LUXURY MARKET REPORT Lake Norman | Q2 2023

Overall Market Report

Lake Norman Luxury Market Continues

Remain Active

Community Updates

Cornelius

Davidson

Mooresville

West Shore

North Shore

Concord & Kannapolis

Forecast

Conditions are Tapering in the Luxury Market

contents

Market

July 2023 Q2

Report

Lake Norman, Luxury Market Conditions, Remain Active

Luxury market conditions around Lake Norman continued to be increasingly location specific, meaning one area or price point might show rising inventories while another remains scarce with favorable selling conditions. While sell-through in most ranges and areas remains off from last year ' s peak numbers, the region remains significantly higher in terms of both unit sales and price levels than pre-Covid. The million-dollar and ultra-luxury market footprints have expanded considerably, with multi-million dollar transactions occurring in areas like Davidson, the North Shore area above the 150 bridge, and spreading into Cabarrus County

Lake Norman

Lake Norman

While closings were down in the mid-market price segment, inventory remained balanced to pending contracts, indicating less than 60 days worth of supply Moving above $1 million in list price, gradual increases in inventory are beginning to bubble up, particularly in the ultra-luxury range of over $2 million Newly remodeled homes continue to command significant premiums and sell quickly, often with multiple offers.

Cornelius

Cornelius

CORNELIUS Q2 HOME SALES

Davidson

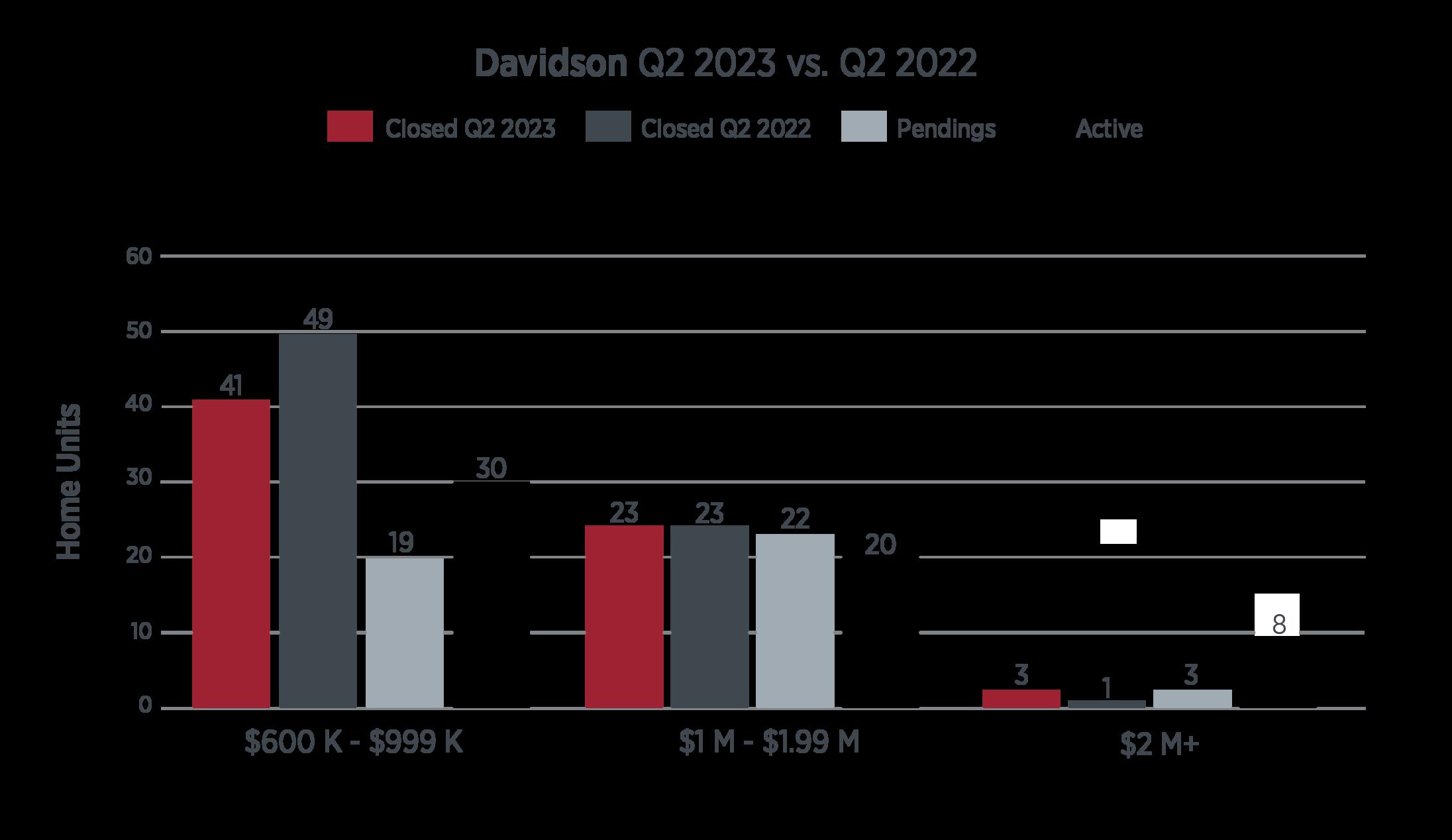

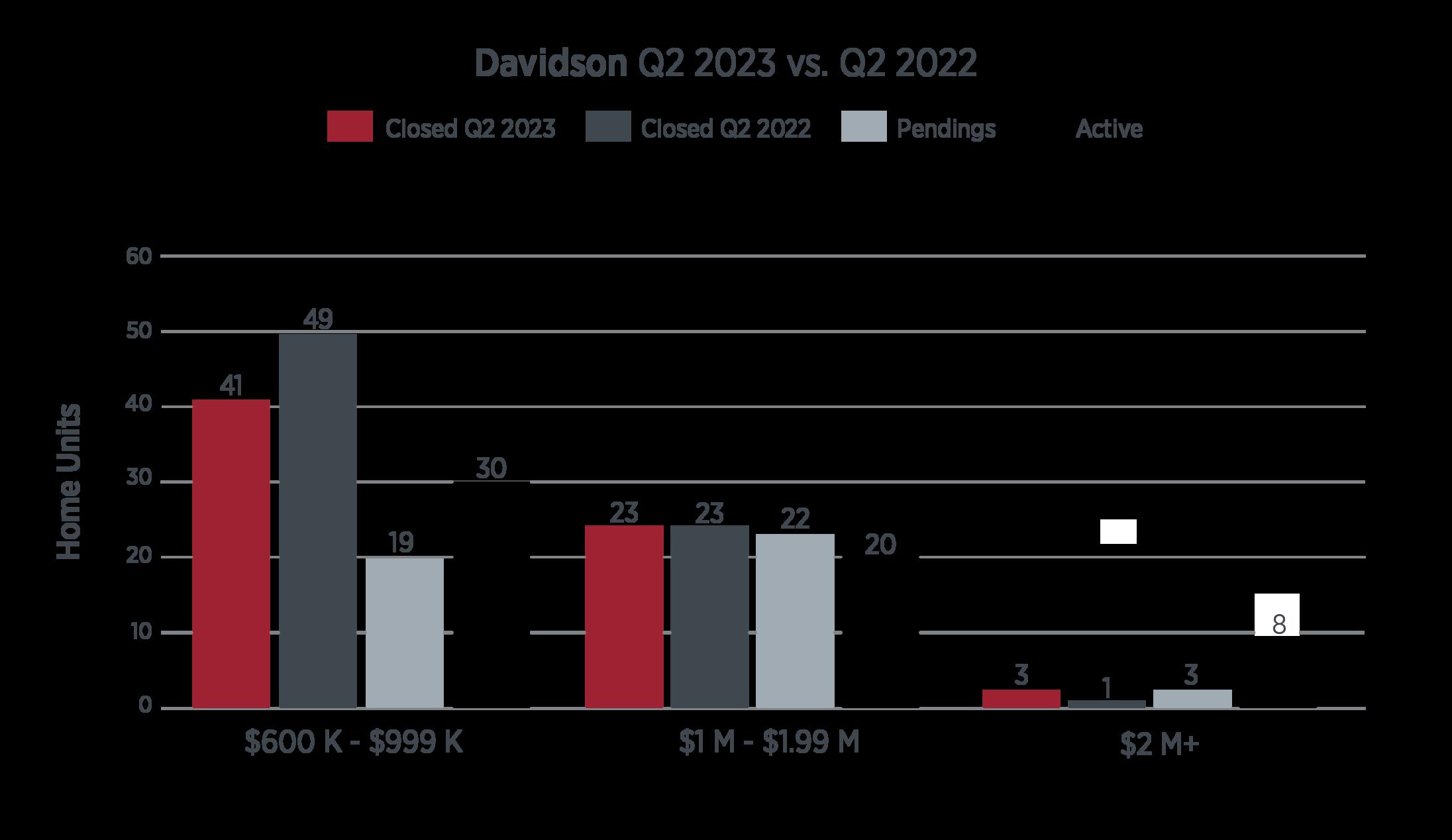

Maintaining the price level expansion it garnered during Covid, Davidson saw 23 homes close above $1 million in list price, with another 3 homes under contract in the ultra-luxury range above $2 million in list price

New construction spec houses are cresting $3 million in some instances, and in general, while the interest rate sensitive ranges below $1 million have seen some decline, the area still displays 30-90 days worth of inventory depending on price point.

Davidson Q2 Home Sales

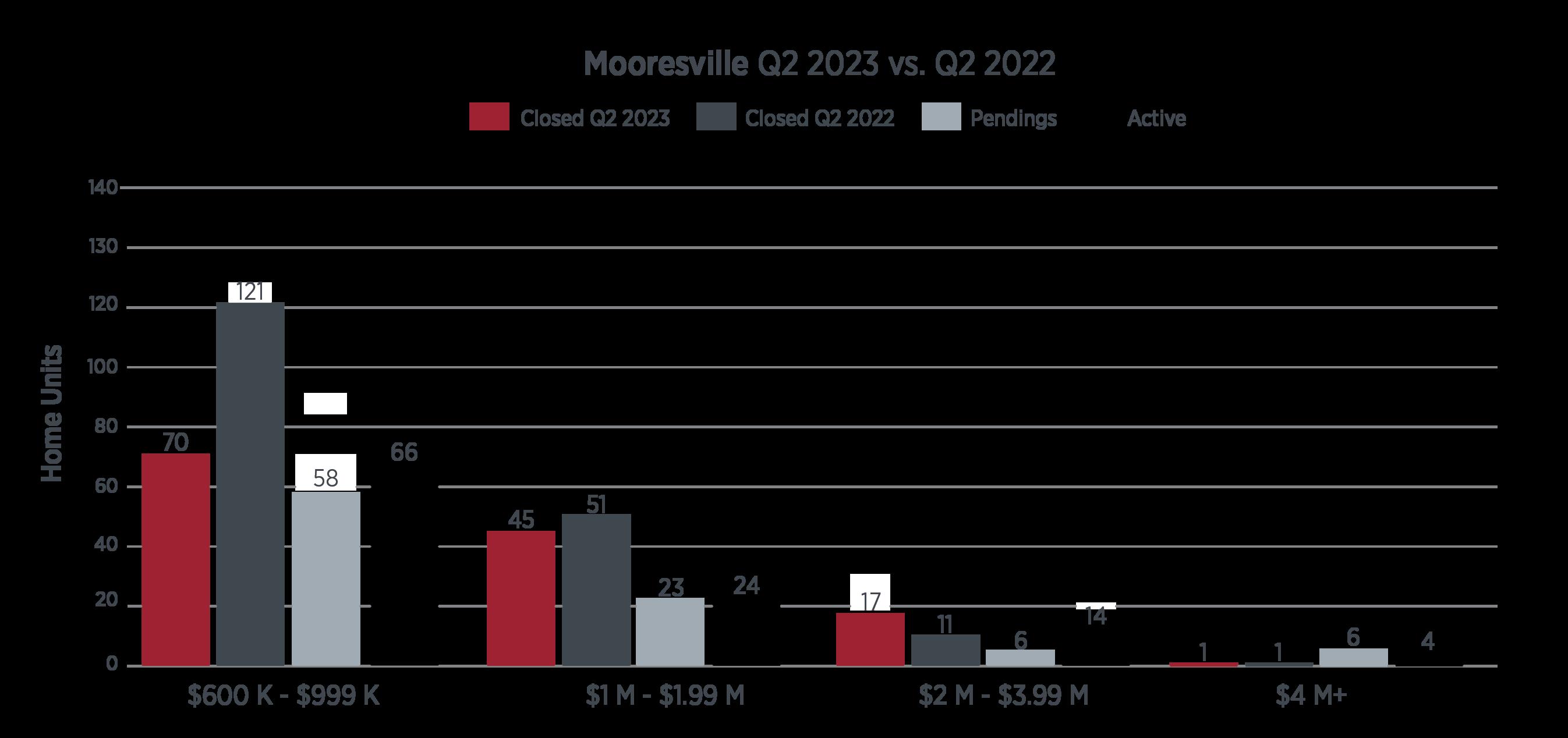

Mooresville

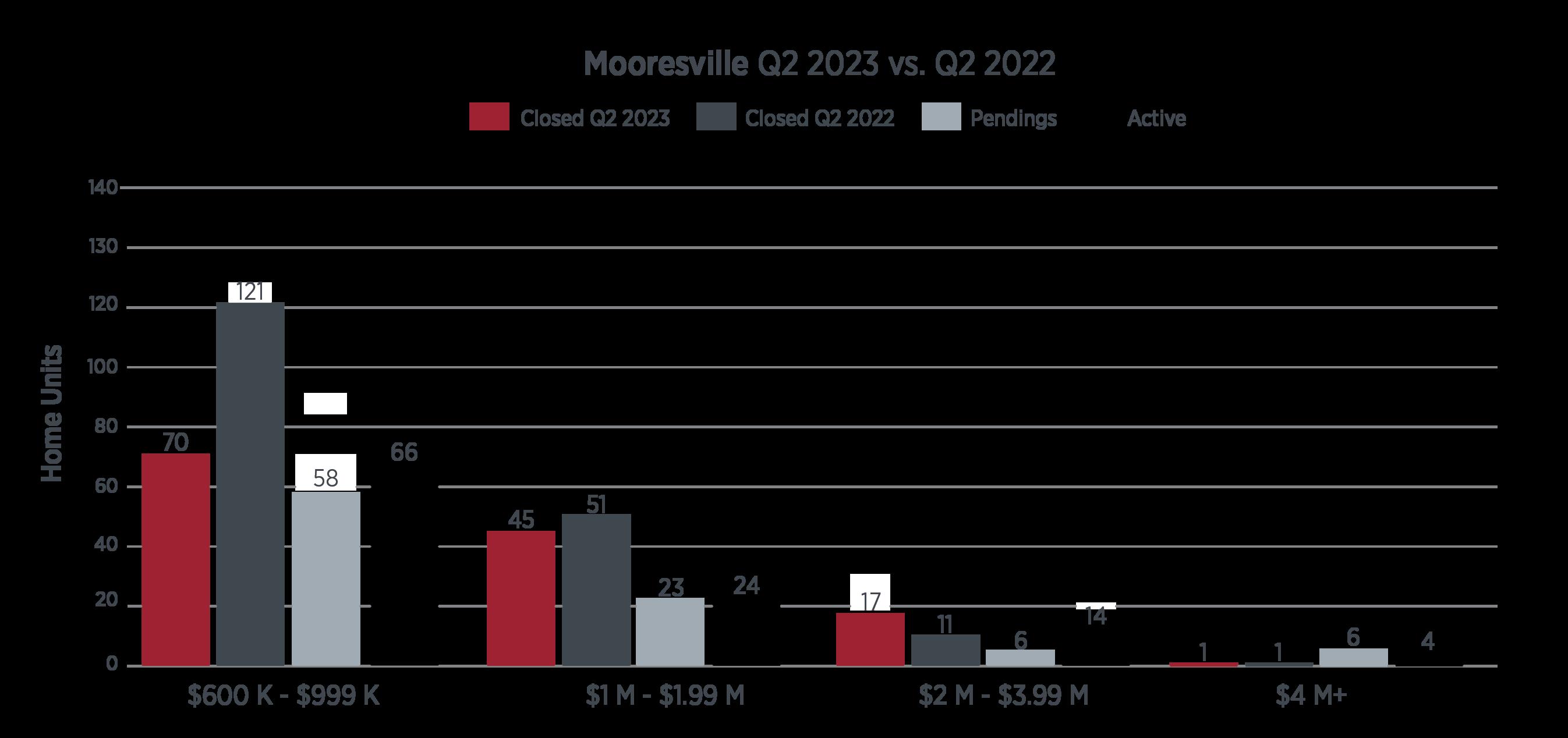

Mooresville produced mixed results within the various price segments of the luxury market. The mid-market segment showed a fairly significant decline in sold units this quarter compared to last year. Yet, the ultra-luxury segment between $2 million and $4 million in list price jumped from 11 to 17 closings in the quarter as the upper ranges continued to show strength at The Point and down Brawley School Road. 6 homes over $4 million in list price were pending at the time of this report.

Mooresville Q2 Home Sales

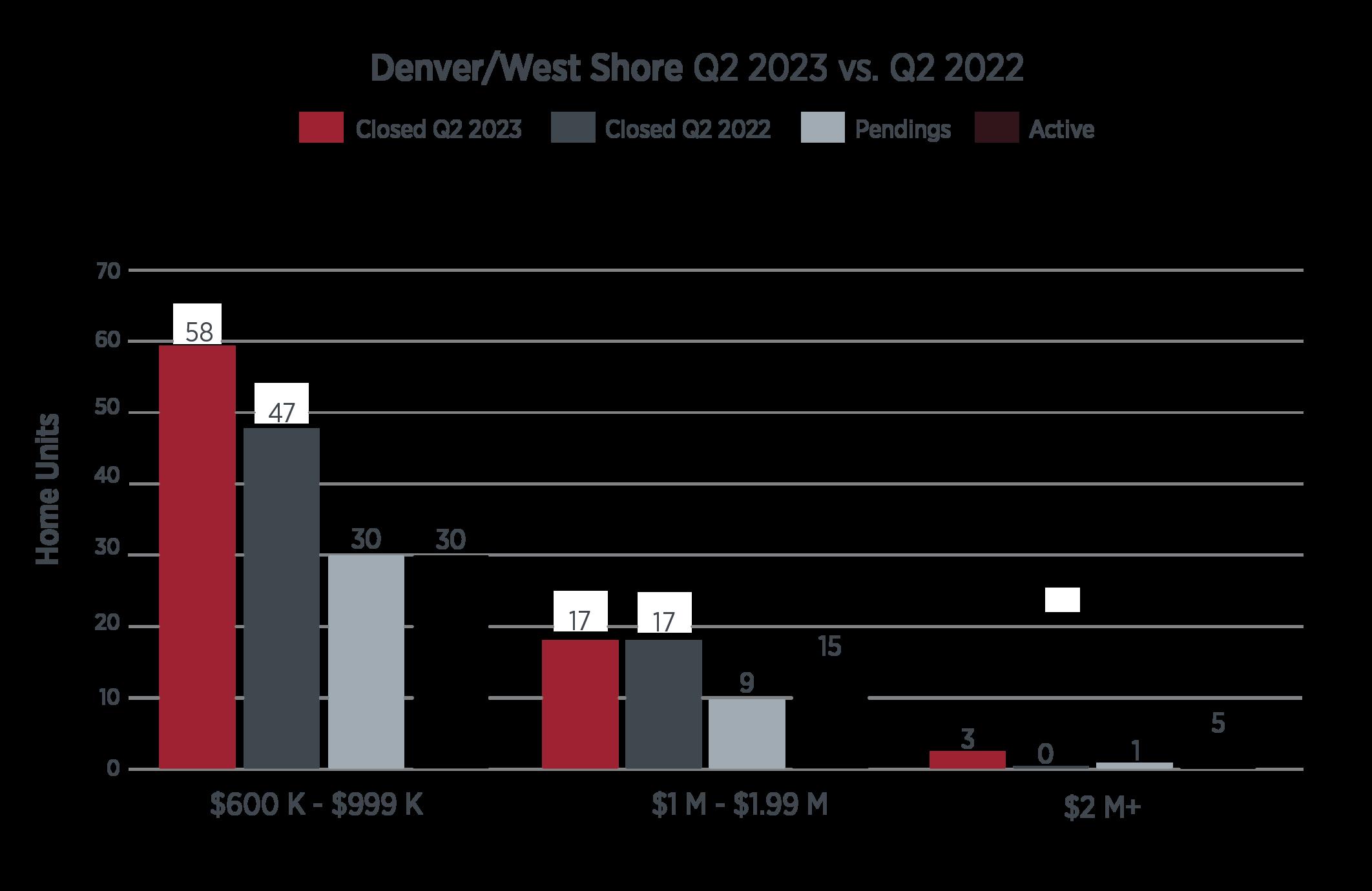

Denver | West Shore

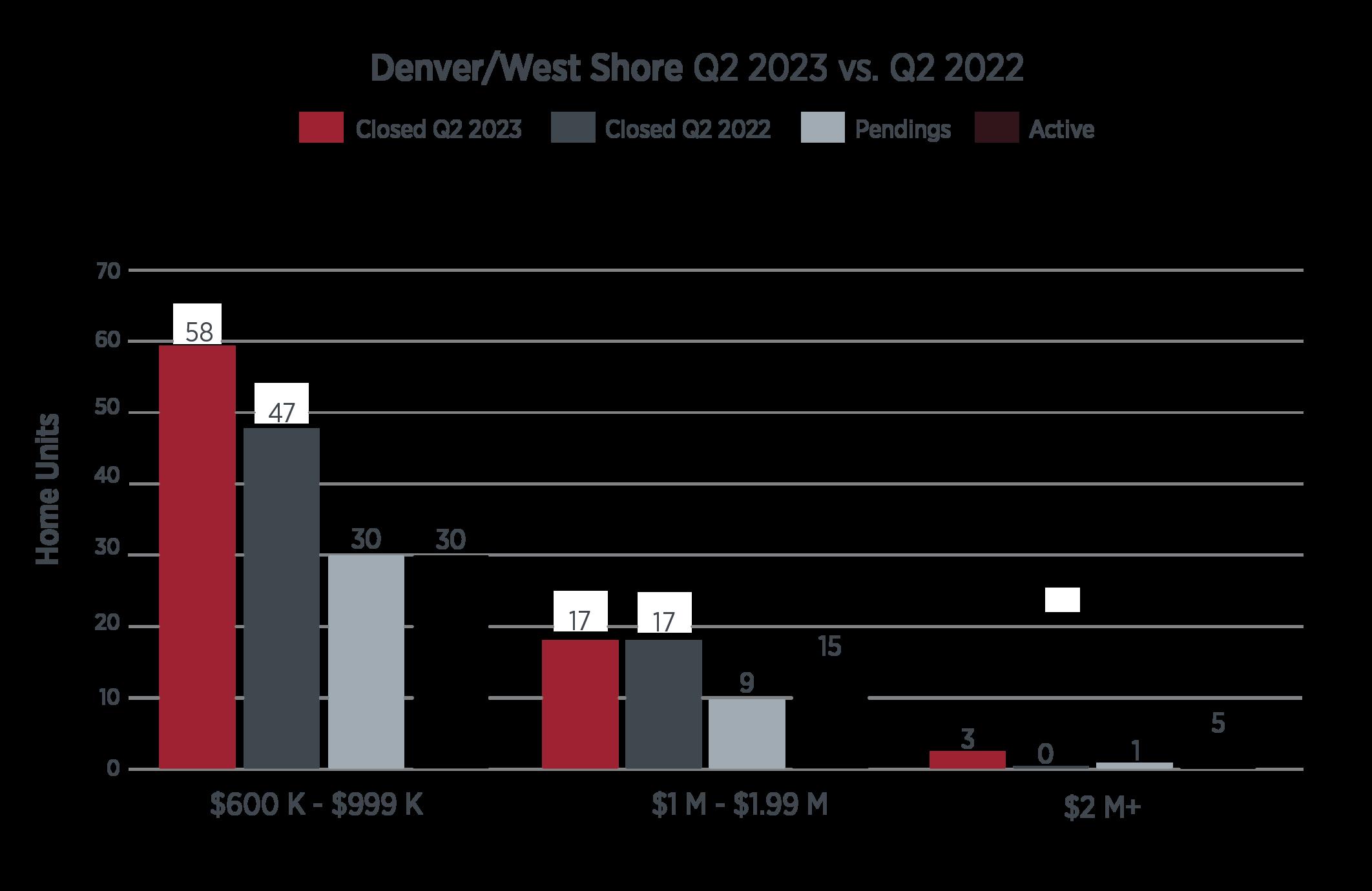

The West Shore area bucked the regional and national trend in the mid-market range, actually seeing a significant increase in sell-through between $600,000 and $1 million in list price, with 58 closings in the second quarter vs 47 last year Pending contracts on 30 homes, while 30 remained in active inventory, indicated roughly 45 days worth of supply in this range Moving up the food chain, the West Shore is seeing some slight build up in inventory over $1 million in list price, yet conditions remain relatively balanced between supply and demand.

Denver/West Shore Q2 Home Sales

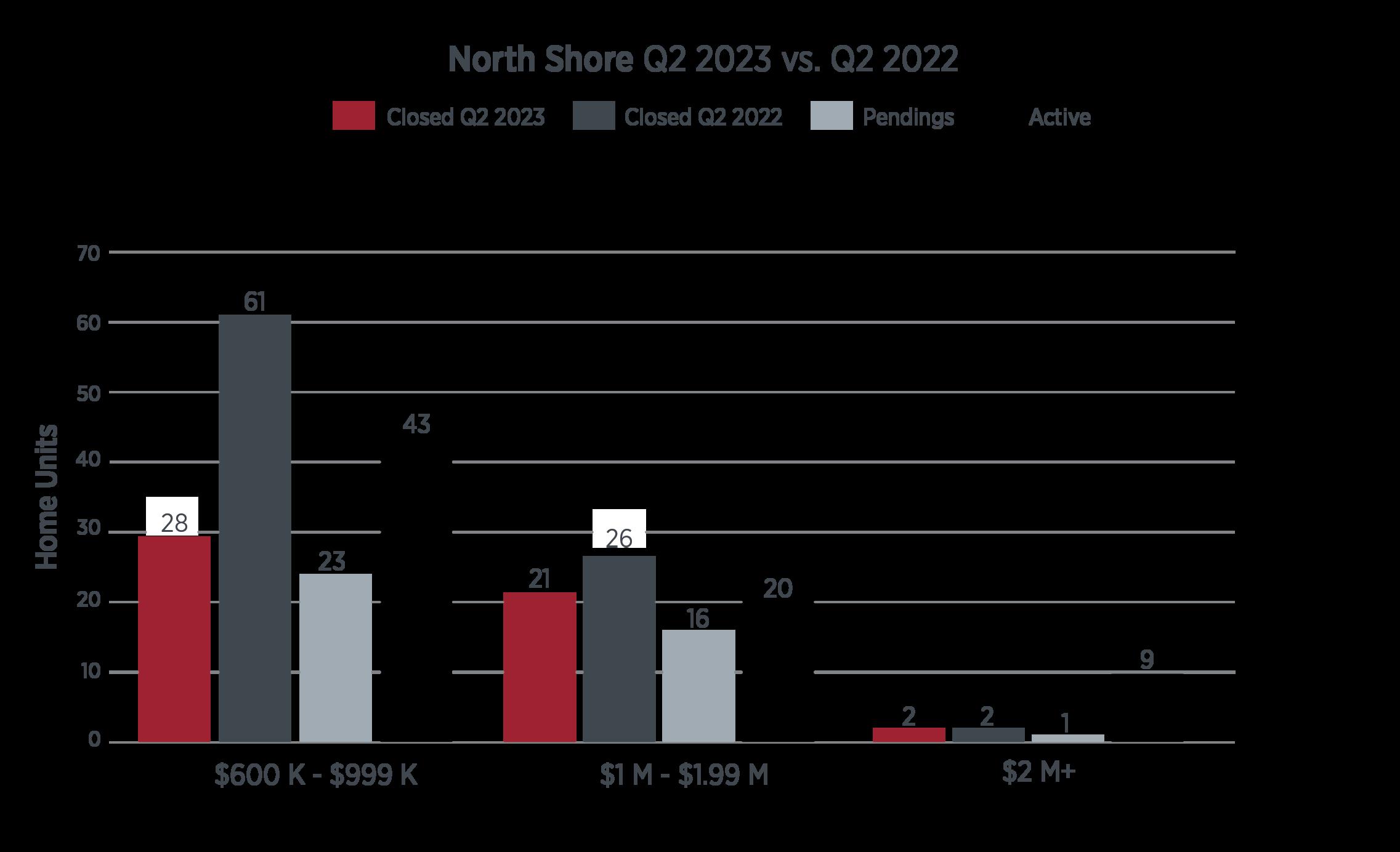

North Shore

Troutman/Sherrills Ford

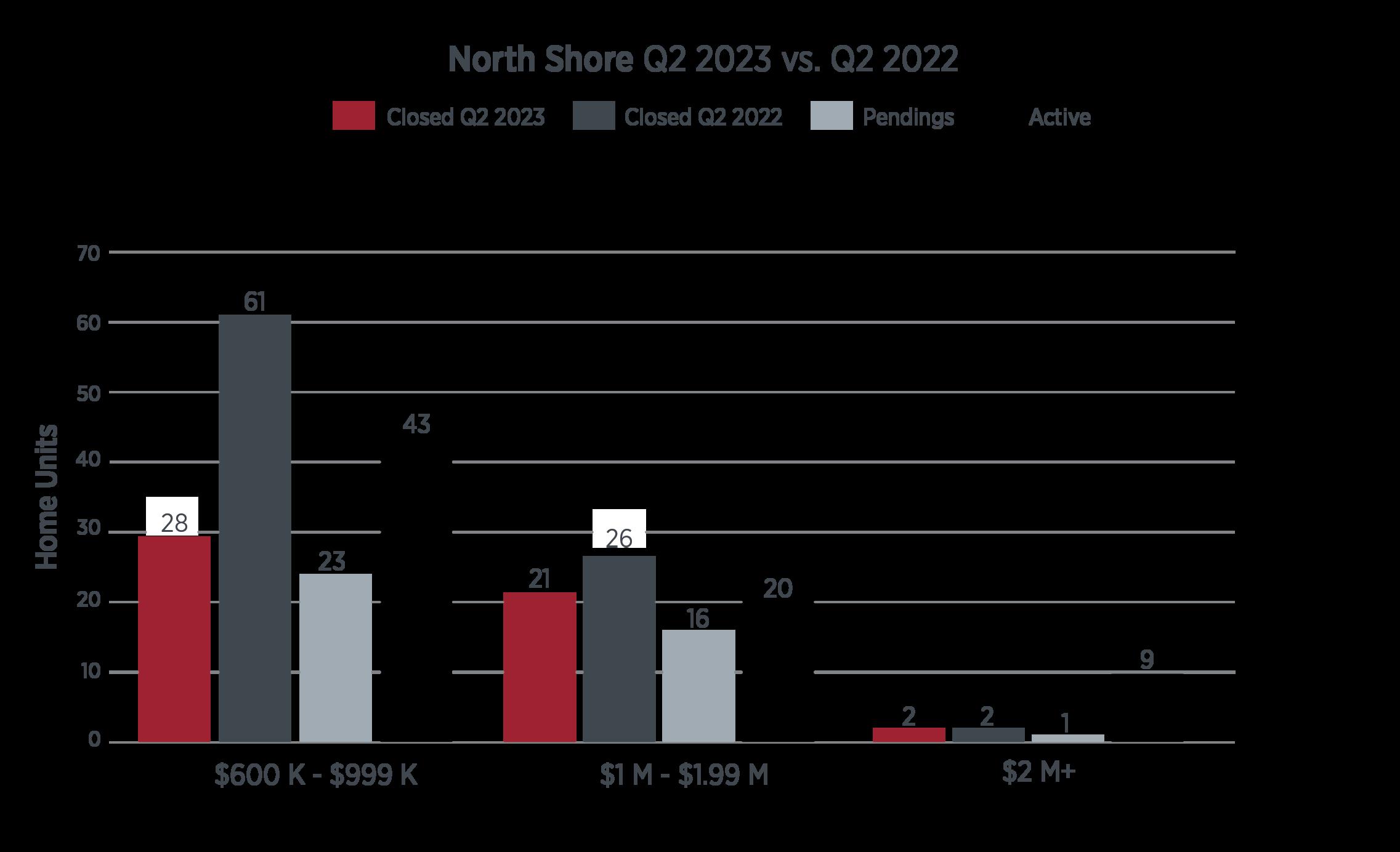

The North Shore area above the 150 bridge displayed more of a return to pre-covid conditions in terms of demand and supply in the midmarket price range. Closings declined by 50%, causing inventory to double pending contracts and leaving the area and price range with about 90 days of supply The area did see 21 closings over $1 million in price, while off from last year, another pretty active quarter compared to pre-Covid days

North Shore Q2 Home Sales

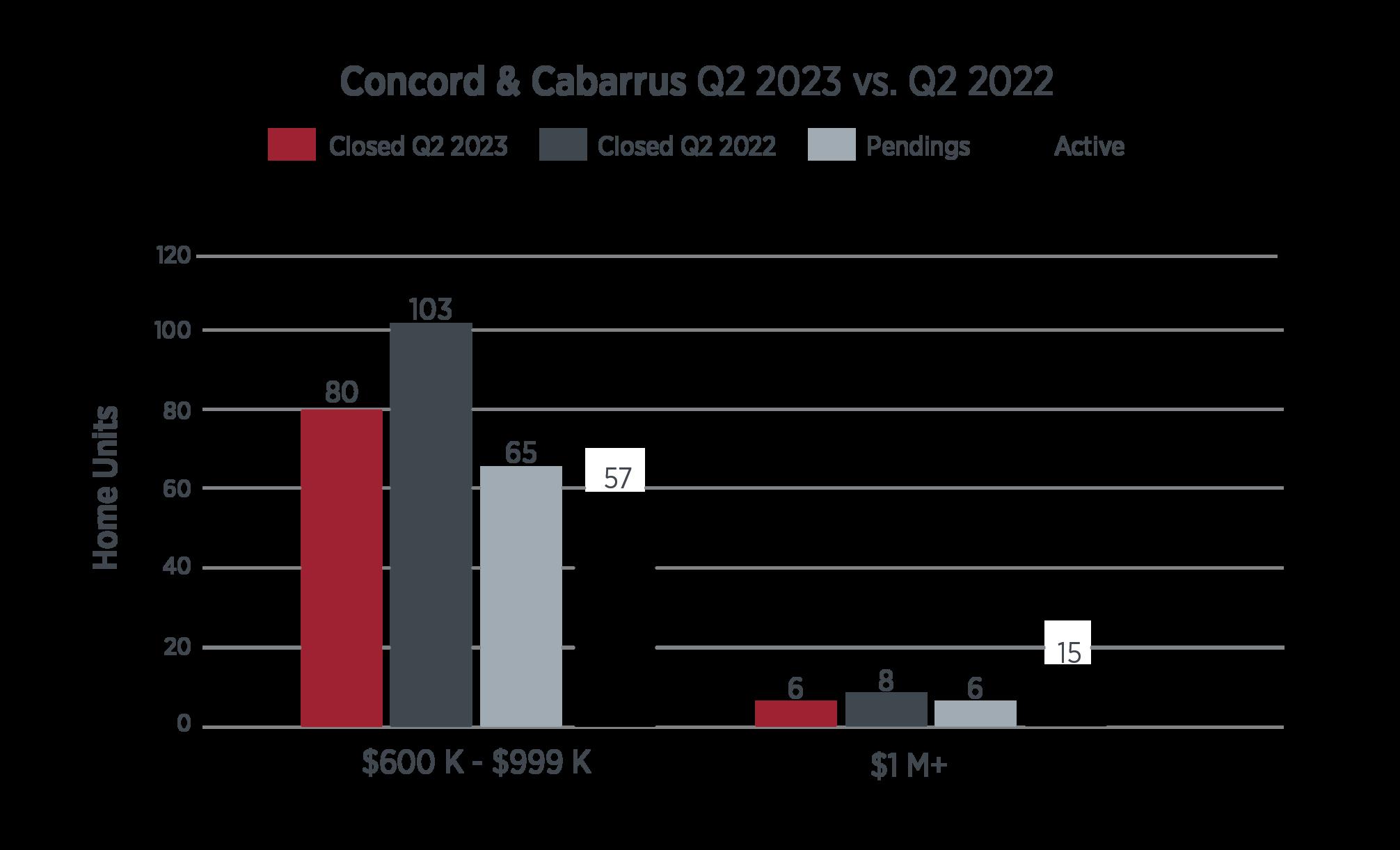

Concord & Kannapolis

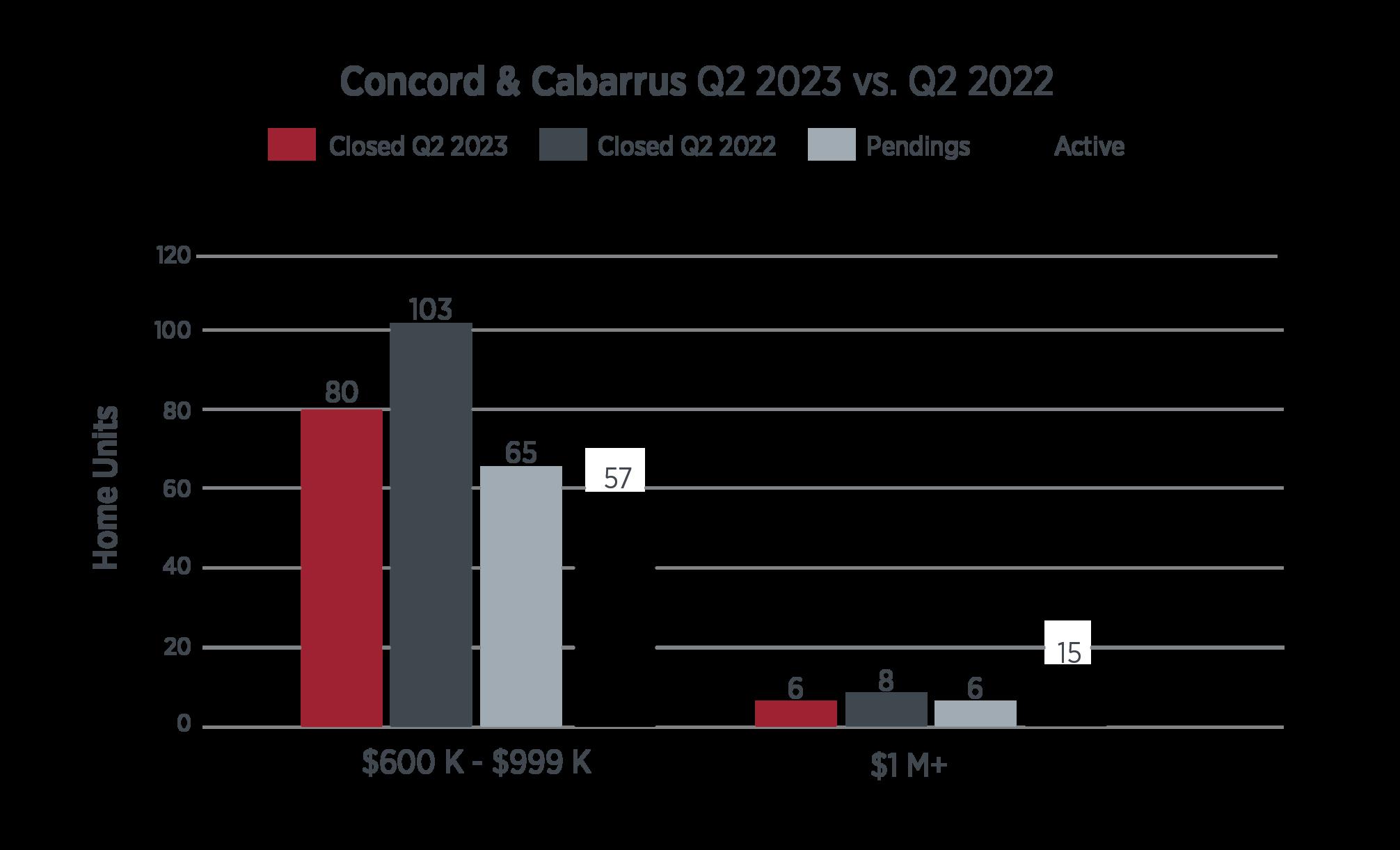

While Cabarrus County showed a decline from last year ' s second quarter closings, the area continues to attract high levels of activity in the range just below $1 million in price and is emerging above $1 million in list price with six homes closed in the second quarter.

Concord & Cabarrus Q2 Home Sales

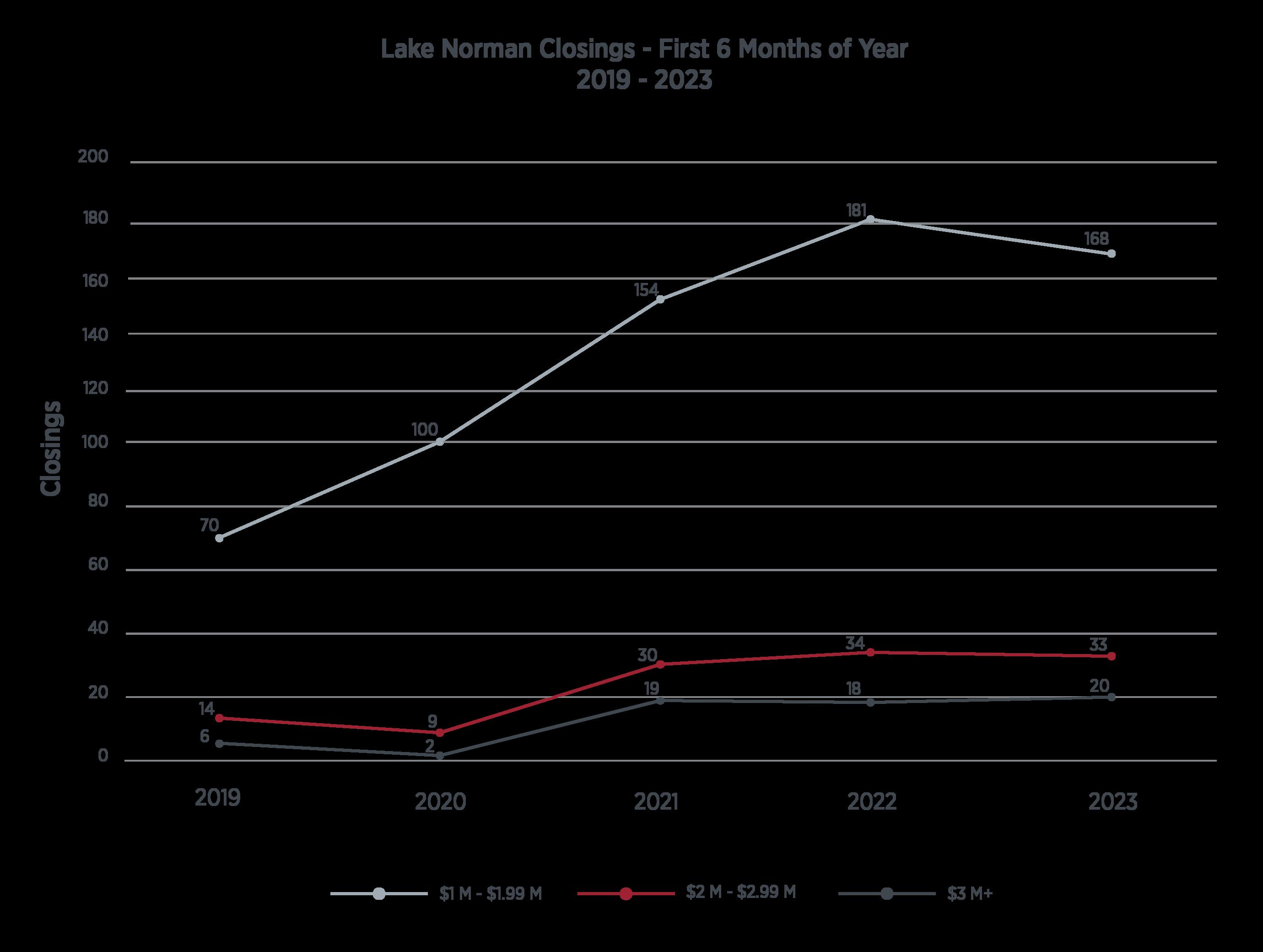

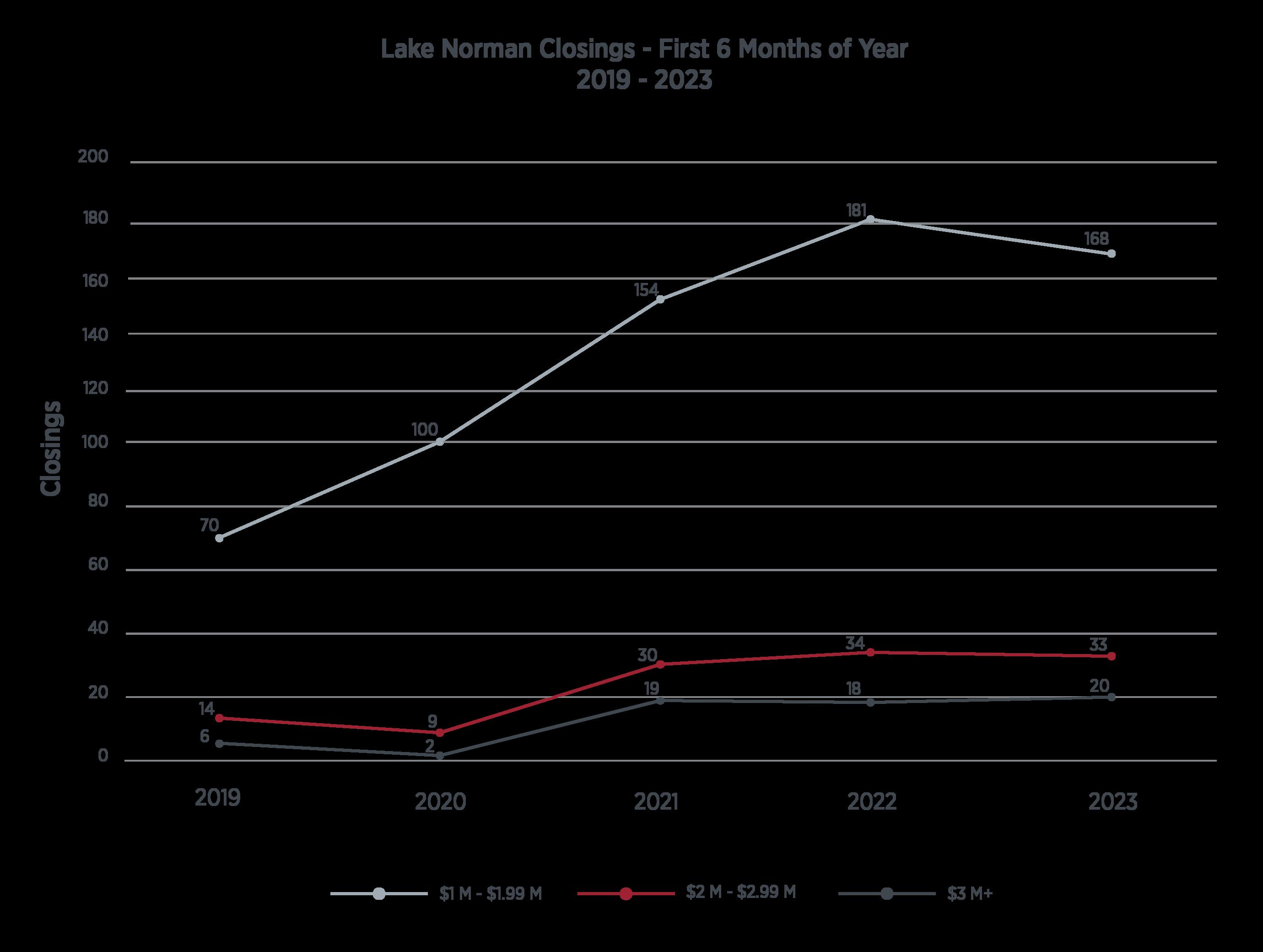

Lake Norman Market Forecast

While conditions are tapering somewhat in the luxury market, it's clear that both unit sell-through and pricing levels are both likely to remain at much elevated levels to pre-Covid periods. In all three luxury segments, over $1 million in list price, unit sell-through has almost tripled from 2019, and while it may be off slightly from last year at this time, deals are still occurring at a significantly higher pace than pre2020 This heightened profile for Lake Norman and Charlotte on the national level has now clearly driven demand for luxury homes to much higher levels, particularly remodeled modern or newly constructed properties.

OUR OFFICES

Charlotte 1515 Mockingbird Lane, Suite 900

Charlotte, NC 28209

Lake Norman 21025 Catawba Avenue, Suite 101

Cornelius, NC 28031

North Shore

350 Morrison Plantation Parkway, Suite C1

Mooresville, NC 28117

Asheville

18 S Pack Square

Asheville, NC 28801

Wilmington 527 Causeway Drive

Wrightsville Beach, NC 28480

Highlands Cashiers 210 North Fifth Street

Highlands, NC 28731

CHARLOTTE | LAKE NORMAN | NORTH SHORE ASHEVILLE | HIGHLANDS CASHIERS | WILMINGTON 704-655-0586 IvesterJackson.com

Cornelius

Cornelius