Market Report Q2

Accelerating success.

Headline

SaltLakeCountyendedthesecondquarterof2024withonlytwoactive constructionprojects—TheBeverlyatHolladayHillsandWestBlock OfficeBuildingtotaling140,000squarefeet.Despiteaverageasking leaseratessittingatastable$27.44full‐service(FS),landlordsare investinginpropertyenhancementstoattracttenants.Absorption reachedanegative282,269squarefeetyear‐to‐date,butafewnotable leasetransactionsbroughtpocketsofactivity.Vacancyratesreached 17.94percent,whilesubleaseavailabilitydecreasedslightly,pointingto acautiousmarket.

OfficeconstructioninSaltLakeCountyremainsexceedingly limited,withonlytwobuildingsunderconstructioninSalt LakeCountymid‐year—TheBeverlyatHolladayHills(at 120,000squarefeet)andtheWestBlockOfficeBuilding(at 20,000squarefeet)—totaling140,000squarefeetforthe entirecounty.Expectsparseconstructionactivityinthe marketfortheforeseeablefuturewithnonewprojectsin thepipeline.Astenantsleaseupexistingspace,lower vacancyrateswillhopefullygivedeveloperstheconfidence toinitiatenewprojectsinthecomingyears.

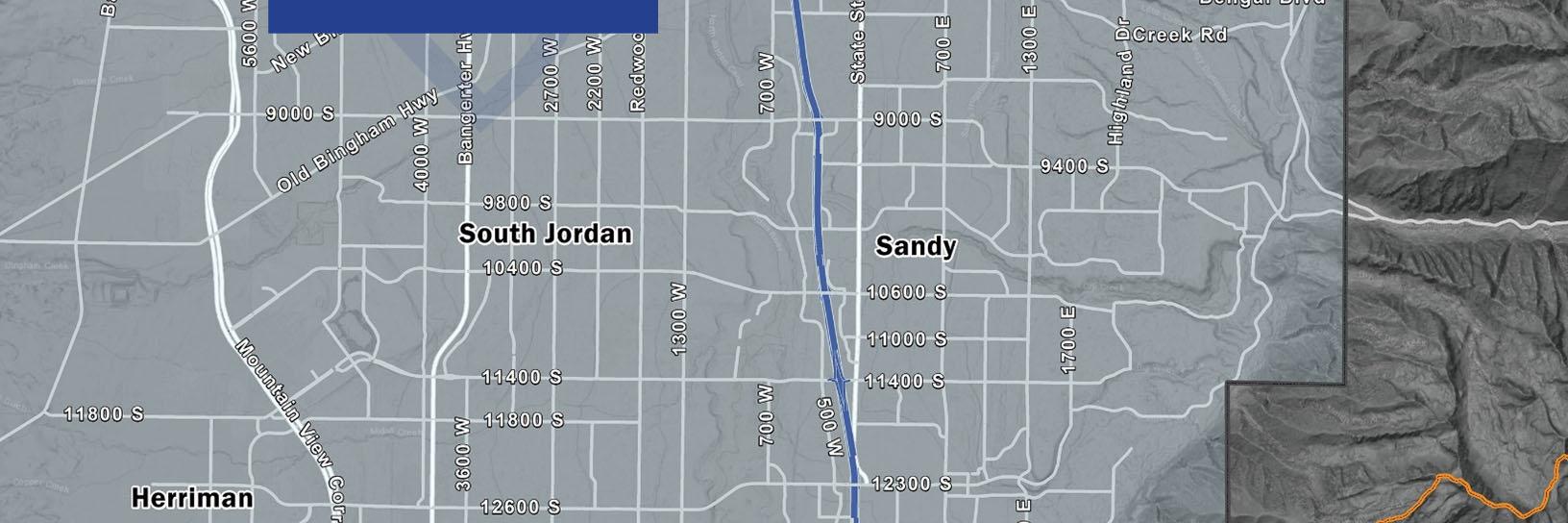

Top Construction Projects

Avg. Asking Lease Rates

TheoverallaverageaskingleaserateforSaltLakeCounty remainedatastable$27.44FS,just$0.01morethanthe $27.43recordedatthesametimelastyear.Suburban propertiescommandedadiscountedaverageof$24.81 FS,whiledowntownlocationssawhigherratesat$28.36 FS.ClassApropertyratesexceeded$30.00FS,averaging $30.93FScountywide.Despitehighvacancyrates,lease ratescontinuedasteadyclimb.Landlordshavebeen investinginpropertyenhancements,upgradingcommon areasandaddingamenitiessuchasgyms,showersand cafestoattractnewtenantsathigherrates.Tenantsare increasinglywillingtopayapremiumforenhanced facilitiesandmodernizedspaces.

Absorption

Year‐to‐dateabsorptionforSaltLakeCountyreached negative282,269squarefeetmid‐year.Infact,thelast recordofpositiveabsorptionwasreportedatyear‐end 2022,sixquartersago.However,somenotableinstances ofpositiveleasingactivitypointtopocketsofresilience andinterest,includingCapitaFinancial’s37,500square‐footleaseatthenewlycompletedHighpointeCenterin Draper,MyriadGenetics’62,737square‐footexpansion atAirportTechnologyParkinSaltLakeCity,and NexHealth’s25,995squarefeetatVistaStationin Draper.

Vacancy

TheoveralldirectvacancyrateforofficespaceinSalt LakeCountyreached17.94percentattheendofthe secondquarter,a2.5percentincreasefromthesame timelastyear.Conversely,subleaseavailability decreasedslightlyfrom4.93percentmid‐year2023to 4.47percentoneyearlater.Whencombined,theoverall vacancyratesitsat22.41percent.Secondquarter subleaseactivityincludedseveraldealsover10,000 squarefeetinsize,including61,615squarefeetatthe PluralsightHeadquartersinDraperbyBambooHR.

(1,500,000) (1,000,000) (500,000) 0 500,000 1,000,000

Salt Lake County | 24Q2 | Office | Market Statistics

Salt Lake County | 24Q2 | Office | Market Statistics

Industrial 24Q2

Current Market Indicators

Headline

TheconclusionofQ2brought2,478,897SFofnewdeliveriestothe market.Despitevariouseconomicheadwinds,developersand tenantshavecontinuedtodisplaystronginterestandactivityinour market.Year‐to‐dateabsorptionfor2024increasedby246%year‐over‐year.AverageweightedaskingrentalratesforSaltLake Countyremainat$0.84NNN,aligningwiththenationalaveragefor industrialspace.Limitedavailabilityandincreaseddemandin smallersegmentsofthemarketcontinuetopushratesupwards. SaltLakeCounty'sdirectvacancydecreasedby30basispoints quarter‐over‐quarterto4.39%,maintainingahealthyoverall atmospherefortenantsandlandlordsalike.

Historic

Industrialdeliveries,suchas9000LogisticsCenterBuildings1 and2,andScannellLogisticsCampusBuildings2and3,have reducedouroverallunder‐constructionnumberto2,354,094 SF.Althoughthisfigureisrelativelylowcomparedtothe surgeofactivityduringthepandemic,itprovidesan opportunityfortenantstoabsorbexistingavailabledirect andsubleasespacebeforenewspeculativespaceis delivered.NotableconstructionstartsduringQ2included CentralCommerceCenterBuildings1and2intheNorthwest QuadrantandtheRivertonWestFlexBuildinginthe SouthwestQuadrant.

Comparison Construction

Top Construction Projects

Industrial 24Q2

Avg. Asking Lease Rates

Overallaverageaskingleaseratesforindustrialproduct inSaltLakeCountyreached$0.84NNNattheendof thesecondquartercomparedto$0.81atthesametime in2023.Thedemandforspaceunder5,000squarefeet droveleaseratesforthisspecificproducttoanaverage of$1.20NNN,asignificantincreaseinamarketwhere ratesover$1.00NNNwereoncerare.Themajorityof SaltLakeCounty’sindustrialinventoryliesinthe NorthwestQuadrant,whererentscontinuetoprovidea stableenvironmentfornewtenantstoenterourrobust marketwhileprovidingstabilityforexistinglandlords.

Absorption

Year‐to‐dateabsorptioninSaltLakeCountyreached 4,953,979squarefeetbymid‐year2024,with3,664,036 squarefeetabsorbedinthesecondquarteralone.Much ofthisabsorptionstemsfromthecompletionof ScannellLogisticsCampusBuilding2preleasedtoiDrive Fulfillment,adding287,620squarefeet,andCopper CrossingBuilding7toHolcim,adding657,895square feet.Additionally,NewBalancepreleased806,661 squarefeetatScannellLogisticsCampusBuilding3,a large1,000,000+square‐footfacility,priortodelivery. Thisperformanceranksourmarketamongthetop10 highest‐performingindustrialmarketsforthesecond quarterof2024.

Vacancy

Theoveralldirectvacancyrateforindustrialproductin SaltLakeCountyclosedthesecondquarterat4.39 percent.Despitethedeliveryofseveralspeculative buildingsthisquarterthatremainfullyvacant,5million squarefeetofnewinventoryhelpedmaintainalower‐than‐averagevacancyrate,evenslightlydecreasingfrom the4.61percentreportedlastquarter.Buildingsover 100,000squarefeetinsizehaveanotablyhigher vacancyrateof6.41percentcomparedtoothersize rangesinthecounty.However,withthecounty’soverall lowvacancyrate,thesenewlydeliveredvacantbuildings arenotexpectedtoremainunoccupiedforlong.

2nd Quarter Transactions

Lease

6802 W Old Bingham Wy Kane Warehousing 1,022,624SF

Transaction Date: 05/16/2024

Lease 821 N 6550 W LogisteedAmerica 173,613 SF

Transaction Date: 05/03/2024

Renewal 6195 W 300 S

InterwestTransportion 142,956SF

Transaction Date: 04/19/2024

Sublease 5350 W Harold GattyDr McLane Global Logistics 105,000 SF

Transaction Date: 04/29/2024

Lease 1568 S 5500 W Westech 89,423SF

Transaction Date: 04/15/2024

Market Activity

North West

Direct Vacancy Rate: 5.30%

YTD Absorption: +3,569,152 SF

Lease Rate: $0.80 NNN

North East

Direct Vacancy Rate: 1.77%

YTD Absorption: +58,644 SF

Lease Rate: $0.95 NNN

Central West

Direct Vacancy Rate: 1.28%

YTD Absorption: +26,745 SF

Lease Rate: $1.01 NNN

Central East

Direct Vacancy Rate: 1.83 %

YTD Absorption: +33,028 SF

Lease Rate: $0.77 NNN

South West

Direct Vacancy Rate: 4.43%

YTD Absorption: +1,254,200 SF

Lease Rate: $1.04 NNN

South East

Direct Vacancy Rate: 1.09%

YTD Absorption: +12,210 SF

Lease Rate: $1.00NNN

Headline

SaltLakeCountyclosedthesecondquarterof2024with653,267square feetofcurrentconstruction,including479,072squarefeetintheSouth Westquadrantalone.DespitemajorprojectslikeAcademyVillage,Midas CrossingandDowntownDaybreakdrivinggrowth,alingeringsupplyand demandimbalanceleftretailersfacinglowvacancyrates.Averageasking leaseratesroseto$21.17NNNcountywideandupto$23.77NNNinthe NorthEastquadrant.Inasharpcontrasttopreviousquarters,absorption reachedapositive239,376squarefeetthankstothecompletionofThe RanchatBluffdale.

Historic Comparison Construction

SaltLakeCountyexperiencedsignificantretailconstruction activitythroughmid‐year2024,with653,267squarefeetofretail spaceunderway.TheSouthWestquadrantishometooverhalfof thecounty'sconstruction,or479,072squarefeet,thankstomajor projectslikeAcademyVillage(at185,000squarefeet),Midas Crossing(at160,000squarefeet)andDowntownDaybreak(at 75,000squarefeet).Despitethisyear‐over‐yearincreasein construction,lowvacancyratesstillleaveretailersstrugglingto findspace.Anescalatingsupplyanddemandimbalancecallsfora moredrasticincreaseinretailconstruction.

Top Construction Projects

Avg. Asking Lease Rates

Mid‐yearoverallaverageaskingleaseratesreached $21.17NNN,anincreaseof$0.17comparedtothesame timelastyear.TheNorthEastquadrantsawthehighest averagerates,at$23.72NNN,followedcloselyby$23.59 NNNintheCentralEastquadrant.Ofthedifferentcenter types,RegionalCenterssawthehighestleaserates,with anoverallaverageof$23.62NNN,whiletheotherthree centertypesrangedfrom$19.00NNNto$21.00NNN. Expectlimitedavailabilitythroughoutthecountyto continuetodriveleaserateincreases.

Absorption

Mid‐year2024sawadramaticturnaroundin absorption,reachingpositive239,376squarefeet comparedtonegative188,790squarefeetinthefirst quarterandbringingyear‐to‐dateabsorptionto positive50,587squarefeetsofar.Over200,000 squarefeetofpositiveabsorptioncamefromthe completionofTheRanchatBluffdalethanksto preleasingeffortsoverthepastfewyears.Leasesfrom LifetimeFitnessandRaisingCane'satTheCrossroads ofTaylorsvillefurtherbolsteredquarterlyabsorption.

Vacancy

Theoveralldirectvacancyratereached2.73percent mid‐year2024,a0.16percentdecreasefrommid‐year 2023anda0.07percentdecreasefromtheprevious quarter.VacancyratesintheNorthEastquadrant reachedahigh5.05percent,drivenprimarilybyover 6percentvacancyinAnchorlessStripCentersand NeighborhoodCenters.Withonlyafewlargeretail centersslatedforcompletionthisyear,tenantsmust innovateandcompeteiftheywanttosecurespacefor newstoreopeningsorrelocationsinSaltLakeCounty.

Overall MarketTotals

Market Activity

North West

Direct Vacancy Rate: 1.18%

YTD Absorption: (2,228) SF

Lease Rate: $21.01NNN

Central West

Direct Vacancy Rate: 1.87%

YTD Absorption: +44,773 SF

Lease Rate: $18.00 NNN

North East

Direct Vacancy Rate: 5.05%

YTD Absorption: (91,029) SF

Lease Rate: $23.72NNN

Central East

Direct Vacancy Rate: 1.91%

YTD Absorption: (22,837) SF

Lease Rate: $23.59NNN

South West

Direct Vacancy Rate: 2.30%

YTD Absorption: +167,746 SF

Lease Rate: $21.33NNN

South East

Direct Vacancy Rate: 3.84%

YTD Absorption: (45,838) SF

Lease Rate: $19.28 NNN

2nd Quarter Transactions

Sale

2500 S Lake Park Blvd

Wasatch Commercial Management 421,212SF

Transaction Date: 05/15/2024

Sale 121 W Election Rd 121 Management 80,937 SF

Transaction Date: 04/19/2024

Sale 986-1030 W Atherton Dr TFH Atherton 64,447SF

Transaction Date: 04/03/2024

Expansion

322 N 2200 W

Myriad Genetics 62,737SF

Transaction Date: 04/10/2024

Sublease 42 E Future Way BambooHR 61,615SF

Transaction Date: 04/01/2024

Top Construction Projects

Overview Overall Market Totals

Market Activity

2nd Quarter Transactions

Sale

121 W Election Rd

121 Management 80,937 SF

Transaction Date: 04/19/2024

Sublease

42 E Future Way Bamboo HR 61,615SF

Transaction Date: 04/01/2024

Sale

12184 S Business Park Dr

Undisclosed 38,430SF

Transaction Date: 06/02/2024

Renewal

2500 W Executive Pkwy

NetDocuments Software 38,646 SF

Transaction Date: 05/01/2024

Lease 14658 S BangerterPkwy Capita Financial Network 37,500SF

Transaction Date: 05/01/2024

Top Construction Projects

South Valley

• Vacancy: 16.82%

• YTD Abs: (142,433) SF

• Lease Rate (FSG): $26.98

Utah County North

• Vacancy: 8.75%

• YTD Abs: +60,077 SF

• Lease Rate (FSG): $25.56

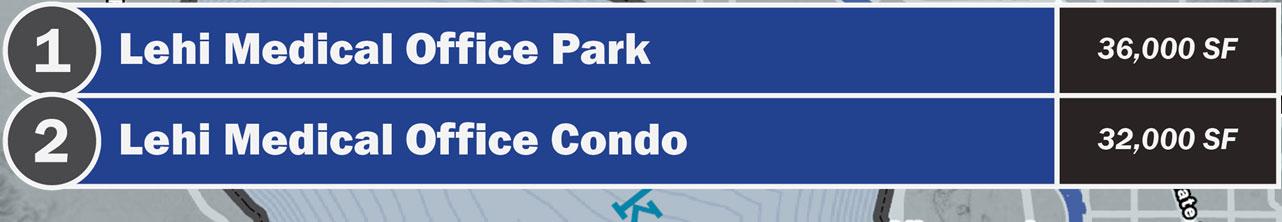

Headline

UtahCounty'sofficemarketsawlimitedconstructionactivitybymid‐year, withjusttwobuildingscurrentlyunderconstruction.Facinghighvacancy andeconomicuncertainty,developershavepausednewprojectsto assessmarketconditions.Averageleaseratesroseto$24.43full‐service (FS),drivenbysteadydemandintheNorthquadrantwhereClassAspace reached$27.90FS.Tenantconfidenceamidanevolvingworkplace landscapebroughtareboundinabsorptionofpositive86,852squarefeet inthesecondquarter,particularlyintheNorthquadrant.

Historic Comparison Construction

OfficeconstructioninUtahCountyslowedsignificantlybymid‐year,withonlytwomedicalbuildingstotaling68,000square feetunderwaynearthenewPrimaryChildren'sHospitalinLehi. Thecompletionofthesetwospacesbythethirdquarterwill bringconstructiontoatemporaryhalt,givingdeveloperstime toplanmorestrategicallyinthefaceofhighvacancyand economicuncertainty.Asinflationstabilizesandcurrent availablespaceisabsorbed,expectnewopportunitiestomeet anticipateddemandforhigh‐qualityofficespaceintheregion.

Avg. Asking Lease Rates

Atmid‐year2024,theoverallaverageaskinglease rateforofficespaceinUtahCountyreached$24.43 FS,a$0.64increaseyear‐over‐year.TheNorth quadrantaveragedahighof$25.56FS,whileClassA spacereached$27.90FS.Highervacancyrates temperedanyaggressiverentincreases,butlease rateshavenonethelessrisenasteady15.18percent overthelastfiveyearsthankstosustaineddemand forqualityofficespaceinUtahCounty.Expectlease ratestocontinueincreasingatamoderatepace throughtherestoftheyear.

Absorption

UtahCountyrecordedanotable86,852squarefeet ofpositiveabsorptionlastquarter,bringing2024 year‐to‐dateabsorptionto77,824squarefeet—a significantturnaroundfromnegative9,316square feetinthefirstquarter.Severaltenantsleasedfull‐floorspacesintheNorthquadrant,includingAgility HoldingsandDentonsDurhamJonesPinegar securing31,749and22,393squarefeet,respectively, atInnovationPointe2inLehi.GabbWirelessalso leased30,344squarefeetofspaceatThanksgiving StationinLehi.Thisrenewedconfidenceamong largertenantsinthemarketsignalsarecoveryfrom theuncertaintiesbroughtbyremoteworkstrategies intheofficesector.

Vacancy

DirectofficevacancyinUtahCountyreached11.69 percentinthefirsthalfof2024,whilesublease vacancyreached5.90percent,foracombined vacancyrateof17.58percentcounty‐wide.ClassB propertiesreachedahighof14.22percent,while ClassAsubleaseavailabilityreached8.64percent. Withnonewconstructionprojectscomingonline, prospectivetenantsmustleaseexistingavailable space,potentiallystabilizingleaseratesbyyear‐end. Despitesubleasespaceofferingmorecompetitive rates,manytenantsarewaryofshorter‐termleases, insteadoptingtorenewcurrentleasesforonetotwo yearstoensuregreaterfinancialmaneuverability amidongoingeconomicuncertainties.

(200,000)

500,000 1,000,000 1,500,000 20202021202220232024

Top Construction Projects

Market Activity

Utah County North Direct Vacancy Rate: 8.75% YTD Absorption: +60,077 SF Lease Rate: $25.56FS

Utah County West

Direct Vacancy Rate: 0.00%

YTD Absorption: 0 SF

Lease Rate: $0.00 FS

Utah County Central Direct Vacancy Rate: 15.63% YTD Absorption: +14,463 SF Lease Rate: $23.70 FS

Utah County South Direct Vacancy Rate: 17.94%

Absorption: +3,284 SF

Rate: $21.50FS

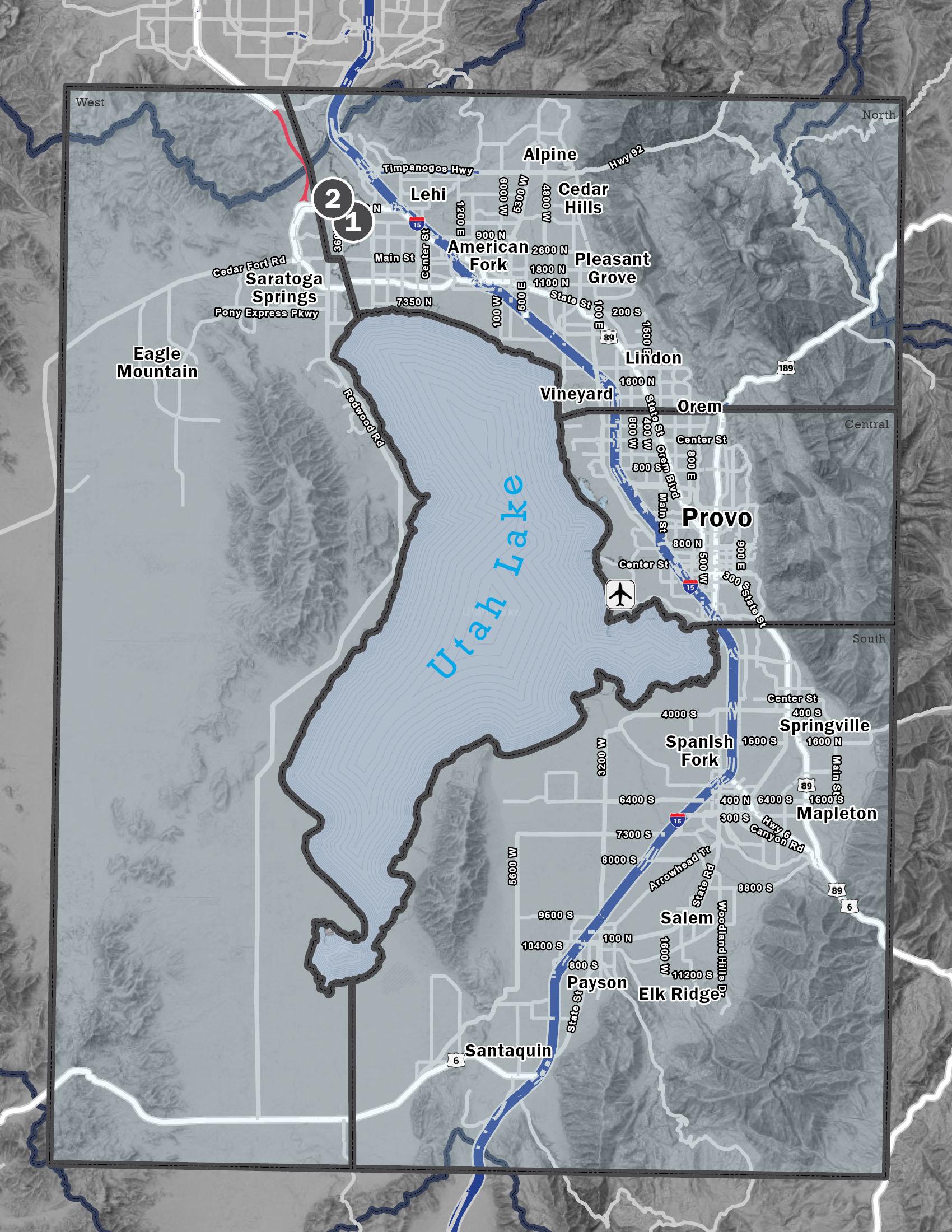

Industrial 24Q2

Headline

UtahCountycontinuestoseepositiveleasingactivityreflectedin theincreasedabsorptionrates,reachingover500,000SF.Someof themajordevelopmentsinUtahCountyreachedcompletionduring the2ndquarterof2024,andnoadditionalnewprojectsbroke groundyet.Thiswillcauseacontinueddecreaseinconstruction numbersovertheremainderoftheyear.Vacancyraterose significantlyasthosesameprojectsreachedcompletionwithnew availablespacefortenantstochoosefrom,increasingtheratefrom 4.21%lastquarterto5.46%.

Current Market Indicators

Historic Comparison Construction

IndustrialconstructioninUtahCountysawasignificant decrease,closingthesecondquarterat2,248,289square feet,astarkcontrasttothe4,358,895squarefeet reportedatthesametimelastyear.Notably,Facebook's expansioninEagleMountain,accountingfor89percent ofthecounty'sconstructionactivityalone,hada substantialimpactonthesefigures.

Avg. Asking Lease Rates

Theweightedaverageaskingleaseratesfor industrialspaceinUtahCountyreached$0.91NNN mid‐year,markingasteadyincreaseof$0.01from thepreviousquarter.Thisupwardtrendinaverage askingleaserates,particularlyinthe0‐20,000square footmarket,isaclearreflectionofthegrowing demandandlimitedinventoryintheUtahCounty industrialmarket.TheNorthernindustrialmarketin UtahCountystandsoutwiththehighestrentalrates acrossallmarkets.Thisislargelyduetoitsunique attributes,suchasastrategiclocationfor employmentbaseandgreataccesstomajorcolleges.

Absorption

Year‐to‐date,UtahCounty'sindustrialmarket recorded537,542squarefeetofpositiveabsorption, including174,863squarefeetinthesecondquarter. Over32,000square‐footleaseinLindonandTKS Product's45,313square‐footleaseinPleasantGrove contributedtoanoverall409,561squarefeetof absorptionintheNorthQuadrant.Whilespacesin the0‐20,000square‐footrangehaveshownnegative absorption,thisdoesnotindicatealackofactivity amongsmallertenants.Thesetenantsare strategicallydelayingtheircommitments, anticipatingabroaderselectionofoptionsthat betterfittheirspecificrequirements.

Vacancy

Theoveralldirectvacancyratehadamodest increaseto5.46percentmid‐year.Thismeansthat businessesnowhavemoreoptionstochoosefrom comparedtopreviousyears.However,thisincrease offerslittlerelieffromprioryearswhentherewere veryfewoptionsavailable.Tenantinterestremains steady,especiallyduetothelackofnew construction.TheWestquadranthasthehighest vacancyrates,withratesexceeding13percentfor spacesover50,000squarefeet.Ratesarehigh becausesupplyinthequadrantislow,meaningeven onelargevacancycansignificantlyimpactthe overallquadrant'snumbers.

YTD Significant Sale Transactions

TheUtahCountyindustrialmarketisprovingtobean idealinvestmentopportunity,with1,543,460square feetofindustrialspacesoldtoinvestorsin2024thus far.Themarket'sappealisemphasizedbythe continuedinterestfrombothowner‐usersand investorssearchingforavailableindustrialproperties. However,therearelimitedoptionsasmostcurrent ownersarereluctanttosell,recognizingthepotential ofthemarket.

Top Construction Projects

Market Activity

Utah County North

Direct Vacancy Rate: 3.37%

YTD Absorption: +409,561 SF Lease Rate: $1.00NNN

Utah County West

Direct Vacancy Rate: 17.73%

YTD Absorption: +24,843 SF

Lease Rate: $0.95 NNN

Utah County Central

Direct Vacancy Rate: 1.98%

YTD Absorption: (25,004) SF Lease Rate: $1.00NNN

Utah County South

Direct Vacancy Rate: 9.26%

YTD Absorption: +128,142 SF

Lease Rate: $0.87 NNN

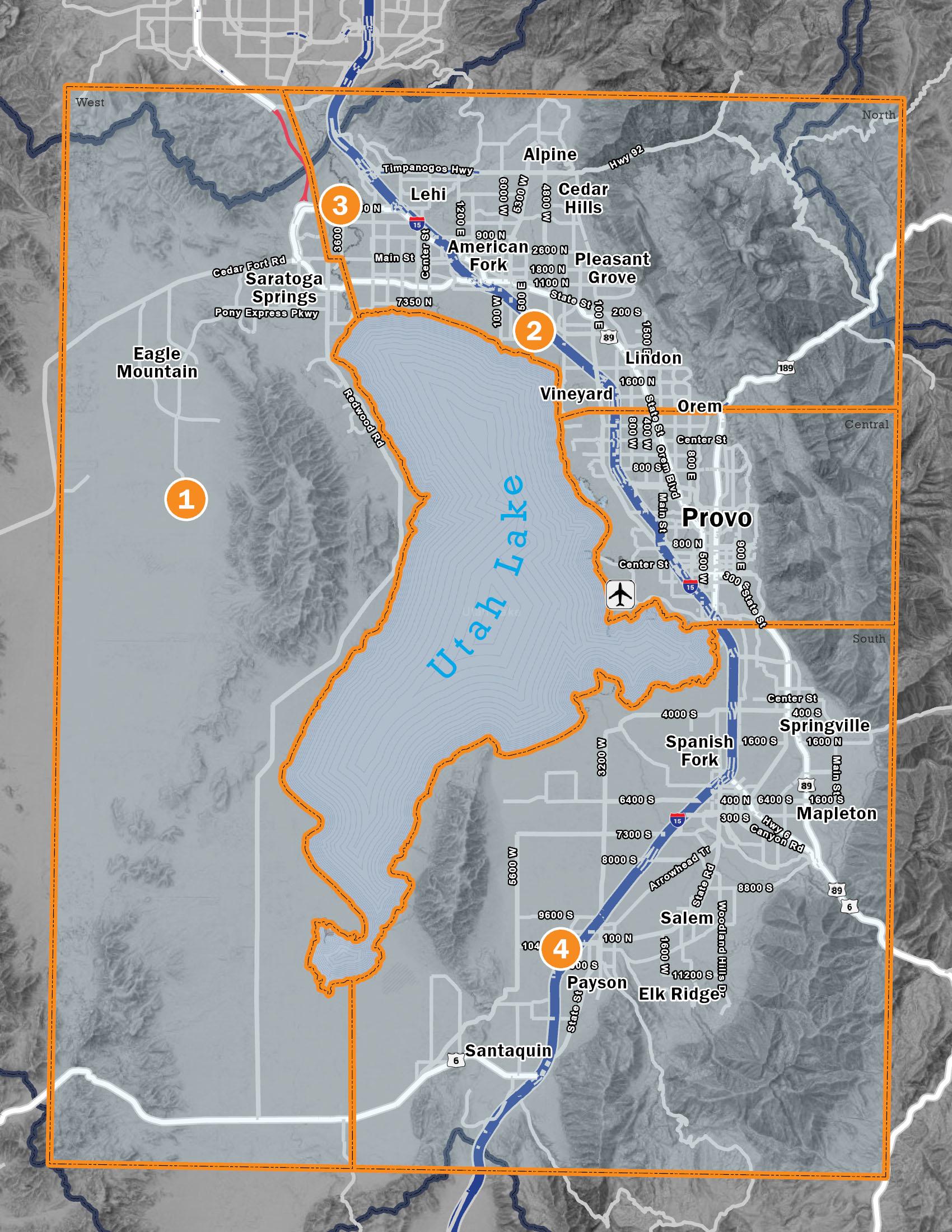

Headline

UtahCountyretailconstructionescalatedto405,772square feetunderwaymid‐year,largelythankstoa200,000square‐foot WalmartinEagleMountain.Averageaskingleaserates increased16.439percentyear‐overyearto$26.42NNN, reaching$35.49NNNforRegionalCentersand$38.22NNNin theWestQuadrant.Alow32,864squarefeetofpositive absorption,impactedbya2.36percenttotalvacancyrate(upto 3.45percentintheSouthquadrant)pointstoacompetitive marketwithhighdemandandlimitedavailability.

Current Market Indicators

Historic Comparison Construction

UtahCountyretailconstructionincreasedyear‐over‐year to405,772squarefeetunderwayattheendofthe secondquarter.Theadditionofa200,000square‐foot WalmartinEagleMountaineffectivelydoubledthe county’stotalconstructionactivity.TheWestquadrant, particularlyEagleMountainandSaratogaSprings,lead thecountyinretailgrowthashometo355,412square feetofcurrentconstruction.Despitestrongdemand bringingvacancytothelowestratesthecountyhasever seen,economicuncertaintyandhighconstructioncosts leavedevelopershesitatingtostartnewprojects.

2nd Quarter Transactions

Lease

1200 S Towne Centre Blvd

Target 135,000 SF

Transaction Date: 06/10/2024

Lease

125 S State St Tractor Supply 13,540 SF

Transaction Date: 04/30/2024

Prelease

1300 W Pony Express Pkwy Taylor’s Bike Shop 6,000 SF

Transaction Date: 05/21/2024

Sublease

1460 N Main St

DT Robotics 3,236 SF

Transaction Date: 04/16/2024

Lease 1347 N State St Bimbo Bakeries USA 2,640 SF

Transaction Date: 06/07/2024

Avg. Asking Lease Rates

OverallaverageaskingleaseratesinUtah Countycontinuedtoclimbin2024,reaching $26.42persquarefootNNNinthesecond quarter,a16.439percentincreasefrommid‐year2023.RegionalCentersaveragedahigh $35.49NNN,nearly$10.00higherthanthe countyoverall,whiletheWestQuadrant—the fastest‐growingareainUtahCounty—reached anoverallaverageaskingleaserateof$38.22 NNN.Expectfurtherpriceincreasesasdemand continuestooutpacesupplythankstolimited constructionandlowvacancy.

Absorption

Despiteevidentdemand,consistentlylow vacancygeneratedsluggishleasingactivity throughthefirsthalfoftheyear.Year‐to‐date absorptionreachedanotablelowofonly 32,864positivesquarefeetbymid‐year2024,a substantialdecreaseof94,836squareyear‐over‐year.TractorSupply’soccupationofthe formerShopkolocationinOremaccountedfora significant13,000squarefeetofcounty‐wide absorption.Anticipateonlyminorincreasesin positiveabsorptionthroughyear‐end.

Vacancy

TotaldirectretailvacancyinUtahCounty reached2.36percentbymid‐year2024,a decreaseof0.38percentyear‐over‐year.The Southquadrantsawthehighestvacancyrateat 3.45percent,includingNeighborhoodCenters reachingasignificant13.49percentdirect vacancyratealone.Alarge72,878square‐foot formersupermarketinSpringvillecontributed substantiallytooverallvacancyintheSouth quadrantlastquarter.Thankstoverylimited availability,smallerspaceswilllikelybetaken quickly,whilelargerspacesmaylingerorbe subdividedtoaccommodatesmallertenants.

20202021202220232024 Anchorless

Top Construction Projects

Market Activity

Utah County North Vacancy Rate: 1.07% YTD Absorption: +25,420 SF Lease Rate: $27.93 NNN

Utah County Central Vacancy Rate: 2.85% YTD Absorption: +63,686 SF Lease Rate: $22.35 NNN

Utah County West

Vacancy Rate: 2.18%

YTD Absorption: (7,714) SF

Lease Rate: $38.22NNN

Utah County South Vacancy Rate: 3.45%

YTD Absorption: (85,148) SF Lease Rate: $30.31NNN

2B