IVESTER JACKSON | CHRISTIE'S

Charlotte | Q3 2024

Charlotte | Q3 2024

Charlotte Region Ultra-Luxury Market Records

New Highs

SouthPark

Myers Park & Eastover

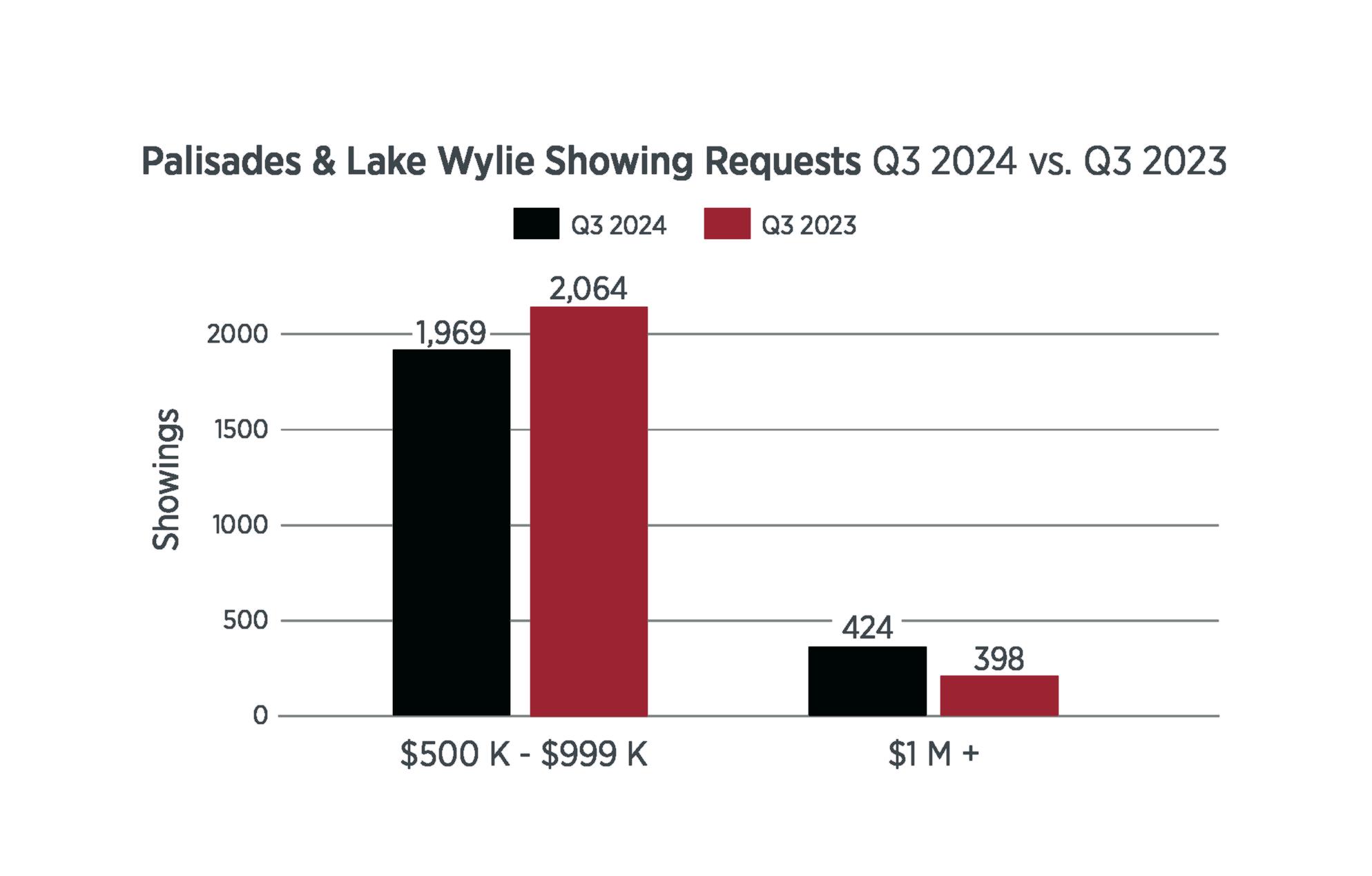

Lake Wylie & The Palisades

Providence, Weddington & Waxhaw

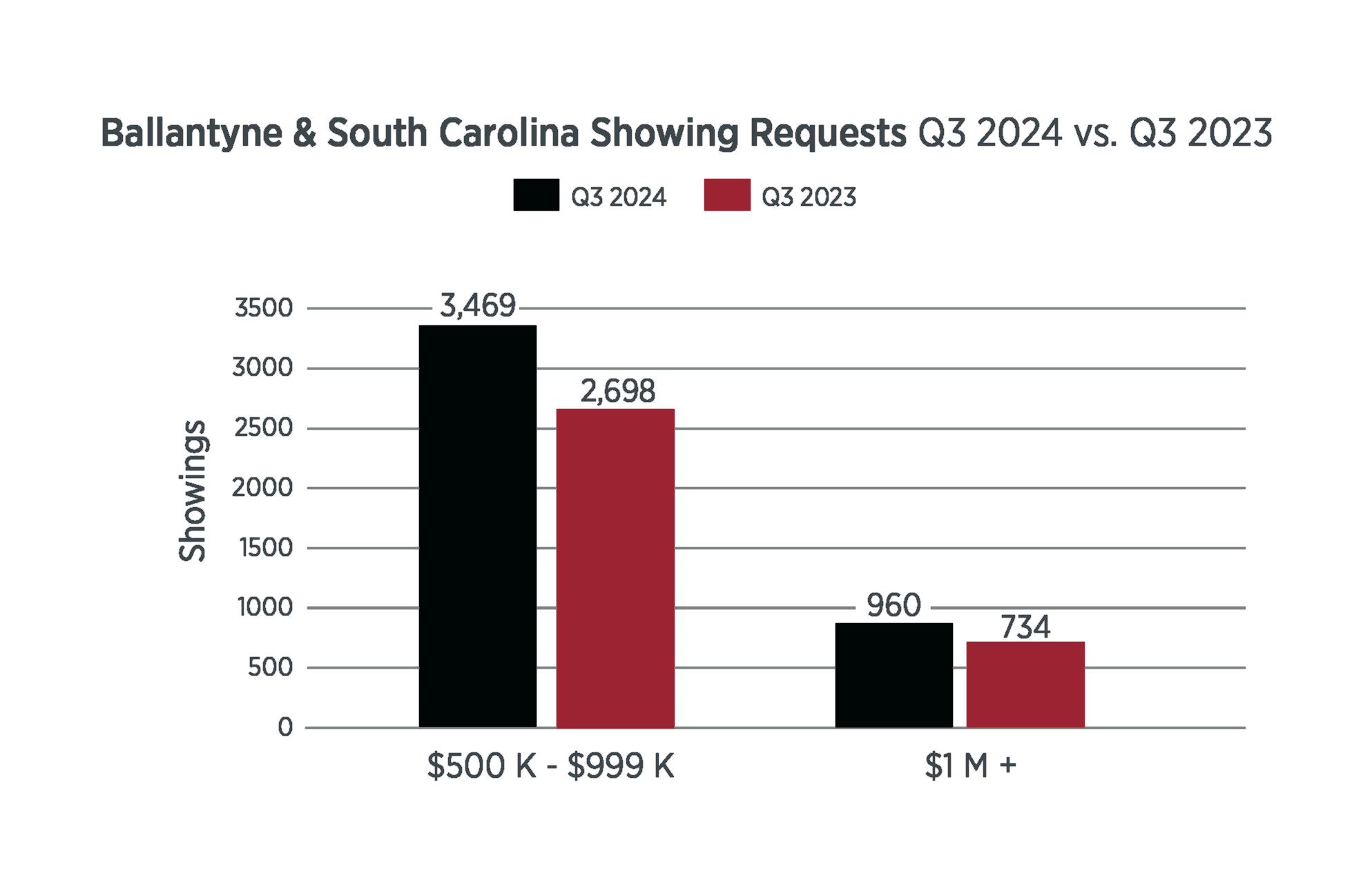

Ballantyne & South Carolina

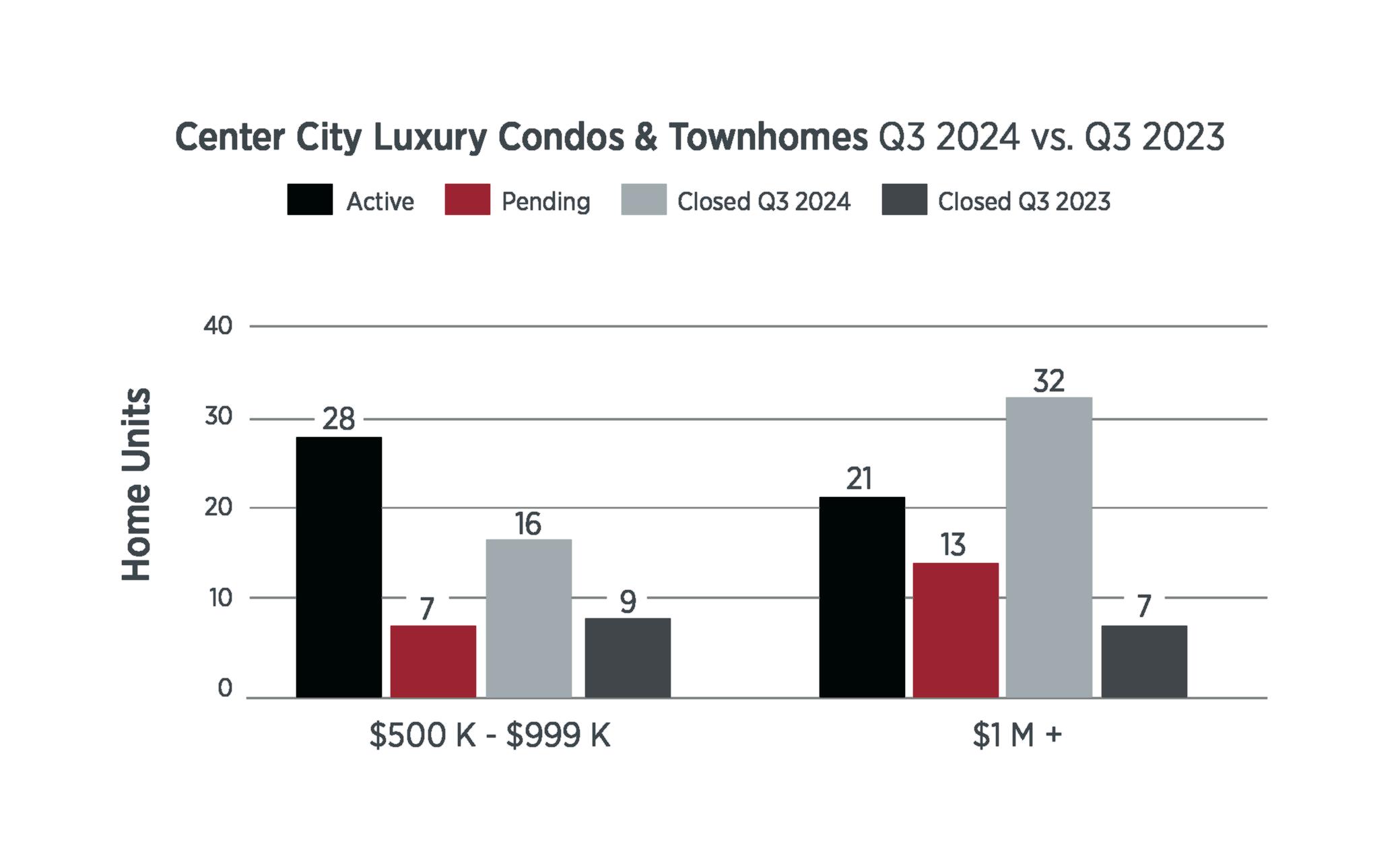

Center City Luxury Condos & Townhomes

With the Charlotte region posting record new highs in closed property values and poised to record yet another historically good year, most leading indicators in the region continue to point upward.

From market forecasts, interviews, and marketing ideas, join the team at Ivester Jackson I Christie's for the latest in the Carolinas luxury real estate content

Riding the increase in property values of infill tear downs and increased building costs, the Charlotte Mecklenburg region has begun to test new luxury resale prices points, while recently built new construction ultra-luxury offerings begin to test the resale market above $10 million in list price

In July and August, Ivester Jackson | Christie’s agents successfully transacted multiple resale deals over $10 million in closed price, selling three ultra-luxury homes in the $10 million to $11.5 million range within 60 days in Cornelius and Mooresville. This price point then spread to Charlotte, where multiple homes now show list prices of over $10 million. Charlotte’s luxury market continues to show fairly tight inventory in most high demand areas, with Myers Park and Eastover exceeding last year ’ s third quarter sell-through over $2 million by 25%, with 15 closed units compared to 12. The SouthPark area below Fairview also showed major strength, with 24 homes listed over $2 million closing in the quarter, vs just 10 at the same time last year In the surrounding areas, both Union County and upstate South Carolina showed strength as well

Following other high demand areas in the Charlotte region, this area showed continued strength in the ultra-luxury segment over $2 million in list price, with 24 homes closing in the third quarter vs just 11 in last year ’ s same period. The popular area also showed another 9 properties pending in this area heading into the fourth quarter. The ranges below $2 million showed continued tight inventory conditions, which have sustained prices despite slightly lower showing appointment activity in the MLS

Tear down activity has now nearly spread exclusively to the range above $1 million in list price, with few offerings available below that threshold Inventory to pending contracts in Myers Park and Eastover remain at low levels, with absorption rates running at near 30 day averages in both the luxury price segments above $1 million in list price. The area currently shows 10 pending contracts over $2 million in list price, with remaining inventory at 15 active homes

Sell-through near the Lake Wylie shoreline showed very solid activity, with nearly the same number of units closing in both the mid-market segment and luxury segment over $1 million in the third quarter compared to last year. 36 homes traded over $1 million, and the quarter ended with another 26 under pending contracts, on a remaining inventory of 62 homes offered This area has seen a slight rise in inventory in both price ranges to roughly 90 days’ absorption rate, still pretty healthy conditions for sellers, yet seeing a little more choice for buyers.

The highway 16 corridor showed slightly mixed conditions, with the mid-market segment seeing a slight decline in sellthrough from last year ’ s third quarter, falling from 161 units closed to 131. The luxury segment, which tends to be less interest rate sensitive, showed a solid increase of 6%, with 86 units closing over $1 million in price, vs 81 closed in last year ’ s third quarter Active inventory stood at roughly 35-40 days absorption in the mid-market segment, while the luxury space showed 75 days’ inventory supply.

The area straddling the state line in south Charlotte showed solid strength in both the mid-market and luxury segments, with the mid-market just below $1 million in price point seeing an increase in sell-through of 12%, while the luxury segment over $1 million jumped 15% The area ended the quarter with another 34 homes pending over that $1 million mark, leaving just about 45 days of inventory remaining with 48 homes for sale.

The 277 beltway multi-family market, which has been sizzling the past 18 months, did finally show a little tapering. Pending contracts over $1 million in value had been running at a torrid pace, yet slowed to 13 pending deals on remaining active inventory of 21 units. The quarter saw 9 closings in the range vs 7 in last year ’ s third quarter, yet overall activity remains solid, albeit less frenzied than the past two years ’ activity

values and poised to record yet another historically good year in closings above the $2 million threshold, most leading indicators in the region continue to point upward With equity markets at historic highs, liquidity flowing from stock options, private equity deals, and increased property value sales all contributing to the region’s robust performance of the past several years, it appears another solid year-end and start to 2025 are looming. While election angst has historically pulled a small percentage of buyers to the side temporarily, other factors continue to furnish confidence boosting dynamics for the luxury real estate market. Resale prices in Mecklenburg County have now broken through the $10 million threshold, new construction projects are pushing beyond that range, and the region’s economy has steamed along solidly. From a macro standpoint, showing activity in the MLS has remained strong over the past 30 days, albeit tapered from the all out frenzied level of the past three years The region may also benefit from instability elsewhere in the state, at least on a temporary basis

Listen To Our Podcast And Visit Our Video Page For Market Forecasts, Interviews, and Marketing Ideas, Join the Team at Ivester Jackson | Christie's for the Latest in the Carolinas Luxury Real Estate Content.

Where will you

center yourself next?

Charlotte

1515 Mockingbird Lane, Suite 900

Charlotte, NC 28209

21025 Catawba Ave, Suite 101

Cornelius, NC 28031

350 Morrison Plantation Parkway, Suite C1

Mooresville, NC 28117

Asheville

18 S Pack Square

Asheville, NC 28801

Wilmington 527 Causeway Drive

Wrightsville Beach, NC 28480

210 North Fifth Street

Highlands, NC 28741