CHARTER MARKET REPORT

JANUARY - SEPTEMBER 2022 OVERVIEW

The 2022 charter season has surpassed market expectations with bookings exceeding those of 2021, which was considered to be a record breaking year. After two years, where international travel was affected by covid related regulations, the appetite for vacationing abroad increased with clients looking to venture on yacht charters around the world. The 2022 winter charter season recorded robust activity and the summer season was stronger than 2021.

The purpose of this report is to provide a synopsis of the prevailing state of the charter market in 2022 and an outlook for the upcoming charter season. IYC is closely following the charter market and client trends, which are shaping the industry as a result of global events.

Irini Saranti Digital Growth Director

As the cost of goods and fuel in particular increase, clients are requested to pay a higher APA (35% or 40% versus 30% of the total charter fee) to cover the cost of provisions and running expenses for their charter.

The trend of booking last minute (less than thirty days prior to the embarkation date) is still apparent although not as strong as 2020 and 2021.

With fuel prices at a high, certain clients especially in the smaller yacht size segment, are favouring yachts that have a lower fuel consumption.

Yachts that employ fully vaccinated crew have gained popularity among clients who are still weary of Covid.

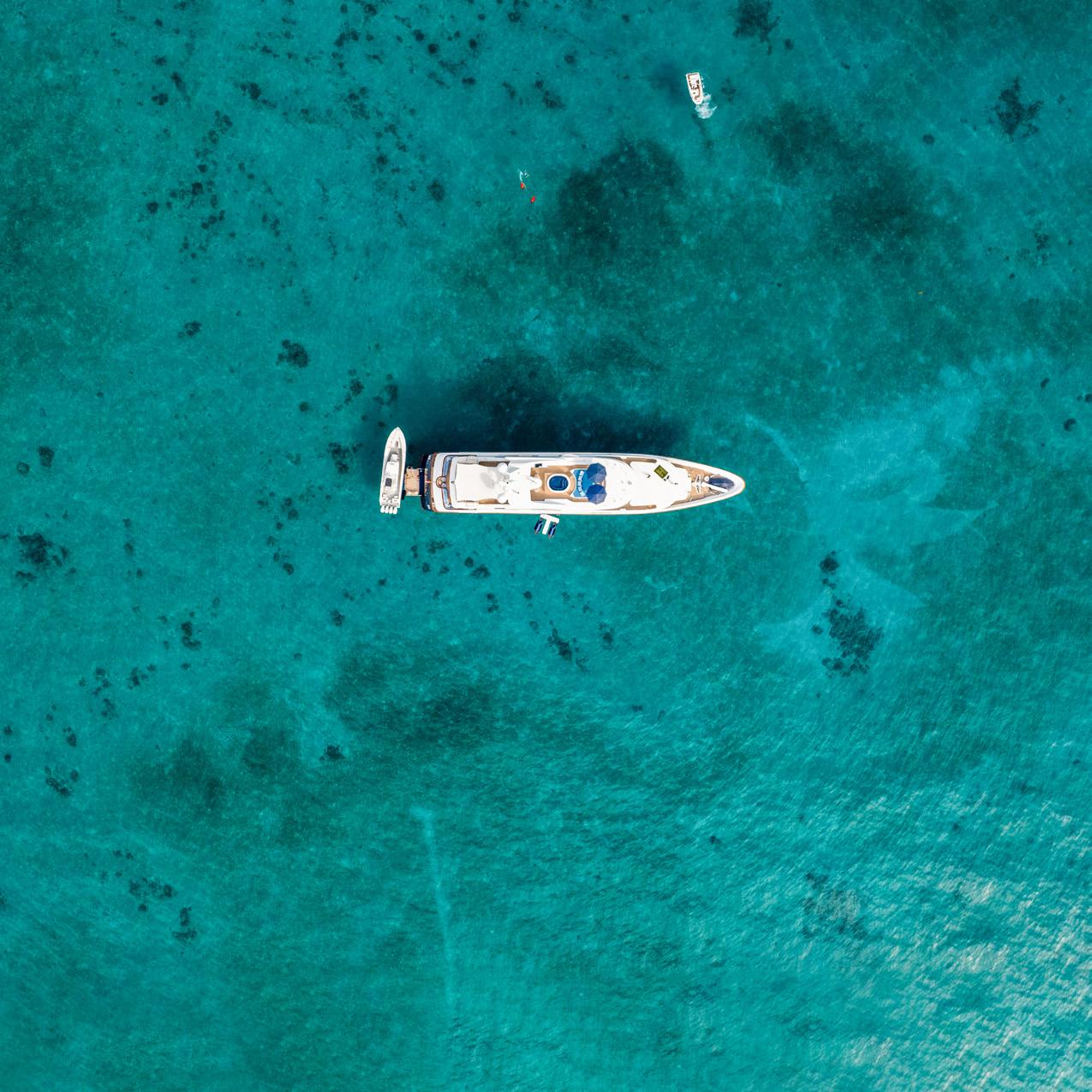

Yachts with a rich water toy collection have become even more popular. With certain charter clients selecting to visit more remote locations, toys are proving to be a great pastime.

The Mediterranean, which accounts for over 90% of total summer charters, recorded a +23% increase in bookings versus 2021, primarily driven by high activity among US based clients who returned to the region following two years chartering ‘closer to home’. The Bahamas and New England, which had seen a surge in bookings in 2020 and 2021, recorded a decline.

Despite a drop in requests during the first 10 days following Ukraine’s invasion, the war has not had a significant impact on the charter market. Turkey was one of the summer destinations to benefit, with several Russian clients choosing to charter in the area. This, coupled with the devaluation of the Turkish Lyra, resulted in a +49% increase in charters versus 2021.

With appetite for travel remaining high the charter market is already recording bookings for 2023, although at a slower pace.

The Caribbean and Bahamas are gradually building up their winter holiday calendars to reach last year’s levels, and the majority of 2023 summer bookings are in the East Mediterranean.

Destinations that can offer more ‘fuel efficient’ itineraries (eg. a charter in a cluster of islands closely located to each other) or have a favourable VAT structure, are expected to gain market share.

CRUISING TRAFFIC

OF

BOOKINGS BY LOCATION

PACIFIC NORTH WEST

Niche summer charter destination attracting US based clients.

*Source:

Steady bookings year round with a year on year increase.

NEW ENGLAND 1% FLORIDA BAHAMAS 7% CARIBBEAN 7% CENTRAL / SOUTH AMERICA

Winter destination with the highest number of bookings and a peak during the New Year’s period.

The most popular

the

with the majority of

in Greece, France,

and

CROATIA TURKEY FRANCE ITALY BALEARICS BAHAMAS CARIBBEAN NEW ENGLAND SOUTH PACIFIC INDIAN OCEAN SOUTHEAST ASIA

GREECE CROATIA TURKEY FRANCE ITALY BALEARICS BAHAMAS CARIBBEAN NEW ENGLAND SOUTH PACIFIC INDIAN OCEAN SOUTHEAST ASIA

The 2022 summer season (May - October 2022) recorded a +20% increase in charters compared to 2021, which was already considered a record breaking year.

Despite what may be called a challenging macroeconomic environment, bookings in the Mediterranean (90% of total summer charters) surpassed 2021 levels by +23%.

EAST MEDITERRANEAN: The region with the highest demand, accounting for 48% of total bookings and recording a +27% increase versus last year. Greece retained its position as the top charter destination globally, while Turkey also recorded an increase in activity this year.

• GREECE: Continues its positive growth trend, with 2022 charters having surpassed 2021 levels by +31%. Low rates in duty-free fuel and VAT favoured yachting activity in the country.

• CROATIA : Recorded a +11% increase in bookings versus 2021, however with slower activity in the 50m+ size segment.

• TURKEY: Charters increased by +49% versus 2021, driven by the Lyra devaluation as well as activity by Russian clients.

WEST MEDITERRANEAN: Although the region had a slower start, bookings picked up in May and June with charters surpassing 2021 levels by +19%. The region accounts for 47% of total summer charters. Number of yachts with bookings is higher compared to the East Mediterranean, but with lower average of weeks booked.

• FRANCE : Retains its position as the second busiest summer charter destination (21%), with stronger activity in the 60m+ as larger yachts made their crossing to the Mediterranean this year. Bookings increased by +22%.

• ITALY: Ranking third in terms of summer charters globally (19%), surpassed 2021 bookings by +22%.

• SPAIN (BALEARICS) : Market share reached 7%, while bookings increased by +8%.

BAHAMAS / NEW ENGLAND: Following a strong 2020 and 2021, driven primarily by US based clients, both areas recorded a slower summer season this year.

*Source: Yachtfolio. Yachts 20 meters and above. September 30, 2022

The 2022 winter charter season (November 2021 to April 2022) was active with 88% of bookings taking place in the Caribbean and the Bahamas. Like every year, the majority of charters were completed by US residents.

Bookings are gradually building up for the 2023 winter season (November 2022 to April 2023).

• 2022: Recorded a +12% increase in charter bookings versus 2021, which was already a very strong year for the region. The area was particularly busy during the holidays with a +26% increase in December charters.

• 2023 YTD: Winter charter season is slowly picking up. Following the Bahamas’ recent introduction of a 10% VAT (on top of its 4% tax), we anticipate that certain charter clients may favor the Caribbean, where in most locations there is no tax.

• 2022: Retained its position as the leading winter charter destination with a 53% market share and a +81% increase versus the previous year.

• 2023 YTD : Remains the leading winter yachting destination and is expected to have a strong season.

• 2022: With most countries still hosting strict travel regulations, the area remained at 2020 levels, a -70% decrease in charters compared to 2019.

• 2023 YTD : With most countries open for tourism the 2023 charter season is already performing positively.

• 2022: Charters in the area recorded a slight decline (-11%), with most occurring in the Maldives.

• 2023 YTD : Activity is expected to remain in par with 2022.

• 2022: The area recorded a slightly stronger season, with a +9% increase in bookings.

• 2023 YTD : Activity in the area is stable, so we expect this year to be in line with previous years.

*Source: Yachtfolio. Yachts 20 meters and above. September 30, 2022

OCEAN

charter fleet has been growing

year at a +6% rate. 2022 is expected to close at a +7%

with the fleet

also

costs due to inflation

make

over 2000

list

yachts for charter in order to offset increasing

above 20 meters available for charter. The year started with 1860 vessels in the fleet, Q2 closed at 1920 boats and by the end of Q3 the fleet has grown to 1960 vessels. This growth is driven by high charter demand on both sides of the Atlantic, an active sales market

the rise in fuel prices. In the current market environment

among buyers.

IYC is a leading company in the charter market, managing the largest superyacht fleet worldwide. We are proud to represent some of the best yachts on the market globally.

IYC manages the largest charter fleet across key cruising grounds.

In the IYC Charter fleet.

Since 2015.

For 2022 YTD.

For 2022 YTD.

Total value of Charter Fees booked for 2022 YTD.

has brought together an exceptional collection of charter yachts, with our fleet located in all key yachting destinations around the world, including the Bahamas, Caribbean, South of France, Italy, Balearics, Croatia, Greece, New England and Australia.

the course of the past years, the company has increased its fleet by +200%, with the addition of 86 superyachts. IYC has earned owners’ trust through the proven ability to maximize yacht bookings and successfully manage a growing fleet.

in

86 yachts added since 2015.

IT’S YOUR CHOICE. WE HELP YOU MAKE THE RIGHT ONE.