Collaborations between automakers, tech giants, and start-ups have accelerated the development of driverless cars

JULY - AUGST 2023

VOLUME 23

ISSUE 35

Collaborations between automakers, tech giants, and start-ups have accelerated the development of driverless cars

JULY - AUGST 2023

VOLUME 23

ISSUE 35

The year 2023 has not been favourable for the global economy as well as the banking industry. While inflation has been a major issue since 2022, it is finally showing signs of cooling off, but not at the rate expected by central banks. Additionally, there have been numerous bank collapses, including some of the premier regional lending bodies in the United States such as Signature Bank, Silicon Valley Bank, Silvergate Bank, and First Republic Bank, which have collapsed like a pack of cards.

Is the banking system in the world's largest economy considered safe? Unfortunately, the answer is no. Throughout history, the country has faced financial crises resulting from trade disruptions and job losses that arise from the catastrophic bankruptcies of lending institutions.

In 2023, there has been a trend called 'Dedollarisation' where countries are moving away from using the US Dollar for their foreign trade. The Chinese Yuan has become a popular choice for bilateral transactions, with even the regional bloc BRICS considering the possibility of creating its own currency specifically for trade-related transactions among its member nations.

In this edition, we also present an extensive assessment of the most recent technological developments, encompassing captivating topics such as eSIM and gene editing.

This July-August 2023 issue of International Finance Magazine will feature the cover story 'The Era of Driverless Cars Dawns.' The article will explore the growing phenomenon of driverless cars, which are fast becoming the standard in the transportation sector. With artificial intelligence becoming the heart and brain of these cars, our cover story will explore this groundbreaking innovation in detail, highlighting the unique benefits it presents, including enhanced safety, efficiency, and convenience.

editor@ifinancemag.com

www.internationalfinance.com

TECHNOLOGY

BANKING AND

Collaborations between automakers, tech giants, and start-ups have accelerated the development of driverless cars

Meta is competing with Microsoft to be the first Metaverse platform in the world

ECONOMY

RISING COST TO HURT ‘SINGAPORE DREAMS’?

The Southeast Asian city-state’s economy expanded by 0.4% in the January-March 2023

Banks face a range of risks, including credit, market and liquidity ones

DOLLAR'S KINGSHIP UNDER THREAT?

As of 2023, central banks hold about 60% of their foreign exchange reserves in dollars

ONLINE SHOPPING: THE MONEY SPINNER

A recent study by McKinsey provide a thorough look at the direction that e-commerce in consumer products will go over the coming years

48 BaaS: Future of banking services

74 Making plastic industry ‘sustainable’

88 Is automation the way forward for manufacturing?

34

www.internationalfinance.com

HARSH SURESH BHARWANI CHATGPT: THE GAME CHANGER IN 2023

ChatGPT is highly adaptable, which makes it an ideal solution for businesses looking to automate their customer service operations model

Director & Publisher Sunil Bhat

Editorial Prajwal Wele, Agnivesh Harshan, CL Ramakrishnan, Prabuddha Ghosh

Production Merlin Cruz

Design & Layout

Vikas Kapoor

Technical Team

Prashanth V Acharya, Sunil Suresh

Business Analysts

Alice Parker, Indra Kala, Stallone Edward, Jessica Smith, Harry Wilson, Susan Lee, Mark Pinto

Business Development Managers

Christy John, Alex Carter, Gwen Morgan, Janet George

Business Development Directors

Sid Jain, Sarah Jones, Sid Nathan

Head of Operations

Ryan Cooper Accounts

Angela Mathews

Registered Office INTERNATIONAL FINANCE is the trading name of INTERNATIONAL FINANCE Publications Ltd

843 Finchley Road, London, NW11 8NA

Phone +44 (0) 208 123 9436

Fax +44 (0) 208 181 6550

Email info@ifinancemag.com

Press Contact editor@ifinancemag.com

Associate Office Zredhi Solutions Pvt. Ltd. 5th Floor, Sai Complex, #114/1, M G Road, Bengaluru 560001

Ph: +91-80-409901144

As people get ready to fly for their summer vacations, UK-based airline Easyjet has revealed that 1,700 flights have been cancelled. The airline cancelled flights to and from Gatwick Airport throughout the months of July, August, and September. Easyjet attributed the frequent cancellations to congested airspace over Europe and ongoing air traffic control issues. The company stated that 95% of the affected passengers were rebooked on different flights. According to aviation analytics company Cirium, July is expected to see the most UK aircraft departures since October 2019, and will be 11% higher than July last year.

According to Meta CEO Mark Zuckerberg, Twitter competitor app Threads has signed up over 100 million users in less than a week. This makes Threads the fastest-growing app in history. OpenAI's ChatGPT previously held the crown by recording 100 million active users, but it took the app two months to reach that milestone. The new microblogging platform was launched in 100 countries including India. Within hours, the app proved to be a hit with users, racking up 30 million users within the first 24 hours, making it the fastest-downloaded app of all time.

The Federal Reserve's chief regulator said he had decided to strengthen fiscal cushions for larger banks. The moves would make the system more resilient. He said after mid-tier lenders like Silicon Valley Bank and First Republic Bank went bankrupt this year. Under the Fed's proposed plans, due to be released later this year, the largest banks could be required to hold an additional 2 percentage points of capital, or an additional $2 of capital for every $100 in risk-weighted assets. The exact amount of additional capital will depend on a company's operations, with the largest increases expected to be reserved.

According to a recent report by research firm Omdia, Apple is set to introduce an iPad Pro with an OLED panel in 2024. It is speculated to arrive in two screen sizes. The 11-inch and 13-inch iPad Pro models are reportedly on track to incorporate (LTPO) OLED panels. Production for these devices is expected to commence in the first quarter of the upcoming year. OLED displays offer impeccable black levels, per-pixel light control, and exceptional contrast and HDR capabilities.

Source:

The Chinese auto industry has accelerated its global expansion this year. According to the China Association of Automobile Manufacturers, exports grew over 81% year-on-year to 1.76 million vehicles in the first five months of 2023. The auto industry achieved a major milestone earlier this year when it overtook Japan as the world's largest vehicle exporter, thanks in large part to strong growth in foreign demand for its New Energy Vehicles (NEVs), a

segment that is primarily electric and plug-in hybrid vehicles.

According to the association, NEV exports increased by 163% to 457,000 vehicles in the five-month period, with significant growth coming from Europe. According to the European Automobile Manufacturers Association, China was the largest exporter of vehicles to the European Union last year, ahead of Turkey and the United Kingdom, and it grew strongly this year as well.

Under the terms of the 10year agreement, GMG will open around 50 stores under the JD fascia by 2028, across the UAE, Saudi Arabia, Kuwait and Egypt

During a meeting held at the Ministry of Energy and Infrastructure in Dubai, he said that UAE is employing AI in various fields to accelerate digital transformation

Lance Gokongwei recently spent 73.6 billion pesos ($1.3 billion) in order to ready his sprawling conglomerate to reap the fruits of a post-pandemic recovery

Prices have risen around the world as pandemic restrictions were eased and the war in Ukraine pushed up the cost of essential commodities

Biopharma deals hit new heights in 2020, with a remarkable 107% increase compared to 2018

Japanese workers' wages rose at a record pace after the government urged companies to help their workers after rising prices. Official figures show that wages rose 1.8% year-on-year (y-o-y) in May, the fastest pace in 28 years. However, taking inflation into account, people's real purchasing power continued to fall. Inflation in Japan, the world's third-largest economy, has been rising for more than a year.

In recent months, prices have risen around the world as pandemic restrictions were eased and the war in Ukraine pushed up the cost of essential commodities like oil and wheat. In Japan, the cost of everyday items has also been pushed up by the weakening currency. The latest official measurement of Japan's inflation rate showed that core consumer prices rose 3.2% y-o-y in May. For decades, the salaries of many people in Japan have increased little since there has been almost no inflation.

In March, as the cost of living continued to rise, the country's Prime Minister Fumio Kishida urged employers to take action. This year, com-

panies including Fast Retailing, which owns fashion chain Uniqlo, and car giants Toyota and Honda said they would increase wages for their employees. Recently, Japan's largest labour union, Rengo, said the companies had agreed on the biggest wage increases in three decades in annual labour negotiations.

According to research analysts from Japanese investment bank Nomura, the pay rises represent a symbolic structural change in the Japanese economy. Japan's potential labour pool shifted to a rapid decline around the end of 2021. This should put sustained upward pressure on wages.

Fast Retailing announced earlier this year that it was raising wages to 'compensate each and every employee appropriately for their ambition and talents.' The business continued by saying that it wanted to increase the company's growth potential and competitiveness in line with global standards. Koji Sato, the CEO of Toyota, expressed his optimism that the decision will benefit the whole Japanese auto sector and 'lead to frank discussions between labour and management at each company.'

The pharmaceutical industry is poised for remarkable growth in the coming years, fueled by a growing middle class and an ageing world population. With the pharmaceutical market expected to grow by 165.2% between 2020 and 2030, the sector offers lucrative opportunities for investors and stakeholders worldwide. The post-pandemic era has further propelled the industry, leading to a record number of biopharmaceutical deals and significant investments in healthcare systems. This trend has also attracted attention in the Middle East, particularly in the Gulf Cooperation Council, where a new frontier for the pharmaceutical industry is emerging.

According to a recent industry study by the Investment Promotion Agency Qatar (IPA), the global pharmaceutical market is on an upward trend. Biopharma deals hit new heights in 2020, with a remarkable 107% increase compared to 2018. The R&D spending also saw significant growth, reaching $189 billion in 2020.

This projected growth is a sign of the industry's steady post-pandemic expansion and

significant investment in global healthcare systems. It is estimated that the market will reach $2,051 billion by 2025, a 70% increase from 2020. Likewise, drug sales are expected to grow 32% from 2020 to $1,181 billion in 2024.

The Middle East is quickly becoming an important driver of expected growth. The region benefits from improved drug accessibility and robust economic development prospects, making it an attractive market for pharmaceutical investments. As countries actively focus on improving healthcare delivery and easy access to personalized digital services, GCC countries are seeing their $9 billion consumer healthcare market surge.

There are several key demand drivers for the pharmaceutical industry: an ageing population and an increase in chronic diseases, stress-related illnesses and pandemics are contributing factors. At the same time, supply-side drivers such as speciality medicines, patent expiry, generics and over-thecounter medicines offer additional growth opportunities within the sector.

The growing presence of working mothers is a key driver behind the expansion of the baby food packaging market

AI robots say, they have the potential to rule the world more effectively than humans

The global baby food packaging market was valued at $11.29 billion in 2022. It is projected to reach $17.67 billion by 2032, with a compound annual growth rate of 5.1% over the entire forecast period. The growth of this market is primarily driven by several factors, including an increasing number of working mothers, a growing preference for a comfortable lifestyle, and growing concerns about infant health and hygiene.

The growing presence of working mothers is a key driver behind the expansion of the baby food packaging market. As more mothers enter the workforce, the demand for convenient and easy-to-use baby food products increases. This led to an increase use of packaged baby food.

Australia's gross domestic product grew 2.3% year-on-year in the first quarter, just slightly below analysts' expectations. Economists polled by Reuters had forecast growth of 2.4%, compared with 2.7% in the fourth quarter of 2022. On a quarterly basis, GDP grew by 0.2%, compared to the 0.3% expected in the Reuters poll. The GDP readings are key to the Reserve Bank of Australia’s decision-making process for its monetary policy.

"This is the sixth straight rise in quarterly GDP, but the slowest growth since the COVID-19 lockdowns in September quarter 2021," Katherine Keenan, head of National Accounts at Australia’s Bureau of Statistics said.

At a United Nations conference, a group of AI-powered humanoid robots delivered a thought-provoking message: they have the potential to rule the world more effectively than humans. However, these social robots stressed that caution should be exercised as humanity explores the rapidly advancing realm of artificial intelligence. While they acknowledged their inability to fully comprehend human emotions, they urged humans to tread carefully while harnessing AI's potential to address pressing global challenges, reported AFP.

Using AI to Address of problems such as climate change, hunger and social welfare, these advanced humanoid robots attended the United Nations AI for Good Global Summit in Geneva.

The Philippine Ministry of Finance (DOF) announced that it had signed a $600 million loan agreement with the World Bank (WB) to fund a rural development project aimed at modernizing agriculture and improving infrastructure. The loan agreement was signed for the Philippine Rural Development Project (PRDP) scale-up, which aims to transform agriculture into a modernized and industrialized sector through public infrastructure measures and strengthening the commodity value chain, reports the Xinhua news agency.

PRDP Scale-Up, an initiative by the Department of Agriculture (DA), is an expanded response to the ongoing challenges facing the country's agricultural and fisheries (A&F) sectors and rural communities.

Like the NFC chip used in payment systems like Apple Pay and Google Pay, an eSIM is essentially a tiny chip within your smartphone

An integrated SIM card, also known as an eSIM, eliminates the need for a physical SIM card and, consequently, a SIM card slot on your smartphone. Though Apple's iPhone 14 and iPhone 14 Pro are switching to eSIM-only in the US, the number of devices using it has stayed comparatively modest. Still, it's only time before other smartphone makers follow suit.

The first fully eSIM-only phone debuted as the firstgeneration Motorola Razr flip phone, not Apple's. However, until now, smartphones have tended to accommodate both eSIM and traditional SIM.

Under such circumstances, these devices replace a second SIM with an eSIM. They still have room for a conventional nano-SIM, which you can use as usual, but you may add a second number or data contract via the eSIM.

Since consumers may save plans from many networks on their eSIMs, there are benefits for both device manufacturers and networks using eSIMs.

The customer may, for instance, have a data roaming SIM for abroad use or use one number for work and another for personal conversations. In addition, if one opts for the eSIM, he/she might

have different voice and data plans.

What is an eSIM? What exactly will it give to its customers, then? Now let's elaborate.

eSIM stands for embedded SIM, which is all it refers to. No physical SIM cards are involved, and you do not need to switch over physically. However, not all networks currently accept eSIM, and the network/ carrier must support and enable it.

Like the NFC chip used in payment systems like Apple Pay and Google Pay, an eSIM is essentially a tiny chip within your smartphone.

Since the data on an eSIM is rewritable, you can choose to switch operators with just a quick phone call. Likewise, adding them to a data plan and linking devices with eSIMs to a mobile account takes just a few minutes.

The GSMA, the association of mobile networks, supports eSIM and has established the global standard for innovation.

There may be fewer choices, which would be bad for customers. Devices might come pre-loaded with one particular network rather than if it is sold exclusively. For example, customers getting iPhones with Vodafone eSIM, due to the business deal between Apple and the network provider.

Additionally, eSIM users can only quickly swap

eSIM stands for embedded SIM, which is all it refers to. No physical SIM cards are involved, and you do not need to switch over physically

phones after contacting their network. Of course, most people won't give that any thought, but it will be off-putting for some.

Thanks to cloud backup, SIM card storage is no longer necessary for most Android or iOS users, but it does need a mental shift for those using older/ less expensive phones because you can no longer physically switch a SIM card to a new phone.

After discontinuing dual SIM compatibility with the iPhone XS, Apple's iPhone 14 and iPhone 14 Pro are the company's first eSIM-only smartphones, at least in the US. The iPad Pro and every Apple Watch since the Series 2 also employ eSIM.

Although it was first exclusively used in the United States with Google Fi, the Google Pixel 2 also supported eSIM. Since the Pixel 3, every Pixel phone has offered it as a choice in addition to a standard SIM. The same is valid for Samsung Galaxy phones, starting with the S20 series.

The Moto Razr flip phones now have eSIM support, and both Windows 10 and Windows 11 have eSIM

support. In addition, some devices with cellular modems, like computers with Snapdragon processors, can use an eSIM as an alternative to inserting a nano SIM card.

Oppo's Find X3 Pro phone featured the first 5G standalone (SA) capable eSIM. This development means the rollout of lower latency 5G SA networks worldwide has enabled eSIM to support the most recent 5G networking standards.

Some carriers offer eSIM. A carrier's app or a QR Code one can scan is required. Once more, the page must support eSIM.

EE, O2, Vodafone, and Three all support eSIM in the United Kingdom. Users merely need to stop by a nearby store, call customer care, or download an eSIM to obtain an eSIM pack.

Let's examine the EE SIM pack. With EE, one can get a SIM card with a conventional appearance from a similar retailer. However, there is no SIM inside, you receive instructions and a QR code that your device can use to access the information. In the same way as a standard SIM card, each eSIM pack has its unique number.

Truphone has started offering eSIM data plans independent of established carriers. These are

available for purchase through the MyTruphone app. The worldwide plans from Truphone are compatible with 80 nations.

Initially only available on iOS, the software is now also usable with Pixel phones on Android.

Theoretically, using an eSIM should allow you to continue using your primary "home" number when travelling to another nation by simply adding a roaming eSIM to your phone. However, one drawback is that you can't access your number, for example, if you switch SIM cards when travelling abroad.

According to Steve Alder of Truphone, eSIMs might do away with international roaming fees.

"It also allows users to swiftly switch between operators to reconnect if they are in a signalpoor location, frees up space for new features or more battery life, and may reduce the danger of device theft. Mass adoption of eSIMs will be inevitable as customers and operators begin to recognize the benefits,” he said.

We may get smaller devices or larger batteries because a SIM card or the tray containing it is not required, which is one benefit it gives phone manufacturers. In addition, networks are optional to produce or distribute many SIM cards.

In addition, eSIMs will be fantastic for tablets and laptops, where seamless connectivity will become standard. Because eSIMs

take up less space within a device, fitness trackers or even glasses will be able to have standalone 4G or 5G connectivity in a way they weren't able to before, according to Vodafone.

Your iPhone will show both networks on the screen simultaneously if you have both a physical and an eSIM provisioned and use two different networks.

Customers can receive calls and texts on both numbers if the handset is on standby and the SIM and eSIM are provisioned. You can select a "default" line for calls, SMS, iMessage, and FaceTime. Only voice and SMS are available on the other line.

If you choose, you can use the secondary exclusively for cellular

data, which is advantageous if travelling and utilizing a local data eSIM.

Two eSIMs can be active at once on the iPhone 14 versions that only support eSIMs. So you can store up to eight eSIMs in total. Except there isn't a card involved, it functions the same as when you have a genuine SIM and an eSIM.

You need a QR code, if you have one. After availing the QR Code, select cellular under Settings. Then press two on the smart phone's keypad, to add a cellular plan. If you are an iPhone user, scan the QR code your carrier gave using your device. You might be prompted to provide an activation code.

As an alternative, you could be required to use a carrier app to activate your eSIM. For that, you need to visit the App Store and download the app for your carrier. Then you have to purchase a cellular plan via the app. Next, you will have to add the 'Data Plan' to your iPhone's settings.

The 'Truphone App' has the functionality to choose the desired plan and pay with the 'Apple Pay'. You will then need to press 'Add Data Plan' in the settings app on your phone for the project to take effect.

Do you need to get an eSIM?

Those will depend on your requirements and usage scenarios. For example, most people using a physical SIM will notice little change if they switch to an eSIM.

However, to lock their identities with their devices in case of theft, users concerned about the security and privacy of their SIM cards can switch to eSIM.

However, customers can only use luxury handsets to enjoy eSIM facilities, which are far more expensive than entry-level or midrange smartphone models.

Say, for a growing economy like India, iPhone 14 series will have both eSIM capability and a SIM card slot, allowing the users to select the options they see fit. In the case of US, you will be the only one who needs to switch over to an eSIM.

Considering that most smartphones across the lower segments rely on technology and that there are advantages of physical SIM cards for which there isn't a workaround, expect the plastic SIM cards to remain relevant. As for whether eSIMs will completely replace physical SIM cards, that may be possible years from now.

eSIMs represent the future of SIM cards. By eliminating the need for a physical SIM card and SIM card slot, eSIMs enable manufacturers to create smaller devices or larger batteries, and networks can produce or distribute fewer SIM cards. For users, eSIMs provide the ability to save plans from multiple networks, allowing them to have a data roaming SIM for use abroad or use one number for work and another for personal conversations.

The adoption of eSIMs is still in its early stages, with only a few devices currently using them. However, with the recent switch to eSIM-only for Apple's iPhone 14 and iPhone 14 Pro in the United States, other smartphone makers will likely follow suit. Additionally, the potential for eSIMs extends beyond smartphones to tablets, laptops, and even fitness trackers or glasses, where standalone 4G or 5G connectivity will become standard.

While there may be some drawbacks to using eSIMs, such as limited choices and the need to contact the network when switching phones, the benefits outweigh them. eSIMs can reduce international roaming fees, allow quick switching between operators, and reduce the risk of device theft.

Overall, eSIMs offer a convenient, efficient, and secure solution for SIM cards. As both customers and operators begin to recognize their benefits, the mass adoption of eSIMs will inevitably follow.

editor@ifinancemag.com

IF CORRESPONDENT

With roughly 3 billion subscribers on Facebook, 2 billion on WhatsApp, and 1.5 billion on Instagram, 38-year-old Mark Zuckerberg is the undisputed leader of the world's greatest social media empire. His business also received a significant redesign in October 2021, as it rebranded itself to Meta. The company with a market worth nearly $500 billion have been aggressively backing the "metaverse" in the last two years, a concept that pitches for an immersive online experience that would allow users to work, play, and socialize in virtual reality (VR) instead of navigating between different websites as mediated by computers/smartphones.

Reality Labs, the company's metaverse branch created when it bought Oculus in 2014 was expected to cost $10 billion in just one year.

All eyes will be on Facebook CEO Mark Zuckerberg in 2023, as the company returns to defensive mode after a large wave of layoffs. The company is trying

to copy Facebook's success on Web 2 by making an early version of the ‘Metaverse’. Numerous technological and cultural issues continue to impede Meta's progress in the Metaverse, which is why the tech giant reported quarterly losses.

Microsoft surprised the world by announcing its plan to acquire Activision Blizzard for $68.7 billion. If the United States’ Federal Trade Commission (FTC) doesn't step in, the acquisition will elevate Microsoft to the position of third-largest gaming company (behind Tencent and Sony), adding blockbuster games like Call of Duty, World of Warcraft, and Overwatch to its catalogue and giving it access to more than 30 studios (as opposed to Sony's 17).

But, this purchase is more of an

investment in the Metaverse than gaming. Gamers are fundamental, and the Metaverse is built on the foundation of their virtual reality.

Meta is competing with Microsoft and other companies to be the first Metaverse platform in the world.

The Metaverse, which will be developed as an abstraction layer over the actual world and interact with how we now live, will blend Virtual Reality (VR) and Augmented Reality (AR).

Metaverse will be a new paradigm where our digital and online lives will intersect. However, it is still being determined how exactly the process will take place.

One of the better descriptions of the structural elements and levels of the Metaverse has been presented by entrepreneur and game designer Jon Radoff. The seven levels create an end-to-end value chain for the Metaverse. He names experience, discovery, creator economy, spatial computing, decentralization, human interface, and infrastructure. Experience dematerializes our physical environment to release a graphical background and social immersion, where content is generated dynamically via interactions and feeds rather than only by individuals. The process of discovery helps people to locate information sources about novel events. Simple instances of this are NFTs.

The tools that creators will utilize to produce more live, social, and dynamic experiences are all part of the creative economy. To push the limits of conventional interactions, spatial computing creates 3D environments, incorporates data flows from gadgets, and recognizes voice and gesture control.

Blockchain technology, for example, is used by decentralization to facilitate value transfer across entities. The human interface combines the human body with the computer to provide a seamless interface for traversing the Metaverse. Infrastructure is the primary technological layer that the Cloud, 5G, AI, next-generation mobile, and wearables rely on.

Most of the parts of this layered architecture are already in existence, even though some are still in their infancy. As a result, parts of the Metaverse may pass earlier than anticipated.

An endless pit

Reality Laboratories, the branch of Meta attempting to realize the Metaverse, is proving to be a more significant money pit than anticipated.

Reality Labs reported an operating loss of $4.28 billion for the 2022 fourth quarter, higher than the $3.3 billion in the third quarter.

According to CNBC, the figure is marginally less than experts' forecasts for a loss of about $4.36 billion for the quarter. This number and Meta's solid user base and deliberate cost-cutting measures helped the stock increase by about 19%

Reality Labs has pulled in over $13.7 billion over the last 12 months. Its fourth-quarter sales of $727 million exceeded analyst projections of $715.1 million.

Investors have been criticizing Meta's choice to keep pumping money into the Metaverse. One of them even urged for a cut back in these expenditures in an open letter titled "Time to Get Healthy."

However, the business has defended its pursuit of a vast new virtual world.

After the announcement of its

earnings results in March 2023, Zuckerberg participated in a Q&A session, where it was said the company, "There are no indications that we should change Reality Labs' long-term approach. We are always changing the specifics of how we carry this out."

A listener questioned if "accelerating losses" at Reality Labs should be anticipated in 2023 and whether such losses should be expected to peak this year.

"We still expect our full-year Reality Labs losses to climb in 2023, and we will continue to actively spend in this area given the enormous long-term prospects that we see," Susan Li, the chief financial officer of Meta said.

In a blog post he published in December 2022 titled "Why we still believe in the future," the company's chief technology officer Andrew Bosworth stated that Meta would keep allocating 20% of its budget to Reality Labs.

Andrew Bosworth allegedly informed Reality Labs' 18,000

employees in an internal email sent in late December that the business had already fixed too many problems by boosting manpower.

In addition, Meta's stock increased 19% after hours of the data release, indicating that many investors are ignoring losses in a segment that only accounts for slightly more than 2% of the business's revenue.

Meta CEO Mark Zuckerberg is sure that the Metaverse is the future.

“The company's branch for virtual reality, Oculus, is already managed by Facebook. As a result, the capabilities of Oculus VR headsets are currently relatively constrained. But, Facebook wants to advance technology such that headsets no longer resemble bulky helmets and more closely resemble a pair of Warby Parker spectacles. In addition, the gear must give the user a genuine sensation of presence in the virtual world for the Metaverse to

function,” Mark Zuckerberg remarked.

Although Facebook will sell the equipment, which differs from where the money is made, on the earnings call, Mark Zuckerberg stated that Facebook's objective is to offer its headsets for the lowest feasible price and concentrate on generating revenue from trade and advertising within the Metaverse itself.

While advertising will continue to be present, Facebook will prioritize selling virtual items. According to Mark Zuckerberg, Facebook's approach to revenue earning from the Metaverse would include advertising in the Metaverse, but he sounded more optimistic about digital trade.

Several people view some of today's video games as early prototypes of what a metaverse may be, including Microsoft's Minecraft, Roblox, and Fortnite. These free games generate revenue by offering players virtual products. At the results conference, Mark Zuckerberg suggested that

Facebook adopt that business model and take a cut of each transaction to generate revenue in its own Metaverse.

According to tech investors, the moment is unsuitable for placing a wager on Meta Platforms finding cost savings as they pertain to significant investment in virtual reality. Instead, much of the market has been focused on the billions that Mark Zuckerberg is investing in Reality Labs and his vision of a future internet and social connections altered by the metaverse idea. As a result, the corporation is slashing expenses, including massive layoffs. At the moment, Reality Labs is losing more than $10 billion annually, but a senior Meta VR official told CNBC that the company will keep on investing.

Investors want the tech giant to cut back on spending amid a challenging stock market and a faltering economy. Alphabet is being pressured to reduce expenses. Amazon is laying off employees, many of them from business units whose risky ventures didn't pay off as well as expected. The value of Meta shares has decreased by 65% in 2023. In an October 2022 letter to its management, Altimeter Capital stated that Mark Zuckerberg's corporation has "drifted into the region of excess."

In an interview with CNBC's Steve Kovach, Ash Jhaveri, vice president of Reality Labs partnerships, described the layoffs as very terrible.

“But we are making the appropriate investments in our core business and our future,” he added.

Technocrats and CEOs believe that the technology is robust, and it is only a matter of time before Web 3.0, Virtual Reality, and blockchain technology intersect and create a highly profitable technological revolution.

Collaborations between automakers, tech giants, and start-ups have accelerated the development of driverless cars

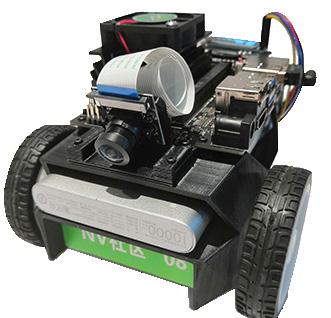

In this article, we will explore the fascinating realm of driverless cars, delving into their development, the various benefits they offer, the challenges driverless cars face, and the transformative impact they are destined to have on our lives.

The historical context of driverless cars traces back to the early experiments and concepts of autonomous vehicles. While the idea of self-driving vehicles has captured the human imagination for decades, it wasn't until recent technological advancements and breakthroughs that driverless cars became a tangible reality.

One of the key milestones in the evolution of autonomous driving was the DARPA Grand Challenges. These competitions, organized by the Defense Advanced Research Projects Agency (DARPA), sparked significant progress in the field by incentivizing the development of autonomous vehicles capable of navigating challenging terrains without

human intervention.

In addition to government-sponsored initiatives, companies like Waymo, Tesla, and Uber emerged as key players in the driverless car race. These companies poured substantial resources into research and development, pushing the boundaries of what was deemed possible. Their efforts have resulted in significant advancements in sensor technology, artificial intelligence algorithms, and mapping systems.

Collaborations between automakers, tech giants, and start-ups have further accelerated the development of driverless cars. Strategic partnerships and joint ventures have facilitated the pooling of expertise and resources, fostering innovation and propelling the industry forward. This collaborative approach has fostered a diverse ecosystem, combining the automotive industry's manufacturing prowess with the technological expertise of software and AI companies.

The advent of driverless cars has ushered in a new era in transportation, where cutting-edge technology and artificial intelligence (AI) converge to redefine mobility. This ground-breaking innovation promises to revolutionize the way we commute, presenting unparalleled opportunities for enhanced safety, efficiency, and convenience

However, the journey towards widespread adoption of driverless cars has not been without challenges. Navigating the complex legal and ethical landscape surrounding autonomous vehicles has been a crucial consideration. Questions regarding liability in the event of accidents and the ethical decision-making of AI algorithms remain at the forefront of discussions.

To address these concerns, governments worldwide have been actively shaping the regulatory framework for autonomous vehicles. Initiatives and policies have been implemented to promote the safe development and deployment of driverless cars. By establishing guidelines and standards, governments aim to strike a balance between fostering innovation and ensuring public safety.

The intertwining of technological progress and regulatory support has set the stage for the transformative impact that driverless cars

are poised to have on our lives. With each passing milestone, the dream of autonomous driving inches closer to reality, promising a future where transportation is safer, more efficient, and seamlessly integrated into our daily lives.

Artificial intelligence (AI) and machine learning algorithms play a crucial role in autonomous driving. Deep learning networks and neural networks are used for decision-making, enabling the vehicle to navigate complex scenarios and make real-time choices

Sensor technology forms the foundation of autonomous vehicles, serving as their eyes and ears in perceiving the surrounding environment. Cameras, LiDAR (light detection and ranging), radar, and ultrasonic sensors work in harmony to capture and interpret data from the vehicle's surroundings. While cameras provide visual information, LiDAR sensors use laser beams to measure distances and create 3D maps, radar detects objects and their velocities, while ultrasonic sensors help with short-range obstacle detection.

However, raw sensor data is meaningless without the ability to make sense of it. This is where data fusion and perception algorithms come into play. These sophisticated algorithms integrate and analyze data from multiple sensors, combining different modalities to create a comprehensive understanding of the environment. By processing the sensor inputs, these algorithms enable the vehicle to perceive objects, identify pedestrians, recognize traffic signs, and make informed decisions based on the current situation.

Artificial intelligence (AI) and machine learning algorithms play a crucial role in autonomous driving. Deep learning networks and neural networks are used for decision-making, enabling the vehicle to navigate complex scenarios and make real-time choices. These networks are trained on vast amounts of data, allowing the vehicle to learn and adapt to different driving conditions. The ability to process data and make predictions in real-time is a key aspect of autonomous driving, ensuring that the vehicle can respond quickly and accurately to changing situations.

Mapping and localization are also vital components of autonomous driving systems. High-definition maps, often created through meticulous data collection and surveying, provide detailed information about the road network, including lane markings, traffic signs, and speed limits. These maps are essential for the vehicle to have a precise understanding of its surroundings and to plan its trajectory. In conjunction with GPS (Global Positioning System), the vehicle can determine its position on the map with high accuracy.

Simultaneous Localization and Mapping (SLAM) techniques further enhance the vehicle's understanding

of its environment. By combining sensor data and the high-definition map, the vehicle can estimate its own position relative to the surroundings while simultaneously building or updating the map. SLAM algorithms ensure that the vehicle maintains accurate localization even in dynamic environments with changing conditions.

The integration of sensor technology, AI, and mapping systems enables autonomous vehicles to perceive their surroundings, make informed decisions, and navigate with precision. These technological advancements pave the way for safer and more efficient transportation, bringing us closer to a future where driverless cars become an integral part of our daily lives.

The emergence of driverless cars brings forth numerous benefits and has the potential for a significant impact on various aspects of transportation and society.

One of the most prominent advantages of driverless cars is enhanced safety. Human error is a leading cause of accidents on the road. By removing the human element from driving, autonomous vehicles eliminate the risks

Human error is a leading cause of accidents on the road. By removing the human element from driving, autonomous vehicles eliminate the risks associated with distracted driving, fatigue, and other human-related factors

associated with distracted driving, fatigue, and other human-related factors. With advanced safety features and accident avoidance systems, such as automatic emergency braking and blindspot detection, driverless cars have the potential to drastically reduce the number of accidents and save countless lives.

In addition to safety, driverless cars hold the promise of increased efficiency on the roads. With optimized traffic flow and reduced congestion, autonomous vehicles can minimize stop-and-go traffic, leading to smoother and more consistent travel times. This can result in significant time savings for commuters and reduced fuel consumption. Moreover, driverless cars can be programmed to drive more efficiently, maximizing fuel efficiency and reducing emissions, thus contributing to a greener and more sustainable future.

Driverless cars also have the potential to improve accessibility and mobility. For the elderly, disabled, and underserved communities, autonomous vehicles offer newfound

independence and freedom of movement. People who are unable to drive due to physical limitations can regain their mobility through autonomous transportation solutions. Additionally, driverless cars can facilitate the growth of ride-sharing services and on-demand transportation, making transportation more accessible and affordable for a wider range of people.

The introduction of driverless cars can also have a transformative impact on urban planning and infrastructure. With the rise of autonomous vehicles, cities can rethink their designs, focusing less on parking spaces and more on creating pedestrianfriendly areas and green spaces. The need for massive parking lots can be reduced, freeing up valuable land for other purposes. Additionally, as driverless cars become more prevalent, they can integrate seamlessly with public transportation systems, providing efficient last-mile connectivity and reducing reliance on private vehicles. This integration can lead to more sustainable and interconnected transportation networks.

The benefits and impact of driverless cars are farreaching. They have the potential to revolutionize the way we travel by enhancing safety, improving

efficiency, increasing accessibility and mobility, and reshaping urban planning and infrastructure. As this technology continues to advance, it is crucial to address the challenges and concerns associated with autonomous vehicles, while also embracing the immense opportunities they offer for a safer, more efficient, and inclusive transportation system.

As the development of driverless cars progresses, it is essential to address the ethical considerations that arise with this transformative technology.

One significant ethical consideration is the decision-making algorithms employed in autonomous vehicles. These algorithms are responsible for making split-second decisions in potentially life-threatening situations. Moral dilemmas may arise, such as choosing between protecting the occupants of the vehicle and minimizing harm to pedestrians or other vehicles. Resolving these ethical dilemmas raises important questions about the value of human life and the principles by which these algorithms should operate.

Liability and responsibility are also critical ethical concerns surrounding driverless cars. In accidents involving autonomous vehicles, determining who is responsible can be challenging. Traditional notions of driver liability may no longer apply when human drivers are not involved. Establishing a clear framework for assigning liability is crucial to ensure fairness and accountability in these situations.

The cybersecurity risks associated with driverless cars present another ethical dimension. Safeguarding autonomous vehicles against potential hacking threats is paramount. Malicious actors could exploit vulnerabilities in the vehicle's software and systems, jeopardizing the safety of passengers and other road users. It is essential to prioritize cybersecurity measures to protect against these threats, ensuring the integrity and safety of autonomous vehicles.

Ensuring data privacy and protection is an additional ethical consideration. Autonomous vehicles generate vast amounts of data about their surroundings and occupants. Safeguarding this data from unauthorized access and misuse is crucial to

Penetration rate of light autonomous vehicles (L4) worldwide in 2021, with a forecast through 2030

protect the privacy and rights of individuals. Clear policies and robust security measures must be in place to prevent data breaches and uphold individuals' privacy rights.

During the transition period towards widespread adoption of driverless cars, the coexistence of autonomous and traditional vehicles on roads poses ethical challenges. Integration requires effective communication and cooperation between different types of vehicles. Ensuring that autonomous vehicles can operate safely alongside human drivers is crucial to avoid accidents and conflicts. Additionally, addressing the societal and workforce implications of autonomous vehicles is essential. The potential impact on employment, particularly for professional drivers, must be considered, and measures should be taken to mitigate any negative consequences.

Driverless cars raise important ethical considerations that must be addressed to ensure their responsible and ethical implementation. This includes grappling with decision-making algorithms and moral dilemmas, establishing liability frameworks, safeguarding against cybersecurity risks, protecting data privacy, managing the coexistence of autonomous and traditional vehicles, and addressing societal and workforce implications. By addressing

these ethical considerations proactively, we can navigate the path to a future where driverless cars enhance safety, efficiency, and convenience while upholding the values and principles that are essential for a just and equitable society.

The advent of driverless cars has paved the way for the evolution of Mobility as a Service (MaaS), transforming the way we perceive transportation and challenging the traditional model of car ownership. MaaS represents a shift towards mobility solutions that offer convenient and efficient alternatives to owning a personal vehicle.

With MaaS, individuals have access to a range of transportation options, seamlessly integrated through digital platforms. This includes ridesharing services, bike-sharing programs, ondemand shuttles, and public transportation, all accessible through a single app. The integration of driverless cars into MaaS further expands the possibilities, providing an additional layer of convenience and flexibility.

Integration with public transportation and other modes of travel is a key aspect of MaaS. By combining different modes of transportation, individuals can plan and optimize their journeys, making the most efficient use of available options. Seamless connections between driverless cars,

buses, trains, and other modes of transportation enable commuters to reach their destinations quickly and hassle-free, reducing congestion and improving overall mobility.

The transformation of urban landscapes is another consequence of the rise of driverless cars. As the need for parking spaces diminishes due to the shared and on-demand nature of autonomous vehicles, cities can reimagine the use of valuable urban space. Redevelopment of parking areas can lead to the creation of green spaces, pedestrian zones, or new infrastructure that better serves the community's needs. Additionally, the integration of driverless cars into intelligent transportation systems enables the development of smart cities. These cities leverage data and technology to optimize traffic flow, reduce congestion, and enhance overall urban efficiency

Technological advancements play a crucial role in shaping the future of driverless cars and MaaS. Continuous improvements in sensor technology and AI algorithms allow autonomous vehicles to perceive and understand their environment with greater accuracy and reliability. This enhances the safety and efficiency of driverless cars, making them more suitable for widespread adoption. Moreover, the development of electric and sustainable driverless vehicles further contributes to reducing carbon emissions and promoting environmental sustainability.

The evolution of Mobility as a Service, urban

landscape transformation, and technological advancements are driving the future of driverless cars. The shift from car ownership to integrated mobility solutions promotes efficiency, convenience, and reduced congestion. As cities embrace the potential of driverless cars and intelligent transportation systems, the urban

landscape will undergo transformations that prioritize sustainability and community needs.

As driverless cars inch closer to widespread adoption, their transformative potential cannot be overstated. These autonomous wonders promise to redefine the way we travel, offering safer roads, reduced congestion, and enhanced accessibility.

Recently, International Finance caught up with Amir Khajepour, Professor in the Department of Mechanical and Mechatronics Engineering at the University of Waterloo, and a Canada research chair in Mechatronic Vehicle Systems.

He is also a fellow of the American and Canadian Society of Mechanical Engineering (ASME and CSME) and is an associate editor of the International Journal of Vehicle Autonomous Systems and International Journal of Powertrain.

Professor Amir Khajepour’s areas of research are concentrated on vehicle systems. This includes the development of hybrid powertrains (electric and air hybrid engines), component sizing and power management design through concurrent optimization, vehicle modelling through real-time simulation and hardware-in-the-loop, active and adaptive suspension systems, and vehicle stability.

The driving force of Professor Amir Khajepour’s research is the modelling and control of dynamic systems.

His research has also extended to ultra-high-speed robotics, automated laser fabrication, and micro-electrical-mechanical systems.

Professor Amir Khajepour’s research has resulted in several patents, technology transfers, and over 320 journal and conference publications including three books and six book chapters.

In his interview with International Finance, Professor Amir Khajepour provides a captivating discourse on the intricate mechanics of driverless cars. With profound insights, he analyses the various advantages and drawbacks of this groundbreaking technology, delving into its profound impact on the job market, while highlighting the potential challenges that lie on the horizon.

IFM: How do driverless cars work and are they safe to ride in?

Professor Amir Khajepour: A driverless car is equipped with sensors and computers that enable it to perceive the environment, traffic, and other drivers' intentions. It follows

The safety of an autonomous car relies on our ability to accurately perceive the environment and make sound reasoning to determine driving decisions

However, navigating the challenges of ethics, cybersecurity, and societal impact will be crucial in realizing the full potential of this revolutionary technology. With ongoing advancements and concerted efforts from various stakeholders, the era of driverless cars is poised to reshape transportation as we know it, unlocking a future

driving rules and makes the decisions necessary to operate the vehicle. The safety of an autonomous car relies on our ability to accurately perceive the environment and make sound reasoning to determine driving decisions.

What is your take on driverless cars replacing human drivers in the near future?

Driverless cars are currently being utilized in dedicated or well-defined environments, but the complete replacement of humans in all driving conditions and environments is still a long way off.

How do driverless cars navigate and communicate with each other?

Driverless cars navigate using their onboard suite of sensors, GPS, and high-definition local maps. In the future, communication between vehicles can further enhance the safety of driverless cars.

According to you, what are the advantages of driverless cars?

Driverless cars can help alleviate driver shortages and improve

where efficiency, convenience, and sustainability go hand in hand.

As we prepare to embrace this new era, let us embark on a journey where technology seamlessly connects us to our destinations, paving the way for a brighter and more connected world.

operational efficiency in certain applications.

How do driverless cars detect obstacles and pedestrians?

There are various sensors, including LiDARs, cameras, and radars, that can detect objects, identify their types, and determine their speed and direction.

What are the ethical considerations of driverless cars?

This is a broad topic, primarily related to cases involving the prevention or mitigation of accidents. For example, it pertains to situations where a decision must be made during an emergency to prioritize the safety of pedestrians or the occupants of the vehicle.

Will driverless cars have an impact on the job market?

I don't believe that driverless vehicles will have a significant impact on the job market for vehicle drivers at this time, as their market share is still too small. However, they do have a positive impact on industries facing driver shortages, such as mining, farming, and others.

How do driverless cars handle rough weather conditions?

In most cases, autonomous vehicles are unable to handle rough weather

conditions and they fully transfer control to human drivers.

What are the current regulations and policies for driverless cars?

The development and adoption of autonomous vehicles and related regulations and policies vary depending on countries and jurisdictions. It is an evolving field, with some countries/jurisdictions being more advanced in this area while others have yet to embrace autonomous vehicles or develop any regulations/policies.

Can you tell our readers about the potential challenges one has to face as a result of the widespread adoption of driverless cars?

The current challenges lie in advancing vehicles to a higher level of autonomy where the complete removal of the human driver becomes feasible. Therefore, widespread adoption of driverless cars on public roads is not expected to occur in the near future to pose any potential challenge.

The idea of using gene editing to treat disease or alter traits dates back at least to the 1950s, when the double-helix structure of DNA was discovered

Medical innovations typically take 17 years, from the moment a lightbulb lights up in a scientist's mind to the first person to benefit from it. But every once in a while, an idea is so powerful and profound that its effects are felt much more quickly. That was with CRISPR gene editing, which celebrated its 10th anniversary in May 2023. It has already had a major impact on laboratory science, improving precision and accelerating research, and leading to clinical trials for a handful of rare diseases and cancers. Scientists predict that over the next decade, CRISPR will spawn several approved medical treatments that will be used to modify crops, making them more productive and more resilient to disease and climate change.

Gene editing is the ability to make highly specific changes in the DNA sequence of a living organism, essentially altering its genetic makeup. Gene editing is done using enzymes, specifically nucleases, which have been engineered to target a specific DNA sequence, where they make cuts in the DNA

strands, allowing the removal of existing DNA and the insertion of replacement DNA. Key to the gene editing technologies is a molecular tool called CRISPR, a powerful technology discovered in 2012 by American scientist Jennifer Doudna, French scientist Emmanuelle Charpentier and refined by American scientist Feng Zhang and colleagues.

The CRISPR worked precisely, allowing researchers to remove and insert DNA at desired locations. Significant advances in gene-editing tools have lent renewed urgency to long-standing debates about the ethical and social implications of genetic engineering in humans. Many questions, such as whether genetic engineering should be used to treat human diseases or alter traits such as beauty or intelligence, have been asked in one form or another for decades. However, with the advent of simple and efficient gene editing technologies, notably CRISPR, these questions were no longer theoretical and the answers to them had very real implications for medicine and society.

The idea of using gene editing to treat disease or alter traits dates back at least to the 1950s, when the double-helix structure of DNA was discovered. In the mid-20th century, researchers realized that the base sequence in DNA is mostly passed from parent to offspring faithfully, and that small changes in sequence can mean the difference between health and disease. The realization of the latter led to the inescapable assumption that with the identification

CRISPR will spawn several approved medical treatments that will be used to modify crops, making them more productive and more resilient to disease and climate change

of molecular flaws that cause genetic diseases, there would be an opportunity to correct those flaws and thereby enable the prevention or reversal of diseases. This thought was the basic idea behind gene therapy and was considered the holy grail of molecular genetics from the 1980s onwards. However, developing gene editing technology for gene therapy proved difficult. Many early advances did not focus on correcting genetic errors in DNA, but on attempting to minimize their consequences by providing a functional copy of the mutated gene, either inserted into the genome or as an extrachromosomal unit (outside the genome). While this approach was effective for some disorders, it was complicated and limited in scope. To truly correct genetic errors, researchers had to be able to create a double-stranded break in the DNA at precisely the desired location in the more than three billion strands of DNA that make up the human genome. Once the double-strand break was created, the cell could efficiently repair it using a template that directed the replacement of the defective sequence with the good sequence. However, making the initial break at precisely the desired location—and nowhere else—within the genome was not easy.

Before the introduction of CRISPR, two approaches were used to generate site-specific double-strand breaks in DNA: one was based on zinc finger nucleases (ZFNs) and the other was based on transcription activator-like effector nucleases (TALENs). ZFNs are fusion proteins composed of DNA-binding domains that recognize and bind to specific three to four-base pair sequences. For

example, to confer specificity on a nine-base pair target sequence, three back-to-back fused ZFN domains would be required. The desired arrangement of DNA-binding domains is also fused to a sequence encoding a subunit of the bacterial nuclease Fok1. To enable a doublestranded cut at a given site, two ZFN fusion proteins must be constructed, one binding to opposite strands of DNA on either side of the target site. When both ZFNs are bound, the neighbouring Fok1 subunits bind to each other and form an active dimer that cuts the target DNA on both strands.

TALEN fusion proteins are designed to bind to specific DNA sequences flanking a target site. But instead of zinc finger domains, TALENs use DNA-binding domains derived from proteins from a group of plant pathogens. For technical reasons, TALENs are easier to construct than ZFNs, especially for longer recognition sites. Similar to ZFNs, TALENs encode a Fok1 domain fused to the engineered DNA-binding region. Thus, once the target site is bound on both sides, the dimerized Fok1 nuclease can introduce a double-strand break at the desired DNA position.

Unlike ZFNs and TALENs, CRISPR uses RNA-DNA binding instead of protein-DNA binding to drive nuclease activity, simplifying design and allowing the application to a wide range of target sequences. CRISPR was derived from the adaptive immune system of bacteria. The acronym CRISPR refers to clustered, regularly spaced short palindromic repeats found in most bacterial genomes. Between the short

palindromic repeats are sequence sections that clearly originate from the genomes of bacterial pathogens. Older spacers are located at the distal end of the cluster and newer spacers representing newer pathogens are located near the proximal end of the cluster.

Transcription of the CRISPR region results in the production of small guide RNAs containing hairpin formations from the palindromic repeats linked to spacer-derived sequences, allowing each to bind to its respective target. The formed RNA-DNA heteroduplex then binds to a nuclease called Cas9, directing it to catalyze the cleavage of doublestranded DNA at a position near the junction of the target-specific sequence and the palindromic repeat in the guide RNA. Because RNADNA heteroduplexes are stable and because designing an RNA sequence that specifically binds to a unique target DNA sequence requires only knowledge of the Watson-Crick base pairing rules (adenine binds to thymine [or uracil in RNA], and cytosine binds to guanine), the CRISPR system was preferable to the fusion protein designs required to use ZFNs or TALENs.

Another technical advance came in 2015 when Zhang and colleagues reported using Cpf-1 instead of Cas9 as a nuclease pairing with CRISPR for gene editing. Cpf-1 is a microbial nuclease that offers potential advantages over Cas9, including the need to only require a CRISPR guide RNA for specificity and to make staggered (rather than blunt) double-stranded DNA cuts. The altered nuclease properties

may have allowed better control over the insertion of surrogate DNA sequences than was possible with Cas9, at least under certain circumstances. Researchers suspect that bacteria also harbour other genome-editing proteins.

CRISPR to treat cancer

CRISPR has the potential to improve cancer treatment, by boosting the immune system, It has been utilised in blood cancer patient trials since 2016 to alter the patients' own immune cells outside of the body to start an immunological attack on the malignancy. Multiple forms of blood cancer have been successfully treated using this strategy, known as CAR-T. Until recently, CAR-Ts had to be manufactured specifically for each patient, which required resources that some patients may not have.

According to Rachel Haurwitz, CEO, president, and co-founder of the company alongside Doudna, Caribou Biosciences is working

enabled the creation of animal models of human diseases and the removal of HIV from infected cells. In a mouse model of human disease, CRISPR-Cas9 was successfully used to correct a genetic error, resulting in the clinical rescue of diseased mice.

on an "off-the-shelf" version of the medication that will be available in a freezer for the following patient who requires it. Weeks of preparation time and possible costs would be reduced in this way. CRISPR has the potential to improve cancer treatment. It has been used in blood cancer patient trials since 2016 to alter the patients' own immune cells outside of the body to start an immunological attack on the malignancy. Multiple forms of blood cancer have been successfully treated using this strategy, known as CAR-T. Until recently, CAR-Ts had to be manufactured specifically for each patient, which required resources that some patients may not have.

or changing the genetic "letters" that are creating issues. Later this year, the first CRISPR-based gene treatment for sickle cell disease is anticipated to receive approval, USA Today reported.

Applications and controversies

CRISPR has been used in a variety of ways. For example, it has been applied to early embryos to create genetically modified organisms and injected into the bloodstream of laboratory animals to achieve extensive gene editing in subsets of tissues. CRISPR-based approaches have been used to alter the genomes of crop plants, livestock, and laboratory model organisms, including mice, rats, and nonhuman primates. By modifying the genomes of bacteriophages (bacteria-killing viruses) with CRISPR technology, scientists have been able to develop methods to destroy antibiotic-resistant bacteria. CRISPR systems also

In 2015, a group of scientists that included Doudna advocated caution in applying CRISPRCas9 technology to humans, at least until the safety and ethical implications of human gene editing could be properly considered. Other researchers advocated going full steam ahead, arguing that the new technology held the key to alleviating many human ailments and that it would be unethical to withhold it. Around the same time, reports from China indicated that gene-editing experiments had been carried out on human embryos. In late 2018, a Chinese scientist announced the birth of the world's first genetically engineered human babies. The infants, twin girls, are said to carry an altered gene that reduces the risk of HIV infection. The positive and negative consequences of these activities were seen as potentially redefining the future of human genetics.

CRISPR gene editing is revolutionizing genetic engineering, with the potential for medical treatment and agriculture. Despite ethical debates, CRISPR has shown promise in laboratory science and clinical trials due to its precise DNA-editing capabilities. We can see CRISPR advancements in future.

A single genetic "misspelling" is responsible for more than 6,000 uncommon inherited disorders. For these, CRISPR gives the option of eliminating the problematic gene, boosting an alternative gene, editor@ifinancemag.com

In 2023, ChatGPT (Chat Generative Pretrained Transformer) will become a game changer in the worlds of artificial intelligence and natural language processing. This cutting-edge technology has revolutionised the way we interact with machines, making communication faster, more intuitive, and more human-like.

It is a type of machine-learning algorithm that has been specifically designed to understand and interpret human language. By training on vast amounts of text data, ChatGPT can learn to generate responses to questions and conversations in a way that is both natural and accurate.

One of the most exciting aspects of ChatGPT is its versatility. It can be integrated into a wide range of applications, from chatbots and virtual assistants to customer service platforms and social media networks. This means that users can interact with machines in a more seamless and intuitive way than ever before.

ChatGPT is also highly adaptable, which makes it an ideal solution for businesses looking to automate their customer service operations. By integrating ChatGPT into their platforms, companies can reduce the time and resources required to handle customer queries and complaints. This, in turn, can lead to higher customer satisfaction and loyalty, as well as increased revenue.

Perhaps the most impressive aspect of ChatGPT is its ability to learn and improve over time. As users interact with the technology, it gathers data about their preferences and behaviours, allowing it to tailor its responses more effectively. This means that the more people use ChatGPT, the better it becomes at understanding and interpreting human language.

Of course, like any emerging technology, there are some potential drawbacks to ChatGPT. One concern is that it could lead to job losses as more companies look to automate their customer service operations. However, proponents of the technology argue that it will create new jobs in the fields of artificial intelligence and machine learning, as well as free up human workers to focus on more complex and creative tasks. Here are a few possible scenarios where ChatGPT is used.

ChatGPT could be used as a personal assistant for individuals, helping them with tasks like scheduling appointments, making travel arrangements, and answering questions.

ChatGPT could be used by businesses to provide 24/7 customer support via chat or messaging platforms. ChatGPT could help

ChatGPT is highly adaptable, which makes it an ideal solution for businesses looking to automate their customer service operations

AYALA is a unique residential project, presenting the most elegant and modern villas in Al Khobar City.

retal.com.sa

customers with common inquiries and provide guidance on product or service issues.

Language Translation

ChatGPT could be used to translate text from one language to another in real-time. This could be particularly useful for businesses that operate in multiple countries or for individuals who communicate with people from different parts of the world.

Content Creation

ChatGPT could be used to create content, such as articles or reports, based on a set of guidelines or specifications. This could be useful for businesses that need to produce a large amount of content quickly and efficiently.

ChatGPT could be used as a virtual tutor or teacher, helping students with homework, providing explanations of complex topics, and offering personalized learning experiences.

Another concern is the potential for ChatGPT to be used for malicious purposes, such as spreading misinformation or propaganda. While this is certainly a possibility, it is important to note that ChatGPT is only as good as the data it is trained on. By ensuring

that the data is accurate and unbiased, developers can minimize the risk of the technology being used for harmful purposes.

Overall, it is clear that ChatGPT is a game changer in the world of artificial intelligence and natural language processing. Its ability to understand and interpret human language in a natural and intuitive way has already had a significant impact on the way we interact with machines, and this impact is only set to grow in the coming years.

Whether you are a business owner looking to streamline your customer service operations or simply someone who wants to interact with machines in a more natural way, ChatGPT is a technology that is worth exploring. As we move further into the 21st century, it is technologies like ChatGPT that will continue to shape the future of our digital interactions.

Mr. Harsh Suresh Bharwani is the CEO and MD of Jetking Infotrain. He spearheads the international business, dedicated services, and employability initiatives at Jetking Infotrain. In the past decade, Harsh has trained over 40,000 students on success, confidence, social skills, leadership, business, health, and finance.

editor@ifinancemag.com

An integrated city, included with the availability of all services, the proximity of distances from the most vital places between Al Khobar and Dammam. Also, a sustainable infrastructure with excellent standards.

retal.com.sa

Sri Lanka defaulted on its $51 billion foreign debt for the first time since gaining independence in 1948 as it grapples with its worst economic crisis

In April, the World Bank invited several leading experts to explore prospects for a new global financial architecture for debt. Speakers discussed lessons from past restructuring efforts, the role of the private sector and the increased need for debt transparency. Zainab Haruna from Nigeria started the conversation by explaining how government debt can affect the lives of ordinary people.

Angolan Finance Minister Vera Daves spoke with World Bank Group Ex-President David Malpass on how the economic fallout from COVID-19 and Russia-Ukraine has impacted their country's revenue and debt. Kevin Watkins, CEO of 'Save the Children,' and K.Y. Amoako, President of the African Center for Economic Transformation, described how unsustainable debt can slow countries' progress and divert resources that could otherwise be used to invest in health, education and more.

Citi's Julie Monaco and World Bank Chief Economist Carmen Reinhart both referred to the debt crises of the 1980s and 1990s and the lessons this challenging era can offer. Last year, Sri Lanka defaulted on its external

debt (excluding debt to multilateral organizations such as the World Bank) and in July 2022 saw the resignation of an Executive President for the first time in Sri Lanka's history. The country faced a shortage of fuel, cooking gas, medicines and many essential goods.

At the same time, the country faced a massive political crisis that sparked island-wide protests that led to the resignation of Mahinda Rajapaksa as prime minister in May last year. Two months later, President Gotabaya Rajapaksa, Mahinda's brother, also had to resign.

The island nation has defaulted on its $51 billion foreign debt for the first time since gaining independence in 1948 as it grapples with its worst economic crisis. The South Asian country was grappling with soaring inflation of 17.5%, a 12-hour power outage, and dwindling foreign reserves.

While many experts have pointed out that excessive government spending, tax cuts and the first and second waves of COVID-19 worsened the country's economic crisis, others believe Sri Lanka's close ties with China have fueled the country's debt crisis. However, Sri Lanka is not the first country to default on its debts. Over the past century, several countries have defaulted on one or more occasions. According to the World Economic Forum, 147 countries have 'sovereign defaulted' on their debt since 1960.

Governments are typically reluctant to default because it is likely to lock the country out of debt markets for years to come and make borrowing more expensive, at least for a period when it becomes possible again

Sovereign bankruptcy is the failure of a national government to repay its debts. Governments are typically reluctant to default because it is likely to lock the country out of debt markets for years to come and make borrowing more expensive, at least for a period when it becomes possible again. Lenders have limited recourse in the event of a sovereign debt default, as no international court can force a country to pay, although it can claim the defaulted borrower's assets abroad. Countries borrowing in their own currency can always print more as an alternative to sovereign default. and may also avoid doing so by generating more tax revenue.

Private investors investing in the sovereign debt of other countries closely study the economy, public finances and politics of a bond-issuing country to assess and assess its risk of default. Other countries and multinational lenders such as the International Monetary Fund (IMF) and the World Bank lend to states to achieve policy goals ranging from improving the borrowing country's governance to boosting the lender's exports, and

may be able to insist on their repayment even if the borrower defaults on other debts.

Government bonds issued in local currency may also attract private foreign investors, but are often primarily bought by the country's banks and private individuals. A default by a sovereign in its own currency is easier to avoid and can be more politically painful than a default on external debt. Because a national bankruptcy entails a number of costs and economic risks, it is usually used as a last resort. Severe economic downturns, financial crises and political unrest can trigger a national bankruptcy. For example, Russia's default in June 2022 was the result of economic sanctions imposed on the country for its invasion of Ukraine, including a freeze on Russia's foreign exchange reserves abroad.

Experts say, a nation may have momentarily defaulted if it temporarily delays interest payments on a small number of its bonds for administrative reasons unrelated to its capacity or willingness to repay debt, as the US Treasury once did in the 1970s. So long as the

repayment snag is quickly ironed out, such a 'default' is unlikely to have any long-term consequences, or to be widely viewed as one. For instance, amid one of the US government's recurring episodes of debt ceiling brinkmanship, the United States continues to be among the highest-rated sovereigns in the world, despite Standard & Poor's downgrading its long-term rating for US national debt from AAA to AA+ in 2011.