International HR Adviser

The Leading Magazine For International HR Professionals Worldwide

FEATURES INCLUDE: Global Tax Update

The Use Of Permanent Transfers Continues To Grow

The AI Advantage: Practical Applications For Talent Mobility Assessing Business-Travel Compliance: Two Ways To Ensure Take-Off!

Employer Of Record: A Key Talent Engagement Option Of The Future? Revolutionising Expatriate Wellbeing With Social Prescribing And Lifestyle Medicine

Global Talent, Local Compliance: Employer Share Schemes For Internationally Mobile Executives Cutting Costs Or Cutting Corners? How Tightening Global Mobility Budgets Can Backfire In The Long Run

ADVISORY PANEL FOR THIS ISSUE:

SUMMER 2024 ISSUE 98 FREE SUBSCRIPTION OFFER INSIDE

In This Issue

Employer Of Record: A Key Talent Engagement Option Of The Future?

Clare Fazal & Iain Martin, Deloitte LLP

Global Talent, Local Compliance: Employer Share Schemes For Internationally Mobile Executives

Karen McGrory, BDO LLP

Global Tax Update

Karen McGrory, BDO LLP

The AI Advantage: Practical Applications For Talent Mobility

Frederic Franchi & Olivier Meier, Mercer

Assessing Business-Travel Compliance: Two Ways To Ensure Take-Off!

Tom Crosby, Tracker Software Technologies (TST)

The Use Of Permanent Transfers Continues To Grow

Kristin White, Sterling Lexicon

The Emerging Tech of Blockchain Will Change the Future of HR Management

Mostafa Sayyadi & Michael J. Provitera

Revolutionising Expatriate Wellbeing With Social Prescribing And Lifestyle Medicine

Dr Shoba Subramanian, UnitedHealthcare Global

Cutting Costs Or Cutting Corners? How Cutting Global Mobility Budgets Can Backfire In The Long Run

Georgia Wilson, ECA International

Directory

1 CONTENTS 2 7 16

While every effort has been made to ensure accuracy of information contained in this issue of “International HR Adviser”, the publishers and Directors of Inkspell Ltd cannot accept responsibility for errors or omissions. Neither the publishers of “International HR Adviser” nor any third parties who provide information for “Expatriate Adviser” magazine, shall have any responsibility for or be liable in respect of the content or the accuracy of the information so provided, or for any errors or omissions therein. “International HR Adviser” does not endorse any products, services or company listings featured in this issue. www.internationalhradviser.com Helen Elliott • Publisher • T: +44 (0) 20 8661 0186 • E: helen@internationalhradviser.com Ben Everson • T: +44 (0) 7921 694823 • E: ben@internationalhradviser.com International HR Adviser, PO Box 921, Sutton, SM1 2WB, UK Cover - Annca from Pixabay In Loving Memory of Assunta Mondello 13 20 Origination by Fresh Designs - www.fresh-designs.co.uk and Printing by Gemini Group The International HR Adviser team work with a British planet positive printer, with a commitment to best practice environmental management including achieving the top score in Europe for the Green Leaf Awards, full FSC Certification, and ISO14001. Well managed sourcing of both virgin pulp and recycled papers, in addition to carbon balancing ensures that you can enjoy International HR Adviser with a clear eco conscience. 18 22 10 24 21

Employer Of Record: A Key Talent Engagement Option?

We are operating in a world where work is no longer defined by jobs, the workplace is no longer a specific place, and many workers are no longer traditional employees. In this world, attracting and retaining talent is a challenge that all organisations are facing, with workers seeking roles that give them the flexibility to work when and where they choose, whilst organisations also seek the candidate with the right skills to fill their role from the global talent market.

This is driving the need for organisations to change to consider a suite of engagement models when hiring individuals. In this article, we are going to focus specifically on the consideration of Employers of Record (EOR) as an enabler to access the global talent pool, covering what they are, when you may consider using them, the benefits and drawbacks, the practical factors to consider when selecting a provider and managing the ongoing relationship with the EOR.

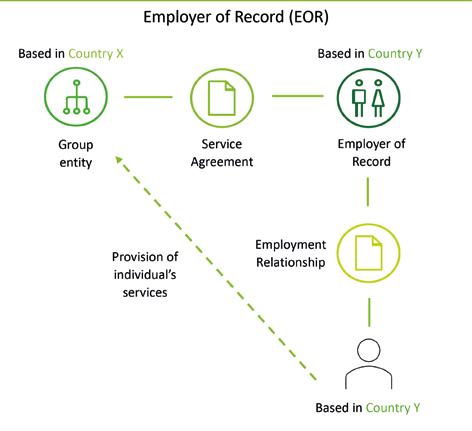

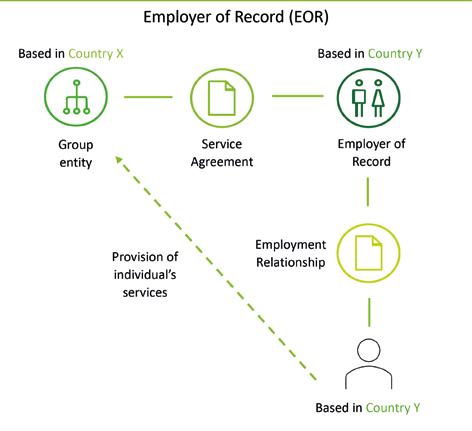

What Do We Mean By An Employer Of Record (EOR)?

It should be noted that there are a number of names and acronyms used in the market - Global Employment Outsourcing (GEO)/ Professional Employer Organisation (PEO), for example - to describe an EOR (or similar, but nuanced structures) and some providers may not refer to themselves as an EOR in the market. What we mean by an EOR is a third-party service provider that acts as the legal employer of an individual and discharges ‘employer functions’ in the work location, e.g., income tax and social security payroll withholding. The EOR then assigns the individual exclusively back to the enduser organisation, via a service agreement, which provides control over the day-to-day activities, job duties and responsibilities of the worker. Refer to diagram.

Whilst it may seem like EORs are a recent phenomenon, they are not new to the market. Initially utilised as an option in the M&A space to aid the transition of employees between organisations, most typically where the acquiring party has no current corporate presence in a location where newly acquired

employees are working, there has been a period of sustained growth and innovation in the EOR market, fuelled by factors such as the expansion of cross-border business activities, advancements in technology and the rise in remote work.

Different EOR providers have varying capabilities, but all generally offer payroll delivery/tax withholding services in the work location at a minimum. Some offer a wider range of additional HR support services and below is a non-exhaustive list of some of these additional services and capabilities:

• Recruitment and staffing servicessourcing, screening and hiring candidates based on required job requirements

• Onboarding support - conducting background checks, verifying employment eligibility, and employment contract creation as part of the onboarding process

• Supporting employee relations issues, like conflict resolution or addressing complaints

• Performance management processes, including setting goals, conducting performance reviews and providing feedback

• Training and development programmes, such as leadership training or skills

development; and

• Employee benefits administration.

How Are EORs Being Utilised?

We have highlighted some of the most common themes/scenarios where organisations engage workers through an EOR:

• Global Expansion – some organisations consider utilising an EOR as a tool to ‘test the market’ in a new location, in line with strategic business expansion. EORs can be a tool to get ‘boots on the ground’ as a first step, before a longer-term solution or commitment to that location is determined, e.g., set up of a corporate presence. In the same vein, some organisations utilise EORs to fulfil urgent staffing requirements, due to the speed at which they are able to provide access to the talent market and onboard workers.

• Global Talent Acquisition – with the ongoing war for talent, increasingly organisations are looking to acquire talent from across the globe, but that talent can reside in jurisdictions where the organisation does not have any corporate presence.

2 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

• Long-Term Remote Work – increasingly EORs are being considered for enabling longer-term international remote working arrangements, whether driven by the individual or the business.

What Are The Typical Benefits And Drawbacks Of Engaging Workers Through An EOR?

Before engaging with an EOR, you should ensure that you have carried out a clear assessment of the specific needs and priorities for a worker, and a clear definition of the job requirements - title(s), responsibilities, qualifications, skills and experience required.

Part of the process prior to engaging an EOR may include a comparative assessment of the different ways of engaging with a worker for the specific job requirements. It is important to ensure that there is a sufficient fit with the strategic objectives of the organisation alongside other considerations such as meeting the business’ key challenges and maintaining appropriate risk levels. This could include ‘voice of the customer’ interviews/surveys to ensure that the benefits and limitations of the various engagement options are identified for the organisation to consider during the decision-making process, feasibility assessments and creation of decision-making frameworks. Alternatives to engaging via the EOR model may include i) via a Global Employment Company, ii) via an existing entity in the location of work, iii) creation of a new entity in the location of work, iv) as an independent contractor, v) via an entity in another location outside the location of work.

There are some clear benefits to using an EOR including:

• Cost Savings: Setting up a legal entity in a new country or region can be expensive and complex. By engaging an EOR, companies can avoid the costs associated with setting up a legal entity, such as legal fees, registration fees, and compliance costs, as well as those for ongoing maintenance and compliance.

• Time Savings: Setting up a legal entity can also be time-consuming, taking many months to complete. By engaging an EOR, companies could utilise an individual's services more quickly (potentially, in simple scenarios, in as little as 2-3 weeks).

• Compliance: Operating in a new country or region can be risky, especially if the organisation is not fully familiar with local laws and regulations. By engaging an EOR, companies can leverage their knowledge of local laws and regulations.

• Flexibility: EORs offer a flexible employment solution, allowing organisations to engage staff on a shortterm or project basis.

As always, the benefits of this type of engagement model should be balanced against some potential limitations that organisations will want to be conscious of and manage wherever possible, including:

• Cost: Whilst using an EOR can provide cost savings compared to setting up a legal entity, there are still costs associated with engaging an EOR. Organisations should carefully evaluate the fees and pricing structure of EOR providers to ensure that it aligns with their budget and expected return on investment.

As always, the benefits of this type of engagement model should be balanced against some potential limitations that organisations will want to be conscious of and manage wherever possible

• Limited Customisation: EORs often provide standardised solutions, which may not fully align with the unique needs and preferences of the engaging organisation. Customisation options may be limited, and organisations should ensure that the EOR provider can accommodate specific requirements, such as industry-specific compliance or specialised benefits packages. With customisation, price increases may follow.

• Potential Cultural Differences: Operating in a new country or region through an EOR means that the individual will be subject to local employment laws and regulations. This can introduce cultural differences and challenges, such as different working hours, holidays, and employment practices.

Organisations should be prepared to adapt to these cultural differences and ensure effective communication between the EOR, the individual, the end user, the organisation, and its staff.

• Tax Considerations: Whilst a key EOR benefit is their delivery of compliance from an employment tax and social security perspective, it is key that organisations review the corporate tax risks with regard to the potential creation of a permanent establishment in the individual’s location of work. The level of risk will depend on the nature and duration of the role, country of work and availability of a ‘Fixed Place of Business’ which can include a home office. In conjunction with business tax, organisations should consider the suitability of using an EOR for the role in question and exclusions for certain roles/activities/seniority. There may also be additional tax considerations which need to be considered. An example, from a UK perspective, is the question of which party has responsibility for tracking and reporting on business travellers to the UK if the traveller is employed by an EOR outside of the UK.

• Employment Law Considerations: Whilst the individual will be employed by the EOR in the location in which they are working, and as a result will be employed under local labour laws, your organisation will want to ensure that the service agreement with the EOR considers aspects such as confidentiality, restrictive covenants, data privacy, collective bargaining agreements and termination. The organisation needs to ensure they are comfortable with the employment contract between the EOR and the individual. The end user should also ensure that the individual’s employment with the EOR stands up to scrutiny and reflects what is happening 'on the ground'. Alternatively, if in practice the individual is treated like an employee of the end user, that would give rise to a number of employment status-related risks from an employment law, as well as a wider tax, perspective.

• Labour Leasing: ‘Labour leasing’ laws need to be considered for any location an individual is working in under an EOR arrangement, and whether the EOR arrangement is caught under any laws in place. Where these laws are in force, there can be registration, approval, and reporting requirements, and even restrictions for labour leasing arrangements.

EORs certainly have their place in the various employment models available to engage workers and can be particularly useful for businesses that are early in their maturity lifecycle, exploring the markets in which they wish to operate.

3 INTERNATIONAL HR STRATEGY www.internationalhradviser.com

The EOR Provider Selection Process

There is an ever-growing market of EOR providers, and appropriate due diligence processes need to be conducted, as you would with any new third-party vendor. When reviewing and selecting an EOR provider there are several factors you should consider: geographic reach and cultural understanding, industry expertise and reputation, track record of their operation and customer service capabilities.

Some providers may have a limited geographic reach, focused on a particular region or country, but with a deep understanding of the local laws and regulations and may be able to offer a wider range of services in respect of those locations. Other providers may specialise in particular industries, and factors related to those industries.

The provider decision that you ultimately make will likely depend upon their ability to deliver the services that you require. For example, if you are clear on the job requirements but want assistance with the sourcing and recruitment for the role, some EOR providers will have a pool of prequalified candidates that they are connected to within an industry, or they will have a network of recruitment partners established in a geography that can help to find the right talent to fulfil the needs of the role.

You should carefully evaluate the technology platforms and reporting capabilities of an EOR provider. Factors to consider are your level of comfort with access rights and security, and accessibility to and transparency of the services being delivered. In addition, platform userfriendliness and workflow capability to aid streamlined and efficient processes, and features such as real-time reporting, employee self-service and integration capabilities with existing talent management systems are also key.

The values, culture and communication style of the EOR provider should be assessed to ensure there is cultural alignment to your own organisation, as this can contribute to a more seamless and collaborative working relationship.

It is worth noting that references and testimonials from existing clients or benchmark data can provide valuable insights into the experience, satisfaction level and quality of services provided by EOR.

Practical Considerations When Engaging An EOR

Contracting

Understandably, service agreements between your organisation and the EOR, and the EOR and the individual, should be detailed and you want to ensure the

following areas at a minimum are covered: Services, fees, term, confidentiality, liability, termination, governing law, and data privacy. Overall, the agreements should be comprehensive, clear, and legally binding, and should be reviewed and approved by all parties before the engagement begins.

It is worth noting that references and testimonials from existing clients or benchmark data can provide valuable insights into the experience, satisfaction level and quality of services provided by EOR

Ongoing Communication And Collaboration

Your organisation will want to maintain a clear line of communication with the EOR provider and should ensure there is clarity over who will have the ongoing responsibility for maintaining this relationship and communicating the organisation’s expectations, requirements, and specific preferences. Continuous evaluation of the performance and effectiveness of the EOR will also help to ensure any issues are addressed promptly and that the partnership between the organisation and EOR remains productive and aligned with the organisation’s goals.

Worker Experience

Although the EOR will be the legal employer, your organisation should still strive to

provide a positive experience to the worker by maintaining communication with them, making sure their needs are met, offering professional growth and development, and reacting to feedback and addressing any concerns promptly, thereby ensuring they remain motivated and satisfied at work.

Long-Term Strategy

You should consider the scalability of the EOR provider’s services, particularly if your intention is to grow in a new market whilst continuing to monitor permanent establishment risk in the work location. In such cases, you should ensure that the EOR can accommodate your evolving needs and provide effective support or ensure you have considered an exit strategy if you do decide to transition away from the EOR provider in the future, again referring to the contractual processes, notice periods, obligations or costs associated, which should be clearly set out in the contract.

Risk Management

It is important that you stay informed about changes in local labour laws, tax regulations, and compliance requirements in the countries where you engage an EOR and regularly communicate with the EOR provider to ensure that they are up to date with any regulatory changes and are implementing necessary adjustments to maintain compliance. Any downstream impact of non-compliance could adversely impact the organisation. For example, through loss of the ability to access the worker, or being held ultimately responsible for the fulfillment of compliance as the end-user of the worker (depending on jurisdiction).

There are currently limited published views from country tax authorities on the use of EORs in their geographies. However, as their use becomes more commonplace, we anticipate views and regulations will be forthcoming which will need to be factored into your ongoing relationship, or which may potentially restrict the ongoing use of EORs.

In the meantime, while the EOR provider assumes certain employment-related risks, it is essential for your organisation to have a wider risk management strategy in place which may include insurance considerations, conducting periodic audits, and having contingency plans in place for potential disruptions.

We would always recommend having the ability to engage legal counsel and tax advisors who are knowledgeable in international employment matters to get appropriate guidance on legal and tax implications, help navigate complex regulations, and ensure compliance with local laws.

4 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

Concluding remarks

The use of EORs is expected to continue growing as companies increasingly embrace global expansion or seek more flexible employment solutions. As the global business landscape evolves, companies are exploring the use of EOR providers and their resources as an option when navigating the complexities of international employment. As noted, there can be benefits in engaging an EOR but it is key that your organisation conducts appropriate feasibility assessments, cost-benefit analysis, appropriate vendor selection and ongoing management processes to ensure that the EOR will meet the businesses’ strategic needs now and in the future.

Deloitte Global Talent & Mobility

CLARE FAZAL Director

CLARE FAZAL Director

E: cfazal@deloitte.co.uk

T: +44 (0) 207 007 0284

IAIN MARTIN Associate Director

IAIN MARTIN Associate Director

E: imartin@deloitte.co.uk

T: +44 (0) 122 484 7311

To address the most challenging business demands, multi-national organisations need to define and understand their global workforce footprint and deliver global talent deployment efficiently and compliantly. Deloitte’s dedicated Global Talent & Mobility practice is a multidisciplinary consulting group of tax, immigration, talent, HR and digital professionals who support clients as they navigate these complex global workforce challenges, developing focused strategies and delivering practical enablement.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (DTTL), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities. ©2024. For information, contact Deloitte Global.

5 INTERNATIONAL HR STRATEGY www.internationalhradviser.com

Global Talent, Local Compliance: Employer Share Schemes For Internationally Mobile Executives

Equity planning for employees can be complicated. International working arrangements can be complicated. Put the two together? Yes, it’s definitely complicated. As is the case with many taxrelated issues though, with acknowledgement of some of these complexities and advance planning, processes can be put in place to ensure that things run smoothly, and compliant reporting can be appropriately managed in any relevant jurisdiction.

Most companies understand how powerful their employee share plans can be in incentivising and retaining employees, and in aligning the interests of employees with those of the company. With increased globalisation and a more internationally mobile workforce, it is increasingly important that employee incentive compensation and equity share plans be designed so they are efficient and effective on a global level. Expanding an incentive compensation and employee share plan can, however, give rise to a number of difficult issues. Indeed, tax compliance, regulatory constraints, and accounting requirements in multiple countries can be a major burden. When implementing a global incentive compensation or employee share plan, retirement plan, or overall compensation structure, companies need robust systems in place to ensure that the programmes are cost-effective, well structured, incentivising to employees, and compliant with all tax and regulatory requirements.

We will consider some of the issues you might face when offering share incentives to an internationally mobile workforce. In many organisations, this will chiefly be for your executives, who are invariably among the participants. Then we’ll consider some potentially helpful actions and considerations for companies dealing with these issues, and alternatives to mitigate some of this complexity.

For simplicity, this article will use the term internationally mobile employees (IMEs) to also include employees with international remote working arrangements.

(1) The Fundamental Questions

Before you can determine what the likely implications are of offering share incentives to their IMEs, employers need to be confident of which employees fall into this population. Some of the fundamental questions for employers are:

• Who are they?

• What are they doing?

• Where are they?

• How long will they be there?

• What awards do they have already? Employers must then ensure that there are robust processes and policies in place to govern these arrangements and track them. Some IME scenarios, like permanent transfers or formal secondments, may be more straightforward to identify if they are monitored actively by a central team, but those IMEs who may trigger overseas tax obligations by international business travel may not be so well captured in employer data. This can be a particular risk area for executives who travel frequently.

(2) Trailing Issues

It is common for employer share schemes like PSPs (Performance Share Plans) or RSU/ PSUs (Restricted Stock or Performance Stock Units) to include vesting periods and/ or performance conditions, which could span several years and multiple tax trigger events (e.g. where tranches of awards vest annually). It is usual for the tax treatment of such awards to be assessed over the relevant earnings period, typically viewed as the period from grant to vest of the award. If there is even a temporary period of international working during an earnings period (or, indeed, multiple award earnings periods), then this could impact the tax treatment and reporting of vesting awards over a series of tax years. Employers require processes to document where employees have worked internationally, potentially in multiple locations, and how this impacts the tax treatment and employer reporting in all relevant jurisdictions.

This may not be a huge problem once tracking processes have been set up, particularly if there is an established annual process on or around the vesting date where such reporting assessments are made, and tax calculations prepared. However, it may become more challenging to administer if you are also dealing with longer-term plans without fixed trigger events. For example, you may have stock option plans that vest after a certain period but then have an extended window for the employee to choose when they exercise the option. This can often be up to ten years after the grant of the option. Processes will need to be put in place to track such share events and ensure that the required compliance actions are taken as and when they exercise options with an international dimension.

(3) Local Reporting Requirements And Restrictions

There may be local rules that require employers to declare employment-related share awards to local tax authorities, whether via payroll or in an alternative format or annual filing. For example, for the UK there are potential PAYE reporting requirements for employers issuing shares to employees as well as annual employment-related securities reporting to HMRC, which is due by 6 July, following the end of the relevant tax year. These rules also apply to employees who may only be taxable on part of their overall share award in the UK. Employers need to assess and understand any such local obligations in all locations where they have IMEs; many countries including Australia, Belgium and Ireland have comparable reporting requirements.

You also need to consider periodic local rule changes in relevant jurisdictions and ensure your processes and reporting are up to date. For example, there has been a recent change in Ireland for the reporting of share option exercises which previously were reported outside payroll but now require payroll reporting and withholding of tax and social security.

(4) The Use Of Cash Or Phantom Share Plans

Some countries may have securities laws or exchange controls which effectively prevent

7 TAXATION www.internationalhradviser.com

employees from owning securities directly, so alternative provisions may need to be considered. In such cases, the employer may include a cash settlement discretion in the plan, or a separate ‘phantom’ share plan which allows an employer to replicate the incentivisation by a stock-based plan (based on performance conditions, and a certain number of ‘shares’) with a relevant ‘exercise price’ that will crystallise in cash value on a fixed date or event. The Company does need to have the funds available to pay cash bonuses, but the upside is that by issuing phantom shares instead of actual shares the company can conserve its equity and avoid dilution of existing holdings (depending on the intent of the plan).

There may also be other circumstances where cash/phantom plans may be needed to work around specific local rules and restraints. For example, in Singapore, noncitizens will typically be deemed to exercise their unexercised stock options and unvested share awards when they cease employment in Singapore. This means that assignees leaving Singapore after an assignment may face a ‘dry’ tax charge before they are able to liquidate any funds in connection with the share awards, creating a cash flow issue as well as a challenge if the value of the award subsequently falls. The use of phantom/cash plans could be helpful in mitigating these issues for Singapore-based assignees.

(5) Tax Advantaged Schemes

Many employers in the UK (and elsewhere) make use of tax-advantaged plans to incentivise their employees in a tax-efficient manner. Employees and employers should be aware that locally recognised plans in one jurisdiction are unlikely to attract the same tax efficiencies in other jurisdictions, so there may be unexpected host country income tax, social security and capital gains tax implications and cost exposures. The company’s assignment/tax policy will need to indicate who should be responsible for settling any such taxes.

Clearly, employers should consider whether local hires and IMEs should be enrolled in these tax-advantaged schemes at all. For EMI (Enterprise Management Incentive) schemes in the UK, for example, there is an overall limit on the value of shares that can be subject to unexercised EMI options, so it may be preferable to allocate this limited pool to employees who will benefit from the tax advantages and use an alternative provision for IMEs.

It may also be possible to review international schemes to assess the viability of introducing local sub-plans which benefit from tax-advantaged treatment in that jurisdiction, and access tax and/or social security savings for the employee and/or employer.

(6) International Remote Workers And Professional Employer Organisations (PEOs)

The number of organisations purporting to offer a one-stop-shop solution for the needs of employers with international remote workers has sky-rocketed over the past few years. They will typically operate as the legal employer of such employees on a local basis, arranging employment contracts, tax and social security arrangements, local payroll reporting, HR needs etc., (for a fee). For employers with a widespread international employee basis but without a local infrastructure (or the desire to create one) to support the admin, PEOs can be an attractive proposition. On many levels reputable providers can be a good solution, but they come with health warnings - particularly for employers using share incentive schemes. Standard or existing plan rules may not permit you to award shares/options to individuals who are not legally your employees. This could be as per the terms of specific Company drafted rules, or the general requirements of certain types of schemes. For example, in the UK companies cannot grant qualifying EMI (Enterprise Management Incentive) options to non-employees of the company (or a group company), and in France non-employees cannot participate in qualified share option plans. This can result in unexpected tax consequences for existing employees who transfer to PEO employment to facilitate international remote work arrangements, or even a legal challenge to their ability to participate in equity plans at all.

(7) The Complexity Of ‘US Persons’

US citizens and Green Card holders are essentially perpetual US tax residents, with their worldwide income and gains remaining permanently within the US tax net even if residing outside the US. The same applies to resident aliens of the US. For an employee being a ‘US person’ for tax purposes also means that IRS tax regulations, some more esoteric than others, continue to apply to them. These rules may not align with the tax rules in their country of employment, and this can cause issues. There are specific US tax rules around non-qualified deferred compensation which can apply to stockbased compensation, and non-US share plans will commonly not be compliant with these rules. This can cause significant issues for US taxpayers, potentially creating unexpected tax liabilities at unexpected times, and a 20% penalty tax if a solution is not implemented. It is, therefore, important to understand if your international plans are properly structured to ensure the penalty charge is not triggered, either for your local US participants or other US persons employed in other locations. Identifying these employee populations is key to effective reward planning.

For employers who tax-protect, or taxequalise, their IMEs on share-based incentives, there are additional associated tax costs.

(8) Corporate Tax Considerations

In the UK, statutory corporate tax deductions for employer share plans have been available for many years. However, there can still be many practical issues with claiming these deductions, one of which is how to deal with claims in connection with IMEs. The specific nature of the underlying plan and the employee’s tax residency and working status in/outside the UK at points of grant and vest/ exercise will potentially impact the nature of any deductions available from a UK corporate tax perspective. Similar considerations may arise in other jurisdictions that the employee works in, and determining the appropriate deductions available to claim in multiple jurisdictions should be considered to secure the overall tax-efficiency of the scheme.

Key Takeaways

Getting the tax right, especially in a global context, is key to the effective implementation of global incentive plans. The design of your overall reward package needs careful thought to attract, retain and incentivise your top talent. Internationally mobile employees can increase the complexity, as different tax regimes in the home and host locations may not be compatible, and the interactions of both tax regimes and their tax and payroll reporting requirements must be considered by the employer to maximise efficiency and ensure compliance.

KAREN MCGRORY

Karen McGrory is head of Expatriate Tax Services at BDO LLP. She has over 30 years’ experience in the field of expatriate taxation. Karen is indebted to Steph Carr for her major contribution to this article. If you would like to discuss any of the issues raised in this article, please do not hesitate to contact Karen McGrory on +44 (0)20 7893 2460, email karen.mcgrory@bdo.co.uk.

8 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

Global Tax Update

Budget proposals across the globe bring significant changes ahead.

The UK, Hong Kong and Cananda have all made announcements in their 2024/25 Budgets to bring in sweeping changes. The UK is abolishing the current favourable tax regime for UK resident non-domiciled individuals and replacing it with a shorter beneficial tax regime with a residence based test. Canada has announced, most notably, the increase in the capital gains inclusion rate from one-half to two-thirds, effective June 25, 2024. In Hong Kong, there is a reduction in salaries tax and tax under personal assessment.

Additional details and guidance regarding the implementation of these rules, are expected in the coming months.

BELGIUM, NETHERLANDS & GEMANY

Clarification of PE and home office rules Belgium, the Netherlands and Germany have all recently clarified permanent establishment (PE) for home office rules. Since the Covid pandemic, a hybrid work pattern has become a permanent way of working for many employees. However, in a cross-border context, working from home can have many consequences on both the employee’s tax and/or social security position, as well as the employer’s tax position. For example, a home office can create a PE for the employer in the employee’s country of residence.

What Is A Permanent Establishment?

Simply put, a PE is the presence in a country (Country A) of a company that is resident in a different country (Country B), that meets certain conditions, and in doing so, triggers local compliance requirements in Country A. When the conditions defined in double tax agreements are met, and a PE is deemed to be present, the right to tax profits of the company located in Country B will shift to Country A.

When employees work from home, the situation that is created in a cross-border context could appear to fall within the definition of PE.

BDO Comment

Belgium and the Netherlands have signed a competent authority agreement to offer guidance to employers regarding whether employees working from a home office in their home country establishes a PE for their employer in that home country. It is the duties, and the frequency of these duties,

that are carried out at home that need to be considered, as well as the conditions of the employment contract as regards to where the employee is obliged to work.

In the same vein, Germany has issued revised guidelines for the establishment of a PE: working from a home office generally does not create a PE within the meaning of the OECD model tax convention. Unlike Belgium and the Netherlands, Germany does not consider a PE is created where the employer does not provide the employee with an alternative workplace to their home office. But Germany does recognise the situation may be different when an employee performs a management function for the employer and has power of attorney to act and represent the employer.

HONG KONG

2024 Budget

Hong Kong’s 2024/25 budget speech announced a reduction in salaries tax and tax under personal assessment for 2023/24 by 100%, capped at HKD 3,000.

The tax reduction will reduce the amount of tax payable for the year of assessment 2023/24.

The budget also proposes the implementation of a two-tiered standard rates regime for salaries tax and tax under personal assessment. For taxpayers chargeable at the standard rate whose net income exceeds HKD 5 million, the first HKD 5 million of net income will continue to be subject to the standard 15% rate. The portion of net income exceeding $5 million will be subject to a standard rate of 16%.

Taxpayers chargeable at progressive rates will not be affected.

BDO Comment

Taxpayers should file their profits tax returns and tax returns for individuals for the year of assessment 2023/24 as usual.

Upon enactment of the relevant legislation, the Inland Revenue Department will effect the reduction for 2023/24 in the final assessment.

The Inland Revenue Department will also apply the two-tiered standard rates in calculating the provisional salaries tax for the year of assessment 2024/25.

UK

Proposed changes to the taxation of nondoms announced in March 2024 Budget

The UK Government announced in the March 2024 Budget proposals to abolish the current favourable tax treatment for UK

resident non-domiciled individuals (nondoms) from 6 April, 2025, and replace it with the foreign income and gains (FIG) regime.

Brief Overview Of Proposed Changes

• The FIG regime will allow foreign income and gains to be treated as outside the scope of UK taxation for four tax years, with overseas workdays relief (OWR) remaining restricted to three UK tax years

• Eligibility for the FIG regime will be based on non-UK tax residence in the 10 UK tax years prior to establishing UK tax residency

• In contrast to the non-dom regime, under the FIG regime, foreign income and gains can be brought to the UK tax free

• Transitional rules will apply during the 2025/26 and 2026/27 UK tax years

• Pre-6 April, 2025, (untaxed) foreign income and gains may be remitted and only be liable to a 12% tax rate during the 2025/26 and 2026/27 UK tax years

• For individuals who are neither UK domiciled, nor UK deemed domiciled by 5 April, 2025, who’ve previously claimed the remittance basis, foreign assets, including shares in their overseas employers, will require an election to be rebased to their value as of 5 April, 2019, and meet other currently unstipulated conditions

• There will be a consultation on how individuals become liable to inheritance tax given this was previously based on an individual’s domicile status; going forward, it will be based on the length of UK tax residency.

BDO Comment

Subsequently, the Labour Party has stated they would make some changes to the proposals should they form the next government (an election is due to take place on 4 July 2024). The most significant of the changes is that all foreign assets within trusts would be liable to UK Inheritance Tax, it is likely any transitional relief would be more limited and there would not be a tax discount on remittances in the first year of the new rules.

To keep up to date see: https://tinyurl. com/4tdjm8xj

We expect HMRC to allow applications for section 690 directions, or a new equivalent, so employers can operate PAYE on a reduced percentage of earnings for IMEs (internationally mobile employees) eligible for OWR.

Employers should revisit their global mobility tax policy in view of the potential attractiveness to IMEs of remitting previously unremitted (and untaxed) earnings as a result of the reduced 12% tax

10 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

rate. The timing will be particularly relevant to US taxable IMEs given the way a foreign tax credit is claimed for US tax purposes.

There is no change to the National Insurance contributions (NICs) position on earnings relating to overseas workdays. The earnings relating to both UK and non-UK workdays are still liable to NIC.

We await clarification of how other expatriate tax reliefs available to non-doms, such as the foreign travel rules (relocation travel, VISA application, home leave, and travel between overseas and a UK workplace) will be impacted. Previously, these measures were available to non-doms for up to five years, and BDO’s representation to HMRC will be that relief for at least this duration should be retained under the FIG regime. We await details of how the rule changes will impact UK resident, and currently non-dom IMEs, and their employers, when dual contract arrangements are in place.

Employer Year End Reporting - Key Dates

There are several important upcoming deadlines for employers to be aware of (or the deadline has already gone), the complexities of the reporting required will vary according to the nature of the business.

Deadlines

• Gender pay gap reporting – 4 April

• Short-term business visitors – 31 May

• Annual PAYE scheme (appendix 8) – 31 May

• P11d reporting – 6 July

• Share plan reporting – 6 July

BDO Comment

There are no extensions, so, clients who do not file on time face penalties and other consequences. If you have missed a deadline the reporting should be brought up to date as soon as you can.

CANADA

2024 budget proposals

Canada’s 2024 federal budget includes significant changes for individuals.

Capital Gains Inclusion Changes

Individuals with net gains not exceeding CAD 250,000 will continue to benefit from the one-half inclusion rate. For 2024, the $250,000 threshold will not be prorated and will apply only against capital gains incurred on or after June 25, 2024.

Capital gains can result upon a normalcourse disposition of certain assets (for example, shares of public corporations and real estate), but also upon death or upon a cessation of Canadian tax residency.

Stock Option Benefit Changes

The stock option deduction that is currently available upon the exercise of employee stock options is to be decreased to one-

third to align with the new capital gains inclusion rate. Individuals would continue to benefit from a deduction of one-half of the taxable benefit from stock options, up to a combined $250,000 for both employee stock options and capital gains. It is unclear whether this will be taken into account at the time the employer must withhold the taxgenerally upon the exercising of the stock options - or as a refund with the individual’s personal tax return. The latter option may result in increased scrutiny of capital transactions reported on the personal tax return and timing issues for any applicable tax refund.

BDO Comment

The changes discussed in this article may add complexity to a departure from Canada as well as normal - course dispositions but equally presents an opportunity to reassess strategies regarding realising latent capital gains, international moves outside Canada, estate planning, as well as exercising vested stock options. This should be considered in the broader context of a cost-benefit analysis of taxation at a relatively lower rate versus continued investment and taxation at a higher rate in the future.

NETHERLANDS

Reminder, benefits of 30% ruling limitation now in place

Since 1 January, 2024, the scope of the benefits provided by the 30% ruling, which offers tax advantages to highly skilled foreign workers in the Netherlands, has been reduced. Previously, some foreign employees with specific expertise deemed scarce in the Netherlands received a tax benefit, known as the 30% ruling. If this arrangement was granted, those employees were able to receive a maximum of 30% of their remuneration free of tax, for a maximum of 60 months. The 30% portion of their salary remained untaxed based on the notion that it was meant to cover “extraterritorial expenses” (often referred to as ET costs), the additional costs expatriates incur by working (temporarily) outside their country of origin.

Since 1 January, 2024, the 60-month period has been reduced to a maximum of 20 months and employees that qualify now receive 20% of their remuneration - rather than 30% - tax-free. Then, for a final period of 20 months, the percentage of tax-free remuneration is now 10%, instead of 30%.

Where an employee already had a 30% ruling in place, that is allowed to continue and such employees can continue to opt to include their income on the income tax return as if they were not resident in the Netherlands (so called ‘partial non-resident taxpayer status’), which will continue to be available until 31 December, 2026.

BDO Comment

The reduction in the benefit of the 30% ruling has increased the costs of assigning foreign nationals. For new assignments it is worthwhile assessing the benefits of the ruling as compared to the option of reimbursement of actual expenses to determine which option is most appropriate for the employer and the employee.

Employers will need to carefully monitor the shorter time period and the change in the reduction to ensure correct implementation for payroll processing.

Communicating these changes to your employees remains important

KAREN MCGRORY

Karen McGrory is head of Expatriate Tax Services at BDO LLP. She has over 30 years’ experience in the field of expatriate taxation. BDO is able to provide global assistance for all tax issues arising from an internationally mobile workforce.

If you would like to discuss any of the issues raised in this article, please do not hesitate to contact Karen McGrory on +44 (0)20 7893 2460, Email: karen.mcgrory@bdo.co.uk.

11 GLOBAL TAXATION www.internationalhradviser.com

The AI Advantage: Practical Applications For Talent Mobility

Managing Fast-Changing Technology And High Expectations

HR teams are facing pressure from top management and end users to implement AI solutions. Executives expect that investing in AI will lead to substantial business growth this year, with productivity increasing by 21% to 35%. However, there are concerns about the impact of AI on job security, and more than half (53%) of executives believe their company will not survive beyond 2030 without AI.

At a time when resources and budgets are limited, HR professionals are increasingly viewing technology as a precondition for managing mobility at scale. Three in five HR managers plan to use generative AI in HR, and 57% of mobility managers want to accelerate the digitalisation of mobility. However, according to our 2024 Global Talent Trends study, only 14% of HR professionals feel ready for an era of human/machine teaming.

1. The Business Case For Using AI To Support Talent Mobility

Mobility teams are under pressure to expand their purview and manage new forms of mobility, but many companies lack specific tools to track and manage assignments. This lack of suitable technology and resources prevents mobility professionals from playing a more strategic role in their organisations. Technology is essential for managing new forms of talent mobility and delivering personalised employee experiences.

While not all HR teams will rush to implement AI solutions, companies need to address the use of AI in policies and processes. Eighty percent of employees report exposing their company’s proprietary data to AI in the past three months, underscoring the importance of clarifying and restricting the use of AI to protect data privacy.

2. Applications Of AI For Mobility

Generative AI lends itself to many applications to support HR management. According to Mercer’s 2024 Talent Trends study, 65% of HR professionals believe AI could reduce current workloads by taking care of the following tasks: (See column 2).

3. Desired Interactions And Outcomes

Successful implementation of AI requires a structured approach. Organisations need

Examples Of Outcomes Sample Metrics

Reduced administrative burden

Enhanced compliance

Streamlined assignment process

Enhanced employee experience

Improved cost efficiency

Improved talent management outcome

Percentage reduction in time spent on administrative tasks, number of manual data entries eliminated

Percentage increase in compliance rates, reduction in compliance-related penalties or fines

Reduction in time to manage the entire relocation process

Employee satisfaction scores, reduction in employee issues related to mobility support

Percentage reduction in overall mobility costs, cost savings achieved through optimised relocation arrangements and expense reduction

Percentage increase in the number of employees participating in international assignments, employee retention rates, and career progression post-assignment

Interaction Requirements Questions

Speed

Knowledge depth

High versus low context

Interpretation and cultural adjustments

Empathy and direct human contacts

How quickly should the answer be provided - 24/7, outside working hours?

What information/knowledge is required to answer queries?

Which inquiries can only be addressed with a good understanding of the business and personal context?

Which questions require human interpretation and adaptation to specific cultural situations?

When is a human interaction needed?

to define desired interactions and outcomes, establish measurable metrics and track progress to evaluate the impact of AI initiatives and make data-driven decisions.

Interactions with mobile employees can be evaluated in terms of speed, accuracy, knowledge depth and the need for empathy to determine whether to use AI, humans or both.

The split between AI and human involvement should be based on a thorough evaluation of the requirements, rather than clichés about machines. It could be tempting to decide that AI will take care of basic urgent queries while humans will provide more detailed answers and be empathic. The reality is more complex and depends on the technology used and the availability and skills of employees.

13 TALENT MOBILITY www.internationalhradviser.com

Analysing large amounts of data 46% Improving decision-making accuracy 43% Innovating and developing new products 40% Increasing decision-making speed 38% Facilitating customer self-service experiences 36% Synthetising and summarising data 31% Automating routine tasks 25% Forecasting future trends 21%

4. Determining The Right Model And Strategy

Generic solutions: The rise of AI co-pilots

Many publicly available AI systems can be used for daily tasks. AI tools are becoming commonly available in the form of “co-pilots” integrated into existing generic software. These tools have the potential to increase mobility teams’ productivity and create new solutions to support assignees. Using these tools meaningfully and safely requires experimentation, training and clear policy guidelines on which tools should be used and what restrictions should be in place to protect data privacy.

HR-Specific Tools

Most companies already have specialised HR tools - determining which systems will be retained, upgraded or discarded is essential. Different starting points will lead to different strategies:

• Implementing AI from scratch: This approach involves deriving solutions from AI models like ChatGPT to build a customised system to meet the organisation’s specific needs. For instance, organisations can develop AI-driven chatbots to answer assignees’ queries or run analyses to determine the most suitable relocation packages based on employees' preferences and company policies. This approach allows HR teams to leverage AI without being limited by existing systems requirements. However, most organisations would need to feed their AI with data from other internal systems, so a minimum level of integration will still be required. Furthermore, AI solutions need a lot of development to compete with specialised HR systems to manage mobility processes

• Combining legacy technology and AI tools: In this approach, AI-driven chatbots or virtual assistants are combined with existing mobility and HR management tools. For example, a company may enhance its current relocation management platform by incorporating a chatbot that can provide real-time updates on visa processing, answer frequently asked questions and guide employees through the relocation process. This approach can increase the functionalities of existing systems and provide quick wins. However, it does not allow for a full integration of the different tools or a real rethink of existing workflows

• Upgrading legacy technology: Another option is upgrading existing systems and platforms by adding AI functionalities. For instance, organisations can integrate AI algorithms into their management systems to automate the verification and approval process, reducing manual effort and improving accuracy. This approach is a way

Data Issues

Data labeling

Output consistency

Privacy and security

Examples

To address efficiency and compatibility issues, data labeling can be used to combine data from different sources/ systems and produce meaningful comparisons.

Texts produced by AI and chatbots must respect the logic and terminology used in talent mobility policies - not blur the terms and conditions offered by a company or create undue expectations.

Inputting company and employee data into publicly accessible AI tools should be avoided. Checking data inputs is critical to prevent copyright and privacy issues.

to leverage existing systems and maintain their overall consistency. However, it could require significant redevelopment and delay the deployment of AI.

When determining the right strategy, organisations should assess whether the chosen AI solution can scale effectively to accommodate future growth and increasing demands. Compatibility and integration with other systems should also be evaluated to ensure seamless data exchange and interoperability.

Compatibility and integration with other systems should also be evaluated to ensure seamless data exchange and interoperability

5. Processes And Data Preparation

More than two-thirds (67%) of organisations adopt new technology without transforming the way they work. Implementing new technologies based on old processes is often a poor solution. Adopting AI tools demands rethinking workflows. The first step is to eliminate unnecessary processes and identify inefficiencies before bringing AI into play. This evaluation helps identify areas where AI can bring significant improvements and streamline operations.

Successful AI implementation relies heavily on data preparation. Organisations must ensure the consistency of data labeling and facilitate data exchanges between legacy and new systems. This may involve data cleansing, standardisation and integration efforts to create a unified data ecosystem.

The outputs from AI used by HR or directly communicated to end users by chatbots need to be monitored carefully for consistency and relevance. Words matter in HR policies and contracts - using the wrong terminology could lead to confusion and false expectations (see above).

6. Roles And Responsibilities

To ensure effective collaboration between employees and AI systems, training and guidance should be provided to help employees interpret AI-generated insights and make informed decisions.

Oversight and compliance require clear ownership and coordination between HR teams. A designated person should monitor, understand and be accountable for every AI-driven action. Decision processes should remain transparent for all mobility stakeholders.

HR team members also need to be aware of the risks of bias in AI outputs (which often result from biases in organisations and in user inputs) and know how to mitigate them in people management decisions.

7. Communication

Employees’ perceptions and skills issues could slow down AI adoption. Job security concerns should be addressed, and a shift towards a more human-centric approach should be embraced. To foster a positive mindset towards AI technologies, HR teams should communicate the company’s goals and implementation plans, emphasising the value AI brings in augmenting human capabilities rather than replacing jobs.

14 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

MERCER

Frederic Franchi, Olivier Meier and Michael Nash. Find

out more: www.mobilityexchange.mercer.com

Assessing Business Travel Compliance: Two Ways To Ensure Take-Off!

The Covid-19 pandemic affected many things, not least the way we work. The crisis necessitated the rise of the ‘working-from-home’ phenomenon, forever changing how organisations and employees structure their working days. Since then, WFH has spurred further changes, one of them particularly prevalent in the world of global mobility, and which we might call the ‘working-from-the-holidayhome’ phenomenon; essentially, people are choosing longer ‘holidays’ (sometimes very much longer!) by mixing leisure and pleasure with work while they are away. Other forms of remote working are also fast developing, such as “Bleisure” or “Workation”.

This trend is part of a broader revival in travel globally, but combining business with leisure abroad, or across State lines, and other forms of remote working can create significant new challenges for affected organisations. Keen to be seen as attractive employers, so they can succeed in the war for talent, companies are often happy to agree to ‘work-from-anywhere’ arrangements, as long as compliance, reputation and duty-ofcare risks are largely surmountable and are managed by a Remote Work policy.

Attitudes towards compliance and duty of care have changed enormously in recent years and interest in data, consulting and technologies relating to these issues is growing fast as they become key concerns. Part of the reason for companies seeking guidance is the often heavy administrative burden that compliance in particular can impose on busy global mobility teams when it comes to remote working.

The good news is that there are ways to lighten such burdens, in the form of technology solutions. For instance, our software helps clients manage all compliance and duty-of-care risks associated with

business travel and remote working (or WFHH!). Stakeholders grappling with such issues should explore the technical capabilities, integration possibilities and likely cultural compatibility of vendors’ platforms and select the one best suited to facilitating and automating safe and compliant travel for their international workforce.

With Tracker Software in hand (or even without it, albeit less easily) a compliance assessment for each trip, whether it be for business travel or remote working reasons, can be made. Such assessments are best done before travel is booked, but they can also be made afterwards. So, how do they work?

A1s or CoCs, work permits etc). It is likely to be linked to an approval process, whereby a high proportion of trips might be automatically approved to allow prompt and effective travel, but with some trips left pending or denied if the risk to the organisation is deemed too high. Rules engines allow trip details to be assessed instantly, and not only on a case-by-case basis, but also tracking the cumulative effects on compliance of the posted person or teams in a location, all of which will have a bearing on whether supporting documentation is required.

Such assessments are best done before travel is booked, but they can also be made afterwards. So, how do they work?

Pre-Booking Compliance Assessment

When an employee informs the organisation about an upcoming business trip or period of international remote working prior to booking it, a compliance assessment can be made there and then before the project advances further, given the right tools. Typically, it is most easily done in an app-based platform, using a rules engine to determine whether any legislation will be triggered and what administration will be needed (posted worker declarations,

The pre-booking questionnaire for employees needs to be as short as possible to minimise the administrative burden, but it must capture everything necessary for making an accurate assessment. The focus does not have to be solely on compliance; security and risk management can also be assessed using the leading software platforms. Furthermore, previously common secondary processes, such as the software provider contacting the traveller to learn more about their needs, are usually no longer required with these solutions. The idea is to capture all necessary information in a single visit by the traveller to the app, portal or platform. A key piece of information here is the ‘why’, or ‘trip purpose’ – what will your traveller be doing in the destination country? This will impact the result of the compliance assessment and whether action is required.

Upon approval, a code can be issued to prove the traveller has followed agreed processes, and API integration with travel booking tools means they may be required to deliver this code upon booking their flight or claiming trip-related expenses. Organisations often have groups of travellers who need to travel at the last minute, for which exceptions can be granted, with compliance processes happening in a retroactive fashion if the trip is deemed risk-worthy.

Both the pre- and post-booking assessment models rely on a core traveller ‘profile’, often gathered from an integration with an HR information system. Profile information includes things like nationality and legal and tax residency, which provide further background on personal circumstances, improving the accuracy of the compliance assessment.

16 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

Post-Booking Compliance Assessment

Under this model, the organisation is likely to be using some sort of travel booking tool. As such, this method is only suitable for business travel purposes, and the travel booking tool will be the starting point for any assessment. The trip is booked and a downstream feed is taken from the booking tool to a compliance and duty-of-care rules engine. The traveller has their ticket and is prepared to travel regardless of the outcome of any assessment.

This type of assessment is usually done without the traveller engaging directly with the platform. Typically, the organisation using this model is looking to perform any compliance administration in a parallel or retroactive fashion – not prior to the trip booking. This is likely to be done on behalf of the traveller by an internal team, HR sharedservice centre or vendor ecosystem.

A limitation of this model is that its success is dependent on the quality of the data that emerges from the travel booking tool. It is standard practice to capture ‘where’ and ‘when’ but rarely do these tools capture the ‘why’. If they do capture this, it will be in scant detail, perhaps limited to three or four predetermined options (e.g. internal meeting, external meeting, conference, etc.,) which are not enough to accurately assess whether a posted worker declaration, an A1/CoC, work

permit or other piece of legal administration will be necessary.

Conclusion

It is not always possible for employers to be one-hundred-percent compliant when it comes to the many types of business travel. Sometimes it is unclear whether a compliance risk arises or not, and employers might decide that the needs of the business override worries about grey areas. Legislation is being created or rewritten all the time around the world, and this is a rapidly changing legal landscape that only the best technologies can keep up with. Properly assessing compliance using either of the models described above, facilitated by a leading app or other software platform, gives you the best chance of ensuring there will be no damage to your company’s reputation.

Ultimately, you and your colleagues in the compliance and travel stakeholder teams will know which model best suits your employees, corporate culture and risk appetite. When you come together to assess these models, be reassured that by implementing either of them you will be attempting to meet the requirements of global compliance legislation, while promoting free-flowing travel, protecting the reputation of your organisation and offering your travelling employees a feeling of safety and security when working abroad in an increasingly compliance-conscious world.

FREE SUBSCRIPTION TO

TOM CROSBY

TOM CROSBY

Tom leads the relationships Tracker Software Technologies (TST) has with our new and prospective Clients. There are many variables when implementing compliance processes, from customer experience and technology configuration to cross-functional collaboration and Tom helps compliance stakeholders navigate this environment to reach a solution that works for the company and their travellers. Tom can be found on LinkedIn, or contacted at Tom.Crosby@tst-international.com , if you wish to explore the contents of this article in greater detail.

SPONSORED

To

You

17 ASSESSING BUSINESS TRAVEL COMPLIANCE www.internationalhradviser.com

The Leading Magazine for International HR Professionals Worldwide For further information please call Helen Elliott on +44 (0) 208 661 0186 Email: helen@internationalhradviser.com Website: www.internationalhradviser.com By signing up for the free subscription we will keep your details in our database to enable us to send you the magazine each quarter, and relevant email communications. SUMMER 2024 ISSUE 98 FREE SUBSCRIPTION OFFER INSIDE The Leading Magazine For International HR Professionals Worldwide International HR Adviser Global Tax Update The Use Of Permanent Transfers Continues To Grow The AI Advantage: Practical Applications For Talent Mobility Assessing Business-Travel Compliance: Two Ways To Ensure Take-Off! Employer Of Record: A Key Talent Engagement Option Of The Future? Revolutionising Expatriate Wellbeing With Social Prescribing And Lifestyle Medicine Global Talent, Local Compliance: Employer Share Schemes For Internationally Mobile Executives Cutting Costs Or Cutting Corners? How Tightening Global Mobility Budgets Can Backfire In The Long Run ADVISORY PANEL FOR THIS ISSUE:

register for

free subscription to International HR Adviser,

email your name, job title, company name and the full postal address you would like the magazine sent to,

helen@internationalhradviser.com

a

please

to

our next Global HR Conference

year and is free to

will also automatically be invited to

that will take place next

attend.

BY:

The Use Of Permanent Transfers Continues to Grow

Why Many Companies See One-Way Moves As Essential For Supporting Their Talent Strategy

Despite mixed messages in the media about the sluggish pace of global economic recovery, significant layoffs and doomsdaystyle predictions of AI taking over all the jobs, the shortage of and competition for skilled talent remains very real. It’s felt on a global scale and is likely to be with us for some time. According to research from ManpowerGroup, 75% of employers say they have difficulty filling needed positions today – that’s a big jump from just 36% reporting the same challenges a decade ago. IT and data skills are some of the hardest to find across all industry sectors, while employers in the healthcare and life sciences fields are most apt to report the greatest difficulty in sourcing the specific talent they need. Business and government leaders around the world are working together to find ways to attract and retain the best talent to give them a competitive edge.

Global mobility (GM) has a key and strategic role to play in helping tackle this challenge. Whether it’s the ability to hire locally in more locations, send employees on project-based or short-term assignments, to help learn new or transfer existing skills and gain cultural proficiencies, or offer permanent transfers to fill the gaps – the most competitive employers will have a suite of well-thought-out options to choose from.

The Rise Of The Permanent Transfer

A few converging forces make the permanent transfer – or one-way move as it’s also often called – an increasingly popular choice for companies to have in their talent toolkit:

1. Location flexibility. The explosion of remote work models over the last four years gave employees a taste for and the flexibility to work from just about anywhere. While various workforce models continue to take shape, employee willingness to move abroad remains high, especially among early career professionals eager for international experience. It’s also an appealing idea for more senior-level employees farther along their professional journeys, but at life stages where they may be less encumbered by family concerns like finding schooling for young children or ensuring spouse or partner career needs align.

In 'Decoding Global Talent 2024', a study jointly produced by The Stepstone Group, The Network and Boston Consulting Group (BCG), 1 in 4 professionals are actively seeking jobs abroad. Given an estimated global workforce of 3.5 billion, that’s potentially 800 million professionals currently open to living and working in another country. Having a permanent transfer policy is clearly one option for attracting and retaining highly valued and skilled employees.

2. Balancing competing demands for positive employee experiences with the need to control costs. The permanent transfer is often a costeffective alternative to a long-term assignment. The assumption is that the employee will shift to host country benefits and compensation packages, removing some of the more expensive traditional assignment elements, like tax equalisation, cost of living adjustments and funding for return home visits.

3. Simplicity. For the most part, a permanent transfer is simpler and easier to administer than a long-term assignment. This is especially true when compensation, lifestyles and cultures are reasonably similar between the origin and destination locations.

Simplicity. For the most part, a permanent transfer is simpler and easier to administer than a long-term assignment

Getting The Permanent Transfer Right

As with all assignment types, it’s key to establish policy parameters up front that outline as consistent, and equitable approaches as possible, while providing clear structure around how your business will handle one-way moves. A few important questions to ask include:

• What are the goals of the move, and what is the expected timeline during which it will occur?

• Will the policy differ if moves are initiated by the company or the employee?

• Will we use a tiered approach, based on family size?

• How will we treat permanent transfers occurring from low-cost areas to high-cost locations and vice versa?

• Will the employee be immediately brought into the host country system and payroll, or will there be a phased-in approach?

• Will we need additional incentives to encourage employees to transfer to certain locations considered less desirable, and if so, what will those be?

• Which services will we deem core and what flexible suite of benefits will we offer, based on employee need and permanent transfer location?

• Will we include a payback stipulation if the move is terminated or the employee leaves the company? What will the duration be, and will it be gradually phased out over time?

It’s equally important to ensure a common understanding of what a permanent transfer really means. In most cases, the expectation is that it will be a one-way move to a host country for an indefinite period, where the employee will live as a local. In defining which benefits must be a core part of a permanent transfer policy, most organisations start with immigration, tax and compensation assessments – in other words, all the legal requirements necessary to get an individual from Point A to Point B. Once you are sure the employee and any accompanying family members will have the proper authorisations to work and live in the new location, other key benefits to consider are covering the travel costs and support with the physical move itself, including not just household goods, but possibly auto and pet transport as well. The provision of 30 days temporary living and permanent home finding services are also

18 INTERNATIONAL HR ADVISER SUMMER www.internationalhradviser.com

often included, as well as assistance with securing all the necessary local registrations, such as with the social security authority, driver’s licenses, etc.

The Importance Of Cultural Assimilation

While the core support covers all the practical and logistical aspects of a permanent move, the ultimate success often comes down to how well the employee –and any family members making the move with them – adapt and assimilate into life in their new home country. Like all moves, the idea can be exciting and invigorating at first, but as the reality of living with different traditions and customs, cultural norms, laws, languages, currencies and possibly even climates sinks in, there is the risk of some “buyer’s remorse.” Particularly in those instances where the move involves very pronounced differences between origin and destination locations, cross-cultural and language training services can be invaluable lifelines to help employees and family members be happy and productive in their newly adopted countries.

The Bottom Line

While the permanent transfer is far from a new idea, its use is only expected to continue

to grow as a key strategy for businesses to attract and retain top talent. As with all types of global mobility, there won’t be a “one size fits all” approach to structuring the support packages that facilitate one-way moves. But, with the right mix of core and flexible support, employers are wise to tap into the current wave of eager, curious professionals ready to take on a new adventure and set them up for success.

KRISTIN WHITE

Kristin is director, thought leadership and communications for Sterling Lexicon. She brings more than 30 years of experience in global workforce mobility, PR, marketing and communications to her role. Before joining the company in 2020, she worked for many years at Worldwide ERC, the workforce mobility association, for the Morton Fraser Partnership and in HR Communications for John Hancock Insurance. Contact Kristin at kristin.white@sterlinglexicon.com.

19 THE USE OF PERMANENT TRANSFERS CONTINUES TO GROW www.internationalhradviser.com

all

there won’t be a “one