International HR Adviser

The Leading Magazine For International HR Professionals Worldwide

FEATURES INCLUDE:

Mind The Gap! - Expectations Vs Reality In Workforce Analytics

Taxing Issues: Expatriate Terminology - Understanding The Tax Adviser

Global Tax Update • Unlocking The Potential Of Serviced Accommodation For Human Resources Needs

The 360o Global Mobility Leader - Skills For Success And Survival In A Dynamic And Disrupted Mobility Environment

Traversing The Great Divide: How HR Professionals Facilitate Civil Conversations On The Future Of AI

Developing And Implementing HR Strategy On The Cusp Of The Digital Era

2023 Key Issues

ADVISORY PANEL FOR THIS ISSUE:

SUMMER 2023 ISSUE 93 FREE SUBSCRIPTION OFFER INSIDE

In This Issue

Mind The Gap! - Expectations Vs Reality In Workforce Analytics

Alister Taylor, Deloitte's Global Workforce Practice

Taxing Issues: Expatriate Terminology - Understanding The Tax Adviser

Andrew Bailey, BDO LLP

Global Tax Update

Andrew Bailey, BDO LLP

Unlocking The Potential Of Serviced Accommodation For Human Resources Needs

Charlie McCrow, Executive Roomspace Ltd

The 360o Global Mobility Leader - Skills For Success And Survival In A Dynamic And Disrupted Mobility Environment

John Kerr, Pinsent Masons

Traversing The Great Divide: How HR Professionals Facilitate Civil Conversations On The Future Of AI

Merilee Kern

Developing And Implementing HR Strategy On The Cusp Of The Digital Era

Mostafa Sayyadi, The Change Leader Consulting Inc., and Michael J Provitera, Author, Mastering Self Motivation

2023

Jordan Turner, Gartner

1 CONTENTS 2 5 12

Key Issues

Free Annual Subscription Directory While every effort has been made to ensure accuracy of information contained in this issue of “International HR Adviser”, the publishers and Directors of Inkspell Ltd cannot accept responsibility for errors or omissions. Neither the publishers of “International HR Adviser” nor any third parties who provide information for “Expatriate Adviser” magazine, shall have any responsibility for or be liable in respect of the content or the accuracy of the information so provided, or for any errors or omissions therein. “International HR Adviser” does not endorse any products, services or company listings featured in this issue. www.internationalhradviser.com Helen Elliott • Publisher • T: +44 (0) 20 8661 0186 • E: helen@internationalhradviser.com Ben Everson • T: +44 (0) 7921 694823 • E: ben@internationalhradviser.com International HR Adviser, PO Box 921, Sutton, SM1 2WB, UK Cover - Annca from Pixabay In Loving Memory of Assunta Mondello 10 17 19

by Debbie Morgan and Printing by Gemini

International HR Adviser with a clear eco conscience. 15 23 7 24

Origination

Group The International HR Adviser team work with a British planet positive printer, with a commitment to best practice environmental management including achieving the top score in Europe for the Green Leaf Awards, full FSC Certification, and ISO14001. Well managed sourcing of both virgin pulp and recycled papers, in addition to carbon balancing ensures that you can enjoy

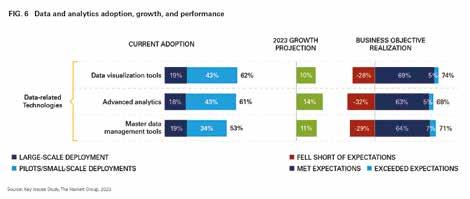

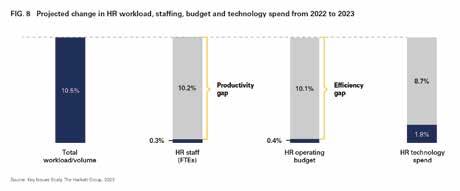

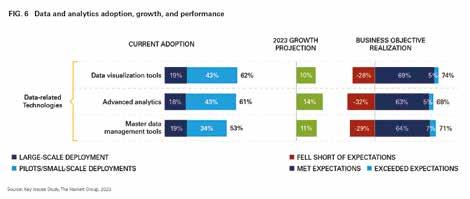

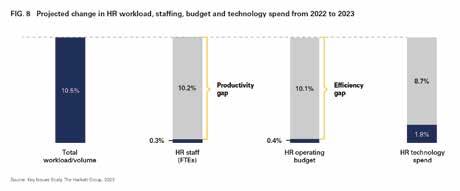

Mind The Gap! - Expectation Vs Reality In Workforce Analytics

With due apology for the misappropriation of a famous Jane Austen literary reference, ‘it is a truth universally acknowledged’ that a person in possession of good data has a significant advantage in their ability to influence their environment. Whether it’s selecting baseball players to win matches or deciding which product to buy, there are few who would argue that they are impervious to the influence of data-driven insight.

Ubiquity Of Data

Data is all around us, in our private lives and at work. We create data for others to use, we consume data to help make decisions and we often rely on complex systems to predict and project an appropriate outcome. If you need convincing of this, take a typical day and count the number of times some form of data analysis has influenced what you do. As I write this article for example, analytics in my word processing software is full of suggestions on ways in which I can improve my grammar. This type of interaction is becoming more prevalent as technology advances and generative AI becomes de rigueur. In turn, this has given us a heightened expectation about the direction of travel, particularly in the area of work. The future of work is data-driven, but we can sometimes feel unsure of who is in ultimate control. Some people are excited about such advances, whereas others are more cautious.

Utility Of Data

The objective of this article is to illustrate that data is not only one of the most influential resources at our disposal, but also one of the most accessible and, therefore, should not be ignored.

For those not convinced that data analytics warrants attention in your area of work, let’s first look at the ‘why’ before moving on to suggestions on how to make tangible progress.

At a fundamental level, the benefits of utilising data fall into two broad categories:

1. It helps make better informed decisions. Instead of acting purely on intuition, when

we have data available, we are better able to make an informed call. It is worth considering the different forms this can take:

• Delivering the relevant timely data and information, potentially leading to reduced risk of error or decision bias, e.g., live and interactive dashboards

• Delivering likely outcomes from different actions, leading to an increased understanding of possible consequences, e.g., predictive analytics

• Identifying blockers or enablers with causal links to intended objectives, leading to a better understanding of the ‘levers to pull’ for targeted results, e.g., determining the benefits that have a causal effect on wellness.

2. It influences behaviour by encouraging action. The other less considered benefit is that delivering the right data doesn’t just increase our knowledge, it causes or motivates people to behave in a certain way.

A good example of this is seen when considering speed cameras. Not the kind that take a picture and trigger a fine, rather, the sort that displays a smiley or sad face depending on speed. Despite the fact there is no fine or any other consequence, studies have shown (1) that simply displaying a happy face when travelling within the speed limit works in curtailing the speed of drivers. I believe the reason is because people are receiving immediate feedback data on something they can influence. When the outcome is something the individual wants, this often encourages people to act.

Relevant data displayed in a timely way that resonates with the recipient, can lead to changes in behaviour. In the work context this can look like:

• Sending regular updates on progress against a specific target, or KPIs encouraging action because ‘what is measured gets done’

• Creating rules to automate or nudge particular behaviours is a reminder that encourages action from people who are bought into the bigger picture

• Showing predictions of how actions influence outcomes helps users see the value in what they are about to do.

The use of AI, particularly Machine Learning, has helped improve outputs in both categories and to deliver otherwise unobtainable insights. However, there is much that can be achieved without AI. It is frustrating to consider how many strategic initiatives may have failed because people are too busy to track the outcome required, or how much time may have been wasted when we do what ‘felt right’ in the moment to impact vague targets without the necessary data-driven validation. These instances can be reduced by turning to data. However, all too often many fail to reach for this readily available and effective resource.

Life In ‘The Gap’

Why is the effective use of data not a priority for many organisations?

One of the reasons for this stalemate is that there is a dichotomy at play. Heightened expectation as to the possibilities of utilising data analytics almost always co-exists with a

2 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

perceived ‘reality check’ about data analytic capabilities. Put another way, there is almost no doubt that there is a data-driven solution, but there is pessimism for many about the reality of what can be done now.

This gap has led to unhelpful pressure from stakeholders due to two competing perceptions:

1. We should be able to achieve ‘mindblowing’ things, and

2. Data analytics is too difficult for my team to competently deliver. These perceptions often lead to inactivity, whilst also leaving a sense of resentment. The key first step for progress is to close the gap between expectation and reality.

We need to shift our thinking, so that our perceptions are more realistic. We should be able to say:

1. There is much value to be gained by focusing on how available data influences the things that matter to us, and

2. With a little effort, not only can our team competently deliver data analytics that enhances our services today, but our people are training to meet the needs of tomorrow.

By shifting our thinking in this way, we will identify opportunities to deliver value and reduce the resentment created by the perception of being ‘left behind’.

Minding The Gap - Step 1: Shift Your Expectations

One reason this is an issue is that data is often only considered in limited and obvious cases. A key first step is therefore to shift expectations to better understand where data can help.

Is It Something Data Can Help With?

Last year, at the Deloitte GES Client Summit, we held a workshop entitled ‘Adopting a data-driven approach in support of your purpose agenda’. We chose this topic because, despite its importance, it is often ignored in the bustle of the day-to-day, often being perceived as too nebulous a concept to get to grips with in a practical way. A recent

Deloitte study found that ‘while roughly two-thirds of employees [in our survey] believe that their organisation has a clearly defined purpose and that it is … true to its purpose, only half (52%) agreed that external purpose communications are consistent with internal practices’. (2) Judging by the workshop feedback we received however, people left the room with increased confidence that data is one of the key resources to use to enhance their purpose agendas.

The reason for this confidence is that the conversation we had shifted the expectation of what data can be used for to include tailored components of importance to each attendee. We thus moved from an inaccessible view of what we should do based on complex techniques, to a more realistic and practical aim of what we can do with available data.

The way that we did this was first to identify the strategic priority befitting the function, then to determine the relevant available data which realises the practical and strategic aim.

The Practical And Strategic Aim

There is little point in measuring data that is not connected to strategic objectives. However, not all strategic priorities have obvious metrics. The first step is therefore

to identify components of the strategic objectives that can be measured. An obvious example is wellness, which is notoriously difficult to measure reliably. However, there are peripheral objectives that could be used as a proxy for wellness, such as sickness or retention statistics or uptake of wellness initiatives. Focusing on these proxies enables you to identify metrics that are both practical and strategic that stakeholders can get behind. The next step is to find data that could provide information on the aims in question. It is essential to look at the type of data as well as its accuracy and completeness, together with what would be needed to keep the data in a useable state. Where no data is available, look at what additional data can be sourced. All of this plays an important part in understanding the limitation of what can be delivered, and therefore ensures we are left with a realistic practical aim arising from the data analysis.

By identifying the priority and focusing on the available data, we were able to determine concrete ways in which our functions can use data to help in achieving the strategic priorities.

Do you know if you have data that can help with the realistic practical aims of your team? The impact of shifting your expectation of data analytics to something practical could be significant.

Minding The Gap - Step 2: Shift Your Understanding Of Reality

What about our capabilities, how do we shift our expectations there?

A couple of years ago, I wrote an article for this magazine (3) covering some fundamentals to get the business function ready to enable a strategic impact from people data. The aim of the article was to encourage people to focus on the right foundations.

This time, we will examine some of the most common excuses I hear for why people-functions often feel unready to use data and look at why these perceived barriers should not stand in your way.

3 INTERNATIONAL HR STRATEGY www.internationalhradviser.com

Most commonly heard excuses:

1. “Our data is rubbish and of course ‘rubbish in’ leads to ‘rubbish out’” – This makes it sound like bad data is something that cannot be fixed. However, with new data wrangling products, it is becoming easier to address this challenge without big investment. When it comes to imperfect data, a better phrase perhaps is “do not let great be the enemy of good” and look for the value to be drawn from imperfect data.

2. “GDPR rules would mean we can never get access to that data” – When it comes to dealing with the people data of your workforce, data privacy concerns are of course very important. However, often this excuse is used by people who have not thought through the detail needed. It is recommended therefore to ask, ‘Why not?’. All too often the rules are used as an excuse because this is a relatively new frontier. Even where there are legitimate concerns about elements of the data required, you may get access to a portion of it, which could be enough. On a practical level, it is useful to get the data protection officer involved early and often in these matters. If you don’t know who that is, a good start is to find out.

3. “We don’t have the people to deliver this type of project” – No longer is data analytics the sole realm of the specialist. With a bit of aptitude, it is getting increasingly easy to undertake data work with codeless products on the market to cleanse, wrangle, analyse and visualise the data. Do you have a strategy for figuring out what are the required skills and how you can build them?

4. “Is there sufficient Return on Investment (ROI)?” – We do not focus on insight for insight’s sake, so ROI is key to any project. To best maximise ROI, it must be connected to business needs, integrated into ‘business as usual’ processes and be focused on realistic outcomes. Also, it must be agile and change if business needs change.

5. “I’m not convinced that a data-based approach will have an impact” – As previously stated, data is a key lever to pull to achieve your strategic priorities. If you are not convinced, start small and get something done to demonstrate value. If you doubt the value in shifting your reality (and increasing your capability) today, think about where you will be as a function in three years’ time. Do you think it is likely you will be more data-driven? The effort made now will make you and your team more future-ready. With the fast advances in AI, one would argue this is something that cannot be left any longer.

Life In ‘The Overlap’

Once you close the gap between expectation and reality, there is an overlapping sweet spot where analytics is truly delivering tangible value in progressing your strategic priorities.

I hope you can see, not only that data is one of the most influential tools at our disposal, but it can also be one of the simplest and most accessible tools available. Focusing on the right priorities without being distracted by the heightened expectation will mean there is no longer the frustration of being left behind.

Of course, we shouldn’t stop there. As value is clarified and ROI on data analytics is realised, there will come a time for further opportunity to invest in capability. Taking these first steps will help you become ready and in control of that data-driven future, where current data science ‘fiction’ will be as common as spreadsheet files are now in supporting the management of your people. Closing the ‘gap’ should mean we can all be excited about where we are headed.

References:

(1) For example, see - www.wired.com/2011/06/ ff-feedbackloop/

(2) www.deloitte.com/uk/en/insights/topics/ strategy/mind-the-purpose-gap.html

(3)Winter 2020 03 International HR Strategy.pdf (internationalhradviser.co.uk)

ALISTER TAYLOR

Director, Global Workforce Analytics

D: +44 20 7303 0403

alistertaylor@deloitte.co.uk

www.deloitte.co.uk/globalworkforce

DELOITTE’S GLOBAL WORKFORCE PRACTICE

Deloitte’s Global Workforce team partners with organisations to establish future-proof global workforce strategies, tailored to client specific business and talent objectives. We embrace design thinking and are data-driven to help clients reimagine and transform their approach to talent mobility, focusing on areas including policy and process design, strategic and operational transformation, global talent strategies, digital innovation, planning and deployment, and workforce analytics. Find out more here: www.deloitte.co.uk/ globalworkforce

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.

© 2023. For information, contact Deloitte Global.

4 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

Taxing Issues: Expatriate TerminologyUnderstanding The Tax Adviser

As we continue to come out of the Covid restricted mobility period, businesses are once again starting to move employees to work in other countries. You may not have dealt with a ‘traditional assignment’ for some time, so this article seeks to provide a quick refresher of some of the terminology you will encounter and will need to navigate when dealing with a new assignment and a tax adviser.

For example, let’s assume you were busy working when your HR director called to tell you that you needed to deal with expatriate issues relating to an employee who is to work in another country. They are due to start in the next two weeks and the HR director is immediately off on holiday. You have just talked to the individual and now it is time to talk to the tax adviser to take matters forward.

If you are new to dealing with expatriates, the terminology used may appear to be a totally different language to that with which you are familiar. This article looks at some of the terminology and aims to help you understand why the adviser is asking you so many questions. As ever, different meanings and terminology may be used within your own company and by tax authorities and advisers around the world. .

Assignment Recap

A quick recap… The individual has told you that they are going on an assignment of 6 to 12 months with a possible extension, and they are remaining employed in the home country. They will be paid various assignment allowances and tax equalisation will apply. You have drafted out the assignment letter, wanted an idea about the tax implications and have now called the tax adviser to talk through the issues.

The initial questions from the adviser are aimed at gathering sufficient data about the assignment, the individual, the assignment package, and the aims of the company. Once we have an overview we can start to advise on the potential implications, the possible alternatives/variations if indeed feasible, and the next steps.

Residence And Domicile Status And Other Determining Factors

Tax is usually based on a variety of factors which may include the residence status, the domicile status, citizenship, centre of vital interests and the place of performance of the duties. Consequently, you will be asked many background questions.

Residence Status - individuals who are resident in a country may often be subject to taxation on their worldwide income. Nonresidents are usually only subject to taxation on income arising in the relevant country. It is therefore essential to ascertain whether an individual will be tax resident or not. In many countries, residence status is based on one or a combination of the following:

• A numerical day test

• The availability of a permanent home

• Intentions about the individual’s presence in the country

• Registration for immigration purposes

• Nationality

• Employment by a governmental/state organisation.

The days test is usually based on whether the individual will be in the country concerned for 183 days or more. You do need to check whether the 183 days are restricted to a single calendar year or tax year or whether the period can span years, for example, Germany. Do remember that most countries tax year is based on the calendar year but as ever there are exceptions such as India, Australia and the UK.

The permanent home factor is not always restricted to one which the individual owns. A ‘permanent home’ can be rented accommodation or potentially the same hotel room or a room always available with a family member. An assignee’s intentions may also play a part in determining the residence status. Registration status with the local municipality, police authorities or residence status for immigration purposes can also influence the residence status. The nationality of the individual may be a determining factor, for example, US citizens are taxable on a worldwide basis. Employment by a government organisation or state authority usually leads to continuing taxation by that organisation or authority.

You do need to check the rules applying to the assignment country as determining factors for residence status will vary.

Domicile Status - is used by a few countries, for example, the UK, in determining taxes. Domicile usually has a degree of permanence and temporary absence may be insufficient to avoid continuing taxation. The status may focus on where the individual was born, their family background and where they usually live.

Centre Of Vital Interests - This test is often also associated with treaty claims. It looks at the wider connections to a particular country such as where the family is located, where are the business ties such as the place of work, the employer and where are personal ties such as investments and property?

Place Of Performance Of Duties – In general, taxation is based on the physical location of the performance of duties and not on the actual work being undertaken. For example, if you are sitting physically working in Germany then even though you may work on a project for a Spanish company this is work in Germany.

Do remember that even though the individual may not be resident for tax purposes in the country a tax liability may still arise there. The general rule applying is that an individual working in a country is subject to taxation there unless a double taxation treaty will apply to allow tax exemption.

Please be aware that certain countries, for example, Switzerland and the US, operate both Federal and State or Cantonal taxes. Municipal and City taxes may also be levied in other locations. The various subsets may also have slightly different resident definitions and/or taxation rules. For example, an individual may be liable to US tax on a State but not Federal level.

The tax advisers’ guidance will focus on ascertaining original intentions so that key dates and cut offs can be identified. Deferring, accelerating, curtailing and extending an assignment can have a material impact notwithstanding the fact that mere days may be involved. The adviser will provide guidance as to whether or not the individual will be resident in a location, what that means, and potential tax breaks that may exist, together with qualification requirements. Background information about the individual including information such as the length of assignment, the accommodation available, the whereabouts of the family, the employer and place of performance of duties are

5 TAXATION www.internationalhradviser.com

essential in helping the adviser to provide best possible advice. The more information you can provide, the easier and cheaper it is for the adviser to provide you with guidance.

Income Tax

With regard to income tax, you need to distinguish between three different taxing issues. These being;

• Wage withholding tax

• Individual income tax

• Tax equalisation/hypothetical tax.

Wage Withholding Tax – as the name suggests this represents a withholding from the wage as advance payment towards the individual’s income tax liability. Examples include the UK’s Pay As You Earn (PAYE) and Australia’s Pay As You Go (PAYG) systems. The exact withholding mechanism will vary from country to country although usually the burden of withholding is imposed on the employer that has the use of the individual’s services whilst they are on assignment. Related monthly, quarterly and annual filings may be required by the revenue authorities. Questions from the adviser are aimed at determining who will operate wage withholding if applicable, together with an outline of the various requirements.

Please be aware that even though an individual may be exempt from tax in a particular jurisdiction due to, for example, application of tax treaty exemption, this may only apply on an individual basis. You cannot assume that corporate withholding is similarly and automatically exempted. You may need to apply for such corporate withholding exemption – sometimes in advance of the commencement of the assignment.

Individual Income Tax – tax on wages is mostly collected through the withholding system, although in some countries it may be collected through a system of advance payments. At the year end, usually, there is the requirement for the individual to file an annual tax return. Do note that China, for example, requires individual monthly tax returns. In some countries filing as a family unit is required, whereas in others partners/spouses have to file separately. Additionally, in some countries such as the US you may get a choice. Tax liabilities can depend on family status and questions around the marital, personal status and number of children are aimed at determining the impact. The tax return is usually the reconciliation with any withholding tax deducted, with the tax return based on actual income figures and deductions/exemptions. Excess tax will be refunded or additional tax will need to be paid. Advice provided will focus on the procedure, relevant dates and requirements, together with an overview of the tax rates and bands applying.

In addition, the adviser will review the proposed assignment package on offer to the individual to consider whether the proposed salary components and benefits can be

provided more tax effectively in a slightly different manner. Provision of housing for example, is sometimes more tax effective where it is provided by the employer. The added cost, direct or indirect, of employer involvement needs to be considered. The adviser will also seek clarification of the exact employer throughout the assignment. They will need to know whether the home country entity remains the underlying contractual employer or not. Expatriate tax concessions usually hinge on this point. Please be aware that the entity paying the individual is not necessarily the contractual employer, and this often gives rise to confusion.

Tax Equalisation/Hypothetical Tax –Where this applies this is not ‘real’ tax, but a calculation agreed between the employee and the employer. It is generally based on what an individual would have paid in taxes on their standard pre-assignment enhanced package had they remained in their home country. This is usually the number on which the assignee is most focused.

Once you are aware of the differences between the three potential taxing issues, both the issues and terminology start to fall into place.

Social Security

Social security (National Insurance in the UK) liabilities can be greater than the tax liabilities particularly for the employer. As with tax it is important to know which entity is the contractual employer, the duration of the assignment and the place of performance of duties. An understanding of the family situation and personal ties is also required. Do be aware that social security definitions such as residence status may vary from those used for income tax purposes.

On provision of the data the adviser can ascertain where the social security liability will arise, the mechanism for payment, and potential variations by, for example, changing the contractual employer. This may of course have tax or legal implications and immigration issues may also need to be considered.

Tax And Social Security Treaties

Treaties are primarily designed to avoid dual liabilities that arise under domestic rules and to determine which country has the right to levy tax or social security and, if dual liabilities arise, which country allows the tax credit.

Tax treaties tend to follow a pattern but all are different and you do need to look at each one in order to identify the variations. Increasingly tax treaties are designed for short-term assignments only with 183 days being a critical factor in relation to employment income. Generally, a liability to tax will arise where the individual is at the location for 183 days or more. Exemption is usually possible where the individual is at the location for less than 183 days, although issues such as the identity of the contractual employer

and the inter-company charging position will need to be ascertained.

Social security treaties generally attribute liability to just one country. Such treaties are separate to tax treaties, will have different conditions and definitions and a liability can arise in a different location to the tax liability. Social security treaties are not as numerous as tax treaties and where treaties do not exist, dual or overlapping liabilities can arise. Credit for dual social security contributions is generally disallowed and is an added assignment cost.

The adviser will let you know whether treaties will apply, the implications including how the situation will interact with the domestic position, together with how the assignment might be adapted to minimise costs.

Summary

The more facts you know about the assignee and the assignment the better. This will help the adviser to guide you through the various issues and possibilities. If you do not understand the terminology or issues do ask. The adviser should be only too willing to assist you.

Having spoken to the adviser you now know what to say to the expatriate and the HR director, how to take the assignment forward, potential pitfalls to avoid and possible variations to make it more costefficient. With a good adviser it is relatively easy to understand the main tax and social security issues relating to an assignment. If you don’t have an adviser how do you go about choosing one in the first place? This will be the subject of my next article in the September edition of International HR Adviser.

Andrew Bailey is head of Global Employer Services at BDO LLP. He has over 30 years’ experience in the field of expatriate taxation. BDO is able to provide global assistance for all your international assignments. If you would like to discuss any of the issues raised in this article or any other expatriate matters, please do not hesitate to contact Andrew Bailey on +44 (0) 20 7893 2946, email Andrew.bailey@bdo.co.uk

6 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

ANDREW BAILEY

Global Tax Update

This global tax update article focuses predominantly on changes to occur within the EU, together with a tax update regarding Ireland.

Whilst not directly tax specific, the EU’s Platform Worker proposals could result in significant changes to the tax and social security treatment of individuals working within selfemployed contractor models in Europe.

The EU Framework Agreement changes reconsider the social security impact of cross-border teleworkers, whose numbers have swelled during and following the Covid pandemic. Tax authorities around the workd are slowly turning their attention to individual and corporate tax implcations of such teleworkers, and we expect tax rules will change in the future to reflect the modern day reality of international remote working.

Is the EU Directive on improving working conditions in platform work a threat to the use of self-employed contractor models in Europe?

In February 2023, the European Parliament voted in favour of amendments to the European Commission’s Platform Worker Directive that would introduce a legal presumption of employment for selfemployed platform workers and greater transparency regarding how artificial intelligence is used in this sector.

The directive does not only apply to platform work companies but may also apply to Employers of Record (EORs)/Agents of Record (AORs), as well as self-employed contractors and gig workers in Europe engaged via staffing companies. Increased remote working following the Covid pandemic has accelerated the use of such alternative ‘employment’ structures.

Based on the directive, persons currently considered self-employed may qualify as workers and as a result, local employment and tax laws would apply to them. This could mean that entire business models may have to be adapted. Companies may already need to act, considering the potential impact to their business and the time any changes may take to implement.

This article aims to alert companies, enabling them to take timely action, when necessary, by setting out what exactly the directive entails, which companies are or may be covered, what the impact of the directive will be and what steps can (and should) be taken now.

Timeline

The European Council is expected to approve the proposed directive in early 2024. Once approved, EU member states will have two years to implement the directive into national law.

member states transpose the directive into national law. Contractual relationships entered into before that date (and still ongoing on that date) are therefore not affected by the legal presumption.

The directive also introduces additional rights and obligations to ensure that more transparency is in place regarding the use of algorithms in platform work. For instance, platforms will be obligated to inform platform workers about the operation and the results of the algorithm being used. The operation of the algorithm on working conditions also must be tested. Platform workers will have to know which actions are monitored, evaluated, and rewarded and on what grounds automatic decisions are generated, e.g., on the distribution of work. Finally, digital labour platforms will be required to report platform work performed in a member state to the competent authority.

Who Will The Directive Apply To?

Directive Objectives And Features

The directive primarily aims to improve the working conditions of platform workers. Their employment status must be correctly determined. In addition, the directive introduces more transparency regarding the operation of the algorithms used in platform work.

To ensure that platform workers have the right employment status, the directive introduces a legal presumption that the platform worker has an employment contract and is therefore a worker and not a self-employed person. The platform, however, will first get the opportunity to rebut the legal presumption. To do so, the platform must be able to demonstrate and prove two points:

1. The worker is free from control and direction of the digital labour platform. One indicator of such control, for example, would be the ability to prevent the person performing platform work to work for any other third party.

2. The worker has his or her own business or independent profession, in which he or she normally does the same type of work as he or she does for the platform. To assess whether the person does indeed own a business, one can look at whether investments have been made in the business by, for example, promoting the company's services or buying business equipment. However, the legal presumption will not have any effect before the date when the

The directive covers all persons performing platform work in the European Union, regardless of where the platform is hosted. To assess the existence of platform work, only a contractual relationship between the individual and the digital labour platform is needed, and not necessarily a contractual relationship between the individual and the recipient of the service. Moreover, activities such as processing payments, which companies focused on payroll services perform, can be considered platform work. A digital labour platform exists when:

• A commercial service is provided, (partly) through electronic means, such as a mobile app or a website

• The recipient of the service requests the commercial service; and

• The commercial service involves the organisation of work, meaning that demand and supply for labour are matched. The location of or the name the contractual relationship is given do not matter. The definition is very broad; thus, many companies may qualify as digital labour platforms. What are the implications of this broad definition?

Included (Or Possibly Included) In The Definition

• Providers of a service, such as transport of persons or goods or cleaning, which mainly involves bringing together labour supply and demand.

Well-known companies such as Deliveroo, Just Eat and Uber are likely to fall under the

7 GLOBAL TAXATION www.internationalhradviser.com

The European Council is expected to approve the proposed directive in early 2024

definition of a digital labour platform, as would companies that have a similar set-up. In such cases, for example, an order is placed via a mobile app, after which the platform designates the nearest rider to pick it up and deliver it to the customer.

• Staffing companies, staffing platforms and (other) intermediaries. Staffing companies, staffing platforms and other intermediaries also may meet the definition of a digital labour platform. To do so, however, they must provide their services (at least in part) by electronic means. If that is the case, staffing companies and platforms will be labelled a “digital labour platform”. This would have significant consequences, particularly for companies that frequently use self-employed consultants through intermediaries, such as in IT or life science industries. Those companies may have to adjust because their staffing costs could rise considerably.

• EOR

or AOR

An EOR/AOR is an organisation that serves as an individual’s legal employer for tax purposes while the individual performs work at a third-party company. They deal with payroll services, for example. Does an EOR/ AOR match supply and demand for labour so it can be said that they “organise the work performed by individuals”? They are less likely to play a role in bringing together the supply and demand of labour. However, not only the contractual name given to the relationship but also the actual situation is considered in determining if a platform is a ‘digital labour platform’.

Not Included In The Definition

• Providers of non-profit services

• Providers of a service whose primary purpose is to exploit or share assets. In this respect, the directive names short-term rental of accommodation or reselling goods. Companies such as Airbnb, Booking.com or Vinted are likely not to fall under the definition.

• Online platforms that merely provide means for contacting service providers. An online platform that provides the means by which the service providers can reach the end-user, for example, by advertising offers or requests for services or displaying available service providers in a specific area, without any further involvement, is not a digital labour platform. This type of online platform does not match supply and demand for labour. This applies, for example, to a platform that only displays the details of carpenters available in a specific area, thereby allowing customers to contact the carpenters to use their services on demand.

What Is The Directive’s Impact?

When the directive enters into effect, it is likely to have the following consequences:

• All digital labour platforms must be

properly managed and keep a proper business administration to comply with the explanation and information obligations

• Every person performing platform work is entitled to claim the legal presumption of an employment relationship unless the digital platform can successfully rebut this presumption. Upon successfully establishing an employment contract, the worker will be entitled to all benefits offered by local employment law, including employment protection, a minimum wage, certain minimum rights, entitlement to minimum vacation days, etc.

• Classifying a person as a worker instead of a self-employed individual would also have other impactful consequences, including for social security contributions and work permits

• If an individual is considered a worker, the digital labour platform must comply with a significant number of additional EU regulations, such as the directive on transparent and predictable working conditions, the directive on work-life balance for parents and carers and the working time directive

• If the digital labour platform works with large numbers of people who have been misclassified as self-employed, the platform's business model will have to be significantly adjusted if the platform intends to work only with genuinely autonomous persons

• Digital platform operators will be considered employers and hence will need to comply with all relevant tax and social security formalities. This includes, but is not limited to, first-day notifications of the employees in the country of work and the registration of the company as an employer. Depending on the legislation of the country where the activities are performed, the platform may also need to start deducting withholding taxes as well as employee social security contributions on the amounts payable to the workers. In addition, they may also be liable to pay employer social security contributions. When the workers perform their activities in more than one country, the implications will need to be evaluated on a case-bycase basis.

The directive also has other, less direct but equally serious consequences. For instance, digital labour platforms may be reluctant to disclose any information about the algorithms they use for competition-related reasons. After all, these algorithms are often at the heart of their business model. In addition, because of the broad definition of a digital labour platform, it may not be easy to adapt the business to an employeeonly model. For staffing companies, this could mean that they would be better off providing their commercial services other than through digital means.

BDO Comment

Companies should give this directive due consideration as soon as possible, given that the timeline for its implementation is relatively short and that the time needed to make significant adjustments to business models, as well as preparing for other likely consequences, such as applying for work permits, may be considerable.

BDO can work with you to determine to what extent the directive may impact your business and to proactively prepare for the changes that are likely to come. Some initial questions we can help you with include:

1. Does my organisation meet the definition of a digital labour platform?

2. Does my organisation meet the criteria to rebut the legal presumption?

3. What are the financial, legal and tax consequences for my organisation if the directive enters into effect?

EU Framework Agreement On Cross-Border Telework Finalised

Telework during the COVID-19 pandemic led to an increase in the amount of employee telework on a structural basis for many companies, including cross-border telework. However, habitual cross-border telework can result in a shift of the social security legislation applicable to a teleworker.

To address this issue, the EU’s Administrative Commission for the Coordination of Social Security Systems in April 2023, agreed on a framework agreement to determine the applicable social security legislation for certain cross-borders teleworkers in the EU. The framework agreement provides a system, based on Article 16 of Regulation (EC) No. 883/2004 on the coordination of social security systems, whereby teleworking in an employee’s residence state will not be taken into account when determining the applicable social security legislation if it accounts for less than 50% of the employee’s working time.

The agreement will enter into force on 1 July 2023 in those countries that sign it before that date. The 27 EU member states, as well as Norway, Iceland, Liechtenstein, Switzerland, and the UK have been invited to sign the framework agreement.

Cross-Border Telework During The COVID19 Pandemic

During the COVID-19 pandemic, a neutralisation period was introduced during which teleworking days were not taken into account when determining the applicable social security legislation of cross-border workers. Thus, for cross-border workers who worked more than 25% of their working time in the residence state, the applicable social security legislation did not shift to the home state based on the general principles of Regulation (EC) No. 883/2004.

The neutralisation period ended on

8 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

30 June 2022, and was followed by a new period (the transition period) during which similar principles were observed for crossborder telework up to 40% of the working time. Both periods included an exemption for the request for an A1 certificate. However, the formalities based on the posted workers directive continue to apply (e.g., the obligation to request a Limosa certificate in Belgium).

The transition period, and therefore the possibility to set aside the general principles set out in EU Directive No.883/2004, ends on 30 June 2023.

Framework Agreement

As a response to structural cross-border telework after the COVID-19 pandemic, the Administrative Commission unveiled the framework agreement in April. According to the agreement, the applicable social security legislation in a cross-border telework situation can remain the legislation of the state where the employer’s registered office is located, provided the amount of telework in the employee’s residence state is less than 50% of the employee’s total working time.

Conditions

The new agreement will apply if both member states involved have adopted the framework agreement, and only if the following conditions are met:

• The employee has one employer or multiple employers with a registered office in the same member state

• The employee habitually works in the member state of the registered office of the employer and teleworks in the residence state; and

• The employee’s teleworking time is less than 50% of his or her total working time. If the conditions are met, the social security legislation of the member state of the employer’s registered seat would continue to apply.

Application And Procedure

To apply the framework agreement, a request must be submitted in the member state where the employer has its statutory seat. Requests can be filed only for future periods, not retroactively.

However, if social security contributions have already been paid in the state where the employer has its statutory seat, the framework agreement provides an exception to the ‘pro futuro’ requirement. In this situation, a request may be filed for a past period if:

• The period isn’t longer than three months; or

• Specifically for the period from 1 July 2023 to 30 June 2024, a request can be submitted for a past period up to 12 months but may not include a period before the entry into force of the framework agreement.

Example 1: An employee has been teleworking two days a week while paying social security

contributions in the state where the employer’s statutory seat is situated. The employer wants to apply the framework agreement for the period from 1 July 2024 to 1 July 2026, and a request is filed on 1 November 2024. The framework agreement cannot be applied because the request concerns a period more than three months in the past and it doesn’t concern the specific period mentioned under (2). Example 2: An employee is planning on teleworking two days a week. Currently, he is subject to the social security legislation of the state where the employer’s statutory seat is situated. The employer wants to apply the framework agreement for the coming two years. The framework agreement applies in this situation because it deals with a request for a future period.

As soon as the member states reach an agreement to apply the social security legislation of the member state where the employer has its registered office, they will issue a corresponding A1 document (the document that states the applicable social security legislation). Note that this agreement, and therefore the A1 document, are limited in time, to a maximum of three years. An extension is possible providing that a new request is filed.

BDO Comment

As indicated above, the principles set out in the framework agreement apply only if both member states involved have signed the agreement. Belgium was actively involved in the preparation of the framework agreement and has already confirmed that it intends to sign the agreement.

IRELAND

Recent guidance issued on tax equalisation arrangements

Global mobility has become an area of increased interest for the Irish Revenue, and they have focused on resourcing this area in recent months. Consequently, they have recently begun to issue detailed guidance specific to global mobility, including a list of risk areas in this space.

In February 2023, the Irish Revenue Commissioners on 27 February issued a Revenue brief, which provides guidance on tax equalisation arrangements, for personal income taxation of employees assigned from abroad under non-Irish contracts of employment.

While the list of topics covered is quite extensive, some of the areas of particular focus for Revenue will be the operation of the pay-as-you-earn (PAYE) system on a realtime basis, the audit trail from income and benefits stated on the assignment letter to the home country payroll and on to the Irish shadow payroll, the correct treatment of trailing bonuses, and the taxing and reporting of share remuneration attributable to the Irish assignment.

Funding Of Foreign Payroll Withholding Tax Liability

The Irish tax authorities recently updated their position in cases where an employee is assigned temporarily to a foreign jurisdiction with which Ireland has entered into a double tax agreement (DTA) during a tax year and the employer funds the foreign payroll withholding tax liability by not seeking payment of the liabilities from the employee during the year. After the year end, the employee files their Irish income tax return and makes a claim for foreign tax relief. The subsequent tax refund is then paid by the employee to the employer.

Revenue’s position now, is that the employer has effectively provided a loan to the employee to fund their income tax liability in the foreign DTA jurisdiction whilst carrying out employment duties there. Effective 1 January 2023, an employee who enters such an arrangement with their employer is considered to be in receipt of a preferential loan until the amounts are repaid to the employer. The taxable value of a preferential loan is currently 13.5% per annum.

The updated guidance is silent on whether the funding of Irish payroll tax liabilities via a shadow payroll would also give rise to a preferential loan.

BDO Comment

Given the amount of updated guidance being issued by Revenue in this area, together with the data being collected through the PAYE real time reporting, there is a strong expectation that Revenue interventions will follow.

9 GLOBAL TAXATION www.internationalhradviser.com

Prepared by BDO LLP. For further information please contact Andrew Bailey on 0207 893 2946 or at andrew.bailey@bdo.co.uk

ANDREW BAILEY

Unlocking The Potential Of Serviced Accommodation For Human Resource Needs

In today's world, staying away from home has become a common experience for many individuals due to the increasing impact of globalisation. This paradigm shift has given rise to the mainstream adoption of short- to mediumterm serviced accommodation across various regions. With the rapid advancement of technology, particularly the advent of highspeed internet at the millennium turning point, the landscape of this industry has transformed significantly. Online platforms such as AirBnB and Booking.com, which have gained immense popularity in recent years, now offer sophisticated listings, information, and booking facilities. The exponential growth of these platforms showcases the remarkable pace at which technology has evolved. AirBnB, founded in 2008, experienced widespread proliferation from around 2014, while Booking.com had already paved the way a decade earlier.

The convergence of property management technology with customerfacing applications has revolutionised the serviced accommodation sector. Property owners and operators have harnessed the power of AI and other emerging technologies to automate and enhance the management of their offerings. As a result, the range of accommodation options has expanded, with brands showcasing unique styles and locations to entice guests. Notably, the utilisation of residential units for short stays through online agencies has emerged as a more comfortable and cost-effective alternative in many cases.

The range of available choices span from traditional hotels with kitchenettes, commonly known as aparthotels or extended stay hotels, to professionally managed

serviced apartments or private homes, both in part and whole, catering to stays ranging from a night to several months. While the latter option offers a broader selection of locations, it also brings variability in management standards, often dependent on the property manager, who is frequently a private landlord.

Operators in the serviced accommodation industry exhibit significant diversity, ranging from experienced hotel chains with wellestablished brands and loyal customer bases, to professional managers serving both leisure and corporate clientele, as well as holiday rental businesses and private/home share owners. Recently, there has been a growing focus on private/home share rentals, driven by tempting financial returns, but at the same time there is a concern about the impact they have made on local housing supplies. Property owners are increasingly opting for short stays to achieve higher yields on their residential property investments when compared to long-term rentals. However, it is crucial to acknowledge that if landlords fail to achieve reasonable returns, increasingly more difficult with higher interest rates and property prices, they may well exit the market, exacerbating the existing housing shortage issue.

When it comes to sourcing accommodation, the process has become easier in some sectors, but more challenging in others, so making a good provider choice is key. In my view, the leading companies for leisure and holiday stays are Booking. com and AirBnB. Booking.com offers loyalty use bonuses and allows owners to filter guest gradings, providing insights into the reputation of potential property options. Similarly, AirBnB enables owners to also grade guests, fostering a mutual understanding of each other's reputation. Another reputable choice for UK holiday stays is Sykes Holidays.

Although availability can be challenging, particularly during special events such as sporting tournaments or conferences that generate high demand in specific periods, great opportunities abound outside these peak periods. Savvy travellers can secure favourable deals and fully immerse themselves in the offerings of their chosen destination.

For direct bookings, hotel chains provide the option to book directly through their websites or via platforms like Booking.com. Personally, I find it helpful to explore the location on a map and assess the available options to make a more informed decision, so branding takes second place in the search, but helps in the selection if there is a known option.

Finally, when it comes to corporate business or relocation needs, there is no doubt that relying on well-established agencies like Silverdoor or SITU is the optimal choice. These agencies possess the expertise, product knowledge and infrastructure required to cater to corporate requirements effectively. They are well-versed

10 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

Although availability can be challenging, particularly during special events such as sporting tournaments or conferences that generate high demand in specific periods, great opportunities abound outside these peak periods

in billing systems, safety and security protocols, sustainability screening, and provide exceptional customer support, which may not be easily accessible through IT-only platforms.

Ultimately though, what truly matters is the quality of the operator and product, despite the rapidly changing landscape of this industry, with all the bells and whistles technology brings, a clean, welcoming, and comfortable place

to live or stay in hasn’t changed in terms of making your day/stay one you will enjoy. Picking carefully, and maybe also selecting flexible terms where possible, will help you stay in control and give you some guarantee.

CHARLIE MCCROW

Charlie McCrow, CEO of Executive Roomspace Ltd, has been involved in the serviced apartment sector since the 1980s. He is the founder of The Apartment Service, the industry specialist agency for extended stays in 1991, the founder of the Roomspace Brand of corporate housing in 1995 catering for business clients and he received the Industry Inspiration award in 2017 at the Serviced Apartment Awards. Charlie is also a founding member of UK’s ASAP (Association of Serviced Apartment Professionals), a long-standing member of the USA’s CHPA (Corporate Housing Providers Association) and publisher and contributor of the internationally recognised Global Serviced Apartment Industry Reports (GSAIR).

11 SERVICED ACCOMMODATION www.internationalhradviser.com

Picking carefully, and maybe also selecting flexible terms where possible, will help you stay in control and give you some guarantee

The 360o Global Mobility LeaderSkills For Success And Survival In A Dynamic And Disrupted Mobility Environment

Summer 2023 has arrived in the Northern Hemisphere, and fortunately the season is set to look much different compared to the rather unfortunate summer of 2020, when the world was in the vicelike grip of the COVID-19 pandemic. For global mobility leaders – including those who might not officially be badged as such – the roles we play in our organisations, and management’s expectations of us, have significantly evolved over the past three years, as has the general visibility of the sometimes-overlooked, misunderstood – perhaps even feared – part of the people function, whether it is staffed by dedicated mobility resource or not.

The pandemic has inadvertently provided ample opportunities for mobility leaders to demonstrate how they can find opportunities amidst chaos – international remote working and the engagement of workers in third country locations perhaps being the two en vogue phenomena which most of us will have had to confront, willingly or otherwise. Working moves have evolved significantly in recent times and in the wake of the pandemic, they will continue to do so. The perception that quality talent is in short supply, coupled with the diverse needs, wants and expectations of a multigenerational workforce, will inevitably force mobility leaders to reconsider how they need to evolve the mobility proposition to support the organisation in its quest to attract, motivate and retain its people where that involves a cross-border element.

Before setting about that, we ought to indulge ourselves for a moment and consider the skills a mobility professional must develop and nurture in order to successfully lead our organisations through their next phase of mobility transformation. In this

article I offer six perspectives in this regard, and suggest that the skills we require are by no means new; rather we must encourage them out of our back catalogue and exercise them regularly until they become part of our native advisory style.

ONE: Focus On Asking The Right Questions, Worry Less About Knowing All The Answers

When a novel or particularly exotic request comes in, it can be all too easy for mobility to default to solutions mode at once, particularly if the request is laced with a sense of urgency. There are seldom occasions where advice can be appropriately provided on a complex case or project without consulting the requesting party, and this is where the power of listening – and being comfortable to let yourself do that – comes in. Whether a request involves a new jurisdiction or pioneering a new policy approach, an upfront investment in getting to understand the background to a request, the wider business context, and the driving forces behind it, will not only permit mobility to design an appropriate solution, but also afford the team the luxury of ensuring that it does not inadvertently establish an inappropriate precedent or solve only part of the business issue. Armed with the required context, a mobility leader should not have

to know all of the answers personally; indeed they should feel empowered to bring together the required experts – whether internal SMEs or external advisers – in order to cover all of the appropriate bases. Using one’s understated authority to command those individuals to come together across functions and providers to solve a multifaceted business issue, is where the mobility leader needs to shine.

TWO: Don’t Settle For Indifference. Ever

Policy refresh, operating model review, service catalogue rewrite – delivering any type of mobility transformation initiative requires appropriate consultation with stakeholders across the business to ensure that the resulting products are relevant, tuned-in, and that any required change management is handled appropriately. While the most obvious stakeholders on the list for consultation may be those who have been frequent mobility customers (e.g. business unit leaders with high volumes of mobility activity, current or ex-assignees), it is just as important to actively solicit input from those areas of the organisation which may not have engaged with mobility previously, including those who may have polar opposite views to those which you hold. While everyone might love to listen to Kylie, remember that Dannii is a singer too. The curious mobility leader will want to understand why some stakeholders have not had any interaction with mobility –are they of the view that the current mobility frameworks are not relevant for their business unit?, do they consider that mobility is only a last resort for resourcing their projects?, or frankly, do they have a preconceived negative view of mobility that has prevented them from wanting to explore the benefits? The mobility leader will need to boldly befriend their alleged foes while keeping their allies on side. Silence is not always golden – failing to consult thoroughly on a large-scale transformation and not being clear on the underlying needs of the organisation may well undermine the principal objective of the initiative altogether.

12 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

A mobility leader should not have to know all of the answers personally

THREE: Engage Courageously With Risk

Mobility leaders enjoy a naturally privileged position in most organisations. As part of delivering both business-as-usual work and bigger mobility projects, they will often have cross-function interaction, and this allows them to gauge where the organisation sits on the risk tolerance spectrum, which can often vary by function or by region. Some functions may firmly occupy the risk averse camp for very good reason, while others may push for the organisation to be more pioneering due to the particular challenges they are facing. It is impossible to do mobility well without actively engaging with colleagues on the subject of risk, and a mobility leader should look to provide positively challenging stewardship to their functional allies, with a focus on encouraging compromise where appropriate. While tax teams may have a default zero tolerance position in relation to a particular country or engagement model, the HR team may be faced with a real people dilemma if there is no flexibility. For many, the short-term international remote working trend which has become more prevalent in recent times, will no doubt be a case-in-point for what can be achieved when compromise is pursued. We should not be afraid of risk, nor should we permit ourselves to dismiss it recklessly. The biggest risk for any organisation comes when no risks are taken at all; engaging with it objectively and continuously, rather than resting on years-old positions therefore, should become the default for everyone, with mobility as the champion of that.

FOUR: Paint The Picture, Trash The Textbook

Fascinating, dynamic, inspiring – that is how those of us who live mobility day-to-day might describe it. To outsiders, however, many of the subject matters under the mobility umbrella can be cumbersome, overwhelming, and complex. When advising our stakeholders on a particular matter, we do not need to apologise for the fact that mobility is indeed complex, but we must remember that it is our role to make the complex uncomplicated. The power of storytelling in a business setting is huge, and mobility leaders should consider how they might embrace this approach, particularly when having to introduce new concepts or seemingly wild ideas to an audience which might otherwise quickly disengage. That might involve literally painting a picture; the use of visuals should not be underestimated. Mobility people can be devils for detail and there can be a tendency to default to lecture mode when providing advice. Generous paragraphs of information, laced with technical references and a healthy dose of caveats, all to leading to the one

line “yes” or “no” answer which the business is seeking. The mobility leader should take confidence in the fact that they have been engaged by the organisation as the appropriately qualified person for the role, so they ought not to need to demonstrate their technical prowess in every single stakeholder interaction. Perhaps trashing the textbook is too strong a statement –there will no doubt be individuals who want to see the underlying detail, so know your audience; just don’t forget about the likely majority who will make do with a concise, precise executive summary and save you a handsome number of keyboard strokes too.

FIVE: Appreciate That Style Is As Important As Substance

Which do you buy first: the product or the salesperson? Arguably it is the latter. There are often occasions where a mobility leader will have to champion change in the organisation or deliver difficult messages to a group of stakeholders, perhaps making themselves momentarily unpopular in the process. Even if the conclusion reached by mobility in a situation is perfectly rational, adequately argued and ultimately, the right thing to do, that does not mean that it will not be disputed by the business. Focusing on cultivating one’s personal brand in the organisation, exuding a quiet confidence, and establishing a reputation for quality, will support the mobility leader to position themselves as a true authority on mobility issues. Worked on consistently, this should lead to quicker adoption of new processes and more instantaneous acceptance of answers which may not necessarily be welcomed by all. The latter part of the British Broadcasting Corporation’s motto – inform, educate and entertain – is perhaps relevant to mobility leaders too. We need to adopt a style that makes our stakeholders want to listen and engage and where the circumstances are appropriate. We shouldn’t shy away from adding some light-heartedness into our interactions on the duller or more contentious subjects we need to educate on. Not only does it encourage everyone to maintain a sense of perspective, it also supports with personal brand maintenance in an environment where mobility is merely one of many valuable cogs in the corporate engine competing for attention.

SIX: Be Unapologetically Human

People moving across borders is at the heart of practically everything a mobility professional concerns themselves with. While it would be remiss of us to downplay the (generally welcome) impact that technology advances could have on the mobility lifecycle, there will undoubtedly always be a requirement for a human touch. No policy, process or system can be expected to handle every single moving scenario, and this is where the mobility

leader needs to remember to reality check a situation. Mobility teams can often run on very lean headcount, and when volumes are high or external developments create additional work, this can risk introducing an air of resentment between mobility and the individuals they support. Actively reminding ourselves that we are dealing with people rather than commodities is a very simple thing, but it is nevertheless powerful in supporting mobility teams to ensure that they are operating in the overarching spirit of the organisation and its mobility frameworks, even if the computer might have defaulted to ‘no’ initially.

My intention with this article has not been to suggest a suite of new skills which mobility leaders need to develop. Rather, it aims to highlight those existing skills which we have all had to deepen to survive the challenges of the past few years and deliver successful results for the organisations we are a part of. Continuing to nurture these skills more consciously going forward should ensure that our organisations continue to benefit from the quality mobility expertise we strive to provide, and ultimately (or perhaps selfishly) lead to greater professional satisfaction for ourselves and the teams we work with.

JOHN KERR Head of Global Mobility, Pinsent Masons LLP

John is an enterprising international mobility professional with 12+ years’ experience. Starting out in professional services as an expatriate tax consultant, he later moved in house and specialises in supporting law firms to define and realise their international mobility ambitions, despite the sometimeschallenging regulatory environment.

John is currently the Head of Global Mobility at Pinsent Masons and was previously the global mobility lead at Freshfields Bruckhaus Deringer. John speaks three languages and spent brief periods working and studying overseas while at university, inspiring him to carve out a career in mobility.

13 GLOBAL MOBILITY LEADER www.internationalhradviser.com

Have you registered to receive FREE Monthly Email Newsletters and invitations to our annual Global HR Conferences SPRING 2023 ISSUE 92 FREE SUBSCRIPTION OFFER INSIDE The Leading Magazine For International HR Professionals Worldwide International HR Adviser Making Global Mobility More Sustainable Global Tax Update Short-Term Business Visitors - Are You Getting Their UK Income Tax And NIC Right? Technology Deployment - Partnering For Success How Much Does It Cost To Sponsor A Skilled Worker In The UK? What Does Your Mobility Programme Look Like For 2023? Reshaping Global Mobility • The Human Resources Pool's Changing How Will AI Affect The Future Of Recruitment? ADVISORY PANEL FOR THIS ISSUE: SUMMER 2023 ISSUE 93 FREE SUBSCRIPTION OFFER INSIDE The Leading Magazine For International HR Professionals Worldwide International HR Adviser Mind The Gap! - Expectations Vs Reality In Workforce Analytics Taxing Issues: Expatriate Terminology - Understanding The Tax Adviser Global Tax Update • Unlocking The Potential Of Serviced Accommodation For Human Resources Needs The 360o Global Mobility Leader - Skills For Success And Survival In A Dynamic And Disrupted Mobility Environment Traversing The Great Divide: How HR Professionals Facilitate Civil Conversations On The Future Of AI Developing And Implementing HR Strategy On The Cusp Of The Digital Era 2023 Key Issues ADVISORY PANEL FOR THIS ISSUE: If not, please email: helen@internationalhradviser.com

Traversing The Great Divide: How HR Professionals Facilitate Civil Conversations On The Future Of AI

Addressing AI Angst: 15 ways HR can best ensure productive, civil discourse on artificial intelligence - the preeminent hot-button tech topic spurring heated discussions, debates and disagreements.

As the digital era rages on, perhaps no technology topic is more polarising at the moment then that of Artificial Intelligence (AI) and Machine Learning (ML). Specifically, the role these rapidly emerging nextgen technologies will, and should, play in our daily lives and professions.

In the ever-expanding realm of AI, having civil conversations that address the potential, and concerns surrounding this technology, has become increasingly challenging - a situation causing new challenges for HR professionals. The two most extreme camps - one fearing an apocalyptic future ruled by machines, and the other advocating for unchecked AI development - clash vehemently, leaving little room (nor inclinations) for more nuanced discussions.

Human Resource professionals play a critical role in facilitating civil and courteous conversation about AI in the workplace for several important reasons:

• Ensuring Inclusive and Respectful Environment: AI discussions can bring up

varying perspectives, concerns, and opinions. HR professionals can create a safe and inclusive space for employees to express their thoughts and engage in respectful dialogue, fostering an environment that values diversity of opinion

• Addressing Employee Concerns: AI implementation may generate concerns among employees regarding job security, privacy, or fairness. HR professionals can listen to these concerns, provide accurate information, and address them proactively. By facilitating dialogue, they can help employees better understand AI and alleviate fears or misconceptions

• Promoting Transparency and Trust: Open and transparent communication about AI initiatives builds trust between employees and the organisation. HR professionals can foster a culture of transparency by sharing information about the purpose, benefits, and limitations of AI systems, addressing questions, and keeping employees informed throughout the process

• Mitigating Resistance to Change: Change, especially technological change, can be met with resistance. HR professionals can help employees embrace AI by creating awareness, explaining its potential benefits, and providing training and support for any necessary upskilling or reskilling.

By facilitating discussions, HR professionals can address concerns, provide clarity, and increase acceptance of AI initiatives

• Ethical Decision-Making: AI raises ethical considerations around privacy, bias, and fairness. HR professionals can guide conversations on ethical frameworks and decision-making processes when implementing AI systems. By involving employees in these discussions, HR professionals can ensure that diverse perspectives are considered and ethical implications are thoroughly examined

• Employee Engagement and Well-Being: Engaging employees in conversations about AI shows that their opinions and concerns are valued. It promotes a sense of involvement and empowerment, which contributes to employee wellbeing and satisfaction. HR professionals can facilitate these discussions to create a sense of ownership and involvement among employees

• Collaboration and Learning: Open dialogue on AI encourages collaboration and knowledge sharing among employees. HR professionals can facilitate crossfunctional discussions where employees from various departments and roles can share insights and learn from each other's experiences. This collaboration can lead to innovative ideas and solutions.

15 THE FUTURE OF AI www.internationalhradviser.com

By facilitating civil discourse and conversation about AI and ML, HR professionals create a culture of open communication, trust, and collaboration. Ultimately, these efforts contribute to successful AI integration and a positive employee experience.

Recognising the urgent need for far more open dialogue and understanding, Milan Kordestani, famed Gen S author of the new, number one best-selling book “I'm Just Saying: A Guide to Maintaining Civil Discourse in an Increasingly Divided World”, provides the below insights to serve as a de facto roadmap for engaging in productive conversations about present and future implications of AI and ML.