Ivester Jackson Christie's Coastal Luxury Market Report

Atlantic Beach & Emerald Isle

Bald Head & Southport

Carolina & Kure Beach

Figure Eight Island, Porter's Neck, & Hampstead

Holden Beach & Oak Island

Topsail Island & Surf City

Wrightsville Beach & Landfall

Wilmington

As Mid Market Conditions Continue to Slow, the Luxury Market Remains Stable

From market forecasts, interviews, and house marketing ideas, join the team at Ivester Jackson I Christie's for latest in Carolinas luxury real estate content

Tight inventories during the latter stages of the Covid rush, in the high demand areas, pushed buyers out into the extended barrier islands. Looking at Holden/Oak Island, Kure/Carolina Beach, Topsail/Surf City, and Emerald Isle/Atlantic Beach, they all saw Q3 sell through which exceeded that of Q3 2021.

This dynamic is evident in many other North Carolina markets, such as the rural counties around Asheville and Lake Norman.

Scarce inventories in the historically high demand areas, to go along with what in many cases were lower prices, drove buyers to evaluate those areas, and once validation occurred in upper price ranges, others felt comfortable to jump in (as evidenced by 4 closings over $2 million on Oak Island and Holden Beach, areas where that threshold was rarely eclipsed in years prior to Covid).

Despite what people have been reading in places like the Wall Street Journal, the just closed third quarter was equal to, or better than last summer ' s Q3, specifically in the million dollar market. Further, when looking at the inventory to just closed quarters, in all of the high demand areas (Wilmington, Wrightsville, Landfall, Figure 8, Bald Head), the inventory numbers remain somewhat in line with the most recent closed quarter, indicative of 90 days or less inventory. Add in the slightly lower pending numbers, and you have the formula for the next 90-120 days, which is likely that inventory will jump up somewhat, but pending activity will almost certainly support recent price gains in the million dollar plus range. For example, Topsail inventory numbers are higher already, so that may see some price declines on a per square foot basis

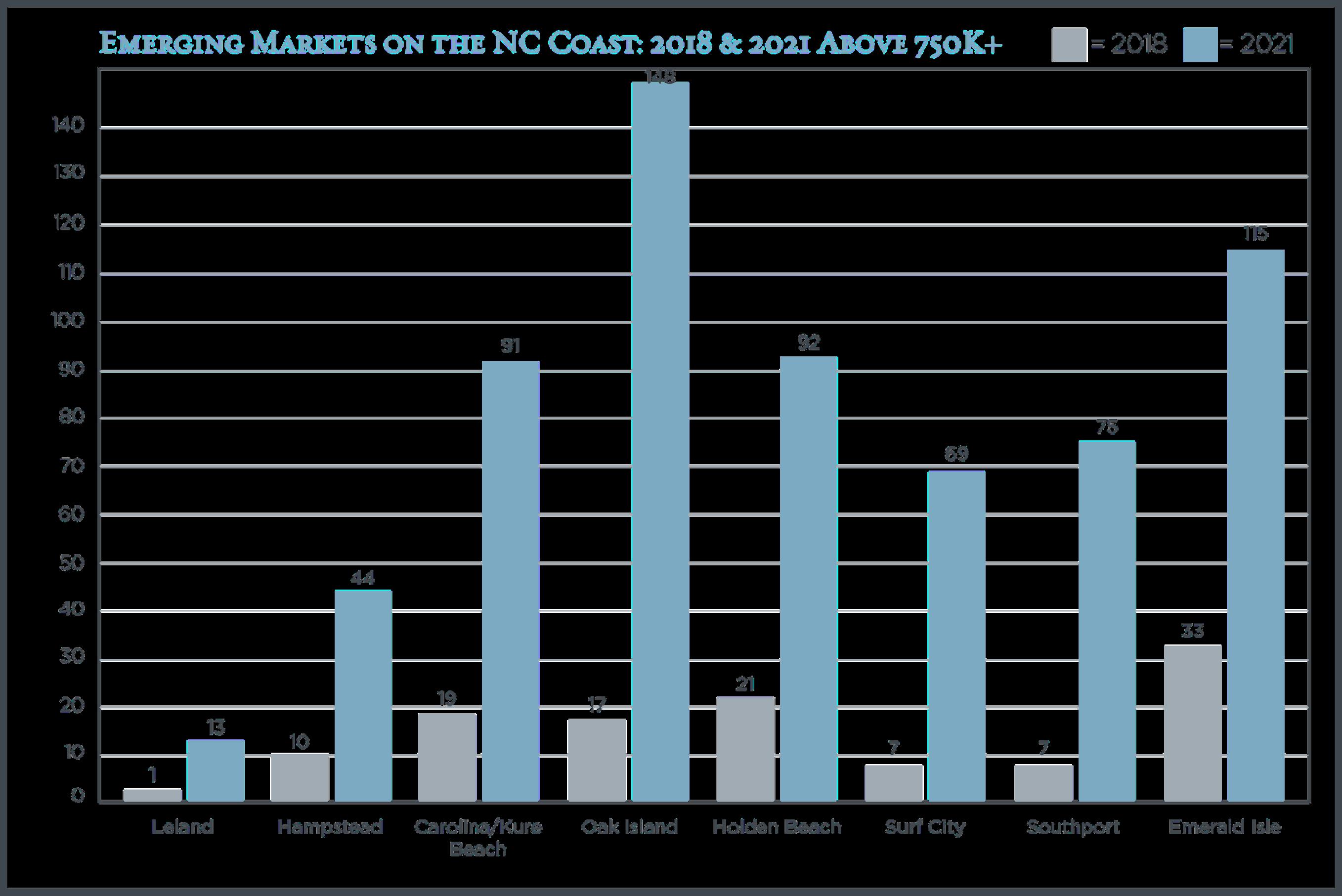

The long history of high demand of the Wilmington and Wrightsville Beach area has led many people to turn to other markets for luxury inventory The steady increase of development and money moving to these areas has flagged them as emerging markets that will continue to grow in the next few years. To read our full report on coastal North Carolina's emerging markets, please visit the link below. https://issuu com/ivesterjackson/docs/emerging markets email

One of the most popular destinations for vacationers, Atlantic Beach and Emerald Isle rest on North Carolina's northern barrier islands below the Outer Banks Emerald Isle is famous for its pristine, emerald colored beaches and Atlantic Beach, north of Emerald Isle, is near popular Morehead City and across from the famous historic port town of Beaufort, NC.

Even as interest continues to grow in the emerging luxury market here, conditions moving into quarter 4 have leveled off but still show relatively low inventory (55 active listings after a quarter which saw 102 closing in the luxury segment)

The southeastern tip of North Carolina has historically been a popular vacation spot for decades, but its luxury market showed mixed results Southport and Bald Head Island showed declining sell through in the $500-999k range, yet the million dollar range jumped, mirroring much of the coast with 19 homes closing vs just 9 in Q2 last year The ultra luxury segment showed a slight decline from 5 homes closed over $2 million to 3 in the just completed Q2

With its close proximity to Wilmington and Wrightsville Beach’s escalating property values, the Pleasure Island area of Carolina and Kure Beach may have benefitted more from the pandemic than any nearby coastal destination Long known for it’s relaxed vibe and small town beach atmosphere, this area ’ s real estate market has seen major jumps in property values as well as unit sell through

The area saw a jump from 62 homes sold to 92 in the midmarket range just below $1 million in list price, and the luxury market sell through between $1 million and $2 million in list price doubled in sales from last year ’ s Q2 to this year ’ s New construction waterfront options now routinely exceed $2 million dollars in list price while significant infill redevelopment is occurring in both Carolina and Kure Beach’s, with some off water offerings topping the $1 5 million range.

Figure Eight Island, Porter's Neck, and Hampstead are north of Wilmington Porter's Neck and Hampstead are two emerging markets that are developing a robust luxury market, while Figure Eight remains one of the region’s flagship upscale communities with some of the most significant coastal estate homes in the Carolinas. The activity in this area skyrocketed this year, with sales jumping from 51 in 2021 to 63 in 2022, with under contract and active listings significantly higher than 2021 quarter 2 Growing inventory inland in both Hampstead and Porter’s Neck, contrast what have been tight inventory conditions on exclusive Figure 8 Island There are currently 5 ultra-luxury homes on the market above $2 million

Holden Beach & Oak Island comprise the South Brunswick Islands southwest of Wilmington Both markets have grown tremendously throughout COVID, with unprecedented activity moving into late 2020 and throughout 2021

The upward sell through trend in units and appreciation in sales price continue to climb in the just completed Q2, as we see a 13% increase in the midmarket homes sold and 4% increase in the luxury segment.

Inventory has climbed to 51 homes over $1 million in list price, yet 27 closed in the second quarter, equating to roughly 5 months in inventory, one of the key reasons prices still remain relatively affordable compared to Wrightsville Beach.

Topsail Island is a barrier island 45 minutes to an hour north of Wilmington that includes the beach town of Surf City, as well as North Topsail Beach. Topsail Island has long been a vacation spot favorite and Surf City is one of the most popular cities on Topsail Island.

In the mid-market and lower luxury range, there was a 24% increase in unit sell through, with 96 homes closing in the range just below $1 million, and another 25 closing over $1 million (compared to 20 in last year ’ s Q2) Topsail’s conditions continue to mirror the South Brunswick islands, with both areas seeing significant piggy back appreciation from proximity to Wilmington yet offering values in the million dollar range

Wrightsville Beach is the furthest eastern part of Wilmington and one of the most popular beaches on the East Coast. In close proximity just inland, Landfall is a flagship gated golf course community in Wilmington, situated between Wrightsville Beach and the intracoastal waterway.

There was a 33% drop in sales from 2021 to 2022 in quarter two in the midmarket range, mostly due to just a scarcity of inventory in this range under $1 million Like the balance of the coast, the range just above $1 million and between $2 million in list price, remained the sweet spot in this area as 26 homes closed in Q2 vs 20 last year The ultru-luxury range led the region with 8 sales over $2 million, yet saw a drop from 12 sales in last year ’ s Q2

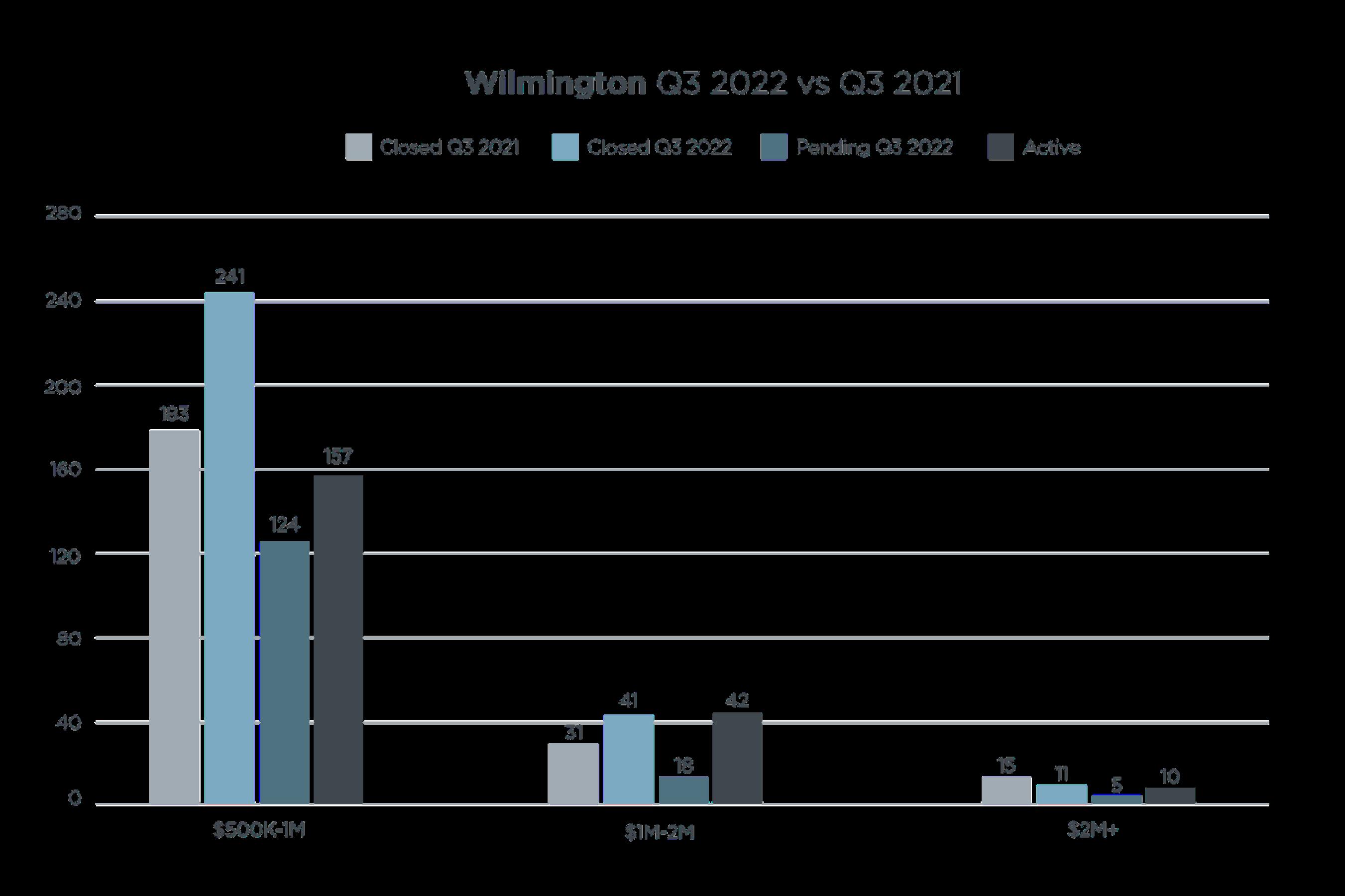

Wilmington saw a robust second quarter in both the mid-market segment below $1 million as well as the sizzling range just above $1 million in list price 47 homes closed in that price range vs 32

last year, and increase of almost 50% year over year The midmarket segment saw an increase of roughly 40%.

Both price segments ended Q2 with less than 90 days inventory available, despite the recent uptick in mortgage rates.

Heading into Q4, it looks like pendings are starting to tail off slightly, yet they are still very solid compared to earlier standards such as 2019/20 Q4. With interest rates rising, its likely the mid-market will continue to see more significant slowing of sell through on a comparative basis, probably through the first half of 2023.

The million plus range in high demand areas displays continued manageable inventory numbers and a significant number of homeowners with already locked in low interest rates or cash basis, which should act as a stabilizing factor on downward pricing pressure through the first half of 2023 Outer barrier islands with lower inventory numbers should continue to grow in the appreciation gained in high demand areas during the two year Covid period, even if 2023 appreciation is minimal.

Check out our "Christie's Luxury Expert Series" as we head to top luxury cities like Charleston, Phoenix and Savannah.

1515 Mockingbird Lane Suite 900 Charlotte, NC 28209 (704)-817-9826

21025 Catawba Ave #101 Cornelius, NC 28031 (704)- 655-0586

Lake Norman North Shore Office

350 Morrison Plantation Parkway, Suite C1 Mooresville, NC 28117 (980)-435-5169

Asheville Office - Ivester Jackson Blackstream

18 S Pack Square Asheville, NC 28801

(828)- 367-9001

Wilmington Office - IJ Coastal

527 Causeway Drive Wrightsville Beach, NC 28480 (910)-300-5140