LUXURY MARKET REPORT Highlands Region | Mid-Year Update

While the rising interest rates have affected sales numbers in our market area, a majority of luxury and ultra-luxury buyers tend to be cash buyers and are not as susceptible to these market forces

Highlands Cashiers

Lake Toxaway/Sapphire

Mixed results across the region as some areas are up year over year while some are relatively flat or down The second half of 2023 will be heavily dependent on housing supply moving into the late summer and early fall

From market forecasts, interviews, and house marketing ideas, join the team at Christie's Highlands Cashiers for the latest in Carolina's luxury real estate content

As in many housing markets across the region, the current market trends are revealing mixed results. US corporate earnings have stabilized in the first and second quarters of 2023 while employment numbers have recently seen a moderate level of job growth, something targeted by the Federal Reserve. Consumer confidence has steadied as many consumers have seen an easing of inflation in month over month results as well as year over year results. While rising interest rates have affected sales numbers in our market area at more interest sensitive mid-market price points, a majority of luxury and ultra-luxury buyers tend to be cash buyers and more typically influenced by the financial markets. We are beginning to the see the signs of more balanced conditions in terms of inventory to pending contract activity, and in fact are observing some actual build up in some areas of western North Carolina.

Highlands' cool temperatures and picturesque mountainscapes make it one of Western North Carolina’s most sought-after destinations throughout the southeast. With recent positive publicity coming from Travel and Leisure Magazine highlighting Highlands in their “America’s Best Small Towns” feature.

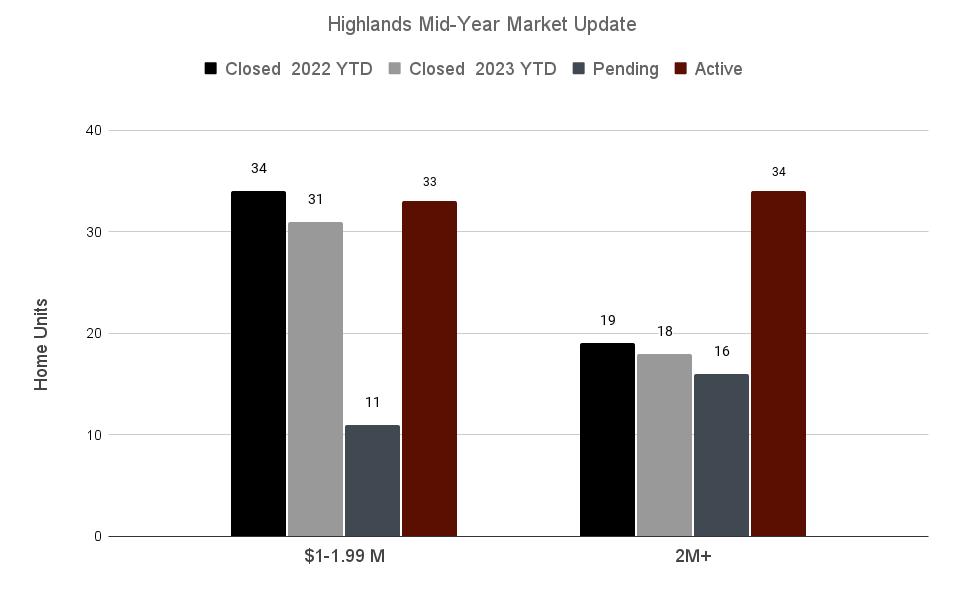

The Highlands luxury property market appears to have returned to solid but stable conditions as we begin to look at mid-year numbers in both the luxury and ultra-luxury segments Active inventory is currently sitting at 33 homes in the luxury (1M-1 99M) segment with another 34 homes active in the ultra-luxury (2M+) market Those numbers represent roughly 6 months of inventory and 9 months of inventory in the marketplace, respectively, however pending contracts have recently increased over the summer The 1M-1 99M range has seen a slight uptick in sales activity year over year, with 34 closed sales year to date in 2023 compared to 31 sales in the same time period of 2022 The ultraluxury range has been relatively flat YTD with 18 sold properties in 2023 compared to 19 sold properties in 2022 The ultra-luxury segments recent jump to 16 pending contracts appears to mirror activity in other North Carolina luxury markets, with high net worth buyers enjoying a robust early summer travel season then actively returning to the property market, a trend which is carrying solidly into the early fall. With inventory numbers on the rise yet still reasonable, the pricing gains of the past three years appear to be stabilizing in the near term

Limited housing inventory in the luxury segment (1M-1 99M) appears to have impacted early summer activity in the Cashiers market resulting in only 2 current pending contracts. Interestingly, the sell-through year to date in 2023 has actually been on par with 2022 numbers, with 27 homes closing YTD in 2023 vs 29 sold YTD in 2022 Inventory levels, particularly offerings with updates and remodeling can impact the sales mix, and thus a mix of homes of that type tend to cast a more broad net and attract buyers

In the ultra-luxury (2M+) market, the Cashiers area experienced a dip inclosed sales year over year. Yet, like Highlands, experienced a stronger mid-summer period in pending contracts, as 9 current 2M+ pending sales point confidently to an increase in buyer activity heading into the third quarter This uptick should continue to support pricing gains seen over the past couple of years as we head into the fall leaf season Regional migrations from both Atlanta and Birmingham, as well as continued interest from south Florida and coastal South Carolina, continue to drive the localized housing market Nevertheless, the lower availability of quality inventory can impact comparative sell through in the more narrow luxury market pricing segments

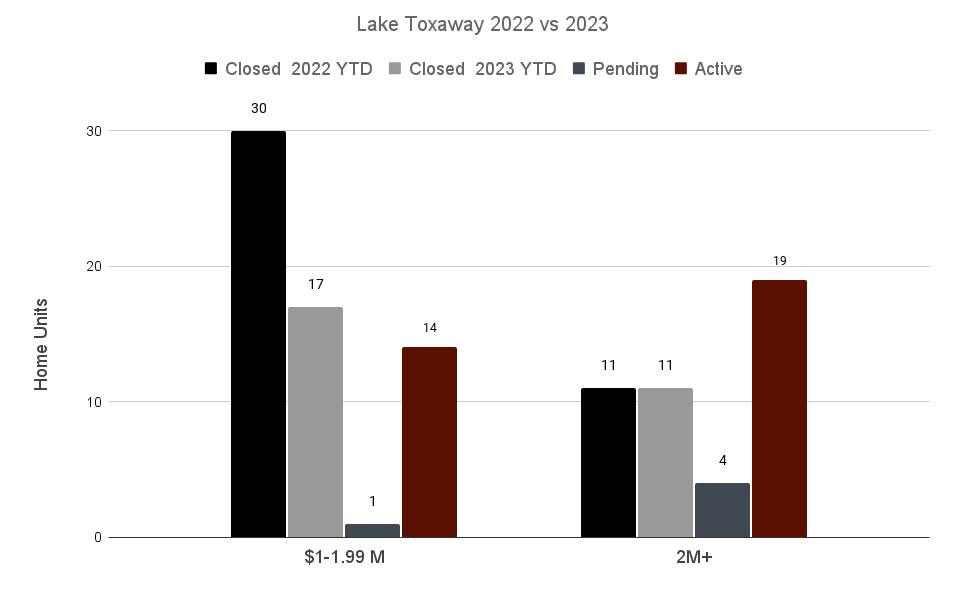

The Lake Toxaway and Sapphire markets appear to be a tale of two price points. The ultra-luxury segment has kept pace with the mid-year numbers from 2022 as compared to 2023, with both periods seeing 11 closed transactions above $2 million in list price Additionally, pending sales activity indicates that the 2M+ range continues to draw some interest with another 4 ultra-luxury homes under contract. Inventory here has seen some 2023 run up relative to pending contract activity, as evidenced by the 19 homes currently on the market In the luxury (1M-1 99M) segment closer to $1 million in price, increased interest rates have impacted diminished sell-through YTD in 2023 with 17 homes sold, while the same time period in 2022 witnessed 30 closings. Inventory to pending contract activity in the Lake Toxaway and Sapphire markets heading into the fall will be a dynamic to watch as those two data points foretell pricing direction.

We see an interesting variety of data relative to housing results across the Plateau entering the second half of 2023. Highlands as a whole is up year over year in the luxury segment and flat in the ultra-luxury segments. In other markets such as Cashiers and Lake Toxaway we have started to see inventory rise, while sell through has began to lag somewhat. Active inventory in these markets are up year over year, while pending activity seemed to arrive later in the mid-summer months in some areas after a busy travel season. Inventory levels may impact price reductions and average days on market heading into the late summer and fall although thus far, pricing stability has been influenced by pending contracts and in high demand areas, more limited inventory.

These results are very similar to what’s happening in other markets across North Carolina as the state’s key areas continue to attract positive press and active demand from out of state interests.

Highlands-Cashiers

210 North Fifth Street

Highlands, NC 28731

828-482-5022

Asheville Office - Ivester Jackson Blackstream

18 S Pack Square

Asheville, NC 28801

828-367-9001

Wilmington Office - IJ Coastal

527 Causeway Drive

Wrightsville Beach, NC 28480

910-300-5140

Charlotte Office

1515 Mockingbird Lane Suite 900

Charlotte, NC 28209

704-817-9826

Lake Norman Office

21025 Catawba Ave #101

Cornelius, NC 28031

704- 655-0586

Lake Norman North Shore Office

350 Morrison Plantation Parkway, Suite C1

Mooresville, NC 28117

980-435-5169

Check out our podcast and videos featuring lifestyle pieces, market information, and North Carolina guides!

Sell-through across the region has been a mixed bag with some areas up year over year, while other areas have seen a slight dip in the action. To read our Q2 2023 Western North Carolina Luxury Market Report, please visit the link below

https://bit.ly/3RkloBB