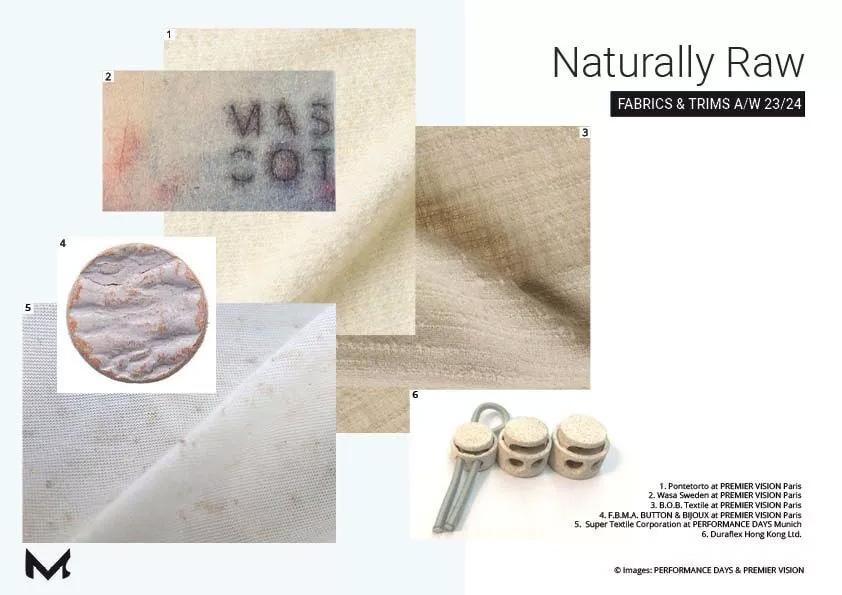

A/W 23/24

Seen at PREMIER VISION and PERFORMANCE DAYS

In this trend report of textile innovations, you my breakdown of the latest Performance Days in Munich and Premier Vision Paris for the A/W 23/24 season. Because fashion and sports influence each other.

The well-known fabric fair for sports fabric and textile innovations concentrate this season on CO2 reducing technologies to reduce this huge impact on climate change. In the Focus Topic category only material and fiber manufacturers who can demonstrate a reduced carbon footprint participate.

In general, four different categories that guarantee lower CO2 emissions when applied can be distinguished:

Synthetic fibers: with variants made from recycled polyester, polyamide or polypropylene

Natural fibers such as Tencel, hemp, Naia spun fiber or recycled natural fiber variants

All fibers that refrain from the use of a chemical dyeing process, instead being spun dyed or with the use of dope dyed yarn

The fourth group is defined by those fibers that combine several variants – i.e. are dyed or recycled in an energy-saving manner or use natural fibers

The main topics for fabrics are:

essential singularity | opulent sobirety | exceptional imperfections | silver focus | sustainability

Sports & Tech fabrics are divided in the following themes:

Micro-velvety surfaces

In pursuit of nature

Rethinking Elasticity

Accessories: reflecting plains

Accessories: Practical Camping

Plains with a secret

The following five trends for fabrics and accessories have turned out to be the most important for me, because they are also well suitable for sportswear:

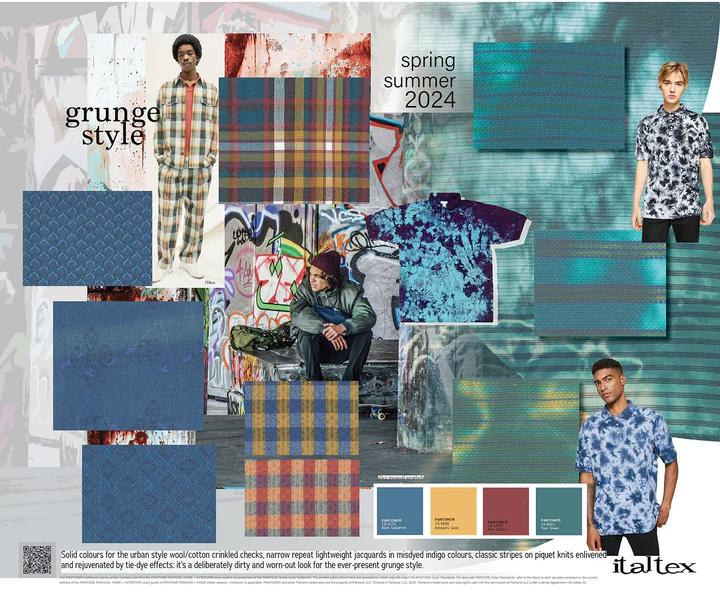

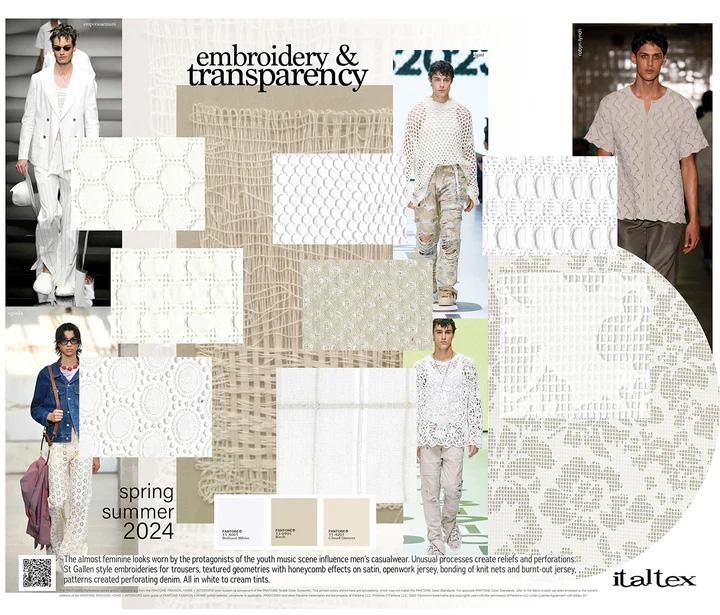

Fashion forecasts on fabrics and colours for casual men’s wear Spring/Summer 2024

The Forecast will take you through the key fashion trends for men’s wear, from embroidery and transparency to ivory, lightness in black and white, crinkled surfaces, rustic look, brown shades, olive greens, ochre, grunge style, denim, reds, greens, a whole series of colours and the fabric themes connected, simplicity, graphic designs, stripes, up to glitters and baroque style. Special emphasys on sustainable fibres, from organic natural fibres to recycled nylon.

Womenswear Spring/Summer 2024 is rend on colours and fabrics that provides complete information on all the main elements of the season: from fibres to woven and knitted fabrics, colours, patterns, finishes, pictures suggesting their use and mood pictures. This season, trends are driven by colour and based on the consciousness that sustainability is the only viable path.

Kingpins, the influential denim supply chain event, happened in Amsterdam last October, where they hosted conversations, workshops and seminars with guests from nearly 700 companies, from across 6 continents.

#1 Dusted Browns : Natural dyes and low-impact over-dyeing give an earthy caste for sandy, desertinspired browns

#2 Overworked craft : Handcrafted, heirloom denim with tactile threads and painterly colour to bring joy to the reworked for an expressive, DIY customisation

#3 Digital darks : The cross-overs of digital technology and utility combine for an alternative moody denim narrative for a futuristic look

#4 Sheeny lightness : Man-made cellulosics and lower-impact synthetics bring subtle sheen and drape to lightweight denim

#5 Classic workwear stripes : Classic workwear stripes take on a vintage, worn and faded character, paying homage to heritage indigo

These days, people all across the world aren’t hesitant to say what’s on their minds and show their emotions openly. The use of striking graphics and attractive typography brings this to life.

In addition, the print industry has become a natural fit for upcycling and DIY techniques, with both designers and manufacturers concentrating on repurposing printed materials for use in their latest creations. There is a deep respect for the natural world, as even the most humble plants may serve as an inspiration for cutting-edge floral designs, and as strong visual statements bring important social and political causes to the fore.

As 2022 rapidly approaches, forecasts for the year’s hues and styles are abundant on the web. But we thought outside the box and asked experts what the most popular fabric trends will be in 2022-23. So here you go!

A floral printwill always be fashionable. It’s one of those classic patterns that never go out of style. Thus, it is the most adaptable design that will likely rule 2022-23 clothing. The best part is that there is a lot of creative leeway with this template for budding designers. Florals use a wide variety of embellishments, including those that are tiny, appliqued, painted, stamped, and graphic in nature.

The previous two years’ worth of headlines can be summed up in one word: climate change. Fabric designersare also keen to incorporate this narrative into their work. Prints with splatters of color, hues that fade into one another, and cloud shapes will be popular in 2023. In addition, grass-blade strokes and lush green patterns will be major trends over the next several years.

leopard, cheetah, and ocelot being some of the most sought-after patterns. However, in 202223, tiger stripes and snake scales will be the most sought-after animal patterns.

Our background, culture, and community all have significant impacts on our daily life. In 2023, this will be a popular trend since designers are going to great measures to showcase this interest in their fabrics. We should expect to see a lot of wacky urban narratives, hand-drawn maps, and landmarks in the next seasons of clothing

Animal patterns are in style because they are sensual, dramatic, and eye-catching. They have been at the forefront of style for decades, and they will remain so far into the future. Animal printshave been quite fashionable recently, with

The Tie and Dye design had a big resurgence in popularity last year. This design has been lauded by both sexes for its attractiveness. This trend, according to the experts, is here to stay for a while. The crumple, fold, and spiral are predicted to be the most popular patterns in 2022-23. Also on the designers’ must-try list are sunburst, shibori, and lightning patterns.

When it comes to global fashion, this design is also a major player. Aspiring designers of the future may use this template to build stunning collections of clothing.

a bayadere, and awning stripes.

Using checks as a method of payment has been common for decades, and this trend is only expected to grow. This extravagantly beautiful design is perfect for the romantic at heart. Nothing is wasted space; instead, it’s packed to the gills with excitement, elegance, and luxury. Astounding garments of unimaginable beauty might be created using this fabric’s gorgeous pattern as a starting point.

Block prints are stunning, bright, and glamorous. Regardless of the fact that the textile printing industry has seen tremendous change in recent decades. On the other hand, nothing can match the elegance and sophistication of block prints. That’s why next year’s block prints will be all the rage.

The Herringbone fish’s distinctive skeleton inspired the design of this pattern. This backward zigzag design is all the rage now. The print is popular with designers since it has a classy and pleasant aesthetic. You can’t go wrong with a herringbone pattern on any article of clothing, whether it’s a tailored suit or a slouchy blazer.

Stripes are a trendy and striking pattern. Every stitch amplifies the drama of the garment, helping it stand out in a crowd. Experts predict that stripes will be one of the year’s most sought-after textile patterns. Candy stripes, barcode stripes, and chalk stripes are all popular now. There is more to it than that. Fans are likely to be drawn to the season’s chevron,

Plaid is edgy, untamed, and ageless. It’s a great design that works in any season. Checkerboard, windowpane, argyle, and Ichimatsu are just some of the plaid patterns you may find. On the other hand, tartan plaid is expected to be a major trend in the next year. This design is the most authentic looking, with lines of varying colors and thicknesses much like authentic Scottish kilts.

A pattern of polka dots is both seductive and eye-catching. It was popular in the ‘50s and ‘60s, but the print will never go out of style. The versatility of this pattern has made it a favorite among creatives. The variety of sizes, colors, and forms is also unparalleled. Designers looking to create classic clothing lines for upcoming works might benefit greatly from this fabric. It’s possible for polka dots to show up on everything from a saree to a ball gown to a shirt. Those are the top fabric patterns for 2022-23 that will significantly impact the fashion industry. If you are looking for a fabric that will accentuate your trendy outfit then Fabriclore is here for you. You can shop numerous printed fabrics and more that will accentuate your sewing project.

April 26-28, 2023

Bombay Exhibition Centre, NESCO Complex, Goregaon (E) Mumbai

Bombay Exhibition Centre, NESCO Complex, Goregaon (E) Mumbai