3 minute read

Free Member Service: 401K Retirement Plan Evaluations

by Matt Vance, KBA CFO

When was the last time you had a trusted advisor take an objective look at one of your most important employee benefits – your employer sponsored employee retirement plan? There have always been high standards placed on 401(k) plan sponsors, made increasingly so by the passing of the Pension Protection Act of 2006. These duties include:

Understand all administrative and investment fees paid from plan assets, especially those charged directly to participant accounts, and to make sure they correspond to the services being provided.

Use appropriate due diligence and have a prudent process in place (including documentation) in the selection of vendors and investment vehicles and when implementing contractual service arrangements.

Keep an eye on the marketplace to ensure the plan provides appropriate benefits and services at a reasonable cost to the participants.

Ensure that participants understand the benefits of participation and eliminate barriers to their participation.

It is considered a fiduciary best practice to re-evaluate your 401(k) service providers at least every three to five years and compare fees and services to make sure employers and their employees are getting the best value.

New class action lawsuits are being filed with increasing regularity that allege breaches of fiduciary duties in connection with the fees 401(k) plan participants are incurring. As a 401(k) plan fiduciary, it is essential that plan sponsors evaluate fees because ERISA requires fiduciaries to act solely in the interest of participants while ensuring fees charged are necessary and reasonable.

Using our fully-integrated retirement plan program as a barometer, as well as access to national bank-specific benchmarking data, the KBA offers a free member service to conduct a no-hassle, no-commitment evaluation of your current 401(k) plan. This free evaluation would require very little input from your end and includes the following areas of concentration:

• Plan Design

• Investment Fund Lineup and Performance

• Plan Fees

• Investment Advisor

• Recordkeeper

• Employee Education

Through the State Banking Association Master Defined Contribution Trust, we are able to offer our members very competitive fees due to economies of scale with over $500+ million in combined plan assets. The SBA 401(k) plan utilizes the explicit fee model which creates transparency for participants and allows the ability to select lower share class mutual funds options (including institutional share class funds) while also still producing strong investment performances for plan participants.

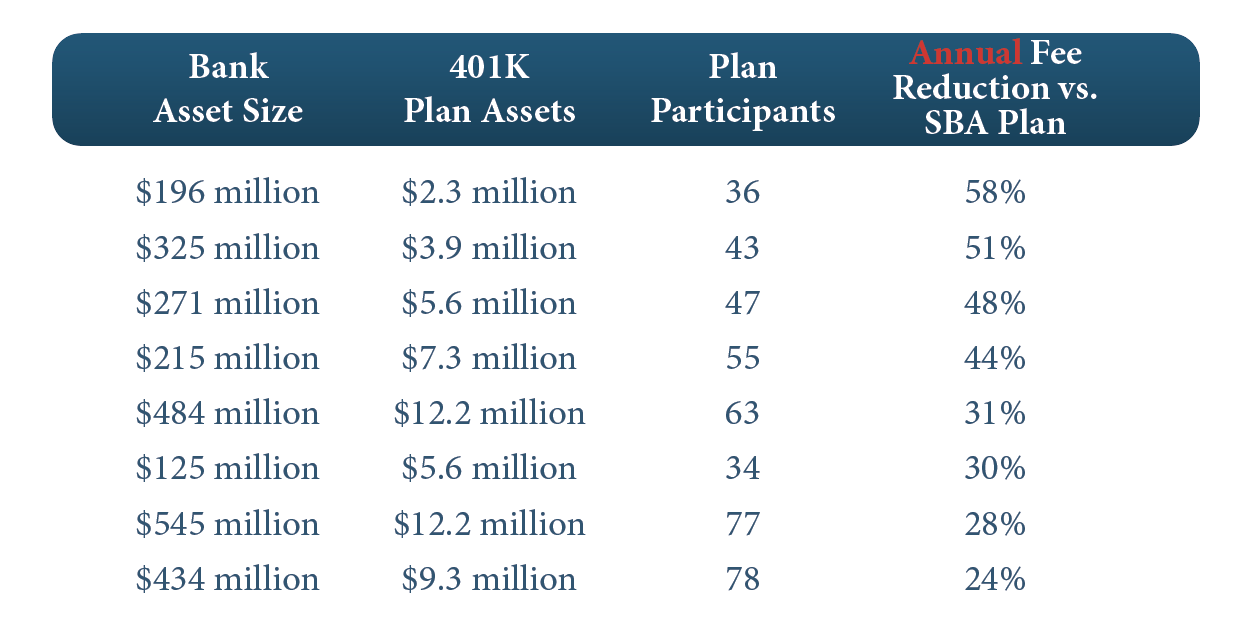

We have performed several KBA member plan evaluations with eye-opening results as it pertains to Plan fees. To name just a few:

by Matt Vance, CPA, MBA Chief Financial Officer

Is your 401(k) Plan all that it can be? Are the Plan fees being passed on to your employees necessary and reasonable? How are the funds in your Plan performing vs. marketplace benchmarks? Are there provisions that could be added to your Plan to make it more in line with ERISA requirements and Industry best practices? Are your employees getting the appropriate level of retirement/participation education?

For expert guidance on these questions and more, contact Matt today!