Leadership is not about titles, positions, or owcharts. It is about one life inuencing another.

Leadership is not about titles, positions, or owcharts. It is about one life inuencing another.

www.X.com/insightssuccess

Onthisfoundationreststhesupposedsuccessinthebusinessworld:

buildingrelationshipsthatbestsuitcorporationsandtheircustomers.A specificthemeisrapidlyevolvingwithinthefinancialsoftware developmentbusiness:creatingacomprehensivesuiteoftoolsbasedoninsights fromeverystageofthecreditcycle.It'schangingthewaythebusinessinteracts withitsclients.

Anorganization,byconstructingsoftwarethatgivesa360-degreeviewof customerengagement,canunderstandwhattheuserislookingforandwhatthey want.Thisisessentialbecauseitwillallowbusinessestotailorservicestosupply andfulfillcustomerdemands.Forinstance,withtouchesthatpeoplecomeinto contactwithduringtheirjourney,organizationsknowwhethertheyexistin patternsorpreferencesandcanthenusethisknowledgetosupplytailored solutionsthatattractclients'attention.

Further,thisholisticperspectivealsoenhancesthecustomerexperience. Knowingwhattheircustomers'needsmightbe,businessescanrespondina timelyfashionandprovideallrelevantinformation.Suchproactiveengagement buildstrustbutalsostrengthensloyalty-conceptsmostimportantinacompetitive marketplace.

Inanutshell,changeinthewayofamoreintegratedapproachtowardsthe developmentoffinancialsoftwareischangingthewaybusinessesrelatetotheir customers.Therefore,thecompanyisnotonlyrefiningitsservicesbutalsolaying afoundationforlong-termprosperityandsuccess.

Inthelatesteditionof Insights Success,titled"Ireland'sTopInfluentialCEO ShapingtheFutureofBusiness2024,"featuresleaderswhoexemplifythis transformativeapproach.TheseCEOsarenotjuststeeringtheircompanies towardsprofitability;theyarealsoredefininghowbusinessesinteractwiththeir stakeholders,particularlyinthefinancialsector.

Have a great read ahead!

06. C O V E R S T O R Y Colin Brown

24. A R T I C L E S

28. Smart Financial Strategies: Managing Money in the Modern World Quest to Revolutionize Financial Software

Disruptive Technologies: What Every CEO Should Consider for Future Growth?

Diversity and Inclusion: Key Strategies for CEOs to Enhance Corporate Culture

Colin emphasizes that Aryza's solutions are not generic, unregulated software that can be sold remotely from the UK or Ireland. The complexity and regulatory nature of their services necessitate a deep understanding of local regulations and markets. Thus, establishing a local presence is paramount.

Colin Brown Chief Executive O�cer

Thekeytosuccessliesin nurturingstrongrelationships betweenbusinessesandtheir customers.Thisprincipleisattheheart ofarevolutionaryformulationto financialsoftwaredevelopment.By creatingacomprehensivesuiteof productsthatleverageinsightsfrom everystageofthecreditcycle, innovativecompaniesaretransforming howbusinessesinteractwiththeir clients.Thisholisticapproachallows foradeeperunderstandingofcustomer needsandbehaviorsthroughouttheir financialjourney

Amongthemanyindividualswrestling withthisapproachwasColinBrown. Knownforhisdeepunderstandingof thecreditanddebtcycle,Colinhad alwaysbeendrivenbyadesiretomake adifference.Yet,despitehisexpertise, thesheercomplexityofthefinancial worldoftenlefthimfeelingtrappedin anever-endingcycleofchallengesand constraints.

Foryears,Colinhadputhisenergy intonavigatingtheintricatewebof regulationsandprocessesthat governedtheindustry.Eachday seemedtobringanewhurdle,whether itwasensuringcompliance,managing loanorigination,ordealingwiththe thornyissuesofinsolvency The demandswererelentless,andColin foundhimselfworkingaroundthe clockandattimesfoundhisvision blinkeredbytheimmediatedemands ofhiswork.

Thencameapivotalevening,onethat wouldchangethecourseofhis journey Afteradayofwork,Colin foundhimselfgazingoutofhisoffice window,andinthatmomentofquiet reflection,arealizationdawnedupon him.Hehadbeensoconsumedbythe minutiaeofhisresponsibilitiesthathe hadlostsightofthebiggerpicture.The constantdemandsandfearoffailure

hadtightenedaroundhim,obscuring thevastpossibilitiesthatlifehadto offer

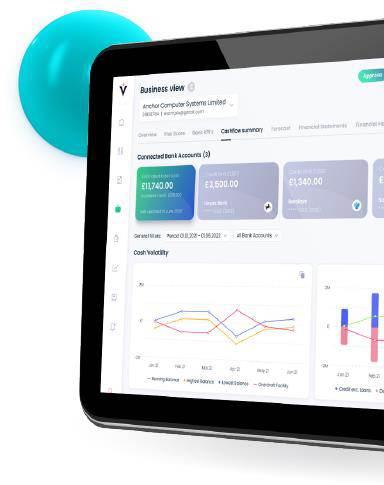

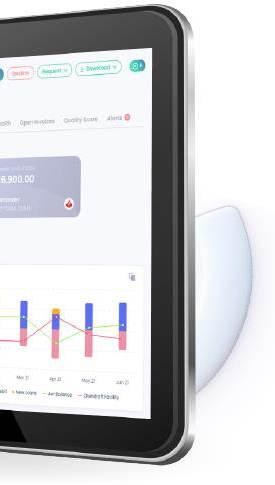

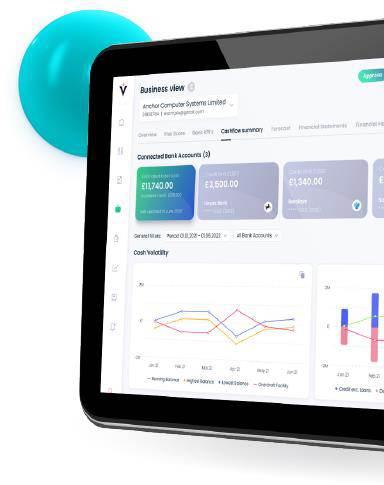

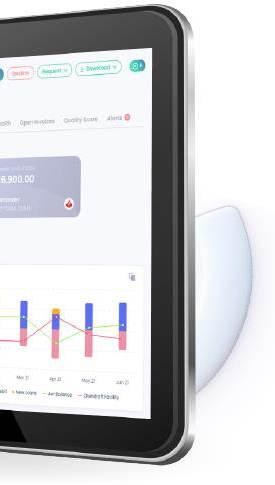

Reinvigoratedbythisrevelation,Colin setouttorevolutionizethefinancial industry.HisgoalwastomakeAryza theglobalstandardforfinancial software,addressingeveryaspectfrom loanoriginationtoinsolvency.Driven byamissiontoenhancethe relationshipsbetweenbusinessesand theircustomers,hefocusedoncreating acomprehensivesuiteofsoftware productsthatleveragedinsightsfrom eachstageofthecreditcycle.

Colin'svisionextendedbeyondmere functionality.Heaimedtointegrate intelligencethroughouttheecosystem, enhancingefficiencyandeffectiveness ateveryturn.Bytrulyunderstanding thecustomerjourney,heembodiedthe Reutersethosanddemonstratedthat eventhegreatestchallengescouldbe overcomewithvision,knowledge,and arelentlesspursuitofexcellence.

Let us learn more about his journey:

Colintrainedasasoftwaredeveloper,a backgroundthatfueledhispassionand interestinsoftware.Asayoung teenager,hevividlyrecallsvisitinga client’ssite—afoodmanufacturing company—andwitnessingusers interactwithsoftwarehehad developed.Theexperienceofseeing hiscreationinactionandthepositive impactithadontheirday-to-day operationsgavehimaprofoundsense ofsatisfactionandinspiration.This earlyexposuretothetangibleeffectsof hisworkwasadefiningmomentinhis career.

Fromthoseearlydaysinfood manufacturing,Colinlearnedthat developingsoftwareoftenmeant understandingotherpeople’s businessesbetterthantheymight themselves.Thisunderstandingcame fromanalyzingtheentirecradle-togravelife-cycleoftheirprocesses, identifyingopportunitiestomake operationsmoreefficientand automatedthroughtechnology

Colin’s innovative thinking led to the integration of predictive analysis into Aryza’s o�erings. By using data from the debt side, Aryza aimed to create predictive models that could identify early warning signs of �nancial vulnerability.

Colin’scareerledhimthroughvarious sectors,predominantlywithinfinancial services.Hefoundhimselfdeveloping softwareforbanking,lending, collections,andeventually,insolvency Thisjourneyprovidedhimwith comprehensiveinsightsintothefull lifecycleofthecreditanddebtcycle. Heunderstoodthecomplexitiesfrom loanoriginationandmanagementto collections,debtresolution,and insolvency Thisholisticviewallowed himtoappreciatethe interconnectednessofthesesegments.

Throughouthiscareer,Colinrealized thatdespitethedifferent roles—lenders,debtcollectors, insolvencypractitioners—thecommon denominatorwasthecustomer Whethercorporateorpersonal, customerswerenavigatingthejourney ofcreditanddebt.Thisinsightsparked hisvisionforcreatingaseamless ecosystemthatcouldenhance relationshipsbetweenbusinessesand theircustomers.

InspiredbyReuters’missionstatement, “How can we ensure that our customers have a better relationship with their customers?” Colin understoodthatfullycomprehending thecustomerjourneywascrucial.He soughttoleveragelearningfromeach partofthecycletobenefitothers, integratinginsightsfromloan managementintoinsolvencyprocesses, andviceversa.

Thiscomprehensiveknowledgeand visionledColintoestablishAryza.He aimedtoprovideafullsuiteof softwareproductsservicingall segmentsofthecreditanddebtcycle. Hislong-termvisionwastocreatea seamlessandfrictionlessecosystemfor hisclients'customers,enhancingthe overallexperienceandstrengthening relationshipsateverylevel.AsaB2B player,hefocusedonmakingthese

journeysassmoothaspossible, ultimatelyfosteringbetterrelationships betweenbusinessesandtheirclients.

Colin’sjourneywithAryzabeganat theendofthecreditanddebtcycle—in thefieldofinsolvency.Hebelievesthat theessenceofinsolvencyis forgiveness,anoftenoverlookedbut vitalcomponent.Forgivenessallows individualsandbusinessesfacing financialdifficultiestostartanew, deservingasecondchancedespiteany pastmissteps.Thiscompassionate perspectivefueledColin’spassionfor theinsolvencymarketandthe impactAryzacouldmakewithinit. Aryzaprovidessoftwaresolutionsto insolvencypractitioners,ensuringthat theirprocessesaresmoothand efficient,ultimatelycreatinga frictionlessexperiencefortheend consumer Thisinitialfocuslaidthe groundworkforAryza’sbroader mission.Asthecompanythrived, Colinandhisteambegantoexplore othermarkets,aimingtoexpandtheir reachandimpact.

Theirfirststepinexpansionwas internationalgrowth,targeting countrieswithlegislativesimilaritiesto theUK,suchasCanadaandAustralia. Thisapproachleveragedexisting expertisewhileopeningnewavenues forAryza’sinnovativesolutions. Simultaneously,Colinexaminedother verticalsrelatedtoinsolvency,drawing onhisextensiveexperienceinbanking andcollections.

Colin’sstrategicvisioninvolved walkingbackwardthroughthecredit anddebtcycle,frominsolvencyto collections,loanmanagement,and finally,loanorigination.Herecognized thatateachstage,thereisadecision-

Colin believes fostering a culture of openness and transparency is crucial. He values compromise and maintaining momentum over indecision and stagnation. The focus should be on moving forward with decisions, even if it means making compromises along the way.

makingprocess,whetherit’sapproving aloanordeterminingeligibilityfor insolvency.Byidentifyingcommon denominatorsacrossthesestages, Aryzacouldapplyinsightsfromone areatoanother,enhancingoverall efficiencyandeffectiveness. Forinstance,theregulatory managementinloanadministration mirrorsthatininsolvency management.Bothrequirehandling customerqueries,managinglate payments,andensuringcompliance withregulatorystandards.By understandingtheseparallels,Aryza developedsolutionsthatstreamline operationsacrossdifferentsegmentsof thecreditanddebtcycle.

Colin’sinnovativethinkingledtothe integrationofpredictiveanalysisinto Aryza’sofferings.Byusingdatafrom thedebtside,Aryzaaimedtocreate predictivemodelsthatcouldidentify earlywarningsignsoffinancial vulnerability.Thisproactiveapproach allowslenderstointervenebeforea situationbecomescritical,shiftingthe industryfromareactivetoaproactive stance.

Aryza’sholisticecosystem,builton Colin’sinsightsandexperience,serves

varioussectorsbyleveraging knowledgefromdifferentsegments. Thisseamlessintegrationof intelligencethroughoutthecreditand debtcycleisdesignedtoenhance relationshipsbetweenbusinessesand theircustomers,ultimatelyimproving thecustomerexperience.

Inessence,Colin’sjourneywithAryza exemplifiesacommitmentto understandingandaddressingthefull spectrumoffinancialchallenges.His abilitytoseebeyondpersonalworries andfocusoncreatingcomprehensive, intelligentsolutionshaspositioned Aryzaasatransformativeforceinthe financialsoftwareindustry.By fosteringforgivenessandsecond chances,hecontinuestoshapeafuture wherefinancialinteractionsare seamless,supportive,andprofoundly impactful.

ForColinandAryza,havingastrong localpresenceiscrucialwhenentering anyregion.Thesectorsthey service—whetherlenders,creditors, debtcollectors,orinsolvency practitioners—areallhighlyregulated.

Understandingregionalregulationsis essential,andthebestwaytoachieve thisisbyhavinglocalSMEsonthe groundwhocomprehendthenuances ofthesegmentstheyareservicing. Theselocalexpertsalsomaintainclose connectionswiththevariousregulatory bodies,suchastheFCAintheUKor regionalinsolvencyassociationslike IPA,CAIRPandARITA.

ColinemphasizesthatAryza's solutionsarenotgeneric,unregulated softwarethatcanbesoldremotely fromtheUKorIreland.The complexityandregulatorynatureof theirservicesnecessitateadeep understandingoflocalregulationsand markets.Thus,establishingalocal presenceisparamount.

Aryzaachievesthisthroughboth organicgrowthandstrategic acquisitions.Organically,theybuild localteamstoensurein-depthregional knowledge.However,thereal momentumcomesfrominorganic growth,particularlythroughmergers andacquisitions.Byacquiring businessesthatalignwithAryza’s ethosandoperationalstyle,theycan quicklyestablishafootholdinnew regions.Theseacquisitionsbring establishedcustomerbasesandstrong seniormanagementteamswhohavean intrinsicunderstandingoftheirlocal markets.

Thisacquisitionstrategysignificantly de-risksexpansionefforts.Bytargeting successfulbusinesseswithrobust management,Aryzaensurescontinuity andlocalexpertise.Onceacquired, thesebusinessesbenefitfromAryza’s broaderknowledgebaseandresources, fosteringanexchangeofbestpractices acrossregions.

Colinfindsthismulti-pronged approach—combiningorganicgrowth withstrategic

acquisitions—particularlyeffective. It allowsAryzatoleverageregional insightsandapplythemacross differentmarkets,enhancingitsoverall serviceoffering.Thismethodnotonly acceleratesgrowthbutalsoensures thatAryzaremainscompliantand effectivewithineachuniqueregulatory landscape.

Ultimately,Colin’svisionforAryzais tocreateaseamless,intelligent ecosysteminthefinancialsoftware industry.Byensuringtheyhaveboots ontheground,Aryzacanoffertailored solutionsthatmeetthespecificneeds ofeachregion,fosteringbetter relationshipsbetweenbusinessesand theircustomers.Throughablendof organicandinorganicstrategies,Aryza continuestoexpanditsreachwhile maintainingthehighstandardsof regulatorycomplianceandcustomer satisfactionthatdefineitssuccess.

Colinbelievesthatmanycompanies struggletodifferentiatethemselves becausetheyoftenprovidesimilar answerstothesamequestions. However,heseesAryza'sstrengthin itsdeepheritageandsectorexpertise. WhileAryzafocusesonsoftware development,heemphasizesthattheir successcomesfromunderstandingthe sectorstheyserveandhiringhighcaliberprofessionalsfromthose industries.Hehighlightstheir customer-centricapproach,which involveslisteningtothecustomer's voiceandaddressingtheirchallenges. Heassertsthatrealinnovationoften comesfromsimplesolutionsthathave asignificantimpactonthecustomer, ratherthancomplexideas.

Colinalsovaluessettingambitious goalsandencouragingdecisivenessin execution.Hebelievesthatmakinga

decision,evenifit'sthewrongone,isbetter thanmakingnodecisionatall.Awrong decisioncanbequicklyrectified.He advocatesforclearcommunicationofbusiness objectivesandencourageshisteamtomake theirowndecisions.Accordingtohim,it's importanttobeopentocritiqueanduseitasa toolforprogress,whetheryouagreewithitor not.

Intermsofleadership,Colinpromotes autonomyanddecision-makingamonghis teammembers.However,heisalsoprepared tostepinandmakedecisionshimselfif necessary.Hestressestheimportanceofbeing supportive,clearwithinstructions,and focusedonlong-termgoals.

Colinbelievesfosteringacultureofopenness andtransparencyiscrucial.Hevalues compromiseandmaintainingmomentumover indecisionandstagnation.Thefocusshouldbe onmovingforwardwithdecisions,evenifit meansmakingcompromisesalongtheway

HisvisionforAryzaistocontinueitsgrowth trajectoryandestablishitselfastheleading softwareproviderforthecreditanddebtcycle worldwide.ColinaimsforAryzatobe recognizedasthego-toprovider,whethera lenderisinEurope,Asia,Australia,or America.Heiscommittedtodrivingthis growthandadaptingthebusinessasneeded.

Additionally,Coliniskeenoncontinuing innovationandembracingtheever-evolving technologylandscape.Heacknowledgesthe importanceofstayingcurrentwith technologicaladvancementsandexploring potentialnewphasesforAryza,suchas expandingintowealthmanagement.

Inclosing,Colinexpressesenthusiasmforthe company'snewinitiativesandappreciatesthe productivediscussion,lookingforwardto futurecollaborationsandcontributions.

romallfacets,disruptive Ftechnologiesdramatically changethebusinessand industrialfabric.Inshort,itisbotha tremendouschallengeandalsoan opportunityforbusinessgrowth.

Themeasuresofthecomplexityinthis environmenthavereachednewheights sothatproperunderstandingofthesaid technologieswillbeimportantto leadersandchiefexecutivesin securingtheirorganizations'future.For thatmatter,thisarticleshalldelveinto themaindisruptivetechnologiesthat CEOsshouldconsiderforfuture growthwithrespecttotheuseof statisticsandinsights.

Artificial

Artificialintelligenceisthemost importanttriggerforchange,basedon Gartner'slatestsurvey,whichfound that21percentofCEOsidentifieditas oneofthemaindriversofchangeinits industryoverthenextthreeyears,with possibleconsequencesfromthe automationofsimpleroutinebusiness operations,improveddecision-making processes,orthegenerationofnew productsandservices.Example:From processinnovationandcostefficiency toa40%boostinproductivity

AnotherareawhereAImakesan impactisinthetransformationof customerexperience.AIpersonalizes customerinteraction;hence,firms usingAIanalyticshavemadetheir offeringsaccordingtocustomer preferences.Thiscreatesalevelof satisfactionandloyaltythatboosts revenuegrowth.

Othercoretechnologiesare5G,which promisesimprovednetwork connectivityandspeedsinmost industries.Indeed,5Gwillmakesmart cities,autonomousvehicles,andalot morepossiblewithfasterdatatransfer ratesandlesslatency.Theglobal5G marketwillgrowto$667billionby 2026ashigh-speedinternetand

connecteddevicesbecomein increasingdemand.

5Gtechnologywillenable telemedicinetopushuptothenext levelsofcaresuchthathealthcare servicesbecomeaccessiblewithout anydelayinmostremotelocations wheremedicalfacilitiesarefew This isusefulinmostruralareas. Businesseswithaninvestmentin5G infrastructurecanstreamlinetheir operationsandseeknewsourcesof revenuethroughnewservices.

Thesecondtransformativeforceis blockchaintechnology.Ithasbrought unprecedentedtransparencyina transactionwithmoresecurity.Sinceit makesitpossibletomaintain decentralizedrecords,blockchain couldhelpsimplifysupplychain management.Blockchaincouldalso cutbackonfinancialservicesfraud.As estimated,companiesthatapply blockchainmightreduceoperational costsandsavingsuptoamaximumof $100billioneveryyear.

Moreover,blockchainpotentialis associatedwithanumberofsectors otherthanfinance.Forinstance,inthe healthsector,thistechnologycan manageandstorepatientrecordswith confidentialityandincompliancewith suitableregulatorystandards.As organizationsappreciatethevalueof blockchaintechnology,theadoption rateofthetechnologywouldalso increase.

Theinternetofthings,atermcurrently beingpromotedworldwide,refersto thelinkbetweenordinarythingsin everydaylifeandtheinternet,through whichtheyexchangedata.Such connectivityallowsbusinessestohave real-timeinsightsintooperationsin ordertoimprovetheirdecisionsand customers'experiences.Statistareports thattheglobalmarketforIoTis expectedtogrowupto$1.6trillionby 2025.

IoTapplicationsrangefromsmart homedevicesthatoptimizeenergy usagetoindustrialsensorsthatmonitor equipmentperformance.Acompany thatusesIoTcanbetteroperationally utilizeitsresourcesandreduceitscosts bypredictivemaintenanceand resourcemanagement.

Themetaverseisanewfrontierinthe digitalworldofinteraction-it'sthe integrationofvirtualrealityand augmentedrealitytechnologies. Metaversewouldsignificantlychange thewaybusinessesperformbycreating immersiveenvironmentsforworkand play.Gartnerpredictsthatfullyvirtual workspaceswillmakeup30%of investmentgrowthinmetaverse technologiesbytheyear2027. Therefore,organizationslookinginto themetaversecouldenhance collaborationforworkersthrough virtualmeetingandtrainingsessions. Corporatecompanieswillalsobeable toleveragethemetaversetodevelop uniqueexperiencesforcustomersto enjoy,suchasvirtualshopping environmentsorinteractiveproduct demonstrations.

Thesetechnologiesbringtremendous opportunitiesbutalsoformidable challenges.Accordingtoasurveyby AlixPartners,85%oftheCEOsfindit achallengeintermsofknowing exactlywheretostartadoptionof disruptivetechnologies.Manyexpress concernsonwhetherorganizations havetheabilitytoadaptfastenoughin alandscapethatischangingrapidly.

Successinridingthroughthese challengesrequiresagileorganizations andtheCEOsincharge.Thisis throughtheestablishmentofaculture ofinnovationwhereindividualsare encouragedtoexperimentandtryout newthingswithoutfearingthe consequencesoffailure.Thebest chanceoffacingthedevastationof disruptionlieswithflexible-minded companies.

Inconclusion,thebusiness environmentistransformingindeep wayswithdisruptivetechnologiesof AI,5G,blockchain,IoT,andthe metaverse.Therefore,anyorganization thatlooksintofuturegrowthfirsthas tounderstandthesetechnologiesto makestrategicdecisionsthatwill benefittheorganization.

Byinvestinginsuchinnovationsand fosteringadaptiveorganizational cultures,leaderscanpositiontheir companiesforsuccessinanentirely competitiveenvironment.Theworkis somewhattoembracechangerather thantoresistit;thosedoingsowillbe well-equippedtoharnessthepowerof disruptionforsustainablegrowthinthe yearsahead.

The only limit to our realization of tomorrow will be our doubts of today. , ,

- Franklin D. Roosevelt

Diversityandinclusion(D&I)

havebecomepartofthe corporatecultureinrecent years.Ascompanieslookforwardto creatingenvironmentswhereall employeesfeelvaluedandincluded, thisbecomesaveryimportantissue, butwhatCEOsdobecomethewhole difference.

Let us explore on how strategic approaches by the CEOs can be deployed in promoting D&I within organizations for better performance and innovation.

Diversityistheexistenceofdifference inagivenenvironment,suchasrace, gender,age,sexualorientation,and manyothers.Inclusionwillmeanthat theabilityofagivenworkplace environmenttomakediverse individualsfeelvaluedandwelcomed exists.

Researchshowsthatorganizationswith diversifiedteamsaresixtimeslikelyto bemoreinnovativeandagile.In addition,D&I-focusedfor-profit organizationsmayearnupto30 percentmorerevenueperemployee comparedtolessinclusivefor-profits. Thesenumbersbolsterthebusiness caseforadiverseworkforce.

TheCEOshouldbethemainchampion ofD&Iprograms.Leadershipis paramountbecause,atthetop,the entireorganization'scultureisset. WhentheCEOpubliclycommitsto D&I,thismessagespreadsthroughout theorganization.

Currently,95%ofCEOsreportthat D&Iisapriority;only34%believe theirorganizationexcelsinit,making thisgapapressingneedforworkable, actionablestrategiesthattranslate commitmentintomeaningfulchange.

D&Ioughtnotbeapproachedas strictlyanHRissuebut,ratherasa corepartoftheoverallbusiness strategy.Throughcorebusiness objectives,embeddingD&Iensures thatdiverseperspectivesare consideredinthedecision-making process.Insodoing,theyimprove creativityandfurtherincreasethe abilityofcompaniestounderstandand betterservetheirdiversecustomers.

OneofthetasksthatCEOShaveto takeinordertoprecipitate transformativechangeistomake executiveleadersaccountablefor gettingcertainD&Iresults.Thiscanbe donethroughtheconstructionofvery cleargoalsandkeyresults,knownas OKRs,thataredirectlyconnectedwith diversityandinclusion.

Thus,itmaybehiringandemployee engagementmetricsamong underrepresentedgroups.Iftheseare coupledwithperformancereviewsand compensation,itwouldnudge organizationalleadersintomaking concreteeffortsinD&I.

Regulartraditionaltrainingprograms onlyincreasetheemployees'awareness ofthebiasesthatmightprevailbut hardlyhelpsthemtoactdifferently TheCEOsmustinsteaddemand constantinclusionmanagement practiceswithcontinuousleadership development.Leadersmustbeableto createpsychologicallysafe environmentsinwhichallemployees canoffermorethanwhat'sregardedas comfortablesharingofthoughtsand viewpoints.

Employeeresourcegroupsissettingup oneofthebestwaysinembracingD&I withinanorganization.ERGspresent

anopportunityforemployeesto networkwithpeoplefromdiverse backgrounds,shareexperiences,and participateinD&Iinitiativeswithinthe organization.Arequirementforevery ERGistheexistenceofanexecutive sponsorwhowillrallybehindits objectivesandalignsthemwiththe company'soverallstrategy

ToinstituteD&Ieffectively, organisationsmustmeasureandreport backregularlyontheirprogress,not justhowtheyaredoingbutwhatthey aredoing.Thiscanbedoneby conductingasurveyorhostingafocus groupintheareasofexclusionand improvement,andthensharingsuch insightwithyouremployeestobuild trustandauthenticity

Diversityatthetopmostlevelof managementbeginswith representationintheleadership.CEOs activelymustensurethattheyare developingapipelineofdiverse candidatesforfutureleadersbyhaving inclusiverecruitmentpractices. Examplesincludejobpostingsthat eliminatebiasesanddiverse representationsamonginterview panels.

Theeconomicbenefitsofdiversityare huge.Morediverseexecutiveteams havea21%probabilityof outperformingpeersinprofitmargins, whileethnicallydiverseteamsenjoyan evengreateradvantageat36%.All thesestatisticsgoontoshowthatD&I spendingisnotjustamoralobligation butalsoastrategicbusinessdecision.

Leadersfromalllevelsaretomake deliberateeffortsinhelpingcreatean inclusiveculture.Theyhaveto acknowledgepeople'scontribution, engageaneasycommunication

channelonmattersofdiversity,and eliminatediscriminatorybehaviors whentheystarttheirwork.Such employeesare,withoutanydoubt, goingtogetall-aroundintegratedinto theirperformance.

Aboveall,managingdiversityand inclusioninthecorporatecultureofan organizationisnotmerelyataskof complianceorconformitytosocietal expectationsbutrathersolvingthefull potentialoftheorganizationthrough variedperspectivesandexperiences.

TheCEOscanmakeadifference meaningfullybyaligningthemselves aschampionsofD&I;theycenteritin theirbusinessstrategy;theyhold leadersaccountable;theymovebeyond traditionalmethodsoftraining;they createsupportivestructures,suchas ERGs;theyregularlyreviewand assessthetrendovertime;theybuild diverseleadershippipelines,recognize theeconomicbenefitsofdiversity,and, mostimportantly,createaninclusive culture.

Thesestrategiescannotonlyenhance themoraleoftheworkplacebutalso improvedecision-makingprocesses, andultimatelydrivebetterbusiness outcomesinthiscompetitive landscape.

Intoday’sworld,managingmoney

effectivelyhasbecomemore essentialthanever Withrising costs,shiftingeconomiclandscapes, andnewfinancialtoolsavailable,it’s crucialtostayinformedandmake smartfinancialdecisions.From budgetingtoinvesting,therearemany strategiestohelpindividualsand businessesachievefinancialsuccess.

Budgetingisthefoundationof financialstability.Knowingwhere everydollargoesnotonlyhelpsavoid unnecessaryexpensesbutalsoallows forbetterplanningforfuturegoals. Manypeopleoverlookbudgeting,yetit isoneoftheeasiestwaystobuild wealthovertime.Bytrackingincome andexpenses,youcanidentifyareas whereyoucansaveandworktoward yourfinancialgoalsmoreefficiently.

• IdentifyIncomeandExpenses: Makealistofallincomesources andmonthlyexpenses.Thisgives aclearpictureofyourcashflow

• SetFinancialGoals:Whether it’spayingoffdebt,savingfora vacation,orinvesting,having specificgoalscanguidespending decisions.

• AdjustSpendingHabits:Look atwhereyoucanreduce expenses,suchasdiningoutless orfindingcheaperalternativesfor monthlybills.

Buildingasavingscushionisessential forunexpectedexpensesor emergencies.Onceyouhavean emergencyfund,investingcanbethe nextsteptogrowyourwealthover time.Stocks,bonds,andmutualfunds arepopularinvestmentoptions,each withitsownriskandreturnprofile. Diversifyinginvestmentscanhelp manageriskandensurelong-term growth.

Loanscanbepowerfulfinancialtools whenusedcorrectly.Theyprovide accesstocapitalthatcanbeusedfor variouspurposes,frompurchasinga hometofundingabusiness.However, notallloansarecreatedequal,andit’s essentialtounderstandterms,interest rates,andrepaymentplans.

Onepopularloanoptionisthe5000 loan,oftenusedforconsolidatingdebt, coveringunexpectedexpenses,or fundingpersonalprojects.Many lendersoffercompetitiveratesfor smallerloans,makingiteasierto managerepayments.Whenconsidering aloan,besuretoevaluateyourability torepayitwithinthedesignatedterm toavoidfinancialstrain.

• PersonalLoans:Idealfor coveringpersonalexpenses, homeimprovements,or consolidatinghigh-interestdebt.

A5000loancanbeapractical choiceforhandlingimmediate needswithoutaccruingsignificant interest.

• BusinessLoans:Perfectfor entrepreneurswhoneedcapitalto startorexpandtheirbusinesses. Theseloanstypicallyrequirea detailedbusinessplanandgood credithistory.

• AutoLoans:Designed specificallyforvehiclepurchases, autoloansusuallyhave competitiveratesandflexible termsbasedontheborrower’s creditscore.

• HomeLoans(Mortgages): Homeloansaregenerallylongtermloanswithlow-interestrates andareusedexclusivelyfor purchasingrealestate.

Forthosewithexistingdebt,creatinga repaymentstrategyisessential.Highinterestdebt,suchascreditcarddebt, shouldbeprioritizedtoavoid escalatinginterestcharges.Methods likethe“avalanche”or“snowball” methods,whichfocusonpayingoff high-interestdebtfirstorsmaller balancesfirst,respectively,canhelp managedebteffectively Iftakingoutaloantoconsolidate existingdebts,ensurethenewloan’s interestrateislowerthanthecombined ratesofthepreviousdebts,allowing youtosaveoninterestandstreamline payments.

Financialsecuritydoesn’thappen overnight.Itrequiresdiscipline, planning,andpatience.Bytakingsteps likebudgeting,saving,andinvesting, andusingloansstrategically, individualscanbuildasolidfinancial foundationforthefuture.

Remember,thegoalisnotjustto accumulatewealthbuttoachieve financialfreedomandstabilitythat allowsyoutolivecomfortablyand confidently,regardlessofeconomic shifts.

Insummary,managingmoneywisely involvesamixofbudgeting, disciplinedsaving,informedinvesting, and,whenneeded,strategicborrowing. Withaclearplanandconsistent actions,anyonecannavigatethe financiallandscapeandbuildasecure future.

Two roads diverged in a wood, and I—I took the one less traveled by, And that has made all the difference.

- Robert Frost

www.X.com/insightssuccess