LUXURY MARKET REPORT & FORECAST

Western North Carolina | Q4 2024

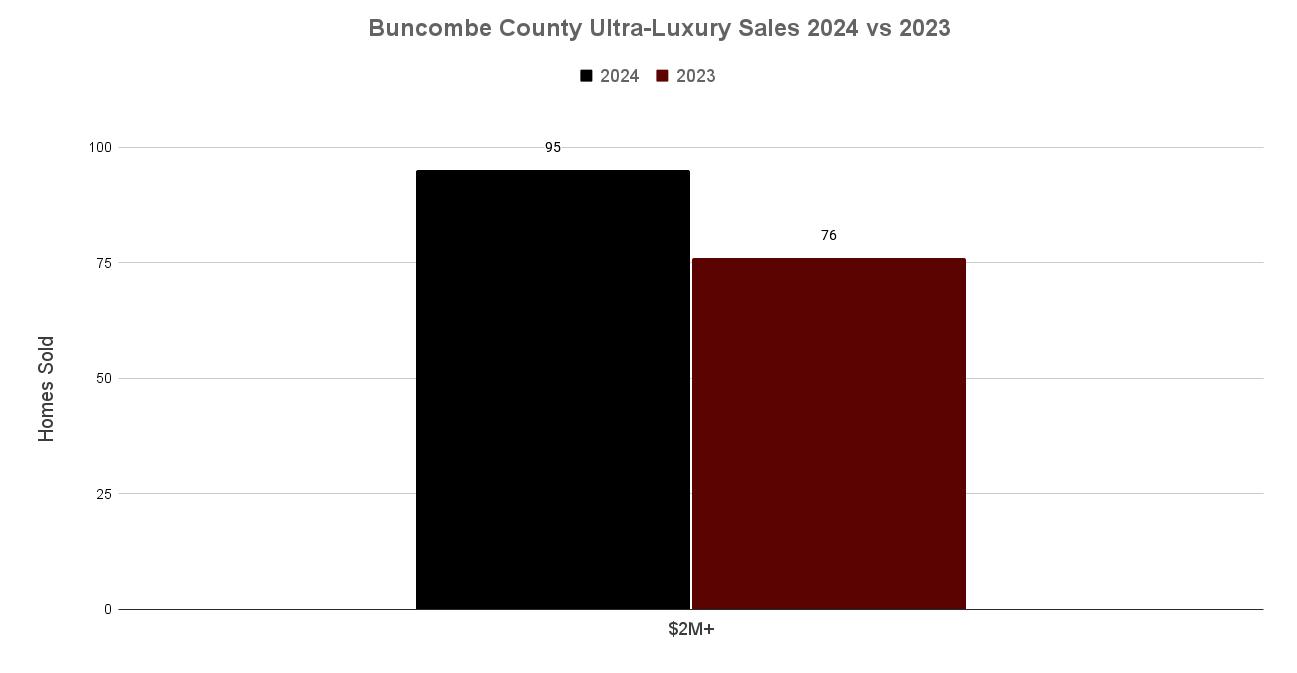

Persistently high interest rates continued to pressure rate-sensitive markets, but showings in the Ultra-Luxury segment remained consistent. Overall Ultra-Luxury home sales in Buncome Couty surged in 2024.

Asheville (City, North)

Downtown Asheville Condos

Buncombe County Arden

Biltmore Forest

Henderson County Haywood

Fairview/Fletcher

Foothills

While the first quarter of 2025 may be muted, the region’s prime selling season promises to bring renewed activity and opportunities for buyers and sellers alike.

From market forecasts, interviews, and house marketing ideas, join the team at Ivester Jackson Blackstream I Christie's for the latest in Carolina’s luxury real estate content.

The Ultra-Luxury Segment has seen significant growth in 2024 in spite of the challenging circumstances Western North Carolina has faced in the last three months. Buncombe county saw 95 homes sold in the Ultra-Luxury Market 2M+ in 2024, up 25% from 77 homes sold in 2023.

Despite high interest rates and limited inventory, the region’s enduring appeal and demand particularly in the Ultra-Luxury market—have been bright spots in an otherwise turbulent quarter.

Across the region, the damage caused by Helene created significant slowdowns in migration and tourism. However, some areas experienced only minor disruptions, attracting a steady influx of visitors that translated to increased showings and pending sales as the year drew to a close. Persistently high interest rates continued to pressure rate-sensitive markets, but showings in the Ultra-Luxury segment remained consistent, underscoring the region's strength as a desirable destination for affluent buyers.

The City of Asheville has faced a challenging fourth quarter, with notable declines in sales activity across all market segments. The MidMarket segment, homes priced $600,000 - $999,000 recorded 66 sales, a significant drop from the 102 sales seen during the fourth quarter of 2023. Similarly, the Luxury Market $1,000,000–$1,999,999 saw a sharp decline, with only 22 sales compared to 40 during the same period last year. The Ultra-Luxury Market $2M+ also faced headwinds, posting just seven sales in the fourth quarter, down from 15 the previous year.

While these numbers reflect current challenges, the city shows promising signs of recovery. Pending sales at the close of the quarter suggest a slow but steady rebound, and showings across all price segments have been on the rise heading into 2025. This renewed interest could signal brighter days ahead for Asheville’s housing market.

North Asheville experienced a similar sales slump in the fourth quarter, with all three market segments underperforming compared to the fourth quarter in the previous year. However, there were positive developments: pending sales in the Mid-Market range have already surpassed total closed sales for the quarter, signaling a rebound. In the Ultra-Luxury segment, while only three properties closed in the fourth quarter, two additional properties were under contract as the year ended, suggesting momentum is building. Inventory remains historically low in this area, which could drive prices higher and reduce days on market as demand continues to outstrip supply.

Ivester Jackson Blackstream celebrated a record-breaking achievement in the fourth quarter, with the sale of a penthouse unit at the Arras Condos for $2.905 million, the highest price per square foot in Downtown Asheville’s history. This significant milestone highlights the enduring appeal of the city’s luxury condo market.

Although overall sales activity in Downtown Asheville was modest, there were encouraging signs. The Ultra-Luxury segment recorded one sale in the fourth quarter, an improvement from zero in 2023, and the Luxury segment remained stable with one sale, matching the prior year’s performance. Pending sales rebounded nicely and are expected to improve further as new inventory, particularly from upcoming construction projects, enters the market later in 2025 and into 2026.

Buncombe County faced a challenging fourth quarter in 2024, with sales declining across all three price segments. However, signs of recovery are emerging as cleanup and infrastructure restoration progress. Since October, showing activity has risen steadily each month, indicating a rebound in demand and increased buyer interest across the county.

Inventory, however, continues to be a limiting factor, constraining opportunities for both buyers and sellers. As warmer weather approaches in early spring, we anticipate an uptick in available inventory, which could help ease some of these pressures. For now, pending sales suggest a subdued start to 2025, but with recovery efforts well underway and buyer interest growing, the county is poised for stronger activity in the months ahead.

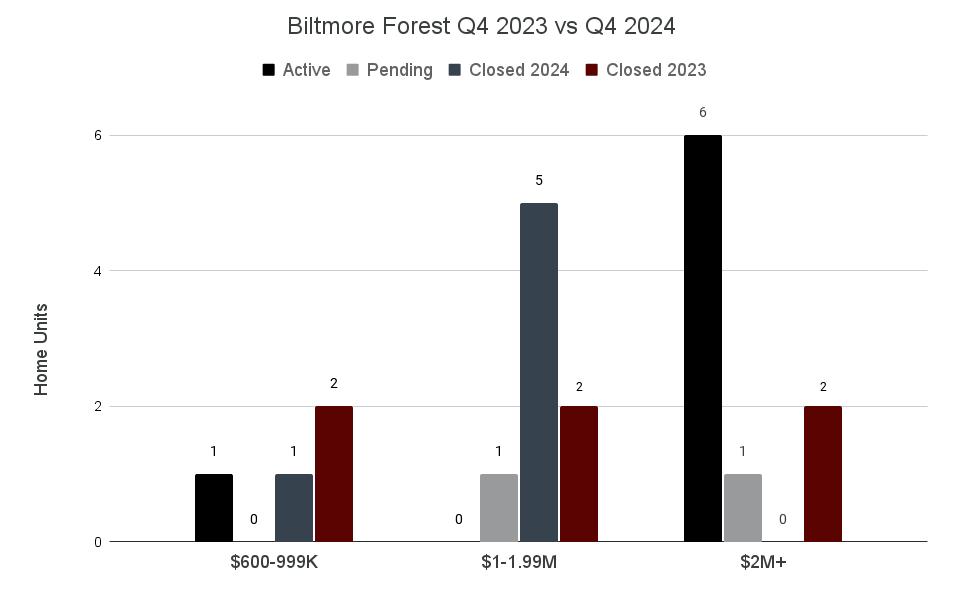

Biltmore Forest was a standout performer in the fourth quarter, with the Luxury Market segment $1,000,000–$1,999,999 posting a 150% year-over-year increase. Sales rose from two in 2023 to five in 2024, highlighting strong demand in this exclusive community. However, inventory in the Luxury range remains critically low, with no active listings to close the year. This scarcity is likely to drive prices higher and could lead to competitive bidding as buyers vie for limited opportunities.

Arden fared better than most markets across Buncombe County in the fourth quarter. Mid-Market sales remained flat year-over-year, with 17 transactions in 2024 compared to 18 in 2023. The Ultra-Luxury segment saw similarly stable results, with seven sales this quarter compared to nine in the fourth quarter of 2023. Although sales in the Luxury segment were slightly down, strong pending sales heading into 2025 suggest a solid start to the new year.

Fairview and Fletcher have faced ongoing challenges due to limited inventory and a slowdown in new construction. While the Ultra-Luxury segment remained flat year-over-year, sales activity in the Mid-Market and Luxury segments declined. High interest rates and limited availability of buildable land have hampered development, a trend that may persist into 2025. These factors continue to constrain inventory, likely putting upward pressure on prices.

Henderson County was largely spared from Helene’s worst effects, allowing the market to maintain steady activity. While tourism slowed slightly, showing activity continued to trend upward throughout the quarter. Downtown Hendersonville remains a popular choice for buyers seeking walkable neighborhoods with vibrant dining and cultural options. With inventory holding steady, Henderson County is well-positioned for continued growth as new developments take shape. However, pending sales suggest a cautious start to 2025, with stronger activity expected as warmer weather arrives.

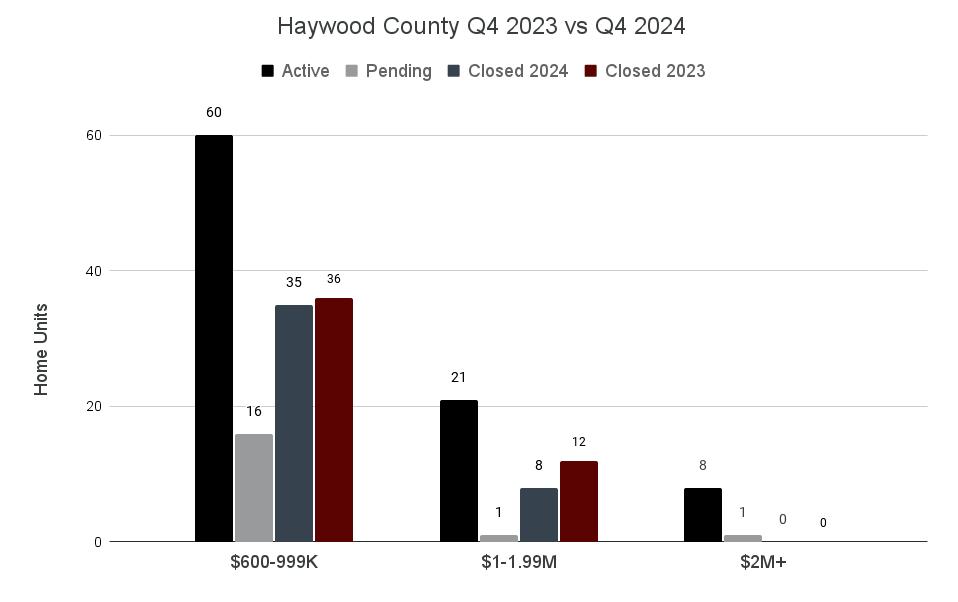

Haywood County delivered a stable fourth quarter performance, with sales numbers closely mirroring those of 2023. The MidMarket segment remained flat, with 35 sales this quarter compared to 36 in the fourth quarter of 2023. The Luxury Market experienced a slight decline, with 8 sales in the fourth quarter compared to 12 in 2023, largely due to storm-related disruptions. The Ultra-Luxury segment saw no closed sales in the fourth quarter, as was the case in the fourth quarter of 2023, but one property under contract offers hope for early 2025 activity. Inventory growth should support sales momentum in the coming quarters.

The Foothills region experienced mixed results in the fourth quarter of 2024. Overall sales remained relatively flat compared to the previous year, though the Luxury segment showed some improvement. Despite this, pending sales have slowed as the year ended, pointing to a quieter start to 2025.

Looking ahead, the warmer months of spring and summer are expected to bring renewed activity, as is typical for the Foothills market. With its scenic landscapes and appeal as a year-round destination, the region remains a reliable choice for both buyers and sellers seeking long-term value.

As storm recovery efforts progress, tourism is expected to rebound, bringing renewed interest and buyers to Western North Carolina. However, inventory remains uneven across the region, with some areas seeing slight increases while others continue to lag. Persistently high interest rates remain a challenge, particularly for new development and rate-sensitive markets.

Western North Carolina has long been a favored destination during the spring, summer, and fall seasons, and this trend is expected to hold steady in 2025. While the first quarter of may be muted, the region’s prime selling season promises to bring renewed activity and opportunities for buyers and sellers alike.

Asheville Office - Ivester Jackson Blackstream

18 S Pack Square

Asheville, NC 28801

828-367-9001

Highlands-Cashiers

210 North Fifth Street

Highlands, NC 28741

828-482-5022

Wilmington Office - IJ Coastal

527 Causeway Drive

Wrightsville Beach, NC 28480

910-300-5140

Charlotte Office

1515 Mockingbird Lane Suite 900

Charlotte, NC 28209

704-817-9826

Lake Norman Office

21025 Catawba Ave #101

Cornelius, NC 28031

704- 655-0586

Lake Norman North Shore Office

350 Morrison Plantation Parkway, Suite C1

Mooresville, NC 28117

980-435-5169