International HR Adviser

The Leading Magazine For International HR Professionals Worldwide

FEATURES INCLUDE:

Expat City Ranking 2022

Remote, Controlled: Insights To Enable Your Approach To Cross-Border Remote Working Global Mobility And Executives - Why We Need To Think A Little Differently Global Tax Update • Immigration: UAE Immigration Landscape And Recent Updates

The Evolution Of Duty Of Care: How To Keep Employees Safe During Business Travel Why You Need An Integrated Approach To People And Data Upskilling Can Make Your Business More Resilient In A Downturn Why Have Dual Career Couples Become A Hot Topic In HR?

ADVISORY PANEL FOR THIS ISSUE:

WINTER 2022/23 ISSUE 91 FREE SUBSCRIPTION OFFER INSIDE

In This Issue

Remote, Controlled: Insights To Enable Your Approach To Cross-Border Remote Working Debra Wardle & Cyrus Davami, Global Employer Services, Deloitte LLP

Global Mobility And Executives - Why We Need To Think A Little Differently Steph Carr, Global Employer Services, BDO LLP

Global Tax Update

Andrew Bailey, BDO LLP

Immigration: UAE Immigration Landscape And Recent Updates Rekha Simpson, Vialto

Why Have Dual Career Couples Become A Hot Topic In HR? Armelle Perben, Author: Managing The Dual Career Of Expat Couples

Creating Empowered And Autonomous Cultures: My Experiences Working As Global Head Of Human Resources Marlo Green, Sinequa

The Evolution Of Duty Of Care: How To Keep Employees Safe During Business Travel Robyn Joliat, 3Sixty Why You Need An Integrated Approach To People And Data Natalie Cramp, Profusion Upskilling Can Make Your Business More Resilient In A Downturn

Sarah Gilchriest, Circus Street Expat City Ranking 2022 Internations

1 CONTENTS 2 7 16 23

Free Annual Subscription Directory While every effort has been made to ensure accuracy of information contained in this issue of “International HR Adviser”, the publishers and Directors of Inkspell Ltd cannot accept responsibility for errors or omissions. Neither the publishers of “International HR Adviser” nor any third parties who provide information for “Expatriate Adviser” magazine, shall have any responsibility for or be liable in respect of the content or the accuracy of the information so provided, or for any errors or omissions therein. “International HR Adviser” does not endorse any products, services or company listings featured in this issue. www.internationalhradviser.com Helen Elliott • Publisher • T: +44 (0) 20 8661 0186 • E: helen@internationalhradviser.com Ben Everson • T: +44 (0) 7921 694823 • E: ben@internationalhradviser.com International HR Adviser, PO Box 921, Sutton, SM1 2WB, UK Cover - Valencia, Number 1 in The Expat City Ranking 2022 In Loving Memory of Assunta Mondello 15 13 20 22 Origination by Debbie Morgan and Printing by Gemini Group The International HR Adviser team work with a British planet positive printer, with a commitment to best practice environmental management including achieving the top score in Europe for the Green Leaf Awards, full FSC Certification, and ISO14001. Well managed sourcing of both virgin pulp and recycled papers, in addition to carbon balancing ensures that you can enjoy International HR Adviser with a clear eco conscience. 18 31 10 32

Remote, Controlled: Insights To Enable Your Approach To CrossBorder Remote Working

Remote work has rapidly evolved to become a key business imperative, a critical talent attraction, retention, and employee experience tool that’s high up on the executive agenda. It is giving rise to diverse employee and employer-driven scenarios, ranging from short-term, day-limited crossborder remote work, enabling people to work overseas for short periods, to virtual assignments and virtual teams, as well as longer-term arrangements and international remote hiring.

The results of Deloitte’s Global Remote Work Survey (1) , a cross-sector survey encompassing more than 820 participants and 45 countries, highlight that organisations are at very different points on their remote work journeys. Whilst organisations are optimistic about the opportunities remote working can bring, there is evidence of a gap between the ambition behind remote work policies and the challenges of how to operationalise remote work in a way that enhances talent and corporate culture strategies whilst managing complex tax, legal and business risks.

The Evolution From Displacement To Dispersal Of The Workforce: Embracing The Realities Of Remote

Whilst 35% of organisations surveyed currently allow employees to work remotely from other countries, there are significant regional differences, with this number rising to 52% for EMEA head-quartered organisations. Freedom of movement within the EU/EEA and existing practices for frontier workers has meant that many organisations are further along their remote work journey in the region, when compared to those based in either the Americas (25%) or Asia Pacific (37%).

As we analyse the data further, amongst organisations that allow their people to fully work remotely in-country, 50% have enabled cross-border remote working in some way. This group is also more likely to be thinking about their remote work policies in terms of talent attraction and retention. This points to

a strong correlation between an organisations’ overall ‘future of work’ and workplace strategy with the way they are approaching the topic of cross-border remote work.

Why Now?

What are the key drivers behind organisations enabling remote work for their people? Our survey suggests most organisations see remote work as a way to drive their talent strategies and objectives.

When asked why they are implementing remote work, some of the most frequent responses included enhancing employee experience (84%), expanding the talent pool (59%), promoting diversity and inclusion (39%), and enabling an alternate career path for employees (10%). These drivers are unsurprising given that in 2022, CEOs ranked labour and skills shortages as the #1 external issue expected to influence or disrupt their business strategy (2)

This data not only reinforces the view that remote work is here to stay as a key talent strategy, but also suggests that organisations are actively looking at the trends in the postpandemic workforce to ensure they are competitive when compared to their peers and aligned with their objectives to expand the talent pool, support diversity and drive sustainability goals.

While some driving forces may be similar across industries, the impact on people, their purpose, the work they do, and importantly,

where and how they do it, will be very different across sectors, businesses and roles. In order to unlock ongoing potential, leaders are shifting their thinking on talent and the very nature of work itself. Remote work, in its various forms, is one of the many levers’ organisations can pull to unlock that potential and realise longer-term talent ambitions.

Operationalising The Strategy: Drawing The Red Lines

While organisations are keen to unlock the benefits of remote and hybrid work, they also need to understand the ramifications of where their people are working. This is driven by a complex mix of considerations, including, but not limited to, business tax risk, employer and individual tax obligations, immigration, corporate governance, employer duty of care and sector-specific regulatory requirements. Our survey indicates that decision-makers are starting to increase their focus on creating more robust policies underpinned by process and guardrails to guide their organisations.

Focusing on such issues up-front, can help deliver results for both the business and employees, whilst taking steps to meet compliance with external legal, tax and regulatory requirements – not an easy balancing act!

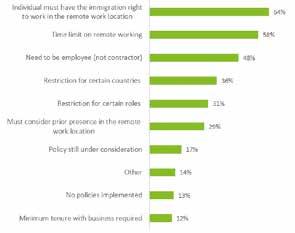

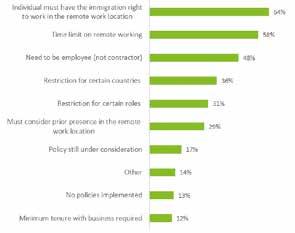

As shown in Fig 1 the top three guardrails’ organisations are implementing for crossborder remote work are:

2 INTERNATIONAL HR ADVISER WINTER www.internationalhradviser.com

Figure 1: Policies Implemented to Enable Cross-Border Remote Working (Deloitte's Global Remote Work Survey)

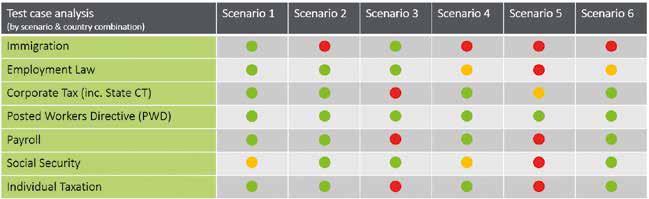

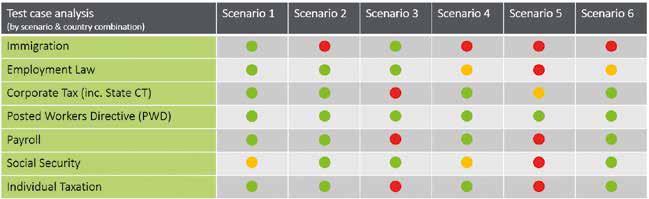

Figure 2: Example Test Case Analysis Of Remote Working Policy Approaches

1. Requiring that the employee must have the immigration right to work in the remote work jurisdiction (64%).

2. Stipulating a prescribed time limit on remote working duration (58%), and

3. Setting an eligibility criteria – the individuals must be an employee, not a contractor (48%).

Some organisations are using technology tools to help stress test their approachi.e., reviewing their remote work policies through various compliance lenses. In doing so they can evaluate how robust their policies are when assessed against compliance requirements, taking into account specific employee scenarios and country combinations (see the example ‘traffic light assessment’ in Fig 2). The results of such assessments help inform the business and define the guardrails they ultimately implement to manage risk.

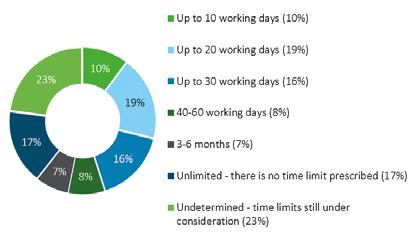

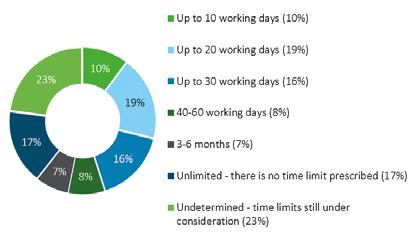

When it comes to time limits, market practice is to define and set a specific day threshold. Our survey results (as illustrated in Fig 3) show that the leading cross-sector trend is to allow up to 20 workdays per year (19%), which is closely followed by up to 30 workdays per year (16%). Organisations tend

to decide on the allowable number of days based on internal discussions (between talent, HR, tax, legal, risk and others) and the feedback they receive from employees and the business.

Whilst our data suggests that some organisations are well along their paths to creating and formalising their remote work policies, a number of organisations are struggling to navigate internal decisionmaking. Uncertainty regarding strategy and approach is cited as one of the top challenges to remote work enablement and many admit they have not yet determined their guardrails. Almost a quarter (23%) say their time limits are still under consideration.

More generally, 30% of those we surveyed indicated that they are either still thinking about what guardrails to put in place or that they currently have no guardrails in place. Many of these are enabling a degree of cross-border remote work, sometimes on an exceptions-only basis but with significant investment of time/effort by internal team members to conclude on these cases or low/no review but with increased risk for the business. Waiting too long to implement appropriate guardrails is a risky path which

could compromise the organisation’s employer duty of care and/or expose it to unmanaged risk and cost.

Although remote work policies, especially those allowing shorter-term restricted remote work, have some similar hallmarks, each will have unique nuances. Many will land on different overall workday thresholds, role and activity exclusions, and other red lines. By encouraging multi-stakeholder collaboration, alignment and buy-in, testing and validating design decisions with your internal function leaders, as well as broader leadership, you can build assurance in your remote work choices, implementing a policy that can be proactively and confidently rolled out across your business.

3 INTERNATIONAL HR STRATEGY www.internationalhradviser.com

Fig 3: Remote Working Time Limit Thresholds (Deloitte's Global Remote Work Survey)

Although remote work policies, especially those allowing shorterterm restricted remote work, have some similar hallmarks, each will have unique nuances

Challenges To Operationalisation: Closing The Gap

Organisations are keen to enhance compliance and mitigate the risk of their remote work policies, but our survey suggests that there is a gap in organisations’ abilities to manage and enforce the guardrails they have implemented. Similarly, organisations are struggling with considerations around the interaction with their business traveller policies as regards tax and compliance thresholds.

With Increased Employee Dispersal Comes Increased Employer Responsibility

Tracking is a particular challenge, with fewer than half of our survey respondents indicating that they currently track all remote work requests.

Given the complexity and volume of remote work requests, some organisations are putting more focus on certain areas – international remote work requests above a certain threshold for example may be examined and assessed more rigorously than a short-term, or in-state/province/country request.

Fewer than half of the survey respondents say they use some form of technology to support their remote work policies (46%). Most report using some form of in-house tool – either with or without an assessment tool capability – to conduct tracking.

Those that do use technology to support their tracking and policy, report finding value in the insights they are able to achieve. Tracking data and aggregation of data allows organisations to demonstrate their compliance if challenged by authorities. It can also aid control functions and other stakeholders to make informed decisions as they review and evolve their policies and review their risk tolerance. Importantly, it allows organisations to know where their people are and to react appropriately in the case of an emergency.

At the start of the pandemic, organisations struggled with ‘one single source of truth’ as to where their people were. Organisations navigated through this but now need to implement the lessons learnt from that period when they proactively surface and roll out a cross-border remote work policy. This includes putting measures in place to track remote workers and mechanisms to help enforce the policies that enable remote work. Individuals choosing to work overseas remotely of their own volition often do not book their travel via central travel systems and, as a result, are less visible to the business. Organisations should consider implementing appropriate processes and technology, with well communicated guidance on the degree of remote work they will permit, and the measures implemented to track or monitor this. We hope that the challenges of recent years will never arise again, but if they do, organisations need to

be prepared with lessons learnt, be that for international assignees, business travellers or remote workers.

to become more human-centred, and respond to talent demands and create stronger, more resilient businesses. Although many organisations are at the beginning of their remote work journeys, they do have the ambitions to go further to progress aspects of their talent strategies. However, there is uncertainty around potential routes to enablement. Global Employment Companies (GECs), Professional Employer Organisations (PEOs) and Employers of Record (EOR) - there are so many acronyms out there and these are not always used in a consistent way! As organisations start to explore the potential for long-term remote work arrangements, some are looking to understand the extent to which alternative employment models can be utilised.

Make Remote… Work!

Whether you are just starting out on your remote work journey and looking to give more flexibility to your people in advance of the 2023 Summer holiday period, or are poised and ready to start offering your business that suite of longer-term remote work packages, here are five key actions that can help you move along that curve and make remote work work!

1. Align To Organisational Strategy

Remote Work – What Next?

The market isn’t standing still - business and employee requests continue to challenge HR and Tax professionals to enable an increasingly diverse portfolio of remote work options. Organisations that have addressed short-term restricted remote work are already being asked by business leaders how and where can they enable longer-term and even permanent remote work scenarios.

Whilst 69% of the survey respondents said they don’t yet permit long-term cross-border remote working and 60% say they don’t use any alternative employment models to manage cross-border remote cases, almost a quarter (23%) have implemented virtual assignments as part of their remote work programme. Long-term remote working may bring increased risk and cost for the business, and it is critical to have early visibility of such cases and gain cross-stakeholder alignment as to the business’s approach to risk and any red lines.

As Deloitte’s Great Reimagination(3) report reflects, remote work and new ways of working offer organisations an opportunity

Every model and approach will look different – there is no one-size-fits-all solution here –so start by knowing what your organisation actually wants to achieve with a remote work policy. If your organisation relies largely upon site-based employees or has made the operational decision to limit days spent remote working, the right policy may be to allow remote work requests only under very specific circumstances. If your strategy is to source talent from around the world, you may want to focus on developing your crossborder work models. This will require you to assess and collectively agree on any risks your organisation is prepared to accept to achieve its ambition. Therefore, the first step must be to align your remote work strategy to the corporate strategy and seek cross-stakeholder buy-in to that strategy alignment.

2. Assess The Risk And Understand Your Red Lines

Work with your leadership and relevant functions (including tax, compliance, talent, HR, payroll and others) to understand what you are allowed to do, what you want to do, and what you can actually do. Develop a clear understanding of the risk and cost tolerance as regard remote work and build in controls and guardrails to manage this. Consider how those red lines might shift as the business and the tax and compliance landscape evolves. Make sure the right capabilities and decisionmakers are at the table.

4 INTERNATIONAL HR ADVISER WINTER www.internationalhradviser.com

As organisations start to explore the potential for longterm remote work arrangements, some are looking to understand the extent to which alternative employment models can be utilised

3. Identify The Routes To Enablement

There is no ‘off the shelf’ strategy or policy that enables remote work, and most organisations will find that, even with a global policy in place, the approach to enablement may need to be adapted to local markets, job roles and business units. However, knowing your risk tolerances allows you to consider the multiple routes to enablement and different options and outcomes along the way.

4. Determine How Best To Track And Govern Your Remote Population

With a clear understanding of what is important to the business and what you want to achieve, consider which technologies can help you manage your remote work policies and tracking most effectively.

There are several technology and tracking tools which can provide greater visibility into remote work requests and activity, delivering better insights and analytics, which lead to more efficient programmes, better enablement to help you discharge your employer duty of care, and improved employee experience together with a more robust tax and regulatory compliance framework. Technology is also key to enabling that the relevant information is fed back into payroll (where applicable), legal, internal audit and corporate functions. Work with the wider business to integrate existing data flows, including interaction with other policies and business travel.

5. Stay Connected To The LongTerm Strategy And Employee Experience

Don’t lose track of why you are doing this and who it is for. Think carefully about how your remote work policies and controls might impact the employee experience and what they might mean in terms of culture for existing and new hires, benefits (including careful assessment of medical, travel and other insurance policies), talent development, performance management and wellbeing. Consider how your remote work policies might influence your duty of care as an employer and your overall employer brand proposition. Make sure you are continuously monitoring and measuring your approach to remote work and assessing employee feedback to keep your programme and policies relevant.

Embrace The Future Of Work, Create A Future That Works

As we enter 2023 there is still no universal agreement on what today’s workplace and work patterns look like. What is clear, however, is that employers increasingly view hybrid work models that combine remote, and in-person work as central to their talent strategies, growth objectives and culture. Now, organisations are

focusing on shifting their remote work journey from ambition to action.

It is a journey of evolution, and every organisation is at their own unique point in that journey, depending on their business objectives, role requirements, risk appetites, and talent strategies.

Based on our survey results and conversations with Deloitte clients around the globe, a robust remote work policy needs to be tethered to clear business goals and a deliberate strategy. Actions need to be taken in several

areas spanning strategy, the assessment of risk, enabling the employee experience, and technology to strengthen and operationalise remote work programmes.

References: (1) www.deloitte.com/remotework

(2) Fall 2022 Fortune/Deloitte CEO Survey (2022 CEO Priorities Survey | Deloitte US)

(3) Deloitte publication: From Great Resignation to Great Reimagination, 2022

Director, Global Employer Services Deloitte LLP

D: +44 20 7007 1805

Email: djwardle@deloitte.co.uk

Associate Director, Global Employer Services Deloitte LLP

D: +44 20 7007 4843

Email: cydavami@deloitte.co.uk

In today’s increasingly competitive world, businesses are having to find new ways to attract, acquire, develop, retain, and deploy key talent and skills. As part of this trend Remote Work, in its many forms, is challenging HR, Reward and Global Mobility functions to delivery ever more innovative and diverse solutions for their business partners. Deloitte’s multi-disciplinary approach to supporting clients to enable Remote Work for their organisations couples’ market leading strategy consulting, with deep technical capabilities across tax consulting, immigration, employment law, regulatory compliance and risk advisory. Find out more here: www.deloitte.com/remotework.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities. © 2022. For information, contact Deloitte Global.

5 INTERNATIONAL HR STRATEGY www.internationalhradviser.com

CYRUS DAVAMI

DEBBIE WARDLE

Tracker Software Technologies Technology to help you manage the Compliance and Duty of Care Risks Associated with Business Travel & Remote Working Pre-Trip Assessment | Live Taxation Alerts | Live Immigration Alerts | Duty Of Care Emergency Location | Remote Working Requests And Location Tracking www.tst-international.com

Global Mobility And ExecutivesWhy We Need To Think A Little Differently

Senior Executives and Board level/C-Suite individuals working in high profile, demanding roles in international organisations are often performing roles with an international dimension. The tax exposure of shortterm (including frequent business travellers) and long-term assignments is both at an employee level and at corporate level. The tax treatment of the employee in the host country may not be consistent with the treatment available in their home country. It is important that the tax issues are identified early on, suitably in advance of any international move or significant travel, to avoid unnecessary exposure. In recent years, there have been increased cross-border initiatives by global revenue authorities and the ensuing legislation has made corporate and employment taxes more inter-related.

While executives are not fundamentally different to any other employee when we consider the impact of international mobility, there are many potential complexities to their circumstances (both personal and given the nature of their role) that means we need to think a little differently about them.

Here are some of the key issues to consider in ensuring the best outcome in global mobility for executives:

1. They Can Represent And Bind The Company

Permanent Establishment risks for Corporate Tax purposes are an important consideration in global mobility of employees. When considering these risks, we are often talking about a spectrum of risk rather than an absolute answer. With executives who are internationally mobile and regularly travelling for business, the risk of triggering Permanent Establishments in other jurisdictions is far more significant than with individuals in a central functions’

role (e.g., HR, IT support) or a junior employee, for example.

Executive team members may well have the right to bind the Company and to sign contracts on its behalf, and routinely participate in the negotiation and conclusion of those contracts. They undoubtedly create some value for their employer. They may have, and make use of, offices available to them in multiple jurisdictions. These are key factors in assessing Permanent Establishment risk. Employers need to be aware of these potential risks and creating Corporate Tax reporting obligations across multiple jurisdictions.

2. They Are Not Always Subject To The Same Oversight

Rightly or wrongly, executives will often have much more freedom in how and when they travel. They don’t always follow standard company policy and may not notify HR or global mobility of their travel. They may need to be able to get to a meeting or event on very short notice, they may be working on a confidential project where it isn’t appropriate for people in the wider business to have sight of details, or for many other reasons. This means that there may not be as much internal oversight of their activities on a global basis, even though these employees may present the most significant profile of risk with their international travel.

There can also be a lack of understanding around executives’ personal circumstances which may impact on their overall tax position, and that of the Company. For example, we have worked with an Executive of a listed financial services business who travelled frequently to the US for business with his employer, but the employer was not aware that his spouse was a US citizen and they also had a home there that they frequently spent time in, with these factors together meaning that he spent enough time to become tax resident in the US and triggered tax and withholding obligations for himself and his employer. Although it would certainly be easier for employers if we could ignore where employees spend their personal time, unfortunately that is not how international tax rules operate, and so more information and background is often required to consider all relevant risks.

3. They Expect Everything To Be Taken Care Of

Company executives are the most senior and responsible individuals within an organisation and have a plethora of demands on their time. They will often be the most vocal. Their absolute priority is the effective running of the business, and they expect a seamless approach to their personal and the corporate entity’s tax affairs when working overseas. Therefore, they need the most timely, responsive, clear and practical advice as possible from their employer and all of their employer’s service providers. Advisers need to be able to move quickly, convey complex issues in a clear and understandable way, and ensure that multiple relevant areas of tax are considered and linked together so the executive and company’s tax affairs are looked at in a holistic way.

4. They Won’t Always Fit Into Standard Policies

The issues to consider when executives undertake an international relocation or assignment may be significant, but these will usually be well planned and understood by all parties involved. Matters become more difficult with the ‘accidental assignment’ or the perpetual business traveller.

The tax risks associated with business travel are more significant with executive employees, as noted above. Their own circumstances are likely to be inherently linked to the Corporate Tax position of their employer, and the Transfer Pricing policy, which will also inform the employee’s income tax position. Frequent business travel by executives should not be overlooked and should be carefully monitored to ensure that local risks are assessed and understood.

Another issue that we have seen many times is that an executive decides that they (and/or their family) do not want to live in the country that they have been employed in, and instead they set up home in one country and commute to work elsewhere. The employee may end up being tax resident in both jurisdictions and potentially create social security and withholding obligations for their employer in the country where they and their family are living. They could also

7 TAXATION www.internationalhradviser.com

create Permanent Establishment risks for their employer in their country of residence if they regularly work from home or from a local office.

5. They May Have More Complex Personal Circumstances

While it won’t always hold true that the most senior individuals in an organisation have the most complex personal tax affairs, they will tend to have more accumulated wealth and may have investment portfolios, property holdings, business investments, trusts and pension funds (among other things). When they relocate internationally, they will likely need to fully understand and plan to maximise the tax efficiency of such investments, consider the implications of consolidating or transferring pension plans internationally, and looking further ahead potentially the Inheritance Tax regime of the country that they are moving to.

Some tax rules in the UK also require some advance thinking to ensure that opportunities are not missed. For example, non-domiciled executives moving into the UK may be able to benefit from Overseas Workday Relief if they structure their accounts and employment income properly. For high earning individuals they will need to consider limits on tax relief for pension contributions under UK rules or consider alternative benefit or cash allowance provision, as well as lifetime allowance protection (and ensuring that protection is not put at risk) for those who have accumulated substantial pension pots.

There are various relevant income thresholds involved, but, very broadly speaking, for executives coming to the UK who have an adjusted income of more than £240,000 per year, it is likely that they will be impacted by rules that act to reduce the amount they can contribute to a pension scheme whilst obtaining UK tax relief. The standard annual allowance for tax-relieved pension contributions in the UK is £40,000, but this is reduced (by tapering) for high earners. If their adjusted income exceeds £312,000 for the tax year, then their annual allowance for pension contributions (employee and employer) will be reduced to a minimum of £4,000 (for the 2022/23 tax year). If their pension contributions exceed this level, then they will be subject to an annual allowance charge to effectively claw back any tax relief they have obtained in respect of these excess contributions. Some employers (and employees) therefore prefer to replace pension scheme contributions with a cash allowance alternative; this is not necessarily any more tax effective, but it reduces the administration involved and also gives the employee a cash flow benefit with which they can do as they choose

(e.g. make investments as opposed to pension scheme funding). Employers should ensure that they give suitable consideration to any ongoing home country pension provisions that could occur during an assignment (e.g. a US to UK assignee remaining in their 401k scheme), which can be impacted by the same annual allowance rules.

High earners in the UK may have also accumulated significant pension savings over the course of their career. In the UK, as well as rules regarding how much can be contributed to a pension each year whilst obtaining tax relief, there is an overall lifetime allowance for pension savings. Pension savings more than the lifetime allowance (currently £1,073,100 for the 2022/23 tax year) are subject to a lifetime allowance charge of at least 25% on a crystallisation event. There have been various opportunities for pension scheme members to apply for lifetime allowance enhancements or protections, which will usually protect rights up to a higher level than the standard allowance. As part of the protection agreement with HMRC, the individual may have been required to agree that they will not start or join a new relevant ‘arrangement’ for employer provision of death or retirement benefits. Therefore, employees and employers should be particularly cautious of, usually unwittingly, invalidating existing lifetime allowance protection through participating in any relevant overseas schemes following an assignment/transfer overseas.

It is also worth remembering that tax favoured investments in one country will not necessarily have the same status in another. For example, ISA’s in the UK are not recognised in the US. Their existence has no tax advantages in the US and can lead to additional and onerous US reporting requirements.

6. Their Remuneration Packages Tend To Be Larger And Individually Negotiated

Executive employees will have the highest levels of remuneration in the organisation and will most likely participate in any bonus and equity plans that the company offers. This will often mean ongoing tax compliance and reporting requirements in both home and host locations both during and after assignment periods.

If they relocate, they often negotiate additional terms and benefits into their agreements, which might range from pet relocation and schooling for children, to flight allowances for their spouse and insurance for their fine art collection to be shipped internationally. Employers should ensure that the tax implications and reporting requirements of all of the different benefits and allowances are fully understood. Some

jurisdictions also have special regimes that mean that remuneration packages can be structured in a particular way to maximise the tax efficiency, so advice should be sought in advance of finalising contracts to understand if there may be a better way to do it.

7. They Are More Likely To Be Subject To Non-Audit Service Restrictions

Some executives will be classified as having a ‘Financial Reporting Oversight Role’ (such individuals often known as “FRORs”), meaning that they have a role in which they are able to exercise influence over the contents of the financial statements or anyone who prepares them. This might therefore include members of the board of directors, CEO, CFO, COO, Legal team, Director of Internal Audit or Financial Reporting etc., (non-exhaustive list). US audit independence rules prohibit an SEC-regulated Company’s audit firm from providing non-audit services to FRORs. This means that your auditor cannot provide tax advice to your FROR executive employees, even if they are your global mobility services tax provider. This can present issues, especially given increasing pressures for companies to regularly rotate audit provider to ensure independence. Executives are often particularly averse to needing to switch advisers part way through their assignment or explain their circumstances to a new team.

8. They Present The Highest Cost Of Getting It Wrong

As the remuneration levels of executives are typically the highest in your organisation, the risk of not properly reporting in any given jurisdiction is more significant as you will be dealing with larger numbers. In many countries penalties and interest for failure to properly report will be tax-geared and proportionate to the lost tax revenues. For that reason, there may also be increased scrutiny of high earning employees by tax authorities.

Aside from tax, social security and payroll issues, an employer must also consider immigration requirements for executives travelling to different countries on business, which can be difficult to do without full oversight of travel plans. No HR team wants to receive a call from their CEO saying they’ve been stopped at a border because they don’t have the right visa (which we have seen happen!).

The reputational risks may also be more substantial, particularly for public companies.

9 They May Wear Many ‘Hats’

We regularly see that executives will possess multiple roles, whether within or outside their main employing group.

Executives may have global roles with their employing group where they have

8 INTERNATIONAL HR ADVISER WINTER www.internationalhradviser.com

responsibilities over multiple entities and jurisdictions. It should be considered from a Transfer Pricing policy perspective how such a global role should be treated, including which entity or entities should ultimately bear the cost of an employee’s remuneration. Such analysis may impact the tax position of the executive, as in many cases an employee’s individual income tax position will be informed by the international cost re-charging arrangements in place for their remuneration. The company and employees’ tax positions must be considered in tandem. The executives may also have roles as statutory directors of different entities within the group; in many countries (including the UK) there are special tax and reporting rules for directors and so these specific rules must be considered. One day they may be wearing their ‘Global CEO hat’ and the next day their ‘UK board director hat’. The question of which ‘hat’ the individual is wearing on any given day may not be straightforward, but for tax purposes it is important for them to keep track of their activities in this way as far as possible.

As well as roles within the group, executives may have external directorship roles. Employers should be aware of any such external roles, particularly where

individuals are internationally mobile, as the interaction of tax and social security rules for multiple roles across multiple jurisdictions can produce some odd and counter-intuitive outcomes.

Summary

There are always many different strands to international employee mobility, including potential areas of risk for consideration. For executives these common risk areas will often be exacerbated due to the responsibilities involved in their roles and the level of their remuneration. There may also be additional specific risks to be considered, such as the complexities caused by directorship roles, Financial Reporting Oversight Roles and more significant personal investment profiles that could be impacted by international mobility. Despite the risks involved, mobility at these levels in the organisation will often be business critical, whether in terms of the activities to be undertaken in a particular jurisdiction, or for the ongoing development and retention of key senior talent. Therefore, the key point will always be to plan ahead as far as possible, be aware of where potential issues could arise and then take steps to proactively manage and mitigate these risks.

Steph Carr is a Director in Global Employer Services at BDO LLP. She has 10 years’ experience in the field of expatriate taxation and also specialises in matters of global equity. BDO can provide global assistance for employment related issues and matters arising from international assignments. If you would like to discuss any of the issues raised in this article or any other expatriate tax matters, please do not hesitate to contact Steph Carr on +44 (0) 20 7893 3538, email steph.carr@bdo.co.uk or Andrew Bailey on +44 (0) 20 7893 2946, email Andrew.bailey@bdo.co.uk

9 TAXATION www.internationalhradviser.com

STEPH CARR

Global Tax Update

EUROPEAN UNION

Cross-border teleworkers and their employers

The European Economic and Social Committee (EESC), a consultative body of the European Union, recently released a statement on the taxation of cross-border teleworkers and their employers.

Some of the key points raised in the document include the following:

• Cross-border teleworking poses particular challenges to the current international taxation systems, particularly in relation to the taxation of wages and the taxation of company profits

• A cross-border teleworking employee could face double taxation on his or her income, resulting in lengthy and costly disputes between the employee and member states' tax authorities

• In terms of the taxation of company profits, international teleworkers may inadvertently create a permanent establishment (PE) for the company in a country other than its own. If a PE were established in another country, the company would be forced to accurately divide its corporate income between the two locations, and thus be subject to different filing obligations and tax liabilities

• It is important that taxation systems be updated further to address the needs of today's work environment. The international corporate tax framework has recently been overhauled through an agreement on an OECD/G20 Inclusive Framework tax package consisting of two pillars

• Any new rules addressing the taxation of cross-border teleworkers should be easy for both employees and employers. One possibility would be for member states to agree to only tax the employee if the number of working days in the country exceeds 96 days per calendar year. The EESC notes that in the OECD/IF tax work, a multilateral instrument (MLI) has been used as a tool to facilitate a timely implementation of new tax rules

• The EESC encourages the EC to consider whether a one-stop shop, like the one in the VAT area, could be a possibility. It would require the employer to report the number of days cross-border teleworkers worked in their country of residence and in the country where the employer is located.

BDO Comment

The EU’s interest in this area mirrors that of other countries such as the UK. In September 2022, the Office of Tax Simplification (OTS) requested evidence regarding emerging

trends and tax implications of hybrid and distance working. These trends are here with us to stay, and a more efficient way of addressing taxation implications are being sought across the world.

The FED provides relief from income tax on up to EUR 35,000 of income for Ireland taxresident employees who travel out of the state to temporarily carry out employment duties in certain countries.

Small Benefit Exemption:

Generally, where an employer provides a voucher or other incentive to an employee, it is chargeable to pay-as-you-earn (PAYE), the Universal Social Charge (USC) and payrelated social insurance (PRSI). The “small benefit exemption” enables an employer to provide a voucher or an incentive to an employee without giving rise to a charge to tax where certain conditions are satisfied.

The budget increases the small benefit exemption limit from EUR 500 to EUR 1,000 per year. An employer can now provide up to two (previously one) benefits, totalling EUR 1,000, in a year. These changes take effect from 28 September 2022, so the increases can be provided to employees in the current tax year.

Rate Bands And Credits:

There will be a significant increase in the standard rate cut-off point to EUR 40,000 so a single individual can now earn an additional EUR 3,200 before paying tax at 40%. There is also a EUR 75 increase in the personal tax credit, employee PAYE and earned income tax credits.

IRELAND

Budget 2023 measures affecting employment tax Ireland’s Minister for Finance presented Budget 2023 on 27 September 2022. The key employment tax measures announced are as follows:

Special Assignee Relief Programme (SARP): SARP provides income tax relief for certain individuals who are assigned to work in Ireland from abroad. The main benefit of the programme is that 30% of the individual’s income in excess of EUR 75,000 is removed from the income tax net. There are a significant number of qualifying conditions to be satisfied to avail of this relief.

The SARP is being extended for another three years through 31 December 2025. However, for individuals claiming the relief for the first time in 2023, their basic salary will have to be at least EUR 100,000, increased under the budget measures from EUR 75,000. Existing claimants are not affected by this change.

Foreign Earnings Deduction (FED):

The FED scheme is being extended for another three years through 31 December 2025.

Finally, while there are no increases to the employer PRSI rates, this may only be a temporary reprieve as this issue is part of the government’s medium-term roadmap for personal tax reform.

Finance Bill 2022 Includes Employment Measures

Ireland’s recent Finance Bill, released on 16 November 2022, introduced some changes regarding employment taxes that were not highlighted in the Minister of Finance’s Budget speech on 27 September.

Employer Reporting Obligations For Certain Benefits:

In a significant development, the Finance Bill proposes the introduction of new reporting requirements for certain tax-free payments made to employees. These include:

• Travel and subsistence payments

• Allowances paid for remote working

• Small benefits.

Employers will be required to report details of such payments electronically monthly. Although precise details of the reporting requirement are pending, the reporting of travel and subsistence payments is likely

10 INTERNATIONAL HR ADVISER WINTER www.internationalhradviser.com

These trends are here with us to stay, and a more efficient way of addressing taxation implications are being sought across the world

to create significant additional work and complexity for employers and may require changes to their systems to facilitate compliance. Although these payments are exempt from PAYE, the proposed amendment may give the Revenue increased oversight of such payments and the ability to manage any perceived tax risk. This proposal is subject to ministerial approval.

Share Options:

Irish Revenue continue to focus their attention on employee share plans. The bill now empowers the Revenue to impose a penalty on employees exercising share options who fail to comply with the requirement under existing share option legislation to file a return (Form RTSO1). Share option gains are not subject to payroll taxes in Ireland, but are taxed through the selfassessment regime.

Pensions

The bill also includes several pension-related amendments.

In a welcome change, employer contributions to a Personal Retirement Savings Account (PRSA) made on behalf of an employee are no longer considered a taxable benefit-in-kind for the employee. Previously, this treatment applied only to occupational pension plans.

The Finance Bill also introduced a number of provisions to give effect to the EU regulations on the creation of Pan-European Pensions Plans (PEPPs). The bill provides for a new form of approved pension product (the PEPP), which will be like existing Irish PRSAs. The tax treatment of benefits and contributions to PEPPs will be the same as applies to other pension products currently available in Ireland. Of particular interest will be individuals’ ability to continue to contribute to their PEPP, even if they change residence between EU jurisdictions, and potentially claim tax relief in their country of residence.

Significant Forthcoming Changes To The Taxation Treatment Of Company Cars Executive Summary:

Significant changes to the basis of taxing the benefit in kind (BIK) arising from the provision of a company car will come into effect from 1 January 2023. The new provisions, which are already on the statute book, will change the basis of the charge from one based solely on the original market value (‘OMV’) of the car and business mileage travelled, to one which also takes account of the vehicle’s CO2 emissions. This will result in a higher level of BIK being imposed on cars with higher emissions. The changes will apply to existing company cars as well as new cars provided to employees on or after 1 January 2023. Employers who provide cars to their employees will need to

take account of these changes in their payroll systems and also review the calculation of current BIK charges.

Current Basis

The cash equivalent/BIK is equal to the OMV x 24% (€28,000 x 24%) = €6,720 New Basis effective 1 January 2023 180g/km in CO€ emissions puts the car in vehicle category E under the new system.

The applicable BIK rate is 30%.

The Cash Equivalent/BIK is equal to the OMV x 30% (€28,000 x 30%) = €8,400.

Electric Cars:

The legislation also provides for the tapering (reduction) of the current BIK exemption for electric vehicles (EVs). This will see the current exemption reducing as follows;

Year BIK Exemption for EVs 2022: €50,000 2023: €35,000 2024: €20,000 2025: €10,000 2026: NIL

Company Vans:

The flat rate BIK charge on company provided vans, currently set at 5% of OMV will increase to 8% from 1 January 2023. The exemption for electric vans will be tapered on the same basis as for electric cars from 2023.

BDO Comment

New Basis Compared To Old:

At present the BIK on company cars is calculated at the rate of 30% of the original market value of the car. A discounted rate is granted where the employee incurs significant business related travel. Currently, there are five mileage bands which provide for a BIK charge ranging from 30% to 6% of OMV depending on the level of business mileage incurred. These will be reduced to four bands.

The new system will retain both OMV and business mileage as factors in calculating the BIK charge, however, it will also take account of the vehicle’s CO2 emissions. For many users with cars in the middle of the emissions range, it is likely that the BIK charge under the new system will remain the same as at present. Those with cars in the highest emission range (over 179g/km), will however, see an increase in the percentage benefit in kind charge across all mileage bands, with a new maximum rate of cash equivalent/ benefit in kind of 37.50%. Furthermore, the minimum BIK rate after discounts for business mileage will increase from 6% to 9%.

Example:

• Employee has use of a car provided by his or her employer on 1 January 2022

• The OMV of the car is €28,000

• The car produces 180g/km in CO € emissions

• The actual business kilometres travelled in the year are 32,000 kilometres.

Employers who provide cars or vans to their employees for private use will need to review the treatment of these benefits now to determine the impact of the changes and to ensure that the correct notional pay is subject to tax with effect from the beginning of 2023. In light of current pressure on fuel prices and the need to address climate change, it may also be an appropriate opportunity to consider whether the provision of cars as a benefit in kind continues to be an appropriate part of remuneration policy going forward.

Should you need any assistance with the implications of any of these changes please contact your BDO advisor.

NETHERLANDS

Budget proposes updates to 30% scheme

In its September 2022 budget proposal, the Dutch government announced that, for 2023 and onwards, it would amend the 30% scheme to limit the maximum amount that eligible employees may receive as a tax-free allowance.

Under the 30% scheme, employees with specific expertise who are recruited abroad to work in the Netherlands are currently eligible to receive up to 30% of their taxable wages tax-free.

The Dutch government has confirmed its plans to limit the 30% scheme by capping the salary basis to which the 30% is applied to the maximum set in the Standards for Remuneration Act effective 1 January 2024 (in 2022 the maximum is set at EUR 216,000). The intent is

include a transitional arrangement

11 GLOBAL TAXATION www.internationalhradviser.com

to

Significant changes to the basis of taxing the benefit in kind (BIK) arising from the provision of a company car will come into effect from 1 January 2023

to decrease the maximum to EUR 216,000 for employees that have taken advantage of the 30% scheme during 2022. These employees’ 30% scheme will be limited from 1 January 2026 onwards. Employees who apply for the 30% scheme on or after 1 January 2023 will be subject to the aforementioned limitation from 1 January 2024 onwards.

SINGAPORE

Administrative concession for employer contributions to mandatory pension/ provident funds to be withdrawn

With effect from the Year of Assessment 2025, concessionary tax treatment that currently is available to employer contributions to an overseas pension fund or social security scheme will be withdrawn in Singapore.

Technically, employers’ contributions to overseas pension plans or social security schemes are taxable benefits that must be reported by the employer to the Inland Revenue Authority of Singapore (IRAS) in the relevant Return of Employee’s Remuneration Form. However, as an administrative concession, the IRAS treats the employer contributions as not taxable if all of the following conditions are fulfilled:

• Contributions are made by the employer to a social security scheme operated, regulated and supervised by the employees’ home country government

• Contributions are mandatory even though the employees are working outside their home country

• Contributions are not borne by, or no deduction is claimed by, a permanent establishment/company in Singapore; and

• The Singapore company is not an investment holding company, a tax-exempt body, a representative office or a foreign company not registered in Singapore.

Withdrawal Of Concessionary Treatment

As noted above, the concessionary tax treatment will cease to apply as of year of assessment 2025. As a result, all contributions made by the employer to an overseas pension fund or social security schemes on or after 1 January 2024, will be taxable in the hands of the employees, regardless of whether the contributions are considered mandatory or nonmandatory for the employees during their period of employment in Singapore. With these changes, the contributions to the overseas pension will be deductible to the employer provided the normal tax rules for the deduction of business expenses are met.

BDO Comment

The withdrawal of the administrative concessions follows removals of other administrative concessions, such as home leave passage and the provision of housing benefits previously available to foreign employees working in Singapore. The change

is in line with the IRAS’ intention to have a consistent application of the principle of taxability of income and benefits in the hands of the employees, and will likely increase the tax liability of foreign employees working in Singapore. As the changes will take effect from 1 January 2024, employers should have sufficient time to prepare for the change in tax treatment. Employers are encouraged to review their systems to ensure that information is readily available to meet the tax filing needs.

report personal data annually to the account holders’ home jurisdictions. Puerto Rico is one of the few jurisdictions that did not adopt the CRS, so this investigation should provide HMRC with new information on accounts held at Euro Pacific International Bank by UK-resident individuals.

HMRC is checking whether account holders have correctly disclosed Puerto Rican accounts and associated investments on past tax returns. If they have not, HMRC will open civil investigations or launch criminal investigations with a view to prosecution; we understand some criminal investigations have already started.

To help speed up the investigation process, HMRC is urging taxpayers connected to the bank to contact HMRC to disclose any undeclared UK taxes. Disclosures may be made via HMRC’s Worldwide Disclosure Facility (WDF) or its Contractual Disclosure Facility, also known as Code of Practice 9 (COP9). It is essential to carefully consider which disclosure method is appropriate based on each taxpayer’s specific circumstances before approaching HMRC. For example, COP9 provides protection from prosecution for tax offences, in exchange for a full disclosure of all UK tax irregularities, so it can be beneficial in many cases.

BDO Comment

UK

HMRC investigating UK account holders of Euro Pacific International Bank

The UK’s HMRC has confirmed that it is investigating hundreds of UK taxpayers who are suspected of using the Euro Pacific International Bank to evade UK taxes, as part of its “No Safe Havens” strategy. The bank’s operations have already been suspended by the Puerto Rican authorities for noncompliance with Puerto Rican regulations.

HMRC is part of the Joint Chiefs of Global Tax Enforcement, known as the J5, which comprises leaders of tax enforcement authorities from Australia, Canada, the UK, the US and the Netherlands. The J5 is involved in this investigation with the Puerto Rican authorities, which follows on from another launched two years ago against suspected tax evasion and money laundering.

The bank, which was formed in St. Vincent and the Grenadines in 2011 before moving to Puerto Rico, provides accounts for individuals and small and medium-sized enterprises (SMEs) amongst others, including mutual funds and precious metal accounts.

HMRC normally receives details of UK taxpayers’ overseas bank accounts through the Common Reporting Standard (CRS), which requires participating countries to

UK residents who hold or held accounts or investments with the bank should seek urgent, bespoke advice from experienced tax dispute resolution specialists who can support them through the disclosure process until a settlement covering tax, interest and penalties is reached. Those taxpayers who are directly approached by HMRC first will also likely need specialists to guide them through the tax investigation they face.

Prepared by BDO LLP. For further information please contact Andrew Bailey on 0207 893 2946 or at andrew.bailey@bdo.co.uk

12 INTERNATIONAL HR ADVISER WINTER www.internationalhradviser.com

ANDREW BAILEY

Employers are encouraged to review their systems to ensure that information is readily available to meet the tax filing needs

Immigration: UAE Immigration Landscape And Recent Updates

The United Arab Emirates (UAE) is one of six members of the Gulf Cooperation Council (GCC) along with Oman, Bahrain, Qatar, Saudi Arabia and Kuwait. Over the last couple of decades, due to its economic and political stability, high living standards and cultural diversity, the UAE has been one of the most attractive regions in the Middle East to foreign nationals for employment, investment, business opportunities and tourism. Whilst the majority of GCC countries are predominantly dependent on the oil and gas and real estate industries, UAE has been able to diversify its economy and other countries in the GCC are following suit. Dubai, one of the seven Emirates in the UAE and one of the most popular cities in the world, is globally recognised as a hub for trade, tourism and banking.

In the last few years, especially since the COVID-19 pandemic, the UAE immigration landscape has undergone several positive changes and reforms. In 2021, the UAE Ministry of Economics announced a new foreign ownership rule which allows foreign investors to have 100% ownership of the onshore based companies (for certain activities) as opposed to mandatorily requiring a local UAE national to hold 51% ownership. In addition, the last couple of years have also seen the introduction of self-sponsored immigration categories, long-term residence permits and ability for foreign nationals to live in the UAE whilst working remotely for their foreign employers. These changes and reforms have further attracted many foreign businesses and entrepreneurs, high-skilled professionals for employment and tourists contributing to the overall growth and economy of the country. Furthermore, the UAE’s technology drive has made giant leaps in the immigration space making the processes, timelines and requirements more efficient and streamlined.

Current Immigration Framework

There are multiple visa categories that form part of the UAE Immigration framework, which include both long-term and shortterm options. Determining the correct visa category for a foreign national is dependent on several factors including but not limited to the intended purpose of the visit/stay; the activities to be performed; duration of visit; and place of remuneration.

The types of UAE visa categories allowing an individual to travel for business, stay or perform work activities in the UAE are outlined as follows:

Long-Term Visas

The Employment Residence Permit (ERP) is a long-term employment visa which requires a local UAE company for sponsorship and allows a foreign national to work and live in the UAE. This visa type is sponsor and location specific which means that the foreign national will only be able to work for the sponsoring company and binds the employee and sponsor in a local employment contract. The validity of this visa type has recently been standardised to two years for both Mainland and Freezone jurisdictions (previously three years in Freezones). An ERP holder is also able to sponsor dependants in the UAE on residence permit (spouses, children and parents).

There are numerous Freezones in the UAE, which are separate and distinct economic areas in which companies and expatriates can hold full ownership rights, and be able to trade within those zones with certain benefits. Regardless of the location of the sponsoring UAE company i.e Mainland or a Freezone set up, the ERP processes across each jurisdiction are very streamlined. The main differentiator between a Mainland and Freezone ERP process is that the former is governed by both the Ministry of Interior (Immigration Department) and the Ministry of Human Resources and Emiratisation (MOHRE), whereas the latter is only governed by the Immigration department. Therefore, the ERP timelines within a Freezone are relatively shorter as compared to the Mainland jurisdiction. The UAE also allows the transfer of ERP sponsorship whilst the individual is inside the country, however, the process may vary depending on the jurisdiction.

As mentioned, an ERP is sponsor and location specific which implies that the holder can only work for, and at, the sponsoring company’s registered location. Therefore, from an immigration compliance perspective, sponsoring companies have to strategise carefully in case of local secondments or when undergoing a Merger or Acquisition as working at other client sites (who are not the ERP sponsors) will not be permissible unless specific authorisations are secured which needs to be assessed on a case by case basis.

Self-Sponsored Visa Types

In 2019, the UAE implemented the Golden Visa programme for long-term residence visas, which allows foreign nationals to secure self-sponsored UAE residence permits with a validity of up to 10 years (renewable). Initially,

Golden Visas were only available or awarded to selected individuals, however, the eligibility for Golden Visas have been widened further to scientists, professionals, entrepreneurs, property investors, outstanding students and graduates, and those considered to be exceptionally talented. Professionals with experience in different disciplines are now eligible to apply for a Golden Visa, provided that they have an employment contract in the UAE and hold a certain occupational level recognised by Immigration authorities (currently Managerial level positions). Individuals should also hold a Bachelor’s degree or equivalent, and have a monthly salary of at least AED 30,000 per month. This category is fluid and the requirements are very much subject to change.

In 2021, the UAE authorities introduced a visa type for foreign nationals to base themselves in the UAE whilst working for their overseas employer based outside the UAE. This nomad visa, known as the Remote Working Visa, is valid for one year and does not require a local company to sponsor the visa. Eligible foreign nationals are able to self-sponsor themselves and perform work activities only for the benefit of their overseas employer. Individuals must be able to provide contractual proof of employment valid for at least one year, and meet a minimum salary level which should be evidenced by way of bank statements and payslips. Evidence of health insurance coverage in the UAE is also required. This visa type allows the holder to sponsor dependents in the UAE on their residence permit and can be renewed subject to the eligibility criteria at the time of renewal.

Since the start of the pandemic, countries around the globe have had to think about remote working, with the UAE leading the way in terms of making provision for a specific immigration category. This category was utilised by individuals and companies following the outbreak of the Russia/Ukraine crisis. The introduction of a separate visa category for remote working, demonstrates the willingness of the UAE government to embrace this way of working and attract expats into the country, where they will be able to benefit from all the perks that the country has to offer; including the nation’s reputation in being a global business and digital hub in the Middle East.

In September 2021, two new exciting visa categories,the Green Visa and Freelance Visa, were introduced by the Minister of State for

13 IMMIGRATION www.internationalhradviser.com

Foreign Trade as part of the UAE’s strategic plans for economic, political and social growth. High performing students, business people, investors and those with specialised skills, will be eligible for the Green visa. Benefits of the Green visa are set to include the ability to sponsor parents, sponsor sons until the age of 25 (this is generally 18 years for other visa categories) and no upper age limit to sponsor daughters. Green visas will also be available for Freelancers and Entrepreneurs, and an annual income from selfemployment in the last two years should be at least AED 360,000, or the individual has to show financial solvency throughout his or her stay in the UAE. These new requirements should also be in place in the last quarter of his year. We are still waiting for the full roll out of the Green Residency Visa at the time of publication.

Freelance visas will apply to self-employed individuals or independent businesses, and could be an expanded version of the UAE’s current Freelance visas allowing greater flexibility for companies and individuals alike. The Freelancer visa allows holders to work remotely or from authorised locations, without needing to have an office space. The UAE Government is very much recognising non-standard employment and work arrangements, and trying to encourage more self-employed and entrepreneurial individuals to establish themselves here.

The UAE also offers a Retirement Visa to foreign nationals who are retired and over 55 years of age (showing no less than 15 years work history). This visa type is granted for five years to those who either have an investment in a residential property or hold accumulated savings of more than AED one million in both scenarios, or have an active monthly income of more than AED 20,000 from pension or a previous employer (AED 15,000 in Dubai). A Retirement Visa can be renewed, subject to meeting the criteria, and again allows individuals to remain in the UAE on a longer-term basis.

In addition to the above visa categories and in a landmark move, in 2021, the UAE Government also introduced new citizenship laws to allow certain categories of foreign nationals, UAE citizenship. Applications are through nominations via the authorities in the UAE, and therefore it is selective in terms of process. However, it enables those who have significantly invested and contributed towards the UAE economy and society, the ability to secure Emirati nationality for the first time.

Short-Term Visas

The Mission Work Permit (MWP) category is the most common short-term work permit category, and requires a local sponsor based in the mainland jurisdiction and allows the foreign national to engage in hands-on and/ or technical work. It is usually meant to facilitate short-term contractual obligations in relation to project-based work. MWP are non-extendable single-entry permits, do not

permit family sponsorships and are valid for up-to 90 calendar days.

A Visit Visa (short-term or long-term) is issued at the request of a local UAE corporate sponsor or legal resident in the UAE. Visit visas sponsored by individuals (i.e. family members) are usually meant to facilitate general visits (tourism/leisure visit visa), while those sponsored by corporates tend to facilitate business travel (Business Visit Visa). Although the UAE authorities do not maintain an exhaustive list of activities that may be conducted on a Business Visit Visa, activities such as attending meetings, conducting research, negotiating contracts, attending training, etc., are permissible in practice. Hands-on or technical work or other activities that may be construed as generating profit are not permissible. Business Visit Visas are generally valid for a period of 30 or 90 days and can be obtained for both single or multiple entries. The type of visa granted would depend on the privileges granted to the sponsoring entity and the quota available to it. Sponsored visit visas for business can be extended in-country, subject to the corporate sponsors eligibility/status and at the sole discretion of the government authorities.

It is important to note that the requirements for obtaining visit visas vary from location to location, with certain areas such as freezones implementing their own list of documentation requirements, which are known to change without prior notice. As such, it is always advisable to check regulations in advance and immediately before travelling.

Certain nationalities such as Brazilian nationals are entitled to a free 90-day Visa on Arrival in the UAE which is only meant for tourism and limited to business meetings.

Dubai’s Vision 2040 And The Future Of UAE’s Immigration

Whilst moving foreign nationals for employment from outside or within the UAE is comparatively easier to the other GCC countries, the UAE alongside other GCC countries is also focused on achieving improvements to the representation of Emirati nationals in the UAE private sector as part of their ‘Emiratisation’ drive. As part of this, the UAE introduced a labour market testing programme in 2017 which required participating employers to advertise jobs on a new portal referred to as Tawteen Gate. This has been gradually ‘replaced’ by the Nafis programme, which was launched in September 2021, and aims to empower Emirati nationals to occupy jobs in the private sector. Included in the Nafis programme is the offer of on-the-job training, talent and apprenticeship programmes, and therefore does not only constitute a local platform to advertise jobs. The UAE Government announced this year that it has an updated Emiratisation target of 10%, to be achieved

by 2026. Companies must ensure that they fulfil all the updated requirements (increasing Emiratisation by 2% each year by the end of 2022, in organisations employing more than 50 employees) otherwise they will be subjected to a monthly ‘contribution’ of AED 6,000 for each vacancy that has not been filled by an Emirati worker, starting from January 2023.

Interestingly, Dubai unveiled its Vision 2040 earlier this year, which primarily aims at boosting Dubai’s economy by focusing on further developing real estate, tourism, health sectors, living standards and investments in the city by 2040. Vision 2040 aims at attracting more foreign nationals to Dubai, and the city’s population is expected to double in the next two decades with the vision of making Dubai the world's best city to live in. Against this backdrop, we anticipate more opportunities for overseas nationals and possibly an expansion of existing Immigration categories or a greater utilisation of existing categories.

As part of the Vision 2040, UAE will also focus on upskilling and developing young Emirati citizens in order to boost local talent in the job market and have a positive impact on the country's future economy. In this regard, a number of initiatives have already been taken by the UAE authorities, such as the introduction of National Development and Emirati Graduate Programmes, where these individuals have a chance to experience on the job training and upskilling with different reputable multinational companies in the UAE.

Whilst UAE’s efforts on developing and upskilling the local Emirati talent will continue, there is a wider focus on foreign investments, with an aim to create balanced opportunities for both the local and international talent. The introduction of new and unique visa types in the last few years, signals a strong intention to ensure that the UAE remains an attractive destination to visit, live, work and reside on a short to long-term basis.

14 INTERNATIONAL HR ADVISER WINTER www.internationalhradviser.com

REKHA SIMPSON Director, Middle East Immigration rekha.simpson@vialto.com

Why Have Dual Career Couples Become A Hot Topic In HR?

Companies that attract and retain high-calibre candidates have integrated the management of dual career couples into their HR policy. They have understood that expat partners are no longer willing to sacrifice their careers to follow them, and that a partner is key to the success of an expatriation. Talented, versatile, highly educated, and financially independent, their expectations must be taken into account.

A few years ago, contacting an expat’s partner directly was seen as crossing a line. Companies were hesitant to interfere with the private lives of employees, and as such had not accounted for them in their HR policies. However, a recent report has shown that 61% of recruitment professionals consider dual careers and partner issues to be of increasing importance to their organisation (Permits Foundation, 2022). Many companies are therefore shifting away from their previous approach; an expat and their partner are inextricable from one another, and the wellbeing of the partner is key to the success of the expatriation as a whole.

TotalEnergies can be considered a role model in this field. In their offices across the world, they host an event every year for expats and their partners; speeches directly address the partners, reminding them of their importance to the expatriation, and the value of this simple act of recognition is undeniable. Moreover, they have integration programmes in place, and partners are an integral part of their HR policy.

In many ways, the company are not sending one employee abroad, but two. Making sure to set aside the time and resources to support an expat couple ensures successful expatriations as the partner is often the unremunerated driving force for integration. They are the Logistics Manager, Minister of Foreign Affairs, Wellbeing Manager, Medical Assistant, the Tour Guide, Event Planner, and often a parent too. So, if they’re not doing well, the whole expatriation can fall apart. Furthermore, relocation and compensation costs may go to waste if an expatriation fails, so investing in integration programmes for expats and their partners and becoming

members organisations that provide professional opportunities to expat partners such as the IDCN, is a worthwhile investment. Not only does this save the company money in the long-term, but it also improves the quality of life of the expat, whose happiness is likely to come through in their work. This in turn improves the company’s reputation as an employer, assuring that they will be able to secure high-profile talent in the future.

Whilst many companies, such as TotalEnergies and L’Oréal, have been trailblazers in supporting expats and their partners, report from the Permits Foundation found that HR professionals in Europe place more emphasis on wellbeing at work, a work/life balance, and the general wellbeing of employees than anywhere else, and only 11% of companies sufficiently support their employees through expatriation (Permits Foundation, 2022). Moreover, their report found that 59% of the companies they studied had had employees reject expatriation opportunities because of concerns regarding the partner’s career or employment, and 44% had seen employees return home early from an international assignment because of concerns about the partner’s career or employment.

So, who are these partners? What are their personal and professional expectations, and how can we prioritise them?

73% of expat spouses work full-time prior to moving abroad (source), 72.4% of them have a bachelor’s degree, and 68% speak at least three languages. They are recognised in their field of expertise, and 80% of them want to work abroad to have a purpose and to avoid financial dependency and gaps in their CV.

“Managing the Double Careers of Expat Couples” is a practical and interactive book which gets to the heart of this issue. There are lots of books written about expats for expats, so why are there so few addressed to the people supporting them? Armelle has interviewed global mobility experts from companies such as TotalEnergies and L’Oréal, and over 100 expats and expat partners, to better understand the new developments in this field.