71 minute read

Five Mins With

ALENA KHARKAVETS

VICE PRESIDENT, DIGITAL STRATEGY AND CX AT BROKERLINK

Advertisement

Q. WHO WAS YOUR CHILDHOOD HERO AND WHY?

»Patricia Kaas. My parents played her single "Mademoiselle chante le blues" in my childhood home in Belarus. The song played while the Soviet Union collapsed and Belarus transitioned to independence. I couldn’t understand a word she was singing. But her voice carried defiance, presence and poise. It anchors me to this day.

Q. WHAT WAS THE BEST BOOK YOU READ LAST YEAR?

»“So You Want to Talk About Race” by Ijeoma Oluo. I picked it up in an independent African-Canadian owned bookstore in Toronto. Raised in a mixed-race family, Ijeoma unpacks complex topics of race and intersectionality through first-hand experiences. It is a superb primer for anyone who wants to see more unity and less division in the world.

Q. WHICH ACTIVITY ARE YOU MOST LOOKING FORWARD TO DOING WHEN THE PANDEMIC IS OVER?

»To have a big party at our house and invite everyone! Also, to travel the world again with my kids and spouse.

Our four-year-old talks non-stop about our last trip to Kuala Lumpur and Bali; it’s really formative for kids to experience the world. On a serious note, it’s about seeing loved ones mask-free.

Q. IS THERE A PERSONAL ACHIEVEMENT FROM 2020 OF WHICH YOU ARE PARTICULARLY PROUD?

»Being able to create new mental health routines – and stick to them. With two toddlers running around at home and working virtually, it took a few months to adjust. First, I started hitting 10,000 steps daily. Then I added a short yoga or meditation routine. I use a great app, Down Yoga. It’s so key to unplug!

Q. WHAT INSPIRES YOU IN INSURANCE TODAY?

»I never imagined how impactful the collaboration is when you bring talents from different disciplines and generations together and ask them to problem solve! It produces unparalleled work. Digitization enabled this. It is pretty cool to work in a centuries old industry where we continue to innovate to make life easier for our customers.

SO MUCH MORE THAN

JUST A LIFT

By creating an ecosystem of collaborative partnerships fueled by innovation, MTM removes barriers and brings a whole-person approach to healthcare

WRITTEN BY:

LAURA V. GARCIA

PRODUCED BY:

JAMES BERRY

By focusing on doing the right things, MTM has created a beautiful thing; An ecosystem of collaborative partnerships, fuelled by innovation, all focused on the same goal— removing community barriers and bringing a whole-person approach to healthcare while doing right by our planet, and its people.

Having experienced immense growth over the last ten years, MTM now runs an estimated 20 million trips per year and is the number one private healthcare transportation provider in the USA, across 32 states. And with good reason.

By remaining unrelentingly focused on its core principles and objectives, MTM has unlocked a whole new level of value for its clients, reducing program costs while increasing satisfaction rates. As Rick

Holbrook, CTO at MTM, says, what MTM has built is more like a community of likeminded business partners who are always looking at the bigger picture of improving health outcomes for members.

When you remain focused on the mission rather than a static idea on how you get there, ideas flourish, and innovation prospers. In the end, everyone wins.

Social Determinants of Health (SDOH)

From The World Health Organization (WHO), “Social determinants of health are the conditions in which people are born, grow,

live, work and age. These circumstances are shaped by the distribution of money, power, and resources at global, national and local levels.”

The organization further states, “The social determinants of health are mostly responsible for health inequities – the unfair and avoidable differences in health status seen within and between countries.” Availability of transportation, food insecurity, and inaccessibility of nutritious food choices are examples of SDOH, which MTM hopes to help combat.

“Our real mission as a company is to remove barriers to individuals to access community and resources. But what we really want to do is accommodate people so that getting their health care is easy and cost-effective. That's why we exist.” said President and CEO Alaina Maciá.

ALAINA MACIÁ PRESIDENT AND CEO, MTM INC.

MTM is re-imagining healthcare with a value-based business model focused on identifying and removing the SDOH that are the cause of health disparities through a holistic, whole-person approach that drives client value and promotes superior outcomes by focusing on the well-being of members. By expanding into providing services such as meals, groceries, and home modifications, MTM is hoping to further assist those who want to age in place so they can do so safely, happily, and healthily.

These services will also be extended to any individuals who require the resource, whether private pay or Medicare/Medicaid beneficiaries. “People want to live a healthy life, but if they don't have access to good quality food, fruits, and vegetables, if they have trip hazards in their home, these things put them at risk and impede their ability to do so. That’s why MTM looks at the whole member experience and what we can do to address social determinants of health.” Maciá said.

Following their commitment to taking a whole-person approach to healthcare, MTM further plans to extend its service. Maciá says, “As the population ages and wants to age in place, we want to transport them where they need to go, but we also want to bring services to them. So we're expanding our platform to allow for meals and grocery, as well as home care coordination and home modifications. Because as people age in place, they need modifications to their homes like turning a tub into a shower, et cetera. And we believe our job is to help people age in place, happy and healthy.”

The Art of Grabbing a Lift

“If the technology works, people are going to adopt. We believe that, and it’s part of our strategy.”- Rick Holbrook, CTO, MTM Inc.

TAMARA CARLTON

TITLE: DIRECTOR OF SOCIAL DETERMINANTS OF HEALTH AND PRODUCT DEVELOPMENT INDUSTRY: HOSPITAL & HEALTH CARE LOCATION: ST LOUIS, MISSOURI, USA

As MTM’s first Director of Social Determinants of Health and Product Development, Tamara leads the organization’s strategies for helping clients remove community health disparities among the populations they serve. Tamara joined MTM in 2016, leading the company’s Product Development team. She has more than twenty years of experience in marketing, operations, and product management for Fortune 500 companies in the healthcare, transportation, retail, and financial industries. Tamara holds a Bachelors of Science from Bradley University and an MBA from Saint Louis University.

EXECUTIVE BIO

Underpinned by a people-first culture, ServiceNow is making the world of work better for people with their digital workflows solutions Underpinned by a people-first culture, ServiceNow is making the world of work better for people with their digital workflows solutions A great workflow is the underpinning of great A great workflow is the underpinning of great experiences. ServiceNow provides digital workflows experiences. ServiceNow provides digital workflows that make for a smarter way to workflow, bringing that make for a smarter way to workflow, bringing scaleability, safeguarding business continuity, and scaleability, safeguarding business continuity, and empowering productivity.empowering productivity. With over 6200 customers and serving 80% of the With over 6200 customers and serving 80% of the Fortune 500 has become the defining enterprise Fortune 500 has become the defining enterprise software company of the 21st century.software company of the 21st century. ServiceNow, putting people-firstServiceNow, putting people-first Jeff Cathey Regional Sales Director at ServiceNow Jeff Cathey Regional Sales Director at ServiceNow explains how ServiceNow’s people-first culture has explains how ServiceNow’s people-first culture has helped them get there. “ServiceNow is making the helped them get there. “ServiceNow is making the world of work better for people. Our cloud-based world of work better for people. Our cloud-based platform and solutions deliver digital workflows that platform and solutions deliver digital workflows that create great experiences and unlock productivity create great experiences and unlock productivity for employees in the enterprise. ServiceNow prides for employees in the enterprise. ServiceNow prides itself on being a people-centric organisation that itself on being a people-centric organisation that wins as a team. We always try to stay hungry and wins as a team. We always try to stay hungry and humble. Diversity, inclusion and belonging are humble. Diversity, inclusion and belonging are essential to who we are, to how we’ll grow, and how essential to who we are, to how we’ll grow, and how we’ll continue to innovate.we’ll continue to innovate. “Our success is dependent on our people and on “Our success is dependent on our people and on those people having the right talent and the right those people having the right talent and the right mentality to be able to deliver the future of work to mentality to be able to deliver the future of work to our customers. And with our underpinnings around our customers. And with our underpinnings around culture and people first, ServiceNow has grown to culture and people first, ServiceNow has grown to over $4 billion in revenue with 13,000 plus employees over $4 billion in revenue with 13,000 plus employees and thousands of customers around the world, and thousands of customers around the world, including MTM, that renew with us at a rate of including MTM, that renew with us at a rate of about 99%. So all of that serves our mission well about 99%. So all of that serves our mission well and helps ServiceNow become the defining and helps ServiceNow become the defining enterprise software company of the 21st century.” enterprise software company of the 21st century.” The digital journey, how service now can help The digital journey, how service now can help

digital transformation journey. “ServiceNow is the digital transformation journey. “ServiceNow is the platform or platforms for digital workflows. And we platform or platforms for digital workflows. And we deliver those workflows across the organisations in deliver those workflows across the organisations in the silos and systems within them, thus creating a the silos and systems within them, thus creating a seamless enterprise system with action that enables seamless enterprise system with action that enables great employee and customer experiences and great employee and customer experiences and unlocks productivity. The Now platform is the unlocks productivity. The Now platform is the foundation for all of those workflows across an foundation for all of those workflows across an organisation. And we really pride ourselves in being organisation. And we really pride ourselves in being one platform, one data model, with one architecture. one platform, one data model, with one architecture. And not only do we have purpose-built workflows for And not only do we have purpose-built workflows for IT, employees, and customers, we’re also able to IT, employees, and customers, we’re also able to integrate and communicate across all of the systems integrate and communicate across all of the systems of record and infrastructure that may be in place, of record and infrastructure that may be in place, providing our customers with a single pane of glass providing our customers with a single pane of glass to get their work done.to get their work done. One of those customers is MTM. Having expertise One of those customers is MTM. Having expertise in the healthcare industry has helped ServiceNow in the healthcare industry has helped ServiceNow in working with MTM to leverage its platform and in working with MTM to leverage its platform and succeed in its goal of breaking down community succeed in its goal of breaking down community barriers by removing silos and streamlining workflow, barriers by removing silos and streamlining workflow, and providing them with the connectivity that’s and providing them with the connectivity that’s required for their people, processes and systems. required for their people, processes and systems. ServiceNow was built to support organisations just ServiceNow was built to support organisations just like MTM drive meaningful outcomes.like MTM drive meaningful outcomes. servicenow.comservicenow.com

Jeff Cathey, regional sales director at ServiceNow Jeff Cathey, regional sales director at ServiceNow explains how ServiceNow helps enterprises on their explains how ServiceNow helps enterprises on their

MTM Technology

20m

Scheduling trips

12m

members nationwide

NEMT broker

one of the most established in North America

7.5m

calls every year

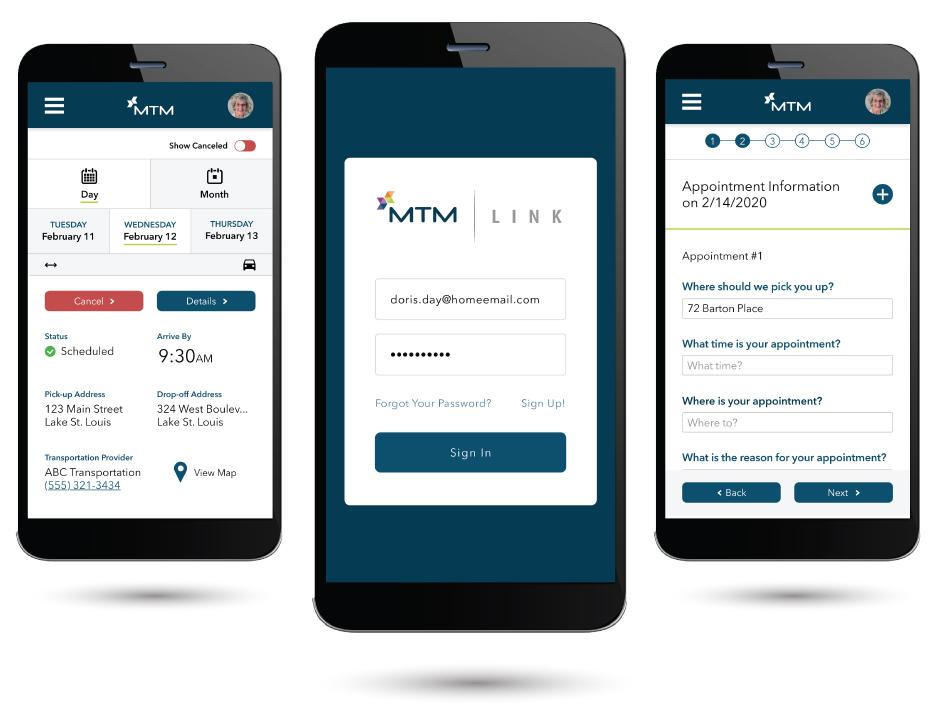

For over twenty years, MTM has collaborated with carefully chosen partners to develop innovative solutions that promote independence, remove barriers, and help connect community resources with the people that need them. By leveraging the capabilities of today’s deep tech and partnering with just the right people, MTM has been able to build a user-friendly digital platform that streamlines workflows. Digitization also avoids the errors and limitations of manual, paper-based processes. And all while increasing the quality of life of members.

MTM has mastered the art of grabbing a lift. MTM Link mimics all the best qualities of Uber and Lyft that make for a user-friendly experience while unburdening users from

the hassle of paper-based claims processes and easing scheduling for their network of transportation providers. They even send appointment reminders and monitor app usage to help clients ensure maximum adoption rates and decrease no-shows.

The ‘Where’s My Ride’ feature connects drivers with users and drops a pin to identify a more exact location than an address can provide, highly beneficial at large, multi-building medical facilities. Personal profiles, auto-fill capabilities, appointment reminders, mileage tracking, and electronic gas mileage claim submission all ease the process of arranging for a ride. Credential checks, quality monitoring, and a user rating and complaint system keep members safe, happy, and arriving at their scheduled appointments on time, helping to increase efficiencies.

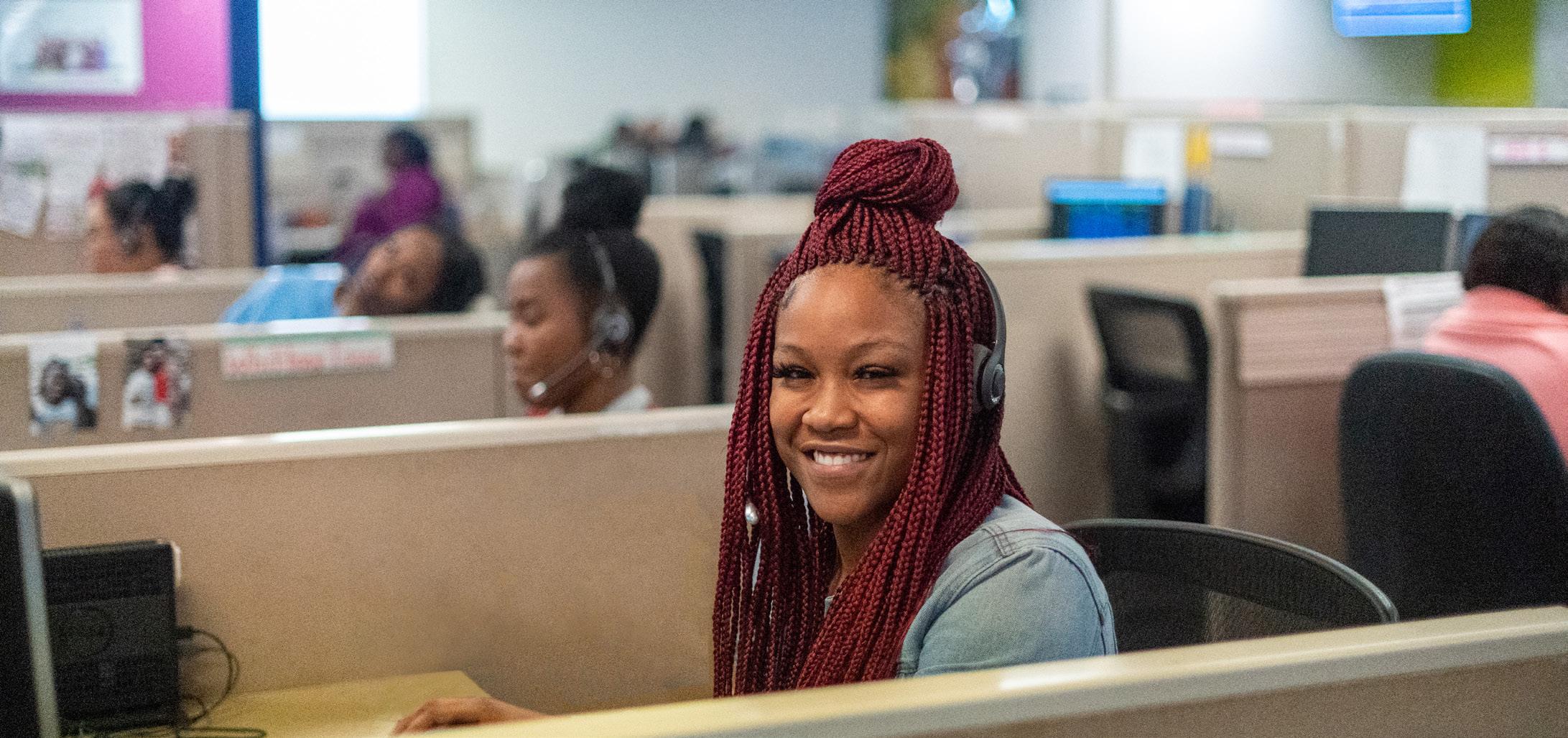

For less tech-savvy customers or even those who simply prefer human interaction,

RICK HOLBROOK CTO, MTM INC. MTM has fully staffed 24/7 call centers. They have also designed a streamlined digital experience for their network of subcontracted transportation providers, so they can quickly and easily accept, deliver and claim trips.

Driving Client and Partner Success

“The thing about technology is that you can't just throw technology at something and expect it to work. You could be automating a bad practice. So you have to reinvent yourself a little bit. You have to find the right technology and the right partners as well. We look for technologies that enable or open up our platform to be intuitive and easy to use,” said Holbrook.

MEET THE TEAM

ALAINA MACIÁ

TITLE: PRESIDENT AND CEO

Named among the 2012 Most Influential Businesswomen by the St. Louis Business Journal. Alaina has taken the non-emergency transportation management business to a new level by focusing on strategic planning, proven management processes, and continued business and personal improvement.

RICK HOLBROOK

TITLE: CTO

Driven entrepreneurial and innovative Chief Executive with nearly 35 years of leading healthcare industry organizations. Expertise in founding numerous inventions, emerging markets and software solutions.

Title of the video

He goes on to explain, “We spend a lot of time looking for the right partners. We don’t use the ‘P’ word lightly when it comes to our technology partners. We find ones that are flexible, that are open, that allow us to flex the system in whatever manner that makes sense so we can streamline workflows and make life easier for the people who need to leverage our system and so we can deliver on our promises in the best way possible.”

The platform was carefully designed with users at heart to ensure optimal extraction of benefits for all parties, from the end-user to service partners, and is at the forefront of MTMs success.

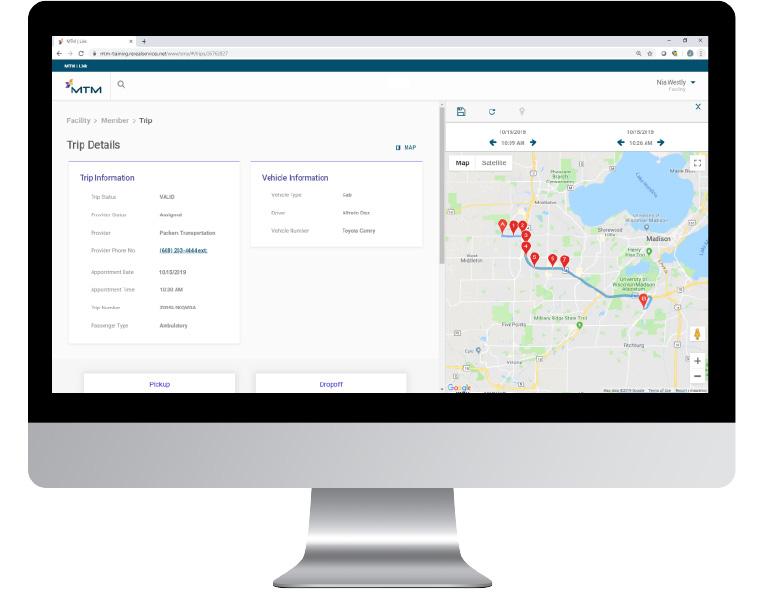

A digital claims process eliminates the likelihood of errors and speeds up the claims process, which improves cash flow, and safeguards against fraud, waste, and abuse. Driver complaints are investigated and validated through GPS records. MTM is also able to monitor who downloads the app and uses the information to offer assistance and help increase adoption rates.

But the fun doesn’t stop there. As all members have a personal profile and the app downloaded onto a device, they can send out targeted marketing to help clients

ALAINA MACIÁ PRESIDENT AND CEO, MTM INC.

Addressing Social Determinants of Health

Access to Quality Healthcare

Economic Stability

Neighborhood & Physical Environment

Education

Food Quality & Stability

Community & Social Contact

ADVERT PAGE GOLD

get a word out. Contract protocols such as two-day notice requirements are built in to ensure compliance. And for their logistical partners, drivers are able to see open orders and route and schedule pickups. MTM also has a dispatch team to ensure lastminute requests are fulfilled and help with any issues.

For their clients, MTM provides a near real-time customizable dashboard that can monitor KPIs and provide decisionmakers with real-time data to help drive improvements.

Through their unwavering dedication to delivering the highest quality of service and their ability to develop comprehensive provider networks, they help clients accomplish their objectives while achieving their vision of communities without barriers.

And they do it all while remaining committed to working towards sustainability and fairness for all. “At heart, MTM is a company that cares about community impact, and we feel very strongly about diversity, equity, inclusion, and climate change. And so we take a stand on these positions. We talk about it frequently, both publicly and with our employee base. And we know that our employees are aligned with our mission and our vision. And these are societal commitments to make our community better,” says Maciá.

The proof is in the pudding. MTM boasts an incredibly long list of awards and accolades, but most notably in corporate culture and wellness, aligning with their core values.

As we said in the beginning, by focusing on doing the right things, MTM really has created a beautiful thing.

RICK HOLBROOK CTO, MTM INC.

REFOCUSING INSURANCE FOR THE DIGITAL GENERATION

Commentators from MAPFRE and Getsafe help us determine which important trends could shape a digitally revitalised insurance sector in 2021 and beyond

WRITTEN BY: WILL GIRLING

2020 was a wake-up call to the industry that old paradigms for insurance can no longer sufficiently meet either customer expectations or needs.

Quick to recognise the writing on the wall, 59% of insurers (according to EIS Group) have refocused their priority to investing in digital transformation. This is understandable: digital leaders like Lemonade, Root and Hippo are proving that an easy, flexible, customisable, and transparent service are the hallmarks of a superior customer experience, and the collective industry is taking note.

Customers’ expectations are changing

Some industry experts contend that the COVID-19 pandemic has done nothing more than to accelerate what was already apparent before it; “There was a time in which customers did not expect much from their insurer. But things changed way before 2020,” explains Joan Cuscó, Global Head of Transformation at MAPFRE. “Customers expect a flawless, omnichannel, personalised, immediate response from any type of company, from any industry, and that’s what insurers have been working on for the last 10 years.” The global lockdowns were a baptism of fire for any digital infrastructure insurers had already put in place, and a spur to invest in the areas that were lacking. Under such difficult circumstances, customers have needed to place a proportionately higher amount of trust in their insurer to still deliver high quality service. Cuscó believes, on average, the industry has risen to the challenge. However, he cautions that future success will depend on maintaining the same levels of commitment. “We need to normalise this. Preparing to deliver in the worst possible scenario should not be a contingency plan, it should be part of our business as usual.”

EIS Group’s survey found that approximately one-third (28%) of surveyed policyholders cited a poor customer experience as the main motivation for

ADVERT PAGE MEDIA SALE

leaving their provider. For Christian Wiens, Founder and CEO of Getsafe, the solution is a resounding dedication to digital tech. “Operating 100% digitally isn’t just something we should do; it’s something we must do.” By shifting operations to the cloud, for example, companies decrease their reliance on physical infrastructure and increase their ability to be agile in a constantly changing market. PwC clarifies by stating, “Digital is not a strategy, it is a business strategy in a digital age,” and credits “speed, visibility and integration” as its core benefits.

The new customer-insurer relationship

If digital is the ‘how’, what is the ‘why’? As well as simply because of necessity in a time of heavily restricted physical spaces, the answer is a new, tech-savvy generation of customers that have come to expect a certain level of sophistication, ease and

CHRISTIAN WIENS FOUNDER AND CEO, GETSAFE

fluidity in their online experiences. After all, no industry exists in a vacuum and any digital platform, whether related to ecommerce, media, or even other financial services (banking, digital payments, etc), will shape the overall discourse surrounding insurance’s evolution.

In research conducted by Deloitte, 45% of surveyed insurers believed that meeting

insur_space & Alma Mundi – MAPFRE

Designed to drive customer-centric transformation via cutting-edge tech and strategic partnerships, Cuscó describes the MAPFRE Open Innovation team’s ‘insur_ space’ programme and participation in the Alma Mundi insurtech fund:

“The purpose of our team is to collaborate with startups and universities in order to develop disruptive solutions that create a positive impact in our business and in society. The two most visible parts of our job are insur_space, our fast-track-to-market program for startups, and Alma Mundi Insurtech, a venture capital fund in which we participate as anchor partners.”

So far, insur_space has launched 22 pilot projects in two years.

evolving customer needs would form their top challenge between 2020 and 2023. Wiens is convinced that technology holds the key to properly engaging the millennial demographic, which he believes has grown wary towards traditional insurance methods. “Young customers in particular are sceptical about insurance. These digital natives have no interest in complicated paperwork or long conversations with brokers and agents. Technology enables us to offer them a new, simple, and transparent insurance experience on their smartphones – one that is as easy and fun as online shopping.”

MEET OUR COMMENTATORS

Christian Wiens

FOUNDER AND CEO, GETSAFE

Based in Heidelberg, Germany, Getsafe is one Europe’s leading insurtechs and a pioneer in smartphone-based insurance. “Together with a team of more than 120 talented people, we want to make mobile insurance the standard throughout Europe.”

Joan Cuscó

GLOBAL HEAD OF TRANSFORMATION, MAPFRE

“I joined MAPFRE in 2017 after some years leading innovation initiatives in the insurance industry. My current position is part of MAPFRE Open Innovation, our strategic bet to foster a customer-centric transformation through alliances and emerging technologies.” Getsafe’s smartphone-based ‘opt-in, opt out, and customise’ platform has recently become one of Europe’s most well-funded insurtechs (US$53m total) and exemplifies the new culture of managing important aspects of life through simple means. “The smartphone revolution is still big in our society: people want to manage their lives on their mobile phones, including insurance,” adds Wiens.

A core benefit of digital omnichannel communication is enhanced, more personalised engagement with customers. But what about those who prefer more distanced interactions? Cuscó contends that “technology allows us to better serve any kind of customer, regardless of their interest in our products and services.” This is significant as it infers that insurers must resist ‘one-size-fits-all’ solutions, but, more to the point, proper investment in digital tech will enable a business to accommodate any individual taste. “For those customers that really want to feel the companionship of their insurer, technology is a great enabler. And for those customers that don’t want to bother at all – they just want to be covered – technology is great, too: think of parametric insurance, where customers can get their claims paid in no time without lifting a finger.”

Digital strategies for the future

Now that insurance has begun its digital transformation journey proper, the need to not only resolve contemporary issues but also pre-empt the problems of tomorrow is clear. Myriad market destabilisation factors (socio-political, economic and environmental) are likely to regain industry focus when the COVID-19 crisis begins to abate. Companies must make hay while the sun shines, particularly with regard to

key concerns such as cybersecurity. The increased adoption of digital channels during the pandemic, particularly with regard to employees’ remote working, says Cuscó, has significantly boosted organisations’ attack surface area. “It becomes more and more difficult to feel safe at home when the bad guys are letting themselves in through your router.” Therefore, insurers and their employees must adopt an attitude of extreme vigilance in the new normal.

Another significant factor, Cuscó posits, is the mounting importance of maintaining good mental health, not just as a reaction

JOAN CUSCÓ GLOBAL HEAD OF TRANSFORMATION, MAPFRE

to the pandemic but as a general attitude shift in society. “We see a growing number of startups addressing mental health with digital solutions, and MAPFRE believes that these initiatives will lower the access barriers to mental care and at the same time help reduce the stigma around it.” The industry’s reaction isn’t just limited to startups: in December 2020, Gen Re announced that it is developing a new insurance product for mental health based on behavioural economics. Using a ‘continuous underwriting’ model, the company is developing a unique policy that can amend itself as the policyholder's health changes. Wiens adds that the importance of investing in data and artificial intelligence (AI) cannot be overstated, both for meeting insurance’s challenges and engaging with its opportunities. “Insurance is made of data. The more accurately insurers can evaluate

CHRISTIAN WIENS FOUNDER AND CEO, GETSAFE

this data, the better they can refine risk profiles, adjust prices and make decisions in real time.

Despite the difficulties of 2020, there are still reasons for great optimism concerning insurance’s place in the digital era: “What we have seen so far in terms of innovation in the insurance market is just the tip of the iceberg,” Wiens states. Equipped with new tools that are capable of addressing problems both old and new, incumbents and startups alike can now harness their ambition to deliver innovative products and services in an era where simplicity, convenience, and choice are redefining a centuries-old industry. “Acting as a broker creates no innovation, and acting as an MGA (managing general agent) is just as limited. To inspire and positively surprise people with a digital customer experience, it’s better to have an insurance licence,” he concludes.

SECURING EVERY LAYER: HOW RAPID7 MANAGES VULNERABILITIES

Rapid7’s Victoria Sitcawich and Bria Grangard discuss the importance of visibility and effective prioritisation to modern cyber threat remediation

WRITTEN BY:

WILL GIRLING

PRODUCED BY:

GLEN WHITE & CAITLYN COLE

The evolution of technology has always run parallel with larger socio-economic trends, and the nature of cyber threat is no different. The COVID-19 pandemic, for example, has uprooted operating paradigms and shifted workers away from the relative safety of siloed corporate networks and towards the security minefield of remote working. Solid vulnerability management requires an ability to navigate the unexpected and know the best course of action to remain protected using cutting-edge tools guided by industry expertise. We spoke to Victoria Sitcawich, Product Marketing Manager, and Bria Grangard, Product Marketing Manager, to find out how security specialist Rapid7 can offer both.

Rapid7’s approach is characterised by its broad scope of coverage, which isn’t restricted simply to traditional network environments but extends to an organisation’s entire infrastructure, including web applications, virtual environments and remote assets. “We view vulnerability management as being a holistic process of identifying the assets in your environment, evaluating them for risk, prioritising that risk, and treating the identified vulnerabilities through remediation or mitigation,” explains Sitcawich. The company enables customers to do this with a suite of dedicated, cloudbased products, including InsightVM and InsightAppSec.

Title of the video

InsightVM allows the user to understand business risk in the context of their entire digital environment, prioritise their focus, and report on findings to both technical and non-technical stakeholders. “Not every asset is created equal; your payroll systems should probably be considered more critical than an individual laptop,” continues Sitcawich. “InsightVM translates that security risk into business risk and helps our customers look at key metrics to track success.” InsightAppSec, Grangard explains, is similar: the highestrated DAST (dynamic application security testing) solution according to Gartner for three consecutive years, InsightAppSec automatically assesses web applications to identify common vulnerabilities. “When developing the product we thought, ‘How can we help test, monitor and ultimately prevent the exploitation of vulnerabilities or weaknesses at the application layer?’ A lot of components from our InsightAppSec and tCell products come into play here: InsightAppSec brings testing and monitoring together so that clients can understand how their apps are being attacked in real-time.”

When it comes to designing and implementing a quality vulnerability risk management strategy, time is one of the most important factors to consider, not just in ‘speed of response’ terms but also overall focus. Rapid7’s five-point process (identification, assessment, prioritisation, remediation, and measuring progress) aims to reduce risk through greater environmental visibility and prioritisation acuity, “Everyone

VICTORIA SITCAWICH PRODUCT MARKETING MANAGER, RAPID7

has the same 24 hours in a day; we want to help you focus on what's most important,” states Grangard. Part of Rapid7’s mission, says Sitcawich, is to establish reasonable expectations with its customers amid a highly complex threat landscape: “It's unrealistic to think that you're going to be able to fix every vulnerability as soon as it appears in your environment. You're going to have to make tough decisions, but, at the end of the day, a vulnerability management programme is meant to reduce risk, and you're not achieving that until you start remediating.” Essentially, customers should define a vision of successful cybersecurity and pursue core goals in attaining it, without being paralysed into inaction by an overwhelming number of possibilities. Developing strong partnerships with key vendors who are able to troubleshoot any problems can support this even further.

While Rapid7’s products and services are able to secure every layer of an enterprise’s digital environment, it is also worth reflecting on root causes of vulnerabilities in the first instance. Neglecting to follow the aforementioned five-point process and other imposed limitations conspire to make addressing security issues more difficult in real-world situations. “Broken authentication (when authentication credentials are compromised) and misconfiguration are two common examples, particularly as companies make the shift to the cloud,” says Sitcawich. “SQL injections and cross-site scripting are also frequent,” adds Grangard. “These are where attackers will try to gain personal information by injecting code into either the website or the application itself.” There are many circumstances that can precipitate these attacks: a lack of resources and expertise are significant factors, but, once again, nothing is so deleterious as a

VICTORIA SITCAWICH PRODUCT MARKETING MANAGER, RAPID7

MEET THE TEAM

BRIA GRANGARD

TITLE: SENIOR PRODUCT MARKETING MANAGER

An award-winning Product Marketer and technology subject matter expert at Rapid7 with experiences in leading GTM strategies, owning and participating in a podcast, and speaking opportunities across Europe, Australia and the U.S.

VICTORIA SITCAWICH

TITLE: PRODUCT MARKETING MANAGER

Product Marketing Manager for Vulnerability Management at Rapid7, responsible for executing on go-to-market strategy for InsightVM.

ADVERT PAGE GOLD

lack of time. “If customers tell us, ‘I don't have the time or the energy’, or ‘this isn't where I want to focus my time’, we inform them that Rapid7 has a group of security experts and a dedicated customer advisor to manage vulnerabilities day-to-day.” Also, it should be remembered that some forms of attack cannot be predicted. This is why keeping informed should go hand-inhand with testing and monitoring to identify vulnerabilities early, “We encourage all of our customers to look at the OWASP Top 10 if they want to stay educated on the most common application security risks.”

When considering the technologies that are changing how vulnerabilities are managed and resolved, Sitcawich has an emphatic answer: automation. “Our InsightConnect solution is specifically dedicated to it. Automation is truly key to helping keep processes efficient.” A no-code platform

BRIA GRANGARD SENIOR PRODUCT MARKETING MANAGER, RAPID7

containing over 290 plugins to connect tools and enable workflow customisation, InsightConnect is envisioned as a tool for liberating teams from routine or mundane tasks and enabling them to be redeployed in more valuable areas; retaining the human element in the remediation process is still vitally important. “Similarly, on the application security side, we’re always exploring which tasks can be automated to make your life easier,” explains Grangard. “We're not losing the human element; we're trying to amplify what humans can do via automation.”

Despite offering comprehensive products, services and insights, Grangard states that Rapid7 does not want to foster customer dependency. On the contrary, it encourages clients to gain confidence using its tools and independently grow their respective vulnerability risk management programmes, “if they feel they have the expertise and can handle it on their own, we absolutely support that.” In instances where a customer’s in-house security creates tension by redirecting other teams towards non-priority goals, Sitcawich adds that Rapid7 can act as a mediating force by establishing a “common language” and creating understanding around critical business objectives. This is particularly important for organisations that are now adopting cloud for the first time because of COVID-19, which has had the dual effect of introducing cloud network vulnerabilities and increasing the surface area for attack on enterprise IT. “There's been a push for businesses to change the emphasis on how they work: ‘mom and pop’ restaurants who relied on in-store patronage

have had to adopt a greater online presence. Rapid7 has always talked about the power of digital transformation, and COVID-19 has accelerated that faster than any of us could have predicted,” says Grangard.

Summarising the qualities of a strong vulnerability management strategy, both Sitcawich and Grangard highlight the importance of regarding security as a collection of individual activities that merge into one holistic solution. “One of the key takeaways is the importance of securing every layer of your modern attack surface,” says Sitcawich. “Not just network infrastructure, but also the cloud and web applications. There needs to be visibility over all of it so that you can prioritise effectively and remediate efficiently, especially as new technologies come into play.” Therefore, Rapid7’s vulnerability risk management tools empower companies to achieve the requisite level of understanding, confidence and agility to thrive in an

increasingly complex cyber threat landscape. “We all need to think about scaling security simultaneously with some of these newly adopted technologies,” concludes Grangard. “It's not just traditional devices anymore; there's so many different layers that must be considered now.”

BRIA GRANGARD PRODUCT MARKETING MANAGER, RAPID7

IoT: Why Connectivity is Transforming the Insurance Industry

Legacy systems, products and services are undergoing monumental change because of better connectivity

Abasic search for the latest insurtech trends in 2021 reveals some interesting truths.

The emerging insurance industry transformations of the next 12 months expose a global market demand for bespoke insurance products and tailored policies shaped by artificial intelligence (AI) and machine learning (ML) insights.

Insurance is shifting from a one-policyfits-all platform into a highly bespoke industry, one in which data will determine how much customers pay for their premiums – and how much mitigation payout they receive.

IoT enablement

As IoT continues to proliferate, so too does its potential to collect valuable data for the insurance industry. To make use of this data, AI and machine learning aggregate and produce insights. These highly accurate reports and predictions determine whether a product is helpful and profitable. With the IoT comes a much greater degree of transparency between customer and service provider.

Dan Lyon, a senior principal security consultant for the US-based Synopsys Software Integrity Group, explains, “The concept of IoT has been around in insurance for a while. One of the first examples is with car insurance where customers could attach a device to their car’s diagnostics port, and that device would report back to the insurance industry. This type of data collection enables the insurance organisation to have greater visibility and objective evidence of customer driving patterns,” he says.

ADVERT PAGE MEDIA SALE

DAN LYON, SENIOR PRINCIPAL SECURITY CONSULTANT, SYNOPSYS SOFTWARE INTEGRITY GROUP

Lyon believes that such transparency is the future of insurtech companies and that technology is only just playing catchup with the idea to make it a reality. The introduction of 5G, which will see the transfer of data happen 100 times faster than with 4G, will be the key to its success.

He says, “Historically, the missing link for this business model has been the communications and data collection from devices. Once these end-user devices could be guaranteed to have network connections back to the companies (through cellular data or Wi-Fi, for instance), the companies could start to collect and analyse customer data.”

But IoT data analysis doesn’t just ensure customers are telling the right story. It also saves users money. For example, usage-based vehicle insurance (UBI) uses individualised data gathered by IoT sensors to determine insurance premiums, rather than the traditional approach, which leverages statistics to determine the risk factor of a particular driver.

IOT and Machine Learning are Revolutionizing Insurance

These systems track a driver’s customers incentives to improve observance to safe driving rules and their health. use the mileage a car is driven to A 2021 report by For example, the New-Yorkwork out premiums. Very often this Mulesoft noted based health service provider K results in better savings for drivers. Paul Fermor, UK Solutions that almost half 44% Health recently announced a new scheme for users utilising AI and ML Director at Software AG, says, “An increasingly important trend for the of those surveyed were happy for insurers to use to lower costs for its customers. Equally, Canadian health next decade is one of personalised products and specifically how third-party data. 18-34 years, this rose to almost insurance provider Foresters Financial recently teamed up these products can be dynamically two-thirds with the Swiss insurtech dacadoo, changed based upon what is 62% to create a wellness arm. The happening to the insured risk, ideally initiative provides benefits and without intervention from the insured party.” discounted premiums for users based on He adds, “IoT is a foundational capability to information received from their wellbeing support product personalisation.” personal fitness apps and devices. Not only do these devices encourage better habits, IoT wearables but they also lower costs, points out Lyon. Similarly, health insurance companies have “Because insurance companies have better been transformed through technological data, they are able to make better, dataadvances in wearable devices. Rather driven decisions that are used to lower the than working out policies based on crisis- company’s financial risk and presumably driven scenarios, they are now able to offer increase profits,” he says. According

PAUL FERMOR, UK SOLUTIONS DIRECTOR, SOFTWARE AG

Insurance IoT surveillance:

Insurance IoT can be used to form profiles on customers, says Dan Lyon, senior principal security consultant for the US-based Synopsys Software Integrity Group

•Food habits: How much fresh vs. processed food? How much pizza is delivered per month to online grocery services data, kitchen equipment and meal delivery services? • Lifestyle habits: Monitored sedentary time deciphered from movementbased data from clothing, fitness trackers, TV streaming/gaming time and sleep apps. •Exercise metrics: Data can be gathered from fitness trackers and home gym equipment. •Driving habits: Are seat belts being used? What is the average speed in relation to the speed limit?

CHRIS GILL, DIRECTOR OF RISK MANAGEMENT AND INSURANCE PARTNERSHIPS, OVER-C

to recent studies, the uptake of such technologies among consumers is also high.

A 2021 report by Mulesoft noted that almost half 44% of those surveyed were happy for insurers to use third-party data from wearables and other smart devices as well as third parties like Facebook if it resulted in lower premiums. The willingness to adopt such practices increases with youth. In younger, digital-native consumers aged 18-34 years, this rose to almost two-thirds (62%).

“This is just another means of data collection technology,” Lyon says of 5G. “It doesn’t change what companies have been doing since connecting to the internet. 5G just makes it faster and easier to collect more and more data. The secret sauce will be the data aggregation and analysis.”

Technology uptake

Though the potential of IoT combined with AI and ML produces infinite possibilities, providers have not adopted as expected. Chris Gill, director of risk management and Insurance Partnerships at Over-C, says, “The truth is, businesses are progressing faster than the insurers when it comes to IoT adoption.

Part of this is to do with the early tech itself, but the hardware and software is now much more advanced and adapted to such a wide range of applications from monitoring crowd flow for pandemic compliance, CO2 air quality to affordable battery-less sensors that anyone can install and connect.”

He explains, “With the many industries such as the retail sector under serious pressure, the focus on cost has never been so acute. Reducing risk wasn’t historically seen as an area of reduction as the true costs are not always fully visible or understood, but the return of investment is clear. Uptake is beginning to accelerate as firms can be more confident in the benefits of IoT.”

One area that has embraced IoT benefits, is the property market, says Gill. “If I had to

name a sector that has led the others on IoT uptake, I’d have to say property insurance. At a project level, there’s good integration of IoT, driven by the fact that many commercial properties now come with at least a partial degree of smart technology built-in.” He continues, “That being said, as with all other sectors the tech isn’t being adopted across all portfolios, but just in pockets. The benefits here are a reduced claims frequency and managed down severity through dynamic risk management.”

Soundbite:

Kris Sharma, Executive Product Management at Canonical, on IoT in car insurance

“The automotive insurance sector is where connected insurance started early and has made the greatest inroads. The IoT devices fitted in cars for ‘payhow-you-drive’ policies make it possible for insurers to offer theft and recovery, roadside assistance and crash-recording services. There is an increased ability to analyse accidents, establish the truthfulness and accuracy of claims and control the way repairs were carried out.”

KRIS SHARMA, EXECUTIVE PRODUCT MANAGEMENT, CANONICAL

Data deployment

While data is used to procure more satisfactory outcomes, the use of personal data and who it belongs to will always be a hot potato. Lyon points specifically to domestic situations where smart devices track eating habits, exercise time and health indicators to create personalised premiums. He believes consumers must be ever vigilant in checking the fine print.

“None of these data sets would typically be protected by legal measures, so consumers are dependent on the terms of use within legal agreements that are signed. Unfortunately, most individuals don’t even read these agreements they enter into,” he says, adding, “This should give all of us pause when thinking about how much data is out there, who owns the data, how the data is controlled, and who is benefiting from it.”

Fermor adds, “Insurance companies have many challenges to address, some of which they are better placed to solve than others. While some may wish to adopt and develop their own IoT capability, it's foreseeable that many won't. Many companies struggle with their current IT infrastructures, so the thought of adding 250,000 new endpoints into that infrastructure is perhaps too much complexity to adopt.”

ACCELERATING

NEW TECHNOLOGIES FOR CLIENTS

Julien Alzouniès, Chief Operating Officer, describes Marsh France’s pursuit of operational excellence and simplified, digitalised insurance processes

WRITTEN BY: WILL GIRLING

PRODUCED BY: JAKE MEGEARY

With a rich and far-reaching history that extends to more than 130 countries over the course of almost 150 years, Marsh’s reputation as an insurance innovator has been crystallised by several notable achievements: inventor of the ‘self insurance’ concept, the first broker to use on-site risk experts, creator of ‘space’ life insurance for astronauts, and much more. When we spoke to Julien Alzouniès, COO of Marsh France & BeLux, he made it clear that the company’s innovative, adaptive and thoroughly modern approach to the industry is helping it optimise digital processes and achieve a perennial goal: operational excellence.

Coming from a long career as a consultant, Alzouniès joined Marsh France in 2018 at a time when the team consisted of only 20 people. Recognising that, as COO, he could make a direct impact on the company’s growth and portfolio retention in an era when client servicing activities are recognised as a key quality differentiator in insurance, Alzouniès chose “service quality

Title of the video

simplification” and “digitalisation” as his guiding principles. Subsequently, the team was expanded 1,000% to 200 people. “The objective was to put the key enablers of user experience transformation under the same scope of accountability, namely data and project management, as well as two main business activities: policy servicing and claims,” he explains.

Marsh France added automated dashboards for its sales placement and servicing activities, modernised its client portals, and implemented internal workflow systems to track tasks and monitor service performance more effectively. The company also launched several new digital solutions, including:

• MarshSignature: an electronic signature solution, wherein contracts can be

“recorded, validated, certified, signed and archived” via an online platform (EDICourtage). • MarshOnline and MarshPartner: online underwriting platforms in support of the company’s Affinity portfolio. • MarshMotor: a multi-device solution allowing the user to report vehicle-related accidents, select a repair company from

Marsh’s approved partners and benefit from remote damage expertise.

The latter solution was developed with Paris-based insurtech WeProov. Founded in 2015, the company is transforming claims through photo recognition AI (artificial intelligence) capable of facilitating easy, fast, and secure online FNOL (first notice of loss). “WeProov is one of our key partners and working with a fintech has actually enriched Marsh by providing added value and agility,” Alzouniès explains. “MarshMotor is a great way to collect information documenting damage and the process has been simplified enough to work on a smartphone; you can raise a claim in as little as five minutes.”

JULIEN ALZOUNIÈS CHIEF OPERATING OFFICER MARSH FRANCE

EXECUTIVE BIO

JULIEN ALZOUNIÈS

TITLE: CHIEF OPERATING OFFICER COMPANY: MARSH FRANCE INDUSTRY: RISK MANAGEMENT & INSURANCE BROKERAGE LOCATION: FRANCE

Julien Alzounies is O&T leader for France and BeLux and a member of the Executive Committee of Marsh France.

Julien Alzounies began his career at Capgemini Consulting, then worked at Stanwell Consulting. He then worked as a change lead at Axa Group Solutions on international transformation programs in Western Europe. He joined AIG Europe Limited in 2012 and AIG France's Management Committee in 2016. In February 2018, he joins Marsh France as Chief Operating Officer, in charge of Operations & Client Service and Technology & Client Solutions. Julien Alzounies holds a Master in Management from Skema Business School and an MBA from the Asian Institute of Technology.

Another key partner is LTI, one of Marsh’s largest global strategic partners over the last two decades. During that time, LTI has supported Marsh on a number of transformational and digital initiatives. “In developing the newly revamped digital extranet offering, LTI has been playing an extremely important role by bringing its deep domain knowledge of our systems and processes acquired through supporting Marsh’s legacy BCP platform,” says Alzouniès. In the digitisation journey, LTI has helped in improving the user experience, enabling a SSO (single sign on) mechanism for clients, building more advanced reporting capabilities, and partnering on the optimisation of approximately onethird of Marsh’s processes, thus providing clients additional flexibility. “LTI has brought very high-quality technical and domain expertise to the initiative, which has augmented Marsh’s capacity to build and launch the new, enhanced Marsh BCP. With LTI strengthening its offerings around cloud, we look forward to strengthening this partnership further.”

Forging strong partnerships and developing innovative solutions has been particularly crucial over the last 12 months, as the COVID-19 pandemic placed significant strains on normal operating

JULIEN ALZOUNIÈS CHIEF OPERATING OFFICER MARSH FRANCE

1871

Year Founded.

800

paradigms. Marsh France’s staff were already well versed in remote working methods, meaning the general shift was weathered with poise. However, this is not to say that the totality of the change wasn’t challenging: “Moving to a new operating model, where we previously had only an average of 10 to 20% of our people working remotely to close to 100%, was a significant challenge. Nevertheless, it only took us about one week to reach the optimal level of performance for all our employees,” says Alzouniès. This impressive achievement is made even more resounding by the concurrent finalisation of Marsh’s integration with

British multinational insurer Jardine Lloyd Thompson (JLT), which formed a significant logistical obstacle in terms of HR and client data migration.

For Alzouniès, remote working is just one component of a larger consideration: the digitalisation of processes, data and document exchanges. “The need has only been accelerated by the pandemic situation and it’s going to become even more important in the future.” Having met this internal transformation with

JULIEN ALZOUNIÈS CHIEF OPERATING OFFICER MARSH FRANCE

JULIEN ALZOUNIÈS CHIEF OPERATING OFFICER MARSH FRANCE

aplomb, Alzouniès states that refining the company through a new OPEX (operational excellence) programme will feature strongly in Marsh’s strategy for 2021. Started at the end of 2020, this will be an ongoing and far-reaching initiative that is currently scheduled to last until 2023. “We decided to launch this at a global level across all our geographies as a major transformation programme. Its scope covers all of our business functions, including sales, placement, policy servicing, finance, and claims through digitalisation, service enhancement and quality improvement.” The end goal of this process is the “harmonisation” of Marsh globally through modernised operating models. “It's very important for us to harmonise our platforms,” continues Alzouniès. “System automation and service integration will also enable Marsh to capture and capitalise on more client data from a risk analysis and placement benchmarking perspective.”

JULIEN ALZOUNIÈS CHIEF OPERATING OFFICER MARSH FRANCE

Alzouniès is determined to further develop Marsh France’s core business solutions aligned with the company’s other offices in continental Europe. Taking a data-centric stance that emphasises the use of “maturing” technology like AI will form the crux of accomplishing this aim, although he states that this focus is not entirely new. “Data is important for our clients because they expect more benchmarking information. We also need to continue mastering our service performance, because it’s crucial to operate in the insurance market efficiently.”

When he considers the benefits that enhanced digitalisation will bring to the company as a whole, Alzouniès summarises them as service improvement through more efficient workforce deployment and overall service simplification. Through its OPEX programme, Marsh France has secured a flying start for incorporating these benefits. First and foremost in 2021, he states, the company’s main objective will be the finalised roll-out of MarshMotor, with the goal of making all the company’s French clients benefit from using the new application. Furthermore, new versions of client portals such as Marsh BCP (business continuity planning) will be launched before the end of Q1, as well as a new portal for real estate insurance management. “Over 2021, we want to significantly improve our work reporting capabilities and the quality of client reporting from a claims perspective. Marsh wants to enrich the quality of the data that we provide clients, not only to deal with risk management but also to enhance risk prevention.”

CLOUD ATLAS: A NEW WORLD FOR INSURTECH IN 2021?

Cloud technology and AI solutions are redefining the insurance industry as companies shift from legacy systems to the cloud

WRITTEN BY: JOANNA ENGLAND

The cloud computing industry is the only industry that is more fashiondriven than women's fashion.” When Larry Ellison, chairman of Oracle Cloud, made that observation back in 2008, not many experts appreciated the gravity of his statement.

But fast forward 12 years and nobody can argue with its sentiment. Because the cloud isn’t just big. It’s massive. And it's increasing in mass globally, with every new quarter.

For example, data shows that between July and September 2020, enterprise spending on cloud computing infrastructure was up by 33% on 2019 figures. As we make headway into 2021, the speed of growth is expected to accelerate further.

Indeed, the global data centre market size was valued at US$6.8bn in 2018. It is currently growing at a compound annual rate (CAGR) of 6.9% and this is set to continue until 2025.

The increased demand for data storage on the cloud has resulted in an upsurge in new data centres mushrooming across the globe. Ellison recently confirmed this phenomenon on an Oracle blog post.

“We have been building as fast as we can, but we’ve been trying not to build ahead of demand,” he said. “And we were doing a pretty good job until this last quarter, where demand actually turned out to exceed our ambitions. We have some large customers that just wanted more capacity than we could supply.”

The ensuing data gravity has then driven advances in artificial intelligence (AI) and machine learning (ML). Both these technologies are critical to the increasingly analytics-driven industries such as insurtech.

Cloud services also drive innovation – which in an increasingly fast-changing world, is an essential survival tool. According to McKinsey, the average worker spends 20% of their time looking for information. But cloud services change the way we interact with data. Labour-intensive tasks are managed far more efficiently, freeing up time to work on innovative projects. The cloud enables businesses to stay ahead of the curve through continuous creativity and new ways of working.

Financial incentives

Kris Sharma, Financial Services Lead for Canonical, the publisher of Ubuntu, believes cloud services can significantly decrease insurtech operating and capital costs. He says, “Cloud-based solutions are less

ADVERT PAGE MEDIA SALE

KRIS SHARMA FINANCIAL SERVICES LEAD, CANONICAL

expensive than those deployed on-premise and help insurtechs reduce costs for licensing, hardware, and maintenance of core infrastructure. Cloud platforms lower the barrier to entry for insurtechs, increase marketplace competition, and drive customer value innovation.”

Some experts also believe that innovations are being customer-driven. "The collaboration between insurers and insurtechs is resulting in a greater number of cloud platform-based innovations,” points out Sharma. “As more and more insurers

Top five cloud service providers #1

Microsoft Azure

#2

Amazon Web Services

#3

Google Clouds

#4

IBM Cloud

#5

Oracle Cloud Infrastructure

move their IT workloads into the cloud, they will be able to collaborate with cloud-based insurtechs to develop innovative products and services, spot new opportunities and reach new markets.”

Considering the insurance industry has incurred significant losses since the COVID-19 outbreak, financial incentives and streamlined services are an attractive option for most insurance companies.

A recent Swiss Re Institute report shows the insurance industry losses from all-natural catastrophes and man-made disasters globally totalled $83bn in 2020, making it the fifth-costliest year for the industry since 1970.

“COVID 19 has had a huge impact on the bottom-line,” confirms Sharma. “Since the outbreak, insurers have suffered a severe financial hit as announced losses have already hit over $25bn globally. Almost 0% interest rates have impacted investment income and profitability of insurers.”

Top 2021 trend: Open-source services

Agility is key to survival in 2021. Businesses require more cloud services and will demand a tailored approach. Open-source cloud services are becoming increasingly popular as businesses require greater flexibility and actively avoid vendor lock-ins.

He continues, “Legacy technology has dragged down the economics of the insurance industry for a long time. This legacy “technical debt” is a major concern for the industry as some of the insurance firms are spending up to 75% of their IT budget on maintaining legacy systems.”

Security risks

As a reaction to this – and an uptick in cybersecurity risks, the transition to cloud services for insurtechs has been inevitable for most companies – not just insurance enterprises, says Sharma. “Response [to COVID-19] necessitated a rapid shift to remote work and insurers have to find a way to maintain customer service standards while managing the workforce change, addressing IT needs and ensuring the protection of systems and data.

“The FBI’s Cyber Division reported an average of 4,000 cyberattacks per day since the beginning of the pandemic, a 400% increase from pre-pandemic numbers. Insurers will have to continually re-evaluate and fine-tune their cybersecurity protocols to accommodate the increased exposures that come with a remote workforce,” he explains.

However, until the dramatic shake ups in 2020, many insurance companies were reticent about the move to cloud technologies, and even today, insurtech startups are the biggest adopters – not established, traditionally structured insurance companies. “Startups aside, relatively few insurers are using the cloud for core processes such as policy administration, claims handling and reinsurance. As a result, only a small proportion of the overall insurance industry IT workload is on the cloud so far,” says Sharma.

Most experts agree that cloud computing has been the most disruptive force in IT and early adopters of cloud have reaped many benefits. The insurance sector, however, is years behind its peers. Insurers initially rejected the idea of using the cloud to run core business activities and store sensitive data.

“Traditional insurers employed agents to broker their policies, and their application and underwriting processes relied heavily on manual, human input especially for life and health insurance products,” says Sharma.

However, he adds, this will change and although legacy systems are slowing down the transformation, the shift is inevitable. “One of the technological barriers that has been holding insurance firms back from innovation and adoption of cloud platforms – the legacy systems that insurers depend on, leave little room for flexibility or advancement. For public

cloud adoption in insurance, security remains the topmost concern.”

WHAT DOES CLOUD OFFER INSURTECH?

The benefits to cloud services are seemingly endless and range from colocation and hybrid services to additional high-powered computing (HPC) solutions for the aggregation of data. These options are a perfect match for forward-thinking insurance companies aiming to build agile infrastructure and flexible services that meet the demands of the current marketplace.

Analytics:

The primary advantage, especially for smaller operatives, is the HPC, AI and ML offered by large-scale cloud service providers. With the introduction of 5G and the IoT adding vast swathes of data to servers, creating accurate analytics from that data – especially predictive analytics for insurance cover purposes – is essential.

Cost-effectiveness:

Like any business, the insurance industry expenses include infrastructure, employee wages, amenities, training, travelling, product development, IT services and more. On a practical level, cloud computing is known for its flexibility and pay-as-you-go plans. But it also helps build better insights which can reduce the number of payouts required. Legacy technology has dragged down the economics of the insurance industry for a long time. This legacy "technical debt" is a major concern for the industry as some insurance firms are spending up to 75% of their IT budget on maintaining legacy systems.

IT Management:

Cloud computing manages and maintains data in a secure and solution-filled environment.

MCKINSEY

Services include storage upgrades, and RAM, scaling of processing speed, equipment management, software updates, applications and handling antivirus programmes.

Security:

With cybercrime on the rise and major breaches marking 2020 for large scale operators, the safety of data is essential. Cloud services provide cutting-edge security options and employ the latest encryption services.

Rapid Deployment:

Cloud computing offers rapid deployment, allowing businesses to swap over to its services within a short time frame. Cloud also has an abundance of resources available to allow for multiple tenants in the shared environment. These resources are always scalable.

Scalability:

Unlike some businesses, insurance is a steady market. However, spikes in activity and growth, especially during new product launches, put a higher demand on resources. Traditional IT setups are not usually equipped to handle these scalability issues. However, cloud services ensure such spikes do not hamper business growth and can accommodate additional services at a low cost.

High-tech services:

More than ever, apps are used to reach customers, facilitate policy cover and advertise new products. Such cuttingedge services require state-of-the-art management – with low latency, high reliability and global access on the go. It makes sense to use a cloud service provider rather than invest in expensive, on-site facilities that will require constant upgrades and maintenance.

Big Data debates due for Insurtech in 2021

The management of Big Data looks set to create better insights but tighter regulations for insurtechs over the next 12 months

WRITTEN BY: JOANNA ENGLAND W ith the growth of the Internet of Things (IoT), Big Bata has got,well, a lot bigger. The sheer volume of collected information from vast numbers of online devices is the cause of much discussion in the world of regtech. Currently, for many companies, oceans of data gravity are pooling on servers with no particular place to go. Without adequate aggregation and analytics, such information remains a financial storage drain, and largely useless. Furthermore, without proper regulation in place and the right analytics, the use of the data also becomes a legal hot potato. Security is a major concern. Facebook, Microsoft, Equifax and Yahoo! have all experienced massive data breaches in recent years. While companies have collected more and more data, they have not always taken the proper precautions to secure it. The rollout of 5G is generating everfaster data collection and transfer too. The problem of data storage, security and aggregation, therefore, may well get worse before it gets better. But, the situation has also led to massive strides in artificial intelligence (AI) and

CHRIS VINNICOMBE VP FINANCIAL SERVICES, ACXIOM

ADVERT PAGE MEDIA SALE

machine learning (ML) which, when employed correctly, are the perfect antidote to Big Data gravity problems.

AI insights and Big Data

Big Data becomes valuable when its insights are extracted. However, only certain aspects of the data are used to build insights, which means much collected by companies, is unnecessary. Callum Rimmer, founder and CEO of By Bits, a new technology platform for the motor insurance industry, believes a more selective approach to data harvesting is required.

He says, “Data will beget data. It is not about collecting everything and anything on the off chance that something might be useful. That just creates noise. It is disingenuous to the supplier of the data and fundamentally creates problems maintaining that data within robust security processes and procedures.”

Rimmer says that while data volume inevitability increases over time, proper segmentation and archiving means insurtech businesses can scale in line with volume while maintaining order, accessibility and portability.

He explains, “Big Data needs structure and a clear application to be of benefit to anyone. As Big Data, both as data itself and the ecosystem around it, grows – it can be used to innovate industry and benefit end consumers.”

However, this is easier said than done, and Rimmer fully admits that the biggest challenge faced by insurtechs is the security of the information they collect.

Top 5 regtech newcomers in 2021 Dathena

For data security management

REGnosys

For compliance services

Cappitech

For reporting solutions

Mind Bridge

For managing auditing

Ceptinel

For monitoring services

"Protecting sensitive data by managing its access internally and externally" is essential, he says.

“It’s critical to have robust data security policies and processes to maintain ISO27001 accreditation. Processes and infrastructure to be GDPR compliant from the ground up which is an advantage that insuretchs have over most incumbent insurers with legacy systems.”

Privacy rights and Big Data

But this raises other questions regarding how that data is used, and to whom it ultimately belongs. GDPR has partly addressed this problem in Europe. The regulation was a game-changer for its emphasis on citizens’ rights. It was created to give EU citizens control over their personal data, as demonstrated by the rights of individuals within the regulation.

Robert Bond, a data protection expert from law firm Bristows, agrees that data collection and retention in a legal minefield that many enterprises fail to appreciate. He explains, "While the use of Big Data has many valuable commercial facets, there are risks over the use of such data breaking the law.

“If the data is taken from various sources such as websites and apps and third-party databases, care needs to be taken that such use does not infringe the contractual nor intellectual property nor data protection rights of others,” says Bond.

He points out that the use of personal details by insurance companies must be only be utilised with consent to avoid privacy breaches. “Where personal data is processed as part of Big Data and analytics there must be a lawful ground for such processing, such as consent of the data subjects or legitimate interests of the business. Insurance businesses need to ensure that its data processing using Big Data is open and transparent and compliant with the law.”

Useful data collection

Successfully data analytics can streamline companies from the inside out, and provide far better services to customers. “The growing use of digital services, combined with the collection and logging of previous interactions and preferences means there is no excuse for financial service companies to have an incomplete picture of their customers wants and needs,” says Chris Vinnicombe, VP Financial Services at Acxiom

“Firms can take a step closer to their digital future by bringing together the data

NICOLAI BALDON CEO AND FOUNDER, SYNTHESIZED

they have on everyday interactions, requests and comments in order to offer the level of personalisation that benefits customers and keeps them coming back.”

Insurtech and ML

Once consent to data usage is provided, operators are tasked with extracting information from it. With advances in AI, ML and HPC (high-performance computing) this task becomes much easier – and the resulting insights become far more valuable.

“Big Data provides insurers with a better way to understand and support their customers and make more accurate decisions when it comes to risk and fraud,” says Nicolai Baldon, CEO and Founder of Synthesized, an artificial intelligence service that enables businesses to research with sensitive data.

He explains, “However, this brings attention to a primary concern: security and data quality. How can you get fast, secure access to highquality data and the ability to collaborate with your partners, be able to test against all possible scenarios, without putting customer data at risk?”

It's a tricky situation, says Baldon, that is made more complicated by the world of insurtech where regulations are particularly complex. “On top of data privacy, organisations in insurtech also have to take into account other elements such as intellectual property rights and meeting marketability standards. Beyond meeting compliance standards, they need to ensure that the data is bias-

ROBERT BOND DATA PROTECTION, BRISTOWS

free, to avoid skewed and unfair models and possible reputational risk,” he points out.

whether that’s testing new risk models or collaborating with external partners. Without robust solutions, this can Insurtech industry changes Baldon believes the 3 trending data compliance issues be an impossible task.” Rimmer comments, "Fundamentally, other entire insurance industry for 2021 than the insurtechs' is experiencing a seismic regulatory responsibility shift – with data at the 1. Use of data: There will be to store policyholder data, heart of it. “We use data more supervisory activity, early a customer can request to drive innovation, intervention, and involvement deletion of collected create competitive across sectors. There is also likely data under GDPR. The advantage, reduce costs, to be a better focus on customer customer is the ultimate and make decisions behaviour and the use of data to arbiter of that data. critical to the future of create better consumer outcomes. “Businesses that will any business,” he says, extract the most value pointing out that the 2. More AI: Upgrades systems from data are those that solutions managing data and AL solutions will be used use the data to create are the key to making to manage real-time data both more customer centric it valuable. for analytics, transmission and insurance products that

“In fact, insurtech storage purposes. help keep our customers is based on the very for longer. Big Data's premise of enabling 3. Better data protection: value is derived from innovation and Companies will build better data its application, not the disruption. But to do protection rights for customers collecting.” this, data needs to be and use Data Protection Impact He adds, “It is a readily available, in a Assessments to manage rights. corporate responsibility safe, compliant, privacy- to be clear about what preserving manner. It data is collected and how needs to be easily available when needed, you use that data to benefit the supplier of that safe to share, and also flexible so one data. If you don't have a clear use for the data, can shape it for the specific task at hand, then don't collect.”

UNICORNS TO WATCH FOR 2021

Insurtech is a burgeoning industry with a growing number of rising stars. We look at the latest unicorns emerging in 2021

WRITTEN BY: JOANNA ENGLAND

Privately held startup companies valued at over US$1bn are fast emerging in the insurtech industry. These dynamic new enterprises have harnessed the latest technology and business models to drive forward and transform the entire spectrum of insurance services.

10

At-Bay

Experts in: Cyber insurance

At-Bay is a California-based insurtech enterprise that provides cyber insurance and risk management services for businesses. Describing itself as “A new insurance company for a new age,” At-Bay was founded in 2016, generates $62.9K in revenue per employee and has received a total of $87m in funding. Founded by Rotem Iram, a cyber expert from the ground up, At-Bay cyber insurance policy provides first and third-party coverage, enhanced with modern risk management services to help insureds avoid loss before it happens. Describing his chosen industry as exciting, Iram says, “Cyber insurance is a new problem that keeps evolving. It requires new models and approaches to risk as well as redesigning the insurance organization to optimize around learning.”

09

Digit Insurance

Experts in: General insurance

Established in 2017 by Kamesh Goyal, Digit has become India’s first unicorn of 2021, with a valuation of $1.9bn. On a phenomenal growth trajectory, Digit’s premium income grew by 31.9% to $186m between April and December 2020. The insurtech has also served around 15 million customers since its inception. Digit was profitable in the three quarters of fiscal year 20-21, despite the economic recession affecting most businesses, it concentrates on 100% cloud-based technology to simplify processes for its users. This includes mobilebased self-assessments for car insurance claims. The company also launched a COVID-19 product that provides a fixed benefit for policyholders who catch the disease and provides a group illness insurance product that covers over two million Indian citizens.

08

wefox

Experts in: All-in-one insurance solutions