Guide to Buying a Home from THE KIM CHILDS TEAM

Darcy Paquette

Licensed Oregon Broker Masters Circle, PMAR

Guide to Buying Your Home Table of Contents The Kim Childs Team

2

The Home Buying Process

4

Working with a Lender

6

Let the Showings Begin!

8

Writing an Offer

10

Your Offer is Accepted

12

Opening Escrow

14

Home Inspection and Appraisal

16

Signing and Closing

18

What Our Clients are Saying

20

Why Keller Williams?

22

The Kim Childs Team Getting to Know Us

It takes years of experience to navigate the twists and turns of a real estate transaction. We have years of commercial business experience and 28 years in specializing in selling homes and getting those tough deals to the closing table. Let us put those years of experience to work for you. “Because who you work with matters.” With a consistent record of real estate sales achievements of 16 years, Kim earns enthusiastic referrals from her loyal client base who buy and sell with her time and time again. Clients know that Kim will do the job right, with no stone left unturned. “I am always excited to meet new people, and to provide service and strategies beyond their expectations,” says Kim. This high level of service has resulted in Kim being honored with Portland Monthly magazine’s “5-Star Real Estate Award” each year it has been offered—from 2011 through 2020. The award is based on client satisfaction and feedback from real estate professionals.

Kim Childs

Licensed Oregon Broker, GRI Masters Circle, PMAR Diamond-Platinum Member Portland Monthly Five Star Realtor Top 7% Portland 2011-2020

Kim’s business model is based on: “Integrity” in all things “Exemplary service” that exceeds expectations “Ingenuity” to provide service with an invaluable wealth of knowledge, real estate sales expertise, and the ability to think outside the box. Highly credentialed, Kim has a vast amount of market knowledge and expertise in handling the most delicate or complex transaction. Kim’s communication is second to none and tailored to each client. Kim considers herself a real estate consultant, providing her clients with information, analytics and knowledge to make the best possible real estate decision. She considers herself to be a solution provider, navigating her clients from where they are to where they want to be. She takes care of all the details along the way, so the transaction is as close to stress free as possible for clients. Prior to real estate, Kim was a CPA, and in management for a Big 8 firm. She also holds a BA in Home Economics Education. Kim’s leisure is spent with family, friends, sporting events, traveling, and cooking.

2

In the last eight years, Terri has worked with some of the top producing agents in the Portland Metro Area. As a full-time realtor, she consistently strives to be innovative in her marketing and interaction with clients. Terri’s previous career and life choices have allowed her to develop a strong customer service background, project management skills, and attention to detail. These are attributes that have created success for her as a real estate agent.

Terri Schneider

Oregon Licensed Broker Masters Circle, PMAR

Her previous jobs have given her a great sense of how to work with people. As a personal fitness trainer, Terri worked with clients to help motivate them to achieve their goals. Terri also worked in the health care industry, and she was awarded “Employee of the Year” for her caring nature. Terri worked at both Nike and Adidas for over 12 years in their credit departments as both an account manager and credit Manager. Terri has lived overseas in both Bangkok, Thailand, and Guangzhou, China.

Terri is currently an active member of her Homeowner Association and her local Rotary Club. She enjoys reading, fitness, cooking, wine tasting, gardening, live music, and her grown children when she gets to visit them.

Darcy is dedicated to providing the best possible real estate experience for all her clients. She works tirelessly to ensure the home buying process is stress-free and seamless as possible. Darcy is knowledgeable about the local real estate market, and educated on all neighborhoods in the metro area. She has creative ways for an offer to be accepted in a multiple offer situation. She even seeks out “off market” properties in her clients’ desired areas. Her background in sales and marketing have served her well in real estate. She worked for over 25 years in highly professional organizations that were deadline driven and required keen negotiating skills (The Oregonian/Oregonlive, KGW-TV Channel 8, and KUFO radio). Darcy has a BA in Journalism, and is active in the community. She serves as a volunteer for Future Connect working with college students at Portland Community College Sylvania campus and is a steering committee member of Meridian Park Hospital.

Darcy Paquette

Oregon Licensed Broker Masters Circle, PMAR

She loves the outdoors, hiking, bicycling, cooking, and travel. 3

The Home Buying Process The Steps You Should Know

Whether you are a first-time homebuyer or a seasoned homeowner wanting to downsize, upsize, invest, or need information, I take pride in providing you with a wealth of knowledge and personalized, exceptional service. Exceptional service begins with getting to know you and understanding your objectives. We strive to provide excellent consultation and representation, and communicate consistently all along the way. Our goal is to be problem solvers and solution providers throughout the entire process, until you become a happy homeowner.

THE HOME BUYING PROCESS: THE STEPS YOU SHOULD KNOW

4

Working With A Lender

Let The Showings Begin

Writing An Offer

Your Offer Is Accepted, Now What?

Open Escrow

Home Inspection And Appraisal

Negotiate Repairs

Sign Title And Escrow Documents

Sold

The steps to buying a house might seem complicated at first—particularly if you’re a home buyer dipping a toe into real estate for the very first time. Between down payments, credit scores, mortgage rates (both fixedrate and adjustable-rate), property taxes, interest rates, and closing the deal, it’s easy to feel overwhelmed. There’s so much at stake when buying a home! Still, if you familiarize yourself with what it takes to buy your first home beforehand, it can help you navigate the real estate market with ease. So let’s get started! In this step-by-step guide, you’ll learn what it takes to buy a home in the current market, from beginning to end. It will be helpful for the first time home-buyer, as well as the buyer who has been through the process before. The very first step every home buyer should tackle is to figure out their finances. Buying a home often requires a mortgage, where a lender lends you part of the purchase price and you pay it back over time. However, typically to get a mortgage, you’ll need some sort of down payment.

5

Working With a Lender

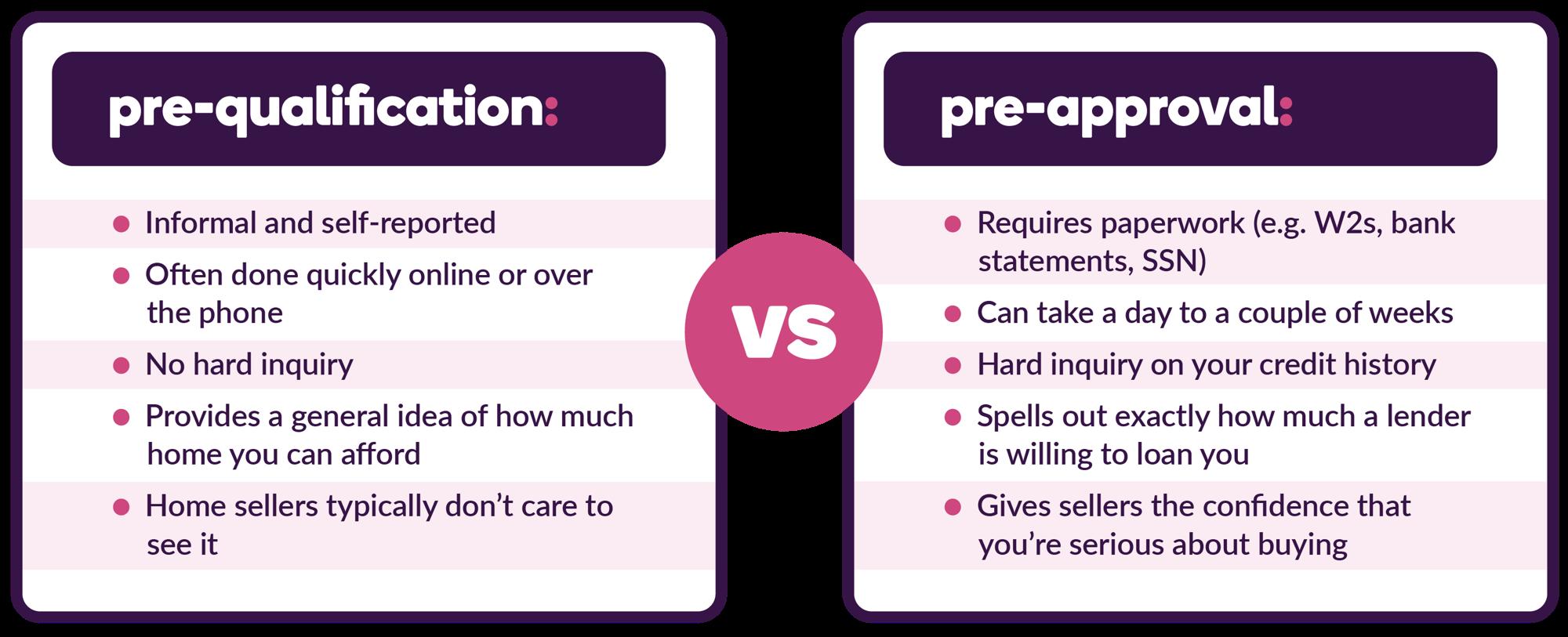

Obtaining financial pre-approved for your loan One of the first things a buyer should do is meet with a lender or mortgage broker to get pre-approved for a loan. Pre-approval is different from pre-qualified. Pre-qualification is a rough estimate of how much you can borrow. Getting pre-approved before shopping for a home saves you time from developing an interest in homes outside of your qualification range, and allows you time to select the best loan package available without the pressure of a deadline.

Pre-approval involves an application process and provides you with a formal commitment from a lender stating how much you can borrow and at what rate. Then the lender will provide you with a pre-approval letter. For an offer to be seriously considered by a seller in today’s market, a pre-approval letter must accompany an offer. It’s an assurance to the seller that you are a serious buyer. The pre-approval process is relatively easy, and the lender will obtain information about income, employment, credit score, and assets. There are a variety of loan options, and your lender will work closely with you to determine which one is the best one for you. Loan Process Once the loan process has begun, it’s best to keep a rein on your finances. Don’t apply for new credit, make a large purchase such as furniture or a car or close credit accounts. Also, best to stay current on any existing accounts.

6

Comparison of Common Loan Programs Our teams at Academy Mortgage are often asked to explain the differences between the most common loan programs. To help answer your questions, the following grid outlines a few general features of three popular loan types: Conventional Loans, FHA Loans, and USDA Loans. It is important to note that all homebuyers have unique home financing needs. Academy will make every effort to find the right loan program and pricing for each situation and to provide superior value. Conventional

FHA

USDA

VA

Minimum Down Payment

3% (can be homebuyer’s own funds, gift funds, or employer-assistance programs)

3.5% (can be homebuyer’s own funds, gift funds, employerassistance programs, or government-assistance 2nd mortgages)

0%

0% (as long as the sales price doesn’t exceed the appraised value)

Maximum Seller Assist

3% (<10% down payment) 6% (>10% down payment)

6%

6%

6%

Mortgage Insurance (MI)

Private Mortgage Insurance (PMI): Required with <20% down payment. Premium dependent on loan parameters. Payment options available.

Two forms of insurance required: 1. Upfront Mortgage Insurance Premium (UFMIP): Factored at 1.75% of the base loan amount (can be financed in the loan); AND 2. Monthly Mortgage Insurance Premium (MIP): Usually factored at 0.85% of the base loan amount.

Two fees required: 1. One-time, upfront guarantee fee: Factored at 1% of the base loan amount (can be financed in the loan); AND 2. Monthly USDA fee: Factored at 0.35% of the base loan amount.

Funding Fee: One-time, upfront charge that must be paid at closing but may be financed in the loan. Factored as a percentage of the loan amount and varies based on the type of loan, the borrower’s military category, etc. Some Veterans may be exempt from this fee.

Potential Advantages

• MI can be canceled once 20% equity is achieved. • Can use gift funds for down payment. • Less money out of pocket.

• Lower credit score requirements. • Less stringent income requirements. • Can use other sources of funds for down payment. • Non-occupant co-borrowers allowed for income qualifying.

• Less expensive MI costs. • Little to no money out of pocket. • Can use gift funds to lower the monthly payment.

• No monthly MI required. • Little to no money out of pocket. • The seller can pay for some closing costs. • VA rules limit the amount charged for closing costs.

Potential Disadvantages

• May have higher MI costs. • Higher credit score requirements. • More stringent income requirements.

• Higher MI costs than USDA Loans but may be lower than Conventional Loans. • MI included for life of the loan and cannot be canceled.

• Monthly guarantee fee included for life of the loan. • More stringent income requirements. • Only allowed in designated rural areas.

• Upfront funding fee. • Veteran must be incomeand credit-qualified. • Eligibility depends on service and prior usage of VA Loans.

Josh Dalglish NMLS #569991

Academy Mortgage Corp NMLS #3113 | Equal Housing Lender Loan Officer 29100 SW Town Center Loop W, Suites #160 and #170 Wilsonville, OR 97070

(503) 998-4016

josh.dalglish@academymortgage.com academymortgage.com/joshdalglish Corp NMLS #3113 | Corp State Lic AZ #LO-0942614 | State Lic AZ #BK-0904081 Conventional sample loan scenario: $200,000 purchase price; $194,000 loan amount; 3% down payment; $1,503/month (PITI); 30-year fixed 5.49% interest rate; 6.321% APR. FHA sample loan scenario: $200,000 loan amount, 3.5% down payment, $1,363.50/month (PITI), 30-year fixed 4.750% interest rate, 4.937% APR. The MI requirements may change if the homebuyer is putting down more than 3.5% or desires a term less than 30 years. USDA sample loan scenario: $200,000 loan amount, 0% down payment, $1,301.80/month (PITI), 30-year fixed 4.750% interest rate, 4.785% APR. VA sample loan scenario: $204,300 loan amount, 0% down payment, $1,265.73/month (PITI), 30-year fixed 4.750% interest rate, 5.072% APR. All mortgage products are subject to credit and property approval. Rates, program terms, and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Additional conditions, qualifications, and restrictions may apply. This is not an offer for extension of credit or a commitment to lend. Please contact Academy Mortgage for more information. MAC221-1468328

7

Let the Showings Begin! Do you have a wish list of wants and needs?

Once you have been pre-approved by a lender (or have proof of funds if you donâ&#x20AC;&#x2122;t need a loan), itâ&#x20AC;&#x2122;s time to start house hunting. Home shopping can be both exciting and exhausting, but doing some preparation beforehand will help tremendously. Buying a home is a long term commitment. The home you buy should be offer the size, features, and amenities you and your family want, yet be affordable. We can set you up on a Keller Williams app, as well as send emails from the RMLS with homes that fit your basic parameters. We will watch for price drops on properties that you like but were more than you wanted to spend. You will receive property history, tax information, and comparable homes in a neighborhood on all houses of interest. Make a Wish List

Features Make a list of must-have features to help you narrow your home search. A front porch, a two-car garage, hardwood floors, and an eat-in kitchen can all add to the enjoyment of your home. Just as important is how the house is designed. The number of bedrooms and baths should suit your household members, and the layout should suit your lifestyle. If you like to entertain, you should have plenty of dining space and storage for dishes and cookware. If you frequently work at home, you need a home office or at least a quiet designated workspace. You may want to consider future needs, as well as current ones.

8

Location Location is about convenience, and you’ll pay a premium to be closer to work centers, parks, shopping, and transportation. Think about your commute to frequent destinations, including jobs, schools, family, and friends. To get “more house,” you may consider moving further away from the core city centers. Sometimes people find their dream home on the first day. We’ve found that on average, most people need to view ten properties before finding “the one.” It’s best to see a home a second time, ideally in different lighting to make sure it is the one. Once we’ve found the home you love, its time to make an offer. We will look at market stats, comps, and other data to get a better picture of the home to know if the asking price is reasonable. We then talk to the listing agent to find out what the seller is looking for so we can craft the perfect offer on your new home.

9

Writing an Offer

What happens when an offer is submitted? So excited! You found the home that you want to live in, so now it is time to write an offer. The location, the price, how long it has been on the market, and other variables will play into what your offer will look like. We will work together to make the offer competitive, considering the current market. Your formal offer will be documented in writing on a purchase contract. The offer will include, among other terms: Sales Price Earnest Money Amount (Typically 1% of the purchase price, more if you want to show you are a serious buyer) Seller-Paid Concessions, if any (Usually in the form of prepaid closing costs and credit at closing) Contingencies (A condition specific to the offer. Do you have a home to sell? Other common contingencies are financing, inspection, and appraisal) Personal Property (These are items you are requesting as part of your offer. Common requests include refrigerators, washer, dryer, sheds)

10

Extending an offer Once the offer is written and presented to the Seller by their listing agent, the Seller can accept, reject, or counter the offer to purchase. The offer can be countered back and forth several times until both Seller and Buyer come to a mutual agreement, or one of the parties wishes to reject the offer or counter offer. A home warranty can be requested as one of the terms of the offer, asking the Seller to cover the cost of a one year home warranty that covers most systems and appliances in the home. Sometimes, if there is competition for the home, you, the Buyer, may choose to purchase your own home warranty.

11

Your Offer is Accepted Now what?

Congratulations, your offer has been accepted! Once the offer is mutually accepted by the Seller and Buyer, there are deadlines outlined in the sales agreement to meet. Now we get to work together on getting to the closing table. Getting an offer accepted is one of the most exciting moments of the home-buying process. But it’s also when things get more serious. By now, you’ve probably heard the terms “closing” and “escrow” thrown around, but a lot happens between offer acceptance and closing escrow. The accepted offer dictates the timing of how and when things will be accomplished, through closing. During the closing process, you’ll put down an earnest money deposit, perform any necessary inspections, negotiate for repairs, get your home appraised, lock down your loan and, if necessary, cancel the deal in accordance with certain contingencies without losing your deposit. Earnest Money Earnest money is a deposit in the range of 1% for the purchase price. It shows good faith that you are serious about purchasing the property and will follow the agreed on terms. These funds will go towards your down payment or closing costs. Earnest money is usually deposited into an escrow account with the title company within three business days of mutual acceptance.

12

Lender Documents As soon as you have an executed sales contract on a home, your Realtor will communicate with your mortgage lender to make sure they get a copy of the fully executed contract. As soon as they receive it, the lender will start the mortgage process for your transaction. To begin this process, your lender will start asking for a myriad of paperwork. Be prepared to provide the requested documentation throughout the transaction. It is best to get the requested documentation to them ASAP to limit any problems with their timeline. Gathering and organizing all of these documents can quickly become overwhelming if you are not prepared; not providing them to your lender on time can slow their process down and could ultimately result in a delay to the closing date. Seller Disclosures The seller disclosures are filled out by the seller, and will disclose any problems with the property that they know about. It will also be noted what issues have been repaired and how it was done. The disclosure is exempt from new construction and bank owned/court-appointment sellers. If the seller does not provide this document, the buyer has until the day of closing to terminate the transaction for non-disclosure. A buyer has 5 business days from receipt of the disclosures to accept or terminate the transaction due to items found on the disclosures.

13

Opening Escrow

A Title Company is your friend that moves you toward closing Our title partners are here to help us through this process. They are trained professionals that supervise the transaction to closing. They will make sure that no funds or property change hands until all terms and instructions in the purchase and sale agreement have been followed.

14

Once an offer on a property is mutually agreed to by buyer and seller, the transaction is then placed into “escrow.” Escrow is a term that describes neutral third-party handling of funds, documents, and tasks specific to the sale of the property. The purpose of escrow is to manage the disbursement of funds and documents according to the mutually agreed upon terms for the buyer and seller. A record of all real estate sales and events on all properties is filed in public archives. A title company will do a title search of the records to see if there are any issues such as liens, levies, or encumbrances associated with the property. Some issues don’t show up on the title search, such as forgeries, filing errors, and undisclosed heirs, so title insurance protects the buyer from any unforeseen problems. In Oregon, the seller provides title insurance for the seller and the buyer provides title insurance for the lender. Before a title insurance policy is issued, a title report is prepared based on a search of public records. This report describes the property, along with any title defects, liens, or encumbrances discovered in the course of the title search. It is different than casualty insurance in that you pay a one-time fee, and it protects against the past (as opposed to future) events. Some ‘clouds on title’ can be corrected relatively easily while others can become quite complicated to remove. You should insist on being kept informed of every step in the title examination process. If title problems are uncovered, you need to understand your legal rights, including consulting an attorney if needed. Title insurance is the best way to protect yourself against title defects that have occurred in the past, which may not appear until after you’ve taken ownership of the property.

15

Home Inspection and Appraisal Negotiating repairs, if needed A home inspection is designed to give a buyer a better understanding of the systems and overall condition of the home they are purchasing. There may be items that the buyer will want to have repaired. Buyer requested repairs are negotiated, and we will help you with this, including offering perspective on what is usual and customary for the current market. The home inspection is typically set up immediately after the offer has been accepted since there is usually a 10-business day deadline for the inspections to be completed and repairs, if any, to be negotiated. Itâ&#x20AC;&#x2122;s recommended that three inspections be done for resale and new construction properties. Whole House Home Inspection The whole house home inspection usually takes two-four hours depending on the type and size of the home. The price of this inspection also typically depends on the square footage of the home. A home inspection typically will cover: - Exterior, porch, and deck - Foundations and walls - Chimneys and roof - Windows, doors, and attics - Electrical components and plumbing - Central heating and air conditioning - Basement/crawlspace and garage Once the inspector gives you the written report, you will know a lot more about the condition of the home you are purchasing and can make informed decisions in consultation with us about what, if anything, needs repair and whether you or the seller should be responsible.

16

Radon Radon is a naturally occurring gas found in many areas of the Portland Metro area. If levels are over a certain amount, mitigation is advised. Sewer Scope A sewer scope inspection checks the sewer lines to make sure there are no problems with tree roots, pooling, cracks, holes or pipe separation. Additional inspections Depending on the property, additional inspections may be warranted. These can include roof, mold, underground storage tank location, well tests, foundation, and others. The cost of testing can add up but is important information for a buyer to have before purchasing the home and may save a buyer thousands of dollars. A repair addendum is put together after consultation with us with items the buyer would like addressed by the seller. Usually, the seller is asked to make the repairs, lower the sale price of the home or provide credit towards the buyers prepaid and closing costs equal to the expense necessary to correct the items requested. If repairs are not mutually agreed upon, the buyer can terminate the sale and receive their earnest money deposit back. Appraisal Once negotiations for the inspection are complete and agreed upon, the buyer’s lender will order an appraisal. The house must appraise for the purchase price of the home for the lender to approve the loan. If the house doesn’t appraise for purchase price of the home, the buyer and seller can renegotiate the price, split the “difference,” or the buyer can bring in an additional amount of money to cover the shortfall. The “difference” is the purchase price of the home, less what the home appraised at. If mutual agreement is not reached, the buyer can terminate the sale and receive their earnest money deposit back.

17

Signing and Closing We can see the sold sign coming! We are getting closer to the finish line now. As a Buyer, you will be able to sign documents usually one or several days before closing, once loan documents are received. This typically will happen at the title company. We will be working with the title company and Sellerâ&#x20AC;&#x2122;s agents to make sure everyone is on track to close your purchase on time. Homeownerâ&#x20AC;&#x2122;s Insurance A homeownerâ&#x20AC;&#x2122;s insurance policy needs to be in place before a lender will fund the loan. The policy protects the property in the event of fire, theft or other damage. Often buyers will use their current car insurance company for a multi-policy discount. If a property is located in a flood zone, flood insurance will be required. Utilities The buyer needs to contact all the utility companies to transfer ownership to their name, starting on the date of closing. This is usually done one week to several days prior to closing on the property. A list of utility companies that need to be contacted will be provided. Signing Closing disclosures (CD) will be provided to you by the lender at least three days before any documents are signed by the Buyer. The CD will contain a detailed description of all costs associated with the transaction, including the exact dollar amount a Buyer will need to bring to the signing table. Once the loan documents are sent to the title company, date and time will be set for the signing of documents. The buyer and seller will sign their documents at different times. Allow an hour for signing and bring a valid ID, cashiers check or obtain wire transfer routing information if you plan to wire your funds to title. The title officer will explain the document and go over the settlement statement, which breaks down all the charges and credits.

18

Funding/Closing Once the title company receives funding from both the buyer and the lender, the lender authorizes the title company to release the property to record with the county. Each county varies, but usually properties record in the afternoon between 1-5 pm. Once the property records, it is considered closed. Often, the buyer receives the keys and possession at 5 pm on the day of closing. However, seller possesion after closing is often part of the sales agreement.

19

What Our Clients are Saying Our Service and Commitment to You: Making You a Raving Fan! What is a raving fan? Ken Blanchard coined the term “raving fan” to describe a customer who is so overwhelmed and floored by the customer service they’ve received that they can’t stop telling everyone about it. This is what we want our clients to do. Tell everyone about us! We go above and beyond for those we work for. “ Darcy was an amazing realtor. She took the time to help my wife and I find our dream home. Darcy was extremely knowledgeable, she was able to answer all of my wife and I’s questions. I have used other realtors in the past and thought were great, but after working with Darcy I realized the level of service I had been missing out on with other realtors. My home buying experience could not have been more positive, and that’s all thanks to Darcy Paquette. ” “ When we decided to retire, sell our home in Tigard, and move to Florida, we chose Darcy as our listing agent, and we are so very grateful we did. From the very beginning, she provided all the help, information and guidance we needed to put our house on the market. She went above and beyond in every way to make the sale of our house as easy on us as possible. Her goal was to sell as quickly as possible for the highest amount possible, and she definitely succeeded! Darcy has been in sales and marketing her entire career, and she put all that expertise to work with an array of amazing marketing materials that highlighted the best features of our house and property. Our listing went live on Friday March 24th, and she held open house events that weekend on Saturday and Sunday using signs and balloons in numerous locations that drew a lot of attention. The open houses were very successful, and we had multiple offers five days later with two above asking price. Throughout the process, Darcy kept us up to date and well informed. She was always kind, thoughtful, honest, and willing to listen. We could not have chosen a better or more professional agent to list our home, and I highly recommend Darcy to both sellers and buyers.” “ Thank you for being an amazing realtor. We are so grateful that God led us to you. You worked hard to find us the perfect house, and helped us through the ups and downs as well. You are a beautiful reminder as to what it means to be a good Christian: patient, gracious, loving and kind. Thank you for all the thoughtful gifts and delicious food too! We look forward to seeing you again.”

20

“ It was a lot of work, but everything went as smooth as it could have possibly gone. We definitely feel we made the right choice in realtors. You exceeded our expectations in all ways. Thanks for all your hard work.” “ In my 37 years as a real estate broker selling thousands of homes, I was the number one broker in the US in 2007. Not bragging, just trying to add credibility. I have never in my career had a broker care so much for her client as Darcy does about you and your wife. In my career I have received phone calls of course from brokers concerned for their clients. Darcy actually asked me to meet in person on a Sunday which got my attention. She explained what you have gone through and the different things you have had to do to adapt to our changing closing dates. You have a great broker, certainly one of the best I have ever dealt with in my career.” “ We truly appreciate all the nice things you have done for us and how wonderful you have been as a realtor. We can’t thank you enough.”

21

Why Keller Williams?

KW is the largest franchise real estate company in the world! My affiliation with the fastest growing and largest Real Estate company in North America is no accident. I wanted to affiliate my real estate services with a company whose values closely matched my own, a company that offered exceptional tools for their agents to in-turn provide an exceptional home-buying experience to each client, and a company that listens to suggestions from it’s agents on ways to improve the company - just like I listen closely to my clients’ wants and needs. Technology Leading-edge tech tools and training give me the edge in effectively communicating with you online, 24 hours a day, seven days a week! Through KW’s exclusive Keller Williams App, you will have exclusive access to the latest inventory in your desired areas. Because the app is branded to me, every time you wish to see a property you find, look no further than liking it on the app! This information will come directly to me so that I can follow up quickly on potential showings for your property of choice. Teamwork Keller Williams Realty was designed to reward agents for working together. Based on the belief that we are all more successful if we strive toward a common goal rather than our individual interests, I’m confident that Keller Williams’ professionals share the common goal of serving you, my client, in the best way possible. Knowledge Keller Williams Realty helps me stay ahead of trends in the real estate industry through its comprehensive, industry-leading training curriculum and research resources. It’s what prepares me to provide you with unparalleled service. Reliability Founded on the principles of trust and honesty, Keller Williams Realty emphasizes the importance of having the integrity to do the right thing, always putting your needs first. It reinforces my belief that my success is ultimately determined by the legacy I leave with each client I serve. Track Record I’m proud to work for #1 Real Estate Franchise in the World, by agent count! It’s proof that when you offer a superior level of service, the word spreads fast.

22

LESS HOUSE HUNTING, MORE HOUSE FINDING INTRODUCING THE NEW KW APP

Discover your next home from the comfort of your phone. If it's time for you to dive back into the real estate market, the KW App has everything you need. View real-time pricing data, insights from local residents, and receive expert guidance every step along the buying or selling process. Download my app today: https://app.kw.com/KW2FFEU1M

Darcy Paquette darcypaquette.kw.com | darcy.paquette@kw.com | 971-409-7731 Each Oï¬&#x20AC;ice Is Independently Owned and Operated

23

“There is no place like home” Dorothy - Wizard of Oz

Darcy Paquette Licensed Oregon Broker 971- 409- 7731 darcypaquette@kw.com www.darcypaquette.kw.com 7504 SW Bridgeport Rd | Portland, OR 97224