Q2 2022

LOCAL REAL ESTATE GUIDE Q2 2024

HINSDALE

HINSDALE LOCAL REAL ESTATE GUIDE

Q2 2022

LOCAL REAL ESTATE GUIDE Q2 2024

HINSDALE

HINSDALE LOCAL REAL ESTATE GUIDE

CLOSED:closed transaction reflecting the final sales price (does not include any seller credits)

CONTRACTED:contingent or pending transaction reflecting the latest asking price

CONTRACT TIME:number of days between the first list date and the contracted date (does not include time from contract to close)

HOME INVENTORY:number of homes currently available for sale

MEDIAN:middle value of a given dataset (all report values are medians, which are less impacted by outliers than averages)

PRICE DISCOUNTS:percentage difference between the initial list and recorded sale price

PRICE PER SQ. FT:ratio of the median price to the median sq. footage of a closed transaction as a relative price measure

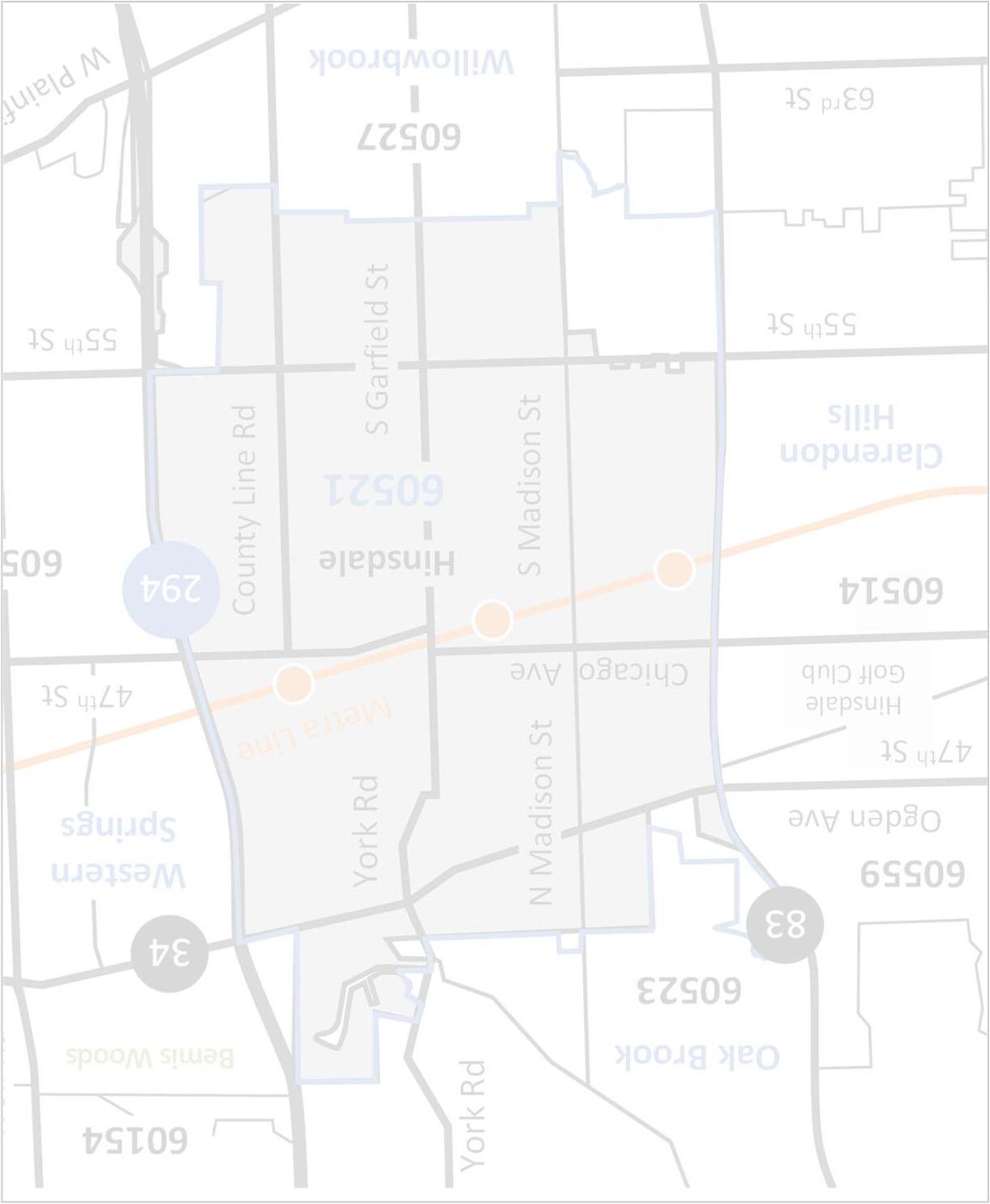

(Rte. 83 to N. York Rd. / N. Garfield St. and Ogden Ave. to W. Chicago Ave.)

(Rte. 83 to S. Garfield St. and W. Chicago Ave. to W. 55th St.)

(Hwy. 294 to N. York Rd. / N. Garfield St. and Ogden Ave. to E. Chicago Ave.)

Hwy. 294 to S. Garfield St. and E. Chicago Ave. to E. 55th St.

(South of 55th St.)

“Seller’s Market” Continues into the Summer with Very Low Home Inventory

(Q2)

2 weeks or lesstime to contract across

South area was longer in Q2

By Price Range

Listings increased nearly 5% in Q2; mixed quarter across price ranges (3 higher / 3 lower)

Meaningful variability each month as April was flat and then a large May jump (85%+) followed by a big June decline (~40%)

Listing activity expected to slow some due to seasonal trends and remain low near-term

–Jun. (YoY%)

Price Range'24'23%

<$500K 42100%

$500K - $999K 2326-12%

$1M - $1.49M 322528%

$1.5M - $1.99M 3133-6%

$2M - $2.99M 1722-23%

$3M+ 126100%

Hinsdale submarkets also varied during the quarter (3 higher / 2 lower)

Northwest and Central East have now moved higher over the last 12 months with recent increases

South listings remain very low (down the most in Q2 and over the last 12 months)

Northwest Northeast Central West Central East South

By

Contracts were up 15% during the quarter driven by homes priced $1M –$2M and $3M+

Most of the last 12 months of contracts for homes <$500K occurred in Q2; ranges higher in the quarter are also up over the last 12 months

Contracts will continue to be limited by low listing activity and a shortage of inventory

Range'24'23%

94125%

Contract activity was higher across all submarkets in Q2, except South (flat)

Central West chart-topping increases began in 2019 and continued to mid-2021 before large declines (now flattening)

South area has consistently lower overall home activity (and declined the most over the last 12 months)

Northwest Northeast Central West Central East South

Closed homes increased nearly 15% in Q2 driven by higher closings above $1M

Very difficult to close on a home for under $500K (averaging less than 1 per month); closings for homes below $1M currently at historical lows over the last 12 months

Closings likely to increase more near-term from additional contract activity

Range'24'23%

63100%

Closed activity was mixed across areas during the quarter (3 higher / 2 lower)

Central West has the most closings despite another decrease in Q2 and the largest decline over the last 12 months

South area is less than half of any other submarket (averaging about a close a month)

Northwest Northeast Central West Central East South

By Price Range

Available homes declined more than 30% on already very low inventory

Overall home inventory is down ~85% from June 2020 (incredible!)

Limited inventory expected to continue driving “seller’s market” conditions

Home inventory is down materially across submarkets; only Northeast area is flat

All submarkets currently have fewer than 10 homes available

Low inventory expected to persist over the coming months

Northwest Northeast Central West Central East South

Northwest Northeast Central West Central East South

Days between listing date and contract signing varied by price range, but overall time was mostly lower

Homes priced $1M –$1.5M took a day longer in Q2 and this is the only price range that increased over the last 12 months Overall contract times shortened more in an already fast-moving market

Apr. –Jun. (YoY%)

Price Range'24'23%

<$500K 770-90%

$500K - $999K 611-45%

$1M - $1.49M 6520% $1.5M - $1.99M 810-20%

$2M - $2.99M 1016-38%

$3M+ 1422-36%

Contract times were mixed in Q2 across submarkets (3 longer / 2 shorter); South area days more than doubled

Central submarkets were very quick during the quarter at under a week

Only the Northwest area has longer contract times over the last 12 months

Northwest Northeast Central West Central East South

Closed price discounts tightened overall during the quarter (despite some variability)

Homes priced $1M –$1.5M sold at full price in Q2 and this was the only price range with no discount during the last 12 months

Price discounts expected to remain narrow due to limited home availability

Price Range'24'23%

<$500K 96%90%6%

$500K - $999K 99%98%2%

$1M - $1.49M 100%101%-1%

$1.5M - $1.99M 97%99%-1%

$2M - $2.99M 100%98%2%

$3M+ 93%94%-1%

Price discounts narrowed during the quarter in most areas with the Central submarkets at or near full asking price

Northern and South areas closed with the widest discounts during Q2; however, South is the narrowest over the last 12 months

Transactions mostly closing with a small discount (but some cases full asking price)

Apr. –Jun. (YoY%)

Northeast Central West Central East South

Relative prices often increase with absolute prices, but this trend wasn’t consistent in Q2

Homes priced $1M –$1.5M declined slightly for the quarter and this range is also down a little over the last 12 months

Relative pricing has been supported by limited home inventory and buyer demand

Apr. –Jun. (YoY%)

Price Range'24'23% <$500K $334$360-7% $500K - $999K $313$28211% $1M - $1.49M $312$315-1%

$1.5M - $1.99M $346$30513%

$2M - $2.99M $381$3761%

$3M+ $557$5580%

Hinsdale submarkets experienced mostly higher relative price trends in Q2 (3 areas increased / 2 areas decreased)

South set records over the last 12 months; other areas were also higher during this timeframe, except Northeast (flat)

South area expected to normalize some with more data (only 3 closings in Q2)

By Submarket

Overall sale prices were up meaningfully across Hinsdale submarkets; Central East jumped to more than $2M in Q2

Northeast and Central West showed sale price increases (due to mix) despite relative price per sq. ft. declines in the quarter

Closed sale prices should be reviewed with price per sq. ft. to gauge overall trends

Northwest Northeast Central West Central East South

Overall closed sale volume for single-family homes increased nearly 30% in Q2, but is only modestly higher over the last 12 months

Eastern submarkets saw the largest increases in the quarter; South area is up the most over the last 12 months

Despite another soft quarter, Central West remains the largest closed sale volume area

Apr. –Jun. (YoY%)

Northwest Northeast Central West Central East South

Analyzing Hinsdale Home Types for Q2 2024

Hinsdale Office

One Grant Square #201

Hinsdale, IL 60521

Compass is a licensed real estate broker and abides by federa l, state and local equal housing opportunity laws. All materialpr esented herein is intended for informational purposes only, is compiled fr om sources deemed reliable but is subject to errors, omissions, and changes without notice. Sources include Midwest Real Estate Data LLC. This is not intended to solicit pr lume based on MLS market share, including off-market sales, from 4/1/23-3/31/24. #1 Compass Team in DuPage based on MLS Market Share, including off-market sales, all property types, from 7/1/23-6/30/24.