Lake Norman Luxury Showing More Balanced Conditions

Certain high-demand areas and price points continued to show some scarcity on the inventory side; however, the balance of buying activity compared to listing absorption displayed more balanced conditions than the frenzied, high-activity peak during COVID-19.

In most areas around the lake, there are 45-90 days of active inventory, with pending contracts maintaining a steady pace as we head into the peak of the spring market. While interest rates have plateaued below 7%, occasional upticks have caused short-term pullbacks. However, this new “normal” seems to have minimal impact on the mid-market ranges, with properties in the $600k to $1 million range showing steady activity and homes just above $1 million.

In the ultra-luxury range, inventory has expanded to 90-120 days on the market. However, recently built or remodeled properties continue to attract buyers, particularly cash buyers who dominate deals above $2 million in list price.

Cornelius

As in many high-demand areas closer to Charlotte, inventory in the mid-market segment just below $1 million has remained low, with less than 45 days of active inventory. Areas around The Peninsula Club have become more challenged in this range, with 37 homes closing in the first quarter vs just 16 in last year ’ s quarter. Interestingly, despite higher interest rates, this range is selling. At the same time, the primarily all-cash ultra-luxury market slowed up a bit over the winter, and in the first quarter, 15 homes were listed as over $3 million, with another 4 under pending contracts. This is not entirely unusual coming off the winter, and we suspect more active sell-through moving into the high-selling season of the second quarter. The Peninsula currently has just 9 active listings.

Cornelius Q1 Home Sales

Cornelius Q1 Home Sales

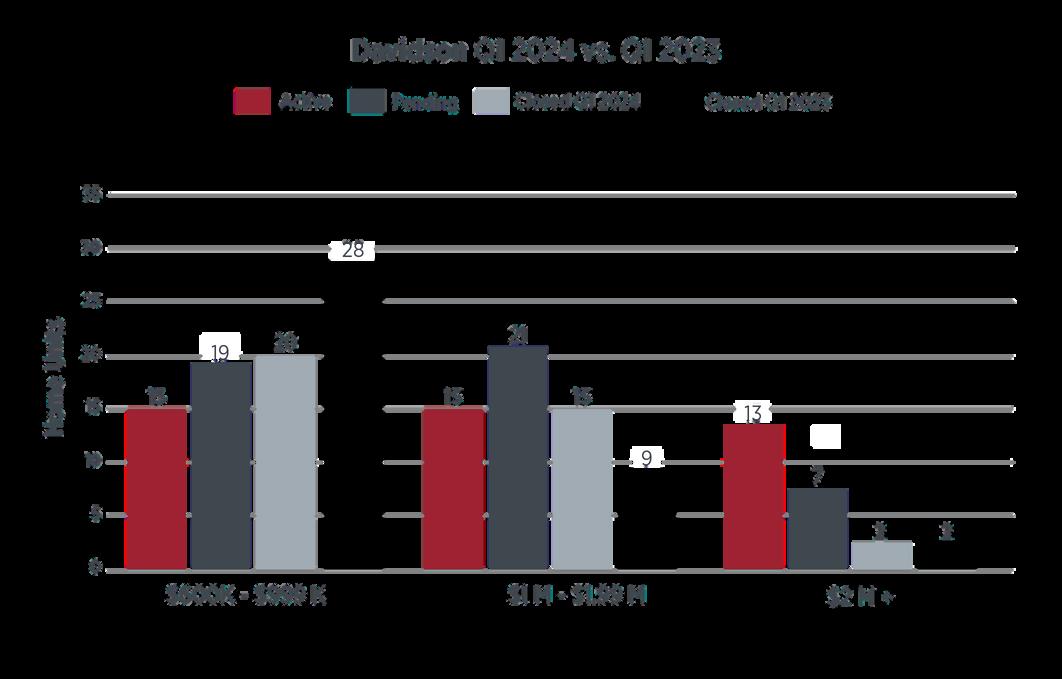

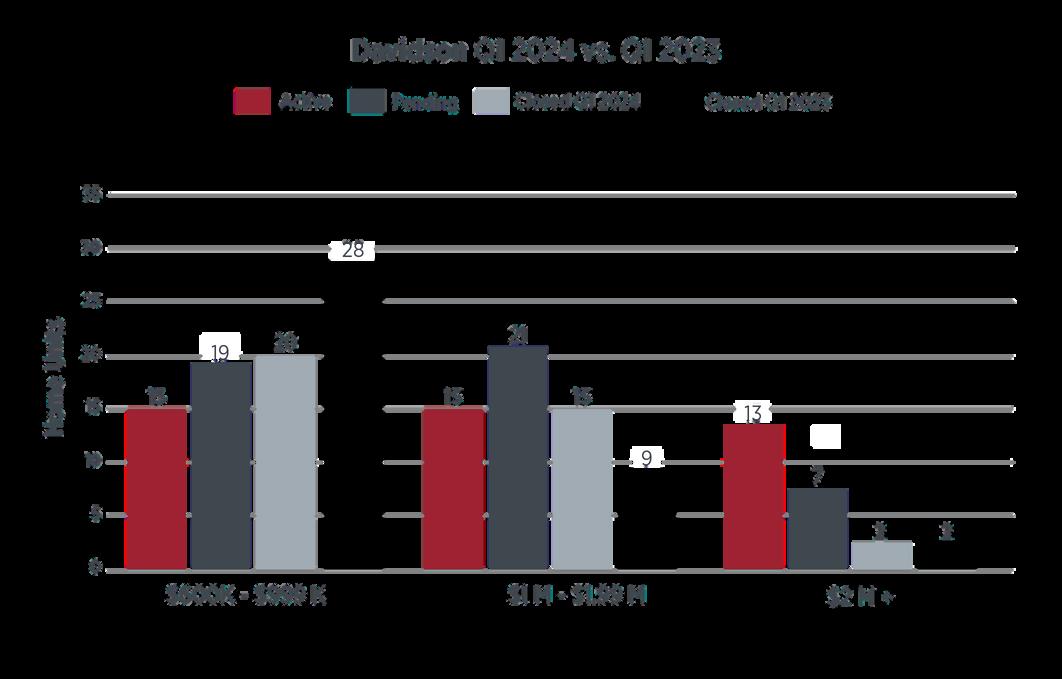

Davidson

As has been the case the past 15 months, Davidson’s emerging ultra-luxury market, over $2 million in value, has recently seen another spurt in activity, with 7 homes over $2 million going under pending contracts heading into the second quarter. The million-dollar range remains very active, as does the lower mid-market segment, with under 45 days of inventory present in many cases, including just 8 homes active in River Run.

Davidson Q1 Home Sales

Mooresville

Like Cornelius, the mid-market segment was steadily active in the first quarter, posting 55 closings and 40 pendings, with 42 homes remaining active.

Mooresville’s upper-end luxury market saw 13 closings above $2 million, another 14 pending contracts, and a remaining inventory of 29 active homes, roughly 75-90 days of inventory. The Point remains inventory-challenged, with just 10 homes active as of this report.

Mooresville Q1 Home Sales

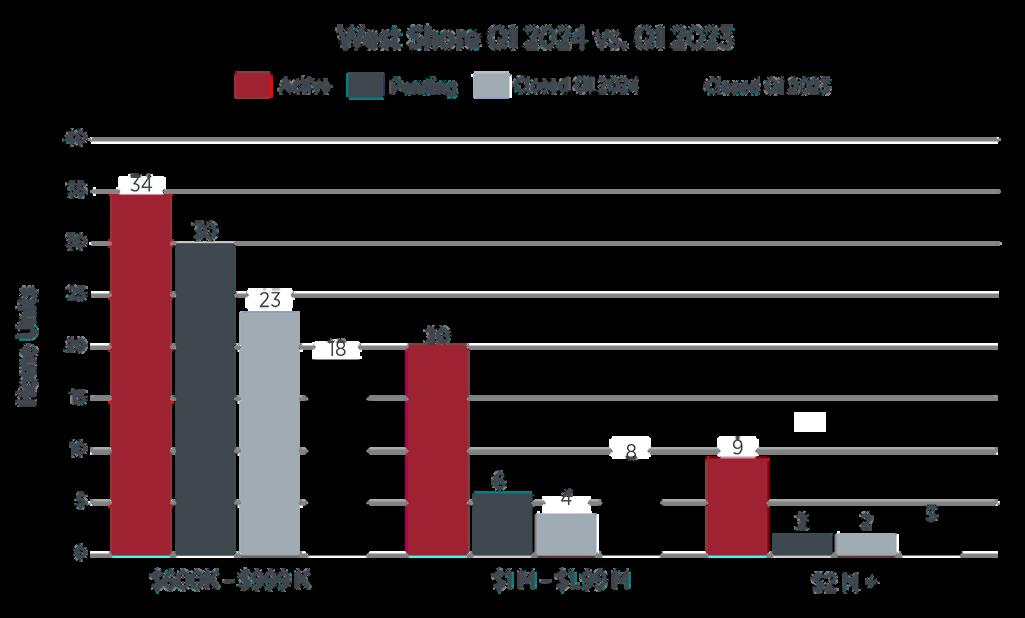

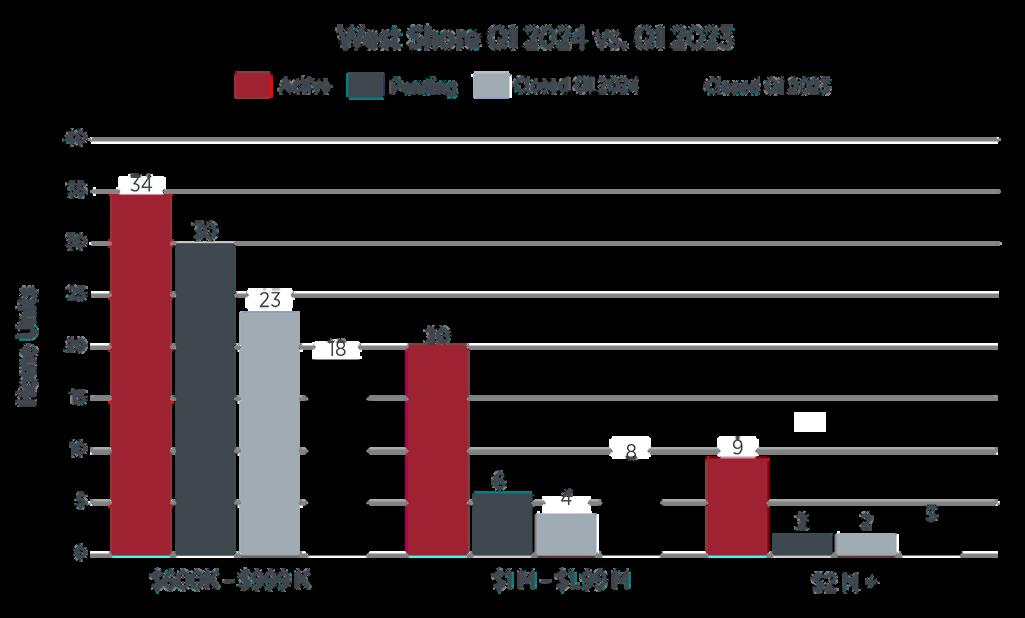

Denver | West Shore

The western shores of Lake Norman showed solid absorption in the mid-market. In contrast, the upper ranges above $1 million showed more balanced and steady conditions, with 8 homes pending on an active inventory of 29 remaining homes. There was a dip in first quarter sales, with 11 units sold in 2023 and 6 sold in 2024's first quarter. Pending activity in the range was respectable yet more steady than the robust COVID-induced frenzy of 2021/22.

Q1 Home Sales

Denver/West Shore

North Shore

Troutman/Sherrills Ford

The communities above the 150 bridge saw solid activity in both the mid-market segment below $1 million in value, all the way to the $2 million threshold, with 18 homes pending between $1 and $2 million heading into the second quarter. Ultraluxury activity above $2 million cooled a bit with 3 closings compared to zero the year before, but no current pending contracts. However, inventory in this area ’ s ultra-luxury segment remained relatively low; thus, it will not take too much activity to see an uptick in this price range in the second quarter.

Q1 Home

North Shore

Sales

Concord & Kannapolis

New construction in Cabarrus County has exploded in areas like Harrisburg, with homes pushing up against the million-dollar mark. The county saw 80 sales in the first quarter compared to 39 last year, with 74 more homes pending in the $600k to $1 million range. Above the million dollar price point, while activity is still emerging in this area compared to North Mecklenburg and Iredell, Cabarrus did see deals close over the $2 million threshold, mainly acreage properties, with another one pending heading into the second quarter, along with 5 homes pending over the million mark.

Concord & Cabarrus Q1 Home Sales

Lake Norman Market Forecast

While showing activity at Lake Norman has declined year over year by about 20% in the luxury ranges, it has to be digested within the context of the frothiness of the past two years. For example, last March, the average home in Cornelius in the million-dollar range was getting 11 showings a month and rarely lasted more than a month. This year, that same price range and area is seeing a healthy 8 showings a month, down on a percentage basis but still a very respectable number compared to pre-COVID activity levels. The ultra-luxury range between $2 million and $3 million saw a very respectable 6 showings per house in Cornelius and Mooresville over the past month, while the top end of the market over $3 million did seem to go on spring break, averaging 2 showings per home over the past month in that range compared to 4 showings per home in last year ’ s late first quarter period.

Overall, inventory levels in the entry-level luxury range remain relatively tight, just below $1 million despite high rates. In comparison, a slight easing has occurred over $1 million and even more so into the ultra-luxury segment. Federal Reserve influences appear to be leaning toward more of the current environment on the rate side, which should serve to stabilize inventory in the lower luxury ranges, something the Fed may prefer given the anti-inflation mandate and housing cost’s impact on consumers. The ultra-luxury range will likely see a solid spring uptick. However, inventory conditions in the upper ranges will give buyers more options than they had the previous two years and thus stabilize what had been an extreme upward trajectory in pricing.

OUR OFFICES Asheville Charlotte Wilmington North Shore Lake Norman Highlands - Cashiers 18 S Pack Square Asheville, NC 28801 210 North Fifth Street Highlands, NC 28741 527 Causeway Drive Wrightsville Beach, NC 28480 21025 Catawba Avenue, Suite 101 Cornelius, NC 28031 1515 Mockingbird Lane, Suite 900 Charlotte, NC 28209 350 Morrison Plantation Parkway, Suite C1 Mooresville, NC 28117

Where will you L E T U S H E L P Y O U N A V I G A T E T H E J O U R N E Y center yourself next?

LAKE NORMAN | NORTH SHORE | CHARLOTTE ASHEVILLE | HIGHLANDS - CASHIERS | WILMINGTON 704-655-0586 IvesterJackson com

Cornelius Q1 Home Sales

Cornelius Q1 Home Sales