DIGITAL TRANSFORMATION

Entering the Copilot eraa story of integration

GLOBAL ENERGY NEWS ENERGY PROJECTS MAP RISK MANAGEMENT LEGAL RENEWABLES CONTRACT AWARDS DECOMMISSIONING STATS & ANALYTICS EVENTS

Entering the Copilot eraa story of integration

GLOBAL ENERGY NEWS ENERGY PROJECTS MAP RISK MANAGEMENT LEGAL RENEWABLES CONTRACT AWARDS DECOMMISSIONING STATS & ANALYTICS EVENTS

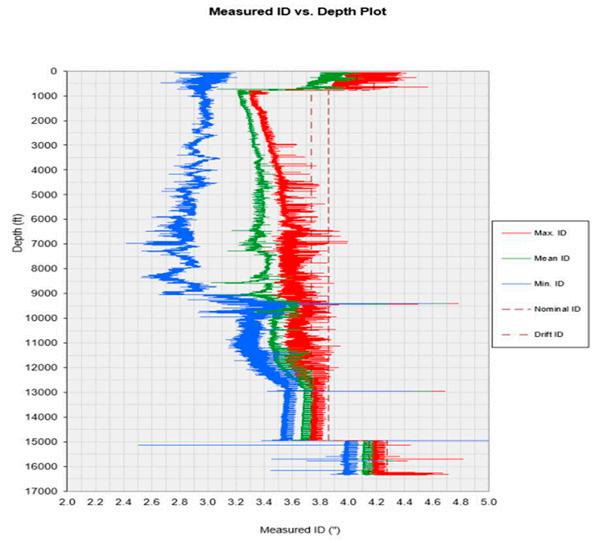

AIVA™, E V’ s As set In sp ection Visua li zatio n and An a ly ti cs system revo lu tionizes data . By revealin g key i nf ormation about cond ition , status a nd perf or man ce , A IVA™ support s th e mana ge ment o f we ll s, pipe line s and othe r critical ener gy assets an d in fr astru ct ures .

AIVA™ is an all-in-one cloud-based platform that allows users to store, visualize and interact with a wide variety of logs and data types. A complete solution to integrate, manage and safeguard your data, instantly accessible from anywhere with internet access.

With the advanced PowerBI analytic tools of AIVA™ you can exploit your data to the fullest, resulting in faster, more complete answers and more effective decision-making.

•Safe, secure, 24/7 access for a wide range of data

•Advanced visualization and analytics functions

•Easy to deploy software as a service solution

•Highly scalable single source of truth

•Field-wide life-of-asset applications

Welcome to the September issue of ‘OGV Energy Magazine’ where we explore the theme of Digital Transformation. A big thank you to our front cover partner Cegal, who introduce us to the biggest revolution to face the human race in decades, 'The Co-pilot era! Read about how this might affect all our daily lives on pages 4 & 5.

We are delighted to showcase other contributions in this months issue from CAN Group, Proserv, BrandSafway, Intervention Rentals, Elementz, IP/GN and Vysus. The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, Middle Eas and the USA along with articles from Brodies LLP and Leyton. Updated industry analysis and project updates from Westwood Global Energy Group, the EIC and Renewables UK.

We hope you enjoy this jam packed publication.

Warm regards, Dan

Hyland - Director

| by Mario Vaz Henriques Business Development Manager, Cegal

The IT and digital industry has seen several major revolutions that have significantly shaped the way we live and work. Some of the most impactful ones include the invention of the computer (1940s), the transistor and integrated circuits (1950s), personal computers (1970s), the internet and the World Wide Web (1990s), and mobile computing (2000s).

We are once again on the verge of a new revolution, and this one could affect us more than all the others combined. The result is something that no one can foresee, but it is already happening and will forever change the way we communicate, collaborate, and live. We are entering the era of Copilots.

Our personal assistants, or Copilots, will soon be integrated into every aspect of our daily lives. They will support us in virtually all of our activities, giving us capabilities that resemble having superpowers.

We are entering a thrilling phase of our existence, as humankind will soon become an interplanetary species. Within this decade, we expect (based on Elon Musk and SpaceX’s plans) the first human landing on Mars. This will require a lot of innovation in technology and human adaptability, and these superpowers will be critical. All of this will bring even more pressure to the energy sector.

To deal with the growing energy demand, particularly from technological advances like blockchain and AI in the last decade, the energy industry needs to boost its efficiency, reliability, and sustainability.

One of the main goals of the energy industry is to minimize its environmental impact and satisfy the rising demand for clean and renewable energy sources.

This is also very important for the AI sector, which depends on large amounts of data and computing power to train and deploy models that can improve various aspects of human activity.

To achieve this goal, the energy industry must update its infrastructure, processes, and policies to enable more efficient and sustainable energy production and distribution. Applying AI and machine learning is the only way to enhance energy forecasting, demand response, grid stability, fault detection, and maintenance. For instance, AI can help determine the optimal mix of energy sources, regulate the output of generators and batteries, and detect anomalies and failures in the grid.

The usage of AI and Copilots however, can and must also encourage innovation and collaboration across the energy sector and other stakeholders, including governments, regulators, consumers, and researchers, to foster a culture of continuous improvement and transformation. Examples could include creating incentives and standards for energy efficiency, carbon reduction, and, data and knowledge sharing.

This is a crucial step to boost innovation in this industry. By sharing data and knowledge, energy experts can utilize Copilots to gain superpowers, enabling them to uncover insights that were previously not visible. Advanced AI models, alongside their unique expertise, is the key to the next step.

When you begin using Microsoft 365 Copilot, you must keep in mind that the information that Copilot can return to the end user is, somewhat, limited. In most cases, the information that the user is looking for resides outside of the Microsoft 365 tenant.

by Mario Vaz Henriques | Business Development Manager, Cegal

Having an integration strategy is essential from the start, in order to identify where the crucial data location is, how sensitive this data is, and to develop a strategy to integrate these external data sources into Microsoft 365. For this reason, it is vital to comprehend Microsoft 365 Copilot plugins and Microsoft 365 Copilot connectors.

| Microsoft 365 Copilot plugins and Microsoft Graph

Microsoft 365 Copilot plugins are designed to extend the capabilities of the Copilot by connecting it to external data sources and applications. These plugins can be customized to meet the specific needs of an organization, allowing users to access and manipulate data from a variety of sources directly within the Microsoft 365 environment. A key component in this integration is Microsoft Graph, a powerful API that provides a unified programmability model to access data in Microsoft 365, Windows 10, and Enterprise Mobility and Security. By leveraging Microsoft Graph, organizations can ensure that their Copilot is equipped with the most relevant and up-to-date information, enhancing productivity and decision-making.

| Microsoft 365 Copilot Connectors and Microsoft Graph

Microsoft 365 Copilot connectors are pre-built integrations that enable seamless data flow between Microsoft 365 and other applications or services. These connectors facilitate the automatic synchronization of data, reducing the need for manual data entry and ensuring consistency across platforms. Using Microsoft Graph, these connectors can pull data from various services and integrate it within Microsoft 365, creating a cohesive ecosystem where information is readily accessible and actionable. By utilizing connectors, organizations can maximize the utility of their Microsoft 365 Copilot.

| Implementing

To fully realize the potential of Microsoft 365 Copilot, it is essential that organizations develop a comprehensive strategy that includes the following steps:

1. Identify Critical Data Sources

Determine which data sources are essential for your organization’s operations and decision-making processes.

2. Assess Data Sensitivity

Evaluate the sensitivity of your data to ensure that appropriate security measures are in place to protect it.

3. Integrate Data Sources

Use Microsoft 365 Copilot plugins and connectors, along with Microsoft Graph, to integrate these critical data sources into your Microsoft 365 environment.

4. Train Users

Educate your team on how to effectively use Copilot and the integrated data sources to enhance their productivity and efficiency.

5. Monitor and Optimize

Continuously monitor the performance of your Copilot integrations and make necessary adjustments to optimize their functionality.

| Conclusion

Personal assistants like Microsoft 365 Copilot marks the beginning of a new era in the IT and digital industry.

By strategically integrating critical data sources and leveraging the power of Copilot plugins, connectors, and Microsoft Graph, organizations can unlock unprecedented levels of efficiency and innovation.

As we stand on the brink of becoming an interplanetary species and witness revolutionary changes in the energy sector, the tools we adopt today will shape the future of how we live and work.

Editorial

+44 (0)

Advertising

+44

Design

Editorial

ICR Group shortlisted for two EIC National Awards 2024

ICR Group, a global leader in maintenance and integrity solutions, has been shortlisted in two categories at the prestigious Energy Industries Council (EIC) National Awards 2024.

The nominations, in the Culture and Environmental & Sustainability categories, recognise ICR's forward-thinking approach to workplace culture and its commitment to sustainable practices in the energy sector.

The culture nomination reflects ICR's dedication to fostering an inclusive, diverse, and supportive working environment, while simultaneously embedding strong Environmental, Social, and Governance (ESG) principles across the business.

Jim Beveridge, CEO at ICR Group, said: “These nominations validate our commitment to both culture and sustainability. Our team has worked tirelessly to develop technologies that not only deliver value to our clients but also support the global energy transition.”

Ashtead Technology expands Norway operation with new Stavanger hub

Ashtead Technology, a leading provider of subsea technology and services, has further invested in the Norwegian market by opening a new facility in Stavanger.

Norway's rich history of innovation in offshore energy presents significant opportunities for Ashtead Technology to enhance its service offerings for customers locally, building on strong foundations having previously supported the region remotely for many years.

The new facility serves as a strategic hub, initially offering a comprehensive suite of ROV tooling and subsea survey technology. Coupled with valuable local expertise and support, the new operation delivers faster response times for customers in the region.

COMET launches COMET

Companion: A six-figure investment in AI to boost user productivity and simplify workflows

Scottish tech firm COMET, formerly known as STC INSISO, is excited to announce the launch of COMET Companion, an AI-powered chatbot designed to make using the COMET platform easier and more efficient. Powered by OpenAI, this new feature provides live support to help users get the most out of the platform’s Incident Management, Investigations and RCA, and Supply Chain modules.

The COMET Suite COMET is a configurable set of intelligent data-driven tools supported by domain expertise for incident management, investigation, root cause analysis, audits & inspections, and supply chain assurance. COMET provides a consistent and structured approach, with integration to major EHS systems and AI enhancements that give users real risk intelligence to see what was previously unseen.

Hydro Group expand cable manufacturing capabilities by investing in state-of-the-art Bunching and Layup Machine

Hydro Group, a global leader in bespoke subsea connectivity solutions have invested further in their cable manufacturing facility with the acquisition of a new Bunching and Layup Machine.

The new machine will replace the old High Speed Twinner Quadder, enabling the business to increase capability by 50% in terms of number of components within each cable design and reduce lead times, whilst maintaining superior quality which is crucial to meet demand and satisfy customers. The machine can process up to six subcomponents, providing a maximum 20mm overall diameter and will assist to maximise efficiency within Hydro Group due to its ability to run lights-out and produce longer lengths.

VSA, the social care charity supporting the people of Aberdeen & North East Scotland, announces the official opening of a new sensory garden at its Linn Moor School facility, supported by Ithaca Energy. Ithaca Energy not only provided a five-figure sum to enable the complete renovation of the garden space, but 259 members of Ithaca’s team gifted 1,813 hours of volunteer time over a 12-month period transforming the space.

The sensory garden now features an outdoor education space, strawberry planter areas, specialist flora and fauna which support smell and touch, musical play and dedicated seating areas for the children to enjoy the outdoor space.

Aberdeen firm expands into four new cities with major acquisition

Aberdeen equipment rental specialist First Integrated Solutions has completed a major acquisition which will see it expand into four new cities and extend its services across multiple sectors.

The fast-growing firm has sealed a seven-figure deal to buy Tusk Lifting, which has depots in Middlesborough, Liverpool, Hull and Glasgow.

The combined business will have a turnover of nearly £20million and employ around 125 people across its five sites, serving a joint customer-base spanning the construction, manufacturing, oil and gas and renewable energy sectors.

Tusk Lifting has been acquired from parent firm Mammoet - part of the Dutch conglomerate SHV Holdings, which also owns retail chain Makro.

ModuSpec provides a combination of in-depth rig-technology inspection services coupled with operator-minded services to put the rig in the context of well operations.

Established by the founder and original senior management of the independent rig inspection company, who first introduced rig inspection services to the industry in 1986, it supports the upstream industry in drilling wells more safely and efficiently reducing non-productive time and establishing a safe work environment.

www.moduspec.com/

As the world leader in drilling waste management, we harness the power of today and pioneer the technology of tomorrow. Whether onshore or offshore, we turn waste into value and lost time into profit. But above all, we keep you turning.

www.twma.com

Established in 2023, Ramco Pipetech Holdings Limited (RPHL) is the holding group for Ramco Norway A/S, Ramco Pipetech Limited, and Ramco Pipe Care Limited. Operating across the UK and Norway, the group’s services encompass OCTG pipe management and specialist cleaning services to the energy and industrial sectors both on and offshore.

www.ramcopipetech.com

We are a casing technology company that provides you with safer and more efficient energy solutions from design through validation and manufacturing. We are designers, we are manufacturers, we are service providers.

www.newlandoiltools.com

Services, Inc. is a global upstream oil and gas services corporation that consists of four locations in the U.S., one in Aberdeen, Scotland, and two in Malaysia. From our humble beginnings in 1978 as a small but unique oilfield rental company, GSI has continually expanded and adapted to meet the needs of the ever-changing oil and gas industry. GSI offers unique solutions for the entire life cycle of the well–drilling, completions, production, well intervention, and P&A / decommissioning.

Innovex designs, manufactures, and installs mission-critical drilling & deployment, well construction, completion, production, and fishing & intervention solutions to support upstream onshore and offshore activities worldwide.

We are an Aberdeen-based valve maintenance and testing facility, providing the highest levels of expertise and service to ensure your probes are repaired and returned with minimum disruption to your operations. We have the facility to carry out a thorough test and inspection of your probes and have access to a robust supply chain should any replacement parts be required.

www.valvetec-services.com

We are specialists in hydraulic and electrical systems from design to manufacture and refurbishment.

With over 70 years’ combined experience in oil & gas / marine / petrochemical / industrial / renewables and infrastructure sectors, we provide product supply, design & manufacture. Specialised site services, system fault finding, hot oil flushing, instrument pipework installation and testing, as well as complete overhauls of all hydraulic and mechanical equipment.

At EV, we help well operators across the energy industry to identify, understand and resolve the most complex of wellbore issues.

At EV we operate in 36 countries across seven regional teams. Our global team of experts apply years of combined experience and cutting-edge technology to deliver detailed, distilled information that enables a better understanding of life of well challenges.

By Tsvetana Paraskova

The

UK’s government plans to further raise the energy profits levy, acquisitions of offshore portfolios, new drilling, and

a number of new contracts featured in the UK North Sea oil and gas industry in the past month.

The UK’s Chancellor of the Exchequer, Rachel Reeves, has confirmed plans for the Energy Profits Levy to be extended one year to 31 March 2030, have its investment allowances tightened, and to increase the rate of the levy by three percentage points to 38 percent from 1 November 2024.

A call for evidence confirming the government’s intention to take action on the carried interest loophole has also been published, as well as a commitment to update on policies at the Budget to help close the tax gap further, the UK government said.

The headline tax rate for the sector would rise to 78 percent, one of the world’s highest, while the EPL’s investment allowance will be removed and further reductions in capital allowances could be introduced.

Industry reacted to the plans for further increases in the so-called windfall tax, saying that the high tax rates would undermine investments in the UK offshore industry that could threaten the future energy security and net-zero investments.

“I hope the government do something sensible rather than cast a wrecking ball across the North Sea,” David Latin, chief executive of North Sea producer Serica Energy, said in response to the planned tax hike.

Offshore Energies UK chief executive David Whitehouse commented,

“This is not partnership working between government and industry. These announcements have been made without meaningful engagement with this sector.”

“The offshore energy sector supports over 200,000 jobs. These are real people, working in our energy industry. This announcement jeopardises jobs in communities across the UK. This is something the Prime Minister committed in his manifesto not to do,” Whitehouse said.

“Announcements like this without engagement is no way to treat these hard-working people.”

OEUK has also called on the government to now honour its pre-election promises to meet and discuss the way forward so the UK can achieve the homegrown energy transition, set out by the industry’s manifesto.

The industry remains concerned about the impact of wider proposals for a further windfall tax and an end to new oil and gas licences, OEUK said.

Offshore Energies UK has also said that the UK’s offshore energy industry is on-track to meet its own climate goals and is not slowing down. OEUK is leading calls to create the positive and stable investment environment needed to achieve a homegrown energy transition that everyone wants to see.

In 2022, the UK’s oil and gas sector reduced production emissions by 24 percent, halved flaring and venting, and cut methane emissions by 45 percent compared to 2018.

This means the sector achieved its interim target – a reduction of 10 percent by 2025 –three years early.

“Further emission reductions will be achieved with the help of major capital projects, like carbon capture, floating wind and hydrogen,” OEUK’s Whitehouse said.

The North Sea Transition Authority (NSTA) said in its latest UKCS Decommissioning Cost and Performance Update 2024 that the North Sea oil and gas industry is forecast to spend £24 billion on decommissioning between 2023 and 2032.

This is £3 billion higher compared with the forecast for the same period in last year’s report. More than half of the overall estimate of £40 billion (in constant 2021 prices) is to be spent during this 10-year period, which shows near-term actions will set the direction for the sector, NSTA said.

Hundreds of wells will need to be decommissioned every year as more oil and gas fields shut down. However, operators only achieved 70 percent of planned well decommissioning activities last year, the regulator warned.

The industry must take action on well decommissioning to support the UK’s supply chain, clean up their oil and gas legacy, and stop costs spiralling, NSTA noted.

“With spending forecast to peak at £2.5bn per year in the current decade, decommissioning can ensure that the UK’s world-leading supply chain is equipped to help operators clean up their oil and gas infrastructure over the next 50 years and support the carbon storage sector, which will rely on many of the same resources,” said Pauline Innes, the NSTA’s Supply Chain and Decommissioning Director.

“I am concerned that this huge opportunity to safeguard highly-skilled jobs and support the transition will be wasted if operators fail to tackle their well decommissioning backlogs. The supply chain wants to do this work, but it is not physically tied to the UK,” Innes said.

“Its skills and resources are in demand in other regions, and we are starting to see companies

marketing their rigs elsewhere. Operators need to use the supply chain, now, or risk losing it.”

In a separate report, NSTA said that top-quality environmental, social, and governance (ESG) disclosure is crucial to attracting further investment into the UK’s oil and gas industry.

Many of the 29 licensees analysed by the NSTA are following good practice across key areas of ESG reporting and are on the right track, though there is still plenty of room for improvement.

“ESG reporting is no longer a ‘nice to have’ extra, it is crucial to attracting and maintaining investment. The principle of ‘No ESG disclosure, no access to finance’ is truer now than ever before,” Joanne Edgeler, Head of Licensee Governance and ESG, said.

A report by the National Engineering Policy Centre found the UK would need additional baseload power, and new nuclear plants will not be ready in time.

Harbour Energy, the biggest producer in the UKCS, said in its half-year results report that it had made significant progress towards completing the Wintershall Dea acquisition, which is now expected early in the fourth quarter of the year.

“The acquisition will transform the scale, geographical diversity and longevity of our portfolio and strengthen our capital structure enabling us to deliver enhanced shareholder returns over the long run while also positioning us for further opportunities,” CEO Linda Cook said.

“Policy will need

to

ensure

that short-term signals do not encourage existing gas-fired capacity to close down while still needed, extending the life of some, where possible.”

SLB has been awarded an integrated engineering, procurement, construction and installation (EPCI) contract by bp to its OneSubsea joint venture and Subsea7 for the Murlach development (formerly Skua field), 240 kilometres east of Aberdeen in the UK North Sea.

The Murlach project will include the first-ever implementation of SLB OneSubsea standard, configurable vertical monobore tree systems in the UK North Sea, which will be deployed by Subsea7 via vessel to reduce rig days.

“The government’s commitment for a strategic reserve of unabated gas capacity is therefore a crucial aspect of ensuring security of supply,” the report says.

“Policy will need to ensure that short-term signals do not encourage existing gas-fired capacity to close down while still needed, extending the life of some, where possible.”

In company news, independent UK firm Viaro Energy signed an agreement to take over Shell and ExxonMobil’s UK Southern North Sea assets. Under the terms of the deal, Viaro Energy will assume full ownership of one of the largest and longest producing gas asset portfolios in the UKCS, including high-quality, well-maintained production facilities and the Bacton gas receiving terminal.

Pending regulatory approval, Viaro will buy a portfolio consisting of 11 operated offshore assets and one exploration field (Shamrock; Caravel; Corvette; Brigantine; Leman; Galleon; Skiff; Carrack Main, Cutter, Carrack East; Barque; and Clipper), all tying back to the Shell-operated onshore Bacton Gas Processing Terminal via the Leman and Clipper fields.

The deal more than doubles Viaro’s producing portfolio and reaffirms long-term commitment to UKCS North Sea, thanks to access to producing operated fields, where 2023 production was equal to about 5 percent of UK total gas production, and to significant growth potential through identified near field exploration opportunities.

Shell U.K. Ltd, the operator of Licence P2437, has informed its project partner Deltic Energy Plc that drilling operations on the Selene exploration well have commenced. The Valaris 123 drilling unit is carrying out the drilling operations, which are planned to last approximately 90 days.

Independent energy group Parkmead announced that further to the provisional award of three blocks as part of the 33rd UK offshore licensing round, the P2634 licence has now been formally awarded to Parkmead by the NSTA. The licence is situated in the Outer Moray Firth. Parkmead as operator with a 50-percent interest, together with its joint venture partner Orcadian Energy with 50 percent interest, will use the expertise gained in developing challenging crudes to work towards commercialisation of Fynn Beauly, one of the UK’s largest undeveloped discoveries. This heavy oil accumulation has been proven by three wells and is estimated to contain oil-in-place of between 740 million and 1.33 billion barrels, Parkmead said.

Aberdeen-headquartered Proserv has successfully completed a sponsor-backed management buyout (MBO), and is introducing an employee ownership scheme.

Led by CEO Davis Larssen and CFO Mark Fraser, the multi-million pound deal was backed by GIIL, a UK-based investment vehicle of Glenn Inniss, the founder and owner of the GII Finance Group.

“Mark and I are thrilled to embark on this new chapter with GIIL’s strategic alignment as we progress on our journey to becoming the energy sector’s leading independent controls technology partner of choice,” Proserv CEO Davis Larssen said.

“We currently have approximately 50% market share in providing leading-edge subsea control systems in the North Sea and the Gulf of Mexico.”

Engineering and services company Kent has been awarded a global three-year enterprise framework agreement by Shell to provide Commissioning and Start-Up Services (CSU) across various onshore and offshore projects. The contract encompasses a wide range of energy sectors, including oil, gas, and new energy initiatives.

By Tsvetana Paraskova

European oil and gas resources, the pledge of the new UK government to materially boost renewables capacity installations, and numerous deals in solar, wind, hydro, and hydrogen across Europe were the highlights in the European energy sector this past month.

Canadian company Tenaz Energy said it had entered into an agreement with Nederlandse Aardolie Maatschappij B.V. (NAM), a 50/50 joint venture between Shell and ExxonMobil, to acquire all of the issued and outstanding shares of NAM Offshore B.V., which

operates in the Dutch North Sea. The base consideration for the deal is 165 million euros ($246 million), prior to closing adjustments and contingent payments. The acquired assets include substantially all of NAM’s offshore exploration and production business, including associated pipeline infrastructure and onshore processing in the Netherlands.

Italian engineering group Saipem has been awarded a contract to ensure the supervision and the subsea intervention services of the GreenStream pipeline throughout the offshore and onshore sections at the Mellitah terminal in Libya and the terminal at Gela in Sicily, Italy.

The new contract, awarded by GreenStream BV, merges the activities that Saipem has been undertaking for GreenStream since 2008 as to asset integrity, inspection, maintenance, and emergency pipeline services, and expands them to cover a wider range of scenarios and customer’s needs.

“With this award Saipem will contribute to managing the integrity of a fundamental underwater infrastructure for the Italian energy supply with an integrated approach, thus confirming the company’s leadership in the underwater domain with promptly available and efficient solutions,” the Italian company said.

bp has completed its acquisition of Germany’s GETEC ENERGIE GmbH, a supplier of energy to commercial and industrial (C&I) customers in Germany.

The acquisition will accelerate the growth of bp’s European gas and power presence, as well as providing opportunities to grow

integrated lower carbon energy solutions for C&I energy customers in Germany and elsewhere in Europe.

Currently, GETEC ENERGIE supplies around 40 TWh of power and gas per year – serving about 400 C&I customers in Germany and supplying over 100,000 gas and power meters directly.

Led by Cord Wiesner, the chief executive officer of GETEC ENERGIE GmbH, the company will join bp trading & shipping, as part of the international gas & power trading business.

The UK government introduced a Bill to set up Great British Energy, a publicly owned clean power company headquartered in Scotland, which will help accelerate investment in renewable energy such as offshore wind.

“Legislation will be brought forward to help the country achieve energy independence and unlock investment in energy infrastructure,” His Majesty said in his Speech to both Houses of Parliament.

The industry welcomed the measures in the King’s Speech to boost renewables.

“It is particularly welcome to see the announcement of a Planning and Infrastructure Bill, to ensure that essential infrastructure can be deployed without delay,” RenewableUK’s Executive Director of Policy Ana Musat said.

According to RenewableUK, it is essential to get the framework for GB Energy right so that the UK can secure the maximum amount of private capital.

UK Prime Minister Keir Starmer and Energy Secretary Ed Miliband have announced the first major partnership between Great British Energy and The Crown Estate to unleash billions of investment in clean power.

The UK’s Climate Change Committee (CCC) has assessed that only a third of the emissions reductions required to achieve the country’s 2030 target are currently covered by credible plans, and the UK is currently off track for Net Zero.

“The country’s 2030 emissions reduction target is at risk. The new Government has an opportunity to course-correct, but it will need to be done as a matter of urgency to make up for lost time. They are off to a good start,” said Professor Piers Forster, interim Chair of the Climate Change Committee.

“Action needs to extend beyond electricity, with rapid progress needed on electric cars, heat pumps and tree planting.”

A few weeks after taking office, the new UK government announced that the budget for this year’s renewable energy auction is being increased by £500 million to over £1.5 billiona record-high budget. The funding is expected to help build new green infrastructure as part of the mission to deliver clean power by 2030.

The budget for this year includes £1.1 billion for offshore wind – the backbone of the UK’s clean energy mission – which has more budget available than all of the previous auctions combined, sending a strong signal to industry to invest in UK waters, the government said.

The raised budget will unlock more investment in renewable energy projects in the UK, RenewableUK said.

While the industry association welcomed the budget boost, it said that “This auction will not unlock investment in all shovel-ready projects, so the Government will need to ensure that the next auction rounds focus on project delivery to ensure we achieve the Prime Minister's clean power mission and increase the confidence of investors in the UK's supply chain.”

The UK offshore sector’s leading trade body, Offshore Energies UK, has warned that the goal of net zero power must be delivered by building on the UK’s existing industrial strengths, creating jobs and growing domestic companies – not simply by importing the technology and skills from other countries.

A report commissioned by OEUK offered a new blueprint mapping out how the UK can meet the new government target of net zero power by 2030.

“It will require a herculean effort by government, regulators and industry working together to deliver change to UK infrastructure on a scale unseen since the industrial revolution,” OEUK

Chief Executive David Whitehouse said.

The British Hydropower Association and Scottish Renewables have urged the UK Government to support the deployment of long-duration electricity storage (LDES), including pumped storage hydro (PSH).

In a letter to Ed Miliband, the Secretary of State for Energy Security and Net Zero, Ian Murray, the Secretary of State for Scotland, and Jo Stevens, the Secretary of State for Wales, the associations call for a ‘cap and floor’ mechanism to accelerate investment and demonstrate a “step-change” in decisionmaking. The UK has a pipeline of more than 9 gigawatts (GW) including several ‘shovel ready’ projects, but inaction has been costing consumers.

“As a well-established technology with a multigigawatt pipeline and several ‘shovel ready’ projects, Pumped Storage Hydro is a key technology to smoothly integrate the increase in generation we require, help reduce system costs and deliver huge economic benefits across the country,” said Claire Mack, Chief Executive of Scottish Renewables.

In company news, Macquarie Asset Management has announced that it intends to acquire, via its managed funds, an additional 39.25-percent stake in the Lynn and Inner Dowsing offshore wind farms off the coast of Lincolnshire from funds managed by BlackRock.

Operational since 2009, the adjacent offshore wind farms have a combined installed capacity of approximately 194 MW and generate enough electricity to power the equivalent of more than 160,000 UK homes each year.

Gilkes Energy and SSE said they plan to progress a new pumped storage hydropower scheme at Loch Fearna in Scotland’s Great Glen. The Fearna Pumped Storage Hydro (PSH) project, located at the western end of Glengarry around 25 km west of Invergarry, envisages the development of tunnels and a new power station connecting SSE Renewables’ existing reservoir at Loch Quoich with an upper reservoir at Loch Fearna.

The proposed development would be up to 1.8 GW in generating capacity and capable of producing around 37 GWh of stored energy capacity. This makes it, alongside the Earba project, one of the two largest PSH developments in the UK in terms of installed capacity and energy stored.

Wood Consulting said it had played a key role in securing more than 1 billion euros of funding for its clients in Europe, enabling three major clean energy projects to reach final investment decisions (FID).

Wood’s team of technical consultants served as Lenders’ Technical Advisors in advancing Lithuania’s largest onshore wind farm.

Wood’s expertise was also key in facilitating European renewables developer Renewable Power Capital (RPC) in finalising financing

for its 553 MW onshore wind portfolio in Sweden, and acted as owner's engineer for the Catalina green hydrogen project, a first-ofits-kind project in Spain, which will combine 1.5 G of wind and solar energy to power a 500MW electrolyser to produce green hydrogen.

Repsol and EDF Renewables have reached an exclusivity agreement to join forces for future offshore wind tenders in Spain and Portugal, considering the significant growth opportunities in the Iberian Peninsula.

In Norway, Kitemill said it had received 2.5 million euros from the European Innovation Council (EIC) to fast-track the commercialization of its Airborne Wind Energy (AWE) technology.

“Our technology has now been accepted and approved by the EU through three separate funding rounds. This tranche will help derisk a critical phase for the KM2 and boost customer and public trust,” CEO Thomas Hårklau commented.

Battery storage developer Harmony Energy is set to deliver France’s largest battery energy storage system (BESS)—the Cheviré battery project – using Tesla Megapack technology. The project will mark a significant milestone for the French energy system, being France's first large-scale 2-hour battery.

Located in Nantes Saint-Nazaire Harbour, the 100 MW / 200 MWh large-scale renewable energy infrastructure will utilise Tesla Megapack and Autobidder technology and will provide enough electricity to power an estimated 170,000 homes for two hours – greater than the population of the City of Nantes.

France’s TotalEnergies has signed agreements with German renewable developer RWE to buy a 50-percent stake in OranjeWind, a 795 MW offshore wind farm under development in the Netherlands. TotalEnergies will dedicate its share of the renewable electricity production from this project to power 350 MW electrolyzer projects.

The European Commission has approved, under EU State aid rules, a 998- million euro Dutch scheme to support the production of renewable hydrogen. The scheme will support the construction of at least 200 MW of electrolysis capacity. The aid will be awarded through a competitive bidding process this year, with the tender open to projects with a capacity of at least 0.5 MW.

Onshore wave energy technology company Eco Wave Power Global AB officially launched works on its first MW-scale wave energy project, which will be located in the city of Porto, in Portugal.

The first MW project is being executed as part of a 20 MW Concession Agreement and will feature a first-of-its-kind underwater wave energy museum.

By Tsvetana Paraskova

Mergers and acquisitions in the US oil and gas industry continued their momentum in the second quarter as pressure grew on some producers to boost scale and production to compete with peers.

While US oil production is set to grow at a slower pace this year compared to the previous two years, while well costs are falling amid increasing efficiency, which is also driving a decline in upstream employment numbers in the top oil-producing state, Texas.

In politics, the US presidential race changed months ahead of the vote in November, with President Joe Biden dropping out and Vice President Kamala Harris becoming the Democratic nominee to run in the election.

Bipartisan legislation was introduced in July, aiming to strengthen US energy security by accelerating the permitting process for critical energy and mineral projects of all types in the United States.

In the second quarter of 2024, upstream mergers and acquisitions activity booked its third consecutive quarter of heightened value with more than $30 billion transacted, Enverus Intelligence Research (EIR) said in its latest M&A report.

The second-quarter tally brings year-to-date activity, including July deals, to nearly $90 billion and nearly $250 billion transacted in the last 12 months. Prior to the latest run of consolidation, quarterly M&A value had only topped $30 billion three times since the start of 2017, Enverus noted.

The biggest deal of the second quarter was ConocoPhillips’ announcement that it would buy Marathon Oil Corporation in an all-stock transaction with an enterprise value of $22.5 billion, inclusive of $5.4 billion of net debt.

Despite heightened scrutiny and additional requests for information from the US Federal Trade Commission (FTC), ConocoPhillips expects to close the deal in late 2024.

The deal, the fifth largest US upstream transaction of the last decade, contributed a lot to the overall Q2 M&A value.

The acquisition marks another historic name exiting the E&P space as Marathon Oil has roots that reach back more than 100 years. Unlike most other big deals in the current consolidation cycle that focused entirely on the Permian Basin, Marathon Oil held a diversified asset base that included Permian exposure along with large positions in the Eagle Ford and Williston Basin, Enverus notes.

“M&A momentum carried into the second quarter as pressure built on companies like ConocoPhillips, Devon Energy and SM Energy, that had previously stayed out of the market to keep pace with peers and grow in scale,” said Andrew Dittmar, principal analyst at EIR.

Due to high prices for prime Permian acreage, US exploration and production companies are now looking at mid-tier inventory and positions outside the Permian, notably in the Eagle Ford and Williston basins, according to Enverus.

Firms are also looking for opportunities to expand their inventory base by testing new zones such as SM Energy buying XCL Resources to gain access to Utah’s underdeveloped Uinta Basin.

“Proving up new economic drilling locations is a top priority for companies and has been the most cost-effective way to extend inventory life,” said Dittmar.

“What is substantially different in this market, and a major shift in the industry, is that companies like Matador Resources and SM Energy are willing to prepay for inventory in deals that has yet to be fully proven up by horizontal wells.”

will realize additional efficiency gains and keep costs lower,” said Nemeth.

“Smaller producers will be most exposed to inflation headwinds — arguably motivating even more M&A activity in the region.”

Texas Upstream Employment Continues To Drop

"Mergers and acquisitions in the US oil and gas industry continued their momentum in the second quarter as pressure grew on some producers to boost scale and production to compete with peers."

Upstream oil and gas employment in Texas fell again in June, with a decline of 2,000 jobs compared to May, the Texas Oil & Gas Association (TXOGA) said in a cautionary note at the end of July, after newly released data from the Texas Workforce Commission indicated that the job count had dropped in 5 out of 6 months this year.

Energy and Natural Resources Committee, thoughtfully considering input from our colleagues on both sides of the aisle, and engaging in good faith negotiations, Ranking Member Barrasso and I have put together a commonsense, bipartisan piece of legislation that will speed up permitting and provide more certainty for all types of energy and mineral projects without bypassing important protections for our environment and impacted communities,” Manchin said.

“For far too long, Washington’s disastrous permitting system has shackled American energy production and punished families in Wyoming and across our country. Congress must step in and fix this process,” said Ranking Member Barrasso.

“Our bipartisan bill secures future access to oil and gas resources on federal lands and waters.”

In addition, private equity firms are capitalizing on the higher prices to sell portfolio companies, according to Enverus’ analysis.

While oil deals have been booming, natural gas transactions have been subdued because of low gas prices.

However, a potential rally in natural gas prices towards the end of 2024 and into 2025 “could generate a wave of deals as long-dated private equity investments rush to market,” Enverus said.

US well costs peaked in 2023 and are now set for a 10-percent drop this year as efficiency gains and lower prices for piping products, proppant, and diesel have combined to push costs down, Wood Mackenzie said in a report in July.

Still, further reduction will be difficult in the current pricing environment, as oilfield equipment and services companies (OSF) seek to keep margins high, the consultancy said.

Additional well cost cuts must come from even higher efficiency gains as the oilfield services providers are unlikely to reduce pricing, said Nathan Nemeth, principal analyst for Wood Mackenzie.

WoodMac’s analysts expect an additional 40 rigs will be active relative to current levels by the end for 2025, led by gas plays and the Permian basin.

However, faster drilling operations mute the need for more rigs and Wood Mackenzie estimates that a 5-percent improvement in drilling efficiency equates to about 28 fewer rigs needed in the market.

“The largest producers with the scale to commit to longer-term contracts (one to three years) for new equipment and technologies

March 2024 was the only month in which the Texas upstream industry saw job gains in the first half of the year.

Commenting on the latest jobs data from the Texas Workforce Commission, TXOGA president Todd Staples said in a statement,

“Operational efficiencies are driving strong production with fewer rigs, which can translate to declining industry job numbers. Baker Hughes data indicate the national rig count has declined 14 percent from 687 in June 2023 to 588 active rigs in June 2024.”

At the same time, the US Energy Information Administration estimates rig productivity gains in excess of 20 percent year-overyear across major shale basins, with many companies maintaining or increasing production despite running fewer rigs.

“These productivity gains result in big benefits for consumers as prices have remained relatively stable despite geopolitical unrest,” TXOGA’s Staples noted.

At the end of July, US Senators Joe Manchin (I-WV) and John Barrasso (R-WY), Chairman and Ranking Member of the Senate Energy and Natural Resources Committee, released the Energy Permitting Reform Act of 2024— bipartisan legislation aimed at strengthening American energy security by accelerating the permitting process for critical energy and mineral projects of all types in the United States.

“After over a year of holding hearings in the Senate

Added Barrasso,

“This legislation is an urgent and important first step towards improving our nation’s broken permitting process.”

The American Petroleum Institute (API), the biggest US oil and gas industry association, welcomed the proposed bipartisan legislation as a step to a more transparent and consistent permitting process.

“This legislation not only takes tangible steps toward a more transparent, consistent and timely permitting process, but also ends the administration’s misguided LNG export permit pause, strengthening American energy leadership while helping to reduce emissions worldwide,” said API Executive Vice President and Chief Advocacy Officer Amanda Eversole.

“We applaud Senators Manchin and Barrasso for renewing bipartisan efforts to build the infrastructure needed for today and the future, and we call on Congress to take up this urgent priority.”

By Tsvetana Paraskova

the cuts, met on 1 August for a regular meeting to assess conformity and the situation on the oil market.

OPEC+ left its oil production policy unchanged, for now, while producers lagging in compliance with the ongoing output cuts pledged to improve their conformity rates and compensate for previous overproduction

JMMC reviewed the crude oil production data for the months of May and June 2024 and noted the high overall conformity for participating OPEC and non-OPEC countries of the Declaration of Cooperation (DoC), OPEC said.

At the end of July, the OPEC Secretariat said that it had received compensation plans from Iraq, Kazakhstan, and Russia for their overproduced volumes for January to June 2024.

The cumulative overproduction in these six months was about 1.184 million barrels per day (bpd) for Iraq, 620,000 bpd for Kazakhstan, and 480,000 bpd for Russia, OPEC said.

At the JMMC meeting in early August, the producers that had expressed intentions to begin easing the cuts in the fourth quarter “reiterated that the gradual phase-out of the voluntary reduction of oil production could be paused or reversed, depending on prevailing market conditions,” OPEC said.

JMMC did not recommend any changes to current policy, but noted that it retains the authority to convene additional meetings or to request an OPEC and non-OPEC Ministerial Meeting.

Saudi Aramco, the world’s largest oil company by both production and market capitalization, reported a net income of $29.1 billion for the second quarter of 2024, down by 3.4 percent compared to the same quarter last year, as Saudi Arabia is reducing its crude oil production as part of the OPEC+ deal and adding an additional voluntary cut of 1 million barrels per day (bpd).

Aramco, which aims to focus on maximizing shareholder returns, declared a base dividend of 76.1 billion Saudi riyals ($20.3 billion) and the fifth distribution of performancelinked dividends of 40.4 billion Saudi riyals ($10.8 billion). This brings the total declared dividends for the second quarter to 116.5 billion Saudi riyals ($31.1 billion).

The company said in its earnings release that it remains confident in its forecasts for medium- and long-term oil demand growth.

In addition, Aramco has progressed several natural gas developments to support its strategy of increasing gas production by more than 60 percent by 2030, compared to 2021, subject to domestic demand.

Saudi oil giant Aramco reported lower secondquarter profits as it continues to restrict production, while it raised $6 billion from a new bond issuance, weeks after a secondary share sale raised more than $12 billion for the Kingdom of Saudi Arabia.

Aramco, as well as the other major national oil companies from the Middle East, have signed several major agreements to develop oil, natural gas, and low-carbon energy projects.

OPEC+ Leaves Oil Production Policy Unchanged

The Joint Ministerial Monitoring Committee (JMMC), the OPEC+ panel monitoring oil market developments and compliance with

The next meeting of the JMMC is scheduled for 2 October 2024.

Russian Deputy Prime Minister Alexander Novak has said that there is no discord between Russia and OPEC+ over Moscow’s recent poor compliance with the group’s production cuts.

Russia’s Energy Ministry said at the end of July that the country remains fully committed to the OPEC+ agreement. Russia exceeded production volumes in June, but output has declined in each month since April, per estimates from independent sources approved by the agreement, the ministry said.

Saudi Aramco Earnings Drop on Lower Output

Design, procurement, and construction activities continued at the Jafurah Gas Plant, part of the Jafurah unconventional gas field development. Phase one is expected to commence production in 2025 and phase two is underway. Production from the Jafurah gas development is expected to reach a sustainable sales gas rate of 2.0 bscfd by 2030, in addition to significant volumes of ethane, NGL, and condensate.

Commenting on the second-quarter milestones for Aramco, president and CEO Amin Nasser said,

“We have also continued to create and deliver both value and growth, as demonstrated by the positive investor response to the Government’s secondary public offering of Aramco shares and our recent $6.0 billion bond issuance.”

Continued Nasser,

“Building on these strengths, we also made significant progress in key strategic areas

during the second quarter — from advancing our gas program and expanding our new energies portfolio, to partnering with leading car manufacturers on lower-emission vehicle technologies and growing our global retail network.”

Aramco has also recently signed definitive agreements to buy a 50-percent equity interest in the Jubail-based Blue Hydrogen Industrial Gases Company (BHIG), a whollyowned subsidiary of Air Products Qudra (APQ). The transaction, which is subject to standard closing conditions, will also include options for Aramco to offtake hydrogen and nitrogen.

Aramco expects its investment in BHIG will contribute to the development of a lowercarbon hydrogen network in Saudi Arabia’s Eastern Province, serving both domestic and regional customers. Upon completion of the transaction, Aramco and APQ, a joint venture between Air Products and Qudra Energy, are expected to each own a 50-percent stake in BHIG.

Italy’s engineering group Saipem said it had been awarded two offshore projects in Saudi Arabia, under the existing LongTerm Agreement (LTA) with Saudi Aramco. The overall amount of the two projects is approximately $500 million.

Saipem’s scope of work under the first project involves the Engineering, Procurement, Construction and Installation (EPCI) of a crude trunkline of approximately 50 km for the Abu Safa Field, while the activities related to the second project involve the production maintenance programs of the Berri and Manifa fields.

ADNOC, the national oil company of the United Arab Emirates, signed in early August a longterm Heads of Agreement (LNG agreement) with Osaka Gas, one of the largest utility companies in Japan, for the delivery of up to 0.8 million metric tonnes per annum (mmtpa) of liquefied natural gas.

The LNG will primarily be sourced from ADNOC’s lower-carbon Ruwais LNG project, which is currently under development in Al Ruwais Industrial City, Abu Dhabi, and is expected to start commercial operations in 2028. Under the agreement, LNG cargoes will be shipped to the destination ports of Osaka Gas and its Singapore-based subsidiary, Osaka Gas Energy Supply and Trading Pte. Ltd. (OGEST).

ADNOC has also deployed RoboWell, AIQ’s artificial intelligence (AI) autonomous wellcontrol solution, in its operations at the offshore NASR field.

RoboWell uses cloud-based AI algorithms to autonomously operate wells that selfadjust according to changing conditions. This enhances the safe operation of the well, improves efficiency, reduces the need for travel and physical interventions, and so minimizes emissions, ADNOC says.

In another AI-enabled digital operation, the Abu Dhabi giant said that its offshore Satah Al Razboot (SARB) field had achieved a 25-percent increase in production capacity through the implementation of advanced digital technologies. The increase at SARB

field, to a total of 140,000 bpd, supports ADNOC’s target to increase its production capacity to 5 million barrels of oil per day by 2027.

“AI and digitalization are at the heart of ADNOC’s smart growth strategy to help responsibly meet the world’s growing energy demand,” said Abdulmunim Saif Al Kindy, ADNOC Upstream Executive Director.

Qatar’s state firm QatarEnergy is expanding operations outside the tiny Gulf nation by signing an agreement with Chevron to acquire a 20-percent working interest in a production sharing contract for block 5 offshore Suriname. Pursuant to the signed agreement, Chevron, as the operator, will retain a 40-percent interest, while Paradise Oil Company, an affiliate of Suriname’s national oil company “Staatsolie”, will own the remaining 40 percent.

“This agreement highlights our continued commitment to exploring the promising basins of Suriname and marks an exciting new partnership with Chevron in the international upstream sector,” said Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs and the President and CEO of QatarEnergy.

Wellpro Group & Omega Well Intervention provide a complete Thru Tubing, Inflatable Packer & Well Intervention portfolio including operational design, project management, service, rental & sales.

The new RMS is designed to give operators a clear, unambiguous overview of critical drilling and mud data processes. The system has been developed by RCP to greatly improve how information is presented using the latest industrial technologies and user-friendly interfaces

The RCP EDR offers a quick and cost-effective solution for clients considering a new installation or a partial upgrade to their existing drilling instrumentation systems Our highly experienced engineers and software developers allows us to tailor each new system to meet your exact needs meaning that you do not pay for functionality you will never use

The RCP EDR utilizes a variety of sensing technologies to monitor the drilling processes, (typically: Level, Pressure, Height, Temperature and Flow). Sensor output signals are received by the distributed I/O racks and are then processed by the EDR.

Processed information is then transmitted through network communication modules to each of the user interfaces including remotely networked PC’s and local HMI’s System and operator interface communications may utilize either: Fibre-Optic, Profinet, Profibus or Industrial Ethernet connection

Brent Oil Column September 2024

1 YEAR AGO

1 Year Ago - $95.20

Hedge funds were piling into the oil market, betting that prices would soon pass the $100 a barrel mark, adding impetus to a rally sparked by production and export cuts from Saudi Arabia and Russia. Riyadh’s extension of cuts until December pushed Moscow to limit exports which saw prices at a fresh high for the year.

5 YEARS AGO

5 Years Ago - $68.66

Oil prices experienced their biggest jump in around 30 years when two attacks on Saudi Arabian facilities knocked out around 5% of global supply. Brent crude initially surged 20% at the start of trading but eased back to the $69 a barrel mark. The drone attacks hit the world’s biggest petroleum-processing facility and a nearby oil field, both operated by Aramco.

10 YEARS AGO

10 Years Ago - $99.53

Brent saw a small rise on the prospect of an OPEC production cut and news that Libya had curbed output after rockets hit an area near a refinery. OPEC Secretary General Abdallah El-Badri told reporters he expected to lower its oil output target to 29.5 million barrels per day (bpd) from 30 million bpd the following year.

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

Wood has been awarded a contract from Rosetti Marino to provide a FEED study for the project. The contract scope includes greenfield topsides installation and brownfield modifications and tie-ins to the existing wellhead and processing platforms. Wood will carry out the engineering design, as well as providing support to Rosetti Marino to develop the execute phase tender for the project.

The operator has announced a delay in the FID decision until 2025. It is understood that the pre-FEED for the project is progressing, and the project will re-enter the FEED phase by Q4 2024.

Energean has taken a final investment decision on the project. First gas is expected in the first half of 2027. The EPCI contract for the subsea scope has been awarded to TechnipFMC and includes four-well-slot tieback capacity to a single large ~30 kilometre production line, which can be used by future Katlan area phases.

CNOOC has announced the discovery of oil and gas in the Eastern Bohai Basin. The discovery well. LK7-1-1 well, was drilled and completed to a depth of approximately 4,400 m, where it encountered 76m of oil and gas pay zones. It well flowed 1,300 b/d of oil and 35.31 MMcf/d of natural gas on test.

Grupo Carso will invest over US$1.2bn to develop Lakach on behalf of Pemex after an exploration and production services contract was signed between the parties. Grupo Carso will build a gas treatment facility onshore to receive output from Lakach starting in 2027. The developer selected Talos Energy and FCC Construction as strategic partners for the development. Pemex will retain ownership of the field and of its recoverable resources.

Vår Energi plans to progress the Cerisa discovery together with the previous Ofelia, Kyrre and Gjoa North discoveries as a fast-track tie-back development to the Gjoa field. Vår Energi is targeting a final investment decision (FID) on Cerisa, Ofelia, Kyrre and Gjoa North projects in 2025.

Equinor has contracted Valaris' DS-17 drillship to drill six wells at Raia. The US$498m contract will span 672 days and will start in 1H 2026. Equinor has also awarded contracts to SLB, Baker Hughes and Halliburton related to drilling and well operations at the Raia project. SLB will be the main service supplier whereas Baker Hughes and Halliburton will execute complimentary services.

GUPCO has confirmed an investment of $226 million to develop oil reserves exceeding 100 million barrels of oil and increase oil production to 15,000 barrels per day in the second half of 2025. The development plan will see the drilling of five new wells, the setting up of a production station and extending pipelines. A consortium comprising of Enppi, Petrojet and Petroleum Marine Services (PMS) is to undertake the work.

CPECC has been awarded the off plot facilities EPCM contract for the South East Bab assets expansion. The contract is worth $397 million and is expected to be complete within 45 months. The contract will involve construction, renovation and upgrading of the offsite facilities at the Asab oil field, and the Sahil, Shah, Qusahwira and Mender satellite oil fields.

BP has issued a positive FID for the Kaskida project, which will require specialist 20,000 psi (20K) technology. The field will initially produce from six wells. First oil from the 80,000 b/d FPU is expected in 2029.

KUWAIT

Kuwait Petroleum Corp.

KPC has made a significant discovery in the Al-Nokhatha field, located in the east of Failaka Island, Kuwait. Early estimations of the hydrocarbon reserves present at the discovery well were around 2.1 billion barrels of light oil, and 5.1 Tcf of gas.

ExxonMobil has announced the project and are set is to hold a series of public consultations on its plans to create the new carbon dioxide pipeline. ExxonMobil is aiming to acquire the DCO for the project, the process to obtain a Development Consent Order can take around three to four years to complete and typically involves two public consultations.

By Tsvetana Paraskova

Digitalisation and AI have started to transform the energy industry, with more oil and gas operations and systems using advanced technology to boost efficiency, reduce costs, monitor performance and emissions, and unlock exploration opportunities.

The much-hyped Artificial Intelligence and AI-enabled technologies are gaining momentum in the energy sector, too, as companies look to be ahead of the curve in emissions and cost reductions while providing the oil and gas the world still needs in large volumes.

AI and robotics are being increasingly used for predictive maintenance, data analytics, reservoir analytics and management, remote monitoring, Industrial Internet of Things (IIoT) asset management, digital twins, and Extended Reality (XR) technology.

Digital twins, for example, have been gaining rapid acceptance in oil and gas operations, data and analytics company GlobalData said in a report this year.

GlobalData estimates that the global market of digital twins technology will be worth $154 billion by 2030, up from about $20 billion in revenues from digital twins services and software this year.

Initially, digital twins were deployed in capital-intensive oil and gas production facilities to streamline processes, mitigate emission footprint, and generate cost savings. Companies have recently created twins of their pipeline systems, gas plants, LNG terminals, as well as refineries and petrochemical complexes, GlobalData notes.

“Digital twins are rapidly becoming a mainstay in oil and gas operations as companies strive to optimize asset performance and minimize unplanned outages. This aims to make oil and gas operations relatively safer while lowering the carbon footprint and improving profitability,” said Ravindra Puranik, Oil and Gas Analyst at GlobalData.

A recent poll by GlobalData aiming to try and gauge what area of AI is having the greatest impact on oil and gas operations showed that about 40 percent of the respondents said that AI-enabled predictive maintenance is having the greatest impact on oil and gas operations.

About 28 percent of the respondents believe that AI-enabled smart monitoring is having the greatest impact on oil and gas operations, the poll found. Another 25 percent of the respondents felt that power forecasting using AI is having the greatest impact operations.

AI and robotics are leading the transformative changes in the oil and gas sector, accelerating advancements in operational efficiency, safety, and environmental sustainability, GlobalData said in a report in July.

“AI and robotics are bringing far and wide changes in the oil and gas sector, fundamentally redefining what is possible,” said Saurabh Daga, Project Manager for Disruptive Tech at GlobalData.

“These technologies help us overcome challenges, from cost reduction to enhanced safety and sustainability, setting new benchmarks for efficiency and innovation. From

autonomous operations, drilling optimization, plant inspections, to fleet optimization, they are transforming upstream, midstream, and downstream operations and pushing the envelope of efficiency and innovation.”

AI in the global oil and gas market is expected to surge to $5.96 billion by 2028, growing at a compound annual growth rate (CAGR) of 13.3 percent, ResearchAndMarkets.com said in a report earlier this year.

Houston, Texas, the heart of the US oil and gas industry, is emerging as a hub for AI deployment in the sector, according to the report.

The surge in AI-driven technology is the result of the integration of advanced digital technologies and the rising demand for energy efficiency and sustainability measures.

North America continues to be the market leader with transformative initiatives underway in the sector, particularly with corporations deploying new technologies in Houston, further bolstering development, ResearchAndMarkets.com said.

Among the firms in the sector operating in Texas, Louisiana, and southwest New Mexico, 50 percent of executives said their firm is not using AI and has no plans to do so in the near future, the quarterly Q2 Dallas Fed Energy Survey showed in June. A total of 26 percent of executives note their firm is using either traditional AI, generative AI or both. The remaining 24 percent of executives said their firm is currently not using AI but plans to do so in the next 12 months.

The adoption of AI differs according to the size of the firms, with the larger ones ahead of the curve in deploying AI technology.

Roughly half of the executives surveyed from large exploration and production (E&P) firms noted in the survey they are using some form of AI, compared with 32 percent of executives from oil and gas support services firms and 16 percent of executives from small E&P firms.

In addition, small E&P firms were also more likely than large E&P firms and services firms to indicate they have no plans to use AI in the near future.

Among the firms using or planning to use AI, the most selected response by executives was that they are using AI for “business analysis or predictive analytics” (64 percent of respondents) followed by “process automation” (44 percent of respondents). Both “geology or reservoir engineering” and “predictive maintenance” were selected by 41 percent of respondents.

Exploration and production firms were more likely to note multiple uses for AI, the survey found.

In terms of benefits seen from AI, the most selected response was “increase(d) productivity” (62 percent of respondents)

followed by “access to better or more timely information” (53 percent of respondents), and “reduction in costs” (47 percent of respondents).

As with AI uses, E&P firms were more likely to note multiple benefits from using AI technology.

There are numerous examples of recent agreements for cooperation and deployment of AI-enabled technology in the oil and gas sector.

Last year, the world’s largest oilfield services provider, SLB, signed a subsurface technology partnership with INEOS Energy. Under the deal, INEOS Energy is partnering with SLB’s Performance Centre in Aberdeen, to collaborate and innovate subsurface technologies, including AI capabilities, to help it drive operational performance for continued growth, new acquisitions, and Carbon Capture and Storage (CCS).

“The Performance Centre is part of the SLB longterm strategy to produce lower carbon energy through collaboration and partnership models with our customers,” said Wallace Pescarini, president of SLB’s Offshore Atlantic basin.

At the end of 2023, Brazil’s state energy giant Petrobras and ANYbotics teamed up to automate offshore inspections using the ANYmal X robotic inspection solution. ANYmal X is deployed on FPSO vessels to perform repetitive and hazardous inspection tasks. The solution has the potential to add value over several years, improving safety and routine task productivity, ANYbotics said.

More recently, ADNOC, Abu Dhabi’s national oil firm, said at the end of July that its offshore Satah Al Razboot (SARB) field had achieved a 25-percent increase in production capacity to 140,000 barrels per day (bpd), through the implementation of industry-leading advanced digital technologies.

The digital solutions implemented onsite at SARB allow the field to be operated remotely from Zirku island, 20 km away. Remote monitoring, smart well operations, and production management technologies are integrated at the remote control centre for optimized real-time decision-making.

“The field’s digitalization will enable the deployment of additional AI solutions to further enhance and optimize operations,” ADNOC said.

The production increase at the SARB field supports ADNOC’s target to increase its production capacity to 5 million barrels of oil per day by 2027.

Abdulmunim Saif Al Kindy, ADNOC Upstream Executive Director, said:

“AI and digitalization are at the heart of ADNOC’s smart growth strategy to help responsibly meet the world’s growing energy demand.”

In an ever-evolving digital world, CAN Group is driving the use of optimised technology for both our own and our clients’ benefits.

We understand that our clients' success is intrinsically linked to the integrity and performance of their assets, and our team of experts work tirelessly behind the scenes, embracing innovative technologies and creative solutions to ensure we continue to meet evolving client needs.

We adopt the latest digital technologies for advanced diagnostics, accurate inspections and proactive maintenance strategies to help enhance asset performance and reliability.

From effective project management to offering real-time analysis of inspection data, our suite of digital tools ensures seamless operations and optimised service delivery, by using market-leading technologies and integrating with technology providers.

Our business transformation into a digital organisation has been a journey, and one that continues to evolve. The asset integrity and inspection arena exemplifies what can be achieved when embracing digital technology, and CAN Group has been invested in this since our inception in 1986. We are continually using next generation digital NDT technology and analysis tools, data visualisation and statistical analysis software to further enhance our service delivery and provide inspection data in new and more meaningful ways.

Leveraging these technologies, we provide a highly optimised inspection and integrity service. Our clients reap the benefits from increased efficiency, which leads to improved safety, compliance, and overall project outcomes.

However, our digital journey doesn’t stop there, it also goes beyond the technical and is integrated across every avenue of our business, enabling smarter and more efficient ways of working.

Adopting tablet-based inspection reporting has been a shared goal for many operators for several years, but the challenge in ensuring this tool is a success has been determining how to fully integrate the technology within the overall Integrity Management process.

CAN Group has been successfully using tabletbased reporting for a number of years utilising our proprietary system, CANtab and ENGAGE; producing digital workpacks in the ENGAGE workpack module which are then available immediately to the inspector offshore.

ENGAGE, our data intelligence solution supports integrity needs across the full asset life cycle and has revolutionised the way inspection data is handled. It offers advanced data management and visualisation capabilities, providing real-time analysis of inspection data. The system enables our clients to access inspection results promptly, allowing for quicker decision-making especially around Anomaly Management.

CANtab integrates with ENGAGE to enable a fully integrated end-to-end inspection data management experience from technicians in the field to office-based engineers worldwide - all information is immediately available for review facilitating safe and efficient operations. These tools ensure that all necessary documentation is prepared accurately and efficiently, reducing the time spent on administrative tasks. As a result, our clients experience a smoother workflow and faster turnaround times for their inspection needs.

Tablet-based reporting eliminates manual data entry, freeing up valuable resource and increasing the efficiency of the overall process, with a clear and traceable digital workflow –a key example of how digitalisation of core processes can deliver very real and tangible added value.

CAN’s Contract Performance Management tool, CANtime, is pivotal in the creation, implementation and monitoring of project inspection plans, including a detailed analysis of productive and non-productive time and budget monitoring for smart and efficient decision making. The system not only ensures efficient use of our resources but also provides our clients with transparent and detailed insights into how project hours are allocated, leading to enhanced project management, plan attainment metrics, cost control and budget forecasting. By integrating CANtime with our accounting systems and processes, we also achieve streamlined and accurate invoicing through assigned time-writing.

Working closely with our clients to understand and gain upfront visibility of their yearly inspection routines, CAN’s project management team can refine, implement and manage the annual inspection plan, ensuring the efficient and effective use of resources and ‘right sized’ teams. An example of what can be achieved by working smarter through the use of CANtime, CAN successfully demonstrated the ability to reduce POB headcount by 25% as well as overall cost savings of 15% for one of its clients - very real and tangible added value.

Inventory management systems play a crucial role in tracking and managing our equipment, including customs compliance. By managing the full workflow from job initiation to completion, it helps identify peaks in utilisation, ensuring the necessary equipment is available when needed. For our clients, this means reduced downtime and the assurance that the appropriate tools are always at hand to complete projects on schedule. Our solution; CANifest.

CAN Group’s investment in digitisation continues to yield significant benefits for both the company and its clients. Whether it be artificial or human intelligence driven, team CAN are actively innovating and improving the asset integrity process through our suite of tried and tested digital systems; streamlining operations, enhancing data accuracy and optimising resource utilisation. www.cangroup.net

With over 60 years of experience, Proserv has established itself as a leading Original Equipment Manufacturer (OEM) in subsea control systems.

Our technical expertise and commitment to innovation have kept us at the forefront of the industry, allowing us to adapt to the evolving demands of the market and ensure our solutions remain cutting-edge. Today, Proserv is leveraging its rich history to usher in a new era of digitization, enhancing our core products and setting the stage for future advancements.

The subsea control systems industry is undergoing a digital revolution, driven by the need for more advanced, data-driven solutions. Clients are increasingly demanding complementary digital tools that enhance operational efficiency and provide predictive insights to prevent failures before they occur. The growing complexity of subsea operations, coupled with the need for increased reliability, highlights a critical need in the market for more targeted and proactive digital tools.

Proserv’s Tailored Response: Developing In-House Prognostic Software

In response to these industry challenges, Proserv is currently developing an in-house prognostic software solution tailored specifically to our Subsea Control Systems