Sleek, modern, midscale — @HOME by Best Western is the flexible extended-stay option designed with developers in mind and backed by BWH Hotels’ powerhouse revenue delivery systems. Our options (not mandates) let you create the right fit for your market.

It may be back to school for students, but it’s also back to business for hoteliers, as we move away from the slower pace of the summer full-throttle into the busy fall season.

In addition to featuring several key topics in this issue, including our annual Hospitality Market Report, produced by CBRE, which provides an in-depth overview of the industry while taking the pulse of the industry, we’re also pleased to mark a special magazine milestone for Hotelier as we celebrate its 35th anniversary.

As we commemorate and celebrate this remarkable milestone, it’s hard to believe that almost four decades have passed since KML launched the industry’s first national hotel publication. As the founding editor of the publication, it’s so gratifying to see the growth and evolution of this magazine. In those early days, the magazine was produced four times a year in print.

Our intent was to create a national magazine that would chronicle the important news of the day, but also shine a light on the pivotal hoteliers and movers and shakers who make this industry what it is. Of course, we had no idea how the industry would respond, but in quick order we realized just how important the publication was to the industry, fostering a sense of connection among readers and contributors alike.

Over the years, Hotelier has established itself as a reputable and trusted source of information, offering insightful articles, compelling stories, and thought-provoking commentary. And, we’ve also created innovative products that continue to stand the test of time, including our infinitely popular “Who Owns What?” poster, created back in 1998 at the height of mergers and acquisitions. From its early days, the magazine has deftly navigated the shifting landscape of media, adapting to the needs and interests of our audience, pivoting in various directions, while remaining steadfast in our commitment to quality journalism.

As we celebrate this momentous milestone, I’d like to thank the writers, photographers and illustrators and thought leaders who have contributed to the magazine’s editorial vibrancy. But I also want to thank our loyal readership who have been the backbone of our magazine from day one. It’s your loyal support and interest that has allowed us to not only survive but thrive, fuelling a community of engaged readers who share a passion for knowledge. The letters, feedback, and stories that you’ve shared over the years have inspired and fuelled our creativity while shaping the magazine’s identity, making it a true reflection of our collective experience.

Of course, our success would not be possible without the ongoing support of our advertisers, who help sustain our business. Certainly, the publishing landscape is challenging these days as the print world continues to meld with the digital world. But our team is committed to continuing the tradition of excellence while embracing new technologies and innovative storytelling. The way we present those stories may be changing, but the strength of our content and the importance of the stories continues unabated. As we venture into our next chapter, we invite readers to join us in exploring uncharted territory together, discovering new voices, and engaging with the issues that matter most. ♦

ROSANNA CAIRA rcaira@kostuchmedia.com

ROSANNA CAIRA

Editor & Publisher

AMY BOSTOCK

Managing Editor

NICOLE DI TOMASSO

Associate Editor

COURTNEY JENKINS

Art Director

JENNIFER O'NEILL

Production Manager

TYLER BECKSTEAD

Web Manager

JIM SZABO

Digital Marketing Manager

JANINE MARAL

Social Media Manager

WENDY GILCHRIST

Director of Business Development

DANNA SMITH

Account Manager

ZACK RUSSELL

Sales & Marketing Assistant

DANIELA PRICOIU

Senior Accountant

Andrew Weir, Destination Toronto; Anne Larcade, Sequel Hotels & Resorts; Bonnie Strome, Hyatt Hotels; Christiane Germain, Germain Hotels; Gopal Rao, Conestoga College; Hani Roustom, Friday Harbour Resort; Laura Baxter, Co-Star Reetu Gupta, Easton's Hotels; Ryan Killeen, The Annex Hotel Ryan Murray, The Pillar + Post Hotel; Stephen Renard, Renard International Hospitality & Search Consultants

HOTELIER is produced eight times a year by Kostuch Media Ltd., Mailing Address: 14 – 3650 Langstaff Rd. Ste. 33, Woodbridge, ON L4L 9A8, (416) 447-0888. Subscription rates: Canada: $25 per year, single issue $4, U.S.A.: $30 per year; all other countries $40 per year. Canadian Publication Mail Product Sales Agreement #40063470. Member of Canadian Circulations Audit Board and Magazines Canada. Printed in Canada on recycled stock.

All rights reserved. The use of any part of this magazine, reproduced, transmitted in any form or means, or stored in a retrieval system, without the written consent of the publisher is expressly prohibited and is an infringement of copyright law. Copyright, Hotelier 2024 ©

Return mail to: Publication Partners 1025 Rouge Valley Dr., Pickering, Ontario L1V 4N8

A low-impact, highly luxurious Hotel collection in our iconic Bath, Body and Hair Care fragrances. Made from 100% recycled aluminium.

The new appointment comes after a comprehensive search process led by the Board with the support of an executive recruitment firm. Claude Paul Boivin served as the interim president and CEO. “His outstanding leadership and direction were crucial during this period of change and allowed the search committee the flexibility and time to find the right leader,” reads a release from HAC

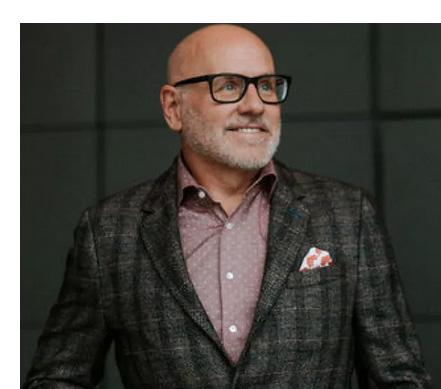

The Hotel Association of Canada (HAC) has named Beth McMahon as its new president and CEO.

An award-winning association leader, McMahon brings extensive experience

to the role and is poised to lead the HAC into an exciting new chapter of growth and advocacy success. McMahon has been a transformative leader in association management for more than 20 years. Most recently, she served as CEO of the Canadian Institute of Planners, growing its membership by more than 40 per cent and substantially expanding its position with government and key partners. Prior to that, McMahon held the position of vice-president, Government and Public Relations, for the Canadian Vintners Association (now Wine Growers Canada).

“The Board is excited by the experience, expertise and energy that Beth brings as the new president & CEO of the Hotel Association of Canada," says Tony Cohen, Chair of the HAC Board of Directors. "Her proven leadership and strategic mindset, specifically within the association environment, will be instrumental in driving our initiatives forward and continue to build on the success of this association. We are thrilled to welcome her as the new leader of this high functioning team and organization.”

As the voice of the Canadian hotel industry, HAC remains dedicated to advocating for policies and initiatives that support the growth and success of its members. Under the guidance of McMahon, the association will continue to champion the interests of the hotel sector, with particular focus on addressing critical workforce issues, ensuring fair rules for short-term rentals, and strengthening Canada’s position as a competitive travel destination.

“I am honoured to join the Hotel Association of Canada at such a pivotal time for our industry,” says McMahon. “The hotel industry is a vital part of Canada's economy and culture, and I look forward to working with our members and partners to continue to build momentum, promote our industry’s value, and effectively influence and advocate on key issues.” ♦

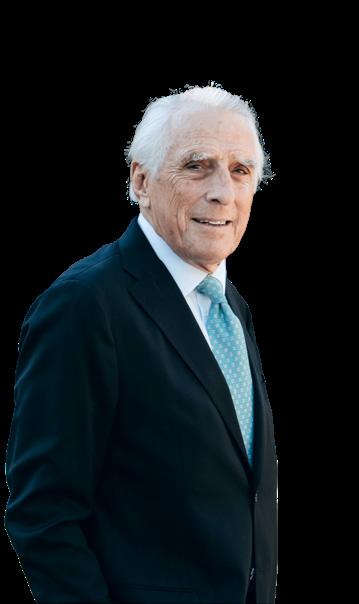

After an illustrious career that spans more than 60 years, working in seven countries, Josef Ebner has announced he’ll be retiring, effective Nov. 15, 2024.

Ebner, who currently serves as regional VP, Canada & managing director at Langham Hospitality Group – Chelsea Hotel Toronto, Canada’s largest hotel property, has worked in 14 properties and seven countries, but the bulk of his career was spent leading the Chelsea Hotel for the past 32 years, where he oversaw the transition of the hotel brand from Delta to Chelsea (under Langham Hospitality Group) 11 years ago.

In a corporate memo from Bob van den Oord, CEO of Langham Hospitality Group, he stated Ebner’s “reputation, not only at the Chelsea Hotel, but across the hospitality industry, has been well recognized through various awards and accolades throughout the years such as the Hotel Association of Canada, Canadian Hotel and Marketing Sales Executives, the Greater Toronto Hotel Association, the Tourism Industry Association of Ontario, the Austrian Canadian Council, and SKAL. An especially proud moment for Josef was receiving the 2011 Decoration of Honour in Gold (Goldenes Ehrenzeichen) from the Province of Styria, Austria, and the 2001 Decoration of Merit in Gold (Goldenes Verdienstzeichen) of the Republic of Austria.”

In addition to an accomplished career, Ebner has always been committed to giving back to the community.

“The ability to give back to the community is not only an important philosophy of Langham, but it’s something he practices every day,” says van den Oord. “Under his direction, the hotel has conducted fundraising efforts and provided volunteers to benefit local as well as international charities. These have included the Juvenile Diabetes Foundation, Special Olympics Canada, and Habitat for Humanity. Since 2013, the hotel has donated more than $1 million in support of SickKids Foundation. On a personal challenge, [Ebner] raised money by climbing mountains such as Kilimanjaro, [raising] $30,000 for Special Olympics Canada, and Aconcagua, [raising] $25,000 for the Jane Goodall Institute of Canada.”

Since joining the Chelsea Hotel in 1992, Ebner has been passionately involved in promoting Canada as a destination through his participation on sales missions to Asia, Europe, the U.K, Middle East and the U.S. Additionally, Ebner has contributed to many tourism-related student/youth programs. At Cornell University, he has acted as a mentor to the Masters students. Locally, he sat on the Dean’s Advisory Council at the Ted Rogers School of Management at Toronto Metropolitan University. He also worked closely with many European tourism management schools that provide internships and personally mentors many of the students himself.

After working tirelessly for more than 60 years, Ebner now plans to spend more time with his wife Annette, and daughter Brigitte and her family.

Green Key Global has announced its first-ever slate of board members and the appointment of Heather McCrory, a hospitality expert with 40 years of experience in the industry, as Chair.

McCrory recently served as CEO of Accor’s North American and Central American operations and currently advises the hospitality industry as principal of Heather J. McCrory & Associates.

She joins other top hospitality professionals who will guide Green Key Global, the world’s leading hotel sustainability certification provider, which is jointly operated by the American Hotel & Lodging Association (AHLA) and the Hotel Association of Canada (HAC).

In addition to McCrory, the other Green Key Global board members are Marianne Balfe, VP of Sustainability at Highgate; Claude Paul Boivin,formerly interim president & CEO, HAC; Kevin Carey, interim president & CEO, AHLA; Susie Grynol, market VP, Eastern Canada, Marriott Hotels; Brian Leon, CEO, Choice Hotels Canada; and Emilio Tenuta, SVP and Chief Sustainability Officer, Ecolab.

New program participants for 2024 include Marriott International, Choice Hotels and Four Seasons, which join existing major hotel company members, such as Accor, Best Western, Crescent Hotels & Resorts, Highgate, Hyatt, IHG Hotels & Resorts, and more.

“I’m delighted to chair Green Key Global’s first-ever board and serve with some of hospitality’s most accomplished sustainability leaders,” says McCrory. “Together, we’ll continue expanding the world’s only sustainability certification designed specifically for hotels throughout North America.”

The Ritz-Carlton, Toronto has joined the exclusive list of hotels as the 11th globally and the only one in Canada and within the Marriott International portfolio to be recognized by the Forbes Travel Guide as Responsible Hospitality Verified.

Responsible Hospitality is recognized by Forbes Travel Guide as the official sustainability verification for its community of star-rated hotels in more than 80 countries. It covers topics such as food and water waste, sustainable amenities, recycling programs, energy usage, health security, integration with the local community and culture, and more.

Designed in partnership with hotelier Hervé Houdré, Responsible Hospitality allows discerning guests to make purposeful choices based on consistent, expertly designed global standards.

“Responsible Hospitality is about creating a welcoming, luxurious experience for guests, while being considerate of the environment and human welfare,” says Houdré.

The Parkside Hotel & Spa has become a signatory of the Glasgow Declaration on Climate Action in Tourism.

The Glasgow Declaration is a unified call to action for all stakeholders within the travel and tourism sector to address the urgent need for climate action collaboratively. It encourages a shared commitment to reducing emissions in tourism by at least 50 per cent over the next decade and achieving Net Zero as soon as possible before 2050.

The hotel will develop and implement climate action plans within 12 months, aligned with the five pathways of the Declaration – Measure, Decarbonize, Re-generate, Collaborate and Finance. Additionally, the hotel will ensure transparency and accountability by publicly reporting progress annually while fostering a collaborative spirit, working with other signatories to share best practices, solutions and information to accelerate the tourism sector’s response to the climate emergency.

Historically, concierges have stood as bastions of trust and expertise, positioned as crucial insiders to whom guests turn to for everything — from securing a reservation at a restaurant to obtaining tickets for a sold-out event. Tasked with handling a spectrum of requests, concierges ensure that each stay isn’t merely satisfactory but genuinely memorable.

Concierges often act as the initial point of contact, even before a guest’s arrival, cultivating relationships that surpass typical guest interactions. They evolve into confidantes and trusted advisors, proving indispensable to guests navigating unfamiliar environments. This role is particularly vital for those visiting a location for the first time, as it transforms potential unease into a comforting sensation of being at home.

Armed with knowledge and local connections, concierges not only enhance guest experiences but also fortify vendor relationships, emphasizing their critical role in the art of hospitality. Additionally, the concierge desk becomes a familiar haven for returning guests who often stop by to share their joys or simply to unburden their hearts, finding solace and friendship in the familiar faces of the concierge team. This ongoing interaction fosters a connection between guests and concierges, transforming the concierge service from a simple amenity into a cherished aspect of the hotel experience where guests feel genuinely cared for and valued.

In today’s digital era, the proliferation of the Internet and digital technologies have significantly altered the dynamics between guests and concierge services. Travellers can manage nearly every aspect of their journey through digital menus, utilizing an array of apps and platforms that provide instant access to information and services. This shift prompts an

Despite technological advancements, the role of a concierge remains irreplaceable

BY HRISHIKESH J C

important question: What’s the role of a concierge in an age where extensive knowledge is readily accessible online?

The advent of the Internet and the expansion of digital technologies have revolutionized how guests interact with concierge services. Guests now arrive well-informed and keen to optimize their travel experiences. They often approach the concierge not merely for suggestions but to validate their online research, particularly regarding trendy dining locations. Whereas guests once sought a concierge’s recommendation for a fine-dining spot, they now come with explicit demands, such as reservations at restaurants known for their top reviews, celebrated chefs and significant social-media presence.

However, the notion of luxury has evolved from simple material indulgence to a bespoke, personalized experience tailored to the guest’s specific tastes and inclinations. At the heart of this tailored approach are concierges. With their ability to anticipate and understand guest preferences, concierges orchestrate experiences that aren’t only engaging but deeply rewarding. Whether recognizing guests by name, anticipating their needs, or offering tailored recommendations, concierges deliver a level of service that far surpasses any digital platform.

Consider a scenario where a guest has independently researched and booked a reservation at one of the city’s top restaurants. Upon learning of this, the concierge collaborates with the restaurant to further enrich the guest’s dining experience. When the guest arrives, they’re not only seated at the best table but also presented with a complimentary glass of champagne, a courtesy arranged by the concierge and delivered by the restaurant manager. This gesture exemplifies the concierge’s ability to leverage their local networks to provide memorable and personalized experiences, enhancing the guest’s visit through thoughtful, behind-the-scenes orchestration.

Concierges also serve as cultural ambassadors, enriching guests’ travel experiences by connecting them with the essence of their destination. From arranging private viewings at exclusive galleries or orchestrating intimate culinary experiences with renowned chefs, concierges ensure every aspect of the experience is personalized and authentic. Despite technological advancements, the role of concierges remains irreplaceable.♦

Agile principles transform the hospitality industry

BY CAYLEY DOW

Recently, my work brought me on an adventure into the technology sector where I was introduced to ‘agile principles’ for the first time, and ever since, I’ve been ponding their importance to work culture. Originally developed to improve software development in the tech industry, these principles have transcended their origins and are now transforming other industries, including hospitality. Agile methodologies promote iterative processes, team empowerment, and a people-centric approaches, all equally relevant to the rapidly evolving hotel industry.

Agile principles improve operations, enhance customer experiences, and drive innovation. These include:

Guest-centricity: Guests are at the centre of every decision. Employees are empowered to go further to meet guest needs, even if it means deviating from standard procedures. Flexibility and personalized service are key to creating memorable experiences.

Adaptability and flexibility: Operations adjust swiftly based on changing circumstances, such as handling last-minute bookings, accommodating special requests, or re-assigning employees to meet shifting demands. Agility is being responsive and adaptable.

Empowerment and autonomy: This abandons the top-down structure and allows employees to make decisions on their own to enhance the guest experience. Guest agents, housekeeping, and restaurant servers are trusted to take initiative, resolve issues, and deliver personalized services without barriers.

Continuous improvement and learning: This means frequently gathering feedback from guests and employees, quickly learning from failure, and being open to experimentation. Whether it’s refreshing a menu, updating room amenities, or improving checkin procedures, continuous improvement is part of the culture.

Collaboration and communication: Front-desk staff, housekeeping, food and beverage, and maintenance teams must work together seamlessly to avoid silos and ensure a smooth guest experience.

Growing agility in the workplace requires a shift in both mindset and practices. Here are key strategies for an agile culture:

Cultivate a growth mindset: Encourage employees to embrace challenges and make decisions. Provide training to handle various scenarios and inspire ownership in their roles. This empowerment allows for quicker responses to guest needs without needing constant managerial approval.

Leverage technology: Utilize tech-driven systems to enhance operational agility.

Mobile check-in, AI-powered guest services, and smart room technology enable more personalized and efficient experiences. For example, AI can predict guest preferences from previous stays, adjusting room settings or offering tailored promotions. Real-time data on occupancy, preferences, and service performance supports agile decision-making.

Break Down Silos: Promote collaboration between different teams to share insights and address challenges. Engaging in cross-departmental discussions helps teams better respond to changing guest needs and operational demands.

Promote role flexibility: Encourage role flexibility and crosstraining. Employees should be trained in multiple areas to adapt as needed. Front-desk staff could assist with concierge duties during peak times, or housekeeping could support food-and-beverage services during events.

Agile teams are equipped with skills to handle disruptions. During the pandemic, agile teams were most swift to implement contingency plans, adjust operations, and maintain clear communication with guests and staff. Adopting agile principles, as the technology industry has, will be key to maintaining a competitive edge in the future.♦

As Hotelier magazine celebrates a milestone 35 years of publishing in Canada, we’re taking you on a walk down memory lane by highlighting some of the people, places and events that have left a mark on the country’s hotel industry. From travel trends and hotel openings, to remembering colleagues we’ve lost along the way, our 35th-anniversary timeline shines the spotlight on the industry-wide coverage Hotelier magazine is known for.

In the face of Canada’s growing travel deficit, a group of more than 20 tourism and hospitality companies banded together to launch a “fix of six” travel-marketing initiative aimed at keeping Canadian tourism dollars inside Canada.

Dubbed “Experience Canada,” the initiative’s first promotion resulted in an extra 600,000 room nights in February 1992.

Delta Hotels & Resorts unveiled an $80-million, 650-room addition to Toronto’s Delta Chelsea Inn, bringing the property’s total room count to 1,590 and making the hotel Canada’s largest property.

An especially tough year resulted in a number of receiverships across the country. Hotels changed hands and brands as much of the industry struggled to stay afloat.

In response to a turbulent global economy, large-scale consolidation and increased internationalization were re-shaping the hotel industry, with M/A taking precedence over new development. At the 1990 Tourism Outlook Conference, Four Seasons Hotels president Isadore Sharp branded the ’90s a white-knuckle decade.

Four Seasons’ chairman Isadore Sharp shocked the industry when he announced that the 44-property chain was for sale. That September, news broke of Prince Al-Waleed Bin Talal Bin Abdulaziz Al Saud’s bid for 25 per cent of the company for approximately $168 million.

The creation of the Canadian Tourism Commission (CTC) was announced on Jan. 25, 1994. To mark this industry milestone, Hotelier named Commonwealth Hospitality’s Michael Beckley, Delta Hotels & Resorts’ Simon Cooper, and Canadian Pacific Hotels & Resorts’ Robert DeMone Hoteliers of the Year in recognition of their role in the development of the CTC.

The formation of the Canadian Hotel Investment Properties Real Estate Investment Trust (CHIP REIT) marks the emergence of Canadian REITs in June 1997, followed by Royal Host and Legacy REITs in November of the same year. A boom in REIT formation contributed to a buying craze that re-shaped the Canadian hotel landscape during the late ’90s. In fact, these three REITs invested a total of $1.2 billion in the Canadian hotel industry in 1997. The frenetic growth of REITs fuelled Hotelier magazine to launch the Who Owns What? poster the next year, helping the industry better understand the ownership landscape.

Recognizing that the Internet had become the most popular option for potential guests to make reservations, an increasing number of hoteliers with websites saw a marked improvement in bookings. Data at the time showed Internet booking capacity had become a necessity, especially for corporate clients.

Days after the tragic events of 9/11, the Canadian hotel industry felt the ripple effect, with hotels across all markets and segments reporting occupancy drops of 30 to 50 per cent in September and October of that year. Many hotels were forced to reduce staff by as much as 20 per cent. Overall, the Canadian hotel industry revenue, which was worth $8 billion a year, was expected to drop by 30 per cent.

Following the room cancellations reservations, prompting formation of Tourism Industry Coalition to business impact

Starwood Lodging Corporation and Starwood Lodging Trust acquired Westin Hotels & Resorts in January 1998 and merged with ITT Sheraton in February 1998, resulting in the largest hotel and real-estate investment companies in the world. At the time, the combined portfolio boasted 650 hotels in more than 70 countries.

Fairmont Hotels and Canadian Pacific Hotels merge, forming Fairmont Hotels & Resorts, a leading luxury hotel brand, which today boasts more than 60 landmark properties worldwide. The newly re-organized Fairmont Company shuttled several properties to its Delta Hotels subsidiary while retaining its other “signature” resorts and hotels from its former CP Hotel and Fairmont properties under the new Fairmont banner.

The hotel industry saw Canada’s timeshare industry begin to gain traction. At the time, approximately 170 properties in Canada offered vacation-ownership options in year-round vacation regions such as Banff, Alta. and Whistler, B.C. The segment was identified as the fastestgrowing segment of the hospitality industry that year.

the SARS crisis, cancellations outpaced prompting the the Toronto Industry Community address the impact of SARS.

Before property-management systems burst onto the hotel scene in 2004, it could take hours to check in a group of guests. With PMS in place, that time was cut back to one or two minutes per person. But the high cost associated with implementing the technology had hoteliers questioning the investment.

2005

As telecommuting and re-location became the norm in the business world, Canadian hotel operators responded to the market conditions with extended-stay offerings, designing properties geared specifically toward that clientele.

Hoteliers in Alberta and B.C. struggle with falling unemployment rates and an aging workforce. In response, the B.C. Human Resources Development Task Force formed Go2, an independent, non-profit industry association working with employers, employees, career seekers, educators, and the government to help operators recruit, retain, train, and develop employees to support industry growth.

A new concept known as Airbnb launched, quickly becoming a thorn in the side of hospitality companies, which felt the company did not contribute to the local economies they serve. However, its impact was undoubtedly a boon for tourism – bringing millions of people to global cities and towns, including Canada.

After five years of anticipation, the new Four Seasons Toronto opened its doors. The flagship property at Bay and Scollard marked the beginning of a new era for the company founded by Isadore Sharp more than 50 years ago.

Hotelier’s first Icons & Innovators breakfast featured Four Seasons founder Isadore Sharp, with the interview staged at the iconic hotel before its move to the new location. The article from that interview appeared in the May issue.

Kostuch Media Ltd. president and group publisher, Mitch Kostuch passed away in October of 2014.

This was the year of the economy tier. Once perceived as the realm of non-branded and unflagged hotels, this segment began attracting the interest of developers with its potential for growth. The downturn in the U.S. economy, and the relative flatness of the Canadian economy, saw hotel developers looking to stylized versions of “once Spartan

Ahead of the 2010 Winter Olympic and Paralympic Games, former Canadian PM Stephen Harper announced the Government of China had granted Canada Approved Destination Status. The result? An influx of big-spending tourists from China. According to Air Canada research, business opportunities through tourism added approximately $10 billion in revenues and 500,000 more Chinese arrivals per year.

Homewood Suites by Hilton opened the first dual-branded hotel in Canada in 2010, joining with the Hampton Inn. As one of the first to push the trend of having two separate hotels under one roof, the deal allowed hotels to capitalize on synergies between brands.

Raffles and Swissôtel – expanding its portfolio to include 500 luxury and upscale properties. In Canada, the deal included iconic properties such as the Fairmont Banff Springs in Alberta, the Fairmont Royal York in Toronto, and the Fairmont Le Château Frontenac in Quebec.

The Indigenous Tourism Association of Canada (ITAC), a consortium of more than 20 Indigenous tourism industry organizations and government representatives from across Canada, is formed. 2016

Marriott International’s acquisition of Starwood Hotels & Resorts Worldwide, Inc. was one of the most significant hotel deals in history. The deal made Marriott the world’s largest hotel company, with a portfolio of 30 global brands, over 5,700 properties, and more than 1.1 million rooms. It also expanded the company’s distribution network in Asia, the Middle East, and Africa

Canada’s 150th birthday was a huge boon for Canadian hotel spending. According to Destination Canada, Canadian residents made close to 110 million international overnight visits in 2017. In addition, Canada’s hotel industry grew 11.1 per cent over its strongest year in nearly 30 years.

Hotelier partnered with Sequel Hotels & Resorts to launch a new organization called WITHorg and to develop the Women in Tourism and Hospitality Summit, Canada’s only conference dedicated to the advancement of women in the hospitality industry, hosting the first Summit at the Park Hyatt Toronto.

KML launched a program, The Design with winners honoured nine categories.

The Black Lives Matter movement became an international phenomenon in 2020. As protesters took to the streets in cities across the U.S. in the aftermath of the police killing of George Floyd, a Black man in Minneapolis, Minn., so did demonstrators in other countries.

The Hotelier team produced first issue (May 2020) home. It also marked the magazine did a print issue during history.

a new awards Design Awards, honoured across categories.

In June 2018, the Hotel Association of Canada (HAC), Tourism HR Canada, and the federal government announced the launch of the Employing Newcomers in Canadian Hotels Pilot Project, an initiative designed to help address chronic labour shortages within the industry. The three-year pilot program will see nearly $7-million dedicated by Immigration, Refugees and Citizenship Canada (IRCC) to connect newcomers to Canada with jobs in the hotel industry.

Hotelier magazine celebrated 30 years as the voice of the Canadian hotel industry.

Hotelier launches its Checking In podcast, which became a popular way to keep everyone updated during the pandemic.

2020 produced the 2020) entirely from marked the first time not produce during its 31-year history.

With a timeline beginning in January with the first positive COVID-19 cases in Canada, 2020 will go down in infamy as business and boarders around the world shut down. The impact on the hotel industry was catastrophic, with properties shuttering and hundreds of thousands of employees (both propertylevel and corporate) let go.

As a result of the pandemic, KML made the unprecedented decision to cancel its annual Pinnacle Awards. In its place, Hospitality Heroes was launched to honour companies and individuals making a difference during the pandemic. Hotelier winners were Hotel Association of Canada, Accent Inns, Fairmont Hotels & Resorts, Sandman Hotels.

In February, the hotel industry was rocked by the passing of Arne Sorenson, CEO of Marriott International, who lost his battle with pancreatic cancer. Sorenson became the third CEO in Marriott’s history in 2012 and the first without the Marriott surname.

Paul Cahill is named SVP, Canada Operations at Marriott International, effective February 2024. Cahill succeeded Don Cleary, who will be retiring after more than 34 years with Marriott.

Tourism Industry Association of Canada (TIAC) named Beth Potter to the role of president and CEO.

KML, in partnership with the Easton’s Group of Hotels, launched an Anti-Racism Commitment Framework intended to help the foodservice-and- hospitality industry create a more equitable and just workplace, while also ensuring that diversity and inclusion are part of the fabric of their businesses.

The Chelsea Hotel, Toronto completed a $25-million refurbishment. The investment — the most extensive since 2013 — included 600 guestrooms in the Executive Tower, hotel corridors throughout the hotel and the modernization and refurbishment of the Executive Tower elevators.

The hotel industry a number and colleagues including Simon Klaus Tenter Vesley.

Hotelier magazine celebrated 35 years as the voice of the Canadian hotel industry.

The Park Hyatt Toronto re-opened following a massive renovation that began in 2017. The COVID-19 pandemic delayed the renovation, which includes new interiors from Studio Munge, luxury guestrooms, a new world-class restaurant and rooftop lounge.

2024 industry lost of friends colleagues in 2024, Simon Cooper, Tenter and Nick Vesley.

The hotel world is saddened to learn of the sudden passing of legendary and respected hotelier John Williams, an icon in the industry who mentored many of

Sara Anghel is named the new president & CEO the Greater Toronto Hotel Association, becoming the first woman to hold the role.

In August, the hotel world lost a true leader with the passing of Silver Hotel Group president Deepak Ruparell. Ruparell, who accepted Hotelier magazine’s Pinnacle Award for Company of the Year in December 2021, was praised for his work with the association during the pandemic and well known for his philanthropic initiatives through The Ruparell Foundation, which he founded.

The Pinnacle Awards celebrated 35 years as the Oscars of the Canadian hotel industry.

Destination Toronto announced the appointment of Andrew Weir as president & CEO.

Don Cleary, who served as president, Marriott Hotels of Canada since 2015, retired. During his tenure, he oversaw the acquisition and successful integration of Delta Hotels, which established Marriott as the largest hotel company in Canada, as well as the integration of Starwood Hotels & Resorts in Canada.

Susie Grynol left her position as president & CEO of The Hotel Association of Canada (HAC). During her tenure, Grynol spearheaded a turnaround strategy for the association, boosting membership by 3,000 per cent and elevating the association’s presence and impact on the Hill. Her leadership and deep commitment to the industry during the COVID-19 pandemic was monumental. As the founder of the Coalition of Hardest Hit Businesses, she led a group of more than 200 business associations through a series of government and publicrelations campaigns.

HOSPITALITY MARKET REPORT

BY NICOLE NGUYEN, SVP CBRE HOTELS

In 2024, the Canadian hotel industry is entering a period of relative calm after the storm. We’re now well removed from the COVID pandemic and its devastating impacts and through the period of accelerated growth which saw national RevPAR make a full recovery in just three years. Across the country markets have, for the most part, returned to or surpassed prior peak top-line metrics, with solid growth expected in 2024.

Supply is again playing a significant role in the industry’s performance in 2024. Between 2020 and 2023, the country only saw about 11,400 new rooms enter the market which is less than two years worth of growth in a four-year period. This year will again see relatively little supply growth (0.8 per cent) or 3,600 rooms, which is both a positive and a negative for the industry. On one hand, lower levels of supply growth may be limiting the ability to accommodate additional demand, particularly during peak periods. But on the flip side, the lower levels of supply have allowed the country to rebound to record occupancy levels and drive strong rate growth.

National demand growth for the year is projected to be a little less than half of a per cent adding approximately 450,000 occupied room nights. With

supply and demand generally balanced occupancy is expected to remain at a peak of 66 per cent.

Growth in ADR coming out of COVID was supported by a macro economic environment with high inflation along with the quick return of leisure travel and the element of “revenge travel.” With Canada’s GDP growth in 2024 projected to be just 0.2 per cent and inflation continuing to fall (dropping to 2.5 per cent in July), the macro economic environment has shifted. This alongside increased demand from contracted rate sources has pulled rate growth back to a level (~3.5 per cent) which is more in keeping with the long run trend of two to four per cent per annum.

While national RevPAR is projected to hit $133 this year, 125-per-cent ahead of 2019 levels, when you dig a little deeper a story emerges: the major markets* vs. the rest of the country. *All projections are rounded

In 2022 and 2023, the growth in demand was being led by the secondary and tertiary markets across the country where demand sources were more local and regional. This resulted in a faster recovery to prior peak demand levels and seasonal capacity constraints while excess capacity lingered in the major markets. In 2024, although demand growth nationally is projected to be about half of a per cent, this will come from the one

per cent demand growth projected in the major markets while the balance of the country is not expected to see any demand growth.

If we drill down into the major market fundamentals and look specifically and the downtown submarkets, it’s worth noting that with the exception of downtown Vancouver, the other major downtown submarkets remain several points off of prior peak occupancy levels for a couple of reasons.

First, in a number of the major downtown submarkets, there’s some softness in 2024 related to city-wide events. Given the length of the booking window for these types of events (threeplus years) the delayed impact of COVID is being felt in this segment now. During part of the period of time when these events were being booked there were still border restrictions, quarantine requirements and other measures in place in Canada due to the COVID pandemic. Market participants have indicated that due to the uncertainty at this time some of the city-wide events our markets should have secured selected other destinations.

Second, many of our major markets are being impacted by the dynamics of their respective office markets. In Canada’s major downtown markets office vacancy rates run from a low of 9.5 per cent in Vancouver to a high of 30.3 per cent in Calgary. While there has not historically been a direct correlation between office vacancy rates and corporate demand for hotel accommodation there is, at a minimum, a loose relationship. With higher vacancy rates, as well as the adaptation of virtual meetings, corporate travel demand remains below 2019 levels.

The Conference Board of Canada is projecting that although overnight visits to Canada in 2024 will be up 7.6 per cent over 2019 levels domestic business visits will be about two per cent behind 2019. Additionally, while total U.S. and overseas overnight visits will only be four-per-cent below 2019 levels, U.S. and overseas business visits will be 68 per cent and 82 per cent of 2019 respectively. As business visitation and corporate demand levels improve so too will the occupancy levels in the downtown markets.

As shown above, RevPAR growth in the major markets is projected to be stronger than for the rest of the country. In the major markets, supply and demand are projected to be

balanced and as a result the four per cent ADR growth should translate into four per cent RevPAR growth. For the balance of the country RevPAR growth is projected to be just two per cent as the three per cent ADR growth is eroded by supply growth outstripping demand growth.

Looking ahead the opportunity for growth in the industry will likely come from the major markets getting back to prior peak occupancy levels once specific sources of demand return. Additional growth is likely to be realized when new supply enters the market increasing capacity. Finally, if the industry is able to continue to drive positive ADR growth RevPAR will see solid year over year increases.

BY CBRE HOTELS & CBRE TOURISM CONSULTING

Heading into the year, the expectation was that 2024 would be the most moderate year of growth for the industry since the onset of the pandemic. With national occupancy already pushing up against historic peaks and a relatively limited amount of new supply, demand growth was projected to be modest. Following significant ADR and RevPAR growth through the recovery phase, both were projected to grow more in line with long run norms, two to four per cent in 2024. Based on the current forecast, national RevPAR performance is generally expected to be in line with these expectations, although there are certain markets and regions where the performance will deviate from the national trend. Its against this backdrop that CBRE has prepared its 2024 Market Forecast.

Canada’s major markets account for approximately 40 per cent of the total rooms across the country and have a significant influence on the national performance for the industry year to year. After realizing exceptional growth in RevPAR in every one of Canada’s major metro markets in 2023, the pace of growth is expected to be much more muted in 2024. It's against this backdrop that CBRE has prepared its 2024 Market Forecast. *All projections are rounded

The provincial economy in British Columbia is facing some headwinds in 2024, however, the regional accommodation market continues to push forward on the strength of tourism. After posting

a record- breaking cruiseship season in 2023, the city is expected to surpass last year’s passenger numbers with a new record of 1.27 million passengers in 2024. Similarly, passenger statistics at YVR in 2024 are pacing well ahead of last year and total volumes may reach pre-pandemic results by year end for the first time. Helping to boost these passenger volumes and visitation to the city in general, has come, at least in part, from the airlines. There were several new routes announced this year, as well as increased frequencies and capacities on some routes into Vancouver.

How this translates for the local accommodation sector is another year of strong occupancy. Room demand is expected to be mostly flat for Metro Vancouver in 2024, however, projected market occupancy at 79 per cent is considered very healthy and is the highest nationally. A modest number of new rooms to the market will be wholly absorbed as some demand growth is expected downtown and in other suburban markets. Market wide ADR is proving its has strong momentum with relatively robust growth expected across all submarkets. Growth of 6.5 per cent or $17 is projected for market ADR. Overall, RevPAR for Metro Vancouver is projected to improve six per cent to $224, the best in the country another year running.

Source: CBRE Hotels

In terms of the provincial economy, Alberta is expected to be among Canada’s growth leaders in 2024 in real GDP, which is forecast to outpace national growth rates. The Trans Mountain Pipeline is officially in operation, which is helping to improve export capacity and boosting energy production. Significant growth in population for the province is driving activity in the construction sector and consumer spending, and the province is diversifying its economy with growth in non oil and gas sectors.

With respect to tourism, the Calgary Stampede set a new all-time record for attendance in July 2024, surpassing the previous record set in 2012. The event saw close to 1.48 million visitors, a 4.9-per-cent increase over the previous record. Likewise, the Calgary International Airport broke its previous record for passenger volumes in 2023 and is ahead of last year’s pace in the

first half of 2024. In June, the expanded BMO Centre at Stampede Park officially opened, making its convention space the largest in western Canada.

Occupancy for the Calgary accommodation market for 2024 is projected to reach 67 per cent, which is well ahead of pre-pandemic results and inching closer to past highs. Occupancy growth, at least in part, is attributable to a lack of any substantial new supply in 2024. In terms of ADR, growth of two per cent for Calgary overall is projected for 2024, reaching $178. Contrary to the norm, downtown Calgary’s projected rate growth is underwhelming relative to its demand growth. The pace of growth has not been there at least in the first half of the year. With that being said, RevPAR in greater Calgary is projected to improve a healthy six per cent on the strength of demand growth.

Source: CBRE Hotels

Edmonton is gathering momentum in 2024 alongside the strides being made provincially. The city has experienced strong population growth due to its relatively affordable housing, which has helped to push up consumer spending, despite recent inflation and interest rate pressures. Edmonton’s office and industrial markets have had continued positive absorption recently, which has led to decreased vacancy rates and expected rental rate growth. And retail has experienced a strong bounce back since the pandemic.

While there were early season wildfires in the northern half of the province that may have tempered at least the perception of upcoming travel, any concerns seemed to be quickly offset by a strong Oilers playoff run.

Passenger statistics at Edmonton International Airport show continually improving traffic through the airport post-pandemic - volume is up 2.3 per cent through two quarters relative to the

same period in 2023. Passenger volume in 2023 reached 7.5 million, compared with 8.15 million in 2019.

From an accommodation perspective, supply growth in the Greater Edmonton market has been very moderate over the last few years after experiencing years of significant growth. As a result, the gains in market demand are leading to improvement in occupancy, which in 2024, is projected to reach 61 per cent, the first time the market has achieved better than 60 per cent since 2015. Very healthy rate growth is expected downtown and in each of the submarkets, which is leading to projected ADR growth of 7.5 per cent overall – a very strong result considering the nine per cent rate growth posted in 2023. RevPAR for the Greater Edmonton accommodation market is projected at $89 in 2024, up from $79 in 2023.

Source: CBRE Hotels

While Regina’s economy has been moving along at a relatively steady pace for a number of years, the accommodation market has had to work hard to try to recover from occupancy levels that were eroded by a significant volume of new supply to the market over a five-year period beginning in 2013. And despite a number of years with very little in the way of new accommodation supply thereafter, the pandemic made the road to recovery even longer.

In 2024, total occupied room night demand for the Regina market is projected to reach above pre-pandemic levels. Outpacing growth in supply, room demand is projected to increase by five per cent, pushing occupancy up two points over 2023. Encouragingly, market ADR is projected to be $137 in 2024, which is an historic high for the market. Overall, RevPAR for the Regina market is expected to increase to $77 in 2024, up approximately seven per cent.

Source: CBRE Hotels

Economists are projecting economic growth for Saskatoon in 2024 due to population growth, steady commodity pricing in potash, uranium and canola, and significant capital investments from both the private and public sectors.

In 2023, passenger volumes at the Saskatoon Airport reached to within 85 per cent of the pre-pandemic volumes and every month to mid year 2024 has outpaced last year. In fact, in more recent months, passenger volumes have outpaced even 2019 levels by up to five per cent per month.

Saskatoon enjoyed healthy RevPAR growth at 21 per cent in 2023 due to improvements in rate and demand in equal measure. A much more muted performance is expected in 2024, albeit at a still healthy 5.5 per cent projected growth in RevPAR. Demand is expected to inch forward to push occupancy up by one point, while ADR is on pace to finish about $6 or four per cent ahead of 2023.

Source: CBRE Hotels

A steady and diverse economy helps to keep Winnipeg in a good economic position year over year, however, in 2024, the economy is expected to slow before picking up again in 2025. Tourism is a bright spot in the local economy as visitation increases year over year, including from international markets. The city continues to host several large events and festivals and Indigenous tourism is on the rise. At least from an accommodation market perspective, 2023 will be a tough

Your dream of building a new hotel is within reach. Join a growing community of hoteliers who have opened or are developing a Sleep Inn® — a unique midscale brand that balances the modern, nature-inspired look and feel your guests crave with the low development and operational costs your business needs to thrive.

Sleep Inn is a stylish hotel with the wellness-focused conveniences travellers of today and tomorrow prefer. Every inch of the Scenic Dreams™ Sleep Inn® Prototype & Design Package is designed for operational e ciency to help provide your best return on investment. And paired with Choice Hotels’ award-winning support, you’ll be set up for success from the start.

The Sleep Inn experience brings to life an uplifting design that is an excellent fit for any hotelier.

year to beat for the Winnipeg market. A perfect storm of a strong local economy, recovery from the pandemic, and Ukrainian refugees housed in hotels, led to the city’s best-ever occupancy, ADR and RevPAR results by a wide margin. While it is expected that there will be some contraction in demand in 2024, the market is projected to continue to build off of recent gains in ADR. Overall, it is projected the market will see occupancy finish at 73 per cent, down four points from 2023, but with a 4.5-per-cent lift in rate. RevPAR is projected to be just $1 behind 2023 results.

Source: CBRE Hotels

The Greater Toronto Area has seen good economic and tourism recovery over the last couple of years, however, 2024 is expected top see a modest contraction in GDP and employment growth. Nonetheless, Toronto remains the economic centre of Canada and conditions over the coming years are expected to improve.

On the tourism side most visitor segments have returned and exceed 2019 levels with the exception of overseas and domestic business which are both in the range of 90 per cent of pre-pandemic levels.

Supply growth in the GTA slowed in 2023 to about two per cent with approximately 850 new rooms opening. It’s expected that supply growth will grow at a similar pace in 2024 as well. The supply is fairly well dispersed across the Toronto sub-markets. Following 11 per cent demand growth last year, lead by the downtown Toronto sub-market, occupancy improved to 74 per cent. In 2024, supply and demand in Toronto are projected to grow in balance with occupancy remaining flat at 74 per cent.

In 2023, ADR growth was very strong at 13 per cent as demand growth in the

shoulder and low periods allowed for stronger rate yield. The market ADR increased by $26 to $228. After a strong start to the year and major events in the latter months including TIFF and the Taylor Swift concerts, it’s projected that ADR will grow by 2.5 per cent, increasing by $5 to $233. The stable occupancy levels and improvement in ADR should drive RevPAR improvement of approximately $4, or three per cent for 2024 following the 23-per-cent increase in RevPAR realized in 2023.

Source: CBRE Hotels

Niagara Falls is one of Canada’s predominant destination leisure markets with travellers from across the country and around the world visiting each year to experience the Falls and various attractions in the area. Visitation to Niagara has rebounded with total visits in 2024 expected to be up over 2019 by eight per cent. The U.S. and overseas visits are still somewhat below 2019 levels but are expected to rebound fully in 2025.

In 2023, Niagara Falls saw a 25-per-cent increase in demand driving occupancy up to 69 per cent. While some of the demand growth was linked to increased U.S. and international individual and group (i.e. tour) travel, there was also non-traditional demand in the market. These conditions were also evident in the market ADR growth being only three per cent. While RevPAR growth of 29 per cent or $32 was significant, it wasn’t expected to hold in 2024.

With no supply changes projected for 2024 and the bulk of the non-traditional sources out of the market occupancy is expected to drop by six points to 63 per cent as the result of an eight-percent decline in demand. However, with this demand, out of the market ADR is showing strong growth through the first

half of the year with the summer and fall expected to be strong as well. The market is projected to see ADR growth of 15 per cent or $31, increasing to $238 in 2024. The significant improvement in ADR will offset the decline in occupancy and RevPAR is projected to increase by six per cent or $8 to $150.

Source: CBRE Hotels

As Canada’s capital city and the seat of the Federal Government, Ottawa’s economic performance is closely tied to government and government-related business. Public administration accounts for about one third of the region’s annual GDP. In 2023 GDP growth was estimated to be 3.1 per cent slowing to just 0.7 per cent in 2024 before rebounding in 2025.

Total overnight visitation to the region was up 15 per cent in 2023 surpassing 2019 levels with another five-per-cent growth projected in 2024. While U.S. visitation levels have largely recovered, overseas visitation is sitting at 93% of 2019 in part due to some geo-political dynamics.

Both occupancy and ADR grew significantly in 2023 up seven points

and 11 per cent respectively. The strongest demand growth took place in downtown Ottawa which recorded a 19-per-cent increase with no changes to supply. This demand was driven by increasing in-person government and the related corporate business as well as meeting and conference activity. As a result of the improved conditions, RevPAR grew by 24 per cent to $134 finally surpassing pre-pandemic levels.

In 2024, the Ottawa market is projected to see occupancy hold flat at 69 per cent as demand and supply are expected to contract modestly. Market ADR is projected to improve by two per cent or $5 to $201 in 2024. As a result of the flat occupancy and the growth in ADR market RevPAR is expected to finish at $138, a $4 or three-per-cent improvement over last year.

GDP growth for the Greater Montreal Area was forecast at 1.7 per cent in 2023 and expected to slow to 0.7 per cent in 2024 before recovering to 2.7 per cent in 2025. The economy in Montreal is experiencing significant growth in manufacturing and retail & distribution. In addition, the housing market is holding up a bit better than others. The Greater Montreal Area saw some of the quickest rebound in visitation, exceeding it’s 2019 levels back in 2022. Montreal has had a significant number of international visitors, not only from the U.S., but also from Europe (namely France) due to its linguistic and cultural ties. While these segments of visitation have returned to almost 2019 levels the visitation has been buoyed by domestic pleasure travel.

Occupancy in 2023 jumped to 71 per cent, nearing pre-pandemic levels with downtown generating more than 850,000 occupied room nights and making the greatest contribution to the

wider market’s performance. The two per cent supply growth was more than absorbed by the 15 per cent demand growth. The increase in occupancy along with the 10 per cent ADR growth resulted in RevPAR improving by 23 per cent to $160.

Although there has been modest demand growth through the first part of the year the supply growth in the market has outstripped this and occupancy has dipped. This trend is expected to persist through the balance of the year. Demand growth for Montreal in 2024 is projected to be one per cent against a two per cent supply growth which will result in occupancy falling one point to 70 per cent. The market is expected to see rate growth continue in 2024 and ADR is projected to increase two per cent or $4 to $231 for the year. The growth in ADR will help to offset the decline in occupancy. Overall, RevPAR in the Greater Montreal market is expected to improve by one per cent, increasing $2 to $162 in 2024.

Source: CBRE Hotels

Quebec City features a diversified economy and is the seat of the Provincial Government. GDP growth in the region was strong in 2023 at 2.9 per cent and while it’s expected to slow in to 1.2 per cent in 2024 over the medium term it’s projected to be in the range of 2.5 to three per-cent per annum. With a significant amount of domestic pleasure and overseas visitation to the city driving robust leisure demand, the city also sees consistent year round demand from government and meeting conference business.

In 2023, Quebec City saw a significant improvement in overall accommodation demand, which grew by 19 per cent and helped lift occupancy by 11 points to 68 per cent. The increased demand in the market was driven by leisure but also increasing government and

meeting/conference business. Demand in the market is expected to much more moderate growth in 2024 increasing by two per cent and pushing occupancy up another point to 69 per cent. The market saw a strong start to the year particularly with meeting/conference activity.

Market ADR saw about four-per-cent growth in 2023 as much of the demand growth was concentrated in the shoulder and low seasons and with lower rated demand segments. The strong occupancy and solid ADR growth resulted in a 23-per-cent increase in RevPAR which was up $28 to $152 in 2023.

While slightly lower than 2023, rate growth in Quebec City is expected to be positive in 2024 at three per cent, lifting ADR to $230. Overall, RevPAR in the market is expected to improve four per cent in 2024 as a result of the good rate growth and solid occupancy, increasing $6 to $158 for the year.

Source: CBRE Hotels

Halifax/Dartmouth is the economic centre of Eastern Canada. After being fairly flat in 2023 GDP growth in 2024 is projected to be 2.1 per cent with a slight uptick in employment. The economy in Halifax continues to expand into new sectors and the post-secondary institutions are bringing additional recognition to the area. As with many other markets, visitation levels in 2023 are projected to exceed 2019 and while total expenditures are up as well, the U.S. and overseas markets have not fully recovered.

The accommodation market in Halifax/Dartmouth saw occupancy recover beyond 2019 levels in 2023 at 71 per cent. The strong demand growth and high levels of leisure travel drove a significant improvement in ADR which was up 14 per cent to $206. Overall, the market saw RevPAR improve by 22 per cent or $27 in 2023 to $147.

A more muted performance is expected in 2024, with RevPAR in the Halifax/Dartmouth market projected to remain flat at $147. Demand is expected to be up by about two per cent, which will be outpaced by nearly five per cent supply growth eroding occupancy by two points to 69 per cent. ADR growth for the market is expected to be solid at three per cent, helping to stabilize RevPAR in 2024.

Source: CBRE Hotels

Economic activity in St. John’s is driven by the region’s focus on natural resources, specifically offshore oil and gas development. Additionally, since St. John’s is the capital city of the province, it provides a significant amount of the consumer and government services for residents. GDP growth was solid in 2023 at 2.2 per cent and is projected to be 2.1 per cent for 2024. Provincial visitation in 2023 was just below 2019 levels and is expected to exceed these in 2024. As a highly seasonal and less leisure driven market domestic travel makes up the bulk of the visitation to the province with only a minor amount of U.S. and overseas visitation.

In 2023, the St. John’s market saw a dramatic increase in the top-line performance metrics driven by non-traditional demand sources, specifically the Ukrainian refugee program. The market finished with a RevPAR of $112 based on a 73 per cent occupancy and an ADR of $154. This represents the strongest RevPAR performance for this market since 2013/2014.

Since the beginning of the year the market has experienced month-overmonth contractions in the occupied room night demand with the absence of the non-traditional demand that buoyed the market last year. As a result, it’s projected that market demand will

contract by 12 per cent in 2024 with occupancy falling eight points to 65 per cent. Even with the contraction in demand the market is seeing strong ADR growth which is expected to continue through the summer months with leisure travellers. While the market is projected to realize six-per-cent growth increasing ADR by $9 to $163, the decline in occupancy is expected to outweigh this, resulting in RevPAR contracting by five per cent or $6 to $106.

Source: CBRE Hotels

* All projections are rounded.

The projections for the national accommodation market are a roll up of the projections completed for the various major markets as well as the provinces and territories across Canada considering the various economic, travel and supply and demand dynamics at play. While the national forecast provides a macro, directional indication of industry performance, there are numerous factors that will impact the recovery and performance of individual markets, such as, supply, the sources/mix of guestroom demand and seasonality which impact the performance results for 2024 and beyond.

After increasing by 0.7 per cent in 2023, national accommodation supply is projected to increase by another 0.6 per cent in 2024. In the coming years as the pace of new build projects picks up with the improved market operating

conditions and financing environment as well as some easing of construction costs and supply-chain issues supply growth should return to levels more consistent with the long run average.

Following the almost 11 per cent demand growth last year, challenging conditions in some markets, along with only moderate demand growth in others, are projected to result in national accommodation demand remaining essentially flat to 2023. With supply ever so slightly outpacing demand growth in 2024, national occupancy is projected to drop one point to hold at 66 per cent.

Nationally, the rate growth has been solid through the first half of the year, and this is expected to be the case for the rest of the year. National ADR is projected to grow by 3.5 per cent in 2024 and increase by $6 to $203. With occupancy expected to hold in 2024, RevPAR growth of three per cent is projected to be driven by the improvement in ADR. National RevPAR is projected to increase to $133, up $4 from 2023. ♦

Source: CBRE Hotels

Effortless work orders, on-the-go PM solutions for your convenience.

Unwind and let us manage your day saying goodbye to complexity—we provide all the tools. Submit work orders on the fly, handle PMs hassle-free, and effortlessly monitor assets with insightful inventory trend analysis.

Try Quore today and learn to relax like a guest.

At the beginning of the year, experts predicted that the global hotel industry was poised for a major rebound in 2024 and 2025, moving past the impacts of COVID-19 into a period of growth. According to Kelsey Fenerty, manager of Analytics at

STR, globally, most markets have now almost reached pre-pandemic demand levels and far exceeded pre-pandemic ADR and RevPAR levels; most regions anticipate continued YOY growth in RevPAR this year as well.

“Most regions are performing well year-to-date (YTD),” says Fenerty. “Occupancy growth has reverted

back to ‘normal’ growth levels, and the Middle East and Asia (excluding China) reported strong YOY growth YTD. Asia Pacific (APAC) OCC (occupancy) growth is underpinned by a weaker 2023 and bigger return to travel in 2024, while Middle East OCC growth comes courtesy of the region’s continued expansion into

international tourism, with Saudi Arabia a key driver as it continues to implement its Vision 2030 plan.

In terms of hotel segments, Fenerty says groups have been a major demand driver across Europe. Weekday demand — which is most frequently corporate travellers — has also been great in Europe, with weekend demand

a bit softer YOY as leisure travel reverts to normal patterns. Branded hotel development is another key global theme, with luxury and upper-upscale rooms expecting the strongest growth and midscale and economy pipelines relatively light.

“Demand growth in China has been slightly slower YTD, with major

BY AMY BOSTOCK

markets still struggling with a slower recovery to international inbound demand. Outbound travel from China has picked up as well, although the domestic market is so strong that any impact to domestic demand as a result of increased outbound travel should be limited,” says Fenerty, adding the Middle East has been modestly

hampered by regional tensions and new supply, but overall continues to grow both business and leisure demand, “with no signs of stopping as regional travel initiatives continue to progress.”

Many of the markets with the strongest pipelines are working to revamp/expand their tourism sectors.

According to STR data, Saudi Arabia is an obvious frontrunner, but Vietnam and Cambodia in SEA, as well as many African countries, all have a significant number of rooms under development.

“Markets with lighter pipelines tend to be geographically constrained (e.g., islands where there is limited space to build) or have high costs associated with development,” says Fenerty.

In terms of RevPAR growth, at more than five per cent, Europe has outperformed the APAC and Americas (where growth is now under three per cent) but is showing slower growth compared to the Middle East and Africa (more than nine per cent) YTD.

“We’re seeing a marked uptick in investment volumes in 2024, largely driven by the stabilization of interest rates, and this has spurred an investment revival in several key markets including the U.K., Ireland, and Italy,” says Ronald Chan, associate director, Hotels Research, Europe at CBRE Hotels, adding CBRE expects a mid-single digit increase in RevPAR this year, and a low-single digit increase next year for Europe.

Kenneth Hatton, head of CBRE Hotels, Europe, says investors will continue to target the markets with a favourable demand/supply dynamic and expects Spain, Italy and France to benefit from further growth potential, “as these countries are expected to see slower-thanaverage pipeline growth in the coming years alongside sustained growth in inbound tourist arrivals.”

He also notes that Greece, which experienced a record 2023 with more than 32 million overnight tourist arrivals, is expected to grow by a further nine per cent and 11 per cent year-over-year in 2024 and 2025, respectively.

Hattan cautions that the perception of over-tourism in certain markets will continue the pressure to maintain or enforce new bans on additional hotel development in cities such as Amsterdam, Barcelona and Venice, so the development environment in such markets will remain particularly challenging.

“Mixed-use developments will continue to grow in adoption as hotel operators are becoming increasingly adept at integrating with adjacent facilities,” Hatton adds. “They’re also more open to standalone branded residential projects, and we see this becoming more common.”

In terms of segments to watch, he says the ability of luxury to price well ahead of inflation has attracted a whole new category of buyers to that segment over the past two years. “At the other end of the scale, the leaner model of the rooms-led economy segment, with little-to-no staffed F&B operation, has become more attractive for its operating model. The segments in between, with full-service operations that are aimed

at guests who are more price-sensitive than the luxury customer, are coming under more scrutiny.”

Juan Pedro Saenz-Diez, senior vice-president for CBRE Hotels in Mexico, the Caribbean and Central America, says Los Cabos, Cancun and Mexico City are expected to have the strongest fundamental performance in 2024. It’s estimated that 2024 will be a record year for travel and tourism in Mexico, contributing $264 billion to GDP. This figure represents an increase of almost three per cent compared to 2019 levels, generating 7.56 million jobs, equivalent to 13 per cent of total jobs in Mexico. By 2034, tourism in Mexico is expected to contribute more than $354 billion to Mexico’s GDP, representing 15.8 per cent of the national economy and providing employment to 9.3 million people.

“Los Cabos is likely to be a high-demand destination in 2024,

according to investors, which is increasingly becoming a luxury market for its visitors,” says Saenz-Diez. “In this context, the Mexican and Caribbean markets continue growing, promoting the destination and improving its infrastructure with projects such as the new International Airport in Tulum and the Mayan Train.”

Apart from these three locations, he says Puerto Vallarta-Riviera Nayarit are also showing strong market fundamentals that should increase with the completion of the Guadalajara Vallarta Road and the expansion of PVR International Airport.

“We also expect an increase in small cities such as Puerto Escondido, Holbox or Todos Santos for ‘Barefoot Luxury,’ for travellers looking for trips to luxury boutique hotels with eco-friendly activities at a slower pace,” says Saenz-Diez.

“There’s strong guest demand for luxury properties in the Caribbean and Latin America region, so we’re bolstering our portfolio with our exclusive Small Luxury Hotels of the World patnership as well as planned openings like Waldorf Astoria Costa Rica Punta Cacique, opening later this year, which will be the first Waldorf Astoria branded hotel in the country,” says Bill Fortier, senior vice-president, Development, Americas, Hilton. “In the Caribbean and Latin America, we recently opened our 225th hotel this year, following a year of record room growth in 2023. We’re expecting to surpass 300 hotels trading in the region within a few years.”

Fortier says Latin America and the Caribbean are prominent growth regions for Hilton and last year the global hotel chain signed more than 35 new hotel deals, bringing its overall pipeline to 110 properties. “Mexico is Hilton’s largest operating market in the region with more than 90 hotels open and more than 30 hotels under development,” he says. “With six hotels in operation in the Dominican Republic and more than 10 in development, Hilton plans to nearly triple its footprint in the country with notable openings including the new-build, 502-room Zemi Miches All-inclusive Resort, Curio Collection by Hilton, set to open in late 2024.” Hilton has 10 hotels and resorts in

Argentina and expects to double its footprint in the coming years, “while Brazil will continue to be a top priority for our growth, with plans to introduce two new brands in the country, Homewood Suites by Hilton and Motto by Hilton.”

The KSA (Kingdom of Saudi Arabia) market is expected to enter a five-tosix-year transitional period due to the amplification of the Saudi Vision 2030 initiative, resulting in anticipated demand growth momentum across both corporate and leisure demand segments.

According to Ali Manzoor, head of Hospitality, Hotels & Tourism in the Middle East for CBRE, the UAE market is also expected to experience increased growth. “While Dubai has historically been the regional standout, investor interest has been accelerating in other emirates as well, particularly in Ras Al Khaimah due to the associated announcements regarding gaming and the observable progress of the Wynn resort.”

Fenerty says while the Middle East has been modestly hampered by regional tensions and new supply, “overall [the region] continues to grow both business and leisure demand, with no signs of stopping as regional travel initiatives continue to progress.”

In fact, in 2023, international tourism arrivals were 149 per cent higher than in 2019, and CBRE expects strong growth to continue in the short-term with the continued delivery of key demand generators.

According to data from CBRE Hotels, all markets in the Asia-Pacific region (with the exception of Maldives) have seen increases in RevPAR performance YOY as of May 2024 YTD, with ADRs remaining mostly stable across the region.

Although airline capacity in Asia Pacific is yet to fully recover to pre-pandemic levels, CBRE forecasts that total international tourism arrivals should reach 2019 levels by the end of this year. While ADRs are expected to normalize in most markets, OCC growth in well-managed assets should drive revenue growth.

STR data shows demand growth in

China has been slightly slower YTD, with major markets still struggling with a slower recovery to international inbound demand. “Outbound travel from China has picked up as well, although the domestic market is so strong that any impact to domestic demand as a result of increased outbound travel should be limited,” says Fenerty.

Henry Chin, global head of Investor Thought Leadership & head of Research, Asia Pacific at CBRE Hotels, says Mainland Chinese tourists are demonstrating a much greater level of outbound activity in 2024, with travellers returning to markets such as Japan, Korea and Southeast Asia. Visa-free entry and weaker currencies are playing pivotal roles in the return of the mainland Chinese demographic.

Rachael Rothman, head of Hotels Research & Data Analytics at CBRE Hotels says “in the U.S., we’ve seen strong performance out of certain smaller markets this year, such as Cleveland, which were boosted by the eclipse. We don’t believe the trends seen in the first few months of the year are necessarily indicative of longer-term trends and instead believe

they demonstrate the power of special events to boost demand and RevPAR growth.”

In terms of which markets expected to show the strongest performance over the next few quarters, she says CBRE would highlight New York City, Boston, Washington, D.C., and San Jose.

“We continue to see development focused in three areas: extended-stay hotels, branded residential — sometimes combined with a luxury resort, and traditional limited- and select-service hotels.”

Fortier says Hilton’s focused-service brands are currently leading the company’s growth in the Americas, as in much of the world. “However, we’re also focused on capitalizing on new opportunities to open hotels under our full-service, lifestyle and luxury brands. There’s clear appetite for our lifestyle brands in the Americas and, globally, it’s a segment in which we expect to double our portfolio over the next four years.”

The company recently opened its first new build Signia by Hilton property in Atlanta, and in the coming months Fortier says it will debut its first LivSmart Studios by Hilton hotel. “We also continue to focus on conversion projects for the Spark by Hilton brand across the U.S. and beyond.”

Looking ahead, Rothman says group travel remains solid and stronger urban demand trends signals continued improvement in inbound international travel, which increased 15 per cent year-over-year in June, as well as improvements in corporate travel. ♦

BY DANIELLE SCHALK

Ensuring successful employeeemployer relationships is essential to hospitality industry success.

And, effective training forms the backbone of all of this.

“Having trained thousands of participants for hotel roles, we’ve found that top-notch training programs are key to attracting and keeping the best talent,” shares Mandie Abrams, executive director of Toronto-based Hospitality Workers Training Centre (HWTC). “Effective training shows a commitment to employee growth and development, which significantly boosts

job satisfaction and retention.”

Robin O’Hearn, area director, Human Resources, Canada, Marriott International, agrees. “The data is very clear. T he core values that candidates are looking for when selecting an employer are a place where they belong, where they can grow and develop their careers and achieve their personal goals,” she explains. “When associates can see their path forward, see where they belong in the organization and know where they’re going, that’s very powerful for retention and loyalty towards the organization.”

And, in the current labour market,

inspiring retention and loyalty are especially pertinent.