Ivester Jackson Blackstream Christie's Asheville Luxury Market Report

Q3 2022

MARKET REPORT

Market conditions across Western North Carolina continue to hold steady and, in some cases, have shown a jump in sell through along with showing activity in both mid market and luxury segments

COMMUNITY UPDATES

Asheville (City, North) Downtown Asheville Condos Buncombe County Arden Biltmore Forest Henderson County Foothills

FORECAST

Housing market steadies as interest rates rise

PODCAST

From market forecasts, interviews, and house marketing ideas, join the team at Ivester Jackson Blackstream I Christie's for the latest in Carolinas luxury real estate content.

contents October 2022 Q3 Market Report

Fairview/Fletcher

3rd Quarter Luxury Market Report

LUXURY MARKET OUTPACES MID-MARKET, WHILE INTEREST RATES CONTINUE TO RISE

Market conditions across Western North Carolina continue to hold steady and, in some cases, have shown a jump in sellthrough along with showing activity in both mid-market and luxury segments. We do expect to see continued pressure on the mid-market sales activity heading into the fourth quarter as this price point is much more sensitive to rising interest rates than the luxury space. While interest rates continue to rise for the foreseeable future, many buyers are closing transactions with cash and forgoing a mortgage altogether.

Arden, Asheville, and Fairview/Fletcher have all posted impressive sold results in the $2 million plus range, despite a national and local media narrative claiming that the luxury market has hit the skids. 21 homes over $2 million closed in those markets compared to just 14 in last year ' s third quarter, an increase of 50%.

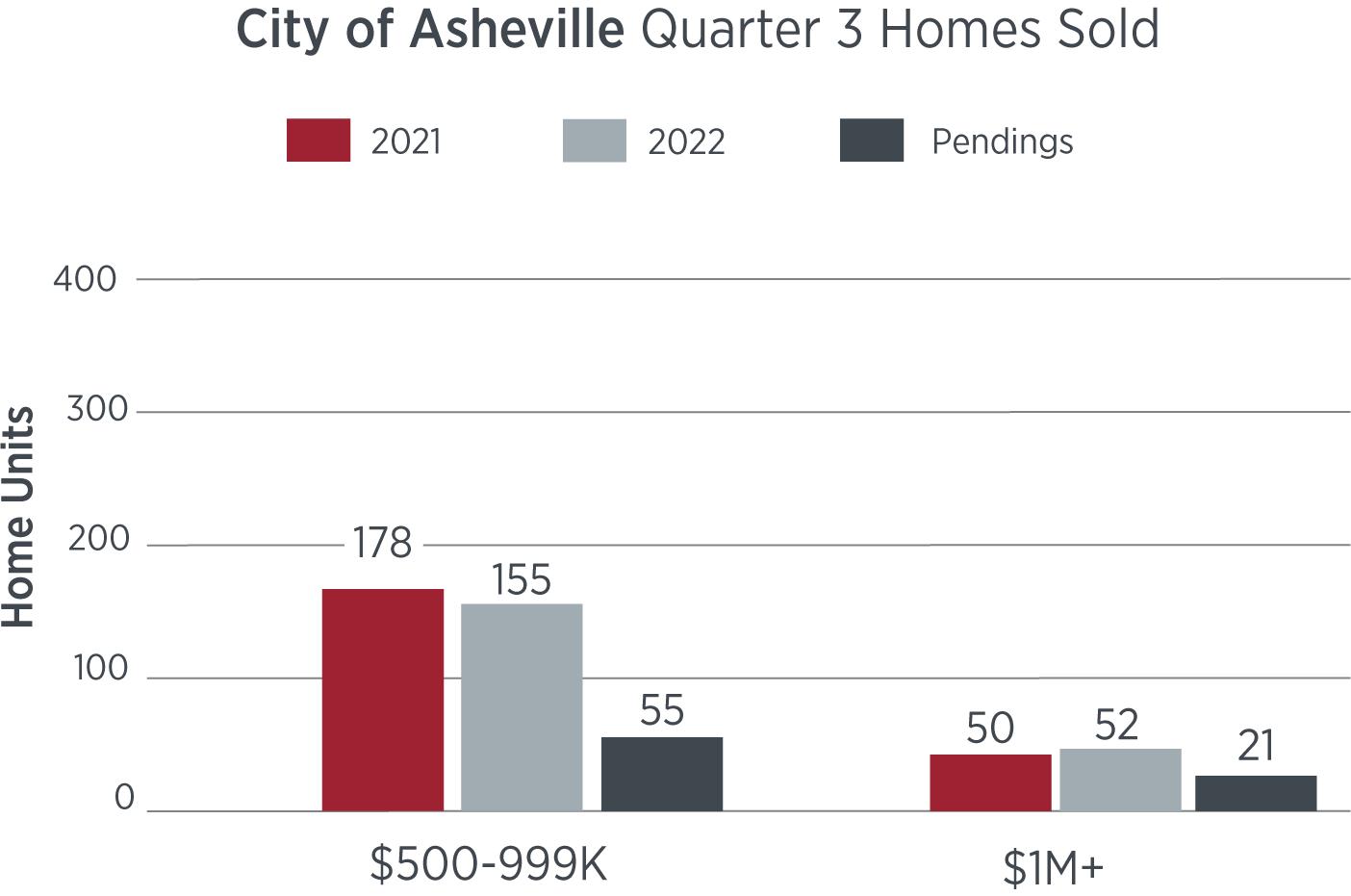

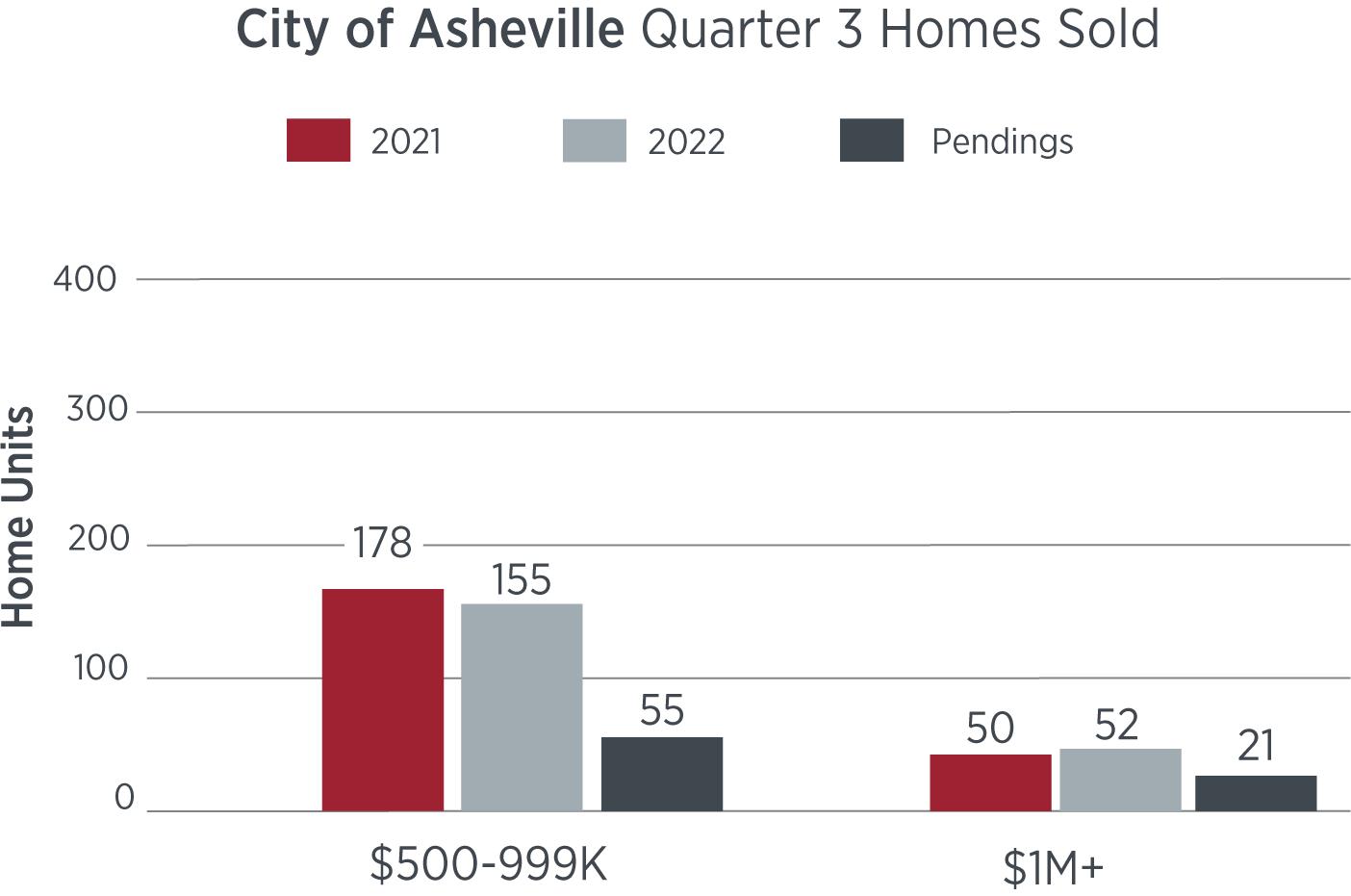

City of Asheville

The Asheville luxury market area saw a slight increase in sales during Q3 2022 vs 2021, yet showings were through the roof with 61% increase year over year. This points to high demand and low inventory as buyers remain in tight competition for housing in Asheville. Pending sales also remain high with 21 currently under contract for properties over $1,000,000. The mid-market has slipped slightly as demand and lack of active inventory have caused sales to dip by 13% vs Q3 of 2021.

City of Asheville

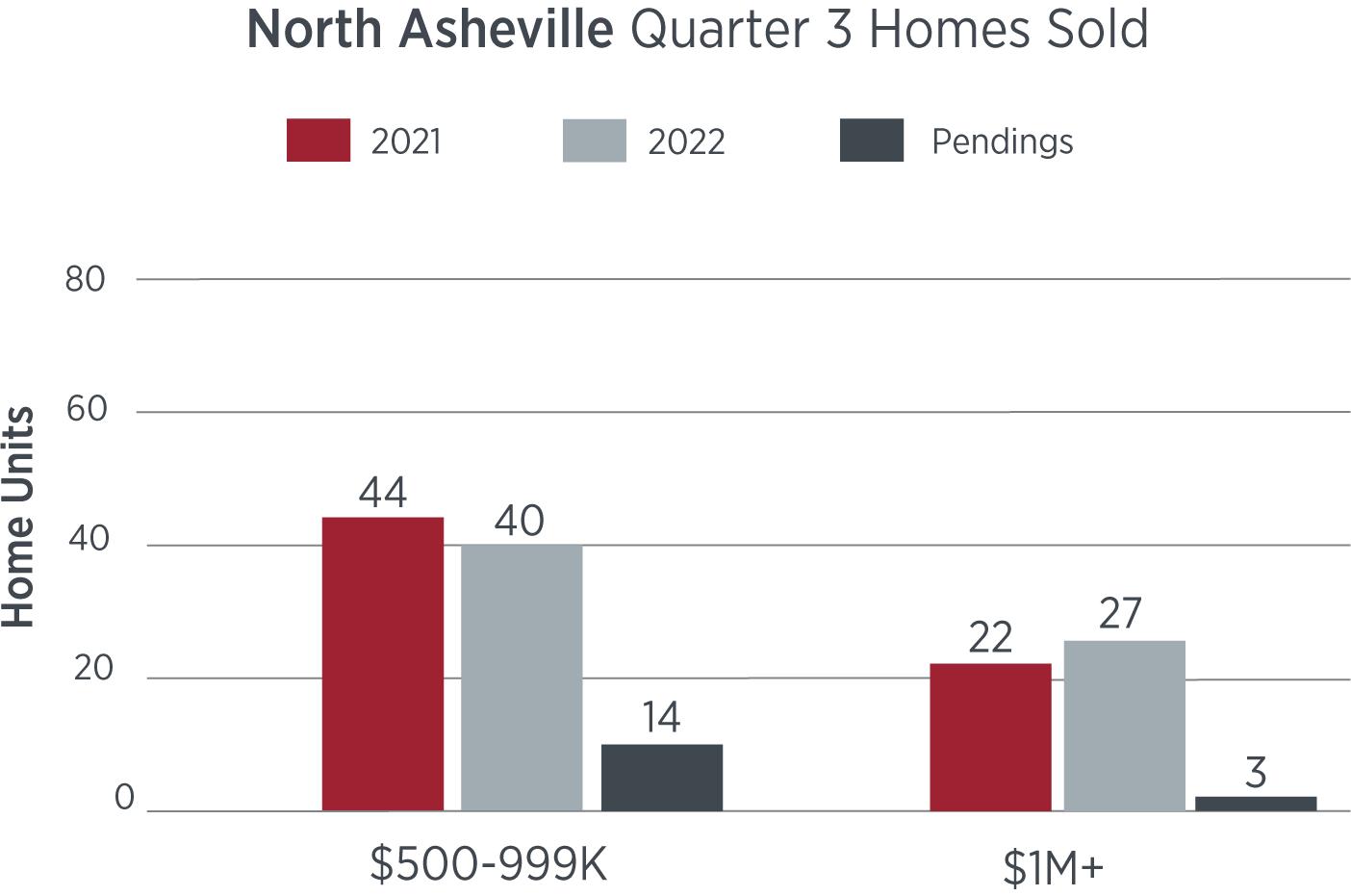

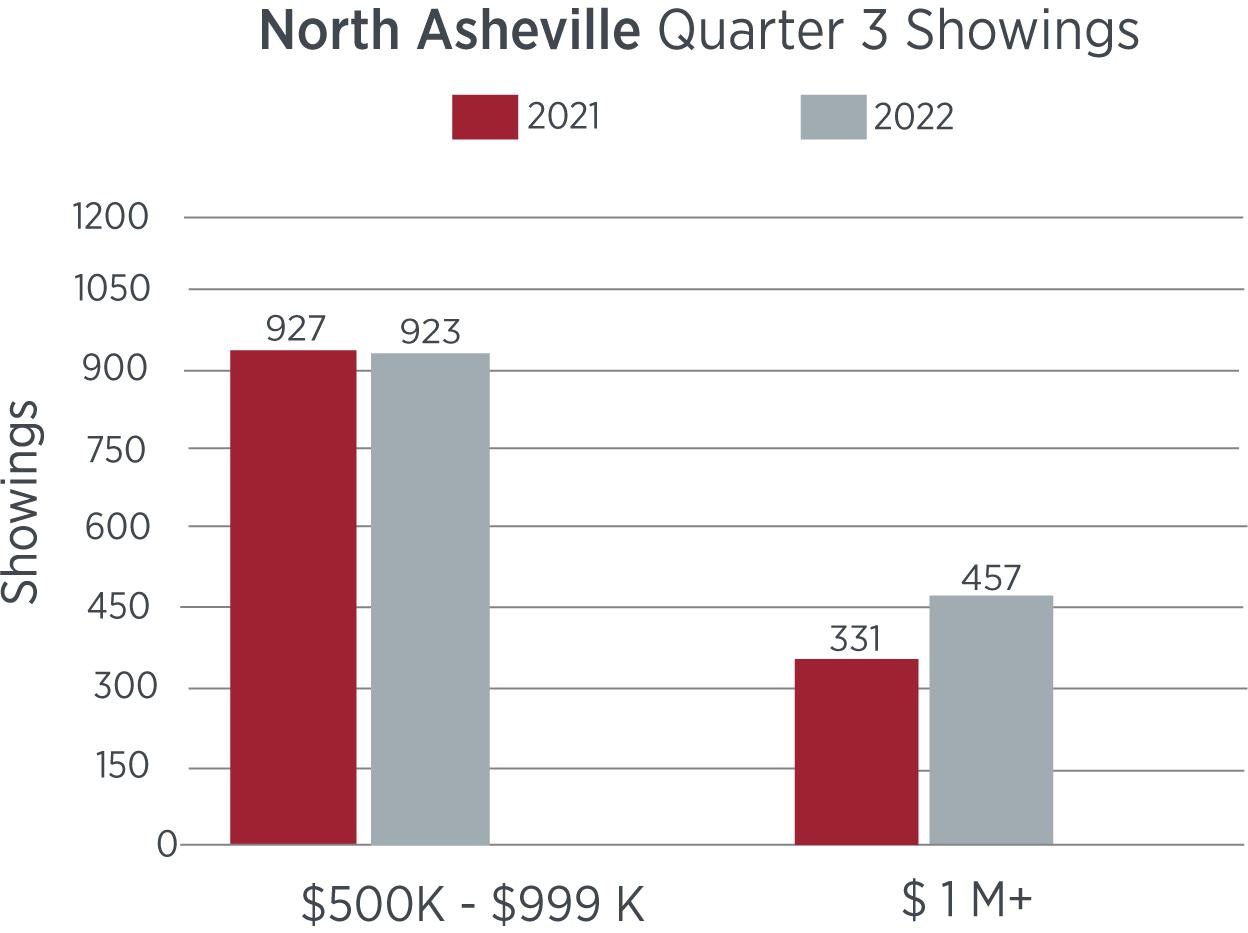

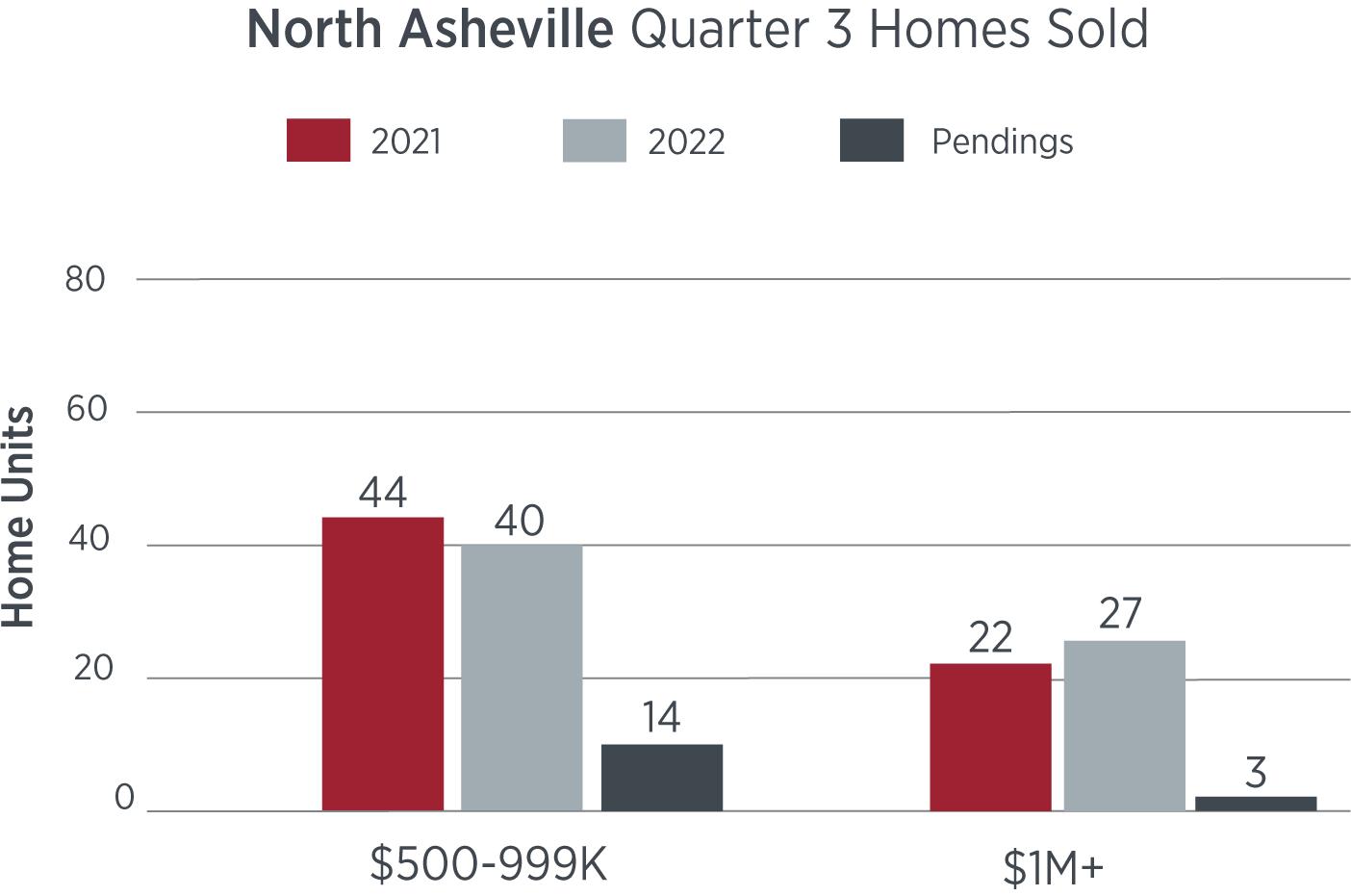

North Asheville

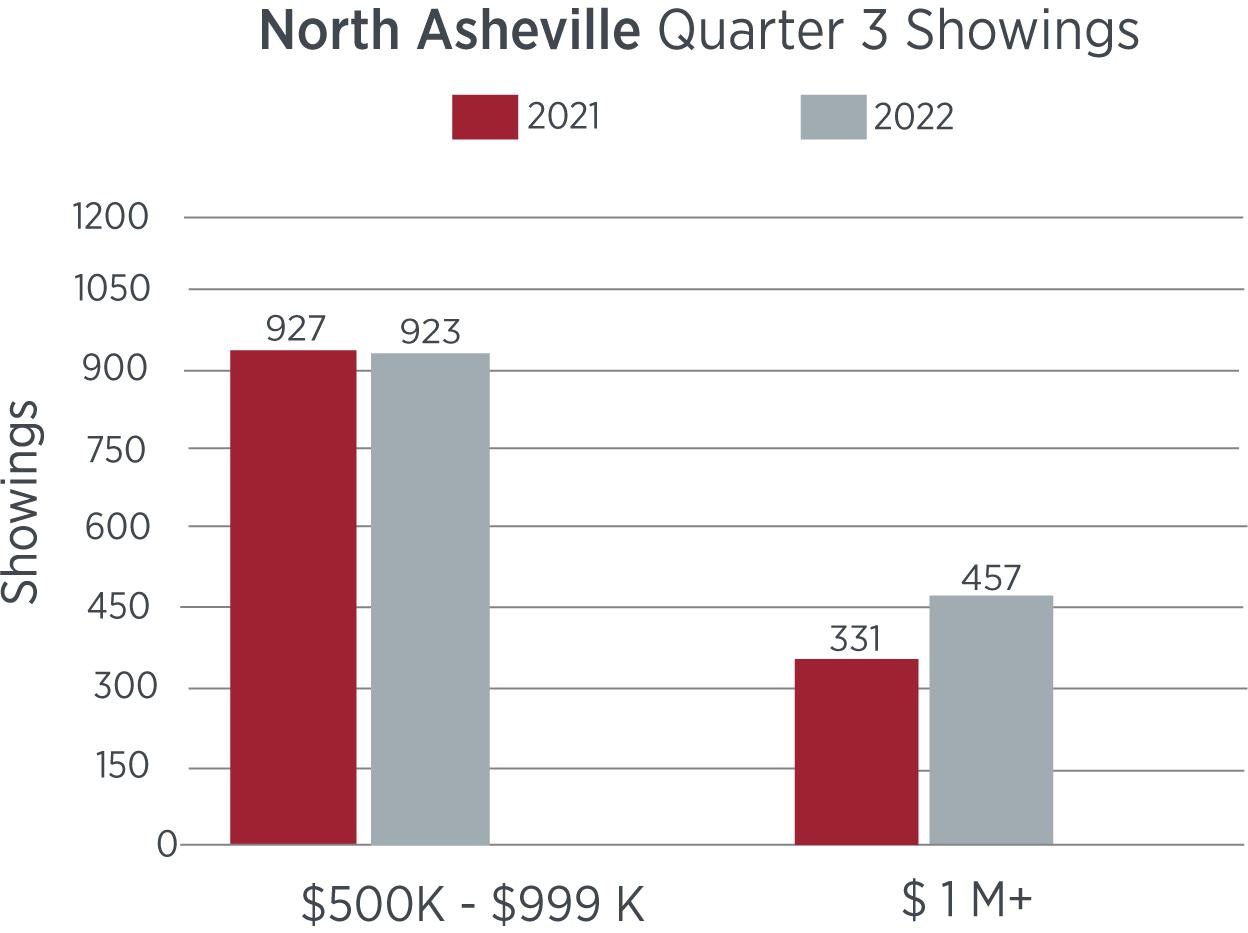

Lack of inventory in the North Asheville area continues to hamper sales and showings in the mid-market range. With only 11 active listings between $500-999k and 14 homes currently under contract, it's no secret that demand has remained at all-time highs for this area of Asheville

Inventory is also low in the luxury space, however both showings and sales are up year over year with an increase of 38% and 23% respectively.

North Asheville

Downtown Asheville Condos

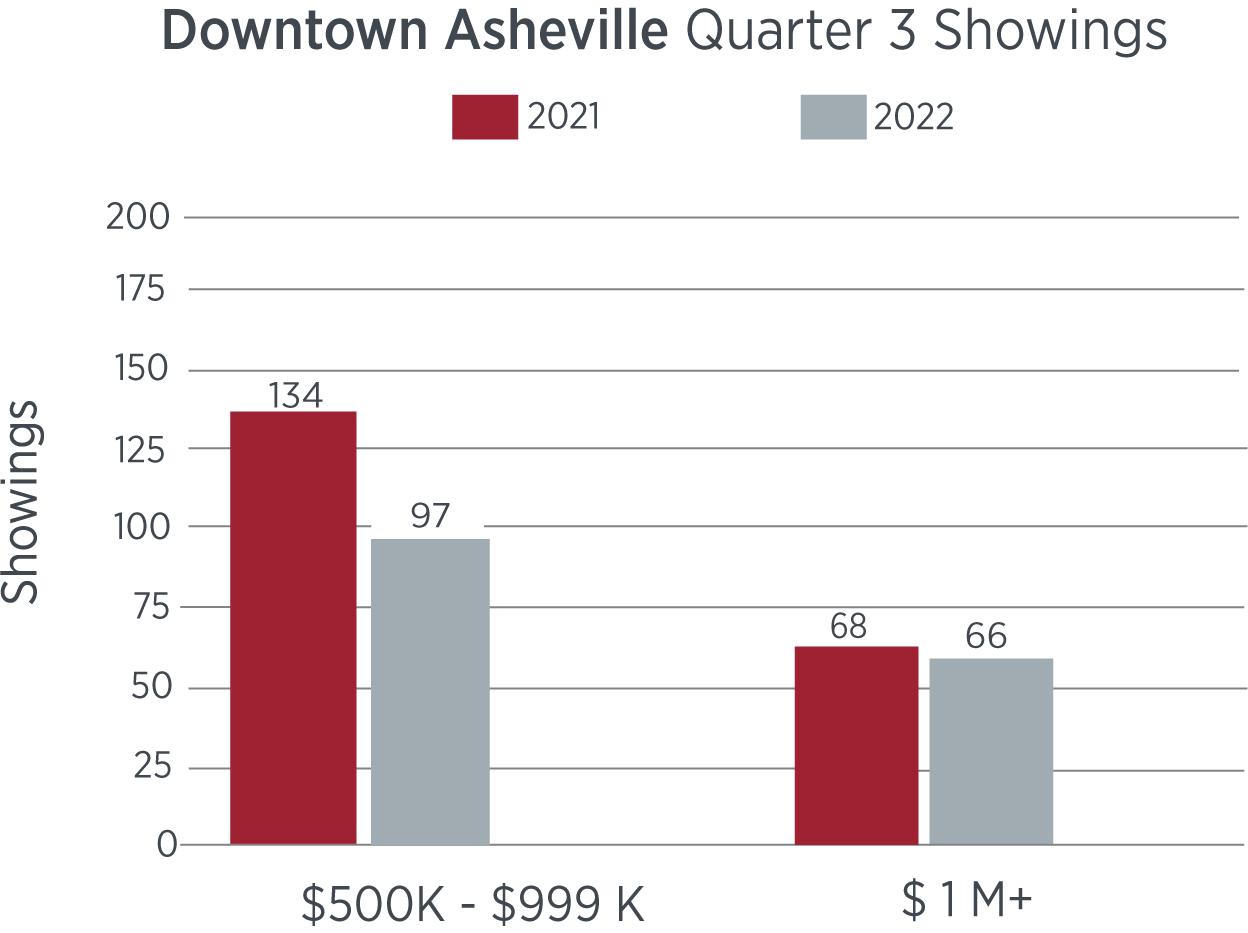

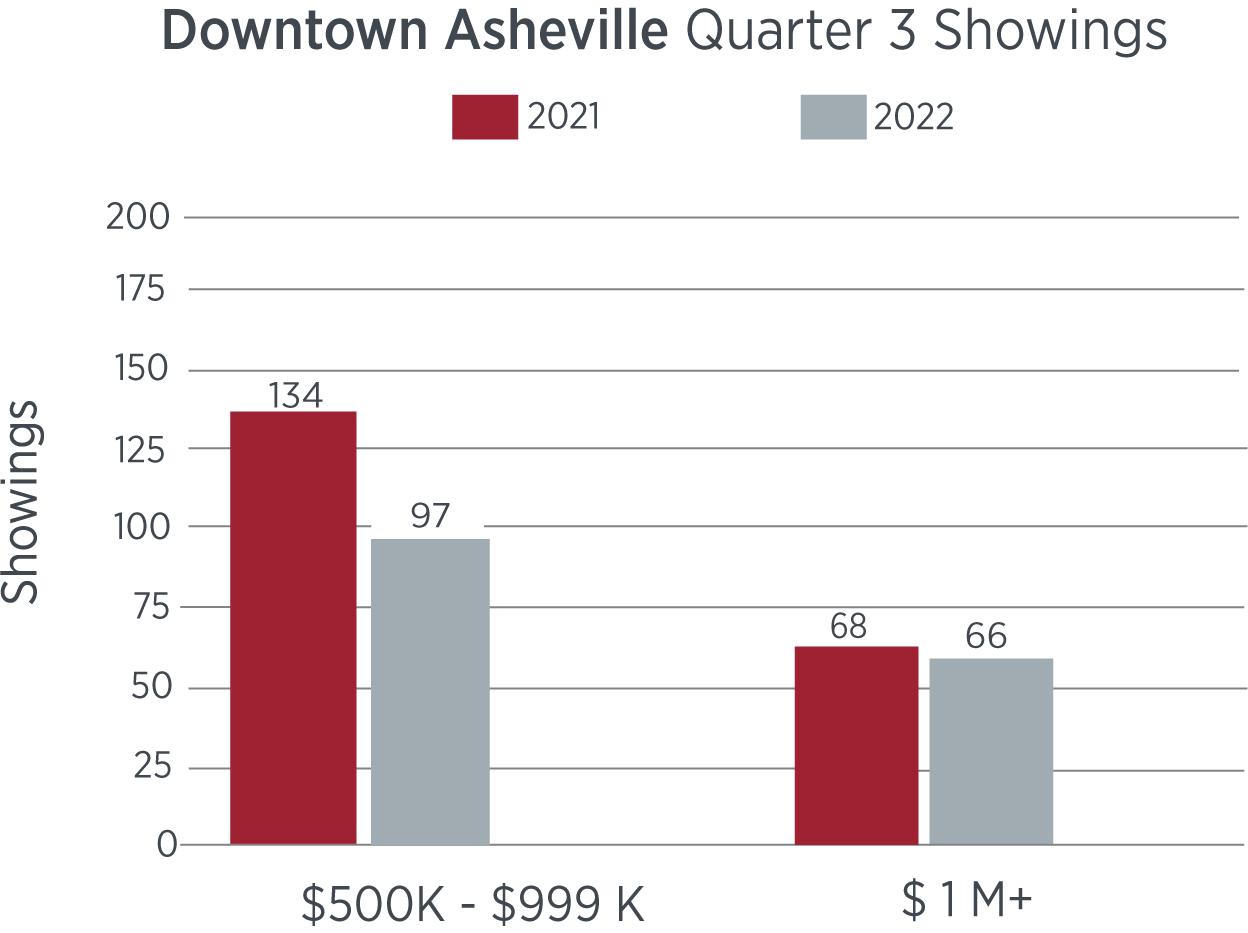

Lack of inventory has stifled showings and sales during the 3rd quarter of 2022 as it relates to downtown condos in Asheville. While the luxury market is relatively flat in both sales and showings over 2021, the mid-market has seen a dip in the action. Many new construction condo buildings are currently under construction or are on the books to start in 2023, which should in turn increase both sales and showing numbers in the coming weeks and months. As interest rates continue to rise for both developers and end users, we will keep an eye on this market moving into the 4th quarter and beyond.

Downtown Asheville Condos

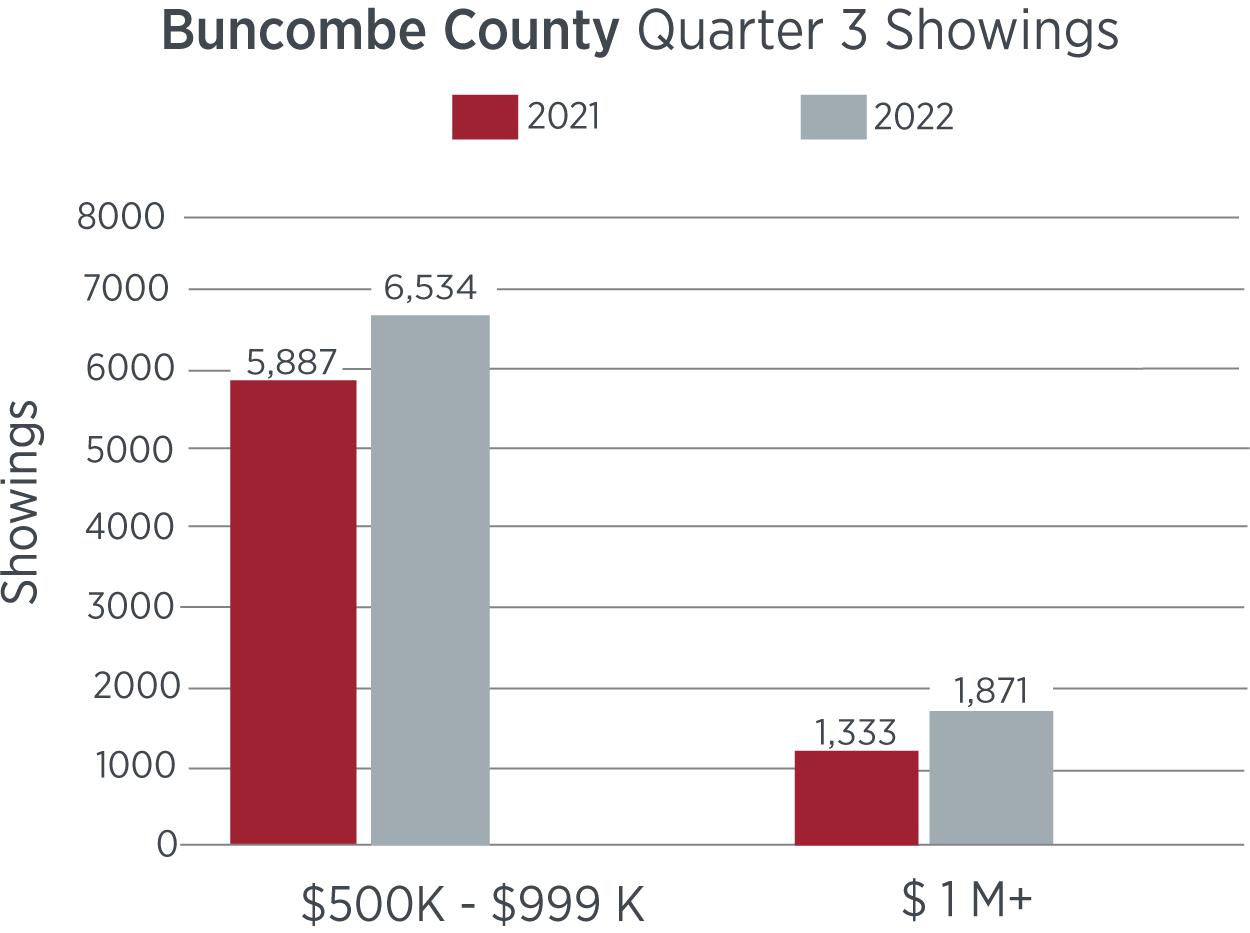

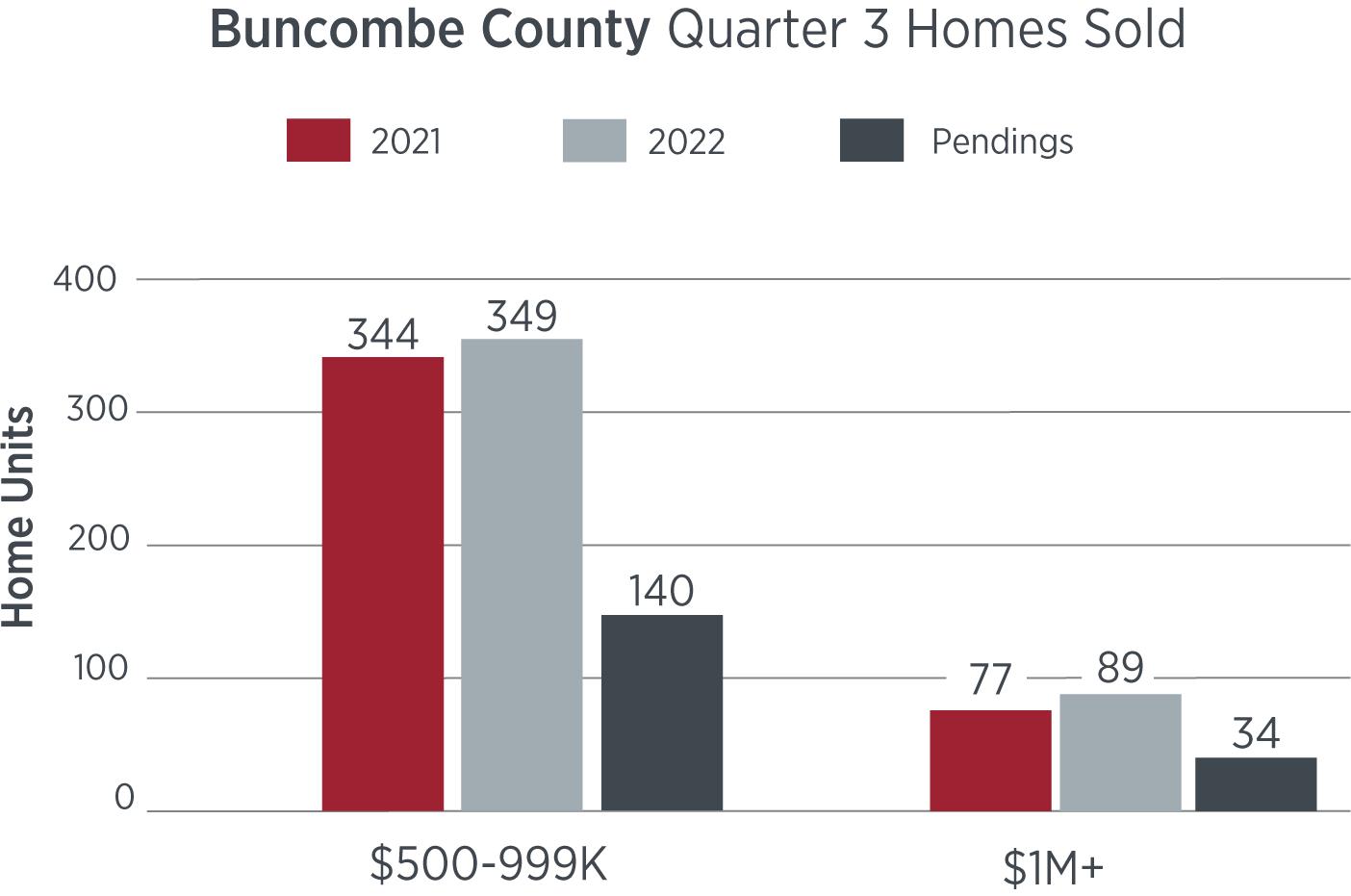

BUNCOMBE COUNTY

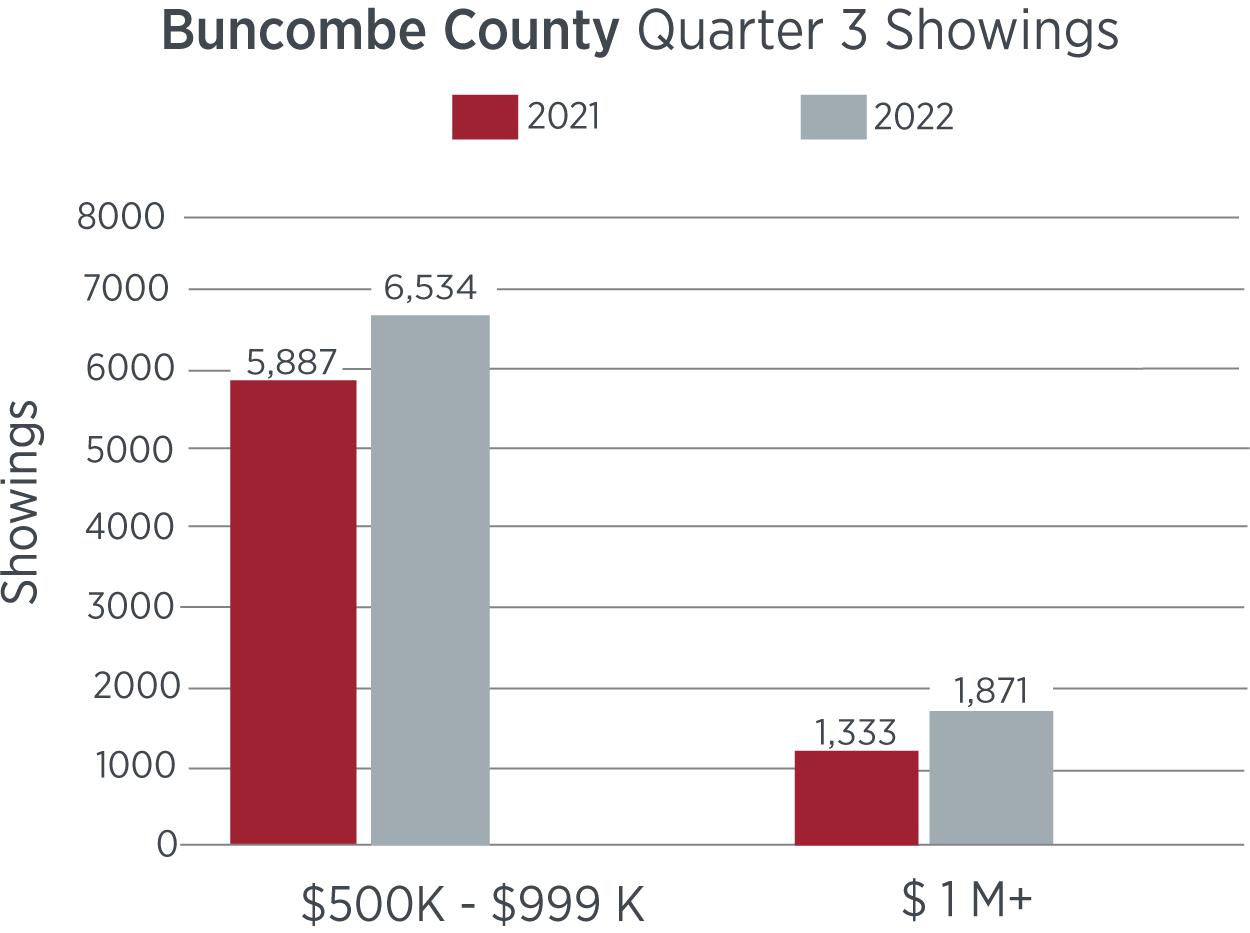

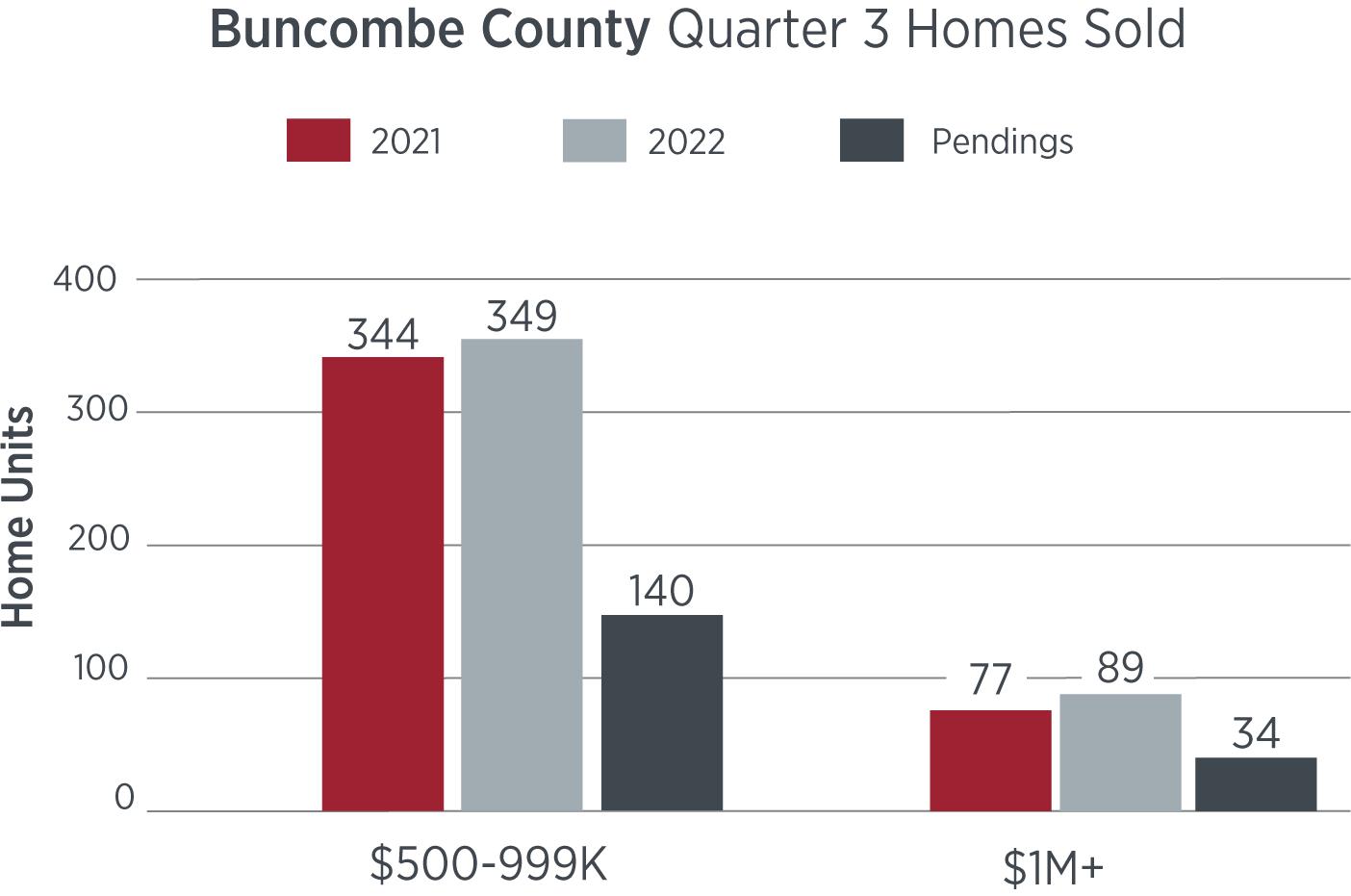

No surprises here, the overall Buncombe County market has shown another increase in both sellthrough and showing activity year over year in the third quarter of 2022. The luxury price point ($1M+) evidenced the largest jump with sales up 16% and showings up a whopping 40% compared to this time frame last year. With the mid-market having 140 pending transactions, the 4th quarter shouldn't disappoint.

Buncombe County

Buncombe Homes

72 Wonderland Ridge Lane #612 $2.28 M | Representing Buyer

Sold 14 Twinflower Trail $1.655 M | Representing Buyer 8 Busbee Road | $1.465 M 100 Ridge Street | $1.25 M

Under

Sold 10 Greenwood Road $2,490,477 | Representing Buyer 11 Stuyvesant Crescent $1.23 M | Representing Buyer

Contract

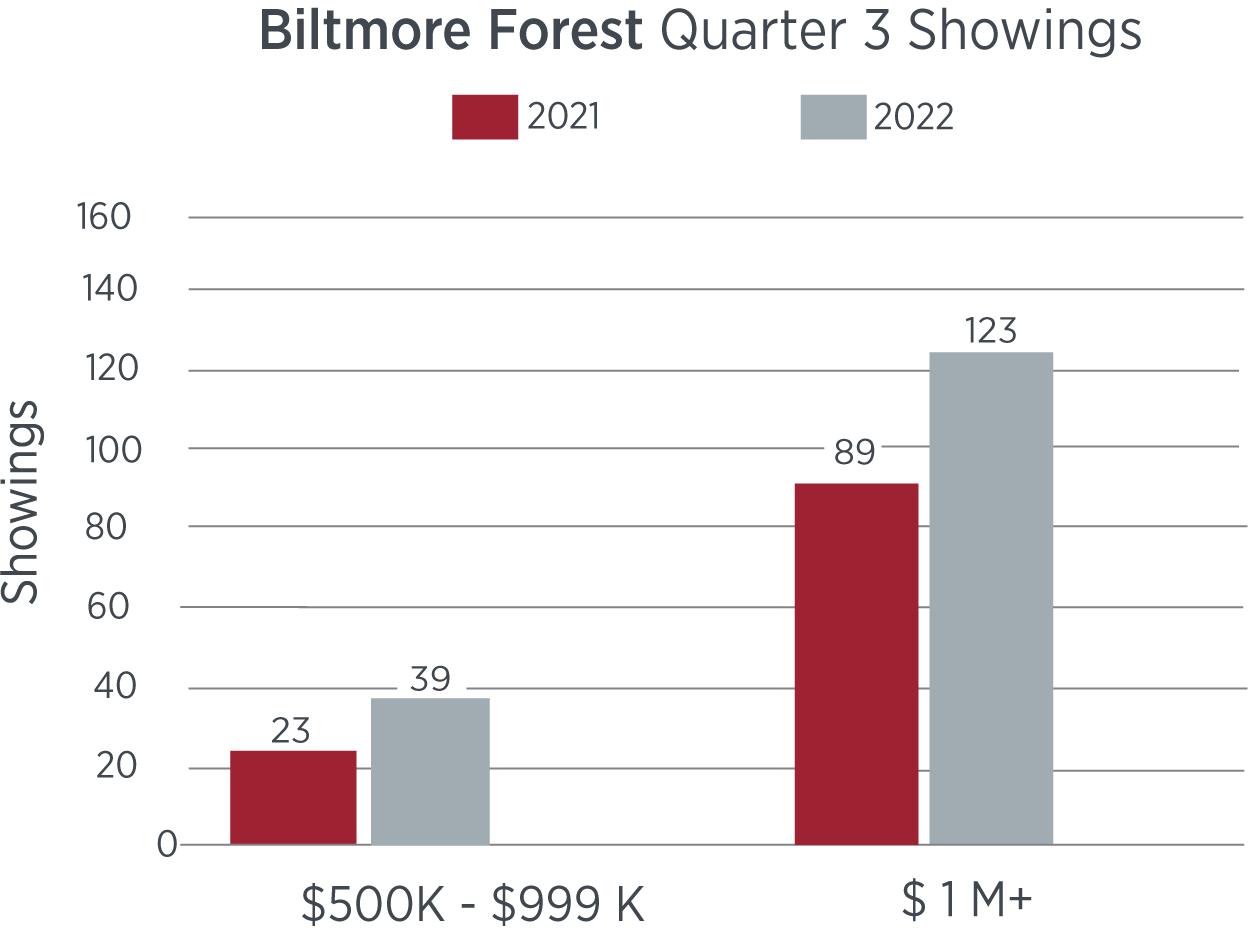

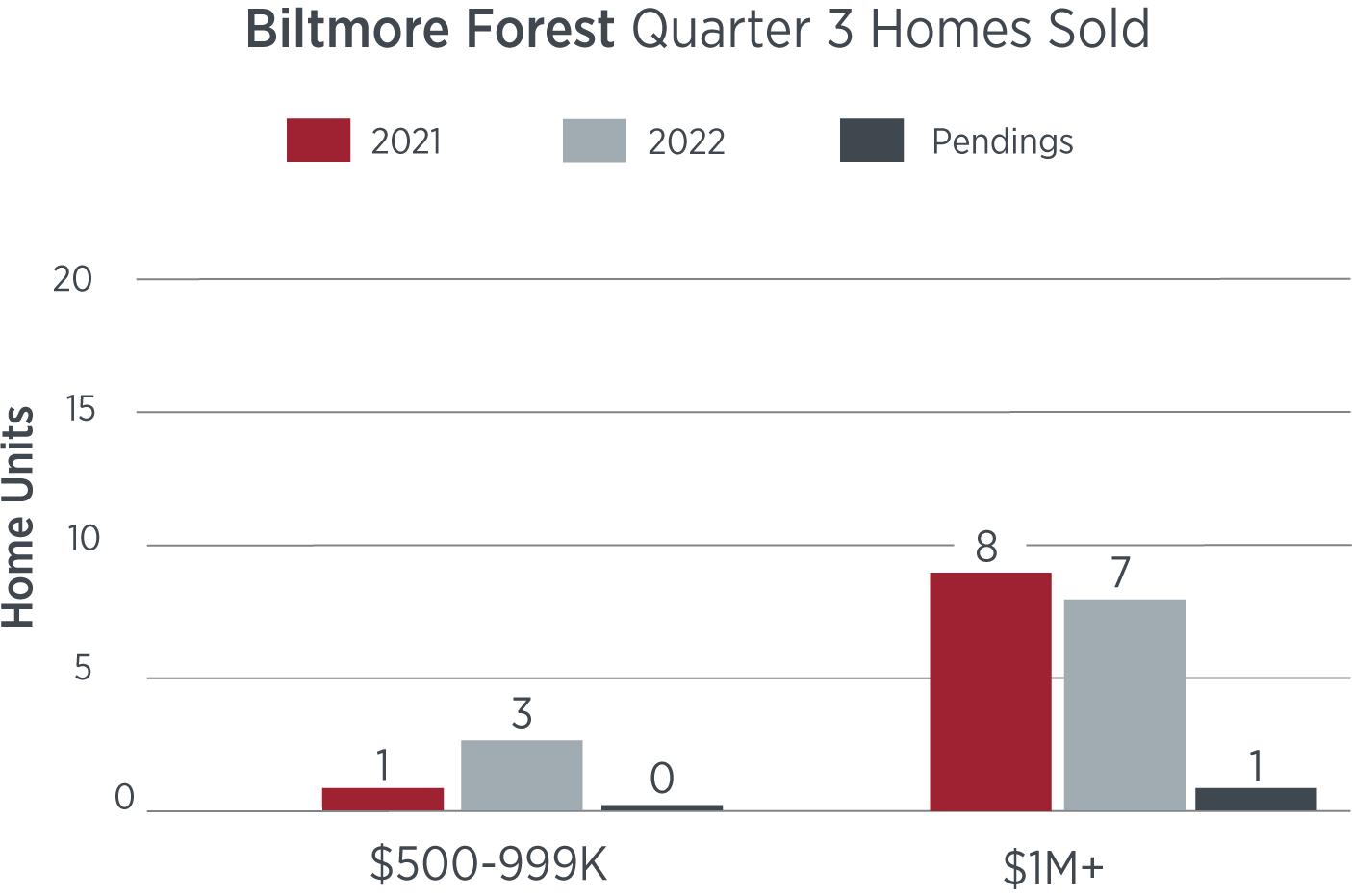

BILTMORE FOREST

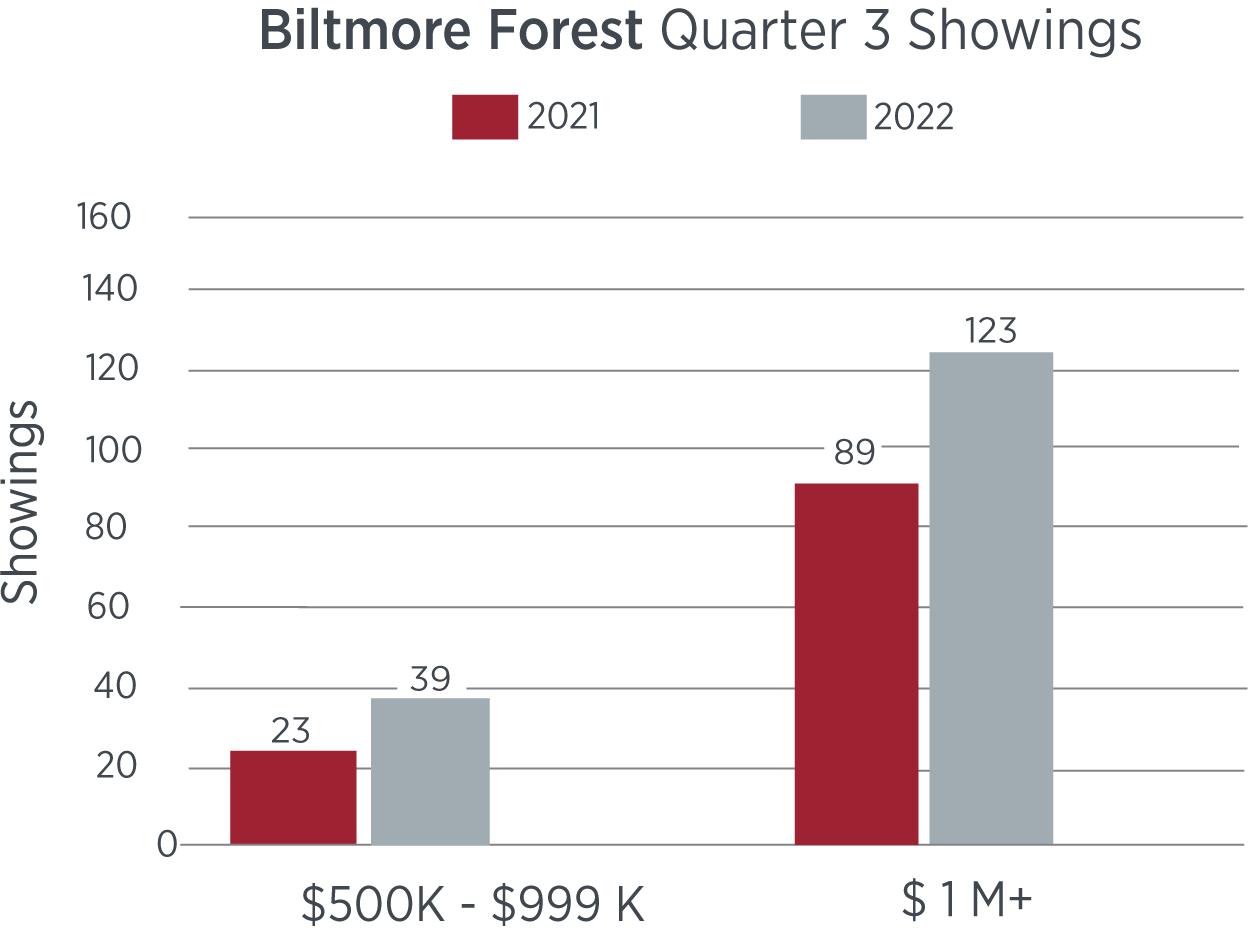

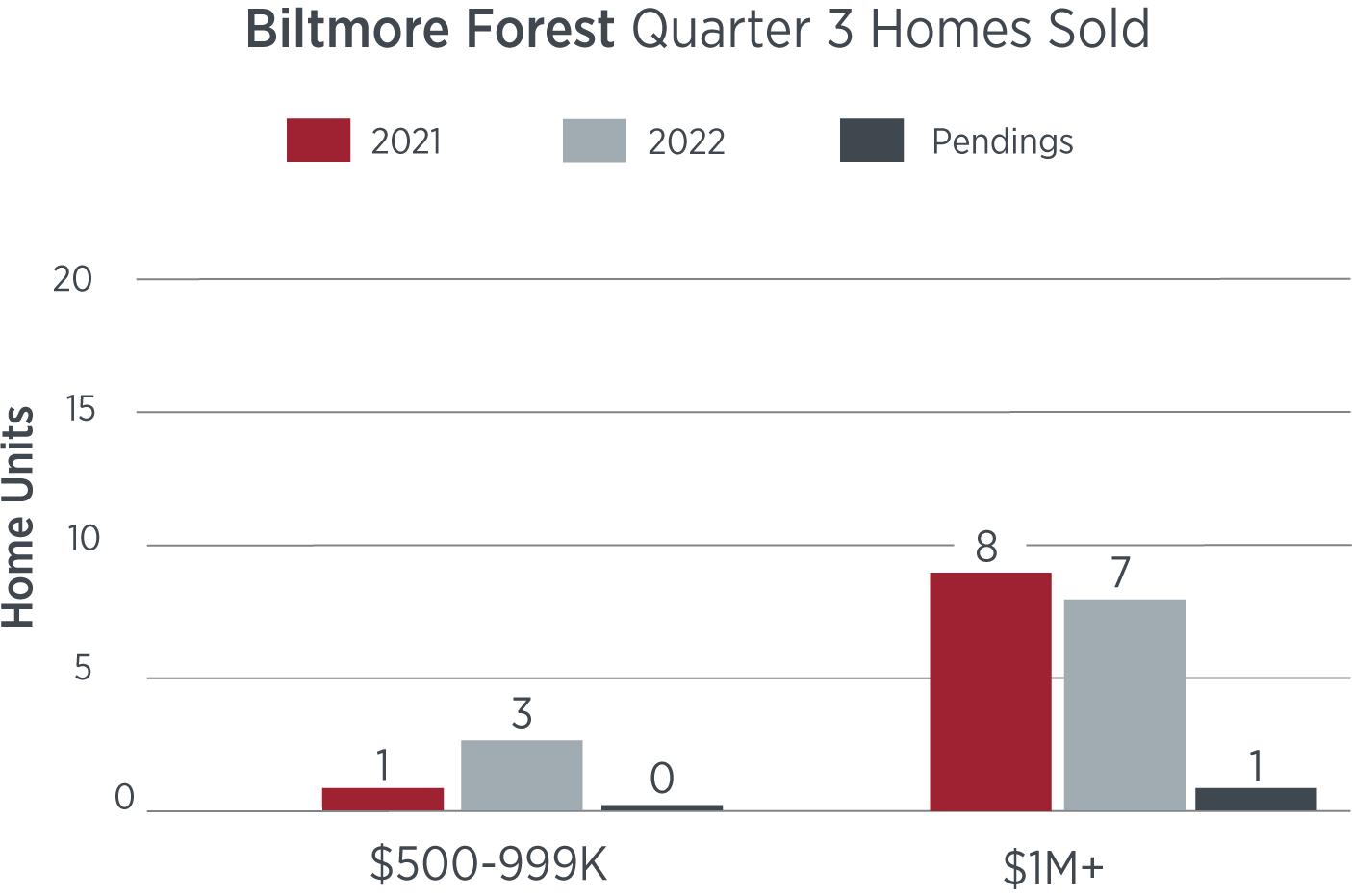

The luxury market in Biltmore Forest has remained relatively flat as it relates to sales vs Q3 of 2021, 8 sales in 2021 and 7 sales in 2022. On the contrary, the mid-market ($500-999k) had a spike with 3 sales vs only 1 sale in 2021. It's also important to note that the ultra-luxury market ($2M+) in Biltmore Forest was on fire, with all luxury sales in the 3rd quarter being above $2,000,000 in value. Demand continues to uptick in Biltmore Forest as well with showing activity up 70% in the mid-market and up 38% in the luxury space. These numbers certainly point to a robust end to 2022 and a strong beginning for the first quarter of 2023.

Biltmore Forest

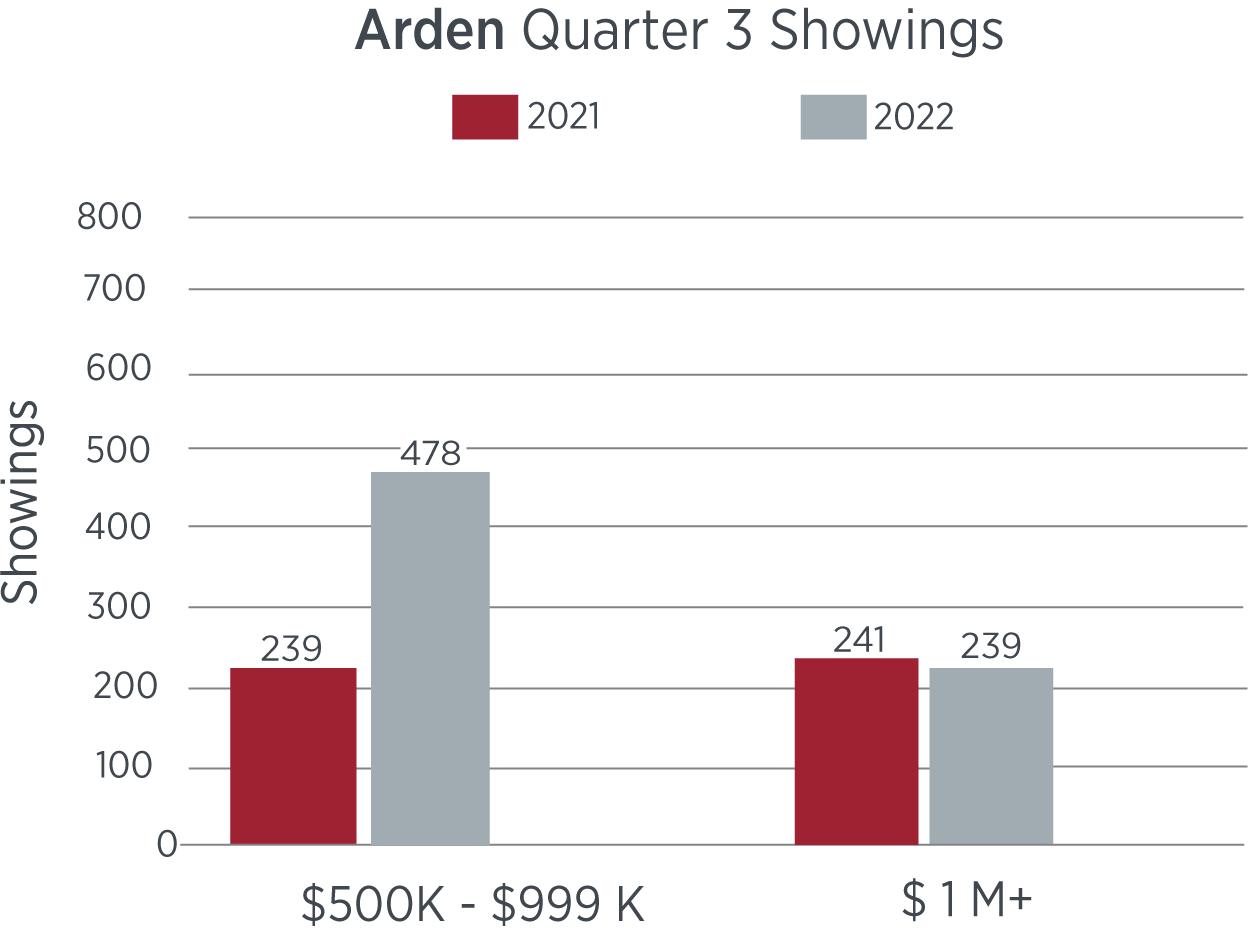

Arden & Fairview/Fletcher

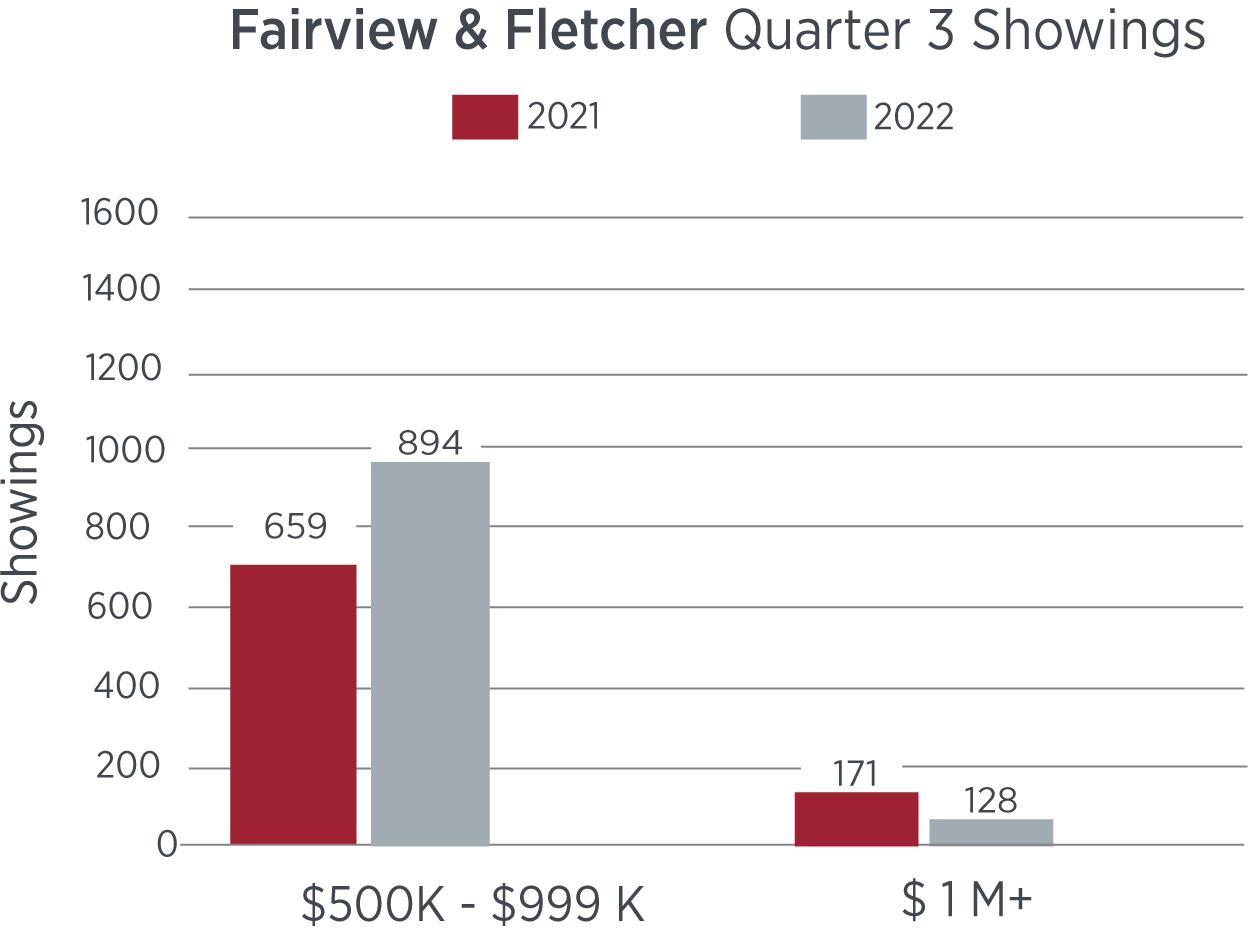

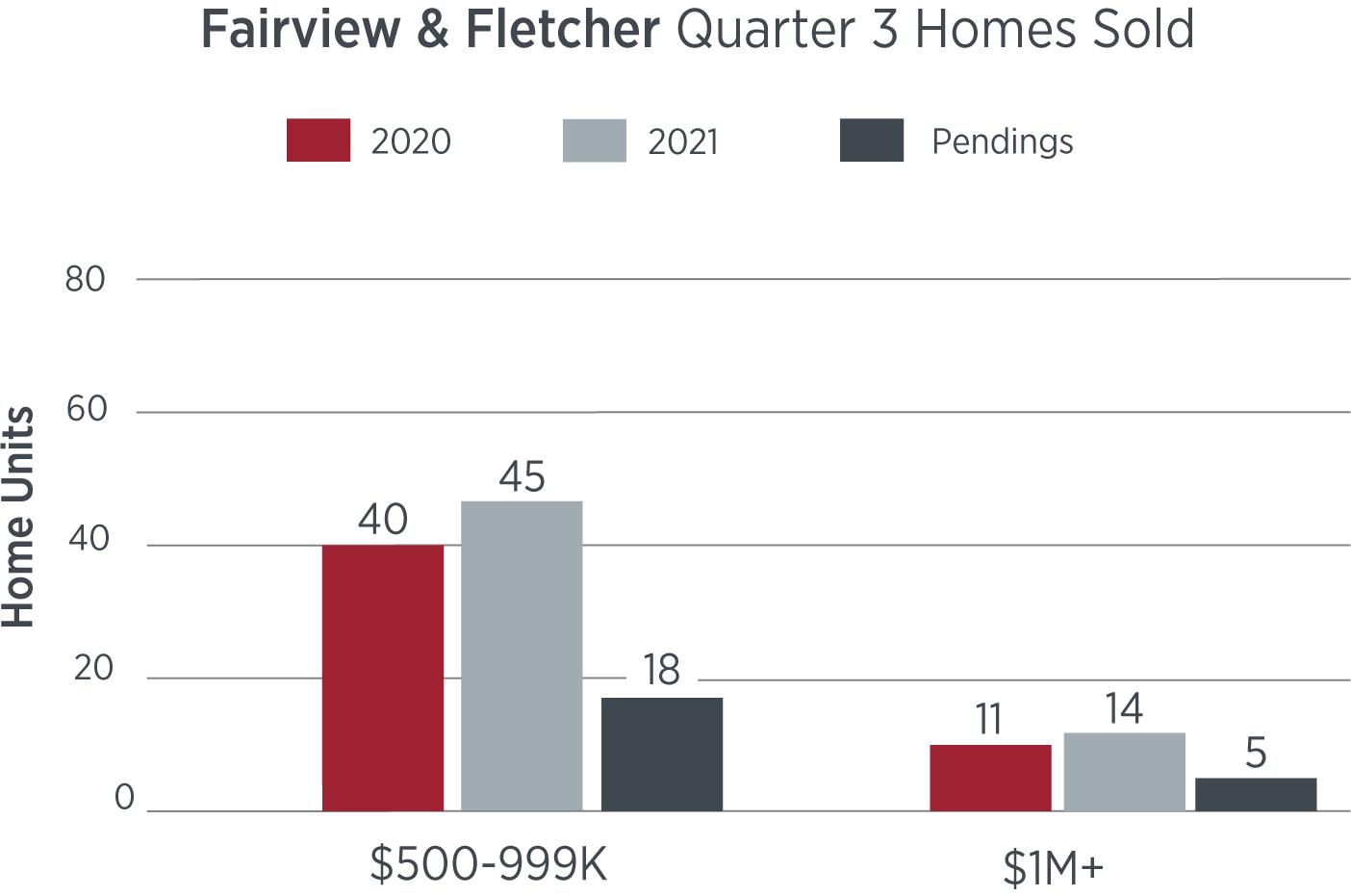

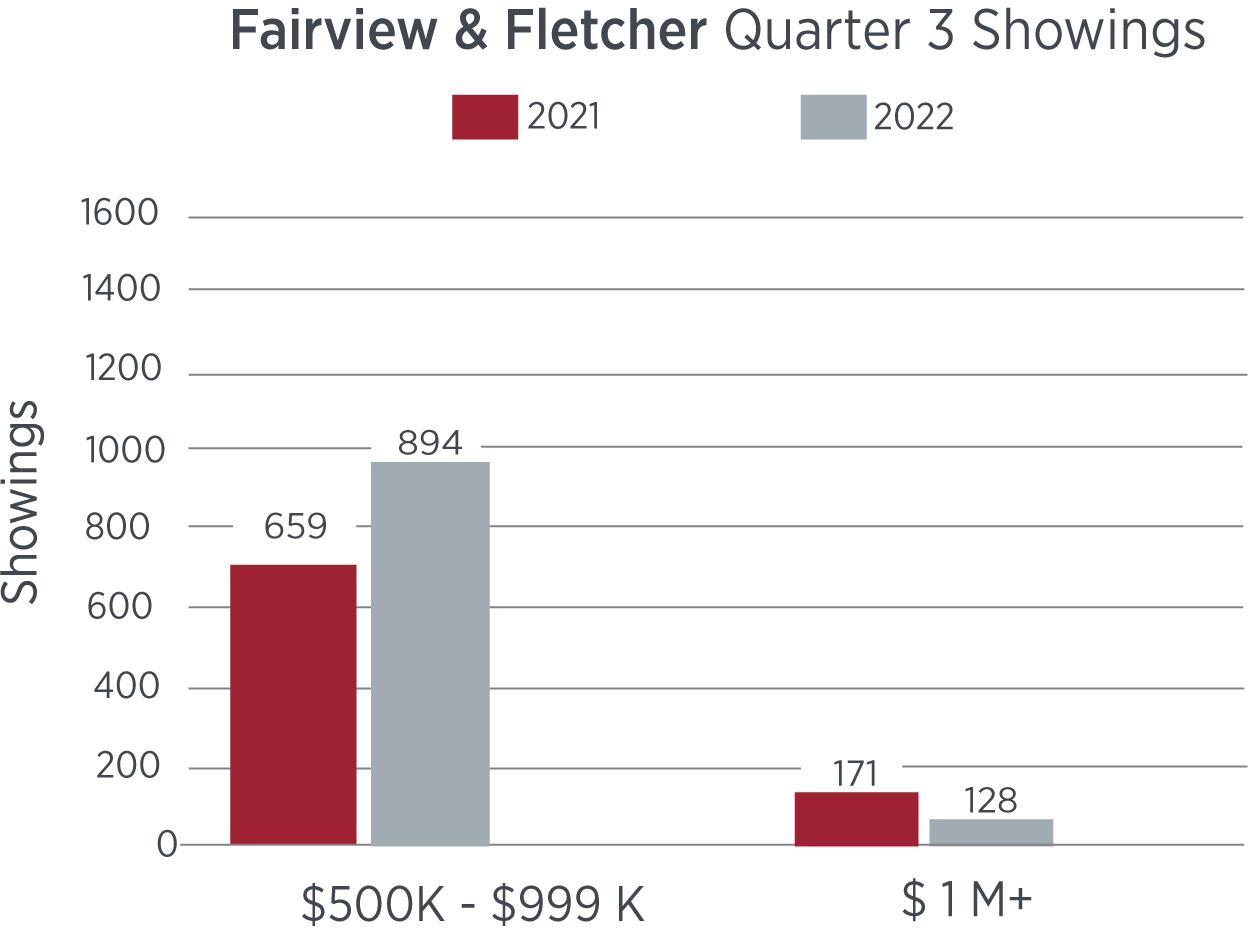

New construction development continues to drive sellthrough in both the luxury and mid-market segments in the 3rd quarter. This trend will continue for the foreseeable future as many new construction starts either are underway or are in the planning phase with starts scheduled to take place in the upcoming 30-60 days. The mid-market has bucked the trend and was up over 50% from this time last year with 38 closed transactions in the previous 90 days. Demand also increased with showings up over 100% year over year. We expect this area to have robust sales numbers moving into the 4th quarter.

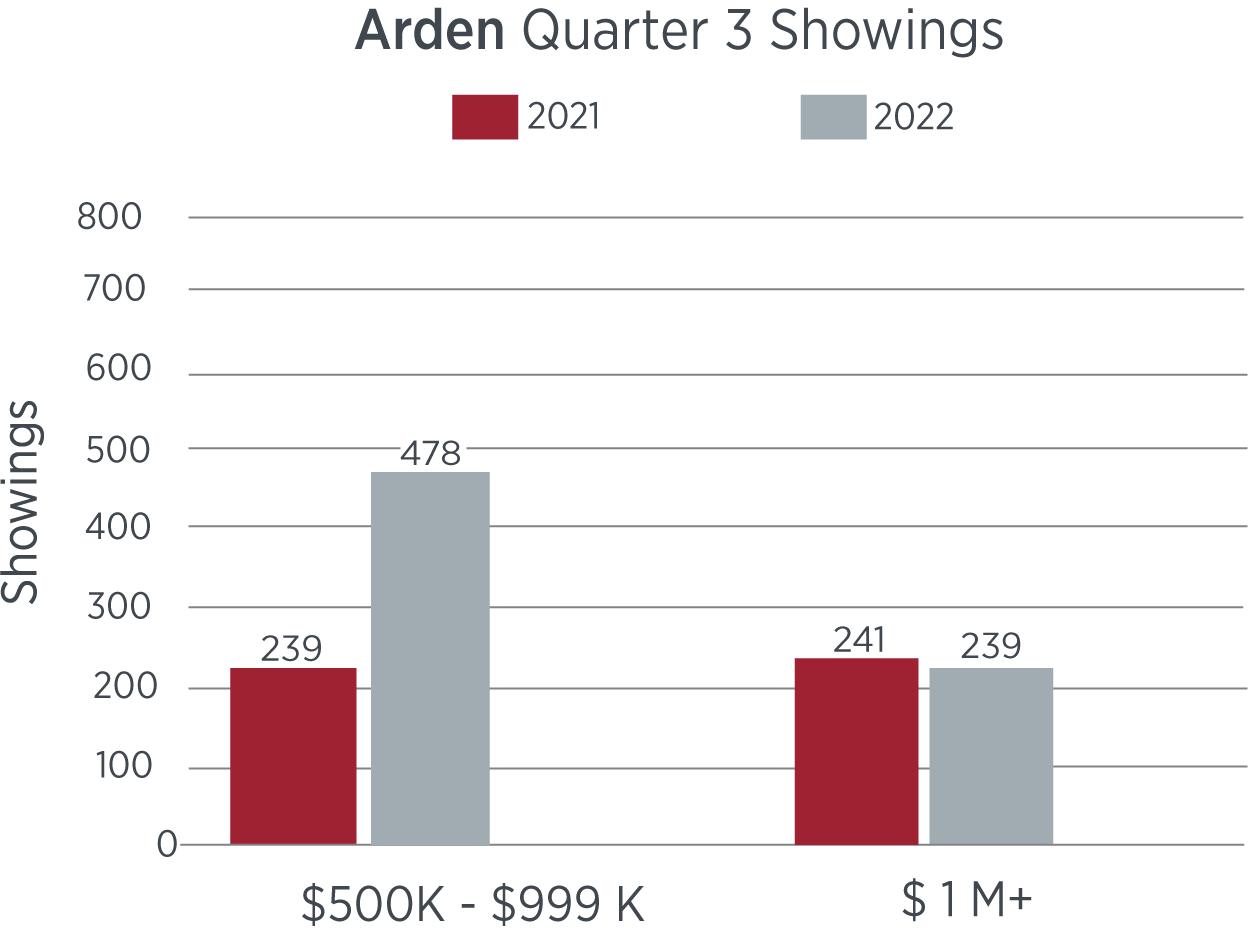

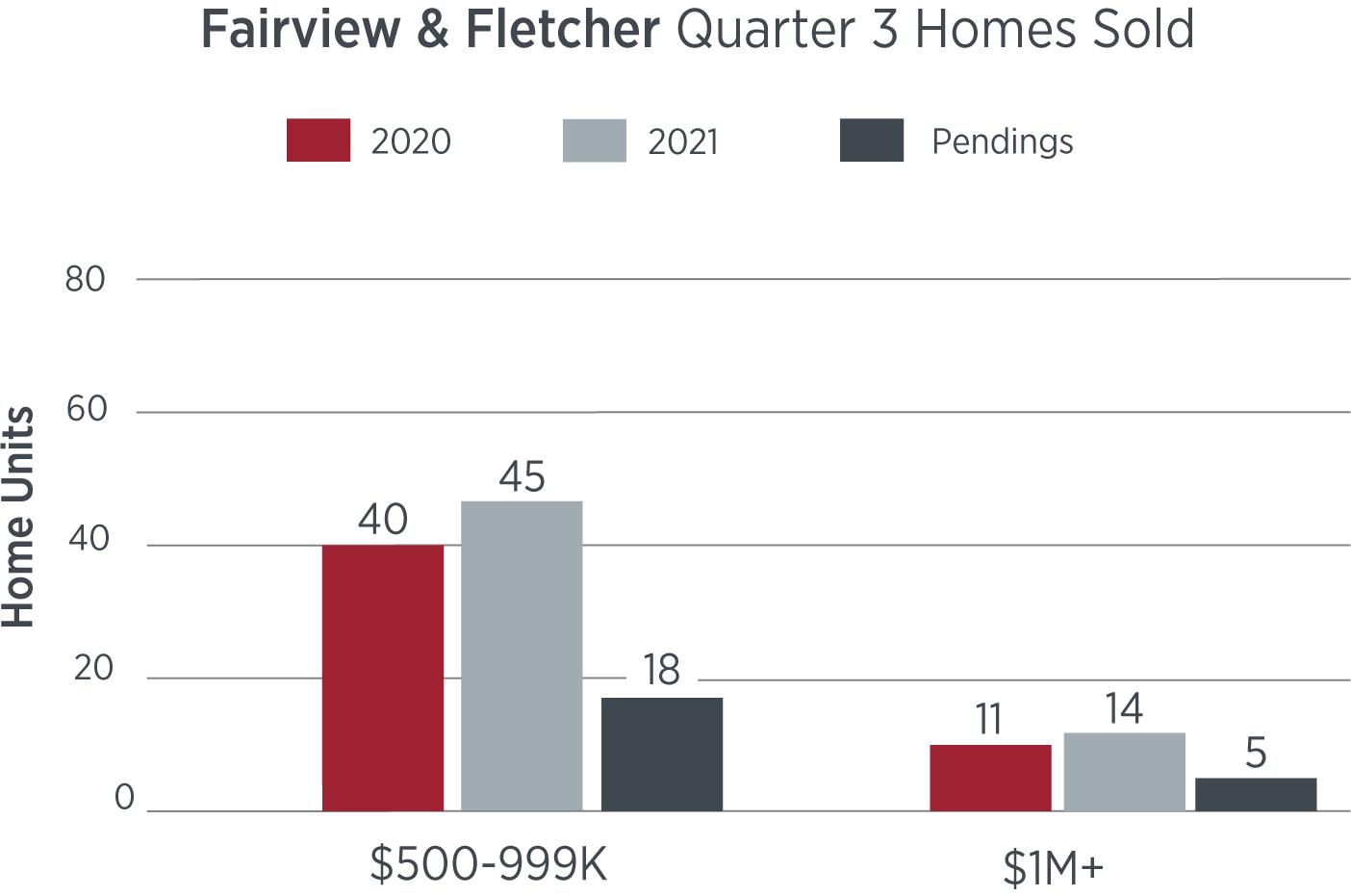

Both luxury and ultra-luxury are up in this area compared to the same period in 2021, posting a 27% increase in sales, while also having two ultra-luxury ($2M+) sales in the same time period. The mid-market has steadied and saw 45 home transactions as well as 18 currently under contract. Demand in this area has increased as showing activity rose by 36% year over year.

Arden

Fairview/Fletcher

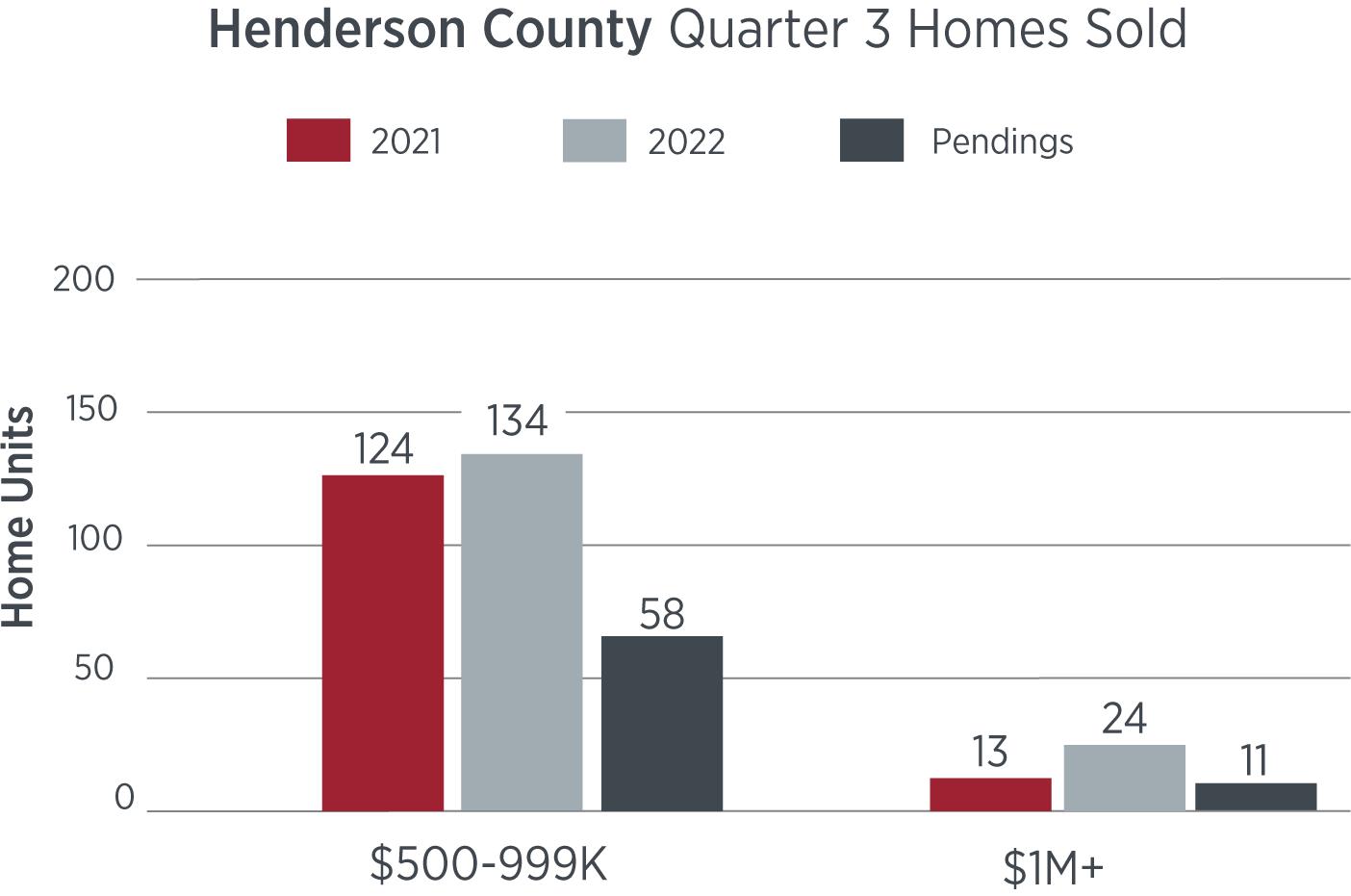

HENDERSON COUNTY

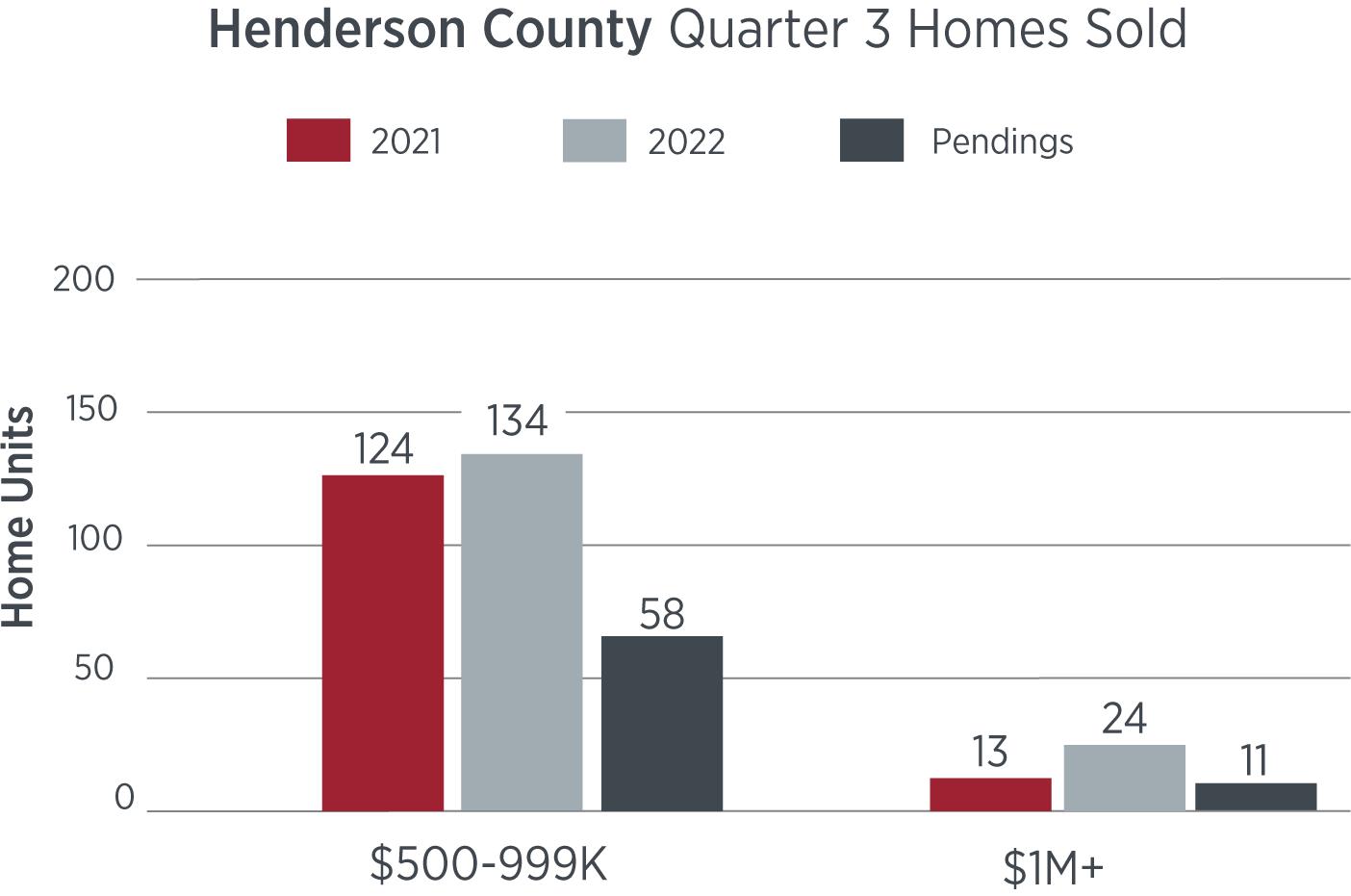

Sell-through in the luxury market of Henderson

County has posted an 85% increase as compared to the third quarter of 2021. As more migration pours into Henderson County, we foresee this area to be a hotbed for luxury sales moving forward. The midmarket saw a tempered increase with an uptick of 8% year over year. Pending sales were also showing strong results and should trickle down to the 4th quarter and beyond.

Henderson County

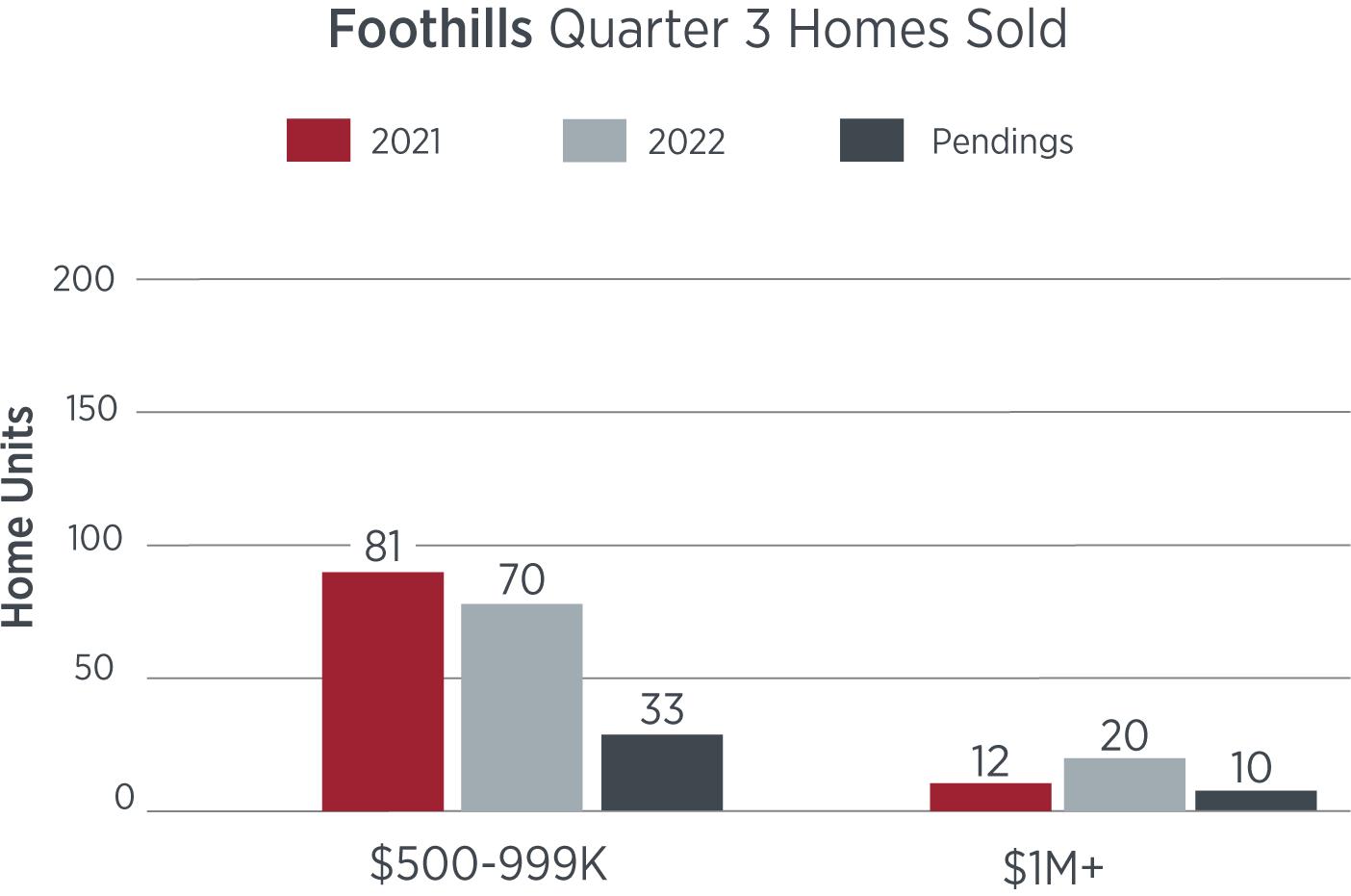

FOOTHILLS: POLK, RUTHERFORD, CLEVELAND COUNTIES

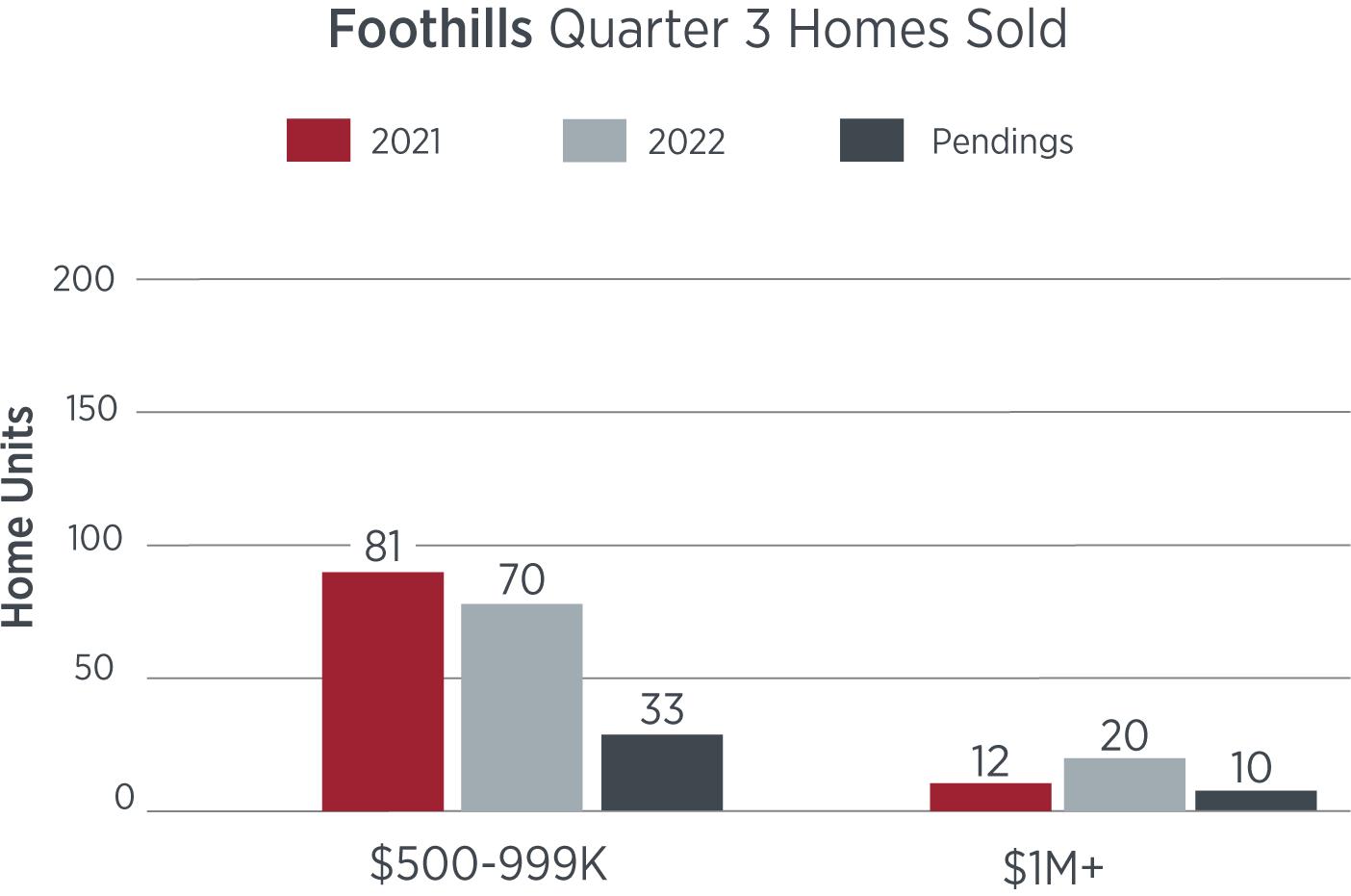

The Foothills market continued its rise as luxury home sell-throughs and showings were both up in the third quarter of 2022 vs 2021. Pending sales were also high and have set up a great fourth quarter for Cleveland, Rutherford and Polk counties. The mid-market was a mixed bag with sell-through off around 14% while showings in this price range were up 15%. As this region continues to grow, we expect to see luxury home sales proceed with an upward trend. Our expectation for the more price sensitive segment will be to lag in the coming weeks and months.

Foothills: Polk, Rutherford, Cleveland Counties

WESTERN NORTH CAROLINA MARKET FORECAST

While the days of pulling numbers out of the sky for home prices have certainly cooled, continued demand (particularly in the luxury and ultra-luxury ranges) provides an ongoing stream of buyers interested in Western North Carolina property Total showings have risen for the most part compared to last year, while days on the market have remained flat year over year.

To apply historic comparisons to the million dollar plus segment, the showing interest remains very solid when framed against historic standards. With the significant amount of low interest refinancing that has been done in recent years, this activity should limit inventory increases in the short term, which will in turn impact home prices. At some point, dynamics in both the public and private financial sectors may trickle down to luxury home buying activity if IPO and private equity paths to business cash outs remain constrained in combination with further deterioration in the public markets. For right now, access to accumulated capital along with high demand for the area continue to drive demand in Asheville and surrounding areas in the upper ranges of values. The mid-market ranges experienced a mixed bag of both increasing demand and declining demand depending on the location. Most of our geographic areas came into this summer ’ s real estate market with historically acute inventory shortages and, as a result, inventory will be a key indicator over the next 6 months.

IJB HOME SEARCH

Struggling to find what you're looking for?

Put Asheville's most experienced agents at your fingertips.

Listings Updated in Real Time Fast Search Results Direct Agent Communication

Where will you L E T U S H E L P Y O U N A V I G A T E T H E J O U R N E Y

center yourself next?

Our Offices

Asheville Office - Ivester Jackson Blackstream

18 S Pack Square

Asheville, NC 28801

(828) 367-9001

Charlotte Office

1515 Mockingbird Lane Suite 900

Charlotte, NC 28209 (704) 817-9826

Lake Norman Office

21025 Catawba Ave #101

Cornelius, NC 28031 (704) 655-0586

Lake Norman North Shore Office

350 Morrison Plantation Parkway, Suite C1 Mooresville, NC 28117

(980)-435-5169

Wilmington Office - Ivester Jackson Coastal

527 Causeway Drive

Wrightsville Beach, NC 28480

910-300-5140

LISTEN TO OUR PODCAST TODAY! Find us by searching CAROLINA LUXURY REAL ESTATE on Spotify, iHeart Radio or Apple Podcasts