LUXURY MARKET REPORT & FORECAST

Western North Carolina | Q3 2024

Inventory levels are expected to rise in the outlying areas of Western North Carolina, while inventory in Asheville and Buncombe County, though still low, is starting to gain traction.

Asheville (City, North)

Downtown Asheville Condos

Buncombe County

Arden

Biltmore Forest

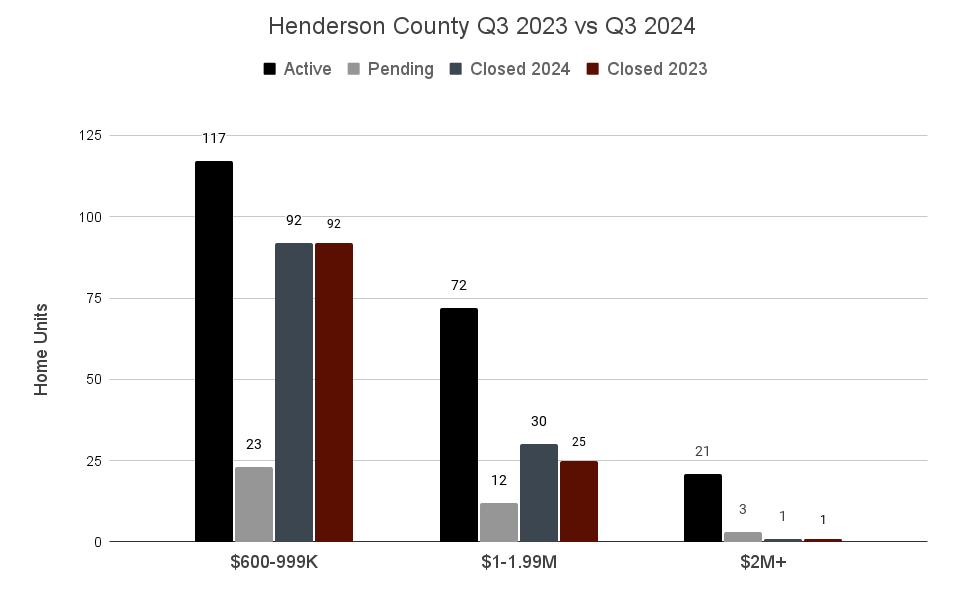

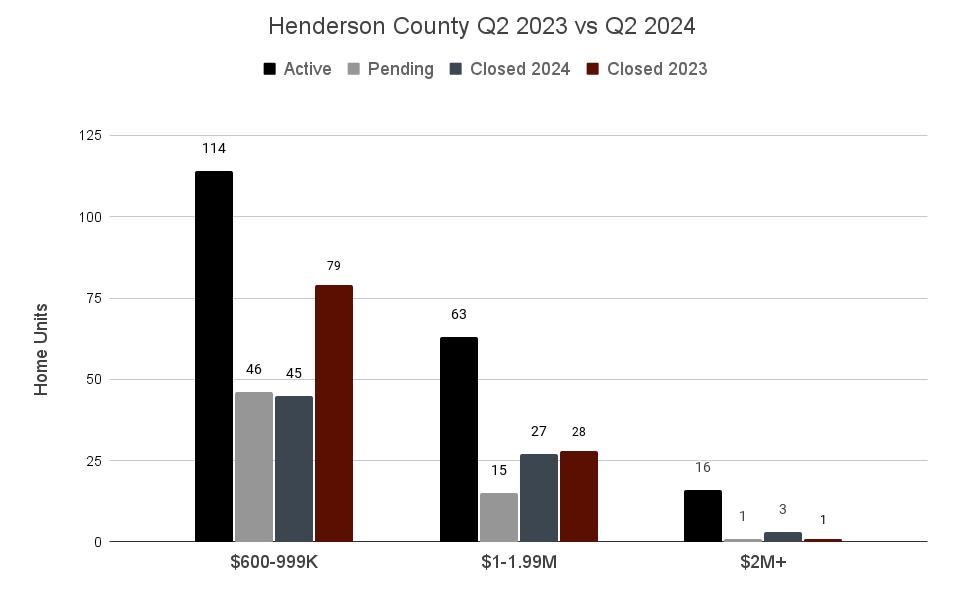

Henderson County

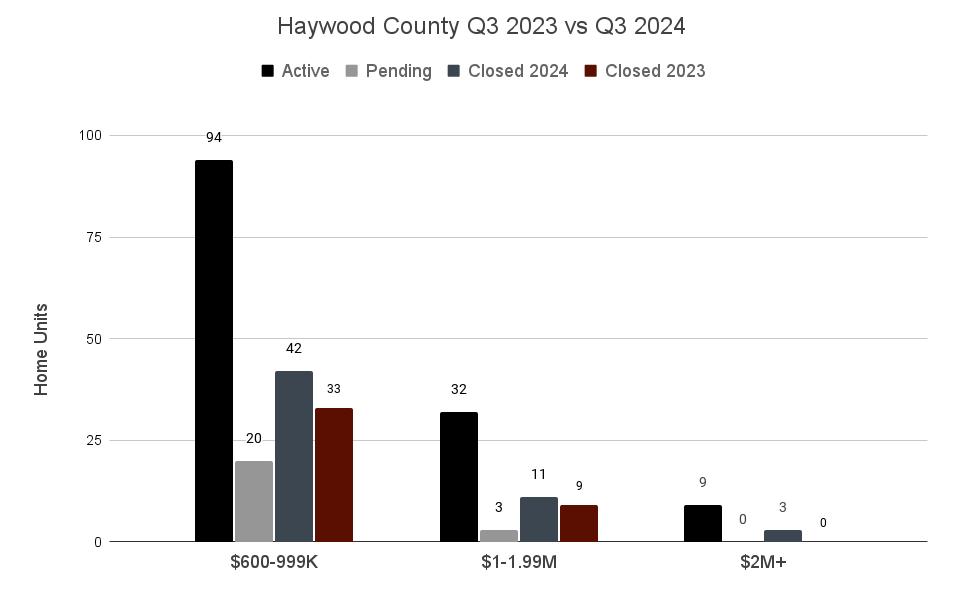

Haywood

Fairview/Fletcher

Foothills

Property values are likely to rise, supported by steady demand and a gradual recovery in inventory levels

From market forecasts, interviews, and house marketing ideas, join the team at Ivester Jackson Blackstream I Christie's for the latest in Carolina’s luxury real estate content.

As we approached the end of the third quarter, Western North Carolina faced significant challenges due to a catastrophic rain event, compounded by the effects of Hurricane Helene. While the storm caused extensive damage, the residents of the region are proving their resilience, and efforts to recover are already well underway. Tourism, a crucial part of the local economy, has been sporadic in the aftermath, but with cleanup operations in full swing, there is optimism that both tourism and the localized economy will rebound in the weeks and months ahead.

The real estate market, especially in the Luxury and Ultra-Luxury segments, continues to be driven by cash transactions. Despite the temporary disruptions caused by the storm, these markets remain active, showcasing the underlying strength of the region's real estate.

In Asheville, the Mid-Market segment, homes priced between $600,000 and $999,000, saw a slight decline in year-over-year sales during the third quarter. This is reflective of leveling demand and softening inventory, though sales activity remains fairly steady The Luxury Market $1 million to $1 99 million has remained firm compared to the previous year, suggesting continued buyer interest at this price point.

In the Ultra-Luxury segment, properties priced over $2 million, experienced significant growth, with 26 closed sales in the third quarter, compared to 16 during the same period last year This upward trend highlights the strength of high-end real estate in Asheville, even as inventory remains low Pending sales across all three segments are down, pointing to a more cautious fourth quarter as buyers take a wait-and-see approach.

North Asheville mirrors the citywide trends, with the Mid-Market segment seeing a slight decline year-over-year, mostly attributed to rising interest rates, along with decreased inventory In the third quarter, 114 units were sold compared to 129 last year Pending sales have also dropped, with 37 units under contract, this suggests that this segment may cool further in the fourth quarter, if we don’t see a calming of interest rates, as this segment is very rate sensitive

In the $1 million to $1.99 million range, sales increased modestly, with 45 units sold compared to 43 in the same period last year Pending sales are holding strong with 18 units under contract, signaling continued momentum in the Luxury Market Meanwhile, the Ultra-Luxury segment saw a substantial jump in sales, with 26 units sold compared to 16 last year However, a decline in pending sales has led to higher average days on the market as inventory rises, indicating a potential tempered 4th quarter

The downtown condo market in Asheville experienced a notable decline in the Mid-Market segment, where sales dropped from 8 units in the third quarter of 2023 to just 3 units in 2024. With only two pending sales, the numbers suggest a more subdued market to close out the year.

The $1 million to $1 99 million segment saw significant gains, doubling its sales year-over-year in the third quarter The Ultra-Luxury condo market, priced over $2 million, remained quiet, with no sales recorded in either 2023 or 2024 of the third quarter. That said, there is one pending sale in this segment, which is expected to close in the fourth quarter, potentially providing a spark for this category.

The Luxury Market in Buncombe County, properties priced between $1 million and $1.99 million, remained level year-overyear. Meanwhile, the Mid-Market saw a slight decline in sales activity, with 196 sales recorded in 2024 compared to 225 in 2023. However, the Ultra-Luxury market demonstrated impressive growth, with 39 closed sales in the third quarter compared to 25 last year

As we move into the fourth quarter, pending sales have slightly decreased, and inventory remains low, reflecting tempered demand across the county in coming months. With recovery efforts ongoing, Buncombe County looks to reverse this trend as we move into 2025.

In Biltmore Forest, the Ultra-Luxury market has seen a remarkable surge, with sales more than doubling in the third quarter of 2024 compared to the same period last year Currently there are 7 properties priced over $2 million on the market, indicating that this segment continues to attract buyers. The luxury market $1million - $1.99 million has also remained steady, posting the same number of sales year-overyear, with a healthy number of properties under contract, signaling a strong close to the year.

The Arden market presents a mixed picture across all price segments The MidMarket $600,000 to $999,000 maintained the same number of sales in the third quarter of 2024 as in 2023 However, inventory continues to lag, though 10 properties are currently under contract, which should provide some stability moving into the final quarter Sales in the Luxury-Market saw a decrease, with only 5 units sold in the third quarter of 2024 compared to 9 last year In contrast, the Ultra-Luxury segment saw a slight increase in sales, and with 7 additional units under contract heading into the fourth quarter, there is reason to expect continued activity in this segment.

The Fairview and Fletcher markets saw minimal year-over-year changes in the Mid-Market, with one additional unit sold in 2024 Both the Luxury and UltraLuxury markets remained flat during the third quarter However, pending sales in the Ultra-Luxury segment indicate rising demand, while the Luxury-Market has only one unit currently under contract Inventory is abundant across all three segments, and though demand has leveled off for the moment, there is optimism that activity will pick up in the coming months

Henderson County’s inventory has continued to rise across all price segments. In the Mid-Market range, 92 units were sold in the third quarter of 2024, mirroring the same number as in 2023

The Luxury-Market $1 million to $1.99 million saw an increase in sales, with 30 units sold compared to 25 last year The UltraLuxury market saw only 1 sale in the third quarter, consistent with the prior year ’ s performance. Henderson County is poised to have a strong first quarter of 2025, with demand and inventory on the rise, along with many new construction starts.

Haywood County experienced growth across all price segments in the third quarter of 2024 Sales in the Mid-Market range increased to 42 units, up from 33 in 2023 The Luxury-Market saw 11 sales, up from 9 last year, and the Ultra-Luxury market recorded 3 sales, compared to none in 2023 Pending sales have lagged, though there is hope for a rebound heading into the first quarter of 2025

The Foothills region has seen robust growth in the Mid-Market and Luxury segments, with sales increasing by 60% and 128%, respectively However, the Ultra-Luxury segment experienced a downturn in activity, with no pending sales over $2 million Inventory across the three-county area continues to rise and is expected to grow further in the coming months.

Looking ahead, inventory levels are expected to rise in the outlying areas of Western North Carolina, while inventory in Asheville and Buncombe County, though still low, is starting to gain traction. Recovery from Hurricane Helene is ongoing, and as the cleanup efforts progress, the region is poised for a steady recovery. Demand is anticipated to rebound in 2025, leading to an increase in sales. As tourism returns to pre-storm levels, we expect to see elevated showing activity in the real estate market as well. With many buyers and sellers are on the sideline in preparation for the upcoming presidential race, we expect a surge in activity across the region heading in the first quarter of 2025.

980-435-5169 Our Offices

Asheville Office - Ivester Jackson Blackstream

18 S Pack Square

Asheville, NC 28801

828-367-9001

Highlands-Cashiers

210 North Fifth Street

Highlands, NC 28741

828-482-5022

Wilmington Office - IJ Coastal 527 Causeway Drive

Wrightsville Beach, NC 28480

910-300-5140

Charlotte Office

1515 Mockingbird Lane Suite 900

Charlotte, NC 28209

704-817-9826

Lake Norman Office

21025 Catawba Ave #101

Cornelius, NC 28031

704- 655-0586

Lake Norman North Shore Office

350 Morrison Plantation Parkway, Suite C1

Mooresville, NC 28117

LISTEN TO OUR PODCAST AND VISIT OUR VIDEO PAGE

Check out our podcast and videos featuring lifestyle pieces, market information, and North Carolina guides!

VIEW OUR LISTINGS