28 minute read

REFERENCIA

REFERENCIA FINANCING SPECIALISTS AT POINT OF SALE

BACKGROUND

Advertisement

REFINANCIA – the company where REFERENCIA was incubated – was founded in 2005. We knew right from the start that we had to be a “worldclass” institution, and understood that we could transcend and be comparable to sophisticated institutions that are respected and recognized for their impact in their industry. During this first phase we frequently included the word “dream” to capture the expected big goals that we established for our company.

The use of concepts like “world-class” and “dream” turned out to be useful because they helped us set aspirations that, at first, seemed impossible and even, some believed, irrational. But they ultimately reflected a business philosophy with high expectations and impactful results. We were not looking to build something small and temporary, but a relevant and influential business. Since the beginning of our business journey, we wanted to be seen as a “case study” associated with “high impact” entrepreneurs in our community, inspiring others to act and prove that doing things right can help go a long way. In communicating this message, the relationship we built with Endeavor1 was critical, as Endeavor supported our positioning in this ecosystem and also created space for our teams to connect with global talent, which was a source of inspiration for the company’s evolution expectations.

We initially developed a business platform within REFINANCIA around purchasing and managing non-performing loan portfolios (NPLs). When

1 Endeavor is a non-profit network that supports high-impact entrepreneurs. Endeavor inspires, supports and connects entrepreneurs so that they can become regional and global impact business owners. REFINANCIA is an Endeavor company since 2008, while Kenneth Mendiwelson became an Endeavor board member in Colombia in 2013. REFERENCIA is an Endeavor company since 2019.

buying NPLs, it was our intention to agree on solutions with clients that had defaulted on their payments. Individuals who had had issues with their loans were given a good quality service, and proposed a repayment agreement according to their needs, ensuring a personalized service.

Purchasing NPL portfolios required the company to design funding structures to move large amounts of capital. World-class players, including local banks, international banks, private equity funds, and Colombian private wealth entities were invited to participate. Over time, together with them, we achieved a robust and predictable models, which allowed for funding not only portfolio purchases from banks, but also new innovative businesses that we designed together.

In order to provide specialized solutions to delinquent loan clients, it was essential to develop an operating platform that would manage large amounts of individual loans, and build a commercial force that would be able to “connect” and offer payment alternatives tailored to each client’s needs. This platform required big teams that would negotiate financial solutions, as well as sophisticated analytics teams that would have to learn about our clients’ payment habits.

REFERENCIA:

Loans at Point of Sale

Very early in our business evolution, we understood that we had to find alternatives for the company to engage in loan origination processes for special niches, leveraging on the skills built during our initial phase – analytical sophistication to reliably predict loan payment behaviors; the understanding of clients’ needs in special niches; funding experience; and the culture of dignified client treatment. With these fundamentals, REFERENCIA was founded and, and as our offering gained traction, this origination business was spun-off, and our fintech with an innovative DNA was consolidated.

Aiming to have a relevant participation in the loan business, we thought that creating channels allowing access to niches with special needs was fundamental. Therefore, in 2012 an alliance was forged with Fenalco2 [National Trade Federation], aiming to leverage their strong merchant relationships, and their extensive knowledge and history of providing payment plan guarantees to their affiliated merchants. Fenalco had been supporting merchants with products that helped them finance sales, such as Fenalcheque and other guarantees. Being based on this platform’s expertise and track record was important for what we built later.

We understood that working through merchants we could provide a number of innovative differentiated alternatives to provide credit to individuals. On the one hand, we could get access to a distribution channel with high-capillarity; and, on the other, we could design Point of Sale loan solutions according to products or services bought by end consumers. In addition, we clearly saw that the Colombian merchants needed alternatives to finance buyers, and they were open minded, with the intention to try new models, considering the digitalization and transformation process happening across the sector.

2 A Colombian association of businesses of all sizes, from all sectors.

SPECIALIZED LENDING PRODUCTS

In REFERENCIA, an orderly loan product design and launch process was structured. Such products are integrated into Colombia’s local reality and executed with merchants and retailers as allies.

Li$to Pago-a-Plazos® In 2014, after completing testing, a flagship point of sale financing product known as Li$to – Pago-a-Plazos® was launched. This solution was designed to offer payment plans to buyers at points of sale. This product uses an online platform, and allows for loans to be immediately approved remotely or in-person, which makes it highly convenient for both sellers and buyers. Li$to Pago-a-Plazos approves loans to individuals who may need to pay in instalments, but do not want to use their credit card. This product is mostly intended for clients with special needs, such as self-employed individuals3, who buy their supplies from specific stores, and clients who buy durable goods or services whose price is relevant enough to affect their household finance4 .

3 Transport; construction professionals; clothing manufacturers, etc. 4 Mattresses, furniture, musical instruments, dental care, jewelry, etc.

Li$to Educativo The partnership with Fenalco also resulted in a strong relationship with the higher education sector, where Fenalco (and now REFERENCIA) has been present for over 20 years and has been a pioneer. We understood that a large number of students needed loans to pay for their tuition, deferring it through the term in which the education services are provided – usually one semester. We adjusted our offering to enable features for colleges and students that wanted to pay for their education over time. With Li$to Educativo, students can apply for a loan to pay for their semester in a matter of minutes right from home or at the college, at very competitive rates. Emerge / Working Capital Credit line After the economic crisis caused by the coronavirus, REFERENCIA, together with Fenalco, led an innovative idea aimed at supporting the reactivation of the merchant sector in Colombia: the Emerge Working Capital Credit line. This initiative consists of making funds available to self-employed individuals and legal representatives of small businesses for working capital on fair terms, with guarantees given by the National Guarantee Fund. People can access this credit product very quickly, as applications can be submitted through our online platform. Aiming to complete such a project in record time, REFERENCIA and Fenalco invited banks, government, and private sector to think big and join forces to work together on a common goal – supporting the small merchants to continue to move forward and bounce back from the crisis.

Fenalcheque Respect for the merchant’s habits has been a core principle in our story, and Fenalcheque is the best proof – a solution that is part of the way of doing business in the country since 1983. This alternative has allowed businesses to accept current dated and postdated checks without taking any credit risk. Although checks are not used as much, they still play a role in industries such as transportation, textile and communications. As commercial allies, we were committed to guaranteeing checks and worked to evolve our offer into a more convenient and more digital solution. Fenalcheque was and is a

springboard for more retailers willing to sell by instalments to evolve toward a better and more convenient products such as Li$to – Pago-aPlazos®.

Other Tailored Products One of our first specialized financing products was a credit card for clients who had defaulted on their credit, but had complied with a payment agreement on their overdue debt with Refinancia. This credit card sought to be a continuation of the relationship built with the client after a refinancing option was completed, and it aimed to offer a solution to those who were not allowed access to credit because of a recent negative credit report. This offer relied on the relationship built with a client in distress, based on “decent treatment”.

By having close ties with banks, we understood that some wanted to enter niches with subprime risk characteristics but, if they did it, they needed to distribute part of the credit risk. We designed a product that helped a number of banks provide higher risk loans – clients exceeding the approval score – by providing a guarantee in parallel to the loan.

We also found that large retailers needed to provide direct loans to their clients, but needed a specialist to help them take the credit risk and manage the product. This supported their goal of strengthening their loyalty programs and entering into new customer niches. We started with a pilot that helped the largest retailer in the country provide a line of credit to clients that had no access to formal loans, but wanted to buy appliances and other durable goods. So, we created a product to “buy now and pay later” at one of the most widely recognized and aspirational retailers in Colombia.

Then, we designed with a major home remodeling retailer, a type of loan that was launched for construction professionals, which allowed for working capital for anyone consistently shopping at the retailer’s shops and signed up for the retailer’s loyalty program. ***

REF CULTURE

Our business culture is a distinguishing pillar we feed and look after carefully. We use all kinds of tools to strengthen our culture; maybe our most representative habit is “energization”, as we call it, which consists of gathering all of our work teams from all cities together every Monday from 8 to 9 in the morning. Here we sing the company’s anthem, the best representatives are recognized, and the priorities for the week are informed; we allow for everyone to connect and participate. This space helped strengthen what we now call REF CULTURE – a way of interacting with each other and doing our work by following our 5 guiding principles: ethics, excellence, teamwork, energy, and efficiency. This business culture is one of the drivers motivating our employees to be part of a project that welcomes and makes them visible, where everyone is part of a higher purpose.

SEEMINGLY EASY FROM THE OUTSIDE

Each of our milestones is ambitious, extraordinary and complex, but with discipline we move towards meeting each milestone. From the outside, you can see a growth path; but from the inside, we have gone through a difficult, extreme and exciting process. We have been on the brink several times, but our higher purpose of writing a differentiated and inspiring story has motivated us to overcome any difficulty in the short term, with premises that protect our reputation in the long term. We are highly committed to our reputational capital and our business health. Ethics, as one of our guiding values, has set us on a path that is ours; we have taken huge risks, but have done it in a highly responsible manner.

FINTECH OF ORIGIN

From the beginning, at REFERENCIA, we have found it important to define our business vision and our history without losing sight of our origin and who we are. We respect our idiosyncrasy and we have adapted to the Colombian dynamics. We might say that REFERENCIA is a “fintech of origin”. This concept has led us to draw inspiration and learn lessons from local models, looking for objectives that can both set our course and contribute to the country. Being a “fintech of origin” means understanding that regardless of all of the technology and analytics we may implement to have more sophisticated processes and products, a strong genuine personal relationship with our stakeholders always comes first. In addition to our alliances with all kinds of entities, we have always aimed to create value for banks, associations, private companies and businesses from many sectors.

We understand the Colombian financial sector, and we work with banks to have access to a funding structures that support the products we are exploring. We have not only intended to achieve synergies to innovate, but we have also engaged in the orderly development of financial sector and entrepreneurship related institutions; we play a proactive role in entities such as Endeavor Colombia, Colombia Fintech and Colcob, not only as members, but also as Board Members.

BIG DREAMS

We have great aspirations because we believe that societies are reflected by our dreams; we believe that business influences the country’s progress, and we seek to be an example.

Therefore, in REFERENCIA, we think big and are continuously looking to innovate. We are committed to continuing on the path to go “beyond the obvious”, and to find opportunities that will benefit financial consumers across the country.

Today, our payment plans are provided through thousands of POSs, and hundreds of thousands of consumers, who need to pay for their purchases in instalments use our products every year... We will continue protecting and combining the interests of our allies – investors, banks and merchants that have supported us in this ongoing evolution process.

Gives you more

Gives you more

We are driving thousands of businesses and our community to a better future www.Puntored.co www.Puntopay.co

PUNTORED “GIVES YOU MORE”

Puntopay is the new technological solution for payment methods from Puntored, Fintech’s Colombian branch, which helps boost the growth of small businesses and independent professionals by providing financial services through innovative applications.

Founded in 2004, Puntored is one of the pioneering Fintech companies in Colombia. Our innovative shared value model is based on providing benefits to thousands of partner businesses, mainly shopkeepers (one of the mainstays of the daily economy, for the lowincome population in emerging economies) and micro-businesses that promote our services in every corner of Colombia. That is why our purpose is to support and facilitate the lives of millions of people at the base of the pyramid to access financial services. In addition to that, we generate additional income to thousands of shopkeepers throughout the national territory.

During our history we have been consolidating ourselves by stages and in each of them successfully developing and launching new

OUR CONTRIBUTIONS

USERS 7 Million

JOBS GENERATED 350

POINTS AWARDED AMONG THE LOWEST-INCOME CLASSES 90% Representing 86,04 of the population.

TRANSACTIONS 900K

Virtual Wallets

SALES. 750 Million USD

COVERAGE. 92%

of the National Territory

POINTS OF SALE 73.000

TRANSACTIONS 172 Million Puntored Products

products aimed at small traders who need to grow their businesses. At Puntored we have four lines of business:

LINES OF BUSINESS

• Collection of more than 12,000 public and private agreements • Nationwide incentive and payroll payments • Deposits and withdrawals from major banks and wallets • International money order payments • Shipping and payment of domestic money orders • Collection and payment of direct agreements • Money collection with dataphone • Payment link • QR Payments • PuntoCupo: Microcredits • Payment to suppliers • Recharge and purchase of mobile packages online • Online payment of public and private services

• Top-ups to all mobile operators • Major mobile operator data packages • Sports recharges • Dematerialized SOAT • Marketplace for the shopkeeper to expand his offer • Tool to create new digital channels • Business Intelligence and Analytics • It represents more than 70,000 stores in 7 major cities • Real-time decision making • Provides Help to shopkeepers to manage their business • My POS box with barcode reader. • Alliance with Servinformation*

Day by day we challenge the existing rules to create a network that excludes no one and connects everyone. To achieve this, we work hand in hand with those who are always willing to help the community; those who know each family and know what they need; who are always close and welcome anyone with a smile; who provide a reliable service that fills everyone with security. These are our allies; they are the vital part of our business; we not only connect them with the whole country, we also connect them with those they love and with the opportunity to help others.

We are a network that transforms businesses, that evolves and simplifies life through technology. A network that puts a bank in every corner, thanks to our correspondent banks, and that makes their lives and those of their clients more practical and simpler. A network full of easily accessible products, with simple, reliable and profitable transactions. And all performed from one place; because when we connect businesses and people, we create a better quality of life for everyone; we give people more time to do what they love, and we provide our partners with tools to grow as they have always imagined.

Our purpose is to support hundreds of thousands of small business owners and independent professionals who are struggling to be competitive in an increasingly challenging environment. We are innovating and generating new businesses on a daily basis so that businesses can offer new alternatives that will generate income and a greater number of people in their business in the long term.

We are committed to helping them in their formalization and connecting them to the opportunities that the digital world offers.

Based on the latest technology, in a robust, replicable, dynamic and efficient structure, we have our own agile and stable platform which performs more than 172 million transactions annually in more than 900 municipalities in Colombia. It is supported in a strong IT security system, tested and monitored by our partners in the financial sector, with certifications of secure IT operation from EY and KPMG; in addition to a solid operational and credit risk control scheme that includes the management and control of SARO, PCN, SARLAFT, IRF policy, and an Independent Risk Committee composed mainly of external advisors, partners and risk and audit directors that ensures the application of the best practices of the financial sector to our Organization.

MONTHLY FIGURES

Prepaid phone providers SOAT’s sold Million of sales

Million correspondent transactions

available collection agreements

correspondent service providers

sports betting transactions

Sales through e-commerce

Billion COP Volume traded

POS making reloads and package sales National coverage nationwide coverage deposit and withdrawal transactions in 6 wallets

integrated banks

CONEXRED S.A.S. Is born. •Integration of operators and cell phone recharges.

•First transaction in the history of Puntored. •Integration with

Redeban making

Mobile Recharge the first non-financial service to travel through a payment network •Launch of new administrative platform (CXR) and start of the process for the sales of recharges through

POS. •The new Puntored service portal goes into production, with more than one million dollars in transactions per day and new technologies for top-up sales.

•20,000 shopkeepers were reached

•More than 10 billion transactions per month and 26 products offered through our network.

•Launch of the new Puntored image •First Fintech company to offer subsidy payment services •We launch our first

Banking Correspondent service in alliance with Davivienda

•Selected as Endeavor

Entrepreneurs •A partnership with

DAVIPLATA is born and we become the first

Fintech company to make transactions with an Electronic Purse in

Colombia •Conexred Caribe is born: First operation outside Colombia:

Puerto Rico (700 stores) •Incorporation of national money orders, payment of remittances, and prepaid television services.

•Nº 1. Leaders in government subsidy payments with more than 800,000 transactions per month worth 150 billion pesos.

•Winners of the I3 Latam

Award as one of the 10 most important enterprises of social impact by New Ventures,

Ashoka and the Swiss

Cooepration Fund.

•Development of the MyCash POS application, where

Servinformación and Puntored are combined.

•EY Award to the best emerging entrepreneurs in

Colombia •We reached 1 billion processed transactions in Puntored’s history •Launch of Puntored

Store, integrated with the main e-commerce sites

•Integration of

Bancolombia in the second semester, achieving more than 40 thousand transactions.

•We become retailer aggregators for non-cash payment methods. •Integration with CB

Bank Scotiabank

Colpatria

•Launch of Cashin and

CashOut by Nequi

•We launched

SERVIPUNTO (Alliance with Servinformación) the most complete service of Information provision with information about

Neighborhood Stores and Minimarkets in

Colombia. •Launch of Puntopay

•With the integration of the banks of the Aval group, we offer the services of 9 banking entities in our points

•Puntored strengthens its electronic payment network with a $20 billion investment

•Integration with

Compensar: the first Family

Compensation Fund in the country.

OUR LINES OF BUSINESS BET ON THE GROWTH OF THOUSANDS OF COLOMBIAN RETAILERS

Puntomarket It is a tool for small and medium businesses, based on a platform that allows them to increase their sales and income with the marketing of products such as cell phone recharges, digital SOAT sales, prepaid TV, content, sports betting, among others.

In the year 2020, two new services are included in the Puntomarket Platform: a seller-center that allows shopkeepers to supply their businesses in complementary categories such as fashion, sports, home, accessories, among others. For several years now, Puntored has been the leader in this category, being the largest aggregator and marketer of virtual products in Colombia with a volume of nearly 700MM USD per year.

Another service, which was born at the time called Mercatiendas, is a digital platform that connects shopkeepers with consumers, allowing them to get their supplies without leaving home. Mercatiendas creates a virtual store for each shopkeeper where their customers can place their order and receive them at the door of their homes. It also makes it easier for storekeepers to accept Puntopay payments. We work together with large mass consumption companies to strengthen the traditional sales channels or Store to Store. An example of this is the Alliance with Bavaria, in the TlendaCerca. co program, which allows to bring buyers and sellers closer together and to place online orders by bringing technology to thousands of Bavaria shopkeepers. Additionally, Mercatiendas was selected to participate in the government program #YoMeQuedoEnMiNegocio (#IRemainAtMyStore) as a support tool in the crisis derived from the Coronavirus in 2020.

Puntobank Puntobank offers transactions from all major banks in one place. Puntored offers a specialized network of more than 4.000 banking correspondents covering 82% of the national territory who provide banking services of the most important financial institutions in the country (Davivienda, Daviplata, Colpatria, Bancolombia, Nequi, Agrario, Giros y Finanzas, Popular, Banco Bogotá, Av Villas, Banco Occidente). We think about our clients’ time and our line of services allows users to carry out different types of transactions without going to a financial institution. At Puntored they can make payments for public and private services, deposits to accounts and withdrawals from the most important wallets in the country, thus achieving the bancarization of thousands of users who did not use technological tools before.

Since 2011, Puntored has made available the proceeds of government subsidy payments from the Elder Colombia, Youth in Action, VAT Refund, Solidary Income, Solidary Bogota at Home, Families in Action, and Victim Unit programs to the network of correspondent points. This has made Puntored a simplified payment option for many financial institutions and the best alternative to reach the beneficiaries.

This line of business turns the shopkeepers into specialized collection centers and ATMs of the community, and the corner store is now a recognized point of reference that provides innovative, different and alternative services for the sale of its products.

Puntopay A new technological solution that enters the market with a varied portfolio of financial services aimed at individuals and businesses. It facilitates

transactions and receipt of any means other than cash, easily, quickly, safely, at any time and anywhere.

Puntopay is a mobile application born in 2020, which seeks to make people’s lives easier and contribute to the growth of our businesses and partners, digitizing their business and betting on the new changes that drive the economy today.

With Puntopay we seek to reach shopkeepers, small retailers, hairdressers, miscellaneous stores, stationers, drugstores, Internet cafes, entrepreneurs, mass consumption companies and people interested in digital payments.

There are different payment solutions within Puntopay:

Payment Link: a tool that facilitates the process of receiving and sending payments for products and services, with all cards and PSE, easily, quickly and securely, without the need for web pages, long subscriptions, or complicated implementations. The purpose of this solution is to provide alternatives to retailers to increase their sales and facilitate the process of collecting payment for their products or services.

Our Payment Link is aimed at retailers, independent professionals and anyone who wants to make payments by credit or debit card.

To use the Puntopay Link, the retailer or person interested in receiving payments must download the Puntopay App in Google Play, register and activate the Link Payment service by following the steps. Once the service is activated you can share the Link through WhatsApp or copying and pasting it to share it as you wish. In the case of the client who receives the link sent by the seller, complete the details of the form, select the payment method (credit or debit card), proceed to make payment to the retailer and that’s it! Both the retailer and the customer receive a transaction confirmation notification.

Mpos or Puntopay Dataphone: acceptance of credit and debit cards through Puntopay dataphone operated through the application.

Puntopay fits the businesses needs offering a clear, transparent, easy and fast value proposition. A retailer can acquire the Puntopay dataphone for a single value, there is no minimum transaction or monthly fee, the device can be used at any time and in any place thanks to its small size and easy functionality.

Once purchased, the retailer activates the service to receive payments in the Puntopay mobile application by following the steps. The activation of the service is done immediately; once this process is completed, the dataphone is linked to the mobile device via bluetooth, and you are ready to start managing the business’ payments, view all transactions and have a detailed report of sales.

It will be possible to send the receipts of the transactions made by each client electronically; thus, eliminating the expenses in stationery and minimizing the environmental impact.

With this product, Puntopay seeks to reach retailers and independent professionals who do not yet receive card payments because of concerns about high costs, and the belief that implementation difficulties and lengthy processes are involved.

QR Payments: continuing with the implementation of a wide portfolio of payment methods, Puntopay makes the access to payments through QR code on location and remotely.

This service, like the others, is accessed through the Puntopay mobile application and its activation is immediate. The retailer can share his code digitally or display it at his point of sale to receive payments easily and quickly.

PuntoCupo and Vendor Payment: With Puntopay we not only seek to offer the small retailer the ability to receive and make electronic payments, we have also generated the possibility for them to access a microcredit charged to their Puntopay account to increase their working capital, pay their vendors and make transactions within the application.

This product not only benefits the retailer, but also adds value to the supplier and/or mass consumption companies.

The product provides an innovation that facilitates payment to suppliers through the application: Reduces the capacity of fraud or theft to the distributor or supplier by not handling cash when payments are made electronically. Minimizes the number of visits of the carrier to the store to verify if it has the cash payment; which implies a reduction of costs and travel times. It has the possibility of increasing the stores dropsize. It has a clear account model, which generates efficiency in the revision of who made the payment and when, avoiding the handling of physical invoices and money counting, this helping to gain time in the operation.

Value Added Services in the Payment App: At Puntopay we have developed an environment for retailers or anyone to sell or top up and buy prepaid packages from different mobile companies and TV suppliers. Retailers are able to offer their community the payment of utilities, make money orders, etc. All these services help to generate income to shopkeepers and retailers.

Puntored is betting on this new solution to continue providing its network of allies new technologies and contributing to the growth of their businesses.

SERVIPUNTO Servipunto was born in 2016 from an alliance between Puntored and Servinformación (Colombian company with more than 19 years in the market, expert in consulting, information gathering, development and implementation of Geographic Information Systems). The alliance provides a service to support large companies in business decision making. Our clients include manufacturers and distributors, banks and telecommunication companies, who through information processing and data mining, can align and structure their efforts to meet the demand and needs in the traditional channel, offering effectiveness in decision making and strategy implementation.

Servipunto has a specialized team of experts in analysis, data scientists, statisticians, among others, who transform more than 3.5 million pieces of data obtained monthly into sophisticated analysis and control panels.

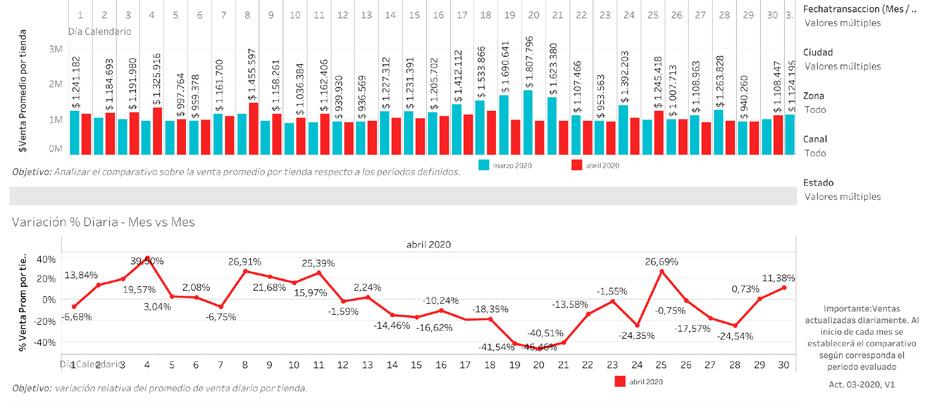

MyCash: Average Daily Sales Per Store Daily Comparison - Current Month vs. Immediate Past Month, 2020.

$ Venta Promedio por tienda $ Average sale per store

Objective: To analyze the comparison of average sales per store over the defined periods

marzo 2020 March 2020 abril 2020 April 2020

% Daily Variation - Monthly

% Venta Promedio por tienda Average sales per store

Objective: Relative variation of average daily sales per store

April 2020

April 2020

Transaction Date (Month/Multiple values)

City: Multiple Values

Zone: All

Channel: All

Status: Multiple Values

Important: Sales are updated daily. At the beginning of each month the comparison will be established as it corresponds to the evaluated period. Act. 03-2020, V1

Ticket Promedio Average Ticket

Objetivo: Comparar los ticket promedio de desembolsos sobre los periodos definidos.Objective: Compare average disbursement tickets over defined periods

Share % accumulated sales by time slot – Month vs. Month

% del total venta % of total sales Franja Horaria de venta Sales time slot

Objective: Establish sales execution analysis by time slots

marzo 2020 March 2020 abril 2020 April 2020

Servipunto was created out of the need to provide more timely and accurate information on mass market trends in the traditional channel to product manufacturers. The benefits for these large companies include: Changes in the behavior of the final consumer. Timely information for decision making. Change in the relationship with the consumer. Evaluate market share and evolution of the competition. Convergence of cutting-edge technology in non-proprietary languages with value-added tools. Real-time information on market behavior

Among the benefits of SERVIPUNTO for the shopkeeper, it is worth mentioning: Integral Management of the Store (Sales, Inventory, Orders, Customer Administration, Portfolio). “Business Intelligence”. “EASY” business knowledge. Access to special offers. Advanced integration with suppliers and distributors. Permanent training.

Puntored today is consolidated as the Fintech company with the greatest variety of digital products for its network of affiliated stores. It currently has 73,200 points of service throughout the country. During its 15 years of operation, its portfolio has diversified not only in cell phone recharges but also in strengthening its financial services and products, each one of them focused on the different needs of the population. Social Puntored Every day we work so that our solutions contribute to the improvement of the community and generate a positive change in society.

Month by month we deliver subsidies to the elderly, to the victims of violence and to the homes with children in school for their health and education; and during the country’s situation with Covid-19, Puntored’s network of correspondents, through the alliances with Banco Davivienda, Nequi and Banco Agrario managed to make more than 150,000 payments of government programs in 47% of the country’s municipalities (VAT refund, Solidary Income, Solidary Bogota at Home, and Vital Bonus).

I DY PAYMENT S SU B

Puntored evolves and supports stores to digitize and have a new method of customer service through the technology platform MARKETSTORE that connects businesses with thousands of users. We have the support of large companies that share our dream of supporting shopkeepers, such as Davivienda, Credibanco, Nutresa and Bavaria (among others) to digitally transform thousands of retailers.

MARKETSTO R E

As a reference of information during the current situation, SERVIPUNTO, an Alliance with the company Endeavor Servinformación, supports the manufacturing and distribution brands, through information processing and data mining, so that they can align and structure their efforts to meet the demand and needs in the traditional channel, offering effectiveness in decision making and strategy implementation.

In this way Puntored continues its amazing growth track and positionings its various products. It will continue to help and facilitate the work of thousands of small shopkeepers in the country.