Asweallknow,therecentpandemiccaused

worldwideisolation.Severalbusinesseswere drasticallyaffectedbythechaosofthevirus. However,itstrokedasanopportunityforseveral organizationstofocusontheirfinancesanddevelop innovativestrategiesthatgainedlargeprofitswhen implemented.Financialleaderswhodevelopedthese strategiesalsofacedoneofthecrucialchallengesinthe unprecedentedtime,whichwastheimperativetestamentof relationshipsbetweenthefinancialadvisorsandtheir clients.However,theseleadersunderstoodclients'exact needsandovercamethesechallengestocelebratethetaste ofvictoryintheprocess.

Leadersinwealthmanagementaretransformingthe industry'slandscapebyimplyingstrategiesthathave createdavastimpactandwillcontinuetodosointhe future.Overtheyears,theseleadershavegarneredtheir expertiseintheindustry,whichassiststhemtobemore agileandresilientintheirworkwhileexecutingcostefficienttechniquesfortheirclients.

Largecorporatesorsmallbusinesses,hugegroups,or individuals,financialadvisorshaveconstantlyreshapedthe decision-makingbyimplementinginnovativeideasthat deliverprofitsandhelpwithcost-cuttingefficiencies.Beit investmentortrade,assetsoroperatingcash,leadersin wealthmanagementhaveallowedthefinancialsubsidiaries tostreamlinetheirworkprocesses.

Numerousindividualsandorganizationswerelefttoponder thequestions,howthesefinancialadvisorshelpedleada seamlessbusinessmodel?Howdidaremoteworkculture

helptoshiftclientrelationships?Whatpattern changedoccurred,andhowhaswealthmanagement significantlyimpactedtheseorganizationstocome outontop?Theanswerstothesequestionshave innuendoforindividualadvisorsandaspiring executiveswhorelyonindustryinsights.

Therefore, Insights Success embarkedonajourney tofindleaderswhomadethemostwiththeir proficientknowledgeandexpertise.Inthiseditionof "The 10 Most Influential Leaders in Wealth Management, 2021," wearecherishingtheleaders whocreatedtheirsuccessfulsagaswithdedicated endeavors,grit,anddetermination.

FeaturedonthecoverofthiseditionisBruce Munster.HeservesastheManagingDirectorat MerrillPrivateWealthManagement.Asan accomplishedfinancialadvisor,headdresseshis clients'wealthmanagementconcernsrelatedto M&Atransactions.

Diveintomorealikeandinspiringstoriesofsuch inspiringleadersandspreadthewordabouttheir contributiontomakethisworldabetterplace.

Whileflippingthroughthepages,makesuretoscroll throughthearticleswrittenbyourin-houseeditorial teamandCxOstandpointsofsomeoftheleading industryexpertstohavetheknow-howaboutthe industry

HappyReading!

sourabh@insightssuccess.com Sourabh More

BruceMunster ManagingDirector

CraigBeden FinancialPlanning andinvestmentstrategies

MerrillPrivate WealthManagement ml.com

Beden WealthManagement bedenwealth.com

EserTorun ChiefGrowthOfficer

Everledger everledger.io

JakeHamlin Partner WealthAdvisor

ChicagoCapital chi-cap.com

KurtWhitesell Advisors

KimBourne ManagingDirector

WhitesellFinancial Group wfgllp.com

PlayfairPlanning playfairplanning.com

Merrillisoneofthelargestwealthmanagementbusinessesin theworld.

BedenWealthManagementprovidesfinancialplanningand sophisticatedwealthandinvestmentmanagementservices.

Everledgerisanindependenttechnologycompanyhelping businessessurfaceandconvergeassetinformation.

Chi-CapisanSECregisteredinvestmentadviser

WhitesellFinancialGroup,LLPsharesthegoaltohelpthe clientspursuetheirpassions.

PlayfairPlanningServicesisaboutiquefinancialfirm.

MarkCortazzo

SeniorVicePresident FinancialAdvisor

PeterLee FoundingPartner

MACROConsulting Group wealth enhancement.com

SummitTrailAdvisors summittrail.com

MACROConsultingGroup's3-stepUniFi™processhelps ensureyourfinanciallifeisorganized,comprehensiveand straightforward.

SummitTrailAdvisorsisaleadingNetworkedFamilyOffice intentionallydesignedforthosewhohaveoutgrowntraditional wealthmanagers.

ScottBarkow SeniorVicePresident Investments-Managing Director

TimPagliara Founder, ChairmanandChief InvestmentOfficer

RaymondJames RaymondJames.com

CapWealth capwealthgroup.com

RaymondJamesFinancial,Inc.providesfinancialservicesto individuals,corporationsandmunicipalitiesthroughits subsidiarycompanies.

CapWealthisanindependentRegisteredInvestmentAdvisory firmthatbuildswealthmanagementsolutions.

FeaturedPerson

Bruce C Munster Managing Director Merrill Private Wealth Management

Bruce C Munster Managing Director Merrill Private Wealth Management

We believe that while significant wealth brings complex challenges, our experience, passion and perspectives can help you simplify your life.

Aroadtosuccessisneverastraightone.Onehasto gothroughmultiplehurdles,failures,and undulatingmovementstoreachtheirdestination. Thosewhoworktheirfingerstotheboneandhavedesired persistencecoupledwithunwaveringpassionand considerableingenuityareabletomakeit.Bruce Munster’sstoryhasbeenthesimilarone.

BruceisaPrincipaloftheMunsterFreemanGroup,an advisorypracticewithinMerrillPrivateWealth ManagementinCenturyCity,CA.Bruceisentrustedwith nearly$3billionandhasbeeninstrumentalindrivingthe successofmanyentrepreneurs,professionalentertainers, professionalinvestors,headsofinvestmentbanksand privateequityfirms.Hisclientstrusthimtoaddresstheir personalwealthmanagementconcernsrelatedtoM&A transactions.Notonlythis,buthehasalsogarneredseveral honorsasafinancialadvisor

Brucehasearnedallthisprominenceandtrustinthewealth managementindustrywithhisdiligence,ingenuity,shrewd financeacumen,andpersonalizedapproach.

Inourendeavortofind “The 10 Most Influential Leaders in Wealth Management, 2021”, wecaughtupwithBruceto unveilhisjourneyandhowMunsterFreemanGroupforms thefoundationofitsclients’financialstrategy.

Below are the highlights of the interview: Briefouraudienceaboutyourjourneyasabusiness leaderuntilyourcurrentpositionatMerrillLynch. Whatchallengesyouhadtofacetoreachwhereyouare today?

Everyonefaceschallengesinlife.Mystoryisnodifferent.I wasblessedtogrowupwithtwolovingparentswho remindedmethatwewerealways‘Rich with Love’.My Dad,BruceSr.,managedalocaldistributioncenter,andmy Mom,Kris,workedasawaitressforgrocerymoney.Itwas CentralCaliforniainthe80’s,andIhadnocluehowbigthe worldwas,butthatwasok.Ididn’tknowitatthetime,but Imettheloveofmylife,Therese,at16inthehallway outsideofmycalculusclassroomatClovisHighSchool.I wasagoodstudentandagoodwrestler,whichcreatedthe opportunityformetostudyengineeringandwrestleat CornellUniversity.MyoldestsonSamuelwasbornover thespringbreakofmyfreshmanyear ThereseandIwere marriedthesummeraftermysophomoreyear,andI realizedgettinganMBAaftergraduationwouldbetough, soIdecidedtopivottothebusinessschool.Igraduated withadegreeinBusinessManagement&Marketingin 1997anddrovebacktoCaliforniawithThereseandSam sleepinginthecar.Webarelyhadenoughgasmoneyafter puttingadepositonasmallapartmentinShermanOaks. MysecondsonBruceJrwasbornafewmonthslater,andI learnedtherewasagraceperiodforhealthinsuranceatmy newjob,sothecostwasnotcovered.Westruggledgreatly intheearlyyears,asitwasnoteasysupportingafamilyof fourinLosAngelesonasmallsalary.

ThingsbegantolookupwhenIstartedatPaineWebber (nowUBS)inJuneof1999asafinancialadvisortrainee.I joinedateamwithtwoveteranadvisorsandwasassigned tocallpeopletoattendtheirfinancialseminars.Afterthe firstyear,IrealizedthatIcouldtrytoworkharder,orI couldfindwaystoworksmarter,soIbegansearchingfor betterwaystoreachclients.OnedayIaccidentallycalleda billionairewholikedwhatIhadtosayandinvitedmeto meetwithhim.Ilistenedandlearnedabouthisfamilyoffice andaboutallthepeoplewhoworkedforhim.This

experienceinspiredmetodevelopabusinessplanto replicatetheservicemodeloffamilyoffices,whichIcalled the ‘Personal Team Benefit’. Mythesiswasthatallhighnet-worthclientsneededcomprehensivefinancialservices coordinatedwiththeirtaxandestatelawyersandCPA. NowIjustneededmoreclients!

In2002,afterlosinganRFPforastockoptionplantoa discountfirm,Iwentbacktothecompanytopitchmy PersonalTeamBenefitidea.Mythenpartnerstoldmeit wasastupidideaandawasteoftime.Myalternativewas morecoldcalling,soItooktheriskandpitchedthedeal anyhow.Iwasgiventheopportunitytoofferourservicesto agroupofappx150executives.Itwasatippingpointfor measIcompleted78financialplansandearned72new clientsoveran18moperiod.Buttowardtheend,Imetmy firstbigclientwhohadgrownasmallfamilycosmetics businessranoutthebackofapharmacyinManhattanintoa powerhousebrandwhichtheysoldtoalargeglobalbrand. Theaccountofthenew‘bigclient’wasalmostasbigasthe 72executives.Itwasatonofwork,andtheclienthadalot moreneedsthanthetypicalclientweserved,buttherewas nocomparingthatworktohandling72accounts.

Whilethebusinesscontinuedgrowing,itwasbecoming increasinglyhardertomanage.Weaddedmorestaff,butI wasworking12+hoursaday,andeverythingseemedlikea firedrill.InApril2007,Iproposedthatwetransitionclients tootherfinancialadvisorsintheofficetofocusonserving onlylargerhouseholds.Whenthisideawasrejected,Iknew itwastherighttimetomakeachange.

InSeptember2007,IacceptedapositionatMorganStanley andstartedmyownteamwithDavidFreeman.Webrought appx$350MofAUM.Weadjustedourclient’sasset allocationsattheendof2007andincorporatedrisk managementstrategies,soourclients(onaverage)were downonlysingledigitsin2008andbackintheblackby Mayof2009.MydaughterHaifawasbornthatMayandit markedthebeginningofanewchapterinourlife.

Aroundthesametime,theUSGovernmentranthefirst trillion-dollardeficitin2009,soIgotcuriousaboutthe deflationaryexperienceinJapanand,aftercarefulanalysis, concludedthatballooningdeficitswouldcauseinterestrates toremain‘Lower for Longer’ Alocalmagazine,C-Suite Quarterly,publishedmythesis,andIgotsomefascinating

feedbackfrommultiplemarketluminaries.Idiscovereda newpassionforwritingandbegantodeliverregularmarket commentaries.From2011to2015,nearlyeveryFriday,I wrotethe‘Quick Update’, whichrecappedallofthe conversationswewerehavingonourdeskandwasemailed toafewhundredpeople,withthegoalofbeingboth insightfulandwitty.Somehowmymissivesfoundtheirway topeopleallovereverywhere.

By2015wehadgrowntheteam’sAUMtoappx$1.1BN. Weweresucceedingbymostmeasuresbutwerefrustrated withlosingmandatesforlargerclientstofirmswhooffered commercialbankingandtrustservices.Wealsohadno supportforwealthstructuringneeds,andlendingwasa continualchallenge.Wehadalwaysadmiredindustry leaderslike Eric Gray, Rebecca Rothstein, Richard Jones, and Reza Zafari, whoremainamongthemostsuccessful advisorsatMerrillPrivateWealthManagementandthe

industryatlarge.IspenttimewithmanagementatMerrill asIwantedtoworkalongsidethebestbutwashesitantto makeachange.Ultimatelyitwas Bank of America’s Los Angeles Market President Raul Anaya whohelpedconvince meto‘taketheleapoffaithandchangejerseys’.Iwas39 yearsoldwhenIjoinedBankofAmericaandMerrilland washumbledtoseethenewsofmymove,aretailadvisor inWoodlandHills,waspickedupbythe Wall Street Journal, Fox Business, andthe LA Times.

WeembracedBofA’s‘OneBank’philosophywherethey coordinateclientcoveragewithspecializedcommercialand investmentbankingteams.Iquicklylearnedthatworking togethergivesusthepowertohelpourclientsaccomplish greatthings.Sincejoining,wehaveworkedwithour teammatestoprovidetreasuryandcreditservicesforour client’smiddleandupper-middlemarketcompanies (revenuesof$50Mto$2BN+).Ourfirmhashelpedthem raisecapitaltoexpand,provideacquisitionfinancing,and advisedthemonIPO’s.Wehavealsohelpedclientsfinance buildings,bigboats,andevenasportsstadiumfora professionalsportsteam.

TheMunsterFreemanGroupnowmanagesnearly$3 billioninclientbalances.In2020,wewererecognizedby Barron’smagazineasoneofthetop50PrivateWealth TeamsinAmerica.Ourclientsincludesomeofthemost successfulpeopleintheirrespectiveindustriesandare generallyfirst-generationwealthcreators.Theyarean impressiveanddiversegroup,withnearlyhalfimmigrating (likemywifeTherese)totheU.S.

Enlightenusonyourapproachtowealthmanagement andhowyouhavemadeanimpactonthewealth managementindustry.

AsaChristian,IbelieveGodhasgiveneachofusgifts,and mineistohelpempowermyclientstohaveagreater

Using a goals-based wealth management approach, we put our clients at the center of every personalized strategy. ‘‘

impactontheworld.Wehaveworkedtoincorporate Biblicalwisdomtoguidekeydecisionsinourclients’ financiallives.Ourexperienceisthatwealthyclientsare bestservedwhentheirprivatewealthadvisorcoordinates withtheirCPAandattorney.Iftheyarepreparingforadeal, forexample,sellingorrecapitalizingtheirbusiness,thenwe alsoneedtocoordinatewiththeinvestmentbankers.Inour experience,itisraretofindadvisorswhopossessasimilar skillsettoservicesignificantclients.

Inadditiontoourworkwithclientsonexitplanning,our colleagueswithinourChiefInvestmentOfficeandBofA GlobalResearchhavebeenparticularlyhelpfulinidea generationandinvestmentguidance.Weregularlyspeak withandhostcallstoeducateourclientswithluminaries suchasourcolleagues Niladri Mukherjee (Privatewealth equitystrategist), Haim Israel (HeadofThematic Research),and Michael Hartnett (ChiefInvestment Strategist).Overtheyears,wehavealsobuiltrelationships withiconicleadersattopfirms.

Beyondexitplanningandinvestmentmanagement,overthe last10years,wehavebecomeknowledgeableacrossall typesofwealthstructuringtechniques.Significantclients

needguidanceonhowbesttostructuretheirassetsfor incomeandestatetaxpurposes.Workingwithourpartners atBankofAmericaPrivateBank,wehavehelpedclients transferassetsoutoftheirtaxableestates.

Asforhowwe’remakinganimpactonthewealth managementindustry,Ibelievesharingbestpracticeswith mypeersandcontinuallyprovidingfeedbacktoourasset managementpartnersandMerrill’smanagementteamhas beenimpactful.Whetherservingasanational representativeforMerrill’speer-to-peerAdvisorGrowth Network(AGN)orspeakingatindustryconferences,I enjoyleadingtrainingsessionsonmanytopics,including wealthstructuring,philanthropy,andalternative investments.Ihavealsomentoredandpartneredwithmany youngadvisorsovertheyearsinsupportoftheir professionalgrowth.

Ourlivesareaseriesofchoicesandexperiences.At46 yearsold,Ihavelotsofideasaboutthefutureofwealth managementandhowtocontinueenhancingtheclient experience.Godwilling,Iwillbeempoweredtocontinue mymissiontohelpmyclientsandpeersoverthenext25to 30years.

FromLefttoRightareDanielleMadick,JoanYee-Barrett,SamuelMunster,BruceMunster,DavidFreeman, AdamLotz,HeidiVanGrove,DonaldCoons,MichaelPierre

Inrecentyears,theriseintheimportanceof

traceability,transparencyandsustainabilityofsupply chainshasbeensubstantial.Thepandemichasmadeit evenmorerelevantandpersonalforallofus.Althoughwe oftengetdiscouragedbythesheercomplexityofsupply chainstoachieverealtransparency,itisverypromisingto seehowtechnologiessuchastheblockchaincanreduce complexity,eliminateunnecessarypaperworkwhile enhancingcomplianceandenableeffectiveconsumer engagement.Wewereveryintriguedhowthetraceability technologycansupportwealthmanagementindustryand foundoutthattheopportunitiesaretremendous.Everyday, innovativetechnologiesseektheirwayintoluxurymarket, andvisionaryleaderssuchasEserTorunareworkingto deliverandmanagegrowthinitiativesbygeneratingnew ideasandexecutingonthem.

Inourendeavortofind"The 10 Most Influential Women in Wealth Management, 2021",wecaughtupwithEserTorun tounveilherjourney,herpassionandhowtheproductsand solutionsherteamcreatesaresignificantlychangingthe industry.

Eser'sjourneybeganwithherlovefornumbers,whereher professorsacknowledgedthisatuniversityandencouraged hertopursueacareerinfinance.Shealwayshadanatural businesssensethathelpedherwhenshestartedher internshipinCitigroupTurkey,whichledtoafull-time opportunityintheBank.Thatbecamethestartofmorethan an18year-longinternationalcareerininvestmentbanking

duringwhichshealsobecameaCFACharterholder ThoughthereweretimesEserconsideredamoveoutof finance,andevencompletedherMBAfromtheRotterdam SchoolofManagementtodoso,she'sstillalwaysfound herselfrootedintheindustry.'Thereissomuchtolearnthat hasalwaysmotivatedme'shesays.Shehasbeenthrough severalmarketcyclesthroughouthercareerininvestment bankingandhasalwaysappreciatedtheimportanceoftwo things:buildingstrongrelationshipswithcustomersand innovatingconsistently

Eser'spassionforinnovationtookaspecialturnwhenshe metEverledgerin2015atBarclaysAccelerator.Shewas firstamentortoEverledgertosupportbusinessapplications oftheirtechnologytofinancialservices.Shementored manytechnologycompaniesinhercareer.However, Everledgerstoodoutforherwiththeboldnessoftheir vision,relentlessfocusoninnovation,andcommitmentto makearealdifferenceintheworld.

Currently,EserisservingasChiefGrowthOfficerat Everledger.Sheisresponsiblefordrivingandmanagingthe company'sgrowthgloballyandhasalsobeenlookingafter directinvestments,fundraising,andM&A.Onecritical aspectofherroleistoheadthegovernmentrelationships fortheCompany'slong-termgrowth.

AbouttheCompany

Everledgerisadigitaltransparencycompany.Ituses blockchainandotherinnovativetechnologieslikeartificial intelligenceandinternetofthingstoenablemoretrustand

transparencyincomplexsupplychains.Thetechnology createsuniquedigitalidentitiesforeachobjectandprovides informationonitsprovenance,authenticity,and sustainabilityfootprint.Thecompanyoperatesanindustryagnostictrack&traceplatform.However,ithasdeep experienceandliveapplicationsinwiderangeofindustries includingdiamonds,gemstones,apparel,wines&spirits, art,andinsurance.Infact,aswewerewritingthisarticle, Everledgerhasreceivedanothermajormandatefromthe AustralianGovernmenttoleadtheNationalBlockchain applicationforcriticalmineralstraceability

Everledgerhasintroducedanewandcriticalconcepttothe world:'KnowYourObject'(KYO)whichwillbeas importantas'KnowYourCustomer'(KYC)isforthe financialservicesindustry.Everledgeralsooffersvery innovativeblockchainapplicationsfortheluxurybrandsto enhancecustomerengagement.

Comingfromamiddle-classTurkishbackground,hard workandperseverancehavealwaysbeenEser'scareer mantra.Lookingback,sheisverypleasedtoseethe financialindustry'sprogressinembracingdiversityacross theranksinthelast25years.However,shefeelsthe industryisstillfarfromwhereitneedstobe.Eseractively supportsdiversityinfinancialservicesandhasbeenserving asanExecutiveCommitteememberattheCFAInstitute's InclusionandDiversityNetworkforthelast4years.

Ontheideaofimpactfulleadership,Eserthinksthatthereis nosingleuniversaldescriptionofimpactfulleadership. Everledgergrowsatsucharapidpacethatthecomplexities andchallengesfacedbytheteamchangeallthetime. Therefore,thesuccessofleadershipoftencomesfromthe abilityandagilitytoadjusttosituationalneeds.Itrequires conscientiousnessandself-reflection.Thatmeanslearning abouttheteam,authenticallycaringandopenly communicatingMostofall,itrequirestheabilityto establishtrustandmoveeveryonetowardsahigher purpose.ForEverledger,thismeansleavingalegendary impactintheworldwithimprovedtrust,transparency,and

sustainabilityacrossthemostcriticalandconflictedsupply chains.ThatiswhytheEverlegderstaffcallthemselves 'Everlegends'.

TheBrave,TheBold,TheBetter EserbelievesthatEverledgercanbetheultimatetrademark fortransparencyandtraceabilityoneveryassetwe consume.Itcanenabletheindustrytoshedlightonthe history,characteristics,andownershipprofileofpretty muchanyproduct.

There'smassivepotentialforthetypeofapplications

Everledgerisbuilding,andit'sfastbecomingthepreferred choiceofhigh-endbrands,astheyneednotonlytotell customersthattheirproductsaresustainableandauthentic butalsotoprovideevidenceforit.

ForEser,thedefinitionofsuccessistoleaveasustainable positiveimpactonourplanetandsocietywhilecreating valueforhercustomers,investors,andcolleagues. Everledgersharesthesamevaluesashers,witha commitmenttoachievesustainableandsociallyresponsible supplychainsinfourcontinents.

Ifgivenachancetobringonechangeinthefinancial industry,Eserwouldchangehowquicklyincumbents embracenewtechnologiesandadjusttheirexisting practices.

Inheradvicetoup-and-comingwomenentrepreneurs aspiringtostepintothefinancialindustry,Esersays, "Whether in finance, technology or any other sector, always do something extra to learn more. Knowledge is the real power, and nobody can take it away from you.”

"Don't be afraid to be yourself and never accept 'no" for an answer when it comes to pursuing your dreams," she concludes.

“Shine a light on the authenticity, provenance, and sustainability record of your products with the Everledger Platform.”

Elitewealthmanagementadvisorsexhibitleadership inmanywaysbythemostvaluablequalitiesthey possess.Theyhavesomebrillianttraitsthathelp thembethebestwealthmanagementadvisorsandmakea differenceinpeople'slivesbyassistingthemtoutilizetheir wealthcorrectly.Theyareverycalculative,andtheyalways accountforavariablechange.Theyareexpertsatanalyzing thingsthatreflectintheirdecision-makingthatisrational andpragmatic,andtheycancomeupwithbrilliant suggestionseveninashortamountoftime.

Thewealthmanagementadvisorsarehighlyawareofthe marketandtheinput-outputratiosindifferentscenarios. Theyoftensuggestpeopleininvestinggoodmoneyfor greaterreturns.Theydriveprofitabilityandexcellent returnsfortheirclients,andtheyensurethattheirclientsare alwaysatanadvantageandavailingtheedge.

Smartwealthadvisorsadvisetheirclientsandhelpthem managetheirwealthtoleadtoattainingmaximum profitabilityandmostappropriateutilization.Theyhavea lotoffantasticqualities.Afewofthosequalitiesare mentionedbelow

1.Theyleadbyinspiringothers–Thisisallbeing visionaryandcommunicatingthatvisioninawaythatteam members,supportstaff,clients,andalliancepartners understandandbenefitfrom.Theykeepafirmgraspofthe currentmarketrealities,and,basedonthat,andtheycome upwithexcellentinsightsandadvicethatwillbebeneficial fortheirclients.Theyleadbyunderstandingthe significanceofleadingbyexample.Elitewealth managementadvisorskeeptheirmoraleandenergyhigh. Theyareconstantlearners,passionate,andcontagious positiveenergyprofoundlymakesadifferenceinthelives oftheirclients.

2.Theyseeproblemsasopportunities-Thisisaquality foundinmosteffectivewealthmanagementadvisors.They

seetheproblemsasopportunitiestodeliverbettersolutions. Theydon'tbecomecomplacent.Theysolvecomplex problems,andtheyliketobetheagentofprovidingthebest totheirclients.Theyleadproactivelyandpersonally communicatewithclientsregularly,understandtheirstatus andneeds,anddeliversolutionsthatsuitthembetter.They providepeaceofmindtotheclientssincetheyhelpthem makethebestdecisionsandresolvetheirfinancialissues.

3.TheyareBroad-minded–Theyknowthatchangeis natural,andtheyareastorehouseofgreatideastohelp clientsdealwithchangingsituations.Theyseethelarger picturewithabroadvisionandleadtheirteammembersby keepingtheirmoralehigh.Theyhelptheirteammembersto focusonsolutionsandimprovementandinstillaclient-first cultureintheirmethodologies.

4.Theyareuptodatewithknowledgeandcurrent realities–Theyenhancetheircapacitytogivebrilliant advicetotheirclientsbystayinguptodatewithcurrent realities.Theyhaveaconstanthungerforlearning,andthey arecurious,thereforehavingadeepunderstandingof finances.

5.Theypromotecalculativerisks–Elitewealth managementadvisorspromotetakingcalculativerisksin theirclients.Theyaskthemtobebraveandboldandhelp themcomeoutoftheircomfortzone.Theyhelptheirclients beinthestretchzonetomakesmartfinancialdecisionsand drivethegrowthoftheirclientsandbuildagoodnetwork, whichenablesthemtodomorefortheirclients.

Thewealthmanagementadvisorshaveexcellentanalytical skills,decision-makingabilities,passionforfinance,and theabilitytobrilliantlyguidetheirclientswiththebest adviceforenduringtheirsustainableeconomicgrowthand development.Inthisway,theymakethemostimpactinthe livesoftheirclients.

Ittakesvariousaspectsforabusinesstobesuccessful,

andoneofthoseaspectsisastreamlinedprocessof financialmanagement.Intoday'sunprecedentedtime, organizationshavetohavetheirfinancialstrategiesplanned tohelpthemsustain.Itiswheretheroleoffinancialleaders iscrucialastheyunderstandthemarket'scurrentneedsand canassistinmeticulouslyplanningthenextmoveofthe organization.JakeHamlinisonesuchleaderwhoprovides tailoredfinancialadvice,customizedportfoliomanagement, andimpeccableservicestohisclientsandhelpsthemreach theirgoals.JakeisaPartnerandWealthAdvisorat ChicagoCapitalLLC,whereheisfocusedontheaimand objectivesofhisclients.

JourneyThroughMultipleRoles

Jake'spost-collegecareerstartedincommercialbanking, whichallowedhimtogainexperienceinmultiplefinance sectors.Heimmediatelygravitatedtowardsthepersonal lendingandprivatewealthadvisoryspace.

Jakeconsidershimselfapeoplepersonandtakesgreat prideindevelopingrelationships.Hemostenjoyedthe consultativenatureofhisbusinessandrecognizedearlyon inhiscareertheneedtolearnasmuchabouttheadvisory spaceashepossiblycould.

Aftertakingthestepintothewealthadvisoryspace,Jake spenttimeatGoldmanSachsandMerrillLynchinportfolio managementandnewbusinessadvisoryroles.Hisgoalhas beentobuildanadvisorypracticefocusedonsimplydoing whatisbestforhisclients,doingwhateverhecantohelp themfeelcomfortablesurroundingallaspectsoftheir financiallives.ChicagoCapitalwastheperfectplacefor Jaketocontinuebuildingthisbusinessasthefirmmatches hisdesiretoputclientsfirst.

Jakesays, "Chicago Capital was founded on one simple principle: Putting clients first. We provide personalized service to help our clients, who span multiple generations, define their goals.”

ChicagoCapitalhasastraightforwardprocesstounderstand thesegoals,developappropriaterecommendations,and helpbalancetherisksandrewardsoflong-term investments,assetallocationcashflowandfinancial planning.Thefirms'advisorsunderstandthatitsclients' goalsareunique,andthereforetheprocessbywhichit helpsthemachievethesegoalsrevolvesaroundtheclient.

Jakestatesthatthefirmhashistoricallyfocusedonlongtermequityinvestments.ItsPartnershaveworkedtogether forupwardsof30yearsandhavemaintainedthissingular focussinceitsfounding.

ChicagoCapital'scapabilitiesandeffectiveuseofitsglobal custodialresourcesallowittoworkwithmanyclients,from individualsandbusinessownerstomulti-generational families,familyoffices,andinstitutions.

JakeexpressesthattheadvisorsatChicagoCapitalarecivic leaderswhohavedecadesofexperiencehelpingclients reachtheirgoalsandahistoryoflastingclientrelationships.

ChicagoCapitalisinvestedinitsclientsandcommunity.It hasagenuineinterestinthecausesandorganizationsthat areimportanttoitsclients.Ithasahistoryofsupporting socialservicesandartsorganizationswithboard memberships,financialcontributions,andvolunteerism.

ChicagoCapitaloffersfinancialplanningtoolsandaportal toitsclientsforviewingtheiraccountsandstatementsfrom anydevice.Itsportfoliomanagement,reporting,trading, andCRMsystemshelpitsadvisorsprovidecustomization ofportfoliostofititsclients'individualpreferencesand goals.

Jakesstatesthatfiduciaryresponsibilityisbecomingthe investmentmanagementindustry'slargestandmost importantfocus,andChicagoCapitalpositioneditself uniquelytocapitalizeonthischange.Itsclientsexpectitto putthemfirstineverysituation.Thisisnotalwaysthecase withmanyofitscompetitorsincentivizedtosellproprietary productsorservicesorchargeout-of-linefeestotheir customers.

ChicagoCapitalinvestsinitsclients,services,andpeople toensurethatitoperatesonlywithintheboundsoffiduciary responsibility.Puttingitsclientsfirstremainsthemost importantfocus.

Jakeintendstospendtheremainderofhiscareerwith

ChicagoCapital,doingeverythinghecantohelphisclients reachtheirgoals.HehopestotakeChicagoCapitaltothe nextlevelbyexpandingitsinvestmentandservice offerings,financialplanningcapabilities,client-facing technology,andbroadnetworkrecognition.Jakeshopes thatpotentialclientswillreachoutiftheywantatrue fiduciaryintheircorner

Inhisadvicetobuddingentrepreneursaspiringtoventure intotheInvestmentManagementsector,Jakesays, "Building a wealth management business requires individuals to think strategically and independently. There is no shortage of opportunity, and motivated individuals can gain meaningful clients and influence by simply building their network and always maintaining their desire to do what is, and only what is, best for their clients.”

“ “

Kim Bourne Managing Director Playfair Planning

Kim Bourne Managing Director Playfair Planning

Financialplanningforthelongtermcanbean

arduoustask. Itrequiresonetofactorina multitudeofvariablesincluding,butnotlimited lifeexpectancy,lifestyle,retirement,income,investment returns,gifting,andlegacyconsiderations. KimBourne understoodthecomplexitiesinvolvedincreatingawellthought-outwrittenfinancialplananddaredtobuilda businessexplicitlydesigningfinancialroadmapstailored aroundherclients'lifestylesatatimewhenwhitemen dominatedthefinancialadvisingindustry

Asalife-longBrooklynite,Kimobserveddecadesof changeinBrooklynneighborhoods. Someunderwent divestment,whilesomepartsenjoyedgentrification. As timewenton,shegotmarriedandstartedafamily Asa mom,hermetricsforsuccessweresimple:

Ÿ Shehadtoproducestrongswimmers,notforjusttheir ownsake,buttosavesomeoneelse'slife.

Ÿ

Shehelpedherchildrentobecomeproficientwritersso thattheycouldadvocateforthemselvesandothers.

Ÿ Andfinally,shesupportedherchildrentobecomeselfsufficientandleadhonestandproductivelives.

Oneday,Kim'smiddlechild,Monique,unintentionally threwamonkeywrenchintoher successplan.Six-year-old MoniqueimploredhertobecomeaGirlScouttroopleader. WhileKimdidnotthinkshehadenoughhourstobean effectivetroopleader,Moniquepersistedandeventually talkedKimintotakingonthisnewcommunity responsibility ThisexperiencemadeKimrealizeitwasnot enoughtobeagreatmomtoherfamily;shealsohadan obligationtotheotherchildren.

Herepiphanyinspiredhertobuildateamofvolunteer parents.Together,theyencouragedtheirgirlstolearn skillslikebudgetingandbecomingproficientinExcel,so theycouldplanandbudgetfortheirGirlScoutdues,costs fortrips,andcalculatetheircookieprofits. Kimalso recruitedparentsandotherprofessionalstoteachskills neededtoearnbadgesinhealth,architecture,and environmentalsustainability

Interestingly,Kimsuccessfullyparlayedtheskillsshe developedasaGirlScouttroopleadertoherroleasthe ManagingDirectorofPlayfairPlanningServicesandlater asaboardmemberoftheGirlScoutCouncilofGreater NewYork.

ItwasawildstretchofKim'simaginationthatablackgirl fromanunderservedBrooklynneighborhoodcould becomethefinancialadvisortosomeofthefinestfamilies inAmerica.Peopletendtotrustpeoplewithwhomthey identify,andraceisacrucialidentifier.Kimwonderedifit waspossibletoattractaffluentfamiliesasclientsbefore becomingaffluentherself!Theoddsofsuccesscertainly seemedliketheywerestackedveryhighandnotinher favor.Nevertheless,shedidwhatGirlScoutsdo:think forward,collaborate,innovate.KimfocusedontheWHY andignoredthemanywhynots!

Justasittakesa villagetoraisechildren,ittakesa specialteamtobuildandpreservewealthforfamilies andinstitutions. Kimhadtheforesighttodesignand successfullyimplementaremoteworkmodelyears beforeCOVID-19. AvirtualworkmodelallowedKim toattracttoptalentwithaboutiquefirm'sbudgetwhile expandingherreachtoclientsoutsideofNewYorkCity.

Supportedbyclient-friendlycloud-basedtechnology, Kimpositionedhercompanytobeagileandresponsive toclients'needswithoutsacrificingsecurityprotocols. Kim'sabilitytoinnovateandleveragetechnologyhas allowedPlayfairtobuildrelationshipswithextended familyandplanwithfuturegenerationswithcharitable givinginmind.

Kim and her team are proud of their ESG/SRI investment models designed to ensure that their individual and institutional clients' investment options align with their most deeply-held values. With the help of sophisticated financial planning software and tools, Playfair can easily enable clients to collaborate with them and their financial plansinreal-time.

Ateveryopportunity,Kimbringsgreatersimplicityand transparencytoinvestmentplans.Sheseesthebenefitsin havingafinancialadvisor'squantitativealphameasured againstgoals,outcomes,andfamilydynamics,notonly indicesandfinancialbenchmarks.

TheauthorsofbookshavealwaysbeenKim'srole models,andSteveJobsandMichelleObamaaretwoon herlonglistoffavorites.Kimsays, "SteveJobswasthe firstpersonIheardsaythatagoodartistcopies,buta greatartiststeals.

Perhapshealsostolethisideafromsomeone.Theideais nottostealorbeunethicalbuttohonorandreplicate excellence.WhenthinkingaboutPlayfair'suniqueness and whatwedodifferentlyfromourcompetitors,itboils downtothewordsourteamlivesby,bothpersonallyand professionally."

Sheadds,"TheGirlScoutPromisebeginswith,'Onmy honor….'WhilewedidnotstealtheGirlScoutPromise, thePlayfairteammembersrecognizetheimportanceof clearlyarticulatingwhatwehonor.Faith,family,friends, andprosperityareourhighestmission.Weworkhard eachdaytoreplicatetheidealsfromtheRitzCarlton's Credo,Motto,EmployeePromise,StepsofService,and ServiceValues.Weinvestineachteammember's enrollmentintheRitzCarlton'sLeadershipInstitute.We strivetomeetagoldstandardandhelpourindividualand institutionalclientscuratewealth."

"Additionally, reading Michelle Obama's book, Becoming helpedmeinternalizetheuniversaltruththatperspectiveis everything. Our energy will follow our focus, and this is what I impress on the rising advisor stars that I mentor," concludes Kim.

Makingfinancialdecisionscanbedifficult,but thesedecisionscansignificantlychangeour lives.However,havinganadvisorinour financiallifecanbebeneficial.Thesefinancialadvisors implementtheirbestpracticestomanageourfinancial activitiesandassistuswithwiserinvestmentsandsavings.

Whenwewerekids,wesavedourpocketmoneyinpiggy banksandspentitwisely.Forsomekids,thisqualityturned intomanagingfinanceswhichtheyincorporatedintheir future,becomingwealthmanagementleadersforthe companies.Itmaybethroughthisqualityforsomebusiness leadersthattheymadetheirmarkinthisfield.Forothers, theyhavedevelopedtheabilityandagilitytoadapttothe particularfieldofwealthmanagement.Wealthmanagement leadersareuniquebecauseoftheirknowledgeandare neverafraidtopursuetheirdreams.

Thereisnoone-tracksolutioninwealthmanagement;that iswhyafinancialleadershouldbedynamicinthedealings. Often,leadersinwealthmanagementleadwiththeirsheer dedicationandservethefirmandthecustomerstheydeeply careabout.Beingawealthmanagementleadermeans buildingstrongrelationshipswithclients,guiding,sharing, andsupportingclientsofdifferentindustrialfieldstosolve financialandwealthchallenges.

Theoverallmanagingoffinancialrelationshipsiswhatthey concentrateontobuildstrongbonds.Theyarethestrategic forceofthewealthmanagementindustry,workingwiththe clientstostayaheadinsuchevolvingtimes.Becauseof theircontributionandtherightapproach,theyhavebecome ahugepartoftheindustrytoday.

Today'swealthmanagementleadershavealltheinsightsto achievetheclients'targets,maintainclientrelationships,

andbringthebestsolutionsforeveryone.Moreandmore frequentbusinessleadersarehappilypursuingtheircareers inwealthmanagement.Thewealthmanagementcareer offersservicesininvestments,mergersandacquisitions, equity,andthediversewealthmanagementfield.Withtheir leadershipqualities,theyseizethepowerofwealth managementandunderstanditsimpactonthepeople.This iswhytheyhavebecomeacrucialpartofthegrowthofthe teamandtheindustry

Insuchadelicateniche,businessleadersarebuildingthe rightfinancialsolutionsforallofus.Theircontributionin thisfieldisvalued,astheyhaveverywelladaptedto providethebestsolutionswhichensuresuccessfor everyone.Thechallengesareinvolvedateverystageof theirwork,buttheyaremakingtheirwaythroughthemand offeringtherightsolutionstosolveallthosechallenges. Theseinfluentialwealthmanagementleadersdefinethe waytoleadbusinessesmeticulously.

Buildingwealthmanagementrequiresleaderstothink strategically,andbusinessleadersarewellawarethatthis fieldisfullofopportunities.So,doingthebestandalways keepingthedesiretosucceedwillbethekey Theleaders seekamoredynamicapproachwhilemaintainingthe relationshipswiththeclientsandapproachingsuccessfor all.

Asaleader,buildingastrongfoundationforstrategic wealthmanagementdecisionsmeansworkingwithintegrity andcompassiontowardsthework.Overthelastfewyears, wehaveseenmorebusinessleadersventuringintothe wealthmanagementindustry,andweareyettowitnessthe bestofthemwithtechnologyandinnovationaroundus.

Thesoaringcompetitioninthefinancialindustry

demandsaninnovativeapproachforconsistent growth.Financialleadersarealwaysthinking multiplestepsaheadtosparenoefforttoofferservicesfor theirclients.

PeterLeeisonesuchleaderwhoisrecognizedforbuilding anunparalleledecosystemofclientsacrosssomeofthe country'stopentrepreneurs,privateequity/venturecapital founders,professionalathletesandentertainers.Peterisa FoundingPartnerofSummitTrailAdvisors,andheand histeamaredefininganewcategoryofthe"Networked FamilyOffice.

WeatInsightsSuccesscaughtwithPeterinourendeavorto find'The10MostInfluentialLeadersinWealth Management,2021.'Wetalkedtohimtounderstandhow hisinnovativestrategieshavecreatedaclient-centric approach.

Below are the highlights of the interview

Briefouraudienceaboutyourjourneyasabusiness leaderuntilyourcurrentpositionatSummitTrail Advisors.Whatchallengeshaveyouhadtoovercometo reachwhereyouaretoday?

Myjourney,asdomostjourneys,tooksomewhatofa circuitouspathasIbeganmycollegeexperienceby acceptingafootballscholarshiptoplayquarterbackatthe UniversityofWisconsin.Afterplayingtwoyearsforthe BadgersandwinningaBigTenChampionshipandRose BowlTitleinmysecondseason,myquarterbackcoachleft theprogramtogototheNFL.Followingaroughspring footballseasonadaptingtoanewsystem,Idecidedto

transfertoYaleUniversity,whereIwouldstudyeconomics andplayquarterbackfortheirstoriedfootballprogramat Yale.

InmysenioryearatYale,Ihadtheamazingopportunityto studyunderDavidSwensenandhisteamattheYale UniversityInvestmentOffice.Thisexperienceinstilledin meapassionforinvestingandsetmyjourneyonanew courseintheworldofinvestments.Followingmytimeat Yale,Iwantedtolearnmoreaboutfinanceandinvesting,so IcamehometoChicagotopursuemyMBAinFinance, AccountingandMarketingattheUniversityofChicago BoothSchoolofBusiness.

Comingoutofbusinessschool,Ithoughtitwouldbe excitingtotaketheplaybookIlearnedfromDavidandhis teamattheYaleEndowmentandbuildapracticeadvising familieswhohadcreatedgenerationwealththatcouldbe investedinaperpetualmanner,likethatofanendowment. PriortofoundingSummitTrailin2015,IledaneightpersoninvestmentmanagementteaminBarclaysWealth andInvestmentManagementGroup.

Aftercontinuousinquiriesfromsomeofourmost significantclientsatBarclaystocomeoverandjustwork fortheirfamilyandsitontheirsideofthetable,five partnersandIdecidedtolaunchSummitTrailAdvisors.We initiallylaunchedthefirmacrossthreecities(Chicago,New York,andSanFrancisco)withroughly$3Billioninassets. Todaywemanageassetsof$13Billionacrosssixoffices throughoutthecountry.

Tellussomethingmoreaboutyourcompanyandits missionandvision.

SummitTrailisaleadingNetworkedFamilyOffice–intentionallydesignedforthosewhohaveoutgrown traditionalwealthmanagersanddesiretheoutcomesofa moredynamicapproach.Weareapartner-ownedand operatedfirmthatprovidesinvestmentadvisoryandfamily officeservicestoultra-highnetworthindividuals,family offices,andnon-profitinstitutionswhileleveragingthe powerofournetworkforthebenefitofourclients.

SummitTrailsourcesdifferentiatedinvestment opportunitiesandotherprofessionalservicesforourclients onanopenarchitecturebasis,workingtodrivepricing powerforclientsandattracttheindustry'stoptalent.

WeleverageourdistinctvantagepointasaNetworked FamilyOfficetobuildgenerationalrelationshipswithour clientssotheycanrealizethefullpotentialoftheir significantwealth.

Enlightenusonhowyouhavemadeanimpactinthe InvestmentManagementnichethroughyourexpertise inthemarket?

Ihadauniqueexperienceatsuchayoungageto,inasense, learntheinvestmentmanagementbusinessbackwardsin thetimeIspentattheYaleEndowment.WhatImeanby thatisIlearnedatonaboutalternativeassetclassessuchas

“Success through partnership.”

privateequity,venturecapital,hedgefunds,andrealassets beforeIreallyknewanythingaboutmoretraditional investments,suchasstocksandbonds.Withthisbackdrop, wehavebuiltafirmthatfocusesontakingadvantageof privatemarketopportunitiesandextractinganilliquidity premiumwheneverpossibleforfamilieswhodonotneed dailyliquidityacrosstheirentireportfolio.

Describeindetailthevaluesandtheworkculturethat drivesyourorganization.

SummitTrail'scorevaluesofpartnership,integrity, excellence,andpassionarelivedanddemonstratedbyour teammemberseveryday Weaspiretosharedsuccessin ourrelationshipswithourclients,ourexternalcolleagues, andeachother Weoperatewithhighethicalstandardsand puthonestyandtransparencyattheforefrontofouractions.

Wecontinuallyevolvetoexceedtheexpectationsofour clientsandourselves.Andwebelievepassioniscontagious; itattractsotherswhosharethesamemotivationand inspiresimpactfulresults.Ourcompany'scultureprioritizes people,andweensurethatworkisfunandstimulating whileweprovideourclientswithaconnected,elevated approachtomanagingtheirwealth.

Undeniably,technologyisplayingasignificantrolein almosteverysector.Howareyouleveraging technologicaladvancementstomakeyoursolutions resourceful?

SummitTrailhasembracedandwillcontinuetoinvestin

bothcurrentandsubstantialtechnologicaladvancementsfor thebenefitofourclientsandfirm.Theoperationaland purpose-builttechnologyinfrastructurewehaveallowsus toaggregate,evaluate,andcommunicateonallaspectsof ourclients'financiallives,doingsowiththehighestdegree ofsafetyandsecurity Theconsolidatedfinancialreporting anddigitalplanningdocumentsweprovideourclients enableinformeddecisionmakingandaclearunderstanding oftheircomprehensivefinancialpicture.

Wheredoyouenvisionyourselftobeinthelongrun, andwhatareyourfuturegoalsforSummitTrail Advisors?

WeareendeavoringtobecomethepreeminentNetworked FamilyOfficeinthecountrybycontinuingtoenhancethe powerofourecosysteminpartnershipwithourclients.

Whatwouldbeyouradvicetobuddingentrepreneurs whoaspiretoventureintotheInvestmentManagement sector?

Firstandforemost,IwouldborrowNike'staglineandtell themto,"JustDoIt!"NotadaygoesbywhereI'mnot thankfulforourdecisiontobecomefellowentrepreneurs andbuildthisfirminpartnershipwithourclients.To balancethatfirstpieceofadvice,Iwouldstressthe incredibleamountofplanningandorganizationthatmust happenbeforeonetakestheleaptobecomean entrepreneur,andIcannotemphasizeenoughtheneedfor preparationpriortolaunchingafirm.

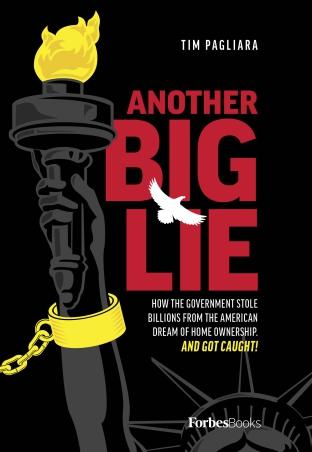

Tim Pagliara

Tim Pagliara

BenFranklinoncesaidthataninvestmentin

knowledgepaysthebestinterest.Thatsentimentis reflectedperfectlyintheworkingsofTim Pagliara Withoverthreedecadesofexperienceinthe WealthManagementindustryasaseasonedfinancial advisor,hetakesaneducationalapproachwithhisclients.

TimistheFounder,Chairman,andCIOofCapWealth, anindependentinvestmentadvisoryfirmthatbuildswealth managementsolutionstomeetinvestors'challengesinan uncertainworld.Thefirmpracticesvariouseffective strategiestounderstandthecomplicatedglobalmarket landscapeinordertodevelopstraightforwardinvestment ideasforitsclients.Timunderstandsclientsareanxious abouttheirmoney.So,heprovidesinsightsabouthiswork toeasetheirconcernsandanswersanyquestionstheyhave. WecameacrossTiminourendeavortofind‘The10Most InfluentialLeadersinWealthManagement.’Inthe followingprofile,wedigintohisjourneytobetter understandhowhisyearsofexpertisehavehelpedhimgain recognitionatboththelocalandnationallevel.

Growingupinalargeworking-classfamily,Timknewthat gettingapropereducationwasimportant.Ashelookedat differentpaths,“onethingwasverycleartome,”hesays. “Lawyersrantheworld.”HereceivedhisJurisDoctorate fromSt.LouisUniversitySchoolofLawandwentstraight toworkatanEdwardJonesfinancialfirm,neverpausing alongthewaytopracticelaw.

Earlyon,Timwasassignedtotheaccountof,awell-known MLBpitcherfortheSt.LouisCardinals.EventhoughTim wasstillinlawschool,ashereviewedtheportfolios,he uncovereddiscrepanciesthatevenaseasonedadvisormight haveoverlooked.DiscoverieslikethathelpedTimworkhis wayupthroughthecompanyuntilhewaschargedwith openingthefirm'sfirstNashvilleoffice.

Inearly2000,afternearly20yearsofexperienceinthe industry,TimformedCapWealth.Sinceopeningitsdoors, CapWealthhassuccessfullyworkedthroughthefinancial bubble,thehousingmarketcrash,andaglobalpandemic. Currently,CapWealthhasgrownto16employeesandis recognizedasatopadvisoryfirminTennesseeandthe countrybybothForbesandBarron'smagazine.

Asaleader,Timstrivestoprovideafoundationforstrategic wealthachievement—anddosowithintegrityanda commitmenttotheethicalprinciplesthatarethefoundation ofCapWealth'sculture.

In2014,hetrademarkedthetermProvableIntegrity™, whichdescribesCapWealth'stransparentapproachto wealthmanagementwhilealsohighlightingthefirm's compliancewithGlobalInvestmentPerformanceStandards (GIPS).Asaveteranofthesecuritiesindustry,hehas pushedforfederalfinancialresponsibility.Hehasalso becomeincreasinglypassionateovertheyearsabout promotingawarenessofthenationaldebtproblemand advocatingforapro-growthU.S.economicagenda.

In2014,TimfoundedInvestorsUnite,representingFannie

MaeandFreddieMacshareholdersseekingfullrestitution oftheirassetsseizedbytheUnitedStatesTreasury Department.

Followingthehousingmarketcrashin2008,Timbecamea vigorousadvocatefortheAmericandreamof homeownership—unawarethatitwouldbecomehisniche intheindustry.HislobbyinginWashingtontoseekjustice forhomeownersandinvestorsalikeleddirectlytohisbook, Another Big Lie,inwhichheoutlinedthefallofFannie MaeandFreddieMac.

Inadditiontoshiningalightonthecorporateand governmentalfactorscurrentlyendangeringtheAmerican Dream,TimothyhascontinuedtofightforGSE shareholdersandworkedtirelesslytobringGSEsoutof conservatorship.Thiscombinationofknowledge, experience,andpassionhaspositionedhimasanexpertin theindustryandago-toresourceonthehousingmarket.

Timbelievesindelayedgratificationandhavingalong-

viewplan,whichmeansinvestingthemoneyinhisteam andbusiness.Asaleader,hestrivestomeetclientneeds andmaketheprocessbettereverystepoftheway

Simultaneously,asanentrepreneurandowner,he recognizesthatit'snotenoughtosimplyattract extraordinaryworkers—onemustinvestinthem.This strategicmindsethashelpedCapWealthsteadilygrowwhile retaininggreatemployeeswhoperformtheirbestforits clients.

“CapWealthcontinuallylooksfortechnological advancementsintheindustryandtriestostayaheadofthe curve,”hesays.Afewyearsago,heinvestedintechnology atthefirmlevel,allowingitsteamtoworkremotelywith easyaccesstoasecurednetwork.Duringtheshutdown,this investmentallowedeveryonetotransitionseamlesslyto workingfromhome.

Thecompanyhasalsorecentlyupdateditsportfolio managementsoftwareattheclientlevel,givingclients accesstoaCapWealthappthatallowsthemtoviewtheir accountsanywhereandanytime.

Envisioningthefuture,TimwantstoseeCapWealth continuetogrowwhileprovidingexceptionalserviceforits clients.Heconsidersthefirmavaluableresourceforboth clientsandmediaoutletsonvariousfinancialtopics.His goalistocontinueadvocatingforGSEshareholdersand eventuallyseeCapWealth'shardworkwithFannieMaeand FreddieMaccometofruition.

Timadvisesbuddingentrepreneurswhoareventuringinto InvestmentManagementtofocusontheircommunication. "Thisbusinesshasafoundationbuiltonfinancial knowledge,buttherealchallengeisbeingableto successfullycommunicateyourplantoaclientattheendof theday,”hesays.“Ifyoucanhoneyourcommunications skillsintheindustry,youwilleasilysetyourselfonthepath tosuccess.”

“Enhancing our clients' lives with their wealth.”