LADUE HORTON WATKINS HIGH SCHOOL 1201 S. WARSON RD. ST. LOUIS, MO 63124 MARCH 2024 VOL. 73, ISSUE 7

O

The Issue Y Y M M

CREDITS:

Editors in Chief

Tarek Al Husseini

Riley Coates

Mimi Zhou

Art Editor in Chief

Olivia Chen

Photo Editor in Chief

Vincent Hsiao

Web Editor in Chief

Arti Jain

In-Depth Editors

Rory Lustberg

Arti Jain

Making Money Editors

Grace Huewe

Will Kodner

Spending Money Editor

Laura Shareshian

Money Talks Editor

Emily Liu

Saving Money Editors

Lathan Levy

Jay Heintz

Making Money Staff

Marie Demkovitch

Luke Lochmoeller

Ira Rodrigues

In-Depth Staff

Celina Zhou

Sara Rohatgi

Ryan Snyder

Kelly Zhang

Josh Devine

Nyla Weathersby

Spending Money Staff

Mason Eastman

Madeline Awad

@ladue.publications

Money Talks Staff

Grace Kweon

Ishaan Pandey

Alzhraa Mahmoud

Michael Zegel

Saving Money Staff

Nitya Nara

Aaron Lin

Cindy Liu

Ella Bender

ID Editors in Chief

Mac Huffman

Annie Zhao

Rory Lustberg

ID Staff

Sylvia Hanes

Maya Matthew Ella Braig

Frank Chen

Grace Kweon

Katie Myckatyn

Advisers

Sarah Kirksey

Abigail Eisenberg

SCAN FOR the full Panorama newsmagazine policy

Editor’s Note, Table of Contents, and cover photos by Vincent Hsiao. Front cover design by Mimi Zhou. Back cover design by Mimi Zhou.

Tarek Al Husseini Mimi Zhou

Follow us 11

20 PHOTO

MAKING

A guide to succeeding in job interviews as a high schooler table of contents // the money issue panorama march 2024 // laduepublications.com 02

Table of Contents Contents

Editors’ Note

Money can be many things. Both a unify ing force and a dividing one. A motivator and a discourager. A dream and a detriment. No matter how it manifests in an individual’s life, people are constantly surrounded, captivated class. That is why for this specialty issue, we are focusing on the effects of money.

At a high school level, money determines our quality of education, our access to higher education and how we interact with those around us. Beyond high school, money often plays a role in which path students pursue. We take a look at both issues, exploring the wealth disparities in districts around St. Louis, along with the risinges many students.

Elsewhere in this issue, we take a look at the many ways students interact with money, from making it to saving and spending it. Take a look at the jobs students hold to make money, and the many ways students and staff are spending. Look further to see efforts on conserving money, from thrift shopping to cheap dining options around St. Louis. We also discuss the impora couple helpful introductions to ways young people can get involved and prepare for their future within our ever changing economy.

the Panorama, so please free of charge (with the help

Sponsors 4

Panorama debates the accuracy of the age old proverb “Money Can’t Buy Happiness” 28 EDITORIAL Editorial: Panorama Perspective Money Talks Mo’ Money, Mo’ Problems? A Distorted Democracy Take a Gamble Saving Money Real vs. Replica Cheap Eats Another Man’s Treasure Worth the Price? Advertisements MONEY TALKS 34 SAVING 36 SAVING SPENDING 23 IN-DEPTH LADUEPUBLICATIONSWEBSITE SCANFOR District Disparities In-Depth: Examining the causes and implications of monetary differences within various St. Louis school districts Counting College 11 In-Depth: Exploring the cost of college in the age of inflation Students should educate themselves on financial literacy before adulthood Lathan Levy reviews budgetfriendly food options in St. Louis $13 $1630 Making Money Interview ABC’s 5 Cashing in 6 Intro to Investment 8 Making Money Moves 10 Trash to Treasure 7 Spending Money Break the Bank 16 WWYD? 18 Photo: Kick it Up 20 Game of Life 22 Classroom Curios 19 03 LADUEPUBLICATIONSWEBSITE SCANFOR spread design by Tarek Al Husseini

Issue

Sponsors Sponsors

The Rodrigues Family

Ariel Premium Supply

Steve + Ginger Lochmoeller

The Awad Family

Lisette and Bill Odell

Ladue Blue

Anonymous

The Snyder/Rosenberg Family

Olesia + Michael Myckatyn

June Collings Ogden

Heidi Long Real Estate

Jim and Kathy Davis

Demkovitch Family

The Mathew Family

Jennifer Poindexter

The Armbruster Family

Bill and Rowena Coates

The Hsiao Family

Ying Du

The Levy-Thomeczeck Family

The Cross Family

The Patney Family

The Devine Family

Gold

Nagarajan-Toon Family

The Luetje Family

Myckatyn Family

David + Karen Kurtzman

Ellen Levy + Carl Desenberg

Dennis + Judy Holcomb

Southern/Lochmoeller Team

The Chang Family

Jeanette Daun

Kathryn Ward

Blair Keltner and TJ Tenison

Silver

The Biernacki Family

C. Joyce

The Gellman Family

Shelly & Barry Milder

Rick & Ardell Oliver

The Kurtzman/Levy Family

Anonymous

Emmett Davis

The Arun Family

The Antony Family

The Mathew Family

Marc + Krista Luckett

Noah Weathersby

The Poindexter Family

Pat and Jerry Coates

The Brooks Family

Alan + Donna Rosenberg

Anonymous

The Gyawali Family

The Harkonen Family

The Lackey Family

Friendly

The Hartrich Family

The Saleeby Family

The Zhao Family

Anonymous

Anonymous

The Kekec Family

Anonymous

The Goldstein Family

Becky Vasta

Hannah Vaughn

Leslie Fortner

The Hofer Family

Arnold Kelly

Yuwei Zhang

Hongxian Zhang

The Gong Family

The Su Family

The Liu Family

Daphne Lui

The Chen Family

The Larrew Family

The Hawkins Alumni

Anonymous

Viragh-Mayo Family

Schlamb Family

Teri Haugen

Anonymous

Mrs. Fletcher-Johnson

The Shack Frontenac

The O’Keefe Family

Judy W. Levy

Olivia Hu

Emmi Walker

The Derdoy Family

Lynne + Mike Lippmann

Ed Fliesher

Mimi’s Aunt

Lisa Litvag

The Claybaugh Family

Anonymous

Anonymous

Paula Hammonds

The Turner Family

Anonymous

Widjaja Family

Saravana Ganesapandian

The Reinheimer Family

Tai Moore

The Moore Family

The He’s Family

The Chode Family

The Ellis Family

Anonymous

The Saleeby Family

Avery Anderson

Allen You

Anonymous

The Husseini Family

Bill Moore, Queenie Moore & Gina Hua

Cathy + John Hoehn

Kodner Art Gallery

The Popu Family

The Rothman Family

The Kodner Family

Marsha and Larry Rothman

Alexandra Signore

Linda Null and Denise Kist

Mrs. Tracy Ward

Sydney Collinger

sponsors // the money issue panorama march 2024 // laduepublications.com 04

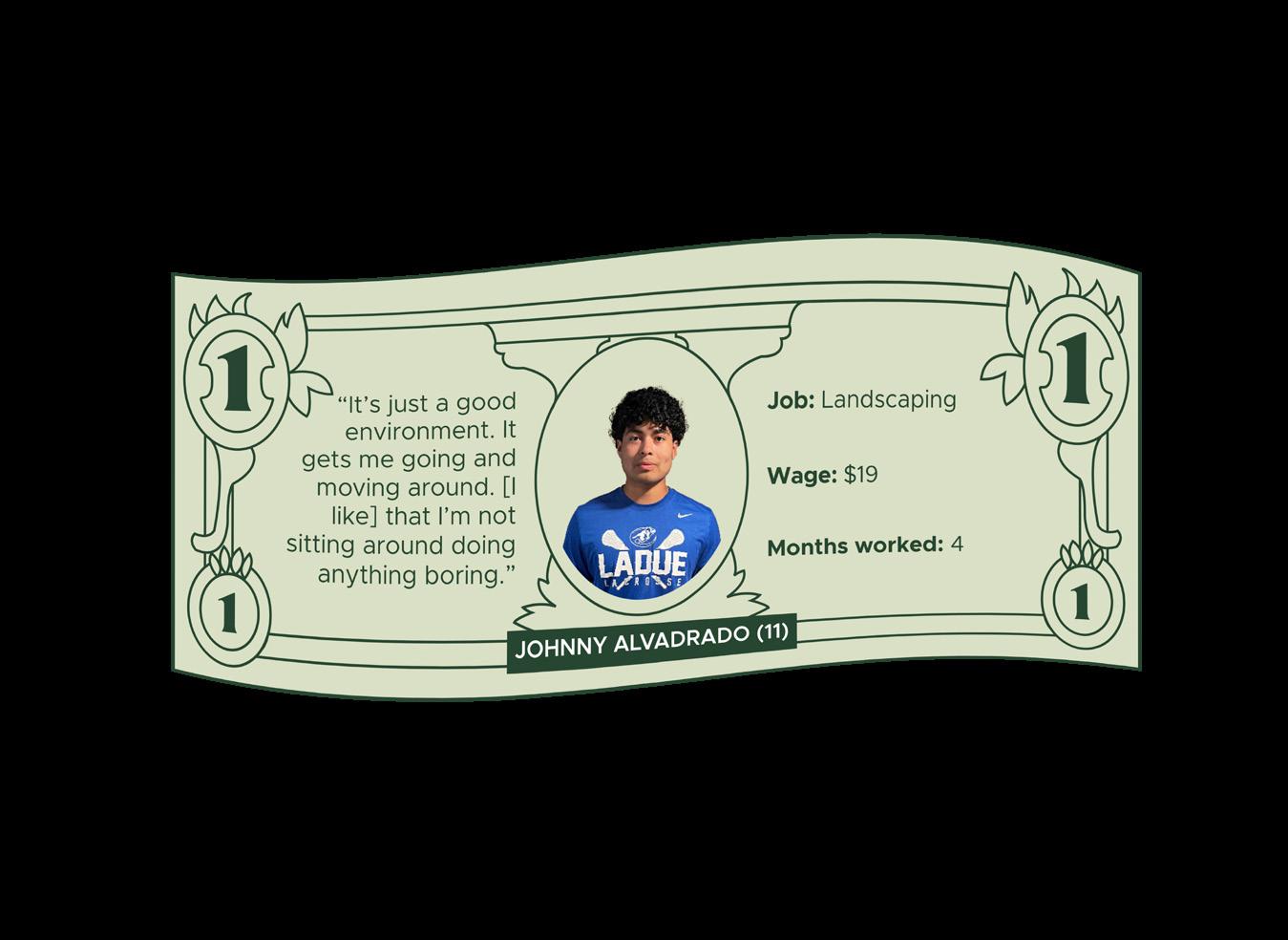

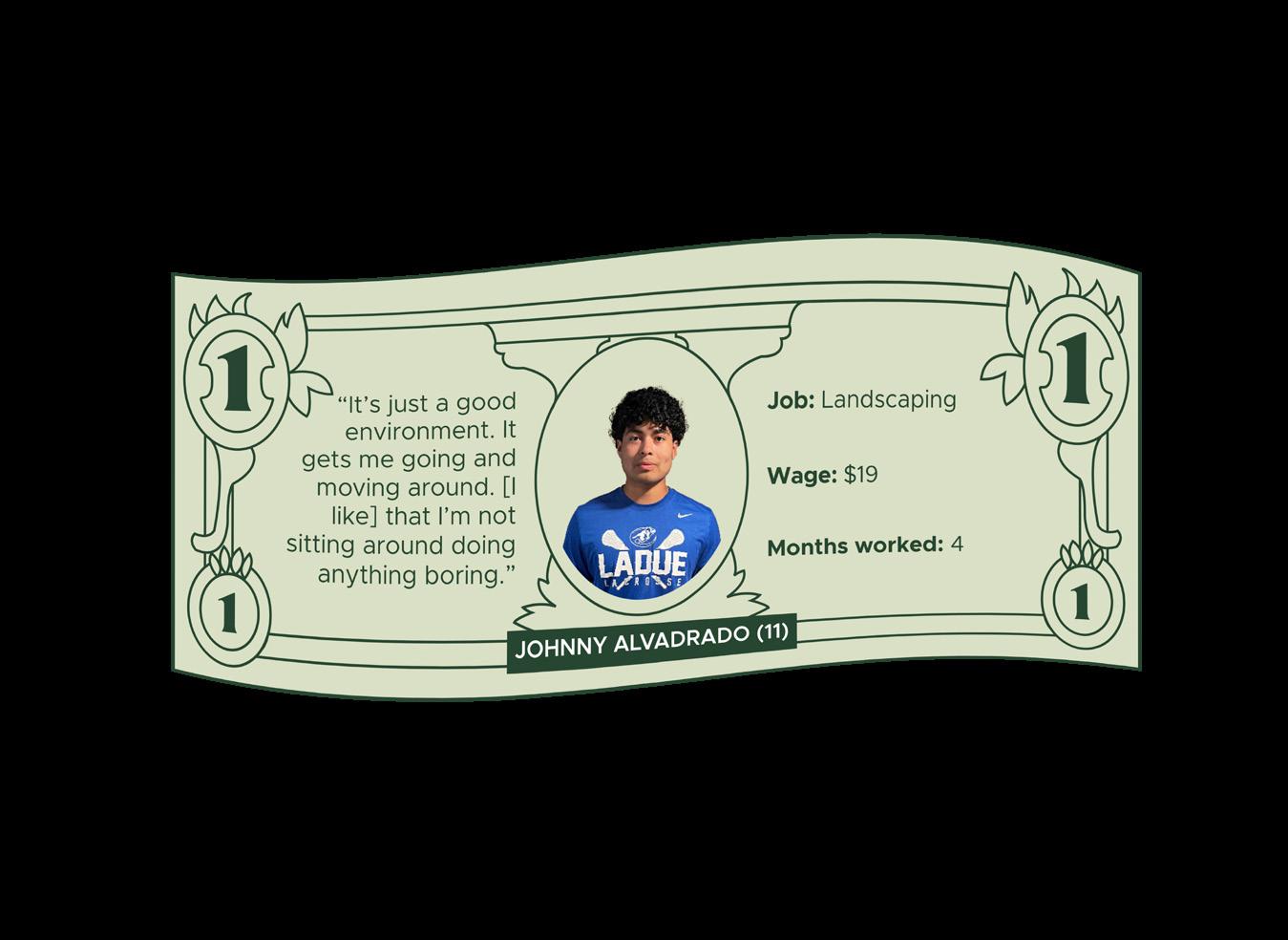

STORY BY MARIE DEMKOVITCH & IRA RODRIGUES

STORY BY MARIE DEMKOVITCH & IRA RODRIGUES

Interview Planned Didn’t Go As

ABC’S ABC’S

A guide to succeeding in job interviews as a high schooler

ASK QUESTIONS

Create a list of questions that you want to ask your interviewer to demonstrate interest. Also, being able to ask questions straight away will help you become more confident during your interview.

BE CONFIDENT

Enthusiasm for the job is a vital step to success. Make sure your employer knows you want the job, because without being confident you may show your interviewer that you are not serious about the opportunity.

COME PREPARED

Be familiar with common interview questions and come prepared with answers. This will show that you are committed to the interview and give the interviewer some insight to what you’d be like if they hired you as an employee.

DRESS PROFESSIONALLY

Making a good first impression in your interview is an essential first step to getting the job you want. Dressing well will show the interviewer that you’re willing to put in the effort to be hired and want to be taken seriously as a candidate.

Comedic anecdotes from student job interviews

“I had a fever, but I couldn’t miss my interview. During the interview I was sweating like crazy, and I kept coughing.”

“I went to Aquaport with my friend who worked there to ask about getting a job lifeguarding. They needed guards so bad they hired me on the spot and I started training the next day.”

CAM CROSS(10) EM Y BASSET(2) LIAM CURRAN(12)

“Once, I had to wait 40 minutes for the manager to interview [me]. They didn’t show up, [so] I had to sit [and] wait.”

SCAN

FOR some common interview questions and how to answer them

spread design by Tarek Al Husseini | Marie Demkovitch & Ira Rodrigues 05 making money

PHOTO BY VINCENT HSIAO

Job Breakdown

7% Tutoring/Academia Panorama surveyed 128 Ladue students March 7 10% Entertainment

4% Maintenance/Janitorial

What jobs are Ladue students working? $$ $$ $ $$$$

Diving into students in the work force

23% Food/ Restaurant

13% Retail/Sales

43% Childcare/Babysitting

FOR Panorama’s take on the modern youth workforce

Cashing In Cashing In SCAN

ILLUSTRATION BY MIMI ZHOU $

making money // the money issue panorama march 2024 // laduepublications.com

“

Treasure Treasure Trash to Trash to

PHOTO BY VINCENT HSIAO

STORY BY GRACE HUEWE & WILL KODNER

PHOTO BY VINCENT HSIAO

STORY BY GRACE HUEWE & WILL KODNER

A1987 PASSENGER VAN that has a broken engine may look like trash to the untrained eye, but for Joe Kaminski (12), it’s an ideal purchase. He buys the van for $300evitable with some cleaning supplies, a toolbox and some elbow grease.

Kaminski began his vehicular endeavors by watching his dad sell cars at his dealership, Joe K’s Used Cars. He enjoyed watching and soon learned the

“The business was struggling a little bit and he needed some extra workers,” Kaminski said. “I wasn’t employed, so I thought it would be a great start to my working career to work for my dad.”

It didn’t take long for Kaminski to learn about the business. Following in his dad’s footsteps allowed him to learn the innerworkings of cars.

“I would go out to the car auction

with [my dad] because he has a dealers license,” Kaminski said. “He would teach me how to look at cars and make sure everything’s looking good on them. I like spending time with him and learning the business through him.”

There are other factors that impact the selling price of the car. Comparing and waiting for offers, for example, can deterwill be made.

A large aspect of detailing and reselling cars is having an understanding of what cars need. The higher level the understanding, the more likely costs are is maximized.

I like spending time with him and learning the business through him.”

JOE KAMINSKI (12)

“Sometimes there’s small issues that sellers don’t catch,” Kaminski said. “That’s one of the pros of going in and looking at the cars yourself. If you can less and make a lot more money.”

“If you want to sell a car quickly and make a small that,” Kaminski said. “But if you want to hold onto it for a little bit longer then you can make more money.”

Kaminski doesn’t plan on leaving the dealership any time soon. “It’s taught me a lot about communication,” Kaminski said. “[I like] getting to know people and being open and honest with them. One day I could end up taking over depending on how well I work.”

P

Joe Kaminski (12) details and restores cars through his dad’s dealership

spread

by

07

design

Grace Huewe & Will Kodner

Joe Kaminski stands next to a recently detailed car in his dad’s dealership. Joe K’s Used Cars has been in business for over 10 years. “My dad broke off from my grandpa and began the dealership because he knew how to do it and wanted to start something of his own,” Kaminski (12) said.

Breaking down the basics of investing for beginners ILLUSTRATION BY EMILY LIU Step-by-Step

five step guide to investment for teenagers Investing early allows for greater returns due to compounding earnings. How much you invest is dependent on your financial situation and investment goal, like retirement. Teenagers can open a Custodial Account or a Roth IRA with parent permission to begin investing. Your investment strategy depends on your timeframe. Short-term savings should be lower risk than long-term.

you decide how to invest, you need to choose what to invest in. Each investment has different risks. Sources: Ameriprise Financial, Black Rock, Investopeida, LendEDU, NerdWallet, Visual Capitalist Start Early Decide Amount Open Account Pick Strategy Choose Options Assessing Investments Investments from least to greatest risk

.

. Stocks Cash Bonds Mutual Funds Asset classes are ranked by their relative riskiness, or the stability/volatility of the investment, to aid investors in making decisions. Fixed income Steady returns Diversified investment managed by professionals Highest risk Highest Exchanges more about Investment Investment 8/10 students want to know 34% 31% 62% of students believe that Cash is the lowest risk investment while of students believe that Bonds are the lowest risk investment

of students know that Stocks are the highest risk investment Intro to Investment SCAN FOR more on the importance of investment making money // the money issue panorama march 2024 // laduepublications.com 08

A

Once

1. 2. 3

5

Only

BEARISH: Opposite of Bullish.

WHALE: A term used to describe institutional investors or wealthy individuals who hold large positions in a particular stock or market.

Opinions on investment across different generations

non-investors don’t invest and their view on investing 72% 73% 57%25%31%35% 42% 29% 28% 49% 46% 32% 63% 59% 55% 55% 59% 56% Recognize their future opportunities would be better if they began investing Want to try investing with a low risk commitment Afraid of losing everything Too worried about their current financial situation to invest in the future Find investing difficult to understand Don’t have enough money to start investing Millennials Gen X Baby Boomers 80% 70% 60% 50% 40% 30% 20% 10% 0% -10% -20% 12/22 1/23 2/23 Magnificent 7

A stock index is a numerical measure that represents the collective performance of a group of stocks

on investment strategies and trends

surveyed 128 students March 7 How US investors would allocate $10,000 40% 50% 60% 70% 80% 90% 100% Pay off debt Real estate Virtual currencyRetirement Savings account Stock market Child’s education Small business Other/unsure Millennials Gen X Baby Boomers Surveying Students What age should people start investing? How would you rate your confidence in making investment decisions? 0-12 years 12-18 years 18-25 years 25-60 years 60+ years 49% 31% 18% 1% 1% How time influences saving and investing Starting Amount High Interest Savings Account Investment Account Before After Through investment, a dollar today is worth more than a dollar tomorrow Stock Slang spread design by Emily Liu 09

Why

U.S. Stock Index Performance

Information

Panorama

STORY BY LUKE LOCHMOELLER

Making Money Moves Money Moves

THE STOCK MARKET

is one of the most powerful components of the economy. It allows businesses and individuals to invest in themselves or others, with the

Yet, as important as it is, there is a lack of education around it in schools. When they become adults, the younger generations are left on their own to try and make their way into the world of investing. Since they often lack a proper understanding of how the market works, many decide to opt out of what could be a transformative addition to their lives.

Eric Fan (11) has become incredibly acclimated to the stock market. According to him, understanding the stock market and how to invest is an invaluable skill that everybody should learn.

of the most important life skills rising so heavily right now,” Fan said. “You see the news every day of how the cost of living is getting so much higher and people are making less and less money. It’s important to make sure you’re turning the money that you have set aside into more money so you can do more with your life.”

Fan’s been accustomed to

the stock market for several years. At Ladue, he was not only reintroduced to the game, but also to the world of investing. His junior year, he took Investment Strategies with business teacher Chris Geisz and began to use what he learned in class in practice.

“It’s been learning a lot of new strategies from Mr. Geisz in the class,” Fan said. “A big unit of the class was about investing in the stock market. So I just took some notes during class, some of the strategies he gave us, and applied them to the Stock Market Game.”

Fan credits his understanding to the advice and help from teachers and friends around him. Geisz suggests young adults make an effort to gain experience with investing, but explains utilizing adult knowledge can be helpful.

“Start early, because you can’t make up for lost time,” Geisz said. “It doesn’t necessarily matter what you invest in. But, if you have the help of a professional or an adult who kind of knows what they’re doing, the earlier you can get invested, the better that’s going to be for you long term. [Investing]

your wealth and your assets.”

Geisz also suggests apps such as Robin Hood or Acorns that allow you to learn different

Hot Stocks

things. However, his biggest piece of advice is to actually start investing.

“The biggest thing I would say is going to the adults in your life and telling them that you want to start doing something like setting up a Roth IRA account,” Geisz said. “In that sense, what you can do is start putting money into that and investing through your Roth IRA. That money will grow as you grow, and then when you pull it out, it’s tax-free money. If you start that early enough, you could get 40-plus years of compounding. It just makes such a big difference long run.”

Geisz feels investing in particular is a vital part of education. Even though the state requires economic classes, he still sees the importance of teachers making an extra effort to educate younger generations.

“I think [investing] is something that every kid should know,” Geisz said. “Every kid should understand how it works. Investment is a part of the curriculum, but how heavily it goes in is kind of up to the different teachers and how they assess all that. I think it’s the most important class we teach because only good things come out.”

SCAN FOR Yahoo Finance Use this to see how the listed stocks are currently doing Safe stocks for begginer investors to buy into MSFT

AMZN MA

UBER

Corporation Amazon.com Uber Technologies Mastercard Incorperated MasterCard

ABOVE: Eric Fan (11) checks his stocks on the stock market game. This is a common ritual. “I started the game in sixth grade with my brothers,” Fan said. (Photo by Lathan Levy )

Microsoft

P making money // the money issue panorama march 2024 // laduepublications.com 10

Eric Fan (11) learns the importance of how to spend and grow money early in life

Probability of College Attendance (AP Students) Probability of College Attendance (Similar Non-AP Students) Selective Semi-Selective Non-Selective Counting College Average APs for Accepted Students (Upper) Average APs for Accepted Students (Lower) AP Testing ACT/SAT Tutoring & Counseling In the fall 2021 application season, 24.3% of applicants had no SAT score, 28.4% of applicants had an SAT score but did not submit it 48.2% submitted an SAT score. Exploring the cost of college and its effects on students’ futures 15% of the class of 2023 took the SAT In 2023, 519 Ladue students took 1089 AP tests. 85% of the class of 2023 took the ACT Summer Programs 40 80 Had no test score Did not submit test score Submitted test score Selective Private Non-Selective Private Non-Selective Selective Public Public Over the pandemic, 1 in 5 upper-income parents hired a tutor for their child In 2023, the private college counseling industry was worth 2.88 billion $100 per AP test $60-70 per ACT/SAT $15-100 per hour tutoring/counseling $500-5000 per summer program 40 80 4 8 12 Subject-based summer camp Private tutoring Traditional summer school Post-pandemic summer school Any summer program No summer program U.S. high schoolers in summer 2021 attended: In 2023, the best scored AP tests at Ladue were Physics: Mechanics, Physics: Electricity & Magnetism, Chemistry, Spanish Literature and Spanish Language, each with a 100% pass rate. 286,000 Each year, in preparation for college, approximately high schoolers attend summer programs 1,700,000 receive tutoring 1,200,000 take AP tests 3,300,000 take the ACT/SAT SCORE: Source: CollegeBoard, Elite Educational Institute, NCES, Household Pulse Survey, Gitnux, BestColleges.com,“THE ROLE OF ADVANCED PLACEMENT IN BRIDGING EXCELLENCE GAPS” 1 2 3 4 5 ILLUSTRATION BY CELINA ZHOU 42% 26% 10% 7% 7% 8% spread design by Luke Lochmoeller | Celina Zhou 11 in-depth Counting College Counting College Source: Collegeboard, Elite Educational Institute, NCES, Household Pulse Survey, Gitnux, BestColleges.com, “THE ROLE OF ADVANCED PLACEMENT IN BRIDGING EXCELLENCE GAPS” Average APs for accepted students (lower) Average APs for accepted students (higher) Probability of college attendance (AP students) Probability of college attendance (similar non-AP students) spread design by Luke Lochmoeller | Celina Zhou 11 Counting College (Universities) $2.88 billion Private Private Public Public at Ladue at Ladue

STORY BY SARA ROHATGI AND RYAN SNYDER

FOUR YEARS OF classes. That’s it. These four years of classes determine how someone is thought of, how much demand there is for their services and how much money a person can make. College did not used to be the key determinant of one’s future. According to Brittanica, only 5 percent of people,aged 18 to 21 were enrolled in college in 1900. Tuition at an elite school, Brown University, totaled $105. Comparatively, tuition at Brown University today is over $65,000. Although tuition continues to increase at this dramatic rate, an increasing amount of students continue to fork over the hefty amount of money required for going to college nowadays.

CLASS

The rising costs of college have presented a challenge particularstatus, and heavily reduced opportunities for social mobility. These rising costs can be credited to the government reducing their willingness to allocate money to colof operational funds on students. According to Nasdaq Personal Finance, between 1980 and 2020, the average price of college with all expenses included has risen by 169%, compared to a 19% wage increase for workers aged 22-27. Having gone through nine years of schooling for his doctorate in education, Ladue math teacher Ryan Rzeszutko empathizes with the decision students are faced with.

“How many 18-year-olds actually know where they want their life to take them?” Rzeszutko said. “You’re being asked to make a decision and bank on a degree that you may not end up doing anything with. It’s really hard to be

GETTING INTO COLLEGE START HERE!

52% of high schoolers feel rushed about their future decisions.

asked at that age to put that much money on the table when so much is uncertain.”

To avoid the mistake Rzeszutko alludes to, students without the means to attend college debtfree are forced to evaluate whether college is the right decision. While the majority of his family have come to terms with the debt attached to college, Cooper Helm (11) has other ideas.

“My plan for after high school is to get into a trade, maybe become an electrician,” Helm said. “Based on what I see myself doing, there’s just no point spending that much money. I don’t want to live a life controlled by my debt.”

Two Cents on Tuition

Do you think college is worth the cost?

19% of Ladue students refrained from AP/SAT/ACT tests or college applications due to fees

Student loans don’t just affect lives after college, they place barriers on what college students of

Do you feel overwhelmed by rising college tuition costs?

22%

to. According to Statista.com, out of the top 25 highest rated academic institutions, all but three of them have a tuition above $57,000 per year, three times the cost of the average tuition in the U.S. Having worked with Ladue students navigating the college system for six years, College and Career Advisor Chad Sisk understands the barriers that exist for top schools.

22%

“Families who haven’t saved as much money for college don’t necessarily have the opportunity to look at out-of-state schools or private schools,” said Sisk. “Iit the opportunities that exist for lower income families.”nancial status has on access to higher education, colleges worknancial aid. While it can make a substantial dent in tuition, college is still expensive regardless of the amount of aid one receives, especially with room and board, academic supplies, food and various other expenses that aren’t made cheaper by aid.

Do you plan on attending a four-year university?

Panorama surveyed 128 students March 7th

41% answered “Unsure” 15% answered “No” 44% answered “Yes” 63% answered “Unsure” 12% answered “No” 25% answered “Unsure” 94% answered “Yes” 5% answered “Undecided” 1% answered

“No”

3 or higher on an AP exam

takes a minimum of $1,900 to start an AP course at a school

of public high school students in 2022 scored a

It

in

scored a 3 or higher on an AP exam in-depth // the money issue panorama march 2024 // laduepublications.com 12

of public high school students

2022

“If you look at the rising costs of tuition across the country, theing equally,” said Sisk. “I don’t think the federal government has done a good job increasing the are eligible for in order to keep up with the rising cost of tuition.”

According to The Education Data Initiative, college will cost an individual student an average of $36,436 per year in the US with everything factored in. The decision on whether it’s worth it to commit that type of money to a college degree really is dependent on the person.

“Actually think about the decision yourself,” said Helm. “Make sure to factor in all the expenses and everything else that goes into it. I made sure I didn’t let people think for me or make a decision for me.”

The high cost of college is seen to be worth it by many due to the increase in earnings down the line. According to the Association of Public and Land-Grant Universities, typical earnings for a bachelor’s degree holder are $36,000, or 84 percent higher, than those without. In its original form college was about learning, while now, students are forced to makenancial risk and reward of college.

“I believe education should be for all,” said Rzeszutko. “If somebody wants to better themselves by pursuing a further education, they should have the ability to do so without worrying about the bills that follow them for the rest of their life.”

UNDER PRESSURE

cents please.” Sliding four dollars across the counter, the student collects the change and an energy drink. On the drive back home,

Passing

$3,000 in college course fees

hours of Sat prep results in a average increase in one’s score by 90 points 6 and8

they turn on those mind-numbing review videos, attempting to concentrate. Sitting at their desk, a familiar struggle emerges – nodding off, eyelids becoming heavier with every passing sentence read. Did the Celsius not work? They know they can’t afford to fall asleep; bombing the test isn’t an option. They can’t take that risk, it wouldture, right? What college would accept them? So back at it, head drooping, they turn to the next page of notes.

next fall. Throughout the application process, she heard gossip about where people were applying and whether or not others thought it was the right choice. These comparisons took a toll on her.

“I never really had a doubt in my mind that I was going to college,” Goodman said. “But, at some point, I was stressed out because I felt I was always trying to compare myself to other people.”

Guidance counselors witness the toll on students as they navigate the competitive culture.

A 10-point difference in ACT Scoring can result in an $8,000 difference in the amount the National Merit Scholarship awards

The intensity surrounding college admissions, fueled by societal expectations, lead to an environment where students feel compelled to mental health and prioritize reputations of colleges over Amidst the high stakes and escalating costs of education, there is a growing question resonating in the U.S.: Is the pursuit of college really worth

It’s really hard to be asked at that age to put that much money on the table when so much is uncertain.”

RYAN RZESZUTKO teacher

“If we can keep in mind thatinstead of the biggest name or the highest ranked, we can for each individual,” guidance counselor Leah Jones said. “A lot of students carry on their own because they think that everyone else has it together.”

$5,000 difference in award money between a top 10% ranked high school and lower 40% ranked high school

SCAN TO listen to the story

At Ladue in 2021, the rate of students going to college was 86% according to the Ladue district website. To some, Ladue has formed a toxic environment around college.

“At Ladue, surrounding the idea of college, I feel like it’s a giant contest,” senior Kate Good-

‘This person got in there; I don’t know how they did that. Their GPA was low. My ACT score was higher.’ People are always saying stuff like that.”

Goodman committed to Boston College and will pursue a major in environmental geoscience

strongest transcript, AP classes are infamous for their stress-inducing curriculum. What’s more enticexcelling in the most challenging themselves picking out classes based on rigor rather than interest.

“Success will come once you

College and Career advisor Diana Redden said. “It’s going to be exhausting trying to do everything and be perfect because that’s unrealistic for anyone.”

FINANCIAL LIMITATIONS

For senior Asher Speicher, he wanted a different path. Speicher

an AP exam can save

spread design by Sara Rohatgi and Celina Zhou 13

is going to attend United States Air Force Academy, a four year military university in Colorado.

“I didn’t really want to attend a typical university because I was searching for something more meaningful than just college,” Speicher said. “I thought military service was something that suited me better.”

The Air Force Academy is a tuition-free school where graduates leave with a Bachelor’s degree in science and commission into the Air Force as a second lieutenant, serving for a minimum of -

ly impacted my decision,” Speicher said. “For a number of years,

Source: Pew Research Center

MAJOR MINOR NOT A FACTOR

$460

SCAN FOR a comparison of slecetive and non-selective universities

I was living in a single parent household, and we did not have much money. I knew wherever I went to college, I would have to pay for it myself.”

Thousands of students around the cost of education to be burdening. According to Think Impact 2021, 51.04 percent of college students drop out because they cannot afford college, 55 percent struggle to fund their education and 79 per-

cent postpone their graduation due to high tuition rates.

Success will come once you actually find that true enjoyment.”

DIANA REDDEN

college and career advisor

“I feel like people don’t realize that we live in such a privi-ent area that the fact that most of our students go to college is insane,” Goodman said. “In the majority of the rest of the country, that’s not the case.”

Students grappling with the stress of high expectations and rising costs of college need avenues for support

How important is cost for you when choosing to apply?

Panorama surveyed 128 students March 7th

66% of 2019 high school graduates immediately enroll into college

44% enrolled in 4-year colleges

22% enrolled in 2-year colleges

in-depth // the money issue panorama march 2024 // laduepublications.com 14

1

5

1 2 3 4 5 10 20 30 40 50 0 1

- Least

- Most

is the average students spend on college applications

GradesACT/SAT RaceGender 61 32 7 39 46 14 7 19 74 4 14 82

Factors in college admissions

Source: Bureau of Labor Statistics

and a place to hold a healthy, productive conversation.

“Sometimes a student might have the credentials to get into a certain type of school, but their family wants them to go somewhere where they might get scholarship assistance or where it might be more reasonable for their family to take on,” Jones said. “It’s important to understand that every family has different means and is comfortable with different entire selves to everyone else’s image of their best self. It’s kind of a losing game.”

The lack of choice based on the amount of money a family can afford can affect a student, consid-

ering the expectations of peers.

“One of the biggest pressures with the application process was the cost of sending all my test scores,” Speicher said. “That alone was costing a couple $100 sending my scores all over the place. AP test scores themselves were also a big cost. This year I have to spend $600 taking AP tests and last year, I spent $400.”

There is a new call for exploring alternative options in the media, such as community college, trade school or going straight to the workforce. Increasing the importance of mental health and self-discovery in the educational journey promotes the idea that -

1 in 3 students foresee college costs and mental health impacting their future plans

68% of Ladue students felt or heard judgment for their college choices

tution one attends.

“No one needs to have ev-

leave high school,” Jones said. “It’s about knowing yourself and area of your life. If we can start destigmatizing it, it takes away the shame of asking for help.”

A shift in conversation from the

and mental well-being might alleviate the burden on high school students about their future paths.

“Have that healthy conversation with your parents,” Redden said. “There’s opportunities for everyone.”P

Tracking Trends | Percent Change of Wages Compared to Cost of Tuition

FIRST LEVEL CLEARED! Source:

150%

0% 50% 100% 200% 250% -50% 1995 2000 2005 2010 2015 2020 WAGES AGES 22-27 COST OF COLLEGE (PUBLIC) COST OF COLLEGE (PRIVATE) COST OF COLLEGE (AVERAGE) 15

Postsecondary

System spread

by

Integrated

Data

design

Sara Rohatgi and Celina Zhou

Students examine outfit costs, spending habits and modes of payment

MARY KATE MORTLAND (STAFF)

TOP LEFT: Mortland wears a striped sweater from a boutique in Florida along 30A ($150) paired with pants from Revolve ($200). Her everyday footwear ($80) comes from Nordstrom. Adorning her wrists, neck and ears are a collection of pieces from David Yurman, Cartier and Genevive Jewelry, cherished gifts from her husband over the years.

ELI LARDGE (10)

TOP RIGHT: Lardge dons a red camo hoodie from Bape ($569), paired with plain gray mall sweatpants (estimated $20). His Balenciaga sneakers ($800) were a birthday gift. He completes the look with a red beanie hat ($18) from Indianapolis.

GRACE AGNEW (11)

BOTTOM LEFT: Agnew sports a Columbia grey fleece zip-up ($35) paired with a black tank top from Amazon ($10). Her bottom is a pair of white cargo pants from Hollister ($66). She accessorizes with a gold necklace ($30) from Creu and completes her look with black high-top Converse ($65).

ELLIOT BROADBENT (9)

BOTTOM RIGHT: Broadbent wears black and white Nike Dunks ($115) as a daily accessory. He pairs this with black Lululemon joggers ($130). On top is a cream Alo hoodie ($130). To complete the look he wears a tan Boys Lie baseball hat ($45).

Bank Bank Break the How Much Are You Wearing?

Exploring the costs of student and teacher outifts

$569 $800 $115 $130 $150 $65 $35 $10 $20 $45 $130 $200 $30 $18 $200 $1000 $66 T o tal: $1, 630 Total: $1,407 Total : $20 6 T o tal:$420 spending money // the money issue panorama march 2024 // laduepublications.com 16

How We Spend

have spent over $100 on a shopping spree

80% 33% still do more of their shopping in store rather than online

56%

of students of students of students of students admit

Shop ‘til You Drop

Students evaluate their expenses

70%

that the most recent trends have a large influence on what they buy have spent over $300 on a shopping spree

OLIVIA CHEN

“I think it’s common to have a spending problem. My friends have admitted they would like to change their spending. To control my spending, I use a monthly budget.”

KATE STEINBERG (12)

SCAN FOR a look into the viral trend of “Girl Math” and our favorites Panorama surveyed 128 students March 7

ILLUSTRATION

BY

PAYMENT METHOD MONTHLY SPENDING APPLE PAY CARD CASH OTHER 55.3% 15.4% 4.1% 25.2% $200 OR MORE $0-$100 $100-$200 77% 16% 7% spread design by Madeline Awad & Mason Eastman 17

“I would buy every single Taylor Swift vinyl and a mansion in Cape Cod.”

LANDON PAGE (9)

What Would Pano Do?

“I would move to Greece and get a Shelby Mustang or a Porsche 911.”

BRIANNA KELLEY (10)

WWYD? WWYD?

Students and Panorama staff answer, “What would you do if you won the lottery?”

BY OLIVIA CHEN

BY OLIVIA CHEN

“I’d buy a bunch of land and start an off-the-grid house and just garden.”

“I would put it into my college fund, start my own grocery chain and donate to underfunded schools.”

BOHAN PAN (11)

“I would buy a football club in England called Luton Town because I really enjoy soccer, and I would like to go there and watch the games.”

LOGAN WALLACE (12)

“I’d go on a shopping spree and order everything in my shopping cart, then [save and invest] the rest of it.”

GRACE HUEWE (11)

MAC HUFFMAN (12) features staff associate editor

“I’d buy a lot of camera gear [and] get all of the latest mirrorless cameras and lenses.”

VINCENT HSIAO (10)

Photo Editor in Chief

ILLUSTRATION

spending money // the money issue panorama march 2024 // laduepublications.com 18

STORY BY LAURA SHARESHIAN

Classroom Curios Classroom Curios

Teachers add interest to classrooms, free of cost

Ragland's Relics

TEN

YEARS AGO, PHYSICS

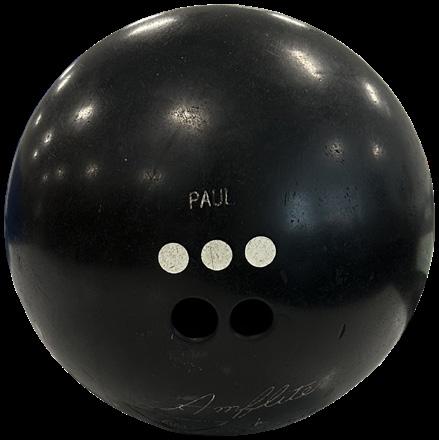

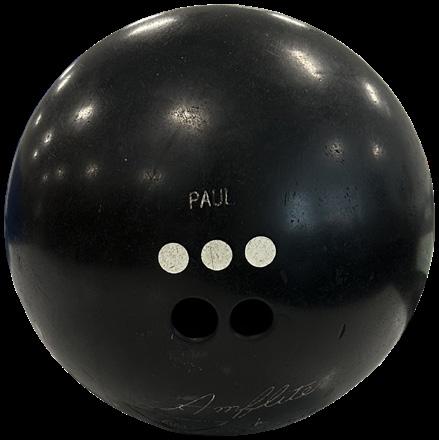

teacher Justin Ragland found Paul in a milkcrate while cleaning out his grandfather's shed. Paul, named for the

“It’s a bit of an enigma, how [Paul] came to reside in a milkcrate in my grandpa’s shed,” Ragland said. “Zero people in my family are named Paul.”

From then on, Ragland has kept Paul.

“I had him with me when I was in grad school, New Orleans and St. Louis,” Ragland said. “He’s lived a well traveled life.”

Today, Paul is well-known in Ragland’s classroom and sometimes used in labs.

“Nobody knows where he came from,” Ragland said. “He just showed up one day, and now he's the physics class mascot.”

Saxtonian Souvenirs

IN THE CLASSROOM OF HISTORY teacher Christopher Saxton, every surface counts. His shelves are lined with monographs and mementos, and his walls are covered by maps. Although these belongings reside in Saxton's room, many were not purchased by the teacher; they were found, gifted or homemade.

Two such belongings are the miniature Native American shelters. my kids,” Saxton said. “I made them. There's an Eastern Woodlands house and an adobe.”

One of Saxton's most pricey possessions is a collection of vintage Nystrom pull-down maps covering U.S. and world history.

“Every one of these maps is [about] $210,” Saxton said. “They're really expensive; they just don't make them anymore. I found [the maps] in a closet while the school was being renovated. [They] add amazing stuff to the classroom.”

Property of physics department, named by students

Property of physics department

SCAN TO learn more about the costs of classroom supplies and decoration

JUSTIN RAGLAND physics teacher

"DIANE"

TEAL BRUNSWICK BOWLING BALL

JUSTIN RAGLAND physics teacher

"DIANE"

TEAL BRUNSWICK BOWLING BALL

FUNKO! POP

"PAUL" $30 $15 CROSSING OF THE DELAWARE RIVER 2019

1966 FIRST EDITION LITTLE RED BOOK TRANSLATION

Gifted ADOBE & EASTERN WOODLANDS SHELTERS

1983 EFFANBEE GEORGE WASHINGTON DOLL

Gifted by sister Origin

unknown

VINTAGE NYSTROM PULL-DOWN MAPS

$2,000+ $150 $50 $0 Prices are estimated market values based on product eBay listings $50 $25

CHRISTOPHER SAXTON history teacher

spread design by Laura Shareshian 19

CLOSE UP: NEW BALANCE 1906D 2023 Year Released $170 Retail Price Colorway spending money // the money issue panorama march 2024 // laduepublications.com 20

Hometown

A timeline of Espinosa’s life spent locally in St. Louis

2000s

Espy attends Spoede Elementary, Ladue Middle School; starts collecting shoes with money earned from landscaping side job

2010s

Enrolls at Ladue High School, plays soccer and wrestles; wrestling state finalist; continues wrestling in college after graduating in 2015

2020s

Hired at Ladue as an assistant coach and supervisory asisstant right out of college in 2019; maintains trendy wardrobe and gives nieces and nephews old pairs

spread design by Vincent Hsiao 21

How to Play People Under Level by State

1. FIND STATE OF BIRTH

Where you were born determines your initial chance of being born into poverty.

2. FIND YOUR INCOME

Attending college

The wealthier you are, the more likely you are to attend college. Roll a 1 to attend college; for every $10,000 of your family’s income you get another chance to roll.

With college degree

Roll a 12 sided die to determine your parents annual income in the $10,000’s. For every $10,000 over the U.S. median income of $70,000 add 1 point to each roll. However, for every $10,000 under median income, subtract 1 point each roll. If you roll over $100,000 start at square 5 regardless of what state you were born in.

3. ATTEND SCHOOL

Roll a 1 on a 12 sided dice to attend college; for every $10,000 of your family’s income you get another chance to roll.

4. SELECT A CHARACTER

Roll a die to determine your characters gender. Remember this number for choosing your jobs later in the game.

5. FIND A JOB

Use your number from step 3 to choose from the job list according to gender dominated fields. This replaces your family income and the same income rules apply.

6. START A FAMILY

Roll a die to see if insurance will cover your childbirth. If it’s 1-4 then you have insurance to cover it, but if it’s 5 or 6 you have to pay. Move 5 squares back if it doesn’t. Then roll to determine how many kids you’ll have.

A

adaptation

classic board

$ $

virtual dice to play the game

fact-based

of the

game Game of Life Life

SCAN FOR

Federal poverty level in 2022 for a family with 2 adults and 1 child was $23,556 Below 9.3% 9.4% - 11.9% 12% - 14.4% 14.5% - 17% 17.1% - 19.9% Percent of state population living below poverty line Start at Start at Start at Start at Start at Starting position based on poverty

Average Student Loan Debt by State 28,000-31,999 $ 32,000-35,999 $$ 36,000-39,999 $$$ 40,000-43,999 $$$$ $$$ $$$$ $$ $$ $$ $$$ $$$ $$ $$ $$$ $$$ $$$ $$ $$ $$$ $$$ $$$ $ $$ $$ $$ $$$ $$ $$ $ $$ $$ $$$ $$$ $$$ $$$ $$ $$$ $$ $$ $$$ $ $ $ $$ $ $$$ $$ $$ $ $$ $$$$

ool G ar noitaud

HighSch

6 90% 85% 80% 75% 70% 65% 60% 55% 2000 2005 2010 2015 2020

College enrollment rate by

First quartile Second quartile Third quartile Fourth quartile

income quartile

Female Male 1. Nurse practitioner (91%), $95,732 1. Childcare (92%), $25,064 3. Pharmacists (58%), $99,996 3. Personal care aid (83%), $25,272 2. Veterinarian (67%), $95,680 2. Hospitality (87%), $20,852 4. IT (97%), $85,072 4. Chef (63%), $24,232 6. Architecture & engineering (92%), $103,948 6. Dishwasher (85%), $20,852 5. Airplane pilot (94%), $90,272 5. Construction (86%), $40,750 iFdn a J o b

Without college

Job fields are frequently dominated by one gender. See step 5 to chose a job. Female dominated Male dominated Female dominated Male dominated Start a F a m yli Cost of childbirth

degree

Vaginal delivery $14,768 Cesarean delivery $26,280 Average cost without health insurance Average cost with health insurance Vaginal delivery $2,655 Cesarean delivery $3,214 On average, it costs to raise a child Housing 29% Food 18% Education 16% Transportation 15% Health care 9% Other 7% Clothing 6% 29% $233,610

Sources: Bankrate, Children’s Bureau, Credit.com, Education Data Initiative, Federal Reserve, Forbes, Institute for Family Studies, KFF, Pew Research Center, Third Way, U.S. News

spending money // the money issue panorama march 2024 // laduepublications.com 22

District District

STORY BY ARTI JAIN & NYLA WEATHERSBY ILLUSTRATION BY JOSH DEVINE & OLIVIA CHEN PHOTOS BY VINCENT HSIAO

Examining the causes and implications of monetary differences within various St. Louis school districts

Disparities Disparities

pennies represent the total amount of additional funding a district would need for students to reach a proficient level on the NWEA test

PARKWAY

$17 MILLION

UNIVERSITY CITY

$23 MILLION

WEBSTER GROVES

$4 MILLION

LADUE

$3 MILLION

a higher amount of money indicates lower levels of student support from the school district

PATTONVILLE

$20 MILLION

spread design by Mac Huffman | Kelly Zhang 23 in-depth

Wgo to high school?”

It’s a question echoed everywhere in St. Louis — a late night escapade to Ted Drewes, visit to the Arch or Cardinals game at Busch Stadium. However, beyond the seemingly innocuous front, the question poses a larger inquiry into one’s identity. It assigns the answerer into their social class — and, by default, their value in society.

St. Louis is home to 109 high schools — 50 private high schools, 17 St. Louis city public schools and 42 St. Louis county public schools — each with varying sources and amounts of revenue.

funded via property taxes. The higher the value of homes surrounding a school, the more money allocated. Additionally, for some schools, taxes aren’t the only source of income — donations from foundations also play a role. Economic disparities are ultimately furthered because not all St. Louis schools have access to such foundations. Monetary means can inevitably build a school and its reputation, affecting the factors such as student environment, teacher environment, stigma and school opportunities.

they were like, ‘Okay, now we’re going to go get the MacBooks.’ I was like, ‘Are you kidding? Macbooks?’” Sheley said. “[In] my experience, we had two iPads in the entire classroom that we had to rotate through. If we had to use computers, we’d get these clunky, old computers and they never ended up working, so we usually worked on paper.”

Monetary resources also come into play when considering a students’ home life: taking care of their siblings, doing chores and juggling a job. Such situations may inevitably take away from studying or participating in extracurricular activities.

SCAN FOR a look at Ladue’s budget

“I knew a ton of kids who had jobs,” Sheley said. “My sister’s friends, who were like 13 [or] 14 [years old], had jobs. I knew kids who just didn’t have time because they had to watch their siblings because their parents were out working.

Kids got behind [in school] because of these economic issues.”

the money.”

The higher paying a parent’s job, the more money their family tends to have. At lower-funded schools, parents are often in lower-paying jobs, and impacts are felt throughout the family.

“Kids look at their parents in an idealistic way,” Sarmistha Pulagam (9) said. “I know that from experience. Parents at Ladue are lawyers or WashU professors, people who have had degrees and who are well educated people. At that many parents like that.”

Parents aren’t the only ones with a say in academic spaces. Teachers, as well, play a role — but when home life isn’t perfect, academics may suffer.

STUDENT ENVIRONMENT

The impacts of being in an underfunded school often manifest in the school’s education quality and the resources they have for students to succeed. Kate Sheley

she attended Flynn Park Elementary School in the University City School District during kindergar-

“When I came to Ladue, and

isn’t the case for 100% of students, even within a singular school. St. Louis University High School, for example, has a tuition of $21,500 per year, implying higher monetary means per student. In reality, more than four out of 10 students require tuition aid each year. This disparity may manifest in athletic activities, where money often

“[Money] gives [some students an] advantage in the athletic department, just naturally, because they come from a wealthy family,” Jack Finney (11) said. “I mean, [if] you looked at all the kids that made the freshman soccer team [at SLUH], it was all these kids [who] were loaded. It can just be about

“Where you come from socioeconomically is going to affect all the things that I can’t control,” science teacher Benjamin Nims said. “The only thing I can control as a teacher is my lesson, how I lay it out [and] how I help you meet these goals. But in terms of when you leave my classroom, I can’t control any of that. Socioeconomics plays into those things that I can’t control [and] a student [can’t have an impact on learning.”

TEACHER ENVIRONMENT

Alongside students, teachers are a large part of a school’s environment, as they provide the knowledge and resources necessary for a student to learn and grow. In the 2022-2023 school year, Saint Louis Post-Dispatch found that a Ladue teacher is paid approximately $76,000 per year, while the average St. Louis Public School District teacher is paid $57,000 per year. The salary difference may be a factor in a teacher’s decision to leave a lower funded school.

“There was only so much

LADUE PRELIMINARY BUDGET Revenues by Source Expenditures by Category Local $75,398,517 State $3,544,205 County $686,277 Non-Current $2,500 2023-2024 Federal $994,655 TOTAL: $80,625,153 Certified Salaries $35,227,225 Non-Certified Salaries $7,007,771 Purchased Services $10,264,401 Supplies $4,222,761 Fringe Benefits $12,616,660 TOTAL: $72,255,102 Capital Outlay $2,834,216 Principal and Interest $82,068

“

indicates a false name to protect the identity of an anonymous community member in-depth // the money issue panorama march 2024 // laduepublications.com 24

HERE DID YOU

*

in terms of salaries [at Sumner High School],” assistant principal Annette Hayes said. “[With] the disparities, we can even go back to [when] segregation was used, [because] it’s existed since then. Separate but equal was never equal — and even more now, because the gap is so wide that it’s still not equitable.”

Even beyond teachers, funding affects a school’s entire staff. Jane Doe* saw this when working at McCluer High School, which is in the Ferguson-Florissant School District.

“The district does not pay custodians very well, so they were leaving and it was hard to staff the custodial team,” Doe said. “That led to more disarray of the building because things weren’t being cleaned up. [Which] leads to an unwelcoming environment for students and teachers.”

Such an atmosphere was only furthered by the limited or lack of support from administration.

“When a teacher [needed] something,

whether that be supplies [or] help with a particular student or a particular class, help from administration would not come quickly,” Doe said. “The communication between the different levels of staff was not good, and lower staff were not supported by higher staff.”

This lack of assistance isn’t exclusive to the Ferguson-Florissant School District — it plagues numerous schools.

“[I] met a teacher at Vashon [High School] who was at a public place, copying passes because the school didn’t have paper,” Villa Duchesne English teacher Kimberly Gutchewsky said. “He was using his own money to make things that were required. When you don’t have the money for things like that, it’s asking a lot of a teaching staff.”

Teachers using their own money may lead to the high teacher turnover present in Title I schools, where at least 40% of the student population

lives in poverty. In 2023, Missouri’s Department of Elementary and Secondary Education reported that the teacher retention rate for Title I schools was 54.2% after three years.

“There is [a] teacher shortage situation,” Hayes said. “There’s not always a guarantee that you’re going to get a

sub for the entire school year, because they don’t have enough teachers that have applied.”

Sources: Ladue Schools, NewAmerica.org, Realtor. com, RedFin, U.S. Census Bureau, U.S. News

ROCKWOOD PARKWAY LINDBERGH MEHLVILLE PATTONVILLE HAZELWOOD FERGUSONLADUE KIRKWOOD RIVERVIEW NORMANDY RITENOUR HANCOCK PLACE BAYLESS AFFTON WEBSTER MAPLEWOOD BRENTWOOD CLAYTON UNIVERSITY CITY JENNINGS VALLEY PARK GROVES GARDENS HIGH SCHOOL GRADUATION RATES ACROSS ST. LOUIS 95%-100% 90%-95% 85%-90% 80%-85% 0%-70%

ST . LO U I S YTIC AVERAGE GRADUATION RATE IN ST. LOUIS 88.95% $360K $242K $273K $235K $840K $424K $180K $160K $93K $110K $189K $235K $196K $190K $248K $380K $56K $314K $602K $265K $265K $63K AVERAGE PROPERTY VALUES AND GRADUATION RATES ACROSS ST. LOUIS DISTRICT BY DISTRICT AVERAGE HOME PRICE IN ST. LOUIS $252K FLORISSANT SCHOOL DISTRICTS IN ST. LOUIS $ 1 6 K6 23 70%-80% spread design by Kelly Zhang 25

STIGMA

Ladue spends $14,289

in order to teach 25 AP classes

$700,000 $137,950 $11,349 the average Missouri public school, per student annually per student annually

Ladue spends compared to however is spent on Ladue High School’s MacBooks

Ladue spends on 13 Project Lead The Way courses

$70,200

which spends $$$ $$$ $ $$$ $$$

In Missouri, only 12.8% of schools offer PLTW classes

Differences often breed stereotypes, and the large disparity between schools in St. Louis can make such stigmatization unavoidable. Ladue School District is no outlier.

“[Ladue is] standardized as the rich school,” Pulagam said. “When I went [to Parkway West], they [were] like, ‘Oh, so you’re rich.’ I’m like, ‘No, I’m not.’ I just didn’t get it. And then, when I went [to Ladue] and saw what the environment was like, I was like, ‘Yeah, now I understand why Ladue’s considered a rich school.’”

Gutchewsky also experienced this stigmatization, as she was ignored because of her ties to Ladue.

“I stopped doing professional development workshops in the St. Louis area, because when I would go to speak to something, people would dismiss me before I opened my mouth,” Gutchewsky said. “[They were] saying, ‘You teach at Ladue, their tutors are going to do all their homework. Why are we even listening to you?’ There was this perception that Ladue [students] are privileged enough where other people do their work. It bothered me so much that I got tired of defending all of my students.”

However, Doe is an example of how such stereotypes can be shat-

tered through proper knowledge and understanding.

“I was guilty of having this perception,” Doe said. “Before I interviewed here, [I would] hear Ladue and think ‘rich white kids.’ And then, when I started looking at the website, interviewed here, got hired, walked around the building and then actually started teaching, [the stigma dissipated]. I really love this district because it is so diverse.”

SCHOOL OPPORTUNITIES

Despite the stigmas present, at the end of the day, a school is a learning institution. Providing a quality education is a fundamental part of a school, with factors such as AP classes and class variety playing into this. A hallmark of having a quality education is a school’s accreditation, which is granted by the state — once accreditation is lost, diplomas are rendered invalid.

“There was provisional accreditation [at Sumner] during my time there,” Hayes said. “The state had the resources are and what [was] needed to get accreditation.”

Due to accreditation’s effect on academics, some students may turn to sports as a way to succeed in college and beyond.

“There is this stereotype that

Accreditation

What is it? How is it obtained?

Who has lost it? Government recognition of a school’s education Request to the Commission of Higher Education Resources, curriculum and program reviewed On sight evaluation performed Accreditation monitored and renewed every 10 years

Normandy School District

St. Louis Public School District

Ritenour School District

a lot of students fought, [thinking that], ‘I can only be successful by way of my athletic abilities. This is my way to afford college. I may not be academically the brightest, but I know I am athletically,’” Hayes said. “It’s a stereotype, and it’s unfortunate.”

However, categorization isn’t true for every school and program — the nuance in educational opportunities is important to recognize, because even students within a singular school come from widely diverse backgrounds.

“In [University City High School] they have great programs, great opportunities for kids and the AP assortments,” social studies teacher Matthew Horn said. “Truthfully speaking, I think the facilities might be a little nicer [at Ladue], but I think that the programs that are offered to students both in and out of school are relatively diverse at both schools.”

When present, equal resources and money can indicate that all students have the ability to succeed. Nims observed this while working at Maplewood Richmond Heights High School for 15 years.

“Everybody has the potential to learn and grow, and everybody has to just start from where they are,” Nims said. “Not everybody’s starting from the same place, but that’s okay. We can all get better. We can all learn.”

3 4 2

P

1

in-depth // the money issue panorama march 2024 // laduepublications.com 26

SCAN TO listen to the story

Ladue household income ranges $150K$200K $74,000 More than $200K National avg. $100K Less than Sources: Apple, Center for Online Education, CollegeBoard.org, Data USA, Niche, PLTW.org, PointHomes. com, Realtor.com, Show Me Institute, U.S. News & World Report, Wisevoter, Zillow in Context Ladue Municipalities Breaking down the wealth and average home values within the Ladue School District boundaries Student Breakdown Analyzing the municipalities that Ladue students reside in Ladue Creve Coeur Frontenac Other Olivette Crystal Lake Park Panorama surveyed 128 students March 7 $1.13M $1.03M $379K Frontenac: Crystal Lake Park: Ladue: Average home value in Creve Coeur: $538K $433K Olivette: 8.1% of each year Ladue home prices are rising 9.2% Ladue students are economically disadvantaged 4.1% 22% 7% 8% 63% 192% of Ladue students are eligible for the free lunch program STOP Ladue’s cost of living is above the national average Ladue Road 38.4% 26.6% 20.3% 6.3% 1.6% 7.2% $100K$150K spread design by Josh Devine 27

PHOTO BY VINCENT HSIAO

PHOTO BY VINCENT HSIAO

Students should educate themselves on financial literacy before adulthood

15 OUT OF 15 PANORAMA

EDITORS AGREE

AMIDST THE FLURRY OF TEENAGE concerns — from academics to social dynamics — the future is a question of college, relationships and job opportunities. As a result, as far-off issues for adults rather than a criticalucational journey and prepare for the future, it’s -

the necessary tools to comprehend the complexities

deductions or reimbursements.

student should prioritize. From rent and groceries to

By creating a budget and monitoring spending habits,ing receipts or utilizing budgeting apps. While it

paramount in today’s changing economic landscape.

Editorial Note: Each editorial, Panorama selects an issue that the staff thinks is important to address and expresses a view that belongs to the majority of the staff. Panorama welcomes the opinions of its readers, and encourages letters to the editors. Please bring signed letters to room 1311 or email Panorama at publications01@ladueschools.net. Panorama reserves the right to revise submissions for length as long as original intent remains unaltered.

-

-

--

-

P editorial // the money issue panorama march 2024 // laduepublications.com 28

MONEY CAN’T BUY HAPPINESS” IS a common statement echoed across same people who have never seen true wealth. In a study conducted by the American Psychologbecause nothing in this world is truly free. Between would say no to a few extra dollars in their account. in wealth would bring an uptick in happiness to the

BY OLIVIA CHEN

BY OLIVIA CHEN

Can Buy Cannot Buy Mo’ Problems? Mo’ Problems? “

lessness and hunger would have the largest global ripple effect of positive change. According to the would change for the better. The weight of stressing your happiness in the form of wants and opportuniyour mind can construct — money could get it done. piness can come from watching our loved ones open a is that money is the driving factor for many of them.

Mo’ Money,

Panorama debates the age old proverb, “Money can’t buy happiness”

IN THE PURSUIT OF HAPPINESS, SOME view the notion that “money can’t buy happiness” as more of a comforting cliché than an absolute

it’s evident that a larger bank account doesn’t pursuit of passions. These aspects of human experience cannot be bought; they are nurtured through personal

in the relationship between wealth and happiness. Beyond a certain income threshold — according

STORY BY ALZHRAA MAHMOUD STORY BY MICHAEL ZEGEL

STORY BY ALZHRAA MAHMOUD STORY BY MICHAEL ZEGEL

annually for emotional well-being — further wealth accumulation doesn’t impact overall happiness. This what’s necessary will not enhance their quality of life. at the expense of relationships and our health. The pressure to amass wealth can foster a culture of competition and human connection and empathy. The time and energy devoted to accumulating wealth can also detract from and self-care. This imbalance can lead to feelings of

emphasizes the importance of prioritizing personal of the digit amount in your bank account.

ARTSULLI T I ON

spread design by Mimi Zhou | Alzhraa Mahmoud & Michael Zegel 29 money talks

A Distorted Democracy Democracy

The

U.S.

government is controlled by money and fails to represent the people

TSTORY BY GRACE KWEON

TSTORY BY GRACE KWEON

HE MAJORITY OF THE members in the 116th congress were millionaires. Six of nine Supreme Court Justices are multimillionaires. Every U.S. president after 1953 has been a millionaire. Heck, even all of our founding fathers were millionaires. These are the politicians who represent

economy, foreign policy and our everyday lives. Yet when our government is consistently represented by the wealthy, is our democracy really representative of the people?

Amidst the growing wealth inequality, Trump’s 1.5 trillion dollar Tax Cuts and Jobs Act reduced the rate of the highest tax bracket by 2.6% and overall corporate tax by 14%. Do you think it was for the working class’ 3% tax deduction or for his own, as a rich politician with a business-owner background? Likewise, when the majority representation of the wealthy drowns out the needs and voices of the working class, it’s especially hard to improve wages, relieve student

When our government is consistently represented by the wealthy, is our democracy really representative of the people?

debt and approve universal healthcare, affect the rich. Furthermore, the wealthy have distinct advantages in terms of getting their foot in the political door. The time commitment, resources, connections and immense amount of funding to even get your name noticed is a dream to the average working-class citizen. Their wealthy counterpart, however, has the free time, resources and money to spend and the ability to take on the risks

money talks // the money issue panorama march 2024 // laduepublications.com 30

Democracy or Plutocracy?

Student

perspectives versus the reality of politicians and their financing

STUDENT

PERSPECTIVE

REALITY

1.06

billion dollars

STUDENT PERSPECTIVE

They’re also more likely to be recruited by important political elites and have greater connections, therefore receiving more campaign funding. From his super PACs, personal funds and collection of wealthy donors, Biden was able to spend over a billion dollars on his presidential campaign last election. And it’s not like people just donate just because; candidates gain the support of wealthy donors and corporations by leading in their interests.

It’s clear that the billions spent on lobbying isn’t freedom of speech; rather, a rebrand for bribery and corruption.

Moreover, corporate money has a greatlobbying. Lobbying, in its purest form, is the ability to petition the government

and is protected under the 1st Amendment. However, when Citizens United v. FEC legalized political spending as lobbying, anyone could spend millions to ingovernment; let it be corporations, organizations, universities, churches or non-profit groups. That’s how 14,000 lobbyists can live next to the politicians they donate to, write their legislations and entice them with gifts, meals and money. Not to mention that 84% of the required legal documents which contain

95%

REALITY of lobbying in the U.S. is done on behalf of big businesses

crucial data about their lobbying activities, which are then released as public information. Despite the breaking of law and regulation, there are no real consequences to this noncompliance. When legislation can’t even touch the interests billions spent on lobbying isn’t freedom of speech: rather, a rebrand for bribery and corruption.

Our democracy is not a democracy until there is greater political representation of the working class, greater monetary restrictions on political camoverturned. We the people can vote, but money can do more.

P

Biden’s 2020 campaign spent

How much do you think President Joe Biden’s campaign cost during the 2020 elections?

Panorama surveyed 206 students March 22 Sources: OpenSecrets, KQED 81-100% 61-80% 41-60% less than 40% 11% $1 million $10 million $100 million $1 billion 11% 31% 43% 15% 10% 31% 23% 36% spread design by Mimi Zhou 31

What percent of lobbying in the U.S. do you think is done on behalf of big businesses?

Take a Gamble Gamble

GAMBLING COMES WITH many risks, but it also comes with the chance to win many rewards. Similarly, investing a large sum of money or buying a lottery ticket is gambling since they all require taking risks. In reality, gambling is basically anything that relates to taking risks. Gambling is a form of art that every person should adopt, regardless of age and class. There are many types of gambling, including investing in the stock market, day trading, sports

betting, etc. When one hears the word “gambling,” they immediately think of the risks and consequences, but never

It’s vital to take risks as early as possible. Risk-taking during teenage failure and enables one to be capable of growth since they will have more chances to build back up. When someone young takes risks they don’t lose as much as risk-taking at an older age since money isn’t that big of a need as a child.

Are there benefits to taking riskswithmoney?

“Yes, because usually there are definitely some benefits because you can invest and make a profit, even though it can be risky.”

Becoming a risk-taker is a valuable skill that everyone should aim to develop. Taking risks can open

“Yes, because usually there are benefits because sometimes you have to take risks to have high rewards such as buying a property and it might go up in price and if it does goes up in price then you will make a lot of money.”

“Yes, I think there are because if you just let your money sit in a bank, it’s slowly losing it’s value, so the best thing to do is take a risk.”

Students should learn the benefits of gambling and take more risks

STORY BY ISHAAN PANDEY

ILLUSTRATION BY OLIVIA CHEN

STORY BY ISHAAN PANDEY

ILLUSTRATION BY OLIVIA CHEN

many doors to opportunities. If someone invests a lot in a stock, they are taking a risk since they could possibly lose all of their money. If someone bets on a sports team and they

people lose all their money, they’ll still have time to rebuild. If older people lose their money, lots of consequences will arise. Gambling during youth also teaches the principles of spending money responsibly and gives more room to experiment.

A lot of psychology plays a part in why people gamble. Taking risks like gambling is an addiction many people have. They fall into the trap of gambler’s fallacy and the adrenaline rush that comes with each move, knowing they can win big. Another psychological factor that feeds into people’s addiction is the button. When playing a slot machine, there is a big red button, which gives people the illusion that they have more control over their money and what happens to it, which is similar to investing since they can see and control when to buy and sell. Taking risks activates the brain’s reward system, releasing dopamine, a chemical inside the body that gives satisfaction.

P

AUDREY STOCKWELL (10)

HAMZA BHUTTO (10)

money talks // the money issue panorama march 2024 // laduepublications.com 32

ANDY DAI (11) SCAN FOR the benefits of taking risks!

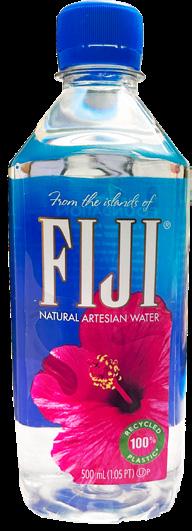

Real vs. Replica Real vs. Replica

Comparing popular products to their cheaper twins

“I’m very prone to losing things, so I prefer not to spend a lot of money on something that I might lose.”

“I prefer the airpods because [I] can use them all the time and they are perfect for everything.”

“I use a Stanley dupe and I prefer it because the lid is better and it’s much cheaper than a Stanley.”

“I use a Stanley and I prefer it because it has a big handle and stores a lot of water.”

“I prefer the [NYX Fat Lip Oil] because I like [that it] lasts a really long time and the applicators are really similar.”

“I use the Dior Lip Oil and I think it’s pretty good, but the lip oil is kind of sticky when you first put it on.”

Apple Airpods

Stanley Cup Dior Lip Oil Replica Real

SANCHO GATUNGAY (11)

JACK MOORE (11)

AUDREY RICKARD (10)

VISHMI RAJAPAKSHA (11)

NARA

LIU

STORY BY NITYA

& CINDY

$30 $45

$40

$99

$2

JO GYAWALI (10)

$9 spread design by Ishaan Pandey | Nitya Nara & Cindy Liu 33 saving money

ALIA AL HUSSEINI (10)

Cheap Eats Cheap Eats

Behind an unlit sign on Page Avenue lies a hidden gem, Taqueria Durango. Every meal starts with a friendly server delivering a complementary basket of warm tortilla chips and three different salsas, varying in spice intensity. The environment of the restaurant is lively with Mariachi music playing in the backround. Ordering from an incredibly expansive and budget friendly menu leads to lightning fast service and delicious food with great portions to leave even the hungriest of eaters stuffed. All in all, a phenomenal f restaurant.

diner tables, along with a bar where you watch food get cooked in front of you. The service was exceptional and employees were super kind. The banana foster pancakes (featured above) were truly incredible. Topped with two scoops of ice cream, this breakfast might be one of my favorite meals ever. The substantial amount of sugar may not be for everyone, but there are other options to satisfy any breakfast cravings on the expansive menu. With great food and constant customers, Olivette Diner has truly stood the test of time.

saving money // the money issue panorama march 2024 // laduepublications.com 34

$10 FREE

in St. Louis Source: DoorDash.com and The New York Times

Lathan Levy reviews budget friendly food options

Panorama surveyed 128 Ladue Students March 7

The top reasons Ladue students order food

directions & menu for Olivette Diner SCAN FOR $3 2 Can’t drive 3 More convenient 4 Wanting to eat at home 1 Feeling lazy $9 $90 30% deliver fee Typically, DoorDash charges a

Suppose a student spent $300 DoorDash per month This means that... would have been spent on delivery

After trying all of the restaurants listed below, I have ultimately decided that Taqueria Durango was my favorite meal. With an entirely cheap menu, this truly fits the criteria of “Cheap Eats.” Also, as a bonus, the free chips are delicious. The meals are always filling and the service is impeccable. This is an incredible spot that I highly recommend .

rolled, packaged and put into a refrigerated dis play. There is a wide variety of rolls, meats and flavor combinations to satisfy any sushi desires. Schnucks uses immitation crab in their rolls, which is still quite tasty, but not as good as the real deal. However, when looking for a high quality roll, I would recommend Wasabi Sushi Bar or Oishi Sushi, even though these options come with steep price tag. As a quick pickup for lunch or a heavy snack, Schnucks sushi is perfect. All things considered, Schnucks, being a grocery story makes pretty darn good sushi.

Another popular restaurant is Michael’s Bar & Grill. Al though this menu features an extremely diverse price range, if so desired, one can eat here for surprisingly cheap. The servers were very kind, however the service was slower than most and the burger that I tried was mediocre. The redeeming factor that put this restaraunt on this list is their fries. Hands down the best French fries I have ever eaten. Crispy and perfectly seasoned on the outside, but warm and doughy on the inside. Although not my favorite restaurant, Michael’s Bar & Grill provided a pleasant atmosphere and an all around good dining experience.

1 5 Meals can cost up to

47%

Users placed in merchants said that without DoorDash, their buisnesses would have failed orders in 2023 for delivery on DoorDash than if you ate at the restaurant

574 million

35%

of Ladue students order from DoorDash at least three times a year

spread design by Lathan Levy 35

directions & menu for Michaels Bar and Grill SCAN FOR $8 $11

STORY BY ELLA BENDER & JAY HEINTZ

STORY BY ELLA BENDER & JAY HEINTZ

Students

Thrifting tips and experiences

Man’s

$5 $0.20

FOR our favorite thrifting spots VINCENT DAUS (1 0 ) R Y A N B I ANUCCI(12)

Another

Treasure Treasure

SCAN

and staff show off outfits from thrift stores Thrifted

SYDNEYPROPER (11) $15 $13 $7 $10 TAP R I CIA CHAVEZ(Staff) saving money // the money issue panorama march 2024 // laduepublications.com 36

Fits

Thrifting Etiquette

1. THINK BEFORE YOU BUY: Consider if you will actually use this item or if you just want it because it’s cheap or trendy. If you find that you want the item for the wrong reasons, leave it for someone else.

2. PUT ITEMS BACK WHERE YOU FOUND THEM: After you’ve tried on clothes, put them back on the rack. If you knock a shirt off its hanger, hang it back up instead of leaving it on the ground. Don’t make the thrift store employees clean up after your mess.

3. DONATE YOUR UNWANTED ITEMS: Give back to the community by donating any unwanted items to a local thrift store. If you don’t find use in something anymore, someone else probably will. But please make sure the items are not

1. WEAR TIGHTLY-FITTED CLOTHES: This way, you can try on your finds over your clothes if there is no dressing room.

2. GO IN WITH A GENERAL GOAL: To help you not get overwhelmed, set goals such as searching specifically for a green sweater or a denim maxi skirt.

3. PLAN: Plan your thrift trip for right after a weekly restock to have first grabs at new items.

4. DON’T BE DISCOURAGED: If you don’t find something one day, you may find it another day. Going to the thrift store often will increase your likelihood of finding the things you want.

De-popping

An overview of a Ladue Depop reseller and his experiences

SCAN FOR Pinex’s Depop

Jeremiah Pinex (11) sells shoes and clothes on Depop, an online store where anyone can sell and buy secondhand clothes. He joined Depop because he enjoys fashion and selling clothes allows him to be more involved in the fashion

$40 $64 $65 $8 $1 $13 spread design by Jay Heintz & Ella Bender 37

Cake

Topped with some Yuzu cream and lemon paste, this Whole Foods cake looked really good. Just like the presentation, the taste did not disappoint. The balance of flavors was great; being sweet, light and refreshing, the fruity mango flavor complemented the rest of the cake.

With some cake mix and sprinkles, I was good to go. The cake didn’t take too long to bake, and the taste actually surprised me. The texture was fluffy, the icing was not over-powering and it overall was pretty good. The only issue with it was presentation. For a measly four bucks and a bit of time, this was a fairly positive result.

TOTAL TOTAL

Worth the

Aaron Lin compares common cheap and expensive foods

Chicken Wings

While at a cheaper price, the Schnucks wings were simply lacking in flavor and texture. The wings were also not fresh, so that hurt the texture. In terms of flavor, they were way more