20 minute read

Win Win Situation of Listed Villas and Owners Economic Losses

An Economic Diagnosis

Heba Hatem Abdelhalim Aggour

Advertisement

Supervisors:

Abeer Elshater, Associate Professor, Ain Shams University Josefine Fokdal, Associate Professor, Stuttgart University Ayat Ismail, Assistant Professor, Ain Shams University

Abstract

Passing by Alexandria’s old town centre is like crossing through an open museum incorporate different architectural styles: Italian, British, Greek and French buildings stand there where it exhibits Alexandria’s history. Desoki (2007) mentioned, since the end of the 19th century Alexandria was a cosmopolitan city including a high number of foreigners lived together and influenced the city to have a collection of an

astonishing variety of architectural styles. One of the most pressing issues today confronting communities with historic preservation laws is restricted proprietors who don’t have the will or the funds to keep up their historic properties. Since the listed buildings in Egypt are not profitable from the financial perspective, the owners are willing to destroy it and locate a substitution option for their monetary needs. The primary objective of the research is to discover the best approach to raising the financial estimation of the listed buildings in Egypt until it has the same estimation of or more than the building if decimated and replaced by a tall structure project, so the owners may become willing to keep and safeguard it.

Keywords Economic diagnosis, Demolition phenomenon, Listed buildings, Owners.

Introduction: Research Problem

The main problem of the research is the rapid destruction of the listed buildings in Alexandria focusing on the period starting from 2011 till 2016. The indicators of the active existence of the problem are evident in Figure 1.a; the yellow line reflects the greatest height stature that is permitted by the building regulations in the area and nobody ought to surpass it. The tall structures developed during and after the revolution are the ones under the red arrows while the ones under the dark arrows are the structures that exceeded the extreme allowed tallness, before 2011. It also represents a pointer for the activism of Alexandria construction mafia, who had an incredible part in this quick development of illegal structures through and after the political disarray occurred in Egypt (Save Alex, 2012).

Figure 1: Visual Indicators of the existence of high number of illegal buildings constructed in the historical sites of Alexandria in 2011. (Source: Save Alex, 2013)

Figure 1: Visual Indicators of the existence of high number of illegal buildings constructed in the historical sites of Alexandria in 2011. (Source: a. Save Alex. Facebook page, 2012. b. Borg, 2013)

Research Justification

Through Roman era, the perception of the natives to their culture heritage primarily concerned its lifetime, elegance, and authenticity (Licciardi, 2012). He said that, though in the 18th century and while the Italian Renaissance, the perception of the citizens shifted to how satisfying the structure mirror the culture, history, and uniqueness of the city (See Figure 1.6). This opinion obtained from the large number of culture preservation schemes and the issuing of the initial charters like Venice Charter, the United Nations Educational, Scientific, and Cultural Organization (UNESCO) and International Council on Monuments and Sites (ICOMOS) (Licciardi, 2012). The power of the private sector, the financial development, and the globalization competition are determinants forced the citizens to perceive the heritage from an economic point of view. The estimate of the historical building value enhanced according to how efficient is the structure, if the financial profits are not

sufficient enough, then it doesn’t deserve to be protected anymore (Licciardi, 2012). That’s why the research adopted the discussion of the problem from the economic perspective.

Aim and Objectives

The main aim of the research is to change the value of the listed buildings from being with only a culture value to be with also an economic interest for the owners. The primary objective of the research is to discover the best approach to raising the financial estimation of the listed villa in Alexandria until it has the same estimation of or more than the building if decimated and replaces by a tall structure, so the owners are willing to keep it and safeguard it. Accordingly, the central question of the research raised, how to achieve a win-win situation between listed buildings in Egypt and the economic needs of the users?

Methodology

The research used the mixed methods research to combine the quantitative and qualitative data together by a Question-driven perspective to first explain, understand realities, relationships and evaluations on the previous decisions taken towards the phenomenon occur in Alexandria, its dimensions, and situations in the form of scenarios and observations. The research then analyzed the domestic situation of Alexandria’s city center with the surrounding regions and creating scenarios of their predicted future situation. To achieve the win-win situation, change a balance between two existing scenarios will be studied in the research. Scenario one is the demolition of the listed building for a real estate construction towards higher financial profits, while scenario two is the keeping of the building and investing in it. The research then studied the economic diagnosis, comparing the two scenarios mentioned above and analysis of a similar case study on the focused level was done by interviews, surveys, and questionnaires about the actual outcomes and ways of evaluating the historical buildings economically. Then the research reflected the theoretical data and the case studies on the future scenarios for the situation, reaching a win-win situation between the preservation of the historical buildings and the economic viability of the restricted owner. This step was done by comparing future scenarios scenario planning process of the building when demolition and when preserved, Questionnaires with the focus group.

Research Structure The research structure was attempted to set up the reader in Chapter One and Chapter Two to peruse whatever is left of chapters quickly as illustrated in Figure 5. In Chapter Four, the research experiences the financial finding of six cases in Alexandria concentrated on three connected urban zones including the downtown area. This chapter talks about the budgetary misfortunes the proprietor of the restricted building faces, through the monetary investigation. The causes behind these crevices were talked about in Chapter Five, ordered into the awareness aspects, rules controls, and the incentives programs. These perspectives will be discussed in the research through a near examination of the German and Egyptian Heritage administration framework. At last, Chapter Six will begin to outline a

conceptual framework, redistribution of partners, an action plan that cover the financial gap and the conclusion of the research.

Conservation and economy: Heritage conservation impact:

Chapter One speaks to the primary watchwords the research is going to state consistently, the effect of legacy preservation, the standard global assessment mechanisms. It also discusses the financial incentives applied globally to see in the further chapter how it can be contextualized in the Egyptian context. In Chapter One the impact of the heritage on the city was brought into the discussion. As seen in Figure 7, the monetary advancement impact of heritage preservation was evident in a study was done in Germany, saw that incomes from the sponsorships and state subsidizing to the proprietors of the enlisted structures were higher by four to twelve times than the anticipated standard yields (Haspel, 2011).

Heritage economic evaluation

The economic evaluation of the heritage, as shown in Figure 6, is practiced understanding the financial impact of the heritage conservation in the area and the city and how it can be integrated into the planning process for a sustainable improvement (Licciardi, 2012). The economic calculation of the historical value of the listed properties is classified into two types: The use and the non-use valuation which also represents the tangible and the intangible heritage. First is the use-value or the market value, related to the direct price valuation, as the value of the land according to the market price, the admission fees of the historical site and the rent value of the residential or the commercial unit in the building (Throsby, 2007). The non-use value is more toward displaying how much it is economically valuable diversifies from person to another or from a locality to another and according to its bequest value. Recently, some researchers commenced studying the mechanisms that can measure the use value and the non-use value of the culture heritage (Licciardi, 2002).

Figure 2: Heritage economic valuation types. (Source: By Author) Figure 9: Statistics of heritage linked tax reductions in Berlin. (Source: by Haspel, 2011. Edited by Author)

Economic diagnosis

The monetary investigation is going to determine the Cost-Benefit analysis of some existing cases in the focus area of study which express whether the real estate high-rise building projects on lands of previously existed listed villas, restoration project, reuse project. It also minds considering in the analysis other listed villas which

have an unknown future, where the research will assess the Cost-Benefits of them in various hypothetical expected scenarios. The aim is to comprehend the measure of the financial misfortunes the proprietor is confronting because of the limitations put on the property he possesses and whether it is feasible to be solved according to the current approach of the city or not. The focus area as shown in Figure 8, in Al-Raml district, Moharem Bek, and Al-Hadara district. The city center contains a big number of villas for the economic diagnosis and the famous monuments. The research intended to analyse not only one concentrated urban space but also include Moharem Bek and Al-Hadara district to pick the comparative cases from it.

Figure 3: The diagram shows the method the economic diagnoses will be calculated to reflect on the value of each scenario. Figure 10: The objective of case one, two and three.

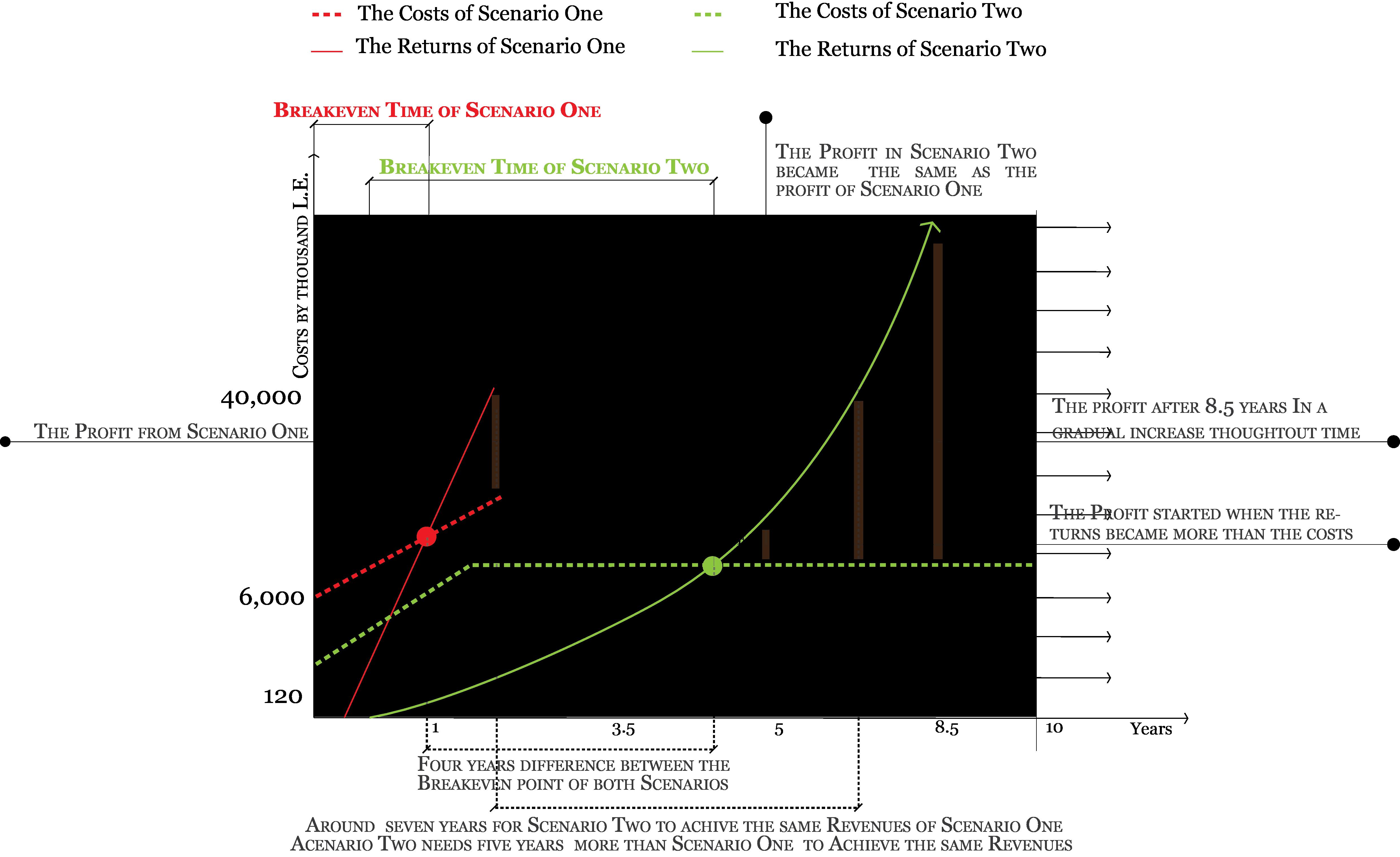

Case one is two real estate projects replaced the previously existed listed villas. In this case, the economic analysis assessed the possible housing price of the project and how much earns the investor will own at the end of contracting all the units. The object of this case is to recognize how the benefit calculations are arranged to be similarly executed over the comparison of the two scenarios. A telephone interview with an employee of the real estate companies were produced to recognize the value of the meter in the two projects. Another semi-structured interview with an experienced contractor. Case two is regarding the reuse of the historical building like L passage, executed a restaurant food court design on the ground floor of a historical multi-story building. The research prepared a semi-structured interview with the investor of L Passage. Another semi-structured interview with the architect and with the operation administration of the company owns the historical building hosting L Passage project “SIGMA”. Case three is about the restoration of the villa, represented in Sarsaa Pasha Palace on Fouad street that is restored by the authority to lease it later to a private foreigner company. The objective of analysing this case is to appreciate how much costs restoration project may require and to practice this on the subsequent comparative cost-benefit analysis. From case four to case six, the comparative cost-benefit analysis of the two scenarios will be implemented, and then measuring the economic profit gap. In Case four, the destroyed Villa, which either in the future was assumed to have another real estate project on its land (scenario one). Scenario two in case the government may reconstruct it again, as an international way of heritage conservation trend, and reuse it as a museum or a restaurant. In case five, the neglected villa calculated the Cost-Benefit price on scenario one and two and concluded the economic interest gap occurred among them. The sixth case is a neutral occupied and wellmaintained villa, which the corresponding estimations are done on it also to test the economic differences that can occur in different locations in Alexandria (see Figure 13 and 14).

The economic diagnosis explained the gap between the two scenarios which varied according to the change in variables. In case four, the implementation of the regulation or not, turned the profit from the villa by reconstructing and reusing it to be higher than the benefits comes from a real estate project on the same land. According to an interview done with Nassar, a member of the Technical Securities Heritage Committee of Alexandria and a professor in Alexandria university, the committee tends to put guidelines in the regulations concerning the heights of the newly constructed constructions in a site containing many historical buildings. The execution of these instructions can spare the villa from demolition and be preserved to be more valuable than the real estate project, or any other project requests the destruction of the building (See Figure 7)

Figure 10: a. case one, example one, b. case one, example 2, c. case two, d. case three. (Source: by Author)

Figure 5: The calculations of case four, five and six. Figure 14: a. case four, b. case five, c. case six. (Source: by Author)

In case five, it was ensured that the implementation of the regulation already stated in the heritage list of Alexandria and the law could change the situation of the villa from being very lower than the other investment project to be near the same amount of revenues or even higher. In case six, the implementation of the regulation can get no difference. The reason is the high value of the land is in the real estate market, due to the prominent location in the city center of Alexandria and the Sultan Hussien old street. In this case, the compensation of the owners is a necessity frequently performed by incentive programs asserted in the regulations on the country, state and city levels. According to the results came from case six, the gap between the two venture is clearly extraordinary. Likewise, scenario one can accomplish a high benefit in brief time, while scenario two, is a long

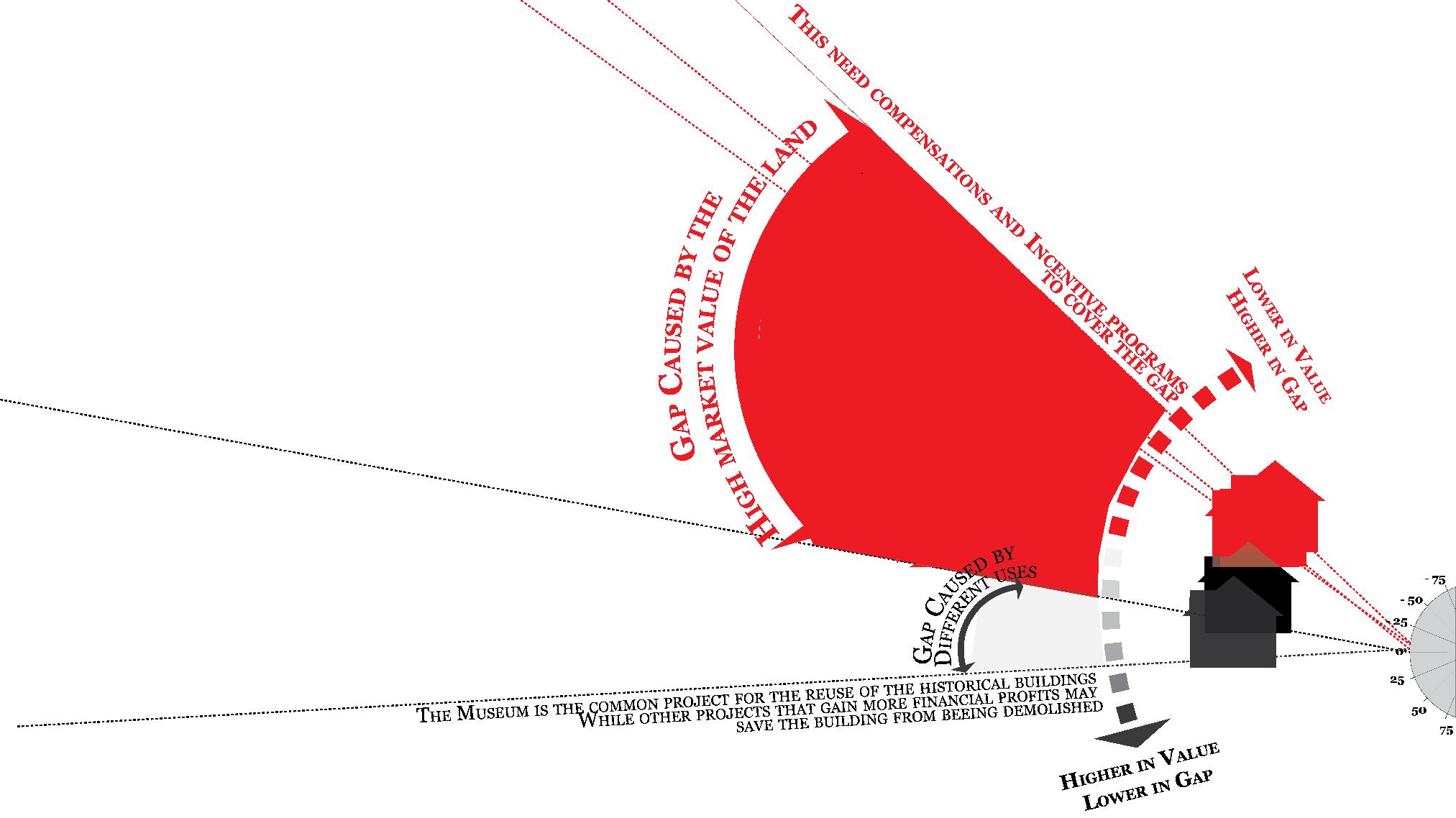

haul nonstop interest investment (See Figure 15). The gap essentially is not the gap of the capital as critical as the time difference between the benefits achievement. In the nowadays extraordinary pace of economic evolution, the demand on quick, high profits is the most aspired intention to survive and attain the life needs for him and his family. So, the main causes behind the economic gap are the not applied regulation of the heritage list, the wrong type of reuse and the not existed incentive programs to cover the difference in the real estate value in the market (see Figure 6).

Figure 6: The calculations of all the cases in the economic diagnosis. (Source: by Author)

Management system comparative analysis

The research then focused on comparing the heritage management system in Germany and Egypt trying to understand the missing points in the Egyptian system that can be tackled to solve the problem of the demolished listed buildings. The result of this comparison led to conclude the need of Egypt to review the importance of involving the city’s culture in schools as a subject. The Egyptian regulations of the listed buildings protection have been developed since 2008 to be more efficient as a written state, however, in the practical execution, these regulations are not efficiently applied whether due to the unclear stakeholders or the conflict occur among them or the high load on the governmental institutions. The not applied rules are prompting the owner to demolish his

property because of the unfair state he endures. There are some written criteria in the folder of Heritage list on the city level which are not practiced on the ground. Some of these not applied regulations are, there should be a set of full documentation file for each historically recorded structure, appropriate guidelines and requirement would be applied to any wanted modifications, improvement or renewal for these historic buildings. The heritage list also declared that there should be setting for regulations and recommendations for the treatment of the disfiguration and the visual pollution generated in the listed buildings which are not applied on the ground. The subjects announced in the law 144/2006 on the national level of Egypt and which controls the heritage management in all the cities, the government should be responsible for preserving and renovating the prohibited constructions. The main reason of these not executed rules is the big load on the governmental bodies to manage the listed buildings and the centralization of the decision makings. The recommendation part in the thesis focused on tackling these causes to drive these laws to be implemented on the ground.

Figure 7: Graph illustrates the Break-even point, Break-even time and Profits on the long-term for a case like case six. Figure 11: The Reasons of the gaps between scenario one and Two from all the cases of the economic diagnosis. (Source: by Author)

Discussion:

At the end of the research a conceptual framework, a roles redistribution map, and an action plan were designed. The conceptual framework tends to put the initial steps needed to be done to tackle the three aspects mentioned in the previous paragraph and the primary stakeholders introduced. The redistribution maps attempt to divide the new stakeholders involved in new relations and decide on their new duties in managing the heritage of Egypt and Alexandria. Then comes the action plan where the initial framework and the new tasks of the introduced stakeholders are combined in a more comprehensive timeline.

Conceptual Framework:

The conceptual framework worked on reducing the existing economic gap illustrated in the economic diagnosis part in Chapter Four by dividing the points of actions into three sections. The first part concerns the activities that should be done to overcome the gap occurred from the loopholes in the regulations. The second part is focusing on reducing the gap arose from the enormous difference in the economic market value of the land. While the last part intends to state the actions that can be taken to minimize the economic gap occurred from the

Figure 4.37: The Reasons of the gaps between scenario one and Two from all the cases of the economic diagnosis. (Source: by Author)

lack of awareness about the existence of the heritage, the right reuse type for each and the rights they own towards the city. The Framework also mentioned the existing and the new stakeholders that should be responsible for these actions.

Roles redistribution map

Towards a workable conceptual framework, a redistribution of the stakeholders’ responsibilities, tasks and relationships of the proposed bodies is to be explained. The research revealed that the three institutes of GOPP, NOUH concerned with the heritage management on the national level and the Heritage Committee of Alexandria on the city level should handle their duties to a newly introduced committee. The three mentioned institutes have to control the regulations and procedures of the heritage management system, the roles of the new private bodies on the national level and utilize comprehensive ordinances on the city level. The three institutes are also qualified for offering indirect incentives with the aid of the launched funding organizations. The newly introduced body is an NGO, which consists of two committees; first, the economic expert's board includes business people and real estate experts, and second the professional board includes urban planning and architecture professionals and a private real estate company. The purpose of the NGO is to perform excellent documentation of the listed buildings, design of described guidelines of its reuse, prepare researches and surveys in the city, determine the use and non-use economic evaluation for all the listed buildings and manage the funds required for the listed buildings.

Short-term Action plan

The action plan is arranged into sixteen steps; some activities combine two sub-steps to be fulfilled. The action plan is presented throughout the stakeholders responsible for practicing each action and which is realized in the various coloured core lines, as shown in Figure 17. The research decided to show a short-term action plan, due to the critical state of the listed buildings, notably the villas, that requires a quick procedure to be performed in parallel with the long-term strategy that should be arranged in the further studies. However, the awareness is the only aspect of the action plan that demands an extended period to influence the heritage process; it is necessary to tackle it as a cornerstone for the seize of the action plan. The action plan is on the national and city level represented in Alexandria, and also relevant for cities have the same context. The aim of the action plan is to apply a way to grant incentives for the owners to be keen on saving their properties and to the investors to seek the funding and the investments in the heritage. It also aims to boost the awareness and to create a new system of managing the legacy in a comprehensive way. The not practiced rules are one of the central factors of the heritage decay in Egypt, which the action plan determines to adjust by decentralizing the process of heritage administration and support the city to have its declarations. Hence, it lessened the load on the government to be only concerned with the setting of the regulations and the indirect heritage incentives. The action plan attempts to involve the private sector to run the legacy on the city levels and to be accountable for monitoring the implementation of the regulations and the laws on the legacy. The action plan was produced in steps and not in particular dates since the short time of the research get it hard to comprehend how long precisely every action should take.

Figure 8: The action plan of the research. (Source: by Author)

References

Dessouki, Yasmin (2007): The Bibliotheca Alexandria and the preservation of Egypt’s visual cultural heritage, checked on January 20, 2015 Save Alex. (2013). Workshop. Alexandria, Egypt Licciardi, Guido; Amirtahmasebi, Rana: The economics of uniqueness. Investing in historic city cores and cultural heritage assets for sustainable development / Guido Licciardi, Rana Amirtahmasebi, editors (Urban development series) Throsby, D. (2006). The value of cultural heritage: What can economics tell us? In Clark, K. (ed.) Capturing the Public Value of Heritage: The Proceedings of the London Conerence 25-26 January, 2016. London: English Heritage. Aboelkhier, M. (2015, September 20). Heritage destruction phenomenon in Alexandria [Telephone interview]. Save Alex member Borg, Y. (2016, January 10). Heritage destruction phenomenon in Alexandria [Telephone interview]. Save Alex member El-Awady, M. (2016, Spring). Heritage destruction phenomenon in Alexandria [Three Telephone interviews]. Accounting professor, Faculty of commercial, Al-Azhar university El-Henawy, I. (2016, May 03). Heritage destruction phenomenon in Alexandria [Personal interview]. The operation administration of the SIGMA company El-Sharabasy, F. (2016, March 15). Costs and Benefits of the construction of a real estate project [Personal interview]. High experienced Contractor Ghoniem, W. (2016, Spring). Heritage destruction phenomenon in Alexandria [Four Telephone interviews]. The owner of AlOla company for real estate marketing Hosny, H. (2016, June 11). Heritage destruction phenomenon in Alexandria [Telephone interview]. Member in the National Organization for Urban Harmony (NOUH) Loatfy (2016, March 13). Heritage destruction phenomenon in Alexandria [Personal interview]. Professor in Alexandria

university, Faculty of Medicine Magdy, M. (2016, May 03). Heritage destruction phenomenon in Alexandria [Personal interview]. architect in SIGMA company in Alexandria Mayer, W. (2016, May 23). The heritage protection system in Germany and Baden-Württemberg [Personal interviews]. Used to be a member in the “Landesämter für Denkmalpflege” Government Entity in Germany Mekawy, E. (2016, April 20). Heritage destruction phenomenon in Alexandria [Personal interview]. Owner of L Passage project and a professional architect Nassar, D. (2016, May 15). Heritage destruction phenomenon in Alexandria [Personal interview]. Professor in Alexandria university, Faculty of Engineering and a member in the technical security Heritage Committee of Alexandria Owner of villa 327 (2016, February 23). Heritage destruction phenomenon in Alexandria [Telephone interview]. The owner of villa number 327 in the Heritage list of Alexandria Ramadan (2016, April 12). Heritage destruction phenomenon in Alexandria [Personal interview]. Restoration expert working on Sarsaa project in Alexandria Sales Taxes organization (2016, May 12). The taxes laws in Egypt [Personal interview]. Employee in the Sales Taxes organization of Alexandria Sief Company (2016, February 20). The Price of the residential and commercial [Telephone interview]. Employee in Sief Company for real estate, the project replaced the villa number 1772 in the heritage list of Alexandria Zamzam Company (2016, February 20). The Price of the residential and commercial meter square [Telephone interview]. Employee in Zamzam real estate Company, the project replaced the villa number 3011 in the heritage list of Alexandria