the charge for digital

Vodafone Cash has highlighted its commitment to improving nancial inclusion in the country at the Mobile Technology for Development Conference (MT4D, 2023), themed “Driving Digital Financial Inclusion in

the Real Economy.”

Vodafone Cash sponsored the event held at the Kempinski Gold Coast Hotel in Accra to foster collaboration among industry players and strengthen e orts toward nancial inclu-

sion in Ghana. Judith Adumua-Bossman, Vodafone Cash Mobile Financial Services Manager, spoke at the event about Vodafone Cash’s e orts to improve nancial inclusion in Ghana.

“Mobile money has gone beyond cash in and cash out, and we are looking for ways to develop innovative products for our customers,” said Judith. As an example, she highlighted Vodafone Cash’s overdraft service, which allows customers to borrow to

The potential of digital technology and innovation to transform lives and create an enabling environment are at the heart of this initiative. Innovative ideas sold during the pitching session, included digitalised farming, eliminating manual labour and using robotics to enhance productivity and multitasking. Others included precision agriculture, drone technology in agricultural spraying (organic fertilizer), and many more.

The Absa/Mastercard Fintech-Agritech programme is a game-changer in Ghana. It is proof that technology can be a powerful tool for transformation and should be harnessed to drive sustainable economic growth and empower the youth. The future of Ghana's economy is in the hands of these young entrepreneurs, and they must be supported and encouraged to reach new heights.

“We nd this relationship with Absa bank very rewarding and impactful. It aligns perfectly with our ethos as a foundation mandated to create change across sub-Saharan Africa,” said Rosy Fynn, Country Director of the Mastercard Foundation.

In a world where innovation and technology are driving growth and development, the Absa/Mastercard Foundation Fintech-Agritech Support programme is an industry leading initiative that is paving the way for young entrepreneurs to revolutionise the sector and transform the Ghanaian economy.

complete transactions, o ering them more convenience when purchasing a bundle, paying bills, and sending money across all networks.

As a business, Vodafone Cash has also made signi cant contributions to the agribusiness sector in Ghana, according to Judith. She spoke about the company’s partnership with Farmerline and Aquafresh, which provides farmers with the technical support they need to practise better farming.

Judith also noted that Vodafone Ghana, with the support of the government, has extended its coverage through its roaming and rural telephony projects. “We believe that nancial inclusion is crucial to the development of the economy and the welfare of the people. It is not enough to have technology; we must evolve it,” said Judith.

Vodafone Cash has been focused on helping liberalise mobile money to embrace all and sundry since its inception.

To achieve this goal, Vodafone Cash has taken the lead in introducing new and pioneering initiatives and campaigns to promote nancial services. “We are passionate about developing nancial products and partnering with technology rms to improve nancial inclusion in Ghana and improve the lives of individuals,” concluded Judith.

The Mobile Technology for Development Conference provides a platform for industry players to discuss the latest developments in the mobile technology space and their potential for driving nancial inclusion in Ghana. Vodafone Cash’s participation as a headline sponsor highlights its commitment to driving nancial inclusion in Ghana through innovative nancial products and services.

Tuesday 21 March 2023 –3 !

Customers want a fr ic tionle ss exprience in acce ssing your ser vi and you c an leverage a world of unt apped re source s through digi t al Thi s will allow you to grow your busine ss and give you a needed advant age in your indus t r y ”

Mrs A sare also shared that the event formed par t of the bank commit ment to foster ing nationa grow th through women empow erment She mentioned, A St anbic Bank , we say Ghana i our home and we dr ive her grow th That grow th i s possible when we as women harne ss the power of digit al.

That i s why at St anbic Bank we are const antly inve sting in proj ec ts that provide young girls and women ac ross the nation with acce ss to the skills and t raining they need in the are a of digit aliz a tion There are a lot of women who are SME owners and we be lieve that if SMEs succeed, the economy succeeds, since they are the backbone of the economy

Therefore, in order to succe ssfully dr ive national grow th, we must inve st in ensur ing that there i s equ al acce ss to innovation and technolo gy ac ross both genders Held in par t nership with A she si Ent repreneurship C enter, the Women in Busine ss Roundt able was under the theme ‘DigitALL: Innovation and Technolo gy for G ender Equ alit y ’. The paneli sts for the di scussion were Renee Q B oateng , Personal Branding C on-

ut of a spec ial women’s ac, FirstG em vent which was attended by bank and the media was ord by the FBNBank Women rk , an internal ladie s’ group promote s the advancement equ al oppor tunitie s for en in FBNBank

c tivitie s dur ing the event ind a panel di scussion themed celebration s hasht ag , “EmEquit y ” which encourage s en to venture into the techneli sts emphasized the need men in technolo gy to work and t rumpet their achievets in order to c re ate vi sibilit y aneli sts for the di scussion ind Far ida B edwie, a Soft ware neer Audrey Mni si Mireku, nformation Secur it y & Ri sk (GAB) and Mr Henr y Obike of E-Busine ss, FBNBank r ing the welcome addre ss, Isaac-Ar yee, Tre asurer of nk Ghana and Chairperson NBank Women’s Net work “the celebration of InternaWomen’s Day i s an oppor tucelebrate ourselve s and apate e ach other for our tirele ss and dedic ation to making ng ful cont r ibutions to the

World It i s also an oppor tunit y to celebrate the unique role we play in shaping the soc iet y through our personal and profe ssional achievements for which, I believe, our men c an st and up and celebrate us ”

A s par t of the evening’s ac tivitie s and as par t of thi s ye ar ’s International Women s Day celebrations, the Bank launched the FirstG em Account Thi s banking produc t i s aimed at empower ing womenclude a higher intere st rate return reward on deposits and an intere st rate much lower than the commerc ial lending rate.

C ommenting on the FirstG em account , the He ad of Ret ail Banking , Allen Qu aye said, “the int roducing women an oppor tunit y for also in the busine ss arena.

It i s st ruc tured to help close the gender gap in line with what the Bank prac tice s. FirstG em Account come s in three var iants; the FirstG em Current Account for individu als, the FirstG em Savings Account also for individu als and the FirstG em Finance for re gi stered women- owned busine sse s Addic apac it y-building through thought-le adership workshops, busine ss advi sor y ser vice s, and

busine ss skills It will also provide we alth management and inve stment oppor tunitie s and convenience to all holders of the account ”

Spe aking at the event , the Managing Direc tor of FBNBank , Vic tor Yaw A sante, who i s also the pat ron of the FBNBank Women’s Net work said, at FBNBank , we put women at the core of our work and operations, so as we mark thi s ye ar s International Women’s Day, FBNBank dedic ate s the entire month of March to celebrate women (who are female colle ague s, customers or relative s) as a reco gnition of their impac t in br inging positive balance to our live s and as a mark of apprec iation for them ”

FBNBank has in its 26 ye ars of operating in Ghana remained focused on putting its customers sought to do through the r ich value and excellence of what the Bank contr ibute s to the relationship with its st akeholders as a whole par ticularly the customers. FBNBank Ghana i s a subsidiar y of First Bank of Niger ia Limited, which i s renowned for its gre at customer ser vice and general st akeholder engagement garnered over its 12 9 ye ars of operation. FBNBank Ghana has 2 3 branche s and 3 agenc ie s ac ross the count r y with universal banking ser vice s to individu als and busine sse s in Ghana

sult ant Amanda D Akushie

L e ad C onsult ant and Founder of Nilee C onsult and Jemila Abdulai, He ad, Digit al and eC ommerce, St anbic Bank Ghana

They were joined by Odelia Ofor i, CEO SNB Group and Mabel Simpson, CEO mSimps. The se ssion was held to equip young female ent repreneurs with the tools and skills they need to succeed in the world of busine ss.

B en Mensah, He ad, C onsumer High Net Wor th St anbic Bank took the oppor tunit y to congratuof St anbic Bank for their cont r ibution to the grow th of the bank He said, “St anbic Bank i s a bank that champions diversit y in ever y are a. We are proud to have st rong women as le aders who work daily to ensure that our busine ss goe s on smoothly At St anbic we are

committed to ac tu ally suppor ting women and not paying lip ser vice rather we put in the ac tu al work to empower ing women to re ach for their dre ams ” St anbic Bank Ghana has par t nered many ac ademic institutions and FinTechs to deliver a number of STEM-related projec ts L ast ye ar, the bank par t nered with WiSTEM (Women in Sc ience Technolo gy Engineer ing and Mathematic s) to organize a 5- day t raining

c amp for young girls from second ar y schools ac ross in STEM St anbic Bank also par t nered with Ghana Enterpr i se s Agenc y (GEA) to launch the Women Ent repreneurship Workshop at the St anbic Busine ss Incubator in Acc ra The t wo - day workshop was de signed to provide female owners of Mic ro Small and Medium Enterpr i se s (MSMEs) with the nece ssar y tools and knowledge to grow their busine sse s

Tu e sd a y 21 M a rch 202 3 –4

The Minister for Finance, Ken Ofori-Atta, has commended Japanese volunteers working in various parts of the country for their invaluable contribution to the country’s growth and development.

He made this known when he addressed the volunteers who are under the JICA’s Volunteer programme which is one of Japan’s Technical Cooperation schemes operated as part of its O cial Development Assistance (ODA).

The JICA Volunteer programme brings Japanese citizens to developing countries to assist their development e orts.

About thirty-three (33) volunteers are currently working in various elds including healthcare, education, ICT, creative arts, Community Development, and a host of technical vocations.

Citing some of the support the Gov-

ernment of Ghana had bene ted from Japan, the Minister mentioned the Noguchi Memorial Institute for Medical Research which was built by the Government of Japan and donated to Ghana in honour of the Japanese researcher, Hideyo Noguchi, who researched Yellow Fever in Ghana and died from the disease in the country in 1928.

According to him, the role the Research Institute played during the Covid-19 pandemic was very commendable as the premiere biomedical research center in the country complemented Government’s e orts at reducing mortality during that time.

Ken Ofori-Atta also mentioned the ongoing Tema-Motorway Phase II Project and the Assin Fosu-Assin Praso Road Projects as some of the many notable ongoing projects funded by the Gov-

ernment of Japan across the length and breadth of Ghana.

“It's amazing how small steps we take can result in good o ers for future generations", he stated.

Mr. Ofori-Atta disclosed that about 45 years ago, in 1977, the rst group of volunteers landed in the country with the sole desire to o er their talents, labour and know-how across the various sectors of the economy.

This, he underscored had contributed signi cantly to improvement in education and healthcare delivery in the country, especially, the rural areas.

“The new skills you are deploying in the communities you serve is helping make a lasting and transformational impact on thousands of people”.

He revealed the Government’s commitment to further improve relationship with Japan and accel-

erate Ghana’s drive for industrialization. He nally called for the continuous support from “Ghana’s longtime friends” including Japan, as the country was going through some economic challenges as a result of the Russian-Ukraine war and the Covid-19 pandemic.

Speaking on behalf of the Japanese Ambassador to Ghana, H. E Tsutomu Hiemeno, Mr. Nakowi Biteri, thanked the Government of Ghana for the hospitality and security provided for the volunteers. He said the volunteers were enthusiastic to work with the local communities as Japanese goodwill ambassadors. He disclosed that, the volunteers were currently working in Greater Accra Region, Volta Region, Ashanti Region, Bono Region, Ahafo Region, Central and Western Regions of Ghana.

According to him, the programme had made adequate preparation to send other volunteers to other parts of the county but were awaiting the clearance from the security agencies to ensure the safety of their volunteers.

He was optimistic of the quick recovery of the Ghanaian economy.

The Chief Representative of JICA in Accra, Mr Yasumichi Araki also noted that the volunteers had become members of the local communities as they lived and shared valuables with them.

After expressing his profound gratitude to the Minister for Finance for the support his o ce had provided them, he added that, their joy was the warmth and appreciation the local communities expressed towards them all the time. Present at the programme were Ofcials of JICA and the Ministry of Finance.

The Food and Drugs Authority (FDA) and its Chief Executive O cer, Mrs. Delese Mimi Darko received national recognition on Tuesday, 14th March, 2023 for the signi cant e orts the Authority made towards the ght against COVID-19.

The Authority was awarded the Presidential Award of Honour for Distinguished Service while the CEO was awarded the Companion of the Order of the Volta. In the award citation, the FDA was commended for providing regular and consistent communication as

well as an enhanced regulatory regime that pro ered sound scienti c direction for drug utilization and performance of COVID-19 diagnostics and therapeutics.

His Excellency commended the FDA for its outstanding contributions during the COVID-19 pandemic.

He acknowledged the initiative of the Authority during the period when Ghana was faced with a shortage in the supply of personal protective equipment (PPEs), by

leading the development of a national standard for locally manufactured face masks.

It is remarked that to ensure the adequate supply of key essentials to prevent the spread of COVID-19, the Authority also instituted a 72-hour product approval process for “low risks” COVID-19 related products such as hand sanitizers. This 72-hour product approval process helped to ensure a constant supply of quality sanitizers and face masks to the market to stem the tides of the pandemic

while providing employment and sustaining livelihoods in society.

As part of the awards ceremony, H.E Nana Addo Dankwa Akufo-Addo, President of the Republic of Ghana, recognized the dynamic leadership of Mrs. Mimi Darko, who is the rst female CEO of the Authority.

His Excellency also noted the leading role Mrs. Darko played on the continent as Chair of the WHO African Vaccines Regulatory Forum (AVAREF) and her extensive work with the Council for

International Organizations of Medical Sciences Vaccine Safety Working Group.

Through the instrumentality of Mrs. Mimi Darko, the Authority instituted the Joint COVID-19 Vaccine Safety Review Committee which worked tirelessly on the vaccine approval processes and related safety monitoring activities. Several investigations and causality assessments on reported adverse e ects were conducted and bi-weekly regulatory updates were churned out the provide the needed assurances to the nation on the approved vaccines.

The Authority is receiving technical support from the GIZ and the European Union to build its capacity to deliver regulatory support for the manufacturing of mRNA vaccines in the country.

Currently, the WHO is considering the Authority for quali cation to Maturity Level 4 which will make the Authority comparable to the FDA of any developed country. With the construction of an ultra-modern molecular laboratory and a number of capacity building programmes for its sta in specialized areas such as lot release, the Authority is positioned to provide regulatory support for the manufacturing of vaccines in Ghana.

The awards conferred on the Authority and the CEO, therefore, come with greater opportunities for the FDA to continue to be the beacon in medicines regulation on the continent.

The FDA with support from its Governing Board is poised to work to achieve greater laurels in the years to come.

Tuesday 21 March 2023 –5

Huawei and partners hold TECH4ALL media roundtable on Day 1 of MWC Barcelona 2023

Ghana, like many other developing countries, is facing a major challenge with the management of plastic waste. According to the World Bank, Ghana generates over 1.7 million tons of plastic waste each year, with only 2% of it being. The lack of proper waste management infrastructure has resulted in the accumulation of plastic waste on the streets, in gutters, and in land lls. This has led to environmental degradation, health hazards, and a loss of revenue due to the cost of waste management.

However, according to the MSc. Development Management Students of KNUST, there may be a solution to Ghana's plastic waste problem. The country should consider plastic waste exportation as a means of gen-

erating revenue and reducing the burden of waste management.

Plastic waste exportation involves exporting plastic waste to other countries that have the infrastructure and capacity to manage it properly.

One of the primary bene ts of plastic waste exportation is that it can generate signi cant revenue for the country. Many developed countries are willing to pay for plastic waste from developing countries as they require a steady supply of raw materials for their recycling industries. By exporting plastic waste, Ghana can tap into this demand and generate a new stream of revenue. This revenue can be used to develop better waste management infrastruc-

ture in the country, create new jobs, and support other development projects.

The team of student who are also known as ECOBUDDIES, embarked on an environmental sustainability project at the Teshie Southern Cluster of Schools duded the Sankofa Project which seeks to educate, engage, empower young students in the cause of ghting plastic waste. In three thematic areas the SANKOFA PROJECT was rolled out. EDUCATION, TRAINING, ECO-BUDDIES CLUB FORMATION. Thy students were taken through a practical session on how to properly dispose of their waste as well as segregating their waste. They were also enlightened on the 4 “Rs” of

plastic waste management which are – REFUSE, REDUCE, REUSE AND RECYCLE. The students were then taken through the process of turning waste materials into valuable and useful thing such as portable lotion holders, stationary holders, ower pots, and beautiful picture arts all using plastic waste. The District Education Director, Mrs. Theresa Tetteh commended the ECOBUDDIES Team for an impact project geared towards environmental sustainability. Post engagement sessions of the Sankofa project the especially with the believe that sustainable development was to ensure that present generations are able to meet their needs without com-

promising on the ability of future generations to meet their own needs. Taylor an International Development Student from Trent University, Canada also joined the team together with Mackintosh Africa to facilitate the trash to treasure training session. The ECOBUDDIES TEAM comprised of Ms. BAABA BANNERMAN, Ms. HANNAH SARFOA, Ms. ESTHER AGYAPONG and led by Mr. PETER ADETOR.

The ECO BUDDIES team is looking froward to partner other international Organizations such as SIDASwedish International Development Cooperation Agency who are keen to support recycling and import of plastic waste initiatives.

Nairobi

China Media Group (CMG) Africa on Friday held a forum entitled “Opportunities Arising from Chinese-style Modernization” in Nairobi, Kenya.

The forum brought together African and Chinese scholars to share their insight on the development of China-Africa relations.

The guests interacted with students from the University of Nairobi on topics such as China’s unique path to modernization, its adherence to peaceful development, the promotion of multilateralism, and new opportunities for cooperation between Africa and China.

Sensational Ghanaian singer, songwriter, and performer, Regina Lamisi Awiniman Anabilla Akuka, known by the stage name, Lamisi, has been awarded in the Kingdom of the Netherlands for her exploits in alternative music and for promoting the rich Ghanaian culture to her global audience.

The musician was part of several distinguished individuals and other professionals in the diaspora awarded for ying high the ag of Ghana and contributing their quota to the country's development in various ways.

The recognition of the musician by the Representative Council of Ghanaian Organisations in the

Netherlands (RECOGIN) and the Embassy of Ghana in the Kingdom of the Netherlands happened on Saturday 11th March 2023 at Schepenbergweg in Amsterdam.

Presenting a plaque to the musician, His Excellency Francis Danti Kotia, Ghana's Ambassador to the Kingdom of the Netherlands commended Lamisi for her great success over the years in representing her people and staying true to her culture, which is evident in her music, costuming, and performances.

“It is important we are doing this today as it shows great respect for

you, the others, and the rules you have decided to live by. Honour helps us act in a way that lives up to high ideals, looks out for vulnerable people, and makes a way forward that is better than what has come before; better for everyone. We are convinced this is going to urge you to do more and we also believe that greater things are yet to come for you”, he added.

The ceremony was part of activities to mark the celebration of Ghana’s independence anniversary dubbed “Ghana @ 66 Celebration”, organised by RECOGIN and supported by the Embassy of Ghana in the Kingdom of the Netherlands, and Akwaaba Holland. Lamisi gave an outstanding performance to crown the ceremony.

Tuesday 21 March 2023 –6

The O ce of the Registrar of Companies (ORC) and the Ghana Association of Restructuring and Insolvency Advisors (GARIA) have inducted over 160 members as newly licensed Insolvency Practitioners (IPs) at its second cohort Induction Ceremony in Accra.

The Induction Ceremony, which was also in partnership with other stakeholders including the Bank of Ghana and the Attorney General’s Department, forms part of ORC and GARIA’s key objectives to provide a forum for practitioners engaged in business recovery and insolvency practice. The new cohort brings to a total of over 270 IPs.

Former Chief Justice, Sophia Aku o, who chaired the induction ceremony, commended the inductees for their perseverance and diligence in reaching this milestone. She also advised practitioners to maintain strong morals and values as these are the pillars of success in their respective elds. She emphasized that the character of an insolvency practitioner matters to the stakeholders they represent, as effective institutions are built on well-rooted value systems.

"Your profession is placed in the engine room of our economy, you must raise yourself and be heard on issues concerning the economy, company rescue, and the e ciency of insolvency practice," she added.

The Minister for Justice and Attorney General, Hon. Godfred Yeboah Dame, in remarks made on his behalf by his deputy, Hon. Alfred Tuah-Yeboah, encouraged licensed Insolvency Practitioners (IPs) to prioritize saving distressed companies, emphasizing that the hasty winding down of rms that have the potential to be revived could harm the growth of the private sector.

He stated that the primary objective when dealing with struggling businesses should not be liquidation, but instead, e orts should be made to rescue and preserve distressed viable companies whenever possible, considering the impact on employment and other factors.

“Where a business can be saved by restructuring, every e ort should be made by skilled professionals to save it by restructuring it, therefore there is now the need to encourage lawyers, accountants, and bankers to take an interest in the restructuring profession,” he said. Furthermore, he expressed his belief that the expertise of well-trained insolvency practitioners would be highly sought after, given the current global economic conditions and the growing complexity of the business environment.

Registrar of Companies, Jemima Oware, reiterated the need for inter-agency collaboration across the nancial spectrum – banking, accounting, taxation, insurance and securities – as well as with the judiciary to promote e ciency in the application of the Corporate Insolvency and Restructuring Act (CIRA).

“It is going to o er greater ability to respond to the local needs of distressed companies, address crossover problems, and will clarify and improve the role de nition of each of these agencies, especially when creditors and other claimants initiate a charge against a distressed company,” she explained, whilst pledging her support for training and related activities.

She stated that the review of the CIRA regulations is still ongoing, as the legal committee of the company of the registrar has requested additional work from the consultant. The aim is to ensure that key stakeholders review and approve the regulation before it is passed by parliament to improve the work of insolvency practitioners.

As for the operationalisation of the ORC, she con rmed that they are close to nalizing and approving the strategy document. Once accepted, the plan is to make the

ORC self- nancing to carry out its mandate, which includes the establishment of an Insolvency Service Division. This division will regulate insolvency practitioners for the rst time.

In her own words, "After these documents have been accepted, we will move to ensure that the ORC is self- nancing to carry out its mandate which includes the establishment for the rst time, an Insolvency Service Division to properly regulate insolvency practitioners."

In a speech delivered by the Bank of Ghana's Head of Resolution O ce, Elliot Amoako, on behalf of the Govenor, Mr. Amoako, said that though it operates in a specialised segment, the Bank would not hesitate to seek the assistance of licensed insolvency practitioners if the need arises.

“I want to stress that the resolution of banks and SDIs is subject to the Special Resolution Regime established by Banks and SDIs Act 930. The Bank of Ghana, however, will not hesitate to rely on licensed professionals under the Ghana Association of Restructuring and Insolvency Advisors (GARIA) in the event of any future occurrences."

In addition, he encouraged licensed insolvency practi-

tioners to stay informed about global developments, as increasing levels of globalization meant that events occurring in other parts of the world could have local consequences.

CEO of GARIA, George Fosu, explained that the induction ceremony is part of the association's broader objective to equip IPs with the essential core competencies required to assist businesses and organizations.

He emphasised that current training and education of insolvency practitioners needs improvement, particularly in terms of business modelling, strategy, and corporate balance sheet restructuring. “This ceremony is essential in laying a solid foundation for the inductees to develop the skills and knowledge necessary to assist distressed organizations in managing their businesses, properties, and a airs,” he said.

Additionally, Mr. Fosu noted that the ceremony aims to raise awareness among businesses across the country about the availability of specialised professionals who can provide assistance, particularly in the current challenging economic climate.

"Another important reason for this ceremony is to raise awareness among businesses across the country that there are specialized professionals who can help and assist them, particularly around this

Tuesday 21 March 2023 –6

Michael Ackon, a student of the University of Professional Studies, Accra (UPSA), has emerged as the winner of the 2022 MTN Pulse Business Challenge.

Michael, a third-year Public Relations student won GHS 10,000 after a keenly contested competition. The six nalists were tested on ‘Business Knowledge’ and lessons from the Business Challenge Boot Camp 2022. Michael proved to be up to the task, impressing the judges with his innovative ideas and business acumen.

In the nal round of the competition, each contestant was given 60 seconds to pitch a business idea to the judges. Micheal delivered a brilliant pitch and was adjudged the winner.

During the three month period, Michael showed exemplary leadership, excellence commitment and teamwork, which he attributes to the quality of education and training he has received from University of Professional Studies. He is currently the Organizer for the Communications Studies Students Association and Vice Presi-

dent for the UPSA Entrepreneurship Club.

In his acceptance speech, Michael thanked the judges, MTN Pulse, and his fellow contestants for the opportunity to participate in the Business Challenge “Winning this challenge means a lot to me. It has given me the opportunity to showcase my potential. It is a validation of the hard work and e ort I have put into my studies and my passion for business.”

He also dedicated his victory to his mother, who he said has been very instrumental in his drive and passion. He added that he will invest the prize money into buying tools and resources to grow his business. The Business Challenge is an annual competition, organized by HR Focus for tertiary students in Ghana to unearth and showcase their entrepreneurial and business skills. This year, the competition was headline sponsored by MTN Pulse.

First Baptist Congregation Church Chicago USA in collaboration with the Christians Helping Children International Non-Governmental organization (CHCI NGO) has made a donation worth GHC 60.000 to Countryside Childrens Home at Bodwease in the Central Region of Ghana.

The Senior Pastor Rev. Dr. George W. Daniels during the presentation revealed that, the church adopted the Countryside Childrens Home in the year 2008 through recommendation by the founder and Director of CHCI Henry Tweneboah Koduah and they have continually supported

the Home. He said, the church is happy about the impact it has made on the Home. The Home received cash, food items, clothing including the settling of their utility bills. The founder and mother of the Home Emma Boafo Yeboah together with the administrator

of the Home, Ernest Owusu received the donation. They expressed their sincere gratitude and promised to use every item received to the bene t of the Home. The Senior Pastor was accompanied by Deacons Timothy L. Davies, Russell Warren and Ronald Myers and Henry Tweneboah Koduah as they visited some other

Tuesday 21 March 2023 –7

Tuesday 21 March 2023 –8 ownload the Bank on the GO! Subsidiaries NTHC WEEKLY MARKET SUMMARY EDITION : 11 /23 E E S S T T 1 1 9 9 7 7 6 6 NTHC Securi NTHC Trustees NTHC Reg istr ars NTHC Commodi NTHC Proper NTHC As set M anagement T T R R E E A A S S U U R R Y Y B B IIL L L L M M A A R R K K E E T T A A C C T TII V VIIT T Y Y A A U U C C T T IIO O N N R E E S S U U L L T S S | | T EN N D D E E R R 1 1 841 1 | | 1 1 3 3 T T H H--1 1 7TH M M A A R R C C H H ,, 2 2 0 0 2 3 3 At the j ust e nde d Tre asury Bi ll au c on , the Governme nt accepte d a total bid of GH¢3.32 bill ion across the 91 , 182 and 364-day bills i n the f ace of a total tende r of bids, amo un ng to GH¢4.20 billio n Securi es Bid Tendered GH¢ (M) Bid A ccepted GH¢ (M) Weighted Average (%) 91 Day Bill 1,991 19 1,434 52 19.9998 182 Day Bill 1,161 83 924.23 22.8483 364 Day Bill 1,056 17 959.57 26.8239 The week-on-week yi eld s witne ssed a n overall approximated d rop of 4.16bps, 3.71 b ps an d 0.72bp s across the 91, 182 and 364 -da y bills resp ec vely. Securi es Current Yield (%) Previous Yiel d (%) Change (bps) 91 Day Bill 19.9998 24.1610 -4.1612 182 Day Bill 22.8483 26.5564 -3.7081 364 Day Bill 26.8239 27.5442 -0.7203 E E Q Q U UII T T Y Y M M A A R R K K E E T T AC C T T IIV VIIT T Y Y | | 0 0 6 6 T T H H M AR -- 1 1 0 0 T T H H M M A A R R,, 2 2 0 0 2 2 3 Days Date Volume Value GH¢ GSE Composite Index (GSE-CI) Monday 06/03/23 - -Tuesday 07/03/23 32,982 43,787.94 2,392 18 Wednesday 08/03/23 71,450 110,211.37 2,391 80 Thursday 09/03/23 37,915 56,742.51 2,420 65 Friday 10/03/23 3,234,930 3,276,899.59 2,479 53 T T O O P P T T E E N N TR A D D E D D E Q Q U UIIT T IIE E S S | | 0 0 6 6 T T H H M AR –– 1 1 0 0 T T H H M M A A R R ,, 2 2 0 0 2 2 3 3500.00 1,000.00 1,500.00 2,000.00 2,500.00 3,000.00 3,500.00 M TN C A L G G BL TOT… BOPP G O IL S IC G C B PBC CPC s 0 0 0 ' n I B B ON N D D M M A A R R K K E E T A A C C T TIIV V IIT T Y Y | | 0 0 6 6 T T H H M M A A R R -- 1 1 0 0 T T H H M A A R,, 2 2 0 0 2 2 35 00 1 0 00 1 5 00 2 0 00 2 5 00 4 Y r 4 . 5 Y r 5 Y r 5 5 Y r 6 Y r 7 Y r 8 Y r 9 Y r 1 0 Y r 1 1 Y r 1 2 Y r 1 3 Y r 1 4 Y r 1 5 Y r Bond Coupon Rat e C ur ve20 00 40 00 60 00 80 00 100.00 120.00 4 Y r 4. 5 Y r 5 Y r 5. 5 Y r 6 Y r 7 Y r 8 Y r 9 Y r 10 Y r 11 Y r 12 Y r 13 Y r 14 Y r 15 Y r s 0 0 0 , 0 0 0 ' n I Bon d Value Traded D D O O M M E E S S T TIIC C M M A A R R K K E E T T A A C C T TIIV VII T T Y Y | | 1 1 3 3 T T H H M M A A R R C C H H,, 2 2 0 0 2 2 3 3 Domes c In dicat ors Current (%) Previous (%) Change (bps) Interbank Rate 25.87 25.87 0.00 In a on 53.60 54.10 50.00 Monetary Policy Rate 28.00 27.00 100.00 C C U U R R R R E E N N C C Y Y M M A A R R K K E E T T A A C C T TIIV VII T T Y Y | | 1 1 0 0 TH H M M A A R R C C H H,, 2 2 0 0 2 2 3 3 Currency Currency Pair Buying Selling US Dol lar USD-GHS 11.0086 11.0196 Pound Sterl ing GBP-GHS 13.3292 13.3447 Euro EUR-GHS 11.7645 11.7751 Japanese Yen JPY -GHS 0.0819 0.0820 O O U U R R S S O O U U R R C C E E S S :: G G S S E E / / G G F FIIM M / / B B O O G G / / C C S S D N N E E W W S S H HIIG G H H L LIIG G H H T S S T--b b iil lll s s a a u u c ctti i o o n n :: IIn n tte erre e s stt rra atte e s s ff o orr tth h iis s w w e e

9

v v e e

m e e n n tt g g e ett

s G G H H

¢

n n G G o o v v e e

n m m e e n n tt tto o s s e ett T T

e e k k ffa alll l tto o 1 1

9 % %,, g g o o

rrn n m

s

¢

4 4 2 2 0 0 b b

rrn

--b b iil lll rra atte e s s a att llo o w wlly y 1 1 5 5 % % iin n c c o o s stt-c c u u ttt tiin n g g m m o o v v e e

after Russia’s invasion, and June “Aramco rode the wave of high energy pr ice s in 2 022,” said Rober t Mo gielnicki of the A rab

32%

As Nigerians prepare to go to the polls on Saturday to elect a new president, a cash shortage caused by a policy to exchange old Naira notes for newly designed bills continues to cripple the economy, creating a rift in the ruling All Progressives Congress (APC) party. The note swap plan championed by incumbent President Muhammadu Buhari has led to violent protests across the country and resulted in a temporary suspension of banking e Supreme Court to overturn the policy, citing severe hardship faced by people and businesses dependent on cash for survival.

Buhari’s apparent intention behind the policy is to curb vote buying by politicians, turning a deaf ear to APC governors who have made repeated calls to postpone the implementation of the policy. Amid fears of the current tensions spilling over to political violence, Buhari said he’s mobilising military and security agents to monitor polling stations for evidence of vote rigging. The severe cash shortage has held the currency steady in spite of the economic turmoil, with the Naira strengthening marginally against the dollar to 755 from 756 at last week’s close. In this context, resolving the cash shortage has become more rate likely to hold around current levels until Naira supplies recover.

Rand sinks to lowest in more than 3 months

The Rand depreciated against the dollar, trading at 18.25 from 18.05 at last Friday’s close—its weakest level since early November. The currency is being dragged lower by broad more than half of the power company’s debt over the next three years to help strengthen the balance sheet and avoid the risk of default. We expect the Rand to continue trading with an 18 handle in the near term, mainly due to the

Foreign Exchange

Down 18%

The Cedi weakened against the dollar, trading at 12.76 from 12.38 at last week’s close as Fitch Ratings cut Ghana’s foreign currency credit rating to ‘restricted default’ after the country missed a $40.6m coupon payment on one of its outstanding Eurobonds. The downgrade aligns with Fitch’s local currency rating, which was cut earlier this month. The foreign debt default was largely expected after Ghana said it would suspend payments on certain bonds as part of its restructuring plan to unlock $3bn in emergency funding from the IMF. The country faces pushback from bondholders over preferential treatment for bilateral lenders, who are being slight improvement in January—we expect the Cedi to depreciate further in the near term.

Down Down 99%

Shilling strengthens as Uganda

resists rate rise

The Shilling strengthened against the dollar, trading at 3674 from 3684 at last week’s close. Uganda’s central bank kept its benchmark interest rate on hold at 10% for a second consecutive monetary policy meeting. The bank last raised by 100 basis points in October, with rates ending the year 350 basis points higher than they were at the start of 2022. Policymakers said the decision to hold rates was aimed at containing domestic demand pressure and supporting edging up to 10.4% last month. In the near term, we expect the Shilling to weaken amid continued food and energy price

Foreign Exchange Down

4.8%

Egypt issues debut $1.5bn sukuk

The Pound depreciated against the dollar, trading at 30.60 from bond, or sukuk, raising $1.5bn. The three-year deal priced to yield 11%, having attracted investor demand of more than $5bn. expect the Pound depreciate further in the week ahead mainly due to dollar strength.

94%

Foreign

Down

Kenyan Shilling hits new low as FX reserves dwindle

The Shilling weakened to a fresh low against the dollar, trading at 126.15 from 125.90 at last week’s close amid increased FX demand from the oil and energy sector. The currency has now lost more than 2% of its value this year. Kenya’s foreign currency reserves also dropped to a new record low $6.88bn from $6.94bn secured a $27m funding deal with the European Union to boost exports to the 27-nation bloc and strengthen the overall business environment. The government is also anticipating $3.4bn in tourism-related earnings this year as it expects tourist numbers to exceed pre-pandemic levels. In the immediate term, however, we expect the Shilling to remain under pressure as importers clamour for dollars to meet month-end obligations.

11.7%

Tuesday 21 March 2023 –9 ! & Thursd a y 16 Ma r c h 202 3 – v est e s 12 9 Senior Treasury Associate, AZA Finance Powered by AZA Finance FX Insights Yadhav Panday Forex Dealer, AZA Finance Foreign Exchange Foreign Exchange Down Ghana’s latest ratings downgrade drives Cedi lower Ikenga Kalu FX Trader, AZA Finance Read our FX insights to stay well informed on latest trends in foreign exchange (FX). MAD GHS AED UGX EUR GBP USD NGN ZAR XOF KES JPY

Nigeria’s election: it’s the Naira shortage that markets are watching Murega Mungai Trading Desk Manager, AZA Finance

Exchange

Forget

Foreign

Exchange

Mitch Diedrick Forex Dealer, AZA Finance

Alex Barmuta Forex Dealer, AZA Finance Weekly Outlook and Review

-

i s a major emit ter of greenhouse gas em i ssions that cont r ibute to climate chan ge Re spondin g to Aramco’s announcemen t , Amn e st y In terna -

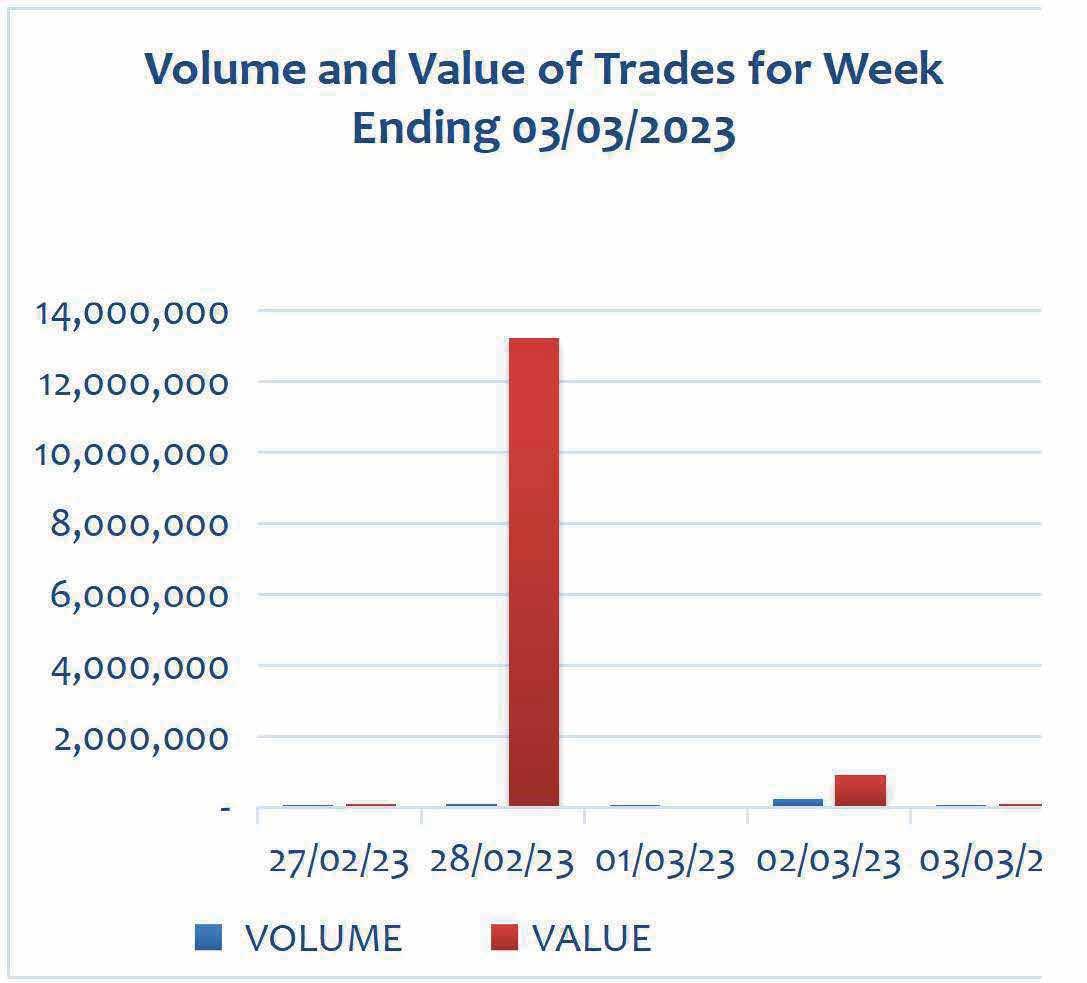

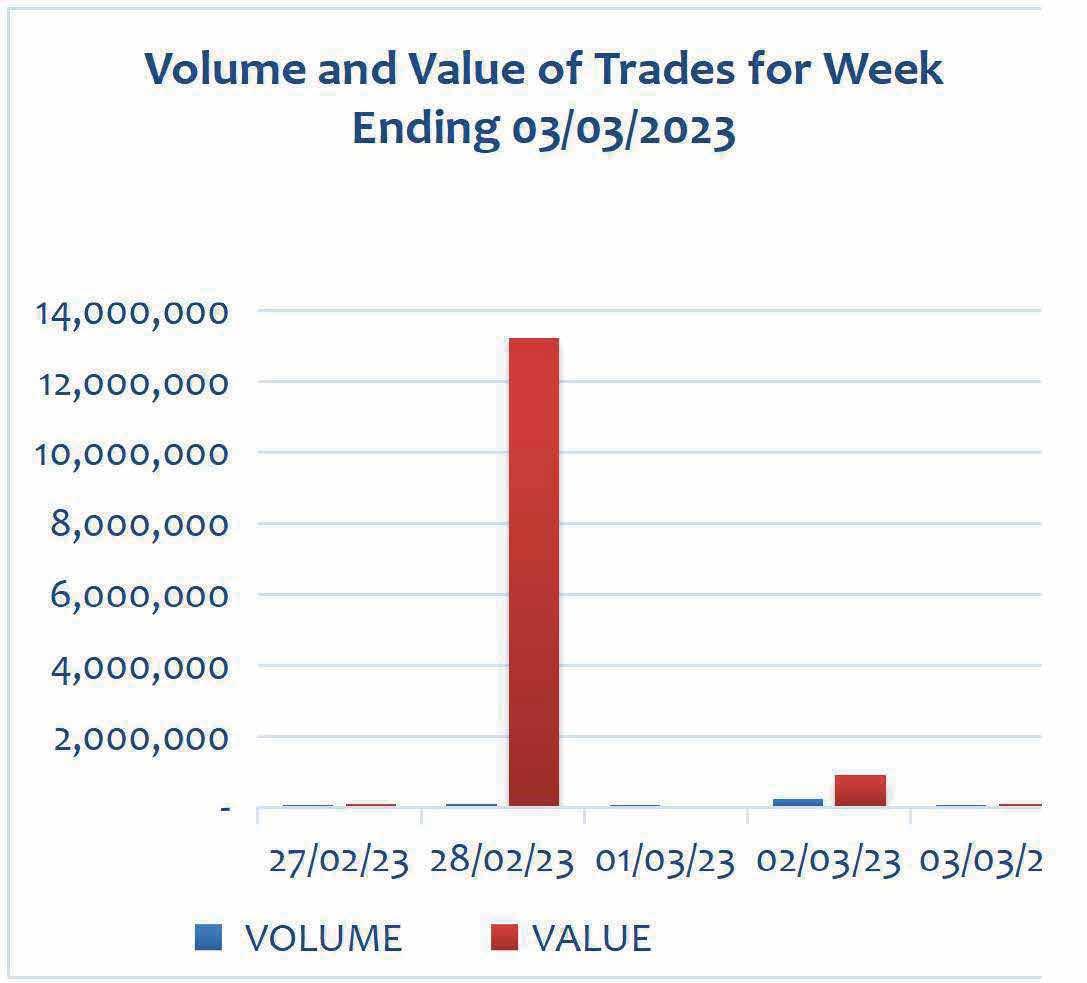

NTHC WEEKLY MARKET SUMMARY EDITION: 10 /23 E E S S T T 1 1 9 9 7 7 6 6 NTHC Securi NTHC Trustees NTHC Reg istrars NTHC Commodi NTHC Proper NTHC As set M anagement T T R R E E A S S U U R R Y Y B BIIL L L L M M A A R R K K E E T T A A CT TII VIIT T Y Y A A U U C C T T IIO O N N R R E E S S U U L L T T S S | T T E E N N D D E E R R 1 1 8 8 4 4 0 0 | 0 0 6 6 T T H H--1 1 0 0 TH M M A A R R C C H H ,, 2 2 0 0 2 2 3 3 Government a t the last tr easu ry bill auc on hel d on March 3, 202 3 rejected all su bmi ed bid s on t he grou nds of hig h i nter est bid rate s It in tur n through t he Bank of Ghana reop ened t he te nde r fo r auc on and directe d all investors to r esu bmit their bi d s at a reduce d rate, p refera bly below 30% because it consid ered the c urre n t bids a t the 35% p lus yi eld s as e xpens iv e It was seek ing to rais e GH¢2.78 billio n to re nance mat urin g b i lls totali ng GH¢2.55 bill ion E E Q Q U UII T T Y Y M M A A R R K K E E T T AC C T T IIV VIIT T Y Y | 2 2 7 7 T T H H F F E E B B -- 0 0 3 3 T T H H M M A A R R ,, 2 2 0 0 2 2 3 3 Days Date Volume Value GH¢ GSE Composite Index (GSE-CI) Monday 27/02/23 45,247 77,192.70 2,426 81 Tuesday 28/02/23 88,932 13,244,114.90 2,408 03 Wednesday 01/03/23 27,318 30,733.82 2,387 88 Thursday 02/03/23 224,323 895,297.97 2,398 87 Friday 03/03/23 55,971 90,660.23 2,38682 T T OP P T T E E N N T T R R A A D D E E D D E E Q Q U UIIT T IIE E S S | | 2 2 7 7 TH H FEB B –– 0 3 3 T T H H M M A A R R,, 2 2 0 0 2 2 3 3 0.00 50 00 100.00 150.00 200.00 250.00 M T N G H C A L G L D G O IL E T F M L U N IL E G H B O P P T O T A L 0 0 0 ' n B B O O N N D D M A A R R K E E T T A A CT TIIV V IIT T Y | | 27 7 T T H H FE E B B -- 0 0 3T T H H M M AR R,, 2 2 0 0 2 2 35.00 10.00 15.00 20.00 25.00 30.00 3 Y r 4 Y r 4. 5 Y r 5 Y r 5. 5 Y r 6 Y r 7 Y r 8 Y r 9 Y r 10 Y r 11 Y r 12 Y r 13 Y r 14 Y r 15 Y r Bond Cou pon Rate Curve5.00 10.00 15.00 20.00 25.00 30.00 3 Y r 4 Y r 4. 5 Y r 5 Y r 5. 5 Y r 6 Y r 7 Y r 8 Y r 9 Y r 10 Y r 11 Y r 12 Y r 13 Y r 14 Y r 15 Y r 0 0 0 0 0 0 ' n Bond Value Traded D D O O M M E E S S T TIIC C M M A A R R K E E T T A A C C T TIIV VII T T Y | | 0 0 7 7 T T H H M M A A R R C C H H,, 2 2 0 0 2 2 3 3 Domes c In dicat ors Current (%) Previous (%) Change (bps) Interbank Rate 25.87 25.87 0.00 In a on 53.60 54.10 50.00 Monetary Policy Rate 28.00 27.00 100.00 CUR R R R E E N N C C Y Y M M A A R R K K E E T T A A C T TIIV VII T T Y Y | | 0 0 7 7 T T H H M M A A R R C C H H,, 2 2 0 0 2 2 3 3 Currency Currency Pair Buying Selling US Dol lar USD-GHS 11.0081 11.0191 Pound Sterl ing GBP-GHS 13.0974 13.1127 Euro EUR-GHS 11.6733 11.6838 Japanese Yen JPY -GHS 0.0805 0.0806 O O U U R R S S O O U U R R C C E E S S:: G G S S E E / / G G F FIIM M / / B B O O G G / / C C S S D D N N E E W W S S H HIIG G H H L LIIG G H H T T S S T T--b b iil lll s s:: g g o o ve errn n m m e e n n tt iin n tte err e e s stt c c o o s stt ffo orr tth h e e lla a s stt tth h rre e e e m m on n tth h s h h iit t ¢ ¢ 4 4 4 4 1 1 6 6 b b n n B B o o n n d d m m a arrk k e ett d d e e c clli i n n e e s s b b y y a a b b o o u u tt 5 5 2 2 5 5 0 0 % % iin n m m a arrk k e ett ttu u rrn n o o v v e err iin n tth h e e m m o o n n tth h o off F F e e b b rr u u a arry y 2 2 02 2 3 3 T T--b b iil lll s s:: go o v v e errn n m

e e n n tt p u u s s h h e e s s iin n v v e e s stto orrs s tto o b b iid d b b e ello o w w 3 3 0 0 % %

Subsidiaries

m

Tuesday 21 March 2023 –10 Thursd a y 26 J an uary 2 0 2 3 – v e s 9 J anua r y 20,202 3 February 17, 2023 Thursd a y 16 M a r c h 202 3 – v est e s 14 u e s d a y 1 4 M a rch 2 0 2 3 – I v es t T i e s 11 M a rc h 03, 20 2 3

Tuesday 21 March 2023 –11 Thursd a y 2 6 J a nu a ry 202 3 – v e s 10 Tues d a y 14 M a rch 2 0 2 3 – I v es t T i e s 12 M a rc h 03, 20 2 3 y 16 M 15

Introduction

Renting a property in Ghana is a common practice for both locals and foreigners who seek temporary or long-term residence. Rent, a condition for tenancy, is paid to the landlord as a result of the landlord/tenant relationship. This is the case whether the lease is for a residential space in a city or a rural property. Understanding rent and tenancy laws in Ghana is essential for both landlords and tenants, as it helps minimizes, disputes and litigation in the courts.

In this article, the statutory and common law rules on the recovery of premises in Ghana is explored. The article will also explain how a landlord can recover possession of a rented property, in accordance with the legal/statutory requirements of the country. By the end of the article, readers will have a better understanding of their legal rights and obligations in the Ghanaian rental market.

What is a valid tenancy under Ghanaian Law?

Tenancy is a legal agreement between a landlord and a tenant where the landlord allows the tenant to occupy their property in exchange for rent. The principal rule is that for a lease or tenancy to be valid/enforceable, it must be in writing and signed by the landlord or by his agent.

There are, however, some exceptions to the above rule. These exceptions are Leases by operation of law; Leases by operation of the rules of equity; and Leases where the lessee is in possession for a term not exceeding three (3) years.

Rights and Liabilities of Tenants and Landlords

Tenants in Ghana have several obligations and rights. The primary obligation of the tenant is to pay rent. Additionally, tenants are required to use a rented property for the purpose for which it was let and not to sublet same without the landlord's consent. The law also requires that a tenant gives a landlord reasonable access to the property for inspections and repairs. Failure to meet these obligations could result in eviction. In a well-drafted lease, there is always an express covenant requiring the tenant to pay rent. In Ghana, however, the majority of tenancy agreements are made verbally and informally, and they often just stipulate the rent and the method of payment. The obligation to pay rent is now implied in residential tenancies for valuable consideration . Under the Rent Act, 1963 (Act 220), tenants have several rights, including the right to peaceful occupation of the premises, the right to adjustment of rent only in accordance with the law, the right of notice any intended eviction or termination of tenancy, and the right to redress before a court of law.

For Landlords in Ghana, their rights and obligations include providing safe and habitable housing, maintaining the property in good condi-

tion, access to their property for maintenance or inspection, to evict tenants who violate the terms of their lease, and the right to terminate a lease at the end of its term.

Equally, landlords must respect the rights of tenants, including but not limited to the right to privacy and quiet enjoyment of the property.

Both tenants and landlords should also adhere to the terms of the tenancy agreement, including the payment of rent, and should resolve any disputes through peaceful and legal means.

The Rent Act on the Recovery of Premises by a Landlord

The Rent Act 1963 (Act 220) (hereinafter referred to as “the Act”) provides the conditions under which a landlord may recover possession from a tenant or that may lead to the ejection of a tenant from the premises.

Premises is de ned by the Act under Section 36 . as any building, structure, stall or other erection or part thereof, moveable or otherwise, which is the subject of a separate letting, other than a dwelling house or part thereof bona- de let at a rent which includes a payment for board or attendance"

According to the law, no order against a tenant for the recovery of possession of the premises or ejectment shall be made by a competent court unless at least one of the conditions below is satis ed. These grounds include non-payment of rent, subletting without the landlord's consent, using the property for illegal or immoral purposes, causing damage to the property among others.

The Recovery of Possession of a Landlord’s property for personal use

A landlord may also apply for an order to recover possession of their property if they require the property for their own occupation or for the occupation of their spouse, children, or parents. The onus of proving that the premises is reasonably required for the personal occupation is on the Landlord. This law was upheld in Adu and Others v. Clegg [1981] GLR 173.

A landlord must further satisfy the following conditions outlined in the case of Boateng v. Dwinfuor [1979] GLR 360 for the recovery of premises for personal use:

1. The landlord must be able to demonstrate a bona de need for the property for their own occupation or that of their spouse, children, or parents.

2. The landlord must have served a notice to quit on the tenant in accordance with the provisions of the Rent Act.

3. The landlord must have given the tenant an opportunity to contest the claim for possession.

4. The tenant must have no valid defense to the claim for possession.

If these conditions are met, the court may grant the landlord an order to recover possession of the property. It is important to note that the Rent Act provides several protections for tenants, and the court will only grant such an order if the landlord can show that the conditions have been met and that the tenant has no valid defense to the claim for possession.

The court must be however be satis ed that, having regard to the circumstances, greater hardship would not be caused by granting the order.

Therefore, in assessing the circumstances of greater hardship, the court shall consider the alternative accommodation available for the person whose occupation the premises are required or for the tenant (Apoloo CJ in Oman Ghana Trust Holdings Ltd v. Acquah (1984-86) 1 GLR 198))

Who quali es as a family member per the Landlord’s recovery of premises for personal use?

The word “family” must not be understood here in the Ghanaian sense of extended relations. A “member of family” is de ned under Section 36 of the Act as meaning the father or mother, a wife, husband, child, brother or sister of the landlord. Other relations are however excluded.

In Nimako v. Archibold [1966] GLR 612 it was emphatically stated that neither statutory law nor customary law places any limitation on the class or age of the landlord's family. Children who are of age or are married are still classi ed as children.

What is the Notice Period Required for ejectment by the Landlord under Section 17?

It was held in Adu and Others v. Clergg (supra) that under section 17(1)(g), six months’ written notice was not required. However, where the lease agreement is terminable by notice, the notice to terminate must be in accordance with the provision of the lease.

Contrastingly, If the lease has expired and the landlord intends to use the premises for their own business purposes, and the premises were originally constructed to be used for such purposes, the landlord must give the tenant not less than six months' written notice of their intention to apply for an order for the recovery of possession or ejectment from the premises .

It is important to note that the landlord must have a genuine intention to use the premises for their own business purposes and must not use this as a ploy to evict the tenant. The court will take into consideration the circumstances of the case, including the nature of the landlord's business, the suitability of the premises for such business, and the reason-

ableness of the notice given to the tenant, when considering whether to grant an order for ejectment. Other grounds for which the Court will grant an order of ejectment?

Where a landlord intends to pull down the premises and construct a new one, or to re-model the premises, an order of ejectment against a tenant may be granted by the court. That is, if the landlord intends to demolish or remodel the rental property, and such construction or remodeling cannot be carried out while the tenant is occupying the property, the court may grant an order for the ejectment of the tenant to enable the landlord to carry out the necessary works. This provision allows the landlord to recover possession of the property to carry out signi cant works, which cannot be done while the tenant is still in occupation.

Secondly, where the tenant was living in the rental property as part of their employment with the landlord, and their employment has now ceased, the court may grant an order for possession or ejectment at the instance of the landlord. This provision allows the landlord to recover possession of the rental property that was provided as part of the tenant's employment package, now that their employment has ended .

Lastly, if the landlord was previously living in the property themselves, but let the property while they were away from Ghana or the local area, and now wishes to re-occupy the property, they must have let the property furnished during their absence. If these conditions are met, the court may grant an order for the ejectment of the tenant to enable the landlord to re-occupy the property if the property was let substantially furnished .

The law, it must be stated, abrogates the tenant's obligation to pay rent in cases where the landlord breaches his fundamental duty to ensure his tenant's quiet enjoyment by entering the property and evicting the tenant before the tenancy expires.

A landlord must satisfy one of the conditions speci ed in section 17(1) of the Rent Act, 1963. Tenants whose tenancy have determined, but who cannot be ejected because the landlord has not satis ed section 17(1) may continue in possession as statutory tenants. The tenant may, of course, decide to quit on the determination of his tenancy; but if he decides not to, he cannot be lawfully evicted unless the landlord satis es section 17(1).

Procedure for Recovery of Premises

The general overview of the procedure for the recovery of premises in Ghana (after any of the provisions under Section 17(1) has been triggered) is espoused as follows:

1. The landlord must rst give the tenant a notice of intention to recover possession of the premises. The notice must be in writing and must state the grounds for the recovery of possession.

2. If the tenant does not comply with the notice of intention, the landlord may then apply to the Rent Control Court or the High Court (depending on the jurisdiction) for an order for the recovery of possession. The application must be made on a prescribed Form, supported by an a davit.

3. The tenant must be served with a copy of the application and the supporting a davit, along with a notice of the date and time of the hearing.

4. The court will then hear both the landlord and the tenant and any witnesses they may call. The court may also order a visit to the premises to assess the condition.

5. If the court is satised that the grounds for the recovery of possession have been met, it may make an order for the recovery of possession of the premises. The order must be served on the tenant, and the landlord may then take possession of the premises.

It is important to note that the procedure for the recovery of premises may vary depending on the speci c circumstances of the case. It is therefore advisable to seek legal advice before taking any action to recover possession of premises.

• Conclusion

The purpose of the Act's statutory provisions is to provide a framework for resolving disputes between landlords and tenants in a fair and just manner. It ensures that both landlords and tenants are aware of their respective rights and responsibilities and that they follow the proper legal procedures in any dispute resolution process. The provisions of the Rent Act provide a clear and objective basis for resolving disputes between landlords and tenants, which helps to prevent arbitrary evictions and protect tenants from abuse by unscrupulous landlords. By setting out these grounds for recovery of premises and the legal procedures for eviction, the law helps to promote fairness, stability, and security in the rental market in Ghana.

THE WRITER IS A BARRISTER AND SOLICITOR OF THE SUPREME COURT OF GHANA AND A MEMBER OF ZOE, AKYEA & CO LAW FIRM. HIS LEGAL INTERESTS INCLUDE BUT ARE NOT LIMITED TO REAL/PROPERTY LAW, COMPANY AND COMMERCIAL PRACTICE, CONSTRUCTION LAW, INTERNATIONAL TRADE & INVESTMENT LAW, AND DISPUTE RESOLUTION.

PUBLISHED BY INVESTMENTTIMES EDITOR: BENSON AFFUL PHONE +233 54 551 6133 MAIL info@investmentimesonline.com ADDRESS Plot 91 Baatsona | Spintex - Accra Tuesday 21 March 2023 –A N E W T HINKI N G policy