MORTGAGE

Paul Lucas

paul.lucas@keymedia.com

Deputy News Editor

Jake Carter jake.carter@keymedia.com

Richard Torne

richard.torne@keymedia.com

Commercial Director

Matt Bond matt.bond@keymedia.com

Advertising Sales Executive

Jordan Ashford jordan.ashford@keymedia.com

Campaign Manager

Amie Suttie

amie.suttie@keymedia.com

Campaign Coordinator

Raniella Alonzo

Content Editor

Kel Pero

Production Manager

Monica Lalisan

Production Coordinators

Loiza Razon, Kat Guzman

Head of Marketing Robyn Ashman robyn.ashman@keymedia.com

It may not seem like it as we go about our day-to-day lives, but we’re living in historic times.

Not only are we still reeling from a pandemic on a scale not s een in more than 100 years, but in the last couple of months alone, we’ve had a new p rime m inister, the loss of our longest reigning m onarch , and a “mini” budget that contained some of the biggest taxation changes in more than 70 years.

value of the property on which firsttime buyers can claim relief, from £500,000 to £625,000.

Much like the overall tax changes, however, its stamp duty adjustments were met with equal parts praise and derision.

KM Business Information UK Ltd

Signature Tower 42, 25 Old Broad Street Tower 42, London EC2N 1HN www.keymedia.com London • Toronto • Denver Sydney • Auckland • Manila • Singapore

Mortgage Introducer is part of an international family of B2B publications, websites, and events for the mortgage industry

CANADIAN MORTGAGE PROFESSIONAL cmpadvertise@keymedia.com

MORTGAGE PROFESSIONAL AMERICA mpaadvertise@keymedia.com

MORTGAGE PROFESSIONAL AUSTRALIA claire.tan@keymedia.com

AUSTRALIAN BROKER simon.kerslake@keymedia.com

NZ ADVISER

alex.rumble@keymedia.com

Copyright is reserved throughout. No part of this publication can be reproduced in whole or part without the express permission of the editor. Contributions are invited, but copies of work should be kept, as the magazine can accept no responsibility for loss.

The last was received with reverence and contempt in near equal measure – praise given for a reversal of the national insurance hike at a time when so many are facing a costof-living crisis, but scorn poured on the fact that it is the richest who seem to benefit most from the changes.

For the housing market, the most notable adjustment came in the government’s decision to cut stamp duty land tax. The nil rate band will be doubled from £125,000 to £250,000, which could enable 200,000 more people every year to buy a home without paying any stamp duty at all. Meanwhile, the government has also extended its support to first-time buyers, who will no longer pay stamp duty up to £425,000. It has also increased the

“Once again, as turbulence has struck, the government has reacted quickly to support the market, just as they did with the COVID-19 stamp duty holiday,” Jatin Ondhia, chief executive at investment firm Shojin , stated on decision day.

Contrast that, however, with the words of Steve Seal, chief executive at Bluestone Mortgages, who highlighted that the “real issue” is demand outpacing supply.

“To combat this, the government must focus on a more staggered approach to stamp duty rather than a cliff edge deadline to reduce pressures across all elements of the housing market,” he said.

Wherever you stand, however, there’s no doubt about the role of the broker now – to be the face of reason and consistency amid tempestuous change. Be the voice your clients can rely on, and bring calm amid the storms.

Paul Lucas

We’ve extended the roll off period on our Product Transfers to six calendar months.

This could give your customers more options and a longer time to complete their transfer with us.

And with no additional underwriting along with quick and straightforward processing your customers could treat themselves to a new deal sooner.

To access our Product Transfer range, go to our products page at intermediary.natwest.com.

ONLY FOR USE BY MORTGAGE INTERMEDIARIES

The challenges facing borrowers continue to mount in the face of heightened energy prices, swap rates trending upwards, rising interest rates, and soaring levels of inflation, all of which are hampering consumer confidence and spending to an extent. However, the intermediary market remains busy and adviser workloads are still high as we move toward the back end of 2022.

This was evident in the latest Money and Credit statistics from the Bank of England, which outlined that mortgage approvals increased to 63,800 in July, up from 63,200 in June. Net mortgage borrowing decreased slightly to £5.1bn in July, from £5.3bn in June. However, this is above the pre-pandemic average of £4.3bn in the 12 months up to February 2020.

Gross lending increased to £26.1bn in July from £24.6bn in June, and gross repayments rose to £20.8bn, from £19.4bn. The effective interest rate paid on newly drawn mortgages also accelerated by 18 basis points to 2.33 per cent in July and is the highest since June 2016 (2.39 per cent).

This set of data emphases the resil ience of the mortgage market and how it defies some expectations. Having said that, with many personal finan cial situations being squeezed, as an industry we have to expect a degree of pushback from potential purchasers. On the flip side, greater levels of activ ity should be expected from home owners who are looking to act quickly and lock into the best deals prior to any further rate hikes.

As cost-of-living anxieties continue to rise, it was a huge positive to see mortgage arrears continue to fall in Q2

Harking back to the BoE figures, these also showed that approvals for remortgaging with a different lender increased to 48,400 in July from 43,300 in June. This does remain below the 12-month pre-pandemic average up to February 2020 of 49,500.

In addition, the latest LMS data showed that remortgage completions increased by 41 per cent in July as homeowners prepare for future rate rises, and suggested that 88 per cent of remortgagors now expect further interest rate increases within the next year. It was also interesting to see that 70 per cent of those who remortgaged in July took out a five-year fixed-rate product – by far the most popular product over the month.

As outlined in commentary around this data, as people grapple with economic uncertainty, the popularity of five-year fixes has hugely increased in comparison to last year. In July 2021, fewer than half of homeowners

remortgaged to a five-year fixed rate, a figure that has increased to 70 per cent this year.

Amidst this uncertainty, the advice process is playing a vital role in help ing a range of homebuyers to secure their monthly mortgage outgoings for longer periods, if appropriate for them. And with personal financial scenarios shifting all the time, the value of this advice will only grow.

As cost-of-living anxieties continue to rise, it was a huge positive to see mortgage arrears continue to fall in Q2. According to the latest figures from UK Finance, there were 74,540 homeowner mortgages in arrears at the end of June. This is defined at 2.5 per cent or more of the outstanding balance. The trade body said that this was a reduction of around 200 homeowner mortgages compared to the previous quarter, and 10 per cent fewer than the same period last year.

UK Finance also noted that, in absolute terms, there were 530 more possessions in Q2 2022 compared with the same period last year. However, it was pointed out that year-on-year comparisons for pos sessions will look unusually large due to greatly suppressed activity in Q2 2021 as the courts and the industry slowly resumed activity following the end of the possession moratori um. Possessions taking place now are, therefore, almost exclusively his toric cases that would, under normal circumstances, have taken place over the course of 2020 and 2021.

Arrears figures may be substantial ly lower than pre-pandemic num bers, but this is certainly an area that needs to be closely monitored, as some households will struggle to keep up with additional living costs, and communication remains key between lenders and borrowers to ensure these levels of arrears remain as low as possible.

It took the sub-prime crash, ensuing credit crunch, and the global financial crisis for regulators and central banks the world over to take a proper look at how lenders assessed borrowers’ ability to repay their mortgages. The Mortgage Market Review (MMR) that followed was seen by many as closing the barn door long after the horse had bolted.

Although not technically the result of the MMR, further regulations imposed by the Bank of England included more robust capital buffers and rigid stress-testing on affordabil ity. In August, that stress test – long argued against in the context of rock-bottom rates – was dropped.

After six base-rate rises in less than a year, and with more on the way, the need for borrowers to have the fi nancial capacity to withstand a three per cent rise in their mortgage rate now looks rather less draconian than it once did.

Caution is more ingrained in lending culture in today’s market, and just weeks after regaining the freedom to use judgement in the underwriting process, lenders are exercising it fully.

The strain that inflation and the cost of energy are putting on house holds and businesses across the country is painfully clear.

Within 48 hours of Ofgem con firming October’s price cap would almost double and the average household’s energy bills would come in at more than £3,500 a year, Jolyon Maugham, director of the Good Law

Project, announced plans to sue for failure to account for the devastation it will cause.

Lenders are acutely conscious of the responsibility this cost-of-living squeeze will lay at their doors. On one hand, borrowers already on their books are going to struggle to main tain mortgage repayments long-term if this cost pressure does not abate reasonably swiftly. Mortgage pay ment holidays, affordable payment plans, and managed arrears are very definitely coming. On the other, borrowers coming to the end of fixed-term deals will be demonstra bly better off if allowed to remort gage onto another fixed-term deal rather than defaulting to standard variable rates or switching to a deal that is higher than the deal they are rolling off.

This raises the question of responsible lending. How do we define responsible in a market such as this? Is it respon sible to allow borrowers to take on mortgages that they cannot afford to repay? Is it irresponsible to refuse to re mortgage borrowers who cannot afford to repay in the current economy?

The cost-of-living crisis is causing a whole raft of issues with affordability – lenders’ duty of care is to their customers, but also to shareholders, members, and staff. When sensibility is allowed to trump commercial reasoning, it may keep roofs over people’s heads – but what happens when it topples the lender?

In many ways, this will come down to the big retail banks, which have the capital resilience to absorb much of the cost-of-living shock its customers are about to feel. Under the regulator’s eye, I have no doubt they will do their bit.

This won’t solve problems for everyone, however, and it is a risk

that smaller lenders would do well to give some serious attention as soon as possible. An increasing number of lenders are quietly giving their affordability models a haircut. The regulator is also concerned, as the Office for National Statistics’ (ONS) date that most lenders use is back ward-facing and currently bears no relation to what expenses will look like in the coming months.

Increasing buffers is now a matter of some urgency, and many are achiev ing that by factoring in higher costs and lower disposable incomes when assessing affordability. It is a prudent thing to do, but it is anyone’s guess what level is the right one to apply.

Brokers report seeing cases de clined when a week or two earlier they would have been accepted.

Implications for borrowers aside, the speed with which affordability is changing poses a big problem for lenders. Already Moneyfacts has noted how much more frequently lenders are withdrawing products from the market, only to replace them with higher rates and lower loan-to-value deals. Big lenders with slick processes can cope with that speed, reacting fast enough to protect against a sudden flood of applications triggered by the with drawal of a competitor’s range.

Smaller outfits, and many of the smaller building societies, will find it increasingly challenging to manage. Typically, smaller lenders have more involvement in higher LTV lending, and can least afford to take a hit on the balance sheet. Yet, counterintuitively, battening down the hatches when the storm clouds are gathering may not be their wisest move. This is a storm that will last, and it requires lenders to invest in thinking, people, processes, and systems if they want to weather it. This storm will need lenders to invest, which will require guile and bravery.

vices – us – who have a responsibility to help them get through it.

Stuart Miller chief customer officer, Newcastle Building Society

By the time you read this, the summer holidays will seem a distant memory.

Forgive me, then, for harking back to an announcement that we made at the very end of July when we published our full-year results. Over the previous 12 months, we had lent £448m in mortgages, with £181m of that in the first half of the year.

It’s been an unpredictable year in so many respects, with the result that inflation forecasts just keep rising. While it was originally expected to peak at 10 per cent, the Bank of England (BoE) then said 13 per cent was more realistic. Analysts from Citi said in August that their models indicate inflation will be more than 18 per cent by Easter next year.

People are worried, understand ably. Strike action over pay and jobs has been rife amid rising concerns over where the money will come from to pay energy bills already expected to surpass £6,000 a year by April 2023. From dockworkers to train drivers, station staff to criminal barristers and teachers, too – the cost of living is biting across the economy and in all walks of life.

It’s at times like these that banks and building societies are needed most. Communities, households, families, the old and the vulnerable all face a very difficult winter, and it is ultimately going to be financial ser

Most homeowners, I am relieved to say, are in reasonably good shape financially. A year of lockdowns al lowed those who could keep working to save money, and it’s a cushion that will be extremely welcome if bills continue rising as quickly as they have. At the end of June, arrears on our book remained very low, and this is reflective of much of the industry. Even so, with the BoE tightening monetary policy and all indications currently suggesting this will contin ue, mortgage rates are on the rise.

We are conscious that, as we head into the autumn and winter, many homeowners will be due to remortgage, and the likelihood is their rate will be noticeably higher than deals taken in 2020, when the pandemic brought the base rate down to 0.1 per cent.

The Bank of England’s decision earlier this year to remove strict affordability assessments based on disposable income in favour of com mon-sense affordability reviews is now becoming embedded in the market.

This should be helpful for borrow ers whose discretionary spending has been relatively high and can there fore absorb a drop to pay for higher energy and food bills. Nevertheless, they will need good-quality advice to navigate what could be a tricky financial balancing act.

We specialise in taking a sensi ble and holistic view of borrowers’ financial circumstances – we always have. Now, when times are uncertain, lenders’ judgement is going to be even more important.

More than the changing costs of heating and groceries will influence customer behaviour in the future.

Choice comes into it – at least for those who have sufficient income to cover rising bills. Mortgage payments are the last thing to go when people face tough times – holidays, expen sive TV packages, and meals out are easier to give up than the roof over your head.

Even if there is a rise in the number of homeowners really struggling to keep up with significantly higher outgoings, we – and, I would hope, others – are about helping borrowers, not com pounding their problems. As a building society, we also believe lenders like us have a responsibility to step up when things are hard for our customers.

Newcastle Building Society was one of the first savings providers to respond to the BoE’s decision to increase the base rate, passing on the rise to the majority of variable-rate savings prod ucts. We continue to focus on support ing first-time buyers and low-deposit borrowers because they need our help.

I am incredibly proud that in the first half of this year, we have given £182,000 in community funding. That includes community grants from the Newcastle Building Society Commu nity Fund to the Community Founda tion, which focuses on charities tackling employability, social isolation, food poverty, homelessness, debt manage ment, and cancer care.

Our strength of purpose is more relevant than ever to our customers and communities. We think it shows – this is the sixth year in a row we have been awarded Best Regional Building Society at the What Mort gage Awards. Serving our customers is at the very core of what we stand for at Newcastle Building Society, so it’s rewarding to know they think we’re doing a good job.

clients don’t actually care.

Steve Carruthers head of business

Moneyfacts data showed the average shelf-life of a mortgage product had sunk to a record low of just 17 days at the start of August. Another base-rate rise later, and providers again pulled products and came back with revised pickings.

The market has seen lenders with draw and reprice far more frequently than had been the case in a good while. Partly that’s down to the changing eco nomic situation; it’s also due to lenders needing to control application volumes as competitors pull products, suddenly rendering their deals best-buys.

Rates continue to climb. Since the start of August, Moneyfacts data shows the overall average two-year fixed rate has already increased by 0.14 per cent and has now reached 4.09 per cent. According to its first-ofmonth averages, this is the first time that this rate has breached four per cent since February 2013.

Even in our Mortgage Efficiency Survey interviews this year, getting products in and out of market has become a serious issue for many of the lenders to whom we spoke – many have not had to go through the gears of quick product repricing for many years, with serious consequences for operational and funding models.

Meanwhile, the price gap between variable and fixed deals is becoming increasingly marked. This is one of the flags that makes me wonder about how the majority of the mortgage market defines value. Sourcing systems throw up results based on rate. We all know that fees matter. We all know that most

Very often I think the need for agility is viewed from the lender’s point of view, but brokers and borrowers will demand it, too. Borrowers are even more price-sensitive than usual given the rising cost of living. Every extra pound in their pockets each month is really going to matter for an awful lot of people. But their financial circum stances are also going to be a lot more complex, unpredictable, and stressful.

This means there is a very good possibility that agility in pricing and mortgage propositions will be with us for some considerable time – not simply because of funding issues that support product pricing, but because consumers will make decisions today on borrowing that they will want to unwind sooner than we, and they, may think.

You can see why. If a borrower is considering a move in the next couple of years, who’s to say an ERC-free tracker isn’t actually a cheaper option for them than a fixed they could have to pay thousands of pounds to get out of early? Some will argue for, others against.

Some lenders are worried that mort gage recommendations, skewed by headline rates dominating the brokers’ sourcing systems, could cause them a real headache in future.

The danger with fixing on the lowest rate possible is that, where loan-to-val ues are high, affordability is stretched. Even where affordability has a very healthy cushion, inflation is going to put the squeeze on.

Of course, this is where good advice is crucial. It’s not just lenders who are thinking this carefully about future affordability. There is also the regulator to consider – what is responsible lend ing in an economy where even stable and well-managed family finances look unavoidably wobbly?

Borrowers – and it’s often first-time buyers who are desperate to get on the

ladder, whatever the cost – are all too often not going to worry about what happens next year. They’ve got the house. For many borrowers, house prices simply go up – don’t they?

I am not for one second saying they won’t – there are too many factors sup porting demand and constraining sup ply for the housing market to tank. But that doesn’t mean that some borrowers will feel obliged to take a lower rate regardless of the upfront cost. It cannot be in customers’ best longer-term inter ests to mortgage themselves to the hilt when all of us are facing a very uncer tain period for our finances.

The question of where mortgage products go next after the current bout of inflation will demand changes of us all. But in terms of implemen tation, speed and agility will matter to everyone because lending will be about delivering the right product at the right price at the right time. As we have seen, good outcomes are becom ing the regulator’s goal for borrowers. The need for good products that serve everyone well will demand operational excellence from systems and people.

The future will require more products and newer propositions – digital and otherwise – that can meet the need for agile borrowing that surfaces as a result of the current market.

In markets as evolved as UK housing, coping with increasingly rapid change can require more ingenuity than might be expected in younger, lessregulated sectors. Challenges from the market, economy, or regulator come thick and fast. But rather than belabour a point about the inadequacies of legacy thinking and technology, I believe that, more than ever, it is important we remain agile to evolve and develop our propositions.

Brand-new apps and chat bots that manage to communicate with teenagers more effectively than their parents do are omnipresent. And there is a tendency in a mature market for its incumbents to feel a mixture of intimidation, confusion, bemusement, and then exasperation with technology brought in to make the process of buying a house “less complicated and less painful.”

I am categorically in support of innovation and investing in technology that supports better customer outcomes and experiences, and, frankly, makes our professional lives easier and less fraught with indemnity risk.

But I also get exasperated by the idea that old and traditional is bad and new is good. It is a binary distinction that makes a snappy soundbite, but it really doesn’t mean very much. More accurate would be to say, some old technology is no longer optimal or is redundant now and some new technology could do the old jobs a lot better.

Some old technology and processes are, however, unbeatable –especially where complex experience and judgement are required –because they have been finessed over hundreds – yes, hundreds – of years. The wheel remains round, so to speak. It can go faster, but it is still round. When the uninitiated come to market claiming to have found the holy grail that will solve everything, that’s when the rest of us sigh and wait for the moment they realise it’s not that easy. Nothing ever is.

Therefore, we need agility of thinking when it comes to new propositions. When one comes to market and is as successful as, for example, our cladding database, we need to understand that new digital propositions may not involve repeating that same proposition. They may use data, and they may use technology, but their application and audience may be entirely different.

It’s why we are working on a myriad of new possibilities all the time. We need to ensure, as does every new business, that when we invent, we are also alive to the possibility that we should not tie ourselves to the original idea and hammer, hammer, hammer away at delivering the perfect version of that idea until a) someone else does it, or b) the market no longer needs or wants it (if they ever really did).

There’s a salutary lesson in this. Fixed ideas are rarely good ones. Like it or not, the world is a place that works for everyone only if there is compromise and openmindedness. The product you begin to design may not be the one you eventually put to market – but that is agility.

Refusing to adapt is likely to result in Canute-type behaviour that ultimately leaves everyone in deep water. Even choosing to change from

one absolute to another absolute fails to recognise that the need for that change will continue to evolve and will necessitate further change.

My point is that if businesses –we, in other words – want to have a chance of thriving as well as surviving then we need to find a way to build a model that reacts to change as and when it happens and is required.

Consider our market and the changes we have had to deal with in under a decade: the Mortgage Market Review, the Mortgage Credit Directive, various Basel regimes, changing monetary policy, capital adequacy rules, affordability and risk weightings, changing stamp duty rules and the withdrawal of tax relief for some parties and not others, energy efficiency thresholds (still to come), leasehold liabilities being legislated upside-down, our ageing population – this list could go on.

I am sure that generations before us must have believed they lived through unprecedented change, and the risks currently facing the UK housing market may, in geopolitical terms, be trivial by comparison. Nevertheless, they are material to homeowners, landlords, and institutional property owners, as well as to the banks and building societies that underwrite that ownership.

These things change, and as we assess them, so might our propositions – even if we currently think we have the right answer. Pivoting in response to these changes is important if, ultimately, we are to produce real value for our market.

Gather your intelligence. Be prepared to change your mind if or when your information changes. And invest in processes, technology, and systems that deliver what you need to remain agile. That way we all benefit from agile thinking.

business and development manager, The London Institute of Banking and Finance

As the old saying goes, knowledge is power. Acquiring knowledge and education will give you the power to make the right decisions and take the right actions.

And in my view, while you’re there to advise your customers about their mortgage needs and help them make the right decisions, you’re also there to educate them.

So, as a mortgage adviser, how does be ing educated help you? Why should you continue to develop your knowledge, when you’re already a skilled and fully qualified adviser?

Well, for a start, things change. And, unless you’ve been a mortgage adviser for over 30 years, you’re unlikely to have seen an economic environment similar to today’s. Even if you have been in the sector that long, there are significant differences between now and the last bout of high inflation.

A key part of your education is actually understanding what’s going on in the economy. The context this provides is an essential component in the toolkit of any mortgage or financial adviser. No, it won’t necessarily tell you what’s going to happen next. But it should help you understand the implications of different scenarios. In turn, this will help you educate your customers about the possible benefits and risks of different options, and how these might be affected by future changes.

It’s also worth understanding what’s

happened in the past. As I’ve said, there are significant differences between today’s economic downturn and previous ones. However, there are still lessons to be learnt from 30 years ago. One example that can be applied to both mortgage advisers and your customers is the importance of minimising unnecessary expenditure.

From an adviser perspective, other important lessons from previous economic crises include:

diversifying your business model investing in your business at the same time as reducing expenses taking short-term measures for long-term gain embracing changes – seeing them as an opportunity, not a threat

In the current climate, education may also increase your ability to empathise with others and to understand the world from another person’s perspec tive. If you know what’s worrying your clients and why, you’re in a far better position to investigate, and possibly alleviate, those concerns.

Education may also change your attitude to risk. By broadening your understanding of risk and becoming better at communicating and explaining risk to your customers, you will be educating them – again enabling them to make more informed choices.

Of course, education isn’t purely about developing your skills and knowledge. It’s just as important to learn how you work most effectively so that you can always present the best version of yourself to your employers and your customers.

Confidence and resilience are key to surviving any form of crisis, and you can increase both of those by understanding the following:

what’s happening around you –

and why

how these changes affect you and others

what the potential risks are – and how to manage or mitigate these

how you work at your best

Education will help you retain control and plan the best way forward for you and your customers.

Choose your CPD carefully to develop the skills and knowledge you need. Why not undertake an advanced mortgage qualification, such as the CeMAP diploma? This will help you better understand the financial impact of global and personal changes on your mortgage customers.

So far, I’ve focused primarily on the benefits of education, either directly to you as a mortgage adviser or to your customers as a result of your advice.

However, your customers and their financial health will also benefit hugely if they understand, and can adopt, a financially educated approach to managing money.

With financial education, your customers will:

be able to make better-informed decisions

be less likely to fall into debt

know when to seek help or advice and from whom

understand and actively manage risks

have better overall control of their finances

You have a responsibility to educate your customers about their mortgage and associated financial products. If you can also provide them with a thirst for further knowledge, you could have a greater impact by encouraging them to thrive in challenging economic times.

support self-employed borrowers in achieving their mortgage and property-related aspirations.

People enter self-employment for many different reasons, at different times in their lives and with different motivations. This includes a variety of occupa tions, roles, and income-generating opportunities. Experiences also tend to vary from person to person, and this is often reflected from a borrowing standpoint, as financial situations tend to be quite fluid.

For many, this was especially ev ident over the course of a pandemic that hit a number of industries hard, with the repercussions still being felt by the self-employed community as income and profit reductions suf fered over the last two years are still proving highly persistent for some.

This was the finding of the fifth, and latest, LSE-CEP survey, entitled COVID-19 and the self-employed – A two-year update. The survey also found an ongoing impact on the number of self-employed people. While in the last two years the number of employees working in the UK has grown above pre-pandemic levels, self-employment has not recovered to pre-2020 levels.

However, it’s certainly not all doom and gloom. Many self-employed people have not only survived but have thrived over this period, although there still ap pears to be a little disconnect over how they view the mortgage market.

As such, it’s important to outline how lenders and intermediaries can work together to help, not hinder, the self-employed. With that in mind, let’s outline some ways in which a specialist lender can

This is pretty self-explanatory. Despite some lenders capping their LTV limits during the pandemic, deals up to 90 per cent LTV do remain.

Grants and bounce-back loans were all prevalent over the course of the pandemic, and many specialist lenders are using the flexibility attached to a manual underwriting approach to support those self-employed borrowers who were affected during this period.

Some businesses’ profits have been hit over the pandemic, which could, historically, have affected potential borrowing limits. More lenders are now taking a more pragmatic approach by accepting one year’s accounts and a verified accountant’s projection for the following year.

Businesses set up toward the latter end of the pandemic may still be in their earliest form, but highly profitable. A few lenders will consider using net profit plus salary or salary plus dividends in this scenario, together with a verified projection from an accountant.

It isn’t uncommon for some business owners to be in more of an admin/ managerial role as their business be comes better established. If they are in non-manual labour roles (for example, have staff working for them), lenders may consider taking the mortgage term to age 75, with no proof of pension needing to be evidenced.

In the past, advisers may have come across customers who had been made partners in firms by which they were previously employed, and wondered where to place the case, as they didn’t yet have a full set of books with those customers as directors. Some special ist lenders can work on the previous year’s salary as income and write to a firm’s accountant to verify income in their new role.

Over the past year or two there has been a significant increase in contractors since the changes to IR35. Many specialist lenders have also shifted criteria re quirements and may now even consider borrowers who have been contracted less than a year, if they have relevant industry experience.

When speaking to self-employed per sons who work in the building trade, ad visers need to make sure they establish whether these people are self-employed, or are CIS contractors. CIS contractors can be assessed in different ways. They may have more borrowing power by using the last three months’ gross pay rather than using the last year’s net-prof it figure.

Some customers prefer interest-only mortgages and would like to use sale of mortgaged property as their repayment vehicle. Again, this is something many specialist lenders can assist with.

This is not an exhaustive list, but does hopefully offer insight into some criteria-related solutions that can meet a range of self-employed needs.

rarely means anything on the ground.

Robin Johnson MD, Kinleigh Folkard & HaywardProperty markets anywhere are influenced by all manner of factors. We talk about housing supply, affordability, and demand more often than anything else, but in fact there are many other considerations when it comes to understanding the value of a home.

Proximity to (good) schools matters. Access to amenities – a GP surgery, a decent hospital, a chemist, supermarket mini or maxi, somewhere to fill up the car, and recreational facilities – these things all matter and can have a significant effect on what someone is prepared to pay for a home.

There are also geographical factors that can wipe out a home’s value at a stroke. Flood plains are a recipe for difficulty. Old extant mine shafts, fault lines, shale, nuclear waste. You get the picture.

London, as I have said before, remains a geography of many markets – all of which ebb and flow according to the distinct characteristics of the boroughs or areas you consider. It’s just one reason why anyone who thinks of London as one homogenous market will likely not understand why some parts are flourishing in comparison to others right now.

It’s the fundamental problem with broad measures. We see it with the many national monthly indices that take varied data (mortgaged and cash purchases) and endeavour to draw a national trend. It gets headlines, but

For my own patch, there continues to be the usual diet of mixed views about London as a single market as opposed to its reality. There’s been a lot of housing market hype brought on by the pandemic. Many headlines trumpeted the great escape from the city to country life. We’re all working from home, ran the front pages. Commuter towns are over, said the pundits. You don’t need station access – fibre broadband access is what you really want.

Now, of course, the pendulum has swung the other way, and we have something of the opposite in some parts. Hybrid working is affecting local markets previously thought to have been abandoned but now proving very resilient.

What is clear is that many factors over and above supply and affordability go into the homebuying decision. There are reasons why many parts of London and its commuter towns remain stubbornly resilient.

These reasons are not hard and fast rules, but they go a long way toward illustrating why people undertake the home moves that they do. People like and need access to green spaces, but not everyone can work from home. An awful lot of people can’t, in fact. What’s more, people are social animals. We enjoy and are extremely affected by issues in our community – even if we do not directly engage with it. We all have a stake in where we live being a good place to live.

On a work level, hybrid working has shown (judging from the recent announcements of many large organisations) that companies like to feel in control and know what their employees are up to. Living within reach of work has not gone out of fashion. This means that

trains and stations continue to be very useful. Expensive, yes, but very useful. Infrastructure, too, is important. Fibre broadband is key for hybrid working, and cities and their environs provide this – and everyone agrees that seeing someone on a screen is not the same as faceto-face.

The idea that metropolitan locations are no longer attractive places to live might grab a headline. It doesn’t really stack up, though. Looking back to 13 April last year, when England reopened from its third major lockdown, the sense of joy felt by those in London was palpable.

“Central London roared back to life with a £100m day-one spending spree in shops, restaurants, and pubs after more than a year of ghost-town desolation,” sang the Evening Standard

“West End bosses said the first day after the easing of lockdown restrictions had unleashed the strongest reopening since the start of the pandemic and had far exceeded expectations.”

The Coutts London Prime Property Index said that by the end of Q2 this year there were “signs that London’s prime property market is getting back on form.” Prices are now just 6.7 per cent below the glory days of their peak in 2014. They’re also up 7.8 per cent compared to last year, with double-digit rises in some areas.

The price difference between central London and outer London is increasing, with central properties now 58 per cent more expensive, up from being 49 per cent pricier at the start of the year – a sign that central London property is picking up, said Coutts.

London is more than one market – in much the same way the rest of the UK is not one market. Once you understand that, you can make good buying and lending decisions.

You may be aware of two recently coined phrases: the Great Resignation and quiet quitting. Both have been trending on social media plat forms, in particular.

The Great Resignation refers to the record number of people who left their jobs following the onset of the pandemic. After extended periods of working from home with no commute, many people decided their work-life balance was more important to them than they had realised, and they left their jobs in favour of others that would let them stay home.

Quiet quitting refers not to an employee leaving a job, but instead reprioritising and limiting tasks to those within the job description –setting clear boundaries to improve work-life balance.

A key finding of consultancy firm PwC’s Global Workforce Hopes and Fears Survey of more than 52,000 workers in 44 countries and terri tories, carried out in March 2022, suggested one in five workers glob ally was planning to quit in 2022. As economies and businesses around the world continue to recover from the pandemic, many organisations have been hiring again, thus offering work ers an abundance of choice. With so many options, PwC said in a press release that higher pay, more job fulfilment, and wanting to be authen tic at work were encouraging workers to change jobs. I suspect the resig nation stampede has been tempered by prevailing global economic issues;

however, without suitable manage ment, those underlying motives may well lead people to stay put, but on their terms.

Interestingly, the survey found that 65 per cent of workers want to discuss sensitive social and political issues at work, something that has historically been seen as potential ly divisive. The importance of this matter was reflected in 69 per cent of under-25s and 73 per cent of ethnic minorities confirming that it was particularly significant to them.

It isn’t surprising that more mon ey is the biggest motivator for a job change – yet finding fulfilment at work is “just as important,” according to PwC. Some 71 per cent of survey respondents said a pay increase would prompt them to change jobs, but 69 per cent said they would change em ployers for better job fulfilment, too.

So, with 66 per cent of those surveyed indicating workers want a workplace that allows them to truly be themselves, the role of employ ers clearly isn’t to tell workers what to think, but to give them a voice, choice, and a safe environment in which to share feelings, listen, and learn about how social and work is sues are affecting them and their col leagues. This may well be uncomfort able, but it is clearly important that work feel like a safe place to discuss major social issues, and firms need to ensure these discussions can benefit teams rather than dividing them.

With significant economic shocks emerging and therefore fewer va cancies available, quiet quitting has emerged, and people who have been confronted with their mortality as a result of the pandemic are thinking more deeply about what they real ly want from life – including their careers. People are asking themselves what their real values are and why

they should spend their days doing something that doesn’t align with those values.

It shouldn’t be forgotten that, as inflation spirals, employees will in real terms have less disposable in come, perhaps making them wonder why they should work so hard.

It is those employees who feel dis connected from their employers who are quietly quitting, and employers must understand that the pandemic, the war in eastern Europe, soaring utility bills, and inflation all mean they need to listen to and empathise with employees’ experiences. If nothing else, engage with your employees more, listen, and discuss what can be done to make them feel supported; this, in turn, will make them feel appreciated. Help employ ees manage stress and look out for ways to combat the mental health issues some will inevitably feel.

From an office perspective, quiet quitting can cause conflicts between employees, as some will feel others aren’t carrying their weight. How ever, again, it is imperative to seek to understand the eternal pressures people may be experiencing before judging their decisions to be less committed than you are.

Gallup’s global workplace report for 2022 showed that only nine per cent of workers in the UK were engaged or enthusiastic about their work, ranking the UK thirty-third out of 38 Europe an countries. Whilst the intermediary mortgage space has been very active, it shouldn’t neglect the importance of adopting a listening and inclusive mindset, ensuring working models are sustainable, and supporting employees in feeling they are doing more than just existing. People are fulfilled by gaining new skills and experiences, having greater control over their jobs, and feeling genuinely appreciated.

head of marketing –insurance, Canada Life

head of marketing –insurance, Canada Life

Equity release mortgages stand out from other financial services products in that they have the potential to affect the finances of entire families. As such, obtaining one could be seen as a family decision rather than an individual choice. This obviously adds a layer of complexity or consideration to the advice process, and requires a deeper understanding of your clients. This is so particularly when it comes to under standing their personal long-term goals and the financial aspirations of their children, but it also encompasses any caring requirements they may have for themselves or loved ones.

Canada Life has been researching the psychology behind this long-term thinking, and in particular the impact of the family on decision-making – all with the aim of providing a blueprint for how these early conversations with clients can be better understood.

It’s understandable, for example, that clients may want to seek out another opinion on what’s best for them. We found that clients would rather share their long-term goals with their families than anyone else. Interestingly, only 23 per cent of peo ple said they would share their goal of securing a good retirement with a financial adviser.

Our psychological insights tell us this is most likely down to so-called safety behaviour, as there’s less perceived risk in sharing goals with family than with an adviser. People find it easier to connect with others when they see suggestions packaged

We found that clients would rather share their long-term goals with their families than anyone else. Interestingly, only 23% of people said they would share their goal of securing a good retirement with a financial adviser

to suit the way they view risk and their behavioural values.

Some clients might appreciate having the details of a policy highlighted to them carefully, while for others this could lead to a loss of interest, as they just want to know what new opportunities it will give them.

Encouraging clients to share their retirement goals and aspirations with you could provide engaging conversations for all involved. And tailoring these conversations to suit your clients could also benefit them,

by helping them form open and honest relationships with you early on, allowing you to support them not just through current circumstances but also through important life events as they unfold.

In fact, this could extend to the wider family, aiding in conversations around the legacy your clients intend to leave and further opportunities for intergenerational planning.

Our research into long-term thinking shows that 46 per cent of people consider financial security their most important legacy to loved ones. And in today’s uncertain climate, passing down wealth could be one of the ways they’re able to achieve this. But in a changing world, it’s becoming difficult to know the best way to approach this matter.

Understanding the behavioural drivers that sit behind family influences and changing mindsets could provide you with helpful ways to encourage your clients to share their long-term goals earlier, strengthening your relationship and leading to more valuable support.

that the overall private rental inflation recorded by the government is a more modest three per cent.

While some speculate that the cost-ofliving crisis could see an upturn in tenant arrears, the health of the sector is underpinned by strong demand, something that is likely to remain amidst current economic conditions.

The colder, longer, darker nights that herald the onset of autumn match the mood of the nation as our economic worries grow. Businesses and consumers alike are facing chal lenging months ahead as the reality of energy costs and other inflationary pressures bite.

Like many sectors of the economy, landlords will face some pressures. Landlords are experiencing record levels of tenant demand, but it’s inevitable that tenant arrears will increase. Operating costs, such as maintenance, are also increasing.

However, I feel that the private rented sector (PRS) will again show its resilience. Yes, the headwinds are there, but the PRS has always demonstrated counter-cyclical and defensive qualities; in times of economic downturn, the sector has historically performed well.

We know that people largely priori tise paying housing costs, and that niceto-haves, such as TV subscriptions, takeaways, and holidays abroad, are the more likely casualties of tightening purse strings.

Much of the media coverage on the PRS has focused on hikes of 20 per cent and more in rents in certain markets, but it’s important to remember that these indices capture new tenancies and

Landlords, on the whole, try to work with their tenants to keep them in their homes. The record level of tenancies being renewed – “the big stay put,” as Propertymark called it –is testimony to this, and our research shows evidence of landlords working with tenants who may experience financial difficulties.

Even if we do see an increase in tenant arrears, lessons learned from the global financial crisis mean that mortgage underwriting is today more stringent, and landlords are not as highly geared as in the late noughties.

Analysis from Moneyfacts revealed that mortgage rates have risen more steeply in the residential market com pared to buy-to-let following the Bank of England’s successive increases to the base interest rate.

This is because landlords pres ent less risk to lenders owing to the ability of their properties to provide income. This is especially true of the professional end of the market, where larger portfolios mean that if one tenant falls behind with rent, other income is usually enough to cover the shortfall.

Our most recent research shows that landlord profitability has remained sta ble. Even though the research shows that landlord confidence has faltered, this is primarily in the outlook for the UK economy rather than the prospects for landlords’ own lettings businesses.

I think central to this outlook is strong demand for privately rented homes. Even though property pur chase prices have started to cool, this is following the sharpest increases in over a decade. When we also con sider that the pressure on household finances comes at a time when the cost of borrowing continues to rise, partic ularly in the residential space, we see

that the ability to get on the property ladder will be hindered for many.

Many indices, including our own, show tenant demand at significantly higher levels than in recent years at a time when the supply of rental homes is constrained. It is estimated that around 10 per cent of landlords have left the sector in recent years, with legislative reforms and changes to Energy Performance Certificate (EPC) requirements potentially exacerbating the situation.

Fewer landlords mean reduced choice for tenants, and lower levels of supply amidst high demand will only serve to increase rents further, so it is our responsibility to do what we can to protect our customers.

Alongside campaigning for regula tion that protects landlords as well as tenants, one way we can aid our cus tomers is by minimising the impact of so-called payment shock.

Increases in the cost of funding for lenders have resulted in rate rises which means that customers reverting on to SVRs will see higher monthly repayments compared to those of their previous fixed-rate mortgage.

We’ve been proactive in trying to minimise this, advising customers to speak to their brokers about switch ing to a new product, something we now allow up to six months ahead of their fixed-rate mortgage maturing. Brokers can take a similar approach, and, by contacting clients and discussing their options well in advance, can help to save them money while generating business.

Landlords are experiencing record levels of tenant demand, but it’s inevitable that tenant arrears will increase

Richard Rowntree MD, Paragon Bank

Much has been talked about over the last decade regarding how politics has shaped the PRS and how succes sive governments have sought to ‘pro fessionalise’ the landlord community.

more supply into the rental sector?

Momentous days in UK politics seem to come much more frequently than they used to.

Consider this. Between 1979 and 2010, we had four prime minis ters (Thatcher, Major, Blair, and Brown); in the past 12 years alone, we have also had four prime minis ters (Cameron, May, Johnson, and Truss), with the last being an nounced on this very day of writing.

The next general election can take place no later than 28 January 2025, with wide anticipation that it will actually take place in 2024. That’s two years away, at which point we might have another prime minister in the role – or, as some are specu lating, the previous prime minister might be back leading the Conser vative party, in which case we might have a former prime minister back in the job.

It’s a head-scratcher, to be sure, but let’s look at the immediate future and see what the housing in-tray looks like for Prime Minister Truss, and how it might work out for the private rented sector, advisers, landlords, lenders, and all other stakeholders.

I think many would agree that the biggest issue facing the UK housing market currently is a lack of supply, and it is just as relevant to the PRS as it is to owner occupation. In fact, there is a very sound argument to suggest that a lack of supply in the PRS needs to be addressed just as vigorously as, and perhaps even more so than, it does for those seek ing to purchase.

In terms of improving the quali ty of housing, getting rid of rogue landlords, and providing tenants with increased rights – few would disagree with focusing resources on this. How ever, the government has sought to do this by increasing the costs of being a landlord, cutting the profitability of property ownership, increasing taxes, and making it more difficult to purchase investment properties.

What this has effectively done is hit good landlords as well as bad. In fact, you might also argue that the rogues have just got on with being rogues. They operated outside the rules before they were introduced, and have operated outside them as those rules increased.

Instead, the ‘unforeseen con sequences’ have been that good landlords have decided that it is too expensive to be active in this sector and have exited. The supply of PRS properties has therefore fallen, but the need for this type of housing has not gone away; indeed, it has been heightened.

People who couldn’t afford to buy have not somehow magically gained the finances to be able to buy. Firsttime buyers have not bought every single ex-PRS property that came to market. Instead, tenant demand has continued to rise – and not just in the major cities and towns, but also in more rural settings.

As supply has fallen and demand has risen, rents have naturally increased, and we have now reached a point where – during a period of significant inflation – that cost is significant. Could this have been avoided? Might this next iteration of the government make some significant changes that help drive

Although it is certainly needed, moves to make it easier for landlords to buy more properties may be deemed politically unpopular. The stamp duty holiday showed how landlords might react if provided with this opportunity, but, again, the narrative of first-time buyer versus landlord is so embedded that any similar move in the future could come with too much criticism for a new PM to bear.

However, a solution is going to be needed. The PRS needs to be treat ed as the equal of home ownership. Millions of people depend upon it, millions want to rent, millions have no means of purchasing, millions need a healthy supply to choose from – other wise, you actually inflate the chances of more rogues preying on people who are desperate and vulnerable.

The announcement earlier in the year that housing associations would be able to sell off their properties to tenants is likely to put even more pres sure on the PRS to step up. Again, will this policy be jettisoned? It can’t really work unless there is a concerted effort to improve supply within the PRS.

The good news for the government here is that landlords are acquisitive, they have ambitions to grow portfo lios, and they continue to do so even when many factors work against them. Lenders, too, are willing and able to fund landlords’ ambitions.

However, the growth in portfolios isn’t matching the demand, and until we can find a closer equilibrium, rents are going to continue to rise – espe cially as mortgage and other costs rise – putting more tenants under pressure.

It is a big in-box for a new PM/ Levelling Up secretary/housing minister to take on, but the fact is the PRS needs as much attention as home ownership. Failure to act here will merely exacerbate the issue. The time for action is now.

few landlords will fail to reach this threshold, and it is likely to be something that a lot of landlord customers will need to be aware of, so any homework that brokers do will come in handy.

Ashift to digital tax submissions seems sensible and overdue in our modern age, but landlords appear unaware of the new requirements. Although the responsibility of educating landlords on regulation shouldn’t fall solely to brokers, raising awareness of such changes can help both parties.

The white paper “A fairer private rented sector” and a proposed overhaul of EPC requirements have been the most talked-about aspects of government policy of late –understandably so, with both set to usher in wholesale changes across the private rented sector (PRS). In the shadow of these regulatory updates, a mandated switch to a fully digital system for income tax self-assessment (ITSA) has flown somewhat under the radar.

Although the transition to what has been labelled ‘making tax digital’ (MTD) will not have the same impact as the broader reforms and move to a more sustainable PRS, the new tax system will definitely bring about considerable changes in the way landlords work.

The government says that MTD supports businesses through their digitalisation journey and provides a digital service that many have come to expect in their everyday lives.

The changes will apply to taxpayers with business and/or property income over £10,000 a year, including landlords. With rents at their current levels, very

The new system could really help brokers when collecting income details from landlords, too.

The shift to digital should make it much easier for landlords to prove their income, or even show an interim picture within a tax year, helping underwriters assess cases based on the most up to date information

Using MTD for ITSA will require landlords to keep digital records of their income and expenditure, with quarterly summaries and an endof-year report submitted to HMRC using MTD-compatible software.

This means no more waiting until January of the following year to get all the information together and, having viewed some of the digital platforms available to landlords, I’m sure this will make life easier for them in the long run.

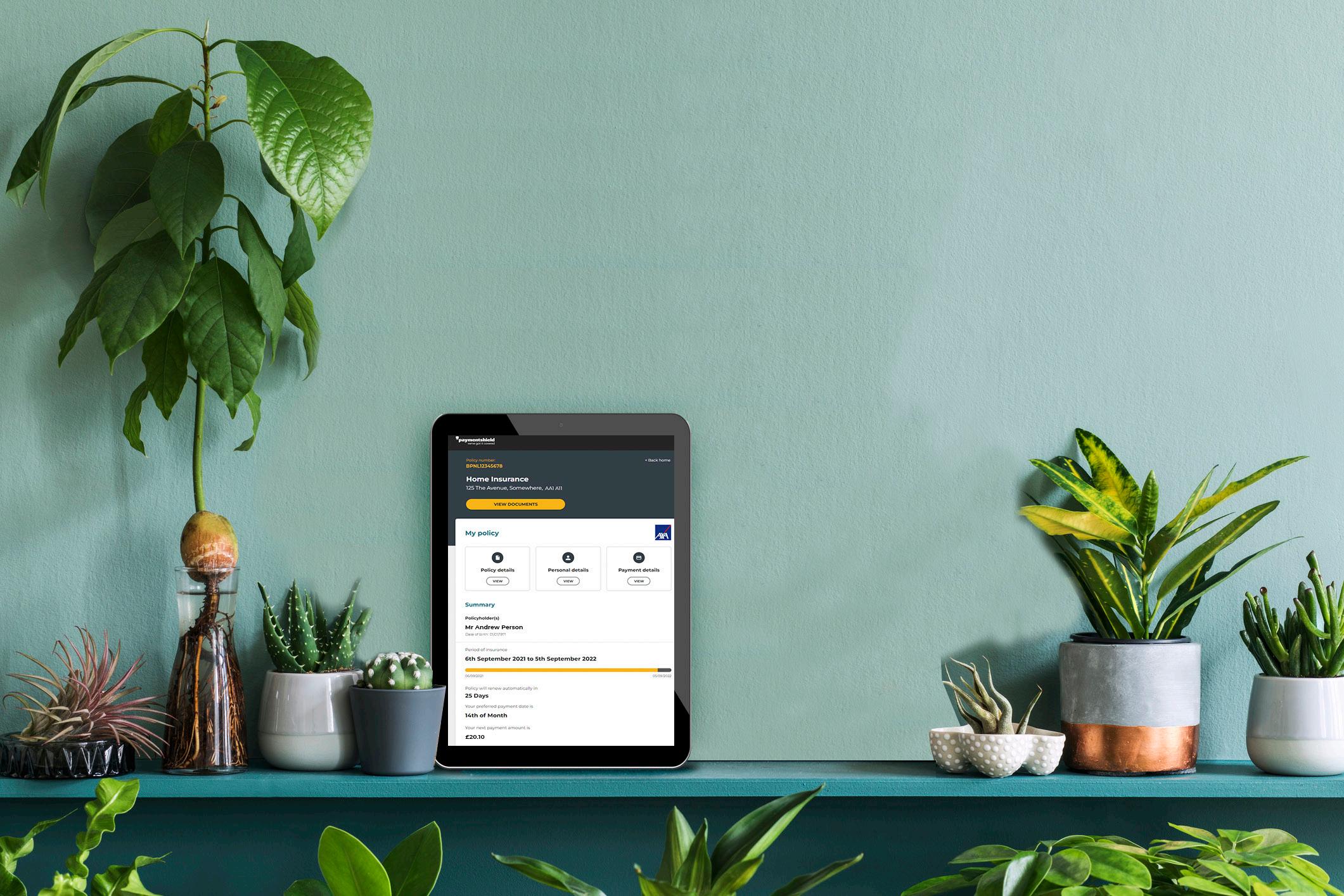

Customers will have the ability to track individual properties, take photos of receipts, use open banking to track rents, and link into HMRC, making the submission semiautomated. Some of the platforms can be more than just tax management tools thanks to the option to track things like AST and mortgage renewal dates or view EPCs.

As a result, the impact of this on the mortgage world could be very positive.

Currently, SA302s and tax returns are generally needed to prove income, which means we are reliant on landlords submitting end-of-year returns, and the picture we get isn’t always accurate and up to date.

The shift to digital should make it much easier for landlords to prove their income, or even show an interim picture within a tax year, helping underwriters assess cases based on the most up to date information. This could be the beginning of a move toward lenders accepting information stored in digital tax apps, which would make pulling together all the necessary documentation much easier and really streamline the application process.

The transition was initially scheduled for April 2023, but the government has extended the deadline by a year in recognition of “the challenges faced by many businesses as the country emerges from the pandemic over the past year.” This means that tax returns covering the 2023–24 financial year will need to be submitted digitally – so landlords will need to be ready from April next year.

All the transformation seen across the sector currently means it would be almost impossible for brokers to be experts in all aspects of regulation, and it is unfair to expect financial advisors to bear responsibility for ensuring landlords are compliant. Despite this, it can be beneficial for brokers to have an awareness of what is on the horizon. Even simply notifying customers of any changes and signposting them to more information can minimise the risk of them being caught out. This is something for which I’m sure landlords will be grateful, and it can help strengthen relationships and position brokers as people with their fingers firmly on the pulse.

Choose Landbay and you’ll find experts at the end of the line, smart technology designed for you, and fast decisions you can count on.

delivering to it.

Jerry Mulle MD, Ohpen

We’ve known it was coming for some time now, but on 27 July the Financial Conduct Authority (FCA) published its final policy plans confirming the implementation of a new consumer duty.

Announcing the paper, the regulator said this duty of care “will fundamentally improve how firms serve consumers.”

It said, “It will set higher and clearer standards of consumer protection across financial services and require firms to put their customers’ needs first. The duty is made up of an overarching principle and new rules firms will have to follow.

“It will mean that consumers should receive communications they can understand, products and services that meet their needs and offer fair value, and they get the customer support they need, when they need it.

“Clarity on our expectations and firms focusing on what their customers need should lead to more flexibility for firms to compete and innovate in the interests of consumers.“

This last line is interesting. I would agree wholeheartedly that focusing on what customers need (and want, within reason) should lead to more flexibility, innovation, and competition.

Should is the operative word when it comes to translating that theory into practice.

Understanding customers has to be central when it comes to product and service design. But understanding demand is quite different from

Now skip to the boardrooms of banks and building societies the UK over. My sense is that no-one needs to be persuaded that it would be a good thing to have more flexible systems that allow swifter product design changes and reactive criteria updates that support a better-served customer.

Practically speaking, the question being asked in most of those boardrooms is, “How do we do this?”

The FCA is itself aware of this. In February last year it published a review of the use and role of technology in financial services firms. Over 90 per cent of the firms it surveyed said they rely on legacy technology in some form to deliver their services.

“We found that firms with a lower proportion of legacy infrastructure and applications had a higher change success rate,” the review noted.

“This supports the view that technology change is more difficult to implement without disruption when dealing with legacy infrastructure. Firms with a lower proportion of legacy technology also had a lower proportion of changes being deployed as emergencies and had a higher chance of those emergency changes being successfully deployed.”

This is not news, perhaps, to many of you, but it is fundamental if operational excellence and delivery are to be achieved so the interests of borrowers can be properly served. The banks, mutuals, and other financial services companies that have experienced the absolute horror of IT going spectacularly wrong will be only too aware of how devastating technology failures can be for a business.

The FCA’s 2018–19 Cyber and Technology Resilience Review found “change-related incidents” are consistently one of the top causes of failure and operational disruption,

accounting for 17 per cent of reported cases.

The need for fast and flexible change, four years later, has accelerated.

It’s not just consumer expectation or operational security, either. The economic environment is moving at breathtaking speed. Energy prices, interest rates, inflation, wages, and both fiscal and monetary policy are mind-bendingly unpredictable.

It makes for a market ripe for innovation and competition. It also presents serious challenges for lenders who haven’t yet decided how to implement systems that allow them to be dynamic and reactive.

The FCA’s review asked board members, “If you had an innovative idea that required IT change as a key component, how long would it take to approve the idea, build it, and deploy it to users on average?”

What do you think the answer was? Six to 12 months. Just think where we all were this time last year. And I’ll leave you with these words from the regulator.

“One of the main benefits of change management in the cloud is that it enables a high degree of automation. This can reduce the manual risks of change and increase the agility of incident response.

“While automation doesn’t guarantee that a change won’t have an adverse impact, it can reduce the risks involved. Automation drives repeatability and consistency through the change lifecycle, reducing the risk of human error and enabling the creation of identical environments for predictable and testable outcomes and automating aspects of recovering from change incidents.

“Public cloud offerings also allow for the automated scaling of IT environments, removing the need to provision additional resources to meet business demand.”

and has the power to turn an AIP into a flat no.

Mark Blackwell COO, CoreLogic

In the past few months we’ve seen an increasing number of lenders run automated valuation models before approving a decision in principle (DIP). There is triage on valuations in which properties trip certain switches, flagging them for a closer look, but it’s increasingly likely that 24-hour DIPs will come to be expected from lenders.

It’s an interesting move, particularly given how unpredictable the current market is. And yet, competition de mands that decisions be made quickly and with certainty.

But it’s easy to see why this move is attractive. Borrowers may be tricky to pin down in terms of credit risk – more so now than usual. Security, on the other hand – that’s considerably more predictable. Recession or recovery.

It’s arguably even more important than ever, in fact, because capital pro tection is going to be increasingly im portant for both borrowers and lenders if the economy does a nosedive.

When it comes to evaluating secu rity, somewhere in between sensible scrutiny and speed is an increased role for data.

For the most part, freehold data is more accurate, and conveyancing quirks are reasonably unimportant for a mortgage and transaction to com plete. Leaseholds are much harder to predict, however. As recently as August, the Competition and Markets Authority ruled that Taylor Wimpey must refund leaseholders the doubled ground rents they snuck into con tracts. That sort of intervention ma terially affects the value of a property

Risk on leasehold is a moveable feast. Added to far more frequent oc currences of disputes over common parts, rights of way, and leaseholder obligations, the data that lenders need to ensure both they and the borrower are protected must be granular. Accessing that sort of data, particularly as it relates to proper ty condition and the way it is used in practice, is not straightforward, although it is improving.

In a paper published by RICS last year, it was suggested that the valua tion and appraisal sector has “reached an inflection point as a result of the ap plication of artificial intelligence, ma chine learning, and other algorithms to structured and unstructured data sets of increasing size and complexity.”

An ever-evolving regulatory landscape and the market’s demand for speed and innovation are driving change faster than ever before, it asserts. I would tend to agree.

Accurate valuations and lending decisions that match lending expec tations are vital for banks and build ing societies to get right. Balance sheet stability depends on it. It is also vital for lenders whose funding is off balance sheet. Jeff Rupp, direc tor of public affairs at INREV, was quoted in the RICS AVM insight paper, noting, “Valuations are argu ably more important for investment in real estate than any other major asset class. For non-listed real estate vehicles, they play a crucial role in reporting to investors, monitoring portfolio strategy, and undertaking transactions, and as a basis for sec ondary market trading.

“As digital technology advances apace, investors’ expectations and demands of real estate valuations are growing. In part this reflects the increasing complexity of many real

estate transactions, which often now involve large portfolios of assets. But more importantly, investors want to benefit from the full potential that technology promises for valuations, potentially making them quicker, less prone to human error, and sensitive to a far wider range of evidence than is currently the case.

“We agree that big data, blockchain, and automated valuation models [AVMs] are all likely to have a role, but an openness among valuers to new ways of harnessing information is likely to be just as crucial as any single technology.”

RICS is of the view that AVMs can be useful to tease out nuances and aid with statistical analysis that valuers may not ordinarily be able to observe during their usual investigations. That is a positive, and adds robustness to the data we have.

On the other hand, the property is not usually inspected when an AVM is used. Instead, an average condition is often used, which RICS admits “could well be inaccurate.” It’s hard in the residential market. Stock is far, far more varied in the UK than in other countries. Condition and age of a property do not necessarily correlate. Value is determined by emotional needs as well as investment sense.

To hold sufficient weight to provide the basis for a DIP, AVM providers require large amounts of reliable, detailed, descriptive data about properties and market transac tion prices to model accurately.

The market is getting there, as is clearly evident in lenders’ increasing willingness to rely on AVM valua tions at the DIP stage. But let’s also remember – analytics and modelling can take us far, but we understand the power of the sum of the parts. Technology, data, and people are the answer.

our lives, be that from a personal, business, or sporting perspective.

Neal Jannels MD, One Mortgage System (OMS)

I’m writing this article on a Monday morning after watching far more football over the course of the weekend than I probably should. Although these days, there seems to be more discussion of the game than actual play. And this was more evident than ever with a number of games that were dominated by three letters: VAR. Don’t worry – I won’t be analysing individual decisions. But some of these did cause such a groundswell of criticism that it feels like a pivotal moment for the future of VAR and technology within the sport.

Not that technology and football have not worked in perfect unison in recent years; they have. Goal-line technology has generated zero debate, as the decision is absolute and there are no grey areas around human interference (up until its little foo-pah this weekend, that is!).

This is where it gets a little trickier for VAR, as there is still a high element of human interference, interpretation, and decision-making. Suffice to say that there is nothing wrong with the technology used in VAR, and technology is not to blame for any poor decisions made on the back of reviewing it. The questions are all around how the technology is being used, when it should be used, and whether it should be used at all.

There is often a balance to strike between enjoying technology and avoiding being too reliant on or distracted by the wealth of technological enhancements available to us. Even worse, tech advances may make the original product worse, and no longer attractive or identifiable to users. What we do have to remember is that the primary role of technology is to enhance

The correct implementation of technology can be a tricky one for businesses operating in the mortgage market, although the past few years have really emphasised how it can help speed up and streamline the mortgage journey, plus help make the process more secure.

One prime example of this is electronic verification (EV), and this is an area that is seeing greater business engagement – although arguably still not enough.

A new survey from SmartSearch outlined that more than 80 per cent of regulated firms in the legal, property, finance, and banking sectors are considering a switch to electronic verification of their customers. The switch comes as firms feel the growing weight of compliance around antimoney laundering (AML) measures amidst a sharp increase in the number of companies being fined by the regulator for breaches of the rules.

The most recent figures from HMRC showed that 85 firms were fined and named last year for breaches of compliance regulations. And a freedom

of information request revealed a sixfold increase in the number of legal firms fined by the Solicitor’s Regulation Authority since 2017. However, almost a quarter (23 per cent) of all the firms persisted with the misconception that using hard-copy documents was more reliable than electronic checks for verification.

Breaking this down, property firms were least likely to turn to EV, with 40 per cent saying they wouldn’t consider it and more than one in ten (12.5 per cent) saying they didn’t trust the technology. This is despite the 2020 Money Laundering and Terrorist Finance Act recommending that regulated firms use EV in order to make their due diligence as effective as possible.

This data represents a good example of how firms don’t always understand the capabilities of technology to help support and safeguard their business and clients in certain areas. In a digital age, addressing tech concerns and integrating the type of technology that can enhance front- and back-office systems, improve efficiencies around the advice process, and protect data have moved rapidly up the agenda for a range of businesses, but more still needs to be done.

Investing in or subscribing to a system, platform, or solution is only the first step. Fully understanding its capabilities and having the right training from real experts to use its benefits are key elements in getting the most from it – as is ongoing support to ensure the right outcomes are sought to meet individual business needs.

In a similar respect to VAR, this emphasises the importance of the people behind the tech. We need real experts who know their product inside-out, understand its capabilities, can see all the right angles at the right time, and can make the correct decisions under pressure. If this combination isn’t firmly in place, the whole process can break down and, through no fault of its own, technology can appear to be a hindrance rather than the asset it was intended to be.

We’re all acutely aware of the rising cost of living. People everywhere are having to make tough decisions on where to cut back. Some may struggle to keep up with monthly payments and might need to make changes to their insurance arrange ments that could leave them without an adequate safety net.

Everyone in the insurance industry has a duty of care to support those struggling to meet the cost of insurance premiums. As a trusted advisor, your role must be to reach out and gain a deeper understanding of each client’s current situation and look at where they could make savings on insurance whilst still ensuring products meet their needs.

With mortgage rates rising fast and first-time buyers finding it harder than ever to get on the property ladder, we are seeing a rise in multi-generational living, and likewise increased demand for cross-generational mortgages –something the government is appar ently actively considering. But what about insurance? A standard household policy will cover the policyholder and direct family members living with them, but each individual will have different insurance needs dependent on lifestyle. Young adults may have expensive hobbies, whilst their parents or grandparents may have high-val ue contents such as jewellery, art, or antiques. The more people you have in a property, the greater the likelihood they’ll have more to insure.

Similarly, the more people, the higher the probability of a claim. For