Overview of Terms and Elmhurst Submarkets

CLOSED:closed transaction reflecting the final sales price (does not include any seller credits)

CONTRACTED:contingent or pending transaction reflecting the latest asking price

CONTRACT TIME:number of days between the first list date and the contracted date (does not include time from contract to close)

HOME INVENTORY:number of homes currently available for sale

MEDIAN:middle value of a given dataset (all report values are medians, which are less impacted by outliers than averages)

PRICE DISCOUNTS:percentage difference between the initial list and recorded sale price

PRICE PER SQ. FT:ratio of the price to the square footage of a closed transaction as a relative price measure (factors in home size)

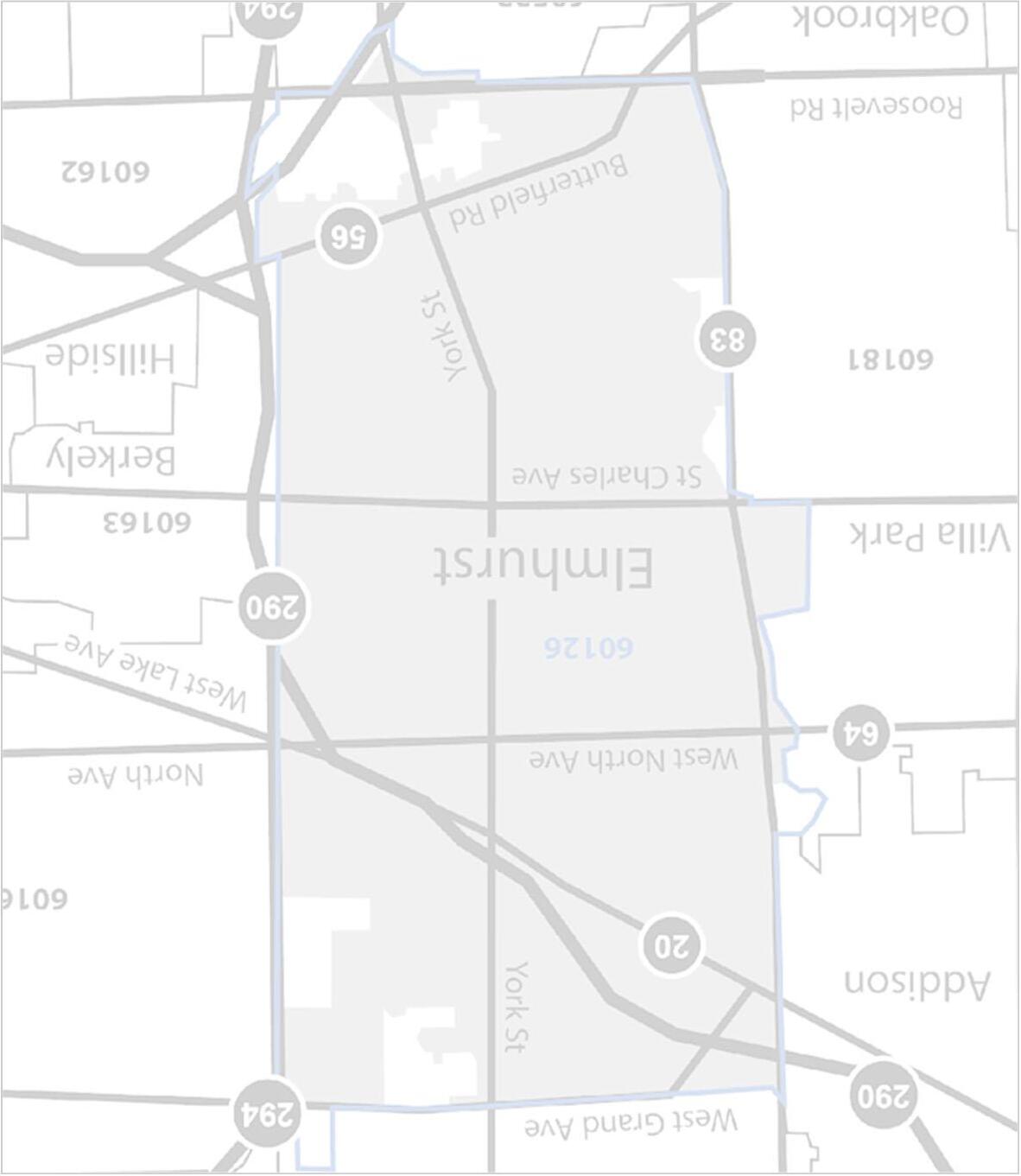

NORTHWEST

(North Ave. to Lake St. and Rte. 83 to Hwy. 294)

CENTRAL WEST

(Prairie Path to North Ave. and Rte. 83 to York St.)

SOUTHWEST

(Prairie Path to Butterfield Rd. and Rte. 83 to York St.)

NORTHEAST

(Lake St. to Grand Ave. and Hwy. 294 to Rte. 83)

CENTRAL EAST

(Prairie Path to North Ave. and Hwy. 290 to York St.)

SOUTHEAST

(Prairie Path to Butterfield Rd. and Hwy. 290 to York St.)

“Seller’s Market” Continues into the Spring with Very Low Home Inventory

Prices moved much higher; relative prices per sq. ft. setting new records in most areas

By Price Range

New listings declined more than 25% in Q1; all price ranges were lower

January and March were both 35%+ lower with February only about 5% down

Homes priced $1M+ remain higher over the last 12 months with prior increases

Listing activity expected to pick up with seasonal trends, but remain low near-term Jan. –Mar. (YoY%)

Rolling Last 12 Months (YoY%)

New listing activity was mixed across submarkets during the quarter (3 areas higher / 3 areas lower)

Central areas and Southwest were down in Q1 and are experiencing historical lows over the last 12 months

Northeast is the only area with more listings over the last 12 months

Contracted homes decreased over 30% in Q1; all submarkets were lower

January and March were down significantly (40%+) more than offsetting the nearly 10% increase in February

Homes $1M+ were up over the last 12 months

Contract activity was mostly lower across areas for the quarter, except the Northeast (up only 1 contract)

Despite the soft quarter, Central East and Southwest are the only areas lower over the last 12 months (Central West was flat)

Northeast and Southwest contract activity remain more than 50% below their postpandemic highs

Closed homes decreased over 10% in Q1; homes priced $1M+ more than doubled, but it was not enough to offset other declines

Closings started the year up in January (15%+), but weakened as the quarter moved ahead (March was down nearly 25%)

Closed home sales were mostly lower across submarkets; Northeast was up (only 2 homes) and Southeast was flat

Northeast continues to climb (now up 60%+) over the last 12 months; Northwest also higher during this timeframe

Southwest and Central East have not yet bottomed following the significant declines over the last couple years

Available homes declined over 30% and remain at 15+ year lows for this time of year

Inventory is very limited for homes priced under $1M; homes over this value represent nearly 60% of all inventory Scarce inventory expected to continue driving “seller’s market” conditions

Home inventory is very low across areas; certain submarkets still showing declines, but others appear to have bottomed

Most Elmhurst areas have only a handful of homes available (4 of the 6 submarkets)

Northwest and Southeast have a higher relative share than normal with each of these areas gaining some inventory

Contract times were down in the quarter, except homes priced $700K –$1M (this range had the fewest contracts and closings though)

Elmhurst submarkets also showed lower contract times over the last 12 months; only homes priced over $1M were flat

Expect contract times to remain short with very limited home availability

Contract times during Q1 were mixed, but mostly lower (4 of 6 areas declined)

Submarkets experienced large percentage changes due to low day counts (i.e., a day or two change was a big relative move)

Homes on the market much beyond a couple weeks are likely overpriced or have other factors impacting time / interest

Jan. –Mar. (YoY%)

Southwest 79-22%

Southeast 2410140%

By Price Range

Sales mostly closed at 98% –99% of original listing price for Q1; homes under $400K sold at wider discounts over the last 12 months (need work or being torn down for re-build)

Multiple offers are situation-specific; homes receiving many offers were underpriced or at a price range with very limited inventory

Price discounts expected to remain narrow given limited home inventory

Jan. –Mar. (YoY%)

Price Range'24'23%

<$400K 98%94%4%

$400K - $699K 99%98%2%

$700K - $999K 98%99%-1%

$1M+ 99%99%0%

Rolling Last 12 Months (YoY%)

Price discounts have been similar across submarkets (especially over the last 12 months), but there is always some variability

Most discounts narrowed some in Q1; Northeast widened on the fewest closings (Central West was flat)

Buyers and sellers typically met at a small (1% –2%) discount during Q1 overall

Jan. –Mar. (YoY%) (-1%)

Submarket'24'23%

Northwest 99%95%4%

Northeast 97%100%-3%

Central West 98%98%0%

Central East 98%98%1%

Southwest 100%99%1%

Southeast 99%97%2%

Price per sq. ft. trend was higher across all price ranges in the quarter

All price ranges currently at record price per sq. ft. levels for any historical quarter as well as over the last 12 months

Prices continue to increase based on very low home inventory and buyer demand

Jan. –Mar. (YoY%)

Price Range'24'23%

<$400K $329$24435%

$400K - $699K $309$28210%

$700K - $999K $305$27411%

$1M+ $371$3545%

Mostly higher relative prices across areas for Q1; only Central West showed a small decline (just 2%)

Majority of submarkets setting new records (4 of 6) over the last 12 months

Southwest had the highest prices per sq. ft. during the quarter as well as over the last 12 months

Jan. –Mar. (YoY%)

Submarket'24'23%

Northwest $344$25237%

Northeast $309$22637%

Central West $316$322-2%

Central East $332$27919%

Southwest $372$28232%

Southeast $346$29019%

Northwest Northeast Central West

Central East Southwest Southeast

Sale prices are were mostly higher across submarkets (Central West saw a small decline consistent with relative prices)

Central East showed a 55%+ increase in closed sale prices in Q1 and now has the highest overall prices over the last 12 months

Despite mix impacting sale prices, they are moving consistently with price per sq. ft. K

Northwest Northeast Central West

Central East Southwest Southeast

Jan. –Mar. (YoY%)

Submarket'24'23%

Northwest $560K$340K65%

Northeast $371K$350K6%

Central West $615K$637K-3%

Central East $800K$513K56%

Southwest $725K$480K51%

Southeast $598K$488K23%

K

K (+23%)

K (+20%)

K (-12%)

K (-10%)

K (0%)

K (-7%)

Over 1,300 new home permits since 2010; Elmhurst continues to be the most active new construction market in the western suburbs

Permits appear to have bottomed after a soft 2023; demos are outpacing early in the year which should lead to more new homes

New Home Permits Issued Demo Permits Issued

Analyzing Western Suburb Markets

SuburbMedian PriceQ1 YoY%Price / Sq. Ft.Q1 YoY%Contract DaysQ1 YoY%

Clarendon Hills$735K-42%$30629%5-86%

Downers Grove$530K20%$2371%10-57%

Elmhurst$588K22%$33621%12-33%

Glen Ellyn$520K9%$26914%11-31%

Hinsdale$1.6M75%$37125%21-5%

La Grange$725K35%$3089%5-69%

Lombard$353K8%$24817%11-35%

Oak Brook$1.2M35%$29520%14-77%

Western Springs$718K6%$35019%5-50%

Wheaton$473K11%$26421%7-42%

Elmhurst Office

103 Haven Road Elmhurst, IL 60126

Compass is a licensed real estate broker and abides by federa l, state and local equal housing opportunity laws. All materialpr esented herein is intended for informational purposes only, is compiled fr om sources deemed reliable but is subject to errors, omissions, and changes without notice. Sources include Midwest Real Estate Data LLC. This is not intended to solicit property already li sted. Closed Volume based on MLS market share, includi ng off-market sales, from 4/1/23-3/31/24. #1 Compass Team in DuPage based on MLS Market Sh are, including off-market sales, all property types, from 4/1/2 3-3/31/24.