IVESTER JACKSON | CHRISTIE'S LUXURY MARKET REPORT Charlotte | Q2 2023

OVERALL MARKET REPORT

Charlotte Regional Luxury Market Mostly Strong Though It Shows Some Signs of Tapering

COMMUNITY UPDATES

SouthPark

Myers Park & Eastover

Lake Wylie & The Palisades

Providence, Weddington & Waxhaw

Ballantyne & South Carolina

Center City Luxury Condos

FORECAST

Charlotte and North Carolina’s Real Estate market continues to show resilience and strength moving into the second half of the year

PODCAST & VIDEOS

From market forecasts, interviews, and house marketing ideas, join the team at Ivester Jackson I Christie's for latest in Carolinas luxury real estate content

2023 Q2 Market Report

contents

Charlotte Regional Luxury Market Mostly Strong Though It Shows Some Signs of Tapering

The regional luxury market in the Charlotte region continued to show post-Covid strength, despite record breaking rate hikes from the Federal Reserve While interest rate-sensitive price ranges below $1 million in list price have seen inventory increases in some areas, many remain with strong demand and under 60 day housing supplies In the luxury and ultra-luxury segments, inventory balanced with pending contract demand continues to be on display, as buyers eagerly snap up homes listed above $1 million and $2 million at paces close to last summer ’ s record pace.

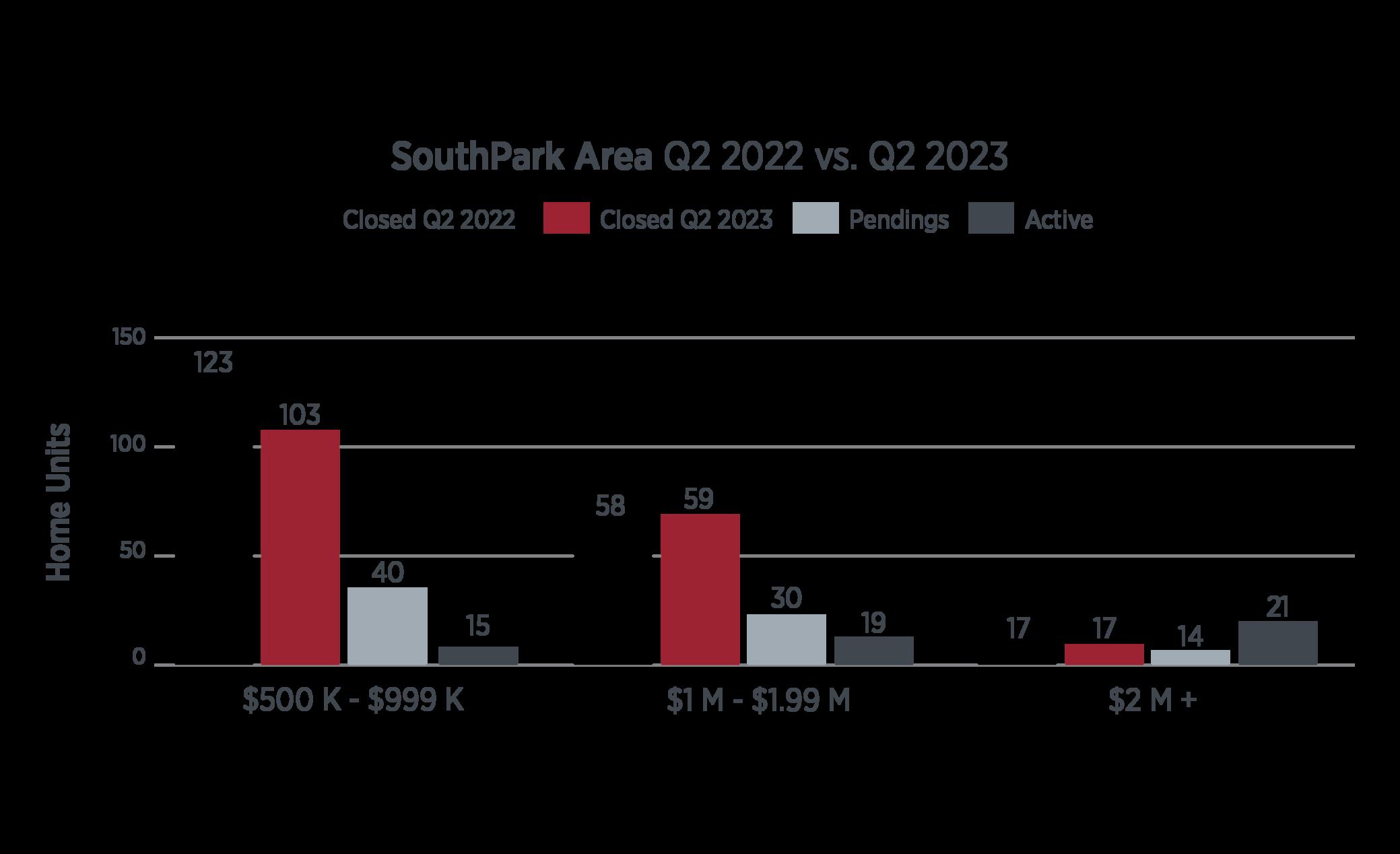

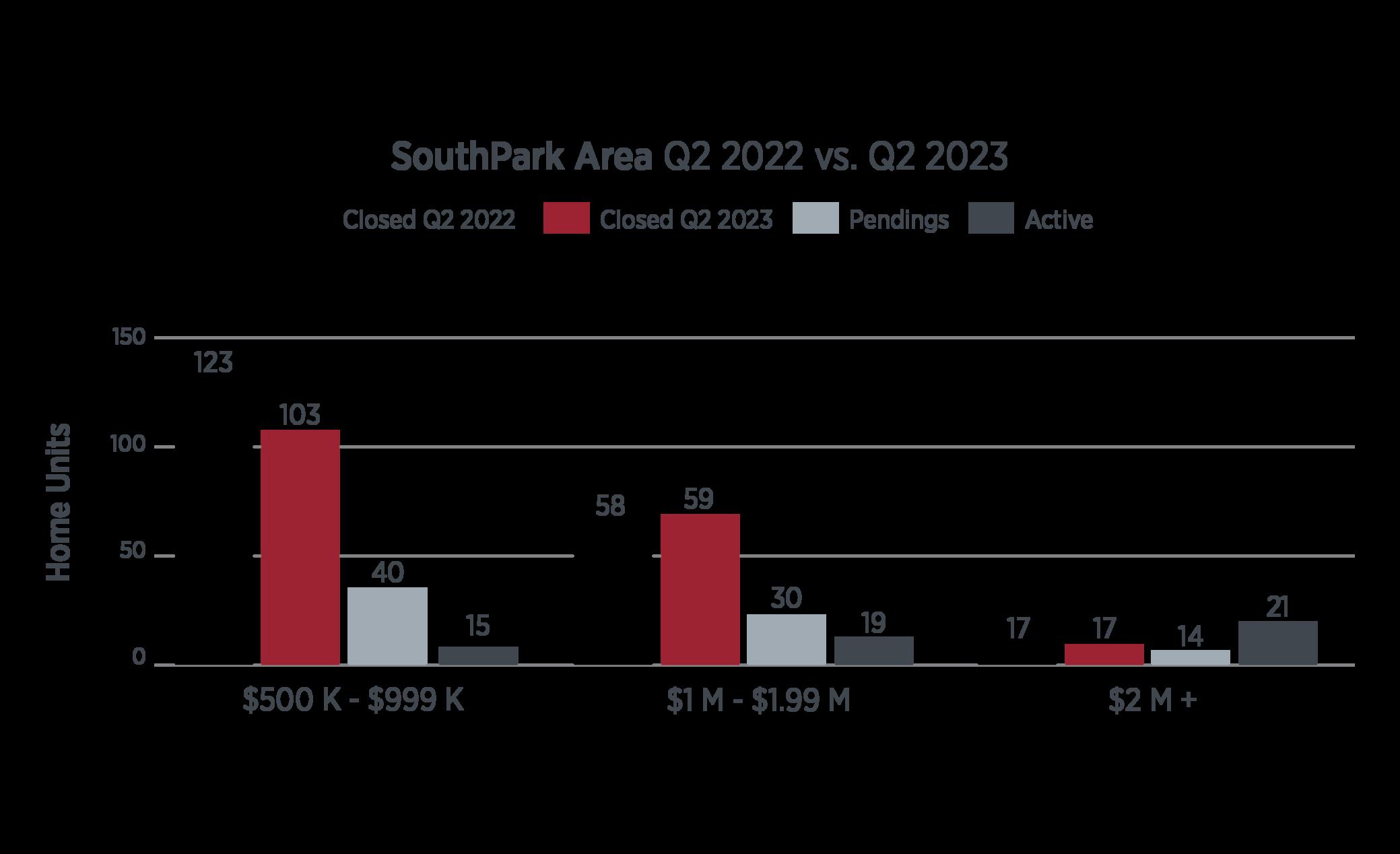

SOUTHPARK

The always in high-demand SouthPark area saw slight declines in the mid-market range below $1 million. However, it once again saw a record quarter with 59 homes closing between $1 million and $2 million with another 17 closing above $2 million, both segments coming in equal to or exceeding last year ’ s second quarter results. The quarter ended with 14 homes under contract over $2 million on an inventory of 21 homes, roughly 60 days worth of supply

SOUTHPARK AREA Q2 HOMES SOLD & SHOWINGS

LAST 90 DAYS

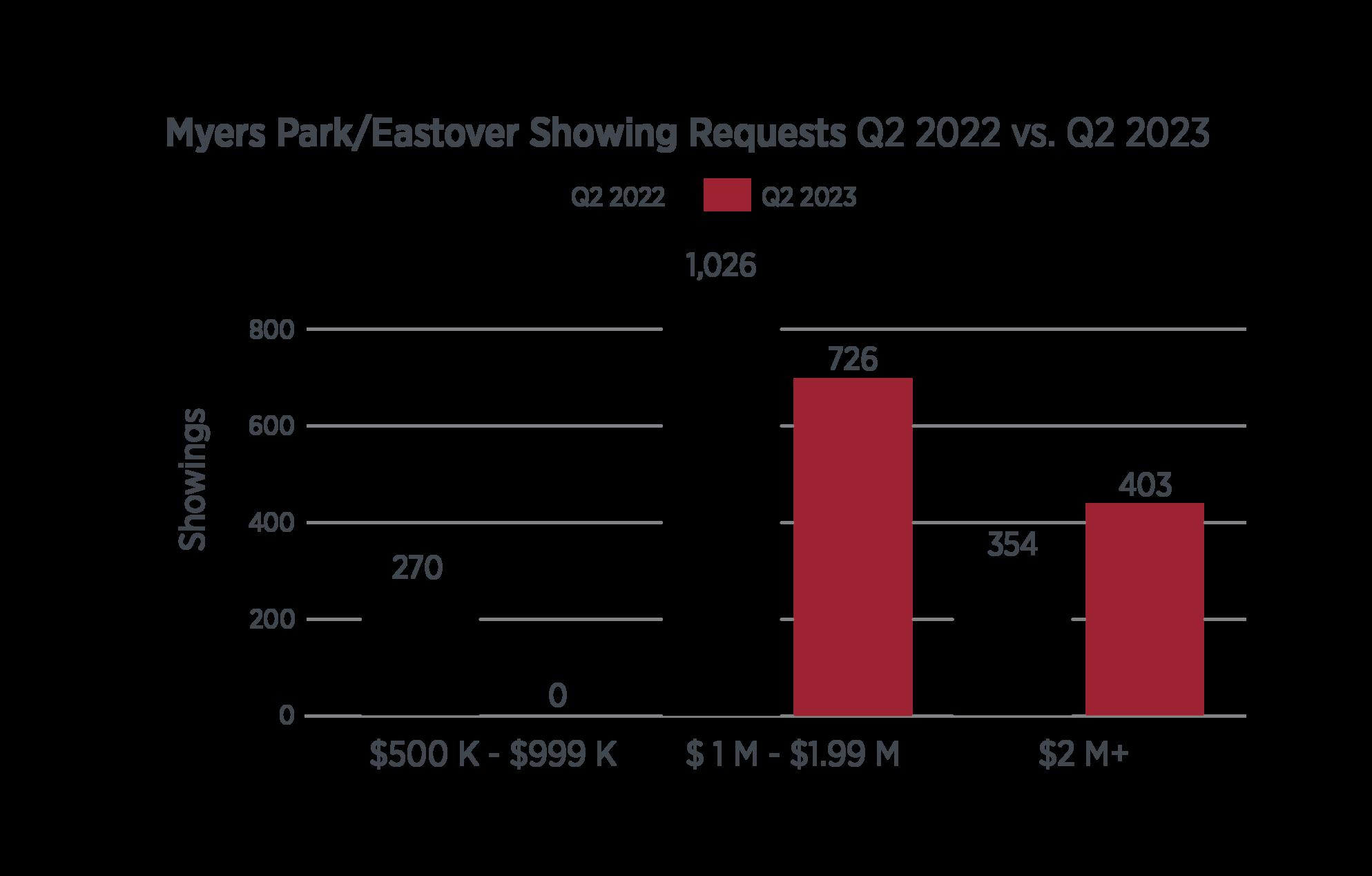

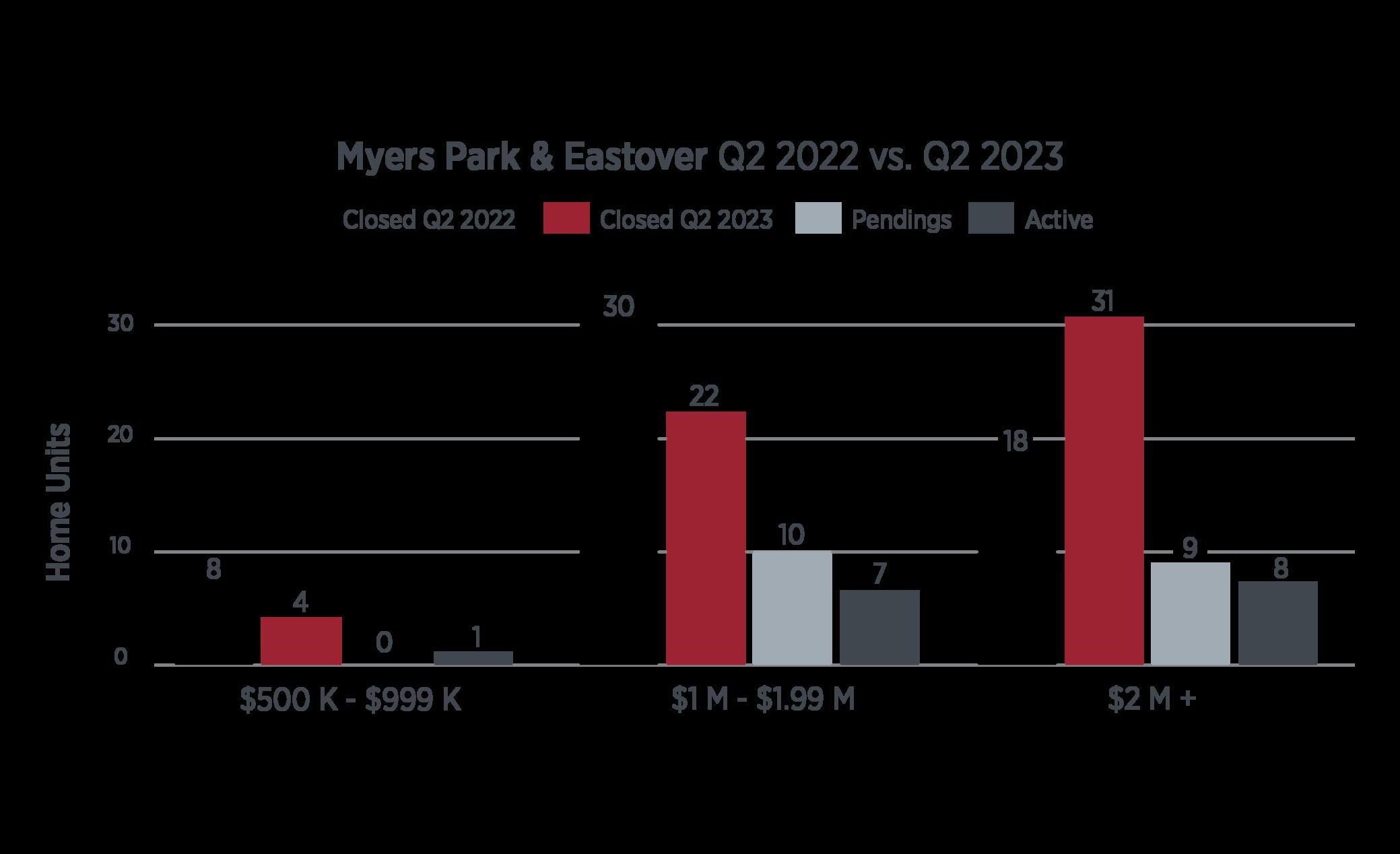

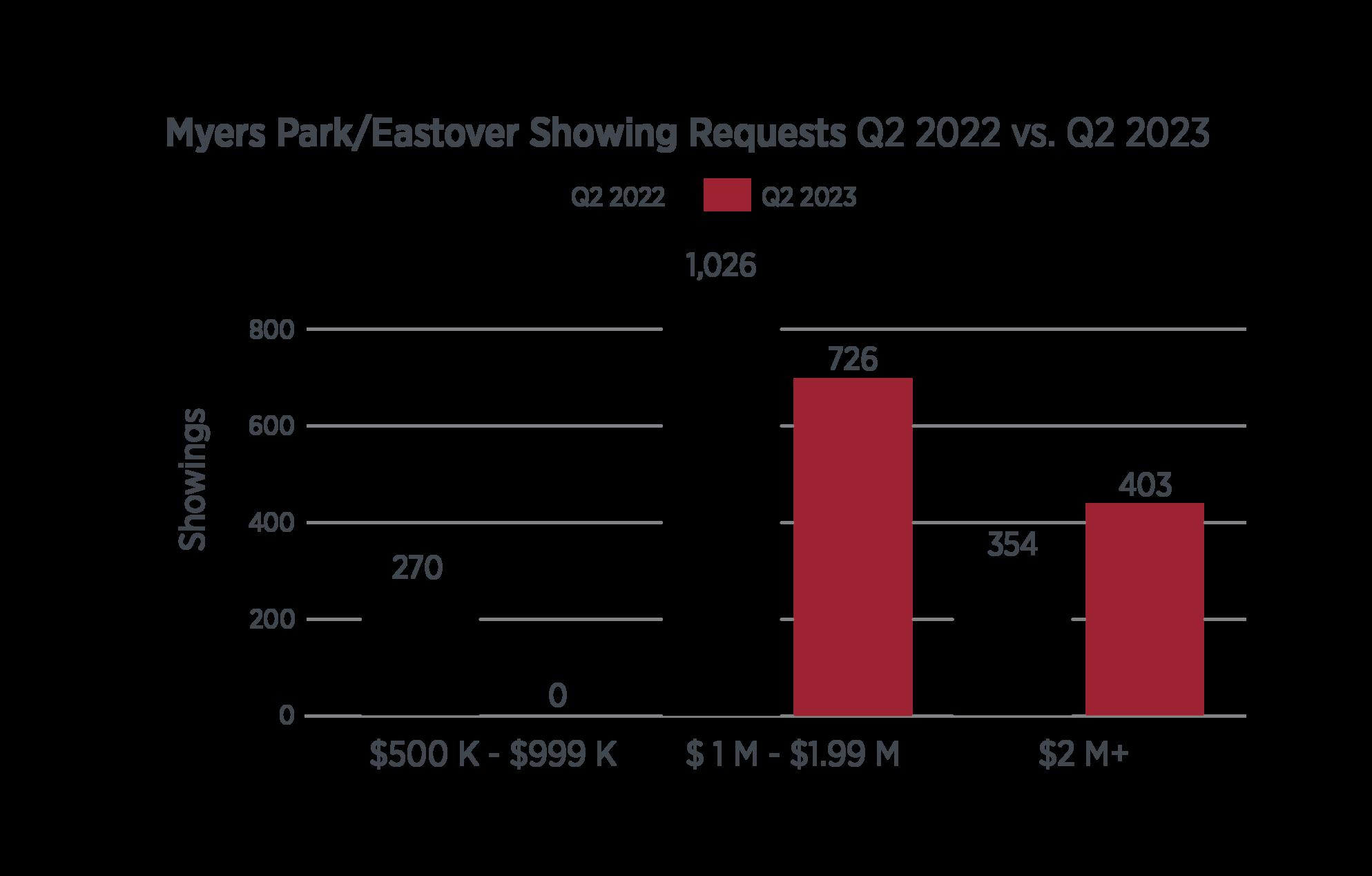

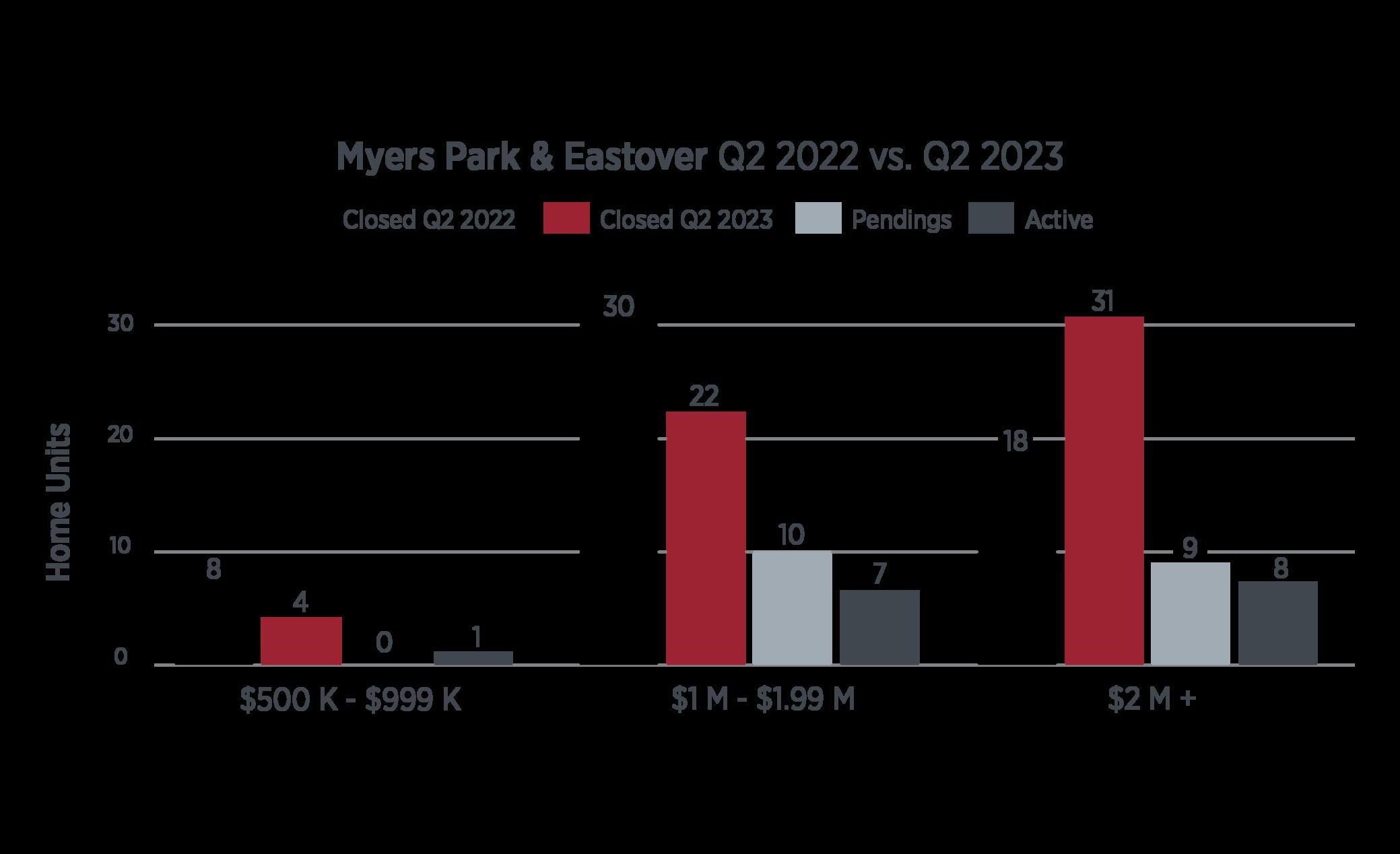

MYERS PARK & EASTOVER

In-town locations continued to be in high demand, as the Myers Park and Eastover area saw 31 transactions close in the ultra-luxury range above $2 million compared to just 18 in last year ’ s second quarter. The quarter ended with 10 homes pending between $1 million and $2 million, and 8 homes pending over $2 million. Both ranges are showing 30 days or less of inventory in the luxury price ranges, indicative of continued advantageous conditions for sellers

MYERS PARK Q2 HOMES SOLD & SHOWINGS

LAST 90 DAYS

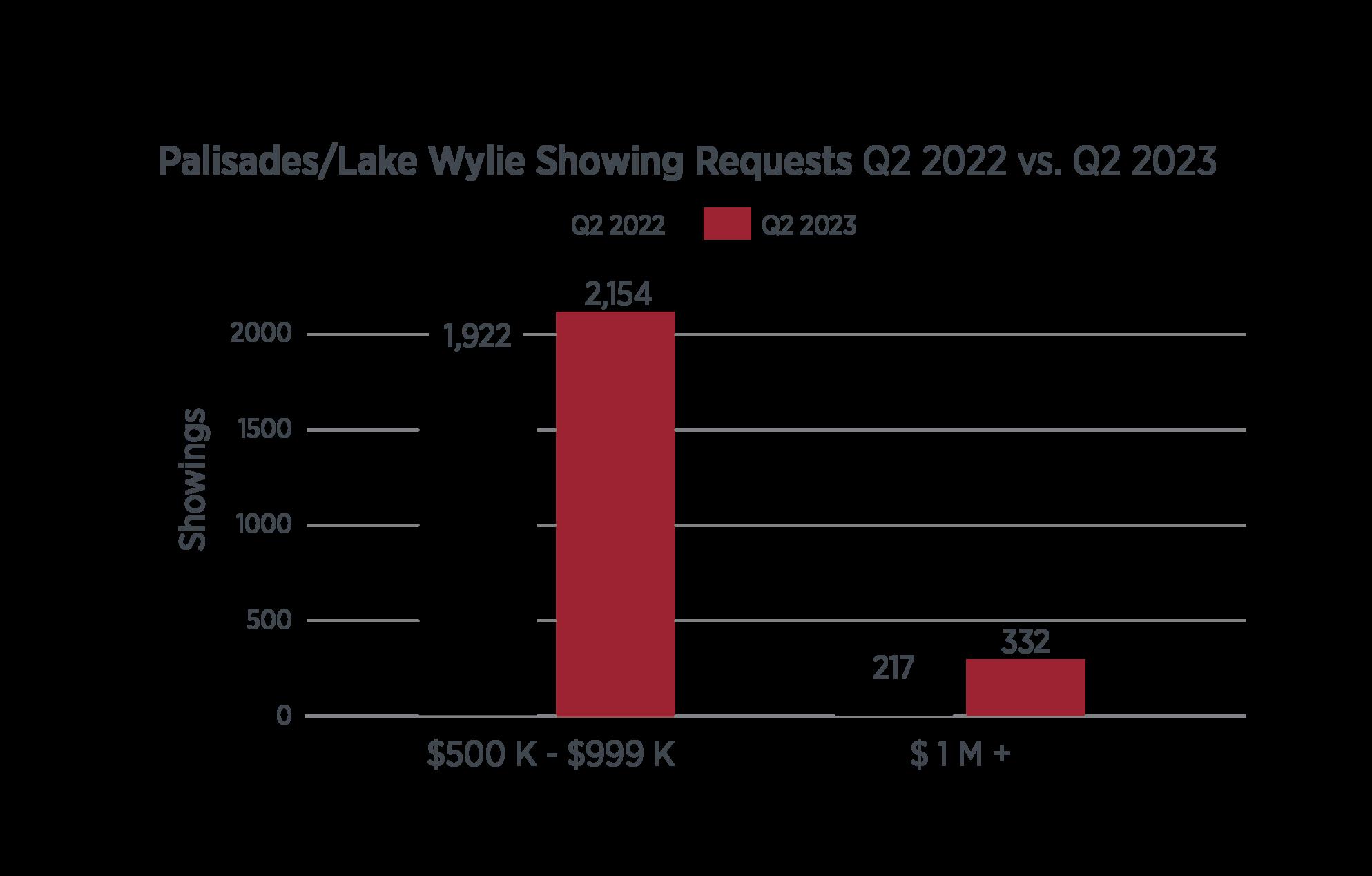

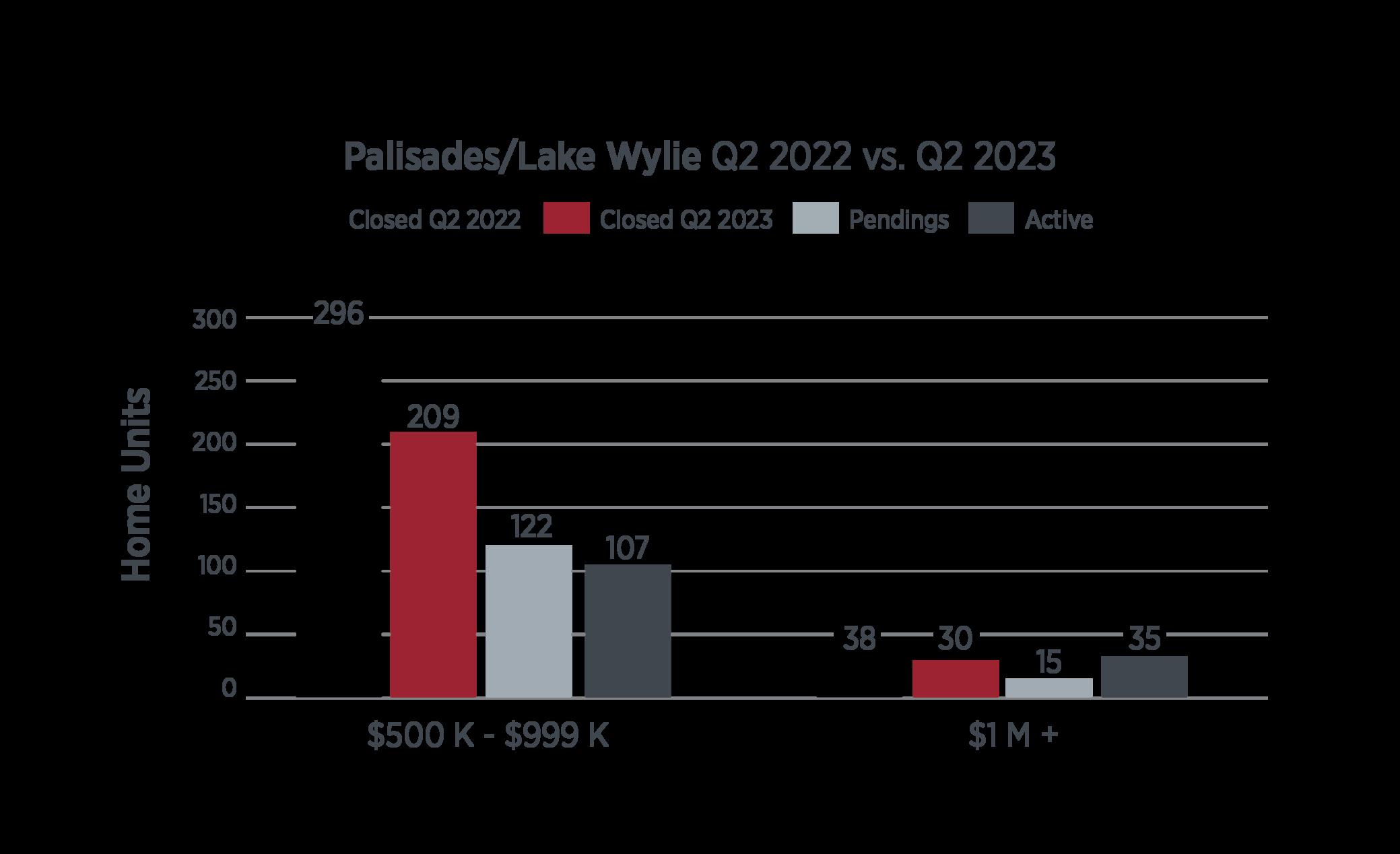

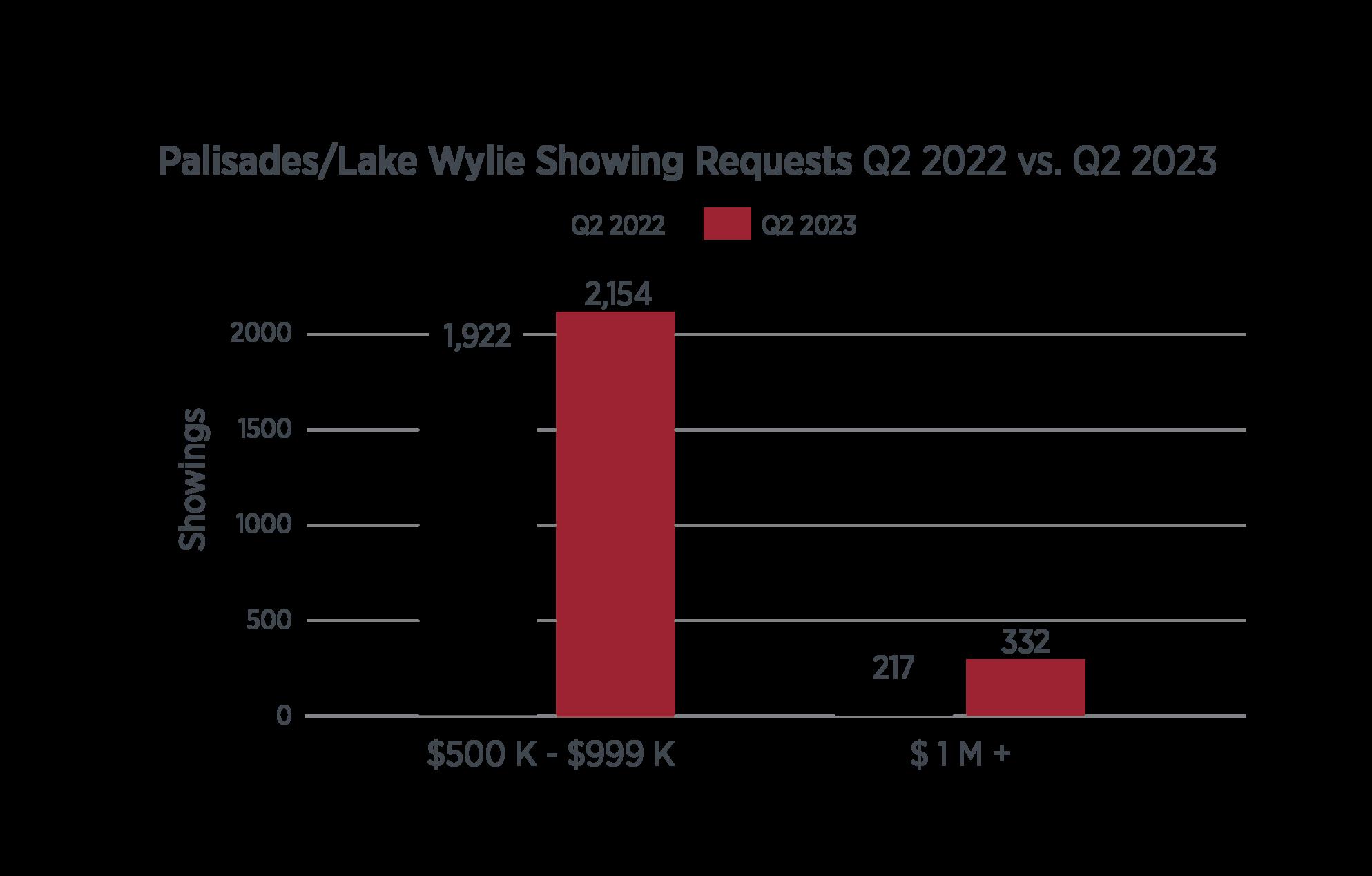

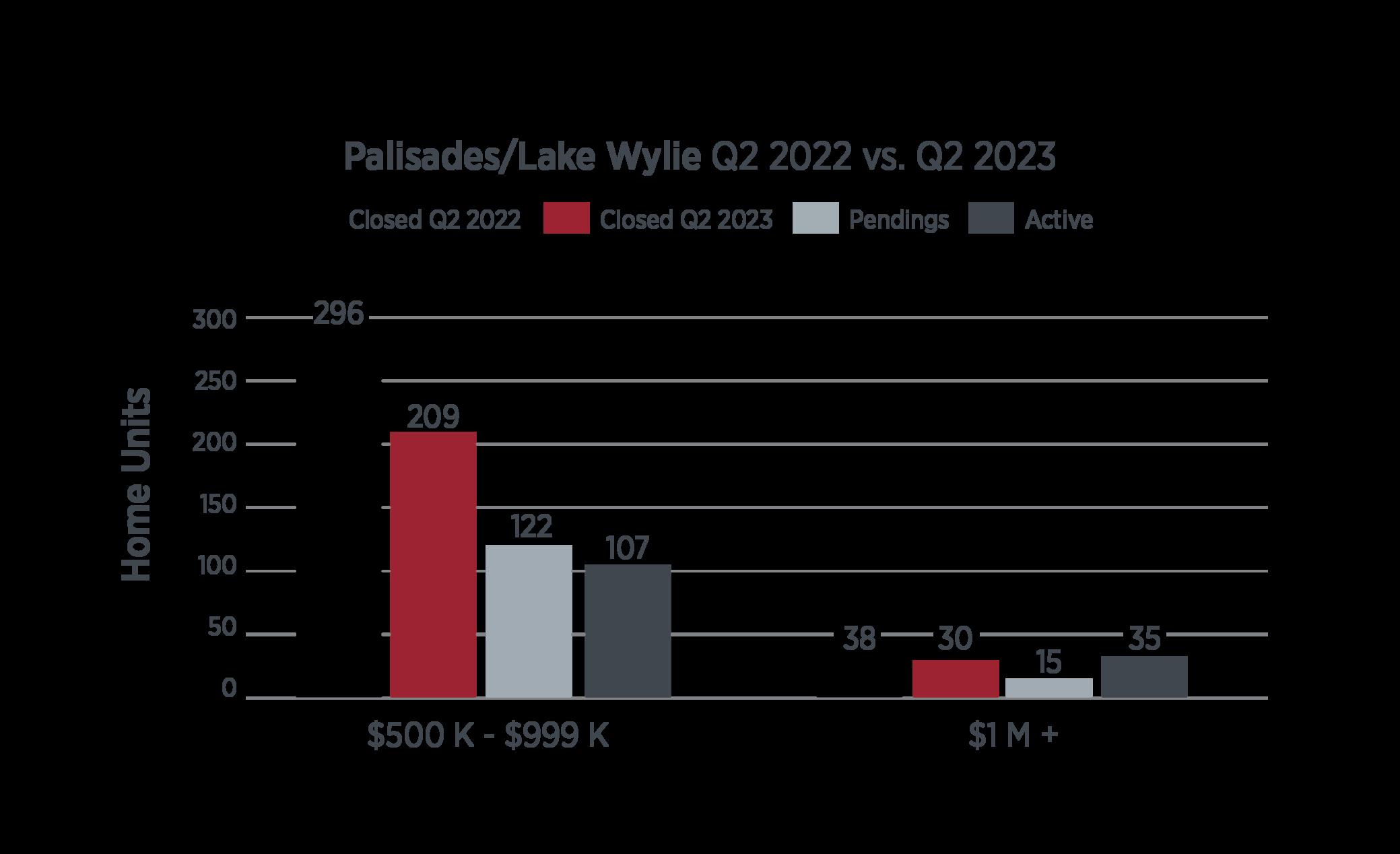

LAKE WYLIE & PALISADES

Demand for homes just below $1 million fell in the Lake Wylie area while still remaining very active. The range above $1 million, while off roughly 20%, continues to display much higher sell-through activity than pre-Covid periods. 30 homes over $1 million closed in the second quarter with another 15 pending heading into the third quarter on inventory of 35 homes, which is roughly 60-70 days of inventory supply.

LAKE WYLIE & PALISADES

Q2 HOMES SOLD & SHOWINGS

LAST 90 DAYS

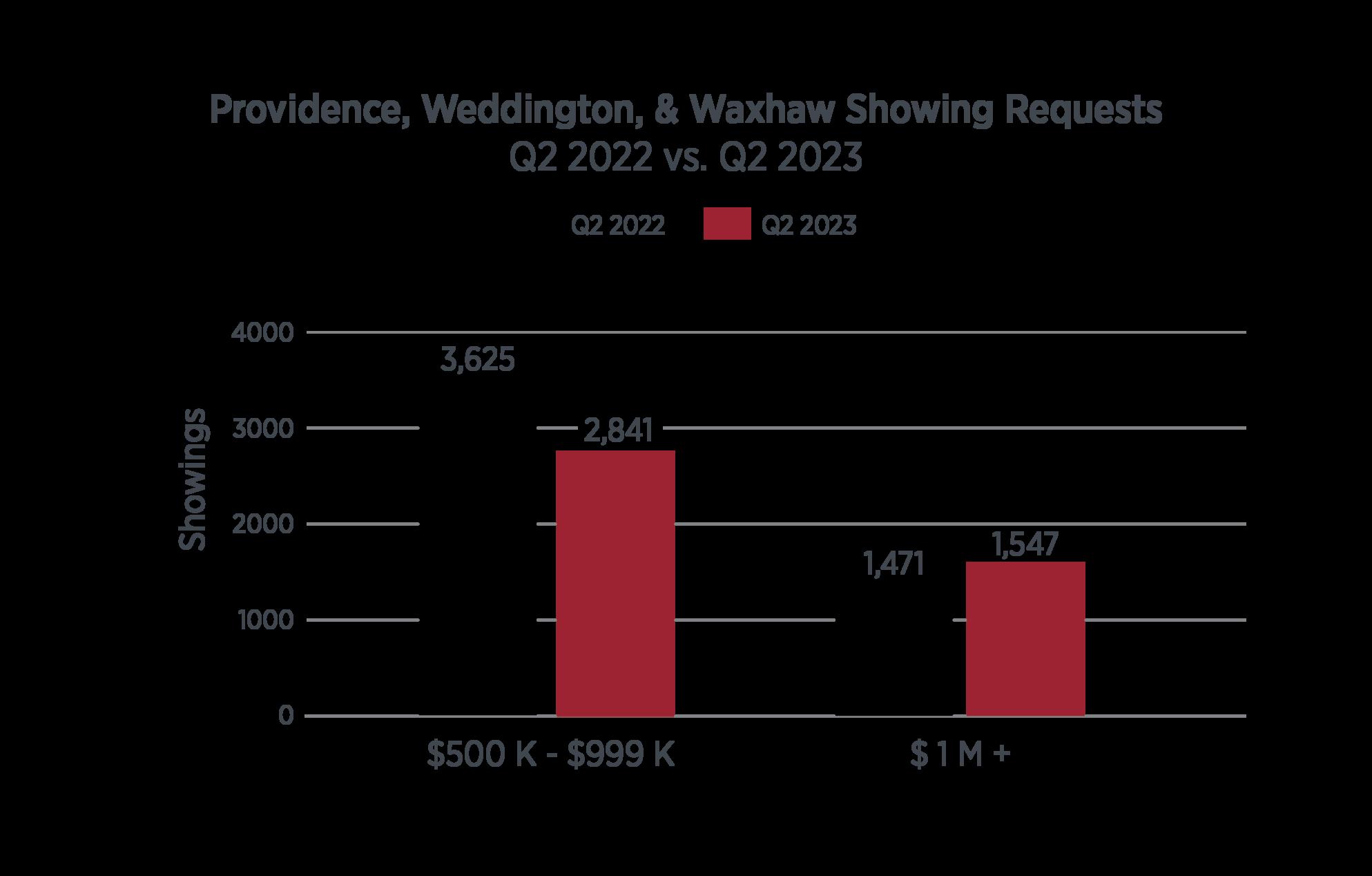

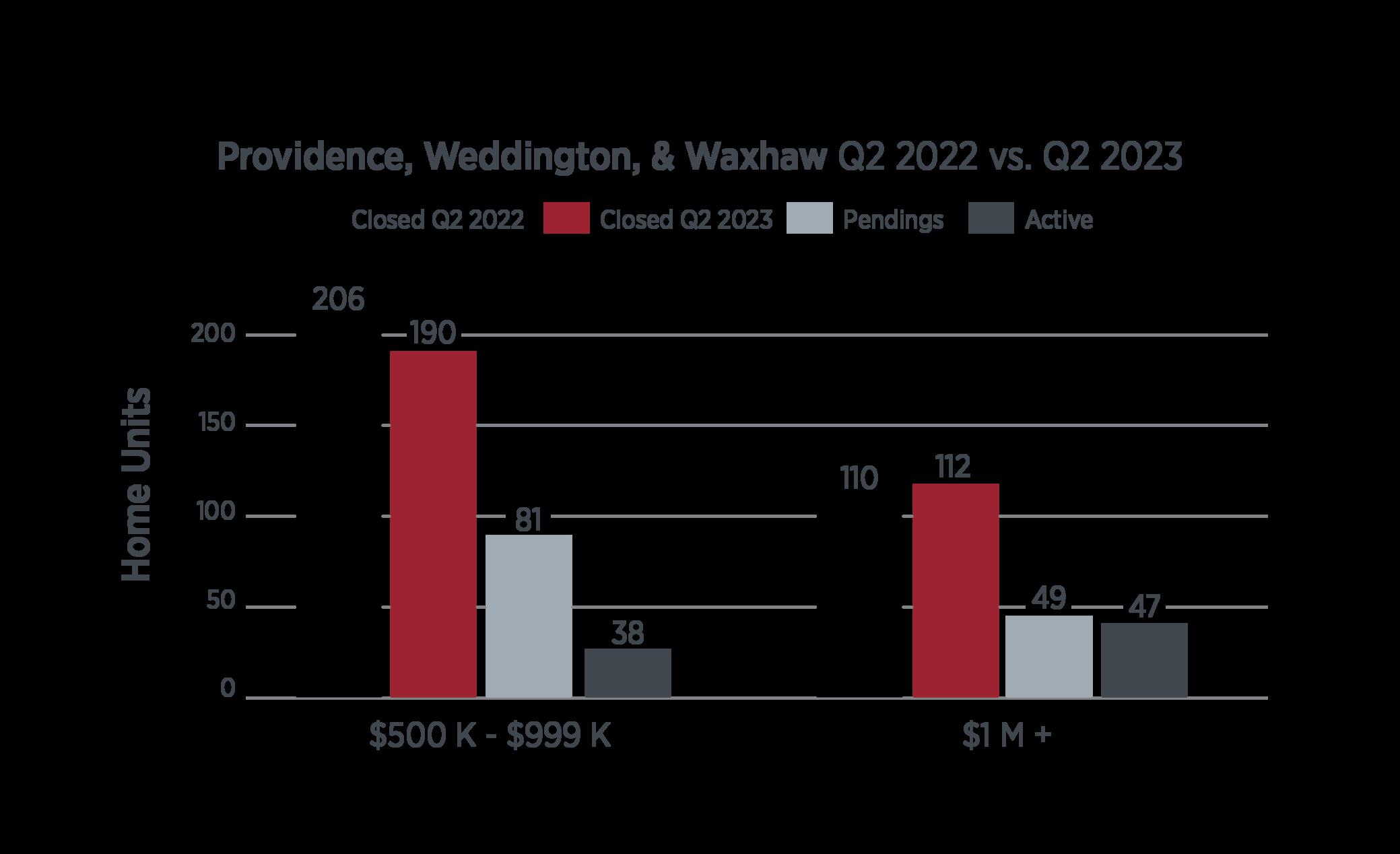

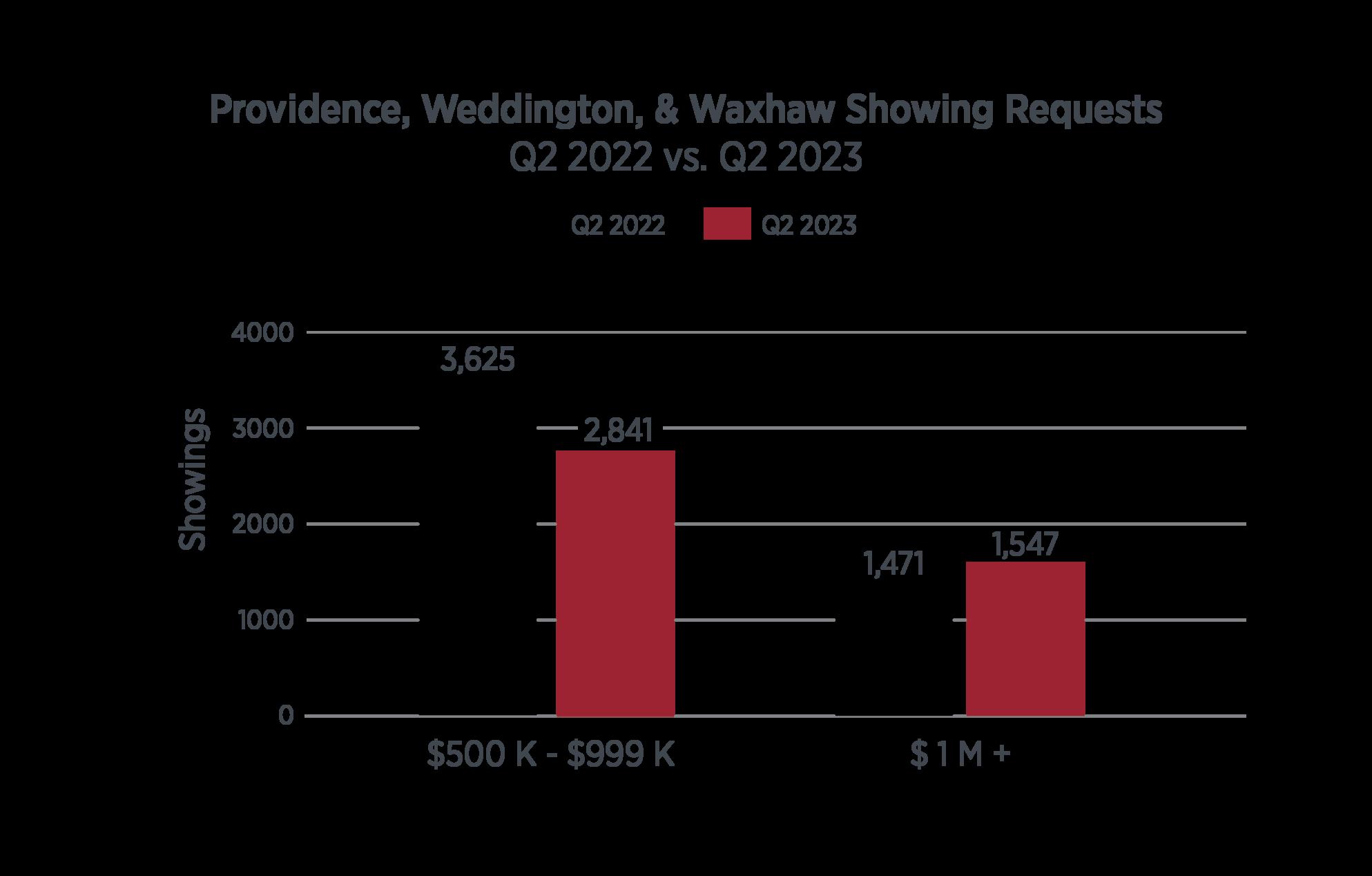

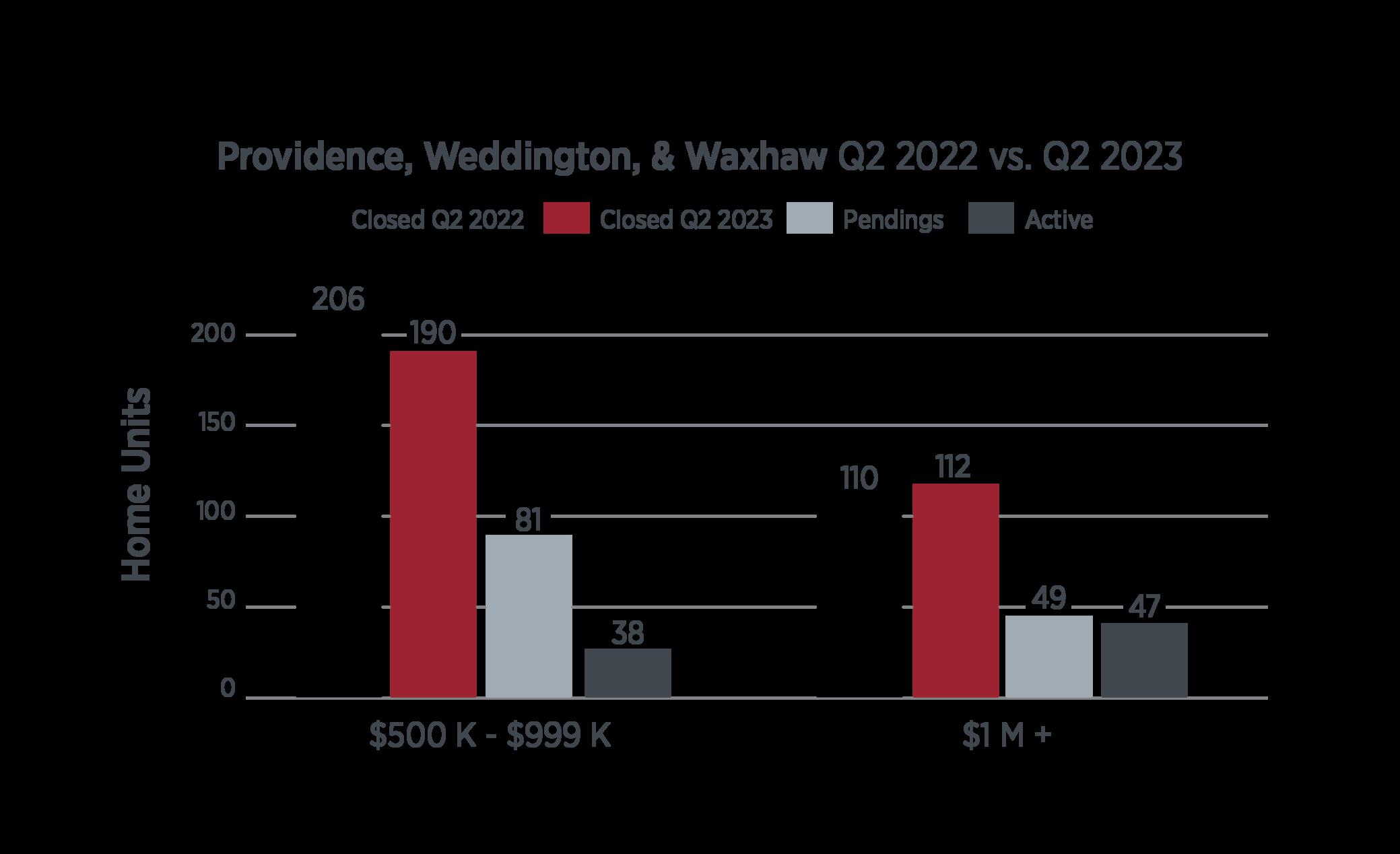

PROVIDENCE, WEDDINGTON & WAXHAW

While this area ’ s mid-market tapered about 8% from last year ’ s second quarter, the $1 million range continued to have robust conditions. 112 homes closed down the Providence corridor into Union County compared to 110 last year at the same time. The area also had 49 pending contracts over $1 million compared to an inventory of 47 active homes, or roughly 45 days of inventory in this still hot area of the Charlotte metro.

PROVIDENCE,WEDDINGTON & WAXHAW Q2 HOMES SOLD &

LAST 90 DAYS

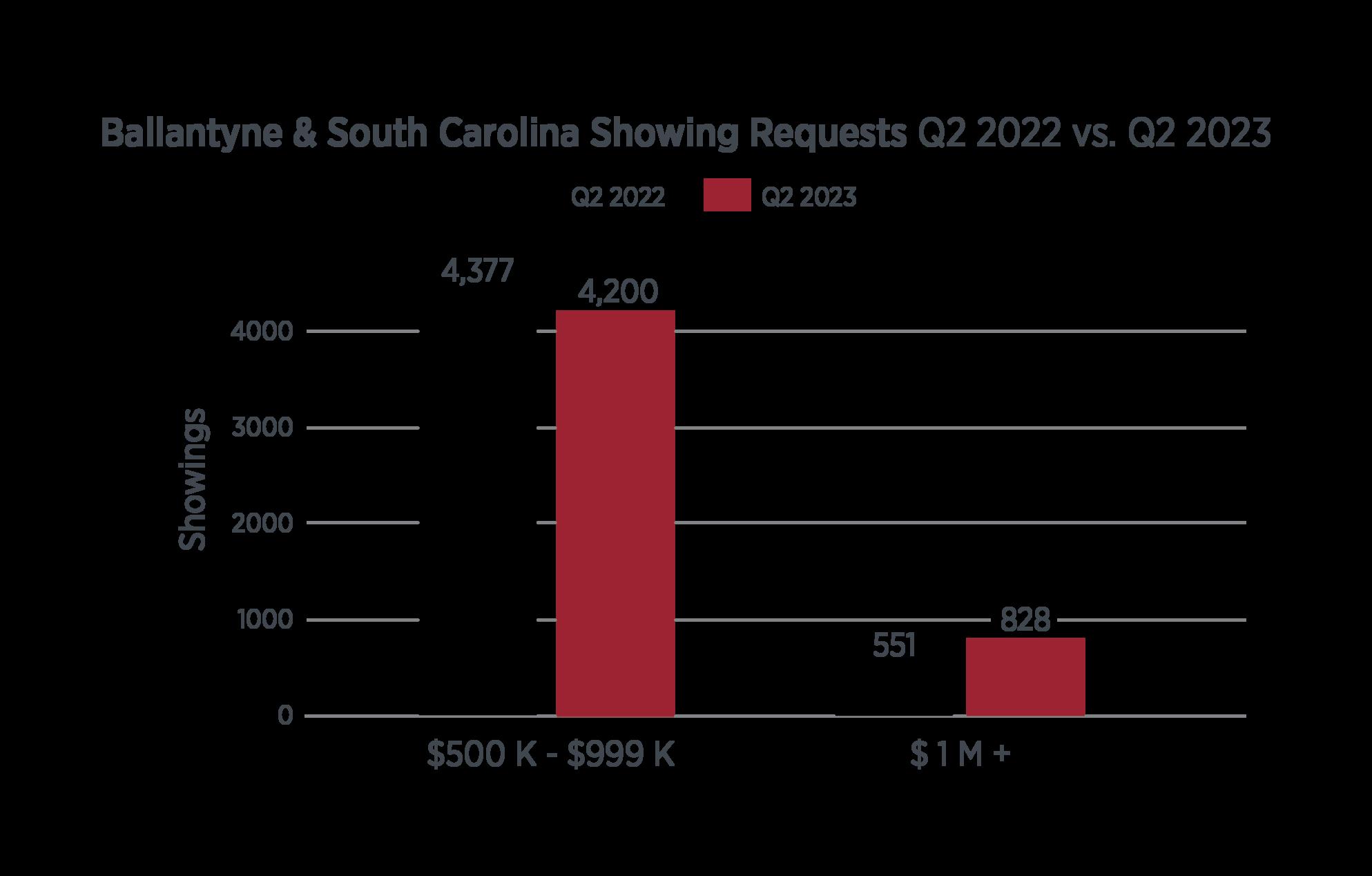

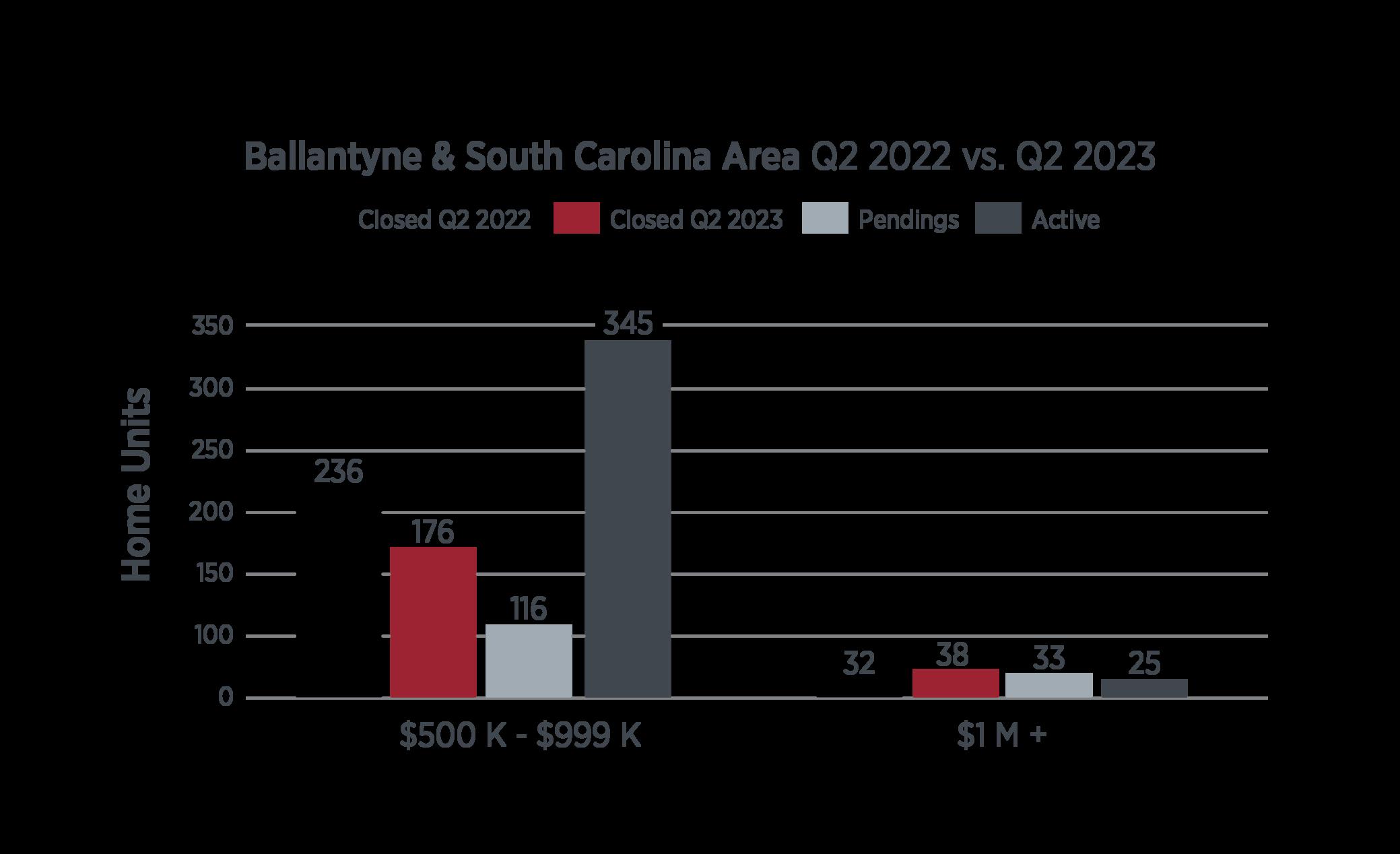

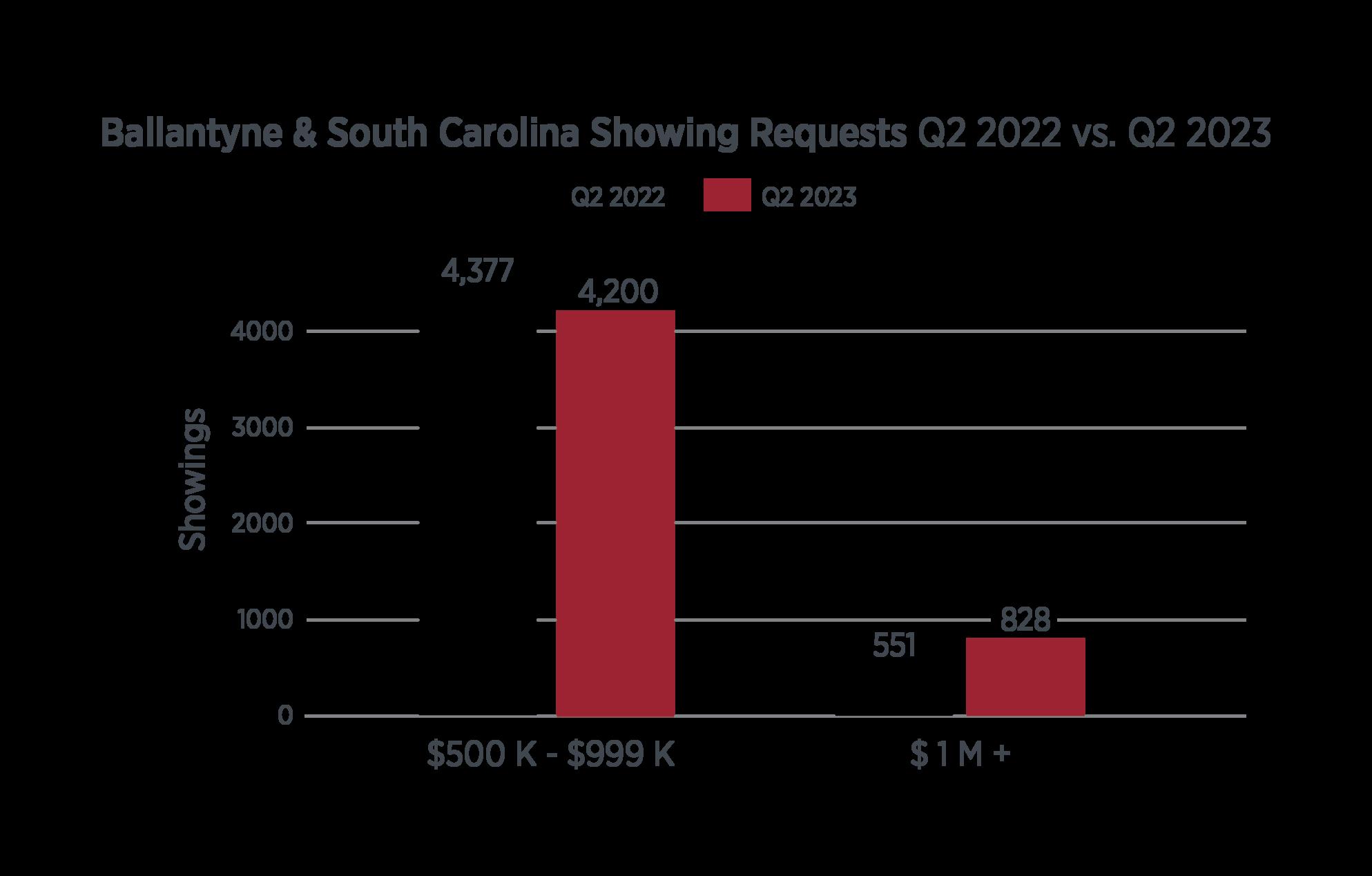

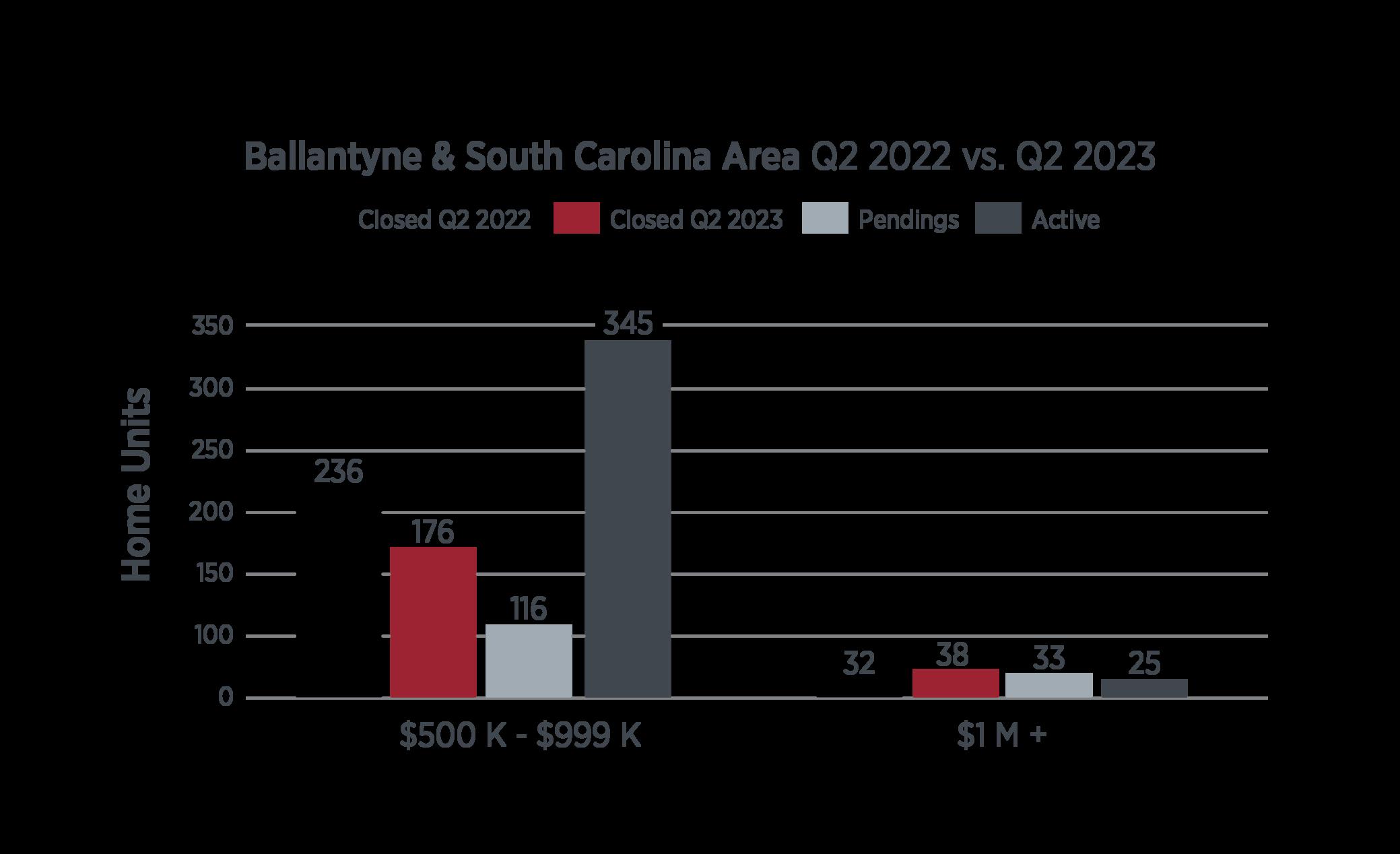

BALLANTYNE & SOUTH CAROLINA

While the interest rate-sensitive, lower end saw declines from last summer ’ s second quarter, the $1 million plus range in this area south of Charlotte actually saw a surge, with 38 homes closing over $1 million in the second quarter, vs 32 last year, a near 20% increase. The quarter ended with another 33 homes over $1 million under contract against inventory of just 25 homes on the market

BALLANTYNE & SOUTH CAROLINA Q2 HOMES SOLD & SHOWINGS

LAST 90 DAYS

CENTER CITY LUXURY CONDOS

The near city condo townhouse market continued to develop and show strength in the $1 million plus range. The quarter ended with 26 units pending above $1 million following a quarter in which 10 closed. While the second quarter’s results mirrored last year ’ s quarter, the trend is most definitely increasing, with demand for lock and leave housing on the rise near South End, NODA, and around the 277 beltway.

CENTER CITY CONDO MARKET Q2 HOMES SOLD

LAST 90 DAYS

Charlotte Market Forecast

Charlotte and North Carolina’s real estate market continues to show resilience and strength moving into the second half of the year While inventory supplies in some areas have now exceeded 45 days supply, this still represents fairly tight inventory conditions In high demand areas like Myers Park and SouthPark, supply is more in line with 30 days worth of absorption. What’s also apparent, is that while sellthrough totals have tapered somewhat off since peak Covid levels, they have still settled at a pace that is often two to three times the demand that existed in 2019 With that demand comes new thresholds in pricing strata. It’s unlikely that the local market in the short term will see much, if any, retrenching on the pricing side absent gradual inventory increases.

OUR OFFICES

Charlotte

1515 Mockingbird Lane Suite 900

Charlotte, NC 28209

Lake Norman 21025 Catawba Ave #101

Cornelius, NC 28031

North Shore

350 Morrison Plantation Parkway, Suite C1

Mooresville, NC 28117

Asheville

18 S Pack Square

Asheville, NC 28801

Wilmington

527 Causeway Drive

Wrightsville Beach, NC 28480

Highlands Cashiers 210 North Fifth Street

Highlands, NC 28731

Listen To Our Podcast And Visit Our Video Page For Market Forecasts, Interviews, and Marketing Ideas, Join the Team at Ivester Jackson | Christie's for the Latest in Carolinas Luxury Real Estate Content.

Where will you

L E T U S H E L P Y O U N A V I G A T E T H E J O U R N E Y

center yourself next?

CHARLOTTE | LAKE NORMAN | NORTH SHORE ASHEVILLE | WILMINGTON | HIGHLANDS CASHIERS 704-499-3054 IvesterJackson.com