Originally from Northeast Alabama, I moved to Auburn to attend Auburn University thinking it would be my home for four years. However, a decade later I am still proudly calling Auburn home. As a former teacher, I readily take on the role of educator and counselor when it comes to working with clients. I believe that with knowledge comes the power to make decisions that benefit your family. Relationships and excellent customer service are the foundations of my business For that reason, I am committed to gaining your trust and working diligently to ensure a smooth transaction.

Auburn University-Bachelor of Science in Elementary Education

• Summa Cum Laude

My Real Estate School State of Alabama Salesperson Real Estate License

My Real Estate School State of Alabama Brokers License

Your paragraph text

National Association of REALTORS®

Lee County Association of REALTORS® Women’s Council of REALTORS®

Lee County Association of REALTORS® Community Service Committee

Auburn Young Professionals

Auburn Chamber of Commerce Opelika Chamber of Commerce

Lana was awesome! Any questions we had she answered and then some! She always came through in our hectic schedule, showed us every option that we could possibly afford, including rentals, condos, and homes. I would recommend her to anyone who is in the market to buy or sell! She is a great person first and then a great realtor! We are extremely thankful as a family who is new to this area to have had Lana as our realtor!

- Bought a Single Family home in Auburn, AL

We would highly recommend Lana for any realty needs you might need. Lana is extremely knowledgeable, very professional and has great work ethic. She listened to our needs and fought through numerous contracts to get what we wanted. Thanks Lana!

Bought a townhome in Auburn, AL

Because I believe in empowering you to be an educated buyer, I will:

Review your buyer representation choices before presenting you with a buyer representation agreement

Give you the most vital and up to date information on available homes Keep you aware of changes in the real estate market Provide neighborhood information

Collect pertinent data on values, taxes, etc. Explain forms, contracts, negotiation and settlement procedures

Because I believe your time is valuable, I will: Meet with you in order to learn about your “needs” and wants”

Provide ready access to all MLS listed properties

Help you select homes to view that fit your needs Show you only homes within your stated budget Arrange for necessary property inspections

Because I believe in and am committed to bringing you value, I will:

· · · ·

Perform a market analysis on chosen properties Advise on offers on properties (if under buyer agency) Write and negotiate your purchase agreement to the seller Negotiate on your behalf (if under buyer agency)

Because I believe in relationships and customer service, I will also:

· · · ·

Monitor and inform you about progress from contract to closing

Return every phone call, text, and email within reasonable time

Follow up with you after closing to see if you have any issues or service needs

Maintain periodic contact and be available to update you on market values

Agent Signature: Date:

This is money paid at the time of contract to secure the contract. The amount will depend on the price of the house. Builders often have minimum builder deposit requirements that are not negotiable

All inspections are at the expense of the buyer. The typical home inspection ranges from $350-$500 but can be more depending on the size of the home.

This is the minimum investment that is required to purchase your new home. Down payments are typically 3 20% of the purchase price of the home. 0% down programs also exist, ask your lender for more information.

The costs to complete the real estate transaction that are paid at closing. Ask your lender for a complete list of closing cost items They often include:

• Government recording costs

• Appraisal fees

• Credit report fees

• Lender origination fees

• Title services

• Prepaid taxes, insurance, and interest

• Underwriting fees

Property taxes, insurance, and prepaid interest that is paid upfront. These items are included in your closing costs.

Meet with your preferred lender (or chose one from the list in this guide!) to determine your budget and get pre approved for a home loan. Doing this first thing will make sure we are viewing properties that are within your price range, and a pre approval letter shows that you are a ready and able buyer!

Set up a Zoom or in person meeting so we can establish your specific plans. This includes getting your pre approval, talking about your goals, timelines, home search criteria, deal breakers, and must haves.

You will be set up on a digital home search based on the criteria discussed at your initial consult From there, we will coordinate in person or virtual showings based on listings you are interested in that match your criteria.

First, we need to talk strategy. Are there other offers on the table? How long has the home been on the market? How does the list prices compare to other homes in the area? What can we do to accommodate the sellers? Together we will put together a strategic offer. We will review the contract then use digital signatures to sign the offer.

Be prepared to negotiate with the sellers. They may counter our offer on price, closing date, concessions, etc. From here we will determine our next steps and process accordingly.

All offer documentation will be forwarded to your lender. You will submit your earnest money, start your loan application, and schedule your home inspection. You will receive a timeline of dates and deadlines along with weekly updates to keep you on track and in the loop.

Use a recommended inspector (see a full list in this guide!) or choose your own. They will coordinate a date and time to do your in person home inspection and share a digital report following the inspection.

Between now and closing is when we will need to make sure all contingencies in the offer have been satisfied If there were repairs required from the home inspection, a home sale contingency on your end, other inspections being done, etc. Once these are completed we are almost there!

Once your contingencies have been satisfied and your financing has been approved, you will receive your final loan commitment and clear to close from the lender. Our final step prior to close is to schedule a walk-through of the property. We will want to go through and make sure everything is as agreed upon with the sellers.

It is finally the closing day! Time to sign all the official paperwork and get the keys to your new home! Plan to arrive at our scheduled place of closing on time and with a check in the amount determined by your lender. Bring Photo IDs and plan to be here for about 45 minutes. Once you leave the closing table, the home is officially yours!

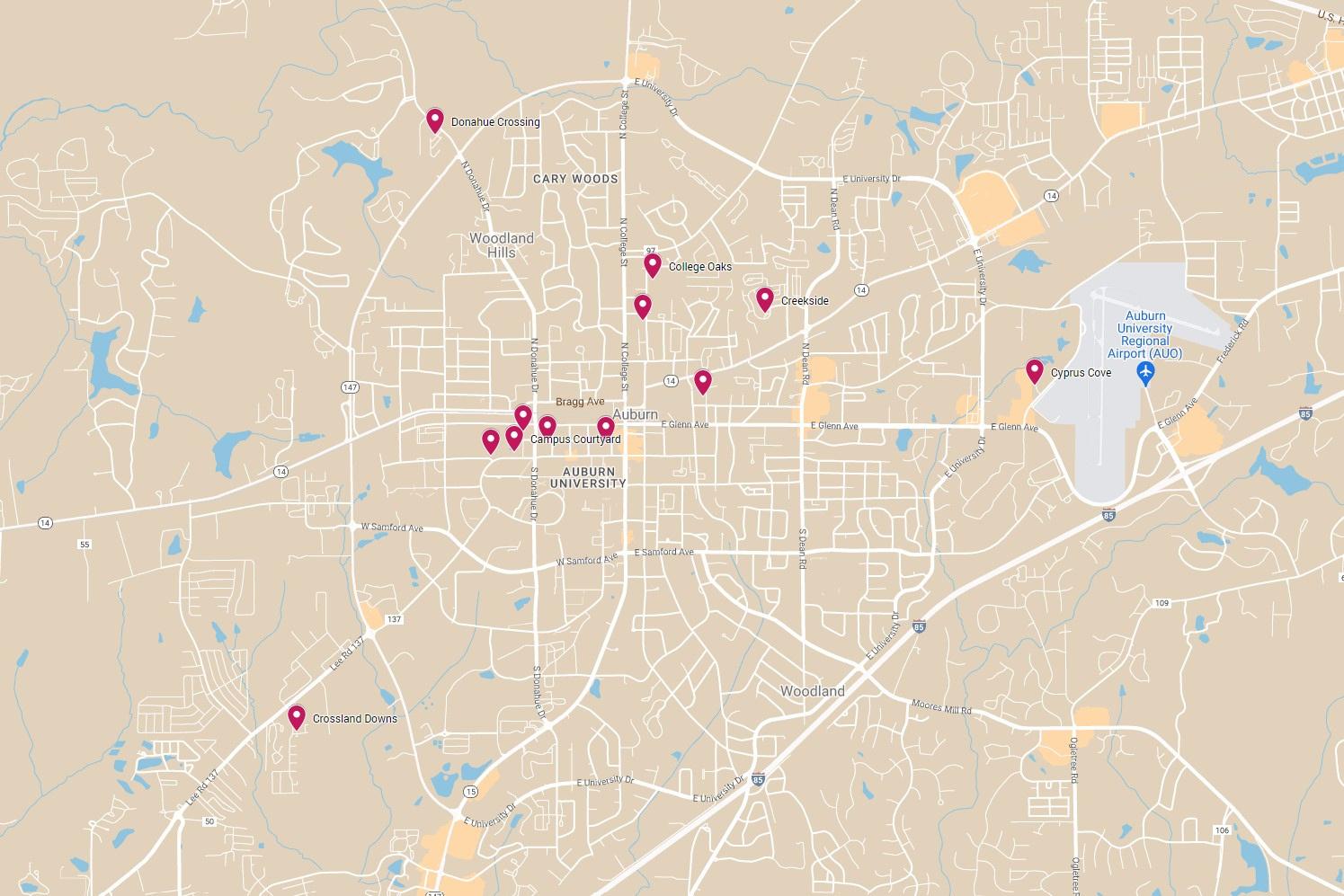

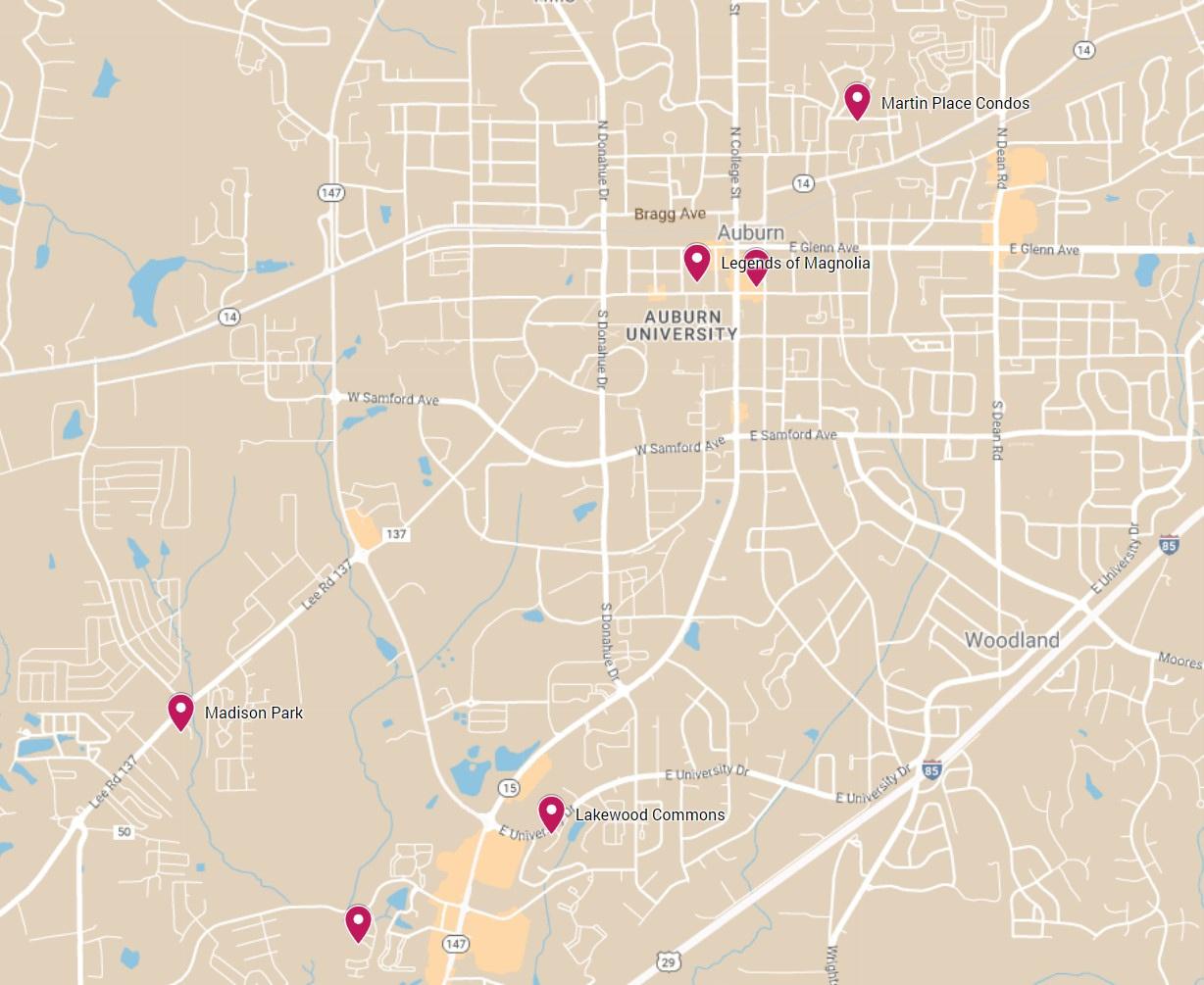

The city of Auburn has zoning restrictions on the number of unrelated individuals that can live together. Areas either allow for up to five unrelated or family plus one. You can verify the zoning of a particular property by visiting the interactive map https://webgis.auburnalabama.org/residentialoccupancylimits/.

Auburn Crossing Auburn Crossing

Auburn Crossing Auburn Crossing

The city of Auburn has zoning restrictions on the number of unrelated individuals that can live together. Areas either allow for up to five unrelated or family plus one. You can verify the zoning of a particular property by visiting the interactive map https://webgis.auburnalabama.org/residentialoccupancylimits/.

GLENN

HEISMAN VILLAS

The city of Auburn has zoning restrictions on the number of unrelated individuals that can live together. Areas either allow for up to five unrelated or family plus one. You can verify the zoning of a particular property by visiting the interactive map https://webgis.auburnalabama.org/residentialoccupancylimits/.

Glenn Heights Glenn

Glenn Oaks Glenn Oaks

Heisman Villas Heisman Villas

Heritage Woods Heritage Woods

Glenn Heights Glenn

Glenn Oaks Glenn Oaks

Heisman Villas Heisman Villas

Heritage Woods Heritage Woods

The city of Auburn has zoning restrictions on the number of unrelated individuals that can live together. Areas either allow for up to five unrelated or family plus one. You can verify the zoning of a particular property by visiting the interactive map https://webgis.auburnalabama.org/residentialoccupancylimits/.

SOUTH CREEK CONDOS

SOUTHERN

STADIUM

The city of Auburn has zoning restrictions on the number of unrelated individuals that can live together. Areas either allow for up to five unrelated or family plus one. You can verify the zoning of a particular property by visiting the interactive map https://webgis.auburnalabama.org/residentialoccupancylimits/.

Shady Glenn Condos Shady Glenn Condos

Southern Edge Southern Edge

Shady Glenn Condos Shady Glenn Condos

Southern Edge Southern Edge

101 S Ross Street

Bedrooms: 2

Bathrooms: 1.5 2.5 Days on market: 39

Amenities: None Avg. Sales Price: $221,500

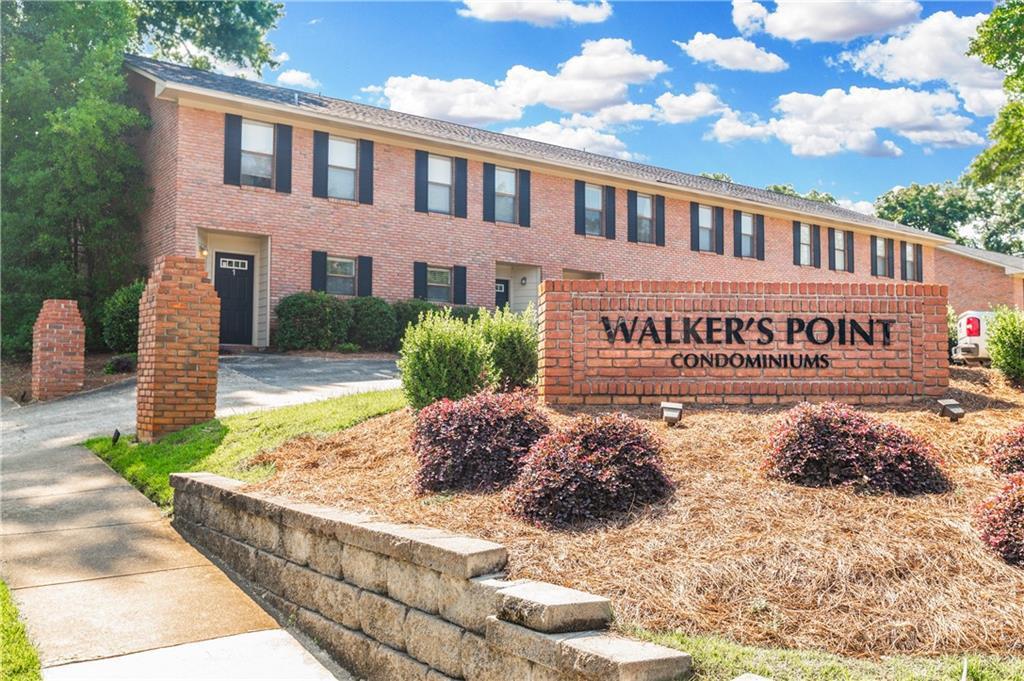

WARRIOR COURT

311 Warrior Court

Amenities: None Avg. Sales Price: $274,900

Bedrooms: 2 or 4 Bathrooms: 2 or 4 Days on market: 5

The city of Auburn has zoning restrictions on the number of unrelated individuals that can live together. Areas either allow for up to five unrelated or family plus one. You can verify the zoning of a particular property by visiting the interactive map https://webgis.auburnalabama.org/residentialoccupancylimits/.

Before you go out and look at homes, you need to get preapproval from a lender. The worst possible situation is to find your dream home, but find out later that you can’t get qualified to buy it.

All lenders differ on what they need from their borrowers. This list is intended to give you a general idea of what will be required at the time of mortgage application Please check with your lender for a complete list of necessary information

Social Security Number and Birth Date -

Required of you and any co borrowers

Your most recent pay stub showing year to date earnings

The lender will require 2 years W 2’s and accompanying tax forms.

The names, addresses, and telephone numbers of your employers for the past two years

Accounts -

You will need the account numbers and current balances of your checking account, savings account, money market account or any other accounts you may have

Current assets such as IRA’s, CD’s, stocks, bonds or securities. Your lender may require a current brokerage statement with name of the stock, amount per share and number of shares owned.

Personal Property -

Value of personal property including life insurance face value, employee retirement accounts, furniture, cars, jewelry, coins, and other valuable property

For each loan, provide the lender with the name and address of each creditor and include both the monthly payment and total amount due. Liabilities will include auto loans, student loans, credit cards and other installment debt.

If you own a home you will need the property address, current market value, mortgage lender name, account number, current monthly mortgage payment and outstanding balance If you rent, you will need the property address, name and address of the landlord, the current monthly rent, and previous address/landlord You will need information about your former addresses if you ’ ve lived in your current address for less than two years

Bring along a signed copy of that agreement and any amendments to it.

Please note, you are welcome to choose any vendors that you feel comfortable with and this list is just to serve as a reference for vendors that I have personal experience with. There is no requirement to use any of the vendors on this list.

Will Golden CMG Mortgage Phone: 334 744 5485 wgolden@cmgfi com

Hutson McGraw Trustmark Bank Phone: 334 419 0824 afolta@guildmortgage net

Aaron Folta Guild Mortgage Phone: 334 750 8189 afolta@guildmortgage net

Drake Martin Alfa Phone: 334 745 6304

William Murphy Alfa Phone: 256 777 6807 WMurphy@alfains com

Kathy Powell State Farm Phone: 334 501 8245

Rusty Prewett Prewett AllState Phone: 334 502 5111 Rprewett1@allstate com

Alabama Power Phone: 800 245 2244 www alabamapower com

Spire (ALAGASCO) Phone: 800 292 4008 www.spireenergy.com

Auburn Water Board Phone: 334 501 3050 www auburnalabama org/wrm

Auburn Trash Pick Up Phone: 334 501 3080

Charter Communications Phone: 877 728 3121 www.charter.com

WOW! Internet Cable Phone Phone: 334 521 7000

Kyle Moseley

Distinct Home Inspections

Phone: 256 749 5340 distincthomeinspectionllc@gmail.com

Luke Craig Inspect Auburn Phone: 334 332 5168 luke@inspectauburn.com

Andrew Barber Eagle Inspection Services Phone: 334 728 2137 abarber@eagleinspectionsauburn com

True Pro Phone: 334 275 0408 garrett@truepromoving.com

Two Men and a Truck Phone: 334 3164014

Opelika Water Works Phone: 334 705 5500 information@owwb com

Opelika Power Services Phone: 334 705 5170 www opelikapower com

AT&T www att com

Precision Surveying Phone: 334 821 0105