Fireplaces, biomass boilers, wood and pellets

Made in Poland 2023

MECHANICAL VENTILATION

ACCUMULATION TANKS

HEAT PUMPS

SOLID FUEL BOILERS

GAS BOILERS ELECTRIC BOILERS

INSTALLATION FITTINGS

FIREPLACE INSERTS & FREESTANDING STOVES

www.en.defro.pl

Poland has been one of the 27 countries of the European Union since 2004, and the unification of legal regulations within the EU framework makes most of the products manufactured in Poland meet common European standards. This is also the case with fireplace inserts, stoves and biomass boilers, which are also covered by the provisions of the EU Regulation 1185/2015 in Poland, the popular „ECO DESIGN directive”.

These regulations entered into force on January 1, 2022, but already much earlier, most devices manufactured in Poland had met them.

Polish manufacturers of fireplace inserts, stoves or biomass boilers are a very experienced group, and many of them have been present on the market for 25 years or even longer. It is thanks to them that, over several dozens of years, from the position of the country-importer of practically everything related to fireplaces, fireplace inserts, connections, ventilation grilles, etc., we have reached the state where Polish producers cover most of the domestic needs. They are not small, because the country with a population of 37.7 million buys and installs 80−120 thousand devices every year, and in addition to the basic requirements, Polish manufacturers also meet the higher technical and aesthetic expectations of their buyers. What is important, these are mostly own constructions, which are the result of many years of experience and the work of our own designers. These include fireplaces with multi-sided and large glazing, with a water jacket, gas fireplaces or bioethanol furnaces.

Polish highly-qualified employees are reliable. That is why the recognized European manufacturers, SPARTHERM, NORDPEJS and JOTUL located their production plants in Poland some years back.

Due to the relatively small and only emerging market for central heating boilers fired with wood and pellets, the manufacturers of these devices are also able to meet the expectations of markets where there is a high demand for this type of device. Modern machinery, professional staff and usually many years of experience mean that not only good wood or pellet boilers are created in Poland, but also a wide range of mechanical and electronic equipment, as well as everything that is necessary to install modern biomass devices.

However, Polish RES industry does not only consist in the production of equipment. As a country with large, sustainably managed forest resources, we have also been a producer of excellent quality pellets for many years, which also goes beyond the borders of Poland.

Polish products are offered by many trade companies in the fireplace and heating industry, in and outside of Europe. Polish products are already used by many satisfied users in many countries.

As you can see, there are many arguments to reach for Polish fireplace industry products without fear. If you do not know fireplaces or biomass boilers from Poland yet, it is worth reading our report, which – we hope – will help you navigate through the wide range of devices made in Poland.

Our publishing adventure with fireplaces began in 2002 and in 2003 resulted in the first issue of “Świat Kominków” – a periodical that is our lead title to this day. We provide them an overview of the wide gamut of fireplaces available on the Polish market as well as the variety of technical solutions used in this type of heating units. We write not only about fireplaces designed for wood, but also for pellet, gas, electricity or bioethanol. We also present the variety of garden heating units such as grills, smokehouses, bonfires, bread ovens or summer kitchens. The whole is complemented by articles dedicated to the use and operation, fuel issues, flue gas evacuation as well as all kinds of equipment and accessories for fireplaces. We try to cover the topic of the fireplace as widely as possible. We pay attention to how to combine the fireplace with other heating systems such as heat pumps, photovoltaics, recuperation systems or gas boilers. Since 2021 there has been a separate section of our journal dedicated exclusively to wood or pellet boilers.

The magazine has a wide distribution system of both the traditional paper version (available in showrooms and fireplace companies, newsagents, DIY stores) and the electronic version available on the issuu platform and promoted, among others, on our portal fireplaces.org and Facebook thematic groups. We participate in many trade fairs, not only those related to fireplaces, but also regional ones, dealing with construction, interior design and gardening.

We are considered a trustworthy and influential magazine. We are a co-founder and a supporting member of the Polish Association “Kominki Polskie”. Since 2006, we have established the Flame of the Year prize awarded, among others, to the best companies, products and events.

Since 2008, we have been creating a fireplace-related website www.kominki.org. Here, the end-customer can not only view a rich photo gallery and read about various technical and aesthetic fireplace solutions, but also find an executive company and manufacturer using the database of companies, or learn about legal issues regarding the construction of fireplaces.

We are constantly advancing, as best proven by the magazine addressed exclusively to professionals from the broadly understood fireplace industry – “KominkiPRO”, which expanded our portfolio in 2009. The periodical is distributed directly by mail (both by snail mail and in electronic form accessible via the issuu platform) to over 2,500 fireplace and fireplace-related companies in Poland. In “Kominki PRO”, there are texts on legal, economic and marketing aspects of the functioning of companies, important current topics for the industry, materials dealing with technical problems important for contractors, as well as update information on industry events, trainings and fairs. It is a perfect place to look for trade representatives, establish business contacts or reach a wide group of fireplace contractors and stove fitters in Poland.

Our professional sales department is always willing to adjust the offer to the needs and expectations of each client. We are not a large media concern, but a small family publishing house that puts the emphasis on quality and genuineness. We are a reliable partner for companies and a valuable source of information for the Readers.

He has been selling fireplace inserts and stoves since 1992. At the same time, he has been involved in social and journalistic activities, writing for “Gazeta Wyborcza”, “Murator” and local media dealing with construction issues. As a result of cooperation with the IHZ Publishing House in 2002, a project of a generally accessible magazine about fireplaces was born, of which he became the editor-in-chief. In 2003, the first issue of “Świat Kominków” was published, followed a few years later by the magazine for specialists in the industry, “KominkiPRO” and the portal, kominki.org.

Since 2006, “Świat Kominków” has been awarding the FLAME OF THE YEAR award for the best companies, products and most important events in the industry.

For some time, the traditional area of interest of “Świat Kominków” with domesticated fire has expanded to include ecological home heating solutions, mainly those based on wood and pellets.

Poland is the sixth-largest European Union country with an area of 312,679 square kilometers. The population of 37.7 million ranks it as the fifth among the 27 member states. Unfortunately, the level of income per citizen is just € 8.294, equaling to 77% of the EU average, which places us as far as at the nineteenth place in terms of GDP per capita . In addition, significant differences in the standard of living can be observed even within the country; 82 counties have GDP per capita above the EU average, but as many as 298 counties remain below the value.

The differences in the income translate, among others, into the numbers of registered cars and, what is important for us, into the number of houses built. Three voivodships: Mazowieckie, Wielkopolskie and Dolnośląskie, which traditionally lead in terms of earnings, also record the largest number of built apartments. Although many institutions, referring to the statistical income levels, expect them to directly affect the number of apartments, Poland makes an exception to the rule. There is still a shortage of flats in Poland. Despite the fact that over 1.7 million apartments were built within the passing ten years (2011−2021), there are still only 400 apartments per 1,000 citizens, and the EU average (495 apartments per 1,000 inhabitants) was exceeded only in 13 out of 380 administrative districts. Poles though, do not care about statistics and using their savings, loans and thrift build extremely intensively. The number of flats completed in 2020 in France was 381.6 thousand, in Germany – 306.4 thousand, whereas in Poland – a country of much smaller area and population – as much as 221.4 thousand. That gave us the third place in the EU!

I provide the data on Polish construction industry for, after all, it is an apartment or a house that makes a potential place for a fireplace. Although multi-family housing is leading the way to developers, it is still individual housing with single-family houses which provides optimal places for fireplaces. The number of single-family houses is still

growing and, according to the numbers provided by the Central Statistical Office, at least 71,500 single-family houses were built every year in Poland in the decade from 2012 to 2022, and in the record period starting in 2019 almost 90,000 houses were built every year. It should be taken into account that the number of houses built in 2019−2022 was negatively affected by the COVID-19 pandemic and Russia’s aggression against Ukraine. Both the events translated into drastic supply shortages, an increase in the cost of materials, and a significant growth in interest rates on loans.

The majority of Polish single-family houses is built with the use of traditional technologies, which even under normal conditions implies a construction cycle of 1−2 years. Under a high inflation rate (officially exceeding 15%), rising prices and lack of materials, limited access to cheap credits will certainly extend the construction time. If viewed from this side, it seems that in the next 2 or 3 years houses, construction of which was started in the period 2020−2022, will only be at the finishing stage. And from the point of view of the demand for finishing materials, including fireplaces, it is optimistic for in the next few years, neither manufacturers of devices and installation materials nor construction contractors shall be afraid of stoppage in the sector.

It cannot be denied that years 2018−2022, for the customers wishing to domesticate fire in their own fireplace were by no means favorable. The unprecedented one-sided campaign against burning with wood and publicly stigmatizing a fireside as “middle-class luxury” caused the fireplaces, stoves and wooden fuel to be taken out of regional air protection programs. Moreover, the intensively promoted government’s Clean Air Programme de facto prohibited the presence of a fireplace in a situation where subsidies were used, e.g. for the replacement of a coal boiler. The same programme explicitly discredited wood or pellet-fueled heating devices. Despite such an unfriendly atmosphere, the number of supporters of fireplaces and wood-burning in Poland remained high enough to keep the whole industry working,

including its manufacturers, distributors as well as contractors. The COVID-19 pandemic and forced staying at home, be it a yearround one or a seasonal cottage, caused that interest in heating devices noticeably grew. That made many companies expand their offer with such heating solutions, even though their potential in this area has never been fully used.

According to the Central Emission Register of Buildings (CEEB), at the beginning of February 2023 in Poland there were: 1,542,251 fireplaces and stoves, 675,215 tiled stoves, as well as 806,378 kitchen stoves and ranges.

The war in Ukraine, the increase in energy prices and the threat of electricity and gas supply shortages, led to the situation where not only the declared enthusiasts of their own hearthside, but the majority of Polish society started to understand the importance of locally available fuel and the devices that enable its use. Consequently, wood-fueled fireplaces and even more freestanding stoves, which are particularly quick to install, have become a sought-after commodity.

Despite various fluctuations caused mainly by factors outside the industry and the lack of co-funding programmes for the replacement of old heating devices or purchase of new ones, which are popular in many other countries (obviously, all the devices sold currently meet Ecoproject standards), the present-day potential of the Polish fireplace market can be estimated at around 100−120 thousand devices per year.

At the moment, the lead time for the most-sought-after models of fireplace inserts or stoves is several months. Teams of stove fitters and fireplace constructors must wait for a similarly long time. Sadly, the fireplace-and wood supporting social movement is still not fully accepted by national and local authorities, and ‘green’ renewable fuels such as pellets and wood are included in the applicable regulations in the same group of “solid fuels” as ‘black’ fossil coal! Despite all of that, people heating their firesides with wood made it the most popular renewable fuel in Poland, as it is in many other countries. Additionally, due to the common use of wood in home heating, Poland has already achieved

the EU ecological target of using renewable fuels (16% share of RES).

“Świat Kominków” has been observing the Polish fireplace-and-stove market for 20 years and we cannot help feeling that the current political and economic conditions lead the market to a kind of turning point. We hope it’s the time for Poland to witness a full social and legal acceptance for renewable wooden fuels and ecological fireplaces. Both the present and future users as well as manufacturers and distributors of fireplaces and any other kinds of devices for wood and pellets are looking forward to it.

Since 1989, when Poland entered the path of democratic development and free market economy, we have been facing a dynamic growth of the economic activity of Poles. Several European manufacturers of fireplaces, such as SPARTHERM, NORTHSTAR or

JOTUL, took advantage of the possibility of doing business and locating their production plants in Poland. However, the Poles themselves also took matters into their own hands. Numerous small workshops that functioned in the shade of large state-owned behemoths, at most using materials the letter rejected, grew into enterprises employing several dozen or even several hundred people.

Among the companies that were created completely from scratch, there are mainly one-person or several-person service establishments. However, whenever the founding ideas were original and supported by the determination and perseverance in pursuing their goals, companies that were created are today appreciated not only on the domestic market but also on the demanding markets of other countries.

The fireplace industry, its diversity and current potential are a perfect example of this growth. While in the early 90’s the Polish fireplace market was dominated mainly by products imported from France, Norway or Germany, currently these are Polish manufacturers that prevail on the domestic market in terms of the number of devices sold. Attractive products from other EU and non-EU manufacturers only complement the market. Polish fireplace companies have made excellent use of the advantages associated with our accession to the structures of the European Union on the 1st of May 2004.

Several companies such as DEFRO, HAJDUK, HITZE, KAWMET, KRATKI.PL or UNICO provide

the Polish market with the most noticeable number of fireplace inserts or wood-fueled stoves. The size and range of production places some of them among leading producers in Europe. The offer of Polish manufacturers includes not only air and water-fired fireplaces for wood, but also attractive models for gas or pellets. In every large DIY store in Poland one can find fireplace inserts and stoves from KAWMET or NORDFLAM. To the contrary, manufacturers such as CEBUD or IWONA PELLETS do not produce tens of thousands of hearths, but offer innovative devices which are attractive just for a specific groups of buyers. These are, among others, accumulation stove inserts with a pellet gasification hearth or dual-fuel inserts for wood and pellets. And this is just a part of the list of Polish manufacturers of fireplace inserts and stoves. The total production potential of Polish companies exceeds 200,000 fireplace inserts and free-standing stoves. Polish fireplace companies produce about 250.000 pieces of various devices each year. This production volume allows not only to cover the domestic demand for modern hearths, but to deliver a noticeable number of high-quality devices to outer markets.

It is one of Polish specializations. The most famous manufacturer of bioethanol fireplaces in the world is, of course, PLANIKA, the creator of the innovative BEV combustion system. However, at almost every construction fair in Europe one can also meet the INFIRE company, which expands its offer year by year.

The COVID-19 pandemic made many people, not only in Poland, spent more time at homes and in their cottages or in the gardens surrounding them. Although various forms of outdoor fire installations have been present for centuries, in recent years they relive their youth. Currently available materials and technologies make it possible to expand the garden and terrace range with various forms of gas, bioethanol or pellet heaters and to create their attractive shapes not only from traditional ceramics but also of steel. This group of products attracted such a great interest that almost every manufacturer of the fireplace industry has garden heating devices in its offer. So do Polish producers.

A fireplace is not a bare fireplace insert or stove. To build a fireplace or just install a ready-made one, which is a freestanding wood or pellet stove, one needs additional materials. Ropes and insulating tapes as well as ceramics for lining the hearth are necessary already at the stage of production. This is only the beginning, for then one needs materials to connect the fireplace to a chimney, make insulation, accumulation, ventilation grilles, and to create and finish the body of the fireplace. If the fireplace is to perform a heating function, additional elements are required to create a system distributing hot air or accumulating and distributing heated water. Several Polish manufacturers offer advanced electronic control systems for the operation of various types of wood and pellet furnaces, as well as systems controlling the cooperation of a number of heaters. The wide gamut of fireplace accessories and electronic drivers can be found in the offer of Polish manufacturers, which is addressed not only to the domestic market, but also to the one overseas.

It is difficult to compete with experienced leaders in ceramic production from Austria,

Germany or the Czech Republic. Nevertheless, several Polish ceramic manufactories managed not only to create an assortment that almost completely meets the demands of the Polish consumer, but also demonstrates attractive modern design solutions and allows to complete ambitious renovations of antique fireplaces.

“Świat Kominków” visits many construction fair events all over the Europe. It must be stressed that for quite a few years also the presence of Polish fireplace products can be noticed. If the trade fair presentations are not made by companies themselves, then the products are exhibited at least by local distributors.

We do remember the timid beginnings of the fireplace market in Poland, so we are all the more pleased with the current production volume and assortment. The thriving activity of the Polish fireplace sector makes us look with optimism to the future.

AGKOM

Materials for central heaters, fireplace http://puhagkom.pl

ARYSTO Piegat i Alewras s.k. Fireplace inserts http://arysto.com.pl

CEBUD S.C. Jacek Ręka, Maria Ręka Fireplace inserts, accumulation materials https://cebud.eu

CSTEC Paweł Węgrzyn

Warm fireplace cladding system https://www.lc600.pl

DARCO sp. z o.o. Heat distribution systems, chimney systems, chimney cowls, chimney venting systems https://darco.pl

DEFRO R. Dziubeła s.k. Fireplace inserts, stoves, gas fireplaces, outdoor heaters https://www.defrohome.pl

DORAKO Piotr Koper

Fireplace inserts, stoves, gas fireplaces, outdoor heaters https://dorako.pl

ECO PAL sp. z o.o. Briquettes for fireplaces https://eco-pal.pl

FHU EKO-TERM Kućmierz

Accumulation materials http://www.etksystem.pl

HAJDUK Agnieszka i Dariusz Nasińscy sp. z o.o. s.k. Fireplace inserts, stoves https://hajduk.eu

INFIRE Karol Lipka

Bio-ethanol fireplaces https://www.infire.pl

IWONA PELLETS sp. z o.o. Hybrid fireplaces heated with wood and pellet, outdoor heaters https://iwonapellets.pl

KAFEL-ART Pracownia Ceramiczna Lidia Pogonowska Tiles

https://kafelart.pl

KAFLARNIA KAFEL-KAR Rafał Karny

Tiles, ceramic wall panels https://kafel-kar.pl

KOMIN-FLEX sp. z o.o. Gas garden heaters https://vulkan.com.pl

KORNAK Spółka Jawna Tiles

http://kornak.pl

KRATKI. PL Marek Bal

Fireplace inserts, stoves, gas fireplaces, garden equipment https://kratki.com

KUBU

Saunas and garden tubs

https://kubu-wellness.com

LAVA Nikodem Szymkowiak, Julia Tomczak sp.j.

Fireplace inserts

http://www.lavakominki.pl

LIFE POLSKA

Saunas and garden tubs

https://lifepolska.pl

MAKROTERM Agata i Krzysztof Wąchała sp.j.

Fireplace inserts

https://makroterm.pl

NORDFLAM HS sp. z o.o. Fireplace inserts, stoves, outdoor heaters

https://nordflam.pl

Odlewnia KAW-MET Marek

Kawiński

Fireplace inserts, stoves, outdoor heaters

https://kawmet.pl

PARKANEX sp. z o.o.

Flue connections, outdoor heaters, fireplace inserts, bio-ethanol fireplaces

https://parkanex.pl

PEKABET Krzysztof Paluszak

Chimney systems

https://pekabet.pl

RIWAL sp. z o.o.

Tiles, ceramic wall panels

https://ceramikaiszklo.riwal.pl

STALKO sp. z o.o. s.k.

Fireplace inserts, stoves, gas fireplaces, outdoor heaters

https://hitze.pl

TAPIS.PL

Fireplace inserts, electric fireplaces, saunas, swimming pools

https://www.tapis.pl

TATAREK sp. z o.o.

Electronics

https://tatarek.com.pl

TEXTHERMA.EU

Glass and basalt sealing rope

https://dortech.eu

UNIROL sp. z o.o.

Fireplace inserts, stoves, outdoor heaters

https://www.unico-kominki.com

VITCAS Polska sp. z o.o. Stove fitting materials

https://www.vitcas.pl

WĘGIER GLASS Wojciech Węgier

Fireplace glass

https://www.wegierglass.com.pl

The National Association of Fireplaces and Stoves (pol. acronym: OSKP) brings together manufacturers, importers, agents and contractors of fireplaces and stoves throughout Poland. The association promotes the idea of clean wood. Members recognize the role of wood as the Polish national treasure and indicate that heating by means of wood does not only protect the interest of the poorest groups of society, but also ensures security and is a supplement to the energy balance. The association cooperates with Polish stove fitting guilds, chimney sweep guilds and chimney organizations. It also belongs to the European Associations of the stovefitters trade VEUKO and works closely with the Polish Pellet Council and the Polish Climate Forum.

www.kominkipolskie.com.pl

The Guild of Polish fireplace fitters takes care of continuing the tradition connected with stove fitting and learning the profession of a stove fitter. The guild conducts social, social and organizational, cultural, educational and integration activities for the benefit of the community. The aim of the Guild is to strengthen the bond among the fireplace fitters and to reinforce the environment’s image in line with the principles of professional ethics and dignity of the Polish craftsmen. The Guild also aims at executing tasks in the field of supervi-

sion over the craftmanship courses of young workers, people employed in enterprises run by the Guild members and provides assistance in the field of further training and additional active qualification of the Guild. The guild cooperates with the Chamber of Crafts in Kalisz.

www.cechzdunowpolskich.zduny.pl

Guild of Fireplace Fitters and Related Professions of Lesser Poland is affiliated with the Lesser Poland Chamber of Crafts and Entrepreneurship in Krakow. The aim of the Guild is to introduce acceptable exhaust gas emission standards in the legal regulations, which will be at a level that do not cause the deterioration of air quality, and to ensure that the only stoves and fireplaces that are allowed to be used are the ones that technically meet specific emission requirements and will have the appropriate certificate. This means that these will only be installations for wood (biomass) – the largest, cheapest and most available Polish RES. Guild of Fireplace Fitters and Related Professions of Lesser Poland primarily aims to train professionals in order to be able to guarantee that its members will build installations that meet the required standards. The guild organizes training and vocational examinations in two levels – journeyman and master stove fitter. The Guild was established in 2016 to revive the Krakow Gild of Fireplace Fitters, Ceramics and Potters from 1403.

www.zduni.eu

Fireplace manufacturer Kratki.pl celebrates its anniversary!

The Kratki brand is celebrating its 25th anniversary under the motto: “25 years together”. The motto reflects the nature of the company’s activities. Kratki.pl is not only a long-standing leader in the fireplace industry, but also a company that has been successfully developing business with a positive impact on the environment and local communities for over two decades.

Industry leader

Kratki.pl has been operating since 1998, when it started producing fireplace vent covers. Today, the company’s range of products includes more than 2,500 products such as fireplace inserts, gas heaters or biofireplaces. Since the company was established, the production of equipment has taken place in Wsola near Radom. The current area of the machinery and warehouse park is more than 26,500 sqm, and the employment exceeds 700 people. This makes Kratki.pl one of the largest employers in the region. The brand is successful in Poland as well as on foreign markets. Nowadays, the products of the company from Wsola can be found in nearly 80 countries all over the world.

From the beginning, Kratki.pl has paid a lot of attention to high product quality and ecology. All devices meet the highest standards and complies with all European norms. This is possible thanks to the company’s unique research and development centres and high-class specialists. The products developed at the Research and Development Centre find their way into our homes through an extensive sales network. All these products, just from Poland, are distributed not only to other European countries, but also to Africa, China or North America.

Kratki.pl is not only one of the largest employers in the region, but also a local philanthropist. Regularly supports or organises events, social and cultural initiatives such as the family picnic for the Radom community and the noble gift. The manufacturer has also supported Radom hospitals in the fight against coronavirus. Recently, the company and its employees have been heavily involved in helping Ukraine.

We manufacture PREFABRICATED ROOM STOVES made of Akubet, ACCUMULATIVE STOVE HEARTHS made of Akubet, for generated from pellets wood gas burned in a Blucomb® burner or wood.

Set of elements: hearth + accumulation modules + heating plates.

Ready to install of room stoves which are the main source of heating the house for 12-24 hours.

For the construction of room stoves, which are the main and independent source of heating the house.

27 types, 84 models of heavy hearths weighing from 250 to 650 kg (+ modules and casing).

PUH

mob. +48 660 761 202

mob. +48 509 220 470

e-mail: puhagkom@gmail.com

www.puhagkom.pl

We offer a wide range of sealing materials for central heaters, fireplace inserts and fireplace doors:

• thermal insulation glass cords;

• self-adhesive glass tapes;

• repair kits (ready-made)

Production capabilities:

• glass tapes up to 35 mm, thickness up to 4 mm;

• thermal cords from 5 to 30 mm;

• thermal cords up to 20 mm without glass lling;

• thermal cords over 20 mm with glass lling;

• rectangular thermal cords sewn with non- ammable thread;

• square ceramic sealants from 6 to 30 mm (up to 1200°C);

• ready-made.

• konfekcja. The thermal insulation products we offer are produced on our own, therefore we are able to customize technical parameters of the products to specific requirements our customers, within the technical capabilities of our machines.

ETK-SYSTEM panels are made of accumulation mass. They are used to build bodies of stoves and heating fireplaces. The heat obtained from burning wood is stored and then slowly released into the surrounding space. The distribution and circulation of heat takes place in a horizontal line. The wall built in this technology, apart from the fact that it can be plastered, is above all a very solid structure for gluing (or anchoring) sinters, ceramic, brick, stone or metal elements and any other materials that "like" heat and conduct it well.

The base plate with the dimensions of 70 × 35 cm and the weight of 15.5 kg is the basic element of this system (apart from this there is also a corner and a filler).

The plate has a variable shape. At its thinnest point, it is 18 mm thick (40% of its surface) and this part conducts heat very quickly (1.66 w/mK at a surface temperature of about 35ºC). Its remaining area, i.e. 60%, is the conductivity averaged due to the "gradient" variables (thicknesses) of the active surface ~0.8 w/mK. The average permittivity is 1.23 m*K (at a surface temperature of 35ºC).

Intended for convection fireplaces, stoves and heating walls in the hypocaust technology

A modern design solution that consists of accumulation plates and fittings

AGKOM Agnieszka Piotrowska- Jakimowicz

AGKOM Agnieszka Piotrowska- Jakimowicz

The magic o f fire , w h e r e v er y ou w ant .

W it h out chimne y o r g a s

Wi t hou t smoke, odou rl ess ly a n d safely

Fireplace control for traditional and modern fireplaces, heating fireplaces and wood stoves.

The control stabilizes the burning process to maintain the desired temperature in the stove for as long as possible and extend the burning time.

The flue gas temperature sensor measures the temperature above the combustion chamber, and the air damper regulates the air supply for combustion.

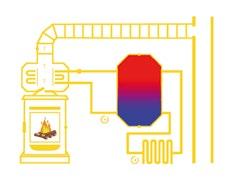

Fireplace control for water -circulating fireplaces, including buffer storage and central heating.

The control stabilizes the burning process to maintain the desired temperature in the stove for as long as possible and extend the burning time.

In addition, the control can manage two pumps (buffer storage charging pump, circulation pump), as well as other devices (e.g. room ventilation, smoke exhaust fan).

Fireplace control for tiled stoves, basic stoves, combination stoves, and other storage systems.

The control ensures optimal air supply to the combustion chamber for a quick heating process. Controlled air supply prevents premature cooling of the stove and stores the heat obtained for as long as possible.

The optimal air supply ensures low-emission combustion and protects the stove from overheating.

Fireplace control for watercirculating fireplaces with heat storage system, including buffer storage and central heating.

The control ensures optimal air supply to the combustion chamber for a quick heating process. Controlled air supply prevents premature cooling of the stove and stores the heat obtained for as long as possible.

In addition, the control can manage two pumps (buffer storage charging pump, circu-

As an expert in biomass combustion, he is a co-author of numerous scientific papers and patents in the field of reducing dust emissions in heating devices.

Co-owner of the family company Budmet Nocoń, which produces boilers for solid biofuels in the form of wood and herbaceous pellets.

His research activity is based on the analysis of the operation of low-power boilers in real and laboratory conditions.

He is a practitioner in his industry, thanks to which he can use the acquired knowledge in innovative projects co-financed by the European Union.

The Renewable Sources of Energy Systems Chamber of Commerce (pol. acronym: IGU OZE) is a nationwide local-level self-government body that supports manufacturers of heating units and components.

We believe that the transformation of the individual-housing heat sector in Poland towards the use of low-emission and emission-free heat generators powered with the use of flow resources should be carried out with the use of technologies available and produced in our country. It is to take care for the domestic industry, fasten the decarbonization process and foster diversification policy of the technological sector supplying the broadly understood power and heat engineering. We work together with state and local government authorities as well as financial institutions. We closely and objectively cooperate with R&D institutes and universities. We are present wherever the issue of promoting domestic and ecological products is important.

The renewable energy industry is a fast-developing multidisciplinary field spanning business, environmental sciences, engineering and social sciences. This sector is extensive.

The boiler industry is a traditional one, nevertheless it uses modern technologies and innovative product solutions, and it’s all because of ambitious entrepreneurs with vision and ideas, talented constructors and engineers, as well as highly qualified production staff.

The main export commodity of Polish business is its innovativeness. Our entrepreneurs have all the necessary talents and skills to create products with international potential. The strengths of Polish products often include high quality as compared with the general offer of foreign producers.

The Polish industry of boiler manufacturers is the largest in Europe. Our biomass heating systems are exported, among others, to Austria, Belgium, France, Germany, Italy and Northern countries. In recent years, a dynamic development of this sector throughout Europe

has been noticed. In Poland, the section of boiler manufacturing is also undergoing a metamorphosis – similarly to automotive industry introducing to the market products adapted to the requirements of air and climate protection.

One of the apparent marks of these industrial changes is the widening range of affordable solid biofuel boilers made by Polish manufacturers of heating systems, even though just a few years ago the market was dominated by coal boilers.

The popularity and advantage in terms of installed capacity in RES installations is also clearly evidenced by financial indicators. The value of investments made between 2014 and 2019 in Poland in low-emission energy sources in buildings amounted to approximately PLN 5 billion. The largest investments were made in photovoltaics (32% of funds). Solar collectors (24%) came second, followed by biomass sources (20%), heat pumps (13%), connections to district heating (9%), and geothermal infrastructure (2%).

In terms of the installed capacity of these heat sources, the list opens with biomass-fuelled ones – 532 MW, followed by solar collectors – 423 MW, and photovoltaics –314 MW. [3]

What can be said with all certainty, is that the increasing use of flow energy sources and significant improvements in clean energy technologies are generating more and more jobs. According to previous analyses, the Polish RES sector provides employment for nearly 20,000 people, the majority of whom work in the area of biomass. [1] The development in the production of heating systems based on renewable energy sources creates innovations and the greatest economic added value in the entire renewable energy sector.

Currently, the market offers solid biofuel boilers of various design spanning from the most basic to the very complex ones. They can be divided according to the maximum operating temperature, maximum pressure, power, energy carrier, fuel supply method, fuel type, construction solutions, body mate -

rial, and so on. Among these products one can distinguish:

wood pellet boilers;

wood and green pellets boilers;

firewood boilers;

firewood and wood pellet boilers;

wood gasification boilers (germ. Holzgas);

wood chip boilers.

The share of energy obtained from renewable sources in Poland and in the world is constantly growing. Thus, knowledge and proper understanding of national and UE legal regulations in this field become important.

Polish heating systems meet a number of restrictive national and EU standards and regulations. From the 1st October 2017 solid fuel boilers introduced to our market have to comply with standards of permissible pollutant emissions for class 5 according to PN-EN 303-5:2012. Another change is EU Commission Regulation 2015/1189 from 28th of April 2015 implementing Directive 2009/125/EC of the European Parliament and the Council regarding ecodesign requirements for solid fuel boilers (Official Journal EU L 193 of 21.07.2015, p. 100). The act is applicable directly from the 1st of January 2020 in all EU member states. It defines the requirements to be met by solid

fuel boilers and specifies the obligations of entities providing such boilers on the EU market. Additionally, the EU Commission Regulation 2015/1187 of 27th of April 2017 introduced the obligation of energy labeling of boilers. This results from the framework Directive of the European Parliament and the Council 2010/30/EU of 29th of May 2010.

Pellet as a renewable energy resource in the form of compressed sawmill by-products is commonly used in different biomass heating systems. The convenient option of automatic fuel feeding in heating devices of the type, ease of storage and relatively low price caused that the niche production of pellet boilers evolved into a wide and still growing market offer. Besides specialized manufacturers of pellet boilers, companies that originally produced other heating systems fuelled with wood and fossils have also appeared on the market.

As pellet boilers have long ceased to be a niche market, even the largest manufacturers of boilers offer pellet heating systems. Modern pellet boilers are fully automated and the fuel is transmitted with the use a screw conveyor. High quality of pellet becomes important in order to prevent the formation of sinters that are likely to damage the device. An innovative solution is the use of a hybrid boiler that can

pellet boilers, 5th class and Ecoproject

automatic coal boilers, 5th class and Ecoproject

hand fed wood boilers (Holzgas), 5th class and Ecoproject

hand fed coal boilers, 5th class and Ecoproject

other boilers, including exported ones

be fuelled with pellet as well as firewood. Attention should be paid also to the ingenious boiler for three fuels – two types of A1 and A2 class wood pellets and green pellets, where the dust emission is below 10mg/m³.

Pellet boilers production has by far been the fastest expanding sector of the solid fuel boiler market in recent years. Interest in this type of boilers is growing quite quickly due to numerous grants, as well as the increasing pro-ecological awareness of users. The potential of pellet boilers production by Polish companies is 80−120 thousand units per year. Predispositions to sell pellet boilers are very high despite changes in legal regulations, technologies used and rising costs.

The care for air quality and natural environment are the main reasons for introducing changes in EU legal regulations on the purchase and operation of heating systems.

Legal regulations, norms and restrictions are introduced successively and apply to all EU member states. We are bound by EU regulations regarding exhaust emissions generated by stoves, fireplaces and other heat systems. The entire heating industry has been prepar-

ing for these changes, hence currently only heating systems that meet the demanding environmental requirements are available on sale.

The strong presence of higher standard biomass boilers is a consequence of meeting the requirements for dust emission index below 20mg/m³. 80% of pellet boilers on the market conform to the norm and have a certificate confirming that they comply with the standards of the EU eco-design. All of these devices are listed on “Green Devices and Materials” (UTI), where one can verify their quality certificates. Due to the plans of the Market Quality Control Department, which was established by the Chamber of Commerce for RES Equipment, all members of this Chamber have agreed for 100% of their devices to be of reduced emission by October 2023.

Since 2017, the share of wood biomass-fired boilers introduced to the domestic market (16−20%), especially wood pellets, has been increasing. In the total volume of solid fuel boilers, the share of pellet heating units in 2018 reached the level of approximately 40% (Fig. 1). From the beginning of 2020, a further increase in sales of boilers fueled with wood biomass was recorded – to the level of 65−70%. There is a growing interest in pellet

boilers, which at the end of 2020 at the level of approximately 120,000 units accounted for over 60% of the entire production of solid fuel boilers produced.[2]

The production of stove and fireplaces sector in our country translates into the yearly sale of around 65 thousand heating units, including pellet heaters.[4] The number should be increased by the sale of pellet burn-

Sources:

ers, chimney systems and controllers, production of which Poland also can pride itself on. There is no other sector of renewable energy systems in Poland so strongly building the economical strength of the country and supporting the process of its decarbonization and elimination of coal-powered systems. The photovoltaic and heat pump sector relies heavily on imported products.

[1] https://globenergia.pl/w-polskim-sektorze-oze-pracuje-okolo-100-tys-osob/

[2] WiseEuropa: Renovation. An overview of low-emission investments in the building sector, Report from the 18th of Deceber 2020: https://wise-europa.eu/2020/12/18/ renowacja-po-polsku-raport-o-niskoemisyjnych-inwestycjach-w-sektorze-budynkow/

[3] Raport: Rynek Urządzeń Grzewczych 2020, SPIUG, Warszawa 2021, https://nape.pl/raport-rynek-urzadzen-grzewczych-2020/; K. Kubica, Clean combustion of solid fuels. Polish small capacity boilers in terms of Commission Regulation (EU) 2015/1189 ecodesign; COP 24 KATOWICE 2018, December 11, 2018; http://www.old.pie.pl/materialy/_upload/COP24_2018/Prezent_KK_11_12_2018/Clean_Combustion.pdf

[4] Sprzedaż i dystrybucja kominków w latach 2015−2020. Kominki Pro nr 1/2021, p. 44. https://issuu.com/kominkipro/ docs/kp44i

The Chamber of Commerce for RES Devices (IGUOZE) was formally established in August 2022, but in fact it has been operating since April 2020 (until August 2022 as the Association of Polish Producers of RES EquipmentSPPUOZE). In our ranks we associate both manufacturers of modern pellet boilers, producers of wood pellets, fireplaces, heat pumps as well as installation wholesalers and installers. Our primary goal is to promote

domestic and ecological products using renewable energy sources both in Poland and abroad. As a Chamber, we have signed an agreement with scientific units - the University of Agriculture in Krakow, the Warsaw University of Life Sciences, the Institute of Mineral Resources and Energy Management of the Polish Academy of Sciences in Krakow. By establishing cooperation with representatives of many fields, we have a real impact on the development of the RES industry, in the

form of future legal acts created at the local, local--government and national level, we contribute to increasing public awareness of renewable energy sources.

We want to actively shape the future of the energy industry in Poland. As the Chamber of Commerce, we care about the interests of producers of all renewable energy devices and, above all, consumers who have to choose a device for both a new and an existing home. The choice of a heating device should take into account not only the momentary fashion, but should also be based on a thorough analysis of the operation of a given device over a period of several years.

Our structures bring together representatives of various professions, where the common denominator is the production of devices using renewable energy sources. These are not only producers of biomass boilers, including pellets, but also producers of heat pumps, fireplaces and geothermal energy. The consolidation of the entire industry is possible thanks to common goals and priorities that motivate us to act. In times of such major climate change and political turmoil, it is necessary for Poland to achieve energy independence. Environmental requirements follow climate change and indicate the need to invest in low-emission heat sources. The goal for the next dozen of years or so is to build an almost new power system based on zero-emission sources. Only the sustainable development of all heat sources will ensure our energy security. Within the structures of the Chamber, departments have been created that reflect our activities: the department for the development of solid biofuels, the department for market quality control, the department for geothermal energy and heat pumps, and the department for the development of RES equipment. The directors of individual departments - as experts in their field - are responsible for undertakings and the implementation of our goals, since they know the problems of their industry best.

Thanks to the full commitment of our members, we are able to determine the direction of our activities on an ongoing basis.

Regular monthly meetings allow us to identify priorities and delegate representatives of the department to implement our assumptions. The overriding objectives of the Chamber is to cooperate with authorities and state administration, local government, economic and social organizations in order to co-create the legal basis for the activity conducted by the members of the Chamber. A large variety of devices using renewable energy sources requires numerous consultations during the preparation of projects and legal acts in the field of environmental protection and the functioning of the Polish RES industry. The Chamber of Commerce is the body that takes part in such debates, thanks to which it contributes to the law-making process and the necessary regulations regarding the implementation of reforms in the municipal and housing sector in the field of individual heating, thermal modernization of buildings, replacement of high-emission and inefficient heating sources.

We have many ambitious activities ahead of us. The mission of the Chamber is the development of the Polish industry through cooperation, legislative activity and strong and effective representation of common interests in dialogue with Polish government administration institutions, as well as with non-governmental organizations. The dynamic development of the institution is an incentive to organize symposiums, conferences and congresses on topics that are of interest to the members of the Chamber. An important point in 2023 is the 8th international conference on renewable energy sources that we are preparing, which will take place on May 22−24, 2023 at the Arłamów Hotel. https://iguoze.pl/

BRAGER sp. z o.o.

Manufacturer of controllers and regulators for boilers and heat pumps https://www.brager.pl

BTI GUMKOWSKI sp. z o.o. sp.k.

Manufacturer of KIPI pellet burners https://kipi.pl

BUDMET NOCOŃ

Producer of low- and high-power pellet boilers, wood-fueled boilers and biomas-fueled outdoor heat lamps https://budmetnocon.pl

DEFRO R. Dziubeła sp.k.

Manufacturer of pellet boilers, heat pumps, buffer tanks and fireplaces https://www.defro.pl

DREW-MET

Manufacturer of low- and highpower pellet boilers, wood-fueled boilers and buffer tanks https://kotlydrewmet.pl

ECO-BURNER sp. z o.o.

Manufacturer of ECO-PALNIK SKIEPKO pellet burners https://eco-palnik.pl

GALMET sp. z o.o. sp.k.

Manufacturer of pellet boilers, heat pumps and buffer tanks https://galmet.com.pl

HEIZTECHNIK sp. z o.o.

Manufacturer of low- and high-power pellet boilers, heat pumps and buffer tanks

https://heiztechnik.pl

KOŁTON sp.k.

Manufacturer of low- and high-power pellet boilers, heat pumps and buffer tanks

https://www.kolton.pl

M PLUS M sp.j.

Manufacturer of fans for the heating industry

https://mplusm.com.pl

MACZKA GROUP sp.k.

Manufacturer of pellet burners

VENMA PELLET BURNERS

https://venma.pl

METAL-FACH

Technika Grzewcza sp. z o.o.

Manufacturer of pellet boilers, wood-fueled boilers and heat pumps https://metalfachtg.com.pl

PLUM sp. z o.o.

Manufacturer of controllers and regulators for boilers and heat pumps

https://www.plum.pl

RAKOCZY STAL sp. z o.o.

Manufacturer of pellet boilers

https://rakoczy.pl

STALMARK sp. z o.o. sp.k.

Manufacturer of low- and highpower pellet boilers, wood-fueled boilers and buffer tanks

https://stalmark.pl

TECH CONTROLLERS sp. z o.o.

Manufacturer of controllers and regulators for boilers and heat pumps

https://www.techsterowniki.pl

TERMOTECHNIKA Michał Kotelba

Manufacturer of ECOMAT pellet burners

http://www.ecomat.waw.pl

TIS sp. z o.o.

Manufacturer of low- and high-power pellet boilers

https://tisgroup.pl

ZD-MOTOR sp. z o.o.

Supplier of mechanical components for the manufacture of pellet boilers and heat pumps

https://www.zdmotor.eu

ZGM “ZEBIEC” SA

Manufacturer of low- and high-power pellet boilers

https://www.zebiec.pl

P.P.U.H Zamech Zygmunt Nocoń company has been operating in the Polish market continuously since 1983. From the very beginning, our activity has been related to two sectors: machining and production of non-ferrous metal castings.

We provide high-end machining services, produce non-ferrous metal castings, manufacture gears, and regenerate all kinds of gantry and crane wheels, shafts, rollers, etc.

Our customers include steel mills, mines, power plants, large and small companies, as well as private clients.

Thanks to our highly qualified staff and extensive technological capabilities, we offer the manufacture of all types of components for machinery and devices.

proudly present our latest development, which is a boiler using three types of pellets.

The resulting project was co-financed by the European Union from the European Regional Development Fund under the Smart Development Operational Programme 2014−2020.

EKO Balance is an innovative boiler that meets the requirements of EU directives, regulations and standards at the highest European level. The product is technologically advanced as it uses a combination of a heat exchanger design with an integrated electrostatic precipitator to reduce emissions. The construction of the EKO Balance boiler is characterised by a high level of reliability and it is almost maintenance-free.

EKO Balance, as the only device on the European market, can be fuelled with A1, and A2 class wood pellets as well as miscanthus biomass. This allows for energy independence, enables the use of locally available raw materials and is in line with distributed energy trends. The main components of the boiler are the pellet burner with an extensive air feed system, the combustion chamber with an aerodynamic particle capture system, the heat exchanger integrated with an electrostatic precipitator and the fuel feed systems.

The integrated design of the heat exchanger and electrostatic precipitator of compact dimensions allow for a higher degree of particle separation while maintaining a highly efficient combustion process.

Thanks to the solutions used, dust emissions can be significantly reduced, the local potential of solid biofuel can be exploited and the operating costs of the device can be reduced.

With support from the European Union and the Smart Growth Operational Programme Intermediate Body, the company’s research and development department has been expanding for several years. Thanks to this initiative, among others, we can P.P.U.H. Zamech Zygmunt Nocoń phone:

The execution of our products is seen as trustworthy and of the highest quality. Emissions depending on the fuel used:

A1 wood pellet 9.26 mg/m³

A2 wood pellet 8.02 mg/m³

Miscanthus pellet 17.51 mg/m³

Laser cutting

• maximum sheet size: 3000 × 1500 mm

• machining precision: 0.1 mm

• black steel up to 30 mm

• stainless steel up to 30 mm

• aluminum up to 20 mm

• copper up to 10 mm

Cutting & punching

• possibility of cutting painted sheets

• possibility of using embossing

• cutting with a circular saw

• cutting with a guillotine

• sheet metal bending with the use of press brakes with a pressure of up to 200 tons

• automatic bending center

Stalmark is a Polish manufacturer of central heating boilers, present on the market since 2002. For almost twenty years, we have been constantly improving our products to provide you with the highest quality central heating boilers. Being a boiler manufacturer is a responsible role towards our customers and the environment and Stalmark fulfils this mission in every way.

Our boilers use selected solid fuels such as pellets, eco-pea coal and wood, all of which meet current environmental standards. Modern Stalmark pellet and eco-pea coal boilers can operate almost automatically. Thanks to the combination with capacious tanks and fuel feeders, they require a minimum of daily maintenance.

Robot welding

• serial welding

• individual welding

MIG, MAG & TIG welding

• welding of single elements

Spray painting

Manufacture of central heating boilers (OEM)

Fabrication of metal structures

Fabrication of aluminum structures

For more information call

33 476 13 26

We are a reliable company with 20 years’ experience. We are willing to undertake any kind of cooperation on metalworking and construction. Our highly qualified stuff is always ready to meet your expectations.

Vice-president of the Polish Pellet Council ENplus®, DINplus/SURE-UE/DDS Systems Lead Auditor

A graduate of the Faculty of Commodity Science with specialisation in Commodity Science and Quality Management at the Gdynia Maritime University and postgraduate studies in Energy and Renewable Resources at the University of Warmia and Mazury in Olsztyn.

For 10 years associated with the certification of product quality systems and product management systems. Long-term third party auditor in the field of factory production control, due diligence systems for biomass used for energy purposes, quality of wood pellets and sustainability criteria for solid biofuels, in respective certifiers, viz. Polish Center for Research and Certification, SGS Polska sp. z o.o., Control Union Poland sp. z o.o., DQS Polska sp. z o.o., DINcertco GmbH and Bureau Veritas Polska sp. z o.o. Co-author of standards for the due diligence system for solid biomass, e.g. the SWP-SNS:2015 standard “System for verifying the origin of solid biomass for energy purposes”.

A member of Technical Committees operating at Bioenergy Europe. Member of technical committees at the Polish Committee for Standardization (PKN) and of the Forestry and Wood Commission at the General Directorate of State Forests. Currently also Vice-President of the Polish Pellet Council. Gained her experience in over 50 full implementation projects preparing plants to meet the requirements of ENplus®/DINplus certification schemes.

Wood is an important resource for the Polish economy. In 2020 production sectors based on the processing of this raw material, i.e. woodworking, furniture manufacture and paper production, made 9.5% sales in the whole industry. Every year, approximately 40 million m³ of wood, including around 35 million m³ of usable timber, is supplied to the Polish market; this is the total amount that Polish producers have at their disposal. At the same time, the constantly growing demand for timber and wood products makes this raw material more and more valuable and it becomes necessary to optimize its use. A possible reduced supply of wood on the market will issue a number of challenges for producers. Adaptation of the timber industry to the new supply conditions may require, for instance, an increase in imports and a decrease in exports of raw material from Poland, as well as an increase in production efficiency and in the share of recycled wood (see Scheme 1).

Analyzing biomass fuels produced by domestic producers available in Poland, one

must consider wood pellets and agripellets (made of straw and agricultural production residues) as the most important ones. Taking into account the logistic aspects as well as the accessibility and possibility of contracting supplies of this type of fuel, it should be assumed that:

Industrial wood pellet is characterized by high availability and relatively stable price. However, it should be noted that industrial pellets (usable in combustion processes carried out in large installations) often happen to be produced with the use of waste wood from woodworking and furniture manufacture, which in practice means that not pure wood biomass is used as a raw material but one contaminated with adhesives, resins and varnishes. Unfortunately, the method of market surveillance carried out by governmental services – Voivodeship Environmental Protection Inspectorate (Pl. WIOŚ), Office of Competition and Consumer Protection (Pl. UOKIK) – is ineffective, which results in the presence of large amount of adulterated form of the fuel on the market.

Agripellet, similarly to the wood pellet described above, is produced within the country, mainly for the needs of the electric utility in Poland. However, considering the possible

use of this type of fuel, two factors that have a significant impact on the choice should be noticed. The first one, comes down to physical and chemical parameters, i.e. particularly low calorific value (approx. 13 GJ/Mg) and high chlorine content of pellet (especially in the case of pellets made of fresh straw), which may negatively affect technical installations by accelerating corrosion. The second and equally important one, consists in the lack of an effective system of quality control upon this type of fuel and the lack of supervision against possible fuel adulteration by using admixtures of various types of non-biomass waste.

Poland, like any other pellet-producing country, is struggling with the availability of raw material, which is concurrently used for the production of wood-based plates and the like, or burned by electric utilities. It should also be added that the occurrence of smog, which is a common problem of Polish cities, makes more and more Poles change their minds about the use of solid fuels, and the obligatory replacement of old boilers with ecological ones (meeting Ecodesign) increases the demand for pellets on the local market. However, we are one of the leaders in the production of the ecological biofuel, which pellet indeed is.

Taking into account the growing demand for wood pellets in Europe and all over the world, it can be predicted that in the next few years its production in Poland will be constantly increasing. The effect of this will not only be an even greater public demand and awareness, but primarily the growth of the wood pellet and briquette market.

Dry and uncontaminated sawdust from coniferous trees, which is the remnant of the main sawmill production, is most often used for the production of wood pellets. The most frequently purchased raw material is dry wood dust (with moisture content of about 15%), which comes from highly specialised timber-processing plants able to facilitate collection and storage proper for maintaining low humidity and ensuring that the material is not contaminated.

However, due to the high demand and low supply of this raw material, pellet producers are often forced to collect sawdust of worse parameters, or even wood raw material in the form of woodchips or edgings, and grind this type of raw material on their own. There are also cases where large sawmills invest in a granulation line and thus use practically all of the purchased round wood (main product + post-production residue). Although the wood pellet industry in Poland is developing very well, it suffers from a shortage of raw material. The production potential of many Polish plants is very small and they are mainly suppliers to the local market (as solid fuel for households). Larger production plants, due to the high investments made to improve the quality of the finished product, are mainly interested in the production of pellets for export. Therefore, they mainly cooperate directly with foreign customers or with distributors specialised in exporting pellets to the Austrian, French, German, Italian and Nordic markets. According to the EPC

Survey for 2021, Poland produced around 1.2 million tons of wood pellets, of which some 500,000 tons were sold domestically and about 700,000 tons were exported. The results of Poland in this industry compared to other EU countries are shown in Figures 1 and 2 (see p. 35).

According to the figures collected by the Polish Pellet Council, five companies with the production volume of around 0.5 million tons per year make 30% of the annual production of wood pellets in Poland. There are also about 100 smaller companies operating mainly on the local market, half of which produce yearly up to 10,000 tones, whereas the remaining ones have a total production capacity of 15−20,000 tons. It should be noted that about 50% of wood pellets produced in Poland are sold to the West as ENplus®/ DINplus certified products.

Analyzing the current data published by the Lithuanian biomass marketplace BALTPOOL International Biomass Exchange on its website (https://www.baltpool.eu/; Figure 3), which brings together producers, traders and buyers of biomass in the Baltic States, it can be seen that pellet prices in the short period from the second quarter of 2021 to February 2022 more than doubled – rising from below EUR 25/MWh to above EUR 45/MWh.

Reports published by the European Pellet Council (EPC) list Poland among the leading producers of wood pellets – next to Belgium, Finland and Hungary. In 2017−2018, for instance, an 18% increase in pellet production was recorded in Poland. At the same time, Europe witnessed an increase of over 10% in pellet production, reaching 20.3 million tones. Importantly, Poland also follows Europe closely in the number of new production plants and trading companies certified in quality systems according to the ENplus®/ DINplus schemes. From December 2017 to January 2021 there were as many as 60 new ones, and at the beginning of March 2021, we recorded the 100th certificate issued in the ENplus® system in Poland. This is a huge success of the industry, which brought an increase in the overall domestic production!

Growing popularity of biomass fuels results not only from the greater care for the environment, but also from growing thriftiness. Still, even today the majority of the production is exported to countries such as Sweden or Denmark, which started producing green energy on an industrial scale as early as in the 1980s and began reducing CO₂ emission and liquid fuel consumption earlier than Poland.

The year 2019 in Polish wood pellet industry was similar to 2018. It was characterized by a growing demand for pellets, mainly to be exported to Italy and Denmark. Already in 2018 some producers had problems with obtaining raw material, and the situation recurred in 2019. Warm winter of 2019/2020 forced entrepreneurs to suspend production despite putting some new production units into operation. Nevertheless, Polish wood pellet industry kept pace with European leaders – we observed a constant production increase affected primarily by new medium-sized units producing up to 10,000 tons of pellet per year. Most of them decided to obtain a certificate confirming the repeatability of pellet parameters in A1 or A2 quality class, i.e. ENplus®/DINplus certificates. From January 2020 to the end of February 2021, several new

entities were recorded on the list of certified producers and trading companies. Currently, in Poland there are 60 producers and 45 trading companies that have already obtained the ENplus® certificate.

The consumption of pellets in Poland has been growing steadily since 2014. Government and local government subsidies for the replacement of old heating systems resulted in an increasing number of new, ecological heating units, which translated into a growing consumption of pellets. It is expected that the impact of these grant programs (including the „Clean Air” program) will be felt for many years to come. In terms of retail sales in Poland, the capacity of the market is growing. However, due to the high VAT rate (23%) for pellet, it will be rather a long-term process. For comparison, in the countries of Western Europe, it is reduced to the level of 10%, which encourages buying this kind of fuel. Still, the price of pellets remains competitive in relation to, for example, eco-pea coal. It is also important that producers pay constantly more attention to products’ quality and thus certify them, which does not come unnoticed by the increasingly aware fuel consumers.

The growth in retail sales of pellets is also influenced by the manufacturers of boilers, which are modern, easy-to-use and, above all, affordable. All of these factors are of great importance for the development of the industry, which should become even more apparent in the coming years. Thus, in a long-term perspective, the choice of RES may contribute to the economic growth of the entire country.

In the group of renewable resources, the major role is played by biomass, the source of which are both timber-processing companies and farms with a surpluses of straw, hay and other agricultural products. These are the main raw materials of which the so-called agripellets, i.e. pellets of agricultural origin, are made in Poland. However, it is a product that is relatively hard to find on the local market. The low supply results from the specificity of its production and use. In order to

produce it one must compress large volumes of raw material, which should be stored for a sufficiently long period so that its chemical properties, in particular the chlorine content and moisture, were at pelletizing-appropriate levels. Agripellet is characterized by physical and chemical parameters of exceptional variability conditioned by the given batch of delivered input material. The fluctuations of these parameters depend not only on the type of agricultural biomass used, but also on harvesting techniques, seasoning time and storage methods. Due to the properties of the finished product, it is mainly used as animal bedding or as fuel in biomass burning installations.

Research shows that currently the largest part of wood biomass intended for the production of green energy is obtained from timber-processing plants, specifically from sawmills. Sawmill activity leads to the production of solid biofuels in a natural way – these are by-produced during the main technological process in the form of sawdust, edgings and woodchips. Polish Pellet Council has been conducting research on the wood biomass market in Poland since 2015. This market has been analyzed by conducting audits of production sites and telephone surveys. Active economic agents supplying wood biomass mainly to RES production units or to intermediaries have participated in the research. Most sawmills and timber processing plants purchase timber mainly from the State Forests, whose forest districts have valid FSC and/or PEFC certificates. These plants possess from a few to a dozen or so contracts with local Forest Inspectorates, which guarantee them the yearly contracted amounts of roundwood. Some of the sawmills also purchase timber from private forests, and those located near the southern border of Poland occasionally buy wood imported from the Czech Republic or Slovakia. Following is a description of biomass production in a sawmill.

Roundwood is transported to the timber yard, where it is sorted and pre-cut into

the appropriate length. It is then forwarded to the sawmill and a series of saws shape the timber to the size requested by buyers. During the mechanical processing of timber, waste is produced in the form of sawdust and edgings, which constitute biomass. It should be noted that a large number of sawmills do not remove the bark before sawing the wood, so the outer edgings will contain it. Sawdust is often collected mechanically from the place of production and directed to the appropriate storage locations. The edgings are directed to a chipper or to an edging storehouse. Sawmills do not use any chemical substances at any stage of timber processing that leads to the production of biomass. The product is therefore a clean biomass that meets the

requirements of RES. This biomass is most often produced on the spot (in the sawmill) and freighted by road transport to the recipient. Some sawmills are not equipped with chippers, so they sell edgings to their customers, who chip wood material on their own yards before delivering it to the power industry. The sawmill companies included in this study are active biomass supply companies, but they are not direct suppliers. Sawmills usually offer products from both deciduous and coniferous trees. It should be noted that these two types of timber are not separated at any stage of biomass extraction. The exceptions are highly specialized plants that produce only specific types of wood products. Looking at Figure 4, it is easy to see that Polish forest stands are dominated by conifer trees.

According to the data provided by the Industry Monitoring, Sectoral Analysis of PKO BP on the 9th February 2023, the utility wood harvesting in Poland has fluctuated around 39 million m³ over the past few years. From 2018, the average annual export of wood amounted to 4.7 million m³, whereas its import to 2 million m³, which translated into a positive trade balance in this raw material group. Poland is the 7th largest exporter of timber in the world and an important supplier of wood-based panels. The vast majority of unprocessed timber from Poland goes to the EU market and to China (20% of export, though the export of wood to this market is decreasing). The largest foreign suppliers of the raw material are the Czech Republic, Germany and Lithuania. The second half of 2022 brought a slowdown on the wood market, which was white-hot during the pandemic. According to the Large-scale Inventory of the State Forests (pol. acronym: WISL, 2013−2017), coniferous species dominate on 68.4% of Poland’s forest area. Pine occupies 58% of the area, with 60.2% in the State Forests and 54.9% in private stand. Therefore, one should expect to find a similar ratio of softwood to hardwood processed by sawmills.

Research has revealed that the yearly biomass production capacity of the largest sawmill plants producing pure biomass (wood chips and sawdust) often exceeds 12,000 m³

deciduous large-size timber

coniferous large-size timber

medium-size timber

small-size timber

in total. Among the surveyed companies, the median value of total produced biomass is 2.5, and the average value of 5.3 thousand m³/year. Of which, on average, they produce 3.1 thousand m³/year of chips and 2 thousand m³/year of sawdust. Moreover, the forecasts show (Table 1) that the amount of utility wood available in Polish forests will systematically increase on yearly basis, which means that both, its processing in timber industry plants and the amount of wood biomass they produce, will increase.

In Poland, at the beginning of the development of RES based on wood biomass, also the furniture industry had its share in supplying biomass. However, after a few years, the leading suppliers of wood biomass resigned from buying it from this type of plants. The main reason for this was the frequent questioning of this wood material as biomass. The doubts were due to the problem with separating clean wood residue from the one contaminated with various

types of chemical substances. According to the current legal regulations, this resulted in qualifying the entire wood residue produced as waste, and not as biomass. Similar criteria were adopted for wood material from the industry producing or processing wood panels and other industries where wood used for biomass production could come into contact with chemical substances that contaminate it. Therefore, such plants were not taken into account. As shown in Figure 5, large wood processing plants are located mainly in the northern and north-western part of Poland.

According to the report of Industry Monitoring prepared by the PKO BP Sectoral Analysis Team on the 11th of October 2021, forests cover 29.6% of Poland. This is less than the EU-27 average, where the forest cover is approximately 40% (after H. Mauser, Key

Wood in general entities purchasing more than 150 thousand m3Figure 5. Sale of wood by National Forest Holding State Forests (PGL LP) to the largest consumers in 2016 according to spatial distribution of timber processing plants According to Innowacyjne leśnictwo szansą rozwoju społeczno-gospodarczego. Znaczenie sektora leśno-drzewnego w rozwoju kraju i regionu, PGL LP 2017

questions on forests in the EU. Knowledge to Action 4, European Forest Institute, 2021). The countries with the highest forest cover in the EU are Finland (66%), Sweden (64%), Slovenia (58%), Estonia (54%) and Latvia (53%). The majority of forests in the EU-27 are privately owned (58%). In Poland, the share of private woodland is much smaller - less than 20%, of which 94% belongs to natural persons. 76.9% of the total forest area in Poland is under the management of the State Forests. The share of woodland in Poland increased in 2009−2018 by 3.6 pp, while on average in the EU this increase was 2.4 pp (according to Eurostat, data for 2018). A greater relative increase in forest area than in Poland was recorded in Portugal, Greece, Hungary and the Baltic States – Figure 6.

According to the data of the Central Statistical Office, 39.7 million m³ of wood was harvested in Poland in 2020, including 38.1 m³ of timber. In turn, FAO data for 2020 show that the production was at the level of 40.6 million m³. The timber stock on the market, understood as the volume of domestic production plus imports and minus exports of the raw material, reached the level of 39.1 million m³, of which 88% was utility wood. It can be assumed that this amount of raw material was available to buyers of wood in Poland – Figure 7.

The main recipients of wood are woodwork manufacturers (PKD 16), the furniture industry (PKD 31) and the paper industry (PKD 17). The sold production of these industries

reached the level of PLN 103.4 billion in 2020, which corresponded to 9.5% of the sold production of the Polish industry in total. All these sectors of industry use wood for production, but the vast majority of raw material is purchased by sawmills and producers of wood-based panels. It is worth noting that raw material, by-products of the sawmill industry (e.g. shavings, sawdust) as well as recycled wood are used for the production of panels (see Scheme 1). The share of sawmill by-products in satisfying demand of wood panel producers for raw material is estimated at nearly 50%, of which 46% is raw material and 4% is recycled wood. The systematic increase in the share of secondary raw material in production should be considered as a plus; in some plants it currently reaches the level of 25%.

Wood and wood industry products are widely used in construction and in the furniture industry. The links in the supply chain for the furniture industry are strong. Therefore, furniture companies are more and more willing to integrate supply chains, investing, for example, in their own sawmills or panel factories. Wood is also used in the production of joinery or pallets. The demand for the raw material is also reported by producers of the garden joinery (so-called garden program) – Poland is the largest producer of wooden garden architecture in the EU.

Wood-based pulp is supplied to manufacturers of paper and paper products. The COVID-19 pandemic significantly accelerated the development of the e-commerce sector, which in turn increased the demand for packaging (cardboards, paper boxes). Statista estimates that the European paper production market will be 5.5% higher in 2027 as compared to 2019. Wood is also used for energy purposes. In the wood sales offer for 2022 published by the State Forests Directorate, the pool of wood fuel in the total sale offer was nearly 6%.

Countrywide supply of biomass for energy purposes is influenced, on the one hand, by the overall volume of timber harvested (theoretical potential) and, on the other hand, by the actual amount of wood available for these purposes, which principally depend on