Q1 2023

OVERALL MARKET REPORT

Charlotte’s Luxury Market Rebounds From Sluggish Winter To Show Strength

COMMUNITY UPDATES

SouthPark

Myers Park & Eastover

Lake Wylie & The Palisades

Providence, Weddington & Waxhaw

Ballantyne & South Carolina

Center City Luxury Condos

FORECAST

This spring’s numbers still exceed almost any other historic comparison other than 2022.

PODCAST & VIDEOS

From market forecasts, interviews, and house marketing ideas, join the team at Ivester Jackson I Christie's for latest in Carolinas luxury real estate content

2023 Q1 Market Report

contents

Charlotte’s Luxury Market Rebounds From Sluggish Winter To Show Strength

Headlining the spring luxury market conditions in the Charlotte region is the rebounding strength of the region’s higher-end market after a sluggish winter. Showing activity moving into the height of the spring continued to accelerate to near Spring 2022 record levels, while inventory in high demand areas, once on the rise in late fall, has once again declined relative to pending contracts.

Additional areas and price segments of strength currently include south Charlotte down the Providence Road corridor into Union County, the ultra-luxury segment above $2 million in list price in the SouthPark area, the upper mid-market range in York County, and the burgeoning luxury townhouse and condo market near center city Charlotte and the surrounding 277 beltway.

SOUTHPARK

The area around SouthPark and below Fairview, always in high demand, continues to show ultra-luxury infill momentum, as older neighborhoods off Carmel, Sardis, and Park Road areas transition to higher price points. While the area ’ s ultra-luxury segment had a fairly flat first quarter, with 11 homes over $2 million closing vs. 14 in last year ’ s first quarter, the area has rebounded with 17 homes pending to close, and recent offerings with updated interior design once again seeing multiple offer scenarios

The delta between original or pre-2010 décor and today’s popular styles has continued to widen in terms of price per square foot, often exceeding over 25% with cash buyers looking to avoid the building process

SOUTHPARK AREA Q1 HOMES SOLD & SHOWINGS

LAST 90 DAYS

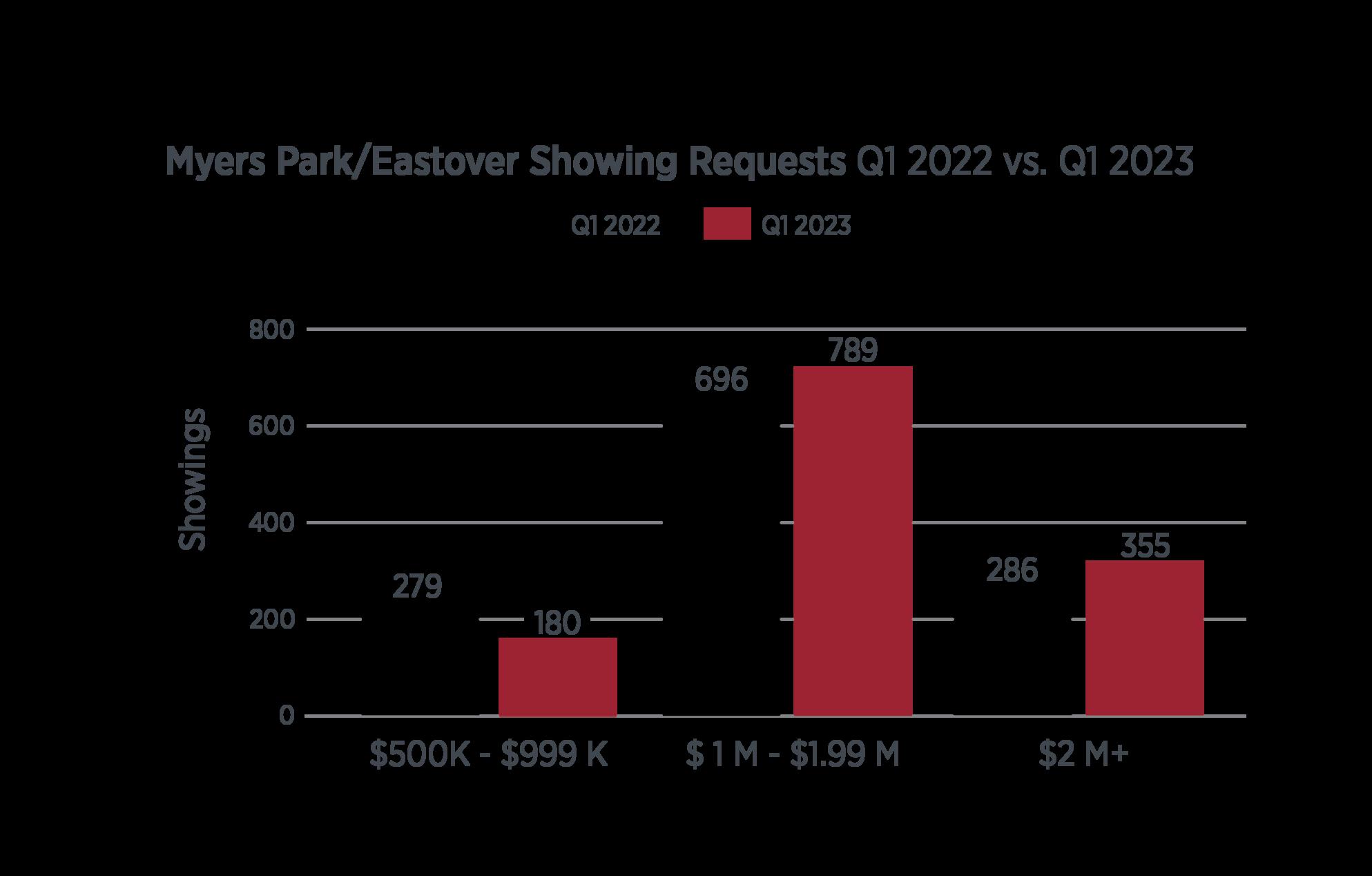

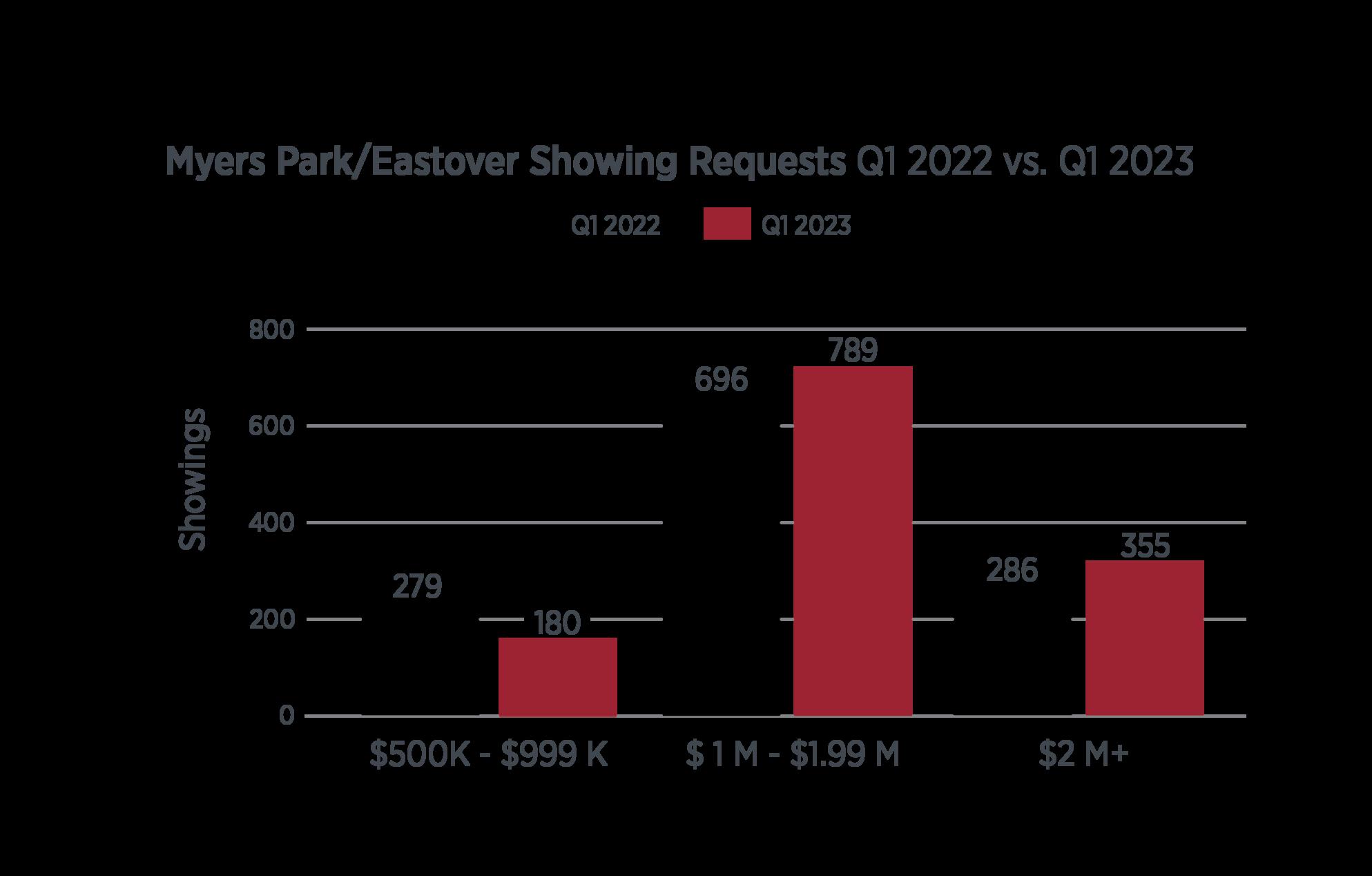

MYERS PARK & EASTOVER

Limited inventory continues to be the story in traditionally popular Myers Park and Eastover, with just 5 active homes in the million range and another 5 active homes above $2 million in list price. Off market deals, infill projects, and multiple offers on updated homes continue to drive market conditions. With the MLS reporting 17 pending contracts over $1 million in list price and just 10 remaining actives, it's highly likely this area will see upward pricing pressure as we move into late spring and early summer.

MYERS PARK Q1 HOMES SOLD & SHOWINGS

LAST 90 DAYS

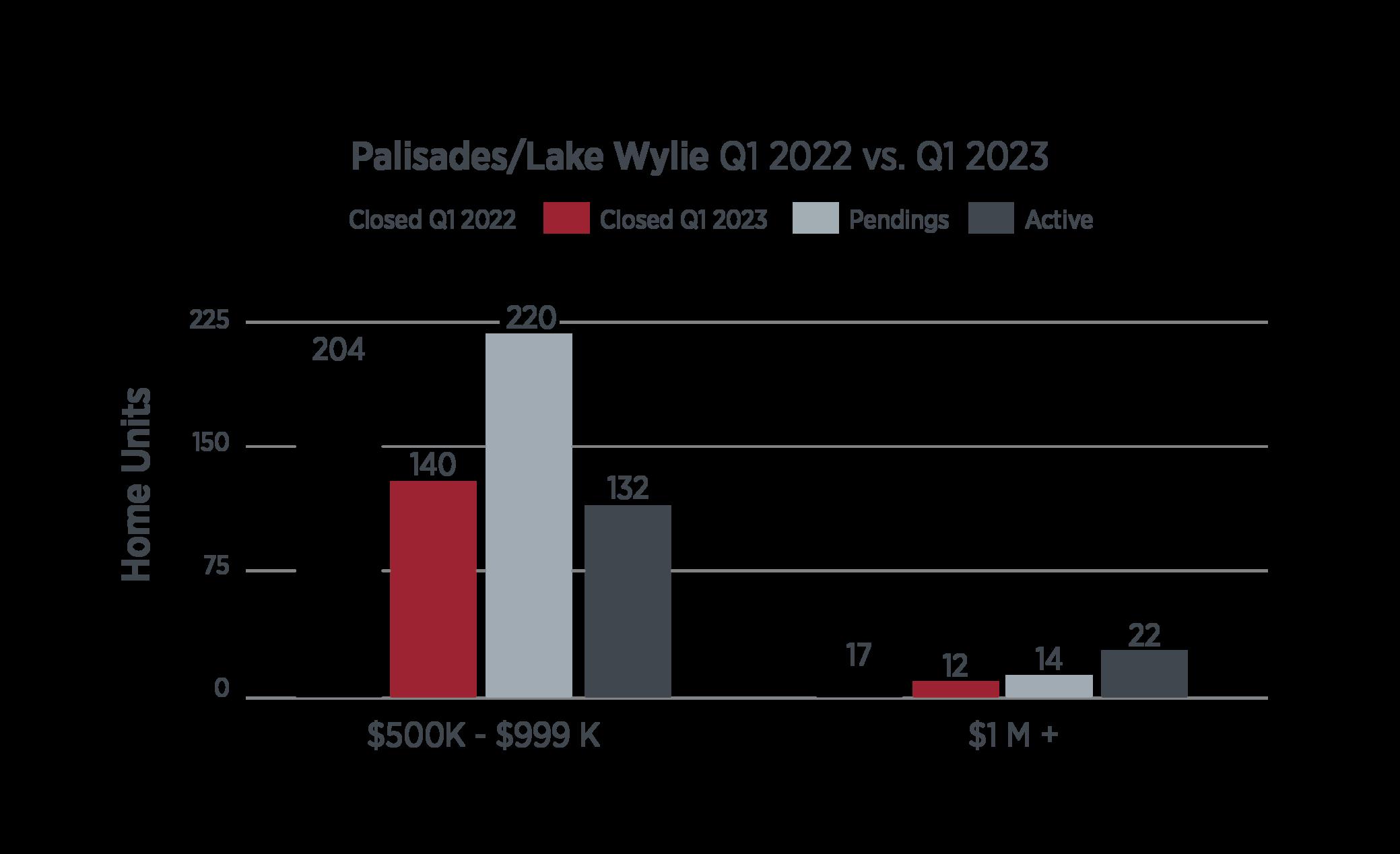

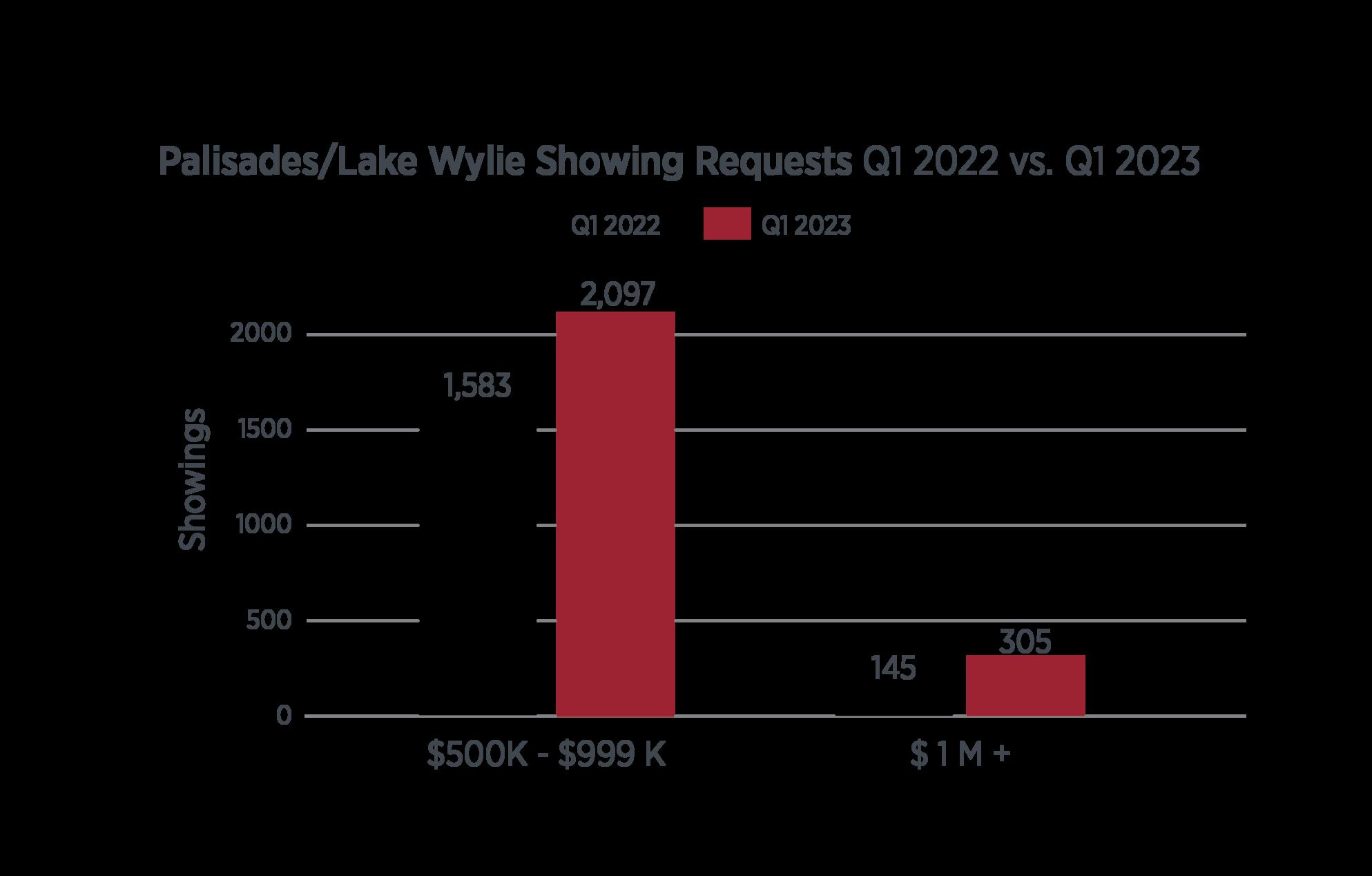

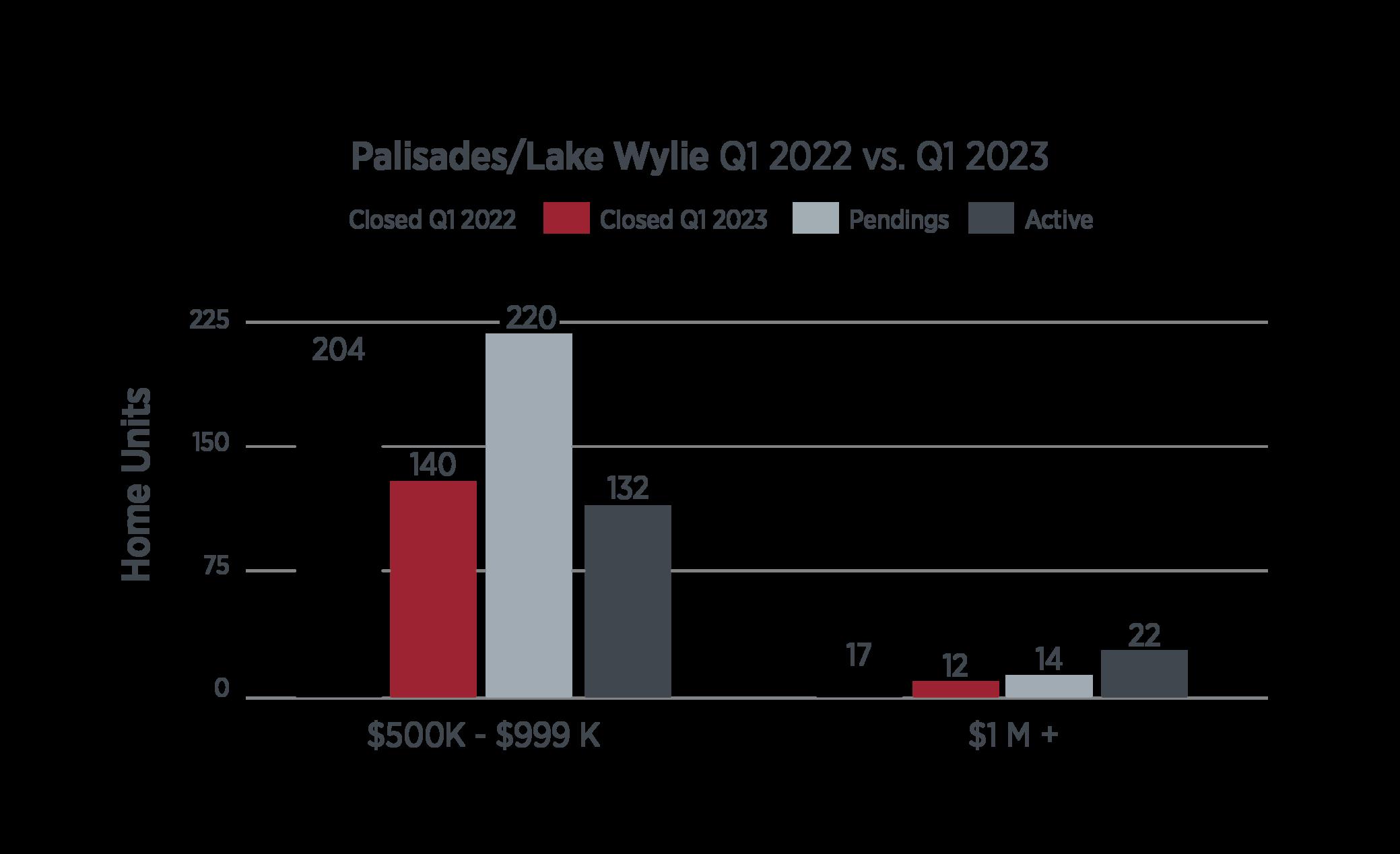

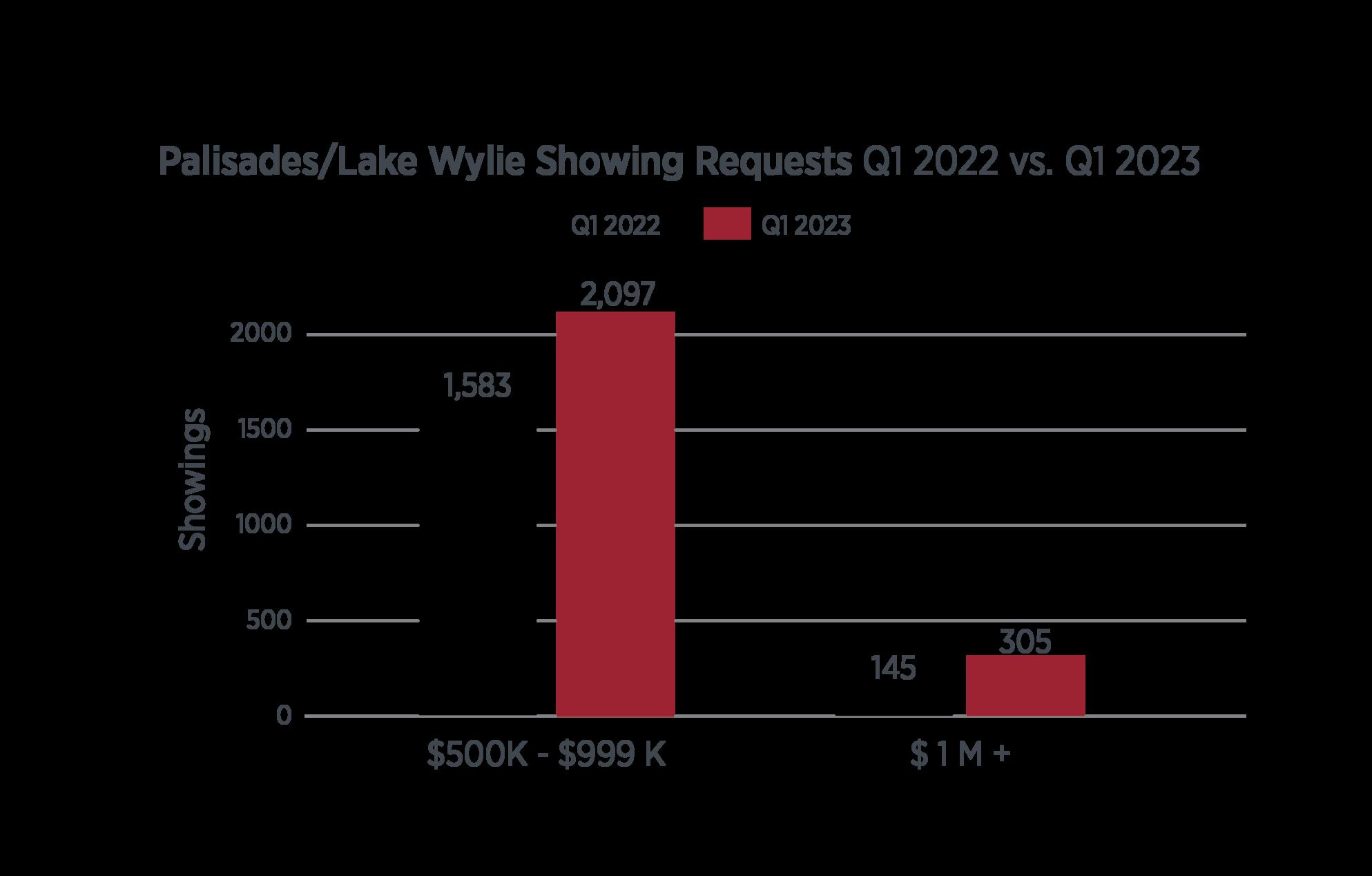

LAKE WYLIE & PALISADES

Like much of the region, this area showed a slowdown in sellthrough compared to last year ’ s first quarter of over 20% However, it has recently rebounded again on declining inventory to pending contract ratios With 121 pending contracts in the range just below $1 million, exceeding the 93 active homes, this range looks to be tightening up again The luxury range over $1 million reported 14 pending deals with 22 active listings, pointing to 45-60 day absorption rates in that segment.

LAKE WYLIE & PALISADES

Q1 HOMES SOLD & SHOWINGS

LAST 90 DAYS

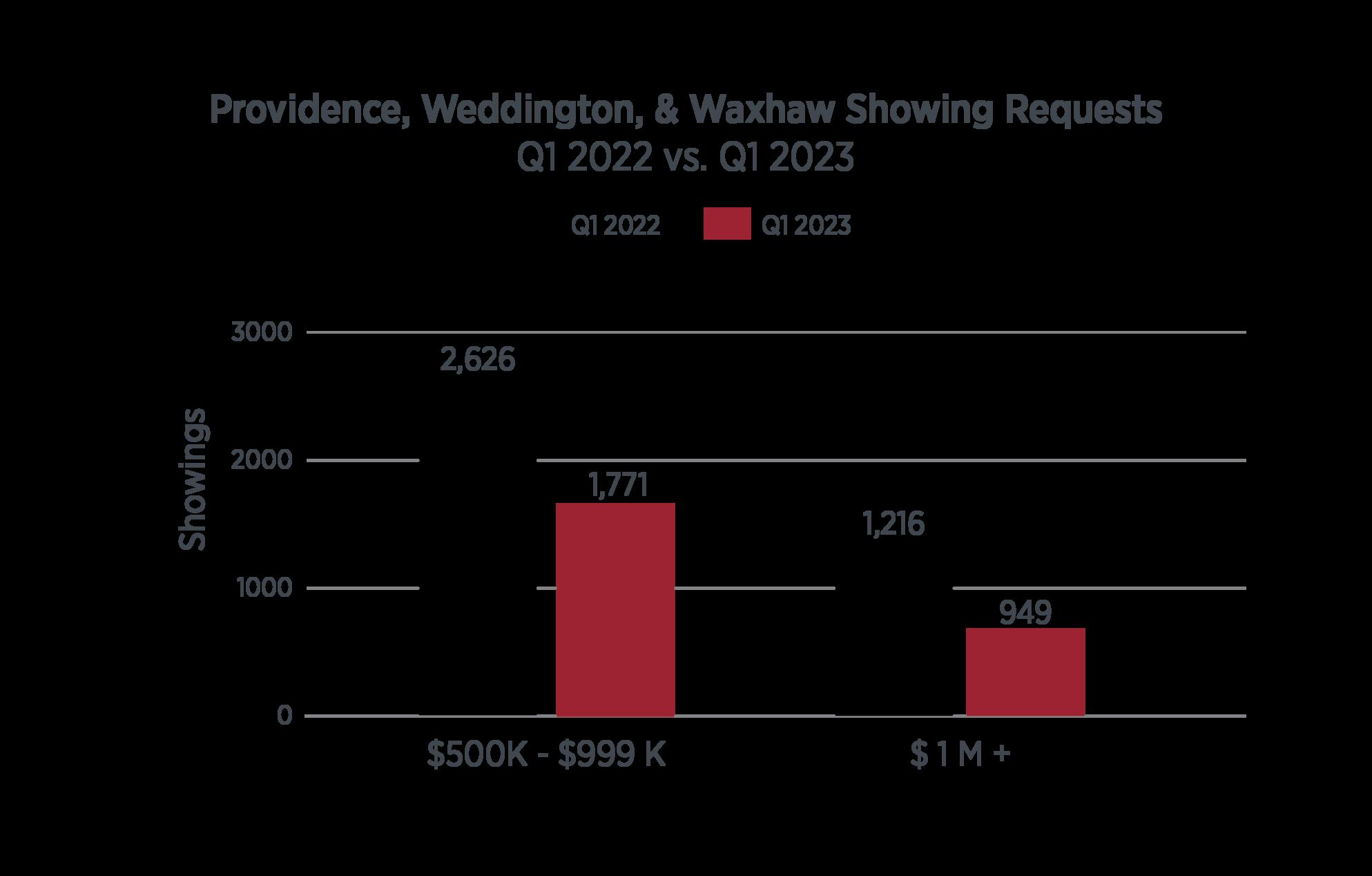

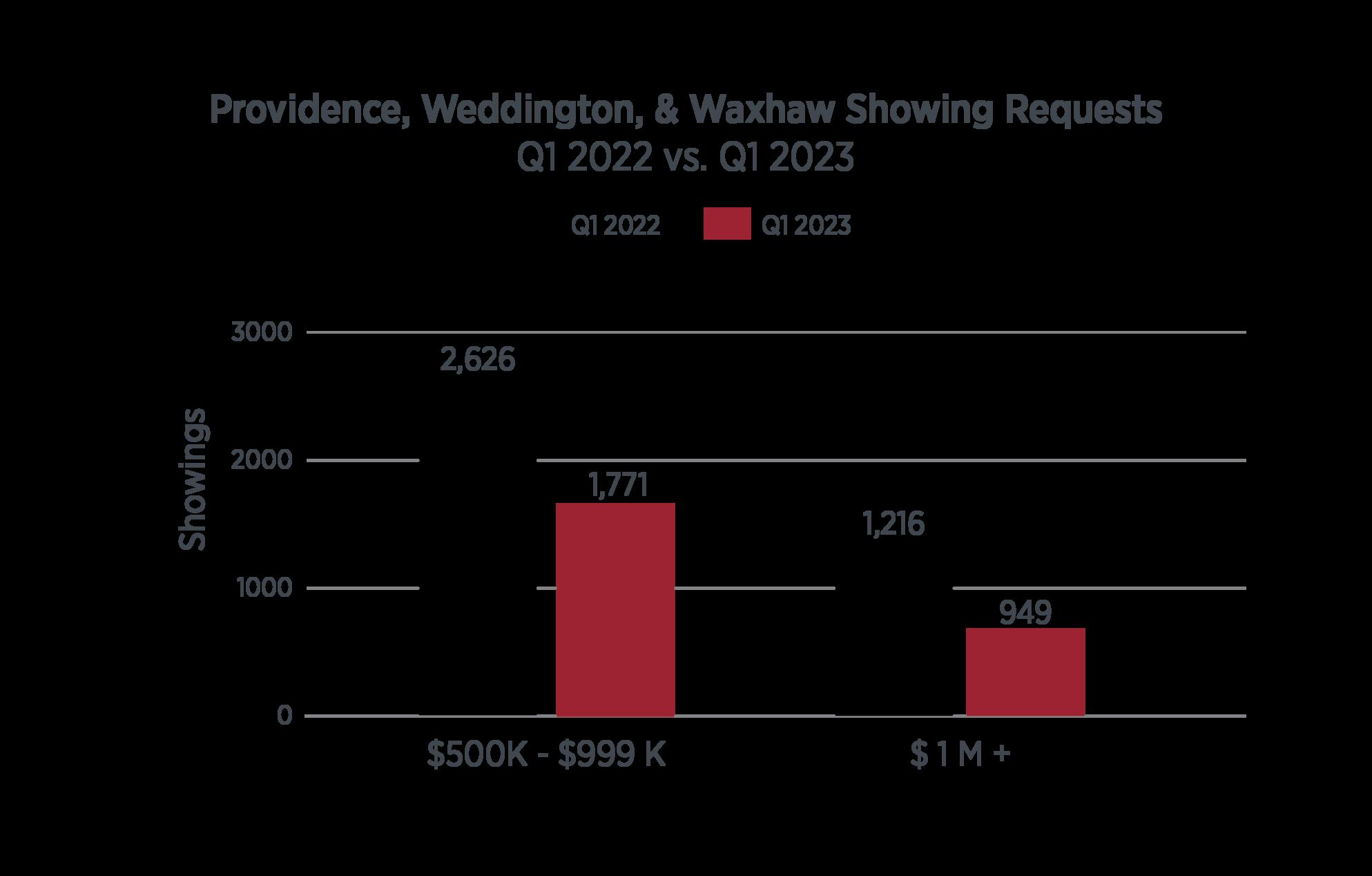

PROVIDENCE, WEDDINGTON & WAXHAW

While this area showed percentage declines in sell through below $1 million and above it, the area also showed strong showing activity and rebounded in late spring. 56 homes above $1 million in list price went under pending contract, with just 33 remaining as active listings, again pointing to narrowing options for borrowers and possible upward pricing pressure as we move into late spring/early summer

PROVIDENCE,WEDDINGTON & WAXHAW Q1 HOMES SOLD &

LAST 90 DAYS

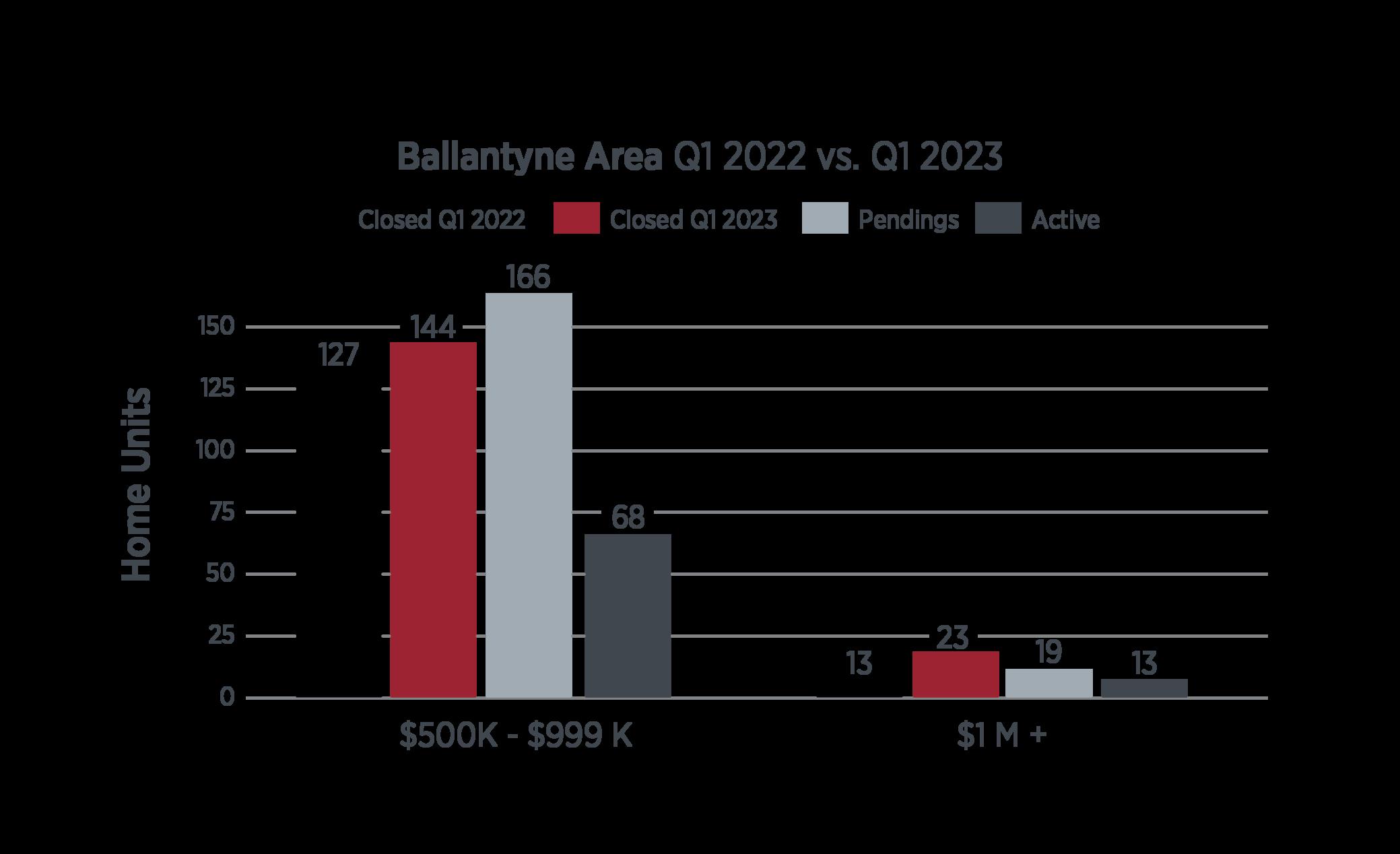

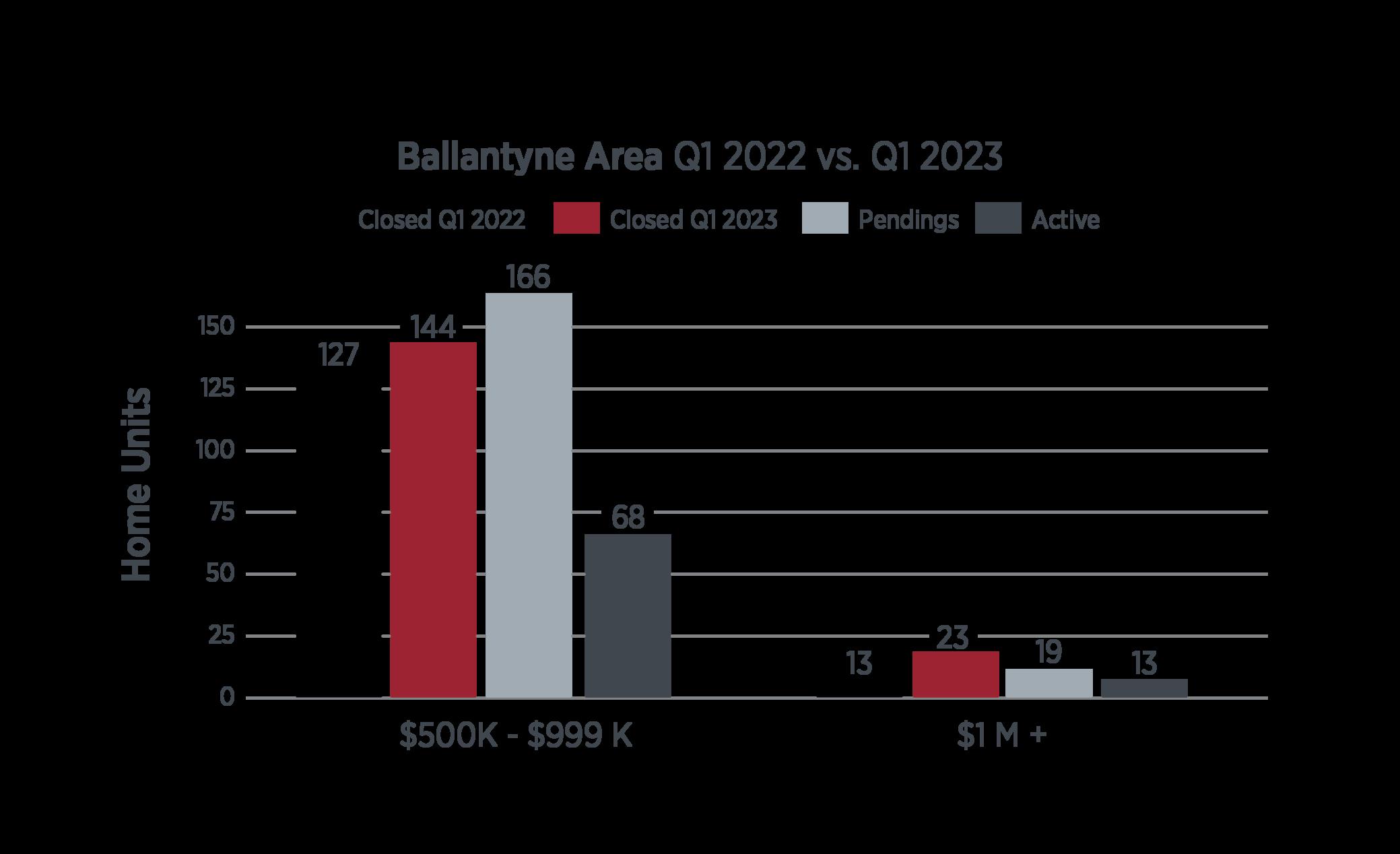

BALLANTYNE & SOUTH CAROLINA

The Ballantyne area and upper York County continued to attract upper mid-market, $750k+ price range, and million-dollar luxury buyer interest With

113 pending contracts just below $1 million on inventory of just 46 active homes, the luxury range above $1 million in list price showed 19 pending contracts with just 13 remaining active listings. Both levels represent less than 30 days active inventory.

BALLANTYNE & SOUTH CAROLINA Q1 HOMES SOLD & SHOWINGS

LAST 90 DAYS

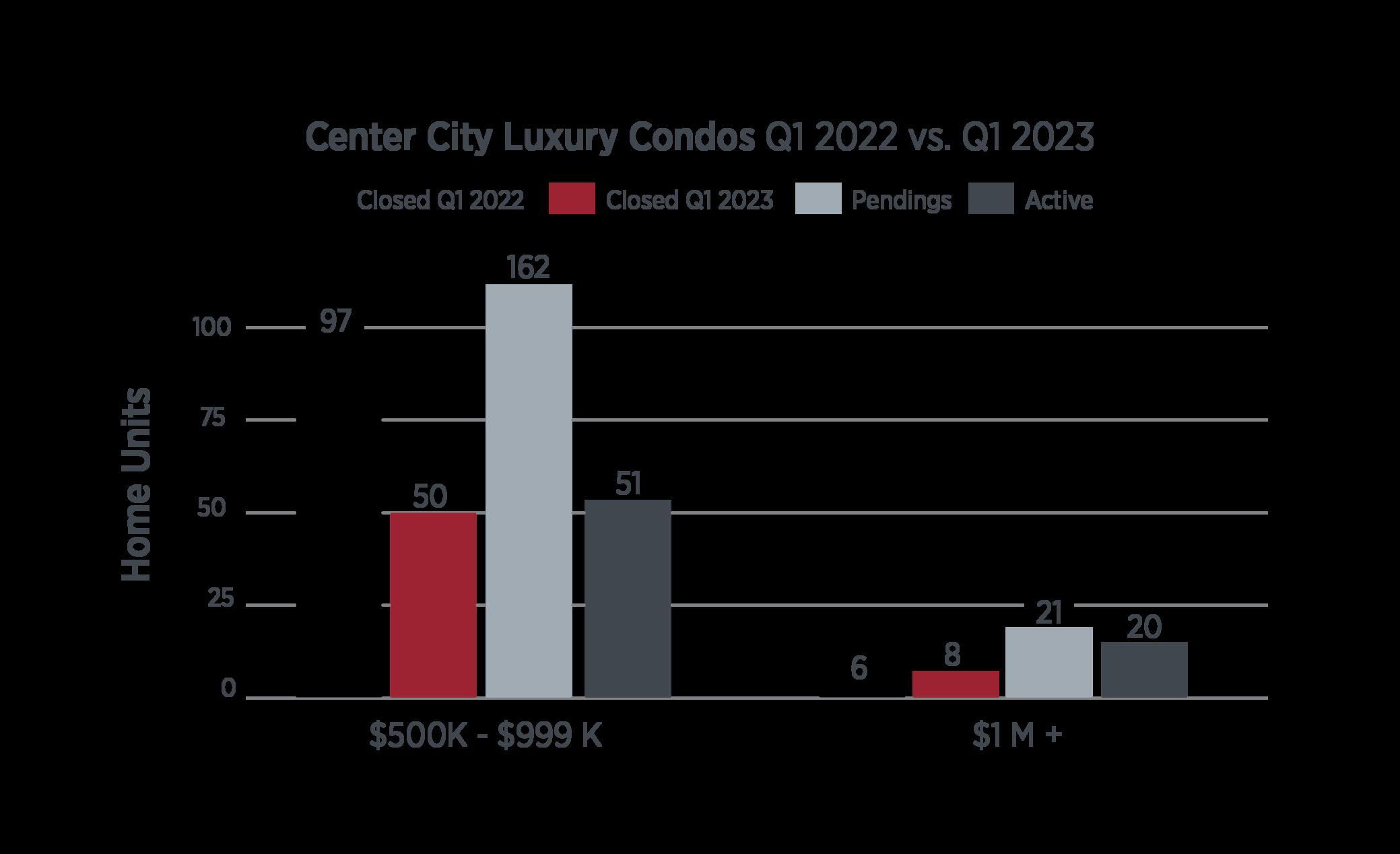

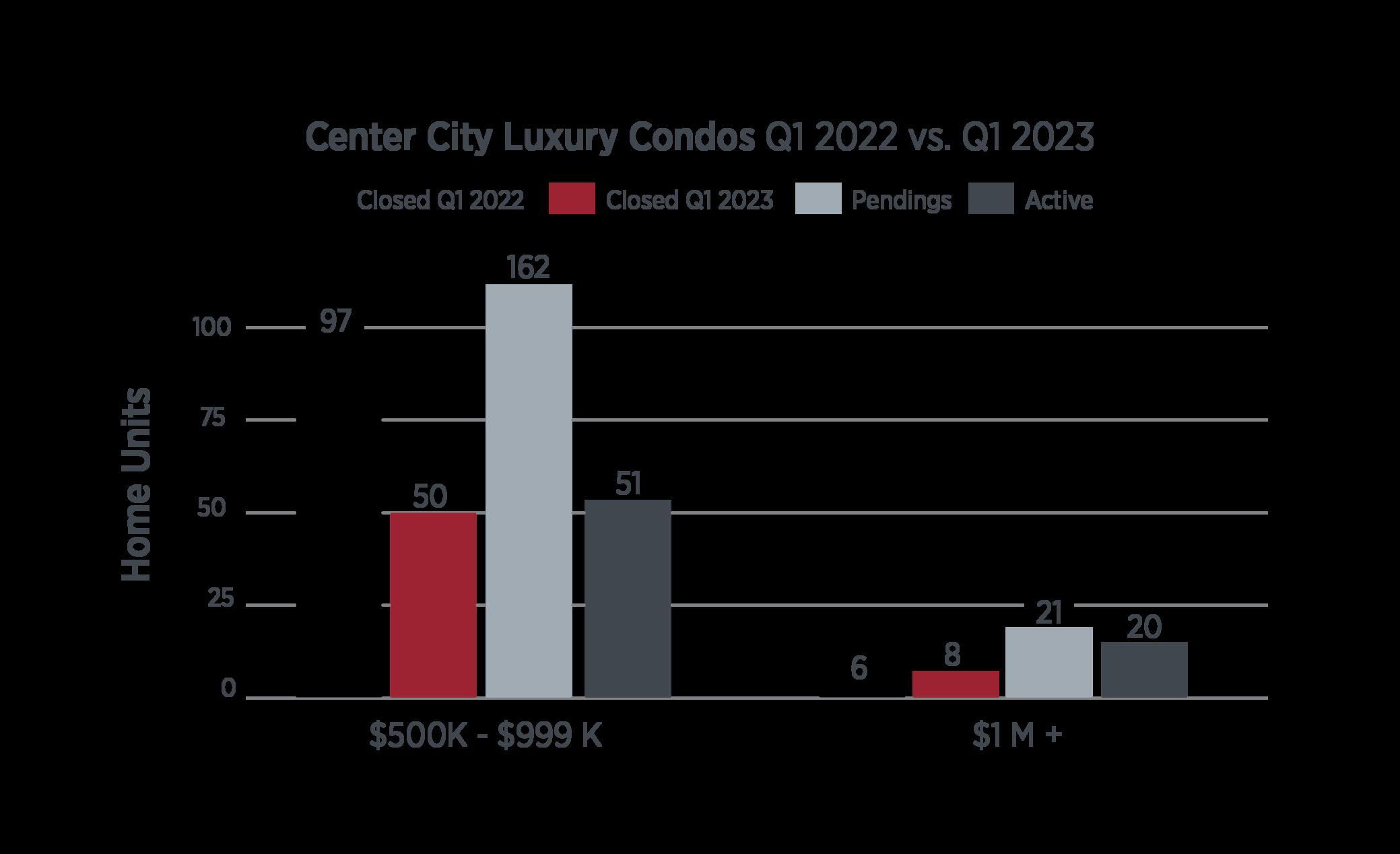

CENTER CITY LUXURY CONDOS

The near city luxury multi-family market continued to show strong growth, with luxury enclaves and projects sprouting inside and around the 277 beltway. Light rail expansion has spurred luxury development on both sides of the city, with 69 units pending in the range just below $1 million, and an impressive 21 units over $1 million now under pending contracts This segment is one of the region’s most dynamic, as luxury townhomes and condos now routinely begin to exceed the million dollar mark and begin to push upward into the ultra-luxury range above $2 and $3 million in list price.

CENTER CITY CONDO MARKET Q1 HOMES SOLD

LAST 90 DAYS

CHARLOTTE MARKET FORECAST

While the interest rate sensitive segments below $1 million in value are off 1020% in realtor showing requests, they are coming off such historic highs that this spring’s numbers still exceed almost any other historic comparison other than 2022 With that, the range above $1 million in many areas is on par with last spring and in some areas is exceeding those historic levels, clearly displaying the strength of Charlotte’s luxury real estate market. While prices paused over the winter, despite national media reports, Charlotte’s luxury market has shown little erosion, and in fact, in the tighter inventory areas discussed above, will likely see continued upward pricing pressure absent a highly unlikely increase in inventory

The percentage of “distressed” properties coming to market remains extremely low, particularly in the upper price ranges, this dynamic, coupled with locked in homeowners riding 2 and 3% mortgages, combines to provide both pricing stability and limited inventory options. Builder sentiment is once again on the rise. A recent research study projected that dynamic new urban growth, benign climate, and improved access to a young professional workforce will all drive companies and relocating individuals to join some 20 million residents migrating to sunbelt states between 2020 and 2030 With North Carolina now ranked as the third highest state in terms of inbound migration, demand continues to drive markets across the state

HarnessingthePower oftheCommunity

toEndHomelessness

Ivester Jackson Christie's Team Captains

Lori Ivester Jackson (Lake Norman Region)

Lisa McCrossan (Charlotte Region)

How It Works

Everyoneinvolvedineachhometransactionisasked

todonateagiftof$10ormoretothe

HomeownersImpactFund

Thisincludestheagents,buyer,seller,lender,titlecompany, andclosingattorney,foragoalofcollecting$70ormoreper closing.

LISTEN TO OUR PODCAST AND VISIT OUR VIDEO PAGE

FROM MARKET FORECASTS, INTERVIEWS, AND HOUSE

MARKETING IDEAS, JOIN THE TEAM AT IVESTER JACKSON |

CHRISTIE'S FOR THE LATEST IN CAROLINAS LUXURY REAL ESTATE CONTENT.

Where will you

center yourself next?

L E T U S H E L P Y O U N A V I G A T E T H E J O U R N E Y

CHARLOTTE | LAKE NORMAN | NORTH SHORE | ASHEVILLE | WILMINGTON 704-499-3054 IvesterJackson.com