Phone 615.385.1898

Toll Free: 1.800.264.1898

Email: marketing@insurors.org

Editor: Ron Travis

Publisher: MarketWise, Inc

President ..............................Kym Clevenger, CPCU, CIC, CAWC

IIABA National Director ........................John McInturff III, ARM

VP Region I, President-elect ......................................Bobby Sain

VP Region II .........................................Battle Bagley, III, CIC, CPA

VP Region III ................................................................Kevin Ownby

Treasurer ......................................................Richard Whitley, CIC

Secretary ................................................................Jamie Williams

Director, Region I

Director, Region I

Director, Region

Director,

Director, Region

Director, Region

Director, Region III

Director, Region III

Director, Young Agents

Maddox

Lofton-Wells

Matt Felgendreher, CIC

Chip Piper

Winterburn

Gibbons

Tim Goss, CIC

Stuart Oakes

Organek, CIC, CISR

Matt Swallows, CIC, CRM

Display advertising rates, deadlines and specifications may be obtained by writing to Insurors of Tennessee, 2500 21st Avenue South, Suite 200, Nashville, TN 37212, calling 615.385.1898, e-mailing marketing@insurors.org or online at www.insurors.org

The Insurors of Tennessee’s Annual Convention being held in downtown Nashville at the J.W. Marriott on October 5-8, 2024, is approaching quickly. At this point, members of the Insurors of Tennessee staff are putting the finishing touches on plans for the event and have put a lot of work into making certain the event will be informative, engaging, and enjoyable for our members and partners. This is the “crown jewel” of Insurors of Tennessee events each year.

The conference starts on Saturday, October 5, with a football watch party, where you will have the opportunity to watch college football with your peers and cheer your alma mater or favorite team on to victory. The 2024-2025 college football season will certainly be exciting with major conference realignments and an expanded playoff system at the end of the season. Join us to enjoy this year’s college football rivalries with your insurance colleagues.

One of the centerpieces of the event is the annual trade show scheduled at the beginning of the convention. This is the time and place where our vendors and partners showcase the products and services they offer independent insurance agencies to help propel their success in the marketplace. The trade show also provides an excellent opportunity for our members and our partners to get to know each other to form key professional relationships that can be mutually beneficial. We encourage members to explore the Exhibit Hall early in the conference to look, listen, and learn!

During the course of the convention, we are offering a slate of excellent guest speakers addressing current topics that may be important to your agency as it competes in a rapidly evolving marketplace. These seminar options are certain to enhance the reservoir of knowledge and expertise in your

agency as you serve the insurance and risk management needs of your clients.

For example, the first education session on Monday morning is on Ethics. Since insurance is at its core a trust-based business, the session will provide an excellent refresher on key ethics related topics and insights as it relates to the conduct of our business. Getting ethics right in your agency and in your company forms the very bedrock of your business and our industry.

At a time when technology, including Artificial Intelligence (AI) is evolving quickly as it relates to the insurance industry, C.J. Hutsenpiller will make a presentation entitled “AI: Practical Use Cases for Your Agency” at the WINS Breakout Session. C.J. is a leader in leveraging and applying technology in his agency and shares his experience and expertise with others via podcasts and other channels. C.J.’s presentation will provide you with key examples of how you can leverage AI to enhance operational efficiency at your agency.

Opposite that breakout session in the same time slot will be another technology and insurance coverage session presentation called “Beyond the Cyber Policy” giving you valuable insight into a range of issues about the risk asso -

ciated with cyber liability and coverage topics. This is an ever-evolving area of exposure that requires being up to date on the latest challenges to best serve clients.

Later Monday afternoon, there will be two additional presentations opposite each other in the same time slot giving you two additional interesting and compelling options to enhance your insurance knowledge. Martin & Zerfoss and Chubb Insurance Company will present an entertainment and educational event at Blake Shelton’s Ole Red Bar

& Grill located on lower Broadway. This session will feature entertainment by Rhett Atkins who has written 34 number one songs for himself and other well-known musicians including Brooks & Dunn, Blake Shelton, Luke Bryan, Thomas Rhett, Jason Aldean, and others. A representative from Chubb will make a presentation on a special topic associated with insuring musical instruments and other valuable items. This should be both an entertaining and informative event on lower Broadway.

Opposite this event at the same time a Soup-er Bowl with the Young Agents will feature a presentation entitled “Non-Profits: Dealing with the Aftershock” by Paula Burns, CIC, CRM at the J.W. Marriott Hotel. Many insurance agencies work with and provide insurance and risk management consultations to non-profits, so this session should be of great value to many members.

Paula Burns has been in the insurance industry for 38 years and has earned her CIC, Certified Insurance Counselor, designation in 2009 and her CRM, Certified Risk Manager, designation in 2011. Paula teaches classes to insurance professionals, risk managers, and organizations nationally. She is a faculty member of The National Alliance as a “Ruble Professor” and teaches master’s level classes to Insurance Agents and Risk Managers nationally.

Be sure to check the agenda for more details about the time and place for the many educational opportunities available to you during the convention. Knowledge powers success in our business so we hope you will take advantage of the education sessions offered.

Since we are in Nashville, there are music and entertainment activities scheduled along with ample opportunities to explore lower Broadway, the Country Music Hall of Fame, or the famous Ryman Auditorium during the convention. For example, on Sunday night, Rollo is sponsoring an event at The Valentine on lower Broadway where you’ll have an opportunity to enjoy great music, food, and beverages.

Spend less time managing your payroll and more time focusing on success. When you partner with BBSI for your payroll needs, you’ll be matched with a dedicated payroll analyst who is committed to helping you ensure your employees are paid efficiently, accurately and on time, every time.

You’ll have access to our proprietary payroll system to help you streamline payroll and employee onboarding with the ability to scale as your business grows.

An important element of the event is the association breakfast and annual meeting scheduled for Monday morning from 7:30AM to 9:30AM where the official business of the association required by statute takes place. This session is where you will have the opportunity to learn about the state of your association as it moves towards its 132nd year of serving our industry in Tennessee and beyond. We encourage you to attend this essential part of the program.

The convention culminates with the longstanding Member Appreciation breakfast where we recognize the agents and company representatives who are making tremendous impact with the Insurors of Tennessee. Please be sure to peruse the agenda provided to plan your activities during the conference. If you have not yet registered, now is the time to go to the Insurors of Tennessee website at www.insurors.org and register at your earliest convenience.

We look forward to seeing you in Nashville!

All the products you need to protect your customers

As an agent, the more you have to offer, the more opportunities you have to customize coverage for your customers. That’s why we equip you with a full suite of products—including auto, home, motorcycle, boat, RV, and more—so you can give your customers peace of mind knowing that whatever they need, you’ve got it covered.

Plus, as a Progressive agent, you have access to our industry-leading commercial coverage to round out your offerings and meet all your customers’ needs.

TO LEARN MORE

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.

Scan for more details and to register

SATURDAY, October 5

4:00pm - 5:30pm - Young Agents Committee Meeting (by invitation)

6:00pm - 8:00pm - Football Party

Location: Bristol Room Dress: Casual

SUNDAY, October 6

8:00am - 11:00am - Board of Directors Meeting

Location: Bristol Room

10:00am - 1:00pm - Exhibitor Setup Time

Location: Griffin Ballroom

11:30am - 12:30pm - Past Presidents Luncheon (by invitation)

Location: Brentwood Room Dress: Business Casual

12:00pm - 5:00pm - Onsite Registration Table Open

Location: Griffin Pre-function

1:00pm - 5:00pm - Trade Show and Reception

Location: Griffin Ballroom Dress: Business Casual

5:00pm - 7:00pm - Exhibitor Breakdown Time

Location: Griffin Ballroom

7:00pm - 10:00pm - Opening Night Party

Location: The Valentine on Lower Broadway Dress: Casual

MONDAY, October 7

7:30am - 9:30am - Association Breakfast & Annual Meeting

Location: Griffin Ballroom Dress: Business Casual

8:00am - 12:00pm - Onsite Registration Table Open

Location: Griffin Pre-function

9:45am - 10:45am - Breakout Session #1: Ethics CE filed

Location: Griffin Ballroom Dress: Business Casual

Late Morning Session Option 1

11:00am - 12:00pm - WINS Panel Breakout SessionAI: Practical Use Cases for Your Agency featuring C.J. Hutsenpiller

Location: Griffin Ballroom Dress: Business Casual

Late Morning Session Option 2

11:00am - 12:00pm - Breakout Session #2: Beyond the Cyber Policy

Location: Belle Meade Room Dress: Business Casual

12:00pm - 1:15pm - All Attendee Luncheon

Location: Griffin Ballroom Dress: Business Casual Exhibitor Door Prizes!

Afternoon Activity Option 1

1:30pm - 3:30pm - Martin & Zerfoss + Chubb Special Event with Songwriter Show

Location: Ole Red on Lower Broadway Dress: Casual Registration + Additional fee required - limited seats available!

Afternoon Activity Option 2

1:30pm - 3:30pm - Soup-er Bowl with the Young Agents Non-Profits: Dealing with the Aftershock presented by Paula Burns, CIC, CRM, 1 hour CE

Location: Griffin Ballroom Dress: Casual All attendees welcome to join!

3:30pm - 5:00pm - Free Time

5:00pm - 6:00pm - InsurPACTN Donor Reception (by invitation)

6:00pm - Company Night Dinner on your own

9:00pm - 11:00pm - Young Agents Night Out

Location: TBD Dress: Casual

TUESDAY, October 8

8:00am - 10:00am - Member Appreciation Breakfast

Location: Griffin Ballroom Dress: Business Casual

10:00am - 11:00am - Board Member Portraits & Group Photo

Location: Griffin Ballroom Dress: Business Professional

1. Register to attend and make hotel reservation

2. Register for an exhibit booth at the Trade Show and Member Reception

3. Become an Insurfest Sponsor

INDEPENDENT MEMBER AGENCIES PREMIUMS WRITTEN

2020 PROFIT SHARING DISTRIBUTED TO MEMBERS

INDEPENDENT AGENCY START-UPS ASSISTED $400M+ 140+ 20+ 5 $4M $3M

2020 BONUSES DISTRIBUTED TO MEMBERS

WAYS TO EARN ON A SINGLE BOOK

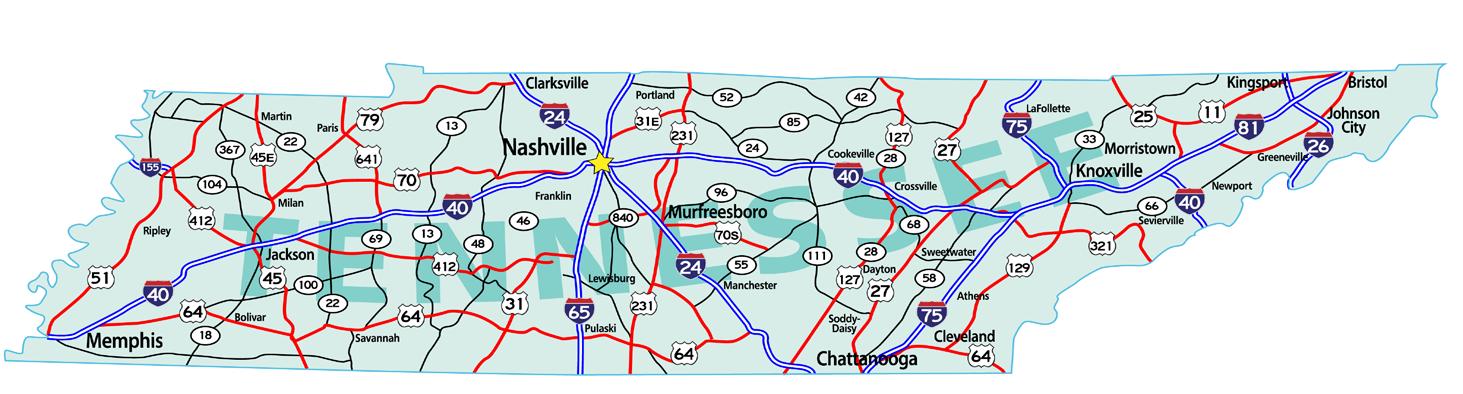

Anderson, Bedford, Bledsoe, Blount, Bradley, Campbell, Cannon, Carter, Chester, Claiborne, Clay, Cocke, Coffee, Crockett, Cumberland, Davidson, Decatur, Dekalb, Dickson, Fayette, Fentress, Franklin, Giles, Grainger, Greene, Grundy, Hamblen, Hamilton, Hancock, Hardeman, Hardin, Hawkins, Haywood, Henderson, Hickman, Jackson, Jefferson, Johnson, Knox, Lauderdale, Lawrence, Lewis, Lincoln, Loudon, Macon, Marion, Marshall, Maury, McMinn, McNairy, Meigs, Monroe, Moore, Morgan, Overton, Perry, Pickett, Polk, Putnam, Rhea, Roane, Rutherford, Scott, Sequatchie, Sevier, Shelby, Smith, Sullivan, Tipton, Trousdale, Unicoi, Union, Van Buren, Warren, Washington, Wayne, White, Williamson, and Wilson

Your attorney clients know their firm inside and out. You know your markets and your competitors. At Swiss Re Corporate Solutions, we have the capabilities and the financial strength to meet the risk needs of insureds for Lawyer’s Professional Liability. Whether the risk is basic or complex, we believe there’s only one way to arrive at the right solution. And that’s to work together and combine your experience with our expertise and your strengths with our skills. Long-term relationships bring long-term benefits. We’re smarter together.

We are pleased to introduce you to Kristen Gulson who is the incoming CEO of the Insurors of Tennessee. She will take over full responsibilities of the position at the end of the year and will help shepherd this association into its 133rd year of serving the insurance industry in this state from Memphis to Mountain City and points in between. Kristen is looking forward to building on the success of Ron Travis’ tenure as CEO of this association for the past three years.

Through his leadership, Ron helped the association navigate out of the difficult pandemic years, staff changes at the association, and other challenges. Like the leaders before him he moved the association forward and ensured it was able to grow and prosper.

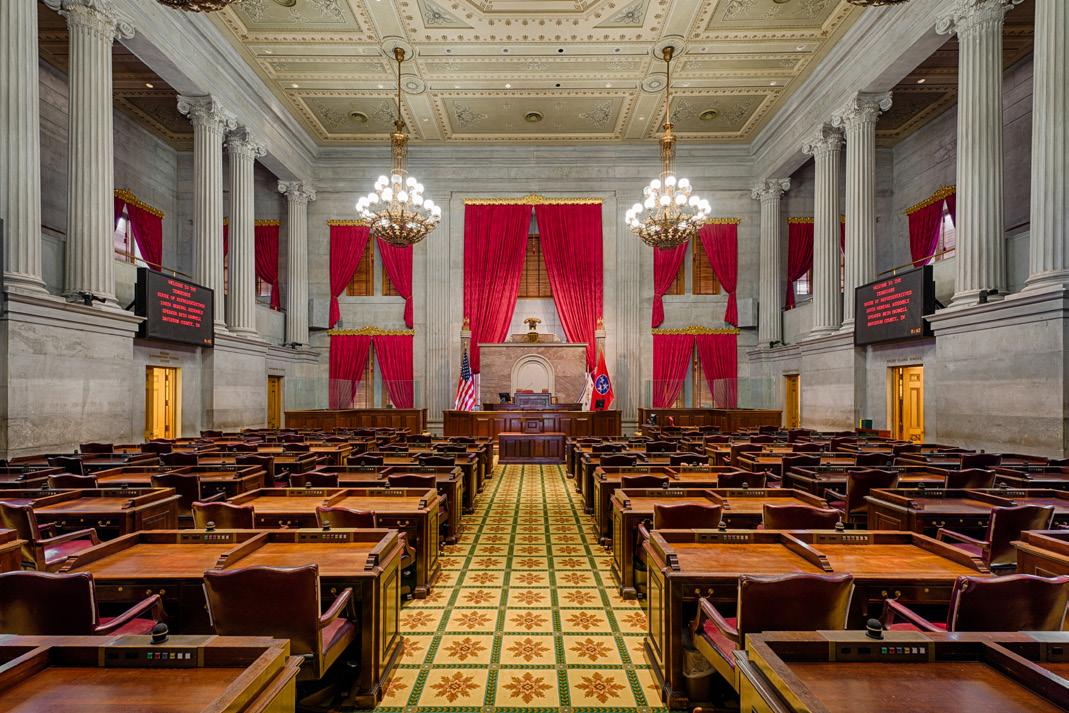

Kristen truly appreciates Ron’s support during the transition in leadership and wishes him the best as he retires from the association. Hopefully, he will have more time to enjoy his home in beautiful Rhea County and have more time to spend with his wife Laura, his children, and grandchildren. We do know one thing. He will be busy serving the citizens of Tennessee House District 31 and the people of the state of Tennessee in the next session of the Tennessee General Assembly.

Kristen has a strong business background with her most recent position being the leader of an association of real estate professionals in South Dakota giving her valuable experience in association management. Prior to her work with the association, Kristen worked as a human resources management consultant.

After graduating from St. Benedict College in Minnesota she became a flight attendant with a major airline. In time, she was promoted to an aviation management position with the airline. Eventually, she was assigned to manage airline operations at Reagan-National Airport in Washington D.C. At one point she also worked with the airline in operations management at Memphis International airport. So, this is not her first time working in the Volunteer state. To be sure, Kristen has the knowledge and experience to contribute to the ongoing success of the Insurors of Tennessee as Chief Executive Officer (CEO).

Kristen’s grandparents were farmers in Kansas. Her dad left Kansas when he joined the Navy and qualified to be a naval aviator flying fighter jets during the Vietnam War. As an accomplished and skilled aviator, he spent most of his career stateside as an instructor pilot at NAS Pensacola training new aviators to fly jets and qualify for carrier landings. Upon leaving the service, he became an airline pilot, and the family settled in Minnesota where Kristen grew up, went to college and worked. In case you are wondering, yes Kristen is a devoted Minnesota Viking fan to this day! You may hear her chant Skol!

Kristen has a son, Dylan, who is a junior at the University of North Dakota where they have one of the most advanced aerospace and aviation programs in the country. He is working on earning a degree in Commercial Aviation with hopes of running a flight department for a private aviation organization or facility upon graduation. Dylan is continuing the line of aviation industry careers in the family for another generation.

Kristen also has a six-year-old Golden Retriever named Lexi who Kristen enjoys spending time with and taking on walks. Or is it that Lexi takes Kristen on walks? If you know Golden Retrievers, this is often the case. In her spare time Kristen enjoys playing golf, cooking and is an avid reader. She also enjoys staying current on news and the latest developments.

In the coming weeks and months, you’ll have the opportunity to meet Kristen and hear from her as she settles into her new position as the CEO of this historic association. We look forward to the future of the association with Kristen’s leadership as she works with the board and its committees to advance the development of the association. u

BY Jennifer Becker, Big “I" Senior Director, Agent Development, Research & Education

The Best Practices Study is released annually by the Big “I" and Reagan Consulting. It is based on the data received from agencies that have demonstrated real, measurable success. Best Practices data is gathered through a data collection process and scored objectively. The highest performers are deemed “Best Practices agencies."

Agencies of all sizes can utilize the report's 3,000 data points to compare their agency's performance with Best Practices agencies and create a performance dashboard to measure future success and create benchmarks towards growth.

Measuring your agency against Best Practices agencies can yield valuable insights. The Best Practices framework helps agencies understand if the right information is being tracked, where they are successful and whether the agency is spending time and resources in the areas that provide the most benefit and increase agency value.

Best Practices agencies are split into six revenue categories, which means agencies can compare themselves to the right category to measure and manage business—and look ahead for scale and growth.

To get an idea of how the Best Practices process can benefit your agency, start by picking one metric, review the results and then use the proper tools or seek education to address the performance gaps. Then, move from one priority to the next. By following this process, you will turn potential into significant improvements.

What should be your first priority? Reagan Consulting has determined that growth is twice as important as profitability in the valuation equation. Without consistent and sustainable growth, an agency will never reach its valuation potential and will likely fail to deliver appropriate investment returns to its owners. So, starting with the sales velocity metric can ease an agency into the Best Practices process.

Expressed as a percentage, sales velocity is calculated by dividing the new business written in the current year by the prior year's commissions and fees. By using the Best Practices Study and benchmarks, you can determine where your agency stands against firms in your same revenue category.

Sales velocity is one of the most important indications of an agency's ability to succeed and perpetuate over the long term. Through the Best Practices process, principals and managers can focus on what an agency can do to impact the specific metric and drive results based on new business activity.

Additional metrics are available to measure agency performance, including an organic growth rate formula. Also, weighted average shareholder age (WASA) and weighted average shareholder producer age (WAPA) indicate if an agency is prepared for perpetuation. Meanwhile, to evaluate your new talent investment needs, use the net investment in unvalidated producer pay (NUPP) metric.

Looking for a place to begin? Download a free Excel Comparison Workbook. Use the spreadsheet to compare your most recently completed year-end results with the results obtained by the Best Practices agencies and then calculate any performance gaps between the two. Areas to explore include revenue, growth, expenses, profit, finance, staffing and producer metrics.

If your performance is aligned with the Best Practices results, consider participating in the Best Practices agency process. Share your interest with your local Big “I" state association or complete the self-nomination form. The opportunity to become a Best Practices agency only occurs every three years and is taking place now.

The process is an excellent agency management exercise that can reveal success, validate decisions and reveal areas of opportunity. For those who are nominated and selected to participate, inclusion provides the prestigious status of "Best Practices agency" and opens the doors to many benefits. u

BY Nicholas Ritchie, The Workplace Advisors

Rapid technological advancements and shifting employee expectations have added another layer to successfully recruiting and retaining top talent, which means the world of employee benefits must evolve to meet the changing needs of the workforce.

Traditional benefits like health insurance, retirement plans and paid time off serve as “hygiene factors," or factors that help prevent employee dissatisfaction. On the other hand, creative and non-traditional benefits can serve as “motivational factors," positioning employers as going above and beyond to increase employee satisfaction.

A combination of benefits that meet both types of employee needs is necessary to maintain a productive workforce. Here are some traditional and creative benefits trends.

Traditional benefits typically satisfy essential employee expectations and will continue to be a cornerstone of a competitive benefits package. Here are three examples:

1) Insurance. Insurance remains a cornerstone of employee benefits, with a growing emphasis on expanding coverage and reducing costs. About 86% of private-sector employers offer employer-sponsored health insurance, according to an Insurance Component of the Medical Expenditure Panel Survey (MEPS-IC) data analysis.

Employees value a variety of health benefits, including comprehensive health plans with vision and dental coverage. The average coinsurance rates for employer-sponsored health insurance plans are 19% for primary care, 20% for specialty care, and 20% for hospital admissions, according to the “2023 Employer Health Benefits Survey" from the Kaiser Family Foundation.

More organizations are offering customized health benefits options or cafeteria plans to enhance their benefits packages. Health savings accounts (HSAs) enable employees with highdeductible health plans to save pre-tax

funds for medical expenses, with the advantage of rolling over unused funds from year to year.

Flexible spending accounts (FSAs) also contribute to a robust benefits plan. Unlike HSAs, FSAs do not require enrollment in a high-deductible plan and provide similar pre-tax benefits for medical expenses, although funds do not roll over and contribution limits are lower. Additionally, HSAs are portable from employer to employer but FSAs are not.

2) Paid time off. Paid time off (PTO) is crucial for maintaining work-life balance and employee well-being. In 2024, companies increasingly offer flexible PTO policies, a move away from separate vacation, sick leave and personal time banks.

While PTO on an accrual basis remains common and serves as an employee motivator, the added flexibility in PTO and holidays helps employees manage their time effectively, reducing burnout and promoting overall well-being. This, in turn, enhances job satisfaction and performance.

Additionally, organizations in 2024 are more frequently offering summer hours, shortened workweeks, such as fourday schedules, and sabbatical leave programs to support personal and professional development.

On average, private-sector employees receive 11 days of vacation after one year, 15 days after five years, 18 days after 10 years, and 20 days after 25 years, according to the U.S. Bureau of Labor Statistics. These averages show the evolving standards in PTO offerings and can be a helpful benchmarking tool.

However, more than 2 in 3 (68%) of U.S. and Canadian employees report working while on PTO, according to an ELVTR survey, indicating a need for better boundaries and support during time off.

Crucially, employers must encourage the use of PTO. Otherwise, employees may feel unsatisfied and the investment in these benefits could be squandered.

(Continued on pg 18)

3) Retirement plans. Retirement plans are paramount for the long-term financial security of employees. Companies are strengthening their retirement benefits by modifying employer contributions or offering matching programs to help employees save for the future.

In addition to traditional offerings, some organizations are revisiting retirement options to give employees more flexibility and multiple retirement options are now being offered by some organizations.

Additionally, an upcoming regulatory change will make automatic enrollment obligatory for all 401(k) and 403(b) plans established after Dec. 29, 2022. This change was part of the Secure Act 2.0 and will go into effect January 2025. Plans established before this date will be “grandfathered in" and exempt from the automatic enrollment obligation. In theory, this change should incentivize employee financial wellness, simplify access to retirement savings, and encourage higher participation rates.

A creative benefits package can be a competitive advantage, improving employee satisfaction, well-being and performance. Here are three examples:

1) Flexible work arrangements. Flexible work arrangements have become popular since the COVID-19 pandemic and continue to be valued. Employees increasingly seek autonomy over their schedules as a way to find work-life balance, favoring flexible work hours (94%) and flexible locations (90%) as key benefits, even over annual compensation increases (88%), according to Businessolver's “2024 State of Workplace Empathy" study.

Companies are expanding their remote work policies and hybrid work models to accommodate employee needs. Innovative organizations are limiting burnout and improving performance by moving to a four-day work week or making other adjustments to work arrangements.

2) Family benefits and work-life balance. In addition to statutory benefits like maternity and paternity leave, many companies are prioritizing work-life balance and family-related benefits. Offerings may include extended parental leave and childcare assistance programs.

Facilitation of

Organizations also recognize the need for elder care support, helping employees care for aging parents or relatives. Some companies go above and beyond with pet care, pet insurance and other subsidies for employees' four-legged friends.

3) Mental health and well-being. The focus on mental health and well-being has intensified, driven by the recognition of its significant impact on employee productivity and satisfaction. In addition to traditional employee assistance programs (EAPs), companies are implementing comprehensive mental health initiatives, with some even staffing mental health providers to offer more extensive support than typical health insurance covers.

These programs are designed to provide multiple levels of support, including access to therapists and counselors both in person and through telehealth services. Promoting physical health and wellness remains a priority, with companies incentivizing healthy behaviors through various health and fitness programs, such as subsidies for gym memberships and encouraging employees to prioritize their physical well-being.

A software upgrade offered to the owners of Hyundai and Kia vehicles that were sold without electronic immobilizers cut theft rates by more than half, new research from the Highway Loss Data Institute shows.

The companies began implementing the software upgrade in February 2023 in the wake of a tidal wave of theft claims that started during the COVID-19 pandemic, when instructional videos posted on social media kicked off a viral trend. With the new software installed, vehicles will only start if the owner’s key or an identical duplicate is in the ignition. Vehicles with the software also receive a window sticker aimed at deterring potential thieves.

Roughly two dozen 2011-22 Hyundai and Kia models are eligible for the upgrade. Those vehicles that received it as of December 2023 — a total of 30% of the eligible Hyundais and 28% of the eligible Kias in HLDI’s database — had theft claim frequencies that were 53% lower than vehicles that didn’t get the upgrade, HLDI found.

Those claims aren’t all for thefts of the entire vehicle. They also include claims for damage to vehicles that were stolen and recovered, theft of vehicle parts and items stolen from inside the vehicle. The frequency of whole vehicle theft, which HLDI calculates by matching the cost of the claim to the amount insurers pay for the same model if it’s totaled in a crash, fell by a larger 64% for vehicles with the upgrade.

“The companies’ solution is extremely effective,” said Matt Moore, senior vice president of HLDI. “If you own a Hyundai or Kia without an electronic immobilizer, you should call your local dealer about getting the software upgrade today.”

Electronic immobilizers were standard equipment on only 17% of 2011 Hyundai and Kia models, compared with 92% of 2011 models from all other brands. While that percentage climbed rapidly after model year 2015, even in model year 2022 immobilizers were standard on only 84% of Hyundai and Kia models, compared with 96% of models from other brands. (By 2023, electronic immobilizers were standard on all the companies’ models.)

While the HLDI study period ended in December 2023, Hyundai and Kia have continued to upgrade vehicles. According to the two automakers, as of mid-July approximately 60% of eligible vehicles had been upgraded. Some trims without immobilizers are ineligible for the software upgrade because they lack alarm systems.

Theft claim frequency for Hyundai and Kia vehicles remains elevated, even for models with the new software. One reason may be that the software-based immobilizer only activates if the driver remembers to lock the vehicle with a fob, while many people are in the habit of using the switch on the door handle. In addition, thieves who are thwarted by the software upgrade may be stealing other items from inside the vehicle.

Overall, theft claim frequency for 2003-23 Hyundai and Kia models in the second half of 2023 was more than 11 times as high as in the first half of 2020 and more than 8 times as high as the July-December 2023 theft claim frequency for other brands, a separate HLDI study found. Vandalism claim frequency for Hyundai and Kia models over the second half of 2023 was also 6 times as high as the first half of 2020 and 5 times as high as the July-December 2023 vandalism claim frequency for other brands. Presumably, vandalism claims spiked as a result of failed theft attempts, which typically result in broken windows, scratched doors or damage to the steering column.

Notably, claim frequency for both theft and vandalism continued to rise for Hyundai and Kia throughout 2023 despite the implementation of the software upgrade, though the rate of increase for theft tailed off dramatically. Theft frequency increased to 11.7 claims per 1,000 insured vehicle years in JulyDecember from 11.5 claims in January-June, while vandalism frequency rose to 9 claims per 1,000 insured vehicle years.

Vandalism claims were also more common for Hyundai and Kia vehicles with the anti-theft software than for those without it. The 61% increase in vandalism claim frequency, relative to vehicles that haven’t received the upgrade, was almost equivalent to the decrease in whole theft claims — though the monetary cost of vandalism is much lower.

“Based on these trends, we expect claim rates for Hyundai and Kia vehicles to gradually drop back in line with those of other brands, as thieves learn they’re no longer so easy to steal and the fad gets stale,” Moore said. (source IIHS) u

We’re right here to do more.

To help support both your physical and mental health while giving back to our communities is to go beyond what is expected from a health insurance company. And that’s exactly why we do it.

As a mutual company, we are owned by our policyholders. We focus our time, attention, and resources on delivering superior financial strength and stability, a comprehensive product portfolio, and most of all, on doing what’s right for policyholders. To us, policyholders are much more than insurance consumers. And because of that, all of our business decisions are made with a policyholder-first focus.

For more information about our products, please contact one of our territory managers at 615-889-2740.

Brent Potts ext 7514

Jane Kinard ext 7518

Andy Wilder ext 7545

Kym Clevenger presented by

I hope you all have had a safe and enjoyable Summer and had a chance to take a vacation or a long weekend to get away and relax. As you all know, running an agency or working in the insurance business can be rewarding on many levels both professional and personal. However, the challenges of our business, particularly in a “hard market” can get to all of us from time to time. So, finding time to decompress and refresh is essential for you to perform at your best.

On the subject of performance, just a few weeks ago Americans had the opportunity to watch the 2024 Paris Olympics and witness the best of America’s athletes compete against the world’s best in the pool, at the track, on the courts, and in other venues for each sport. It was inspiring to watch these athletes who have trained the past four years and in some cases for a lifetime compete for gold, silver, and bronze medals performing at the very highest levels. Many athletes from America and around the world won medals, broke world records, set personal best records and excelled by any measure.

Even now the 2024 Paris Para Olympics are being held where athletes from America and around the world have persevered to overcome their disabilities and challenges to compete at the highest levels to pursue their own Olympic glory. These Para Olympians redefine what is possible when people have the grit and determination to prevail no matter their circumstances.

Olympic and Para Olympic athletes all demonstrate the triumph of the human spirit and the ability to accomplish more than many ever thought possible. Though we all cannot or will not be Olympic level athletes there is so much to be learned from these individuals.

They show us all how we can elevate who we are and how we can employ determination and perseverance to exceed even our own expectations.

How does all of this relate to folks working in the insurance business at independent agencies, companies, vendors and support organizations? Actually, there is much to be learned from these Olympians. It starts with preparation by doing the work each day to improve and move forward. In the insurance world, this might translate to learning more, taking professional education courses and always doing the work to make sure you’re prepared to meet the needs of your clients based on your superior knowledge and expertise. This is how you compete and win in the insurance business.

In the Olympics, many competitors won their swimming event or track event by one-hundredth of a second. What was the difference between the gold medal winner and the silver medal winner? Many of the highest performing athletes will tell you it is about paying attention to the details of their strokes, strides, or athletic form with every event. In the insurance world, those who pay attention to the details consistently outperform the competition by identifying opportunities or challenges for their clients relative to insurance and risk. Those who sweat the details don’t make the mistakes, in the unforgiving world of insurance, that those who are less diligent in their efforts make. You can win the day by paying attention to the details!

Finally, those who win have the winning attitude, determination, and perseverance to not only prevail in their chosen sport but to dominate most of their competition. It is about having the will and commitment to win and win the right way. It is about continuous improvement

and having the grit to overcome difficulties and failures to move forward. So, on those days when things are not going as you hoped in the agency, at your company or organization. Remember and discover the lessons of the Olympians and Para Olympians from the Summer of 2024. They show the way to win in business and in life if you look, listen and learn.

Thank you for following along with this Olympic thought exercise. I hope this gives you things to consider and maybe even provides some inspiration.

The Insurors of Tennessee Annual Convention is just around the corner. If you have not yet registered, please do so as soon as possible. We have a great event planned with an abundance of education and continuing education opportunities to help you be prepared to compete in the marketplace. There are also many opportunities to network and get to know your peers from across the state. In short, this is the capstone event of the year for your association, so we encourage you to be there and to engage in all the event offers.

In closing, I want to thank the Young Agents Committee, Jake Smith and Kyra Garrison for the great series of Young Agent gatherings held across the state in the month of August. More young agents are attending and taking part in these events, and we are seeing a significant increase in interest from the folks that are the future of our industry and this association.

I look forward to seeing you at the convention in Nashville! u

Running a successful small business is hard work, but finding the right insurance program for your client is easy with West Bend.

Our business insurance program covers liabilities and expenses specifically designed for small business operations.

• Great pricing and exceptional coverage

• Experienced claim representatives

• Convenient options for reporting losses – available 24/7

Learn more about the variety of business line coverages available through West Bend by visiting thesilverlining.com.

The worst brings out our best.®

Ron Travis presented by

I hope you all have enjoyed this Summer albeit it has been a bit warm as of late. I am looking forward to the cool crisp days of Fall in Tennessee. With Fall comes cooler weather, the return of football time in Tennessee, and the Insurors of Tennessee annual convention being held October 5-9, 2024, at the J.W. Marriott in downtown Nashville. In fact, the annual convention starts with a watch party on Saturday night where members can gather to watch college football in a year that is sure to be exciting with conference realignments and an expanded playoff at the end of the season. We hope you’ll join us to cheer on your team on Saturday night!

We have an excellent event planned for this year starting with the tradeshow that show cases the vendors and partners that help drive success in our industry and most likely in your agency. I strongly encourage you to take time to explore the exhibit hall to meet and talk with the exhibitors to learn more about their products and services. You might be surprised at what you may learn from these folks.

While on the subject of the tradeshow and partners, I want to thank each of our association partners for their support relative to the convention and throughout the year. Your financial contributions and support help make the convention possible and power our initiatives and efforts across the association throughout the year. Your dedication to our industry helps to keep the insurance business in Tennessee vibrant and healthy for agencies, insurance companies, and most importantly consumers.

Our professional development and education sessions planned for the confer-

ence this year present a strong slate of guest speakers at various sessions offering attendees many options to enhance their knowledge on a wide array leading edge topics and subject matter. These sessions also offer you and your staff the opportunity to earn continuing education credits to stay current from a licensing perspective. Most importantly we all are aware, knowledge, experience, and expertise are the great differentiators for professional independent insurance agencies across Tennessee. Knowledge and experience are the competitive advantage against more commodity driven entities that distribute and sell insurance across the state. Please do not miss the opportunity to learn and grow as a professional.

As always, we have great opportunities for you to relax and unwind from the rigors of the insurance business, taking advantage of all Music City has to offer. I encourage you to take part in these events to renew old friendships and make new ones. As many of the more tenured members of this association will tell you, the relationships you develop over the course of your career are invaluable both personally and professionally. So, get in the game and enjoy all the convention has to offer.

If you have not yet registered for the convention, time is running out. So, please visit the Insurors of Tennessee website to and go to the annual convention section at www.insurors.org/annual-convention to register. I am looking forward to seeing you in Nashville.

In other news, as some of you may have heard, I am retiring at the end of this year as your CEO. We have accomplished quite a bit during my time here and have

worked hard to protect the interests of independent insurance agencies across this great state, offered enhanced educational opportunities, energized the development of our Young Agent and WINS organizations, and much more. I have enjoyed working with the Insurors of Tennessee board of directors, our members, and our staff to advance this association the past several years. It truly has been an honor to serve this historic and impactful association as CEO.

I have been working with your incoming CEO, Kristen Gulson, to help orient and support her as she prepares to take full responsibility for the position towards the end of this year. Kristin is going to bring her unique experience and knowledge to the position working with the board and staff to carry the Insurors of Tennessee forward in the coming years. Kristin is delightful to work with and is going to excel at leading this exceptional organization.

I am looking forward to spending more time at home in Rhea County just sitting on the porch with my wife Laura to enjoy more time together and the chance to spend more quality time with my adult children and with my grandchildren. We also look forward to travelling and exploring along the way. I also plan to continue to serve the citizens of my house district and the people of Tennessee in the upcoming Tennessee General Assembly if the people of my district reelect me in November.

I hope to see you all at the Insurors of Tennessee Annual Convention! u

presented by

This edition of the Young Agent Spotlight features Miller Lane who is a producer at Bradshaw in Dyersburg, Tennessee. As many of you may know, the principal of the agency is Walt Bradshaw who served as President of the Insurors of Tennessee in 2009. Walt continues to be a steadfast supporter of the association today. In fact, the Bradshaw family has a long tradition of supporting the association as Walt’s father Sam Bradshaw also served as President of the association in 1977. Sam Bradshaw and his wife Clara Nell Yarbro Bradshaw founded the agency in 1965. Today, the agency continues to be a family-owned insurance agency.

Miller Lane is from the area where he grew up in Ripley, Tennessee and graduated from Ripley High School where he played football and baseball. He also played golf as well. Miller’s baseball skills earned him a scholarship to Jackson State Community College where he played first base. Miller said, “Baseball was a great learning experience both on and off the field where I learned the importance of listening, following instructions, and being part of a team.” He further commented, “Through baseball I learned the importance of working together in common purpose to achieve goals and to win.”

He then transferred to the Memphis area with Enterprise serving as an Assistant Manager at their Lakeland, Tennessee location. Like many recent college graduates, Miller learned quite a bit about business, management, sales, and marketing with the company.

In March 2019, Miller joined the Bradshaw agency in Dyersburg as a Producer. He focuses on providing personal and commercial lines insurance products and services to clients in Northwest Tennessee. He is also able to provide life and health insurance products to his clients as well. Through the mentorship of Walt Bradshaw and his colleagues in the agency, Miller learned the importance of providing potential clients and existing clients with the right insurance coverage for their circumstances. The agency focuses on establishing a consultative relationship with clients to help them make the right decisions relative to insurance and risk management. At this agency, insurance is not a commodity product where one size fits all at the lowest possible price. It is about the right coverage, with the right carrier, at the right price to protect the client.

While at Jackson State Community College, Miller studied Mass Communications and Media Studies from 2010 to 2012. He then transferred to the University of Tennessee – Knoxville to continue his studies where he earned a B.A. in Communications and Media Studies.

During and after college in Knoxville, Miller worked for Enterprise Rental Car Company in the Knoxville area first as a Management Assistant and then as an Assistant Brand Manager.

When asked about the challenges he encounters these days as an agency producer, he described the “hard market” and the attendant challenges of securing the right insurance protection for his personal and commercial insurance clients. Conversely, he enjoys the opportunity to work with families and businesses to help members of his community protect their assets and their financial security via the products and services he can provide. He appreciates the chance to be there for his clients when they need him the most when misfortune strikes whether it is a house fire, automobile accident, damage from a severe storm or other circumstance.

Join Young Agents at Insurfest!

Monday, October 7, 2024

1:30pm - 3:30pm

Soup-er Bowl with the Young Agents featuring a 1-hour CE opportunity

"Non-Profits: Dealing with the Aftershock" presented by Paula Burns, CIC, CRM

Location: Griffin Ballroom

Dress: Casual

Miller serves on the Insurors of Tennessee Young Agents Committee and enjoys getting to know more about the association, how it works, and what missions can be accomplished. Miller said, “I am really happy to see more and more young agents participate in social events being held in the area and taking the opportunity to get to know their peers.” Young agents are engaging in this association in greater and greater numbers, which bodes well for the future.

Miller met his wife Anna Claire at a University of Tennessee football game tailgate against North Carolina State in Atlanta. They had never met before despite both attending the University of Tennessee and being from hometowns that were only a few miles apart in West Tennessee. By happenstance Anna Claire is also the daughter of Walt Bradshaw. Serendipity must have brought the two of them together.

Anna Claire is a high school guidance counselor at Dyersburg High School and is active in the community. Miller and Anna Claire have a two-year-old son named Cooper they adore and love spending time with every day. In their spare time they like to travel to Knoxville from time to time to attend University of Tennessee football games. They also enjoy going to area concerts. Miller enjoys playing golf as often as possible and enjoys following St. Louis Cardinals baseball. He has been a fan since his teen years. u

Below is just a broad listing. If you don’t see what you’re looking for, please contact us.

• General Contractors

• Building Trade Contractors

• Utility Contractors

• Land Improvement Contractors

• Pavement Maintenance-Non DOT

• Services Contractors

• Building Cleaning & Maintenance Contractors

• Construction Material Suppliers

• Manufacturing

• Wholesale and Distributing

All classes may not be available in all states.

• 24/7/365 loss reporting-including online •

• Accelerated auto and property estimating and repair options •

• “Fast Track” medical only claims handling program •

• Tele-emergent medicine program-connects injured workers to medical care, not “triage” •

Bill Vanderslice, Regional Vice-President 615-932-5508 | bvanderslice@berkleysig.com or your Middle Market Underwriter

AF GROUP

ASSOCIATED INSURANCE ADMINISTRATOR

BERKSHIRE HATHAWAY GUARD INS.

BUILDERS INSURANCE GROUP

CENTRAL INSURANCE COMPANIES

EMC INSURANCE

FRANKENMUTH INSURANCE

GOVERNMENTAL RISK INSURANCE PLANS

THE HANOVER INSURANCE GROUP

HARFORD MUTUAL

I HATE BUYING INSURANCE

J.M. WILSON

MARKEL SPECIALTY

MEM

SAFEWAY INSURANCE COMPANY

UTICA NATIONAL

Welcome to election season. The 2024 primary elections in Tennessee include some incumbent losses in Senate races and the likely emergence of some new faces at the State Capitol come January. As we move toward the general election, politicos’ attention is hyper-focused on just a handful of competitive races, with state parties and outside organizations gearing up for a concentrated effort in key districts. This article provides an overview of primary results and a preview of some upcoming general election tilts.

• Incumbent Upsets: State Rep. Patsy Hazlewood (R-Signal Mountain), chair of the House Finance, Ways, & Means Committee, narrowly lost her Republican primary to activist Michele Reneau by 137 votes, despite a substantial campaign fund. Similarly, Rep. John Ragan (R-Oak Ridge), Chair of the House Government Operations Committee and staunch social conservative, was defeated by Rick Scarbrough in Anderson County's District 33. Three-term State Senator Frank Niceley (R-Strawberry Plains) fell to challenger Jessie Seal in District 8, with Seal receiving considerable campaign spending support from school choice advocates due to Niceley's opposition to the governor’s education savings accounts initiative. On the flip side, State Senate Education Chair Jon Lundberg (R-Bristol), an ally and advocate for the governor’s education proposal, lost to Republican primary challenger Bobby Harshbarger of Kingsport in a highly contentious race. Harshbarger, who was endorsed by former President Donald Trump, expressed skepticism about the governor's voucher initiatives during the campaign. Lundberg's defeat also marks a setback for Senate Speaker Randy McNally, as Lundberg was a key ally. The race further complicated Governor Lee's political positioning, as he faced criticism from Trump, who mocked Lee's influence following the election.

Spencer in a high-profile Senate race. Freshman Rep. Kevin Raper (R-Cleveland) won a rematch against Troy Weathers in Bradley County, and Rep. Paul Sherrell overcame a challenge from White County Commissioner Robert McCormick. Additionally, Reps. Rusty Grills, Chris Todd, Tim Rudd, and Robert Stevens successfully defended their seats against various opponents.

• Open Seats: Tom Hatcher secured the Republican nomination to succeed retiring Sen. Art Swann (R-Maryville) in District 2. Renea Jones won the GOP primary to replace retiring Rep. John Holsclaw (R-Elizabethton), and Fred Atchley clinched the nomination for the seat vacated by Rep. Dale Carr (R-Sevierville)

• Democratic Highlights: Gun control activist Shaundelle Brooks, whose son was a victim in the 2018 Waffle House shooting, won the Democratic nomination in House District 60, filling the vacancy left by Rep. Darren Jernigan. Gabby Salinas, after two previous close general election losses, secured the nomination for the Shelby County seat vacated by Rep. Dwayne Thompson, facing no Republican opposition in the upcoming general election. Incumbent Reps. Yusuf Hakeem (D-Chattanooga) and Sam McKenzie (D-Knoxville) fended off challenges from Chattanooga City Councilwoman Demetrus Coonrod and Knox County Commissioner Dasha Lundy, respectively.

• Incumbent Victories: Despite facing strong challenges, several incumbents secured their positions. Republican Ferrell Haile achieved an 18-point victory over Chris

With the primaries behind us, attention is turning to the general election which is just under three months away (Nov. 5). Competitive general elections in Tennessee are anomalies, if not quite unicorns, in recent cycles. With seemingly no “lowhanging fruit” left on the tree for Republicans, the majority has to search pretty intently for potential seat pickups; but this also allows them to invest heavily on “reach” districts and to defend potentially vulnerable seats. All this means is that state parties, caucuses (and outside money in the form of independent expenditures) will spend heavily on just a few key state and federal races.

One of those well-heeled “outside spending” special interests, Planned Parenthood, announced a $1 million campaign to support Democratic candidates in their efforts to unseat Republican incumbents in the General Assembly. The organization's goal is to make Tennessee's recent changes to abortion laws, enacted by Republican supermajorities, a central issue in the upcoming election. And with a female at the top of the ticket, Planned Parenthood and Democratic operatives hope the women vote will have a meaningful impact in key down-ticket races, even in a reliably Republican state like Tennessee.

• District 18 (Knoxville): Freshman Rep. Elaine Davis (R) is facing Bryan Goldberg (D), president of the Knoxville Jewish Alliance. Goldberg is hoping the district's shifting demographics will favor Democrats in this race. Goldberg reported $51,600 in campaign cash on-hand. Davis reported $61,900.

• District 49 (Smyrna): Rep. Mike Sparks (R) is being challenged by immigrant advocate Luis Mata (D), who was born in Mexico and is now a naturalized U.S. citizen. Mata reported $57,000 in his campaign account, while Sparks reported $29,700.

• District 75 (Clarksville): Incumbent Rep. Jeff Burkhart (R)is faces Allie Phillips (D), who gained national media attention in the wake Tennessee's abortion law changes. Phillips has raised an enormous amount of money from places far and wide, reporting $186,800 cash on-hand. Burkhart's reported $84,200, respectable by any other measure despite being less than half of Phillips’ war chest. Nevertheless, Burkhart likely has sufficient resources to run the type of campaign to be successful. This race will see significant outside spending efforts.

Republican House Targets

• District 67 (Clarksville): Republicans are focusing on the seat held by incumbent Democrat Ronnie Glynn, who emerged a winner by just 153 votes for the open seat two years ago. Glynn, a first-termer, faces Jamie Dean Peltz, a political consultant with $19,500 in campaign funds. For his part, Glynn reported $43,400. Despite the difference, the House Republican Caucus, which reported over $1 million raised in the last reporting period, figures to spend heavily to erase any fundraising gap in this one.

• District 60 (Nashville): Republicans are eyeing the open seat left by moderate Democrat Darren Jernigan. Gun control activist Shaundelle Brooks, a Democrat, will face Republican Chad Bobo, a former

aide to House Speaker Cameron Sexton. Among the other six Republicans challenging Democratic incumbents, Metro Nashville Councilwoman Jennifer Frensley Webb has raised $17,000 for her bid against Rep. Bo Mitchell, who has $59,800 in his campaign account.

• District 97 (Memphis): Incumbent Rep. John Gillespie’s (R) district is considered the most vulnerable Republican seat. Gillespie, with $78,600 in campaign funds, faces Jesse Huseth, who has $85,700 and has been in the race and working to flip the seat for almost two years. In 2020, Joe Biden carried this district by 6 percentage points which is a key reason Democrats are bullish here.

More than a third of the 99 House members (40) are running unopposed in the general election, including 26 Republicans and 14 Democrats. Notable among these are Renea Jones, a Republican from Unicoi County, and Democrat Gabby Salinas from Shelby County, who will be sworn-in to state office for the first time.

(Continued on page 35.)

You have invested time and energy into your firm, and you’re still passionate about the insurance business, your clients and your employees. If you’re interested in taking your business to the next level, while enjoying the fruits of your labor, let’s explore a possible partnership.

Why insurance firms choose to partner with Higginbotham:

• Ten-year average return of 30% IRR

• Ten-year average annual shareholder distribution of 25%

• Insurance Business America, 2022 Top Insurance Employer

• Privately-held and run by insurance professionals

• Majority ownership held by employee shareholders

• Leverage Higginbotham’s consistent 20% compound annual growth rate

• Broad risk management and benefit plan services add client value to support your growth

• Maintain your leadership role

• $5 million donated to nonprofits through the Higginbotham Community Fund

Are you ready to soar?

Contact David Fishel | (817) 349-2260 | dfishel@higginbotham.com higginbotham.com

The Senate saw significant action in the primaries with the losses of Republican incumbents Lundberg and Niceley, discussed above. Despite this, few Senate races appear to be very competitive in the general election. Democrats have fielded challengers in 10 of 14 Republican-held seats, though most Democratic candidates have limited campaign funds. One race of interest is in Chattanooga, where Republican Sen. Todd Gardenhire is being challenged by Missy Crutchfield, daughter of the late Democratic leader Ward Crutchfield. It is a new-looking district for Gardenhire, which has changed considerably via redistricting since Gardenhire was last reelected. In addition to parts of Hamilton Co., Gardenhire previously represented southern portion of Bradley Co. The new district picks up Bledsoe, Marion, and Sequatchie Counties, all new territory for the current Chairman of the Senate Judiciary Committee.

In Nashville, Democrat Heidi Campbell, who previously unseated former Republican senator Steve Dickerson, is facing Republican Wyatt Rampy, a real estate broker with $122,100 in campaign funds. Rampy ran unsuccessfully for a House seat in West Nashville two years ago. For her part Campbell reported $65,000 cash on-hand.

Bobby Harshbarger, who defeated Lundberg in the District 4 primary, along with several other Senate candidates, faces no Democratic opposition in the general election.

If you haven’t yet given to InsurePacTN, it’s certainly not too late. In fact, there’s no better time to help make sure we have the resources it needs to support candidates that support independent agents in the upcoming general elections. Doing so is easy: just visit https://www.insurors.org/donateto-insurpactn/. Of course, please do not hesitate to reach out to me or any of the staff at Insurors with questions. Of course, for those that have already contributed, we greatly appreciate your support. It makes a huge difference.

About the Author—Trey Moore is the government and legal consultant for Insurors. He operates Trey Moore Consulting in Nashville and formerly served as senior public policy counsel for one of Nashville’s largest law firms. Trey has over a decade of experience in representing clients before the Tennessee General Assembly and state government. u

BY Raaed Haddad, Big “I" director of federal government affairs

Earlier this year, U.S. House Ways and Means Committee Chair Jason Smith (R-Missouri) created various tax teams to identify legislative solutions for the sections of the 2017 Tax Cuts and Jobs Act (TCJA) that are scheduled to expire at the end of 2025.

Rep. Smith tasked Rep. Lloyd Smucker (R-Pennsylvania) to lead the Main Street Tax Team. Rep. Smucker is also the lead sponsor of H.R. 4721, the "Main Street Tax Certainty Act," which would make permanent the 20% small business deduction, also known as section 199A.

Recently, Rep. Smucker hosted a roundtable and visited stores in Shrewsbury, Pennsylvania to discuss this legislation. Specifically, he wanted to hear from local small business owners on how TCJA and 199A have benefited their businesses and their communities. He was joined by Rep. Mike Kelly (R-Pennsylvania), who chairs the tax subcommittee on the House Ways and Means Committee.

Sarah Brown, Big “I" member and president and CEO of KellerBrown Insurance Services in Shrewsbury, Pennsylvania, hosted Reps. Smucker and Kelly at her agency, which is in its 125th year of continuous family ownership. Brown and her team explained the importance of the 199A deduction and what it means to their agency, their customers and their community.

The deduction, which is scheduled to expire at the end of 2025, is heavily relied upon by many Big “I" members and their clients to expand their small businesses, hire more employees, and better serve their communities. Pass-through entities have factored this deduction into their operations and its expiration would result in a tax increase on many small businesses. Such an increase would create an unlevel playing field and put pass-throughs at a disadvantage to those filing taxes at the corporate rate.

The Big “I" was the only insurance trade association asked to participate in this important roundtable discussion. The Big “I" is in regular contact with Rep. Smucker and has developed a strong relationship with him and his staff.

The Big “I" is working tirelessly to educate all elected officials about the importance of the 199A deduction and will continue to do so. If you have examples of how 199A has benefited your agency, send the Big “I" a brief testimony that the government affairs team can use to educate elected officials. u

Since 2020, SFM has written over 2,700 pool policies for $9.75 million putting an extra $500,000+ of commission in agents’ pockets.

n Diverse class code list

n Premium range up to $25,000

n Quick online quoting

n Manage applications and policies online using SFM Agency Manager (SAM)

With 50 eligible class codes, now is the time to prospect from the pool or move your current pool accounts to SFM!

than an account.

For more than 60 years, we’ve built a business based on basic principles: handle claims quickly and fairly, provide superior service and put people first. At FCCI, we help businesses thrive, manage risks and face the future with confidence.

The Insurors of Tennessee and Grange Insurance recently hosted four fantastic Young Agents events during the month of August, bringing together emerging professionals from across the state for memorable nights of networking, learning, and fun.

The first stop was in Nashville at Fat Bottom Brewery, where young agents gathered for an evening filled with lively conversations, valuable connections, and insights into the industry. The relaxed atmosphere allowed attendees to unwind after a busy day while forging new relationships and strengthening existing ones. Insurors was also able to officially welcome new agents who recently graduated from the MTSU risk management program and are now full-time agents with our agency members!

Following the success in Nashville, the excitement continued in Memphis at Wiseacre Brewery. The Memphis event was equally engaging, offering young agents another opportunity to connect, share experiences, and learn from each other. The vibrant setting of Wiseacre Brewery added a unique charm to the gathering, making it a night to remember.

These Young Agent events highlight the importance of community and collaboration among young professionals in the insurance industry. A huge thank you to Grange Insurance for sponsoring these events and to everyone who attended and contributed to their success. We’re already looking forward to the next opportunity to bring our Young Agents together! u

Next, the Young Agents headed to Chattanooga for an evening at OddStory Brewery. Attendees had a strong focus on discussing local market trends and the challenges facing young professionals in the insurance industry. The event also highlighted the importance of community and mentorship, as seasoned agents offered guidance and support to those newer to the field. See photos from Chattanooga starting at the top of the next column.

Insurors finished the Young Agents tour in Knoxville at Yee Haw Brewery on the same day the brewery launched the Vol Lager. Our attendees were able to try this new brew, get a photo op with Smokey, and meet several of the Vols athletes while listening to live music.

Becky Bozza, CISR Elite, has been named the new President of RSS Insurance in Chattanooga.

Becky was promoted from her pervious position of Operations Manager.

Becky began her insurance career in 1998 with Travelers Insurance Company in Orlando, FL. There she worked as a licensed claims adjuster on commercial accounts and later moved into the commercial underwriting department as an underwriter for the assigned risk market. After that she moved to McGriff Insurance Services (formerly BB&T Huffaker Insurance) as an Account Manager for 15 years with 2 of those years as supervisor. Becky started at RSS Insurance in 2021 as Operations Manager and then Chief Operations Officer. u

FCBI, a Florida based self-insurance fund specializing in providing workers’ compensation insurance to companies across Florida, has acquired MidSouth Mutual Insurance Company, a Tennessee based company effective August 22, 2024. The carrier has been demutualized and renamed MidSouth Insurance Company. MidSouth Insurance Company will operate as a subsidiary of FCBI.

The two companies share a strong commitment to exceptional customer service, encouraging workplace safety, and assisting clients with cost containment as it relates to worker’s compensation insurance.

FCBI was born out of the need for Florida citrus growers to secure affordable and reliable workers’ compensation insurance more than 45 years ago. Over time, the company shifted focus to also provide workers’ compensation insurance to heterogeneous industries, with an emphasis on construction related trades. FCBI has been a mainstay of the Florida workers’ compensation market providing the products and services needed to power the industry for many years.

MidSouth Insurance Company has roots back to the 1990’s when homebuilders and contractors in Tennessee faced similar pricing and availability headwinds in the workers’ compensation insurance marketplace. Since that time, the organization has successfully met the needs of the Tennessee marketplace and fifteen additional states across the South and the Midwest.

The acquisition of MidSouth Mutual Insurance Company by FCBI extends their market reach far beyond the state of Florida. The two companies share the same culture: focusing on their clients and agency partners with a commitment to doing business the right way.

FSB Insurance announced it has acquired the Montgomery & Associates Insurance Agency in Franklin, Tennessee, which is led by long time insurance professionals

Jefry Mayes, President and CEO and Houston Hartsock, VP of Personal Lines. Mayes said, “Montgomery & Associates is incredibly thrilled to be a part of FSB’s exceptional insurance organization. Their reputation for excellence, integrity, and customer-focused solutions aligns perfectly with our mission,

enhancing our ability to deliver even better services to our customers. The opportunity to collaborate with industry experts and leverage their vast knowledge and resources bodes well for our customers and our future."

FSB Insurance is a division of Sunstar Insurance Group, LLC and is led by Andy Gaddie, the TN Regional CEO for Sunstar. He stated, “This acquisition complements our growth strategy in Tennessee and further enhances our Private Client services.”

Builders Mutual, a leader in providing insurance coverage to the construction industry, is proud to announce it has been named to the prestigious Ward's 50 group of top performing companies for the sixth consecutive year. The recognition focuses on Builders Mutual’s outstanding financial results in the areas of safety, consistency, and performance over a five-year period (2019-2023).

This annual designation from the industry-leading organization, Ward Group, identifies companies that pass financial stability requirements and measure their ability to grow while maintaining strong capital positions and underwriting results. To be awarded this designation, insurance companies must pass thresholds of performance and excellence.

“We are delighted to be recognized once again by Ward Group in Ward’s 50 for the sixth consecutive year,” said Mike Gerber, President and CEO of Builders Mutual. “We know the esteem that comes with this designation and are proud of the work of our staff day in and day out to excel in safety, consistency, and performance in support of our policyholders, our agents, and the entire construction industry.”

Ward Group is the trusted leader of benchmarking and best practices services for the insurance industry. For over 30 years, the firm has analyzed the financial performance of nearly 3,000 property casualty insurance companies, identifying the top performers per segment. Each Ward’s 50 company has passed all safety and consistency screens and achieved superior performance over the five years analyzed.

JM Wilson is pleased to announce the addition of Misty Whitaker as Brokerage Manager. Misty is responsible for the day-to-day operations of the Brokerage Department, managing the staff, and developing relationships that foster growth with carrier partners and independent insurance agents in all states that JM Wilson writes.

Misty brings a substantial background in underwriting, leadership, and project management to JM Wilson. Her career has encompassed diverse roles including Member Support Leadership, Systems Analyst, Sales and Support and most recently, Underwriting Practices Manager. Misty has consistently emphasized customer success in each of her roles.

JM Wilson is excited to announce the addition of Todd Loy as Sales & Agency Relations Specialist. Todd is the primary resource and liaison for independent insurance agents in North Carolina and Tennessee. He offers product knowledge and support while cultivating strong relationships with our agency partners.

Prior to joining JM Wilson, Todd worked as a Business Development Representative for Pennsylvania Lumbermen’s Mutual Insurance Company. A graduate of the University of North Carolina Wilmington, Todd earned a bachelor’s degree in business. He also holds AU (Associate in Commercial Underwriting), AINS (Associate in Insurance), and AIS (Associate in Insurance Services) designations.

JM Wilson is pleased to announce the addition of Yonata Ambaye as Personal Lines Underwriter. Yonata is responsible for underwriting a wide variety of new and renewal personal lines risks, as well as strengthening relationships with independent insurance agents and company underwriters in all states that JM Wilson writes in.

Yonata joins JM Wilson with a wealth of experience in consumer lending, having previously served as a Wealth Management Associate at Morgan Stanley and a Credit Analyst at Upstart Holdings. He graduated from Ohio State University with a Bachelor of Art degree in economics.

J.M. Wilson is pleased to announce the addition of Brandon Madden as Assistant Brokerage Underwriter. Brandon is responsible for providing vital support to underwriters with a diverse range of new and renewal professional and brokerage accounts.

Brandon joins JM Wilson with prior experience in the technology, financial services, and insurance industries where his latest role was a Benefits Specialist with eHealth Insurance. He is currently working towards a bachelor's degree in Cybersecurity.

JM Wilson is pleased to announce the promotion of Jamie Yohn to Senior Transportation Underwriter. In this role, Jamie is responsible for underwriting a wide variety of new and renewal commercial transportation risks, as well as building relationships with carrier underwriters and independent insurance agents in GA, FL, NC, SC and TN. With an increased level of product knowledge, Jamie is a leader and resource to other underwriters in her department.

Jamie began her career at JM Wilson in 2020 as an Assistant Transportation Underwriter. Within a year, she was promoted to Renewal Transportation Underwriter, and by 2022, she

had advanced to the position of Transportation Underwriter. A Clemson University graduate, Jamie earned a bachelor’s degree in history and a minor in chemistry.

Acuity Insurance announced that employees donated over 1,000 items in its recent school supply drive. All contributions were provided to the Sheboygan County Health and Human Services Department to benefit local students.

“Acuity comes through once again to start the school year off on the right foot and help children have the correct supplies, a new backpack, and a good attitude for the academic environment,” said Pat Prigge, Social Worker at the Sheboygan County Health and Human Services Department.

“Thanks go out to Acuity employees not just from our department, but also from all of the children and families who received crayons, pens, erasers, pencils, calculators, a backpack, note cards, notebooks, folders, and so much more from Acuity,” she added. u

Ryan Specialty Underwriting Managers is a specialty delegated authority underwriting business consisting of property and casualty managing general underwriters and distinct national specialty programs. With solutions for over 150 lines of business, Ryan Specialty Underwriting Managers o ers innovative, bespoke solutions for even the most complex risks. Within our extensive marketplace, we have the following solutions available to retail agents and brokers through the featured MGUs and National Specialty Programs.

ryanspecialtyum.com

The Insurors of Tennessee offers education opportunities to member agents across a wide range of insurance specialties that satisfy individuals at many different experience levels. If you are looking to further your career, seeking a professional designation, or need to satisfy continuing education requirements, check out the variety of courses available. Additional course options and details of each class can be found online or by contacting Teresa Durham at tdurham@insurors.org or 615.515.2607.

Register for CISR & CIC at www.insurors.org under education. Classes with (*) have option for in person or webinar event.

10/17 CISR Agency Operations* Nashville 12/12 Commercial Property * Nashville

9/25-26 Ruble MEGA Seminar * Nashville

10/2-3 Personal Lines* Nashville

11/20-21 Commercial Casualty * Nashville

12/4-5 Life and Health* Nashville

Other

10/5-8 Insurefest Nashville

Additional courses for designation programs are offered on-demand at your own pace and as live webinars.

The National Alliance for Insurance Education & Research is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Suite 700, Nashville, TN, 37219-2417. Website: www.nasba.org. Advanced Curriculum Rating = 20 CPE Credits. For more information regarding administrative policies such as complaint and refund, please contact our offices at 800-633-2165.

Additional courses are available On-Demand and as Live webinars at the IIABA Virtual University *check the VU site for course offerings, CE and pricing (independentagent.com/vu)

From The National Alliance (www.scic.com)

Choose from the following programs CIC, CRM, CISR, CPRM, CSRM, Dynamics, RGS, MEGA, PROFOCUS, WTH, Intro, Producer School, Ethics, Flood and other.

Choose by topic, location, delivery method and/or date.

From The Institutes (ceu.com/customer/insurors-tn )

Insurors of Tennessee has partnered with CEU, powered by The Institutes, to provide you with relevant and convenient online insurance continuing education (CE) courses. Through our partnership with CEU, you will enjoy a 35% discount on any of CEU’s relevant, practical courses when you log in. More than 150 course topics.

(insurors.aben.tv)

The below are examples of the webcast classes that are available at insurors.aben.tv. View website for more.

BY AnneMarie McPherson Spears, IA news editor

Total reconstruction costs in the U.S. rose by 5.2% from July 2023 to July 2024, according to “Verisk's 360Value Quarterly Reconstruction Analysis for Q3," a significant increase over the 4% cost growth from July 2022 to July 2023.

Total residential reconstruction costs increased 4.9% between July 2023 to July 2024 when every state saw an increase. New Hampshire had the highest increase at 9.6%, followed by Colorado at 9.1% and Nebraska at 6.4%.

Commercial property saw total reconstruction costs increase by 5.5% from July 2023 to July 2024, increasing by at least 3.4% in every state. Again, New Hampshire had the highest increase at 12.4%, followed by Colorado at 11.6% and Massachusetts at 8.9%.