Despite Reports of National Luxury Downturn, Charlotte Bucks Trends

SouthPark Myers Park & Eastover Lake Wylie & The Palisades Providence, Weddington & Waxhaw Ballantyne & South Carolina Center City Luxury Condos

Suburban Markets Continue To Attract Buyers While Winter Conditions Soften in Some Areas

From market forecasts, interviews, and house marketing ideas, join the team at Ivester Jackson I Christie's for latest in Carolinas luxury real estate content.

As national media sources such as the Wall Street Journal reported luxury real estate “crashes” in some of the country’s largest markets, the Charlotte region’s upper end luxury residential market held up solidly in the just completed third quarter.

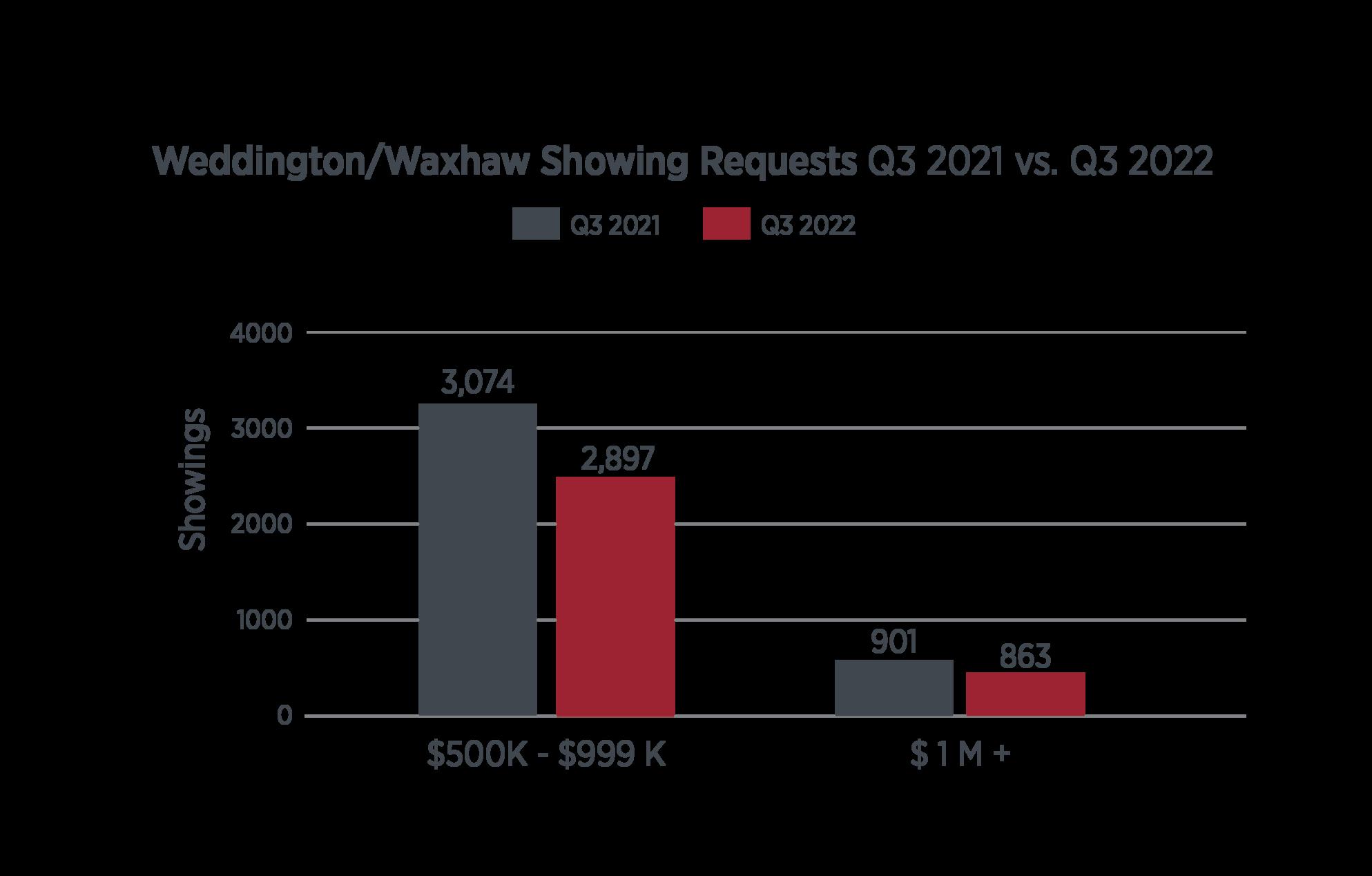

While the range below $1 million in list price showed some softening due to the rapid rise in interest rates, Charlotte’s $1 million market continued to attract high levels of showing activity, pending contracts, and closings, with many areas rivaling last year ’ s strong results.

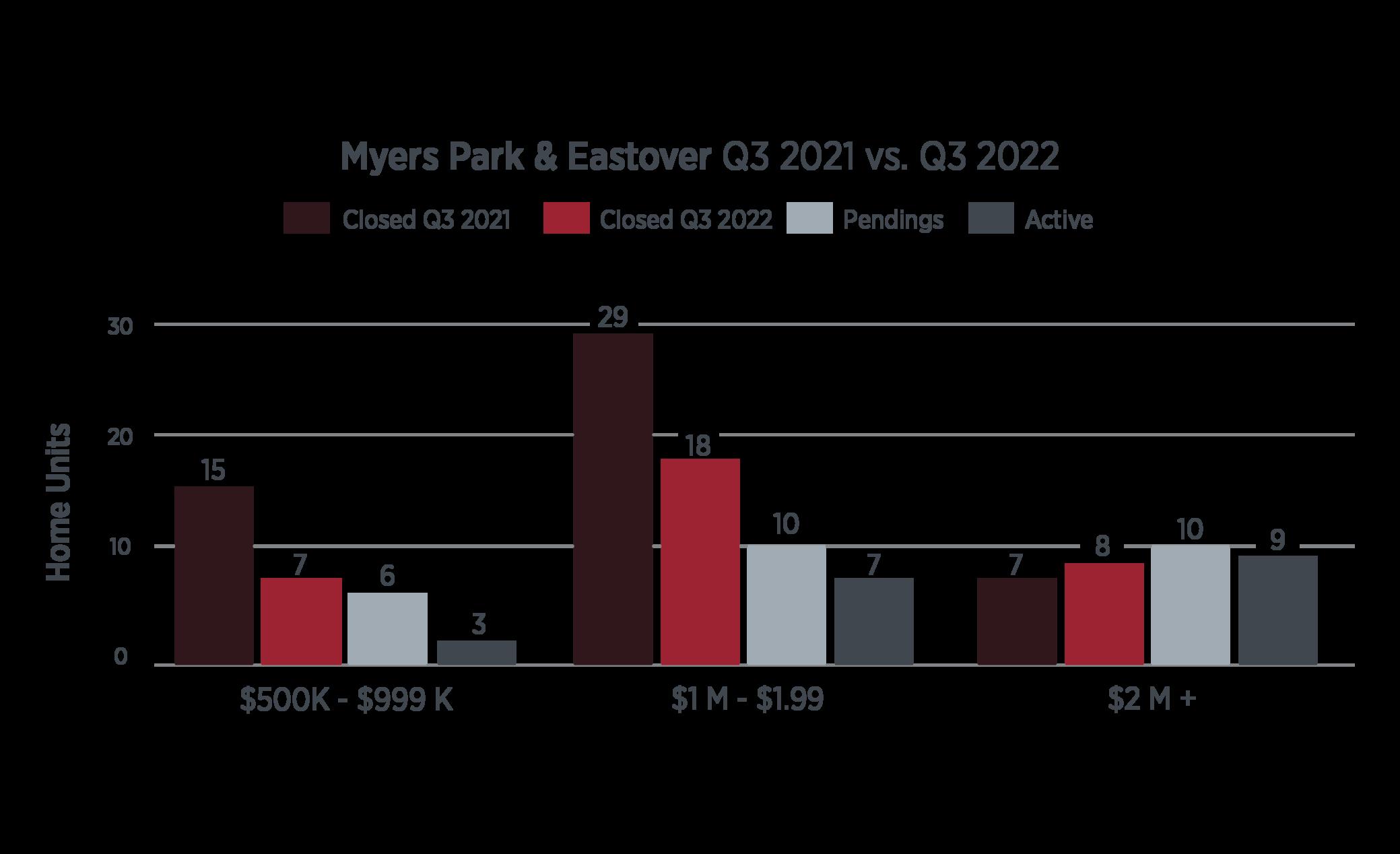

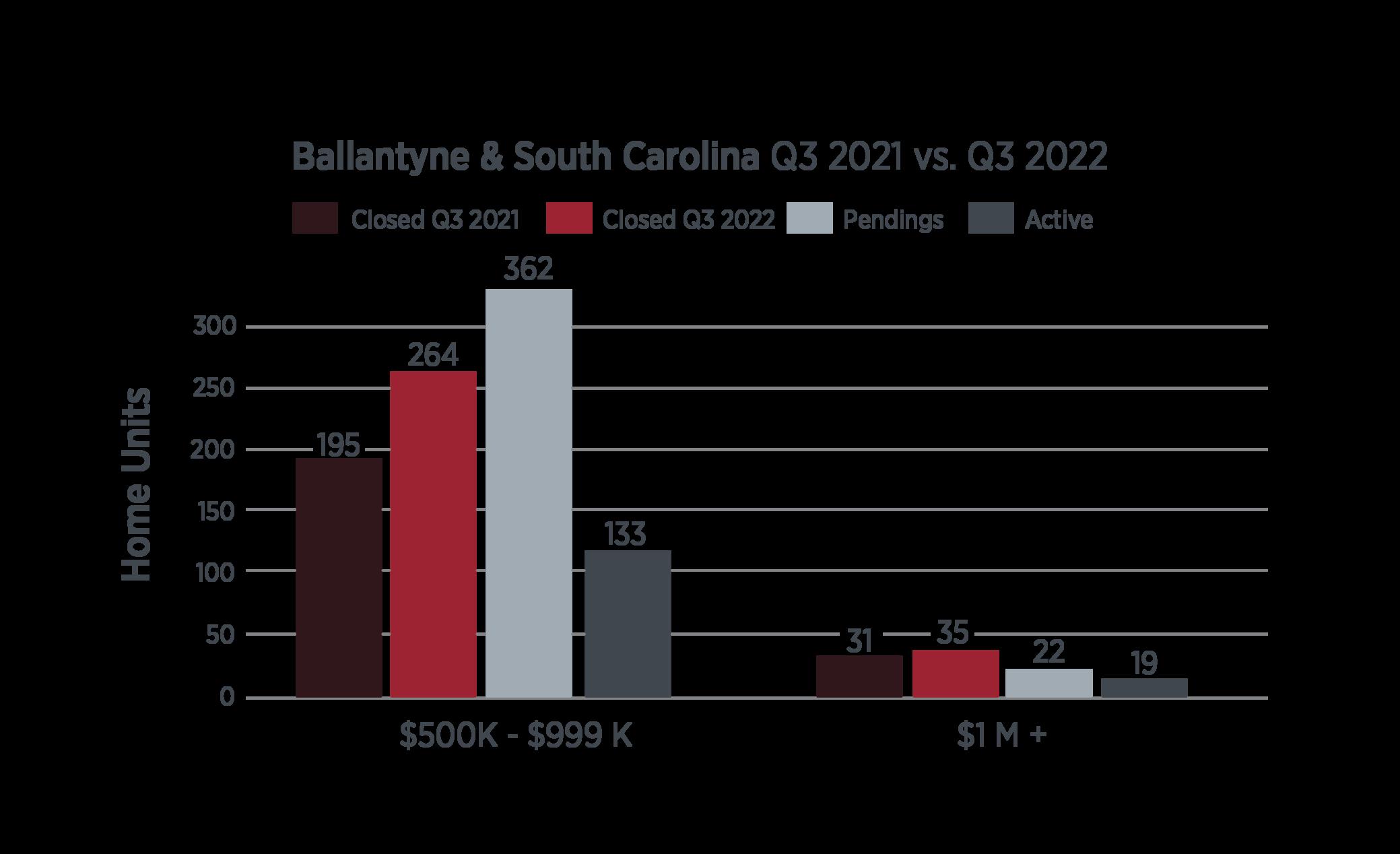

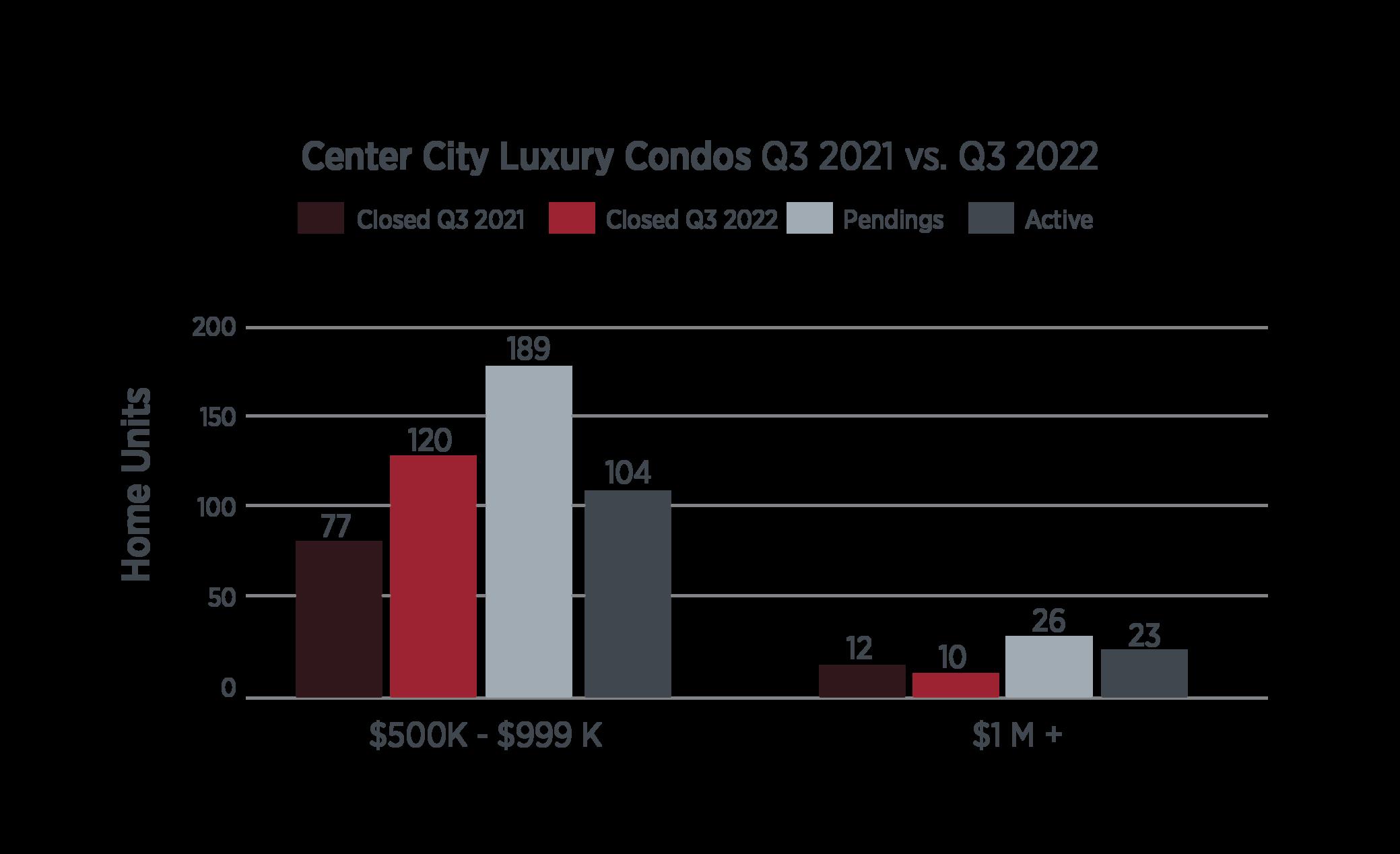

Standout areas and price segments included the continued emergence of upstate South Carolina on the Lake Wylie and Ballantyne sides of I-77, activity in the Fort Mill area surpassing last year ’ s third quarter in the luxury segment. The Providence Road corridor into Union County continued to attract high levels of luxury activity, with over 100 properties over $1 million in value closing for the quarter. Niche segments that stood out included the 277 beltway area ’ s condo and townhouse market with 120 closings vs last year ’ s 72, and Myers Park and Eastover’s high-end luxury segment above $2 million, which recorded 8 closings and 10 pending contracts, leaving just 9 active homes in the MLS.

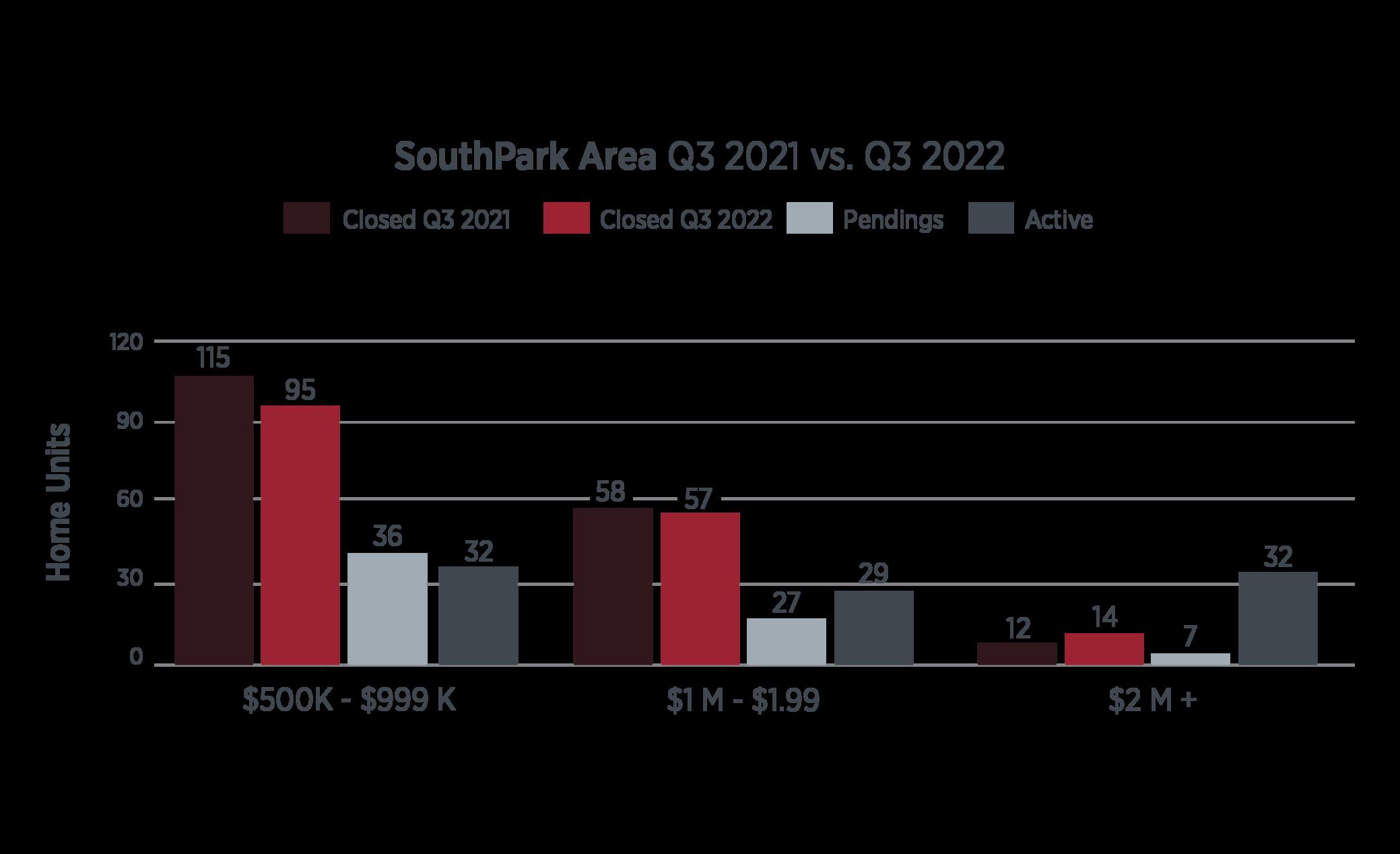

The always in demand area around SouthPark and below to I-485 posted solid results in line with last year ’ s third quarter. While the mid-market range was off, as has been the case elsewhere, the $1 million range matched last year ' s, with the high-end luxury segment above $2 million in price exceeding last year ’ s third quarter sell-through by 15% Both pending contracts and showing

appointment requests in the MLS remained on par with last year ’ s late fall, with just a slight drop off in pending contracts as a percent of the remaining inventory SouthPark’s inventory to pending ratio in the $1 million range stood at 32 pendings with 31 active homes, while inventory in the high-end luxury range jumping to 32 units with just 7 pending, which is something to watch moving into the final quarter of the year

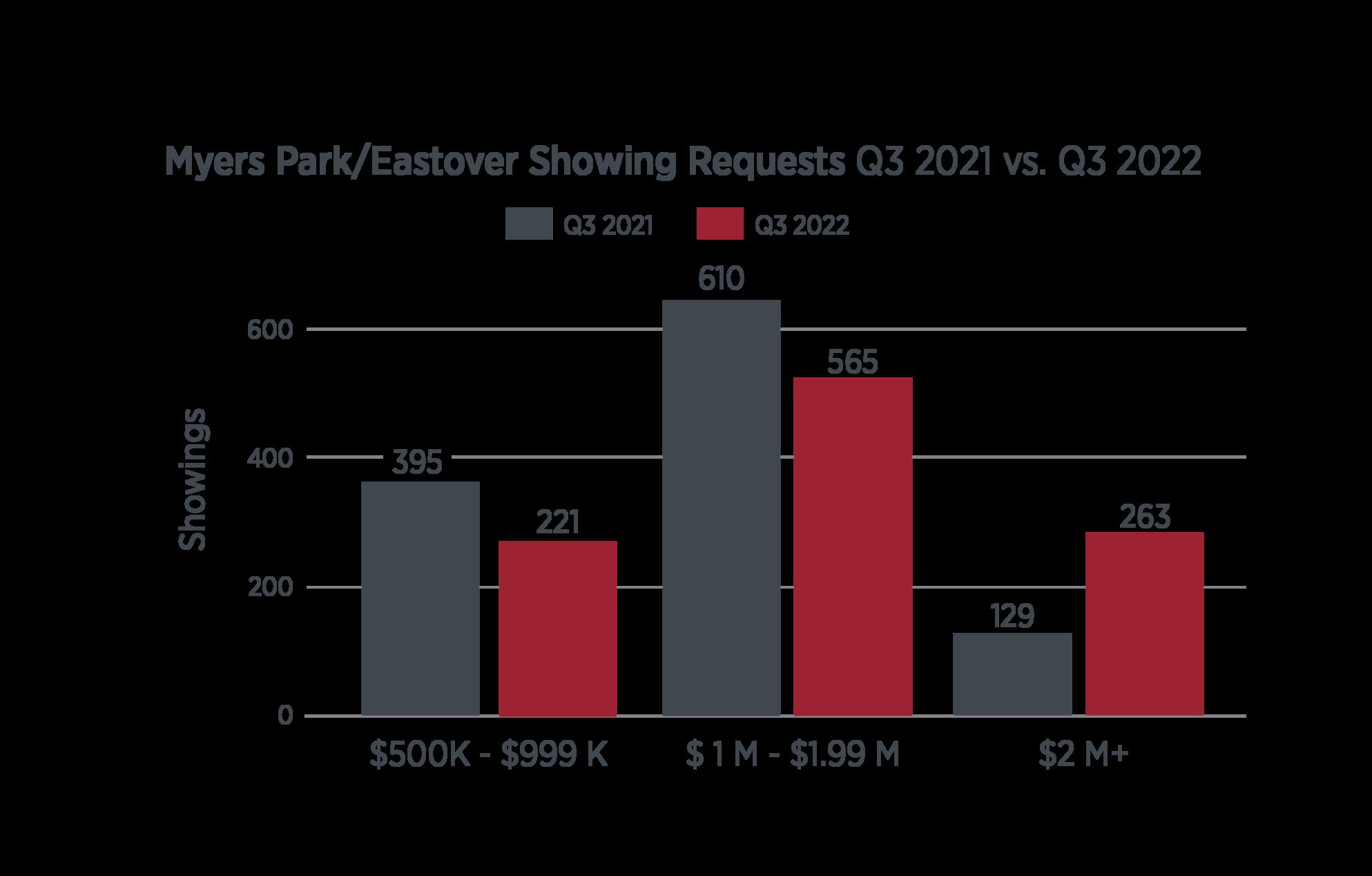

Price appreciation and infill activity have made properties in Myers Park and Eastover under $1 million in value scarce, rendering much discussion in that range meaningless While the area ’ s activity in the $1 million to $2 million range did tail off for the quarter compared to last year, the high-end luxury range continued to show scarce inventory relative to recent closings and current pending contracts. Between the just completed third quarter’s 8 closings at the high end and another 10 pending contracts over $2 million, the area is left with just 9 active listings. Conditions at the high end of the market continue to support recent price gains.

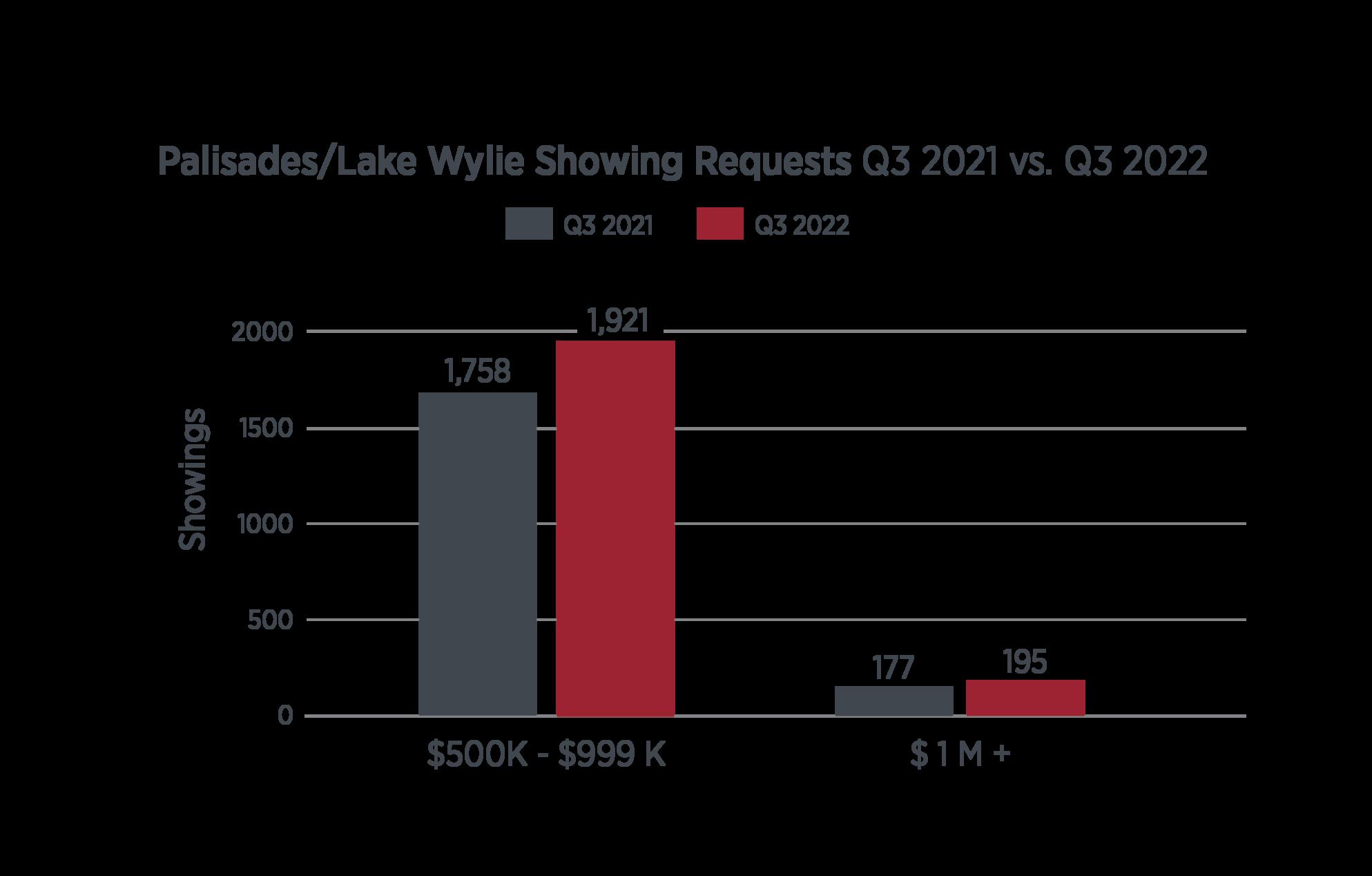

As another area that has benefitted tremendously from the spread to the suburbs during Covid, this area saw another quarter in which 30 homes closed over $1 million in value, which is in line with last year ’ s third quarter Mid-Market activity remained strong at just under $1 million, while the lower price ranges showed softening in the 20% range due to higher interest rates. Showing requests in the $1 million range were up 10% compared to last year ’ s end of the third quarter, which points to a solid fourth quarter and another 23 deals pending over $1 million in price.

While the mid-market range softened, the Providence Road corridor out into Union County has firmly established itself as one of the region’s leading hotbeds of luxury activity This area saw limited luxury activity just six years ago, but in the just completed third quarter, over 100 properties closed over $1 million in list price This surpassed last year ’ s record third quarter by 6% despite volatile conditions To further frame activity in this area, there were another 49 pending contracts, with 43 remaining in active inventory after a 100 home closing quarter This limited inventory to closing/pending ratio, which should stabilize prices through the first quarter

This area ’ s continued emergence included an almost 30% increase in mid-market closings over last fall's third quarter in the $500K to $999K range, 264 vs 195. The area posted another strong quarter in the $1 million plus range, with 35 closings vs. 31 last fall. Showing requests remained strong with 10% increases in the mid-market range, despite much higher interest rates, and a 20% increase in the luxury range over $1 million, both indicative of a strong fourth quarter finish to 2022.

Emerging from Covid lockdown conditions, Charlotte’s lock and leave segment of luxury condos and townhomes in the near center city beltway locations has spiked upward as demand for walkable low maintenance living has rocketed

Much of this activity is in the mid-market range between $500K and $1 million in list price, with 120 closings in the third quarter compared to just 77 in last year ’ s same quarter. The luxury segment remains active, with not only 10 closings over $1 million in price but a whopping 26 under pending contracts moving into the fourth quarter.

With the surprisingly strong results for the just completed third quarter rivaling, and in some cases surpassing last year ’ s record third quarter levels, the Charlotte region, like much of North Carolina, continues to ride a wave of demand from out of state migrating buyers and local move up buyers. MLS showing appointment requests in the majority of our key measurable areas were either on par with last year ’ s same period or in some cases, up slightly. The areas showing declines were in the minority, though they are likely to finally be joined by others who’ve held up well over the coming winter While national media outlets are reporting more than 30% downturns in terms of activity, the Charlotte region has so far seen no more than single digit declines in a few areas

The price segments below $500K in list price are showing softness given what will likely be high borrowing costs at some point this begins to domino upward into the $1 million range, something we may see in the first quarter of 2023 The high-end luxury range continues to be driven by financial markets, which thus far have held up statistically better than they did in 2009 There’s an expectation that Federal Reserve actions will continue to influence borrowing costs well into 2023, yet limited inventory and recent refinancing activity in the 3% range has influenced the past year ’ s price gains to remain intact

Ivester Jackson Christie's Team Captains

Lori Ivester Jackson (Lake Norman Region)

Lisa McCrossan (Charlotte Region)

Everyone involved in each home transaction is asked to donate a gift of $10 or more to the Homeowners Impact Fund. This includes the agents, buyer, seller, lender, title company, and closing attorney, for a goal of collecting $70 or more per closing.

CHECK OUT OUR NEW "CHRISTIE'S LUXURY EXPERT SERIES" AS WE HEAD TO TOP LUXURY CITIES LIKE CHARLESTON, PHOENIX AND SAVANNAH.