For nearly half a century, the World Economy has been rapidly moving from cash-oriented to cashless. Ease of use, secure transactions, accountability, low chances of corruption, and informal economy and reduced use of paper are some factors that have been constantly promoting a cashless economy. The now omnipresent internet ensured that the use of cards and digital payments reaches not just the urban population but the rural as well.

Security, forms the backbone of this cashless economy. If it weren’t safe enough it wouldn’t gain popularity. Along with the payments industry, security technology has also advanced to deal with all kinds of threats that may hamper it. From cards made of cardboard and celluloid to the modern chip implanted ones and the digital wallets, the digital payment industry sure has come a long way with technology by its side.

After the first plastic cards were introduced, the first line of security included a tamper-resistant signature panel, embossed digits on the card, and other micro features. With electronic development came more robust cards which could be authorized in real-time The rising need for authentication and authorization paved the way for the introduction of Card Verification Value (CVV) numbers and PINs.

With e-commerce creating up a storm in how people purchased goods, CVV2, Address Verification Services, etc. came to the fore. With a new century stepping in, securing the data by implementing encryptions, digital signatures, firewalls became the norm. Linking of mobile phones, Transaction alerts, multiple PINs to authenticate transactions also came up

As people join-in the digital revolution, the cards and digital payments of the future need to be loaded with more features and needless to say security. So the cards of the future will be utilizing geolocation to ascertain the location of the registered mobile device and the card being used at a given time and microchips that can be locked-in or waved to transact. Eyes will also be on the biometric technology and how it can help make card transactions safer

This edition brings to you, 2020’s Most Trusted Payment and Card Solution Providers that are fuelling the digital economy and making sure that millions of transactions being carried out across the globe are safe and secure.

Crosskey is a financial services company which provides flexible and modular solutions to help clients select precisely the functionality they need, and to expand and adapt in line with changing demands. Limonetik is a disruptive B2B payment platform providing High Standard Quality payment services to gateways, acquirers and Tier 1 international merchants and marketplaces (B2B & B2C). PayMotion is a leading

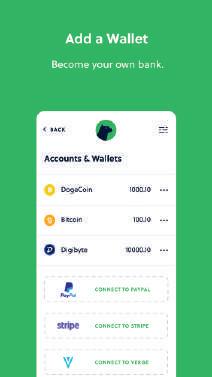

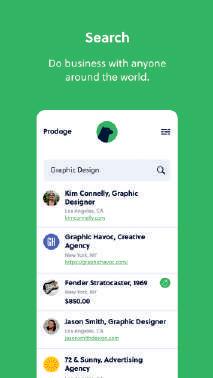

multi-channel payment platform for online merchants. It is an enterprise-grade platform designed to help small and medium-sized businesses sell across the web, mobile, and social media storefronts. Paytweak develops innovative payment management services to enable companies to accept secure electronic payment on all channels, globally. The company facilitates collection, down payment, distance selling and payment at the point of sale via its unique functionalities on the market. Prodoge- Headquartered in Los Angeles, Prodoge began as a Dogecoin processing company in 2019 and has grown to become a crypto wallet supporting Dogecoin, Bitcoin, and Digibyte, while offering all the tools anyone needs to do business with those crypto currencies along with fiat currencies. Some of the other promnant shortlisted companies areSoldo, Bancontact, Praxell, Rapid Financial Solutions, Bitmymoney

While flipping the pages you might also come across articles and CXO-articles penned by our in-house writers and executives respectively. We believe that these articles will further give insights into how strong-headed leaders are changing the world.

Happy Reading!

Sneha Sinha

Thomas Lundberg CEO

Thomas Lundberg CEO

TheFinTechsectorhas undergoneamassive transformationinthelast coupleyears.Takingspecifically digitalpaymentsintoconsideration, theneedforphysicallyvisitingbanks forourfinancialneedsisnow becominganincreasinglyredundant requirement.

Flawlessaccessandutmostconveniencearetheprimaryfactorsthat makedigitalpaymentplatformsour

go-tooptionforallfinancialtasks. Undoubtedly,securityisapressing concernandcompaniesacrossthe worldarecompetitivelypacing towardsprovidingcustomerswiththe mostsecure,easyandrewarding services.

Thisedition, 2020’s Most Trusted Payments and Card Solutions

Providers,emphasizesexplicitlyon suchcompaniesandexhibitsthemto theworld.Pertainingtothesame

motive,wepresenttoyou,Crosskey, afinancialservicescompanywhich providesflexibleandmodular solutionstohelpclientsselect preciselythefunctionalitytheyneed, andtoexpandandadaptinlinewith changingdemands.

HeadquarteredinMariehamn, Finland,Crosskeywasoriginallyan in-houseIT-departmentof Ålandsbanken andbecamea standaloneIT-companyin2004.The companyhasbeensuccessfulinthe SwedishandFinnishmarketby winningclientsandsupportingthem intheirsuccessfuljourneys.

Crosskeyhasbeenanimportantpart oftheFinnishS-Bank’ssuccessful journeyfromastart-upbankin2006 tooneofthetop3-4banksinFinland today.Also,Crosskeyisapioneer withintheFintech/OpenBanking marketwiththeco-operationbetween ÅlandsbankenandDreams,Trustly andDoconomyasCrosskeyhas enabledtheseco-operations.

TodayCrosskeyhasapproximately 280employees,over3millionend usersinthebanksystems’databases andpeaksabove1.5milliontransactionsperhour,daily Thecompany providessolutionsinthreedifferent marketsegmentsviz.,Banking(core banking),CardissuingandCapital Markets(backoffice).

Thecompany’ssolutionsarebuilton a‘step-by-step’integrationmodel, makingitpossibleforcustomersto implementonemoduleatatimewith ashorttimetomarket.Economicand environmentalsustainabilityispartof everythingCrosskeydoes.Apartfrom beingsustainableallsolutionsfrom Crosskeyarebuilttosupportthe FintechandOpenbankingstrategyof theircustomers.

Inthefollowinginterviewwith ThomasLundberg,Crosskey’sCEO givesusprofuseinsightsonthe FinTechmarketanditsintricacies. Thomasalsosharehisopinionsand perspectivesonhowhiscompanyis sustainingitscompetencyinacutthroatindustrysegment.

Belowarethehighlightsofthe interview:

Whatisyouropiniononthecurrent scenarioofdigitalpayments?

Today’smarketfordigitalpayments isextremelyexcitingandtheglobal digitalpaymentsmarketisgrowing rapidly.Today’scustomersexpect seamless,securepayments,ontopof whichthemarkethaschangedsothat increasinglymorenon-bank companiesareofferingdigital payments.Imaginewhatopportunities forustechnologyproviderstooffer customizedsolutionsforour customers!

Ofcourse,thereistremendous developmentinthisareaandthe challengesaretofindthegoldgrains intherangeofopportunities.Security isalsoofparamountimportanceandit

islikelythatinthefuture,theamount ofregulationwillincrease.Ithinkthe keytosuccessinthismarketisto haveaneartothegroundandlistento whatthecustomersthinktheywant andthencombineitwithalotof knowledge,complianceandvisionary thinking.

Whatarefactorsthatcontributeto yourcompany’ssuccessandwhy?

Firstandforemost,duetoourhistory beingspunoutofabank,ourbanking expertise(aboutthemarket,the marketneeds,complianceetc.)is bespokenandinaclassofitsown amongIT-companies.

Secondly,weoperateclosetoour customersandoursystemsarebuilt onacommoncore,butouroffering includesalayerofextensivecustomer adaptations,whichputsusclosetothe customersonceweintegrateour solutions.

Thirdly,weoperatelocally,with officesclosetoourcustomers’ markets,whichallowsustobe‘inthe market’togetherwithourcustomers. Oneofourcorepillarsisstrong personalrelationshipsanditisared threadthroughoutourbusiness.Also, westartedourjourneyinagile workingmethodsalreadyin2012.

Whyshouldcustomerschooseyou astheirpreferredpayment partner?Howdoyoudistinguish yourofferingsfromyour competitors?

BychoosingCrosskeyasasupplier youwillgainaccesstoalarge

networkofexperiencedexperts, innovativebusinessdevelopersand responsivedevelopmentteams.One ofCrosskey’scorecompetencesis thatwecontrolthewholevaluechain fromin-housesystemdevelopment, certifiedprocessesalongwithagile workingmethodsforrequirement handling,projectmanagement,and releasehandlingallthewayto monitoring;bothmanualand automatedaredonecompletelyinhouse.Thisguaranteeshighqualityin ourdevelopmentprocessaswellas excellentstability

TheCrosskeyCardsPlatformisnew andmodern,builtwithreal-time processingandAPIsthroughout.Such standardizedAPIshavealsomadeit possibletointegrateCrosskey’sbank systemtowardsmanyFintech applicationsprovingthattheplatform isoneofthefewsystemsonthe Nordicbankmarketthatalreadyhasa provenreadinesstodeliveronthe currentandfuturemarketdemands.

TheCrosskeyCardsolutionis handledwithcontinuousdelivery, deployingtheapplication,and runningmanythousandsofautomated testscontinuouslyeverydayofthe week.Ourcardsystemisoperating severalinstallations–allwiththeir uniqueneeds.Performanceandcost canbescaleddependentonsize, solutionsrunningwithnumberofend customersrangingfromtensof thousandstomillions.

HowdoesCrosskeyamendits offeringsandcriterionaccordingto therulesandregulationsofthe differentcountriesitserves?

Ourmarketisundergoingamajor changerightnow,oursystemsare beingopenedthroughvarious technologicalplatformsandmany newplayersintheindustryare emergingwhowanttosupportthe developmenttowardsendcustomers. Standardizationisinthiscaseavery goodwaytogoincreatingopportunitiesforeveryoneonequalterms.

Thefinancialsectorisnotallabout innovation;thepressurefrom legislatorsandthebigplayersonthe markethasbeenenormoustheselast coupleofyears.Oneexampleofthis isthePCIrequirementsthatarea musthaverequirement.Crosskeyare proudtobeoneofthefirstCard issuingplayersintheNordicsthatare fullyPCI-DSScompliantalongwith directconnectionstowardsboth MasterCardandVisanetworks.We offeraservicethatiscompliantwith theindustryrequirements.

• Crosskey has been awarded as IT project of the Year 2016 in Finland.

• ‘Crosskey’s solutions are the cornerstone of our business”Iikka Kuosa, SVP, Business Development, IT and Service Center at S-Pankki.

• During 2019, Crosskey was ranked and recognized as a top 10 supplier of banking platforms in Europe, with specific support in the platform for banks in their cooperation with Fintechs

• Crosskey is PCI-DSS and ISO9001 certified.

• Recently, the leading Nordic challenger banks ICA Banken, Ikano Bank, Söderberg & Partners and Ålandsbanken recognized Crosskey as the best and most future proof banking platform to build their coming joint new mortgage bank venture on.

Whatcanbeexpectedfrom Crosskeyinthecomingyears?

Fromafunctionalityperspective,our systemisnowdevelopinginafaster thaneverspeedinordertosupport ourcustomers’journeysindigitalizationandautomationandgenerally aroundscalingthebusinessvolumes withminimalincreaseinheadcountor othercosts.

Wehaveenhanced,improvedand modernizedourbankingplatformin therecentyears,andwewillcontinue doingthatincrementallygoing forward.

Weavoid“bigbang”modernization projects,thuswedotheenhancements incrementally,protectingourcustomersfrombeingnegativelyimpacted byrisky,timeconsumingand expensivetransformationprojects.

ThegrowthoftheFintechecosystembroughtwithit aninfluxofPaymentServiceProviders(PSP). Thesenewarrivalsarechangingthewaythe industryisservingandinteractingwithitscustomers.

Itdoesn’tmatterifyouareaB2CoraB2Bcompany,you arenowfacingamoreinformed,savvier Customer/Merchantwhoislookingnotjustforthebest pricingbutforthebestvaluefortheirmoney

Thisevolutionofthecustomerrequiredtheserviceprovider toevolveaswell,simplytokeepup.Providershavehadto consideradditionalservicesaspartoftheirvalue proposition–notalwaysaneasytaskforcompanieswith limitedresourcesandlegacysystems.

Themarketbecamemoreaccessibletoyoung,freshbrands offeringagileandinnovativeapproachestopayments. Manyveteranplayershavebeenlefttofollowtheirleador

risklosingbusiness.Customerstodayarelookingforfaster onboarding,fewerquestionsandmoreservicesoffered instantly,from“one-click-checkout”totheabilitytologin withsocialnetworksandeveneasywaystoshareexpenses onthego.

PaymentServiceProviderSquareisanexcellentexample ofaPSPwhoactedquicklytorespondtocustomerdemand. SquarestartedoutwiththeircardreaderandMPOS,then quicklyexpandedtheirservicestoecommerce,scheduling andmanymoreoptionsdesignedtohelpSMBs(Small MediumBusiness)expandandscaletheirownenterprises. Square’seaseofusehashelpedthousandsofmerchants improverevenuesandtakecontroloftheirdaytoday activity.

AtCoriunder,wehavebeenfocusedonthePSP-As-AStartup(PAAS)approach,wherethePSPischangingtheir strategyandallocatingtheirbudgetstobecomemore

competitivewithnewer,moreagile providers;thisledtoanotherPAAS approach.Thisone hasbeenaround forawhilebutwasn’tconsideredasan alternative;Payments-As-A-Service. Thisoptionpavesthewayforwhite labelgatewayprovidersthathavebeen enablingthequicksetupofaPayment ServiceProviderwithouttheneedofa largetechnicalteamandthesecurity certificationsthatcomewithit.

Themajorityofprovidersarefocusing onthelargenetworkofacquiring banksandalternativesolutionsinstead ofontheflexibilityneededforthePSP tobuildhisclientbase.Butit’snotjust aboutthepayments.

Ourapproachisslightlydifferent;we builtaBAAS(Backend-As-A-Service) modelthatgivesourclientstoolsto manageCustomers(Card holders/Users),Merchants,Affiliates andeventheirownemployees.This providesourclientswitha wayto buildappsandservicesaspartoftheir offeringandtomanagethebillingand “standard”servicesallwithinone,PCI Level1certified,managementsuite.

ThisapproachmadePaymentsan “Add-on”tothePSP’sserviceandnot themainservice;weseesomeclients expandingourMerchantManagement Portaltoallowschedulingand invoicing.Otherusersarebuildingrisk andfraudtoolstoextendtheKYC checksandtransactionsmonitoring theyhaveinplace.

Weserveasahubthatprovidesthe PSPwiththeoptionstheyneedto integratetoeveryserviceproviderthey wishto.Together,theycancreate intuitiveworkflowsthatbetterserve theirbusinesslogic.

Anevolutionofacustomercomes handinhandwiththeevolutionofthe “Fraudsters”.Inmanycases,thePSPis leftexposedonbothfronts;theyneed tobothcatertothecustomerand combatfraud.ClientsadoptingBAAS areusingtheBackendsolutionto managebothtransactionsand customers,sotheynowhavetheability tointegrateRiskandFraudtools.In manycases,theycanevenbuildtheir owncustomtoolstodefineworkflows thathelpthembettermitigateriskand moreeffectivelyfightchargebacksand fraud.

Weseethestrugglesofourcustomers asasharedchallenge,soweoffera C2C(Client-to-Client)integrationas

Eliad Saporta is the Managing Director of Coriunder. With a background in law and an MBA in finance, Eliad has always been drawn to product management and design. He worked as a consultant for various companies, assisting them in their efforts to build products in the payments ecosystem. Today, he helps entrepreneurs not only by assisting them, but also by offering the right tools and services for building their vision.

partofthecorefunctionality,brands canhelponeotherfindsolutionsmore quickly.WithC2Cintegration, additionalrevenuestreamscanbe established,asclientsdevelopingnew servicesorexpandingtonewterritories canassistoneanotherwithgrowthand opportunity

Whenwelaunchedourservicewe aimeditatstartupslookingtobuild theirideaontopofourBackend;we soonwelearnedthatthePSPmarket wasindireneedofaservicelikeours. WearenowservingPaymentService Providersglobally,withpartnersbased inHongKong,theUnitedStates, Cyprus,Malta,CostaRicaandmore. Byaddressingtheneedsofthisrapidly growingindustryandhelpingclients createinnovativecustomsolutions, BAAScanresolvethedilemmafaced bytheaveragePSP

AboutCoriunder:

CoriunderisaBackend-As-A-Service platformforfintechandecommerce companies.Whateveryourservices mightbe,Coriunderprovidesyouwith reachmanagementtoolstomonetize yoursolutionandenablesyouto expandgloballywithourPayment optimizationtoolsandasinglepointof integrationforallofyourservices.

Withover300availableintegrationsto acquiringbanksandserviceproviders, CoriunderisthelogicalBackend-AsA-ServiceforthePaymentService Provider

PleaseintroduceLimonetiktoour readers,alsoaboutitsfoundational history,andservices.

Originallycreatedtoofferaprepaid paymentcardusableontheInternetand to dematerialize giftcardsandloyalty cards,Limonetikchangedcoursein2014 followingitssecondfundraising.The goal:becomeaglobalpayment facilitator

Besides,theMarketplacemodelhas spreadaroundtheworld,accountingfor 30%ofB2Cinternationalpayment;ithas highlightedallthecomplexityofa transactionincludingmultipleparties (financial,regulation,logistic).Butthe Marketplacemodelisnowthetrend.All retailerswouldliketobethe“new Amazon”whichhasjustannouncedan increaseof81%inItalyofitssales duringthelastweeksoftheCovid.

Intherecentpast,theconsumerhas clearlycomprehendedthe capabilitiesandthenecessityof goingdigital.Ifaclassroomcancometo alaptop,ifa2000pagenovelcanberead onaphone,andifyourcarcanpark itself,wemostcertainlycanandshould moveonfromchequesandcashto digitalpayment.

Inourquesttobringtoyourdesk,an ardentlycuratedlistofprofound companiesinthefinancialservices segment,wecrossedpathswith Limonetik,adisruptiveB2Bpayment

platformprovidingHighStandard Qualitypaymentservicestogateways, acquirersandTier1international merchantsandmarketplaces(B2B& B2C).

Inthefollowinginterviewwith ChristopheBourbier,Limonetik’s CEO,wegetabriefyetreassuring glimpseoftheindustryanditsfuture. Christophealsoprovidesuswithinsight intohiscompanyanditsvisionforthe nearfuture.

Belowarethehighlightsoftheinterview:

Thenormistobuildpackagedall-in-one full-servicepaymentsolution.Butall-inoneFull-servicesolutionscan'tmanage themultiplicityandheterogeneityof everypaymentscenario.That’swhyat Limonetikwedecidedtocreatevalue withoneofthemostcustomizablefullserviceplatforms.We decomplexify the processformerchantsexplainingthem wherethemoneycomesfromand dispatchingeveryonecommissionatthe endoftheday Weunderstoodthe complexityandthedifficultyof globalizationandomni-channel challenges.Ourgoalistosupport retailersandalsoPSPs,Gateways, Acquirers,Banks,inthosedifficulties.

Todoso,weproposetoconnectwith250 paymentmethodsover170countries managingdifferentcurrencies.We

Christophe“ “

managepaymentcomplexity,foronline aswellasin-storeshopping,like paymentmethodprocessing, reconciliation,bookkeeping,fees handling,payout.Andaboveall,the integrationisthroughonesingleAPI. Theback-officeenablescompaniesto monitorpaymentaccountsandpayment transactions.Companiestrustusas paymentexperts.From2018to2019,our transactionvolumehasincreasedto44%.

Whatisyouropiniononthecurrent scenarioofdigitalpayments?

Theworldhasbeencompletelydisrupted bythedigitalization,ewalletization, mobilization,uberization& internationalization.Now,themerchant wantstointegratethebestpayment methodssothecustomerdoesn’teven realizeheispayingandwantstodispatch instantlyallitspartnerscommission.And themorediversifiedpaymentmethods are,themorecomplicateditistoreceive moneyformerchants.

Eventhoughaunificationofpayments methodswouldeasemerchant’sbusiness, itisnotpossiblewithreallydiversified internationalpaymentlandscapeandthe constantarrivalofnewpayment methods.Chinese,forexample,don’t paywithVisa.Theypreferactorslike WeChatPayorAliPay.InAfrica,people hasshiftfromcashtomobilepayment withoutthecredit/debitCardstep.

Inthisnewworldofglobalconsumption, thetraditionalpaymentserviceproviders needtheagilityofStartupstobetimeto marketandproposeinnovativesolutions totheirclients.Ourgoalistohelpthe ecosystemtoeasilyembracetheNew WorldOfPaymentsanditsissues.

Whatarefactorsthatcontributeto yourcompany’ssuccessandwhy? Theevolutionofthecurrentmarketisthe keytooursuccess.Cardsarenolonger theprimarypaymentmethodsfor consumersovertheworld:only23%of

theonlinetransactionsaremadebybank cardsglobally.

Everycountryhasdevelopedseveral localpaymentmethods:morethan400 hundredidentified.Plus,Marketplacesis becomingthenorm:itwillabsorb70% ofthe2024B2Cinternationalpayments. Andthenormistobuildpackagedall-inonefull-servicepaymentsolution.But All-in-onefull-servicesolutionscan’t managethemultiplicityand heterogeneityofeverypaymentscenario.

That’swhywecreatedacustomizable full-servicepaymentsolution.Each monthweintegratenewpayment methodstoourpaymentmethods cataloguethatincludestodaymorethan 250internationalpaymentmethods.Plus weenablemarketplacespaymentflows andmakethempossibleandcompliant withregulation.

Whyshouldcustomerschoose Limonetikastheirpreferredpayment partner?Howdoyoudistinguishyour offeringsfromyourcompetitors? Thecompetitioninthepayments segmentoccursbetweenall-in-onefullservicepaymentsolutionstomeet merchantsandmarketplacesneeds. Agnostic,Limonetikistheonlyactor thatcanconnectandenhanceafullservicesolutionbyusingtheexisting PSPoftheclient.Limonetikhelpsthe PSPtobuildand/orenrichaunique paymentvaluechainfortheend merchants/marketplaces.Limonetikis agnosticofthegateway,theacquirer,the front-endsolutionorthepayment method.

Tomeetclient’sspecificneeds, Limonetikisfocusedtoprovideahighlevelofsupportwiththecapacityto adjustitslegal,technical,financial,risk &compliancesolutions.Wearefully compliantwithPSD2.Limonetikisalso certifiedPCIDSSlevel1,GDPR compliantandtwo-factorsauthentication

(2FA)isactiveforeverypayment accountofthecompany.

Whatcanbeexpectedfromyour companyinthecomingyears?

Oneofourmaindevelopmentforthe futureistobecomemoreandmore international.Todosowearecurrently developingourcomplianceabroad.

WhenQualityisAssured

Limonetikhasbeenawardedthe following:

•Bestpaymentsolutionprovider

FRANCE2020byGlobalbankingand financereview

•InsightsSuccessinthe10Payment& CardSolutionProviders2018

•ThankstoLimonetikGourmingwon the“TrophéesdelaTransformation Numérique”

TheGuidingMind

Graduatedwithamaster’sinbusiness andinternationalrelationsfromSan DiegoUniversity,ChristopheBourbier, CEOisabornentrepreneurandan executivewithover20yearsof experienceincompetitiveanddisruptive strategy.Competitoratheart,captivated byinternationalaffairs,Christophe, beforehefoundedLimonetik,had createddifferentcompaniesinHighTech andCommunications.In2008,hecofoundedLimonetikwiththeaimto marketthedigitalgiftcard.

Christophequicklyrealizedthatthe companywastoofaraheadofitstime anddecidedtoevolvetheofferby movingfromdematerializedgiftcardsto dematerializedpayment.Afterseveral fundraisersandproductevolution, Limonetik'sstrategypaidoff.Byplacing thecompanyinindirectsales(i.e. throughPSPsandacquirerssuchas Ingenico,Worldline,Computop,ACI), Christophehassecuredaplacefor Limonetikinahighlytechnical environmentthatislesscompetitivethan playersindirectsalessuchasStripe,for example.

Bobbi Leach CEO

Bobbi Leach CEO

Inthehindsightofstatingthe observable,AlbertEinsteinonce said, “It has become appallingly obvious that our technology has exceeded our humanity.”

Indeed,technologyhasexceeded humanity Withtechnologicaleaseat thetouchofmerefingertips,wehave madeourworldeasyforusandthose surroundingus.Andwithinthe financialworld,now,weareheading towardsacashlesssociety—aworld wherepaymentsbecomemore

digitizedandembeddedinour everydaylives.

Intheyearstocome,aspeoplewill usedevicesandotherdigital signaturestopayfortheirneeds, physicalcurrencieswillcontinueto diminish.Theevidenceitselfisinour hands,oursmartphones,anddigital walletsbeingusedasdigitalpayment middlemen.

Paymentswillbecomesomethingwe won’tevenneedtodoanymore.It

willbecomeanentirelyinvisiblestep intheactofpurchasingitems.One canperceiveafuturewherepeople willmaketheirpurchaseandbe automaticallycharged.

Suchdevelopmentswouldn’thave beenpossiblewithoutthesignificant industryplayerstakingontheedgeof innovationtodelivertheirbesttothe paymentindustry

Assuch,ournextinnovatorin “2020’s Most Trusted Payment and

Card Solution Providers” is PayMotion,aleadingmulti-channel paymentplatformforonline merchants.Itisanenterprise-grade platformdesignedtohelpsmalland medium-sizedbusinessessellacross theweb,mobile,andsocialmedia storefronts.

•Regulationsindifferentcountries

•Productstailor-madeforeach market

•UnifiedComplianceManagement System

•PartneredwithPayPal

•14thannualBronzeStevieAwards forNewBusinessIntelligence Solution

•2019SilverGoldenBridgeAwards forBusiness-to-BusinessProductof theYear

•Ranked5thinTheSoftware Report’sBestEcommerceSoftware of2020Awards

Helmingleadershipdutiesat PayMotionisanexceptional personality,BobbiLeach,theCEO ofthefirm.Bobbihasbeenleading thecompanysince2009andhas broughtherwealth,knowledge,and experienceinthetechindustry.

Herleadershipskillsareresponsible behindPayMotion’sgrowth, evolution,andwhatitistoday; an end to end payment solution tailored for online businesses.Shehasguided thebusinessanditsofferingstowards theworldofsubscriptions, consequentlymakingitpossiblefor

thefirmtoacquiretheexpertiseinthe industry

Bobbiismuchactiveinhertech communityasshehasbeenaguest speakeratlocaltechevents, universities,aswellasvariouswomen intechevents.

PayMotion’sexpertiseand functionalitiescovertheentiretyof onlinebusinessowners.Thefirm concentratesonclientsthatoffer digitalservices,products,and subscription-basedbusinesses. Leveragingyearsofexperience, PayMotionunderstandstheneedsin place,particularlymarkets,andthus hasoptimizeditsservicesandtailored accordingly.

“We pride ourselves in the way we offer our services, offering our clients an actual team of experts in payments that will help them and support them in growing their online business, at no extra cost, each step of the way,” assertsBobbi.

Otherthanthat,whatmakes PayMotionuniqueisitsdeep expertiseinonlinesubscriptions. Unlikeothersfollowingabroad strategyofpaymentsforall, PayMotionspecializesin subscriptions.Ithasbuiltaplatform highlytailoredfortrackingsalesfrom channelpartnersandthusmakesit easytomanagebusinesses.

Furthermore,thefirmhassupport businessinmultiplecountriesin NorthAmericaandtheEuropean

Union.Consequently,offeringthem localizationcapabilitiesthatallow themtotransactinternationally. Thebestofall,allthesefeaturesare pairedwithexpertsinthefield.They offertheirknowledgeandexpertiseat nocosttothemerchants.

PayMotionisarobustdigitalservice provider;however,aboveall, PayMotionprioritizestoconfrontany securitybreachesandanytheftof customerdata.

Inrelevance,Bobbishares, “Through our platform, we are able to track and monitor all access to our network and cardholder data in real-time and provide instant alerts for attempted breaches.” AspartofthePCIDSS Level1certification,PayMotion adherestoregularscans,test protocols,andindependentauditsto meetandmaintaintheseindustry standards.

Revealingtheplans,Bobbicitesthat thefirmwillcontinuetogrowasa businessintheregionsitserves. Herein,sheplanstoworkon enhancingandoptimizingthe platformtoservethecustomersbest andmakingroomforupcoming clientstoo.

Forforthcomingyears,PayMotion willcontinuetoinnovateandcreate newfeaturesandtechnologiestokeep upwiththeevolvingpayment industrytoremaincompetitiveand bestservethemerchants.

Thewaypeoplemakepaymentsarechangingfasterduetotheimprovedintegrationofdigitaltechnology Thishas benefitedtheindustrywithincreasedcompetitionandconsumerdemands.

ThechangescanbewitnessedinTravel,E-commerce,HouseholdBillpaymentsetc.Therecentintegrationoftechnologyin paymentsolutionsmakestransactionsfastandseamlessandcanbedoneatthecomfortofyourhomes.

Althoughwearewitnessingaconsiderablechangeinthepaymentsolutionindustry,thereisstillaconsistentuseofthecash andcards,whichsolelydependsonthegeographicalsetting.Insomeplaces,peopleprefercashandcards,whileinother places,theyencouragethemoreuseofdigitalsolutions;forexample:TheUnitedStatesandCanada.Analysishasshownthat

intheseareas,theyarelikelytoswitchcompletelyto technologyenabledpaymentsolutions.

Thepaymentsolutionprocesseswillbecomemore innovativebecauseofthefollowingdisruptivetrends;

Astheyoungeragedmassesareturninguptotechnology morethanthetraditionalmediums,thereisanotionthat mostpaymentsolutionswillbedonethroughdigitalenabledmediumsratherthancashorcheque.Thiswill resultinmoreengagementofmobilephonesanddigital softwareapplications.

Variousbusinessoutletsareacceptingmoreofmobile paymentwhichishelpingthemtoimprovecustomer experience.Theadditionofinstantalerts,appreciation notificationsandinstantpaymentdeliveryismakingthis innovationmoreinteresting.

One retained customer is one attained success. ~ Chidiebere Moses Ogbodo

Customerexperiencepostbusinessencounteriswhat makesadifferenceintheindustry.Digitalbankingsolutions areimprovingthewaycustomersfeelaftermakingtheir payments.Inthepastyears,oneneedtostandinaqueuein thebankbeforetheycanmakeeventhesmallest transaction,buttheintegrationoftechnologyinnovationhas reducedthestresstothelowestlevel.Wecanwitness improvedservicesandinstantexpensemanagementwhich ishelpingeveryonethatisusingthismediumtostayabove thecrowd

Acustomertendstocheckbackonthesales-personwho gavethematipordiscountafterpurchase.Thisisalso applicableinpaymentsolution.Afterpeoplemakesa purchaseonlineorevenviacardsandtheselleroffersthem acertainpercentageofdiscount,theywillalwayswantto comeback.Thegoodnewsisthatmostbusinessenterprises aresupportingthisideaincollaborationwiththefinance institutions.

Theinnovationinpaymentsolutionisincorporating feasibilityofresourcemanagementbetweenthefinancial

andnon-financialorganizations.Throughthisdevelopment, theresultwillleadtoeasymergingofboththetraditional mediumofresourcemanagementconceptswiththerecent anddigitalizedconcepts.Variousfinancialorganizations thatmaynotbeabletohandletheprocessofmigrating fromthetraditionalformattothedigitalizedplatformfinds easeindoingsobypartneringwithtechnologycompanies.

Organizationalgrowthismeasuredbothinmarketvalue, infrastructureandtheextentoftheirnetworks.The integrationofdigitaltechnologyadvancesinpayment provisionshelpsespeciallythefinance-oriented establishmentstoeasilyexpandtheirreach,eventothe mosthiddenplacesintheworld.Thishelpstotouchthe livesofpeoplenomattertheclassandstatusanditrepays withtremendouscustomergrowth.

Securityishugeconcernwhenmoneyisinvolved.People aresoconsciousandveryinquisitiveabouthowtheir moneywilltravelfromthesendertothereceiver.Inso manycases,theywilleventhinkthatsuchplatformsas digitalizedmediumsarenottrustworthyasasinglewrong numbercandirecttheirmoneytounknowndestination. Thetransactionasoftheoldwastruecheques.Buttoday, therewillbealimitedneedforthosemethods,rather, paymentwillsimplybedonebyinputtingacertain usernameandpasswordandyourdashboardwillbeopened. Throughthispage,youcaneasilymakeeverypayment.The ageofdigitalizationisturningthewholeprocessintocodebasedandthisraisesthequestionofhowtostaysafe.Itis alsobelievedthatforsecuritypurposes,theinstant notificationoftransaction,linkingofsecuredemailand encryptiontoindividualdataanddisaster-recovery provisionswillleadtheinnovationtobetterdirection.This concernhasabigdealwithblockchain,augmentedreality, IoTandbiometrics.

Youmaybeaskinghowthefuturewilllooklikewithtechenabledpaymentsolutions.Astheworldisgrowingand globalizationisgainingagoodground,peopleblendsinto whattheyseethatisworkingwell.So,asdigitalpayment solutionismakingeventhelifeofthelaymanonstreet easy,morepeopleinthenearfuturewillcompletelyadopt thisinnovation.Itwillnotharmthefinancialinstitutions, butitwillbegreatiftheycanmigrateorbetterintegrate someformoftechnologystrategiesintheirfinancial solutions.Thischangemaybeslow,butitwillbeconsistent asthetechnologychangesarenotgivingroomfor procrastination.

collection,downpayment,distance sellingandpaymentatthepointofsale viaitsuniquefunctionalitiesonthe market.

Paytweak’sproprietarytechnologies combinesBlockchain,Artificial IntelligenceandMachineLearning withitsrevolutionaryinfrastructure andmakesitboththe expert and leader ofsecureremotepayment.Connected toallbuyersandallPSPsaroundthe world,thecompanytriggersinstant paymentsthatspeedupcollectionsand reducecustomerpaymenttimes.

Paytweakisanefficientwaytocollect allyourdistantpayments.Simple,fast and100%secure,thefollowing featuresevidentlymakePaytweaka classapart:

• EaseofUse:

Inaneraofeverything-internetand virtualreformation,digitalsafety, securityandprivacyholdspeak significance.Malware,torjan, phishing,soonandsoforthcanonly bethetipoftheicebergifwetakeinto considerationthebreachesthathave takenplaceinrenownedbanksand financialinstitutionsacrosstheworld. Inlightofsuchsituations,asendusers orbusinessowners,turningtoasafe, securedandtrusteddigitalplatformfor allourfinance-relatedtasksisof utmostnecessity.

Withtheintentofbringingcompanies thatoffertheaforementionedsafety andtrust,intospotlightthroughthis editiontitled, 2020’s Most Trusted Payment and Card Solution Providers, weatInsightsSuccesshavethe privilegetointroduceyouto Paytweak

Paytweakdevelopsinnovative paymentmanagementservicesto enablecompaniestoacceptsecure electronicpaymentonallchannels, globally.Thecompanyfacilitates

Chooseexistingpaymentrequest messagesorsimplycreate/upload yourown–Filltheamountandthe customer’se-mailaddressormobile phonenumberandsecurelysendthe paymentrequeststhroughthe Paytweak’santiphishingpatented technologyorthroughyourusual software.

• EncryptedandFast: Digitallysigned–Customersreceive

securemessagesviaPaytweak, meaningtheycanclearlyidentify youandmakepaymentsintotal confidence.

• EnjoyProfitability:

Allpaymentscomesdirectlyinto yourbankaccount–Yousaveon intermediariescommissions/feesand receiveyourfundswithoutdelay

Paytweakoffersbusinessownerswith greatfeaturesthatmakeiteasierto collectpayment.Ithelpstomake paymentmethodsmoreprofitablesince businessespayfewerfeesandbemore efficient.Belowareafewof Paytweak’sB2Bofferings:

• SecureOnlineInvoicing:

Createe-invoicesfollowingyour modelswithanintegratedpayment method,reducelatepayments, litigationsanddisputes–Senddigital invoicescustomizedwithyourlogo andcolourswithinnovativepayment methods,soyourprivateand/or professionalcustomerscanpayfaster andmoreeasily

FollowsyourModel:Paytweak makesanidenticalcopyofyour invoice,usingyournumbering systemandintegratingsecure paymentmethods.

ScheduledPayment:Planthe creationandsendingofyourinvoices inadvance,inbatchesorviayour software.

TrackingandTraceability:The digitalinvoicemeansinformation

canbetrackedandsharedinyour informationsystem.

AccountsExport:Exportyour accountstoyourinternalorexternal accountants

• TravelIndustryPaymentServices:

Paytweakhaspopularlybecomethe instantpaymentservicefortourism andhospitalityprofessionals, allowingthemtoconfirmbookingsin oneclickandauthenticateremote cardholders,anddeliveringcomplete protectionfromfraud.

WithPaytweakyoucanauthenticate remotecardholderswith3Dsecure, andprotectyourselfagainstfraud. Youinstantlygeton-screen notificationsofsecurepaymentand pre-approvals,asyoutalktothe customer.Paymentsareprocessedin realtimeandguaranteedbyyour bank.WithPaytweakyousecurethe remotesalesprocessfromstartto finish,andprotectyourimageaswell astheprivacyofyourcustomers’ bankdetails.

• CallCentrePaymentServices:

Paytweaksecurestelephonepayment duringtheconversationlikeno othersandallowsyoutomakephone saleshappen.Thisallowsyoutoput yourcustomers’mindsateaseand receivepaymentsoverthephone, whileyourcustomers’bankdetails stayprivate.Paytweakmakesall yourprocessDSP2andRGPDfully compliant.

WithPaytweak’sinnovations recommendedbytheBanksandPSP aroundtheworld,youcanremotely

authenticatecardholdersinrealtime,preservingyourselffromfraud andmaintainingthecustomer relationshipatthehighestlevelof requirement.Paytweaktriggers, securesandmanagesremotepayment whileyouareonthephone,notifying youwhenithasbeenprocessedand preservingyourcustomers’brand image.

• DebtCollectionServices:

Paytweakreducesyourneedfor workingcapitalbyoptimising receivablesmanagement.Its innovativeprocessautomatesthe invoicingandcollectionprocess, schedulingcustomisedfriendly remindersaccordingtothescenarios youset.

Tolimitlitigations,Paytweak managesthecreation,sendingand paymentofyourdigitalinvoices.The solutionalsoallowsyoutoset scenariosforcustomisedreminders intheeventoflatepayment.

Paytweak’s SmartScheduler gives youcompletevisiononsums outstandingandreminderssent, allowingyoutointerveneatevery stageoftheprocess.Youbecome moreavailableforyourcustomers.

TolearnmoreaboutPaytweakandits offerings, click here.

Tames Rietdijk (1966) started his career in 1987 at KPMG as accountant (division financial institutions) and has been working mostly for software companies since 1994 in different positions from Product Manager to CTO. Since 2005 Tames has been certified as Anti Money Laundering Specialist by the Association of Certified Anti-Money Laundering Specialists (ACAMS) and he is a tutor at the Radboud Management Academy. Tames is Chief Executive Officer at BusinessForensics and his area of expertise lies with Product management, Forensic investigations and Data analytics. He is responsible for the design and development of the various BusinessForensics propositions applicable for the banking, investment and insurance industries.

In his vision on Risk management Tames calls for Risk based supervision instead of traditional Rule based supervision. Risk based supervision requires trend analyses with a total view instead of a snapshot of a specific event. For Risk management to be effective, more is needed than just detection of risks and that is the reason why the BusinessForensics platform offers a total solution in data mining, big data processing up until case management and sanctioning.

Duetoseveralincidentswithinthefinancialsector relatedtotheirintegrity,peopleandsocietyin generalhavelosttheirtrustinbanksandinsurance firms.Mostofthebanksandinsurancefirmsknowthis betterthananybodyelse.Regulatorsandsupervisorsare almostfuriouslytryingtorestorethistrustbyimposing strictrulesuponthemthatfocusonpreventingtheprevious incidentsfromhappeningagain.Eventhoughthismight winthemsomebattles,Iwilldefinitelynotwinthemthe war,astheissuestheyarestrugglingwitharefarmore complex:

• Tryingtomanagetheirdata:volume,privacy, complexity,security,availabilityetc.Especiallyina contextoffinanceandrisk,additionalrequirements applytotheconfidentiality,originationandaudittrailof data;

• ReducingtheirITexpenses:keepingoldagedsystems up-and-runningisdifficultandexpensive,resources understandingthesesystemsaregrowingscarce,and suchasituationisdefinitelystallingITinnovations, wheretheyseemtoberequiredtoadoptnew technology;

• Respondingtofindingsfromregulatorsand supervisors,whichneedtoberesolvedimminentlyat theriskoflargefines,negativecareerimplicationsor

even license consequences.

• Replacingcurrent solutionsbeing‘endof-lifecycle’forwhich safeguardingthehistoryas builtupintheircurrentsystem maybeaspecificissue,inadditionto apotentialoperationalriskwhen solutionsceasetofunction;

• Processingtoomanyoperationalriskissues, imposingareputationalriskforboththebankandits leaders,istroubledbyalargenumberoffalsepositive alerts,takingupvaluabletimeandresources.Theseis onlyanexampleofreasonsforagrowingbacklog.

BusinessForensicsalsoaimsforbanksandinsurance companiestorebuildtrust.Yetwerealizethattowinthe war,ittakesadifferentapproach.Webelievethatbanksand insurancecompaniesneedtoreorganizethemselvesinorder toimprovetheiroperatingmodelsandtosafeguardthe integrityoftheiremployeesandclients.Yes,thisinvolves newrules®ulations.Butthatisnotenough.

Sustainabilityrequiresbanksandinsurancesfirmsto embracetheirfuturewithconfidence.Thisalsoinvolves newtechnologiesandnewdata,whichinturnwillbring themnewrisks.Iteveninvolvesnewcompetition.

Webelievethattrulygood-naturedbanksandinsurance firmscanbecompliantwithnewrulesandregulations. Embracenewtechnologiesandnewdata.Timelyidentify newrisks.Facetheirnewcompetitionwithconfidence.To createanorganizationthatisincontrol.Bydesign.Only thenwilltheybeabletoavoidcrime,coincidenceand prejudice.AndthatiswhereBusinessForensicscomesin.

Weachievethatlevelofcontrolforourcustomersby continuouslymonitoringtheircompliance-andintegrity risks,frommultipleangles.Theresult:atransparentand truthfulviewon‘whatishappening,hereandnow’intheir organization.Ourfocusonriskallowsthemtorespond effectivelytoemergingchallenges,inordertokeepthebad guysout(intermsofclientsandemployees).Bylearning fromourcustomer’sexperience,oursystemcontinuously improvestheirresponsivenessandresilience.Improves theirlevelofcontrol.Controlbringsconfidence,andonly withconfidencecanyoubuildabrightfuture.

BusinessForensicsaimstobethetrustedpartnerofchoice forbanksandinsurancecompaniesaimingtorebuildtrust. Tous,partnershipmeanscooperatingtoreduceallrelevant compliance-andintegrityriskstolevelsthatareacceptable forbanksandinsurancefirms,fortheirclientsandfor societyasawhole.Ourapproachfollows7standardsteps:

Ÿ Anexperiencedteamthatunderstandsandis passionateabout(big)dataanalysis,machinelearning and(cyber)security,bringingsustainablefintech innovationtoyourcompany,

Ÿ Westructureyourdatainsuchawaythatyouare preparedforeverypossibleoutcome,asitisimpossible topredictwhatyouwillcomeacrossduringyour analyses.

Ÿ

Wedeliverafinegrained,adaptableconfiguration becauseeveryorganizationisuniqueandthesystem mustresembleyourspecificsituationasmuchas possible.

Ÿ

Asaresult,yourorganizationfeelsasifitis‘Designed forControl’,havingprotectedboththeprivacyof individualsandvalueofyourassets.

Inthiscomplexfinancialworld,BusinessForensicsprovides acoherentpackageoffuture-proofsolutionstothemajor challengesfacingallfinancialinstitutionsinthecoming decades: Ÿ

Implementingnewlawsandregulations, Ÿ Becomingmoreresponsivetonewemergingrisks, Ÿ Theincreasingvolume,complexityandvelocityof (new)data, Ÿ Embracingnewtechnologies,beingabletodrive businessinnovation, Ÿ Preparingforthenewcompetition:technology platforms,cryptocurrencies,fintechetc.

BusinessForensicsprovidesastructuredapproachto reducingabankorinsurer’sriskprofileswhilereducing theircostofcompliance,andatthesametimeimproving theirdamagerecoveryrates.

Trustacceleratesperformance.Betweenbanksandtheir clients,manandmachine,oldandyoung.

The team at Business Forensics consists of consultants, architects and developers with offices in The Hague and Singapore, and has been offering software and know-how for monitoring and managing compliance and integrity risks since 1998, amongst which are financial and economic crime risks. Preferred customers are those banks and insurcance firms that take pride in maintaining or (when necessary) rebuilding the trust of their clients, who do not view compliance as a burden but feel the inherent need to ‘do the right thing’. So as partners, we can keep crime, abuse and coincidence away from their clients.

Ÿ

Theresultsorourjointanalysismustresultinan increasedawarenessandunderstandingofwhatis happeninghereandnowwithinyourorganization,with afocuson(integrity)risk.

Ÿ

Thisimprovedinsightintheidentifiedriskswillallow youtodecidehowtobestrespondtothem,inorderto reducepotentialdamagesasmuchandassoonas possible.

The forensic platform (the HQ products) provides real-time (big) data analysis of network, transactions and signal of evolving risks and threat. These are presented users in an accessible and understandable way, providing context and situational awareness. As a result, companies and institutions can discover these risks early and immediately take measures aimed at limiting possible damage as much as possible and optimizing chances for recovery.

Ÿ

Ourcollaborativelearningapproachallowsyour organizationtocontinuouslyimproveitsresilienceand pro-activelyreduceitsriskprofilethroughautomated feedbackloops,

Compliance is also demonstrated by measuring good behavior. Confidence in our system increases by minimizing the number of false positive alerts. In addition, unnecessary (reputational) damage is reduced and corporate agility is greatly improved. Trust improves performance; between man and machine, young and old, customer and supplier.

Julian Kopald Vice President

Julian Kopald Vice President

Theonsetofan everything-digital erahasbeenevidently showcasingsignsofanendless influenceoverthecommercialworld.It hasbeenimpactfultosuchalevel,thatas endusersorconsumers,ourday-to-day tasksandneedsarenoweffortlessly achievableandattainable.

Thechange-drivenadoptionofthis digitaltransformationbythefinance industryhasopenedupamyriadofdoors forbothfinancialinstitutionsaswellas thecommonpublic.Theneedforan

extendedexplanationwouldn’tarise, takingintoconsiderationthenatureof the industry,therelatedmarket FinTech anditsbenefitstocustomers.

Pertainingtothisevolutionofthe financialindustryintoamuch sophisticatedyeteasilyadoptablemodels andfunctioning,weatInsightsSuccess, throughthisedition,bringtoyourdesk, 2020’sMostTrustedPaymentandCard Solutionproviders;featuringcompanies strivingtoprovidebest-in-class solutions.

Oneprominentnameamongthose companiesisProdoge.Headquarteredin LosAngeles,Prodogebeganasa Dogecoinprocessingcompanyin2019 andhasgrowntobecomeacryptowallet supportingDogecoin,Bitcoin,and Digibyte,whileofferingallthetools anyoneneedstodobusinesswiththose cryptocurrenciesalongwithfiat currencies.

Thesetoolsincludepeertopeer payments,invoicing,pointofsale, shareablepaymentlinks,onlinecheckout

widgets,andaglobalmarketplacewhere people&businessescanpromote themselves,sendmessages,andlist& selltheirgoods&serviceswithout merchantfees.

Inthefollowinginterview,Julian Kopald,VicePresidentofProduct Development,sharesvaluableinsight intothecurrentdigitalcurrencymarket andhowProdogestrivestosustainits competency

Belowarethehighlightsoftheinterview:

Whatisyouropiniononthecurrent scenarioofdigitalpayments?

Thefuture/presentofpaymentswillsee themarketsplitbetween“custodial” solutionsofferedbybanks,card networks,andother“legacy”fintech providers,and“non-custodial”solutions offeredbycryptocurrencyfocused businesses.Non-custodialsolutionswill growaspeople&businessesseekgreater privacy,morecontrolovertheirfunds, andembracethenearinstantandnearly freeglobalvaluetransfersofferedby cryptocurrencies.

Whatarethemajorcontributing factorsbehindProdoge’ssuccessand why?

Prodogereallytakescryptobeyondmere speculationandgivesanyonethetoolsto becomeaglobalmerchantinundera minute.It’snotjustapaymentsolution, butanewwaytodobusinessand promotegoodsandservices,withit’s ownglobalmarketplacetolistproducts, profilesformerchants,andinstant messagingallbuiltintooneplatform, alongsidetraditionaltoolssuchas invoicing,pointofsale,website checkouts,andshareablepaymentlinks.

Whyshouldcustomerschoose Prodoge?Howdoyoudistinguishyour offeringsfromyourcompetitors?

Prodogeisperhapstheonlysolution availablethatallowspeopleand businessestosendoracceptbothcrypto

orcardbasedfiatpaymentsinover200 countries.AddtothisthatProdogehas zeromerchantfeesforlistingproducts, ordoingtransactions,alongwithnearly instantglobalsettlementwhenusing crypto,anddoingbusinesswithProdoge canquicklyyieldpositivereturnsinboth timeandmoney

Howdoyouamendyourofferingsand criterionaccordingtotherulesand regulationsofthedifferentcountriesit serves?

Prodogeisanon-custodialsolution,so ourclientsbecometheirownbanks, controltheirownfunds,andareintotal control.Ourroleistoprovideagreat platformfordoingbusinessandwe activelymonitorourmarketplaceto makesureit’sbeingusedlawfullyfor legalbusinessusecases.

Securityisaprimaryconcernwhenit comestopayments.Howdoesyour companyensuresecurityandsafety? Prodogeclientscontroltheirownkeys (seedphrases)totheirwallets,which putsthemincontrolovertheirfunds insteadofrelyingona3 party rd

WhataspectsofProdogedisplayits footholdinthemarket?

Prodogeclientslovebeingabletosend oraccepteithercrypto,orcardpayments (throughourintegrationswithStripe&

Paypal).Thisallowsthemtocontinueto dobusinessinthe“traditional”way, whileexpandingintothenewworldof digitalpaymentsofferedbycrypto, whereglobaltransactionscansettle almostinstantlyandforfree.

Allofoursolutionsarealsomobilecentric,sopeoplecaninvoice,take paymentsanywherewiththepointof sale,orevenonlinewithourmulticurrencywebcheckouts.Ourshareable paymentlinksarealsopopular,aspeople seektogetpaidfasterandeasierover socialmediaandthroughchannelslike WhatsAppandothers.

Whatcanbeexpectedfromyour companyinthecomingyears?

Prodogewillbecontinuingtoimprove ourmarketplace,merchantprofiles,and makingiteasierforbusinessestoboth promotethemselvesandfindeachother Inadditiontothis,wewillbelooking intoaddingexchangeservicesforcrypto &fiat,sothatourclientscanmanage theirfundswithgreaterease. Already, throughProdoge’sintegrationwith Zapier,merchantscanexporttheirdatato over1,000appssuchasQuickbooks,or Salesforce,andinthefuture,weexpect tocontinueopeningoursolutionvia API’stolistproductsorperformactions fromanywhere.

Businessesoperate,surviveandprogressinahighly dynamic economy, where change is the rule, not theexception.Thechangemaybeslow,suddenor almostextensive.Oneoftheimportantforcesofchangeis thechangeintechnology Mostofthesechangesareusedto enhance human capabilities to accomplish meaningful work These changes are sometimes thriving on the entrepreneur.Asuccessfulentrepreneurworkstovisualize thesefuturechangesratherthanwaitingforitandcreatea moredesirableenvironmentintheorganization.

Technologicalbreakthroughsdooccurandittakescourage for an entrepreneur to accept the change and its implication. Technology breakthroughs like computers, colortelevisionsets,electronicsets,fuel-efficientvehicles, etc. have encouraged entrepreneurs to manufacture these products. Thus changes in technology from time to time poseseveralalternativesbeforetheentrepreneur.Thisisan ongoing process in which the entrepreneur sets goals and strategiestomeetchangesintechnology Butforstrategies like marketing, human resource, supply chain, financial and legal strategies, etc connection with people is important. Entrepreneurs define the formal relationships among people and specify both their roles and responsibilities. Because the end product is an integrated system of people & technology and to administer these systems,entrepreneurisrequired.

Technology is helping us solve problems where human power alone is not enough. Different types of businesses requiredifferenttechnologies,butagain,itisimpossibleto solve all integration needs with a single technology. This articlewillhelpyouunderstand,thattechnologyisonlythe partoftheoriginalsolutionandhowindifferentsectorsthe entrepreneur’ssurroundingreallymatters.

Ÿ Accounting Technologyallowsustocompletetasksfaster.Itreplaces thetiresometasksofmanuallystoring,compiling,sorting, etc. and the ability to use data with a simple digital solution. For example, Sales ledger in the early days was time-consuming, expensive and all paper-based process. Technology helped increase productivity with the development of spreadsheet software like Microsoft Excel.Employeestodayarefarbetteratfindingwhatthey needwhentheyneedit.Thoughonlythiswillnotachieve the outcome. Here, let’s take a clear look at how the entrepreneur’sspiritisreallyhelpingtoachievethedesired goal.

Technologyisgoodforbringingthechangenotforcingit. It cannot make employees more efficient. Yes, the right technology can help to make the work easier, but if an employeeistrulyfallingbehindorisjustinefficient,allthe technologyintheworldwillnotsolvethissituation.The

truthissuchemployeescanbesometimesinefficientdueto either inexperience or laziness. An entrepreneur can identifythisproblembyimprovingcommunicationinsuch departments. This explains why human interference is important to address this situation, where technology is just a bandage, fix the problem for a short time. Adding newandfastertechnologywillnotfixtheproblem.Whilea bettersolutionissittingthedepartmentsdowntogetherand talking about the problem with the entrepreneur will be a realsolution.

Ÿ Retail Technology allows retailers to be available day and night interactingwithcustomershow,whenandwheretheyare readytoshop.Retailersdependontechnologytomanage inventory, track customer-purchasing habits, predict trends and deliver goods and services Wireless communication, QR codes and Augmented Reality are some of the changes in technology to the retail industry. Ultimately, the entrepreneurship element remains central evenifitisembeddedwithinAI,advancedanalytics,etc.

Because a customer’s shopping experience is more important than price and product quality. Entrepreneur encourages employees to use their creativity to ensure every customer experience is memorable. Entrepreneur's human interaction adds the value to the company and maintainsloyalcustomers. Ÿ

Invirtualworkplaces,employeescaninteractanddevelop ideasbyconnectingthroughtheuseofvideoconferencing. Thismayincludetrainingandimportantmeetingsfromfar places to the employees. Technology can also be used as real-time feedback from the employees which allows the entrepreneur to improve the needs of the employees. Entrepreneur’sgoodcommunicationisnecessarytoallow efficient flow both internally (among employees) and externally(usingtechnology). Ÿ

Therobotsarecomingandcanactuallyhelpus,tobemore productive,freeingusfrommostofthetime-consuming

and repetitive tasks. One of the most important areas of application of automation is computer-aided manufacturing. Today CAD/CAM technology has been applied in many industries including machine components, electronics products, and equipment design. Even banking and financial institutions have embraced automation technology in financial transactions. But just because technology is advancing it does not mean it will replacehuman.Technologycandoanadequatejob,butwe still need humans. It is certain that people to people communication remains fundamental where the entrepreneur’scontactinthevariousstagesisrequired.

Ÿ Security Technology becomes even more critical when operating thebusinessonline.Itisimportanttoprotectthebusinesses from cybercriminals who could steal data or lead to website downtime. Encryption and decryption protect information from being accessed by a third party or cybercriminals. It takes only about a minute without slowingdownanyfileordocument.

Ÿ Storage Technologyhasledtothedevelopmentofcloudcomputing to store business information and has been accepted by many in the world of business. Cloud Computing is cost

effectiveandconvenienttothecompanymanagementand employeescanaccessdatafromanywherebyjustusinga devicethatcanaccesstheinternet.Ithelpsentrepreneursto trust these technologies and build a strong trust among internalmanagementofthecompany

Overall Artificial Intelligence, Blockchain technology, Cloud Computing, Internet of Things, 3D printing, etc. today are helping entrepreneurs to use this technology in everyfieldtogrowtheirbusinesses.Buttechnologyalone cannot create a company culture, where human interactions are valued. Because it is people who are assignedtoworkonthistechnologyandtoencouragethem the entrepreneurs keeps their spirit alive. By creating an interested working environment, interactive dialogues among employees, support and motivation to the employees, reward system, etc. reflects the culture of the company. It is an entrepreneur who understands what the needsofthecompanyare,bycreatingaconnectionwithall the stages of management that brings the desired output. Hence, entrepreneurial spirit and technology should go hand in hand. Therefore we need evolving technology as well as intelligent humans. We need guided missiles as wellasguidedmentocreatethebetterworld.